6c942530a7d3043e35a8a7f5fdcab93f.ppt

- Количество слайдов: 24

Western Financial Group Q 3 2008 Financial Results Conference Call • November 17, 2008

Western Financial Group Q 3 2008 Financial Results Conference Call • November 17, 2008

Forward-Looking Statements This presentation contains certain forward-looking statements. Forward-looking statements include, without limitation, statements regarding the future financial position, business strategy, budgets, litigation, projected costs, capital expenditures, financial results, taxes and plans and objectives of or involving Western Financial Group Inc. (the “Company”) or its subsidiaries. Many of these statements can be identified by looking for words such as ‘‘believe’’, ‘‘expects’’, ‘‘expected’’, ‘‘will’’, ‘‘intends’’, ‘‘projects’’, ‘‘anticipates’’, ‘‘estimates’’, ‘‘continues’’ or similar words. The Company believes the expectations reflected in such forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements should not be unduly relied upon. Forwardlooking statements are not guarantees of future performance and involve a number of risks and uncertainties only some of which are described herein. Many factors could cause the Company’s actual results, performance or achievements to, or future events or developments to, differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the risk factors, which are discussed in greater detail in the ‘‘Risk Factors’’ section of the prospectus. Any forward-looking statements are made as of the date hereof and the Company does not assume any obligation to publicly update or revise such statements to reflect new information, subsequent events or otherwise. Non-GAAP Measures Throughout this presentation, the Company may use the term ‘‘operating income’’ to refer to earnings, including investment income, before interest expense, taxes, depreciation and amortization of intangible and capital assets, excluding gain (loss) from the sale of assets and income (loss) from equity investments. The Company uses ‘‘operating income’’ to assist it in measuring corporate performance before the costs of capital and amortization of capital and intangible assets. Operating income is not a measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other issuers and investors are cautioned that it should not be used as an alternative to ‘‘net income’’ or other measures of financial performance calculated in accordance with GAAP.

Forward-Looking Statements This presentation contains certain forward-looking statements. Forward-looking statements include, without limitation, statements regarding the future financial position, business strategy, budgets, litigation, projected costs, capital expenditures, financial results, taxes and plans and objectives of or involving Western Financial Group Inc. (the “Company”) or its subsidiaries. Many of these statements can be identified by looking for words such as ‘‘believe’’, ‘‘expects’’, ‘‘expected’’, ‘‘will’’, ‘‘intends’’, ‘‘projects’’, ‘‘anticipates’’, ‘‘estimates’’, ‘‘continues’’ or similar words. The Company believes the expectations reflected in such forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements should not be unduly relied upon. Forwardlooking statements are not guarantees of future performance and involve a number of risks and uncertainties only some of which are described herein. Many factors could cause the Company’s actual results, performance or achievements to, or future events or developments to, differ materially from those expressed or implied by the forward-looking statements, including, without limitation, the risk factors, which are discussed in greater detail in the ‘‘Risk Factors’’ section of the prospectus. Any forward-looking statements are made as of the date hereof and the Company does not assume any obligation to publicly update or revise such statements to reflect new information, subsequent events or otherwise. Non-GAAP Measures Throughout this presentation, the Company may use the term ‘‘operating income’’ to refer to earnings, including investment income, before interest expense, taxes, depreciation and amortization of intangible and capital assets, excluding gain (loss) from the sale of assets and income (loss) from equity investments. The Company uses ‘‘operating income’’ to assist it in measuring corporate performance before the costs of capital and amortization of capital and intangible assets. Operating income is not a measure recognized by GAAP and does not have a standardized meaning prescribed by GAAP. Therefore, this measure may not be comparable to similar measures presented by other issuers and investors are cautioned that it should not be used as an alternative to ‘‘net income’’ or other measures of financial performance calculated in accordance with GAAP.

