e6dcde9910108669ea65c7b2c73d74f8.ppt

- Количество слайдов: 13

What Does a Payment Provider Provide? Ralph Joy Senior Vice President Payables & Account Services Steve Stone Senior Vice President Strategic Business Development

What Does a Payment Provider Provide? Ralph Joy Senior Vice President Payables & Account Services Steve Stone Senior Vice President Strategic Business Development

What Does a Payment Provider Provide? What Are The Minimum Requirements For Payment Providers? Process payments Ø Process only authorized payments Ø Collect money from the party that owes, pay the party that’s owed: settlement Ø Ø Handle payment exceptions Ø Monitor and control risk

What Does a Payment Provider Provide? What Are The Minimum Requirements For Payment Providers? Process payments Ø Process only authorized payments Ø Collect money from the party that owes, pay the party that’s owed: settlement Ø Ø Handle payment exceptions Ø Monitor and control risk

What Does a Payment Provider Provide? What Types of Payments Exist? Ø Coin and currency Ø Ø Checks Debit and credit cards Wire transfer (EFT) Automated clearing house (EFT)

What Does a Payment Provider Provide? What Types of Payments Exist? Ø Coin and currency Ø Ø Checks Debit and credit cards Wire transfer (EFT) Automated clearing house (EFT)

What Does a Payment Provider Provide? What Are Customers Asking Payment Providers to Provide? (What Would Payment Providers Need to Do In Any Case? ) • “Traditional” payment processing services: wholesale vs. retail Ø Make payments owed: checks, EFT Ø Collect payments due: checks, EFT, cards(? ) Ø Open and maintain accounts: Activity & funds repositories Ø Provide information pertaining to payment activity Ø Resolve problems, answer questions • Risk management Ø Transaction / operational risk Ø Control credit risk (unique to banks) Ø Balanced legal / compliance risk mitigation Ø Provide liquidity and manage liquidity risk Ø Minimize strategic and reputation risk

What Does a Payment Provider Provide? What Are Customers Asking Payment Providers to Provide? (What Would Payment Providers Need to Do In Any Case? ) • “Traditional” payment processing services: wholesale vs. retail Ø Make payments owed: checks, EFT Ø Collect payments due: checks, EFT, cards(? ) Ø Open and maintain accounts: Activity & funds repositories Ø Provide information pertaining to payment activity Ø Resolve problems, answer questions • Risk management Ø Transaction / operational risk Ø Control credit risk (unique to banks) Ø Balanced legal / compliance risk mitigation Ø Provide liquidity and manage liquidity risk Ø Minimize strategic and reputation risk

What Does a Payment Provider Provide? How Do Providers’ and Customers’ Needs Differ? Provide credit vs. Control credit risk Quality vs. Service price vs. Minimal risk Balanced terms & conditions

What Does a Payment Provider Provide? How Do Providers’ and Customers’ Needs Differ? Provide credit vs. Control credit risk Quality vs. Service price vs. Minimal risk Balanced terms & conditions

What Does a Payment Provider Provide? How Do Providers Differentiate Their Services? Hours of operation and service Ø Input, output and reporting options Ø Multi-currency or global capabilities Ø Ø Degree of integration between systems Use of the web: reporting, initiation, service Ø Industry specialization: credit, service capabilities, knowledge Ø Cost of processing Service pricing Ø Ø Comprehensive solutions…. not just all types of payments

What Does a Payment Provider Provide? How Do Providers Differentiate Their Services? Hours of operation and service Ø Input, output and reporting options Ø Multi-currency or global capabilities Ø Ø Degree of integration between systems Use of the web: reporting, initiation, service Ø Industry specialization: credit, service capabilities, knowledge Ø Cost of processing Service pricing Ø Ø Comprehensive solutions…. not just all types of payments

What Does a Payment Provider Provide? Liquidity Risk Why would a customer need $5, 000, 000 of liquidity?

What Does a Payment Provider Provide? Liquidity Risk Why would a customer need $5, 000, 000 of liquidity?

What Does a Payment Provider Provide? Quality. . . How Will You Know It When You See It? TQM: what does it mean? Ø Service standards: agreements, guarantees Ø Independent assessments: Baldridge awards, ISO 9001 Ø Ø Service: when and how?

