11e04dad1f979081a1664e1fb292c525.ppt

- Количество слайдов: 77

What are “CANDLESTICKS” And How To Use Them

What are “CANDLESTICKS” And How To Use Them

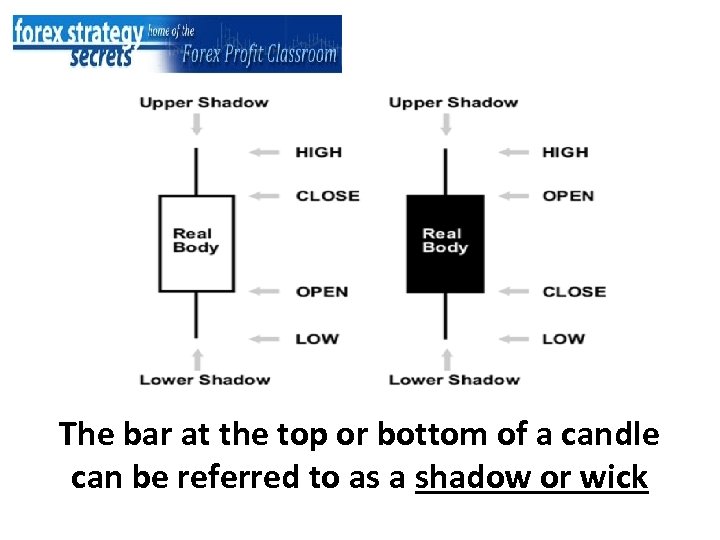

The bar at the top or bottom of a candle can be referred to as a shadow or wick

The bar at the top or bottom of a candle can be referred to as a shadow or wick

Candlesticks can be used: • On any time frame, one day, one hour, 30 -minutes etc.

Candlesticks can be used: • On any time frame, one day, one hour, 30 -minutes etc.

Candlesticks can be used: • On any time frame, one day, one hour, 30 -minutes etc. • To describe the price action during a given time frame.

Candlesticks can be used: • On any time frame, one day, one hour, 30 -minutes etc. • To describe the price action during a given time frame.

There are many candlestick patterns but for the most part they can be grouped into 6 major patterns

There are many candlestick patterns but for the most part they can be grouped into 6 major patterns

Sometimes it is hard to determine what each candle stick formation is trying to tell you

Sometimes it is hard to determine what each candle stick formation is trying to tell you

The recommendation form all the candle stick instruction we have seen is: Always confirm the candle stick patterns with other indicators.

The recommendation form all the candle stick instruction we have seen is: Always confirm the candle stick patterns with other indicators.

What is the highest probability direction of the market. Each Candle gives us reason to ask… Is this a continuation or a reversal pattern?

What is the highest probability direction of the market. Each Candle gives us reason to ask… Is this a continuation or a reversal pattern?

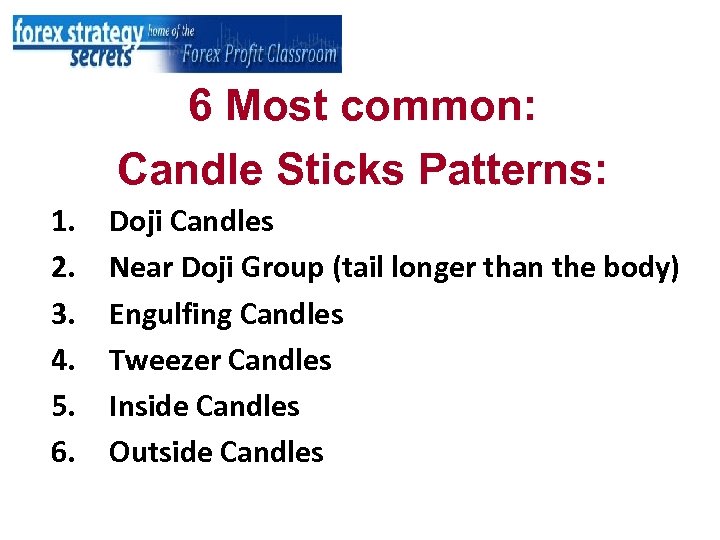

6 Most common: Candle Sticks Patterns:

6 Most common: Candle Sticks Patterns:

6 Most common: Candle Sticks Patterns: 1. Doji Candles

6 Most common: Candle Sticks Patterns: 1. Doji Candles

6 Most common: Candle Sticks Patterns: 1. 2. Doji Candles Near Doji Group (tail longer than the body)

6 Most common: Candle Sticks Patterns: 1. 2. Doji Candles Near Doji Group (tail longer than the body)

6 Most common: Candle Sticks Patterns: 1. 2. 3. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. 5. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles Inside Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. 5. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles Inside Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. 5. 6. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles Inside Candles Outside Candles

6 Most common: Candle Sticks Patterns: 1. 2. 3. 4. 5. 6. Doji Candles Near Doji Group (tail longer than the body) Engulfing Candles Tweezer Candles Inside Candles Outside Candles

