eb97c2624cc70ab251fc769ac3570e56.ppt

- Количество слайдов: 36

Welcome

Welcome • New Members – – – AGI-Shorewood Corporate Rewards Card Commerce TK Maxx & Home Sense Wickes • Guests – – – – HMV 2 ergo People Value Marketing Week Live! Figleaves Different Openbucks Eflorist American Express Universal Cards & Mailings Logbuy Ltd The Gourmet Society BI Worldwide Jessops

Nick Bolshaw Rostrum PR UKGCVA PR Agency

PR Objectives 1. Increase the quality of press coverage; 2. Establish relationship with Retail Week; 3. Increase focus on B 2 B publications; 4. Maximise / leverage research; 5. Generate unique, creative content;

Increase the quality of the press coverage

Establish relationship with Retail Week

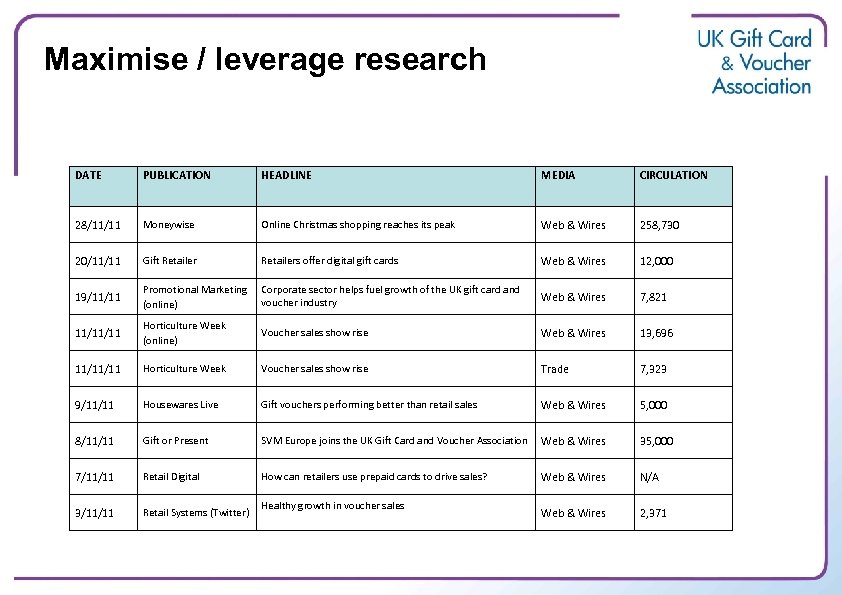

Maximise / leverage research DATE PUBLICATION HEADLINE MEDIA CIRCULATION 28/11/11 Moneywise Online Christmas shopping reaches its peak Web & Wires 258, 730 20/11/11 Gift Retailers offer digital gift cards Web & Wires 12, 000 19/11/11 Promotional Marketing (online) Corporate sector helps fuel growth of the UK gift card and voucher industry Web & Wires 7, 821 11/11/11 Horticulture Week (online) Voucher sales show rise Web & Wires 13, 696 11/11/11 Horticulture Week Voucher sales show rise Trade 7, 323 9/11/11 Housewares Live Gift vouchers performing better than retail sales Web & Wires 5, 000 8/11/11 Gift or Present SVM Europe joins the UK Gift Card and Voucher Association Web & Wires 35, 000 7/11/11 Retail Digital How can retailers use prepaid cards to drive sales? Web & Wires N/A 3/11/11 Retail Systems (Twitter) Web & Wires 2, 371 Healthy growth in voucher sales

Generate unique, creative content UK Gift Card & Voucher Association reveals 5 bizarre activities people do on Christmas Day The UK Gift Card & Voucher Association reveals the top 5 ways to get dumped this Valentine’s Day

Campaign highlights § 39 hits to date (since November) § Retail Week coverage x 3; § Creative TL content- Valentines & Christmas releases; § Q 3 results – record coverage; § National coverage;

