ef7180af690c2e68a0e13c15c079ed4f.ppt

- Количество слайдов: 22

What are the efficiency gains of bancassurance? A two-side analysis: the banking and the insurance standpoint Emerging Scholars in Banking and Finance Contemporary Issues in Financial Markets and Institutions Cass Business School, London 9 th December 2009 Franco Fiordelisi, University of Roma Tre, Bangor Business School Ornella Ricci, University of Roma Tre oricci@uniroma 3. it

Agenda • • Introduction and motivations Literature Review Methodology Data and variables ▫ banking side ▫ insurance side • Results ▫ banking side ▫ insurance side • Conclusions

Introduction and motivations (1) • The development of bancassurance is the result of many factors… ▫ Regulatory Framework EU Second Banking Directive, 1989 USA Gramm-Leach-Bliley Act, 1999 ▫ Economic rationales Drop in the interest margin from traditional banking activity Development of life products o progressive ageing of population in all developed countries o decrease in welfare state protection offered by governments Existence of some similarities and complementaries between the banking and the insurance activities

Introduction and motivations (2) • Most studies dealing with bancassurance have only been descriptive in nature (Chen et al. 2008) • Empirical analyses focus on the risk diversification hypothesis (Boyd et al. 1993, Genetay and Molyneux 1998, Laderman 2000, Estrella 2001, Fields et al. 2005, 2008, Chen et al. 2006, Nurullah and Staikouras 2008), while cost and revenue synergies resulting in efficiency gains are still a poorly investigated issue • The aim of this paper is to assess if bancassurance results in efficiency gains from both the banking and the insurance sides, answering the following research questions: 1) Are banks engaged in the insurance business more cost and profit efficient than their competitors specialized in traditional and investment banking? 2) Are bancassurance companies more cost and profit efficient than independent companies operating in the life business? 3) Which model of bancassurance reaches the best performance?

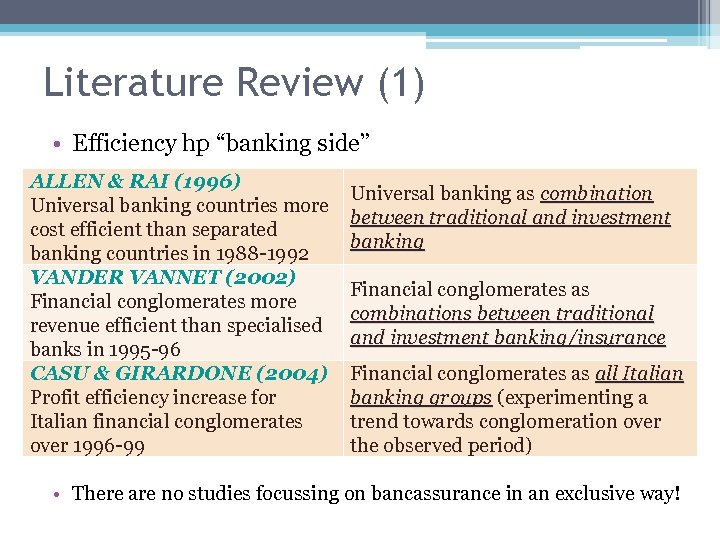

Literature Review (1) • Efficiency hp “banking side” ALLEN & RAI (1996) Universal banking countries more cost efficient than separated banking countries in 1988 -1992 VANDER VANNET (2002) Financial conglomerates more revenue efficient than specialised banks in 1995 -96 CASU & GIRARDONE (2004) Profit efficiency increase for Italian financial conglomerates over 1996 -99 Universal banking as combination between traditional and investment banking Financial conglomerates as combinations between traditional and investment banking/insurance Financial conglomerates as all Italian banking groups (experimenting a trend towards conglomeration over the observed period) • There are no studies focussing on bancassurance in an exclusive way!

