baf84c4232eaa57e0533c47c924bd2c4.ppt

- Количество слайдов: 37

What are Thailand’s macroeconomic data? … and Where are they? Somprawin Manprasert, Ph. D. Faculty of Economics Chulalongkorn University Somprawin. M@chula. ac. th

What are Thailand’s macroeconomic data? … and Where are they? Somprawin Manprasert, Ph. D. Faculty of Economics Chulalongkorn University Somprawin. M@chula. ac. th

Why are macroeconomic data so important?

Why are macroeconomic data so important?

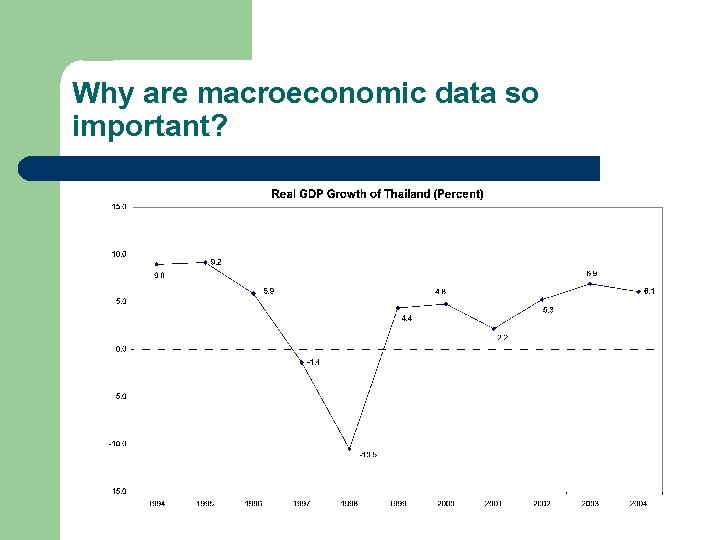

Why are macroeconomic data so important? There are uncertainties. The economy can be good or bad.

Why are macroeconomic data so important? There are uncertainties. The economy can be good or bad.

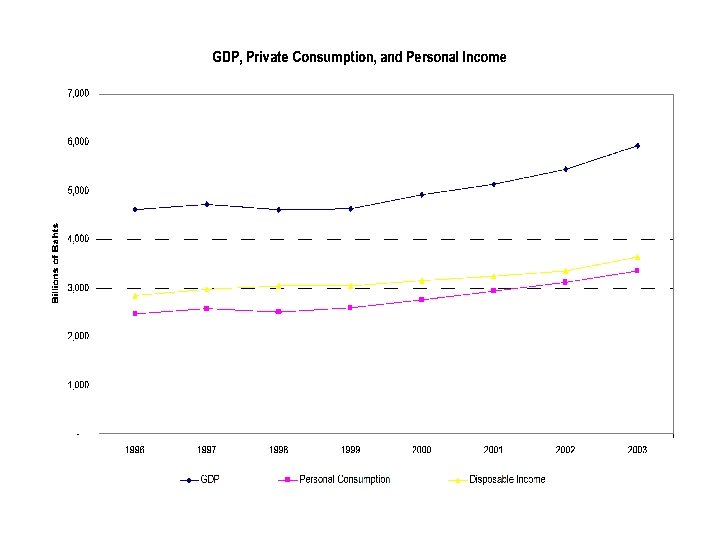

Why are macroeconomic data so important? Its effects seem to be far from us, but in fact it could affect your wellbeing and your future income.

Why are macroeconomic data so important? Its effects seem to be far from us, but in fact it could affect your wellbeing and your future income.

Why are macroeconomic data so important? l The bottom-line is we need to know what are consequences of a good economy, and what are consequences of a bad one. l We need to know ‘what is going on out there’ and ‘how could it affect your life’.

Why are macroeconomic data so important? l The bottom-line is we need to know what are consequences of a good economy, and what are consequences of a bad one. l We need to know ‘what is going on out there’ and ‘how could it affect your life’.

From Macroeconomic Condition To Anticipating Policy Reaction l In addition, whenever there is an undesired economic condition, the government usually intervenes. l Consequently, not only can the economic condition affect you, but the government’s counter-problem policies (such as interest rate hike) could also influence your decision.

From Macroeconomic Condition To Anticipating Policy Reaction l In addition, whenever there is an undesired economic condition, the government usually intervenes. l Consequently, not only can the economic condition affect you, but the government’s counter-problem policies (such as interest rate hike) could also influence your decision.

What are characteristics of a good economic practitioner? People who understand: 1. macroeconomic condition, 2. its consequences, and 3. are able to anticipate the government’s stabilization policy will be better off during the course of business cycle.

