4de83770cba3f77660b69adb16a5f2e6.ppt

- Количество слайдов: 113

Welfare Rights Training 2016

Welfare Rights Training 2016

A claimant under pension age could be claiming? Income Support Jobseekers Allowance Employment Support Allowance Incapacity Benefit Severe Disablement Allowance Universal Credit

A claimant under pension age could be claiming? Income Support Jobseekers Allowance Employment Support Allowance Incapacity Benefit Severe Disablement Allowance Universal Credit

Which one would give them the most income?

Which one would give them the most income?

Would you be able to tell them which one to claim?

Would you be able to tell them which one to claim?

By the end of today you should be able to tell them!

By the end of today you should be able to tell them!

INCOME MAXIMISATION What’s this all about? The ability to listen, fact find, and notice that something is missing, advise accordingly, helping to identify further claims due. Thus increasing the weekly income of any client.

INCOME MAXIMISATION What’s this all about? The ability to listen, fact find, and notice that something is missing, advise accordingly, helping to identify further claims due. Thus increasing the weekly income of any client.

INCOME MAXIMISATION How do you do this?

INCOME MAXIMISATION How do you do this?

Interview and listen carefully

Interview and listen carefully

Think ahead

Think ahead

Write down or record the facts / information given on a case record sheet

Write down or record the facts / information given on a case record sheet

Check this information again at the end

Check this information again at the end

Calculate existing entitlements using the above information

Calculate existing entitlements using the above information

Submit and backdate any and all existing claims identified at this first stage

Submit and backdate any and all existing claims identified at this first stage

Identify any possible new claims due

Identify any possible new claims due

Re-calculate again as if these claims where awarded / paid

Re-calculate again as if these claims where awarded / paid

Submit any and all claims that would become payable only if or when these new claims are paid / awarded

Submit any and all claims that would become payable only if or when these new claims are paid / awarded

Clearly explain to the client what will or will not happen

Clearly explain to the client what will or will not happen

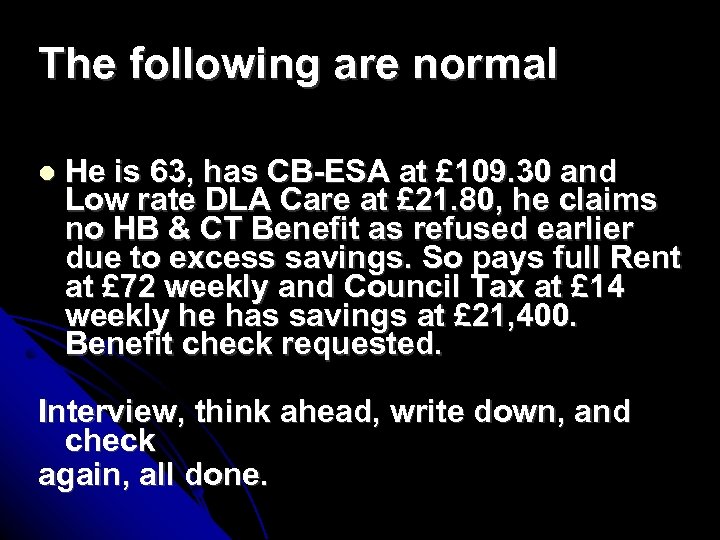

The following are normal He is 63, has CB-ESA at £ 109. 30 and Low rate DLA Care at £ 21. 80, he claims no HB & CT Benefit as refused earlier due to excess savings. So pays full Rent at £ 72 weekly and Council Tax at £ 14 weekly he has savings at £ 21, 400. Benefit check requested. Interview, think ahead, write down, and check again, all done.

The following are normal He is 63, has CB-ESA at £ 109. 30 and Low rate DLA Care at £ 21. 80, he claims no HB & CT Benefit as refused earlier due to excess savings. So pays full Rent at £ 72 weekly and Council Tax at £ 14 weekly he has savings at £ 21, 400. Benefit check requested. Interview, think ahead, write down, and check again, all done.

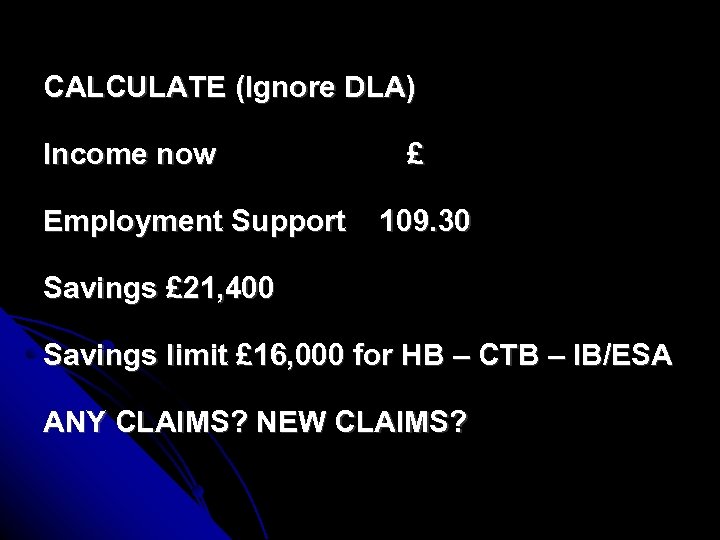

CALCULATE (Ignore DLA) Income now Employment Support £ 109. 30 Savings £ 21, 400 Savings limit £ 16, 000 for HB – CTB – IB/ESA ANY CLAIMS? NEW CLAIMS?

CALCULATE (Ignore DLA) Income now Employment Support £ 109. 30 Savings £ 21, 400 Savings limit £ 16, 000 for HB – CTB – IB/ESA ANY CLAIMS? NEW CLAIMS?

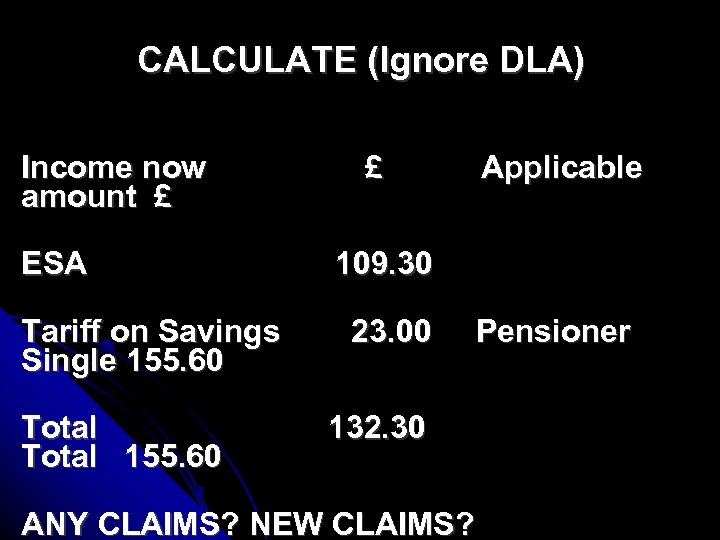

CALCULATE (Ignore DLA) Income now amount £ ESA Tariff on Savings Single 155. 60 Total 155. 60 £ Applicable 109. 30 23. 00 132. 30 ANY CLAIMS? NEW CLAIMS? Pensioner

CALCULATE (Ignore DLA) Income now amount £ ESA Tariff on Savings Single 155. 60 Total 155. 60 £ Applicable 109. 30 23. 00 132. 30 ANY CLAIMS? NEW CLAIMS? Pensioner

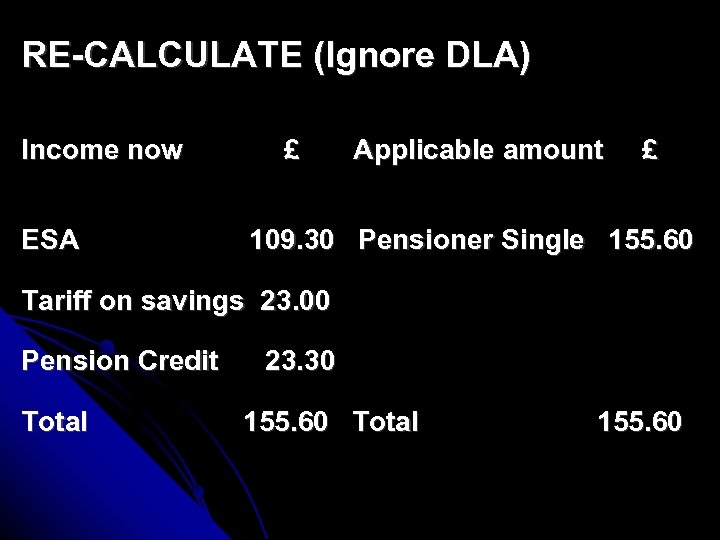

RE-CALCULATE (Ignore DLA) Income now ESA £ Applicable amount £ 109. 30 Pensioner Single 155. 60 Tariff on savings 23. 00 Pension Credit Total 23. 30 155. 60 Total 155. 60

RE-CALCULATE (Ignore DLA) Income now ESA £ Applicable amount £ 109. 30 Pensioner Single 155. 60 Tariff on savings 23. 00 Pension Credit Total 23. 30 155. 60 Total 155. 60

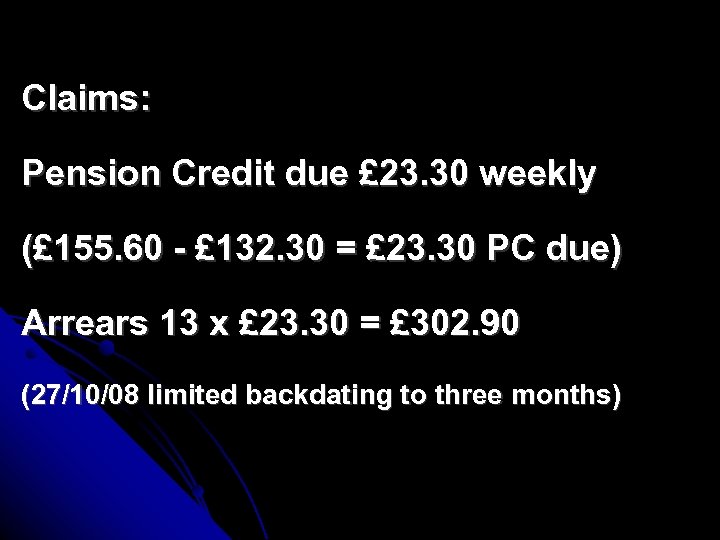

Claims: Pension Credit due £ 23. 30 weekly (£ 155. 60 - £ 132. 30 = £ 23. 30 PC due) Arrears 13 x £ 23. 30 = £ 302. 90 (27/10/08 limited backdating to three months)