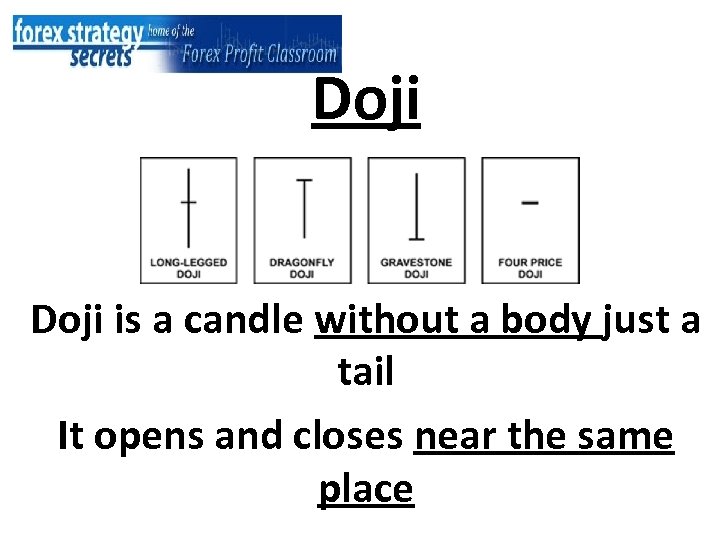

Doji is a candle without a body just a tail It opens and closes near the same place

Doji is a candle without a body just a tail It opens and closes near the same place

Near Doji Group Where the wick is longer than the body

Near Doji Group Where the wick is longer than the body

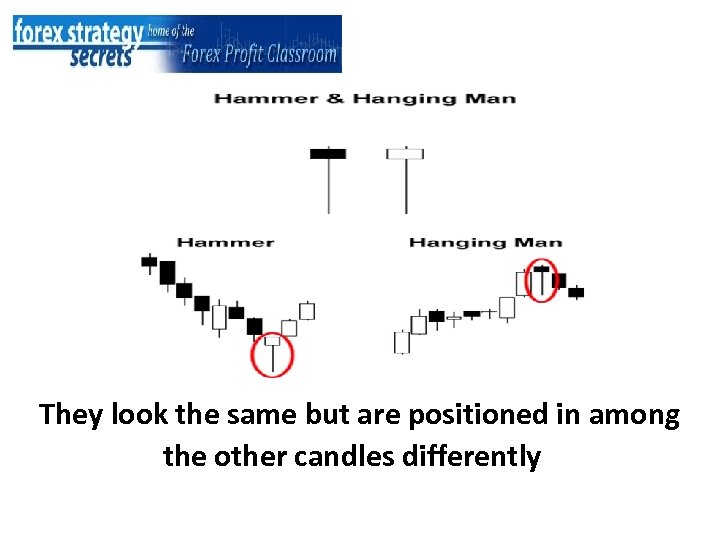

They look the same but are positioned in among the other candles differently

They look the same but are positioned in among the other candles differently

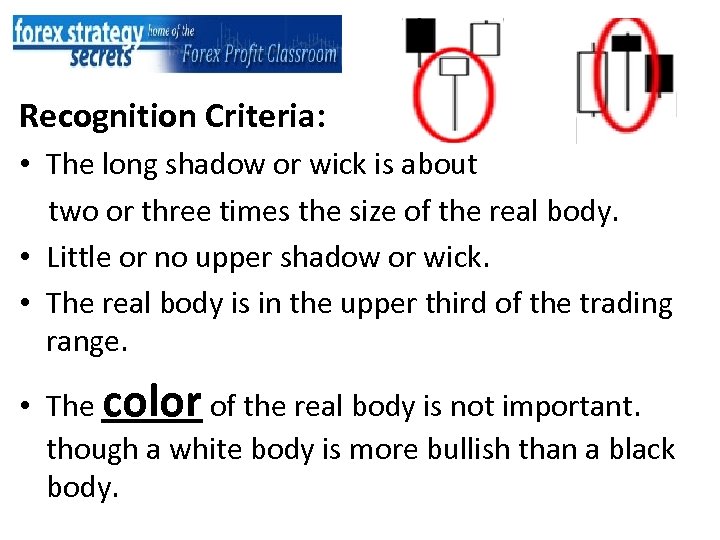

Recognition Criteria: • The long shadow or wick is about two or three times the size of the real body. • Little or no upper shadow or wick. • The real body is in the upper third of the trading range. • The color of the real body is not important. though a white body is more bullish than a black body.

Recognition Criteria: • The long shadow or wick is about two or three times the size of the real body. • Little or no upper shadow or wick. • The real body is in the upper third of the trading range. • The color of the real body is not important. though a white body is more bullish than a black body.

• The hammer is a bullish reversal pattern that forms during a downtrend. • Just because you see a hammer form in a downtrend doesn't mean you automatically place a buy order! • You need to have more bullish confirmation before it's safe to pull the trigger. • The hang man is bearish where the hammer is bullish

• The hammer is a bullish reversal pattern that forms during a downtrend. • Just because you see a hammer form in a downtrend doesn't mean you automatically place a buy order! • You need to have more bullish confirmation before it's safe to pull the trigger. • The hang man is bearish where the hammer is bullish

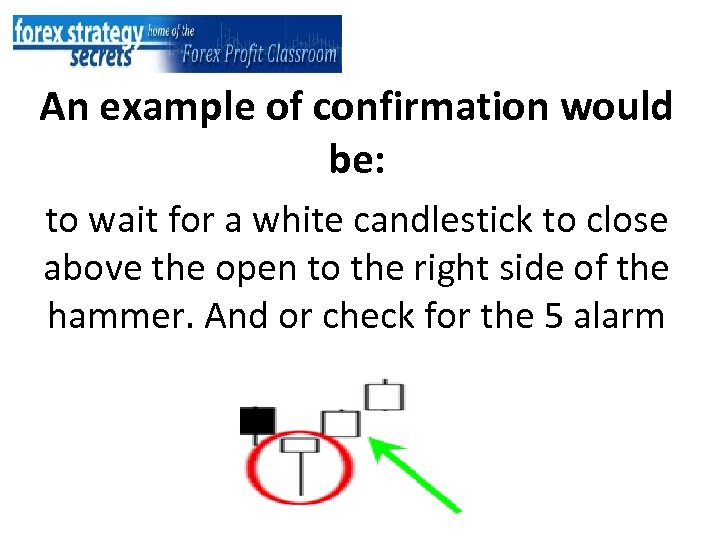

An example of confirmation would be: to wait for a white candlestick to close above the open to the right side of the hammer. And or check for the 5 alarm trade

An example of confirmation would be: to wait for a white candlestick to close above the open to the right side of the hammer. And or check for the 5 alarm trade

The Hammer and Hang man should give you heads up that the market is slowing and my be setting up for a reversal

The Hammer and Hang man should give you heads up that the market is slowing and my be setting up for a reversal

• Almost always goes in the direction if opens on opposite side of wick • Tails usually represent a reversal accept when the reversal covers the tail.