What are characteristics of a good economic practitioner? People who understand: 1. macroeconomic condition, 2. its consequences, and 3. are able to anticipate the government’s stabilization policy will be better off during the course of business cycle.

Objective l To know macroeconomic condition of a country, we must first understand economic data. l In this class, we will learn 1. What are macroeconomic data? 2. Where could we find those data in Thailand?

Objective l To know macroeconomic condition of a country, we must first understand economic data. l In this class, we will learn 1. What are macroeconomic data? 2. Where could we find those data in Thailand?

Economic Data and Economic Theory l Economics is a social science. Therefore, its methodology is in line with other sciences, such as physics, chemistry, and etc. l Scientists observe surrounding nature and try to develop a theory that could explains those natural behavior. l Like all other sciences, economic theories have been motivated by observation. Rather than nature, economists try to explain human behavior.

Economic Data and Economic Theory l Economics is a social science. Therefore, its methodology is in line with other sciences, such as physics, chemistry, and etc. l Scientists observe surrounding nature and try to develop a theory that could explains those natural behavior. l Like all other sciences, economic theories have been motivated by observation. Rather than nature, economists try to explain human behavior.

Why do we have to study ‘historical’ data anyway? l Leading theorists observed human’s economic behavior and put forward undeniable economic theories (such as Alfred Marshall, John Nash, and Robert Lucas). Data Observation Question Finding Answer Economic Model l In reverse, a good economic practitioner needs to balance his/her knowledge between economic theory and economic reality. Data Economic Theory

Why do we have to study ‘historical’ data anyway? l Leading theorists observed human’s economic behavior and put forward undeniable economic theories (such as Alfred Marshall, John Nash, and Robert Lucas). Data Observation Question Finding Answer Economic Model l In reverse, a good economic practitioner needs to balance his/her knowledge between economic theory and economic reality. Data Economic Theory

Outline of the Lecture The National Accounts System 1. • • 2. Structure of the data Meaning and interpretation Macroeconomic data sources in Thailand

Outline of the Lecture The National Accounts System 1. • • 2. Structure of the data Meaning and interpretation Macroeconomic data sources in Thailand

The National Accounts System l The National Accounts System is the most comprehensive macroeconomic data of a country, including all economic activities and transactions. l The system has been standardized by the UN – The United Nations System of National Accounting (UN SNA)

The National Accounts System l The National Accounts System is the most comprehensive macroeconomic data of a country, including all economic activities and transactions. l The system has been standardized by the UN – The United Nations System of National Accounting (UN SNA)

Components of the UN System of National Accounting 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

Components of the UN System of National Accounting 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

Implication of the System l The System of National Accounting is a country’s economic map, which consists of Real Activities and Financial Activities. l Real Sector contains economic activities that relate to production, income, and expenses, such as investment and consumption. l Financial Sector is an intermediary that facilitates financial transactions among economic agents, such as banking. l First two represent real activities, while the latter three display financial activities.

Implication of the System l The System of National Accounting is a country’s economic map, which consists of Real Activities and Financial Activities. l Real Sector contains economic activities that relate to production, income, and expenses, such as investment and consumption. l Financial Sector is an intermediary that facilitates financial transactions among economic agents, such as banking. l First two represent real activities, while the latter three display financial activities.

Let’s look at the first component… the National Accounts 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

Let’s look at the first component… the National Accounts 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

1. National Accounts l The National Accounts is a component of the System of National Accounting. l The National Accounts depicts 1. 2. 3. Gross output of the country National income of the country Expenses of the country Gross Output Expenditure National Income

1. National Accounts l The National Accounts is a component of the System of National Accounting. l The National Accounts depicts 1. 2. 3. Gross output of the country National income of the country Expenses of the country Gross Output Expenditure National Income

