27c389958077952ebbafb7920bf60f63.ppt

- Количество слайдов: 77

Welfare Reform for Housing Support Workers Fiona Campbell Housing & Benefits Consultant

Aims l To enable housing support workers to: deal confidently with benefit issues relating to individual service users l know when to help a person obtain more specialist advice on welfare benefits l help clients access such advice l l To equip delegates to brief other support workers within their organisations

Topics l “Bedroom Tax” l Scottish Welfare Fund l Benefit Cap l Universal Credit and Direct Payments l Discretionary Housing Payments l Personal Independence Payments l Case studies

Quiz

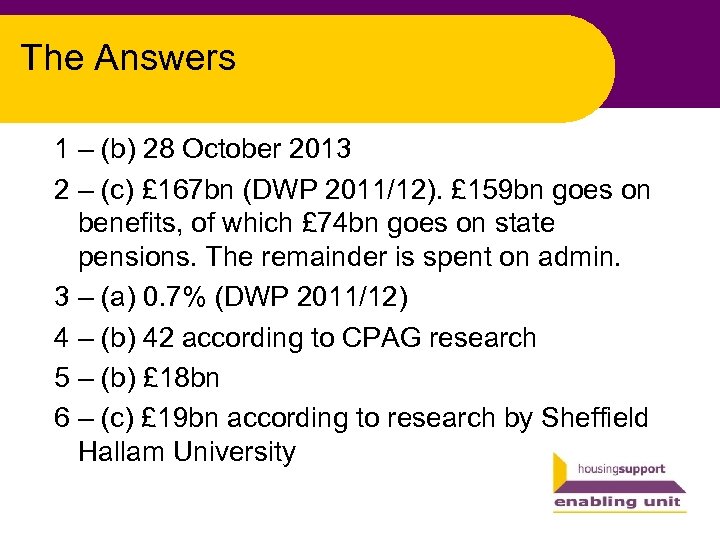

The Answers 1 – (b) 28 October 2013 2 – (c) £ 167 bn (DWP 2011/12). £ 159 bn goes on benefits, of which £ 74 bn goes on state pensions. The remainder is spent on admin. 3 – (a) 0. 7% (DWP 2011/12) 4 – (b) 42 according to CPAG research 5 – (b) £ 18 bn 6 – (c) £ 19 bn according to research by Sheffield Hallam University

Your role l Who do you work for? l What do you do? l Who are your clients?

Boundaries l Boundaries between housing support and specialist advice work depend on: your organisation l your position l your access to up-to-date information l l Topic for discussion at team briefings l Each organisation may want to clarify these boundaries in writing

Help l Who can give you the answers? l Where can you send your clients for the answers? l Who else can help them? l Compile your own list

BEDROOM TAX

Maximum rent (social sector) l Known as “bedroom tax” or “spare room subsidy” l Only applies to the social rented sector l Reduction of 14% or 25% in the rent used to calculate a Housing Benefit payment l Based on the number of bedrooms a household requires l Exemptions in certain circumstances

Accommodation l Local authority housing stock – yes l Registered social landlords – yes l Private landlords – no l Temporary accommodation - no l Supported accommodation - ? l Excluded tenancies - no

Temporary accommodation is… l Homeless accommodation provided by the LA or HA for a charge that includes cooked meals, or l provided in a hotel, guest house, lodging house or similar establishment, but l excludes accommodation provided in a care home, an independent hospital or a hostel l l Includes accommodation which the LA or HA holds on a lease or an agreement with a third party

Excluded accommodation is… l Complicated! l Agricultural tenancy l Bail hostel or probation hostel l Shared ownership l Housing action trust tenancy l Housing stock disposal but only if there has not been a rent increase

Supported accommodation l Some supported accommodation is exempt where the landlord is a housing association, registered charity or voluntary organisation; and l the landlord also provides the claimant with care, support or supervision; or l a body or a person acting on the landlord’s behalf also provides the claimant with care, support or supervision l

