4ec69c28bff5debca2132c15640111fb.ppt

- Количество слайдов: 115

WELCOME TO NATIONAL LEVEL MEETING OF PROJECT DIRECTORS OF RURAL DEVELOPMENT

WELCOME TO NATIONAL LEVEL MEETING OF PROJECT DIRECTORS OF RURAL DEVELOPMENT

ANDHRA PRADESH PRESENTATION ON 1. Community Managed Health & Life Insurance 2. Total Financial Inclusion 3. Food Security

ANDHRA PRADESH PRESENTATION ON 1. Community Managed Health & Life Insurance 2. Total Financial Inclusion 3. Food Security

SANJEEVANI “Community Managed Health Insurance”

SANJEEVANI “Community Managed Health Insurance”

SANJEEVANI • Sanjeevani is a Community based and Community managed Health Welfare Scheme, promoted by Zilla Samakhya, Vishakhapatnam. • This is an initiative to make Healthcare Services accessible to rural Self Help groups ( SHGs) and to promote preventive Healthcare. Good health is a pre-requisite to human productivity and the development process. A healthy community is the infrastructure upon which an economically viable society can be built.

SANJEEVANI • Sanjeevani is a Community based and Community managed Health Welfare Scheme, promoted by Zilla Samakhya, Vishakhapatnam. • This is an initiative to make Healthcare Services accessible to rural Self Help groups ( SHGs) and to promote preventive Healthcare. Good health is a pre-requisite to human productivity and the development process. A healthy community is the infrastructure upon which an economically viable society can be built.

Need for the Scheme • Existing schemes are not pro-poor • Cumbersome Procedure • Uncertainty of coverage of financial shock from health care expenses • Expulsion of pre-existing deceases (Rural poor won’t go for regular check-up of deceases

Need for the Scheme • Existing schemes are not pro-poor • Cumbersome Procedure • Uncertainty of coverage of financial shock from health care expenses • Expulsion of pre-existing deceases (Rural poor won’t go for regular check-up of deceases

Need for the Scheme • Uniqueness of existing schemes – Insurer, Insured, TPA and Service Providers are unhappy • Existing health care facilities from Govt. institutions not accessed adequately

Need for the Scheme • Uniqueness of existing schemes – Insurer, Insured, TPA and Service Providers are unhappy • Existing health care facilities from Govt. institutions not accessed adequately

Scope of the Scheme • Hospitalization Cover for Surgeries and Medical Conditions • Free Outpatient Consultations. • Fixed discounts on - Medicines - Investigations • Consultation by a lady doctor on specified days.

Scope of the Scheme • Hospitalization Cover for Surgeries and Medical Conditions • Free Outpatient Consultations. • Fixed discounts on - Medicines - Investigations • Consultation by a lady doctor on specified days.

Administration of the Scheme • The scheme will be implemented and administered by Zilla Samakhya, in coordination with the Mandal Samkhaya, and Village Samakhyas.

Administration of the Scheme • The scheme will be implemented and administered by Zilla Samakhya, in coordination with the Mandal Samkhaya, and Village Samakhyas.

The Role of Zilla Samakhaya The ZS is responsible for the day-to-day operation of the Scheme and will ensure service standards at provider Network for hospitalization and Diagnostics. The duties will include, Ø Maintaining member database Ø Issuing Photo ID cards to the families covered under the scheme Ø Creating a network of hospitals to facilitate Cashless treatment to the beneficiaries of the scheme Ø Facilitating the authorization process with the Network Hospitals Ø Claims Processing and settlement.

The Role of Zilla Samakhaya The ZS is responsible for the day-to-day operation of the Scheme and will ensure service standards at provider Network for hospitalization and Diagnostics. The duties will include, Ø Maintaining member database Ø Issuing Photo ID cards to the families covered under the scheme Ø Creating a network of hospitals to facilitate Cashless treatment to the beneficiaries of the scheme Ø Facilitating the authorization process with the Network Hospitals Ø Claims Processing and settlement.

Coverage and Premium Ø Period of operation from 1 st May 2007 to 30 th April 2008 Ø Maximum amount payable Per Family Rs. 30, 000/- for surgeries ( List provided ). Ø Maximum amount payable is Rs 5000/- for medical conditions other than surgeries under the Family Package 5. Ø 10% of Co-Payment by the patient on the final bill. Ø Premium payable is Rs. 260 per year for a family of 5. Ø Age Limit: 0 -60

Coverage and Premium Ø Period of operation from 1 st May 2007 to 30 th April 2008 Ø Maximum amount payable Per Family Rs. 30, 000/- for surgeries ( List provided ). Ø Maximum amount payable is Rs 5000/- for medical conditions other than surgeries under the Family Package 5. Ø 10% of Co-Payment by the patient on the final bill. Ø Premium payable is Rs. 260 per year for a family of 5. Ø Age Limit: 0 -60

Features of the Scheme 1. Out Patient Consultation PHC level: consultation with lady doctors once in a week free of cost Network Hospital (NWH): consultation free of cost 2. Diagnostics: Basic diagnostics will be done at PHC free of cost Diagnostics at NWH will be done at a fixed discounted rate. 3. Quality Medicine Free of cost at PHC level 2. 10% Discount rate at NWH 3. Grossly discount at Drug depots of IKP (Sanjeevani Pharmacy)

Features of the Scheme 1. Out Patient Consultation PHC level: consultation with lady doctors once in a week free of cost Network Hospital (NWH): consultation free of cost 2. Diagnostics: Basic diagnostics will be done at PHC free of cost Diagnostics at NWH will be done at a fixed discounted rate. 3. Quality Medicine Free of cost at PHC level 2. 10% Discount rate at NWH 3. Grossly discount at Drug depots of IKP (Sanjeevani Pharmacy)

Features of the Scheme Contd… 4. Hospitalization cover: • Cover- Inpatient treatment requiring hospitalization for more than 24 hours. • Cover would include consultation, investigation and room charges, medicines and consumables. 5. Medical and Secondary and Tertiary Surgical Care Treatment provided through Referral Network Hospitals only with 100% Cashless facility 6. Pre existing diseases are covered 7. Treatment in General ward only

Features of the Scheme Contd… 4. Hospitalization cover: • Cover- Inpatient treatment requiring hospitalization for more than 24 hours. • Cover would include consultation, investigation and room charges, medicines and consumables. 5. Medical and Secondary and Tertiary Surgical Care Treatment provided through Referral Network Hospitals only with 100% Cashless facility 6. Pre existing diseases are covered 7. Treatment in General ward only

Surgeries Covered The scheme covers more than 1500 surgeries, including all categories of complex and common surgeries, such as 1. OBG – includes normal delivery, LSCS and Hysterectomy 2. General Surgery 3. Gastroenterology 4. Orthopaedics – includes fracture surgeries 5. Genito-Urology 6. Endocrinology 7. ENT

Surgeries Covered The scheme covers more than 1500 surgeries, including all categories of complex and common surgeries, such as 1. OBG – includes normal delivery, LSCS and Hysterectomy 2. General Surgery 3. Gastroenterology 4. Orthopaedics – includes fracture surgeries 5. Genito-Urology 6. Endocrinology 7. ENT

The Team Case Manager – Role and Responsibilities 1. Coordinate the referral system of the patient 2. Regularly visit the Network Hospitals, at least once a week, and ensure that the terms and benefits of the scheme are being properly followed. 3. Regularly interact with the beneficiaries of the scheme undergoing treatment for feedback. 4. Inform the Implementing Agency (ZS) about any non-conformance, if any, and follow-up on action taken. 5. Collate data and statistics from network hospitals on the scheme every week end and Submit it to the ZS

The Team Case Manager – Role and Responsibilities 1. Coordinate the referral system of the patient 2. Regularly visit the Network Hospitals, at least once a week, and ensure that the terms and benefits of the scheme are being properly followed. 3. Regularly interact with the beneficiaries of the scheme undergoing treatment for feedback. 4. Inform the Implementing Agency (ZS) about any non-conformance, if any, and follow-up on action taken. 5. Collate data and statistics from network hospitals on the scheme every week end and Submit it to the ZS

The Team Case Manager – Role and Responsibilities 6. Randomly verify the operated cases for authenticity of the members. 7. Verify the authenticity of every case received for pre-authorization and submit report to ZS. Medical Officer – Role and Responsibilities 1. Approval of Preauthorization based on necessity of treatment 2. Liaison with NWH 3. Quality monitoring of service providers

The Team Case Manager – Role and Responsibilities 6. Randomly verify the operated cases for authenticity of the members. 7. Verify the authenticity of every case received for pre-authorization and submit report to ZS. Medical Officer – Role and Responsibilities 1. Approval of Preauthorization based on necessity of treatment 2. Liaison with NWH 3. Quality monitoring of service providers

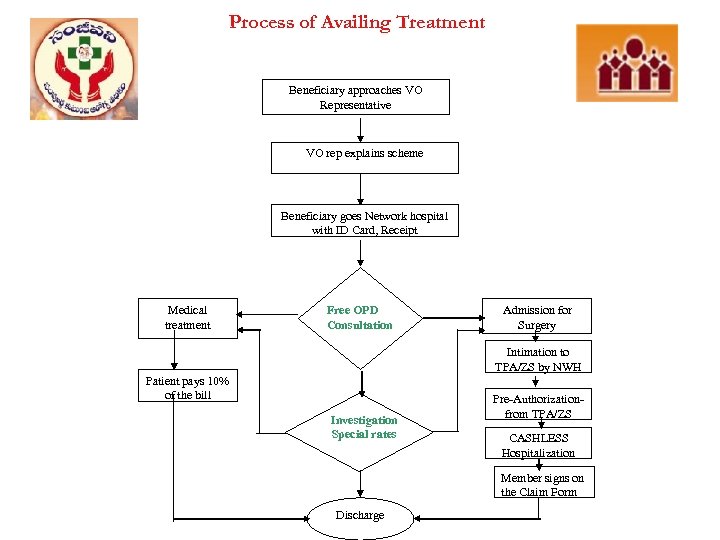

Process of Availing Treatment Beneficiary approaches VO Representative VO rep explains scheme Beneficiary goes Network hospital with ID Card, Receipt Medical treatment Free OPD Consultation Admission for Surgery Intimation to TPA/ZS by NWH Patient pays 10% of the bill Investigation Special rates Pre-Authorizationfrom TPA/ZS CASHLESS Hospitalization Member signs on the Claim Form Discharge

Process of Availing Treatment Beneficiary approaches VO Representative VO rep explains scheme Beneficiary goes Network hospital with ID Card, Receipt Medical treatment Free OPD Consultation Admission for Surgery Intimation to TPA/ZS by NWH Patient pays 10% of the bill Investigation Special rates Pre-Authorizationfrom TPA/ZS CASHLESS Hospitalization Member signs on the Claim Form Discharge

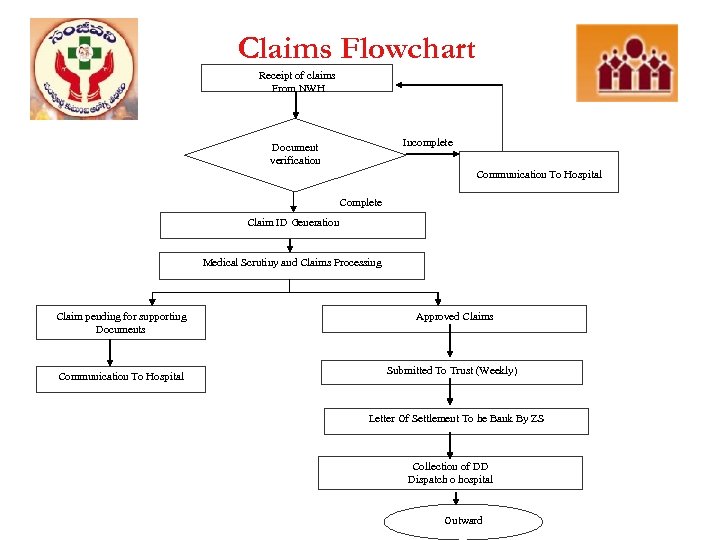

Claims Flowchart Receipt of claims From NWH Incomplete Document verification Communication To Hospital Complete Claim ID Generation Medical Scrutiny and Claims Processing Claim pending for supporting Documents Communication To Hospital Approved Claims Submitted To Trust (Weekly) Letter Of Settlement To he Bank By ZS Collection of DD Dispatch o hospital Outward

Claims Flowchart Receipt of claims From NWH Incomplete Document verification Communication To Hospital Complete Claim ID Generation Medical Scrutiny and Claims Processing Claim pending for supporting Documents Communication To Hospital Approved Claims Submitted To Trust (Weekly) Letter Of Settlement To he Bank By ZS Collection of DD Dispatch o hospital Outward

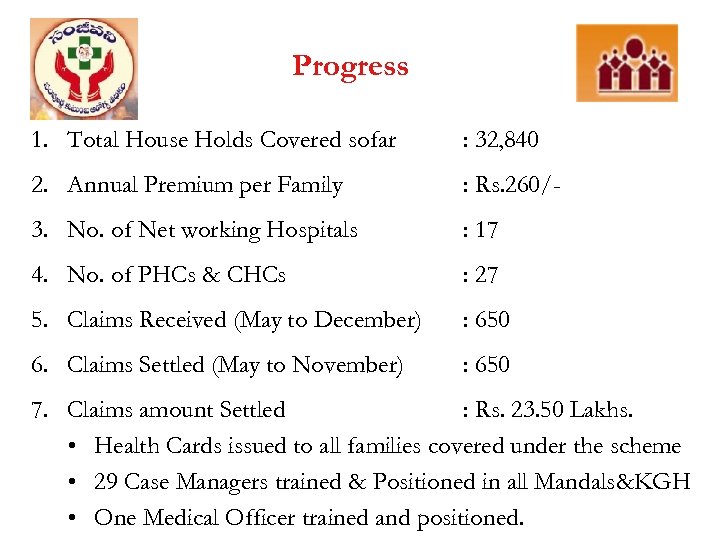

Progress 1. Total House Holds Covered sofar : 32, 840 2. Annual Premium per Family : Rs. 260/- 3. No. of Net working Hospitals : 17 4. No. of PHCs & CHCs : 27 5. Claims Received (May to December) : 650 6. Claims Settled (May to November) : 650 7. Claims amount Settled : Rs. 23. 50 Lakhs. • Health Cards issued to all families covered under the scheme • 29 Case Managers trained & Positioned in all Mandals&KGH • One Medical Officer trained and positioned.

