c357e62bc7a83d11663495c03067085a.ppt

- Количество слайдов: 94

Welcome to Self Direction! Self Directed Retirement Plan Services

Welcome to Self Direction! Self Directed Retirement Plan Services

Our Agenda - Who Am I? Who is Entrust Georgia, LLC Tax-Deferred & TAX–FREE Investing Types of Accounts Self-Directed Accounts & Administrators Potential & Opportunities Pitfalls & IRS Rules Case Studies

Our Agenda - Who Am I? Who is Entrust Georgia, LLC Tax-Deferred & TAX–FREE Investing Types of Accounts Self-Directed Accounts & Administrators Potential & Opportunities Pitfalls & IRS Rules Case Studies

Agenda - Ask Questions! - Complete Evaluations - CE Certificates

Agenda - Ask Questions! - Complete Evaluations - CE Certificates

Monte Smith Education Director Entrust Georgia, LLC 3525 Piedmont Rd NE Building Eight, Suite 101 Atlanta, GA 30305 4 • Former financial analyst • Former HS Spanish Teacher • Started working for Entrust in 2007 • Moved to Atlanta in Feb. , 2009

Monte Smith Education Director Entrust Georgia, LLC 3525 Piedmont Rd NE Building Eight, Suite 101 Atlanta, GA 30305 4 • Former financial analyst • Former HS Spanish Teacher • Started working for Entrust in 2007 • Moved to Atlanta in Feb. , 2009

Entrust Has a Legacy of Self-Direction The Entrust Group was Founded by CEO Hubert Bromma (who still is the CEO today) Entrust’s only business is self-directed investment administration and record-keeping Entrust is the only self-directed administrator to open affiliate offices across the US in order to better service their clients Over four billion $ in self-directed assets

Entrust Has a Legacy of Self-Direction The Entrust Group was Founded by CEO Hubert Bromma (who still is the CEO today) Entrust’s only business is self-directed investment administration and record-keeping Entrust is the only self-directed administrator to open affiliate offices across the US in order to better service their clients Over four billion $ in self-directed assets

Overview: Self Direction What Makes A Truly Self-Directed Plan: Self-Directed IRA = Real Estate IRA • You choose and control the investments in your retirement plan. • You choose the tools - IRA and/or Qualified Plan. • You direct the trustee or custodian to make legal investments on your behalf. Greater Freedom to Control YOUR Tax Advantaged Assets

Overview: Self Direction What Makes A Truly Self-Directed Plan: Self-Directed IRA = Real Estate IRA • You choose and control the investments in your retirement plan. • You choose the tools - IRA and/or Qualified Plan. • You direct the trustee or custodian to make legal investments on your behalf. Greater Freedom to Control YOUR Tax Advantaged Assets

2 Types of Self Directed Clients Two Main Reasons Clients Invest IRA/401(k) Funds into Real Estate: - A “New” Source of Capital - Tax Deferral/Tax Free Investing

2 Types of Self Directed Clients Two Main Reasons Clients Invest IRA/401(k) Funds into Real Estate: - A “New” Source of Capital - Tax Deferral/Tax Free Investing

Opportunities for the Real Estate Professional - Your Own Account - Capitalize on your expertise - Clients IRA’s - Currently trillions of $$ in Retirement Accounts Currently less than 2% Self-Directed Real Estate is tangible, safe, & comfortable Typical Client?

Opportunities for the Real Estate Professional - Your Own Account - Capitalize on your expertise - Clients IRA’s - Currently trillions of $$ in Retirement Accounts Currently less than 2% Self-Directed Real Estate is tangible, safe, & comfortable Typical Client?

Tax Deferred Investing Why Think Tax Deferral? • A tax-deferred or tax/fee environment may permit you to compound assets faster as a result (Rule of 72). • A Roth may permit you to prepay the tax & never pay tax again. Rule of 72: If your assets earn a 10% return it will take 7. 2 years for them to double. (Divide your expected rate of return into 72. For example, 72/12=6 years, 72/10=7. 2 years, 72/6=12 years. If paying tax on gains, how much longer will it take you to compound your assets?

Tax Deferred Investing Why Think Tax Deferral? • A tax-deferred or tax/fee environment may permit you to compound assets faster as a result (Rule of 72). • A Roth may permit you to prepay the tax & never pay tax again. Rule of 72: If your assets earn a 10% return it will take 7. 2 years for them to double. (Divide your expected rate of return into 72. For example, 72/12=6 years, 72/10=7. 2 years, 72/6=12 years. If paying tax on gains, how much longer will it take you to compound your assets?

Overview: Self Directed Benefits Take Control: • Make your own investment choices Diversification: • Invest in all types of assets • Invest in what you know & understand Tax Savings: • • Contributions may be tax deductible Tax deferred or Tax free growth

Overview: Self Directed Benefits Take Control: • Make your own investment choices Diversification: • Invest in all types of assets • Invest in what you know & understand Tax Savings: • • Contributions may be tax deductible Tax deferred or Tax free growth

Overview: The Techniques Potential Self-Directed Investment Choices: • • • Undeveloped land Rentals Real Estate Options Pre Construction Contracts Private Placements LLC and Partnerships Privately Held Stock Tenants In Common Timeshares Foreign Currency Exchange Notes/Mortgage Receivable

Overview: The Techniques Potential Self-Directed Investment Choices: • • • Undeveloped land Rentals Real Estate Options Pre Construction Contracts Private Placements LLC and Partnerships Privately Held Stock Tenants In Common Timeshares Foreign Currency Exchange Notes/Mortgage Receivable

Overview: The Techniques How might one use retirement funds? IRA and/or 401(k) Investment Techniques: • • • Purchase using cash from retirement funds Partnering retirement funds and personal funds Partnering retirement funds with other investors Leverage with non-recourse financing Other options

Overview: The Techniques How might one use retirement funds? IRA and/or 401(k) Investment Techniques: • • • Purchase using cash from retirement funds Partnering retirement funds and personal funds Partnering retirement funds with other investors Leverage with non-recourse financing Other options

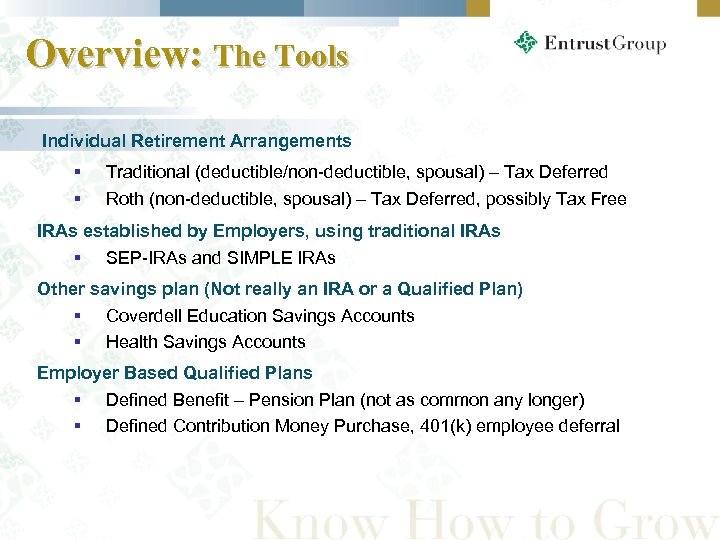

Overview: The Tools Individual Retirement Arrangements § Traditional (deductible/non-deductible, spousal) – Tax Deferred § Roth (non-deductible, spousal) – Tax Deferred, possibly Tax Free IRAs established by Employers, using traditional IRAs § SEP-IRAs and SIMPLE IRAs Other savings plan (Not really an IRA or a Qualified Plan) § Coverdell Education Savings Accounts § Health Savings Accounts Employer Based Qualified Plans § Defined Benefit – Pension Plan (not as common any longer) § Defined Contribution Money Purchase, 401(k) employee deferral

Overview: The Tools Individual Retirement Arrangements § Traditional (deductible/non-deductible, spousal) – Tax Deferred § Roth (non-deductible, spousal) – Tax Deferred, possibly Tax Free IRAs established by Employers, using traditional IRAs § SEP-IRAs and SIMPLE IRAs Other savings plan (Not really an IRA or a Qualified Plan) § Coverdell Education Savings Accounts § Health Savings Accounts Employer Based Qualified Plans § Defined Benefit – Pension Plan (not as common any longer) § Defined Contribution Money Purchase, 401(k) employee deferral

Traditional IRA Who is it for? Individuals under 70½ What is the criteria? Traditional IRA Anyone with earned income is eligible to contribute to a Traditional IRA, deductibility is based on annual income. What benefits does it have? • Tax deduction, lowering your current tax bill. * • Retirement savings. *Note: Some individuals still contribute to a traditional IRA even without the tax deduction. 14

Traditional IRA Who is it for? Individuals under 70½ What is the criteria? Traditional IRA Anyone with earned income is eligible to contribute to a Traditional IRA, deductibility is based on annual income. What benefits does it have? • Tax deduction, lowering your current tax bill. * • Retirement savings. *Note: Some individuals still contribute to a traditional IRA even without the tax deduction. 14

The Tools: Traditional/Roth Traditional IRA: • Tax deduction (if eligible) • Tax-deferred earnings Why a Traditional IRA • Pay tax later – Not Now • Old 401(k) can be rolled directly in without any tax penalty • Taxes equal or higher upon retirement • Not qualified for Roth IRA