Claims: Pension Credit due £ 23. 30 weekly (£ 155. 60 - £ 132. 30 = £ 23. 30 PC due) Arrears 13 x £ 23. 30 = £ 302. 90 (27/10/08 limited backdating to three months)

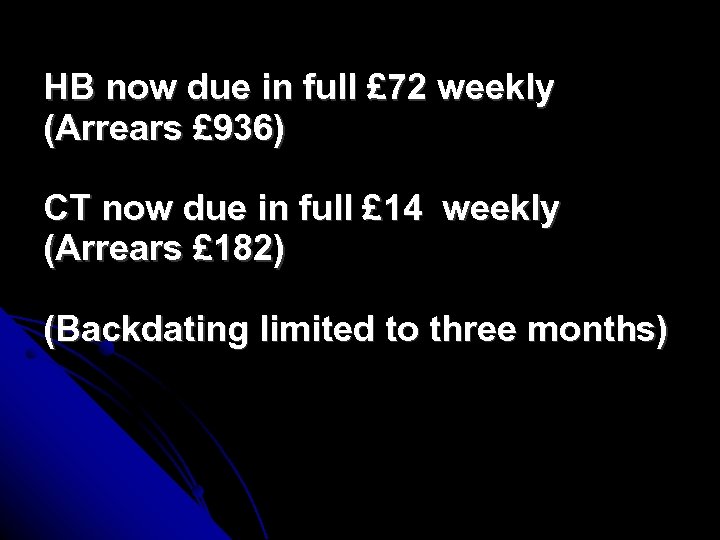

HB now due in full £ 72 weekly (Arrears £ 936) CT now due in full £ 14 weekly (Arrears £ 182) (Backdating limited to three months)

HB now due in full £ 72 weekly (Arrears £ 936) CT now due in full £ 14 weekly (Arrears £ 182) (Backdating limited to three months)

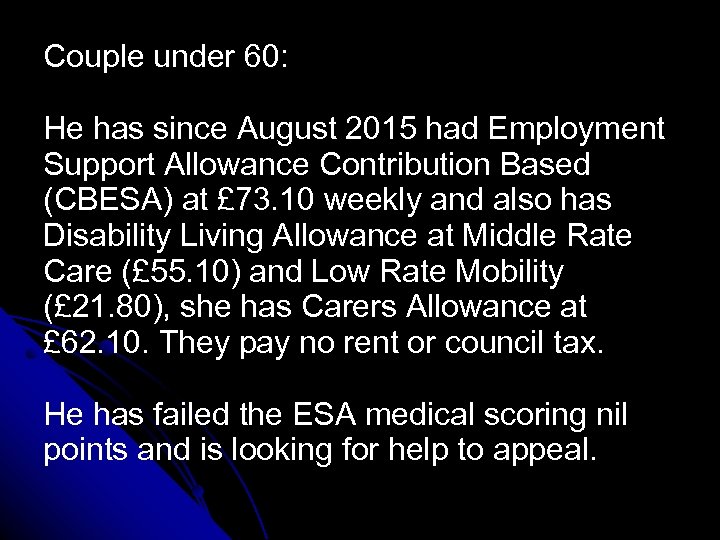

Couple under 60: He has since August 2015 had Employment Support Allowance Contribution Based (CBESA) at £ 73. 10 weekly and also has Disability Living Allowance at Middle Rate Care (£ 55. 10) and Low Rate Mobility (£ 21. 80), she has Carers Allowance at £ 62. 10. They pay no rent or council tax. He has failed the ESA medical scoring nil points and is looking for help to appeal.

Couple under 60: He has since August 2015 had Employment Support Allowance Contribution Based (CBESA) at £ 73. 10 weekly and also has Disability Living Allowance at Middle Rate Care (£ 55. 10) and Low Rate Mobility (£ 21. 80), she has Carers Allowance at £ 62. 10. They pay no rent or council tax. He has failed the ESA medical scoring nil points and is looking for help to appeal.

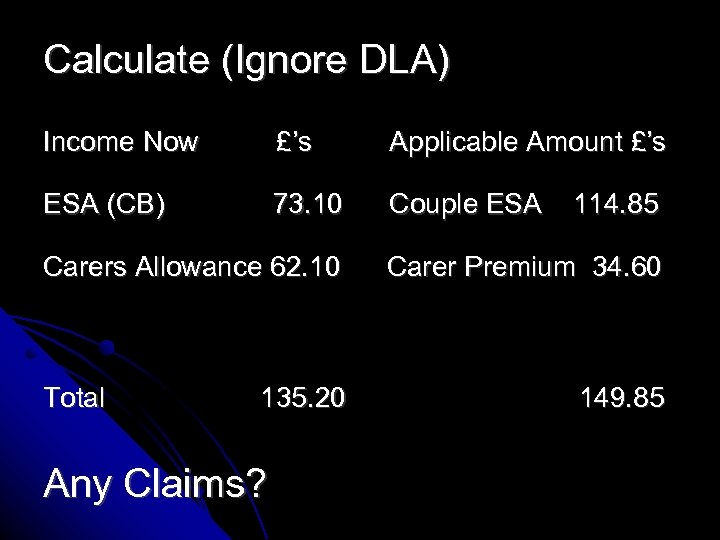

Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple ESA Carers Allowance 62. 10 Total 135. 20 Any Claims? 114. 85 Carer Premium 34. 60 149. 85

Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple ESA Carers Allowance 62. 10 Total 135. 20 Any Claims? 114. 85 Carer Premium 34. 60 149. 85

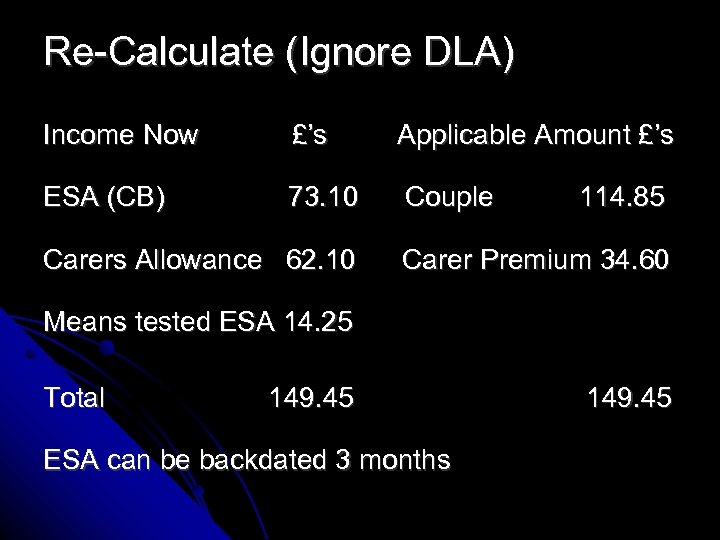

Re-Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple Carers Allowance 62. 10 114. 85 Carer Premium 34. 60 Means tested ESA 14. 25 Total 149. 45 ESA can be backdated 3 months 149. 45

Re-Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple Carers Allowance 62. 10 114. 85 Carer Premium 34. 60 Means tested ESA 14. 25 Total 149. 45 ESA can be backdated 3 months 149. 45

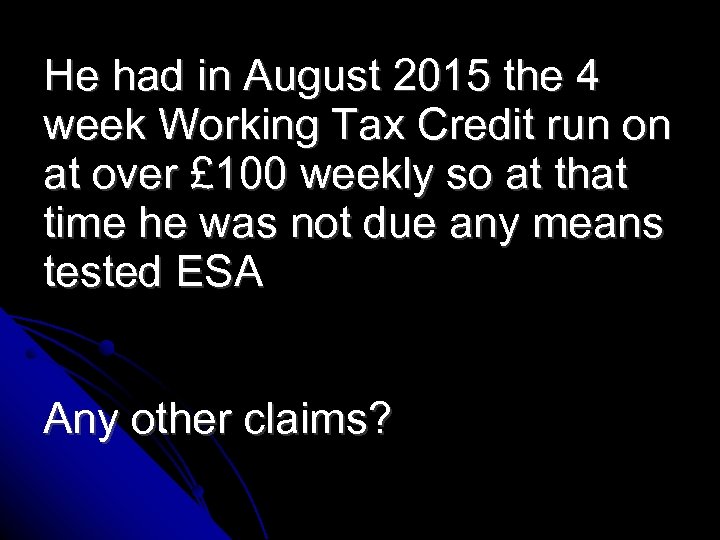

He had in August 2015 the 4 week Working Tax Credit run on at over £ 100 weekly so at that time he was not due any means tested ESA Any other claims?

He had in August 2015 the 4 week Working Tax Credit run on at over £ 100 weekly so at that time he was not due any means tested ESA Any other claims?

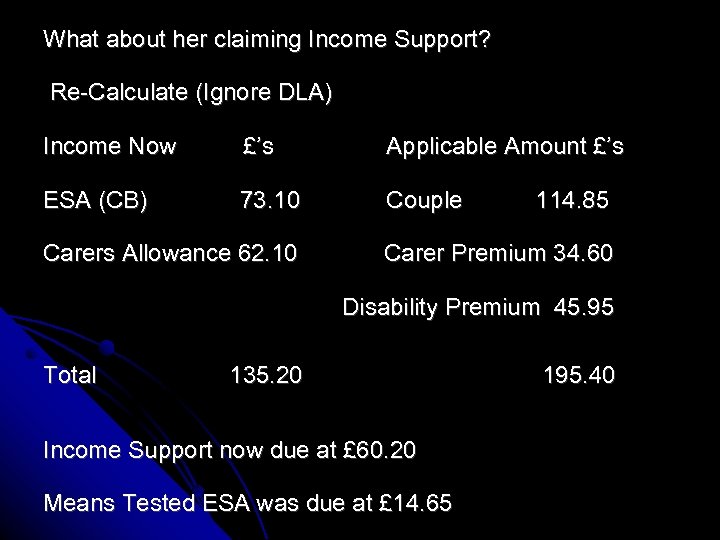

What about her claiming Income Support? Re-Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple Carers Allowance 62. 10 114. 85 Carer Premium 34. 60 Disability Premium 45. 95 Total 135. 20 Income Support now due at £ 60. 20 Means Tested ESA was due at £ 14. 65 195. 40