Progress 1. Total House Holds Covered sofar : 32, 840 2. Annual Premium per Family : Rs. 260/- 3. No. of Net working Hospitals : 17 4. No. of PHCs & CHCs : 27 5. Claims Received (May to December) : 650 6. Claims Settled (May to November) : 650 7. Claims amount Settled : Rs. 23. 50 Lakhs. • Health Cards issued to all families covered under the scheme • 29 Case Managers trained & Positioned in all Mandals&KGH • One Medical Officer trained and positioned.

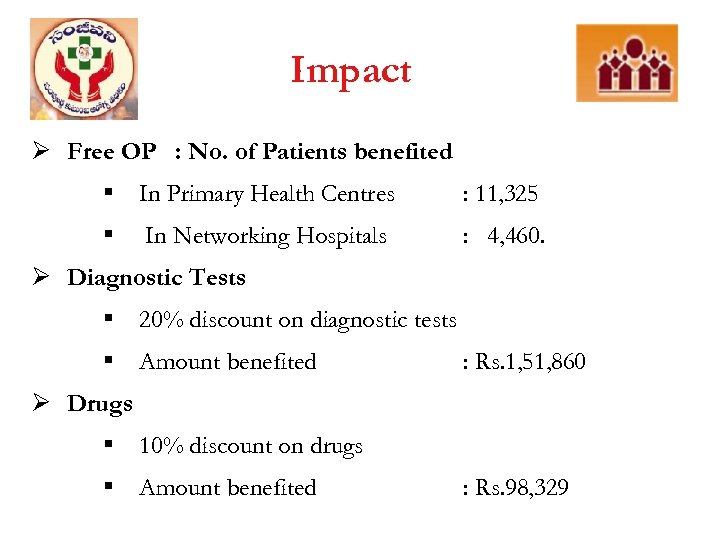

Impact Ø Free OP : No. of Patients benefited § In Primary Health Centres : 11, 325 § : 4, 460. In Networking Hospitals Ø Diagnostic Tests § 20% discount on diagnostic tests § Amount benefited : Rs. 1, 51, 860 Ø Drugs § 10% discount on drugs § Amount benefited : Rs. 98, 329

Impact Ø Free OP : No. of Patients benefited § In Primary Health Centres : 11, 325 § : 4, 460. In Networking Hospitals Ø Diagnostic Tests § 20% discount on diagnostic tests § Amount benefited : Rs. 1, 51, 860 Ø Drugs § 10% discount on drugs § Amount benefited : Rs. 98, 329

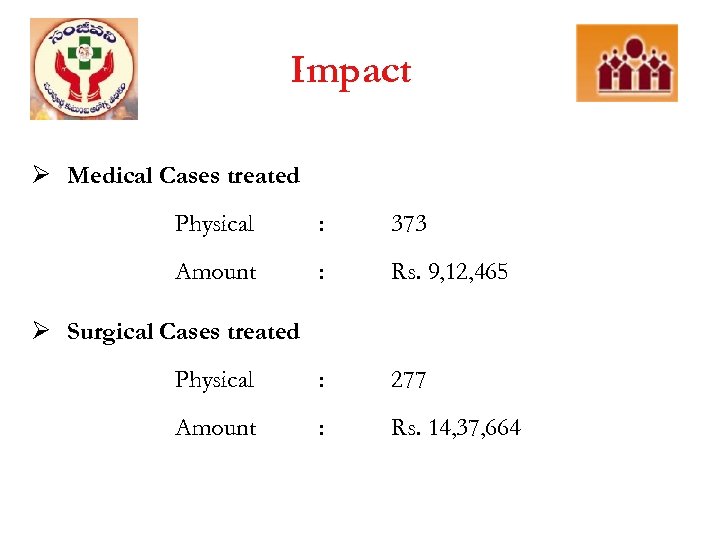

Impact Ø Medical Cases treated Physical : 373 Amount : Rs. 9, 12, 465 Physical : 277 Amount : Rs. 14, 37, 664 Ø Surgical Cases treated

Impact Ø Medical Cases treated Physical : 373 Amount : Rs. 9, 12, 465 Physical : 277 Amount : Rs. 14, 37, 664 Ø Surgical Cases treated

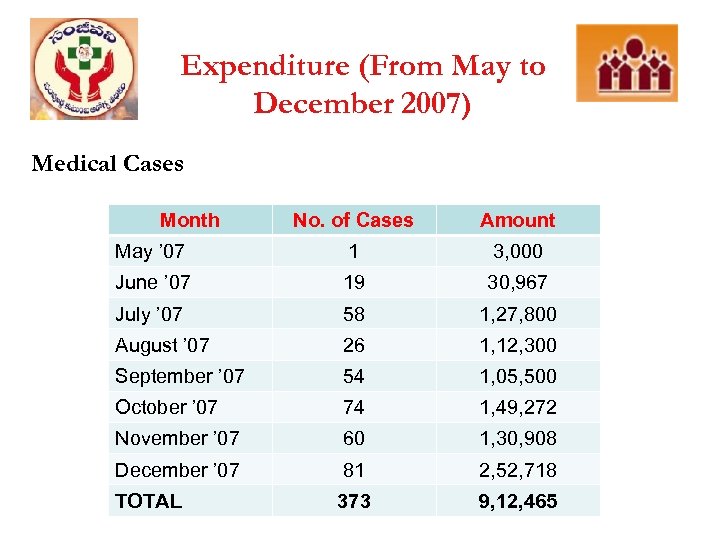

Expenditure (From May to December 2007) Medical Cases Month No. of Cases Amount May ’ 07 1 3, 000 June ’ 07 19 30, 967 July ’ 07 58 1, 27, 800 August ’ 07 26 1, 12, 300 September ’ 07 54 1, 05, 500 October ’ 07 74 1, 49, 272 November ’ 07 60 1, 30, 908 December ’ 07 81 2, 52, 718 TOTAL 373 9, 12, 465

Expenditure (From May to December 2007) Medical Cases Month No. of Cases Amount May ’ 07 1 3, 000 June ’ 07 19 30, 967 July ’ 07 58 1, 27, 800 August ’ 07 26 1, 12, 300 September ’ 07 54 1, 05, 500 October ’ 07 74 1, 49, 272 November ’ 07 60 1, 30, 908 December ’ 07 81 2, 52, 718 TOTAL 373 9, 12, 465

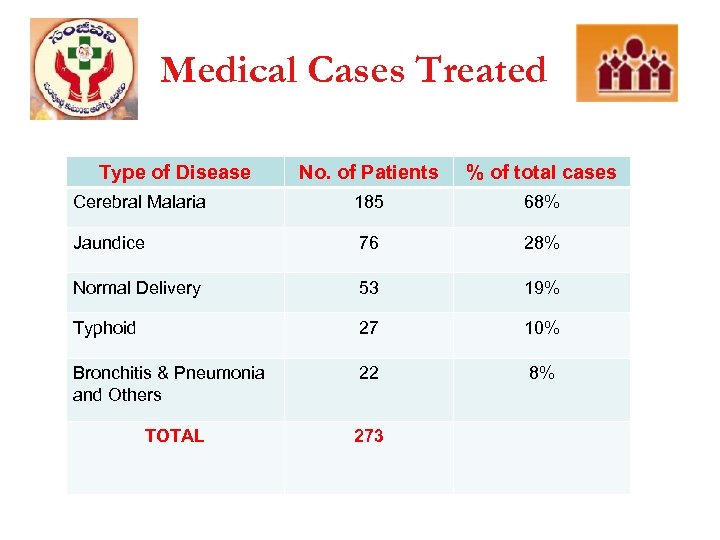

Medical Cases Treated Type of Disease No. of Patients % of total cases Cerebral Malaria 185 68% Jaundice 76 28% Normal Delivery 53 19% Typhoid 27 10% Bronchitis & Pneumonia and Others 22 8% TOTAL 273

Medical Cases Treated Type of Disease No. of Patients % of total cases Cerebral Malaria 185 68% Jaundice 76 28% Normal Delivery 53 19% Typhoid 27 10% Bronchitis & Pneumonia and Others 22 8% TOTAL 273

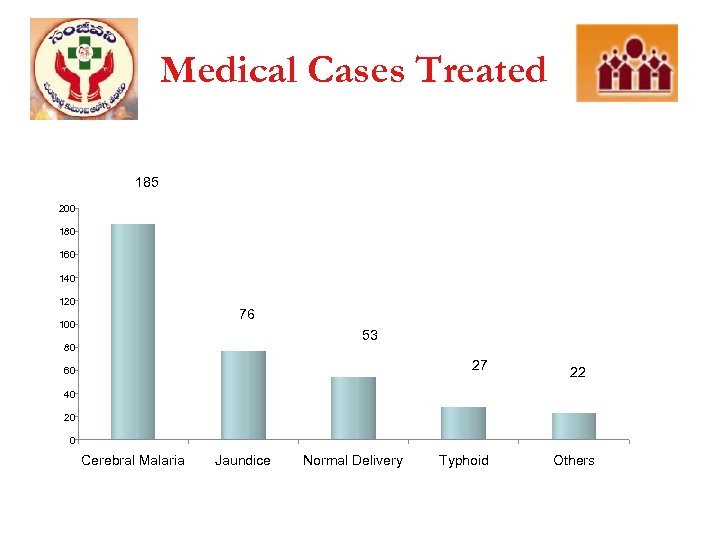

Medical Cases Treated 185 200 180 160 140 120 76 100 53 80 27 60 22 40 20 0 Cerebral Malaria Jaundice Normal Delivery Typhoid Others

Medical Cases Treated 185 200 180 160 140 120 76 100 53 80 27 60 22 40 20 0 Cerebral Malaria Jaundice Normal Delivery Typhoid Others

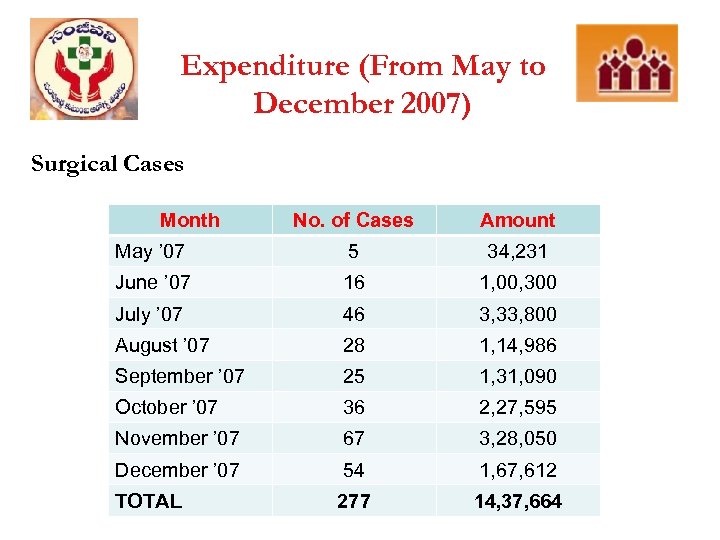

Expenditure (From May to December 2007) Surgical Cases Month No. of Cases Amount May ’ 07 5 34, 231 June ’ 07 16 1, 00, 300 July ’ 07 46 3, 33, 800 August ’ 07 28 1, 14, 986 September ’ 07 25 1, 31, 090 October ’ 07 36 2, 27, 595 November ’ 07 67 3, 28, 050 December ’ 07 54 1, 67, 612 TOTAL 277 14, 37, 664

Expenditure (From May to December 2007) Surgical Cases Month No. of Cases Amount May ’ 07 5 34, 231 June ’ 07 16 1, 00, 300 July ’ 07 46 3, 33, 800 August ’ 07 28 1, 14, 986 September ’ 07 25 1, 31, 090 October ’ 07 36 2, 27, 595 November ’ 07 67 3, 28, 050 December ’ 07 54 1, 67, 612 TOTAL 277 14, 37, 664