Today’s Remarks • • Operational Progress in Q 3 Strategic Events in Q 3 Financial Update Priorities for Q 4 3 TSX: WES

Today’s Remarks • • Operational Progress in Q 3 Strategic Events in Q 3 Financial Update Priorities for Q 4 3 TSX: WES

Operational Progress in Q 3 2008

Operational Progress in Q 3 2008

WFG Agency Network • Same store customer count 4. 3% YTDA. • Same store sales 9. 7% - Market share gains. • Soft market “at bottom” – AB Auto increase approved; anecdotal increases in personal and small commercial. • Acquisition of Vets (Crowsnest Pass, AB), Dunn (Wolseley, SK) and Boyd (Prince Albert, SK). 5 TSX: WES

WFG Agency Network • Same store customer count 4. 3% YTDA. • Same store sales 9. 7% - Market share gains. • Soft market “at bottom” – AB Auto increase approved; anecdotal increases in personal and small commercial. • Acquisition of Vets (Crowsnest Pass, AB), Dunn (Wolseley, SK) and Boyd (Prince Albert, SK). 5 TSX: WES

Western Life Assurance • Creditor Life still strong. • Certificate count and growth 9. 6% over Q 3/07. • Bolt-on product for network is at 6, 159 policies. Target of 20, 000 by Q 2/09. • Total. Guard employee benefits program transfer underway at HED. $5 million + synergy in 2009. 6 TSX: WES

Western Life Assurance • Creditor Life still strong. • Certificate count and growth 9. 6% over Q 3/07. • Bolt-on product for network is at 6, 159 policies. Target of 20, 000 by Q 2/09. • Total. Guard employee benefits program transfer underway at HED. $5 million + synergy in 2009. 6 TSX: WES

Bank West • Negative portfolio growth YTD 2008. Summer funding season slower than 2007. • Portfolio target for 2008 - $360 million. • Very low specific provisions in H 1, “lumpy” in Q 3. • Credit quality solid - > 30 day delinquency improved slightly in Q 3. 7 TSX: WES

Bank West • Negative portfolio growth YTD 2008. Summer funding season slower than 2007. • Portfolio target for 2008 - $360 million. • Very low specific provisions in H 1, “lumpy” in Q 3. • Credit quality solid - > 30 day delinquency improved slightly in Q 3. 7 TSX: WES

Agri. Financial Canada (Proposed acquisition, subject to OSFI approval) • • • Farm credit card – 25, 000 farmers. Equipment loans and leases. $90 million loan book. Profitable operation – bolt-on to Bank West. Geographic and customer synergy. 8 TSX: WES

Agri. Financial Canada (Proposed acquisition, subject to OSFI approval) • • • Farm credit card – 25, 000 farmers. Equipment loans and leases. $90 million loan book. Profitable operation – bolt-on to Bank West. Geographic and customer synergy. 8 TSX: WES

Strategic Events in Q 3

Strategic Events in Q 3

Q 3 Strategic Events • Agency acquisition pipeline active – price/value expectations are still high. • Loan portfolio acquisition opportunities = Agri. Financial. • Business development discussions with Partners - Total. Guard transfer. • Significant advertising increase in advance of 2009 local name “Sunset” plan. 10 TSX: WES

Q 3 Strategic Events • Agency acquisition pipeline active – price/value expectations are still high. • Loan portfolio acquisition opportunities = Agri. Financial. • Business development discussions with Partners - Total. Guard transfer. • Significant advertising increase in advance of 2009 local name “Sunset” plan. 10 TSX: WES

