10fb53860cc4e57bb6a91867098c7ba5.ppt

- Количество слайдов: 17

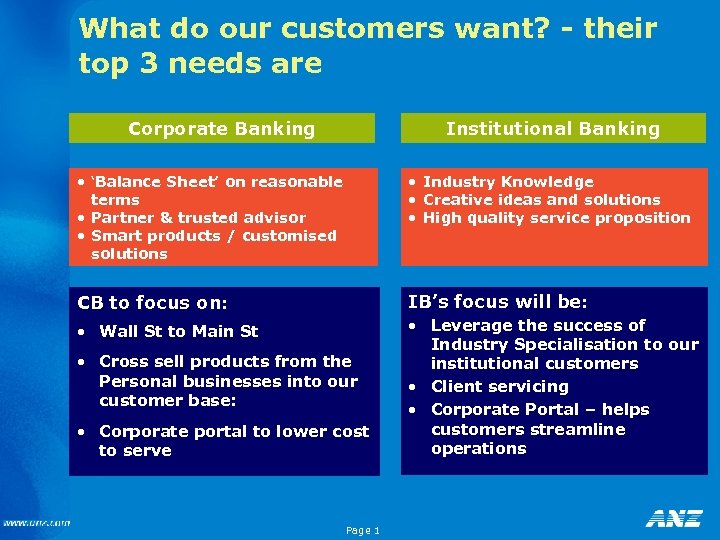

What do our customers want? - their top 3 needs are Corporate Banking Institutional Banking • ‘Balance Sheet’ on reasonable terms • Partner & trusted advisor • Smart products / customised solutions • Industry Knowledge • Creative ideas and solutions • High quality service proposition CB to focus on: IB’s focus will be: • Wall St to Main St • Leverage the success of Industry Specialisation to our institutional customers • Client servicing • Corporate Portal – helps customers streamline operations • Cross sell products from the Personal businesses into our customer base: • Corporate portal to lower cost to serve Page 1

What do our customers want? - their top 3 needs are Corporate Banking Institutional Banking • ‘Balance Sheet’ on reasonable terms • Partner & trusted advisor • Smart products / customised solutions • Industry Knowledge • Creative ideas and solutions • High quality service proposition CB to focus on: IB’s focus will be: • Wall St to Main St • Leverage the success of Industry Specialisation to our institutional customers • Client servicing • Corporate Portal – helps customers streamline operations • Cross sell products from the Personal businesses into our customer base: • Corporate portal to lower cost to serve Page 1

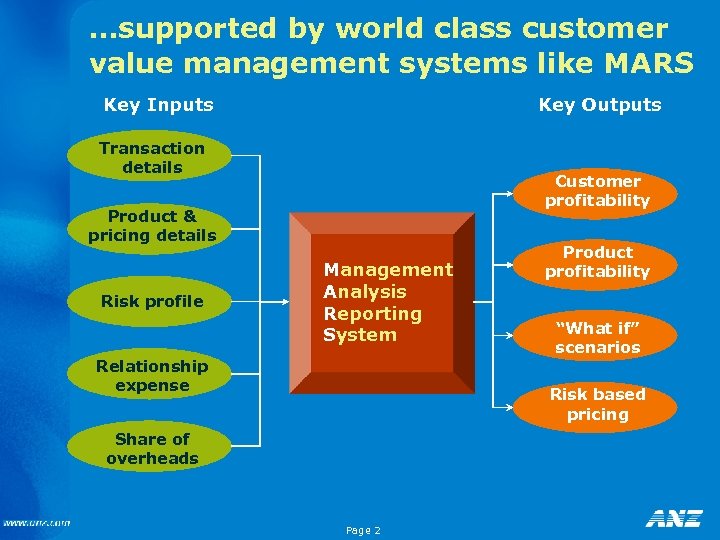

…supported by world class customer value management systems like MARS Key Inputs Key Outputs Transaction details Customer profitability Product & pricing details Risk profile Management Analysis Reporting System Relationship expense Product profitability “What if” scenarios Risk based pricing Share of overheads Page 2

…supported by world class customer value management systems like MARS Key Inputs Key Outputs Transaction details Customer profitability Product & pricing details Risk profile Management Analysis Reporting System Relationship expense Product profitability “What if” scenarios Risk based pricing Share of overheads Page 2

