f2f39402bf7d9aaa514b7ecec5d026ad.ppt

- Количество слайдов: 11

What drives the currency markets? By A. V. Vedpuriswar Feb 10, 2008

Acknowledgment v This presentation draws heavily from Investopedia. com

The five factors v In order of importance, they are: Interest Rates Economic Growth Geo-Politics Trade and Capital Flows Merger and Acquisition Activity

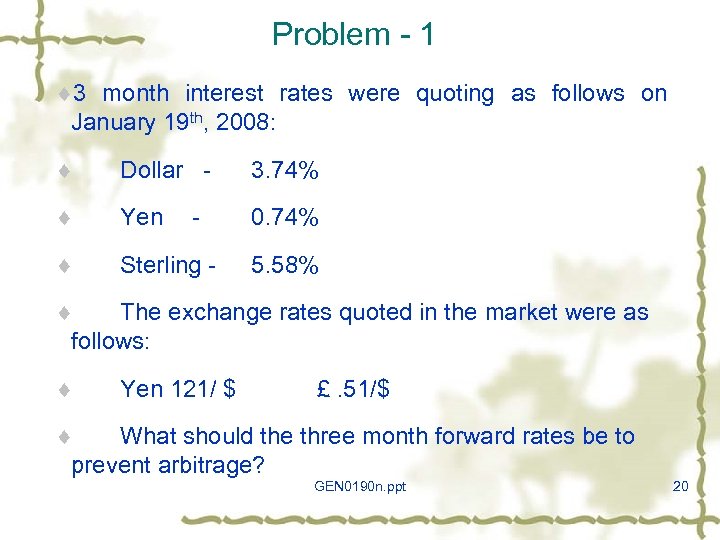

Problem - 1 ¨ 3 month interest rates were quoting as follows on January 19 th, 2008: ¨ Dollar - 3. 74% ¨ Yen 0. 74% ¨ Sterling - - 5. 58% ¨ The exchange rates quoted in the market were as follows: ¨ Yen 121/ $ £. 51/$ ¨ What should the three month forward rates be to prevent arbitrage? GEN 0190 n. ppt 20