The Tools: Traditional/Roth Traditional IRA: • Tax deduction (if eligible) • Tax-deferred earnings Why a Traditional IRA • Pay tax later – Not Now • Old 401(k) can be rolled directly in without any tax penalty • Taxes equal or higher upon retirement • Not qualified for Roth IRA

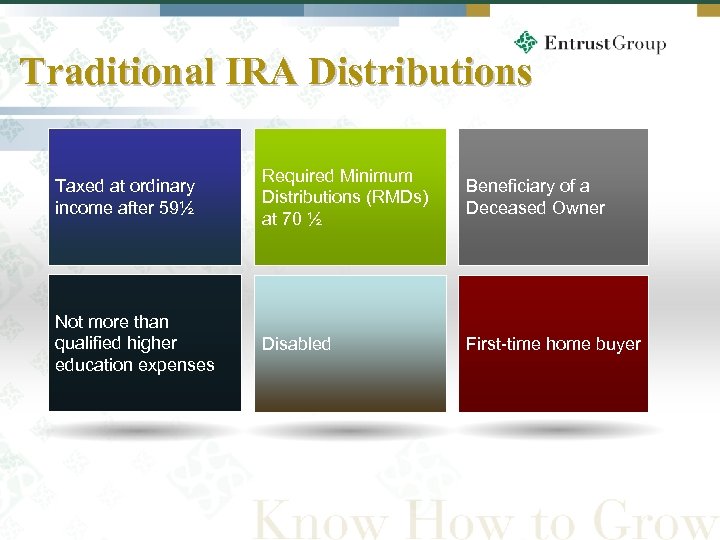

Traditional IRA Distributions Taxed at ordinary income after 59½ Required Minimum Distributions (RMDs) at 70 ½ Beneficiary of a Deceased Owner Not more than qualified higher education expenses Disabled First-time home buyer 16

Traditional IRA Distributions Taxed at ordinary income after 59½ Required Minimum Distributions (RMDs) at 70 ½ Beneficiary of a Deceased Owner Not more than qualified higher education expenses Disabled First-time home buyer 16

Roth IRA Who is it for? Individuals of all ages. What is the criteria? Roth IRA Anyone with earned income which does not exceed the income limits is eligible to contribute to a Roth IRA. What benefits does it have? • Tax-free earnings and no taxation on withdrawals. • You may invest for retirement and still access your funds. • Low tax situation this year and expect higher taxes in the future • Contributions may be made after age 70½. 17

Roth IRA Who is it for? Individuals of all ages. What is the criteria? Roth IRA Anyone with earned income which does not exceed the income limits is eligible to contribute to a Roth IRA. What benefits does it have? • Tax-free earnings and no taxation on withdrawals. • You may invest for retirement and still access your funds. • Low tax situation this year and expect higher taxes in the future • Contributions may be made after age 70½. 17

The Tools: Traditional/Roth IRA – Pay Tax Now, Not Later • No Tax Deduction • Tax-Deferred Earnings • Tax-Free Earnings (for qualified distributions) • No RMDs • Estate Planning Tool • Contributions Post 70 ½ Note: See Individual Roth(k) for larger contributions

The Tools: Traditional/Roth IRA – Pay Tax Now, Not Later • No Tax Deduction • Tax-Deferred Earnings • Tax-Free Earnings (for qualified distributions) • No RMDs • Estate Planning Tool • Contributions Post 70 ½ Note: See Individual Roth(k) for larger contributions

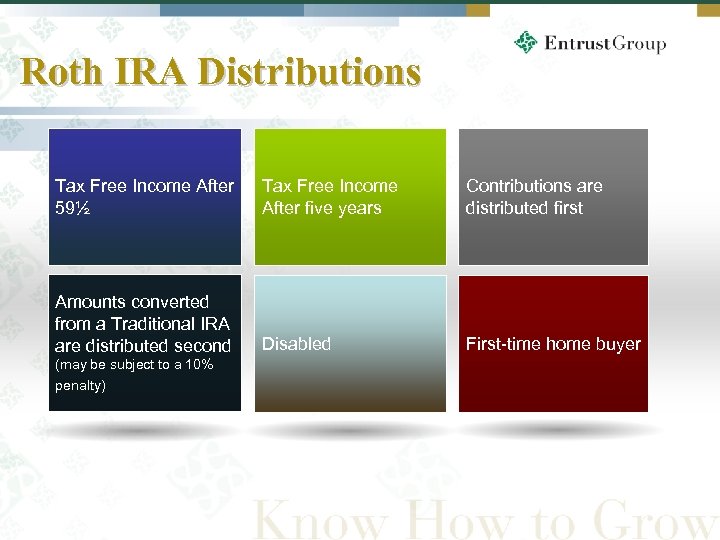

Roth IRA Distributions Tax Free Income After 59½ Tax Free Income After five years Contributions are distributed first Amounts converted from a Traditional IRA are distributed second Disabled First-time home buyer (may be subject to a 10% penalty) 19

Roth IRA Distributions Tax Free Income After 59½ Tax Free Income After five years Contributions are distributed first Amounts converted from a Traditional IRA are distributed second Disabled First-time home buyer (may be subject to a 10% penalty) 19

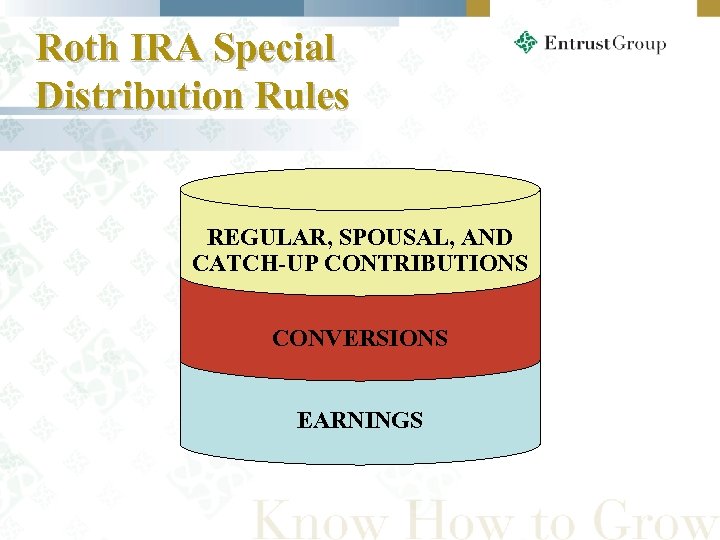

Roth IRA Special Distribution Rules REGULAR, SPOUSAL, AND CATCH-UP CONTRIBUTIONS CONVERSIONS EARNINGS

Roth IRA Special Distribution Rules REGULAR, SPOUSAL, AND CATCH-UP CONTRIBUTIONS CONVERSIONS EARNINGS

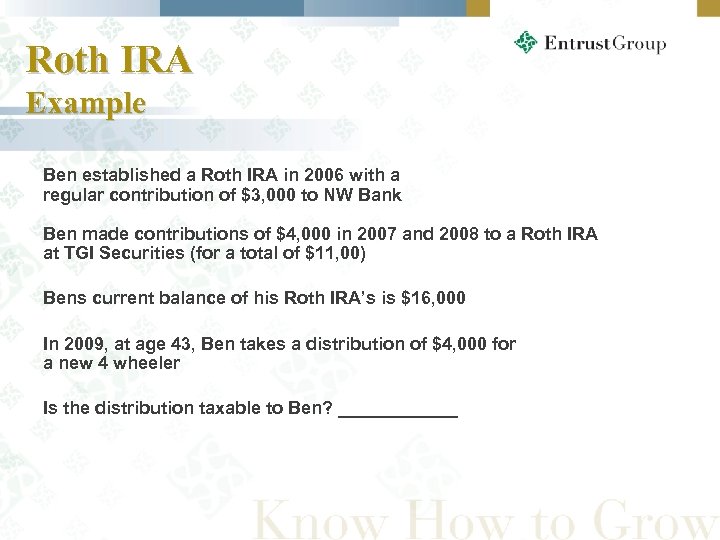

Roth IRA Example Ben established a Roth IRA in 2006 with a regular contribution of $3, 000 to NW Bank Ben made contributions of $4, 000 in 2007 and 2008 to a Roth IRA at TGI Securities (for a total of $11, 00) Bens current balance of his Roth IRA’s is $16, 000 In 2009, at age 43, Ben takes a distribution of $4, 000 for a new 4 wheeler Is the distribution taxable to Ben? ______

Roth IRA Example Ben established a Roth IRA in 2006 with a regular contribution of $3, 000 to NW Bank Ben made contributions of $4, 000 in 2007 and 2008 to a Roth IRA at TGI Securities (for a total of $11, 00) Bens current balance of his Roth IRA’s is $16, 000 In 2009, at age 43, Ben takes a distribution of $4, 000 for a new 4 wheeler Is the distribution taxable to Ben? ______

