a90e402ff663eba16d2f002b4b6a73b1.ppt

- Количество слайдов: 37

Welcome to the presentation ON Budget 2012 -2013 Dr Abdul Mannan Shikder Commissioner Customs, Excise & VAT (Appeal) Commissionerate, Dhaka-1

Budget 2012 -2013 n n n Declared on : 07 June, 2012 Declared by : Hon’ble Finance Minister Total Expenditure Budget : Tk. 1, 91, 738. 00 Crore Total Income Budget : Tk. 1, 39, 670. 00 Crore Budget Deficit : Tk. 52, 068. 00 Crore

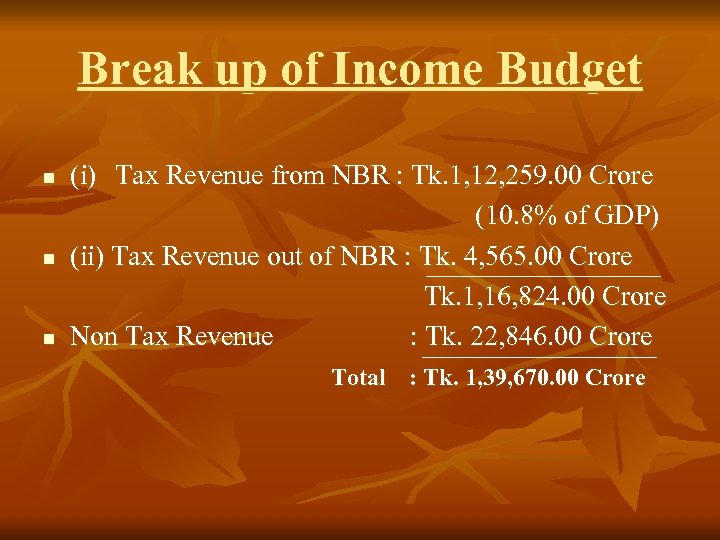

Break up of Income Budget n n n (i) Tax Revenue from NBR : Tk. 1, 12, 259. 00 Crore (10. 8% of GDP) (ii) Tax Revenue out of NBR : Tk. 4, 565. 00 Crore Tk. 1, 16, 824. 00 Crore Non Tax Revenue : Tk. 22, 846. 00 Crore Total : Tk. 1, 39, 670. 00 Crore

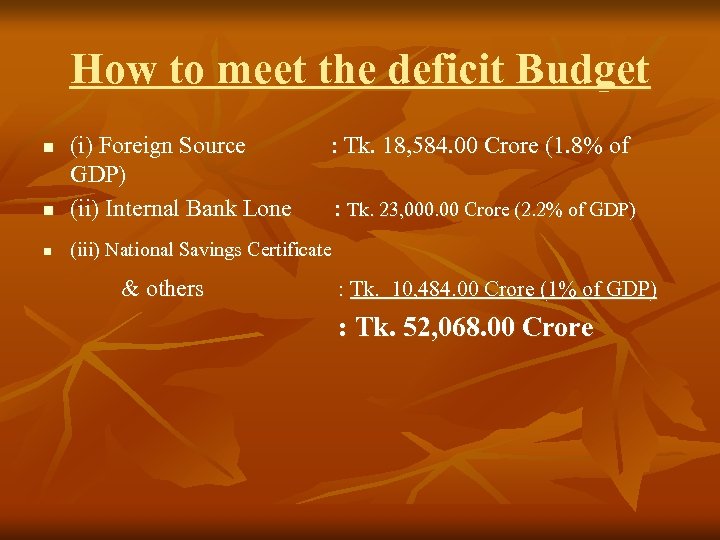

How to meet the deficit Budget n (i) Foreign Source GDP) (ii) Internal Bank Lone n (iii) National Savings Certificate n & others : Tk. 18, 584. 00 Crore (1. 8% of : Tk. 23, 000. 00 Crore (2. 2% of GDP) : Tk. 10, 484. 00 Crore (1% of GDP) : Tk. 52, 068. 00 Crore

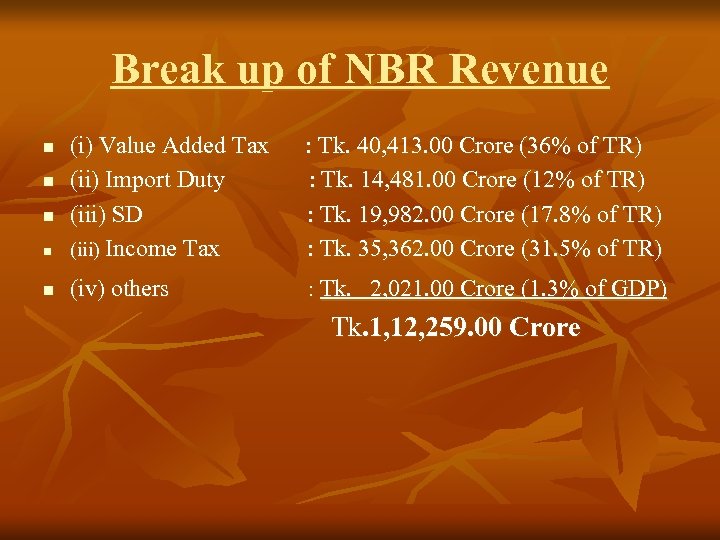

Break up of NBR Revenue n (i) Value Added Tax (ii) Import Duty (iii) SD (iii) Income Tax : Tk. 40, 413. 00 Crore (36% of TR) : Tk. 14, 481. 00 Crore (12% of TR) : Tk. 19, 982. 00 Crore (17. 8% of TR) : Tk. 35, 362. 00 Crore (31. 5% of TR) n (iv) others : Tk. 2, 021. 00 Crore (1. 3% of GDP) n n n Tk. 1, 12, 259. 00 Crore

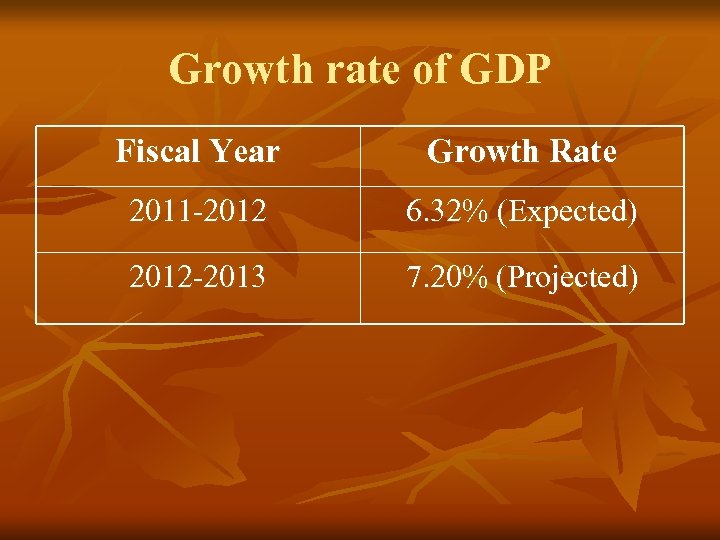

Growth rate of GDP Fiscal Year Growth Rate 2011 -2012 6. 32% (Expected) 2012 -2013 7. 20% (Projected)

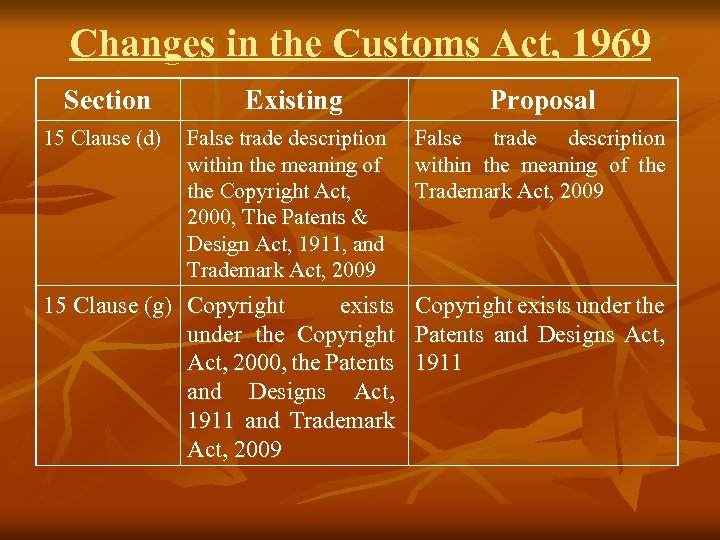

Changes in the Customs Act, 1969 Section 15 Clause (d) Existing False trade description within the meaning of the Copyright Act, 2000, The Patents & Design Act, 1911, and Trademark Act, 2009 Proposal False trade description within the meaning of the Trademark Act, 2009 15 Clause (g) Copyright exists under the Copyright Patents and Designs Act, 2000, the Patents 1911 and Designs Act, 1911 and Trademark Act, 2009

