6af9beec5e7a3fdaff297371ee06f036.ppt

- Количество слайдов: 59

WELCOME TO THETOPPERSWAY. COM

WELCOME TO THETOPPERSWAY. COM

Unit 2 Indian Financial System : Monetary And Fiscal Policy, Economic Trends, Price Policy, Stock Exchange Of India, Role of regulatory instituions in Indian financial system – RBI and SEBI , National Income, Role of Industry in Economic Development, Foreign Trade and Balance of Payment, Poverty in India, Unemployment in India, Inflation, Human Development, Rural Development, Problems of Growth 1 -2

Unit 2 Indian Financial System : Monetary And Fiscal Policy, Economic Trends, Price Policy, Stock Exchange Of India, Role of regulatory instituions in Indian financial system – RBI and SEBI , National Income, Role of Industry in Economic Development, Foreign Trade and Balance of Payment, Poverty in India, Unemployment in India, Inflation, Human Development, Rural Development, Problems of Growth 1 -2

STOCK EXCHANGE

STOCK EXCHANGE

Stock Exchange (Meaning ) • Stock exchange constitute the primary institution of the secondary market. The stock exchange is a highly organized market for the purchase and sale of second-hand quoted or listed securities. Thus the stock exchange is a key institution facilitating the issue and sale of various types of securities. • There are 21 stock exchange in India including Over The Counter Exchange of India(OTCEI), National Stock Exchange (NSE), and Inter-Connected Stock Exchange(ICSE).

Stock Exchange (Meaning ) • Stock exchange constitute the primary institution of the secondary market. The stock exchange is a highly organized market for the purchase and sale of second-hand quoted or listed securities. Thus the stock exchange is a key institution facilitating the issue and sale of various types of securities. • There are 21 stock exchange in India including Over The Counter Exchange of India(OTCEI), National Stock Exchange (NSE), and Inter-Connected Stock Exchange(ICSE).

Stock Exchange (Definition) • According to Securities Contracts (Regulation) Act, 1956, Stock exchange means(a) Any body of individual, whether incorporated or not, constituted before corporatization and demutualization under sections 4 A and 4 B or (b) A body corporate incorporated under the Companies Act, 1956 whether under a scheme of corporatization or otherwise, for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities.

Stock Exchange (Definition) • According to Securities Contracts (Regulation) Act, 1956, Stock exchange means(a) Any body of individual, whether incorporated or not, constituted before corporatization and demutualization under sections 4 A and 4 B or (b) A body corporate incorporated under the Companies Act, 1956 whether under a scheme of corporatization or otherwise, for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities.

Contd. According to this Act, securities include the following: • Shares, scrips, stock, bonds, debenture stock or other marketable securities of a like nature of any incorporated company or body corporate. • Derivative • Units or any other instrument issued by any collective investment scheme to investors in such schemes • Government securities • Rights or interest in securities

Contd. According to this Act, securities include the following: • Shares, scrips, stock, bonds, debenture stock or other marketable securities of a like nature of any incorporated company or body corporate. • Derivative • Units or any other instrument issued by any collective investment scheme to investors in such schemes • Government securities • Rights or interest in securities

Functions of Stock Exchange • Ready and continuous market • Protection to investors • Provides information to assess the real worths of securities • Proper channelization of funds • Promotion of industrial growth • Accelerates capital formation • Raising long-term capital • Impact on company performance • Economic barometer

Functions of Stock Exchange • Ready and continuous market • Protection to investors • Provides information to assess the real worths of securities • Proper channelization of funds • Promotion of industrial growth • Accelerates capital formation • Raising long-term capital • Impact on company performance • Economic barometer

Importance of Stockindustrial and Exchange • The stock exchange promotes economic growth. • The stock exchange is one of the basic financial tools for stimulating the economy by attracting capital for investment in the projects. • The stock exchange also helps to revive other sectors of the economy such as commerce, industry and service. • Stock exchange is providing a market that mobilizes and distributes the nation' savings utilized for the best purpose of the country.

Importance of Stockindustrial and Exchange • The stock exchange promotes economic growth. • The stock exchange is one of the basic financial tools for stimulating the economy by attracting capital for investment in the projects. • The stock exchange also helps to revive other sectors of the economy such as commerce, industry and service. • Stock exchange is providing a market that mobilizes and distributes the nation' savings utilized for the best purpose of the country.

Contd. The opportunity for stock exchange to render the services of stimulating private savings and channelizing such savings into productive investment. • It ensures optimum utilization of scarce financial resources. • The listed companies on the stock exchange enjoy better reputation, goodwill and credit-standing in the market. • The stock exchange is attracting foreign capital to the country.

Contd. The opportunity for stock exchange to render the services of stimulating private savings and channelizing such savings into productive investment. • It ensures optimum utilization of scarce financial resources. • The listed companies on the stock exchange enjoy better reputation, goodwill and credit-standing in the market. • The stock exchange is attracting foreign capital to the country.

• Stock exchange enables a company to raise Contd. larger amount of funds through accessing a wider market. • The communication of information about the prices of different securities enables the investors to make sound investment decisions. • It provides liquidity to investors as securities can be converted into cash without any difficulty. • The interests of investors are safeguard by regulations imposed by the stock exchange authorities

• Stock exchange enables a company to raise Contd. larger amount of funds through accessing a wider market. • The communication of information about the prices of different securities enables the investors to make sound investment decisions. • It provides liquidity to investors as securities can be converted into cash without any difficulty. • The interests of investors are safeguard by regulations imposed by the stock exchange authorities

Organization of stock Exchange • The working of stock exchange is regulated by the Securities Contracts (Regulation) Act, 1956. it frames out following organization of stock exchange • Management: the stock exchange is managed by an Board of Directors/Council of management/Governing body which is an elected body. The main functions of governing body are to ensure that its rules are observed by the members, to protect the interests of the investing public and to approve the quotation of new shares. • Membership • Listing of securities • Types of dealings: Ready delivery contracts & Forward delivery contracts • Clearing house : this is an institution where accounts of the brokers are settled. • Speculation and Speculators: Speculation refers to making quick profits by anticipating the changes in the prices of shares • Speculators are of three types- bulls, bear and Stags