• Almost always goes in the direction if opens on opposite side of wick • Tails usually represent a reversal accept when the reversal covers the tail.

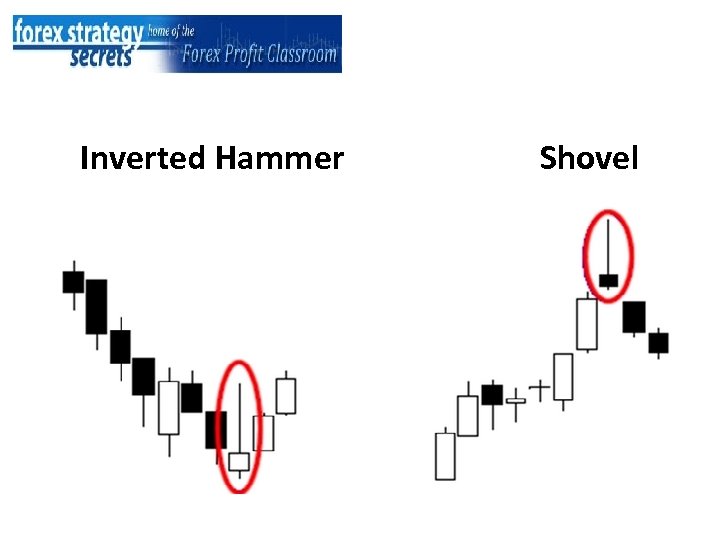

Inverted Hammer or Shovel

Inverted Hammer or Shovel

Inverted Hammer Shovel

Inverted Hammer Shovel

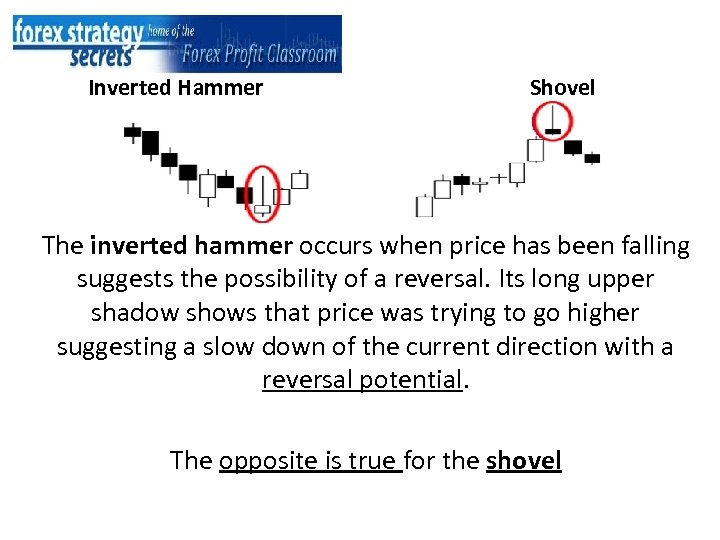

Inverted Hammer Shovel The inverted hammer occurs when price has been falling suggests the possibility of a reversal. Its long upper shadow shows that price was trying to go higher suggesting a slow down of the current direction with a reversal potential. The opposite is true for the shovel

Inverted Hammer Shovel The inverted hammer occurs when price has been falling suggests the possibility of a reversal. Its long upper shadow shows that price was trying to go higher suggesting a slow down of the current direction with a reversal potential. The opposite is true for the shovel

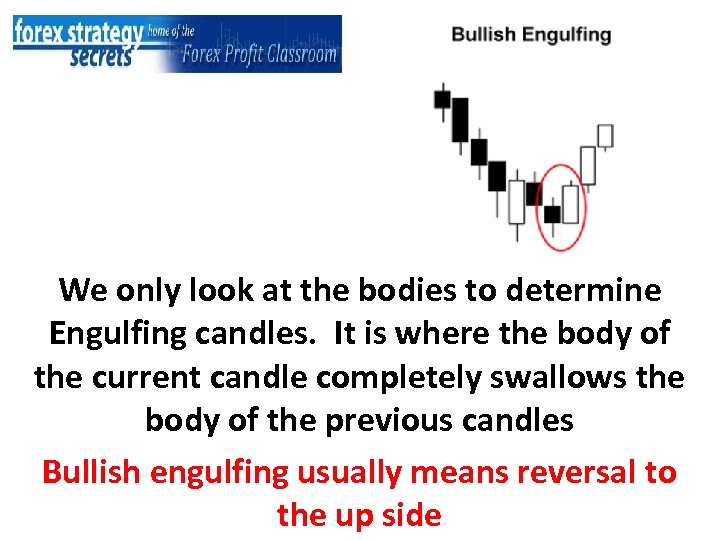

ENGULFING CANDLES

ENGULFING CANDLES

We only look at the bodies to determine Engulfing candles. It is where the body of the current candle completely swallows the body of the previous candles Bullish engulfing usually means reversal to the up side