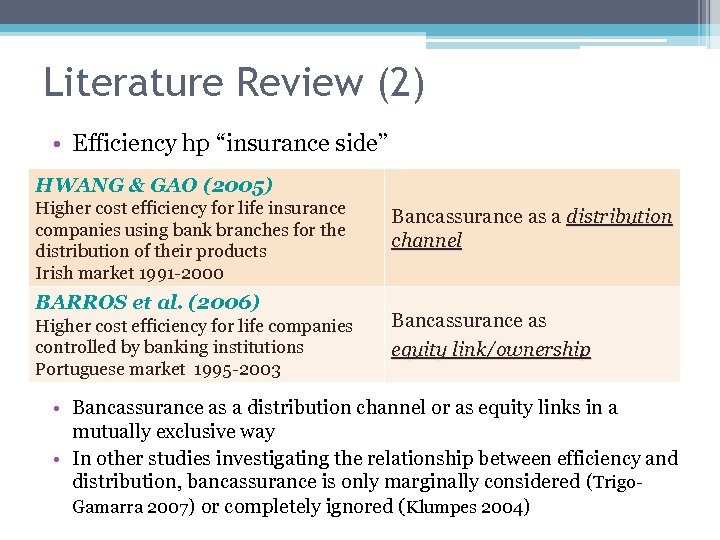

Literature Review (2) • Efficiency hp “insurance side” HWANG & GAO (2005) Higher cost efficiency for life insurance companies using bank branches for the distribution of their products Irish market 1991 -2000 BARROS et al. (2006) Higher cost efficiency for life companies controlled by banking institutions Portuguese market 1995 -2003 Bancassurance as a distribution channel Bancassurance as equity link/ownership • Bancassurance as a distribution channel or as equity links in a mutually exclusive way • In other studies investigating the relationship between efficiency and distribution, bancassurance is only marginally considered (Trigo. Gamarra 2007) or completely ignored (Klumpes 2004)

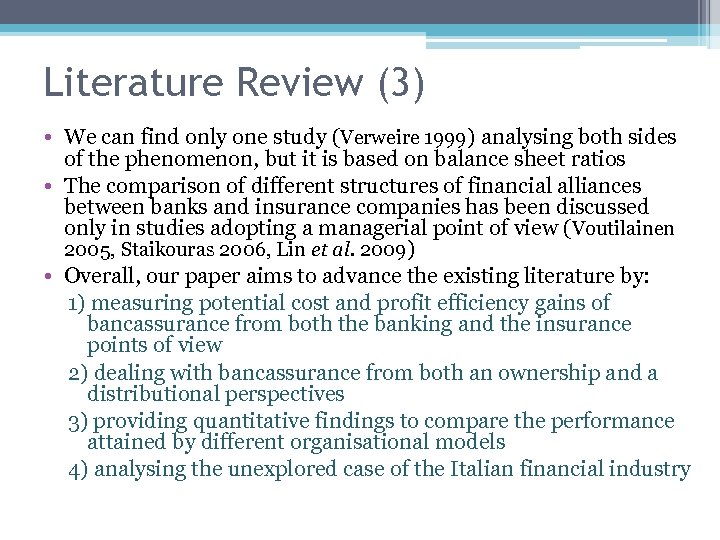

Literature Review (3) • We can find only one study (Verweire 1999) analysing both sides of the phenomenon, but it is based on balance sheet ratios • The comparison of different structures of financial alliances between banks and insurance companies has been discussed only in studies adopting a managerial point of view (Voutilainen 2005, Staikouras 2006, Lin et al. 2009) • Overall, our paper aims to advance the existing literature by: 1) measuring potential cost and profit efficiency gains of bancassurance from both the banking and the insurance points of view 2) dealing with bancassurance from both an ownership and a distributional perspectives 3) providing quantitative findings to compare the performance attained by different organisational models 4) analysing the unexplored case of the Italian financial industry

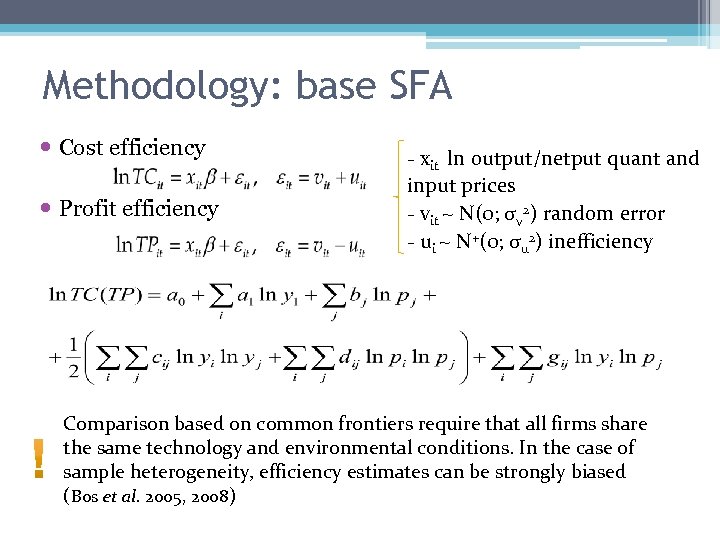

Methodology: base SFA Cost efficiency Profit efficiency - xit ln output/netput quant and input prices - vit ~ N(0; σv 2) random error - ui ~ N+(0; σu 2) inefficiency Comparison based on common frontiers require that all firms share the same technology and environmental conditions. In the case of sample heterogeneity, efficiency estimates can be strongly biased (Bos et al. 2005, 2008)