Organization of stock Exchange • The working of stock exchange is regulated by the Securities Contracts (Regulation) Act, 1956. it frames out following organization of stock exchange • Management: the stock exchange is managed by an Board of Directors/Council of management/Governing body which is an elected body. The main functions of governing body are to ensure that its rules are observed by the members, to protect the interests of the investing public and to approve the quotation of new shares. • Membership • Listing of securities • Types of dealings: Ready delivery contracts & Forward delivery contracts • Clearing house : this is an institution where accounts of the brokers are settled. • Speculation and Speculators: Speculation refers to making quick profits by anticipating the changes in the prices of shares • Speculators are of three types- bulls, bear and Stags

NATIONAL STOCK EXCHANGE (NSE)

NATIONAL STOCK EXCHANGE (NSE)

NATIONAL STOCK EXCHANGE (NSE) The NSE was established in November, 1992 by IDBI, UTI and other financial institutions to encourage stock exchange reform through system modernization and competition. It is the 9 th largest stock exchange in the world by market capitalization (around US$1. 59 trillion) and largest in India by daily turnover and number of trades, for both equities and derivative trading. NSE's key index is the S&P CNX Nifty, known as the NSE NIFTY NSE is the third largest Stock Exchange in the world in terms of the number of trades in equities. It is the second fastest growing stock exchange in the world

NATIONAL STOCK EXCHANGE (NSE) The NSE was established in November, 1992 by IDBI, UTI and other financial institutions to encourage stock exchange reform through system modernization and competition. It is the 9 th largest stock exchange in the world by market capitalization (around US$1. 59 trillion) and largest in India by daily turnover and number of trades, for both equities and derivative trading. NSE's key index is the S&P CNX Nifty, known as the NSE NIFTY NSE is the third largest Stock Exchange in the world in terms of the number of trades in equities. It is the second fastest growing stock exchange in the world

(NSE) contd. It is an electronic screen based system where members have equal access and equal opportunity of business irrespective of their location in different parts of the country as they are connected through a satellite network. The NSE is to operate in two segments as outlined below: (a) Wholesale Debt Market: is concerned with trading instruments such as Gilt edge securities, commercial papers, PSU Bonds, units and Certificate of Deposits. (b) The Capital Market : is concerned with equity and corporate debt instruments.

(NSE) contd. It is an electronic screen based system where members have equal access and equal opportunity of business irrespective of their location in different parts of the country as they are connected through a satellite network. The NSE is to operate in two segments as outlined below: (a) Wholesale Debt Market: is concerned with trading instruments such as Gilt edge securities, commercial papers, PSU Bonds, units and Certificate of Deposits. (b) The Capital Market : is concerned with equity and corporate debt instruments.

NSE (Advantages) It establishes nationwide trading facility for equity, debt and hybrid. It facilitates equal access to investors across the country. It provides fairness, efficiency and transparency to the securities trading. It enables shorter settlement cycles. It meets international securities market standard.

NSE (Advantages) It establishes nationwide trading facility for equity, debt and hybrid. It facilitates equal access to investors across the country. It provides fairness, efficiency and transparency to the securities trading. It enables shorter settlement cycles. It meets international securities market standard.

BOMBAY STOCK EXCHANGE (BSE)

BOMBAY STOCK EXCHANGE (BSE)

(BSE) contd. Exchange (BSE) is a stock The Bombay Stock exchange, located on Dalal Street, Mumbai, India. The BSE developed the BSE Sensex in 1986, giving the BSE a means to measure the overall performance of the exchange. Historically an open-cry floor trading exchange, the BSE switched to an electronic trading system in 1995. In 2000 the BSE used this index to open its derivatives market, trading Sensex futures contracts. The development of Sensex options along with equity derivative followed in 2001 and 2002, expanding the BSE’s trading platform.

(BSE) contd. Exchange (BSE) is a stock The Bombay Stock exchange, located on Dalal Street, Mumbai, India. The BSE developed the BSE Sensex in 1986, giving the BSE a means to measure the overall performance of the exchange. Historically an open-cry floor trading exchange, the BSE switched to an electronic trading system in 1995. In 2000 the BSE used this index to open its derivatives market, trading Sensex futures contracts. The development of Sensex options along with equity derivative followed in 2001 and 2002, expanding the BSE’s trading platform.

BSE (contd. ) The BSE is the oldest stock exchange in Asia and has the third largest number of listed companies in the world, with 4900 listed as on Feb, 2010. On Feb, 2010, the equity Market Capitalization of the companies listed on the BSE was US$1. 28 trillion, making it the largest stock exchange in South Asia and the 12 th largest in the world. With over more than 5459 Indian companies listed & more than 8000 scrip's on the stock exchange, it has a significant trading volume.

BSE (contd. ) The BSE is the oldest stock exchange in Asia and has the third largest number of listed companies in the world, with 4900 listed as on Feb, 2010. On Feb, 2010, the equity Market Capitalization of the companies listed on the BSE was US$1. 28 trillion, making it the largest stock exchange in South Asia and the 12 th largest in the world. With over more than 5459 Indian companies listed & more than 8000 scrip's on the stock exchange, it has a significant trading volume.

Why do we need a regulatory body for Investor protection in India? ØIndia is an ` informationally ' weak market ØBoosting capital market demands restoring the confidence of lay investors who have been beaten down by repeated scams ØProgressively softening interest rates and an under performing economy have eroded investment options, and require enhanced investing skills.

Why do we need a regulatory body for Investor protection in India? ØIndia is an ` informationally ' weak market ØBoosting capital market demands restoring the confidence of lay investors who have been beaten down by repeated scams ØProgressively softening interest rates and an under performing economy have eroded investment options, and require enhanced investing skills.

SEBI - Genesis To ensure effective regulation of market, SEBI Act, 1992 was enacted to empower SEBI with statutory powers for protecting the interests of investors in and promoting the development of securities market. According to section 3 of the Act, SEBI is a body corporate having perpetual succession and a common seal with power to acquire, hold and dispose of property, both movable and immovable and to contract, sue and be sued in its own name.

SEBI - Genesis To ensure effective regulation of market, SEBI Act, 1992 was enacted to empower SEBI with statutory powers for protecting the interests of investors in and promoting the development of securities market. According to section 3 of the Act, SEBI is a body corporate having perpetual succession and a common seal with power to acquire, hold and dispose of property, both movable and immovable and to contract, sue and be sued in its own name.