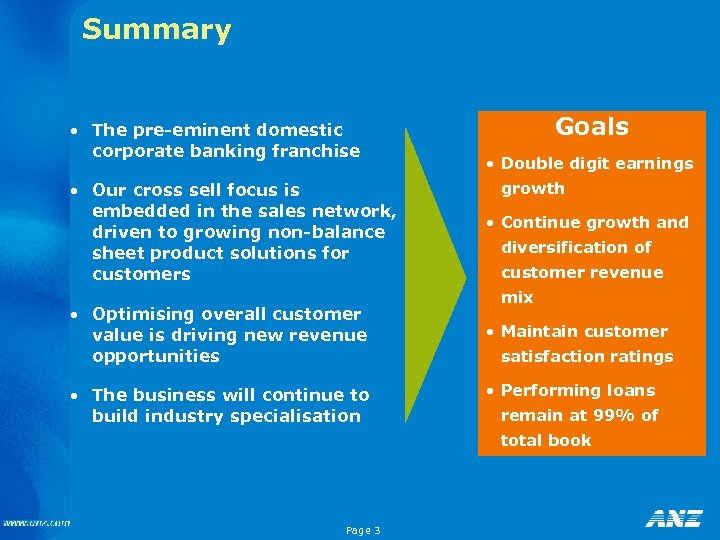

Summary • The pre-eminent domestic corporate banking franchise • Our cross sell focus is embedded in the sales network, driven to growing non-balance sheet product solutions for customers • Optimising overall customer value is driving new revenue opportunities • The business will continue to build industry specialisation Goals • Double digit earnings growth • Continue growth and diversification of customer revenue mix • Maintain customer satisfaction ratings • Performing loans remain at 99% of total book Page 3

Summary • The pre-eminent domestic corporate banking franchise • Our cross sell focus is embedded in the sales network, driven to growing non-balance sheet product solutions for customers • Optimising overall customer value is driving new revenue opportunities • The business will continue to build industry specialisation Goals • Double digit earnings growth • Continue growth and diversification of customer revenue mix • Maintain customer satisfaction ratings • Performing loans remain at 99% of total book Page 3

Global Capital Markets David Hornery Global Head of Capital Markets Australia and New Zealand Banking Group Limited 20 July 2001

Global Capital Markets David Hornery Global Head of Capital Markets Australia and New Zealand Banking Group Limited 20 July 2001

Leveraging capabilities for high growth segments • What do we do? • Financial performance • Low risk profile • Realising our growth opportunities • Goals for Global Capital Markets Page 5

Leveraging capabilities for high growth segments • What do we do? • Financial performance • Low risk profile • Realising our growth opportunities • Goals for Global Capital Markets Page 5

Capital Markets means different things to different people • Derivatives trading and sales, interest rate & equity • Credit: – Underwriting – Trading and sales activities – Short and long dated securities – Government and non-government credit derivatives • Primary Markets activities: – Securitisation – Syndication – Origination Page 6

Capital Markets means different things to different people • Derivatives trading and sales, interest rate & equity • Credit: – Underwriting – Trading and sales activities – Short and long dated securities – Government and non-government credit derivatives • Primary Markets activities: – Securitisation – Syndication – Origination Page 6

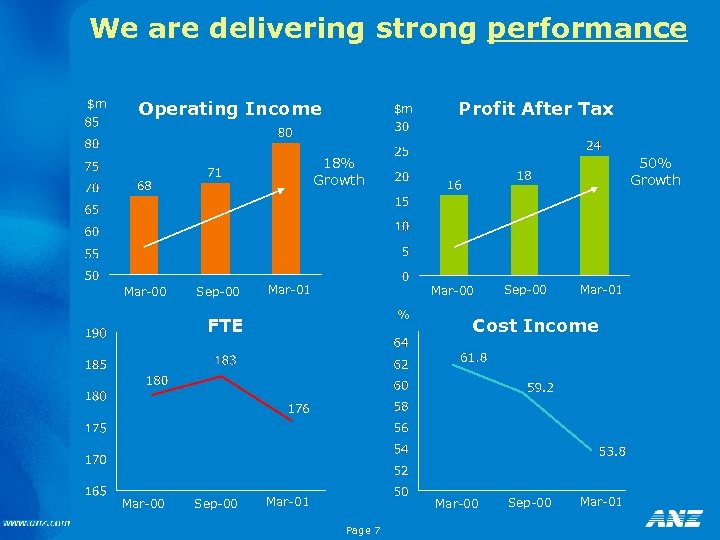

We are delivering strong performance $m Operating Income $m Profit After Tax 18% Growth Mar-00 Sep-00 Mar-01 Mar-00 % FTE Mar-00 Sep-00 50% Growth Mar-01 Cost Income Mar-00 Page 7 Sep-00 Mar-01