What about her claiming Income Support? Re-Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s ESA (CB) 73. 10 Couple Carers Allowance 62. 10 114. 85 Carer Premium 34. 60 Disability Premium 45. 95 Total 135. 20 Income Support now due at £ 60. 20 Means Tested ESA was due at £ 14. 65 195. 40

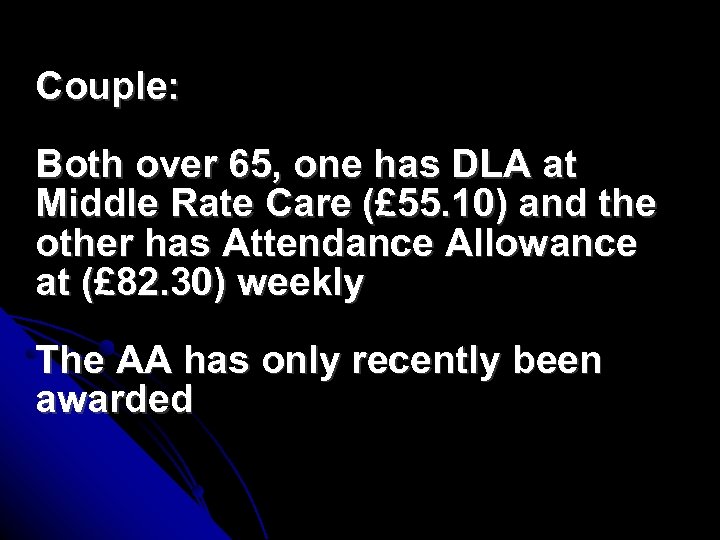

Couple: Both over 65, one has DLA at Middle Rate Care (£ 55. 10) and the other has Attendance Allowance at (£ 82. 30) weekly The AA has only recently been awarded

Couple: Both over 65, one has DLA at Middle Rate Care (£ 55. 10) and the other has Attendance Allowance at (£ 82. 30) weekly The AA has only recently been awarded

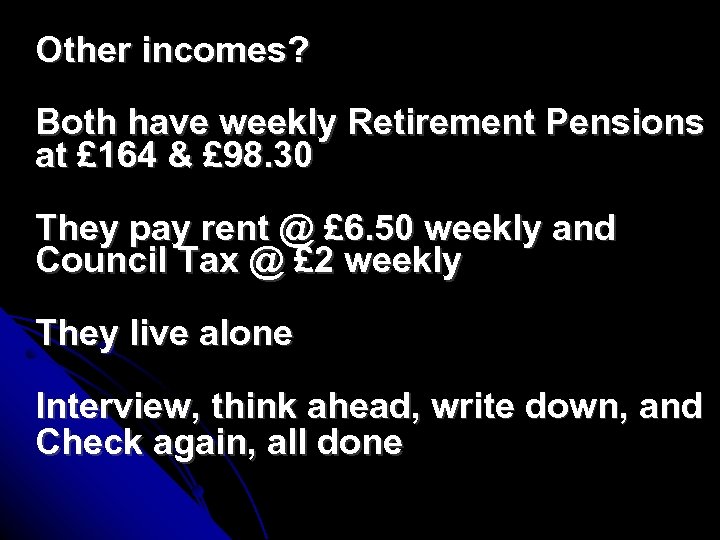

Other incomes? Both have weekly Retirement Pensions at £ 164 & £ 98. 30 They pay rent @ £ 6. 50 weekly and Council Tax @ £ 2 weekly They live alone Interview, think ahead, write down, and Check again, all done

Other incomes? Both have weekly Retirement Pensions at £ 164 & £ 98. 30 They pay rent @ £ 6. 50 weekly and Council Tax @ £ 2 weekly They live alone Interview, think ahead, write down, and Check again, all done

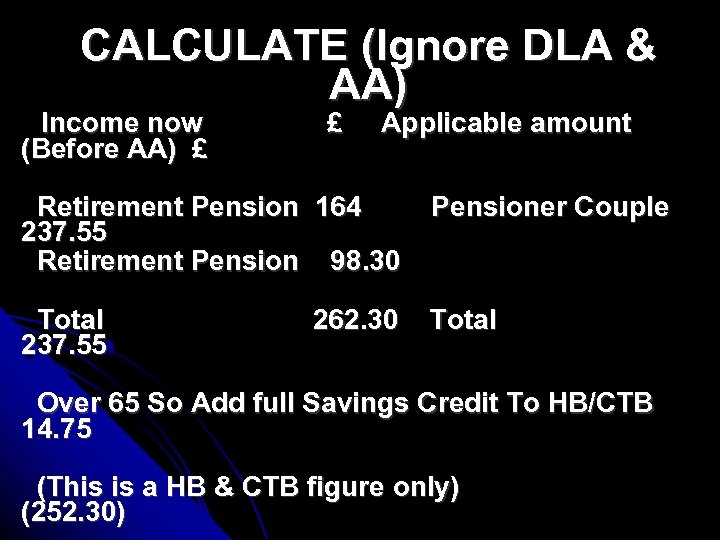

CALCULATE (Ignore DLA & AA) Income now (Before AA) £ £ Applicable amount Retirement Pension 164 237. 55 Retirement Pension 98. 30 Pensioner Couple Total 237. 55 Total 262. 30 Over 65 So Add full Savings Credit To HB/CTB 14. 75 (This is a HB & CTB figure only) (252. 30)

CALCULATE (Ignore DLA & AA) Income now (Before AA) £ £ Applicable amount Retirement Pension 164 237. 55 Retirement Pension 98. 30 Pensioner Couple Total 237. 55 Total 262. 30 Over 65 So Add full Savings Credit To HB/CTB 14. 75 (This is a HB & CTB figure only) (252. 30)

ANY CLAIMS? NEW CLAIMS?

ANY CLAIMS? NEW CLAIMS?

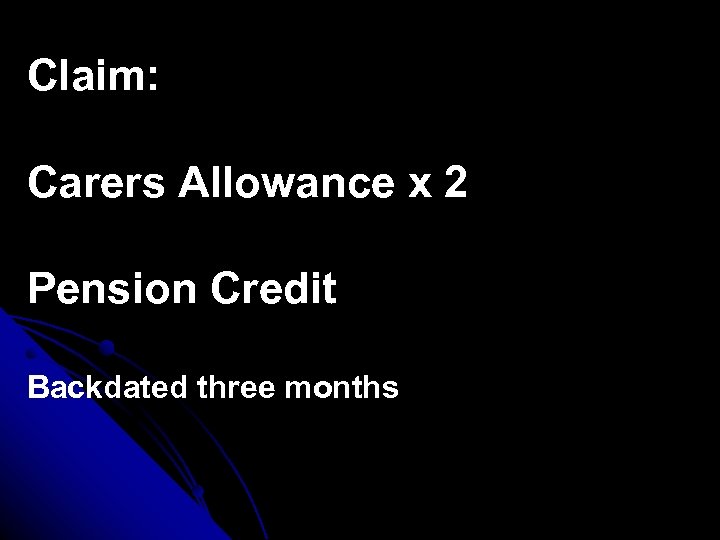

Claim: Carers Allowance x 2 Pension Credit Backdated three months

Claim: Carers Allowance x 2 Pension Credit Backdated three months

RE-CALCULATE (Ignore DLA & AA)

RE-CALCULATE (Ignore DLA & AA)

Income now £ Applicable amount £ Retirement Pension 164 Pensioner Couple 237. 55 Severe Disability Prem x 2 123. 70 Carer Premium 34. 60 Retirement Pension Total 98. 30 430. 45 262. 30 Savings Credit Due in full @ Rent paid now 00. 00 Council Tax paid now 00. 00 Pension Credit Due (£ 430. 45 - £ 262. 30 = £ 168. 15) £ 14. 75 £ 168. 15

Income now £ Applicable amount £ Retirement Pension 164 Pensioner Couple 237. 55 Severe Disability Prem x 2 123. 70 Carer Premium 34. 60 Retirement Pension Total 98. 30 430. 45 262. 30 Savings Credit Due in full @ Rent paid now 00. 00 Council Tax paid now 00. 00 Pension Credit Due (£ 430. 45 - £ 262. 30 = £ 168. 15) £ 14. 75 £ 168. 15

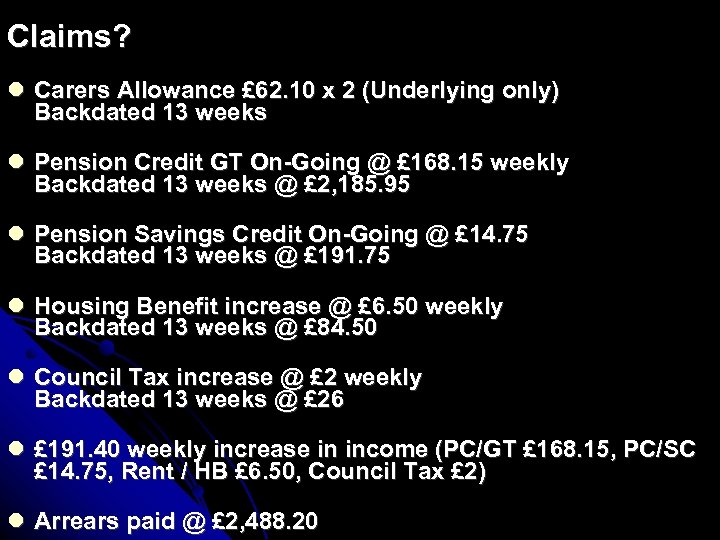

Claims? Carers Allowance £ 62. 10 x 2 (Underlying only) Backdated 13 weeks Pension Credit GT On-Going @ £ 168. 15 weekly Backdated 13 weeks @ £ 2, 185. 95 Pension Savings Credit On-Going @ £ 14. 75 Backdated 13 weeks @ £ 191. 75 Housing Benefit increase @ £ 6. 50 weekly Backdated 13 weeks @ £ 84. 50 Council Tax increase @ £ 2 weekly Backdated 13 weeks @ £ 26 £ 191. 40 weekly increase in income (PC/GT £ 168. 15, PC/SC £ 14. 75, Rent / HB £ 6. 50, Council Tax £ 2) Arrears paid @ £ 2, 488. 20

Claims? Carers Allowance £ 62. 10 x 2 (Underlying only) Backdated 13 weeks Pension Credit GT On-Going @ £ 168. 15 weekly Backdated 13 weeks @ £ 2, 185. 95 Pension Savings Credit On-Going @ £ 14. 75 Backdated 13 weeks @ £ 191. 75 Housing Benefit increase @ £ 6. 50 weekly Backdated 13 weeks @ £ 84. 50 Council Tax increase @ £ 2 weekly Backdated 13 weeks @ £ 26 £ 191. 40 weekly increase in income (PC/GT £ 168. 15, PC/SC £ 14. 75, Rent / HB £ 6. 50, Council Tax £ 2) Arrears paid @ £ 2, 488. 20