Objectives of SEBI Securities & Exchange Board of India (SEBI) formed under the SEBI Act, 1992 with the prime objective of – Protecting the interests of investors in securities, – Promoting the development of, and – Regulating, the securities market and for matters connected therewith or incidental thereto. ’ Focus being the greater investor protection, SEBI has become a vigilant watchdog

Objectives of SEBI Securities & Exchange Board of India (SEBI) formed under the SEBI Act, 1992 with the prime objective of – Protecting the interests of investors in securities, – Promoting the development of, and – Regulating, the securities market and for matters connected therewith or incidental thereto. ’ Focus being the greater investor protection, SEBI has become a vigilant watchdog

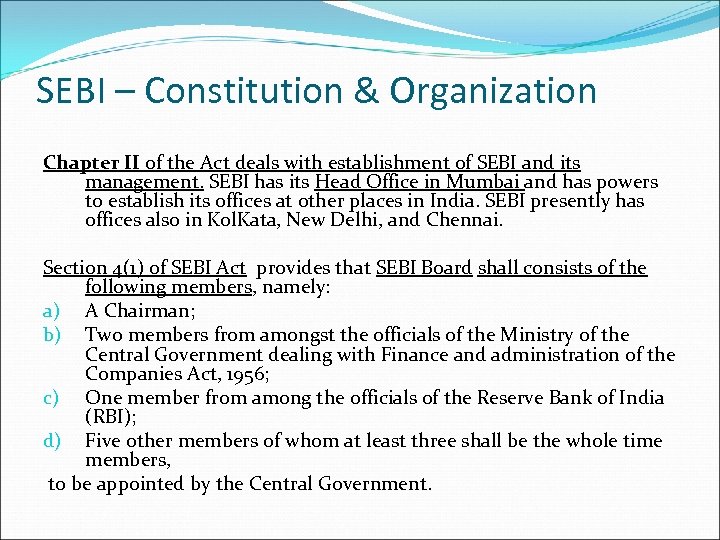

SEBI – Constitution & Organization Chapter II of the Act deals with establishment of SEBI and its management. SEBI has its Head Office in Mumbai and has powers to establish its offices at other places in India. SEBI presently has offices also in Kol. Kata, New Delhi, and Chennai. Section 4(1) of SEBI Act provides that SEBI Board shall consists of the following members, namely: a) A Chairman; b) Two members from amongst the officials of the Ministry of the Central Government dealing with Finance and administration of the Companies Act, 1956; c) One member from among the officials of the Reserve Bank of India (RBI); d) Five other members of whom at least three shall be the whole time members, to be appointed by the Central Government.

SEBI – Constitution & Organization Chapter II of the Act deals with establishment of SEBI and its management. SEBI has its Head Office in Mumbai and has powers to establish its offices at other places in India. SEBI presently has offices also in Kol. Kata, New Delhi, and Chennai. Section 4(1) of SEBI Act provides that SEBI Board shall consists of the following members, namely: a) A Chairman; b) Two members from amongst the officials of the Ministry of the Central Government dealing with Finance and administration of the Companies Act, 1956; c) One member from among the officials of the Reserve Bank of India (RBI); d) Five other members of whom at least three shall be the whole time members, to be appointed by the Central Government.

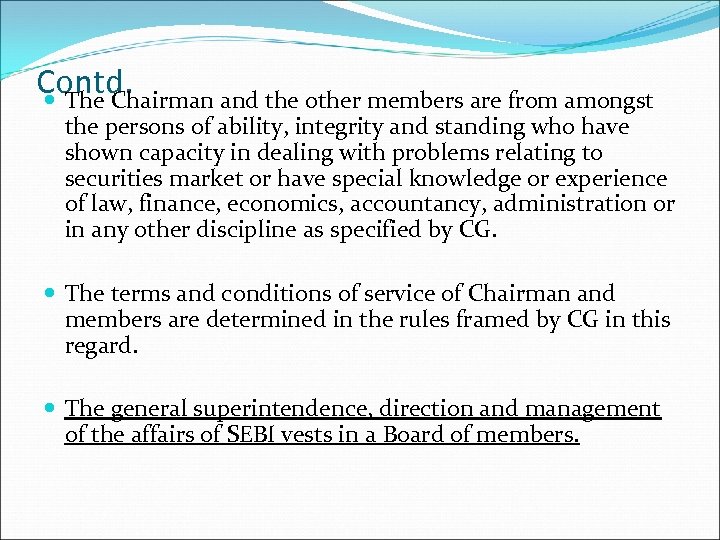

Contd. The Chairman and the other members are from amongst the persons of ability, integrity and standing who have shown capacity in dealing with problems relating to securities market or have special knowledge or experience of law, finance, economics, accountancy, administration or in any other discipline as specified by CG. The terms and conditions of service of Chairman and members are determined in the rules framed by CG in this regard. The general superintendence, direction and management of the affairs of SEBI vests in a Board of members.

Contd. The Chairman and the other members are from amongst the persons of ability, integrity and standing who have shown capacity in dealing with problems relating to securities market or have special knowledge or experience of law, finance, economics, accountancy, administration or in any other discipline as specified by CG. The terms and conditions of service of Chairman and members are determined in the rules framed by CG in this regard. The general superintendence, direction and management of the affairs of SEBI vests in a Board of members.

