What do we know, what have we learned? Michigan, US, and Obamanomics Jared Bernstein Economic Policy Institute MLHS Annual Meeting jbernstein@epi. org

What do we know, what have we learned? Michigan, US, and Obamanomics Jared Bernstein Economic Policy Institute MLHS Annual Meeting jbernstein@epi. org

Real Economy, macro • It’s official—recession, that is…but you knew that. • Consumer: retrenching, big time. • Investment: squeezed on credit and profit sides • Exports/Imports: Maybe, maybe not… • Government: most reliable source of short term growth?

Real Economy, macro • It’s official—recession, that is…but you knew that. • Consumer: retrenching, big time. • Investment: squeezed on credit and profit sides • Exports/Imports: Maybe, maybe not… • Government: most reliable source of short term growth?

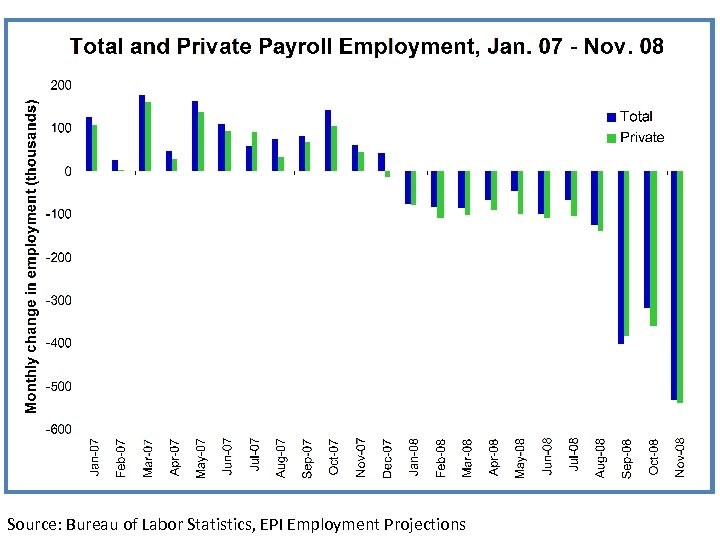

Source: Bureau of Labor Statistics, EPI Employment Projections

Source: Bureau of Labor Statistics, EPI Employment Projections

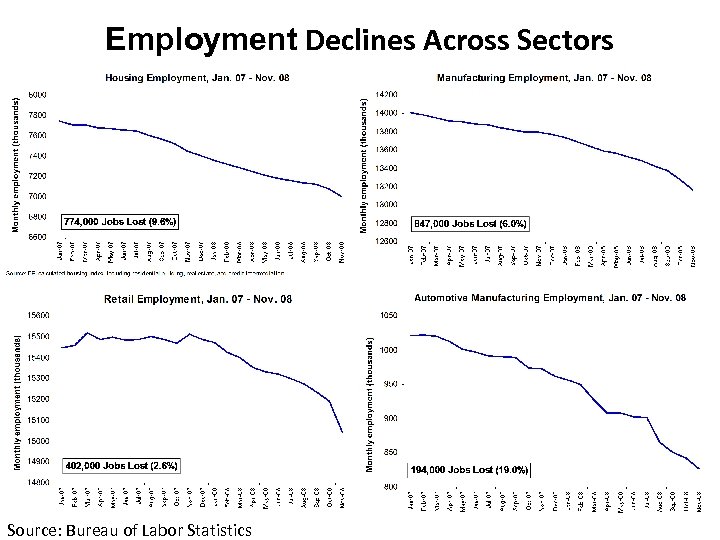

Employment Declines Across Sectors Source: Bureau of Labor Statistics

Employment Declines Across Sectors Source: Bureau of Labor Statistics

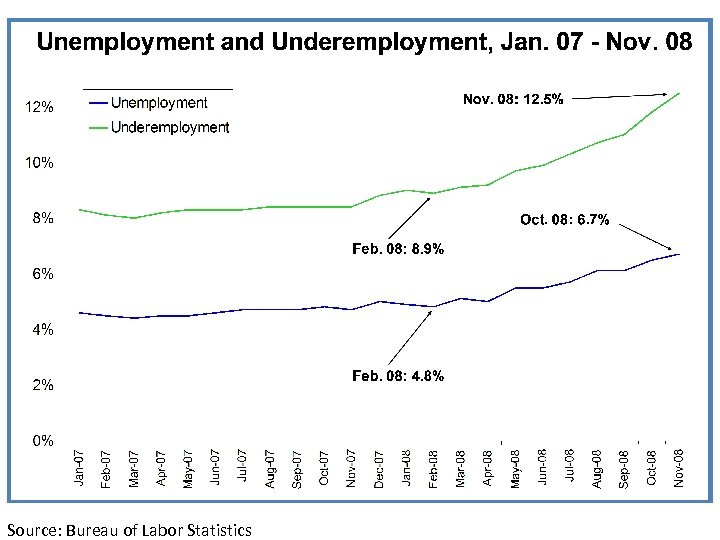

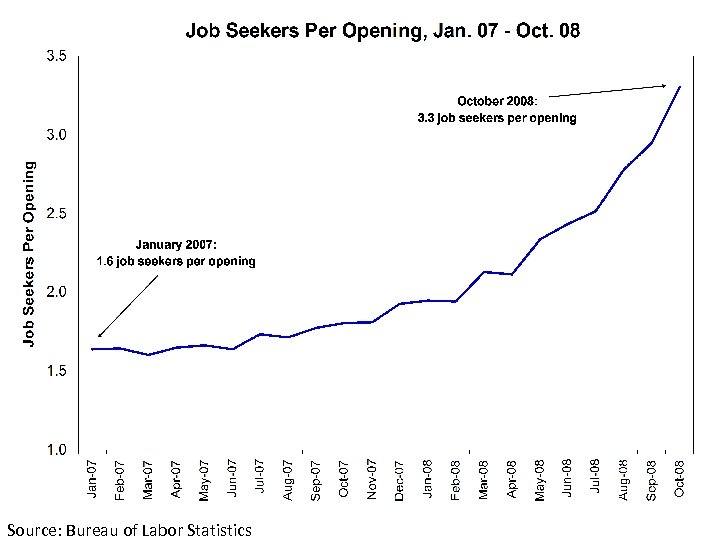

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

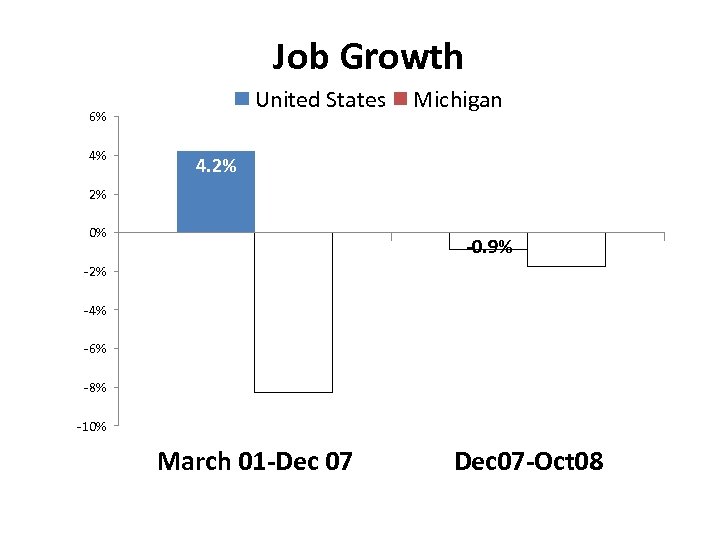

Job Growth United States 6% 4% Michigan 4. 2% 2% 0% -0. 9% -2% -1. 7% -4% -6% -8. 3% -10% March 01 -Dec 07 -Oct 08

Job Growth United States 6% 4% Michigan 4. 2% 2% 0% -0. 9% -2% -1. 7% -4% -6% -8. 3% -10% March 01 -Dec 07 -Oct 08