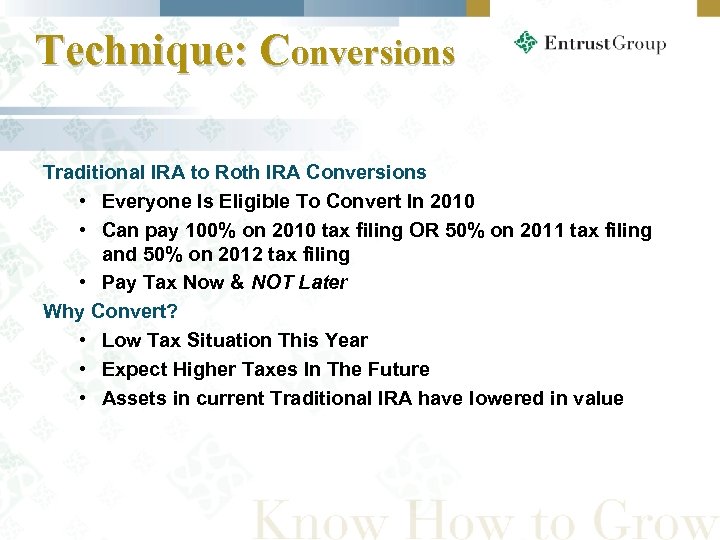

Technique: Conversions Traditional IRA to Roth IRA Conversions • Everyone Is Eligible To Convert In 2010 • Can pay 100% on 2010 tax filing OR 50% on 2011 tax filing and 50% on 2012 tax filing • Pay Tax Now & NOT Later Why Convert? • Low Tax Situation This Year • Expect Higher Taxes In The Future • Assets in current Traditional IRA have lowered in value

Technique: Conversions Traditional IRA to Roth IRA Conversions • Everyone Is Eligible To Convert In 2010 • Can pay 100% on 2010 tax filing OR 50% on 2011 tax filing and 50% on 2012 tax filing • Pay Tax Now & NOT Later Why Convert? • Low Tax Situation This Year • Expect Higher Taxes In The Future • Assets in current Traditional IRA have lowered in value

Definition: Transfer vs. Rollover vs. Direct Rollover/Transfer Assets to IRA Advantages: • Transfers occur between like accounts (e. g. , Traditional IRA to Traditional IRA) • A Direct Rollover moves funds from a Qualified Plan to an IRA • A Qualified Plan Rollover is when… (20% withholding) • IRA rollover (1 time for 60 days only every 12 months

Definition: Transfer vs. Rollover vs. Direct Rollover/Transfer Assets to IRA Advantages: • Transfers occur between like accounts (e. g. , Traditional IRA to Traditional IRA) • A Direct Rollover moves funds from a Qualified Plan to an IRA • A Qualified Plan Rollover is when… (20% withholding) • IRA rollover (1 time for 60 days only every 12 months

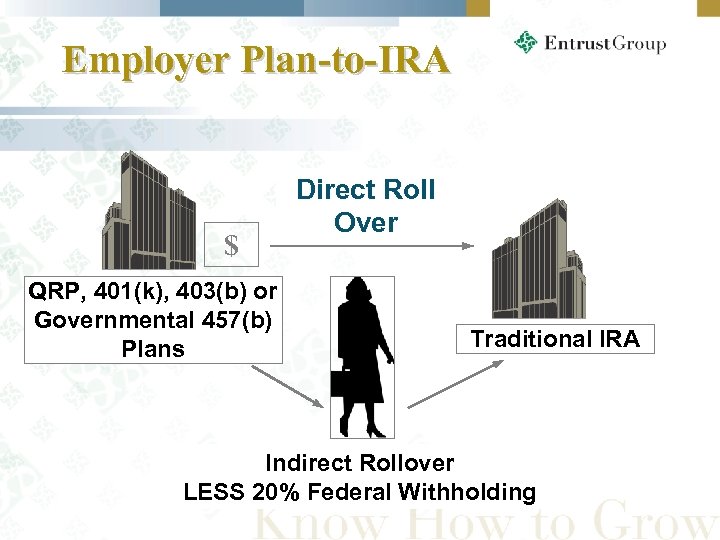

Employer Plan-to-IRA $ QRP, 401(k), 403(b) or Governmental 457(b) Plans Direct Roll Over Traditional IRA Indirect Rollover LESS 20% Federal Withholding

Employer Plan-to-IRA $ QRP, 401(k), 403(b) or Governmental 457(b) Plans Direct Roll Over Traditional IRA Indirect Rollover LESS 20% Federal Withholding

IRA Rollover Example Mike Artison, age 64, recently changed jobs from Potlatch Inc. to Mills Motor. Mike has a balance in Potlatch’s 401(k) of $100, 000 If Mike chooses to have the 401(k) distribution made payable to Mike, how much will the check be made payable to Mike for? $_______ If Mike chooses to have the check made payable to his Traditional IRA, how much will the check be made payable for? ______

IRA Rollover Example Mike Artison, age 64, recently changed jobs from Potlatch Inc. to Mills Motor. Mike has a balance in Potlatch’s 401(k) of $100, 000 If Mike chooses to have the 401(k) distribution made payable to Mike, how much will the check be made payable to Mike for? $_______ If Mike chooses to have the check made payable to his Traditional IRA, how much will the check be made payable for? ______

Employer Sponsored Plan SEP Simple Individual(k) Contributions and Distributions 26

Employer Sponsored Plan SEP Simple Individual(k) Contributions and Distributions 26

The Tools: SEP/SIMPLE/Individual 401(k) Who Would Benefit: • • Owner-Only/Self Employed Sole Proprietorship Family-Operated Businesses With “Excludable” Employees Ø SIMPLE IRA Plan

The Tools: SEP/SIMPLE/Individual 401(k) Who Would Benefit: • • Owner-Only/Self Employed Sole Proprietorship Family-Operated Businesses With “Excludable” Employees Ø SIMPLE IRA Plan

IRA Based Employer Plan: Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? SEP IRA Self employed individuals who received earned income. What benefits does it have? • Low start-up and administrative costs. • Helps you to reduce business taxes. • Easy to set up and run. 28

IRA Based Employer Plan: Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? SEP IRA Self employed individuals who received earned income. What benefits does it have? • Low start-up and administrative costs. • Helps you to reduce business taxes. • Easy to set up and run. 28

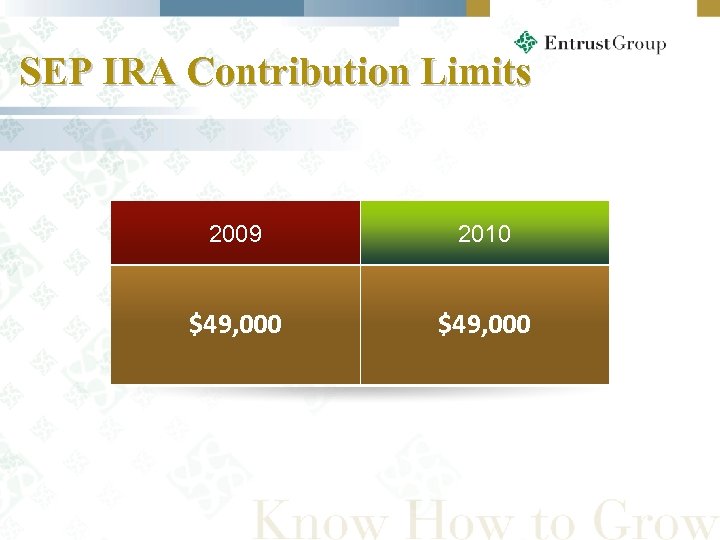

SEP IRA Contribution Limits 2009 $49, 000 29 2010 $49, 000

SEP IRA Contribution Limits 2009 $49, 000 29 2010 $49, 000

IRA Based Employer Plan: Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? SIMPLE IRA 30 Designed for small business with less then 100 employees or self-employed who receive earned income. What benefits does it have? • Low start-up and administrative costs & easy to set up and run. • Provides you and your employees with a simplified way to contribute toward retirement. • Helps you to reduce business taxes. • Employees may contribute through convenient payroll deductions. • The plan provides for flexibility in how much to contribute for your employees.

IRA Based Employer Plan: Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? SIMPLE IRA 30 Designed for small business with less then 100 employees or self-employed who receive earned income. What benefits does it have? • Low start-up and administrative costs & easy to set up and run. • Provides you and your employees with a simplified way to contribute toward retirement. • Helps you to reduce business taxes. • Employees may contribute through convenient payroll deductions. • The plan provides for flexibility in how much to contribute for your employees.

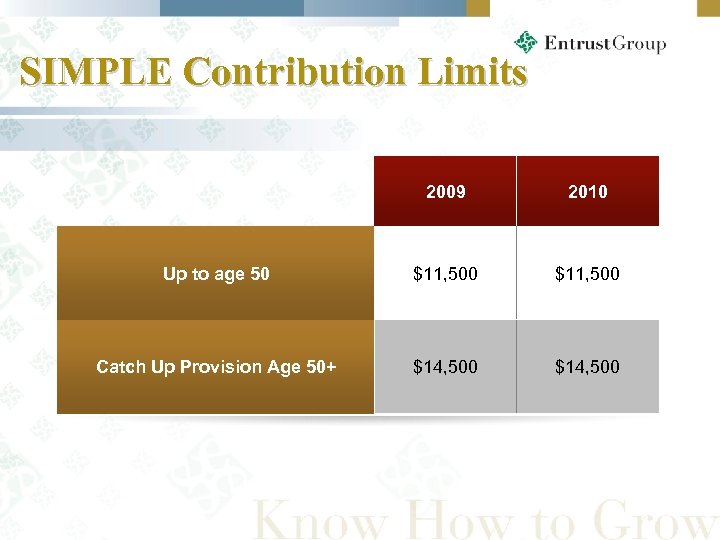

SIMPLE Contribution Limits 2009 Up to age 50 $11, 500 Catch Up Provision Age 50+ 31 2010 $14, 500