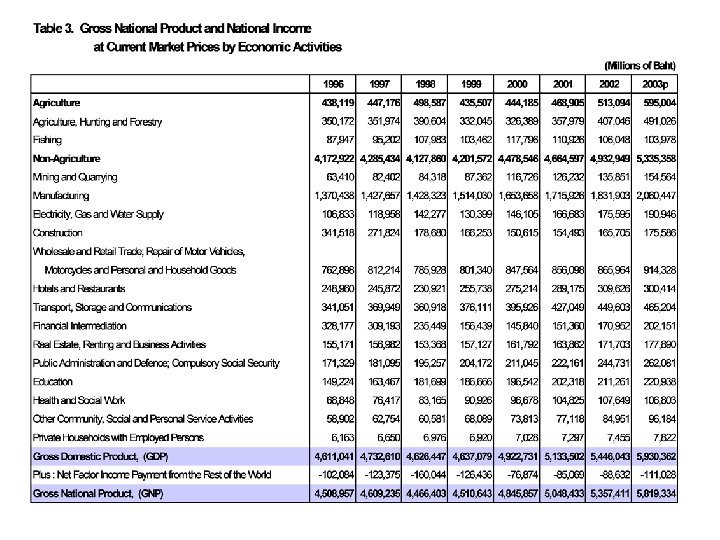

Example 1 - What exactly is the GDP? l Consider “Table 3” from the National Accounts of Thailand. l What do we see when we look at the GDP? l Why do economists (or, anyone) always mention about the GDP?

Example 1 - What exactly is the GDP? l Consider “Table 3” from the National Accounts of Thailand. l What do we see when we look at the GDP? l Why do economists (or, anyone) always mention about the GDP?

Example 1 - What exactly is the GDP? l What do we see when we look at the GDP? # Gross Domestic Product (GDP) is the total value of all products produced within the country’s territory. l Why do economists (or, anyone) always mention about the GDP? # If we believe in the statement ‘the more, the better’, the GDP represents the producing capacity of the country.

Example 1 - What exactly is the GDP? l What do we see when we look at the GDP? # Gross Domestic Product (GDP) is the total value of all products produced within the country’s territory. l Why do economists (or, anyone) always mention about the GDP? # If we believe in the statement ‘the more, the better’, the GDP represents the producing capacity of the country.

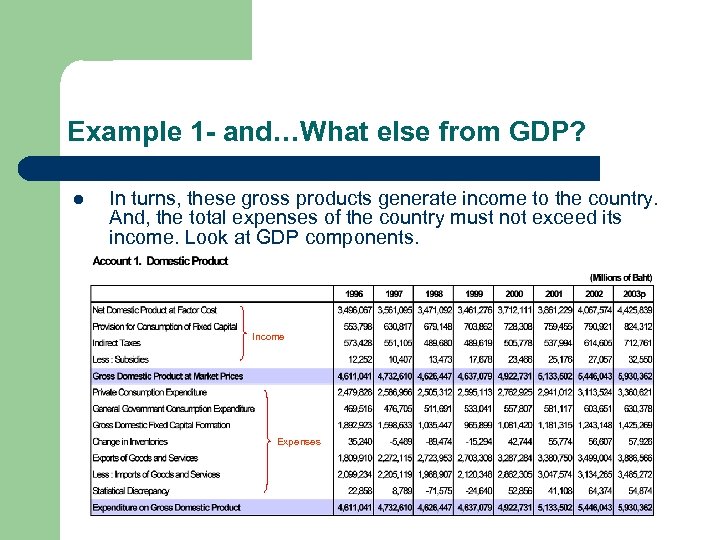

Example 1 - and…What else from GDP? l In turns, these gross products generate income to the country. And, the total expenses of the country must not exceed its income. Look at GDP components. Income Expenses

Example 1 - and…What else from GDP? l In turns, these gross products generate income to the country. And, the total expenses of the country must not exceed its income. Look at GDP components. Income Expenses

Example 1 - What exactly is the GDP? …to sum up l In accounting, these 3 things must be equal: Value of the Gross Domestic Product 2. Total factor payment to primary inputs 3. Total expenditure of the country 1.

Example 1 - What exactly is the GDP? …to sum up l In accounting, these 3 things must be equal: Value of the Gross Domestic Product 2. Total factor payment to primary inputs 3. Total expenditure of the country 1.

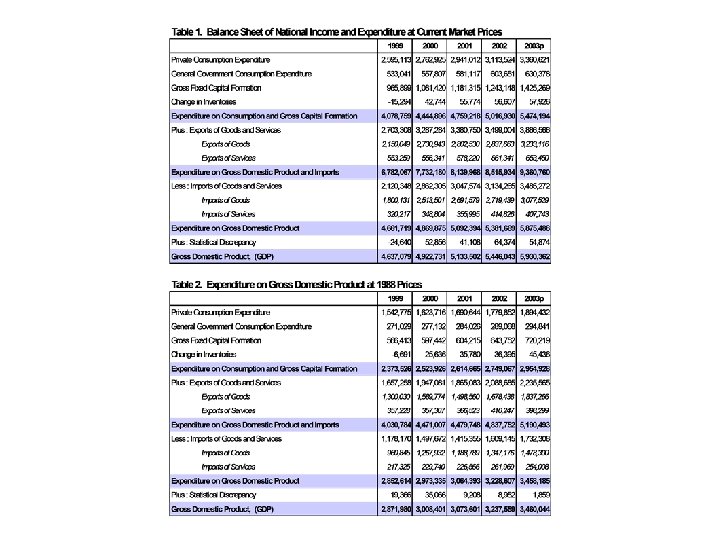

Example 2 Current Prices vs. Constant Prices l Consider ‘Summary Table 1 -2’ from the National Accounts