2011 Sales Review

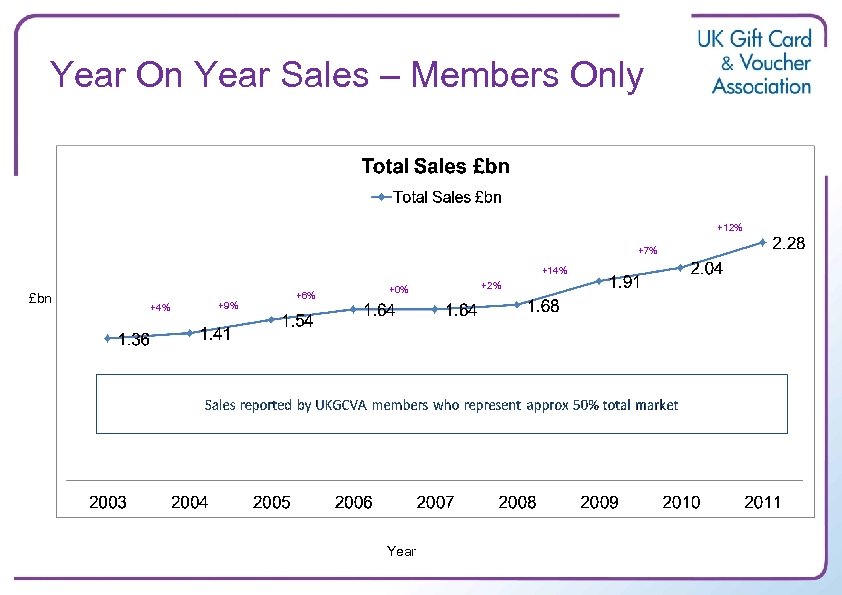

Year On Year Sales – Members Only +12% +7% +14% £bn +4% +9% +6% +0% Year +2%

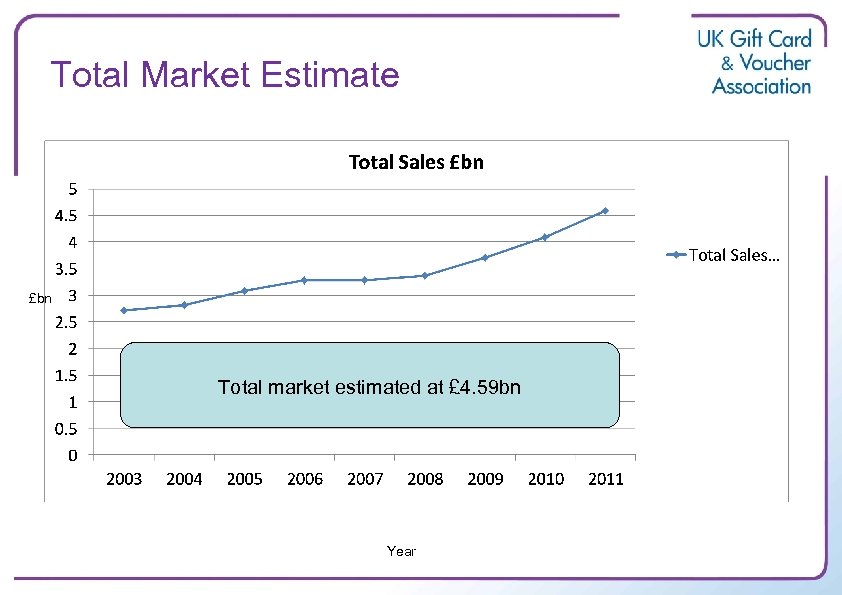

Total Market Estimate £bn Total market estimated at £ 4. 59 bn Year