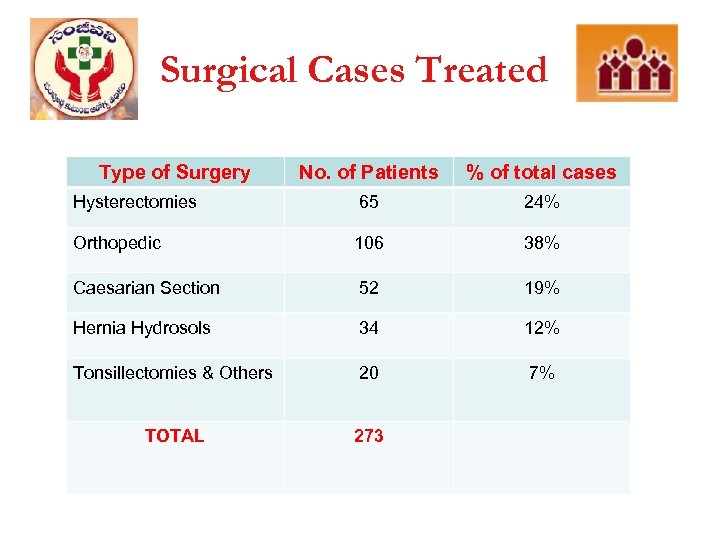

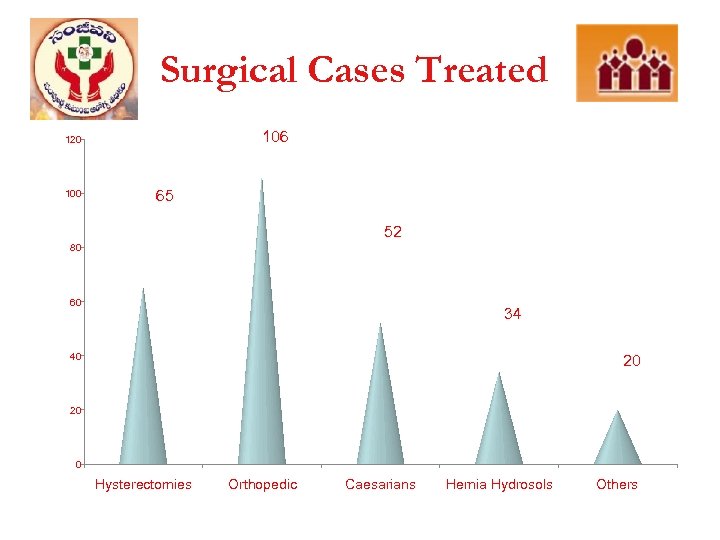

Surgical Cases Treated Type of Surgery No. of Patients % of total cases Hysterectomies 65 24% Orthopedic 106 38% Caesarian Section 52 19% Hernia Hydrosols 34 12% Tonsillectomies & Others 20 7% TOTAL 273

Surgical Cases Treated Type of Surgery No. of Patients % of total cases Hysterectomies 65 24% Orthopedic 106 38% Caesarian Section 52 19% Hernia Hydrosols 34 12% Tonsillectomies & Others 20 7% TOTAL 273

Surgical Cases Treated 106 120 100 65 52 80 60 34 40 20 20 0 Hysterectomies Orthopedic Caesarians Hernia Hydrosols Others

Surgical Cases Treated 106 120 100 65 52 80 60 34 40 20 20 0 Hysterectomies Orthopedic Caesarians Hernia Hydrosols Others

Community Managed Life Insurance Scheme

Community Managed Life Insurance Scheme

Community Based life Insurance Scheme ü Objective ü Need ü Evolution ü Implementation ü Claim Settlement Process ü Impact DRDA SERP

Community Based life Insurance Scheme ü Objective ü Need ü Evolution ü Implementation ü Claim Settlement Process ü Impact DRDA SERP

Objective § Scheme seeks to offer a risk mitigation measure for the rural poor against sudden death & disability. § The CBO - SHG and their federations VO Mandal Samakhyas and ZS play key role in evolution, implementation of the scheme DRDA SERP

Objective § Scheme seeks to offer a risk mitigation measure for the rural poor against sudden death & disability. § The CBO - SHG and their federations VO Mandal Samakhyas and ZS play key role in evolution, implementation of the scheme DRDA SERP

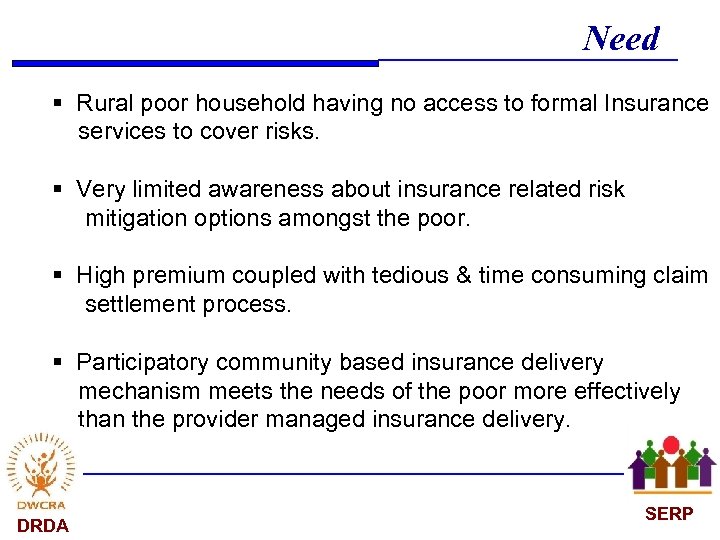

Need § Rural poor household having no access to formal Insurance services to cover risks. § Very limited awareness about insurance related risk mitigation options amongst the poor. § High premium coupled with tedious & time consuming claim settlement process. § Participatory community based insurance delivery mechanism meets the needs of the poor more effectively than the provider managed insurance delivery. DRDA SERP

Need § Rural poor household having no access to formal Insurance services to cover risks. § Very limited awareness about insurance related risk mitigation options amongst the poor. § High premium coupled with tedious & time consuming claim settlement process. § Participatory community based insurance delivery mechanism meets the needs of the poor more effectively than the provider managed insurance delivery. DRDA SERP

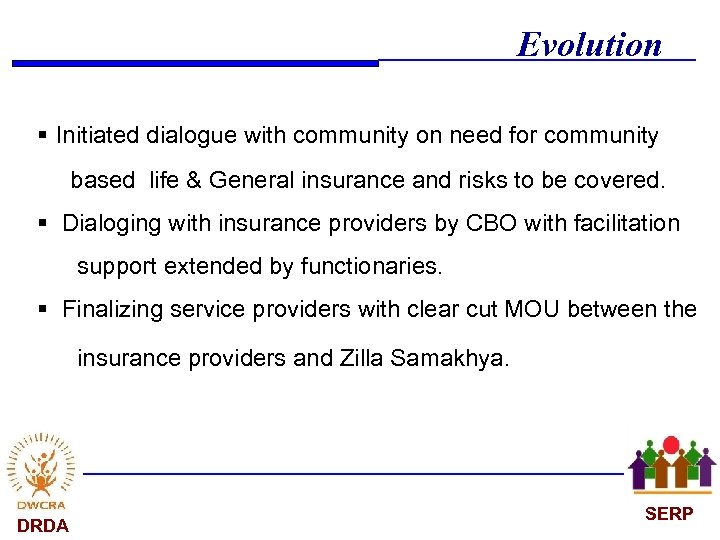

Evolution § Initiated dialogue with community on need for community based life & General insurance and risks to be covered. § Dialoging with insurance providers by CBO with facilitation support extended by functionaries. § Finalizing service providers with clear cut MOU between the insurance providers and Zilla Samakhya. DRDA SERP

Evolution § Initiated dialogue with community on need for community based life & General insurance and risks to be covered. § Dialoging with insurance providers by CBO with facilitation support extended by functionaries. § Finalizing service providers with clear cut MOU between the insurance providers and Zilla Samakhya. DRDA SERP

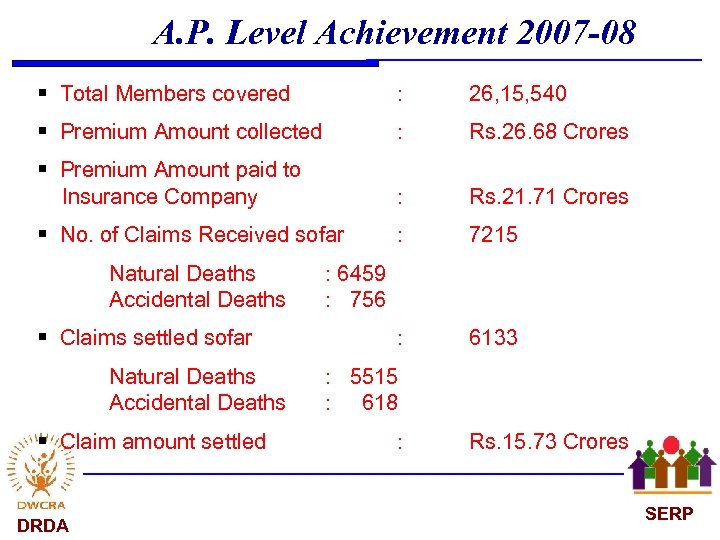

A. P. Level Achievement 2007 -08 § Total Members covered : 26, 15, 540 § Premium Amount collected : Rs. 26. 68 Crores § Premium Amount paid to Insurance Company : Rs. 21. 71 Crores § No. of Claims Received sofar : 7215 : 6133 Natural Deaths Accidental Deaths § Claims settled sofar Natural Deaths Accidental Deaths § Claim amount settled DRDA : 6459 : 756 : 5515 : 618 : Rs. 15. 73 Crores SERP

A. P. Level Achievement 2007 -08 § Total Members covered : 26, 15, 540 § Premium Amount collected : Rs. 26. 68 Crores § Premium Amount paid to Insurance Company : Rs. 21. 71 Crores § No. of Claims Received sofar : 7215 : 6133 Natural Deaths Accidental Deaths § Claims settled sofar Natural Deaths Accidental Deaths § Claim amount settled DRDA : 6459 : 756 : 5515 : 618 : Rs. 15. 73 Crores SERP

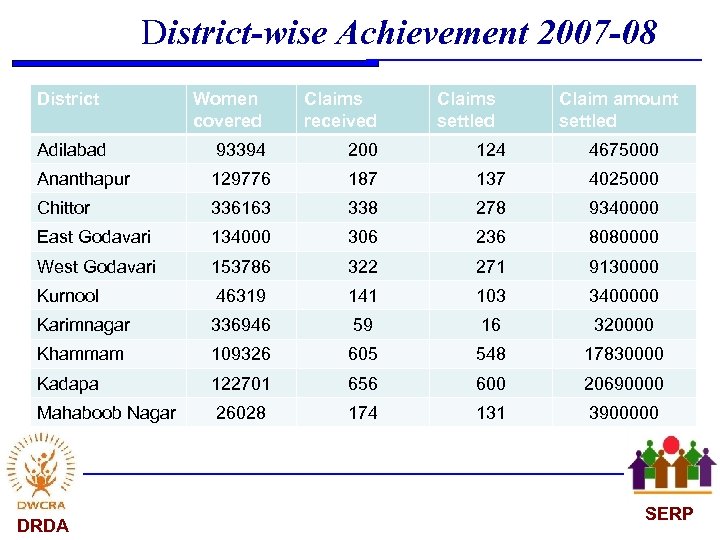

District-wise Achievement 2007 -08 District Women covered Claims received Adilabad 93394 200 124 4675000 Ananthapur 129776 187 137 4025000 Chittor 336163 338 278 9340000 East Godavari 134000 306 236 8080000 West Godavari 153786 322 271 9130000 Kurnool 46319 141 103 3400000 Karimnagar 336946 59 16 320000 Khammam 109326 605 548 17830000 Kadapa 122701 656 600 20690000 Mahaboob Nagar 26028 174 131 3900000 DRDA Claims settled Claim amount settled SERP

District-wise Achievement 2007 -08 District Women covered Claims received Adilabad 93394 200 124 4675000 Ananthapur 129776 187 137 4025000 Chittor 336163 338 278 9340000 East Godavari 134000 306 236 8080000 West Godavari 153786 322 271 9130000 Kurnool 46319 141 103 3400000 Karimnagar 336946 59 16 320000 Khammam 109326 605 548 17830000 Kadapa 122701 656 600 20690000 Mahaboob Nagar 26028 174 131 3900000 DRDA Claims settled Claim amount settled SERP

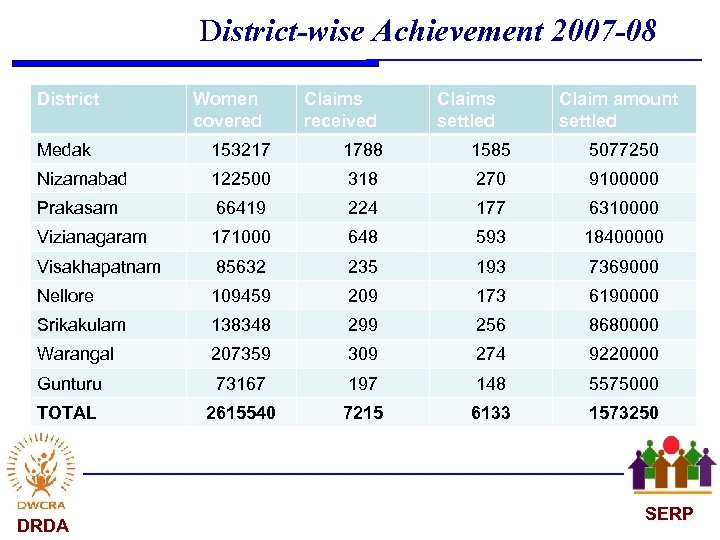

District-wise Achievement 2007 -08 District Women covered Claims received Claims settled Claim amount settled Medak 153217 1788 1585 5077250 Nizamabad 122500 318 270 9100000 Prakasam 66419 224 177 6310000 Vizianagaram 171000 648 593 18400000 Visakhapatnam 85632 235 193 7369000 Nellore 109459 209 173 6190000 Srikakulam 138348 299 256 8680000 Warangal 207359 309 274 9220000 Gunturu 73167 197 148 5575000 TOTAL 2615540 7215 6133 1573250 DRDA SERP

