adf7a6b3172db3bad8068096884e146a.ppt

- Количество слайдов: 18

Western Wind Transmission Ronald L. Lehr AWEA Western Representative 4950 Sanford Circle West Englewood, CO 80110 303 504 0940

Western Wind Transmission Ronald L. Lehr AWEA Western Representative 4950 Sanford Circle West Englewood, CO 80110 303 504 0940

Wind Situation • • • New generation 90% + natural gas Gas prices high, volatile Coal environmental risks, timing Public, policy support for wind Wind costs continue to decline Wind PPAs offer firm prices

Wind Situation • • • New generation 90% + natural gas Gas prices high, volatile Coal environmental risks, timing Public, policy support for wind Wind costs continue to decline Wind PPAs offer firm prices

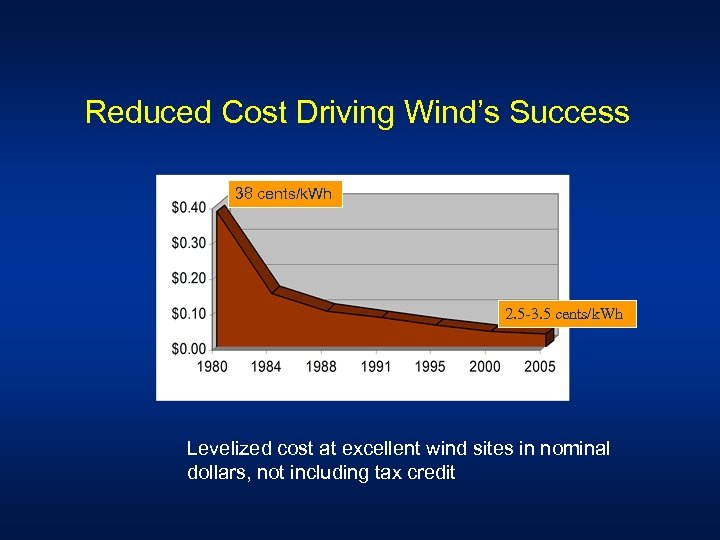

Reduced Cost Driving Wind’s Success 38 cents/k. Wh 2. 5 -3. 5 cents/k. Wh Levelized cost at excellent wind sites in nominal dollars, not including tax credit

Reduced Cost Driving Wind’s Success 38 cents/k. Wh 2. 5 -3. 5 cents/k. Wh Levelized cost at excellent wind sites in nominal dollars, not including tax credit

Transmission for Wind • • Build case for needed transmission investments Transmission Planning: study and report Consider all transmission alternatives 1. Use existing transmission • SSG-WI constraint data shows physical capacity available • 2. Upgrade existing transmission routes • 3. Plan new transmission routes

Transmission for Wind • • Build case for needed transmission investments Transmission Planning: study and report Consider all transmission alternatives 1. Use existing transmission • SSG-WI constraint data shows physical capacity available • 2. Upgrade existing transmission routes • 3. Plan new transmission routes