What Does a Payment Provider Provide? Quality. . . How Will You Know It When You See It? TQM: what does it mean? Ø Service standards: agreements, guarantees Ø Independent assessments: Baldridge awards, ISO 9001 Ø Ø Service: when and how?

What Does a Payment Provider Provide? PAYMENTS -- The Next Generation

What Does a Payment Provider Provide? PAYMENTS -- The Next Generation

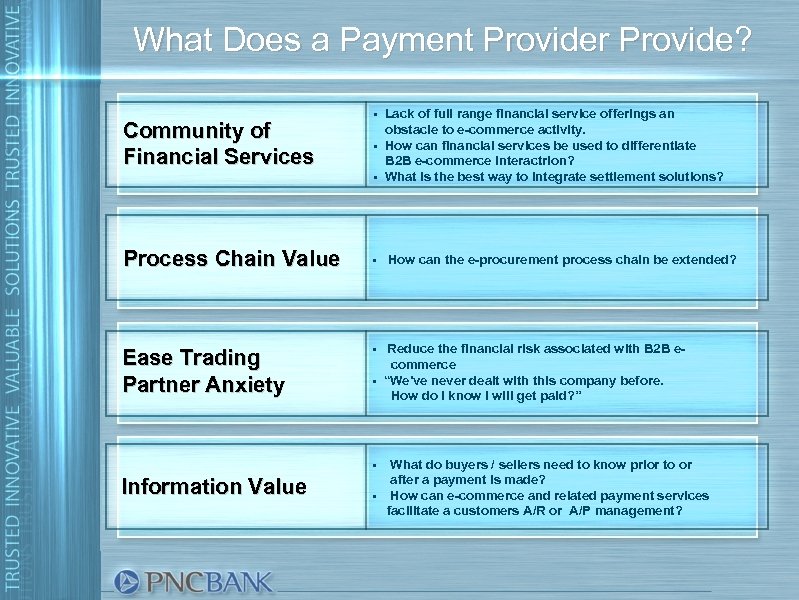

What Does a Payment Provider Provide? • Community of Financial Services Process Chain Value Ease Trading Partner Anxiety Lack of full range financial service offerings an obstacle to e-commerce activity. How can financial services be used to differentiate B 2 B e-commerce interactrion? What is the best way to integrate settlement solutions? • How can the e-procurement process chain be extended? • • • Information Value • Reduce the financial risk associated with B 2 B ecommerce “We’ve never dealt with this company before. How do I know I will get paid? ” What do buyers / sellers need to know prior to or after a payment is made? How can e-commerce and related payment services facilitate a customers A/R or A/P management?

What Does a Payment Provider Provide? • Community of Financial Services Process Chain Value Ease Trading Partner Anxiety Lack of full range financial service offerings an obstacle to e-commerce activity. How can financial services be used to differentiate B 2 B e-commerce interactrion? What is the best way to integrate settlement solutions? • How can the e-procurement process chain be extended? • • • Information Value • Reduce the financial risk associated with B 2 B ecommerce “We’ve never dealt with this company before. How do I know I will get paid? ” What do buyers / sellers need to know prior to or after a payment is made? How can e-commerce and related payment services facilitate a customers A/R or A/P management?