District-wise Achievement 2007 -08 District Women covered Claims received Claims settled Claim amount settled Medak 153217 1788 1585 5077250 Nizamabad 122500 318 270 9100000 Prakasam 66419 224 177 6310000 Vizianagaram 171000 648 593 18400000 Visakhapatnam 85632 235 193 7369000 Nellore 109459 209 173 6190000 Srikakulam 138348 299 256 8680000 Warangal 207359 309 274 9220000 Gunturu 73167 197 148 5575000 TOTAL 2615540 7215 6133 1573250 DRDA SERP

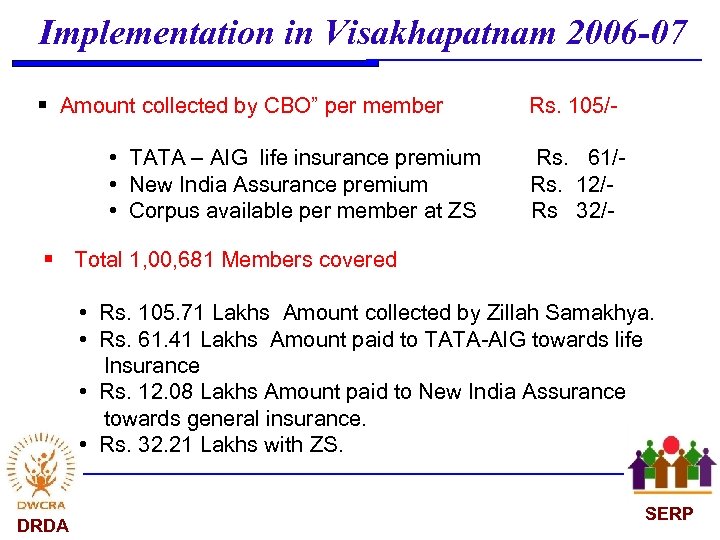

Implementation in Visakhapatnam 2006 -07 § Amount collected by CBO” per member Rs. 105/ • TATA – AIG life insurance premium Rs. 61/ • New India Assurance premium Rs. 12/ • Corpus available per member at ZS Rs 32/- § Total 1, 00, 681 Members covered • Rs. 105. 71 Lakhs Amount collected by Zillah Samakhya. • Rs. 61. 41 Lakhs Amount paid to TATA-AIG towards life Insurance • Rs. 12. 08 Lakhs Amount paid to New India Assurance towards general insurance. • Rs. 32. 21 Lakhs with ZS. DRDA SERP

Implementation in Visakhapatnam 2006 -07 § Amount collected by CBO” per member Rs. 105/ • TATA – AIG life insurance premium Rs. 61/ • New India Assurance premium Rs. 12/ • Corpus available per member at ZS Rs 32/- § Total 1, 00, 681 Members covered • Rs. 105. 71 Lakhs Amount collected by Zillah Samakhya. • Rs. 61. 41 Lakhs Amount paid to TATA-AIG towards life Insurance • Rs. 12. 08 Lakhs Amount paid to New India Assurance towards general insurance. • Rs. 32. 21 Lakhs with ZS. DRDA SERP

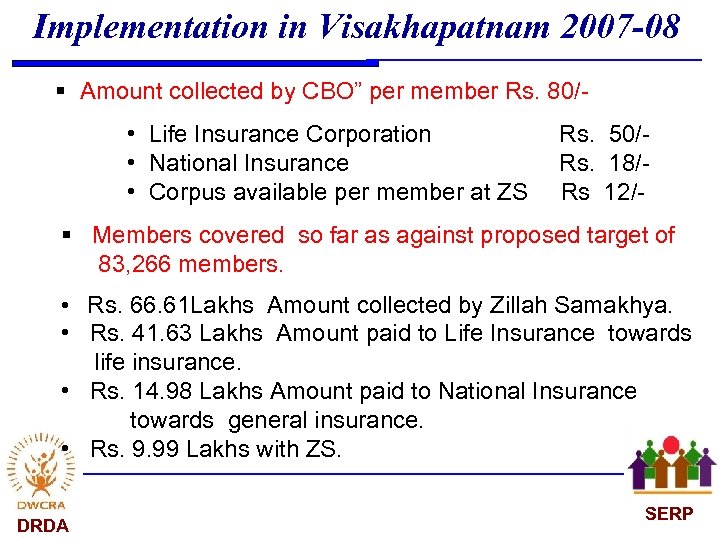

Implementation in Visakhapatnam 2007 -08 § Amount collected by CBO” per member Rs. 80/ • Life Insurance Corporation Rs. 50/ • National Insurance Rs. 18/ • Corpus available per member at ZS Rs 12/§ Members covered so far as against proposed target of 83, 266 members. • Rs. 66. 61 Lakhs Amount collected by Zillah Samakhya. • Rs. 41. 63 Lakhs Amount paid to Life Insurance towards life insurance. • Rs. 14. 98 Lakhs Amount paid to National Insurance towards general insurance. • Rs. 9. 99 Lakhs with ZS. DRDA SERP

Implementation in Visakhapatnam 2007 -08 § Amount collected by CBO” per member Rs. 80/ • Life Insurance Corporation Rs. 50/ • National Insurance Rs. 18/ • Corpus available per member at ZS Rs 12/§ Members covered so far as against proposed target of 83, 266 members. • Rs. 66. 61 Lakhs Amount collected by Zillah Samakhya. • Rs. 41. 63 Lakhs Amount paid to Life Insurance towards life insurance. • Rs. 14. 98 Lakhs Amount paid to National Insurance towards general insurance. • Rs. 9. 99 Lakhs with ZS. DRDA SERP

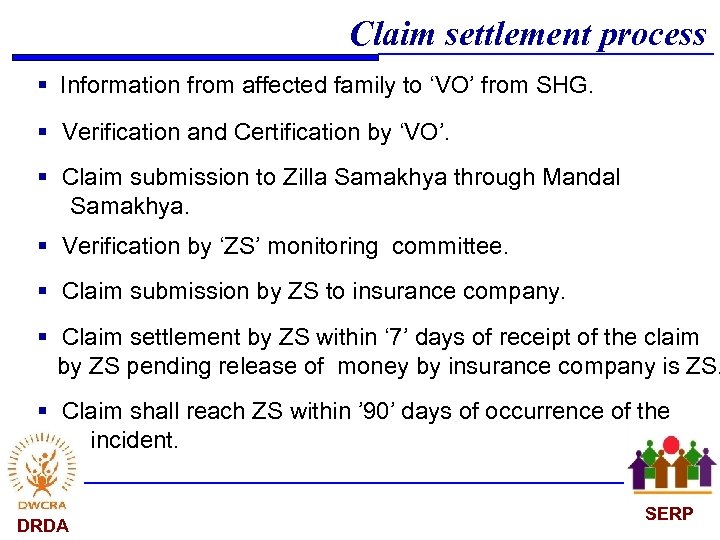

Claim settlement process § Information from affected family to ‘VO’ from SHG. § Verification and Certification by ‘VO’. § Claim submission to Zilla Samakhya through Mandal Samakhya. § Verification by ‘ZS’ monitoring committee. § Claim submission by ZS to insurance company. § Claim settlement by ZS within ‘ 7’ days of receipt of the claim by ZS pending release of money by insurance company is ZS. § Claim shall reach ZS within ’ 90’ days of occurrence of the incident. DRDA SERP

Claim settlement process § Information from affected family to ‘VO’ from SHG. § Verification and Certification by ‘VO’. § Claim submission to Zilla Samakhya through Mandal Samakhya. § Verification by ‘ZS’ monitoring committee. § Claim submission by ZS to insurance company. § Claim settlement by ZS within ‘ 7’ days of receipt of the claim by ZS pending release of money by insurance company is ZS. § Claim shall reach ZS within ’ 90’ days of occurrence of the incident. DRDA SERP

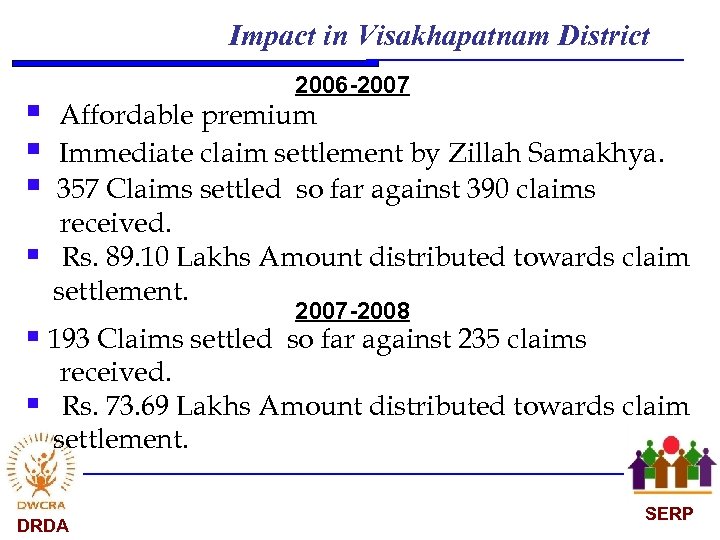

Impact in Visakhapatnam District § § 2006 -2007 Affordable premium Immediate claim settlement by Zillah Samakhya. 357 Claims settled so far against 390 claims received. Rs. 89. 10 Lakhs Amount distributed towards claim settlement. 2007 -2008 § 193 Claims settled so far against 235 claims § received. Rs. 73. 69 Lakhs Amount distributed towards claim settlement. DRDA SERP

Impact in Visakhapatnam District § § 2006 -2007 Affordable premium Immediate claim settlement by Zillah Samakhya. 357 Claims settled so far against 390 claims received. Rs. 89. 10 Lakhs Amount distributed towards claim settlement. 2007 -2008 § 193 Claims settled so far against 235 claims § received. Rs. 73. 69 Lakhs Amount distributed towards claim settlement. DRDA SERP

‘Total Financial Inclusion’

‘Total Financial Inclusion’

General definition of financial inclusion q Accessing to banking services at affordable cost - Opening of ‘no frills account’ - Issue of ‘General Purpose Credit Card’

General definition of financial inclusion q Accessing to banking services at affordable cost - Opening of ‘no frills account’ - Issue of ‘General Purpose Credit Card’

Objective • To address all the financial needs of all households

Objective • To address all the financial needs of all households

Should we focus on all or should we focus on poor ?

Should we focus on all or should we focus on poor ?

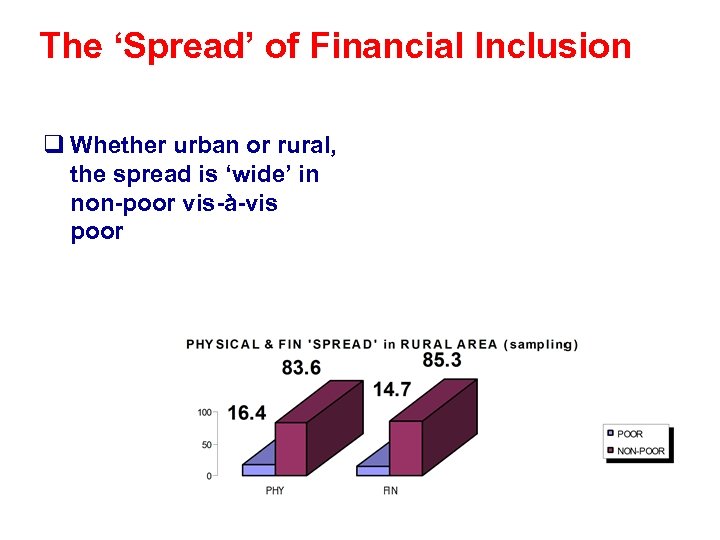

The ‘Spread’ of Financial Inclusion q Whether urban or rural, the spread is ‘wide’ in non-poor vis-à-vis poor

The ‘Spread’ of Financial Inclusion q Whether urban or rural, the spread is ‘wide’ in non-poor vis-à-vis poor

Analysis of financial needs of the poor

Analysis of financial needs of the poor

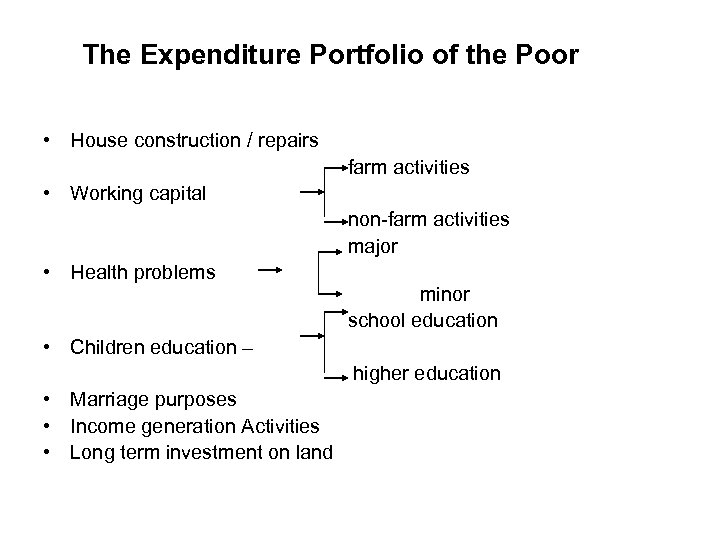

The Expenditure Portfolio of the Poor • House construction / repairs farm activities • Working capital • Health problems non-farm activities major minor school education • Children education – higher education • Marriage purposes • Income generation Activities • Long term investment on land