Exempt households l Claimant and/or partner has reached pension age l www. gov. uk/calculate-state-pension l Death of household member – up to 52 weeks l Could previously afford rent – up to 13 weeks

Bedrooms l One bedroom for each person or couple in the household, except: two children of the same gender aged under 16 are expected to share l two children aged under 10 are expected to share l l No bedrooms for anyone who does not normally live there (e. g. child visiting divorced parent)

More bedrooms l In addition, one bedroom is allowed for: non-resident carer where the tenant or partner requires overnight care l son or daughter in the armed forces who normally lives there when not on deployment l foster child, provided the tenant has become a registered foster parent, or has fostered a child within the last 52 weeks l student living away during term time – up to 52 weeks l

Disabled people l 2 legal challenges l Not practical for a disabled child to share a bedroom with a sibling l local authorities now have discretion to allow an extra bedroom l Not practical for a disabled adult to share a bedroom with partner ongoing legal challenge – 10 families l currently no discretion l

Questions you may be asked l I’m in temporary homeless accommodation – am I exempt? l Yes l I live alone in a 2 -bedroom sheltered housing flat owned by the Council. Am I exempt? l No – unless you have reached pension age l 6 months ago I registered with the Council as a foster carer but I haven’t fostered any children yet. Am I allowed a spare room? l Yes

More questions l I’m disabled and rent a 2 -bed flat from a HA – they have contracted with another organisation to provide me with care and support. Am I exempt from bedroom tax? l Yes l My friend lives in a 2 -bed HA flat and gets an allowance from the Social Work Dept to arrange her own care. Is she exempt? l No

Helping people to appeal l Check carefully the grounds for appeal is it a factual error? l is it a discretionary area (disabled child)? l l Provide evidence to support the appeal medical reports l proof of foster carer registration l l Get help from CAB or Welfare Rights if it is complicated

SCOTTISH WELFARE FUND

Scottish Welfare Fund l Replaces DWP Social Fund loans and grants l Scottish government scheme l Run by local authorities l No loans, only grants l Applicants can get up to 3 grants in any 12 - month period

Scottish Welfare Fund l Certain payments still administered by DWP: funeral payments l Sure Start Maternity Grants l cold weather payments l winter fuel payments l

Scottish Welfare Fund l Similar qualifying criteria to DWP scheme l Aged 16 or over l Entitled to a qualifying benefit: Income Support l income-based Jobseeker’s Allowance l income-related Employment & Support Allowance l Pension Credit l no savings over £ 700 (£ 1200 if pension age) l

Scottish Welfare Fund l Crisis Grants l Provide a safety net in a disaster or emergency – fire, flood, burglary l where there is an immediate threat to the health or safety of the applicant or his family l l One-off payment

Scottish Welfare Fund l Community Care Grants l Enable independent living l Help people: set up home in the community or remain in the community rather than going into care l facing exceptional pressures who need essential items such as a cooker l provide safe and secure environment for children l care for prisoner or young offender on release on temporary licence l

Scottish Welfare Fund l Some things not covered: holidays l court expenses l removal expenses l funeral expenses l maternity expenses l medical treatment/services l travelling expenses l no recourse to public funds l

Scottish Welfare Fund l Local authorities have discretion over the type of support they offer cash l fuel cards l food vouchers l loaded store cards for white goods or furniture l

BENEFIT CAP

Benefit Cap l Aims to ensure that work pays l Limits welfare benefits for non-working households l Limit is equivalent to average income in a working household l Applied to Housing Benefit l Applied to Universal Credit where households receive it

Benefit Cap – how much? l Single adults - £ 350 per week l Lone parents - £ 500 per week l Couples with children - £ 500 per week

Benefit Cap - exemptions l Households on these benefits are exempt: Attendance Allowance l Disability Living Allowance l Personal Independence Payment l support component of ESA l Industrial Injuries Benefits l Armed Forces Compensation Scheme payments l War Pension Scheme payments l Working Tax Credit l

Benefit Cap – other exemptions l Entitled to claim Working Tax Credit because of the hours worked, but not in payment because earnings are too high l exempt l Continuously in work for the previous 12 months l benefit cap not applied for 39 weeks