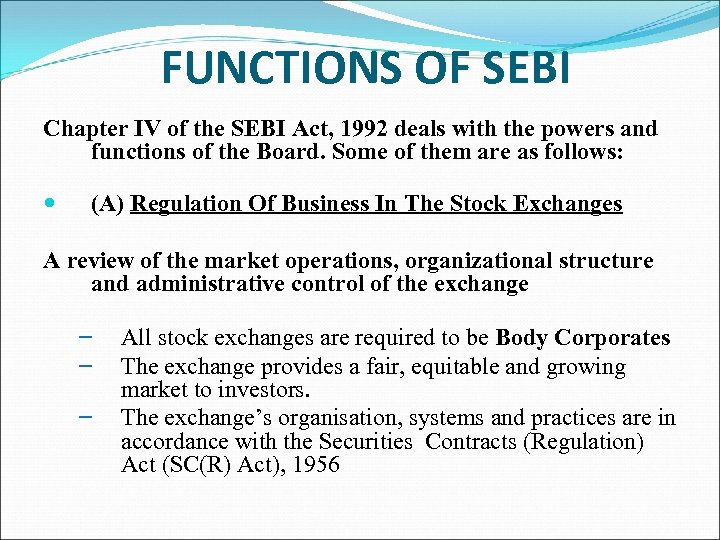

FUNCTIONS OF SEBI Chapter IV of the SEBI Act, 1992 deals with the powers and functions of the Board. Some of them are as follows: (A) Regulation Of Business In The Stock Exchanges A review of the market operations, organizational structure and administrative control of the exchange – – – All stock exchanges are required to be Body Corporates The exchange provides a fair, equitable and growing market to investors. The exchange’s organisation, systems and practices are in accordance with the Securities Contracts (Regulation) Act (SC(R) Act), 1956

FUNCTIONS OF SEBI Chapter IV of the SEBI Act, 1992 deals with the powers and functions of the Board. Some of them are as follows: (A) Regulation Of Business In The Stock Exchanges A review of the market operations, organizational structure and administrative control of the exchange – – – All stock exchanges are required to be Body Corporates The exchange provides a fair, equitable and growing market to investors. The exchange’s organisation, systems and practices are in accordance with the Securities Contracts (Regulation) Act (SC(R) Act), 1956

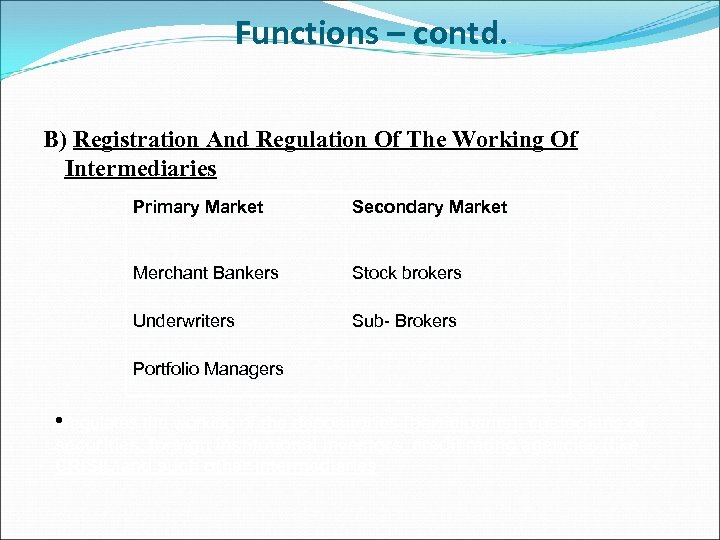

Functions – contd. B) Registration And Regulation Of The Working Of Intermediaries Primary Market Secondary Market Merchant Bankers Stock brokers Underwriters Sub- Brokers Portfolio Managers • regulates the working of the depositories [participants], custodians of securities, foreign institutional investors, credit rating agencies (like CRISIL)and such other intermediaries

Functions – contd. B) Registration And Regulation Of The Working Of Intermediaries Primary Market Secondary Market Merchant Bankers Stock brokers Underwriters Sub- Brokers Portfolio Managers • regulates the working of the depositories [participants], custodians of securities, foreign institutional investors, credit rating agencies (like CRISIL)and such other intermediaries

Functions – contd. C) Registration And Regulation Of Mutual Funds, Venture Capital Funds & Collective Investment Schemes ? AMFI-Self Regulatory Organization-'promoting and protecting the interest of mutual funds and their unitholders, increasing public awareness of mutual funds, and serving the investors' interest by defining and maintaining high ethical and professional standards in the mutual funds industry'. ? Every mutual fund must be registered with SEBI and registration is granted only where SEBI is satisfied with the background of the fund. ? SEBI has the authority to inspect the books of accounts, records and documents of a mutual fund, its trustees, AMC and custodian where it deems it necessary

Functions – contd. C) Registration And Regulation Of Mutual Funds, Venture Capital Funds & Collective Investment Schemes ? AMFI-Self Regulatory Organization-'promoting and protecting the interest of mutual funds and their unitholders, increasing public awareness of mutual funds, and serving the investors' interest by defining and maintaining high ethical and professional standards in the mutual funds industry'. ? Every mutual fund must be registered with SEBI and registration is granted only where SEBI is satisfied with the background of the fund. ? SEBI has the authority to inspect the books of accounts, records and documents of a mutual fund, its trustees, AMC and custodian where it deems it necessary

Functions – contd. D) Promoting & Regulating Self Regulatory Organizations (The Microfinance Institutions Network (MFIN), a self-regulatory body, initiated by RBI – In order for the SRO to effectively execute its responsibilities, it would be required to be structured, organized, managed and controlled such that it retains its independence, while continuing to perform a genuine market development role E) Prohibiting Fraudulent And Unfair Trade Practices In The Securities Market – SEBI is vested with powers to take action against these practices relating to securities market manipulation and misleading statements to induce sale/purchase of securities.

Functions – contd. D) Promoting & Regulating Self Regulatory Organizations (The Microfinance Institutions Network (MFIN), a self-regulatory body, initiated by RBI – In order for the SRO to effectively execute its responsibilities, it would be required to be structured, organized, managed and controlled such that it retains its independence, while continuing to perform a genuine market development role E) Prohibiting Fraudulent And Unfair Trade Practices In The Securities Market – SEBI is vested with powers to take action against these practices relating to securities market manipulation and misleading statements to induce sale/purchase of securities.

![Functions – contd. F] Prohibition Of Insider Trading – Stock Watch System, which has Functions – contd. F] Prohibition Of Insider Trading – Stock Watch System, which has](https://present5.com/presentation/6af9beec5e7a3fdaff297371ee06f036/image-29.jpg) Functions – contd. F] Prohibition Of Insider Trading – Stock Watch System, which has been put in place, surveillance over insider trading would be further strengthened. G] Investor Education And The Training Of Intermediaries – SEBI distributed the booklet titled “A Quick Reference Guide for Investors” to the investors – SEBI also issued a series of advertisement /public notices in national as well as regional newspapers to educate and caution the investors about the risks associated with the investments in collective investment schemes – SEBI has also issued messages in the interest of investors on National Channel and Regional Stations on Doordarshan.