We are delivering strong performance $m Operating Income $m Profit After Tax 18% Growth Mar-00 Sep-00 Mar-01 Mar-00 % FTE Mar-00 Sep-00 50% Growth Mar-01 Cost Income Mar-00 Page 7 Sep-00 Mar-01

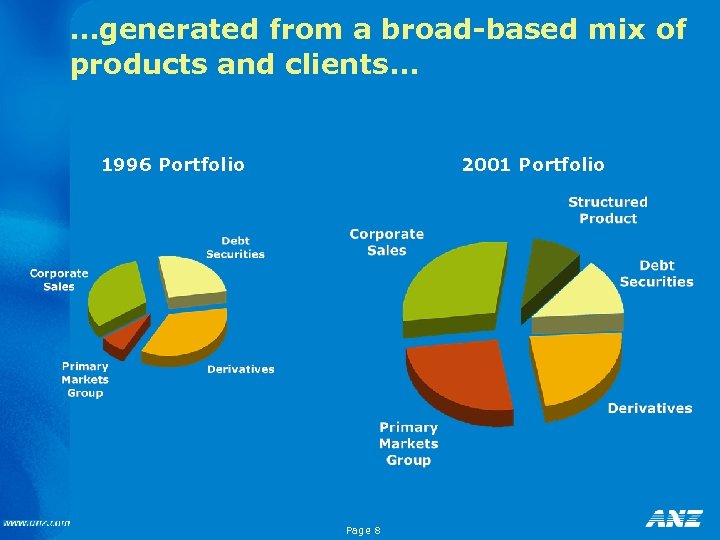

…generated from a broad-based mix of products and clients. . . 1996 Portfolio 2001 Portfolio Page 8

…generated from a broad-based mix of products and clients. . . 1996 Portfolio 2001 Portfolio Page 8

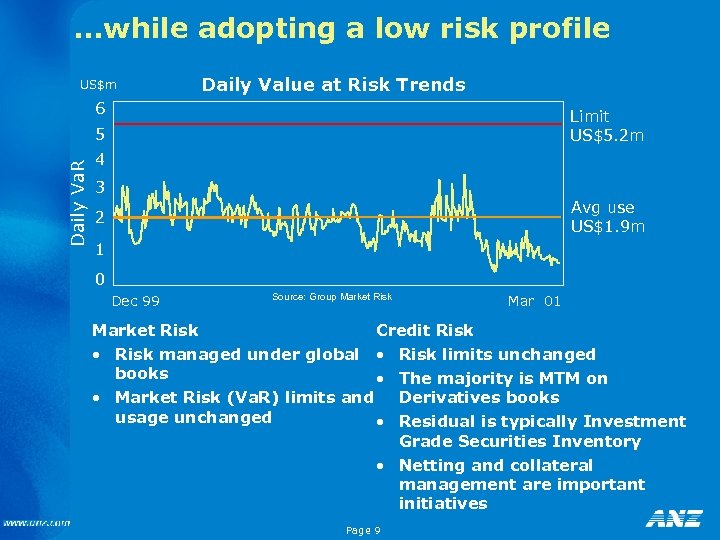

…while adopting a low risk profile US$m Daily Value at Risk Trends 6 Limit US$5. 2 m Daily Va. R 5 4 3 Avg use US$1. 9 m 2 1 0 Dec 99 Market Risk Source: Group Market Risk Mar 01 Credit Risk • Risk managed under global • books • • Market Risk (Va. R) limits and usage unchanged • Risk limits unchanged The majority is MTM on Derivatives books Residual is typically Investment Grade Securities Inventory • Netting and collateral management are important initiatives Page 9

…while adopting a low risk profile US$m Daily Value at Risk Trends 6 Limit US$5. 2 m Daily Va. R 5 4 3 Avg use US$1. 9 m 2 1 0 Dec 99 Market Risk Source: Group Market Risk Mar 01 Credit Risk • Risk managed under global • books • • Market Risk (Va. R) limits and usage unchanged • Risk limits unchanged The majority is MTM on Derivatives books Residual is typically Investment Grade Securities Inventory • Netting and collateral management are important initiatives Page 9