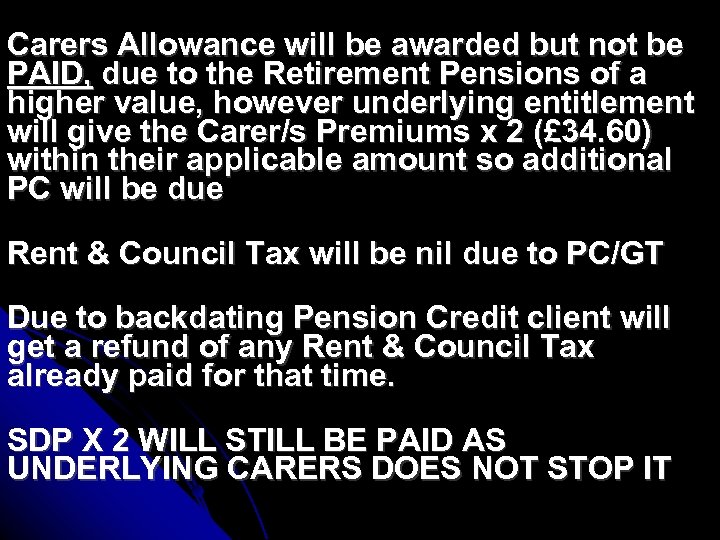

Carers Allowance will be awarded but not be PAID, due to the Retirement Pensions of a higher value, however underlying entitlement will give the Carer/s Premiums x 2 (£ 34. 60) within their applicable amount so additional PC will be due Rent & Council Tax will be nil due to PC/GT Due to backdating Pension Credit client will get a refund of any Rent & Council Tax already paid for that time. SDP X 2 WILL STILL BE PAID AS UNDERLYING CARERS DOES NOT STOP IT

Carers Allowance will be awarded but not be PAID, due to the Retirement Pensions of a higher value, however underlying entitlement will give the Carer/s Premiums x 2 (£ 34. 60) within their applicable amount so additional PC will be due Rent & Council Tax will be nil due to PC/GT Due to backdating Pension Credit client will get a refund of any Rent & Council Tax already paid for that time. SDP X 2 WILL STILL BE PAID AS UNDERLYING CARERS DOES NOT STOP IT

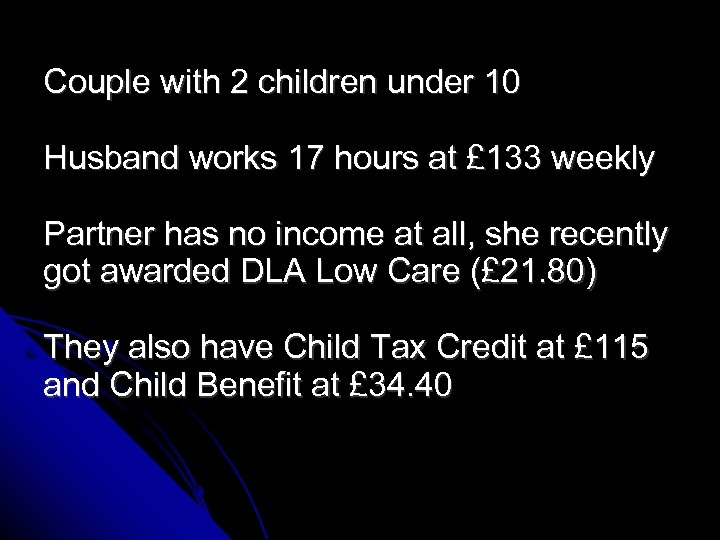

Couple with 2 children under 10 Husband works 17 hours at £ 133 weekly Partner has no income at all, she recently got awarded DLA Low Care (£ 21. 80) They also have Child Tax Credit at £ 115 and Child Benefit at £ 34. 40

Couple with 2 children under 10 Husband works 17 hours at £ 133 weekly Partner has no income at all, she recently got awarded DLA Low Care (£ 21. 80) They also have Child Tax Credit at £ 115 and Child Benefit at £ 34. 40

They had until April 2012 working tax credit at £ 70 weekly but due to the 24 hour couple rule this was stopped. They have a mortgage at £ 50 weekly and are struggling to pay the household bills etc. They already get full Council Tax Benefit What if any claims are available to them?

They had until April 2012 working tax credit at £ 70 weekly but due to the 24 hour couple rule this was stopped. They have a mortgage at £ 50 weekly and are struggling to pay the household bills etc. They already get full Council Tax Benefit What if any claims are available to them?

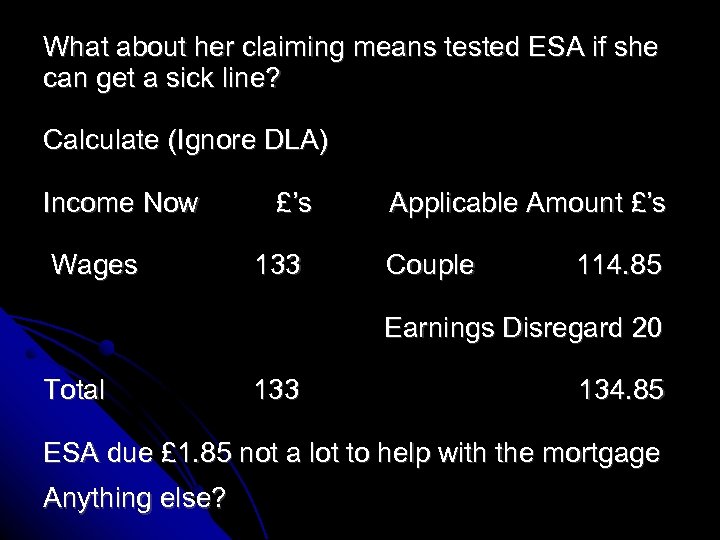

What about her claiming means tested ESA if she can get a sick line? Calculate (Ignore DLA) Income Now Wages £’s 133 Applicable Amount £’s Couple 114. 85 Earnings Disregard 20 Total 133 134. 85 ESA due £ 1. 85 not a lot to help with the mortgage Anything else?

What about her claiming means tested ESA if she can get a sick line? Calculate (Ignore DLA) Income Now Wages £’s 133 Applicable Amount £’s Couple 114. 85 Earnings Disregard 20 Total 133 134. 85 ESA due £ 1. 85 not a lot to help with the mortgage Anything else?

Jobseekers Allowance? Would give more help but she is unable to work due to sickness so this is not an option.

Jobseekers Allowance? Would give more help but she is unable to work due to sickness so this is not an option.

Now that she has the DLA she is classed as disabled for Working Tax Credit purposes so they are now due Working Tax Credit even although he only works 17 hours, this worth at about £ 70 weekly. That will help with the mortgage

Now that she has the DLA she is classed as disabled for Working Tax Credit purposes so they are now due Working Tax Credit even although he only works 17 hours, this worth at about £ 70 weekly. That will help with the mortgage

Couple with one disabled child under 16, the child recently got DLA at Middle Rate Care She works 22 hours earning £ 180 weekly.

Couple with one disabled child under 16, the child recently got DLA at Middle Rate Care She works 22 hours earning £ 180 weekly.

They also have Child Benefit at £ 20. 70 and Child Tax Credit at £ 65 weekly. No Working Tax Credit paid since April 2012 due to the 24 hour couple rule. Any other claims?

They also have Child Benefit at £ 20. 70 and Child Tax Credit at £ 65 weekly. No Working Tax Credit paid since April 2012 due to the 24 hour couple rule. Any other claims?

The Child Tax Credit at £ 65 weekly is very low for a disabled child? Suggesting that they have failed to tell Tax Credits that the child now has DLA? This DLA award will increase the Child Tax Credits by about £ 58 weekly, backdating is now limited to one month unless done quickly. Anything else?

The Child Tax Credit at £ 65 weekly is very low for a disabled child? Suggesting that they have failed to tell Tax Credits that the child now has DLA? This DLA award will increase the Child Tax Credits by about £ 58 weekly, backdating is now limited to one month unless done quickly. Anything else?

He can now claim and backdate a Carers Allowance claim worth £ 62. 10 weekly for him looking after the disabled child As he is now a Carer, she only has to work 16+ hours now (Rather than the previous 24 hours) to allow Working Tax Credit to be paid at about £ 70 weekly

He can now claim and backdate a Carers Allowance claim worth £ 62. 10 weekly for him looking after the disabled child As he is now a Carer, she only has to work 16+ hours now (Rather than the previous 24 hours) to allow Working Tax Credit to be paid at about £ 70 weekly

Single person aged 48 who was working full time but is now off work sick. She is getting paid basic Statutory Sick Pay (SSP) at £ 88. 45 weekly, she also has Working Tax Credits at £ 12 weekly and DLA at Low Rate Mobility. Any other claims?

Single person aged 48 who was working full time but is now off work sick. She is getting paid basic Statutory Sick Pay (SSP) at £ 88. 45 weekly, she also has Working Tax Credits at £ 12 weekly and DLA at Low Rate Mobility. Any other claims?

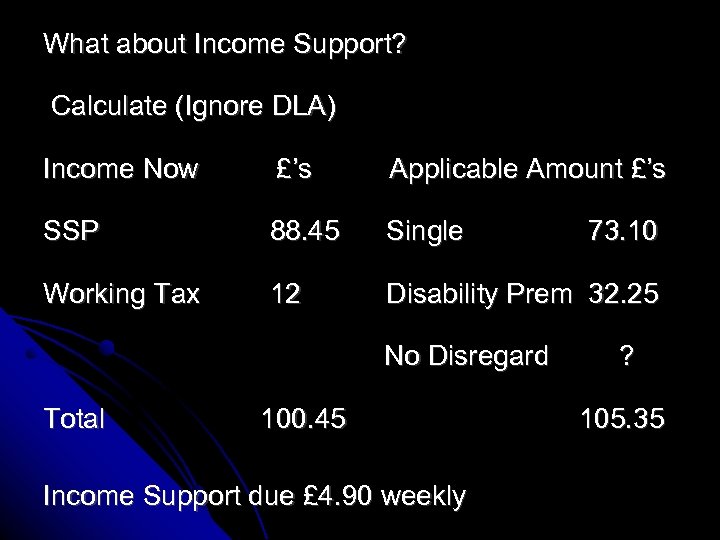

What about Income Support? Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s SSP 88. 45 Single Working Tax 12 Disability Prem 32. 25 No Disregard Total 100. 45 Income Support due £ 4. 90 weekly 73. 10 ? 105. 35

What about Income Support? Calculate (Ignore DLA) Income Now £’s Applicable Amount £’s SSP 88. 45 Single Working Tax 12 Disability Prem 32. 25 No Disregard Total 100. 45 Income Support due £ 4. 90 weekly 73. 10 ? 105. 35

SSP allows an Income Support claim if your income/s are below your applicable amount. Although HB & CTB count SSP as earnings and allow an earnings disregard IS counts it as other income with no earning disregard allowed.