Functions – contd. F] Prohibition Of Insider Trading – Stock Watch System, which has been put in place, surveillance over insider trading would be further strengthened. G] Investor Education And The Training Of Intermediaries – SEBI distributed the booklet titled “A Quick Reference Guide for Investors” to the investors – SEBI also issued a series of advertisement /public notices in national as well as regional newspapers to educate and caution the investors about the risks associated with the investments in collective investment schemes – SEBI has also issued messages in the interest of investors on National Channel and Regional Stations on Doordarshan.

Functions – contd. H) Inspection And Inquiries I) Regulating Substantial Acquisition Of Shares And Takeovers J) Performing Such Functions And Exercising Such Powers Under The Provisions Of The Securities Contracts (Regulation) Act, 1956 As May Be Delegated To It By The Central Government; K) Levying Fees Or Other Charges For Carrying Out The Purposes Of This Section L) Conducting Research For The Above Purposes

Functions – contd. H) Inspection And Inquiries I) Regulating Substantial Acquisition Of Shares And Takeovers J) Performing Such Functions And Exercising Such Powers Under The Provisions Of The Securities Contracts (Regulation) Act, 1956 As May Be Delegated To It By The Central Government; K) Levying Fees Or Other Charges For Carrying Out The Purposes Of This Section L) Conducting Research For The Above Purposes

Search & Seizure and Penalty To impose penalties of up to Rs 25 crore or three times the amount involved in the violation of a norm, whichever is higher. (e. g. In case of insider trading) In the cases of some offences, including defaults by brokers, a failure to furnish returns and information by corporates and brokers and other lapses, the market regulator can impose a higher penalty of Rs 1 lakhs a day or a maximum fine of Rs 1 crore, whichever is lower. At present, the offences carry penalties ranging between Rs 5, 000 and Rs 5 lakhs.

Search & Seizure and Penalty To impose penalties of up to Rs 25 crore or three times the amount involved in the violation of a norm, whichever is higher. (e. g. In case of insider trading) In the cases of some offences, including defaults by brokers, a failure to furnish returns and information by corporates and brokers and other lapses, the market regulator can impose a higher penalty of Rs 1 lakhs a day or a maximum fine of Rs 1 crore, whichever is lower. At present, the offences carry penalties ranging between Rs 5, 000 and Rs 5 lakhs.

RESERVE BANK OF INDIA ( RBI)

RESERVE BANK OF INDIA ( RBI)

RESERVE BANK OF INDIA (RBI) Establishment : Reserve Bank of India (RBI) is the central bank of the country. It was established in April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934 with a share capital of Rs. 5 crores on the basis of the recommendations of the Hilton Young Commission. The share capital was divided into shares of Rs. 100 each fully paid which was entirely owned by private shareholders in the beginning. The Government held shares of nominal value of Rs. 2, 20, 000. RBI has been fully owned by the Government of India since nationalization in 1949.

RESERVE BANK OF INDIA (RBI) Establishment : Reserve Bank of India (RBI) is the central bank of the country. It was established in April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934 with a share capital of Rs. 5 crores on the basis of the recommendations of the Hilton Young Commission. The share capital was divided into shares of Rs. 100 each fully paid which was entirely owned by private shareholders in the beginning. The Government held shares of nominal value of Rs. 2, 20, 000. RBI has been fully owned by the Government of India since nationalization in 1949.

Contd. It’s headquarter is in Mumbai. RBI is governed by a central board (headed by a Governor) appointed by the Central Government. The current governor of RBI is Raghuram Rajan RBI has 22 regional offices across India. There are 16 departments of RBI. It has a majority stake in the State Bank of India.

Contd. It’s headquarter is in Mumbai. RBI is governed by a central board (headed by a Governor) appointed by the Central Government. The current governor of RBI is Raghuram Rajan RBI has 22 regional offices across India. There are 16 departments of RBI. It has a majority stake in the State Bank of India.

OBJECTIVES To promote monetization and monetary integration of the economy. To manage currency and regulate foreign exchange. To institutionalize saving through promotion of banking habit. To build up a sound adequate banking and credit structure. To evolve a well differentiated structure of institutions purveying credit for agriculture and allied activities.

OBJECTIVES To promote monetization and monetary integration of the economy. To manage currency and regulate foreign exchange. To institutionalize saving through promotion of banking habit. To build up a sound adequate banking and credit structure. To evolve a well differentiated structure of institutions purveying credit for agriculture and allied activities.

Organization Structure of RBI The organization structure of the RBI consists of the Central Board of Directors and the Local Board of Directors. Central Board of Directors Consists of 20 members consisting of Governor and 4 Deputy Governors appointed by the Government of India for a period of five years. Four directors are nominated by the Central Government, one each from the four Local Boards situated at Mumbai, Kolkata, Chennai and New Delhi. Ten directors nominated by the central government are the experts drawn fro various fields appointed for four years. The 20 th member of CBD is a government official who is usually the Secretary, “Ministry of Finance” nominated by the central Government. The final control vests with the Central Board of Directors. Functions of CBD : General superintendence and direction of Bank’s affairs.

Organization Structure of RBI The organization structure of the RBI consists of the Central Board of Directors and the Local Board of Directors. Central Board of Directors Consists of 20 members consisting of Governor and 4 Deputy Governors appointed by the Government of India for a period of five years. Four directors are nominated by the Central Government, one each from the four Local Boards situated at Mumbai, Kolkata, Chennai and New Delhi. Ten directors nominated by the central government are the experts drawn fro various fields appointed for four years. The 20 th member of CBD is a government official who is usually the Secretary, “Ministry of Finance” nominated by the central Government. The final control vests with the Central Board of Directors. Functions of CBD : General superintendence and direction of Bank’s affairs.

The Local Board of Directors Consists of four from Mumbai, Kolkata, Chennai and New Delhi. The local Board of Directors' will be assisted by four members each nominated by the Central Government for a term of four years. And these local boards will advise the Central Board of Directors. A Committee of Central Board of Directors consists of Governor, Deputy Governor and Directors as may be present in the meeting. Functions of LBD : to advise the CBD on local matters and to represent territorial and economic interests of local cooperative and indigenous bank; to perform such other functions as delegated by CBD from time to time.