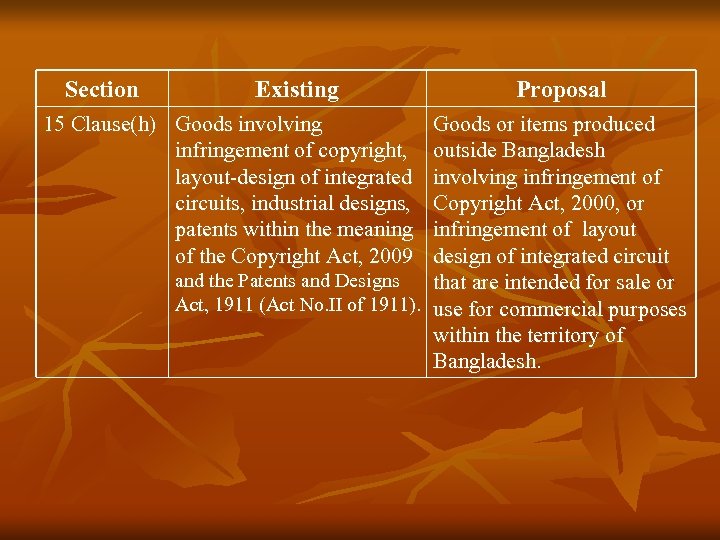

Section Existing 15 Clause(h) Goods involving infringement of copyright, layout-design of integrated circuits, industrial designs, patents within the meaning of the Copyright Act, 2009 Proposal Goods or items produced outside Bangladesh involving infringement of Copyright Act, 2000, or infringement of layout design of integrated circuit and the Patents and Designs that are intended for sale or Act, 1911 (Act No. II of 1911). use for commercial purposes within the territory of Bangladesh.

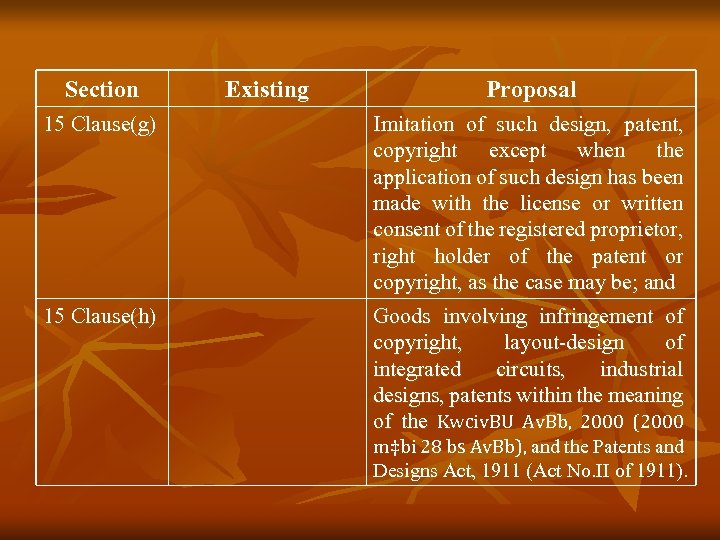

Section 15 Clause(g) 15 Clause(h) Existing Proposal Imitation of such design, patent, copyright except when the application of such design has been made with the license or written consent of the registered proprietor, right holder of the patent or copyright, as the case may be; and Goods involving infringement of copyright, layout-design of integrated circuits, industrial designs, patents within the meaning of the Kwciv. BU Av. Bb, 2000 (2000 m‡bi 28 bs Av. Bb), and the Patents and Designs Act, 1911 (Act No. II of 1911).

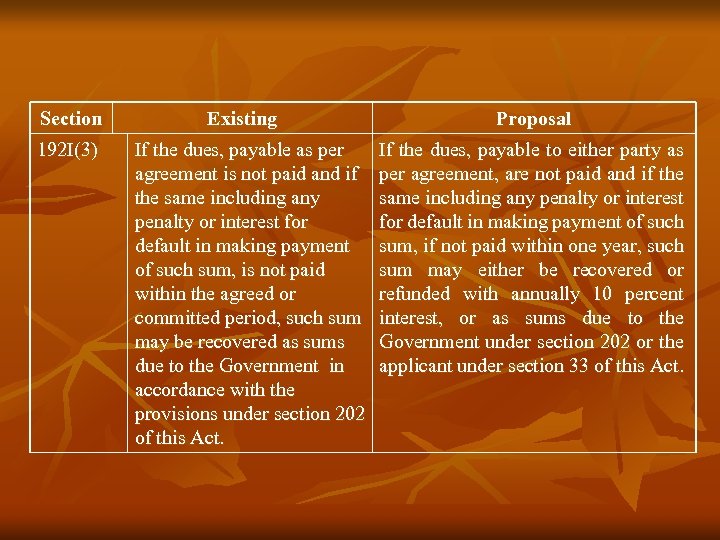

Section 192 I(3) Existing If the dues, payable as per agreement is not paid and if the same including any penalty or interest for default in making payment of such sum, is not paid within the agreed or committed period, such sum may be recovered as sums due to the Government in accordance with the provisions under section 202 of this Act. Proposal If the dues, payable to either party as per agreement, are not paid and if the same including any penalty or interest for default in making payment of such sum, if not paid within one year, such sum may either be recovered or refunded with annually 10 percent interest, or as sums due to the Government under section 202 or the applicant under section 33 of this Act.

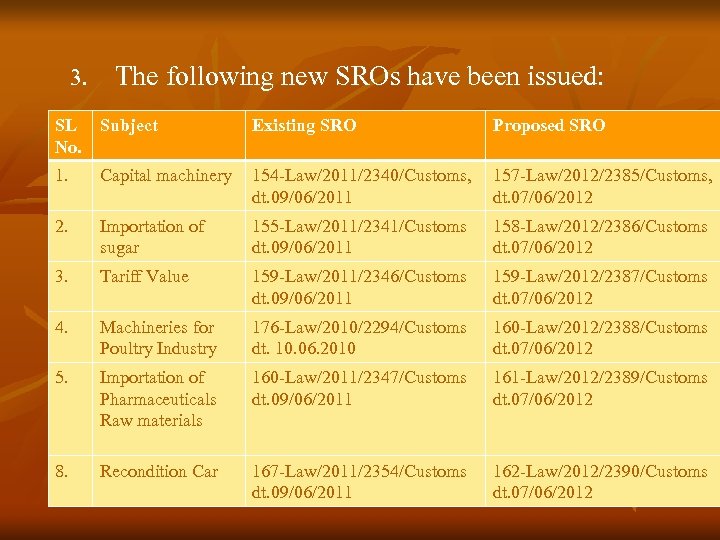

3. The following new SROs have been issued: SL Subject No. Existing SRO Proposed SRO 1. Capital machinery 154 -Law/2011/2340/Customs, dt. 09/06/2011 157 -Law/2012/2385/Customs, dt. 07/06/2012 2. Importation of sugar 155 -Law/2011/2341/Customs dt. 09/06/2011 158 -Law/2012/2386/Customs dt. 07/06/2012 3. Tariff Value 159 -Law/2011/2346/Customs dt. 09/06/2011 159 -Law/2012/2387/Customs dt. 07/06/2012 4. Machineries for Poultry Industry 176 -Law/2010/2294/Customs dt. 10. 06. 2010 160 -Law/2012/2388/Customs dt. 07/06/2012 5. Importation of Pharmaceuticals Raw materials 160 -Law/2011/2347/Customs dt. 09/06/2011 161 -Law/2012/2389/Customs dt. 07/06/2012 8. Recondition Car 167 -Law/2011/2354/Customs dt. 09/06/2011 162 -Law/2012/2390/Customs dt. 07/06/2012