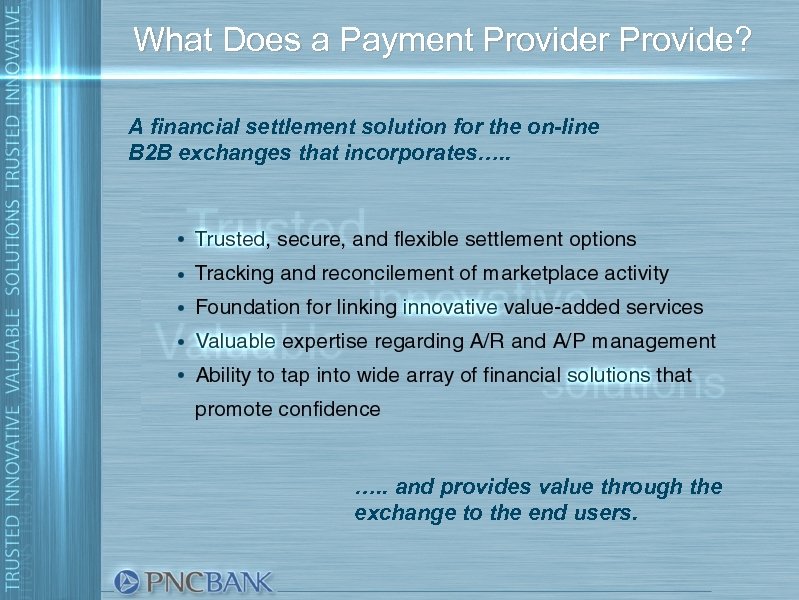

What Does a Payment Provider Provide? A financial settlement solution for the on-line B 2 B exchanges that incorporates…. . and provides value through the exchange to the end users.

What Does a Payment Provider Provide? A financial settlement solution for the on-line B 2 B exchanges that incorporates…. . and provides value through the exchange to the end users.

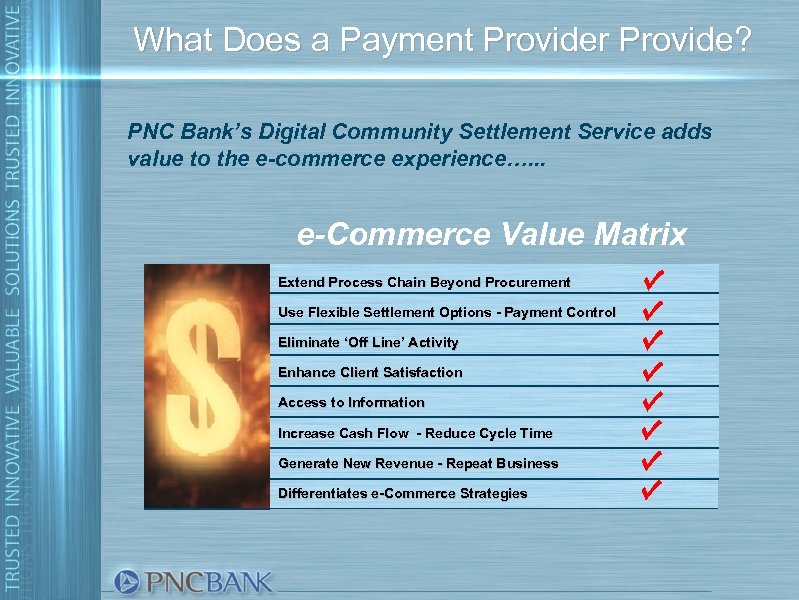

What Does a Payment Provider Provide? PNC Bank’s Digital Community Settlement Service adds value to the e-commerce experience…. . . e-Commerce Value Matrix Extend Process Chain Beyond Procurement Use Flexible Settlement Options - Payment Control Eliminate ‘Off Line’ Activity Enhance Client Satisfaction Access to Information Increase Cash Flow - Reduce Cycle Time Generate New Revenue - Repeat Business Differentiates e-Commerce Strategies

What Does a Payment Provider Provide? PNC Bank’s Digital Community Settlement Service adds value to the e-commerce experience…. . . e-Commerce Value Matrix Extend Process Chain Beyond Procurement Use Flexible Settlement Options - Payment Control Eliminate ‘Off Line’ Activity Enhance Client Satisfaction Access to Information Increase Cash Flow - Reduce Cycle Time Generate New Revenue - Repeat Business Differentiates e-Commerce Strategies

What Does a Payment Provider Provide? Aren’t Banks Obsolete? Why Use A Bank? Banks = or ? Banks can take deposits and make loans Ø High on trust scale: reliability and confidentiality Ø Risk management: credit, settlement, liquidity, legal, operational Ø Access to the payments system: own the card networks Ø Infrastructure investments: ACH, Chip cards, on line scoring, etc. Ø Are B 2 B Needs the same as B 2 C or C 2 C Needs? ?

What Does a Payment Provider Provide? Aren’t Banks Obsolete? Why Use A Bank? Banks = or ? Banks can take deposits and make loans Ø High on trust scale: reliability and confidentiality Ø Risk management: credit, settlement, liquidity, legal, operational Ø Access to the payments system: own the card networks Ø Infrastructure investments: ACH, Chip cards, on line scoring, etc. Ø Are B 2 B Needs the same as B 2 C or C 2 C Needs? ?