We only look at the bodies to determine Engulfing candles. It is where the body of the current candle completely swallows the body of the previous candles Bullish engulfing usually means reversal to the up side

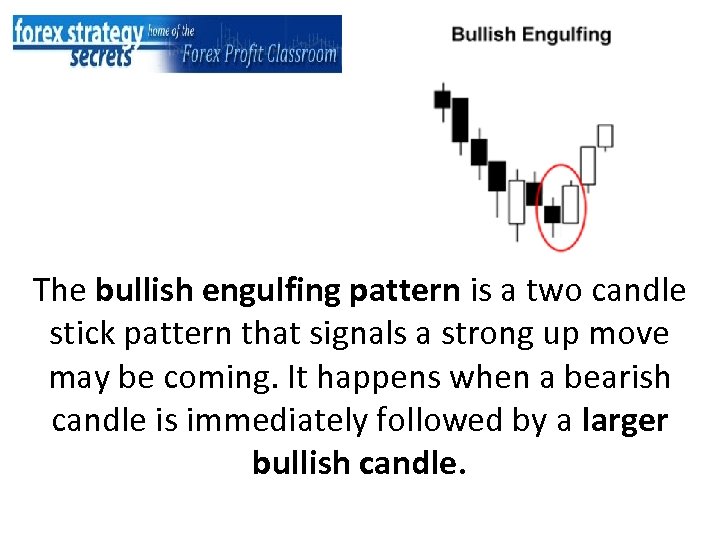

The bullish engulfing pattern is a two candle stick pattern that signals a strong up move may be coming. It happens when a bearish candle is immediately followed by a larger bullish candle.

The bullish engulfing pattern is a two candle stick pattern that signals a strong up move may be coming. It happens when a bearish candle is immediately followed by a larger bullish candle.

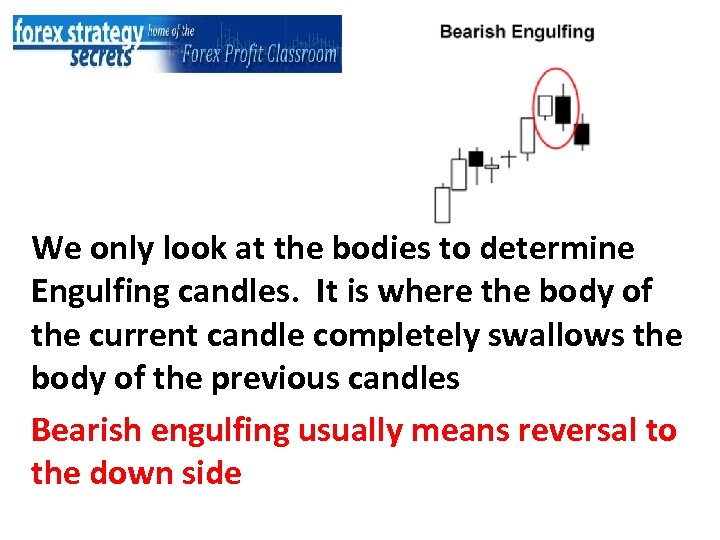

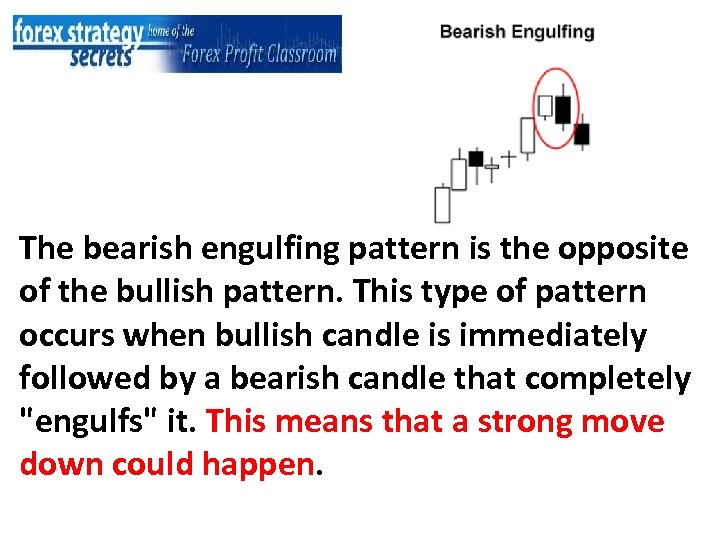

We only look at the bodies to determine Engulfing candles. It is where the body of the current candle completely swallows the body of the previous candles Bearish engulfing usually means reversal to the down side

We only look at the bodies to determine Engulfing candles. It is where the body of the current candle completely swallows the body of the previous candles Bearish engulfing usually means reversal to the down side

The bearish engulfing pattern is the opposite of the bullish pattern. This type of pattern occurs when bullish candle is immediately followed by a bearish candle that completely "engulfs" it. This means that a strong move down could happen.

The bearish engulfing pattern is the opposite of the bullish pattern. This type of pattern occurs when bullish candle is immediately followed by a bearish candle that completely "engulfs" it. This means that a strong move down could happen.

An engulfing candle is more significant if it happens near a support level. It is even more significant if it hits near another high or low… maybe a double or triple top or bottom.

An engulfing candle is more significant if it happens near a support level. It is even more significant if it hits near another high or low… maybe a double or triple top or bottom.

