b1e5371a6ae6da48c24b966e3cd9d2b9.ppt

- Количество слайдов: 17

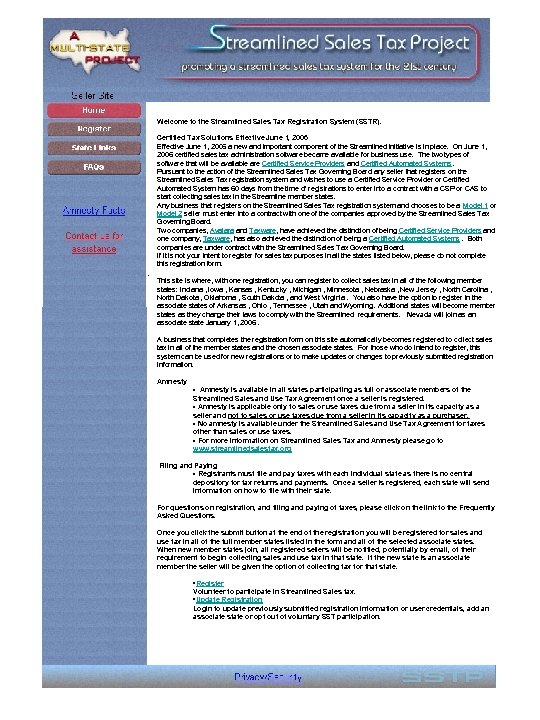

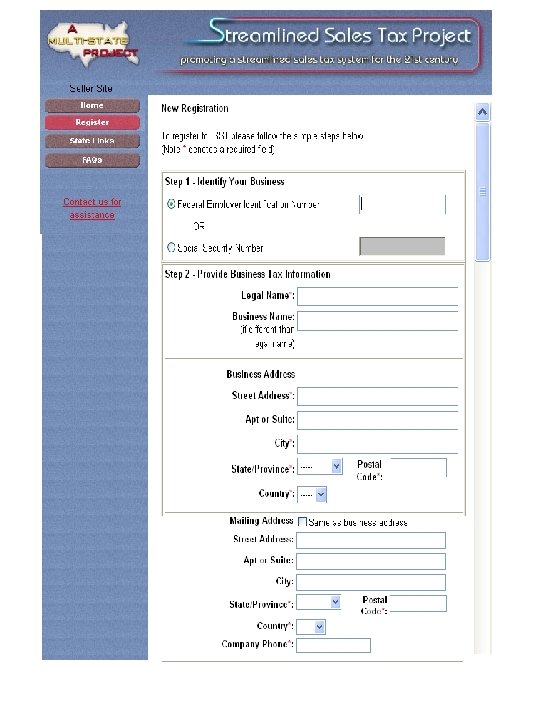

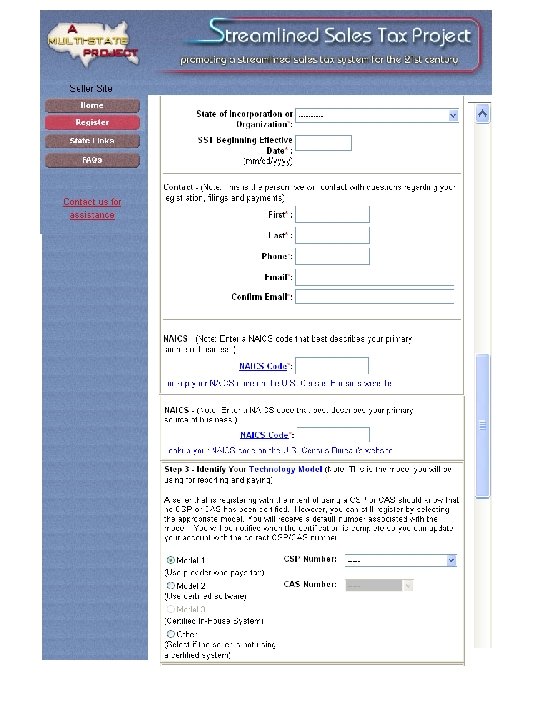

Welcome to the Streamlined Sales Tax Registration System (SSTR). Certified Tax Solutions Effective June 1, 2006 a new and important component of the Streamlined initiative is in place. On June 1, 2006 certified sales tax administration software became available for business use. The two types of software that will be available are Certified Service Providers and Certified Automated Systems. Pursuant to the action of the Streamlined Sales Tax Governing Board any seller that registers on the Streamlined Sales Tax registration system and wishes to use a Certified Service Provider or Certified Automated System has 60 days from the time of registrations to enter into a contract with a CSP or CAS to start collecting sales tax in the Streamline member states. Any business that registers on the Streamlined Sales Tax registration system and chooses to be a Model 1 or Model 2 seller must enter into a contract with one of the companies approved by the Streamlined Sales Tax Governing Board. Two companies, Avalara and Taxware, have achieved the distinction of being Certified Service Providers and one company, Taxware, has also achieved the distinction of being a Certified Automated Systems. Both companies are under contract with the Streamlined Sales Tax Governing Board. If it is not your intent to register for sales tax purposes in all the states listed below, please do not complete this registration form. This site is where, with one registration, you can register to collect sales tax in all of the following member states: Indiana , Iowa , Kansas , Kentucky , Michigan , Minnesota , Nebraska , New Jersey , North Carolina , North Dakota , Oklahoma , South Dakota , and West Virginia. You also have the option to register in the associate states of Arkansas , Ohio , Tennessee , Utah and Wyoming. Additional states will become member states as they change their laws to comply with the Streamlined requirements. Nevada will join as an associate state January 1, 2006. A business that completes the registration form on this site automatically becomes registered to collect sales tax in all of the member states and the chosen associate states. For those who do intend to register, this system can be used for new registrations or to make updates or changes to previously submitted registration information. Amnesty • Amnesty is available in all states participating as full or associate members of the Streamlined Sales and Use Tax Agreement once a seller is registered. • Amnesty is applicable only to sales or use taxes due from a seller in its capacity as a seller and not to sales or use taxes due from a seller in its capacity as a purchaser. • No amnesty is available under the Streamlined Sales and Use Tax Agreement for taxes other than sales or use taxes. • For more information on Streamlined Sales Tax and Amnesty please go to www. streamlinedsalestax. org Filing and Paying • Registrants must file and pay taxes with each individual state as there is no central depository for tax returns and payments. Once a seller is registered, each state will send information on how to file with their state. For questions on registration, and filing and paying of taxes, please click on the link to the Frequently Asked Questions. Once you click the submit button at the end of the registration you will be registered for sales and use tax in all of the full member states listed in the form and all of the selected associate states. When new member states join, all registered sellers will be notified, potentially by email, of their requirement to begin collecting sales and use tax in that state. If the new state is an associate member the seller will be given the option of collecting tax for that state. • Register Volunteer to participate in Streamlined Sales tax. • Update Registration Login to update previously submitted registration information or user credentials, add an associate state or opt out of voluntary SST participation.