Financial Update

Financial Update

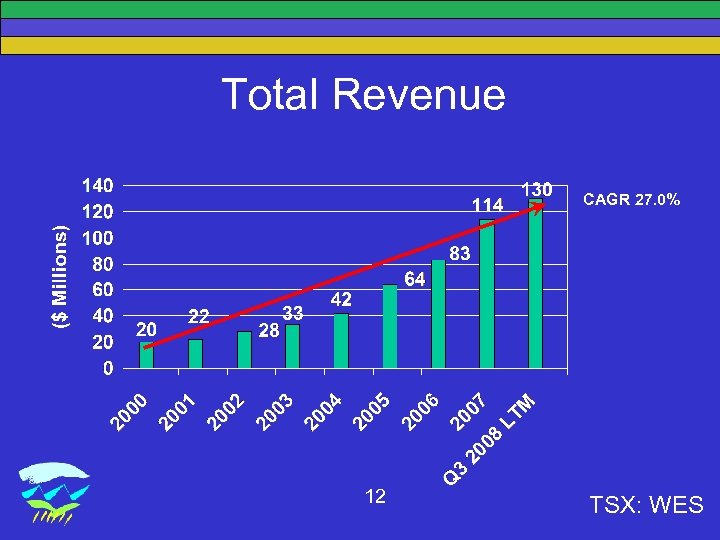

Total Revenue CAGR 27. 0% 12 TSX: WES

Total Revenue CAGR 27. 0% 12 TSX: WES

Earnings Per Share CAGR 32% CAGR 31% 13 TSX: WES

Earnings Per Share CAGR 32% CAGR 31% 13 TSX: WES

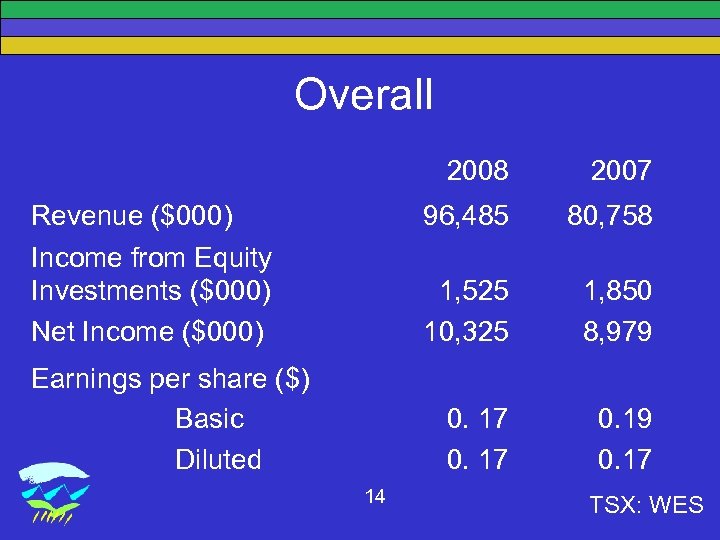

Overall 2008 96, 485 14 1, 850 8, 979 0. 17 Earnings per share ($) Basic Diluted 80, 758 1, 525 10, 325 Revenue ($000) Income from Equity Investments ($000) Net Income ($000) 2007 0. 19 0. 17 TSX: WES

Overall 2008 96, 485 14 1, 850 8, 979 0. 17 Earnings per share ($) Basic Diluted 80, 758 1, 525 10, 325 Revenue ($000) Income from Equity Investments ($000) Net Income ($000) 2007 0. 19 0. 17 TSX: WES

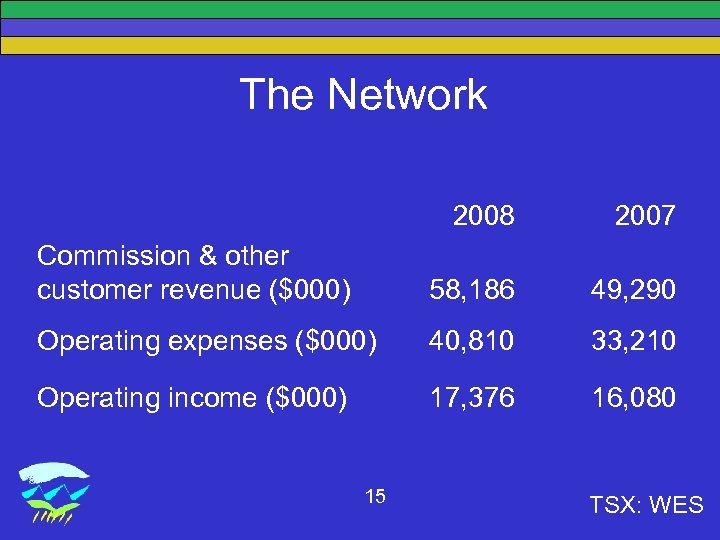

The Network 2008 2007 Commission & other customer revenue ($000) 58, 186 49, 290 Operating expenses ($000) 40, 810 33, 210 Operating income ($000) 17, 376 16, 080 15 TSX: WES

The Network 2008 2007 Commission & other customer revenue ($000) 58, 186 49, 290 Operating expenses ($000) 40, 810 33, 210 Operating income ($000) 17, 376 16, 080 15 TSX: WES