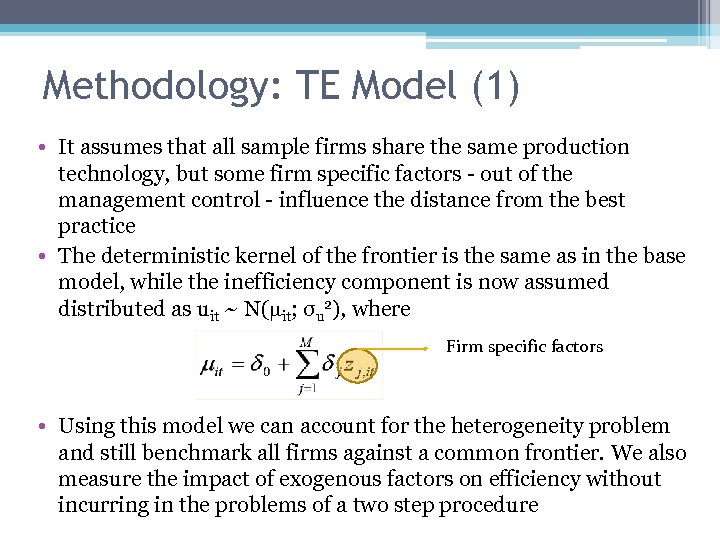

Methodology: TE Model (1) • It assumes that all sample firms share the same production technology, but some firm specific factors - out of the management control - influence the distance from the best practice • The deterministic kernel of the frontier is the same as in the base model, while the inefficiency component is now assumed distributed as uit ~ N( it; σu 2), where Firm specific factors • Using this model we can account for the heterogeneity problem and still benchmark all firms against a common frontier. We also measure the impact of exogenous factors on efficiency without incurring in the problems of a two step procedure

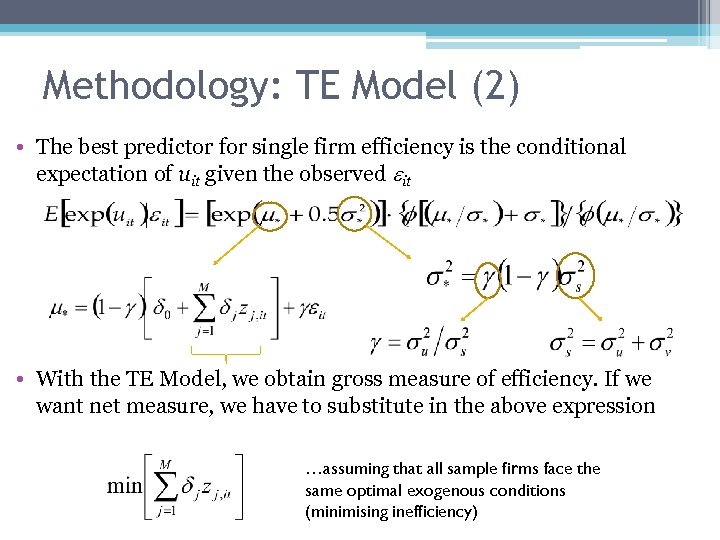

Methodology: TE Model (2) • The best predictor for single firm efficiency is the conditional expectation of uit given the observed it • With the TE Model, we obtain gross measure of efficiency. If we want net measure, we have to substitute in the above expression …assuming that all sample firms face the same optimal exogenous conditions (minimising inefficiency)