Welcome to the Streamlined Sales Tax Registration System (SSTR). Certified Tax Solutions Effective June 1, 2006 a new and important component of the Streamlined initiative is in place. On June 1, 2006 certified sales tax administration software became available for business use. The two types of software that will be available are Certified Service Providers and Certified Automated Systems. Pursuant to the action of the Streamlined Sales Tax Governing Board any seller that registers on the Streamlined Sales Tax registration system and wishes to use a Certified Service Provider or Certified Automated System has 60 days from the time of registrations to enter into a contract with a CSP or CAS to start collecting sales tax in the Streamline member states. Any business that registers on the Streamlined Sales Tax registration system and chooses to be a Model 1 or Model 2 seller must enter into a contract with one of the companies approved by the Streamlined Sales Tax Governing Board. Two companies, Avalara and Taxware, have achieved the distinction of being Certified Service Providers and one company, Taxware, has also achieved the distinction of being a Certified Automated Systems. Both companies are under contract with the Streamlined Sales Tax Governing Board. If it is not your intent to register for sales tax purposes in all the states listed below, please do not complete this registration form. This site is where, with one registration, you can register to collect sales tax in all of the following member states: Indiana , Iowa , Kansas , Kentucky , Michigan , Minnesota , Nebraska , New Jersey , North Carolina , North Dakota , Oklahoma , South Dakota , and West Virginia. You also have the option to register in the associate states of Arkansas , Ohio , Tennessee , Utah and Wyoming. Additional states will become member states as they change their laws to comply with the Streamlined requirements. Nevada will join as an associate state January 1, 2006. A business that completes the registration form on this site automatically becomes registered to collect sales tax in all of the member states and the chosen associate states. For those who do intend to register, this system can be used for new registrations or to make updates or changes to previously submitted registration information. Amnesty • Amnesty is available in all states participating as full or associate members of the Streamlined Sales and Use Tax Agreement once a seller is registered. • Amnesty is applicable only to sales or use taxes due from a seller in its capacity as a seller and not to sales or use taxes due from a seller in its capacity as a purchaser. • No amnesty is available under the Streamlined Sales and Use Tax Agreement for taxes other than sales or use taxes. • For more information on Streamlined Sales Tax and Amnesty please go to www. streamlinedsalestax. org Filing and Paying • Registrants must file and pay taxes with each individual state as there is no central depository for tax returns and payments. Once a seller is registered, each state will send information on how to file with their state. For questions on registration, and filing and paying of taxes, please click on the link to the Frequently Asked Questions. Once you click the submit button at the end of the registration you will be registered for sales and use tax in all of the full member states listed in the form and all of the selected associate states. When new member states join, all registered sellers will be notified, potentially by email, of their requirement to begin collecting sales and use tax in that state. If the new state is an associate member the seller will be given the option of collecting tax for that state. • Register Volunteer to participate in Streamlined Sales tax. • Update Registration Login to update previously submitted registration information or user credentials, add an associate state or opt out of voluntary SST participation.