The Expenditure Portfolio of the Poor • House construction / repairs farm activities • Working capital • Health problems non-farm activities major minor school education • Children education – higher education • Marriage purposes • Income generation Activities • Long term investment on land

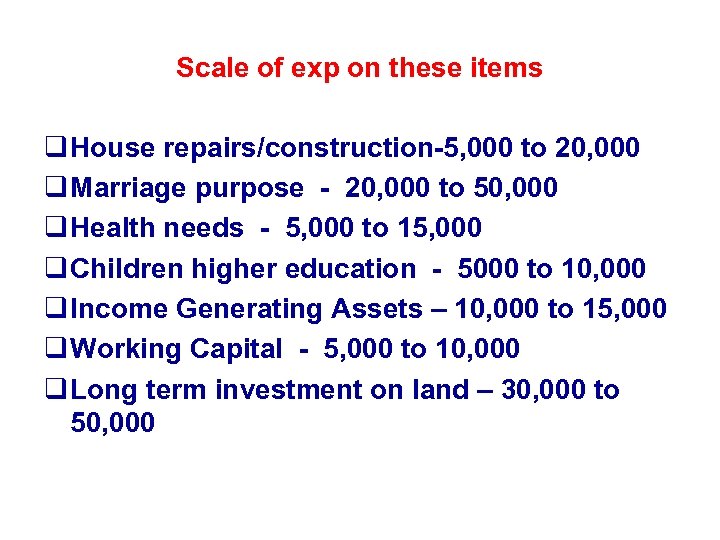

Scale of exp on these items q House repairs/construction-5, 000 to 20, 000 q Marriage purpose - 20, 000 to 50, 000 q Health needs - 5, 000 to 15, 000 q Children higher education - 5000 to 10, 000 q Income Generating Assets – 10, 000 to 15, 000 q Working Capital - 5, 000 to 10, 000 q Long term investment on land – 30, 000 to 50, 000

Scale of exp on these items q House repairs/construction-5, 000 to 20, 000 q Marriage purpose - 20, 000 to 50, 000 q Health needs - 5, 000 to 15, 000 q Children higher education - 5000 to 10, 000 q Income Generating Assets – 10, 000 to 15, 000 q Working Capital - 5, 000 to 10, 000 q Long term investment on land – 30, 000 to 50, 000

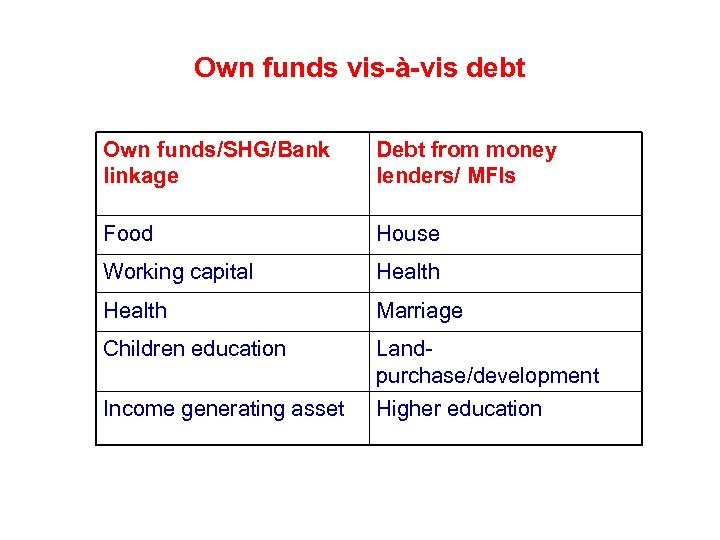

Own funds vis-à-vis debt Own funds/SHG/Bank linkage Debt from money lenders/ MFIs Food House Working capital Health Marriage Children education Landpurchase/development Income generating asset Higher education

Own funds vis-à-vis debt Own funds/SHG/Bank linkage Debt from money lenders/ MFIs Food House Working capital Health Marriage Children education Landpurchase/development Income generating asset Higher education

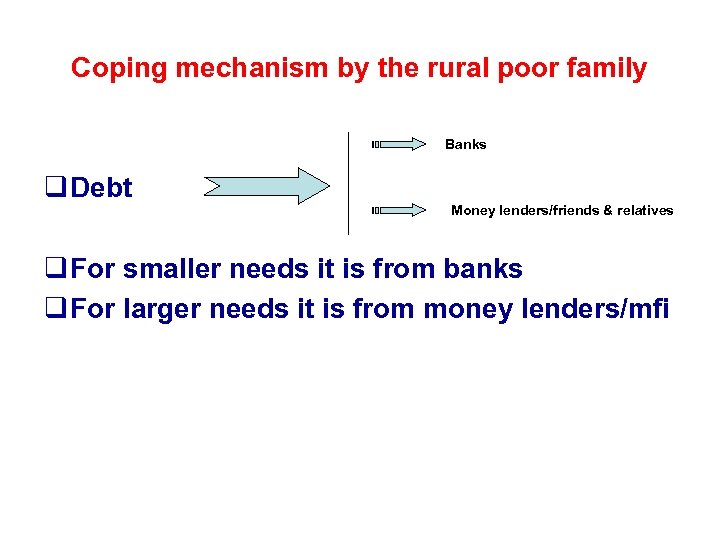

Coping mechanism by the rural poor family Banks q Debt Money lenders/friends & relatives q For smaller needs it is from banks q For larger needs it is from money lenders/mfi

Coping mechanism by the rural poor family Banks q Debt Money lenders/friends & relatives q For smaller needs it is from banks q For larger needs it is from money lenders/mfi

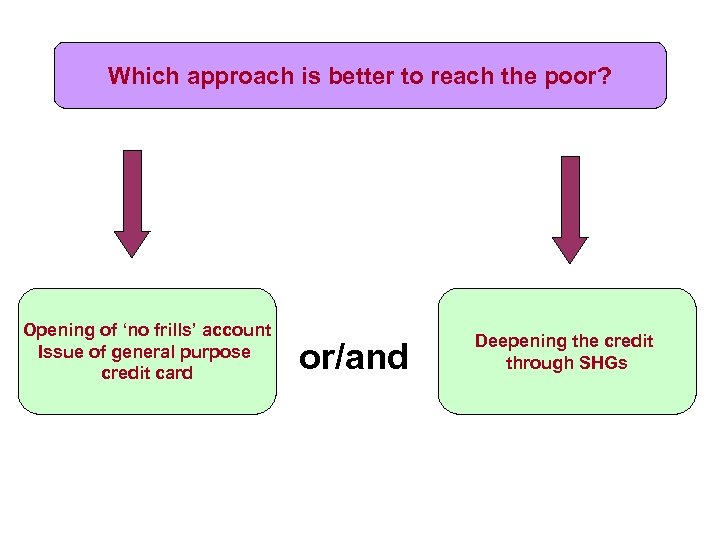

Which approach is better to reach the poor? Opening of ‘no frills’ account Issue of general purpose credit card or/and Deepening the credit through SHGs

Which approach is better to reach the poor? Opening of ‘no frills’ account Issue of general purpose credit card or/and Deepening the credit through SHGs

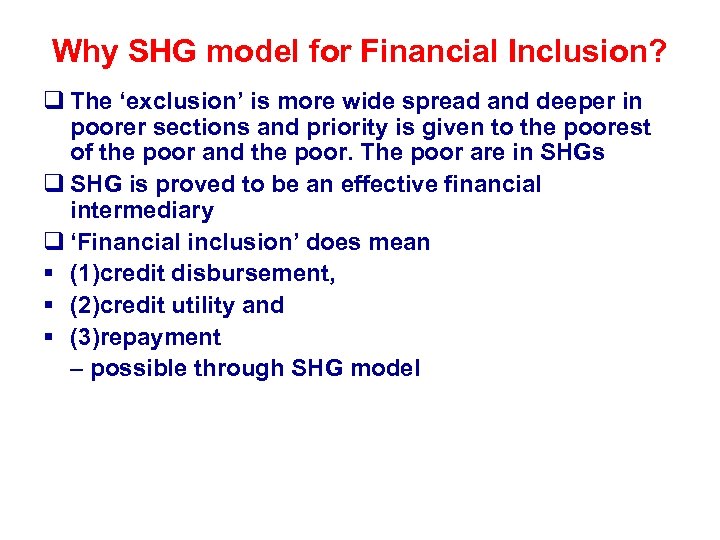

Why SHG model for Financial Inclusion? q The ‘exclusion’ is more wide spread and deeper in poorer sections and priority is given to the poorest of the poor and the poor. The poor are in SHGs q SHG is proved to be an effective financial intermediary q ‘Financial inclusion’ does mean § (1)credit disbursement, § (2)credit utility and § (3)repayment – possible through SHG model

Why SHG model for Financial Inclusion? q The ‘exclusion’ is more wide spread and deeper in poorer sections and priority is given to the poorest of the poor and the poor. The poor are in SHGs q SHG is proved to be an effective financial intermediary q ‘Financial inclusion’ does mean § (1)credit disbursement, § (2)credit utility and § (3)repayment – possible through SHG model

Financial inclusion of Poor in Andhra Pradesh through SHG-Bank linkage

Financial inclusion of Poor in Andhra Pradesh through SHG-Bank linkage

Financial inclusion of the poor in Andhra Pradesh through SHG-Bank linkage q In AP, 90 -95% of the poor are in SHGs and hence, ‘inclusion’ is wider (number covered) in the poor. q But inclusion is NOT deeper (when compared to financial needs)

Financial inclusion of the poor in Andhra Pradesh through SHG-Bank linkage q In AP, 90 -95% of the poor are in SHGs and hence, ‘inclusion’ is wider (number covered) in the poor. q But inclusion is NOT deeper (when compared to financial needs)

Financial inclusion – not deeper - empirical evidence

Financial inclusion – not deeper - empirical evidence

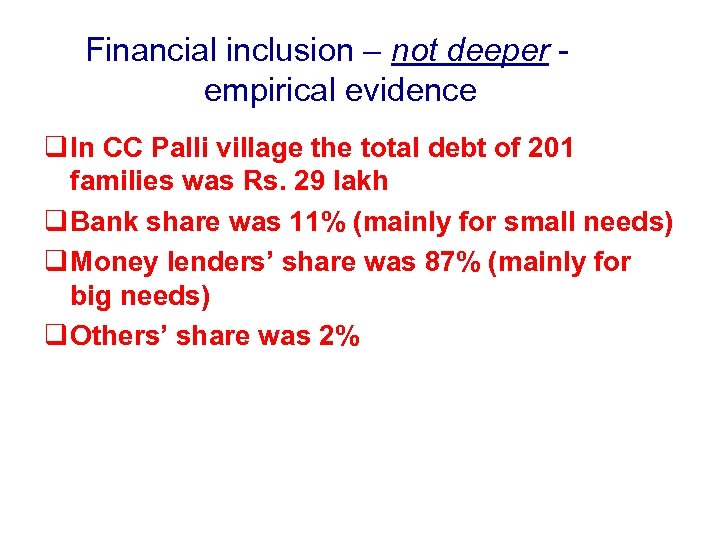

Financial inclusion – not deeper - empirical evidence q In CC Palli village the total debt of 201 families was Rs. 29 lakh q Bank share was 11% (mainly for small needs) q Money lenders’ share was 87% (mainly for big needs) q Others’ share was 2%

Financial inclusion – not deeper - empirical evidence q In CC Palli village the total debt of 201 families was Rs. 29 lakh q Bank share was 11% (mainly for small needs) q Money lenders’ share was 87% (mainly for big needs) q Others’ share was 2%

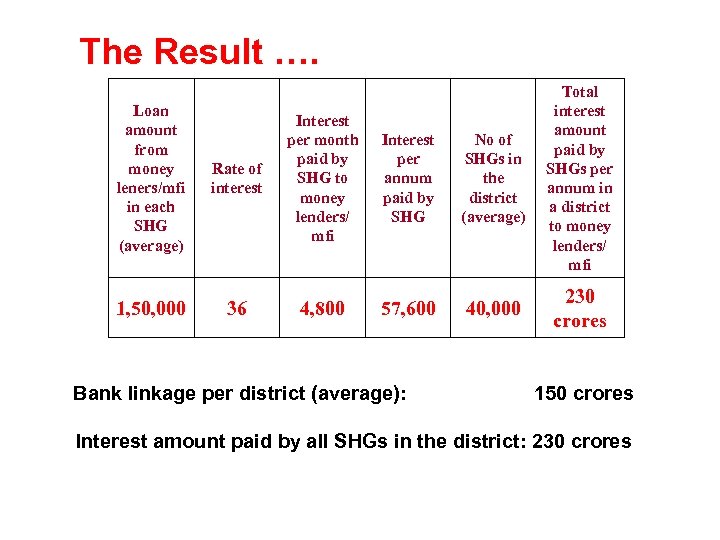

The Result …. Loan amount from money leners/mfi in each SHG (average) 1, 50, 000 Rate of interest Interest per month paid by SHG to money lenders/ mfi Interest per annum paid by SHG No of SHGs in the district (average) Total interest amount paid by SHGs per annum in a district to money lenders/ mfi 36 4, 800 57, 600 40, 000 230 crores Bank linkage per district (average): 150 crores Interest amount paid by all SHGs in the district: 230 crores

The Result …. Loan amount from money leners/mfi in each SHG (average) 1, 50, 000 Rate of interest Interest per month paid by SHG to money lenders/ mfi Interest per annum paid by SHG No of SHGs in the district (average) Total interest amount paid by SHGs per annum in a district to money lenders/ mfi 36 4, 800 57, 600 40, 000 230 crores Bank linkage per district (average): 150 crores Interest amount paid by all SHGs in the district: 230 crores

PLAN OF ACTION

PLAN OF ACTION

Piloting the model q Take up this model in two villages in each service area of each bank-branch during 2007 -08.