SSP allows an Income Support claim if your income/s are below your applicable amount. Although HB & CTB count SSP as earnings and allow an earnings disregard IS counts it as other income with no earning disregard allowed.

This man has been working part time for the last 4 years earning just £ 140 weekly for his 18 hours worked. He has now turned 60 and is asking you about him claiming Pension Credit? He lives with his brother who owns the house. Any claims?

This man has been working part time for the last 4 years earning just £ 140 weekly for his 18 hours worked. He has now turned 60 and is asking you about him claiming Pension Credit? He lives with his brother who owns the house. Any claims?

Pension Credit is not available for people aged 60 now so that is not an option for him. What about Working Tax Credit? People aged over 60 can now get WTC if they work over 16+ hours and their income / earnings are low enough? He should get about £ 40 weekly

Pension Credit is not available for people aged 60 now so that is not an option for him. What about Working Tax Credit? People aged over 60 can now get WTC if they work over 16+ hours and their income / earnings are low enough? He should get about £ 40 weekly

This couple are both under 60 She works full time earning £ 400 weekly His only income now is his work Occupational Pension at £ 200 weekly They own the house with no mortgage and pay full Council Tax

This couple are both under 60 She works full time earning £ 400 weekly His only income now is his work Occupational Pension at £ 200 weekly They own the house with no mortgage and pay full Council Tax

They have a disabled daughter with Downs Syndrome in the house aged 30 She has ESA (£ 125. 05) and DLA at the High Rate Care and High Rate Mobility They are asking for a benefit check for their daughter? Clearly the daughter has her full legal entitlements at this time! Anything Else?

They have a disabled daughter with Downs Syndrome in the house aged 30 She has ESA (£ 125. 05) and DLA at the High Rate Care and High Rate Mobility They are asking for a benefit check for their daughter? Clearly the daughter has her full legal entitlements at this time! Anything Else?

Dad can claim and backdate Carers Allowance at £ 62. 10 weekly His Occupational Pension at £ 200 weekly does not stop him claiming this He should let HMRC know as Carers Allowance is a taxable benefit so he may pay more tax on his pension Anything else?

Dad can claim and backdate Carers Allowance at £ 62. 10 weekly His Occupational Pension at £ 200 weekly does not stop him claiming this He should let HMRC know as Carers Allowance is a taxable benefit so he may pay more tax on his pension Anything else?

Looking at the daughter with the High Care of DLA and Downs Syndrome the chances are she would fit the severely mentally impaired criteria for Council Tax exemption That then leaves 2 adults in the house mum and dad. They could both claim a Carers Exemption from Council Tax making them both invisible as well that leaves no adults in the house so a 50% Council tax discount would apply.

Looking at the daughter with the High Care of DLA and Downs Syndrome the chances are she would fit the severely mentally impaired criteria for Council Tax exemption That then leaves 2 adults in the house mum and dad. They could both claim a Carers Exemption from Council Tax making them both invisible as well that leaves no adults in the house so a 50% Council tax discount would apply.

This person has a severely disabled child with DLA and has had Carers Allowance at £ 62. 10 weekly for the past two years She also works 10 hours weekly earning £ 100 so is just below the Carers earnings limit at £ 110, her partner works full-time. Her employer has asked her to work 10 hours overtime for the next 3 weeks She is worried about her Carers Allowance stopping and is looking for your advice?

This person has a severely disabled child with DLA and has had Carers Allowance at £ 62. 10 weekly for the past two years She also works 10 hours weekly earning £ 100 so is just below the Carers earnings limit at £ 110, her partner works full-time. Her employer has asked her to work 10 hours overtime for the next 3 weeks She is worried about her Carers Allowance stopping and is looking for your advice?

Once you have had Carers Allowance for over 22 weeks you are allowed 4 weeks holidays or a break from caring just like someone employed During this 4 week period you can go over the normal £ 110 weekly earnings limit and remain entitled to Carers Allowance This can be done every 22 weeks

Once you have had Carers Allowance for over 22 weeks you are allowed 4 weeks holidays or a break from caring just like someone employed During this 4 week period you can go over the normal £ 110 weekly earnings limit and remain entitled to Carers Allowance This can be done every 22 weeks

This couple have come to you looking for help as he has been made redundant last week after 35 years He is 60 years old. He got £ 25, 000 redundancy and has a weekly company pension at £ 128 weekly She is 63 with her old age pension at £ 72 weekly

This couple have come to you looking for help as he has been made redundant last week after 35 years He is 60 years old. He got £ 25, 000 redundancy and has a weekly company pension at £ 128 weekly She is 63 with her old age pension at £ 72 weekly

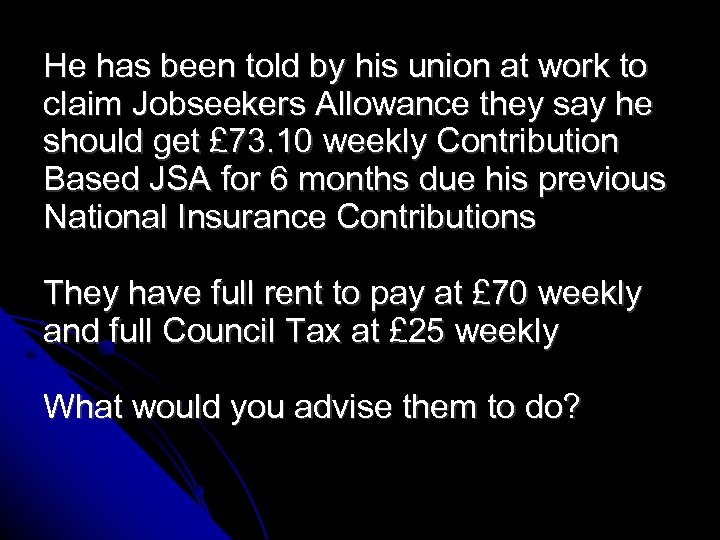

He has been told by his union at work to claim Jobseekers Allowance they say he should get £ 73. 10 weekly Contribution Based JSA for 6 months due his previous National Insurance Contributions They have full rent to pay at £ 70 weekly and full Council Tax at £ 25 weekly What would you advise them to do?

He has been told by his union at work to claim Jobseekers Allowance they say he should get £ 73. 10 weekly Contribution Based JSA for 6 months due his previous National Insurance Contributions They have full rent to pay at £ 70 weekly and full Council Tax at £ 25 weekly What would you advise them to do?

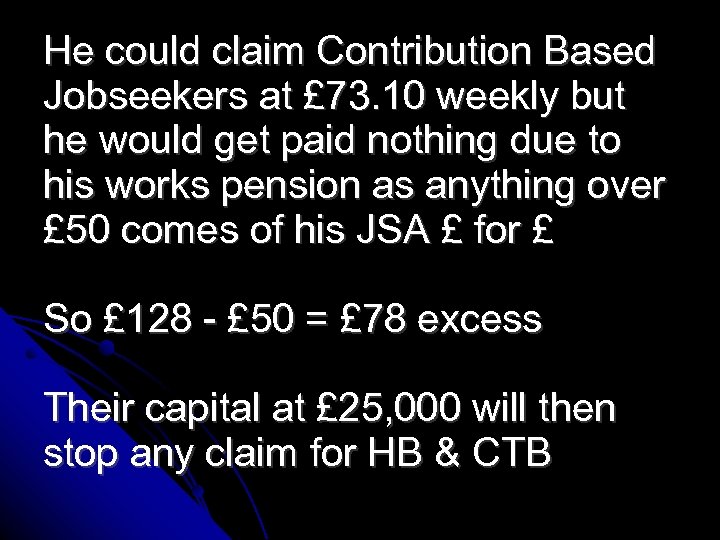

He could claim Contribution Based Jobseekers at £ 73. 10 weekly but he would get paid nothing due to his works pension as anything over £ 50 comes of his JSA £ for £ So £ 128 - £ 50 = £ 78 excess Their capital at £ 25, 000 will then stop any claim for HB & CTB

He could claim Contribution Based Jobseekers at £ 73. 10 weekly but he would get paid nothing due to his works pension as anything over £ 50 comes of his JSA £ for £ So £ 128 - £ 50 = £ 78 excess Their capital at £ 25, 000 will then stop any claim for HB & CTB

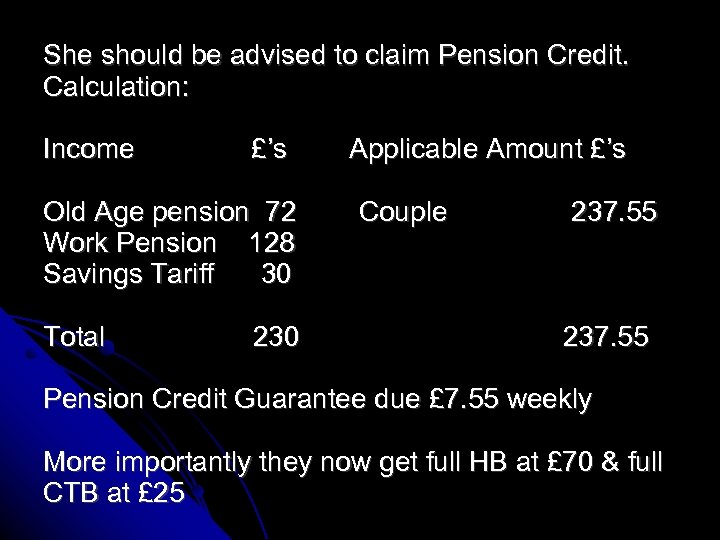

She should be advised to claim Pension Credit. Calculation: Income £’s Old Age pension 72 Work Pension 128 Savings Tariff 30 Total 230 Applicable Amount £’s Couple 237. 55 Pension Credit Guarantee due £ 7. 55 weekly More importantly they now get full HB at £ 70 & full CTB at £ 25