SIMPLE Contribution Limits 2009 Up to age 50 $11, 500 Catch Up Provision Age 50+ 31 2010 $14, 500

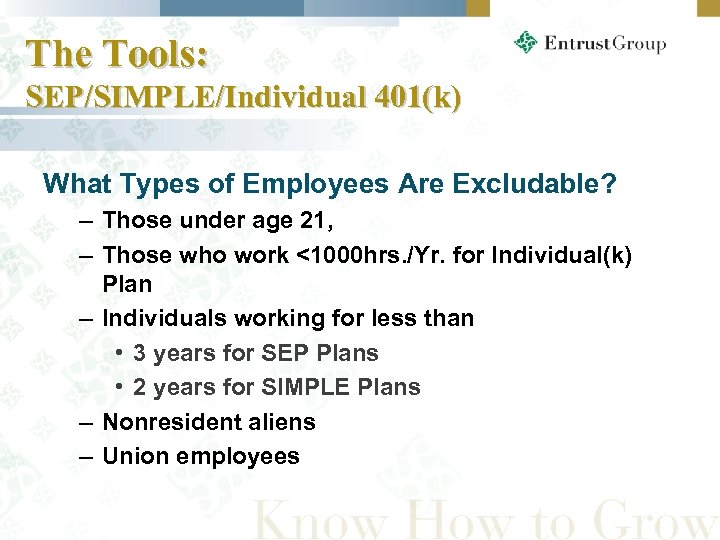

The Tools: SEP/SIMPLE/Individual 401(k) What Types of Employees Are Excludable? – Those under age 21, – Those who work <1000 hrs. /Yr. for Individual(k) Plan – Individuals working for less than • 3 years for SEP Plans • 2 years for SIMPLE Plans – Nonresident aliens – Union employees

The Tools: SEP/SIMPLE/Individual 401(k) What Types of Employees Are Excludable? – Those under age 21, – Those who work <1000 hrs. /Yr. for Individual(k) Plan – Individuals working for less than • 3 years for SEP Plans • 2 years for SIMPLE Plans – Nonresident aliens – Union employees

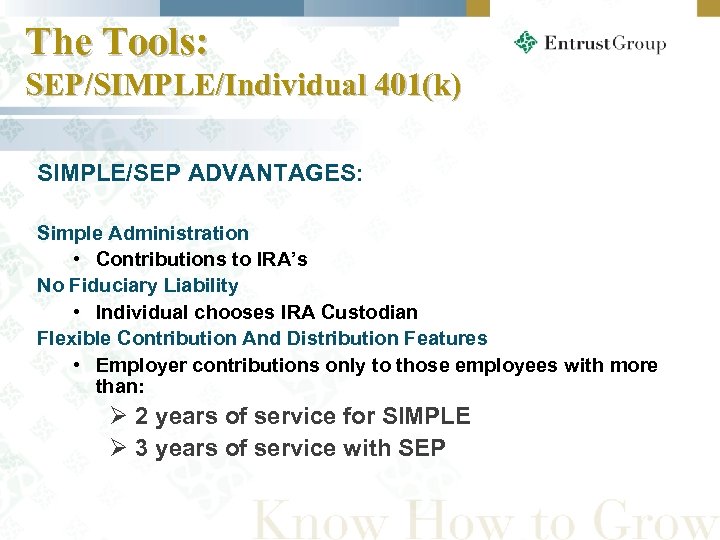

The Tools: SEP/SIMPLE/Individual 401(k) SIMPLE/SEP ADVANTAGES: Simple Administration • Contributions to IRA’s No Fiduciary Liability • Individual chooses IRA Custodian Flexible Contribution And Distribution Features • Employer contributions only to those employees with more than: Ø 2 years of service for SIMPLE Ø 3 years of service with SEP

The Tools: SEP/SIMPLE/Individual 401(k) SIMPLE/SEP ADVANTAGES: Simple Administration • Contributions to IRA’s No Fiduciary Liability • Individual chooses IRA Custodian Flexible Contribution And Distribution Features • Employer contributions only to those employees with more than: Ø 2 years of service for SIMPLE Ø 3 years of service with SEP

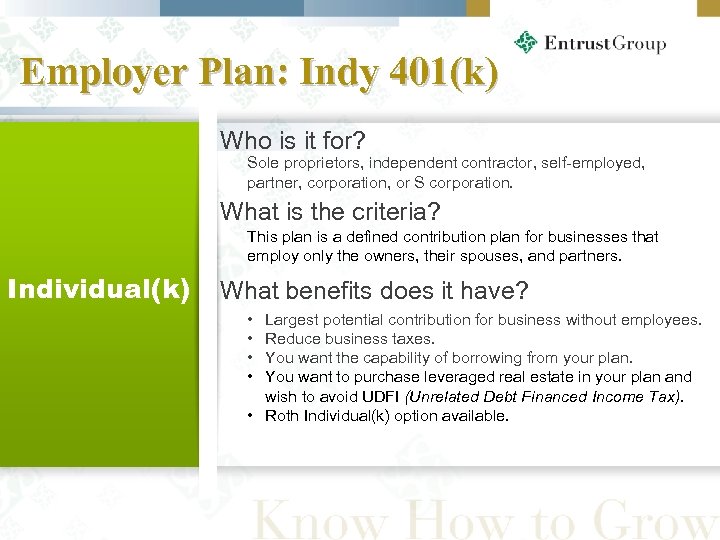

Employer Plan: Indy 401(k) Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? This plan is a defined contribution plan for businesses that employ only the owners, their spouses, and partners. Individual(k) What benefits does it have? • • Largest potential contribution for business without employees. Reduce business taxes. You want the capability of borrowing from your plan. You want to purchase leveraged real estate in your plan and wish to avoid UDFI (Unrelated Debt Financed Income Tax). • Roth Individual(k) option available. 34

Employer Plan: Indy 401(k) Who is it for? Sole proprietors, independent contractor, self-employed, partner, corporation, or S corporation. What is the criteria? This plan is a defined contribution plan for businesses that employ only the owners, their spouses, and partners. Individual(k) What benefits does it have? • • Largest potential contribution for business without employees. Reduce business taxes. You want the capability of borrowing from your plan. You want to purchase leveraged real estate in your plan and wish to avoid UDFI (Unrelated Debt Financed Income Tax). • Roth Individual(k) option available. 34

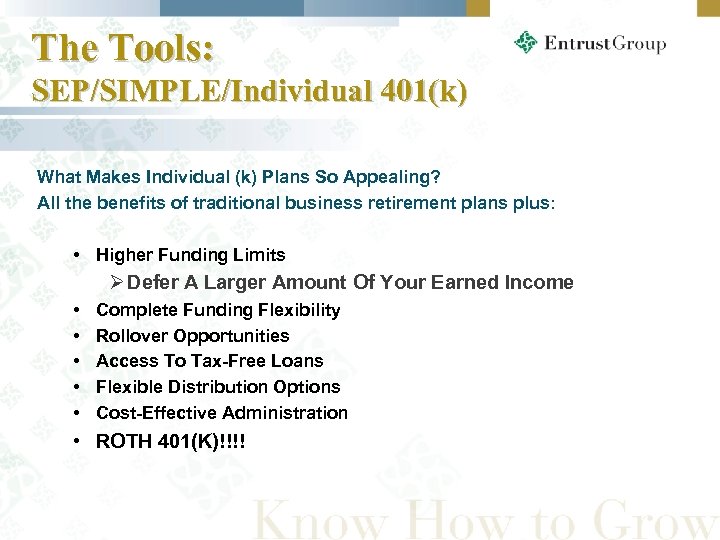

The Tools: SEP/SIMPLE/Individual 401(k) What Makes Individual (k) Plans So Appealing? All the benefits of traditional business retirement plans plus: • Higher Funding Limits Ø Defer A Larger Amount Of Your Earned Income • • • Complete Funding Flexibility Rollover Opportunities Access To Tax-Free Loans Flexible Distribution Options Cost-Effective Administration • ROTH 401(K)!!!!

The Tools: SEP/SIMPLE/Individual 401(k) What Makes Individual (k) Plans So Appealing? All the benefits of traditional business retirement plans plus: • Higher Funding Limits Ø Defer A Larger Amount Of Your Earned Income • • • Complete Funding Flexibility Rollover Opportunities Access To Tax-Free Loans Flexible Distribution Options Cost-Effective Administration • ROTH 401(K)!!!!

Individual(k) Contribution Limits 2009 2010 Up to age 50 $49, 000 Catch Up Provision Age 50+ $54, 500 Roth option available… 36

Individual(k) Contribution Limits 2009 2010 Up to age 50 $49, 000 Catch Up Provision Age 50+ $54, 500 Roth option available… 36

Techniques: RMDs Distribution & Inheritance Options: • • Age 70 ½ Techniques Required Minimum Distributions Taxable Distribution Continue To Contribute – Roth IRA Option Inheriting IRA Options Roll To Own IRA (Spouse Only) Roll To Beneficiary IRA Receive Life Expectancy Distributions From IRA

Techniques: RMDs Distribution & Inheritance Options: • • Age 70 ½ Techniques Required Minimum Distributions Taxable Distribution Continue To Contribute – Roth IRA Option Inheriting IRA Options Roll To Own IRA (Spouse Only) Roll To Beneficiary IRA Receive Life Expectancy Distributions From IRA

SELF-DIRECTION § People & Companies with investment products to sell, have changed our perception of what is possible! § The product providers wrote plans and IRAs which limited the scope of investments. § Stocks, bonds, mutual funds, CDs, Annuities § Self-direction within these products is also permitted, but only to the extent that the custodian’s document permits. § Losses are not necessarily self directed if people are convinced by their advisors that they have no other choices.