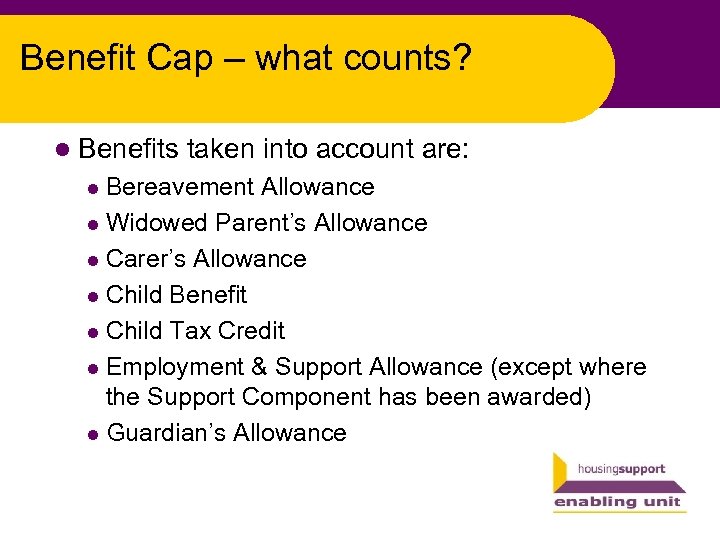

Benefit Cap – what counts? l Benefits taken into account are: Bereavement Allowance l Widowed Parent’s Allowance l Carer’s Allowance l Child Benefit l Child Tax Credit l Employment & Support Allowance (except where the Support Component has been awarded) l Guardian’s Allowance l

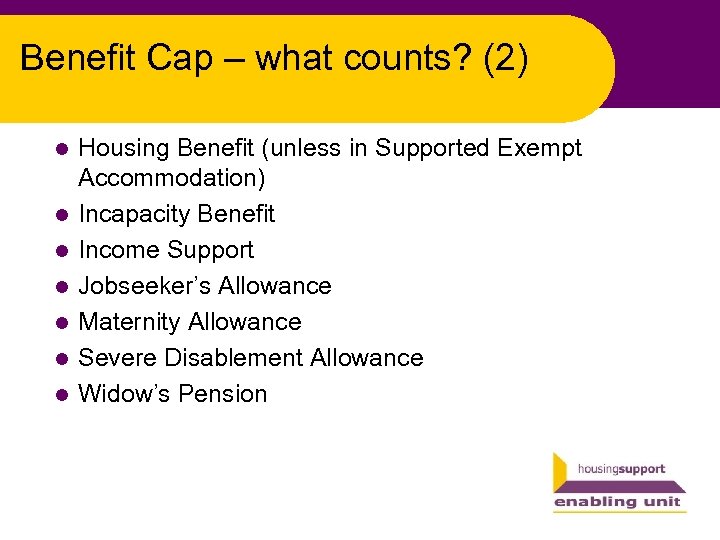

Benefit Cap – what counts? (2) l l l l Housing Benefit (unless in Supported Exempt Accommodation) Incapacity Benefit Income Support Jobseeker’s Allowance Maternity Allowance Severe Disablement Allowance Widow’s Pension

Benefit Cap - disregarded l Benefits and payments disregarded: Bereavement payment (lump sum) l Council Tax Reduction l Discretionary Housing Payments l Scottish Welfare Fund payments l Cold Weather & Winter Fuel Payments l Funeral Payments l Sure Start Maternity Grants l Pension Credit l