She should be advised to claim Pension Credit. Calculation: Income £’s Old Age pension 72 Work Pension 128 Savings Tariff 30 Total 230 Applicable Amount £’s Couple 237. 55 Pension Credit Guarantee due £ 7. 55 weekly More importantly they now get full HB at £ 70 & full CTB at £ 25

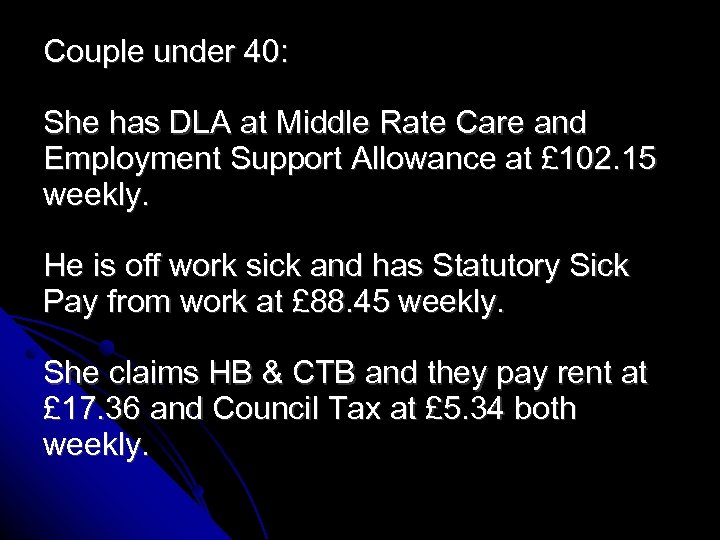

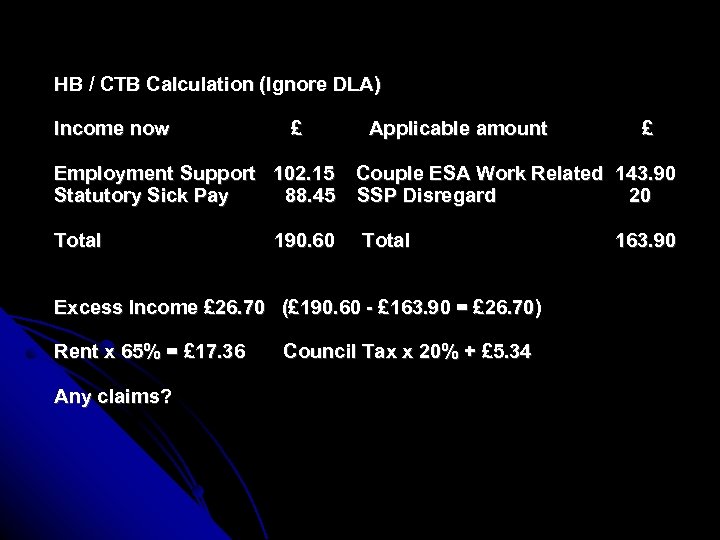

Couple under 40: She has DLA at Middle Rate Care and Employment Support Allowance at £ 102. 15 weekly. He is off work sick and has Statutory Sick Pay from work at £ 88. 45 weekly. She claims HB & CTB and they pay rent at £ 17. 36 and Council Tax at £ 5. 34 both weekly.

Couple under 40: She has DLA at Middle Rate Care and Employment Support Allowance at £ 102. 15 weekly. He is off work sick and has Statutory Sick Pay from work at £ 88. 45 weekly. She claims HB & CTB and they pay rent at £ 17. 36 and Council Tax at £ 5. 34 both weekly.

HB / CTB Calculation (Ignore DLA) Income now £ Employment Support 102. 15 Statutory Sick Pay 88. 45 Total 190. 60 Applicable amount Couple ESA Work Related 143. 90 SSP Disregard 20 Total Excess Income £ 26. 70 (£ 190. 60 - £ 163. 90 = £ 26. 70) Rent x 65% = £ 17. 36 Any claims? £ Council Tax x 20% + £ 5. 34 163. 90

HB / CTB Calculation (Ignore DLA) Income now £ Employment Support 102. 15 Statutory Sick Pay 88. 45 Total 190. 60 Applicable amount Couple ESA Work Related 143. 90 SSP Disregard 20 Total Excess Income £ 26. 70 (£ 190. 60 - £ 163. 90 = £ 26. 70) Rent x 65% = £ 17. 36 Any claims? £ Council Tax x 20% + £ 5. 34 163. 90

Can he claim Carers Allowance while on Statutory Sick Pay?

Can he claim Carers Allowance while on Statutory Sick Pay?

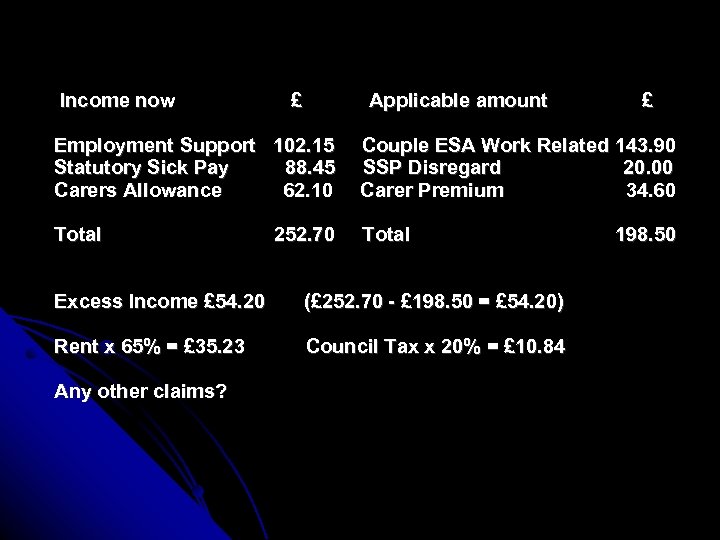

Income now £ Applicable amount £ Employment Support 102. 15 Statutory Sick Pay 88. 45 Carers Allowance 62. 10 Couple ESA Work Related 143. 90 SSP Disregard 20. 00 Carer Premium 34. 60 Total 252. 70 Excess Income £ 54. 20 (£ 252. 70 - £ 198. 50 = £ 54. 20) Rent x 65% = £ 35. 23 Council Tax x 20% = £ 10. 84 Any other claims? 198. 50

Income now £ Applicable amount £ Employment Support 102. 15 Statutory Sick Pay 88. 45 Carers Allowance 62. 10 Couple ESA Work Related 143. 90 SSP Disregard 20. 00 Carer Premium 34. 60 Total 252. 70 Excess Income £ 54. 20 (£ 252. 70 - £ 198. 50 = £ 54. 20) Rent x 65% = £ 35. 23 Council Tax x 20% = £ 10. 84 Any other claims? 198. 50

It may be your Council would do this anyways?

It may be your Council would do this anyways?

Swap the Housing Benefit claimants?

Swap the Housing Benefit claimants?

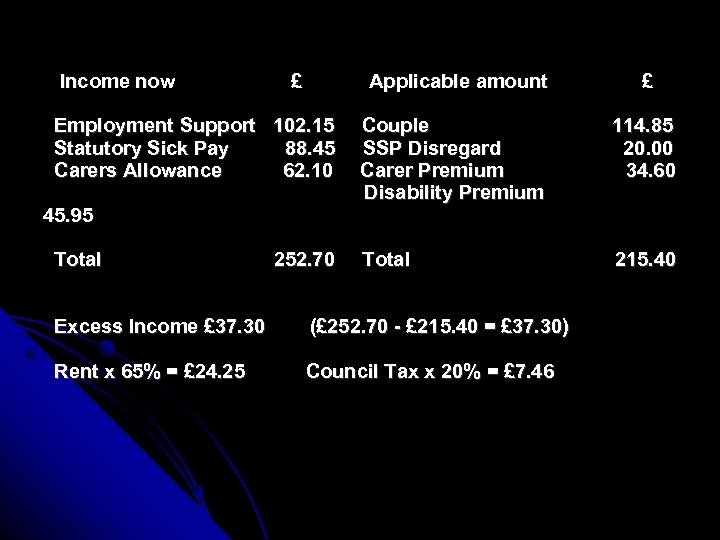

Income now £ Applicable amount Employment Support 102. 15 Statutory Sick Pay 88. 45 Carers Allowance 62. 10 45. 95 Total 252. 70 £ Couple SSP Disregard Carer Premium Disability Premium 114. 85 20. 00 34. 60 Total 215. 40 Excess Income £ 37. 30 (£ 252. 70 - £ 215. 40 = £ 37. 30) Rent x 65% = £ 24. 25 Council Tax x 20% = £ 7. 46

Income now £ Applicable amount Employment Support 102. 15 Statutory Sick Pay 88. 45 Carers Allowance 62. 10 45. 95 Total 252. 70 £ Couple SSP Disregard Carer Premium Disability Premium 114. 85 20. 00 34. 60 Total 215. 40 Excess Income £ 37. 30 (£ 252. 70 - £ 215. 40 = £ 37. 30) Rent x 65% = £ 24. 25 Council Tax x 20% = £ 7. 46

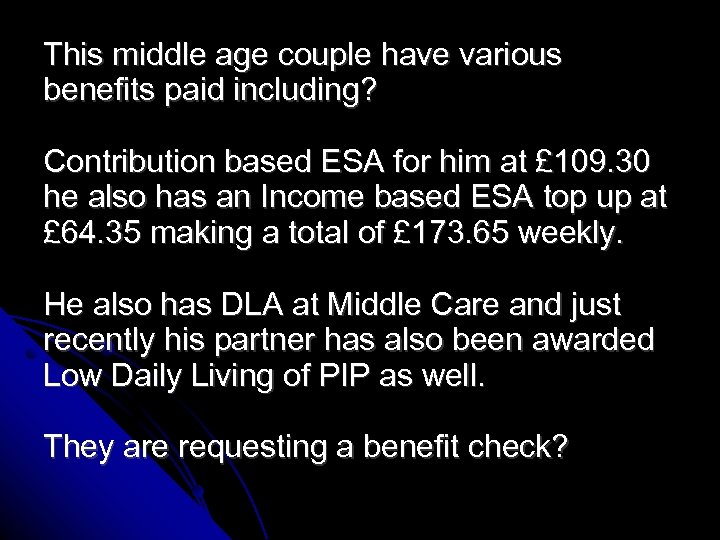

This middle age couple have various benefits paid including? Contribution based ESA for him at £ 109. 30 he also has an Income based ESA top up at £ 64. 35 making a total of £ 173. 65 weekly. He also has DLA at Middle Care and just recently his partner has also been awarded Low Daily Living of PIP as well. They are requesting a benefit check?