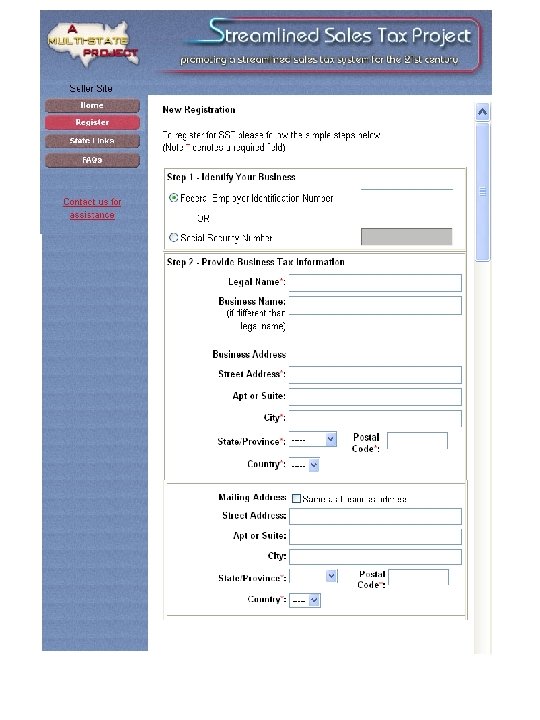

• New form starts on next slide

• New form starts on next slide

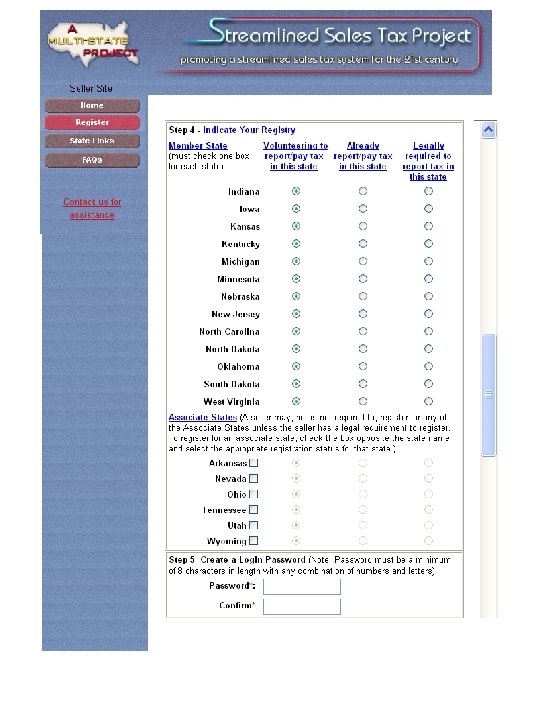

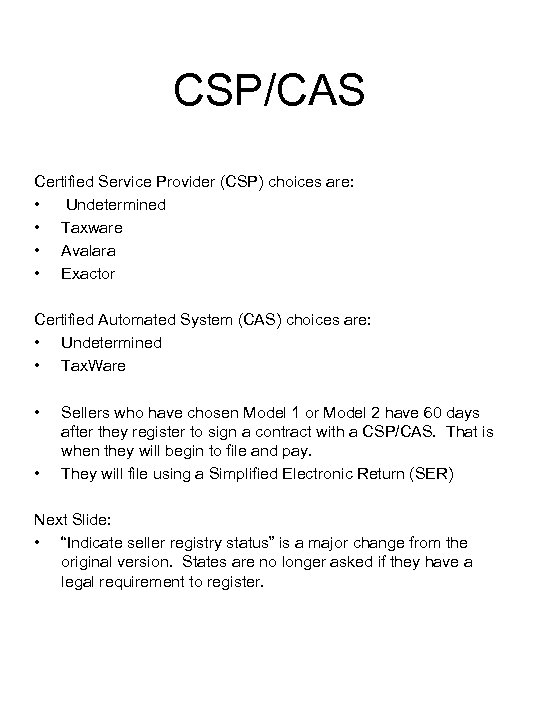

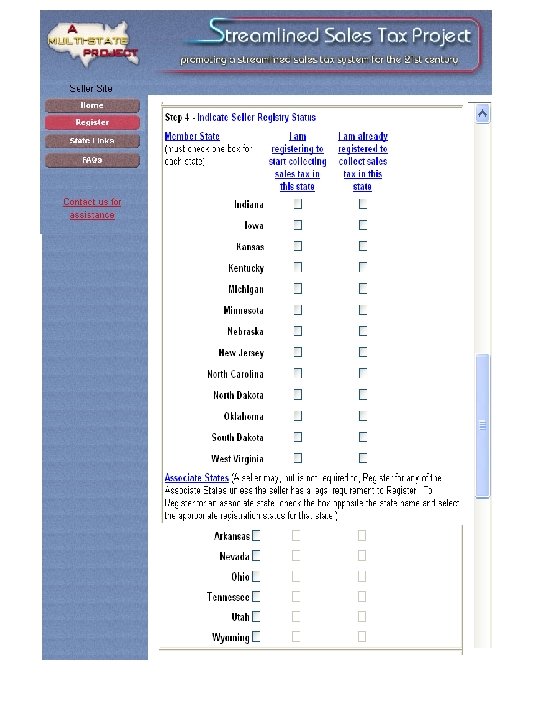

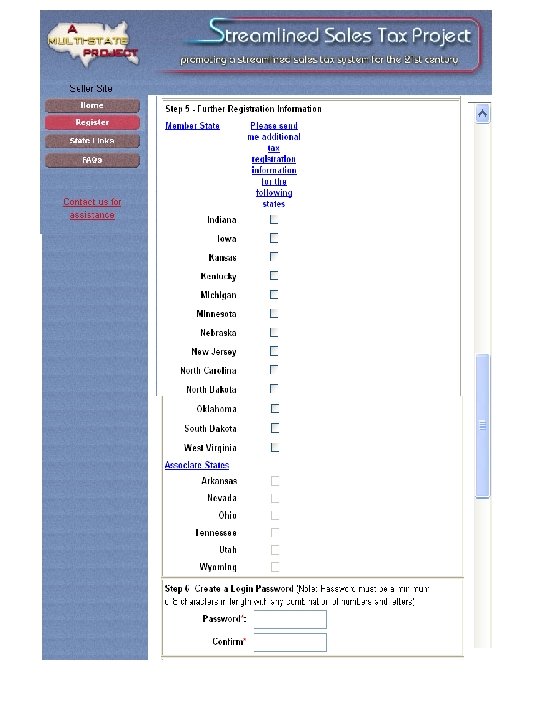

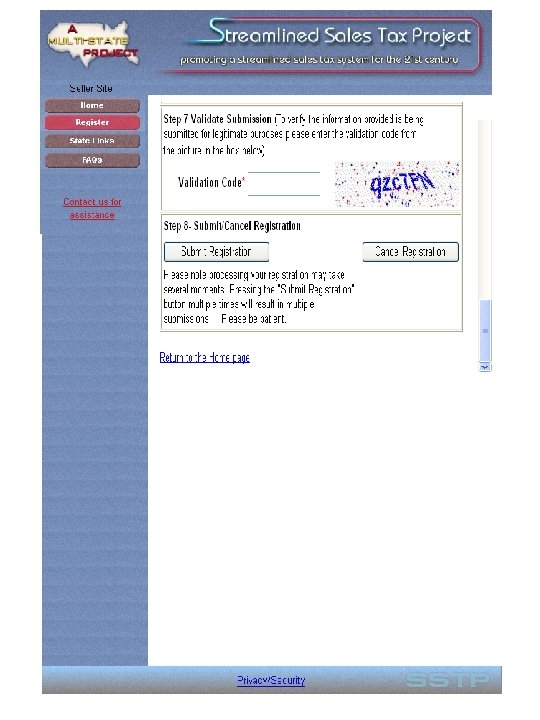

CSP/CAS Certified Service Provider (CSP) choices are: • Undetermined • Taxware • Avalara • Exactor Certified Automated System (CAS) choices are: • Undetermined • Tax. Ware • • Sellers who have chosen Model 1 or Model 2 have 60 days after they register to sign a contract with a CSP/CAS. That is when they will begin to file and pay. They will file using a Simplified Electronic Return (SER) Next Slide: • “Indicate seller registry status” is a major change from the original version. States are no longer asked if they have a legal requirement to register.

CSP/CAS Certified Service Provider (CSP) choices are: • Undetermined • Taxware • Avalara • Exactor Certified Automated System (CAS) choices are: • Undetermined • Tax. Ware • • Sellers who have chosen Model 1 or Model 2 have 60 days