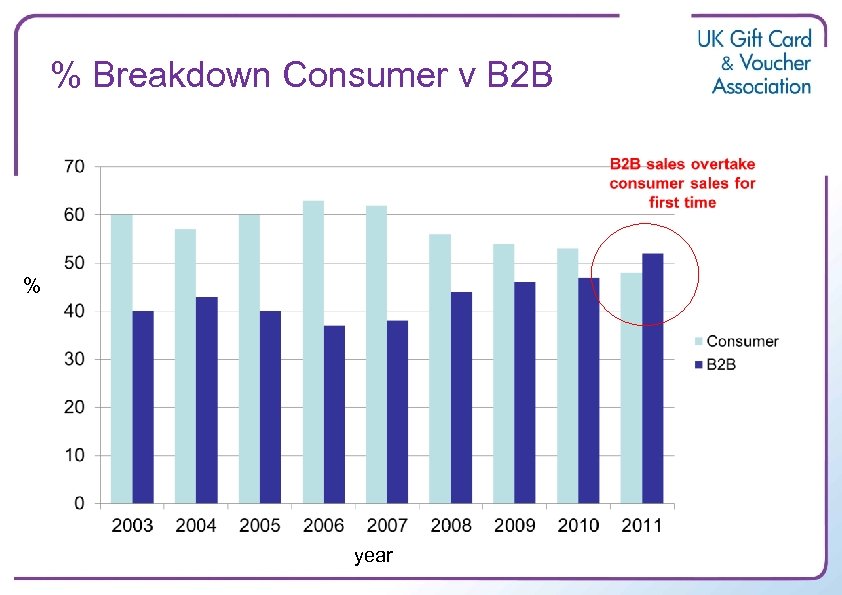

% Breakdown Consumer v B 2 B % year

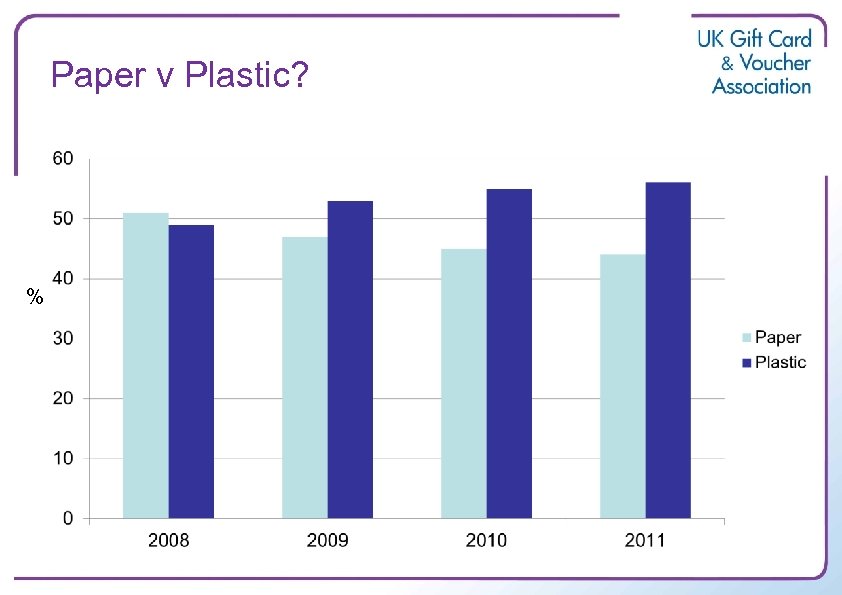

Paper v Plastic? %

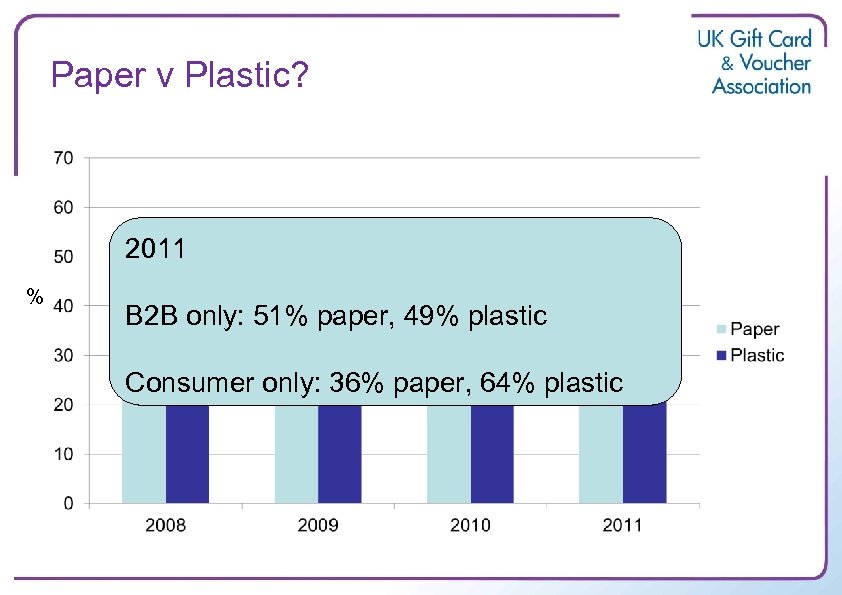

Paper v Plastic? 2011 % B 2 B only: 51% paper, 49% plastic Consumer only: 36% paper, 64% plastic