This middle age couple have various benefits paid including? Contribution based ESA for him at £ 109. 30 he also has an Income based ESA top up at £ 64. 35 making a total of £ 173. 65 weekly. He also has DLA at Middle Care and just recently his partner has also been awarded Low Daily Living of PIP as well. They are requesting a benefit check?

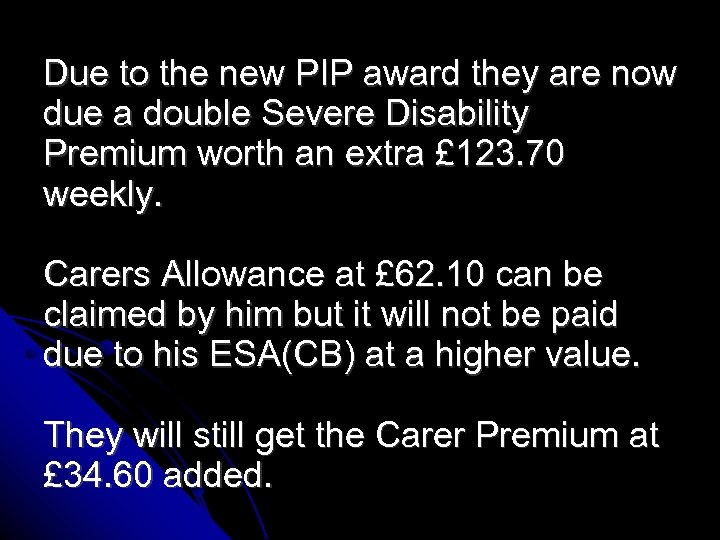

Due to the new PIP award they are now due a double Severe Disability Premium worth an extra £ 123. 70 weekly. Carers Allowance at £ 62. 10 can be claimed by him but it will not be paid due to his ESA(CB) at a higher value. They will still get the Carer Premium at £ 34. 60 added.

Due to the new PIP award they are now due a double Severe Disability Premium worth an extra £ 123. 70 weekly. Carers Allowance at £ 62. 10 can be claimed by him but it will not be paid due to his ESA(CB) at a higher value. They will still get the Carer Premium at £ 34. 60 added.

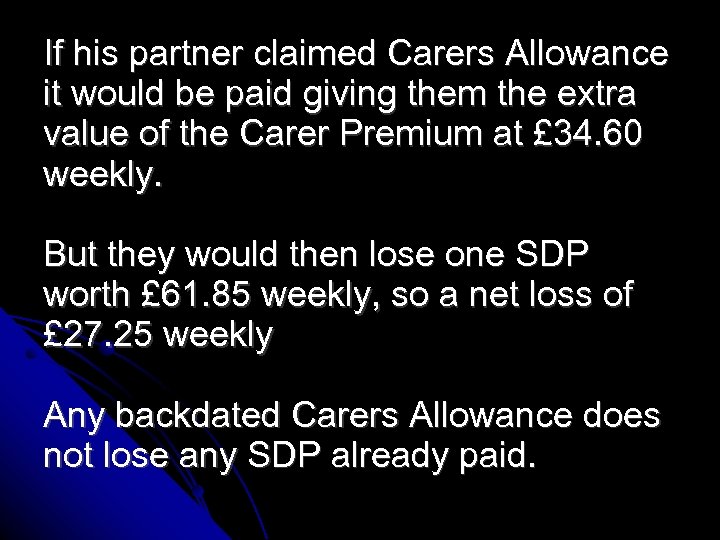

If his partner claimed Carers Allowance it would be paid giving them the extra value of the Carer Premium at £ 34. 60 weekly. But they would then lose one SDP worth £ 61. 85 weekly, so a net loss of £ 27. 25 weekly Any backdated Carers Allowance does not lose any SDP already paid.

If his partner claimed Carers Allowance it would be paid giving them the extra value of the Carer Premium at £ 34. 60 weekly. But they would then lose one SDP worth £ 61. 85 weekly, so a net loss of £ 27. 25 weekly Any backdated Carers Allowance does not lose any SDP already paid.

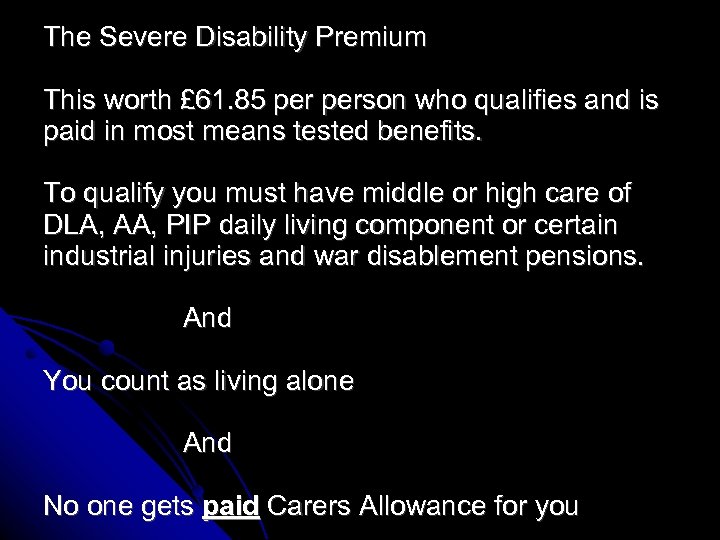

The Severe Disability Premium This worth £ 61. 85 person who qualifies and is paid in most means tested benefits. To qualify you must have middle or high care of DLA, AA, PIP daily living component or certain industrial injuries and war disablement pensions. And You count as living alone And No one gets paid Carers Allowance for you

The Severe Disability Premium This worth £ 61. 85 person who qualifies and is paid in most means tested benefits. To qualify you must have middle or high care of DLA, AA, PIP daily living component or certain industrial injuries and war disablement pensions. And You count as living alone And No one gets paid Carers Allowance for you

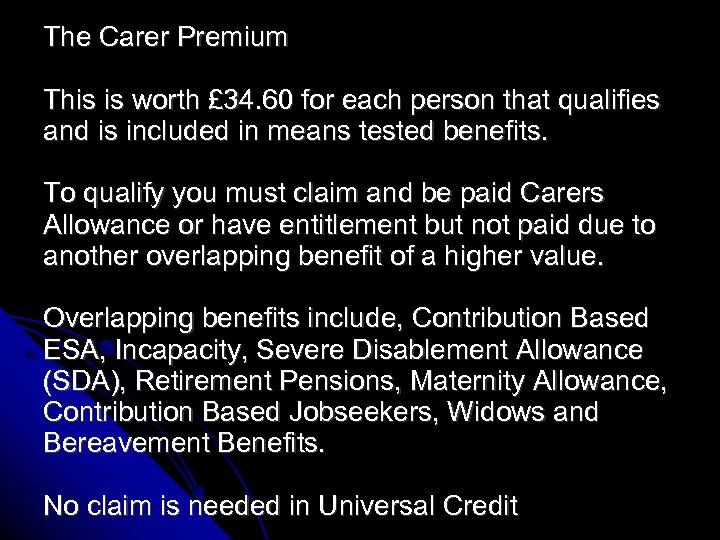

The Carer Premium This is worth £ 34. 60 for each person that qualifies and is included in means tested benefits. To qualify you must claim and be paid Carers Allowance or have entitlement but not paid due to another overlapping benefit of a higher value. Overlapping benefits include, Contribution Based ESA, Incapacity, Severe Disablement Allowance (SDA), Retirement Pensions, Maternity Allowance, Contribution Based Jobseekers, Widows and Bereavement Benefits. No claim is needed in Universal Credit

The Carer Premium This is worth £ 34. 60 for each person that qualifies and is included in means tested benefits. To qualify you must claim and be paid Carers Allowance or have entitlement but not paid due to another overlapping benefit of a higher value. Overlapping benefits include, Contribution Based ESA, Incapacity, Severe Disablement Allowance (SDA), Retirement Pensions, Maternity Allowance, Contribution Based Jobseekers, Widows and Bereavement Benefits. No claim is needed in Universal Credit

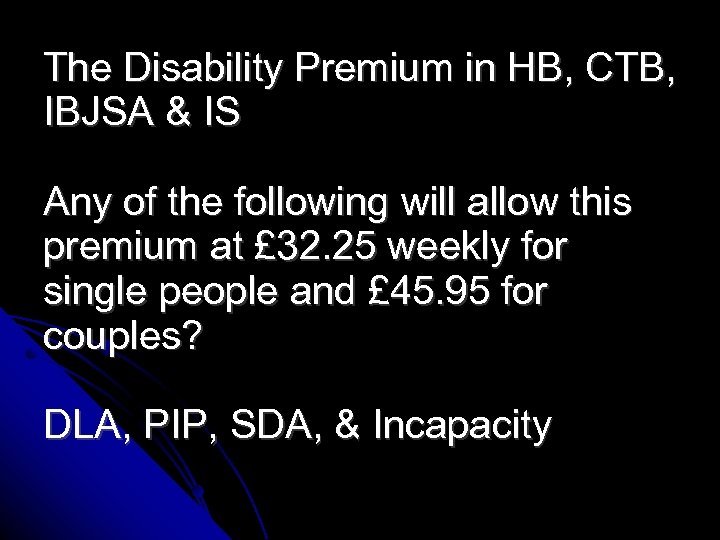

The Disability Premium in HB, CTB, IBJSA & IS Any of the following will allow this premium at £ 32. 25 weekly for single people and £ 45. 95 for couples? DLA, PIP, SDA, & Incapacity

The Disability Premium in HB, CTB, IBJSA & IS Any of the following will allow this premium at £ 32. 25 weekly for single people and £ 45. 95 for couples? DLA, PIP, SDA, & Incapacity

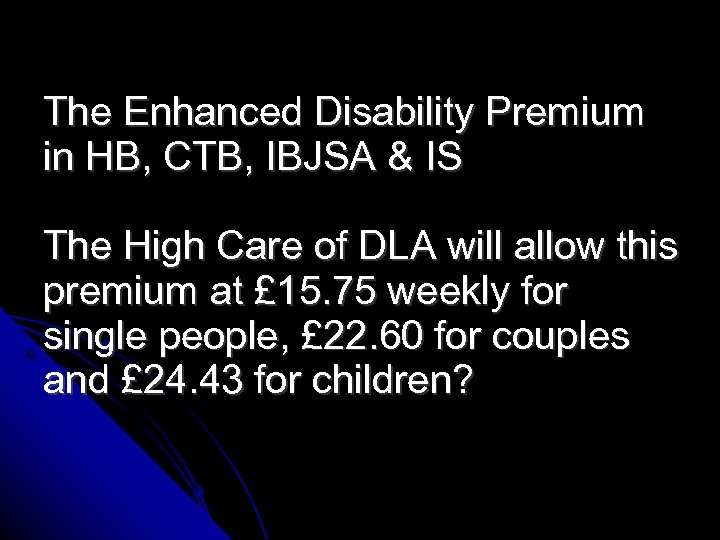

The Enhanced Disability Premium in HB, CTB, IBJSA & IS The High Care of DLA will allow this premium at £ 15. 75 weekly for single people, £ 22. 60 for couples and £ 24. 43 for children?