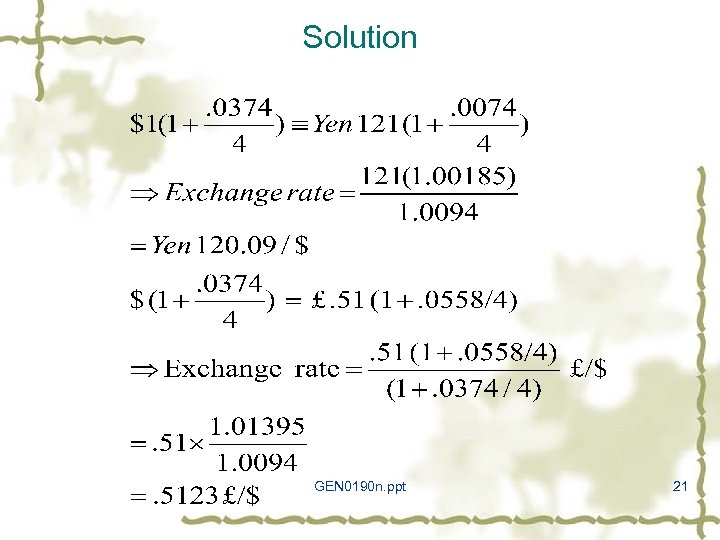

Solution GEN 0190 n. ppt 21

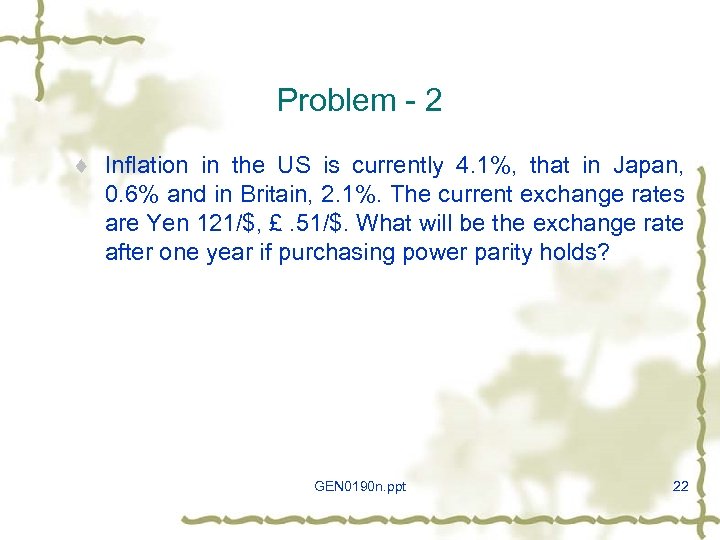

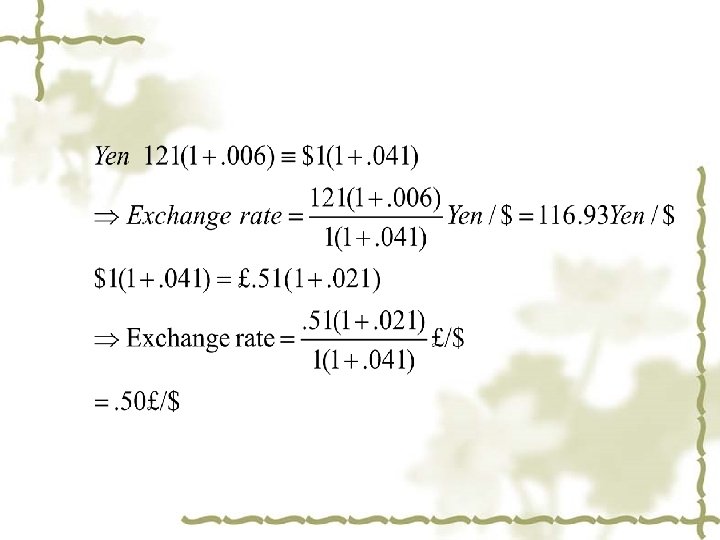

Problem - 2 ¨ Inflation in the US is currently 4. 1%, that in Japan, 0. 6% and in Britain, 2. 1%. The current exchange rates are Yen 121/$, £. 51/$. What will be the exchange rate after one year if purchasing power parity holds? GEN 0190 n. ppt 22

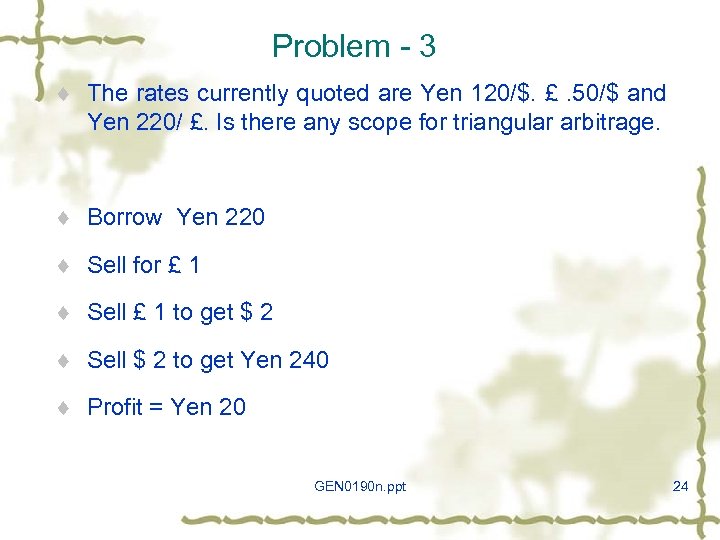

Problem - 3 ¨ The rates currently quoted are Yen 120/$. £. 50/$ and Yen 220/ £. Is there any scope for triangular arbitrage. ¨ Borrow Yen 220 ¨ Sell for £ 1 ¨ Sell £ 1 to get $ 2 ¨ Sell $ 2 to get Yen 240 ¨ Profit = Yen 20 GEN 0190 n. ppt 24