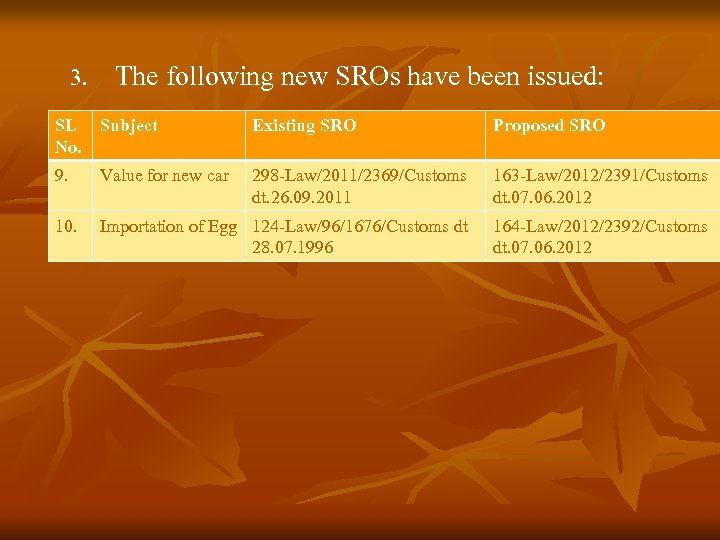

3. The following new SROs have been issued: SL Subject No. Existing SRO Proposed SRO 9. Value for new car 298 -Law/2011/2369/Customs dt. 26. 09. 2011 163 -Law/2012/2391/Customs dt. 07. 06. 2012 10. Importation of Egg 124 -Law/96/1676/Customs dt 28. 07. 1996 164 -Law/2012/2392/Customs dt. 07. 06. 2012

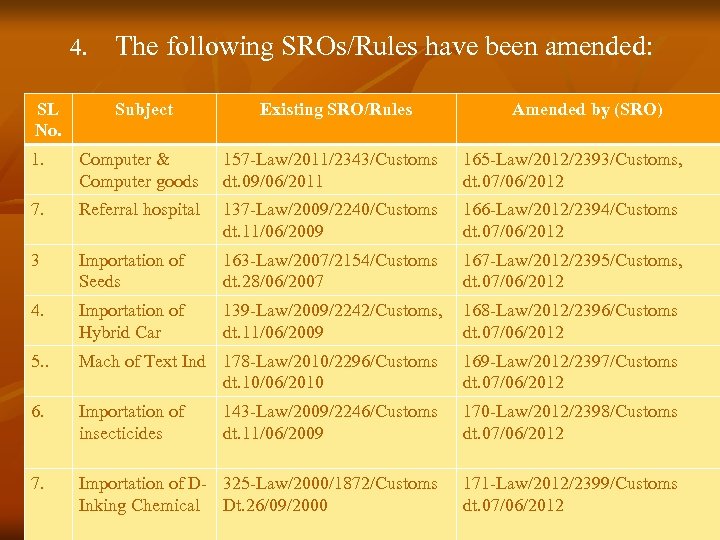

4. SL No. The following SROs/Rules have been amended: Subject Existing SRO/Rules Amended by (SRO) 1. Computer & Computer goods 157 -Law/2011/2343/Customs dt. 09/06/2011 165 -Law/2012/2393/Customs, dt. 07/06/2012 7. Referral hospital 137 -Law/2009/2240/Customs dt. 11/06/2009 166 -Law/2012/2394/Customs dt. 07/06/2012 3 Importation of Seeds 163 -Law/2007/2154/Customs dt. 28/06/2007 167 -Law/2012/2395/Customs, dt. 07/06/2012 4. Importation of Hybrid Car 139 -Law/2009/2242/Customs, dt. 11/06/2009 168 -Law/2012/2396/Customs dt. 07/06/2012 5. . Mach of Text Ind 178 -Law/2010/2296/Customs dt. 10/06/2010 169 -Law/2012/2397/Customs dt. 07/06/2012 6. Importation of insecticides 143 -Law/2009/2246/Customs dt. 11/06/2009 170 -Law/2012/2398/Customs dt. 07/06/2012 7. Importation of D- 325 -Law/2000/1872/Customs Inking Chemical Dt. 26/09/2000 171 -Law/2012/2399/Customs dt. 07/06/2012

4. SL No. The following SROs/Rules have been amended: Subject Existing SRO/Rules Amended by (SRO) 8. Baggage Rule, 2011 Baggage Rule, 2012 [172 Law/2012/2400/Customs, dt. 07/06/2012] 9. Cus Agent Lisence Customs Agents (Licensing) Rule, 2009 173 -Law/2012/2401/Customs dt. 07/06/2012 10. Importation of RM 340 -Law/2011/2371/Customs for Text Ind Dt. 03/11/2011 174 -Law/2012/2402/Customs Dt. 07/06/2012 11. Importation of RM for Ship Build Ind 280 -Law/2011/2367/Customs Dt. 08/09/2011 175 -Law/2012/2403/Customs dt. 07/06/2012 12. Imp Mach for Oil, Gas CNG Station 105 -Law/99/1784/Customs dt. 23/05/1999 176 -Law/2012/2404/Customs dt. 07/06/2012 13 Freight Forward (Licensing Rule) Rule, 2008 177 -Law/2012/2405/Customs dt. 07/06/2012

4. SL No. The following SROs/Rules have been amended: Subject Existing SRO/Rules Amended by (SRO) 13. PSI Exemption 158 -Law/2011/2344/Customs Dt. 09/06/2011 178 -Law/2012/2406/Customs Dt. 07/06/2012 14. RM for Medicine approved by Drugs Administration 261/2009/Customs Dt. 11/06/2009 315/2012/Customs dt. 07/06/2012

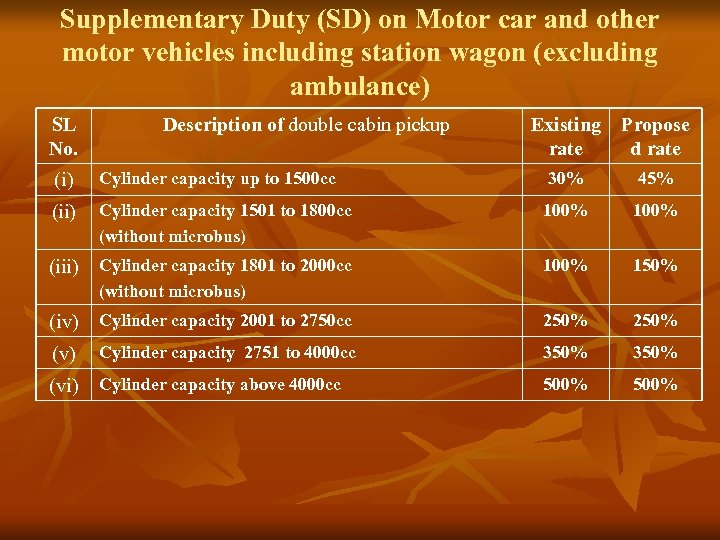

Supplementary Duty (SD) on Motor car and other motor vehicles including station wagon (excluding ambulance) SL No. Description of double cabin pickup Existing Propose rate d rate (i) Cylinder capacity up to 1500 cc 30% 45% (ii) Cylinder capacity 1501 to 1800 cc (without microbus) 100% (iii) Cylinder capacity 1801 to 2000 cc 100% 150% (iv) Cylinder capacity 2001 to 2750 cc 250% Cylinder capacity 2751 to 4000 cc 350% 500% (without microbus) (vi) Cylinder capacity above 4000 cc