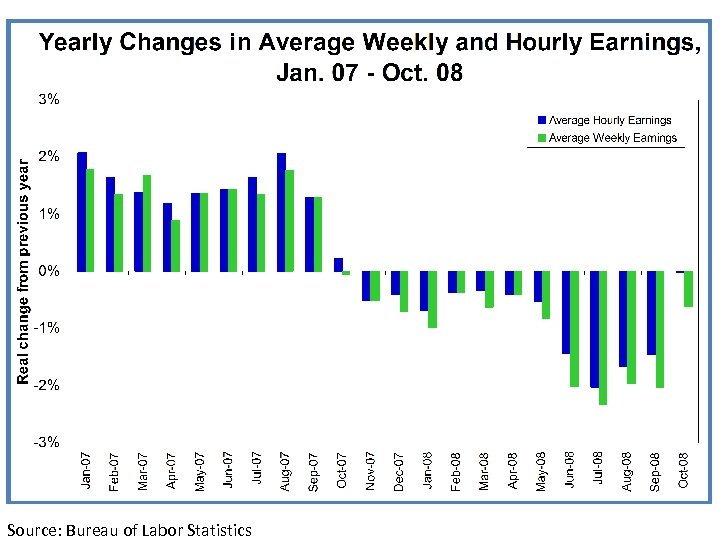

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

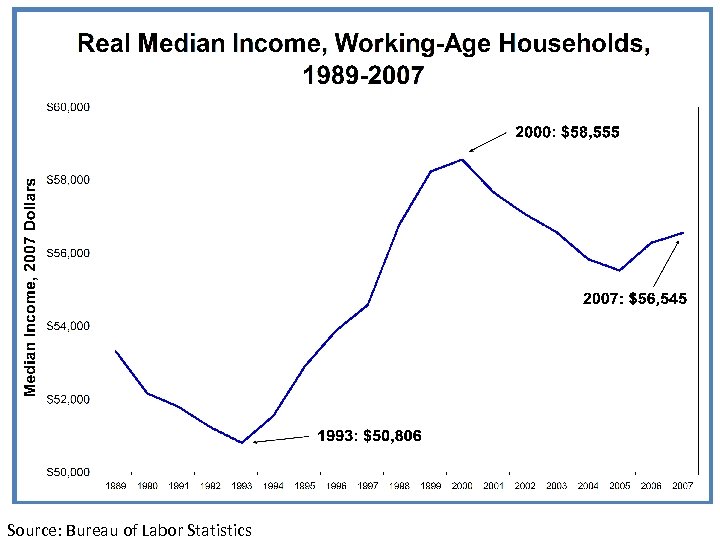

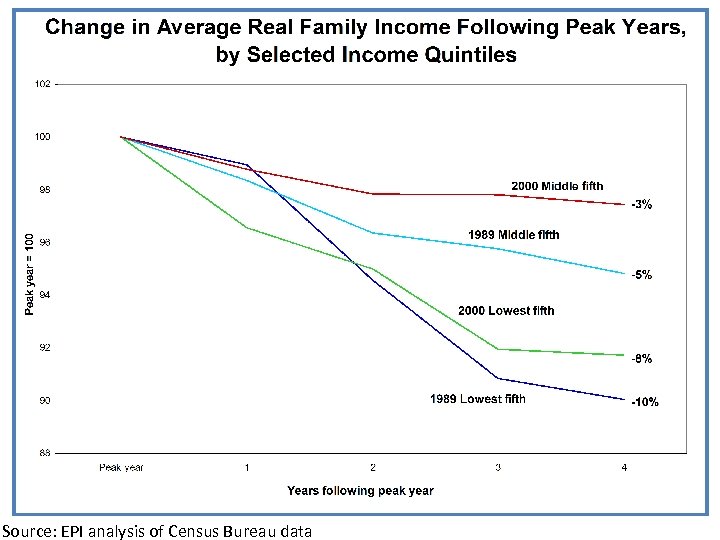

Source: EPI analysis of Census Bureau data

Source: EPI analysis of Census Bureau data

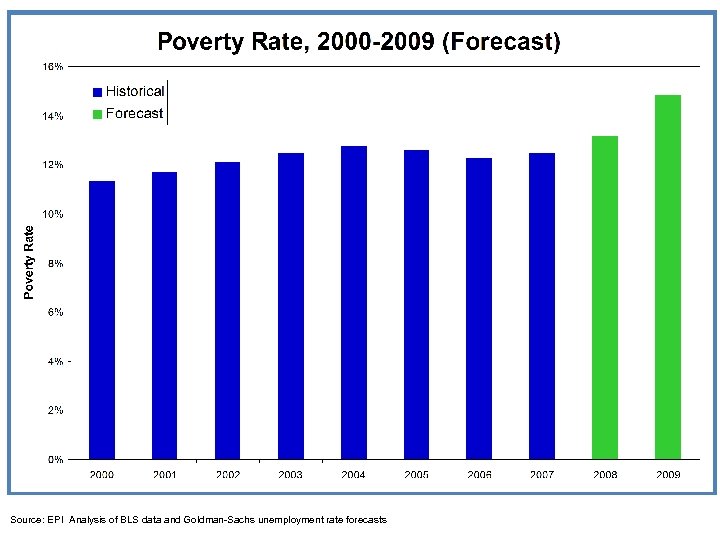

Source: EPI Analysis of BLS data and Goldman-Sachs unemployment rate forecasts

Source: EPI Analysis of BLS data and Goldman-Sachs unemployment rate forecasts

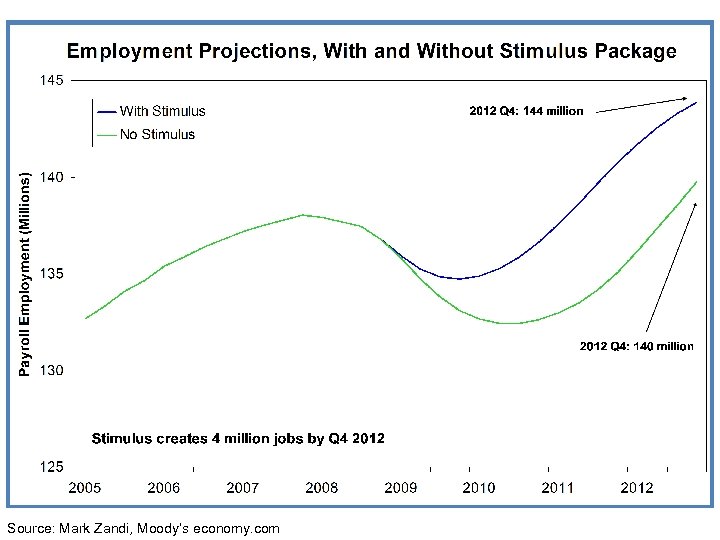

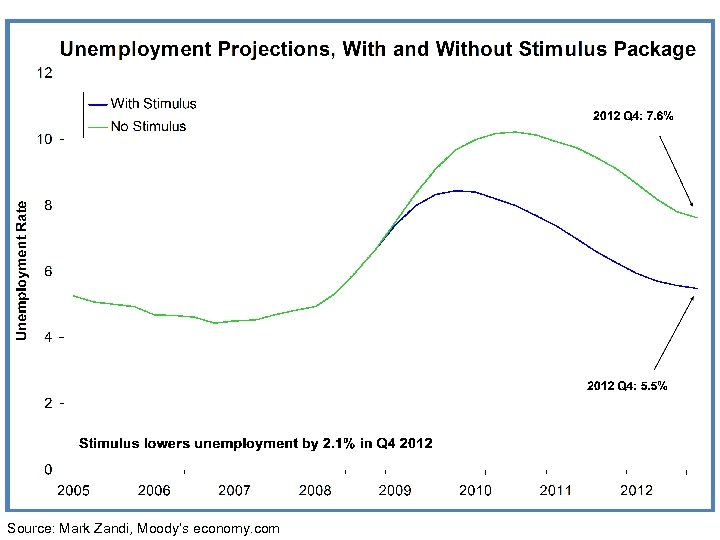

Source: Mark Zandi, Moody’s economy. com

Source: Mark Zandi, Moody’s economy. com

Source: Mark Zandi, Moody’s economy. com

Source: Mark Zandi, Moody’s economy. com

Un-Real Economy • Financial Markets: Dow, Nasdaq, S&P 500, Russell 2000…all down about 40% ytd. • But: good news…”Ted Spread” responding • Housing: some signs bottom in sight, but no signs re uptick…prices still falling…inventory overhang; • TARP: Certainly not a confidence builder yet. • Fed: pushing on string but not giving up.

Un-Real Economy • Financial Markets: Dow, Nasdaq, S&P 500, Russell 2000…all down about 40% ytd. • But: good news…”Ted Spread” responding • Housing: some signs bottom in sight, but no signs re uptick…prices still falling…inventory overhang; • TARP: Certainly not a confidence builder yet. • Fed: pushing on string but not giving up.