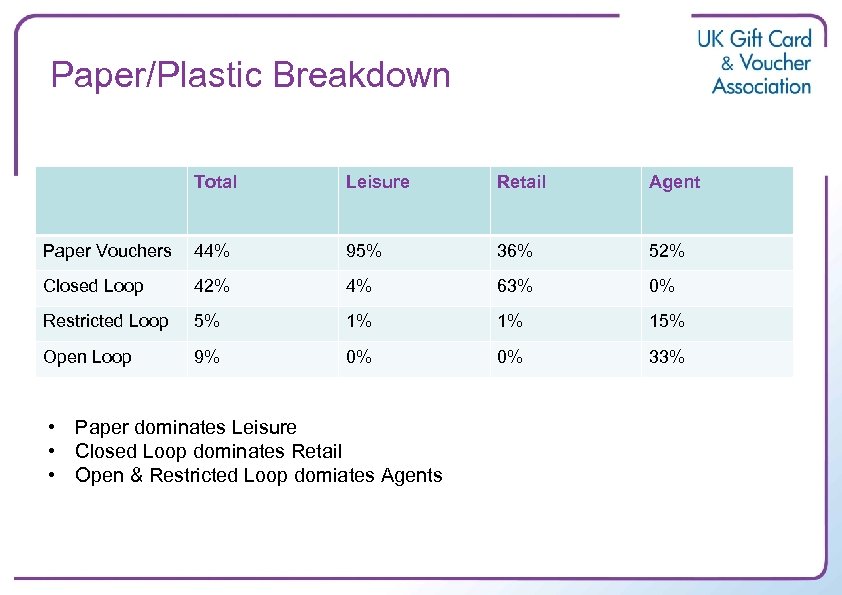

Paper/Plastic Breakdown Total Leisure Retail Agent Paper Vouchers 44% 95% 36% 52% Closed Loop 42% 4% 63% 0% Restricted Loop 5% 1% 1% 15% Open Loop 9% 0% 0% 33% • Paper dominates Leisure • Closed Loop dominates Retail • Open & Restricted Loop domiates Agents

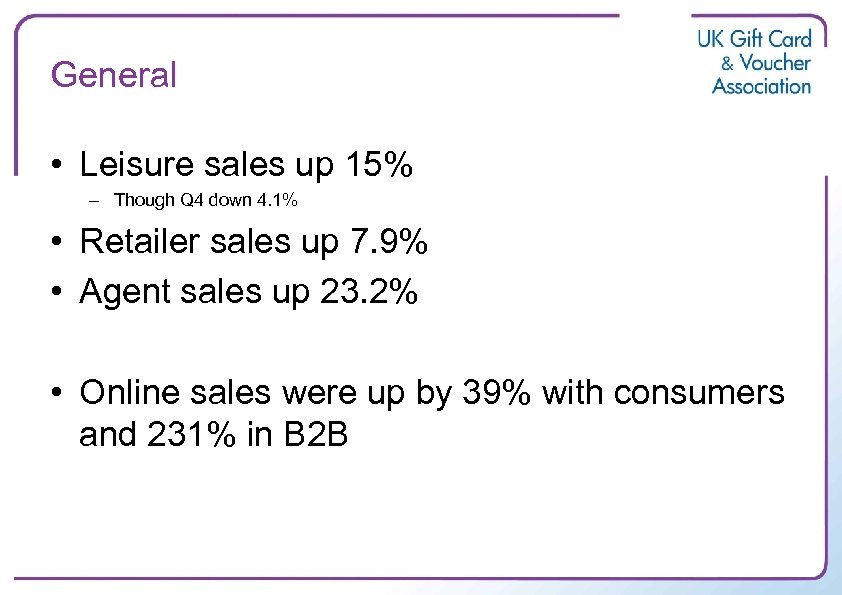

General • Leisure sales up 15% – Though Q 4 down 4. 1% • Retailer sales up 7. 9% • Agent sales up 23. 2% • Online sales were up by 39% with consumers and 231% in B 2 B

% of Market UKGCVA represents? • Historically UKGCVA members represent approx. 50% of the total UK gift card and gift voucher market • What is the figure in 2011? • Leisure, Retail, Agent – what %?