SELF-DIRECTION § People & Companies with investment products to sell, have changed our perception of what is possible! § The product providers wrote plans and IRAs which limited the scope of investments. § Stocks, bonds, mutual funds, CDs, Annuities § Self-direction within these products is also permitted, but only to the extent that the custodian’s document permits. § Losses are not necessarily self directed if people are convinced by their advisors that they have no other choices.

Possible IRA investments Real Estate LPs & LLCs Mortgage Notes, Unsecured Loans, Tax Lien Certificates Auto Paper Stocks, Bonds, Mutual Funds Like & Unlike Exchanges Contract Options Building Bonds Extraordinary Investments Security Agreements & Notes Private Placements Certificates of Deposit Tangible Asset Deeds Foreign Sales Corporate Stock Accounts Receivable Financing Precious Metals 39 Trust Deeds Commercial Paper Commodity & Option Exchanges Commodities / Futures Leases Joint Ventures Foreign Currency Exchange

Possible IRA investments Real Estate LPs & LLCs Mortgage Notes, Unsecured Loans, Tax Lien Certificates Auto Paper Stocks, Bonds, Mutual Funds Like & Unlike Exchanges Contract Options Building Bonds Extraordinary Investments Security Agreements & Notes Private Placements Certificates of Deposit Tangible Asset Deeds Foreign Sales Corporate Stock Accounts Receivable Financing Precious Metals 39 Trust Deeds Commercial Paper Commodity & Option Exchanges Commodities / Futures Leases Joint Ventures Foreign Currency Exchange

IRS RULES… § Collectibles & Life Insurance = PROHIBITED § Self Dealing / Current Personal Benefit § Prohibited Transactions - Disqualified Persons § UBIT – Unrelated Business Income Tax § Business/ Operating Income (NOT rents, dividends, etc. ) § Debt Financed Income

IRS RULES… § Collectibles & Life Insurance = PROHIBITED § Self Dealing / Current Personal Benefit § Prohibited Transactions - Disqualified Persons § UBIT – Unrelated Business Income Tax § Business/ Operating Income (NOT rents, dividends, etc. ) § Debt Financed Income

IRS Rules and Regulations: Prohibited Investments Collectibles & Life Insurance • Any Work Of Art, • Any Rug Or Antique, • Any Metal Or Gem, • Any Stamp Or Coin**, • Any Alcoholic Beverage **Exception US Government Minted Gold Or Silver Eagle, Gold & Palladium Bullion

IRS Rules and Regulations: Prohibited Investments Collectibles & Life Insurance • Any Work Of Art, • Any Rug Or Antique, • Any Metal Or Gem, • Any Stamp Or Coin**, • Any Alcoholic Beverage **Exception US Government Minted Gold Or Silver Eagle, Gold & Palladium Bullion

IRS Rules and Regulations: Disqualified Persons Examples of Disqualified Persons: You & Your Spouse • Lineal Ascendants (Their Spouses) • Lineal Descendants (Their Spouses) • Any Fiduciary Of IRA • Anyone Providing Services To Your IRA • Corporations, Partnerships, Trusts, or Estates in which you own, directly or indirectly, at least 50% •

IRS Rules and Regulations: Disqualified Persons Examples of Disqualified Persons: You & Your Spouse • Lineal Ascendants (Their Spouses) • Lineal Descendants (Their Spouses) • Any Fiduciary Of IRA • Anyone Providing Services To Your IRA • Corporations, Partnerships, Trusts, or Estates in which you own, directly or indirectly, at least 50% •

IRS Rules and Regulations: Prohibited Transactions Some examples of prohibited transactions between a disqualified person and an IRA are: • Selling, Exchanging Or Leasing Property • Lending Money Or Extending Credit • Furnishing Goods, Services Or Facilities Two Key Points With IRAs & Real Estate: NO Self Dealing & NO Personal Use!

IRS Rules and Regulations: Prohibited Transactions Some examples of prohibited transactions between a disqualified person and an IRA are: • Selling, Exchanging Or Leasing Property • Lending Money Or Extending Credit • Furnishing Goods, Services Or Facilities Two Key Points With IRAs & Real Estate: NO Self Dealing & NO Personal Use!

Rules, Rules… § § You MUST have a custodian/trustee between you and the plan. That custodian must be an approved IRS custodian. You decide what investment to use, the custodian makes the actual investment of the plans assets and holds all assets. § You CANNOT borrow from the plan. § You CANNOT pledge your IRA as collateral for ANY purpose. § Debt financed property held by IRA must be a non-recourse loan. § You can roll over the assets of any/each IRA you have once a year and not have to put them back for 60 days. § Depending on state law, your IRA might be able to be attached.

Rules, Rules… § § You MUST have a custodian/trustee between you and the plan. That custodian must be an approved IRS custodian. You decide what investment to use, the custodian makes the actual investment of the plans assets and holds all assets. § You CANNOT borrow from the plan. § You CANNOT pledge your IRA as collateral for ANY purpose. § Debt financed property held by IRA must be a non-recourse loan. § You can roll over the assets of any/each IRA you have once a year and not have to put them back for 60 days. § Depending on state law, your IRA might be able to be attached.

Structuring the Deal I have $50 K in an IRA and I want to buy a parcel of real estate that is $100 K. How can I accomplish that? 3 Options 1) Partnering (IRA funds and Personal cash) 2) Partnering with Personal Financing (home equity line, etc. ) 3) IRA gets non-recourse loan (UBIT/UDFI) for difference

Structuring the Deal I have $50 K in an IRA and I want to buy a parcel of real estate that is $100 K. How can I accomplish that? 3 Options 1) Partnering (IRA funds and Personal cash) 2) Partnering with Personal Financing (home equity line, etc. ) 3) IRA gets non-recourse loan (UBIT/UDFI) for difference

Take Control in 3 Easy Steps 1. Account Set Up: Contact Your Local Entrust Office For An Application 2. Fund Your Account: YOU Choose How To fund Your IRA – Transfer, Rollover, Contribution 3. Find The Asset: You Are Ready To Purchase Your First Asset!

Take Control in 3 Easy Steps 1. Account Set Up: Contact Your Local Entrust Office For An Application 2. Fund Your Account: YOU Choose How To fund Your IRA – Transfer, Rollover, Contribution 3. Find The Asset: You Are Ready To Purchase Your First Asset!

8 Steps To Purchasing Real Estate In A Retirement Plan 1. Locate Investment 2. Make Offer In IRA Name 3. Complete “Buy Direction Letter” 4. Entrust Will Assist In The Closing Process

8 Steps To Purchasing Real Estate In A Retirement Plan 1. Locate Investment 2. Make Offer In IRA Name 3. Complete “Buy Direction Letter” 4. Entrust Will Assist In The Closing Process

8 Steps to Purchasing Real Estate in a Retirement Plan 5. Review & Approve Closing Documents 6. Entrust Wires Funds To Escrow 7. Deed Is Recorded In The Name Of Your IRA 8. Entrust Provides Record Keeping Services

8 Steps to Purchasing Real Estate in a Retirement Plan 5. Review & Approve Closing Documents 6. Entrust Wires Funds To Escrow 7. Deed Is Recorded In The Name Of Your IRA 8. Entrust Provides Record Keeping Services

Techniques: Long Term Growth Investment Options: For Long Term Growth • Undeveloped Land • LLC’s • Partnerships • Tenants In Common • Closely Held Stocks

Techniques: Long Term Growth Investment Options: For Long Term Growth • Undeveloped Land • LLC’s • Partnerships • Tenants In Common • Closely Held Stocks

Case Study: Undeveloped Land Bill Smith wants to use his $50, 000 Rollover IRA to purchase a $40, 000 piece of undeveloped land.

Case Study: Undeveloped Land Bill Smith wants to use his $50, 000 Rollover IRA to purchase a $40, 000 piece of undeveloped land.

Case Study: Undeveloped Land 1. 2. Bill Locates The Property Bill Initiates A Contract To Purchase In The Name Of His IRA Entrust FBO Bill Smith IRA #1234. 3. Bill Submits The “Buy Direction Letter” & Contract to His Local Entrust office.

Case Study: Undeveloped Land 1. 2. Bill Locates The Property Bill Initiates A Contract To Purchase In The Name Of His IRA Entrust FBO Bill Smith IRA #1234. 3. Bill Submits The “Buy Direction Letter” & Contract to His Local Entrust office.

Case Study: Undeveloped Land 4. Entrust Coordinates The Closing With Title Company The asset is titled Entrust FBO Bill Smith IRA #1234. 5. Bill Reviews and Approves All Closing Documents 6. Funds Are Wired From IRA To Title Company To Close

Case Study: Undeveloped Land 4. Entrust Coordinates The Closing With Title Company The asset is titled Entrust FBO Bill Smith IRA #1234. 5. Bill Reviews and Approves All Closing Documents 6. Funds Are Wired From IRA To Title Company To Close

Case Study: Undeveloped Land The IRA Is Now The Owner Of Record On The Warranty Deed Entrust FBO Bill Smith IRA #1234 *Note: Bill leaves $10, 000 in his Entrust IRA to cover expenses

Case Study: Undeveloped Land The IRA Is Now The Owner Of Record On The Warranty Deed Entrust FBO Bill Smith IRA #1234 *Note: Bill leaves $10, 000 in his Entrust IRA to cover expenses

Case Study: Undeveloped Land Additional Uses Of Land: • • • Grow Timber Rent To A Farmer Vineyard Storage Units Mobile Home Park Resources- Oil & Coal

Case Study: Undeveloped Land Additional Uses Of Land: • • • Grow Timber Rent To A Farmer Vineyard Storage Units Mobile Home Park Resources- Oil & Coal

Case Study: Utilizing an LLC John Wood and four of his friends want to purchase three office condos using a combination of Individual(k) funds, IRA funds & personal funds. They will utilize a Limited Liability Company (LLC).