The Local Board of Directors Consists of four from Mumbai, Kolkata, Chennai and New Delhi. The local Board of Directors' will be assisted by four members each nominated by the Central Government for a term of four years. And these local boards will advise the Central Board of Directors. A Committee of Central Board of Directors consists of Governor, Deputy Governor and Directors as may be present in the meeting. Functions of LBD : to advise the CBD on local matters and to represent territorial and economic interests of local cooperative and indigenous bank; to perform such other functions as delegated by CBD from time to time.

FUNCTIONS OF RBI Note Issuing Authority Banker to Government Bankers’ Bank Supervising Authority Exchange Control Authority Promoters of the Financial System

FUNCTIONS OF RBI Note Issuing Authority Banker to Government Bankers’ Bank Supervising Authority Exchange Control Authority Promoters of the Financial System

Role of Reserve Bank of India To maintain monetary stability. To maintain financial stability. To maintain stable payments system (e. g. RTGS) To promote the development of financial infrastructure of markets and systems. To ensure that credit allocation should reflect the national economic priorities and societal concerns. To regulate the overall volume of money and credit in the economy.

Role of Reserve Bank of India To maintain monetary stability. To maintain financial stability. To maintain stable payments system (e. g. RTGS) To promote the development of financial infrastructure of markets and systems. To ensure that credit allocation should reflect the national economic priorities and societal concerns. To regulate the overall volume of money and credit in the economy.

MONETARY POLICY

MONETARY POLICY

Monetary Policy (Meaning & Definition) Monetary policy is that instrument which is used to control the volume of money and credit in the economy. In other words, it is the policy of the government executed by the medium of the central bank to control the availability, cost and use of money and credit with the help of monetary measures in order to achieve predetermined economic objectives. According to Harry G. Johnson, monetary policy is a “policy employing the central bank’s control of the supply of money as an instrument for achieving the objective of general economic policy”. Thus monetary policy is meant to regulate the supply of money and credit.

Monetary Policy (Meaning & Definition) Monetary policy is that instrument which is used to control the volume of money and credit in the economy. In other words, it is the policy of the government executed by the medium of the central bank to control the availability, cost and use of money and credit with the help of monetary measures in order to achieve predetermined economic objectives. According to Harry G. Johnson, monetary policy is a “policy employing the central bank’s control of the supply of money as an instrument for achieving the objective of general economic policy”. Thus monetary policy is meant to regulate the supply of money and credit.

Monetary Policy (Objectives) The main objectives of monetary policy are: Price stability Exchange stability Healthy balance of payments High rate of economic growth Controlled Expansion Of Bank Credit Promotion of Fixed Investment Restriction of Inventories Promotion of Exports and Food Procurement Operations

Monetary Policy (Objectives) The main objectives of monetary policy are: Price stability Exchange stability Healthy balance of payments High rate of economic growth Controlled Expansion Of Bank Credit Promotion of Fixed Investment Restriction of Inventories Promotion of Exports and Food Procurement Operations

Types of Monetary Policy Contractionary Monetary Policy : tends to curb inflation by contracting the money supply. Expansionary Monetary Policy : tends to encourage growth by expanding the money supply especially in the phase of recession.

Types of Monetary Policy Contractionary Monetary Policy : tends to curb inflation by contracting the money supply. Expansionary Monetary Policy : tends to encourage growth by expanding the money supply especially in the phase of recession.

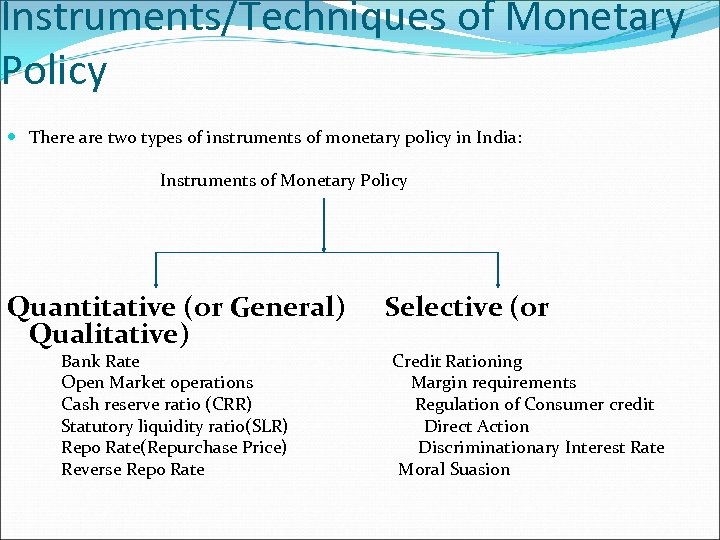

Instruments/Techniques of Monetary Policy There are two types of instruments of monetary policy in India: Instruments of Monetary Policy Quantitative (or General) Qualitative) Selective (or Bank Rate Credit Rationing Open Market operations Margin requirements Cash reserve ratio (CRR) Regulation of Consumer credit Statutory liquidity ratio(SLR) Direct Action Repo Rate(Repurchase Price) Discriminationary Interest Rate Reverse Repo Rate Moral Suasion

Instruments/Techniques of Monetary Policy There are two types of instruments of monetary policy in India: Instruments of Monetary Policy Quantitative (or General) Qualitative) Selective (or Bank Rate Credit Rationing Open Market operations Margin requirements Cash reserve ratio (CRR) Regulation of Consumer credit Statutory liquidity ratio(SLR) Direct Action Repo Rate(Repurchase Price) Discriminationary Interest Rate Reverse Repo Rate Moral Suasion

Repo Rate Repo rate or repurchase rate is the rate at which banks borrow money from the central bank (RBI for India) for a short period by selling their securities (financial assets) to the central bank with an agreement to repurchase it at a future date at predetermined price. It is similar to borrowing money from a money-lender by selling him something, and later buying it back at a pre-fixed price.

Repo Rate Repo rate or repurchase rate is the rate at which banks borrow money from the central bank (RBI for India) for a short period by selling their securities (financial assets) to the central bank with an agreement to repurchase it at a future date at predetermined price. It is similar to borrowing money from a money-lender by selling him something, and later buying it back at a pre-fixed price.