Working with Other Associations

Working Together • Historically UKGCVA worked with – – – Prepaid International Forum British Promotional Merchandise Association Institute of Promotional Marketing Retail Gift Card Association USA Polish Gift Card & Voucher Association • Some relationships have lapsed • Re-ignite these relationships • Explore new relationships

Why? • • • Strength in numbers! Collaboration on regulations Attending exhibitions Shared learning's Research Who?

Scope of Membership

New Entrants to Market • What is the scope of UKGCVA membership? – – – – – Paper Gift Vouchers Closed Loop Gift Cards e. Gift Vouchers Restricted Loop Gift Cards B 2 B Restricted Loop Gift Card B 2 C Open Loop Gift Cards B 2 B Open Loop Gift Cards B 2 C Childcare Vouchers New products?

Business to Business Market Research

Objective • Understand what % of B 2 B sales fall into the following categories: – – – Employee Incentive & Motivation Consumer Sales & Promotions Employee Benefits Insurance Replacement Christmas Savings Legislative • Understand what corporate buyers attitudes are towards gift cards and vouchers – those that currently buy and those that don’t

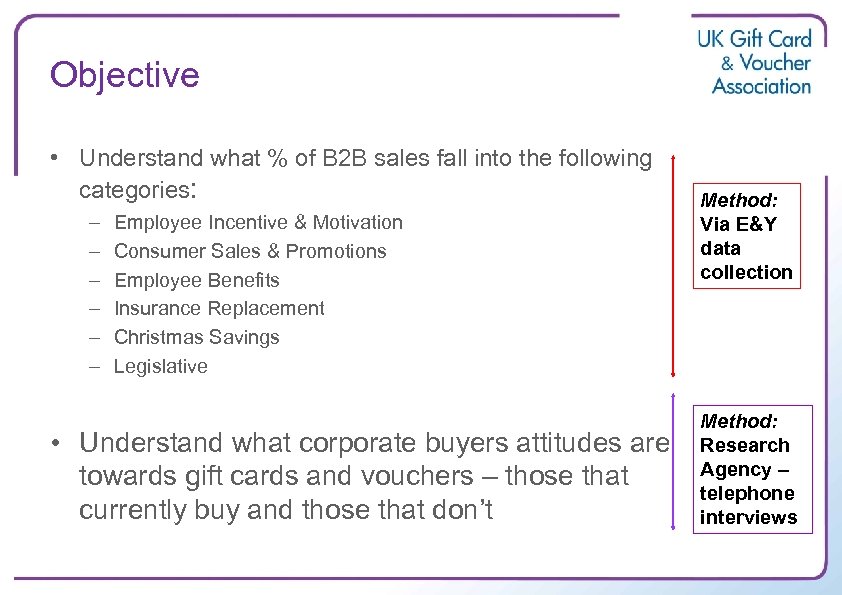

Objective • Understand what % of B 2 B sales fall into the following categories: – – – Employee Incentive & Motivation Consumer Sales & Promotions Employee Benefits Insurance Replacement Christmas Savings Legislative • Understand what corporate buyers attitudes are towards gift cards and vouchers – those that currently buy and those that don’t Method: Via E&Y data collection Method: Research Agency – telephone interviews

Types of Question • • • • • What influences are there on the decision making? What are the barriers? Who makes the buying decision? Why do/don’t B 2 B buyers buy gift cards and vouchers? What are your buying patterns, have they changed? How might they change in the future? Budgets – has this changed? Timings – when do you buy, how has this changed? How do you buy – direct or via an agent or reseller? Product – which products do you buy – paper vouchers, gift cards or virtual? Does the product influence your decision to buy? Are you just buying vouchers or do you engage with a motivation agency who manage the whole of your motivation scheme? Is there something you’d like to see that isn’t currently on the market? Do you use the prepaid Master. Card type products? If so, why do you use them? Do you prefer single choice or multi-choice vouchers or gift cards? How influenced by the brand on the card are you? What don’t you like about the current products and services offered? What other incentive products do you buy? How much or what % is vouchers v other products?