Pres/VP Elect • Fiscal constraints? • Deficit could go as high as 6% of GDP, but debt around 40% (avg 46% in 1990 s). • Must he alter his long-term plans--hth care/energy? • There is a time for budget austerity; this ain’t it. • Middle-class, poor, labor agenda (EFCA, min wg, UI reform, OSHA, etc…)

Pres/VP Elect • Fiscal constraints? • Deficit could go as high as 6% of GDP, but debt around 40% (avg 46% in 1990 s). • Must he alter his long-term plans--hth care/energy? • There is a time for budget austerity; this ain’t it. • Middle-class, poor, labor agenda (EFCA, min wg, UI reform, OSHA, etc…)

Their Agenda • Morph his recovery package with House D’s (Making Work Pay tax cuts; new jobs tax credit; mortgage relief; small biz, UI) • Manage TARP • Tax agenda • Energy/Health Care • Infrastructure (who gets the jobs? ) • Regulation (Cooper Union speech)

Their Agenda • Morph his recovery package with House D’s (Making Work Pay tax cuts; new jobs tax credit; mortgage relief; small biz, UI) • Manage TARP • Tax agenda • Energy/Health Care • Infrastructure (who gets the jobs? ) • Regulation (Cooper Union speech)

What Have We Learned? • • • Markets Ineq Public investment No more TBTF Financial markets

What Have We Learned? • • • Markets Ineq Public investment No more TBTF Financial markets

Learned…cont. • • • Budget priorities Supply-side Amply funded gov’t Shampoo economy Better economists

Learned…cont. • • • Budget priorities Supply-side Amply funded gov’t Shampoo economy Better economists