We are a leader in Capital Markets League Tables • #1 Interest Rate Products in Australia 2001 (Asia Risk) • #2 Bank Australian Equity Derivative Product (Asia Risk) • Runner Up Debt House of the Year (INSTO) • #1 Commercial Paper Australia (Asia Money) • Lead & Arranger Debt Issuer of the Year (INSTO) • Arranger & Lead Mgr Securitisation Deal of the Year (INSTO) • #1 Lead Arranger Australian Syndicated Loans (IFR) • #2 Lead Arranger New Zealand Syndicated Loans (IFR) • Lead Arranger Project Deal of the Year 1999 & 2000 (INSTO) • #1 Issuer Put Warrants, #3 Overall Equity Warrants (ASX turnover statistics) Page 10

We are a leader in Capital Markets League Tables • #1 Interest Rate Products in Australia 2001 (Asia Risk) • #2 Bank Australian Equity Derivative Product (Asia Risk) • Runner Up Debt House of the Year (INSTO) • #1 Commercial Paper Australia (Asia Money) • Lead & Arranger Debt Issuer of the Year (INSTO) • Arranger & Lead Mgr Securitisation Deal of the Year (INSTO) • #1 Lead Arranger Australian Syndicated Loans (IFR) • #2 Lead Arranger New Zealand Syndicated Loans (IFR) • Lead Arranger Project Deal of the Year 1999 & 2000 (INSTO) • #1 Issuer Put Warrants, #3 Overall Equity Warrants (ASX turnover statistics) Page 10

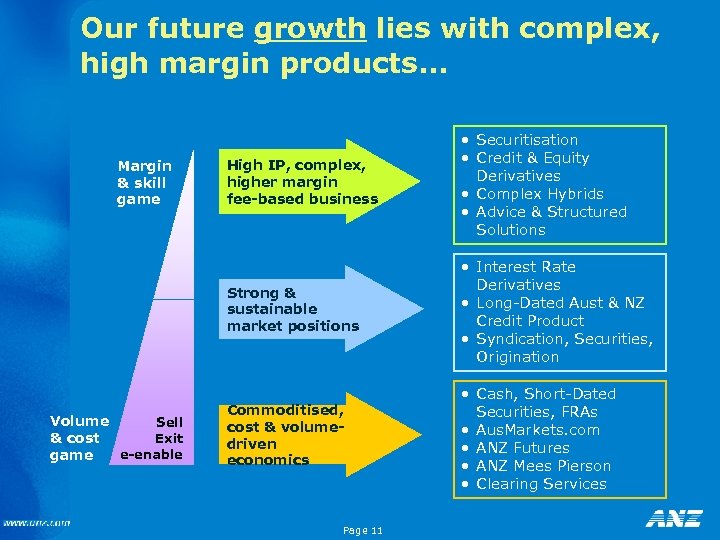

Our future growth lies with complex, high margin products. . . Volume Sell & cost Exit e-enable game High IP, complex, higher margin fee-based business Strong & sustainable market positions Margin & skill game • Securitisation • Credit & Equity Derivatives • Complex Hybrids • Advice & Structured Solutions • Interest Rate Derivatives • Long-Dated Aust & NZ Credit Product • Syndication, Securities, Origination Commoditised, cost & volumedriven economics • Cash, Short-Dated Securities, FRAs • Aus. Markets. com • ANZ Futures • ANZ Mees Pierson • Clearing Services Page 11

Our future growth lies with complex, high margin products. . . Volume Sell & cost Exit e-enable game High IP, complex, higher margin fee-based business Strong & sustainable market positions Margin & skill game • Securitisation • Credit & Equity Derivatives • Complex Hybrids • Advice & Structured Solutions • Interest Rate Derivatives • Long-Dated Aust & NZ Credit Product • Syndication, Securities, Origination Commoditised, cost & volumedriven economics • Cash, Short-Dated Securities, FRAs • Aus. Markets. com • ANZ Futures • ANZ Mees Pierson • Clearing Services Page 11

…such as securitisation. . . Increasing complexity • • • • • Principal finance/structured investment vehicles Corporate bonds/loans CBO/CLN Project finance CLO Margin loans Commercial loans Insurance premium loans Consumer loans Future flows Credit cards Trade receivables Auto loans & inventory leases Big ticket leasing (eg aircraft) Equipment loans/leases CMBS/credit lease Sub-prime mortgages Residential mortgages Page 12 Track Record • Securitisation Deal of the Year - Kingfisher 2000 -1 D (Insto Magazine) • 1 st Non-Credit Lease CMBS • 1 st & Only Term Trade Receivables Transaction • 1 st & Only Private Label Credit Card Transaction • 1 st Consumer Loans Transaction • 1 st & Only IPF Funding Loans • Global 1 st & Only Asset. Backed A-3 CP Program (almost 100% market share in A-2 & A-3)