Next Steps • Research agency has been appointed • Specialist B 2 B agency • More information on the project to be emailed to members • Co-operative research so expect price to be circa. £ 750, based on 35 members, will be less per member the more members take part

The Conference 2012 Victoria Park Plaza Hotel, London Tuesday 20 th March 2012

Supported by Gold Sponsor Silver Sponsors Exhibitors

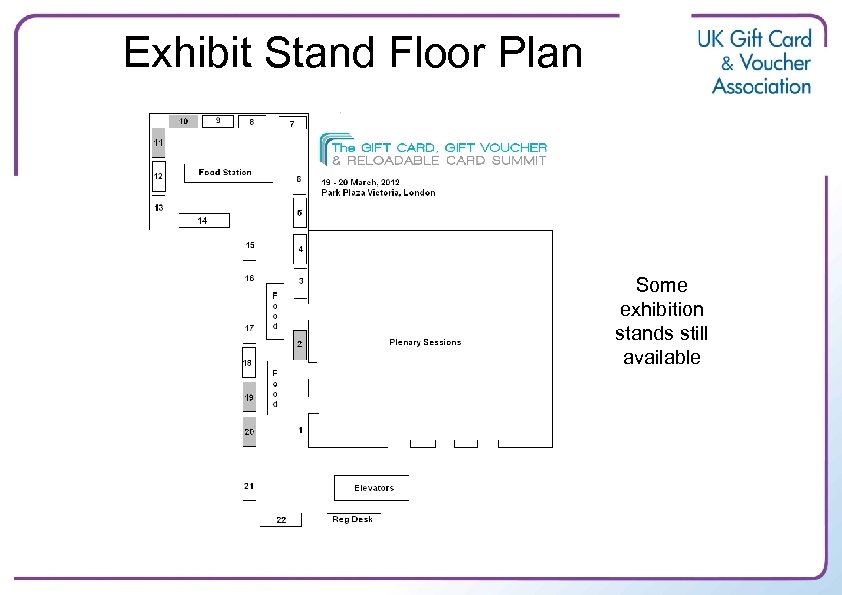

Exhibit Stand Floor Plan Some exhibition stands still available

Workshop Day – 19 March, 2012 Highlights • Global Expansion of the Prepaid Market – Prepaid International Forum • Lessons from Global Leaders – IMA • Consumer & Retail Trends – Global Prepaid Exchange Attend workshops for free if you are attending the conference or by invitation Evening Reception by invitation www. giftandreloadablecardsummit. com

Main Conference – 20 March, 2012 Highlights • Europe's Economic Climate & Prepaid – Marion King (new Head of Master. Card UK & Ireland) • Business to Business – includes Wal-Mart, SVS, Ovation Incentives • Marketing – includes LAKS, Giftango, Prepay Solutions • New Players – WRAPP • Emerging Markets – Cash. Star • Social Networks – Gloople • Prepaid in Retail – Master. Card • Paybefore Awards Europe For full agenda & members discounts see: www. giftandreloadablecardsummit. com Or follow the link from www. UKGCVA. co. uk

Other Events Event Date Venue British Retail Consortium Various See UKGCVA website Prepaid Expo USA 12 – 14 March Las Vegas Prepaid Expo Europe, UKGCVA Conference, Paybefore Awards Europe 20 March London UKGCVA Networking & Seminar 22 nd May London Prepaid 12 13 – 14 June London UKGCVA Member Meeting 20 June ICO, London Marketing Week Live 27 – 28 June Olympia, London Prepaid Awards 4 October London UKGCVA Member Meeting 13 November tba Special Member Rates Available for Prepaid Expo USA & Prepaid Awards Motivation Pavilion available to members at Marketing Week Live

eb97c2624cc70ab251fc769ac3570e56.ppt