Case Study: Utilizing an LLC John Wood and four of his friends want to purchase three office condos using a combination of Individual(k) funds, IRA funds & personal funds. They will utilize a Limited Liability Company (LLC).

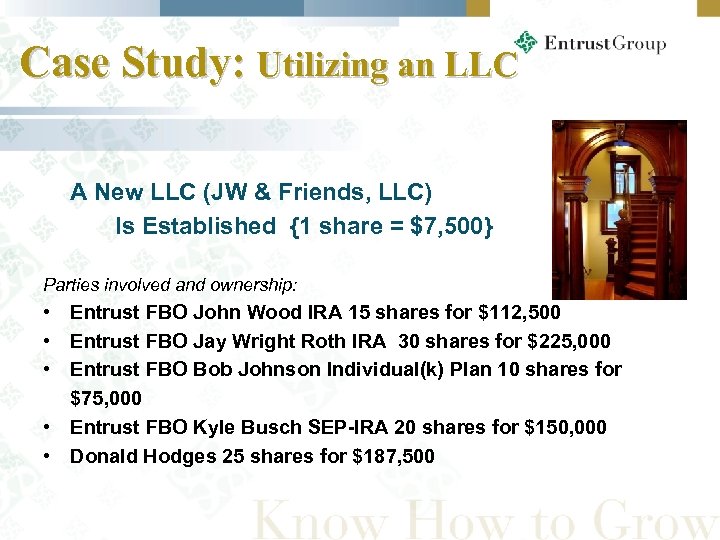

Case Study: Utilizing an LLC A New LLC (JW & Friends, LLC) Is Established {1 share = $7, 500} Parties involved and ownership: • Entrust FBO John Wood IRA 15 shares for $112, 500 • Entrust FBO Jay Wright Roth IRA 30 shares for $225, 000 • Entrust FBO Bob Johnson Individual(k) Plan 10 shares for $75, 000 • Entrust FBO Kyle Busch SEP-IRA 20 shares for $150, 000 • Donald Hodges 25 shares for $187, 500

Case Study: Utilizing an LLC A New LLC (JW & Friends, LLC) Is Established {1 share = $7, 500} Parties involved and ownership: • Entrust FBO John Wood IRA 15 shares for $112, 500 • Entrust FBO Jay Wright Roth IRA 30 shares for $225, 000 • Entrust FBO Bob Johnson Individual(k) Plan 10 shares for $75, 000 • Entrust FBO Kyle Busch SEP-IRA 20 shares for $150, 000 • Donald Hodges 25 shares for $187, 500

Case Study: Utilizing an LLC Transaction for Entrust IRAs: • John, Jay, Bob, and Kyle Set Up Entrust IRAs Then Transfer Funds to Entrust. • Their Attorney Creates JW & Friends, LLC. • John, Jay, Bob and Kyle Send LLC Documents & Buy Direction Letters To Entrust. • LLC documents Are Made Out In The Name Of: Ø Entrust FBO John Wood IRA Ø Entrust FBO Jay Wright Roth IRA Ø Entrust FBO Bob Johnson Individual(k) Plan Ø Entrust FBO Kyle Busch SEP-IRA • Clients Review & Approve All Closing Documents • Entrust Wires Retirement Funds To The Operating Account Of The LLC and executes operating agreement on behalf of accounts.

Case Study: Utilizing an LLC Transaction for Entrust IRAs: • John, Jay, Bob, and Kyle Set Up Entrust IRAs Then Transfer Funds to Entrust. • Their Attorney Creates JW & Friends, LLC. • John, Jay, Bob and Kyle Send LLC Documents & Buy Direction Letters To Entrust. • LLC documents Are Made Out In The Name Of: Ø Entrust FBO John Wood IRA Ø Entrust FBO Jay Wright Roth IRA Ø Entrust FBO Bob Johnson Individual(k) Plan Ø Entrust FBO Kyle Busch SEP-IRA • Clients Review & Approve All Closing Documents • Entrust Wires Retirement Funds To The Operating Account Of The LLC and executes operating agreement on behalf of accounts.

Case Study: Utilizing An LLC Acquisition of Rental Properties: • JW & Friends, LLC Initiates A Contract To Purchase The Office Condos • The LLC & Its Managers Execute The Closing Documents. • The Properties Held In The Name Of The LLC

Case Study: Utilizing An LLC Acquisition of Rental Properties: • JW & Friends, LLC Initiates A Contract To Purchase The Office Condos • The LLC & Its Managers Execute The Closing Documents. • The Properties Held In The Name Of The LLC

Case Study: Utilizing an LLC The LLC now owns the office condos: • A Property Management Company Is Hired. • The Property Manager Secures A Tenant. • Property Management Company Maintains The Record Keeping. • Expenses are paid out of the LLC’s operating account.

Case Study: Utilizing an LLC The LLC now owns the office condos: • A Property Management Company Is Hired. • The Property Manager Secures A Tenant. • Property Management Company Maintains The Record Keeping. • Expenses are paid out of the LLC’s operating account.

Case Study: Utilizing an LLC Over The Next Three Years, They Sell The Units. • The Managers Of The LLC Coordinate The Closings. • Proceeds Are Wired Back Into The LLC’s Operating Account. • After All Three Units Are Sold, The LLC Is Dissolved. • The Pro-Rated Portions Are Returned To The Owners. • Retirement Fund Portions Are Returned Tax Deferred.

Case Study: Utilizing an LLC Over The Next Three Years, They Sell The Units. • The Managers Of The LLC Coordinate The Closings. • Proceeds Are Wired Back Into The LLC’s Operating Account. • After All Three Units Are Sold, The LLC Is Dissolved. • The Pro-Rated Portions Are Returned To The Owners. • Retirement Fund Portions Are Returned Tax Deferred.

Case Study: Utilizing an LLC Notes on Limited Liability Companies (LLC): – The Entity Has The Obligation To Follow All IRS & Department Of Labor Requirements Including Prohibited Transaction & Tax Rules – No Disqualified Persons May Receive Any Current Benefit From The Investment – UBIT May Apply – The Entity Must Prorate Dividends To The Owners Based On The Percentage Owned – The entity should seek the advice of counsel when naming a manager for the LLC

Case Study: Utilizing an LLC Notes on Limited Liability Companies (LLC): – The Entity Has The Obligation To Follow All IRS & Department Of Labor Requirements Including Prohibited Transaction & Tax Rules – No Disqualified Persons May Receive Any Current Benefit From The Investment – UBIT May Apply – The Entity Must Prorate Dividends To The Owners Based On The Percentage Owned – The entity should seek the advice of counsel when naming a manager for the LLC

Techniques: Income Producing Investment Options: Income Producing • Rentals • Notes Receivable • Tenants In Common

Techniques: Income Producing Investment Options: Income Producing • Rentals • Notes Receivable • Tenants In Common

Case Study: Rental Property John and his associate purchase an office condo for $250, 000 within their SEP - IRAs. They each transfer $150, 000 from their SEP-IRA brokerage accounts to their Entrust SEP- IRAs to purchase the property.

Case Study: Rental Property John and his associate purchase an office condo for $250, 000 within their SEP - IRAs. They each transfer $150, 000 from their SEP-IRA brokerage accounts to their Entrust SEP- IRAs to purchase the property.

Case Study: Rental Property • John and his partner initiate contract to purchase the office condo under the SEP - IRAs. Entrust FBO John Wood SEP - IRA Entrust FBO Jay Wright SEP - IRA. • John & Jay Each Complete A Buy Direction Letter. • Entrust Sends Escrow Deposit Of $10, 000 ($5, 000 From Each Account) To The Title Company & Coordinates Closing.

Case Study: Rental Property • John and his partner initiate contract to purchase the office condo under the SEP - IRAs. Entrust FBO John Wood SEP - IRA Entrust FBO Jay Wright SEP - IRA. • John & Jay Each Complete A Buy Direction Letter. • Entrust Sends Escrow Deposit Of $10, 000 ($5, 000 From Each Account) To The Title Company & Coordinates Closing.

Case Study: Rental Property • John & Jay Review & Approve All Closing Documents • Entrust Wires The SEP - IRA Funds To The Title Company To Close • The Warranty Deed Is Recorded And Sent To Entrust For Safekeeping

Case Study: Rental Property • John & Jay Review & Approve All Closing Documents • Entrust Wires The SEP - IRA Funds To The Title Company To Close • The Warranty Deed Is Recorded And Sent To Entrust For Safekeeping

Case Study: Rental Property The 2 IRAs Are Now The Owner On Record On The Warranty Deed. Entrust FBO John Wood SEP-IRA as an undivided 50% interest Entrust FBO Jay Wright SEP-IRA as an undivided 50% interest John & Jay Decide To Hire A Property Manager.