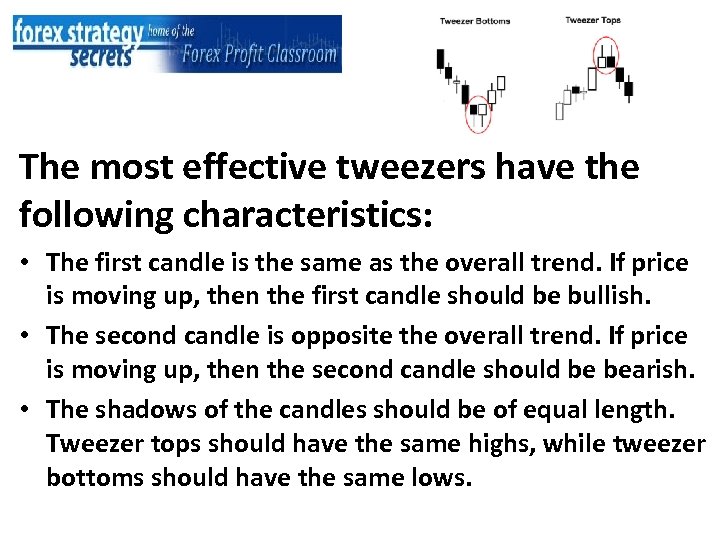

Tweezer Bottoms and Tops

Tweezer Bottoms and Tops

Tweezer Bottoms and Tops The tweezers are dual candlestick reversal patterns. This type of candlestick pattern could usually be spotted after an extended up trend or downtrend, giving heads up that a reversal may happen soon.

Tweezer Bottoms and Tops The tweezers are dual candlestick reversal patterns. This type of candlestick pattern could usually be spotted after an extended up trend or downtrend, giving heads up that a reversal may happen soon.

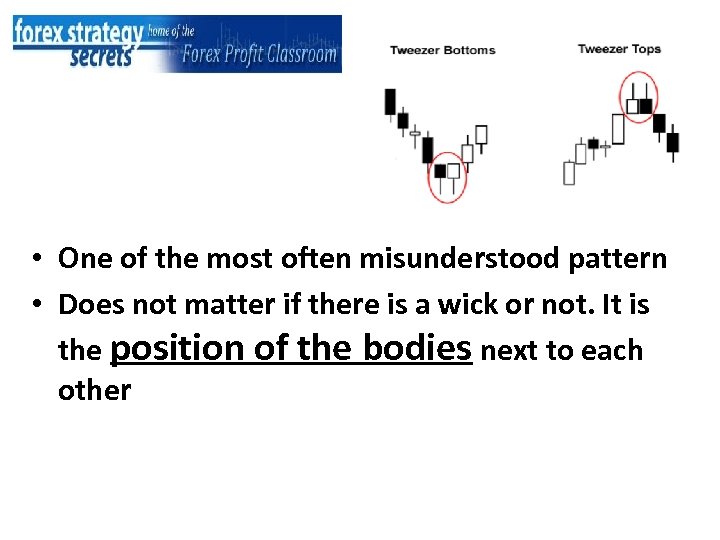

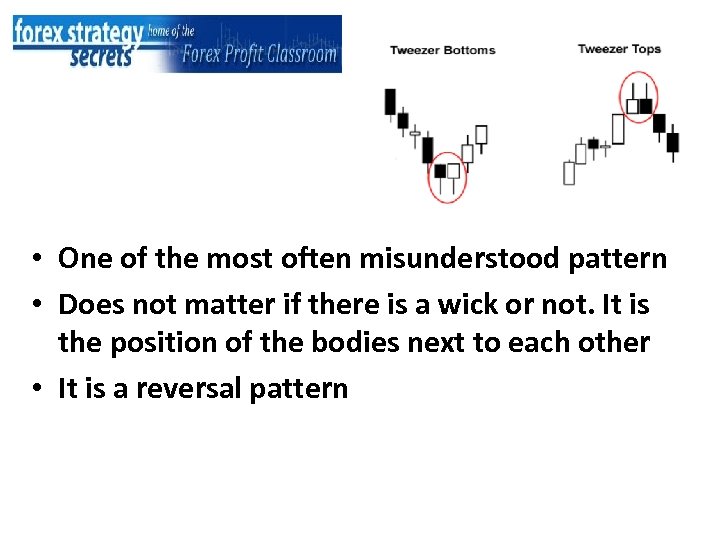

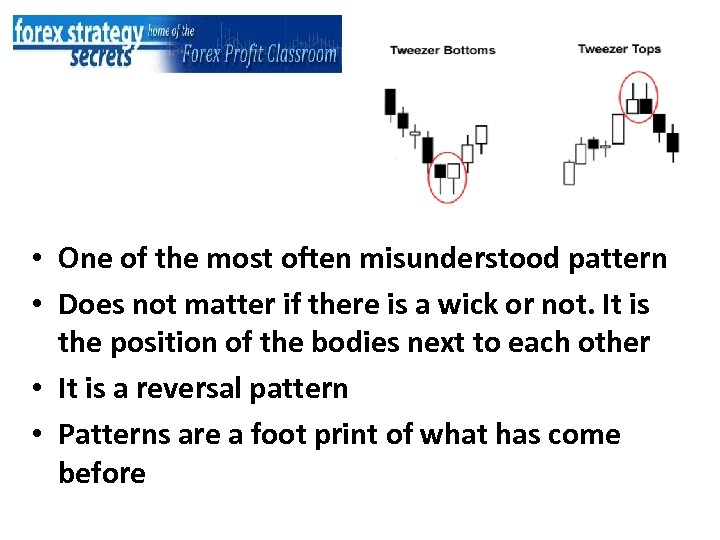

• One of the most often misunderstood pattern

• One of the most often misunderstood pattern

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other • It is a reversal pattern