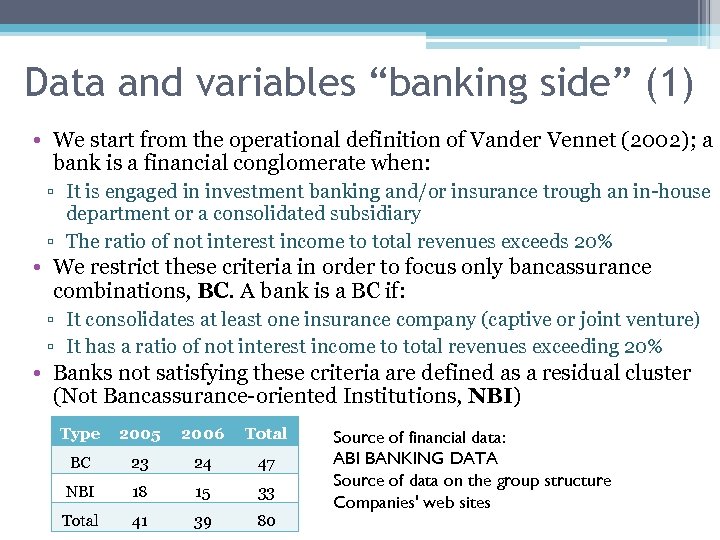

Data and variables “banking side” (1) • We start from the operational definition of Vander Vennet (2002); a bank is a financial conglomerate when: ▫ It is engaged in investment banking and/or insurance trough an in-house department or a consolidated subsidiary ▫ The ratio of not interest income to total revenues exceeds 20% • We restrict these criteria in order to focus only bancassurance combinations, BC. A bank is a BC if: ▫ It consolidates at least one insurance company (captive or joint venture) ▫ It has a ratio of not interest income to total revenues exceeding 20% • Banks not satisfying these criteria are defined as a residual cluster (Not Bancassurance-oriented Institutions, NBI) Type 2005 2006 Total BC 23 24 47 NBI 18 15 33 Total 41 39 80 Source of financial data: ABI BANKING DATA Source of data on the group structure Companies' web sites

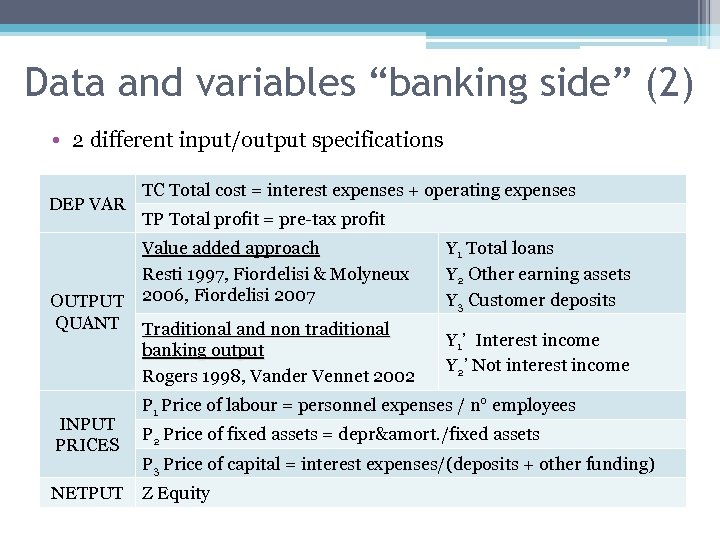

Data and variables “banking side” (2) • 2 different input/output specifications DEP VAR OUTPUT QUANT INPUT PRICES NETPUT TC Total cost = interest expenses + operating expenses TP Total profit = pre-tax profit Value added approach Resti 1997, Fiordelisi & Molyneux 2006, Fiordelisi 2007 Y 1 Total loans Y 2 Other earning assets Y 3 Customer deposits Traditional and non traditional banking output Rogers 1998, Vander Vennet 2002 Y 1’ Interest income Y 2’ Not interest income P 1 Price of labour = personnel expenses / n° employees P 2 Price of fixed assets = depr&amort. /fixed assets P 3 Price of capital = interest expenses/(deposits + other funding) Z Equity