Piloting the model q Take up this model in two villages in each service area of each bank-branch during 2007 -08.

Identification of village § Having good track record in SHG-Bank Linkage § Having SHGs which are following best practices § Having good book keeping practices in SHGs § Having SHGs with Poorest of the Poor and SCs and STs § Identification shall be done in consultation with CBRM/Mandal Samakhya

Identification of village § Having good track record in SHG-Bank Linkage § Having SHGs which are following best practices § Having good book keeping practices in SHGs § Having SHGs with Poorest of the Poor and SCs and STs § Identification shall be done in consultation with CBRM/Mandal Samakhya

Pre-conditions § Facilitating the SHGs to enable them to be good SHGs - at least THREE months preparatory work has to be done in the village § All the members of each SHG shall be educated on financial inclusion § Book-keeping shall be strengthened § Good Monitoring mechanism shall be positioned

Pre-conditions § Facilitating the SHGs to enable them to be good SHGs - at least THREE months preparatory work has to be done in the village § All the members of each SHG shall be educated on financial inclusion § Book-keeping shall be strengthened § Good Monitoring mechanism shall be positioned

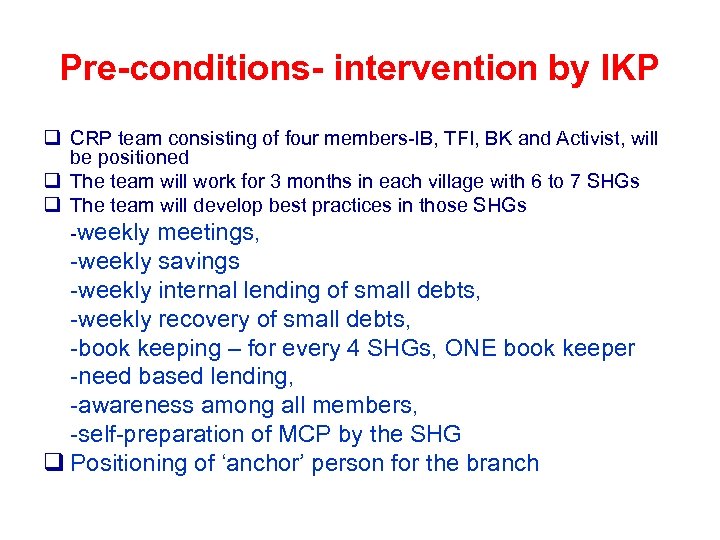

Pre-conditions- intervention by IKP q CRP team consisting of four members-IB, TFI, BK and Activist, will be positioned q The team will work for 3 months in each village with 6 to 7 SHGs q The team will develop best practices in those SHGs -weekly meetings, -weekly savings -weekly internal lending of small debts, -weekly recovery of small debts, -book keeping – for every 4 SHGs, ONE book keeper -need based lending, -awareness among all members, -self-preparation of MCP by the SHG q Positioning of ‘anchor’ person for the branch

Pre-conditions- intervention by IKP q CRP team consisting of four members-IB, TFI, BK and Activist, will be positioned q The team will work for 3 months in each village with 6 to 7 SHGs q The team will develop best practices in those SHGs -weekly meetings, -weekly savings -weekly internal lending of small debts, -weekly recovery of small debts, -book keeping – for every 4 SHGs, ONE book keeper -need based lending, -awareness among all members, -self-preparation of MCP by the SHG q Positioning of ‘anchor’ person for the branch

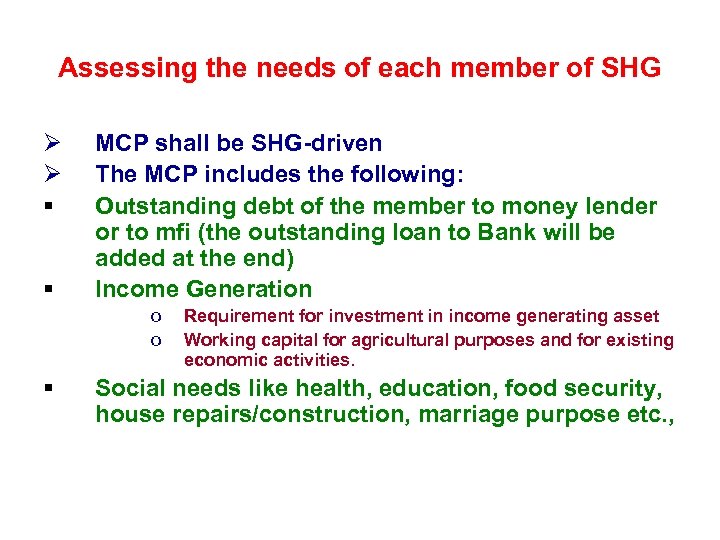

Assessing the needs of each member of SHG Ø Ø § § MCP shall be SHG-driven The MCP includes the following: Outstanding debt of the member to money lender or to mfi (the outstanding loan to Bank will be added at the end) Income Generation o o § Requirement for investment in income generating asset Working capital for agricultural purposes and for existing economic activities. Social needs like health, education, food security, house repairs/construction, marriage purpose etc. ,

Assessing the needs of each member of SHG Ø Ø § § MCP shall be SHG-driven The MCP includes the following: Outstanding debt of the member to money lender or to mfi (the outstanding loan to Bank will be added at the end) Income Generation o o § Requirement for investment in income generating asset Working capital for agricultural purposes and for existing economic activities. Social needs like health, education, food security, house repairs/construction, marriage purpose etc. ,

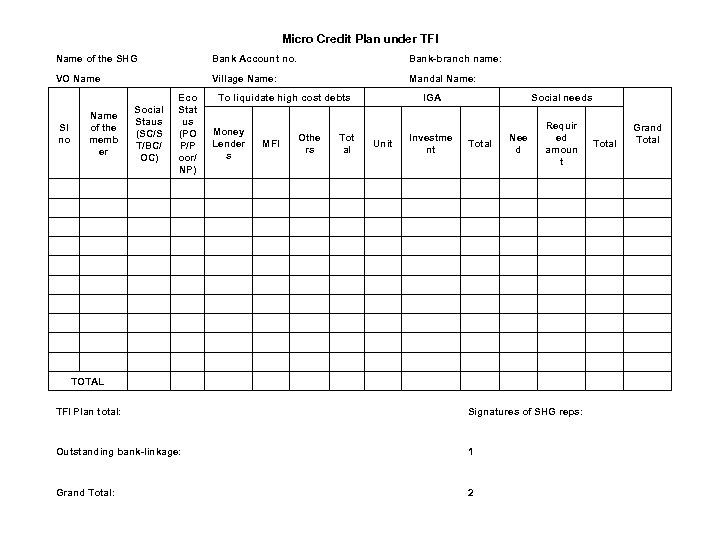

Micro Credit Plan under TFI Name of the SHG Bank Account no. Bank-branch name: VO Name Village Name: Mandal Name: Sl no Name of the memb er Social Staus (SC/S T/BC/ OC) Eco Stat us (PO P/P oor/ NP) To liquidate high cost debts IGA Social needs Total Nee d Requir ed amoun t Total Grand Total TOTAL Money Lender s MFI Othe rs Tot al Unit Investme nt TFI Plan total: Signatures of SHG reps: Outstanding bank-linkage: 1 Grand Total: 2

Micro Credit Plan under TFI Name of the SHG Bank Account no. Bank-branch name: VO Name Village Name: Mandal Name: Sl no Name of the memb er Social Staus (SC/S T/BC/ OC) Eco Stat us (PO P/P oor/ NP) To liquidate high cost debts IGA Social needs Total Nee d Requir ed amoun t Total Grand Total TOTAL Money Lender s MFI Othe rs Tot al Unit Investme nt TFI Plan total: Signatures of SHG reps: Outstanding bank-linkage: 1 Grand Total: 2

Repayment by members to SHG § The installment shall comprise both principal and interest § It shall be monthly installment § It shall not be short term repayment – minimum 60 months § The members’ repayment is as per their capacity to re-pay § The members’ repayment schedule may vary-below 60 months-may be 40 to 48 months § There shall be surplus in SHG in every month

Repayment by members to SHG § The installment shall comprise both principal and interest § It shall be monthly installment § It shall not be short term repayment – minimum 60 months § The members’ repayment is as per their capacity to re-pay § The members’ repayment schedule may vary-below 60 months-may be 40 to 48 months § There shall be surplus in SHG in every month

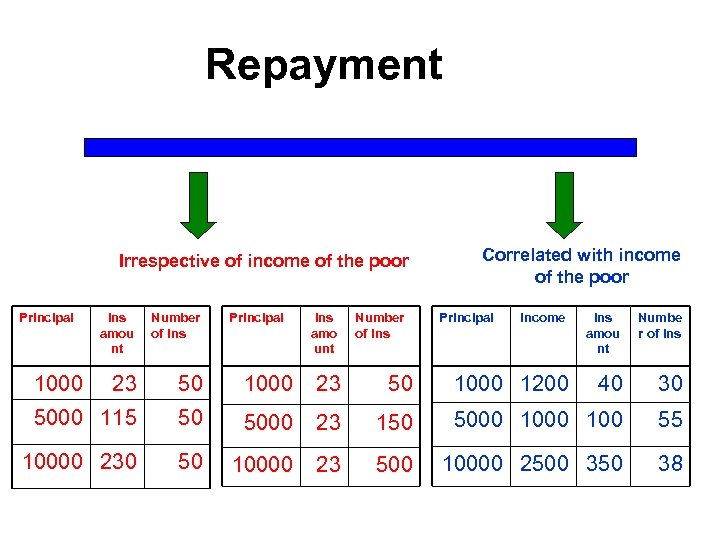

Repayment Irrespective of income of the poor Principal Ins amou nt Number of Ins 23 50 1000 23 50 5000 115 50 5000 23 10000 230 50 10000 23 1000 Principal Ins amo unt Number of Ins Correlated with income of the poor Principal Income Ins amou nt Numbe r of Ins 1000 1200 40 30 150 5000 100 55 500 10000 2500 350 38

Repayment Irrespective of income of the poor Principal Ins amou nt Number of Ins 23 50 1000 23 50 5000 115 50 5000 23 10000 230 50 10000 23 1000 Principal Ins amo unt Number of Ins Correlated with income of the poor Principal Income Ins amou nt Numbe r of Ins 1000 1200 40 30 150 5000 100 55 500 10000 2500 350 38

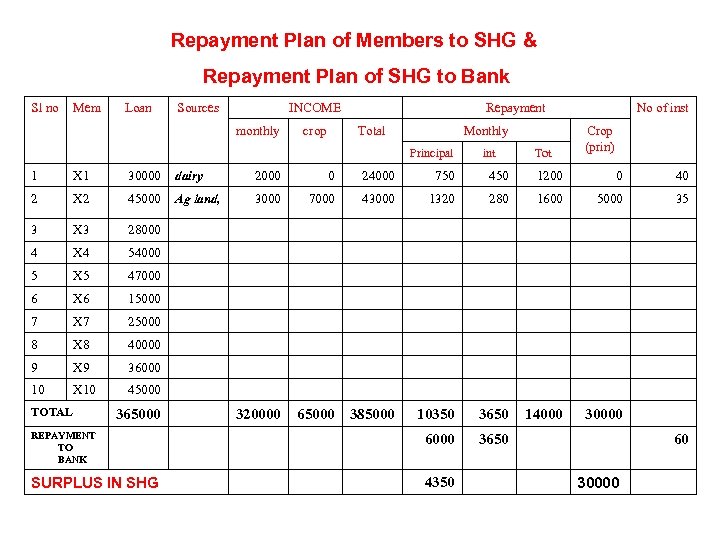

Repayment Plan of Members to SHG & Repayment Plan of SHG to Bank Sl no Mem Loan Sources INCOME monthly crop Repayment Total Monthly Principal int Tot No of inst Crop (prin) 1 X 1 30000 dairy 2000 0 24000 750 450 1200 0 40 2 X 2 45000 Ag land, 3000 7000 43000 1320 280 1600 5000 35 3 X 3 28000 4 X 4 54000 5 X 5 47000 6 X 6 15000 7 X 7 25000 8 X 8 40000 9 X 9 36000 10 X 10 45000 320000 65000 385000 10350 3650 14000 30000 REPAYMENT TO BANK 6000 3650 SURPLUS IN SHG 4350 TOTAL 365000 60 30000