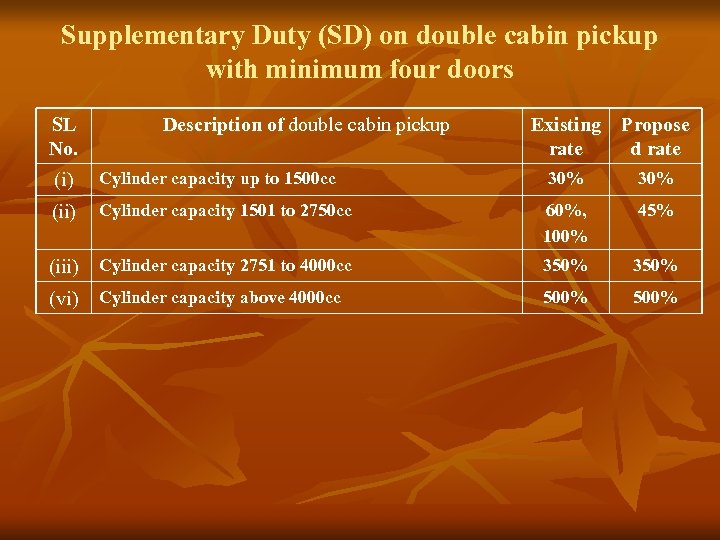

Supplementary Duty (SD) on double cabin pickup with minimum four doors SL No. Description of double cabin pickup Existing Propose rate d rate (i) Cylinder capacity up to 1500 cc 30% (ii) Cylinder capacity 1501 to 2750 cc 60%, 100% 45% (iii) Cylinder capacity 2751 to 4000 cc 350% (vi) Cylinder capacity above 4000 cc 500%

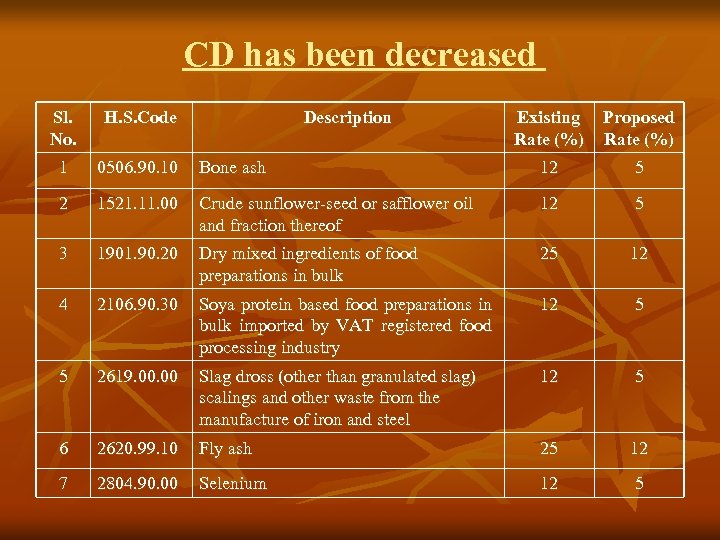

CD has been decreased Sl. No. H. S. Code 1 0506. 90. 10 2 Description Existing Rate (%) Proposed Rate (%) Bone ash 12 5 1521. 11. 00 Crude sunflower-seed or safflower oil and fraction thereof 12 5 3 1901. 90. 20 Dry mixed ingredients of food preparations in bulk 25 12 4 2106. 90. 30 Soya protein based food preparations in bulk imported by VAT registered food processing industry 12 5 5 2619. 00 Slag dross (other than granulated slag) scalings and other waste from the manufacture of iron and steel 12 5 6 2620. 99. 10 Fly ash 25 12 7 2804. 90. 00 Selenium 12 5

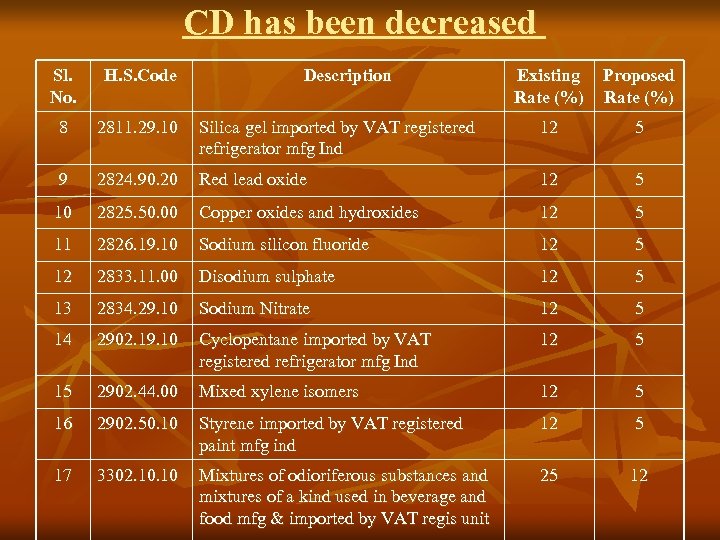

CD has been decreased Sl. No. H. S. Code 8 2811. 29. 10 9 Description Existing Rate (%) Proposed Rate (%) Silica gel imported by VAT registered refrigerator mfg Ind 12 5 2824. 90. 20 Red lead oxide 12 5 10 2825. 50. 00 Copper oxides and hydroxides 12 5 11 2826. 19. 10 Sodium silicon fluoride 12 5 12 2833. 11. 00 Disodium sulphate 12 5 13 2834. 29. 10 Sodium Nitrate 12 5 14 2902. 19. 10 Cyclopentane imported by VAT registered refrigerator mfg Ind 12 5 15 2902. 44. 00 Mixed xylene isomers 12 5 16 2902. 50. 10 Styrene imported by VAT registered paint mfg ind 12 5 17 3302. 10 Mixtures of odioriferous substances and mixtures of a kind used in beverage and food mfg & imported by VAT regis unit 25 12

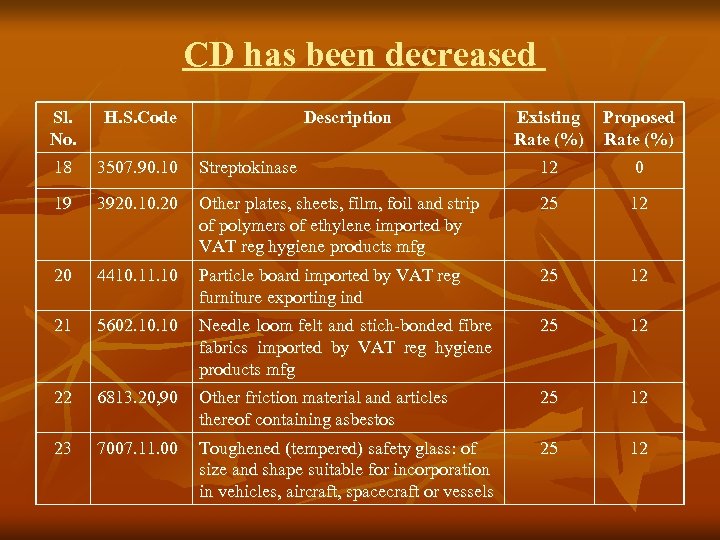

CD has been decreased Sl. No. H. S. Code 18 3507. 90. 10 19 Description Existing Rate (%) Proposed Rate (%) Streptokinase 12 0 3920. 10. 20 Other plates, sheets, film, foil and strip of polymers of ethylene imported by VAT reg hygiene products mfg 25 12 20 4410. 11. 10 Particle board imported by VAT reg furniture exporting ind 25 12 21 5602. 10 Needle loom felt and stich-bonded fibre fabrics imported by VAT reg hygiene products mfg 25 12 22 6813. 20, 90 Other friction material and articles thereof containing asbestos 25 12 23 7007. 11. 00 Toughened (tempered) safety glass: of size and shape suitable for incorporation in vehicles, aircraft, spacecraft or vessels 25 12