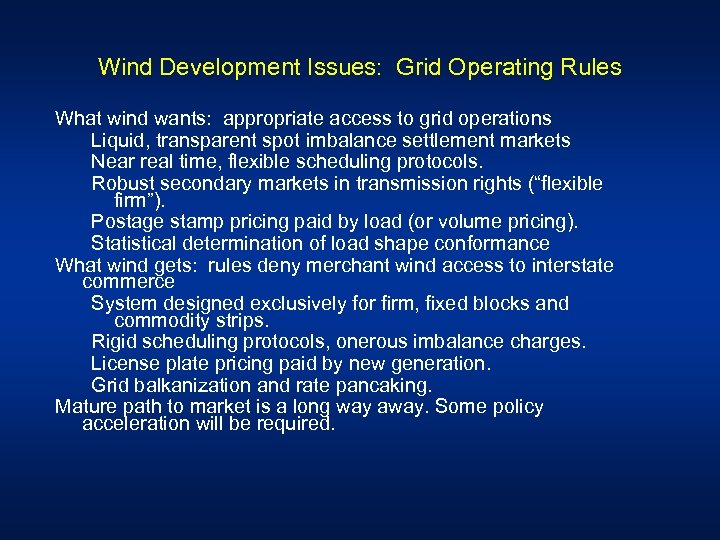

Wind Development Issues: Grid Operating Rules What wind wants: appropriate access to grid operations Liquid, transparent spot imbalance settlement markets Near real time, flexible scheduling protocols. Robust secondary markets in transmission rights (“flexible firm”). Postage stamp pricing paid by load (or volume pricing). Statistical determination of load shape conformance What wind gets: rules deny merchant wind access to interstate commerce System designed exclusively for firm, fixed blocks and commodity strips. Rigid scheduling protocols, onerous imbalance charges. License plate pricing paid by new generation. Grid balkanization and rate pancaking. Mature path to market is a long way away. Some policy acceleration will be required.

Wind Development Issues: Grid Operating Rules What wind wants: appropriate access to grid operations Liquid, transparent spot imbalance settlement markets Near real time, flexible scheduling protocols. Robust secondary markets in transmission rights (“flexible firm”). Postage stamp pricing paid by load (or volume pricing). Statistical determination of load shape conformance What wind gets: rules deny merchant wind access to interstate commerce System designed exclusively for firm, fixed blocks and commodity strips. Rigid scheduling protocols, onerous imbalance charges. License plate pricing paid by new generation. Grid balkanization and rate pancaking. Mature path to market is a long way away. Some policy acceleration will be required.

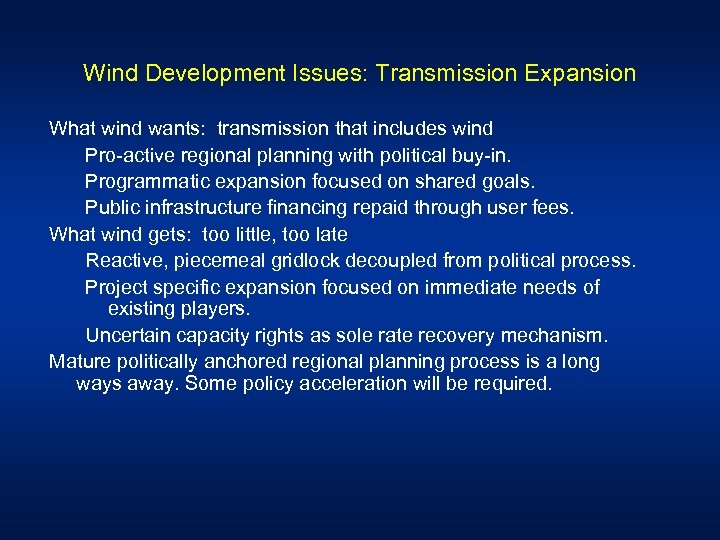

Wind Development Issues: Transmission Expansion What wind wants: transmission that includes wind Pro-active regional planning with political buy-in. Programmatic expansion focused on shared goals. Public infrastructure financing repaid through user fees. What wind gets: too little, too late Reactive, piecemeal gridlock decoupled from political process. Project specific expansion focused on immediate needs of existing players. Uncertain capacity rights as sole rate recovery mechanism. Mature politically anchored regional planning process is a long ways away. Some policy acceleration will be required.

Wind Development Issues: Transmission Expansion What wind wants: transmission that includes wind Pro-active regional planning with political buy-in. Programmatic expansion focused on shared goals. Public infrastructure financing repaid through user fees. What wind gets: too little, too late Reactive, piecemeal gridlock decoupled from political process. Project specific expansion focused on immediate needs of existing players. Uncertain capacity rights as sole rate recovery mechanism. Mature politically anchored regional planning process is a long ways away. Some policy acceleration will be required.