after they register to sign a contract with a CSP/CAS. That is when they will begin to file and pay. They will file using a Simplified Electronic Return (SER) Next Slide: • “Indicate seller registry status” is a major change from the original version. States are no longer asked if they have a legal requirement to register.

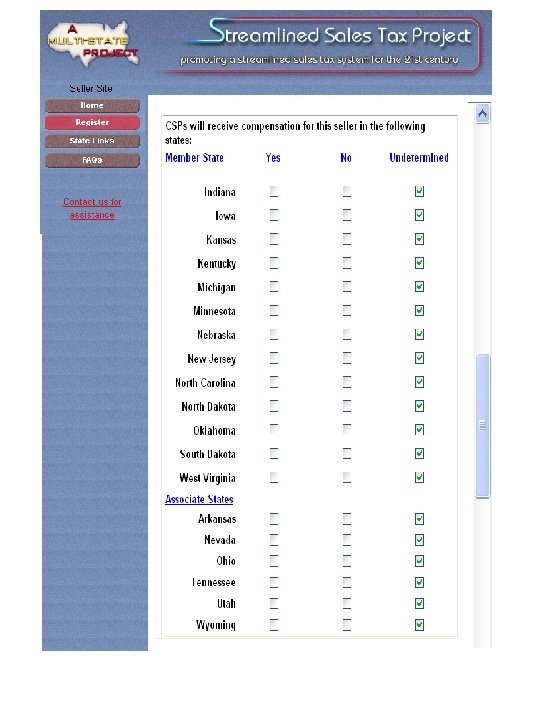

New States: Rhode Island Vermont have petitioned to join Streamlined as of January 1, 2007 How the states will know if they are to pay an allowance to a seller’s CSP 1. A seller signs a contract with a CSP 2. The seller informs the CSP in which states they are a volunteer 3. The CSP sends this information to the SST administrator 4. The administrator reviews and updates the seller’s registration form with the volunteer information for each state. 5. The next time a state pulls their transmission they will receive this information.

New States: Rhode Island Vermont have petitioned to join Streamlined as of January 1, 2007 How the states will know if they are to pay an allowance to a seller’s CSP 1. A seller signs a contract with a CSP 2. The seller informs the CSP in which states they are a volunteer 3. The CSP sends this information to the SST administrator 4. The administrator reviews and updates the seller’s registration form with the volunteer information for each state. 5. The next time a state pulls their transmission they will receive this information.

REPORTS • Number of active registrants as of 8 -18 -2006 _____ • Number of Model 1 registrants (CSP) _____ • Number of Model 2 registrants (CAS) ______ • Number of Model N registrants ______ – No certified system PROBLEMS Sellers use the Streamlined registration system by mistake Sellers register through Streamlined then try to cancel the registration with a few individual states

REPORTS • Number of active registrants as of 8 -18 -2006 _____ • Number of Model 1 registrants (CSP) _____ • Number of Model 2 registrants (CAS) ______ • Number of Model N registrants ______ – No certified system PROBLEMS Sellers use the Streamlined registration system by mistake Sellers register through Streamlined then try to cancel the registration with a few individual states