Reverse Repo Rate Reverse Repo rate is the rate of interest at which the central bank (RBI) borrows funds from other banks for a short duration. The banks deposit their short term excess funds with the central bank and earn interest on it.

Reverse Repo Rate Reverse Repo rate is the rate of interest at which the central bank (RBI) borrows funds from other banks for a short duration. The banks deposit their short term excess funds with the central bank and earn interest on it.

SLR Statutory liquidity ratio (SLR) refers to the amount that the commercial banks require to maintain in the form of gold or govt. approved securities before providing credit to the customers. Here by approved securities we mean, bond and shares of different companies. Statutory Liquidity Ratio is determined and maintained by Reserve Bank of India in order to control the expansion of bank credit.

SLR Statutory liquidity ratio (SLR) refers to the amount that the commercial banks require to maintain in the form of gold or govt. approved securities before providing credit to the customers. Here by approved securities we mean, bond and shares of different companies. Statutory Liquidity Ratio is determined and maintained by Reserve Bank of India in order to control the expansion of bank credit.

Cash Reserve Ratio is a specified minimum fraction of the total deposits of customers, which commercial banks have to hold as reserves with the central bank.

Cash Reserve Ratio is a specified minimum fraction of the total deposits of customers, which commercial banks have to hold as reserves with the central bank.

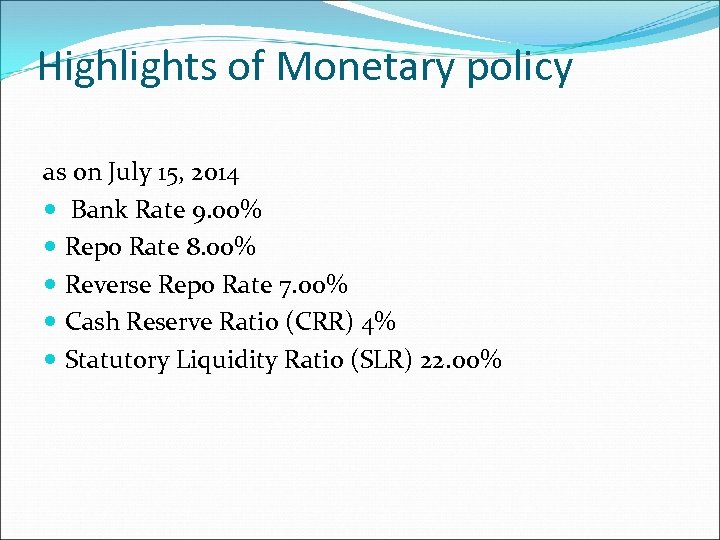

Highlights of Monetary policy as on July 15, 2014 Bank Rate 9. 00% Repo Rate 8. 00% Reverse Repo Rate 7. 00% Cash Reserve Ratio (CRR) 4% Statutory Liquidity Ratio (SLR) 22. 00%

Highlights of Monetary policy as on July 15, 2014 Bank Rate 9. 00% Repo Rate 8. 00% Reverse Repo Rate 7. 00% Cash Reserve Ratio (CRR) 4% Statutory Liquidity Ratio (SLR) 22. 00%

FISCAL POLICY

FISCAL POLICY

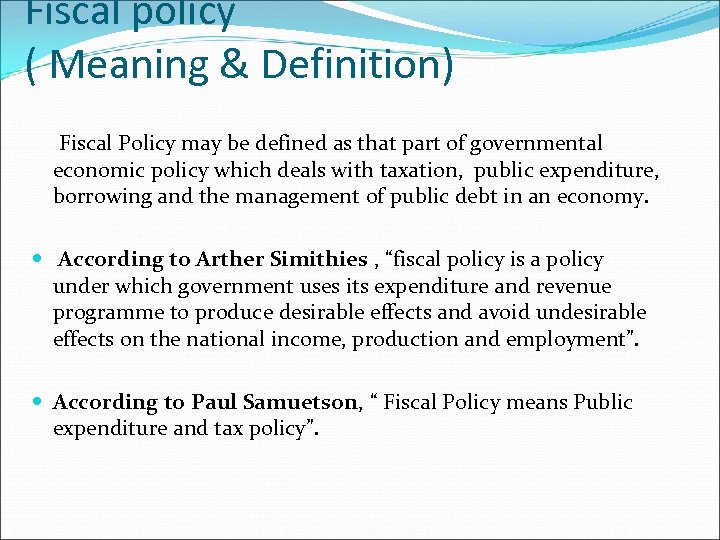

Fiscal policy ( Meaning & Definition) Fiscal Policy may be defined as that part of governmental economic policy which deals with taxation, public expenditure, borrowing and the management of public debt in an economy. According to Arther Simithies , “fiscal policy is a policy under which government uses its expenditure and revenue programme to produce desirable effects and avoid undesirable effects on the national income, production and employment”. According to Paul Samuetson, “ Fiscal Policy means Public expenditure and tax policy”.

Fiscal policy ( Meaning & Definition) Fiscal Policy may be defined as that part of governmental economic policy which deals with taxation, public expenditure, borrowing and the management of public debt in an economy. According to Arther Simithies , “fiscal policy is a policy under which government uses its expenditure and revenue programme to produce desirable effects and avoid undesirable effects on the national income, production and employment”. According to Paul Samuetson, “ Fiscal Policy means Public expenditure and tax policy”.