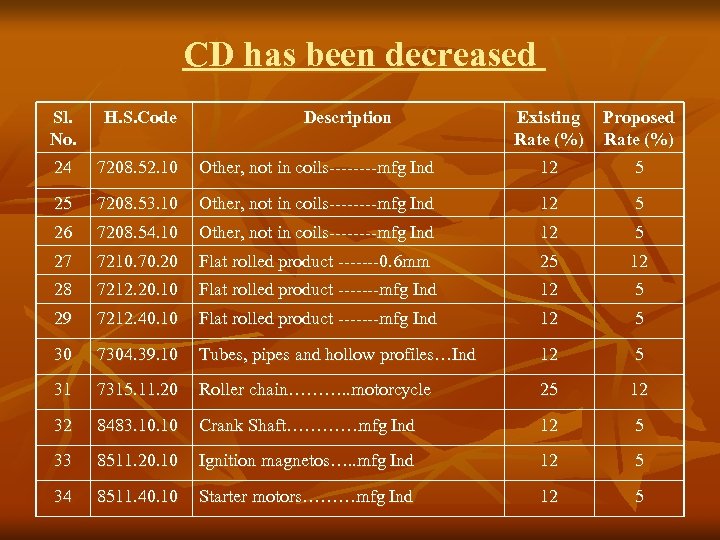

CD has been decreased Sl. No. H. S. Code 24 7208. 52. 10 25 Description Existing Rate (%) Proposed Rate (%) Other, not in coils----mfg Ind 12 5 7208. 53. 10 Other, not in coils----mfg Ind 12 5 26 7208. 54. 10 Other, not in coils----mfg Ind 12 5 27 7210. 70. 20 Flat rolled product -------0. 6 mm 25 12 28 7212. 20. 10 Flat rolled product -------mfg Ind 12 5 29 7212. 40. 10 Flat rolled product -------mfg Ind 12 5 30 7304. 39. 10 Tubes, pipes and hollow profiles…Ind 12 5 31 7315. 11. 20 Roller chain………. . motorcycle 25 12 32 8483. 10 Crank Shaft…………mfg Ind 12 5 33 8511. 20. 10 Ignition magnetos…. . mfg Ind 12 5 34 8511. 40. 10 Starter motors………mfg Ind 12 5

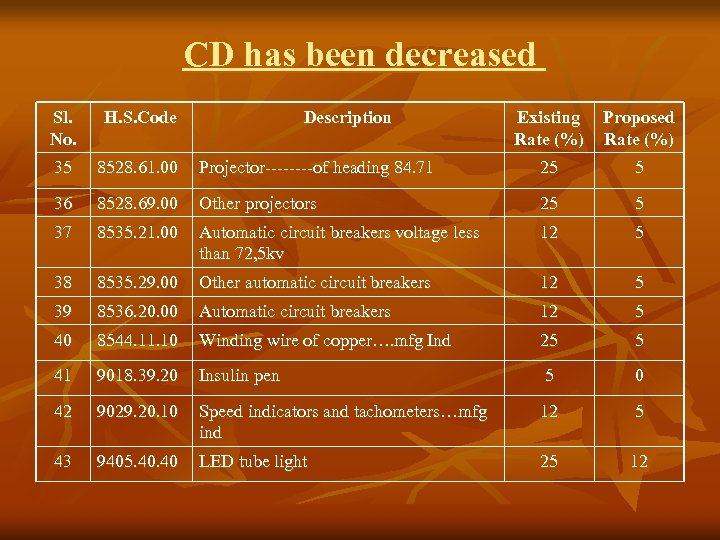

CD has been decreased Sl. No. H. S. Code 35 8528. 61. 00 36 Description Existing Rate (%) Proposed Rate (%) Projector----of heading 84. 71 25 5 8528. 69. 00 Other projectors 25 5 37 8535. 21. 00 Automatic circuit breakers voltage less than 72, 5 kv 12 5 38 8535. 29. 00 Other automatic circuit breakers 12 5 39 8536. 20. 00 Automatic circuit breakers 12 5 40 8544. 11. 10 Winding wire of copper…. mfg Ind 25 5 41 9018. 39. 20 Insulin pen 5 0 42 9029. 20. 10 Speed indicators and tachometers…mfg ind 12 5 43 9405. 40 LED tube light 25 12

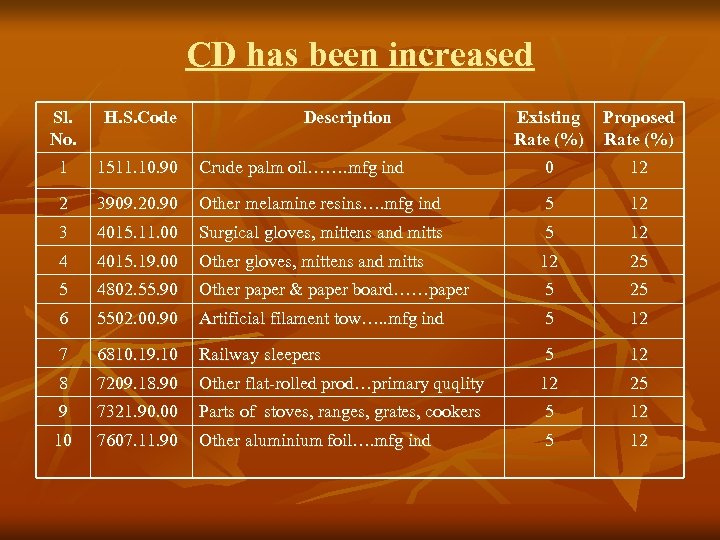

CD has been increased Sl. No. H. S. Code 1 1511. 10. 90 2 Description Existing Rate (%) Proposed Rate (%) Crude palm oil……. mfg ind 0 12 3909. 20. 90 Other melamine resins…. mfg ind 5 12 3 4015. 11. 00 Surgical gloves, mittens and mitts 5 12 4 4015. 19. 00 Other gloves, mittens and mitts 12 25 5 4802. 55. 90 Other paper & paper board……paper 5 25 6 5502. 00. 90 Artificial filament tow…. . mfg ind 5 12 7 6810. 19. 10 Railway sleepers 5 12 8 7209. 18. 90 Other flat-rolled prod…primary quqlity 12 25 9 7321. 90. 00 Parts of stoves, ranges, grates, cookers 5 12 10 7607. 11. 90 Other aluminium foil…. mfg ind 5 12

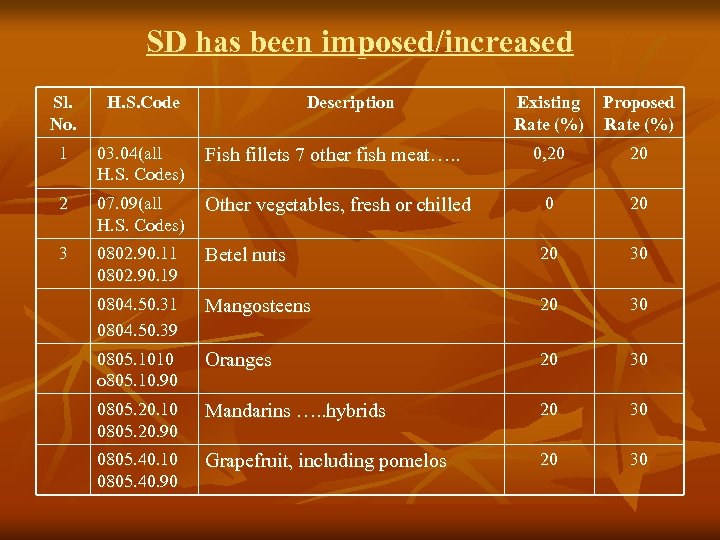

SD has been imposed/increased Sl. No. H. S. Code Description Existing Rate (%) Proposed Rate (%) 1 03. 04(all H. S. Codes) Fish fillets 7 other fish meat…. . 0, 20 20 2 07. 09(all H. S. Codes) Other vegetables, fresh or chilled 0 20 3 0802. 90. 11 0802. 90. 19 Betel nuts 20 30 0804. 50. 31 0804. 50. 39 Mangosteens 20 30 0805. 1010 o 805. 10. 90 Oranges 20 30 0805. 20. 10 0805. 20. 90 Mandarins …. . hybrids 20 30 0805. 40. 10 0805. 40. 90 Grapefruit, including pomelos 20 30