Example 2 Current Prices vs. Constant Prices l Consider ‘Summary Table 1 -2’ from the National Accounts

Example 2 Current Prices vs. Constant Prices l What is the difference between ‘current market prices’ and ‘constant at 1988 prices’? l Value = Price x Quantity l In each year, both prices and quantity change. Therefore, if we want to examine only how the country’s producing capacity change over time, we need to fix prices. l In practice, we measure each year production value in terms of the base year. In this case, all years are measured in 1988 prices. When each year is measure in 1988 prices, its value represents quantity.

Example 2 Current Prices vs. Constant Prices l What is the difference between ‘current market prices’ and ‘constant at 1988 prices’? l Value = Price x Quantity l In each year, both prices and quantity change. Therefore, if we want to examine only how the country’s producing capacity change over time, we need to fix prices. l In practice, we measure each year production value in terms of the base year. In this case, all years are measured in 1988 prices. When each year is measure in 1988 prices, its value represents quantity.

Other Accounts l GDP by sector l Private consumption expenditure in details l Investment by type of goods l Others

Other Accounts l GDP by sector l Private consumption expenditure in details l Investment by type of goods l Others

Now… Let’s move on. 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

Now… Let’s move on. 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

2. Input-Output Table – What is it? l It is what it’s named ! l Information from the table tells us: 1. The economy’s output structure: What kind of goods are we producing? And, how many are they? 2. The economy’s structure of production: To producing these output, what kind of inputs do we use? And, how many do we need? …for the whole economy! l Think of the economy as a factory.

2. Input-Output Table – What is it? l It is what it’s named ! l Information from the table tells us: 1. The economy’s output structure: What kind of goods are we producing? And, how many are they? 2. The economy’s structure of production: To producing these output, what kind of inputs do we use? And, how many do we need? …for the whole economy! l Think of the economy as a factory.