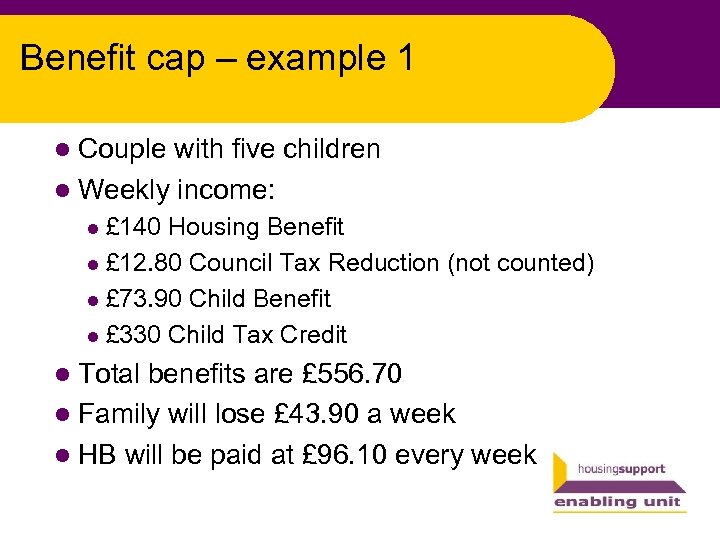

Benefit cap – example 1 l Couple with five children l Weekly income: £ 140 Housing Benefit l £ 12. 80 Council Tax Reduction (not counted) l £ 73. 90 Child Benefit l £ 330 Child Tax Credit l l Total benefits are £ 556. 70 l Family will lose £ 43. 90 a week l HB will be paid at £ 96. 10 every week

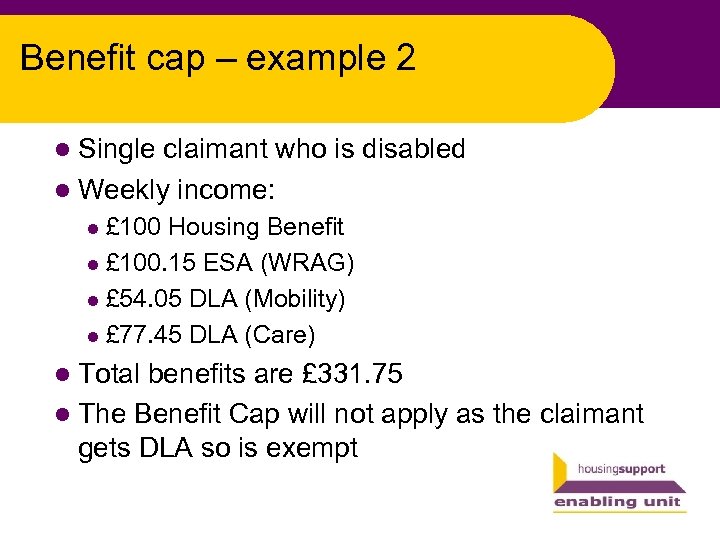

Benefit cap – example 2 l Single claimant who is disabled l Weekly income: £ 100 Housing Benefit l £ 100. 15 ESA (WRAG) l £ 54. 05 DLA (Mobility) l £ 77. 45 DLA (Care) l l Total benefits are £ 331. 75 l The Benefit Cap will not apply as the claimant gets DLA so is exempt

UNIVERSAL CREDIT

Universal Credit l Intended to simplify benefits system by bringing together a range of working-age benefits into a single payment. l Affects working age claimants of a range of earnings replacement and in-work benefits l North-west England from April 2013 l October 2013 to 2017 – national rollout starting with new claims

Universal Credit l Replaces income-based Jobseeker’s Allowance l income-related ESA l Income Support l Child Tax Credits l Working Tax Credits l Housing Benefit l l Other pensions and benefits will continue to be claimed and paid as at present

Universal Credit - work l Easier for claimants to start a new job or work more hours l UC reduces gradually as take home pay increases l No fixed hours thresholds, such as the 16 and 30 hours rules for current benefits

Universal Credit - claiming l People encouraged to claim online l Face to face and telephone support available to those who do not have internet access l Advice agencies able to provide internet access and help with claims process

Universal Credit - payment l Paid monthly, directly into a bank account l Couples living together, both claiming UC, will get one monthly payment into one account l Monthly payments designed to help people move into work and manage a monthly budget l Exceptional circumstances more frequent payments l UC payment to be split between two recipients l