…such as securitisation. . . Increasing complexity • • • • • Principal finance/structured investment vehicles Corporate bonds/loans CBO/CLN Project finance CLO Margin loans Commercial loans Insurance premium loans Consumer loans Future flows Credit cards Trade receivables Auto loans & inventory leases Big ticket leasing (eg aircraft) Equipment loans/leases CMBS/credit lease Sub-prime mortgages Residential mortgages Page 12 Track Record • Securitisation Deal of the Year - Kingfisher 2000 -1 D (Insto Magazine) • 1 st Non-Credit Lease CMBS • 1 st & Only Term Trade Receivables Transaction • 1 st & Only Private Label Credit Card Transaction • 1 st Consumer Loans Transaction • 1 st & Only IPF Funding Loans • Global 1 st & Only Asset. Backed A-3 CP Program (almost 100% market share in A-2 & A-3)

…and equity derivatives TE CR Growth Cycle IBU TR EA TE DIS Full suite of structured/customised High net worth product Corporate Investment & Stock Option Management t uc od pr box ll l Fu too Structured Investment PROTECT Investor Services Trading Business Basic Core Competencies (people, risk, systems, reputation) ty ui eq s d ant te is arr L w d on tion c s Se era ive n at ge riv de in ip d t sh e er tur duc o ad c Le tru pr s lth ea w e ag ty r xi ve le p m alu ise o r c ed v nch he s a ig rea r fr • HInc ate • Gre • Page 13

…and equity derivatives TE CR Growth Cycle IBU TR EA TE DIS Full suite of structured/customised High net worth product Corporate Investment & Stock Option Management t uc od pr box ll l Fu too Structured Investment PROTECT Investor Services Trading Business Basic Core Competencies (people, risk, systems, reputation) ty ui eq s d ant te is arr L w d on tion c s Se era ive n at ge riv de in ip d t sh e er tur duc o ad c Le tru pr s lth ea w e ag ty r xi ve le p m alu ise o r c ed v nch he s a ig rea r fr • HInc ate • Gre • Page 13

Summary • Our areas of strong & sustainable competitive advantage are the Australian & New Zealand Credit & Derivative product suite • Our growth will come from: – e-enabling, selling or exiting those businesses subject to commoditisation and scale economics – Growing our core businesses at 10%-15% compound, consolidating our top 3 status – A clear focus on select, high growth, high IP businesses, in which we have already built a strong pipeline Page 14 Goals • 15% + earnings growth • Global leadership in Australian and NZ credit & derivative products

Summary • Our areas of strong & sustainable competitive advantage are the Australian & New Zealand Credit & Derivative product suite • Our growth will come from: – e-enabling, selling or exiting those businesses subject to commoditisation and scale economics – Growing our core businesses at 10%-15% compound, consolidating our top 3 status – A clear focus on select, high growth, high IP businesses, in which we have already built a strong pipeline Page 14 Goals • 15% + earnings growth • Global leadership in Australian and NZ credit & derivative products

ANZ Corporate is a growth business • Strongly positioned: – 30%+ of earnings come from outside Australia – The leading corporate bank – top ranked in the eyes of customers – Excellent financial performance • Platforms for growth – Each business has strong growth potential – Leading edge intellectual capital to drive fee income • On track to double profit by 2004 Page 15

ANZ Corporate is a growth business • Strongly positioned: – 30%+ of earnings come from outside Australia – The leading corporate bank – top ranked in the eyes of customers – Excellent financial performance • Platforms for growth – Each business has strong growth potential – Leading edge intellectual capital to drive fee income • On track to double profit by 2004 Page 15

The material in this presentation is general background information about the Bank’s activities current at the date of the presentation. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate. For further information visit www. anz. com or contact Philip Gentry Head of Investor Relations ph: (613) 9273 4185 fax: (613) 9273 4091 Page 16 e-mail: gentryp@anz. com

The material in this presentation is general background information about the Bank’s activities current at the date of the presentation. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate. For further information visit www. anz. com or contact Philip Gentry Head of Investor Relations ph: (613) 9273 4185 fax: (613) 9273 4091 Page 16 e-mail: gentryp@anz. com

Copy of presentation available on www. anz. com Page 17

Copy of presentation available on www. anz. com Page 17