Repayment Plan of Members to SHG & Repayment Plan of SHG to Bank Sl no Mem Loan Sources INCOME monthly crop Repayment Total Monthly Principal int Tot No of inst Crop (prin) 1 X 1 30000 dairy 2000 0 24000 750 450 1200 0 40 2 X 2 45000 Ag land, 3000 7000 43000 1320 280 1600 5000 35 3 X 3 28000 4 X 4 54000 5 X 5 47000 6 X 6 15000 7 X 7 25000 8 X 8 40000 9 X 9 36000 10 X 10 45000 320000 65000 385000 10350 3650 14000 30000 REPAYMENT TO BANK 6000 3650 SURPLUS IN SHG 4350 TOTAL 365000 60 30000

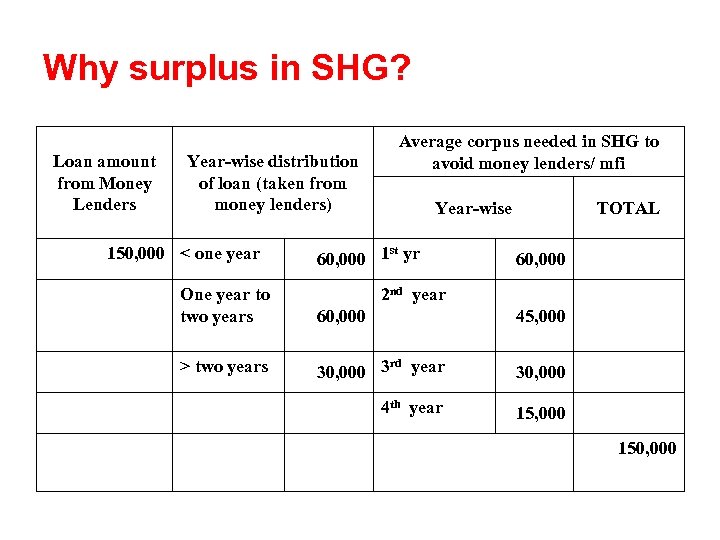

Why surplus in SHG? Loan amount from Money Lenders Year-wise distribution of loan (taken from money lenders) 150, 000 < one year One year to two years > two years Average corpus needed in SHG to avoid money lenders/ mfi Year-wise st 60, 000 1 yr TOTAL 60, 000 2 nd year 60, 000 45, 000 rd 30, 000 3 year 30, 000 4 th year 15, 000 150, 000

Why surplus in SHG? Loan amount from Money Lenders Year-wise distribution of loan (taken from money lenders) 150, 000 < one year One year to two years > two years Average corpus needed in SHG to avoid money lenders/ mfi Year-wise st 60, 000 1 yr TOTAL 60, 000 2 nd year 60, 000 45, 000 rd 30, 000 3 year 30, 000 4 th year 15, 000 150, 000

How to pay on monthly basis by the member ?

How to pay on monthly basis by the member ?

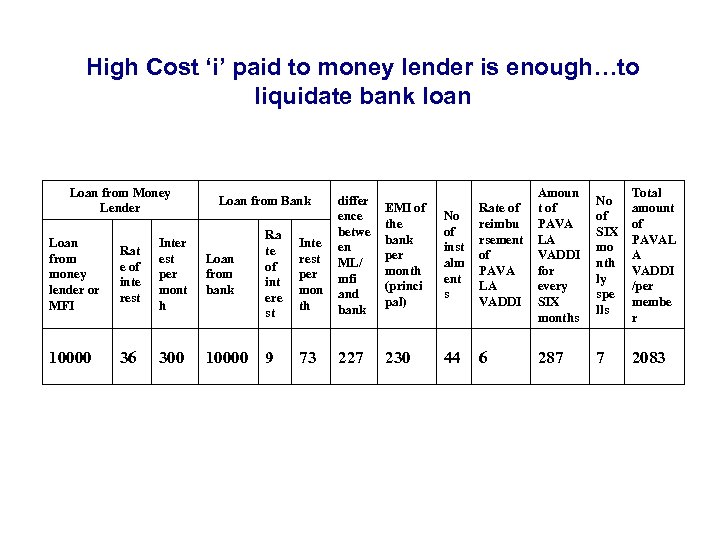

High Cost ‘i’ paid to money lender is enough…to liquidate bank loan Loan from Money Lender Loan from money lender or MFI 10000 Rat e of inte rest Inter est per mont h 36 300 Loan from Bank Loan from bank Ra te of int ere st Inte rest per mon th differ ence betwe en ML/ mfi and bank 10000 9 73 227 EMI of the bank per month (princi pal) No of inst alm ent s 230 44 Rate of reimbu rsement of PAVA LA VADDI Amoun t of PAVA LA VADDI for every SIX months No of SIX mo nth ly spe lls Total amount of PAVAL A VADDI /per membe r 6 287 7 2083

High Cost ‘i’ paid to money lender is enough…to liquidate bank loan Loan from Money Lender Loan from money lender or MFI 10000 Rat e of inte rest Inter est per mont h 36 300 Loan from Bank Loan from bank Ra te of int ere st Inte rest per mon th differ ence betwe en ML/ mfi and bank 10000 9 73 227 EMI of the bank per month (princi pal) No of inst alm ent s 230 44 Rate of reimbu rsement of PAVA LA VADDI Amoun t of PAVA LA VADDI for every SIX months No of SIX mo nth ly spe lls Total amount of PAVAL A VADDI /per membe r 6 287 7 2083

Monthly payments…. . § Stabilising the monthly income § Multiple livelihoods § Access to Employment Guarantee Scheme

Monthly payments…. . § Stabilising the monthly income § Multiple livelihoods § Access to Employment Guarantee Scheme

If a big loan is again required …….

If a big loan is again required …….

Increase in the corpus of SHG Ø Surplus in SHG every month-the difference between members’ repayment to SHG and SHG’s repayment to bank ØIncrease in savings by the member in SHG

Increase in the corpus of SHG Ø Surplus in SHG every month-the difference between members’ repayment to SHG and SHG’s repayment to bank ØIncrease in savings by the member in SHG

Increase in the corpus of VO • Increase in savings by the SHG to VO • Introduction of ‘APADA NIDHI’-Rs. 10 per each member with VO • Converting the CIF into ‘emergency fund’

Increase in the corpus of VO • Increase in savings by the SHG to VO • Introduction of ‘APADA NIDHI’-Rs. 10 per each member with VO • Converting the CIF into ‘emergency fund’

Financial Inclusion and other products Ø To members Ø To Village Organisation

Financial Inclusion and other products Ø To members Ø To Village Organisation

Other Products to members of SHG Ø savings product – RD for their children Ø insurance product-covering life, health, and assets Ø educational loan product through SHGs

Other Products to members of SHG Ø savings product – RD for their children Ø insurance product-covering life, health, and assets Ø educational loan product through SHGs

Cash Credit Limit to VO Ø Ø Ø Food Security initiative Milk collection centers Marketing activities The limit may be provided to the VO as per the guidelines approved by SLBC.

Cash Credit Limit to VO Ø Ø Ø Food Security initiative Milk collection centers Marketing activities The limit may be provided to the VO as per the guidelines approved by SLBC.

Interventions in ‘key activities’ by the project • Identification of those ‘key’ activities, where huge investments are made by the members • Providing backward and forward linkages to increase production and marketing access

Interventions in ‘key activities’ by the project • Identification of those ‘key’ activities, where huge investments are made by the members • Providing backward and forward linkages to increase production and marketing access

Monitoring

Monitoring

Self-monitoring by SHG and VO • ‘Vetting’ of the plan by the SHG itself and later by the VO • Disbursement of loan to the members as per MCP • Utilization of loan by the member in the presence of the SHG or it’s committee • Submission of UC by the SHG to the bank and to the VO • Verification of assets purchased by SHG in a periodical manner by SHG itself and by VO

Self-monitoring by SHG and VO • ‘Vetting’ of the plan by the SHG itself and later by the VO • Disbursement of loan to the members as per MCP • Utilization of loan by the member in the presence of the SHG or it’s committee • Submission of UC by the SHG to the bank and to the VO • Verification of assets purchased by SHG in a periodical manner by SHG itself and by VO

Monitoring – intervention by IKP … Ø Community Based Recovery Mechanism (CBRM) Ø Participation of Branch Manager/Field Officer in VO’s scheduled meeting Ø Computerisation of transactions Ø One Anchor Person for each bankbranch

Monitoring – intervention by IKP … Ø Community Based Recovery Mechanism (CBRM) Ø Participation of Branch Manager/Field Officer in VO’s scheduled meeting Ø Computerisation of transactions Ø One Anchor Person for each bankbranch

Community Based Recovery Mechanism (CBRM) q Two members from each VO q All the rep from all VOs in a service area will form into CBRM q They will meet once in a month on a fixed date in the premisis of the branch q Each VO committee will maintain DCB of the linkage for that VO and bring it to the meeting q The OD & NPA will be discussed and corrective action will be taken by the committee before the next meeting and ensures 100% recovery q The utility of the loans will also be monitored by the committee and discussed in the meeting

Community Based Recovery Mechanism (CBRM) q Two members from each VO q All the rep from all VOs in a service area will form into CBRM q They will meet once in a month on a fixed date in the premisis of the branch q Each VO committee will maintain DCB of the linkage for that VO and bring it to the meeting q The OD & NPA will be discussed and corrective action will be taken by the committee before the next meeting and ensures 100% recovery q The utility of the loans will also be monitored by the committee and discussed in the meeting

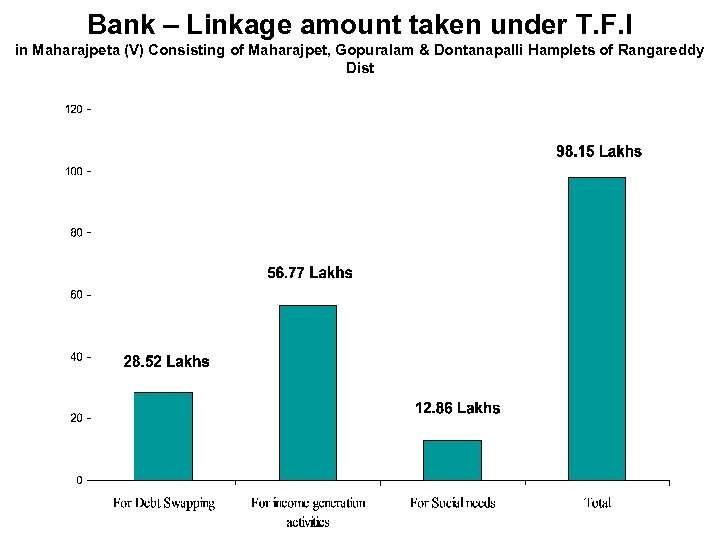

Bank – Linkage amount taken under T. F. I in Maharajpeta (V) Consisting of Maharajpet, Gopuralam & Dontanapalli Hamplets of Rangareddy Dist

Bank – Linkage amount taken under T. F. I in Maharajpeta (V) Consisting of Maharajpet, Gopuralam & Dontanapalli Hamplets of Rangareddy Dist

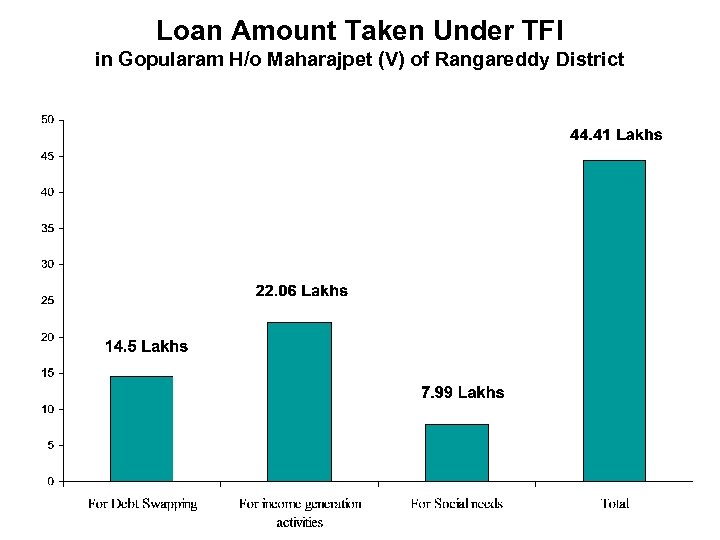

Loan Amount Taken Under TFI in Gopularam H/o Maharajpet (V) of Rangareddy District

Loan Amount Taken Under TFI in Gopularam H/o Maharajpet (V) of Rangareddy District

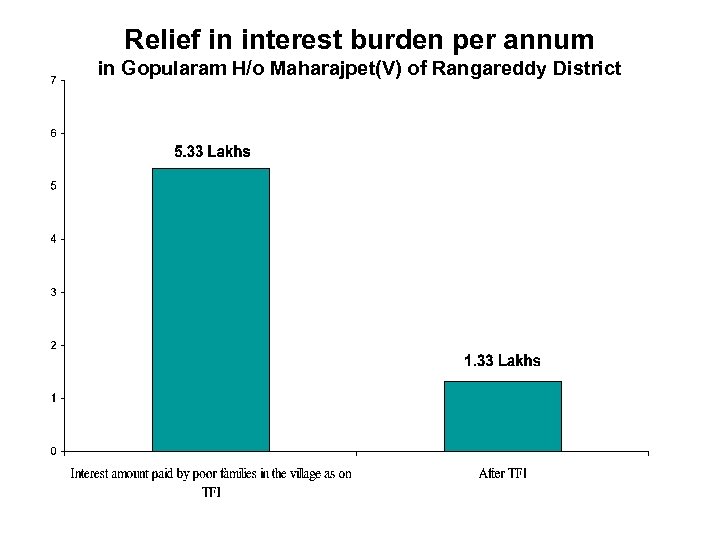

Relief in interest burden per annum in Gopularam H/o Maharajpet(V) of Rangareddy District