Universal Credit – support l Help towards housing costs for people living in supported exempt accommodation provided separately from UC l Supported exempt accommodation is: resettlement place l accommodation provided by housing association, registered charity or voluntary organisation where that body or person acting on their behalf provides claimant with care, support or supervision l

Universal Credit – direct payments l Landlords anxious about no longer receiving HB from the LA l Concerned that rent arrears will increase l Where claimant has rent arrears, likely that housing cost element of their UC will be paid to their landlord l Project to examine direct payment of housing costs being carried out in 6 areas l Extended for further 6 months

Universal Credit – demonstration project l Latest findings show rise in rent collection rate to 94% l 6, 168 tenants currently paid by direct payment l 1, 258 tenants had payments switched back to landlord

Universal Credit - projects l Projects investigating: levels of support e. g. advice on managing personal finances and budgeting l exemptions for direct payments l payment switch-backs to landlord if tenant falls into arrears l support needed to help tenants in arrears pay back arrears and return to direct payments l early intervention switch-backs before arrears reach trigger points l

DP project - Edinburgh l Contact, advice and collection very resource intensive, other landlord services compromised l Need for organisational adjustments to meet challenges of Welfare Reform l Developing new rent collection/arrears and advisory processes and structures l Concerns about how tenants will manage when wider and cumulative impacts of welfare reform changes begin to impact

DP Project - Oxford l Need to support residents can arise at any time, even when customer has managed payments successfully for long period l Triggers for arrears are l delays in payment, lifestyle changes, change of household, impacts of welfare reform l Majority of tenants able to manage direct payment of HB l Trend for arrears to steadily reduce after initial payment

DP Project - Shropshire l Relationships between key partners has become vital part of daily working l 12 weeks arrears trigger too long: allows arrears to escalate to unmanageable level l difficult for customer to recover - particularly where other debts exist l legal action to secure the debt means customer at risk of losing home should further arrears accrue l

DP Project - Southwark l 35% not received DP for various reasons, including not having bank account l 15% switched back to landlord due to arrears l Significant additional admin costs for LA l All tenants offered independent support with banking, budgeting and debt management - take up minimal l 4+4 week arrears trigger – probationary period

DP Project - Torfaen l Contact levels with tenants 3 times higher than before DP 1 in 4 tenants needing support l more likely to engage with tenancy support workers than money advisors l texting reminders to pay has positive impact when backed up with next day intervention l l Trigger to switch to landlord is 15% shortfall in payment over 12 weeks threshold

DP Project- Wakefield l Tenants used HB to meet other costs l Other creditors collected money from accounts prior to funds being accessed for either electronic or manual payment of rent l Many different payment cycles and patterns mean process is difficult to automate and report on l Use range of contact methods including text messaging, telephone and home visits as well as written communication

DISCRETIONARY HOUSING PAYMENT

Discretionary Housing Payments l Government fund distributed to local authorities l Not widely used in some areas l LAs can add to their allocation l When money runs out, it runs out l Paid to HB recipients to help with housing costs l Lump sum or ongoing payments l Not normally indefinite

DHP l DHPs can cover housing costs such as: rent l deposits l removal costs l

DHP l DHPs cannot cover: rent arrears l service charges not eligible for HB l insurance payments l benefit sanctions l overpayments l Council tax l

DHP l Rent normally covered by HB can be met by DHPs where: benefit cap applies l bedroom tax applies l LHA in private rented sector restricted l shared room rate of LHA paid to under-35 s l non-dependant deductions made l HB reduced because income increased l

DHP l April 2013 - DHP fund increased to cover two specific categories: disabled people adapted accommodation subject to the bedroom tax l foster carers who require more than 1 extra bedroom allowed under bedroom tax rules l l DWP recommend DHP award to households where adult has long term medical condition that creates difficulties sharing bedroom