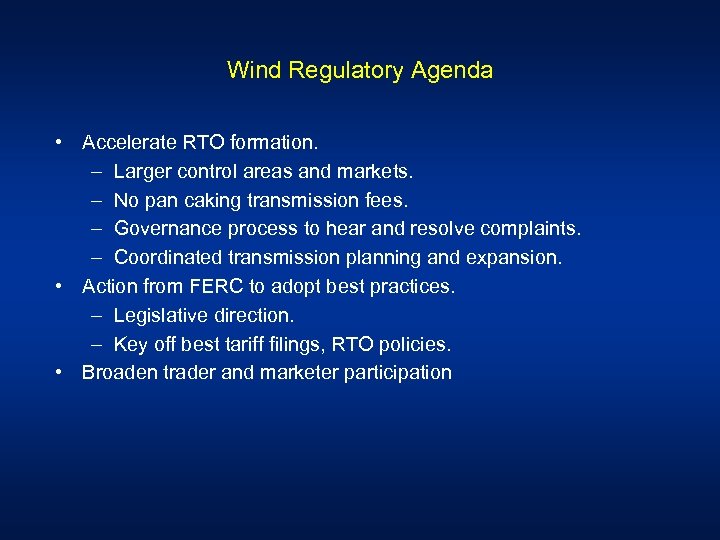

Wind Regulatory Agenda • Accelerate RTO formation. – Larger control areas and markets. – No pan caking transmission fees. – Governance process to hear and resolve complaints. – Coordinated transmission planning and expansion. • Action from FERC to adopt best practices. – Legislative direction. – Key off best tariff filings, RTO policies. • Broaden trader and marketer participation

Wind Regulatory Agenda • Accelerate RTO formation. – Larger control areas and markets. – No pan caking transmission fees. – Governance process to hear and resolve complaints. – Coordinated transmission planning and expansion. • Action from FERC to adopt best practices. – Legislative direction. – Key off best tariff filings, RTO policies. • Broaden trader and marketer participation

Interior West Clean Energy Plan John Nielsen Western Resource Advocates Ronald L. Lehr AWEA

Interior West Clean Energy Plan John Nielsen Western Resource Advocates Ronald L. Lehr AWEA

Study Objectives • Aggressive but feasible long-term clean electric energy plan for the Interior West • Identify the public policies and business strategies needed to implement the plan • Engage energy decision makers across the region on adopting these policies and strategies • Relative to BAU, Clean Plan will include: – Significantly increased reliance on RE & EE – Retires older, less efficient fossil resources now on the system

Study Objectives • Aggressive but feasible long-term clean electric energy plan for the Interior West • Identify the public policies and business strategies needed to implement the plan • Engage energy decision makers across the region on adopting these policies and strategies • Relative to BAU, Clean Plan will include: – Significantly increased reliance on RE & EE – Retires older, less efficient fossil resources now on the system

Who’s Involved • Funding--Hewlett Foundation, DOE on transmission issues • Project Team: WRA, Synapse Energy Economics, Tellus Institute, Ron Lehr (NWCC, AWEA), grn. NRG • Advisory Committee – utility industry, independent power producers, renewable developers, PUC regulators, state energy office officials, environmental and clean energy advocates, DOE, NREL

Who’s Involved • Funding--Hewlett Foundation, DOE on transmission issues • Project Team: WRA, Synapse Energy Economics, Tellus Institute, Ron Lehr (NWCC, AWEA), grn. NRG • Advisory Committee – utility industry, independent power producers, renewable developers, PUC regulators, state energy office officials, environmental and clean energy advocates, DOE, NREL

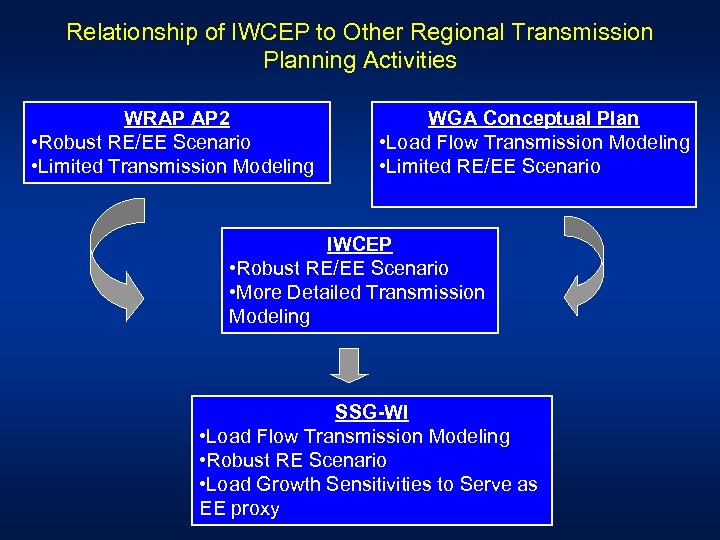

Relationship of IWCEP to Other Regional Transmission Planning Activities WRAP AP 2 • Robust RE/EE Scenario • Limited Transmission Modeling WGA Conceptual Plan • Load Flow Transmission Modeling • Limited RE/EE Scenario IWCEP • Robust RE/EE Scenario • More Detailed Transmission Modeling SSG-WI • Load Flow Transmission Modeling • Robust RE Scenario • Load Growth Sensitivities to Serve as EE proxy