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other • It is a reversal pattern

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other • It is a reversal pattern • Patterns are a foot print of what has come before

• One of the most often misunderstood pattern • Does not matter if there is a wick or not. It is the position of the bodies next to each other • It is a reversal pattern • Patterns are a foot print of what has come before

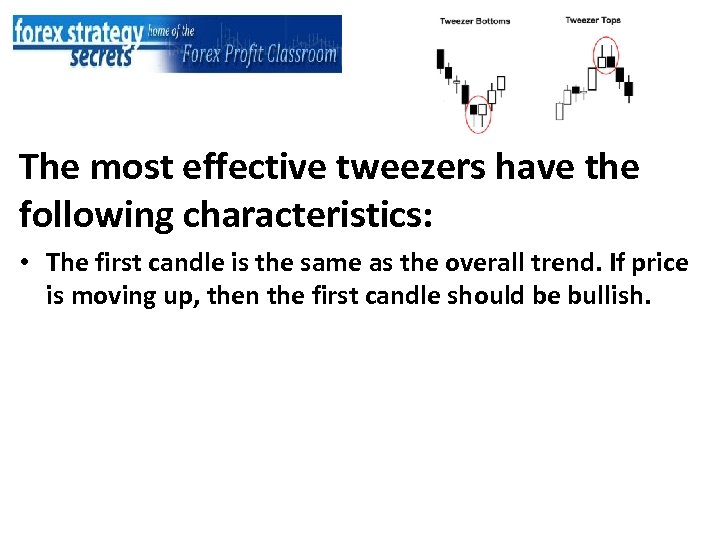

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish.

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish.

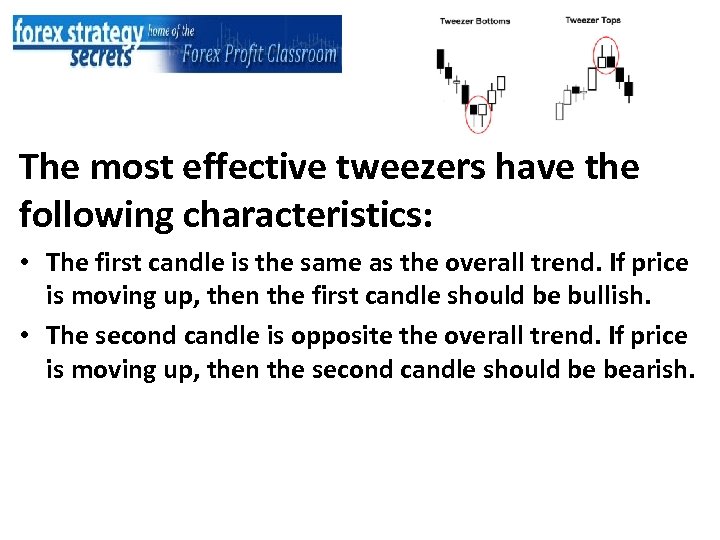

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish. • The second candle is opposite the overall trend. If price is moving up, then the second candle should be bearish.

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish. • The second candle is opposite the overall trend. If price is moving up, then the second candle should be bearish.

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish. • The second candle is opposite the overall trend. If price is moving up, then the second candle should be bearish. • The shadows of the candles should be of equal length. Tweezer tops should have the same highs, while tweezer bottoms should have the same lows.

The most effective tweezers have the following characteristics: • The first candle is the same as the overall trend. If price is moving up, then the first candle should be bullish. • The second candle is opposite the overall trend. If price is moving up, then the second candle should be bearish. • The shadows of the candles should be of equal length. Tweezer tops should have the same highs, while tweezer bottoms should have the same lows.

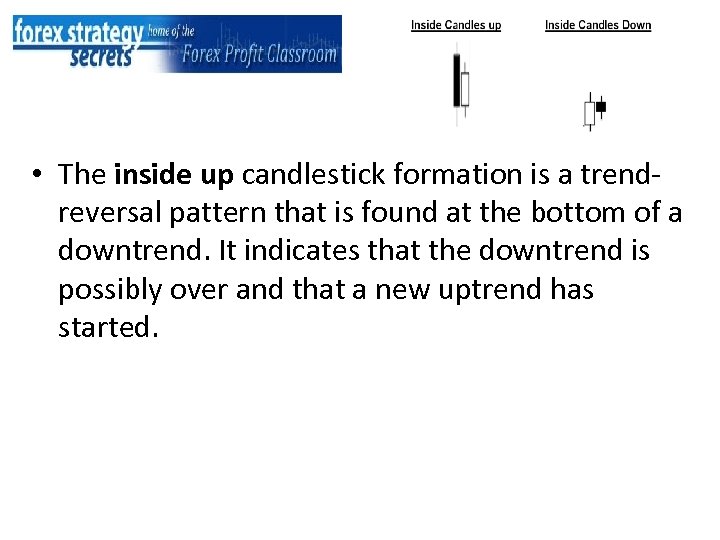

Inside Candles Inside candle usually means you are going to move against the grain. Inside means it opens inside the body of the previous candle

Inside Candles Inside candle usually means you are going to move against the grain. Inside means it opens inside the body of the previous candle