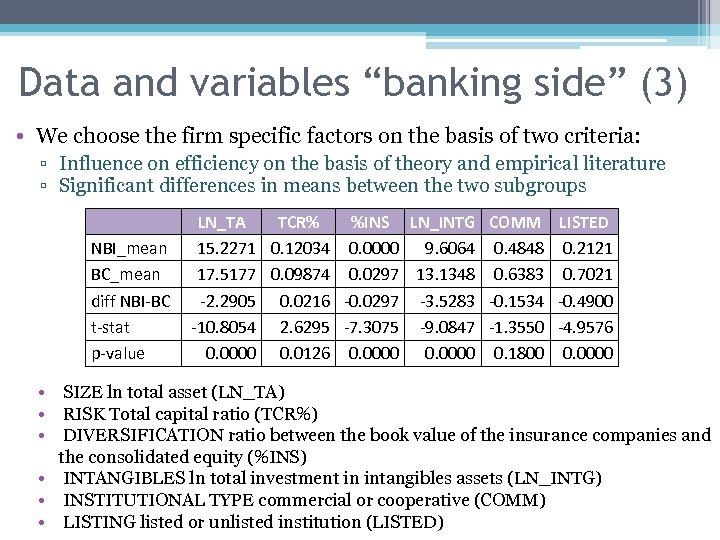

Data and variables “banking side” (3) • We choose the firm specific factors on the basis of two criteria: ▫ Influence on efficiency on the basis of theory and empirical literature ▫ Significant differences in means between the two subgroups NBI_mean BC_mean diff NBI-BC t-stat p-value LN_TA TCR% %INS LN_INTG COMM LISTED 15. 2271 0. 12034 0. 0000 9. 6064 0. 4848 0. 2121 17. 5177 0. 09874 0. 0297 13. 1348 0. 6383 0. 7021 -2. 2905 0. 0216 -0. 0297 -3. 5283 -0. 1534 -0. 4900 -10. 8054 2. 6295 -7. 3075 -9. 0847 -1. 3550 -4. 9576 0. 0000 0. 0126 0. 0000 0. 1800 0. 0000 • SIZE ln total asset (LN_TA) • RISK Total capital ratio (TCR%) • DIVERSIFICATION ratio between the book value of the insurance companies and the consolidated equity (%INS) • INTANGIBLES ln total investment in intangibles assets (LN_INTG) • INSTITUTIONAL TYPE commercial or cooperative (COMM) • LISTING listed or unlisted institution (LISTED)

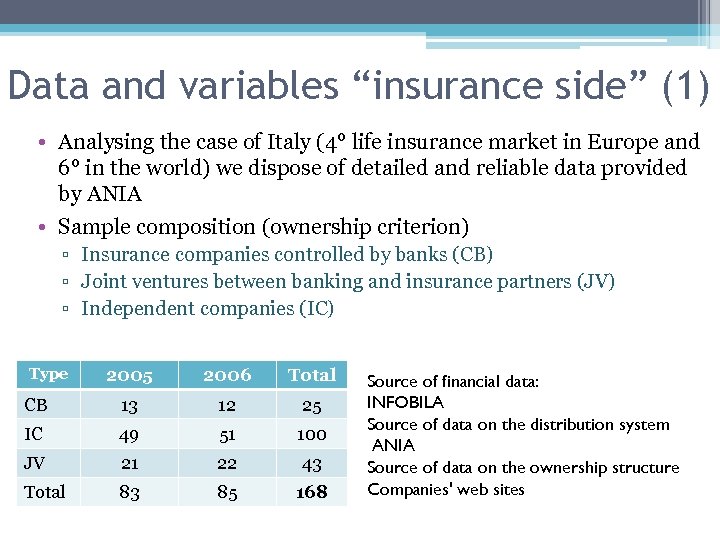

Data and variables “insurance side” (1) • Analysing the case of Italy (4° life insurance market in Europe and 6° in the world) we dispose of detailed and reliable data provided by ANIA • Sample composition (ownership criterion) ▫ Insurance companies controlled by banks (CB) ▫ Joint ventures between banking and insurance partners (JV) ▫ Independent companies (IC) Type 2005 2006 Total CB 13 12 25 IC 49 51 100 JV 21 22 43 Total 83 85 168 Source of financial data: INFOBILA Source of data on the distribution system ANIA Source of data on the ownership structure Companies' web sites

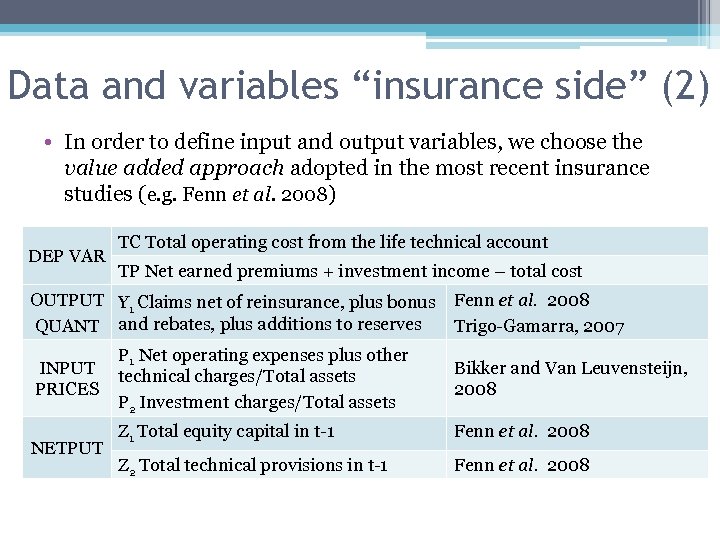

Data and variables “insurance side” (2) • In order to define input and output variables, we choose the value added approach adopted in the most recent insurance studies (e. g. Fenn et al. 2008) DEP VAR TC Total operating cost from the life technical account TP Net earned premiums + investment income – total cost OUTPUT Y 1 Claims net of reinsurance, plus bonus QUANT and rebates, plus additions to reserves INPUT PRICES NETPUT Fenn et al. 2008 Trigo-Gamarra, 2007 P 1 Net operating expenses plus other technical charges/Total assets P 2 Investment charges/Total assets Bikker and Van Leuvensteijn, 2008 Z 1 Total equity capital in t-1 Fenn et al. 2008 Z 2 Total technical provisions in t-1 Fenn et al. 2008