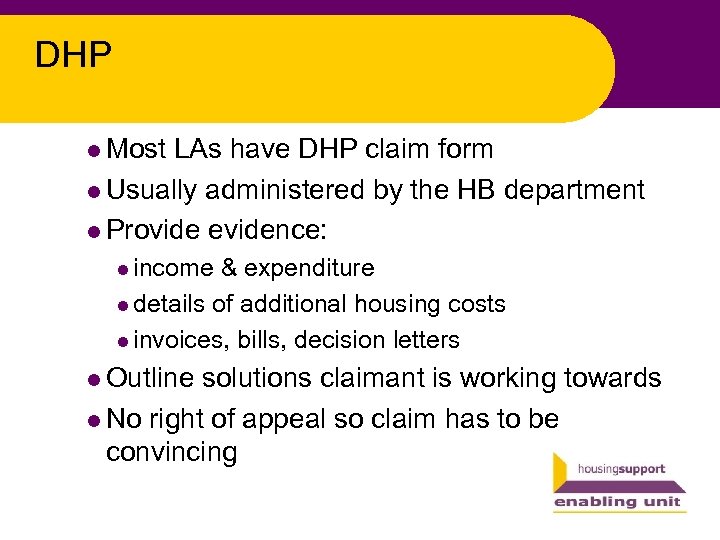

DHP l Most LAs have DHP claim form l Usually administered by the HB department l Provide evidence: l income & expenditure l details of additional housing costs l invoices, bills, decision letters l Outline solutions claimant is working towards l No right of appeal so claim has to be convincing

PERSONAL INDEPENDENCE PAYMENT

Personal Independence Payment l New benefit that replaces Disability Living Allowance for working age claimants l Different criteria l Different claim process

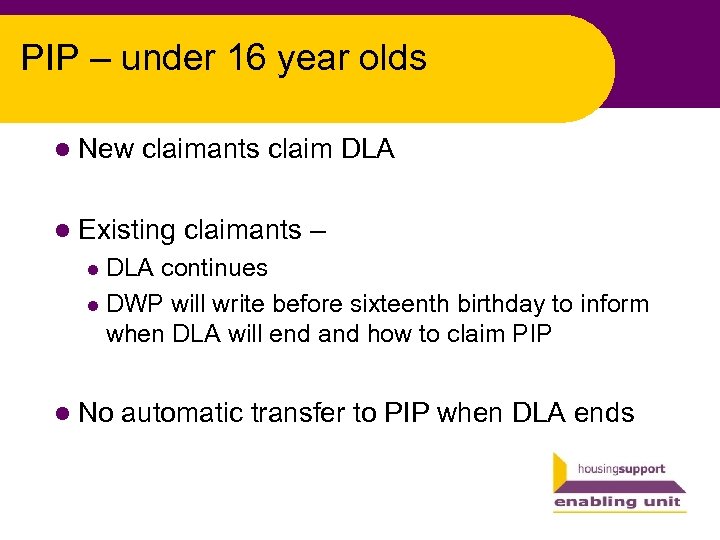

PIP – under 16 year olds l New claimants claim DLA l Existing claimants – DLA continues l DWP will write before sixteenth birthday to inform when DLA will end and how to claim PIP l l No automatic transfer to PIP when DLA ends

PIP – 16 th birthday l From 10 June 2013 New claimants claim PIP l Existing claimants make a DLA renewal claim l l From 7 October 2013 l New claimants and existing claimants claim PIP