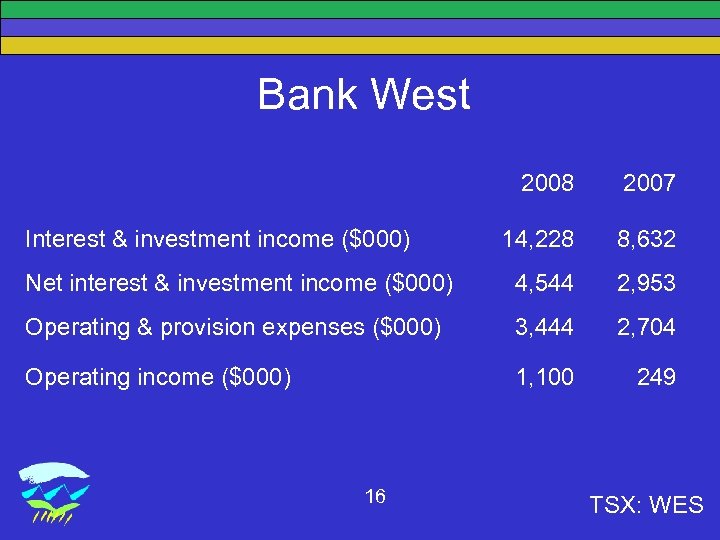

Bank West 2008 2007 14, 228 8, 632 Net interest & investment income ($000) 4, 544 2, 953 Operating & provision expenses ($000) 3, 444 2, 704 Operating income ($000) 1, 100 249 Interest & investment income ($000) 16 TSX: WES

Bank West 2008 2007 14, 228 8, 632 Net interest & investment income ($000) 4, 544 2, 953 Operating & provision expenses ($000) 3, 444 2, 704 Operating income ($000) 1, 100 249 Interest & investment income ($000) 16 TSX: WES

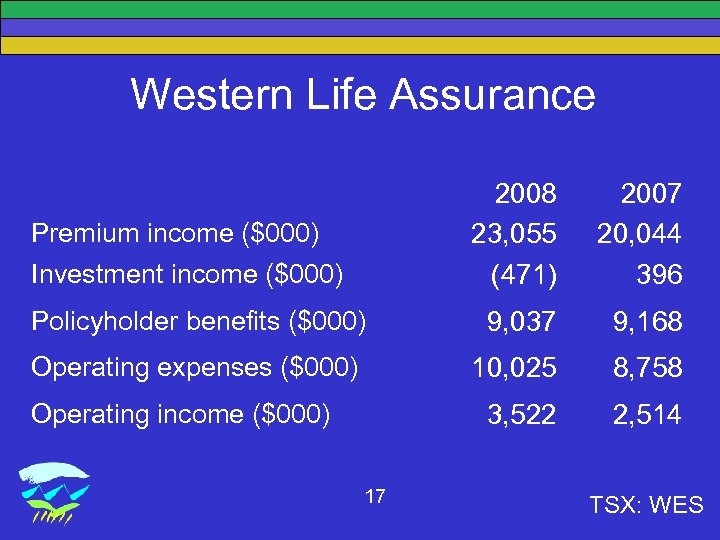

Western Life Assurance 2008 23, 055 (471) 2007 20, 044 396 Policyholder benefits ($000) 9, 037 9, 168 Operating expenses ($000) 10, 025 8, 758 3, 522 2, 514 Premium income ($000) Investment income ($000) Operating income ($000) 17 TSX: WES

Western Life Assurance 2008 23, 055 (471) 2007 20, 044 396 Policyholder benefits ($000) 9, 037 9, 168 Operating expenses ($000) 10, 025 8, 758 3, 522 2, 514 Premium income ($000) Investment income ($000) Operating income ($000) 17 TSX: WES