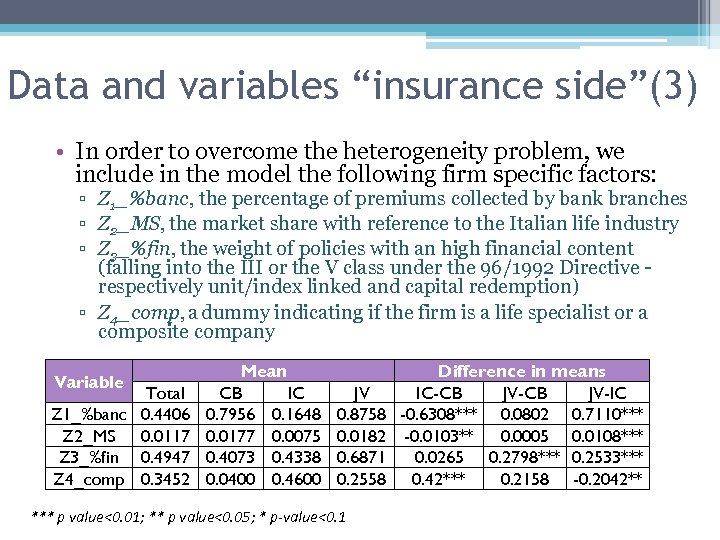

Data and variables “insurance side”(3) • In order to overcome the heterogeneity problem, we include in the model the following firm specific factors: ▫ Z 1_%banc, the percentage of premiums collected by bank branches ▫ Z 2_MS, the market share with reference to the Italian life industry ▫ Z 3_%fin, the weight of policies with an high financial content (falling into the III or the V class under the 96/1992 Directive respectively unit/index linked and capital redemption) ▫ Z 4_comp, a dummy indicating if the firm is a life specialist or a composite company Variable Total Z 1_%banc 0. 4406 Z 2_MS 0. 0117 Z 3_%fin 0. 4947 Z 4_comp 0. 3452 Mean CB IC 0. 7956 0. 1648 0. 0177 0. 0075 0. 4073 0. 4338 0. 0400 0. 4600 JV 0. 8758 0. 0182 0. 6871 0. 2558 *** p value<0. 01; ** p value<0. 05; * p-value<0. 1 Difference in means IC-CB JV-IC -0. 6308*** 0. 0802 0. 7110*** -0. 0103** 0. 0005 0. 0108*** 0. 0265 0. 2798*** 0. 2533*** 0. 42*** 0. 2158 -0. 2042**