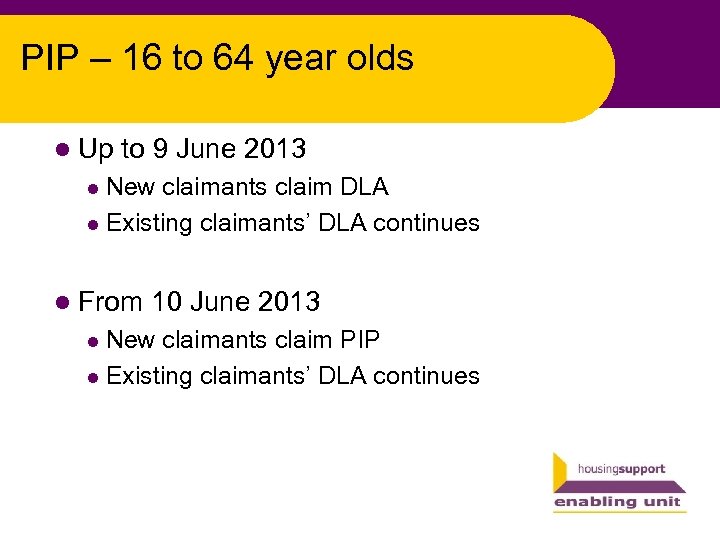

PIP – 16 to 64 year olds l Up to 9 June 2013 New claimants claim DLA l Existing claimants’ DLA continues l l From 10 June 2013 New claimants claim PIP l Existing claimants’ DLA continues l

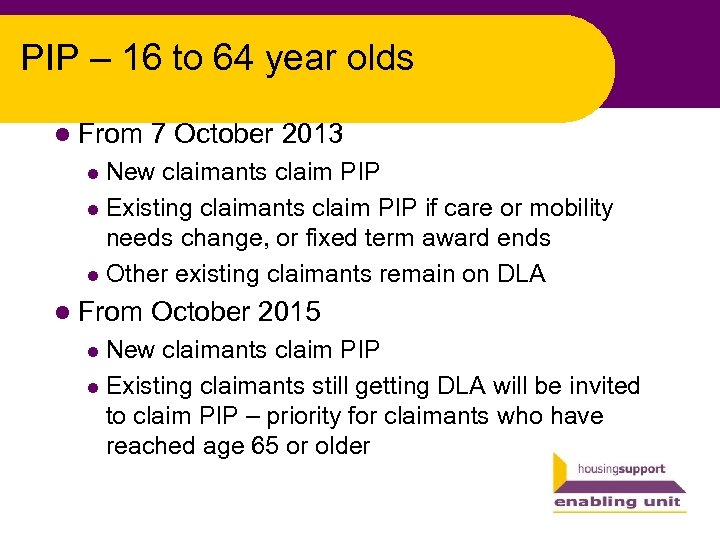

PIP – 16 to 64 year olds l From 7 October 2013 New claimants claim PIP l Existing claimants claim PIP if care or mobility needs change, or fixed term award ends l Other existing claimants remain on DLA l l From October 2015 New claimants claim PIP l Existing claimants still getting DLA will be invited to claim PIP – priority for claimants who have reached age 65 or older l

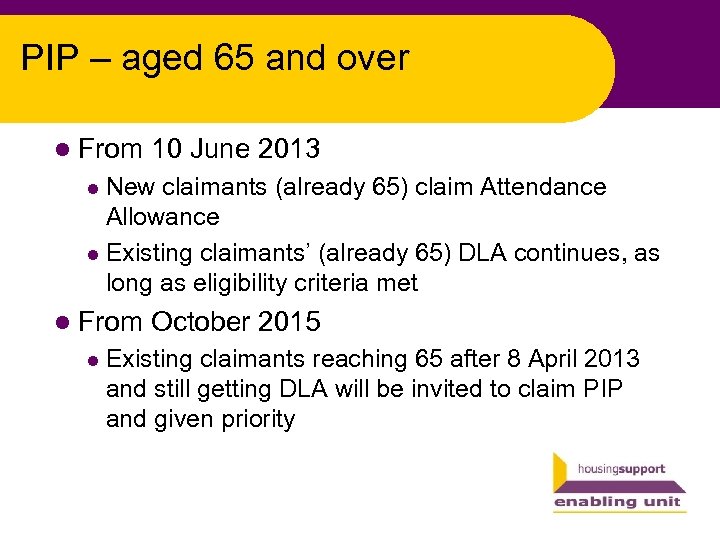

PIP – aged 65 and over l From 10 June 2013 New claimants (already 65) claim Attendance Allowance l Existing claimants’ (already 65) DLA continues, as long as eligibility criteria met l l From October 2015 l Existing claimants reaching 65 after 8 April 2013 and still getting DLA will be invited to claim PIP and given priority