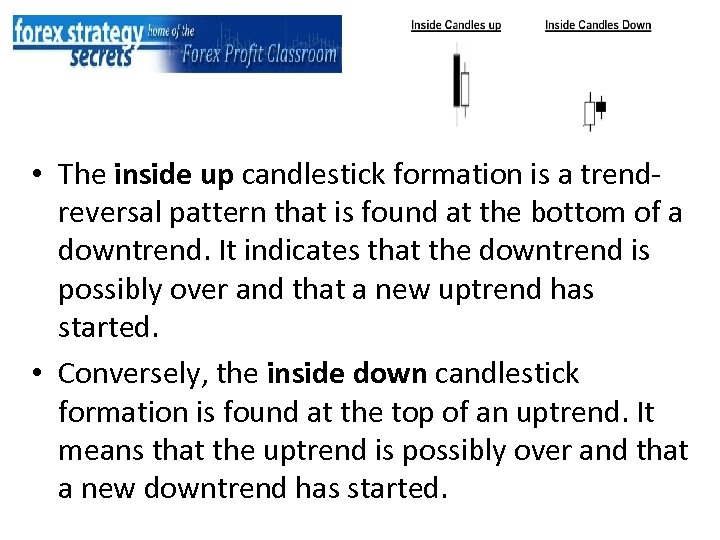

• The inside up candlestick formation is a trendreversal pattern that is found at the bottom of a downtrend. It indicates that the downtrend is possibly over and that a new uptrend has started.

• The inside up candlestick formation is a trendreversal pattern that is found at the bottom of a downtrend. It indicates that the downtrend is possibly over and that a new uptrend has started.

• The inside up candlestick formation is a trendreversal pattern that is found at the bottom of a downtrend. It indicates that the downtrend is possibly over and that a new uptrend has started. • Conversely, the inside down candlestick formation is found at the top of an uptrend. It means that the uptrend is possibly over and that a new downtrend has started.

• The inside up candlestick formation is a trendreversal pattern that is found at the bottom of a downtrend. It indicates that the downtrend is possibly over and that a new uptrend has started. • Conversely, the inside down candlestick formation is found at the top of an uptrend. It means that the uptrend is possibly over and that a new downtrend has started.

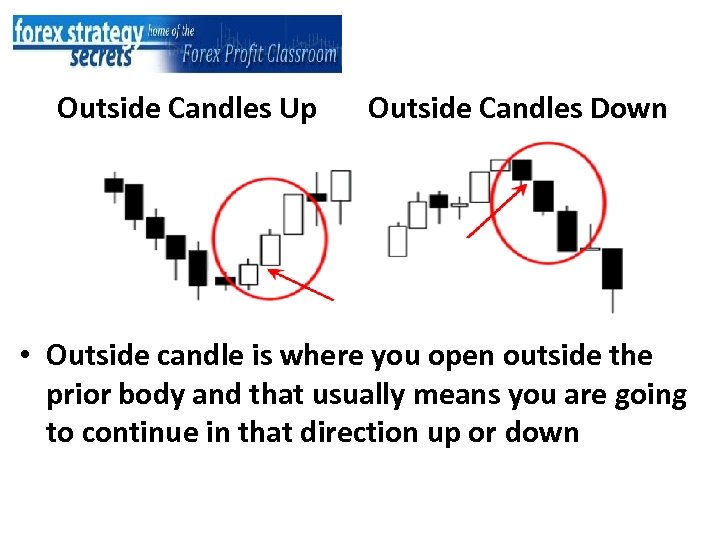

Outside Candles Up Outside Candles Down • Outside candle is where you open outside the prior body and that usually means you are going to continue in that direction up or down

Outside Candles Up Outside Candles Down • Outside candle is where you open outside the prior body and that usually means you are going to continue in that direction up or down

Outside Candles Up Outside Candles Down • Outside candle is where you open outside the prior body and that usually means you are going to continue in that direction up or down • Outside candle trend continuation

Outside Candles Up Outside Candles Down • Outside candle is where you open outside the prior body and that usually means you are going to continue in that direction up or down • Outside candle trend continuation

The outside up candle pattern is formed when the long bullish candles follow a downtrend, signaling a reversal has occurred. This type of candlestick pattern is considered as one of the strongest reversal patterns, especially when it occurs after an extended downtrend a short period of consolidation. The inside down candle pattern if just the opposite of the up candle

The outside up candle pattern is formed when the long bullish candles follow a downtrend, signaling a reversal has occurred. This type of candlestick pattern is considered as one of the strongest reversal patterns, especially when it occurs after an extended downtrend a short period of consolidation. The inside down candle pattern if just the opposite of the up candle

There are several patterns that tell you the same thing for example is the market: • Continuing • Reversing • Undecided

There are several patterns that tell you the same thing for example is the market: • Continuing • Reversing • Undecided

6 Most Common Candlestick patterns: 1. Doji Candles 2. Near Doji Group (tail longer than the body) 3. Engulfing Candles 4. Tweezer Candles 5. Inside Candles 6. Outside Candles

6 Most Common Candlestick patterns: 1. Doji Candles 2. Near Doji Group (tail longer than the body) 3. Engulfing Candles 4. Tweezer Candles 5. Inside Candles 6. Outside Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles Suggest direction change or at least a slowdown depending on where it is in the trend. • Near Doji Group (tail longer than the body) – Hammer, – Shovel – Hang man – Spinning top – Pin bar • Engulfing Candles • Tweezer Candles • Inside Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles Suggest direction change or at least a slowdown depending on where it is in the trend. • Near Doji Group (tail longer than the body) – Hammer, – Shovel – Hang man – Spinning top – Pin bar • Engulfing Candles • Tweezer Candles • Inside Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles Suggest direction change or at least a slowdown depending on where it is in the trend. • Near Doji Group (tail longer than the body) – Hammer, – Shovel – Hang man – Spinning top – Pin bar • Engulfing Candles • Tweezer Candles • Inside Candles Continuation • Outside Candles