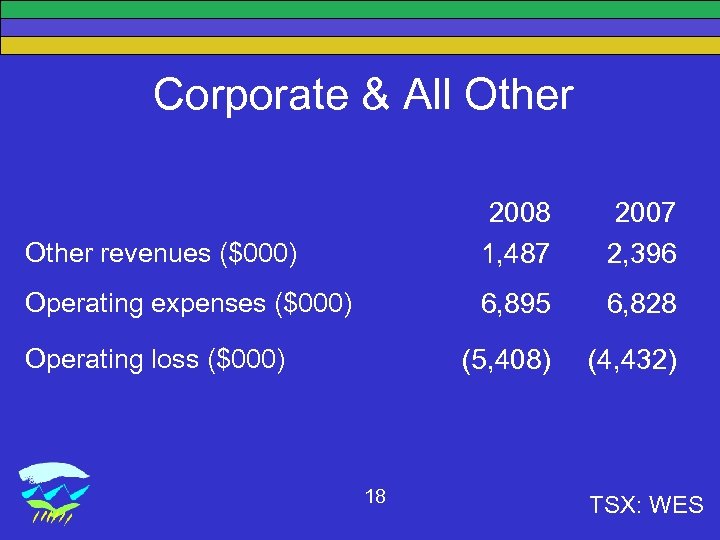

Corporate & All Other revenues ($000) 2008 1, 487 2007 2, 396 Operating expenses ($000) 6, 895 6, 828 (5, 408) (4, 432) Operating loss ($000) 18 TSX: WES

Corporate & All Other revenues ($000) 2008 1, 487 2007 2, 396 Operating expenses ($000) 6, 895 6, 828 (5, 408) (4, 432) Operating loss ($000) 18 TSX: WES

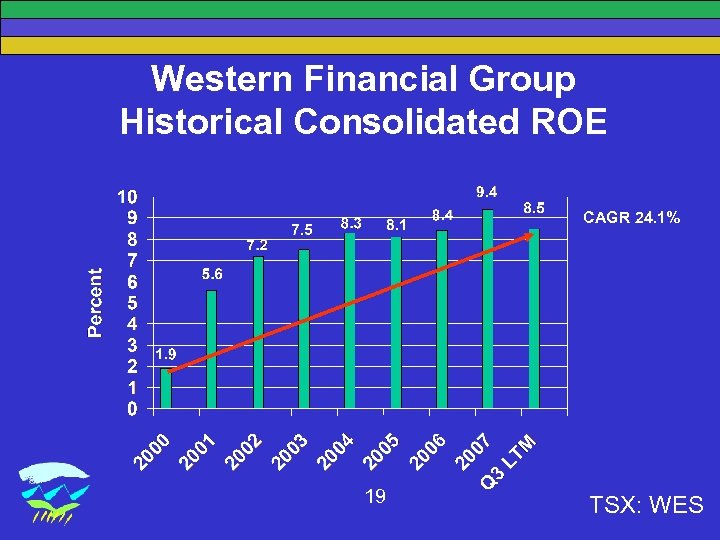

Western Financial Group Historical Consolidated ROE CAGR 24. 1% 19 TSX: WES

Western Financial Group Historical Consolidated ROE CAGR 24. 1% 19 TSX: WES

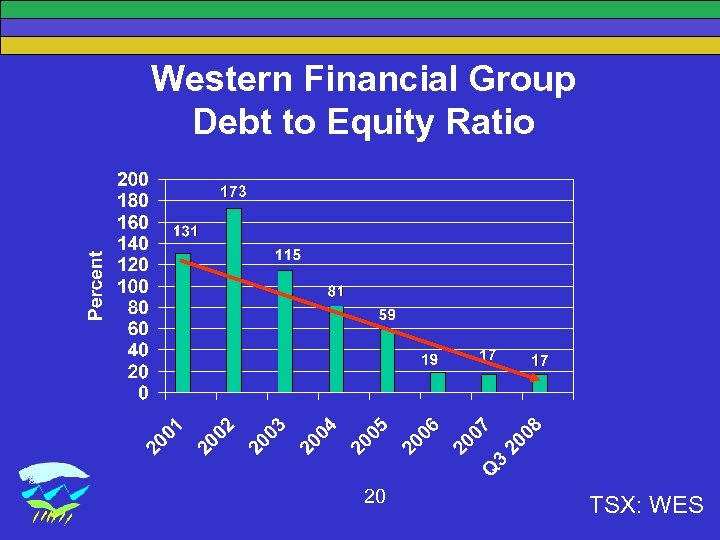

Western Financial Group Debt to Equity Ratio 20 TSX: WES

Western Financial Group Debt to Equity Ratio 20 TSX: WES

Priorities for Q 4

Priorities for Q 4

Q 4 Priorities • • Budget and capital planning. Network/Life WFGO. Agri. Financial approvals. Bank West CEO search. 22 TSX: WES

Q 4 Priorities • • Budget and capital planning. Network/Life WFGO. Agri. Financial approvals. Bank West CEO search. 22 TSX: WES

Questions

Questions

…because we live here.

…because we live here.