Relationship of IWCEP to Other Regional Transmission Planning Activities WRAP AP 2 • Robust RE/EE Scenario • Limited Transmission Modeling WGA Conceptual Plan • Load Flow Transmission Modeling • Limited RE/EE Scenario IWCEP • Robust RE/EE Scenario • More Detailed Transmission Modeling SSG-WI • Load Flow Transmission Modeling • Robust RE Scenario • Load Growth Sensitivities to Serve as EE proxy

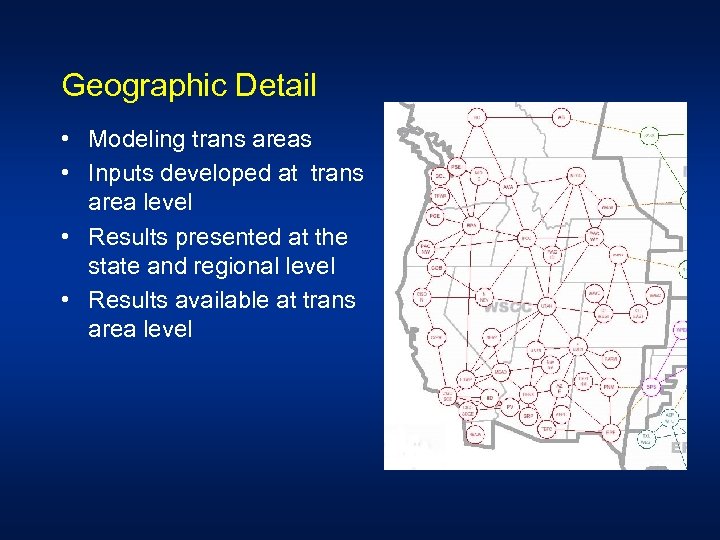

Geographic Detail • Modeling trans areas • Inputs developed at trans area level • Results presented at the state and regional level • Results available at trans area level

Geographic Detail • Modeling trans areas • Inputs developed at trans area level • Results presented at the state and regional level • Results available at trans area level

Renewable Resource Assessment • • Compiles best wind, solar, geothermal, biomass resource data GIS identifies: • Best resource areas • Inappropriate development areas • Location of facilitating infrastructure like existing transmission lines and substations www. energyatlas. org

Renewable Resource Assessment • • Compiles best wind, solar, geothermal, biomass resource data GIS identifies: • Best resource areas • Inappropriate development areas • Location of facilitating infrastructure like existing transmission lines and substations www. energyatlas. org