Case Study: Rental Property The 2 IRAs Are Now The Owner On Record On The Warranty Deed. Entrust FBO John Wood SEP-IRA as an undivided 50% interest Entrust FBO Jay Wright SEP-IRA as an undivided 50% interest John & Jay Decide To Hire A Property Manager.

Case Study: Rental Property John Locates A Property Management Company To Oversee The Unit. • The P. M. Secures A Tenant To Lease The Unit • Rents/Expenses Are Handled By The P. M. • The Office Condo Has A Positive Cash Flow Of $850 ($425 for each SEP- IRA) Tax Deferred Growth. John & Jay Track Their Accounts Using Online Statements.

Case Study: Rental Property John Locates A Property Management Company To Oversee The Unit. • The P. M. Secures A Tenant To Lease The Unit • Rents/Expenses Are Handled By The P. M. • The Office Condo Has A Positive Cash Flow Of $850 ($425 for each SEP- IRA) Tax Deferred Growth. John & Jay Track Their Accounts Using Online Statements.

Case Study: Rental Property Two Years Later, The Tenant Offers To Purchase The Property For $395, 000. • A Sales Contract Is Prepared For $395, 000 • Entrust May Assist In the Coordination Of The Closing • On The Day Of Closing, John & Jay Approve The Closing Documents • Proceeds, After Closing Costs, Are Wired Into Their SEP-IRA Accounts

Case Study: Rental Property Two Years Later, The Tenant Offers To Purchase The Property For $395, 000. • A Sales Contract Is Prepared For $395, 000 • Entrust May Assist In the Coordination Of The Closing • On The Day Of Closing, John & Jay Approve The Closing Documents • Proceeds, After Closing Costs, Are Wired Into Their SEP-IRA Accounts

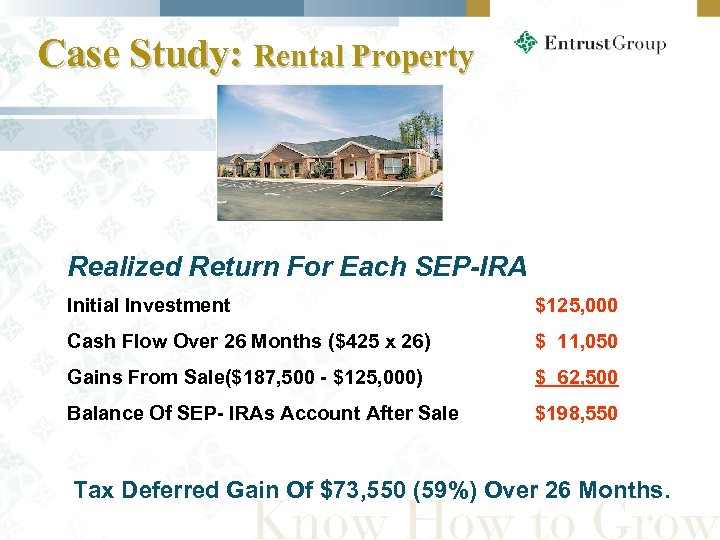

Case Study: Rental Property Realized Return For Each SEP-IRA Initial Investment $125, 000 Cash Flow Over 26 Months ($425 x 26) $ 11, 050 Gains From Sale($187, 500 - $125, 000) $ 62, 500 Balance Of SEP- IRAs Account After Sale $198, 550 Tax Deferred Gain Of $73, 550 (59%) Over 26 Months.

Case Study: Rental Property Realized Return For Each SEP-IRA Initial Investment $125, 000 Cash Flow Over 26 Months ($425 x 26) $ 11, 050 Gains From Sale($187, 500 - $125, 000) $ 62, 500 Balance Of SEP- IRAs Account After Sale $198, 550 Tax Deferred Gain Of $73, 550 (59%) Over 26 Months.

Techniques: Small Account Balances Investment Options: • • • Notes Pre-Construction Partnering Leveraging Tax Liens Options

Techniques: Small Account Balances Investment Options: • • • Notes Pre-Construction Partnering Leveraging Tax Liens Options

Case Study – Realtor Mtg Loan - Joan is a Realtor & has $20, 000 in her IRA - Joan’s client John has a contract to purchase a home for $175, 00…But he needs a 2 nd Mortgage of about $20, 000 in order to qualify for primary 1 st Mtg

Case Study – Realtor Mtg Loan - Joan is a Realtor & has $20, 000 in her IRA - Joan’s client John has a contract to purchase a home for $175, 00…But he needs a 2 nd Mortgage of about $20, 000 in order to qualify for primary 1 st Mtg

Case Study – Realtor Mtg Loan - Joan’s fellow agent Tim, agrees to lend $20, 000 from his IRA to John - 5 Yr Balloon Note @ 10% - Note is secured by 2 nd Mtg

Case Study – Realtor Mtg Loan - Joan’s fellow agent Tim, agrees to lend $20, 000 from his IRA to John - 5 Yr Balloon Note @ 10% - Note is secured by 2 nd Mtg

Case Study – Realtor Mtg Loan WIN, WIN - Client is happy – they got the House!! - Joan is happy…Closing went through & she got her commission! - Tim is happy… IRA is earning 10% instead of 3% in a bank CD!

Case Study – Realtor Mtg Loan WIN, WIN - Client is happy – they got the House!! - Joan is happy…Closing went through & she got her commission! - Tim is happy… IRA is earning 10% instead of 3% in a bank CD!

Case Study: Private Stock Investing In A Local Community Bank Lisa decides to invest $50, 000 of her SEP IRA into a new local community bank. *Retirement plans can hold shares of a privately-held company, just as they can hold stock in a publicly traded company.

Case Study: Private Stock Investing In A Local Community Bank Lisa decides to invest $50, 000 of her SEP IRA into a new local community bank. *Retirement plans can hold shares of a privately-held company, just as they can hold stock in a publicly traded company.

Case Study: Private Stock Investing in a Local Community Bank • • • Lisa Requests A Subscription Agreement From The New Bank. She Completes A Buy Direction Letter For The Purchase Of Private Stock At $2 A Share. The Buy Direction Letter And Subscription Agreement Are Sent To Her Local Entrust Office For Execution. The Administrator Executes The Agreement Then Wires $50, 000 To The Bank. The Stock Certificate For 25, 000 Shares Are Sent To Entrust In The Name Of Lisa’s IRA.

Case Study: Private Stock Investing in a Local Community Bank • • • Lisa Requests A Subscription Agreement From The New Bank. She Completes A Buy Direction Letter For The Purchase Of Private Stock At $2 A Share. The Buy Direction Letter And Subscription Agreement Are Sent To Her Local Entrust Office For Execution. The Administrator Executes The Agreement Then Wires $50, 000 To The Bank. The Stock Certificate For 25, 000 Shares Are Sent To Entrust In The Name Of Lisa’s IRA.

Case Study: Private Stock Three Years Later, The Community Bank Is Bought Out By A Large National Bank. • The National Bank Purchases The Community Bank For $6. 50 A Share. • Lisa Completes A Sell Direction Letter For The Sale Of The Private Stock. • The Proceeds Are Made Payable To Lisa’s IRA And Returned To Her Entrust Cash Account, Tax Deferred.

Case Study: Private Stock Three Years Later, The Community Bank Is Bought Out By A Large National Bank. • The National Bank Purchases The Community Bank For $6. 50 A Share. • Lisa Completes A Sell Direction Letter For The Sale Of The Private Stock. • The Proceeds Are Made Payable To Lisa’s IRA And Returned To Her Entrust Cash Account, Tax Deferred.

Additional Techniques to Self Directed Retirement Plan Investing

Additional Techniques to Self Directed Retirement Plan Investing

Case Study: Rental Property with Debt John Wood purchases an office condo for $100, 000 with his IRA and the seller is willing to hold a non- recourse note for $60, 000. John transfers over $75, 000 from his brokerage IRA to purchase the rental property.

Case Study: Rental Property with Debt John Wood purchases an office condo for $100, 000 with his IRA and the seller is willing to hold a non- recourse note for $60, 000. John transfers over $75, 000 from his brokerage IRA to purchase the rental property.

Case Study: Rental Property with Debt 1. Title company prepares HUD 1, deed and mortgage in the name of the IRA. The borrower/buyer will be: Entrust FBO John Wood IRA 2. Documents are reviewed by John and executed by Entrust. 3. The IRA is the legal owner of the asset and will be responsible for monthly mortgage payments.

Case Study: Rental Property with Debt 1. Title company prepares HUD 1, deed and mortgage in the name of the IRA. The borrower/buyer will be: Entrust FBO John Wood IRA 2. Documents are reviewed by John and executed by Entrust. 3. The IRA is the legal owner of the asset and will be responsible for monthly mortgage payments.