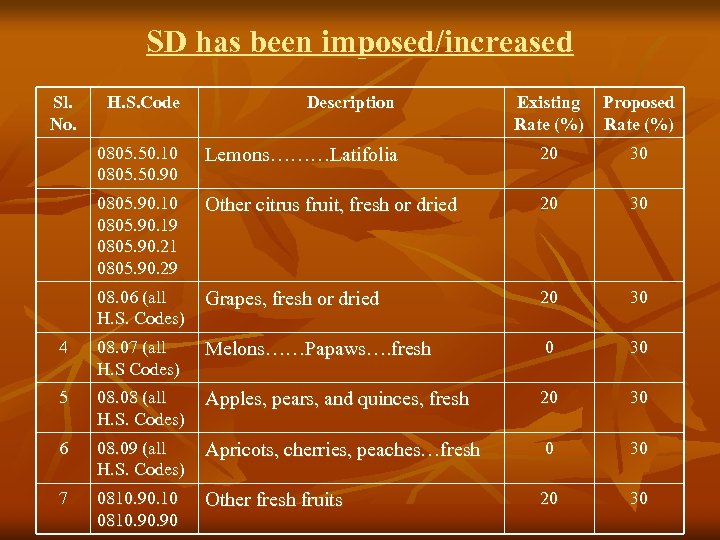

SD has been imposed/increased Sl. No. H. S. Code Description Existing Rate (%) Proposed Rate (%) 0805. 50. 10 0805. 50. 90 Lemons………Latifolia 20 30 0805. 90. 19 0805. 90. 21 0805. 90. 29 Other citrus fruit, fresh or dried 20 30 08. 06 (all H. S. Codes) Grapes, fresh or dried 20 30 4 08. 07 (all H. S Codes) Melons……Papaws…. fresh 0 30 5 08. 08 (all H. S. Codes) Apples, pears, and quinces, fresh 20 30 6 08. 09 (all H. S. Codes) Apricots, cherries, peaches…fresh 0 30 7 0810. 90. 10 0810. 90 Other fresh fruits 20 30

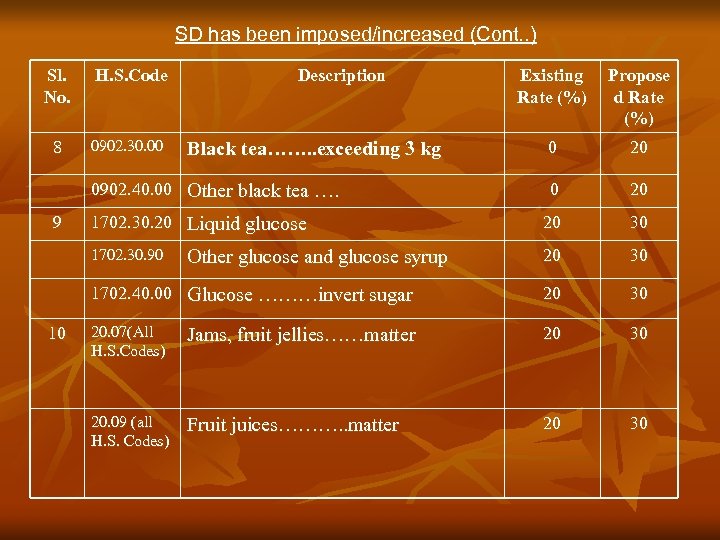

SD has been imposed/increased (Cont. . ) Sl. No. Existing Rate (%) Propose d Rate (%) 0 20 1702. 30. 20 Liquid glucose 20 30 1702. 30. 90 20 30 1702. 40. 00 Glucose ………invert sugar 8 H. S. Code 20 30 20. 07(All H. S. Codes) Jams, fruit jellies……matter 20 30 20. 09 (all H. S. Codes) Fruit juices………. . matter 20 30 0902. 30. 00 Description Black tea……. . exceeding 3 kg 0902. 40. 00 Other black tea …. 9 10 Other glucose and glucose syrup

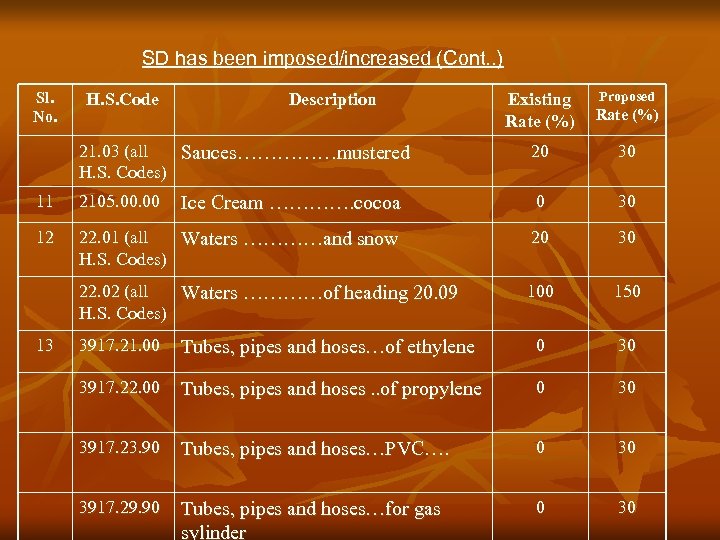

SD has been imposed/increased (Cont. . ) Sl. No. Description Proposed Existing Rate (%) 21. 03 (all Sauces……………mustered H. S. Codes) 20 30 11 2105. 00 Ice Cream …………. cocoa 0 30 12 22. 01 (all Waters …………and snow H. S. Codes) 20 30 22. 02 (all Waters …………of heading 20. 09 H. S. Codes) 100 150 13 H. S. Code 3917. 21. 00 Tubes, pipes and hoses…of ethylene 0 30 3917. 22. 00 Tubes, pipes and hoses. . of propylene 0 30 3917. 23. 90 Tubes, pipes and hoses…PVC…. 0 30 3917. 29. 90 Tubes, pipes and hoses…for gas sylinder 0 30

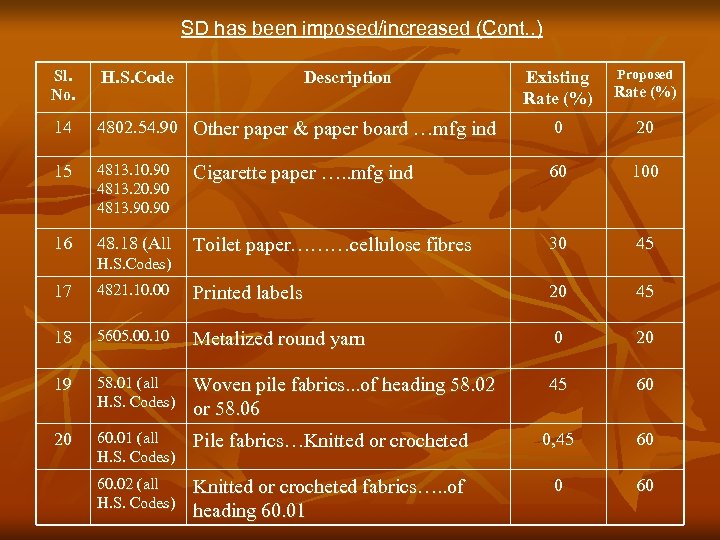

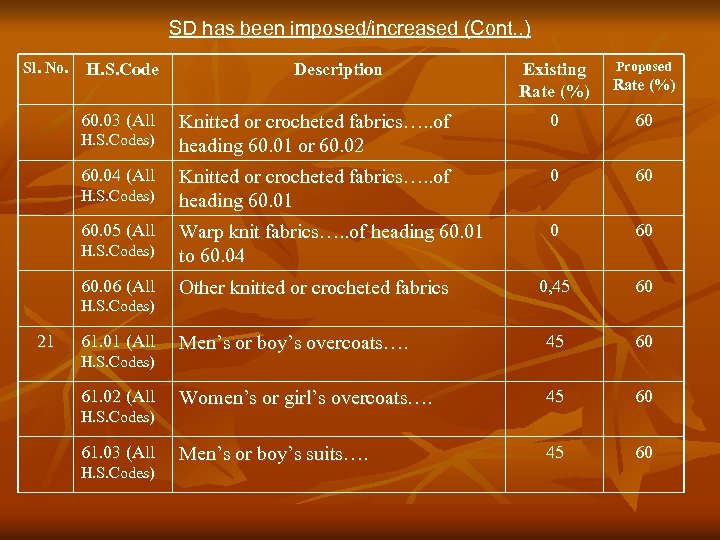

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code 14 Proposed Existing Rate (%) 4802. 54. 90 Other paper & paper board …mfg ind 0 20 15 4813. 10. 90 4813. 20. 90 4813. 90 Cigarette paper …. . mfg ind 60 100 16 48. 18 (All Toilet paper………cellulose fibres 30 45 H. S. Codes) Description 17 4821. 10. 00 Printed labels 20 45 18 5605. 00. 10 Metalized round yarn 0 20 19 58. 01 (all H. S. Codes) Woven pile fabrics. . . of heading 58. 02 or 58. 06 45 60 20 60. 01 (all H. S. Codes) Pile fabrics…Knitted or crocheted 0, 45 60 60. 02 (all H. S. Codes) Knitted or crocheted fabrics…. . of heading 60. 01 0 60