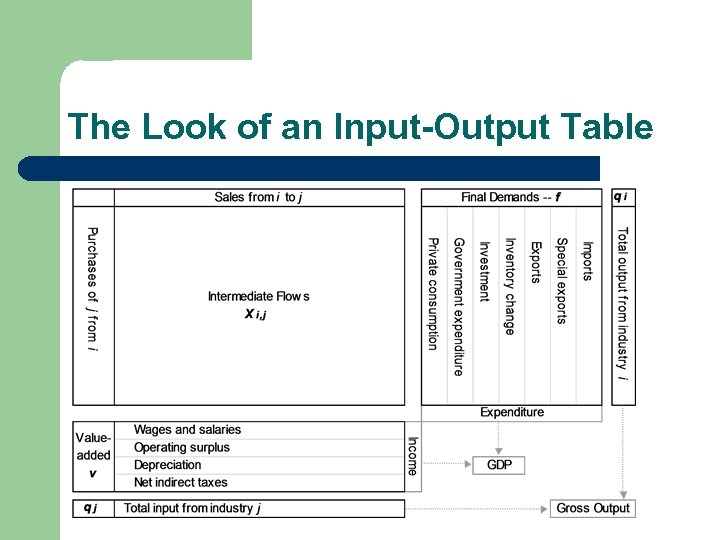

The Look of an Input-Output Table

The Look of an Input-Output Table

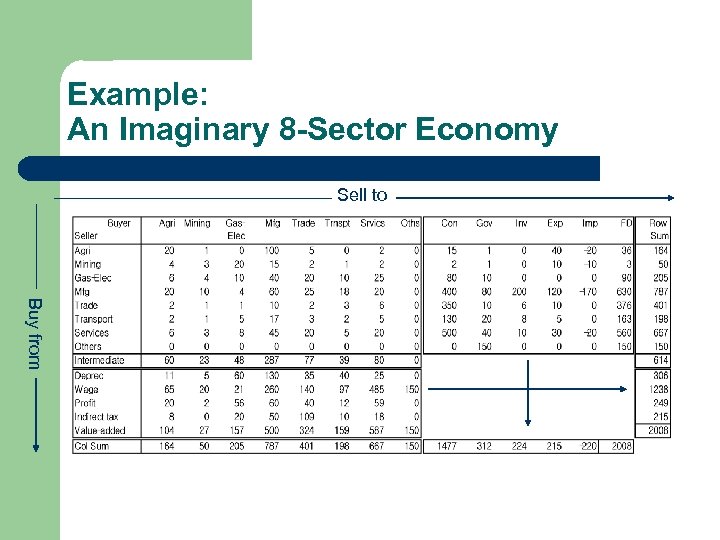

Example: An Imaginary 8 -Sector Economy Sell to Buy from

Example: An Imaginary 8 -Sector Economy Sell to Buy from

The third component is… 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

The third component is… 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

3. Flow-of-Funds Accounts l Look at the table…what information does the table show us? l The Flow-of-Funds Accounts show… the relationship between national savings and investment among economic agents in the country. Those economic agents include Household, Government, Business firms, and other countries. Savings Source of Funds l Investment Use of Funds The Fo. F Accounts also display types of financial intermediaries that facilitate transfers between savings and investment.

3. Flow-of-Funds Accounts l Look at the table…what information does the table show us? l The Flow-of-Funds Accounts show… the relationship between national savings and investment among economic agents in the country. Those economic agents include Household, Government, Business firms, and other countries. Savings Source of Funds l Investment Use of Funds The Fo. F Accounts also display types of financial intermediaries that facilitate transfers between savings and investment.

Look ‘Outside’ for the forth component 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

Look ‘Outside’ for the forth component 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

4. Balance of Payments l Look at the table…what information does the table show us? l The Bo. P displays the country’s trade and financial transactions with the rest of the world over a particular period of time, usually one year. l Two main parts in the Bo. P 1. Current Account – – 2. It shows income and expenditure from trading goods and services with the rest of the world. Example, export of cars, income from tourists. Capital and Financial Account – – It records financial flows between the country with the rest of the world. Example, government external loans.

4. Balance of Payments l Look at the table…what information does the table show us? l The Bo. P displays the country’s trade and financial transactions with the rest of the world over a particular period of time, usually one year. l Two main parts in the Bo. P 1. Current Account – – 2. It shows income and expenditure from trading goods and services with the rest of the world. Example, export of cars, income from tourists. Capital and Financial Account – – It records financial flows between the country with the rest of the world. Example, government external loans.

At Last…. 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

At Last…. 1. National Accounts 2. Input-Output Tables 3. Flow-of-Fund Accounts 4. Balance of Payments 5. National Balance Sheet (or, National Wealth)

5. National Balance Sheet l The National Balance Sheet reveals the value of total assets and liabilities of the country at a particular time. l There are 2 types of assets reported in the National Balance Sheet: 1. 2. l Tangible Assets: land, buildings, machinery, etc. Intangible Assets: Financial instruments, bonds, patents, etc. In addition to the aggregate report, the account also includes balance sheets for detail sectors, such as financial sector, producing sector, household, and government.

5. National Balance Sheet l The National Balance Sheet reveals the value of total assets and liabilities of the country at a particular time. l There are 2 types of assets reported in the National Balance Sheet: 1. 2. l Tangible Assets: land, buildings, machinery, etc. Intangible Assets: Financial instruments, bonds, patents, etc. In addition to the aggregate report, the account also includes balance sheets for detail sectors, such as financial sector, producing sector, household, and government.

Where do we find economic data for Thailand? l The National Economic and Social Development Board (www. nesdb. go. th) – l Bank of Thailand (www. bot. or. th) – l All data about government revenue, expenses, and projects. Ministry of Commerce (www. moc. go. th) – l All data about financial sectors, both in domestic transactions and with external transactions, including the Balance of Payments, capital flow, interest rates, exchange rates. Ministry of Finance (www. mof. go. th) – l All data about real sectors, including the National Accounts, Input-Output tables, Flowof-Fund accounts. All data including Free Trade Agreement, as well as domestic prices. National Statistical Office (www. nso. go. th) – Employment, labor forces, others

Where do we find economic data for Thailand? l The National Economic and Social Development Board (www. nesdb. go. th) – l Bank of Thailand (www. bot. or. th) – l All data about government revenue, expenses, and projects. Ministry of Commerce (www. moc. go. th) – l All data about financial sectors, both in domestic transactions and with external transactions, including the Balance of Payments, capital flow, interest rates, exchange rates. Ministry of Finance (www. mof. go. th) – l All data about real sectors, including the National Accounts, Input-Output tables, Flowof-Fund accounts. All data including Free Trade Agreement, as well as domestic prices. National Statistical Office (www. nso. go. th) – Employment, labor forces, others