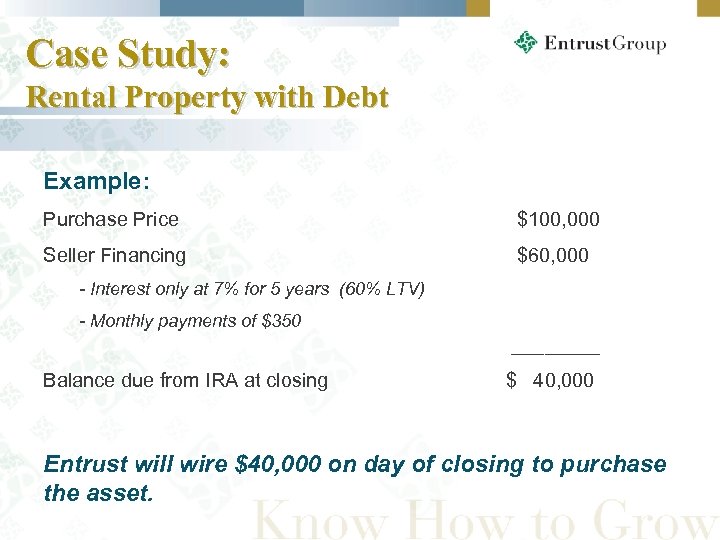

Case Study: Rental Property with Debt Example: Purchase Price $100, 000 Seller Financing $60, 000 - Interest only at 7% for 5 years (60% LTV) - Monthly payments of $350 ____ Balance due from IRA at closing $ 40, 000 Entrust will wire $40, 000 on day of closing to purchase the asset.

Case Study: Rental Property with Debt Example: Purchase Price $100, 000 Seller Financing $60, 000 - Interest only at 7% for 5 years (60% LTV) - Monthly payments of $350 ____ Balance due from IRA at closing $ 40, 000 Entrust will wire $40, 000 on day of closing to purchase the asset.

Case Study: Rental Property with Debt Entrust handles monthly recorded keeping: 4. The office condo is leased for 2 years at $450 a month. 5. Rents are made payable to the IRA account. 6. Entrust deposits rent payments into John’s IRA money market account.

Case Study: Rental Property with Debt Entrust handles monthly recorded keeping: 4. The office condo is leased for 2 years at $450 a month. 5. Rents are made payable to the IRA account. 6. Entrust deposits rent payments into John’s IRA money market account.

Case Study: Rental Property with Debt 7. Mortgage payments of $350 are paid out of IRA each month. 8. Association fees and other expenses are paid out of the IRA. - John tracks the cash flow via Entrust online statements. Office condo has a positive cash flow of $100/Mth.

Case Study: Rental Property with Debt 7. Mortgage payments of $350 are paid out of IRA each month. 8. Association fees and other expenses are paid out of the IRA. - John tracks the cash flow via Entrust online statements. Office condo has a positive cash flow of $100/Mth.

Case Study: Rental Property with Debt What if my Entrust account is short on cash? • If you qualify, make a contribution to IRA • Transfer cash from another plan • Increase “debt finance” • Bring in partner • Sell the property as is • Sell another asset in the plan to raise cash

Case Study: Rental Property with Debt What if my Entrust account is short on cash? • If you qualify, make a contribution to IRA • Transfer cash from another plan • Increase “debt finance” • Bring in partner • Sell the property as is • Sell another asset in the plan to raise cash

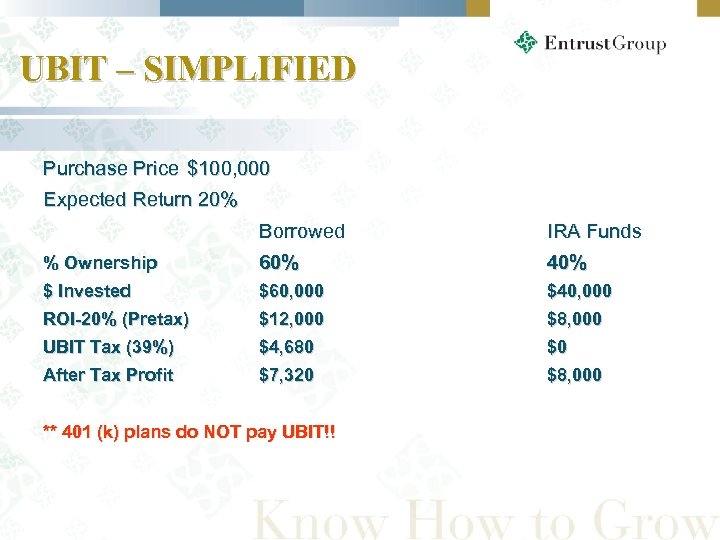

UBIT – SIMPLIFIED Purchase Price $100, 000 Expected Return 20% Borrowed IRA Funds % Ownership 60% 40% $ Invested $60, 000 $40, 000 ROI-20% (Pretax) $12, 000 $8, 000 UBIT Tax (39%) $4, 680 $0 After Tax Profit $7, 320 $8, 000 ** 401 (k) plans do NOT pay UBIT!!

UBIT – SIMPLIFIED Purchase Price $100, 000 Expected Return 20% Borrowed IRA Funds % Ownership 60% 40% $ Invested $60, 000 $40, 000 ROI-20% (Pretax) $12, 000 $8, 000 UBIT Tax (39%) $4, 680 $0 After Tax Profit $7, 320 $8, 000 ** 401 (k) plans do NOT pay UBIT!!

Case Study: Rental Property with Debt Understanding UBIT • Contact your local Entrust office or a tax advisor for more information about UBIT. • Financing with an IRA is an option, but you will want to do your research regarding non-recourse loans and UBIT. • There a number of national non-recourse lenders

Case Study: Rental Property with Debt Understanding UBIT • Contact your local Entrust office or a tax advisor for more information about UBIT. • Financing with an IRA is an option, but you will want to do your research regarding non-recourse loans and UBIT. • There a number of national non-recourse lenders

The Next Step!! How to learn more about self-directed retirement plans: • Ongoing educational classes and webinars Provided by The Entrust Group • Sign up for our free monthly publication “IRA & 401(k) Insights” • Educational books How to Invest in Real Estate and Pay Little or No Taxes by Hugh Bromma Real Estate Investing for the Utterly Confused by Lisa Moren Bromma

The Next Step!! How to learn more about self-directed retirement plans: • Ongoing educational classes and webinars Provided by The Entrust Group • Sign up for our free monthly publication “IRA & 401(k) Insights” • Educational books How to Invest in Real Estate and Pay Little or No Taxes by Hugh Bromma Real Estate Investing for the Utterly Confused by Lisa Moren Bromma

The Next Step!! How to learn more about investment options: - Local real estate investment clubs and groups (REIA & REI) - Attend investment seminars - Private placement opportunities: • - National Venture Capital Association (NVCA) and other groups Loan and note opportunities: • Hard money lenders • Mortgage brokers • Auto and commercial paper

The Next Step!! How to learn more about investment options: - Local real estate investment clubs and groups (REIA & REI) - Attend investment seminars - Private placement opportunities: • - National Venture Capital Association (NVCA) and other groups Loan and note opportunities: • Hard money lenders • Mortgage brokers • Auto and commercial paper

5 Key Points 1. IRAs can hold all types of investments, not just securities. 2. Partnerships and split ownerships are allowed. 3. IRAs and Individual(k) plans grow tax deferred or tax free. 4. All plans qualify & partial transfers are allowed. 5. Contact our office with any questions!

5 Key Points 1. IRAs can hold all types of investments, not just securities. 2. Partnerships and split ownerships are allowed. 3. IRAs and Individual(k) plans grow tax deferred or tax free. 4. All plans qualify & partial transfers are allowed. 5. Contact our office with any questions!

In Closing

In Closing

We Discussed: • Benefits of having a self-directed retirement arrangement • The different types of plans and their contributions • How to set up a self-directed account • How to purchase real estate and sell real estate within the account

We Discussed: • Benefits of having a self-directed retirement arrangement • The different types of plans and their contributions • How to set up a self-directed account • How to purchase real estate and sell real estate within the account

We Discussed: • When using self-directed retirement assets to invest in real estate • You should consult a professional familiar with these transactions • All income & expenses from the investment go in and out of the retirement account

We Discussed: • When using self-directed retirement assets to invest in real estate • You should consult a professional familiar with these transactions • All income & expenses from the investment go in and out of the retirement account

We Discussed: • The real estate purchase must be for investment purposes only. For example, the property to be acquired can’t be owned by a disqualified individual. • Disqualified individuals may not live in or lease the property while it's in your account. • Your business may not lease or be located in or on any part of the property while it's in your account.

We Discussed: • The real estate purchase must be for investment purposes only. For example, the property to be acquired can’t be owned by a disqualified individual. • Disqualified individuals may not live in or lease the property while it's in your account. • Your business may not lease or be located in or on any part of the property while it's in your account.

Entrust Georgia, LLC 3525 Piedmont Rd NE Building 8, Suite 101 Atlanta, GA 30305 800 -425 -0653 ext 1133 www. Entrust. Georgia. com

Entrust Georgia, LLC 3525 Piedmont Rd NE Building 8, Suite 101 Atlanta, GA 30305 800 -425 -0653 ext 1133 www. Entrust. Georgia. com

How to learn more? For More Information, contact: Entrust Georgia, LLC Monte Smith msmith@theentrustgroup. com (678) 513 -8913 ext 1133 Tisa Sinclair tsinclair@theentrustgroup. com (678) 513 -8913 ext 1136 Please also visit our website at www. entrustgeorgia. com for upcoming events and seminars and a wealth of information on self-directed IRAs.

How to learn more? For More Information, contact: Entrust Georgia, LLC Monte Smith msmith@theentrustgroup. com (678) 513 -8913 ext 1133 Tisa Sinclair tsinclair@theentrustgroup. com (678) 513 -8913 ext 1136 Please also visit our website at www. entrustgeorgia. com for upcoming events and seminars and a wealth of information on self-directed IRAs.