The Enhanced Disability Premium in HB, CTB, IBJSA & IS The High Care of DLA will allow this premium at £ 15. 75 weekly for single people, £ 22. 60 for couples and £ 24. 43 for children?

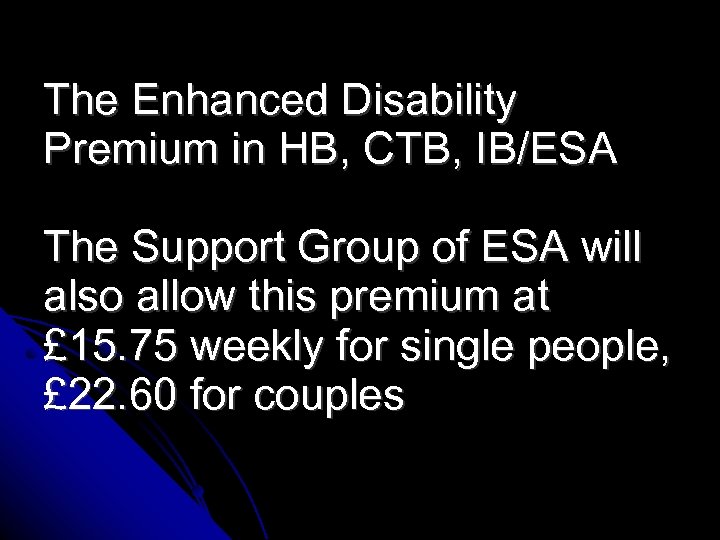

The Enhanced Disability Premium in HB, CTB, IB/ESA The Support Group of ESA will also allow this premium at £ 15. 75 weekly for single people, £ 22. 60 for couples

The Enhanced Disability Premium in HB, CTB, IB/ESA The Support Group of ESA will also allow this premium at £ 15. 75 weekly for single people, £ 22. 60 for couples

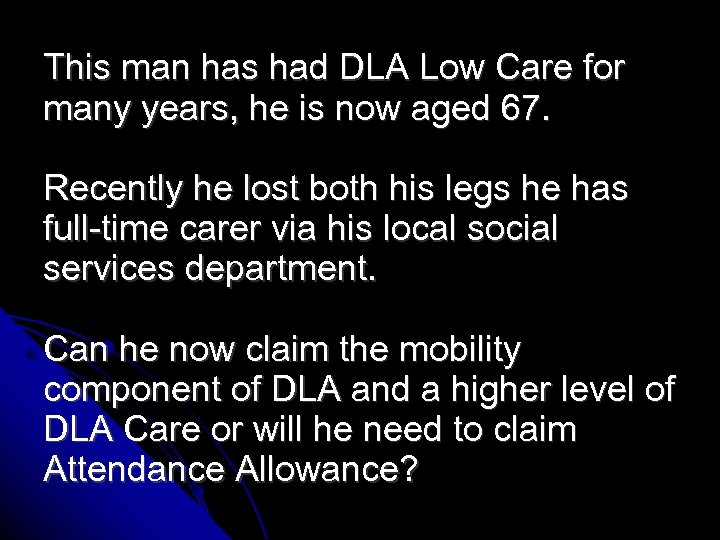

This man has had DLA Low Care for many years, he is now aged 67. Recently he lost both his legs he has full-time carer via his local social services department. Can he now claim the mobility component of DLA and a higher level of DLA Care or will he need to claim Attendance Allowance?

This man has had DLA Low Care for many years, he is now aged 67. Recently he lost both his legs he has full-time carer via his local social services department. Can he now claim the mobility component of DLA and a higher level of DLA Care or will he need to claim Attendance Allowance?

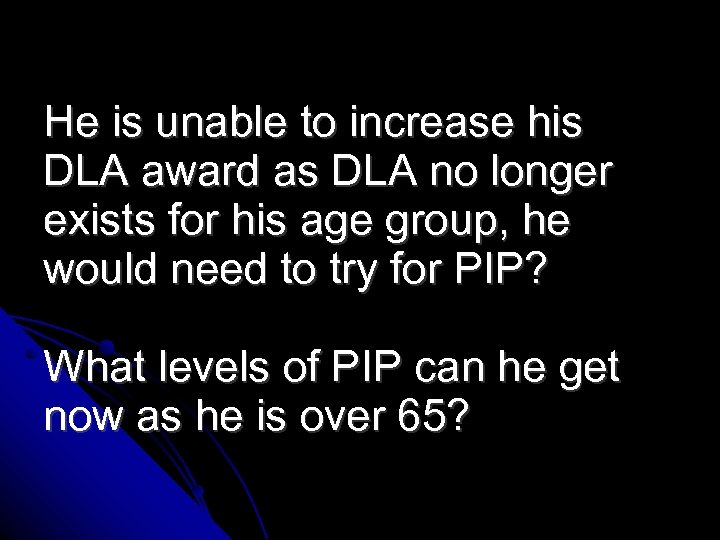

He is unable to increase his DLA award as DLA no longer exists for his age group, he would need to try for PIP? What levels of PIP can he get now as he is over 65?

He is unable to increase his DLA award as DLA no longer exists for his age group, he would need to try for PIP? What levels of PIP can he get now as he is over 65?

All Daily Living levels. As he was under 65 in April 2013 he can also get the mobility part/s as well.

All Daily Living levels. As he was under 65 in April 2013 he can also get the mobility part/s as well.

This person is getting Universal Credit at £ 317. 82 monthly (£ 73. 10 wk) paid on the 5 th of each month. He has recently been awarded PIP at Low Daily Living £ 55. 10 weekly, will his UC increase?

This person is getting Universal Credit at £ 317. 82 monthly (£ 73. 10 wk) paid on the 5 th of each month. He has recently been awarded PIP at Low Daily Living £ 55. 10 weekly, will his UC increase?

No as he has not passed the medical to qualify for any extra premiums within UC. What would you advise him to do about that?

No as he has not passed the medical to qualify for any extra premiums within UC. What would you advise him to do about that?

Can he stop his on-going UC claim and go onto Jobseekers Allowance to gain the extra disability premium at £ 32. 25 and the severe disability premium at £ 61. 85 both weekly?

Can he stop his on-going UC claim and go onto Jobseekers Allowance to gain the extra disability premium at £ 32. 25 and the severe disability premium at £ 61. 85 both weekly?

Yes if he is not in a UC digital area he should be able to stop his UC claim and claim Jobseekers Allowance as he will no longer fit through the UC gateway conditions. When would he stop his UC claim?

Yes if he is not in a UC digital area he should be able to stop his UC claim and claim Jobseekers Allowance as he will no longer fit through the UC gateway conditions. When would he stop his UC claim?

After the 5 th of the following month otherwise he will lose all payments due for the previous month. Payments including any HB

After the 5 th of the following month otherwise he will lose all payments due for the previous month. Payments including any HB

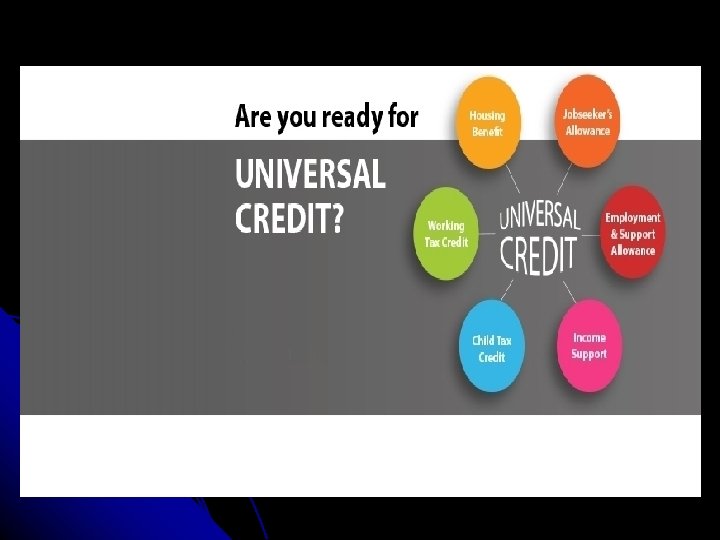

Universal Credit (UC) Coming to a town near you?

Universal Credit (UC) Coming to a town near you?

Nasty benefit that greatly reduces disabled people’s weekly incomes. Massive rent arrears due to housing costs paid monthly in arrears along with other entitlements. Recent statistics dated December 2015 show that over 89% of HB tenants on UC are in rent arrears.

Nasty benefit that greatly reduces disabled people’s weekly incomes. Massive rent arrears due to housing costs paid monthly in arrears along with other entitlements. Recent statistics dated December 2015 show that over 89% of HB tenants on UC are in rent arrears.

Nasty claimant commitments, people will find that couples and families who have to claim HB, working or child tax credits in future may both have to agree these commitments and sign on. Daily signing on and 30+ hour weekly job search to be evidenced. Nasty sanction.

Nasty claimant commitments, people will find that couples and families who have to claim HB, working or child tax credits in future may both have to agree these commitments and sign on. Daily signing on and 30+ hour weekly job search to be evidenced. Nasty sanction.

UC Digital areas: See notes

UC Digital areas: See notes

If you come across anyone who has full HB and/or full CTB and they are not on a means tested benefit alarm bells should start ringing as they may be below their applicable amount and possibly should be claiming something else?

If you come across anyone who has full HB and/or full CTB and they are not on a means tested benefit alarm bells should start ringing as they may be below their applicable amount and possibly should be claiming something else?

END Questions and Answers?

END Questions and Answers?