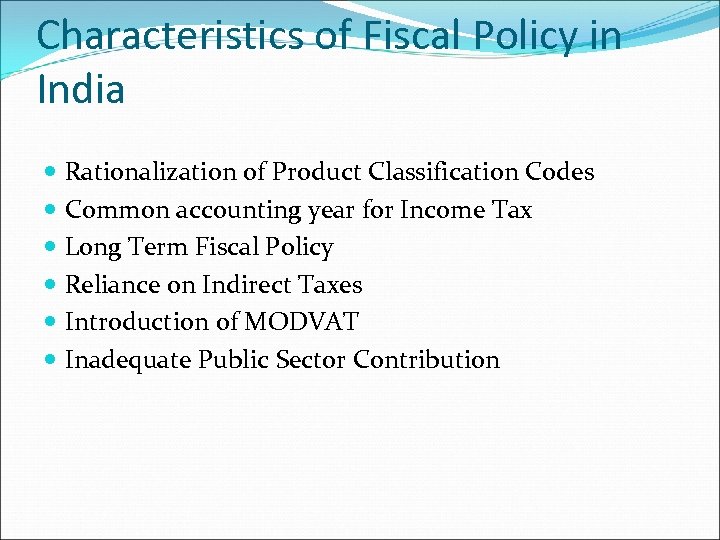

Characteristics of Fiscal Policy in India Rationalization of Product Classification Codes Common accounting year for Income Tax Long Term Fiscal Policy Reliance on Indirect Taxes Introduction of MODVAT Inadequate Public Sector Contribution

Characteristics of Fiscal Policy in India Rationalization of Product Classification Codes Common accounting year for Income Tax Long Term Fiscal Policy Reliance on Indirect Taxes Introduction of MODVAT Inadequate Public Sector Contribution

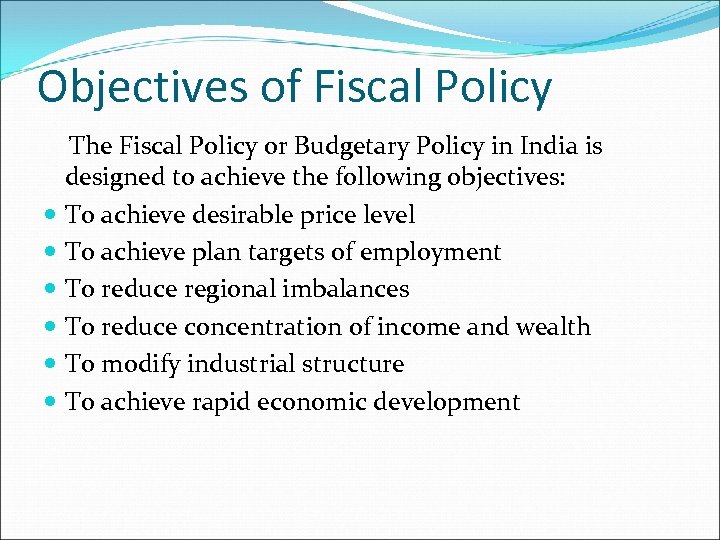

Objectives of Fiscal Policy The Fiscal Policy or Budgetary Policy in India is designed to achieve the following objectives: To achieve desirable price level To achieve plan targets of employment To reduce regional imbalances To reduce concentration of income and wealth To modify industrial structure To achieve rapid economic development

Objectives of Fiscal Policy The Fiscal Policy or Budgetary Policy in India is designed to achieve the following objectives: To achieve desirable price level To achieve plan targets of employment To reduce regional imbalances To reduce concentration of income and wealth To modify industrial structure To achieve rapid economic development

Three possible stances of fiscal policy A neutral stance of fiscal policy implies a balanced budget where G = T (Government spending = Tax revenue). An expansionary stance of fiscal policy involves government spending exceeding tax revenue (G > T). A contractionary stance of fiscal policy occurs when government spending is lower than tax revenue(G < T).

Three possible stances of fiscal policy A neutral stance of fiscal policy implies a balanced budget where G = T (Government spending = Tax revenue). An expansionary stance of fiscal policy involves government spending exceeding tax revenue (G > T). A contractionary stance of fiscal policy occurs when government spending is lower than tax revenue(G < T).

Instruments of Fiscal Policy Budget Policy of Taxation Policy of Public expenditure Policy of Public debt management

Instruments of Fiscal Policy Budget Policy of Taxation Policy of Public expenditure Policy of Public debt management

Instruments of Fiscal Policy- contd. (A) Budget : There are two parts of the Budget 1. Revenue Budget: - Taxation is the main source of income and examples of revenue expenditure are expenditure incurred on Police and Judiciary system, administration expenditure, govt. office expenditure etc. 2. Capital Budget : - Internal borrowings (e. g. from RBI) & External borrowing (e. g. WTO, IMT, IFC etc. ) form the source of income and capital expenditure are construction of dam, roads, highways, building etc. (B) Policy of Taxation: ( Direct Tax – Income and wealth tax & Indirect Tax – Excise duty, custom duty, Sales tax etc. )

Instruments of Fiscal Policy- contd. (A) Budget : There are two parts of the Budget 1. Revenue Budget: - Taxation is the main source of income and examples of revenue expenditure are expenditure incurred on Police and Judiciary system, administration expenditure, govt. office expenditure etc. 2. Capital Budget : - Internal borrowings (e. g. from RBI) & External borrowing (e. g. WTO, IMT, IFC etc. ) form the source of income and capital expenditure are construction of dam, roads, highways, building etc. (B) Policy of Taxation: ( Direct Tax – Income and wealth tax & Indirect Tax – Excise duty, custom duty, Sales tax etc. )

Instruments of Fiscal Policy – contd. Policy of Public expenditure: are of two types – 1. Development Expenditure – which enhances the productivity & efficiency and of lasting nature e. g. construction dam, roads, highway, ports etc. & which enhance knowledge and skills e. g. hospital and education facilities) 2. Non-Development Expenditure - expenditure incurred on Police and Judiciary system, administration expenditure, govt. office expenditure, defense etc. Policy of Public debt management: Internal & External Borrowings

Instruments of Fiscal Policy – contd. Policy of Public expenditure: are of two types – 1. Development Expenditure – which enhances the productivity & efficiency and of lasting nature e. g. construction dam, roads, highway, ports etc. & which enhance knowledge and skills e. g. hospital and education facilities) 2. Non-Development Expenditure - expenditure incurred on Police and Judiciary system, administration expenditure, govt. office expenditure, defense etc. Policy of Public debt management: Internal & External Borrowings

Advantages of Fiscal Policy Capital formation Resource mobilization Incentive to Private Sector Reduction in Inequality of Income and Wealth

Advantages of Fiscal Policy Capital formation Resource mobilization Incentive to Private Sector Reduction in Inequality of Income and Wealth

THANK YOU FOR VISITING THETOPPERSWAY. COM

THANK YOU FOR VISITING THETOPPERSWAY. COM