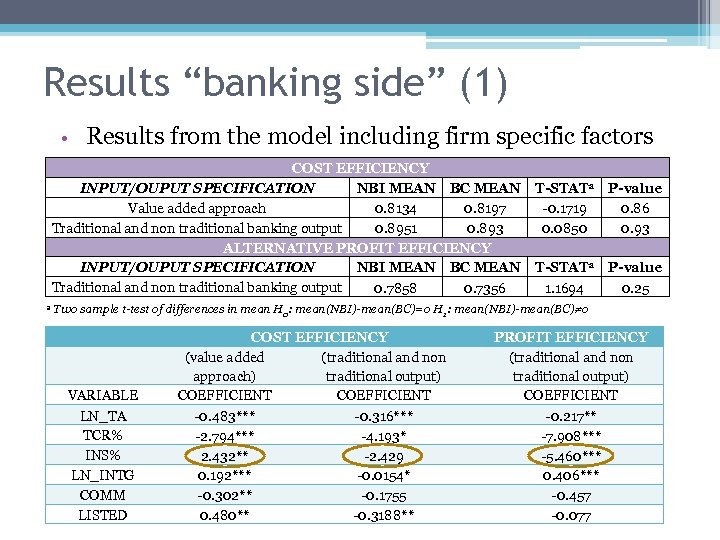

Results “banking side” (1) • Results from the model including firm specific factors COST EFFICIENCY INPUT/OUPUT SPECIFICATION NBI MEAN BC MEAN Value added approach 0. 8134 0. 8197 Traditional and non traditional banking output 0. 8951 0. 893 ALTERNATIVE PROFIT EFFICIENCY INPUT/OUPUT SPECIFICATION NBI MEAN BC MEAN Traditional and non traditional banking output 0. 7858 0. 7356 a T-STATa -0. 1719 0. 0850 P-value 0. 86 0. 93 T-STATa 1. 1694 P-value 0. 25 Two sample t-test of differences in mean H 0: mean(NBI)-mean(BC)=0 H 1: mean(NBI)-mean(BC) 0 VARIABLE LN_TA TCR% INS% LN_INTG COMM LISTED COST EFFICIENCY (value added (traditional and non approach) traditional output) COEFFICIENT -0. 483*** -0. 316*** -2. 794*** -4. 193* 2. 432** -2. 429 0. 192*** -0. 0154* -0. 302** -0. 1755 0. 480** -0. 3188** PROFIT EFFICIENCY (traditional and non traditional output) COEFFICIENT -0. 217** -7. 908*** -5. 460*** 0. 406*** -0. 457 -0. 077

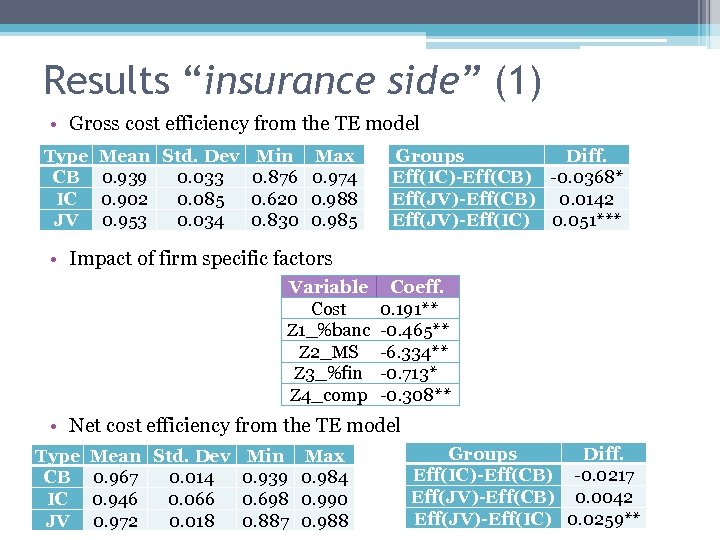

Results “insurance side” (1) • Gross cost efficiency from the TE model Type CB IC JV Mean Std. Dev Min Max 0. 939 0. 033 0. 876 0. 974 0. 902 0. 085 0. 620 0. 988 0. 953 0. 034 0. 830 0. 985 Groups Diff. Eff(IC)-Eff(CB) -0. 0368* Eff(JV)-Eff(CB) 0. 0142 Eff(JV)-Eff(IC) 0. 051*** • Impact of firm specific factors Variable Cost Z 1_%banc Z 2_MS Z 3_%fin Z 4_comp Coeff. 0. 191** -0. 465** -6. 334** -0. 713* -0. 308** • Net cost efficiency from the TE model Type CB IC JV Mean Std. Dev Min Max 0. 967 0. 014 0. 939 0. 984 0. 946 0. 066 0. 698 0. 990 0. 972 0. 018 0. 887 0. 988 Groups Diff. Eff(IC)-Eff(CB) -0. 0217 Eff(JV)-Eff(CB) 0. 0042 Eff(JV)-Eff(IC) 0. 0259**