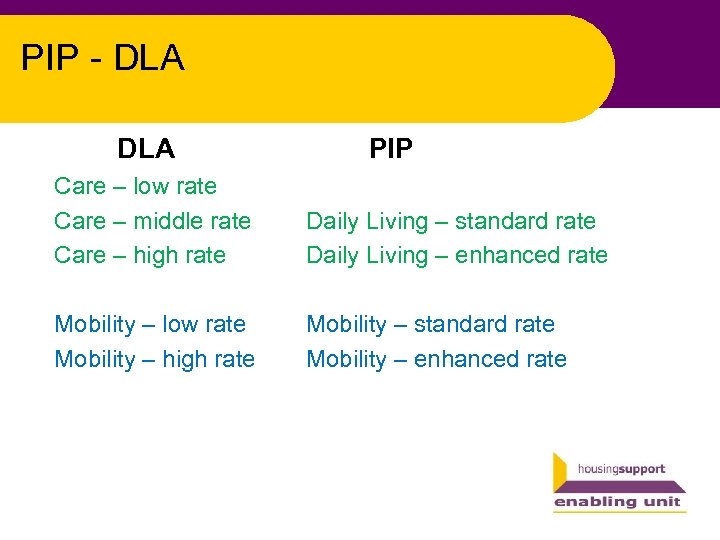

PIP - DLA PIP Care – low rate Care – middle rate Care – high rate Daily Living – standard rate Daily Living – enhanced rate Mobility – low rate Mobility – high rate Mobility – standard rate Mobility – enhanced rate

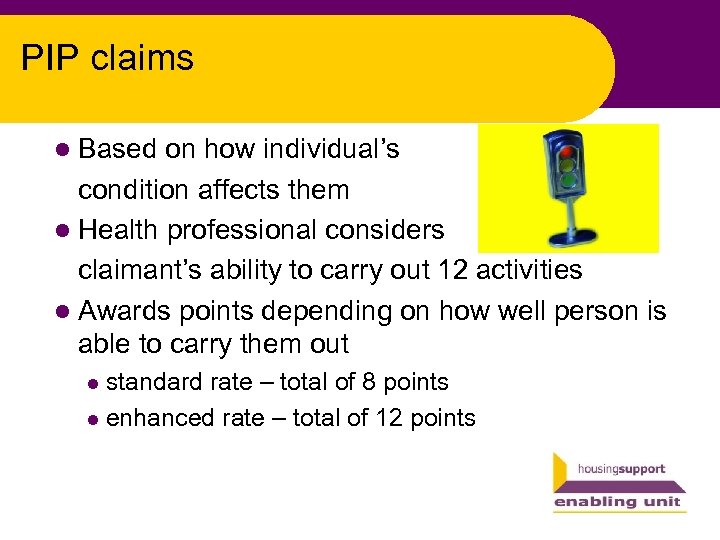

PIP claims l Based on how individual’s condition affects them l Health professional considers claimant’s ability to carry out 12 activities l Awards points depending on how well person is able to carry them out standard rate – total of 8 points l enhanced rate – total of 12 points l

Daily Living Activities l Preparing food l Taking nutrition l Managing therapy or monitoring a health condition l Washing and bathing l Managing toilet needs or incontinence

Daily Living Activities contd l Dressing and undressing l Communicating verbally l Reading and understanding signs, symbols and words l Engaging with other people face to face l Making budgeting decisions

Mobility Activities l Planning and following journeys l Moving around

PIP example l Some claimants better off with PIP l DLA care l require help with bodily functions frequently throughout the day l PIP Daily Living l number of problem areas scoring 2 or 4 points each to total 8 points

Case studies l Any clients who need your help? l What can you help them with? l Will you need to involve specialists? l Do you know who they are and where to find them?

Close l Any further questions to HSEU l HSEU will collate FAQs from the training days and circulate l Slides can be circulated l Factsheets for you to use when briefing your colleagues l Good luck with Welfare Reform!

27c389958077952ebbafb7920bf60f63.ppt