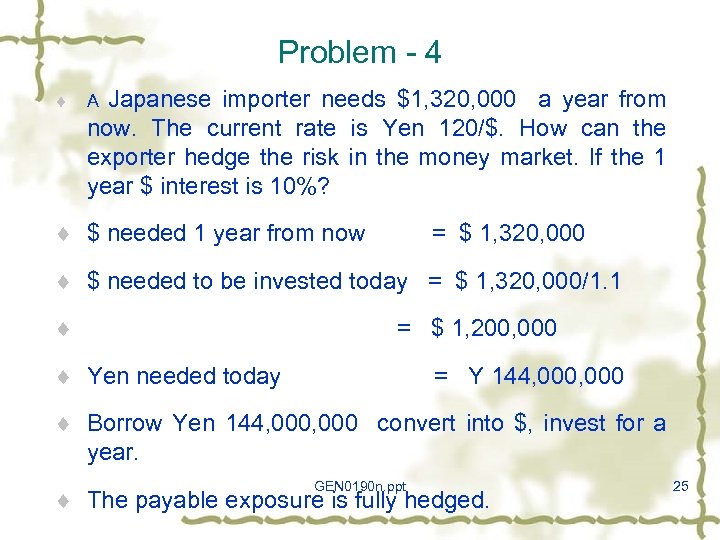

Problem - 4 ¨ Japanese importer needs $1, 320, 000 a year from now. The current rate is Yen 120/$. How can the exporter hedge the risk in the money market. If the 1 year $ interest is 10%? A ¨ $ needed 1 year from now = $ 1, 320, 000 ¨ $ needed to be invested today = $ 1, 320, 000/1. 1 ¨ = $ 1, 200, 000 ¨ Yen needed today = Y 144, 000 ¨ Borrow Yen 144, 000 convert into $, invest for a year. GEN 0190 n. ppt ¨ The payable exposure is fully hedged. 25

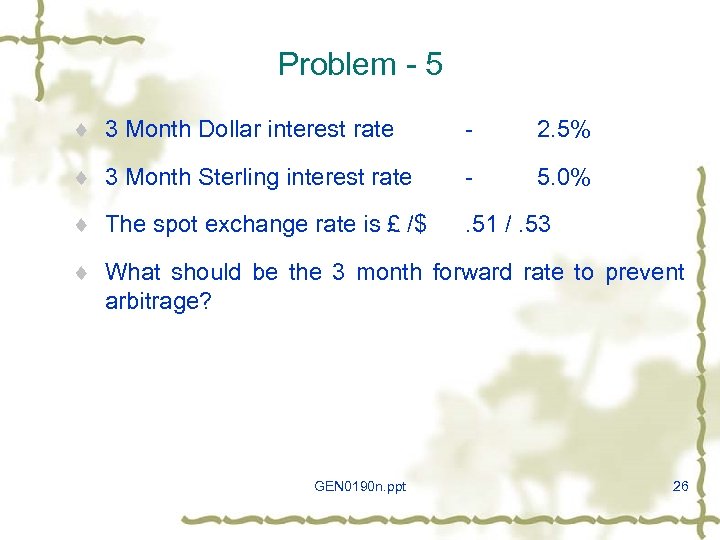

Problem - 5 ¨ 3 Month Dollar interest rate - 2. 5% ¨ 3 Month Sterling interest rate - 5. 0% ¨ The spot exchange rate is £ /$ . 51 /. 53 ¨ What should be the 3 month forward rate to prevent arbitrage? GEN 0190 n. ppt 26

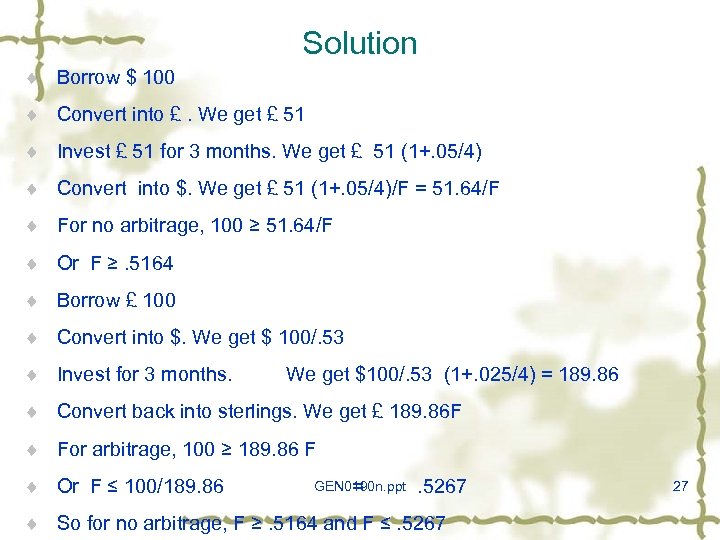

Solution ¨ Borrow $ 100 ¨ Convert into £. We get £ 51 ¨ Invest £ 51 for 3 months. We get £ 51 (1+. 05/4) ¨ Convert into $. We get £ 51 (1+. 05/4)/F = 51. 64/F ¨ For no arbitrage, 100 ≥ 51. 64/F ¨ Or F ≥. 5164 ¨ Borrow £ 100 ¨ Convert into $. We get $ 100/. 53 ¨ Invest for 3 months. We get $100/. 53 (1+. 025/4) = 189. 86 ¨ Convert back into sterlings. We get £ 189. 86 F ¨ For arbitrage, 100 ≥ 189. 86 F ¨ Or F ≤ 100/189. 86 GEN 0190 n. ppt = . 5267 ¨ So for no arbitrage, F ≥. 5164 and F ≤. 5267 27

f2f39402bf7d9aaa514b7ecec5d026ad.ppt