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code Proposed Existing Rate (%) Knitted or crocheted fabrics…. . of heading 60. 01 or 60. 02 0 60 Knitted or crocheted fabrics…. . of heading 60. 01 0 60 H. S. Codes) Warp knit fabrics…. . of heading 60. 01 to 60. 04 60. 06 (All Other knitted or crocheted fabrics 0, 45 60 Men’s or boy’s overcoats…. 45 60 Women’s or girl’s overcoats…. 45 60 Men’s or boy’s suits…. 45 60 60. 03 (All H. S. Codes) 60. 04 (All H. S. Codes) 60. 05 (All H. S. Codes) 21 61. 01 (All H. S. Codes) 61. 02 (All H. S. Codes) 61. 03 (All H. S. Codes) Description

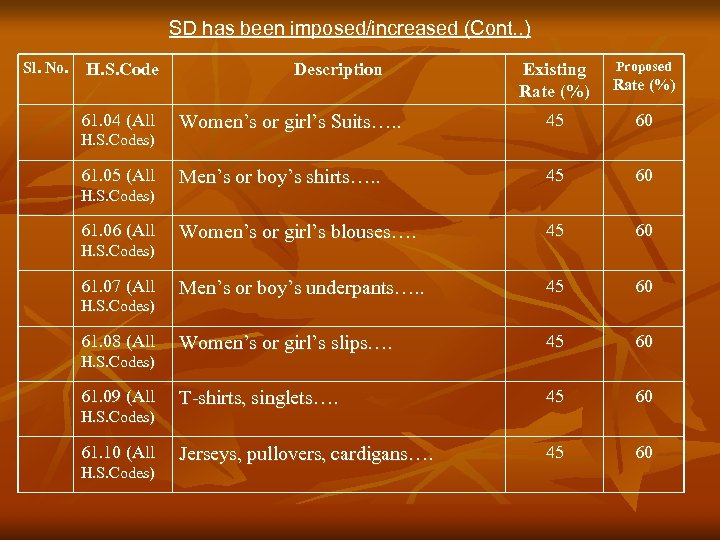

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code 61. 04 (All H. S. Codes) 61. 05 (All H. S. Codes) 61. 06 (All H. S. Codes) 61. 07 (All H. S. Codes) 61. 08 (All H. S. Codes) 61. 09 (All H. S. Codes) 61. 10 (All H. S. Codes) Description Proposed Existing Rate (%) Women’s or girl’s Suits…. . 45 60 Men’s or boy’s shirts…. . 45 60 Women’s or girl’s blouses…. 45 60 Men’s or boy’s underpants…. . 45 60 Women’s or girl’s slips…. 45 60 T-shirts, singlets…. 45 60 Jerseys, pullovers, cardigans…. 45 60

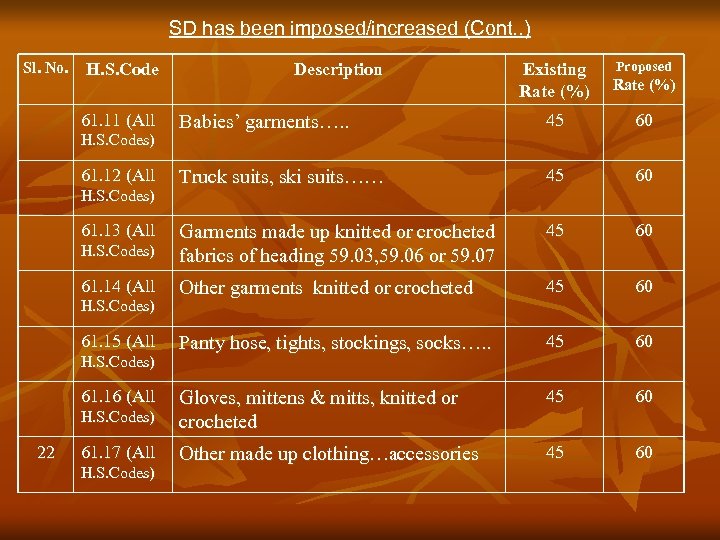

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code Proposed Existing Rate (%) Babies’ garments…. . 45 60 Truck suits, ski suits…… 45 60 H. S. Codes) Garments made up knitted or crocheted fabrics of heading 59. 03, 59. 06 or 59. 07 61. 14 (All Other garments knitted or crocheted 45 60 Panty hose, tights, stockings, socks…. . 45 60 H. S. Codes) Gloves, mittens & mitts, knitted or crocheted 61. 17 (All Other made up clothing…accessories 45 60 61. 11 (All H. S. Codes) 61. 12 (All H. S. Codes) 61. 13 (All H. S. Codes) 61. 15 (All H. S. Codes) 61. 16 (All 22 H. S. Codes) Description

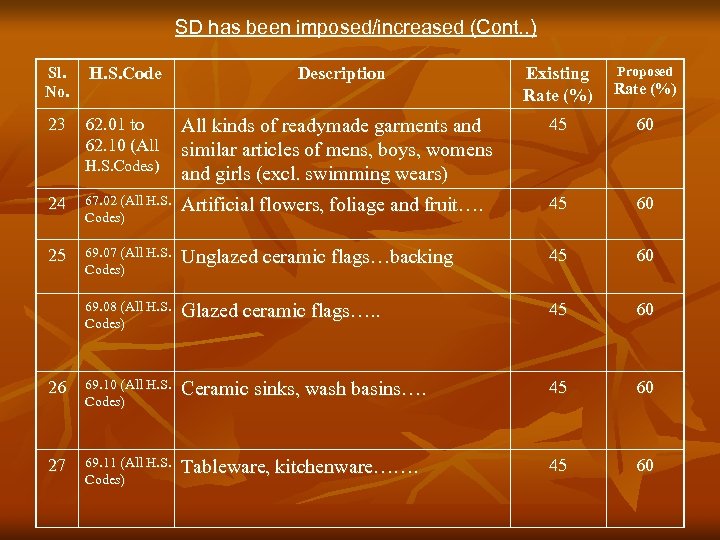

SD has been imposed/increased (Cont. . ) Proposed Sl. No. H. S. Code Description Existing Rate (%) 23 62. 01 to 62. 10 (All kinds of readymade garments and similar articles of mens, boys, womens and girls (excl. swimming wears) 45 60 H. S. Codes) 24 67. 02 (All H. S. Codes) Artificial flowers, foliage and fruit…. 45 60 25 69. 07 (All H. S. Codes) Unglazed ceramic flags…backing 45 60 69. 08 (All H. S. Codes) Glazed ceramic flags…. . 45 60 26 69. 10 (All H. S. Codes) Ceramic sinks, wash basins…. 45 60 27 69. 11 (All H. S. Codes) Tableware, kitchenware……. 45 60

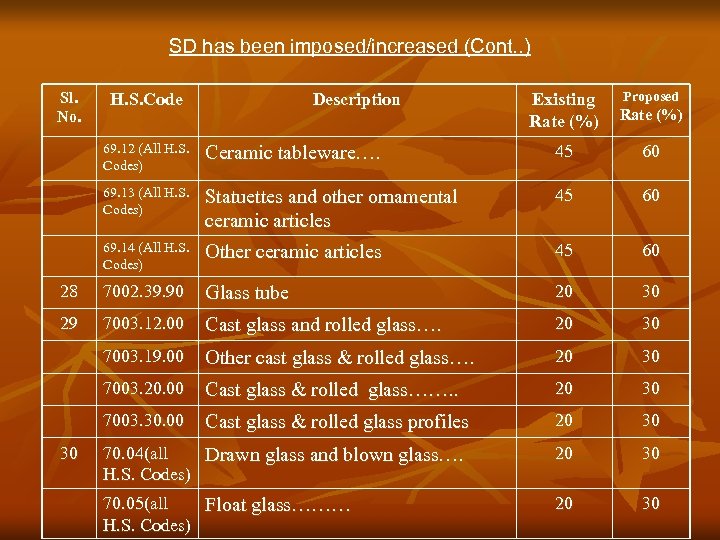

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code Description Proposed Existing Rate (%) 69. 12 (All H. S. Codes) Ceramic tableware…. 45 60 69. 13 (All H. S. Codes) Statuettes and other ornamental ceramic articles 45 60 69. 14 (All H. S. Codes) Other ceramic articles 45 60 28 7002. 39. 90 Glass tube 20 30 29 7003. 12. 00 Cast glass and rolled glass…. 20 30 7003. 19. 00 Other cast glass & rolled glass…. 20 30 7003. 20. 00 Cast glass & rolled glass……. . 20 30 7003. 30. 00 Cast glass & rolled glass profiles 20 30 70. 04(all Drawn glass and blown glass…. H. S. Codes) 20 30 70. 05(all Float glass……… H. S. Codes) 20 30 30