6 Most Common Candlestick Patterns: Indecision Candle, No body • Doji Candles Suggest direction change or at least a slowdown depending on where it is in the trend. • Near Doji Group (tail longer than the body) – Hammer, – Shovel – Hang man – Spinning top – Pin bar • Engulfing Candles • Tweezer Candles • Inside Candles Continuation • Outside Candles

Now a little bit on: Price Action It is shown by Candles

Now a little bit on: Price Action It is shown by Candles

The difference between Price action and candles is: • Price Action adds in support and resistance levels

The difference between Price action and candles is: • Price Action adds in support and resistance levels

The difference between Price action and candles is: • Price Action adds in support and resistance levels • Prior highs and lows and maybe a couple of moving averages

The difference between Price action and candles is: • Price Action adds in support and resistance levels • Prior highs and lows and maybe a couple of moving averages

Candle sticks are part of price action… • whether you are bouncing or breaking support and resistance levels • Candlesticks are the rest of the Price Action decision making process

Candle sticks are part of price action… • whether you are bouncing or breaking support and resistance levels • Candlesticks are the rest of the Price Action decision making process

When you're near support and resistance levels: • You look for candlestick pattern to determine the price action • Also look for 5 alarm trades after grading the strength of the trade

When you're near support and resistance levels: • You look for candlestick pattern to determine the price action • Also look for 5 alarm trades after grading the strength of the trade

Price Action is the information you are getting and the location at which it is happening: For example… Is the information coming near, above, or below Support and Resistance?

Price Action is the information you are getting and the location at which it is happening: For example… Is the information coming near, above, or below Support and Resistance?

It is our opinion that you need more than Candlesticks, and Price Action to take advantage of the biggest part of a trend. Grading the Trade and having profit targets in mind will give you a bigger edge.

It is our opinion that you need more than Candlesticks, and Price Action to take advantage of the biggest part of a trend. Grading the Trade and having profit targets in mind will give you a bigger edge.

Additional Suggestions: • If you are struggling with consistency try a higher time frame

Additional Suggestions: • If you are struggling with consistency try a higher time frame

Additional Suggestions: • If you are struggling with consistency try a higher time frame • It is better to go from the larger time frames to the smaller time frames. You don’t miss anything which is contrary to popular belief. From 1 hr to 30 min etc.

Additional Suggestions: • If you are struggling with consistency try a higher time frame • It is better to go from the larger time frames to the smaller time frames. You don’t miss anything which is contrary to popular belief. From 1 hr to 30 min etc.

• It is recommended to only make decision when a candle closes or at the opening of a new candle rather than in the middle of the formation

• It is recommended to only make decision when a candle closes or at the opening of a new candle rather than in the middle of the formation

• It is recommended to only make decision when a candle closes or at the opening of a new candle rather than in the middle of the formation WE ARE GOING TO SHOW YOU A TECHNIQUE OF HOW TO GET HEADS UP AS TO WHAT A CANDLE WILL LOOK LIKE IN THE MIDDLE OF THE FORMATON.

• It is recommended to only make decision when a candle closes or at the opening of a new candle rather than in the middle of the formation WE ARE GOING TO SHOW YOU A TECHNIQUE OF HOW TO GET HEADS UP AS TO WHAT A CANDLE WILL LOOK LIKE IN THE MIDDLE OF THE FORMATON.

Here is the Key: Look at a smaller time frame to get heads up i. e. Day to 4 hr to 1 hr to 30 min to 15 min

Here is the Key: Look at a smaller time frame to get heads up i. e. Day to 4 hr to 1 hr to 30 min to 15 min

If you can’t determine what a candle stick pattern is telling you… –look at other time frames

If you can’t determine what a candle stick pattern is telling you… –look at other time frames

If you can’t determine what a candle stick pattern is telling you… –look at other time frames –Check other indicators for conformation

If you can’t determine what a candle stick pattern is telling you… –look at other time frames –Check other indicators for conformation

If you can’t determine what a candle stick pattern is telling you… –look at other time frames –Check other indicators for conformation –Check back later when the chart is easier to read.

If you can’t determine what a candle stick pattern is telling you… –look at other time frames –Check other indicators for conformation –Check back later when the chart is easier to read.

It is about quality not quantity… what about both!!!

It is about quality not quantity… what about both!!!

• It is about quality not quantity… what about both!!! • With each new candle you are attempting to answer the question continuation or reversal

• It is about quality not quantity… what about both!!! • With each new candle you are attempting to answer the question continuation or reversal

You do not have to know every pattern to be able to use Candle Stick patterns

You do not have to know every pattern to be able to use Candle Stick patterns

The study of Candle Stick Patterns is: A long term endeavor

The study of Candle Stick Patterns is: A long term endeavor

Lets look at some charts for Candle stick Patterns

Lets look at some charts for Candle stick Patterns

Now just a little on the CANDY BAR SET UP

Now just a little on the CANDY BAR SET UP

• The Candy Bar is one of the safest trade you can take

• The Candy Bar is one of the safest trade you can take

• The Candy Bar is one of the safest trade you can take • It is usually confirmed by one or more other indicators

• The Candy Bar is one of the safest trade you can take • It is usually confirmed by one or more other indicators

• The Candy Bar is one of the safest trade you can take • It is usually confirmed by one or more other indicators • The trade will be earlier than most other entry signals in a continuing trend

• The Candy Bar is one of the safest trade you can take • It is usually confirmed by one or more other indicators • The trade will be earlier than most other entry signals in a continuing trend

Lets look at some charts For Candy Bar setups

Lets look at some charts For Candy Bar setups