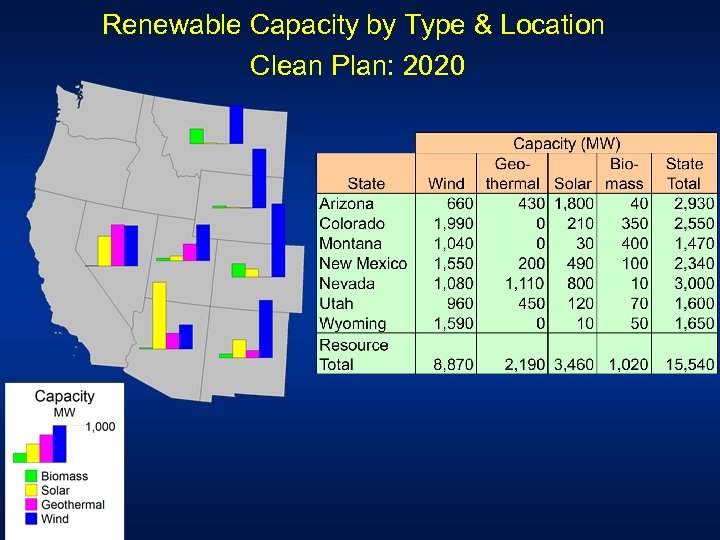

Renewable Capacity by Type & Location Clean Plan: 2020

Renewable Capacity by Type & Location Clean Plan: 2020

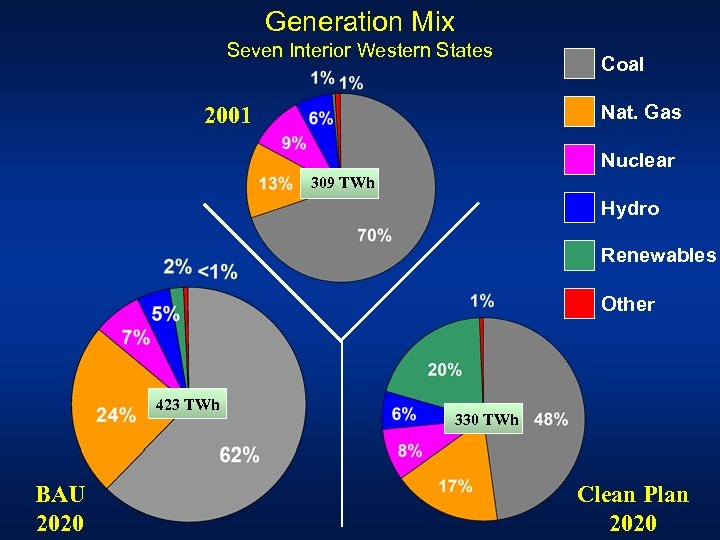

Generation Mix Seven Interior Western States Coal Nat. Gas 2001 Nuclear 309 TWh Hydro Renewables Other 423 TWh BAU 2020 330 TWh Clean Plan 2020

Generation Mix Seven Interior Western States Coal Nat. Gas 2001 Nuclear 309 TWh Hydro Renewables Other 423 TWh BAU 2020 330 TWh Clean Plan 2020

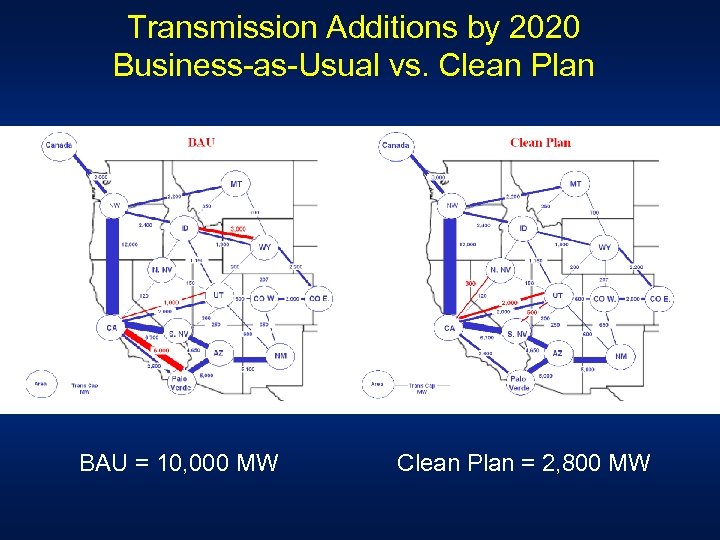

Transmission Additions by 2020 Business-as-Usual vs. Clean Plan BAU = 10, 000 MW Clean Plan = 2, 800 MW

Transmission Additions by 2020 Business-as-Usual vs. Clean Plan BAU = 10, 000 MW Clean Plan = 2, 800 MW

Conclusions • • Build the case for needed investment Study and report Consider transmission alternatives 1. Use existing transmission • SSG-WI constraint data shows physical capacity available • 2. Upgrade existing transmission routes • 3. Plan new transmission routes • Present business, policy case to decision makers

Conclusions • • Build the case for needed investment Study and report Consider transmission alternatives 1. Use existing transmission • SSG-WI constraint data shows physical capacity available • 2. Upgrade existing transmission routes • 3. Plan new transmission routes • Present business, policy case to decision makers

Contact Information John Nielsen Energy Project Director Western Resource Advocates 303 -444 -1188 x 232 jnielsen@westernresources. org

Contact Information John Nielsen Energy Project Director Western Resource Advocates 303 -444 -1188 x 232 jnielsen@westernresources. org