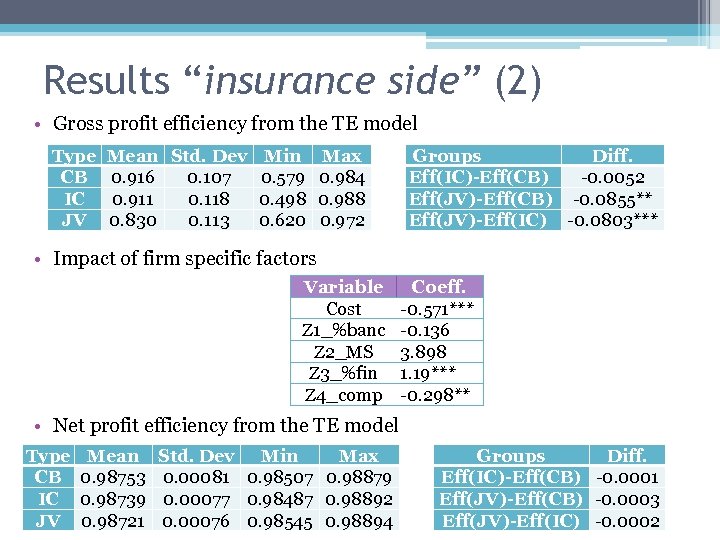

Results “insurance side” (2) • Gross profit efficiency from the TE model Type CB IC JV Mean Std. Dev Min Max 0. 916 0. 107 0. 579 0. 984 0. 911 0. 118 0. 498 0. 988 0. 830 0. 113 0. 620 0. 972 Groups Diff. Eff(IC)-Eff(CB) -0. 0052 Eff(JV)-Eff(CB) -0. 0855** Eff(JV)-Eff(IC) -0. 0803*** • Impact of firm specific factors Variable Cost Z 1_%banc Z 2_MS Z 3_%fin Z 4_comp Coeff. -0. 571*** -0. 136 3. 898 1. 19*** -0. 298** • Net profit efficiency from the TE model Type CB IC JV Mean 0. 98753 0. 98739 0. 98721 Std. Dev Min Max 0. 00081 0. 98507 0. 98879 0. 00077 0. 98487 0. 98892 0. 00076 0. 98545 0. 98894 Groups Diff. Eff(IC)-Eff(CB) -0. 0001 Eff(JV)-Eff(CB) -0. 0003 Eff(JV)-Eff(IC) -0. 0002

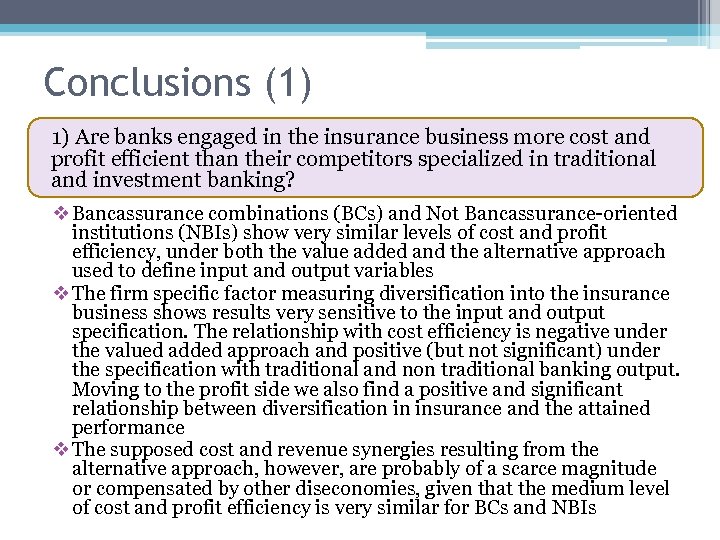

Conclusions (1) 1) Are banks engaged in the insurance business more cost and profit efficient than their competitors specialized in traditional and investment banking? v Bancassurance combinations (BCs) and Not Bancassurance-oriented institutions (NBIs) show very similar levels of cost and profit efficiency, under both the value added and the alternative approach used to define input and output variables v The firm specific factor measuring diversification into the insurance business shows results very sensitive to the input and output specification. The relationship with cost efficiency is negative under the valued added approach and positive (but not significant) under the specification with traditional and non traditional banking output. Moving to the profit side we also find a positive and significant relationship between diversification in insurance and the attained performance v The supposed cost and revenue synergies resulting from the alternative approach, however, are probably of a scarce magnitude or compensated by other diseconomies, given that the medium level of cost and profit efficiency is very similar for BCs and NBIs

Conclusions (2) 2) Are bancassurance companies more cost and profit efficient than independent companies operating in the life business? v Considering gross efficiency scores, we find a significant cost advantage for bancassurance companies. When we observe net scores the advantage of CBs over ICs disappears while that in favor of JVs is strongly reduced, revealing that the bancassurance overperformance is mainly explained by some positive features, such as the share of premiums collected by bank branches and the proportion of high financial content policies in the business mix, that are not exclusive of insurance companies wholly or jointly owned by banks v On the profit side we do not find any strong evidence in favor of bancassurance: the relationship between the performance attained and the share of premiums collected by bank branches is still positive, but not statistically significant. The percentage of product with an high financial content is negatively related to profit efficiency in a significant way, revealing that these policies are less costly to manage than protection insurance but less profitable

Conclusions (3) 3) Which model of bancassurance reaches the best performance? v Results seem to be in favor of JVs for the cost side and present a substantial parity among sample firms on the profit side v The convenience of bancassurance as a distribution channel is relevant and consolidated while the success of insurance products with an high financial content is more volatile and strictly dependent on current market trends, requiring a continuous revision of the business mix v So the existence of ownership links is not necessarily the best strategy for the realization of cost and revenue synergies between the banking and the insurance activities and the subjects involved should consider also the alternative of more flexible and reversible forms of cooperation, such as cross selling agreements and non equity strategic alliances v The identification of the best bancassurance model probably depends also on the characteristics of the subjects involved and undoubtedly deserves further investigation

ef7180af690c2e68a0e13c15c079ed4f.ppt