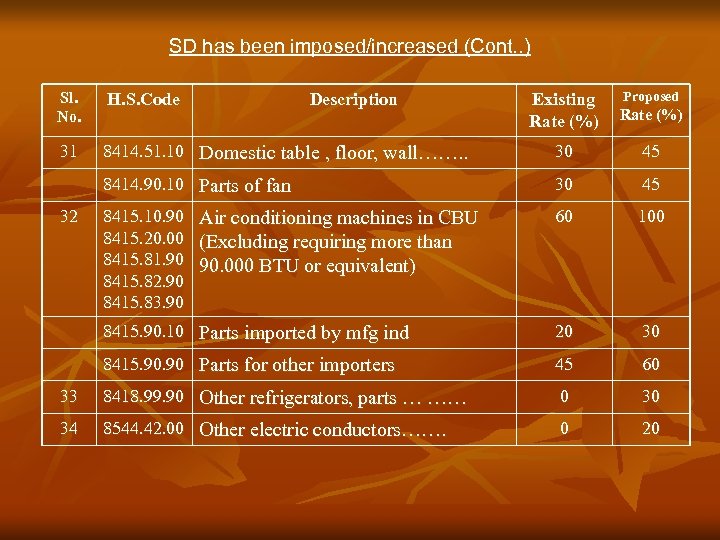

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code 31 Proposed Existing Rate (%) 8414. 51. 10 Domestic table , floor, wall……. . 30 45 8414. 90. 10 Parts of fan 30 45 8415. 10. 90 8415. 20. 00 8415. 81. 90 8415. 82. 90 8415. 83. 90 60 100 8415. 90. 10 Parts imported by mfg ind 20 30 8415. 90 Parts for other importers 45 60 33 8418. 99. 90 Other refrigerators, parts … …… 0 30 34 8544. 42. 00 Other electric conductors……. 0 20 32 Description Air conditioning machines in CBU (Excluding requiring more than 90. 000 BTU or equivalent)

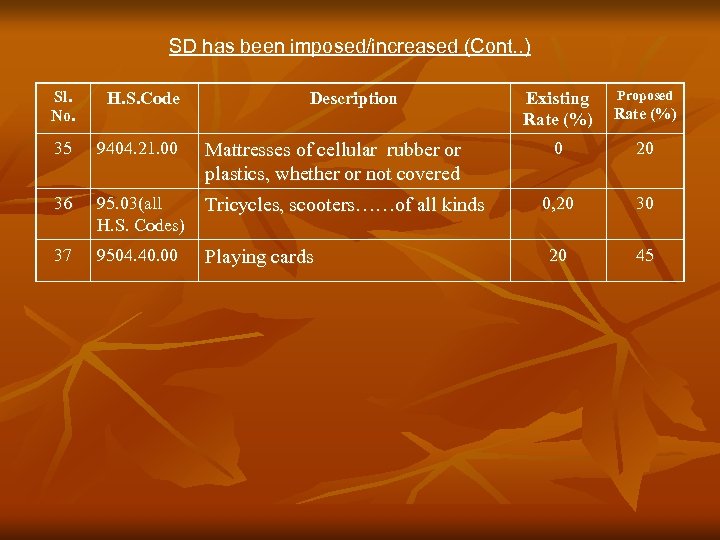

SD has been imposed/increased (Cont. . ) Sl. No. H. S. Code 35 9404. 21. 00 Mattresses of cellular rubber or plastics, whether or not covered 36 95. 03(all H. S. Codes) Tricycles, scooters……of all kinds 37 9504. 40. 00 Playing cards Description Proposed Existing Rate (%) 0 20 0, 20 30 20 45

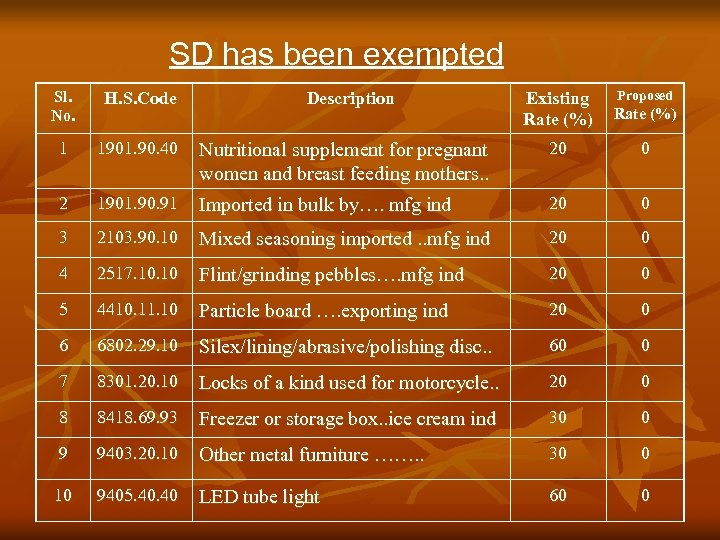

SD has been exempted Sl. No. H. S. Code 1 1901. 90. 40 2 Description Proposed Existing Rate (%) Nutritional supplement for pregnant women and breast feeding mothers. . 20 0 1901. 90. 91 Imported in bulk by…. mfg ind 20 0 3 2103. 90. 10 Mixed seasoning imported. . mfg ind 20 0 4 2517. 10 Flint/grinding pebbles…. mfg ind 20 0 5 4410. 11. 10 Particle board …. exporting ind 20 0 6 6802. 29. 10 Silex/lining/abrasive/polishing disc. . 60 0 7 8301. 20. 10 Locks of a kind used for motorcycle. . 20 0 8 8418. 69. 93 Freezer or storage box. . ice cream ind 30 0 9 9403. 20. 10 Other metal furniture ……. . 30 0 10 9405. 40 LED tube light 60 0

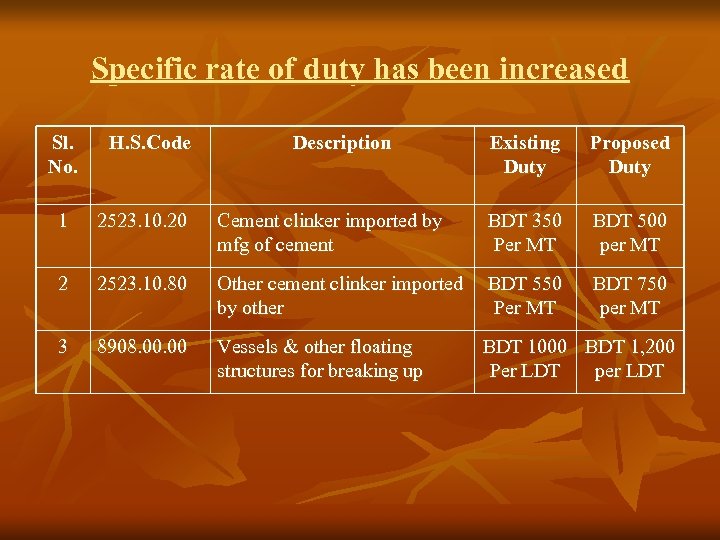

Specific rate of duty has been increased Sl. No. H. S. Code Description Existing Duty Proposed Duty 1 2523. 10. 20 Cement clinker imported by mfg of cement BDT 350 Per MT BDT 500 per MT 2 2523. 10. 80 Other cement clinker imported by other BDT 550 Per MT BDT 750 per MT 3 8908. 00 Vessels & other floating structures for breaking up BDT 1000 BDT 1, 200 Per LDT per LDT

a90e402ff663eba16d2f002b4b6a73b1.ppt