Relief in interest burden per annum in Gopularam H/o Maharajpet(V) of Rangareddy District

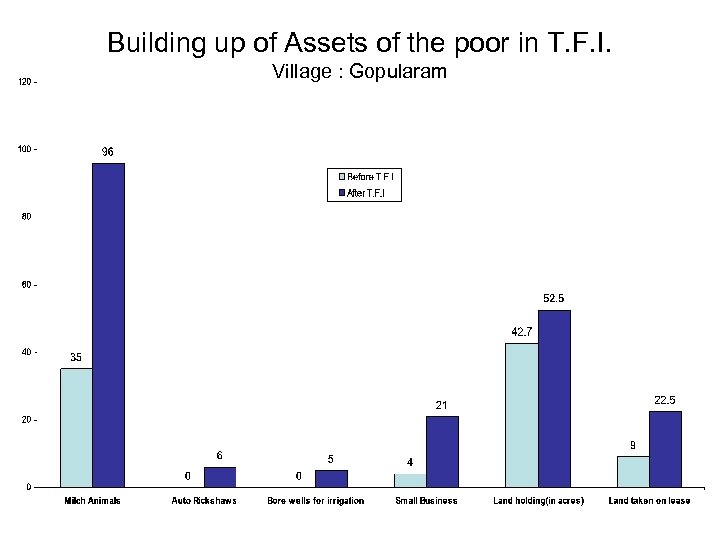

Building up of Assets of the poor in T. F. I. Village : Gopularam

Building up of Assets of the poor in T. F. I. Village : Gopularam

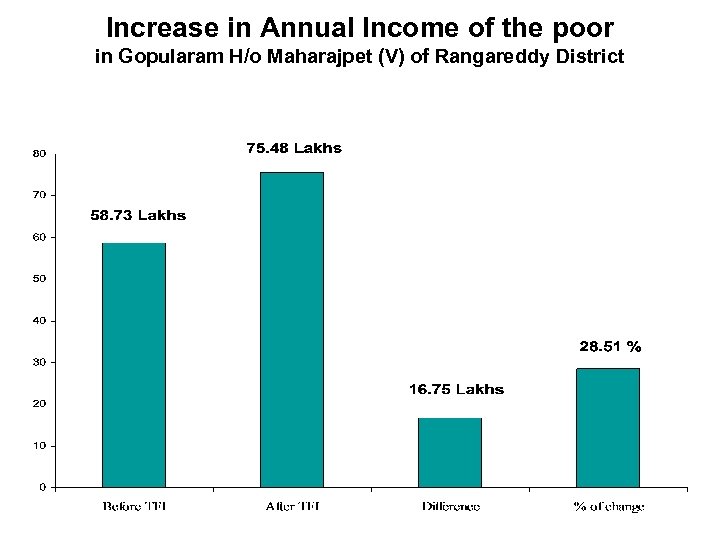

Increase in Annual Income of the poor in Gopularam H/o Maharajpet (V) of Rangareddy District

Increase in Annual Income of the poor in Gopularam H/o Maharajpet (V) of Rangareddy District

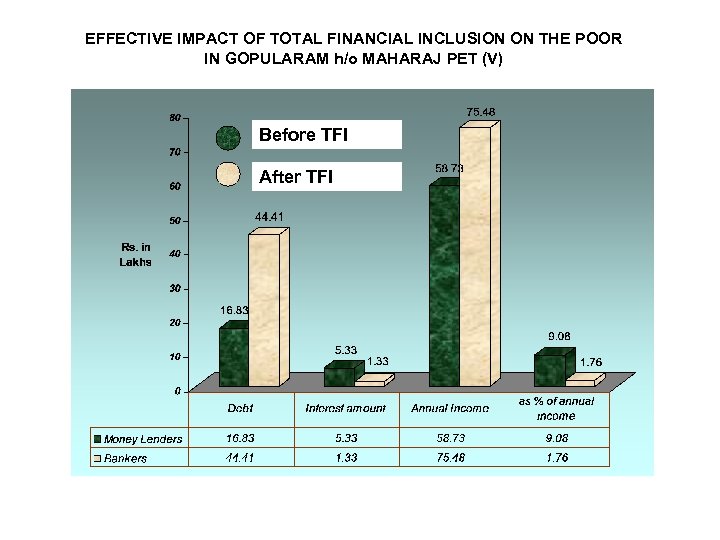

EFFECTIVE IMPACT OF TOTAL FINANCIAL INCLUSION ON THE POOR IN GOPULARAM h/o MAHARAJ PET (V) Before TFI After TFI

EFFECTIVE IMPACT OF TOTAL FINANCIAL INCLUSION ON THE POOR IN GOPULARAM h/o MAHARAJ PET (V) Before TFI After TFI

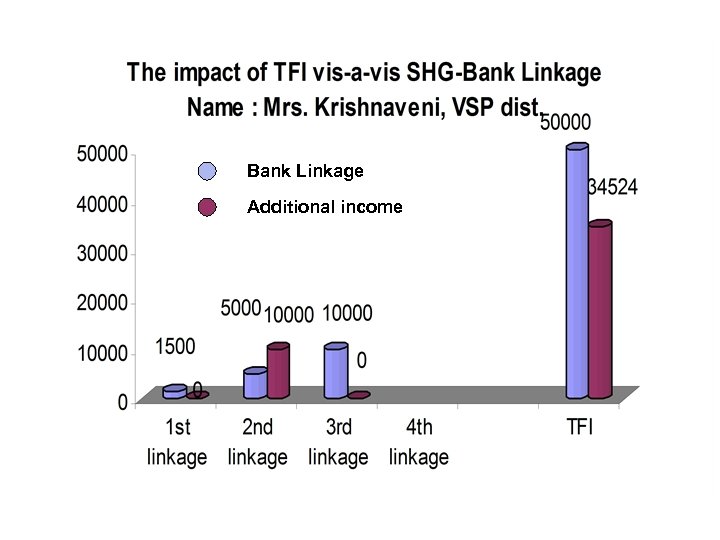

Bank Linkage Additional income

Bank Linkage Additional income

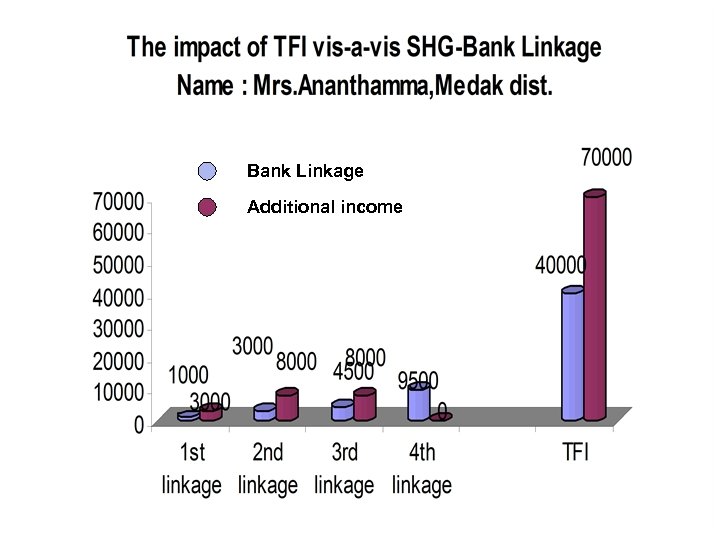

Bank Linkage Additional income

Bank Linkage Additional income

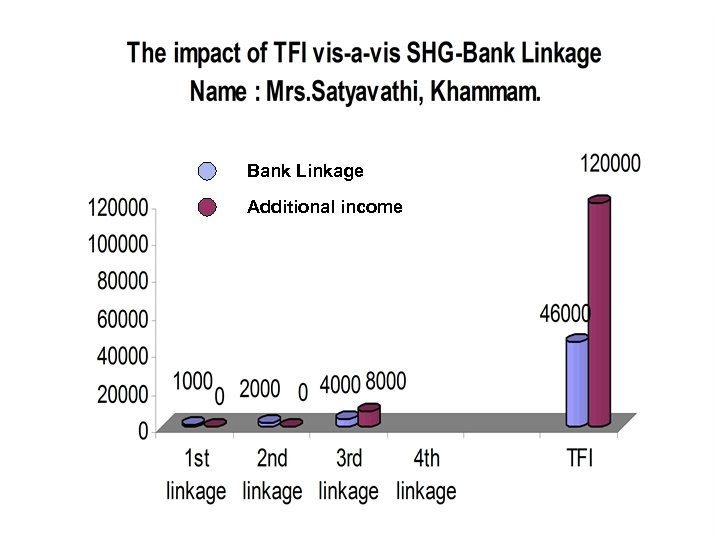

Bank Linkage Additional income

Bank Linkage Additional income

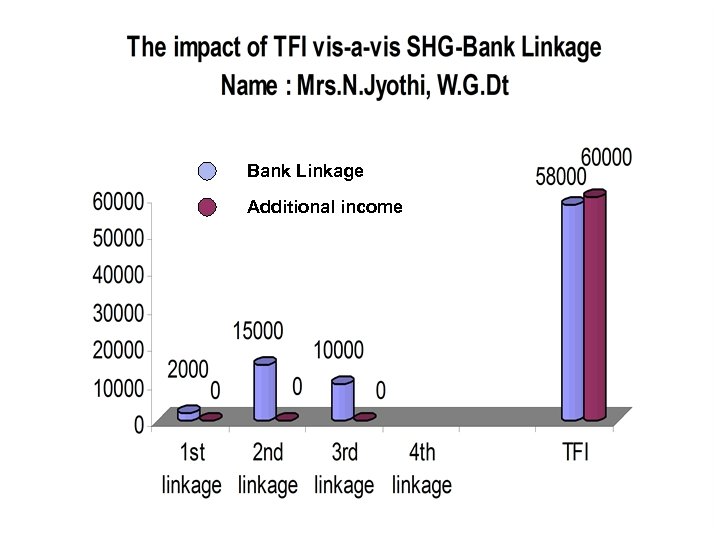

Bank Linkage Additional income

Bank Linkage Additional income

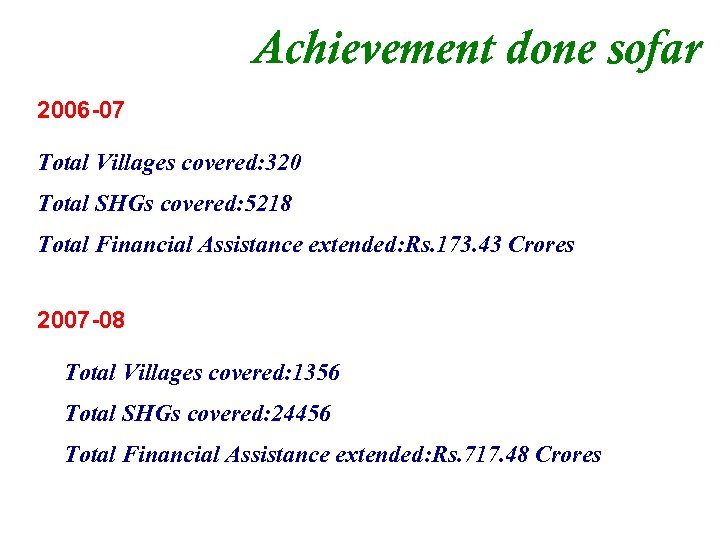

Achievement done sofar 2006 -07 Total Villages covered: 320 Total SHGs covered: 5218 Total Financial Assistance extended: Rs. 173. 43 Crores 2007 -08 Total Villages covered: 1356 Total SHGs covered: 24456 Total Financial Assistance extended: Rs. 717. 48 Crores

Achievement done sofar 2006 -07 Total Villages covered: 320 Total SHGs covered: 5218 Total Financial Assistance extended: Rs. 173. 43 Crores 2007 -08 Total Villages covered: 1356 Total SHGs covered: 24456 Total Financial Assistance extended: Rs. 717. 48 Crores

FOOD SECURITY

FOOD SECURITY

The reason • The availability of rice under PDS is on an average 15 kg/month per family • The requirement of rice for an average size family in rural area is 50 kg/month • The gap is on average 35 kg/month • The 35 kg/month is used to be procured from open market • 2/3 rd of the food security of the poor becomes vulnerable and subject to market fluctuations

The reason • The availability of rice under PDS is on an average 15 kg/month per family • The requirement of rice for an average size family in rural area is 50 kg/month • The gap is on average 35 kg/month • The 35 kg/month is used to be procured from open market • 2/3 rd of the food security of the poor becomes vulnerable and subject to market fluctuations

The coping mechanism • The stream of income of the poor is not regular-it is fluctuating on day basis • The expenditure for food for each day is more or less the same • The negative gap is being met by the poor either through borrowing or obtaining the food grains on credit basis or adjusted with low intake • The sufferers in the family are women and children

The coping mechanism • The stream of income of the poor is not regular-it is fluctuating on day basis • The expenditure for food for each day is more or less the same • The negative gap is being met by the poor either through borrowing or obtaining the food grains on credit basis or adjusted with low intake • The sufferers in the family are women and children

Objectives • To attempt to minimise the “Food Gap” in POP and the Poor • To facilitate for the emergence of ‘Total Food Security’ to the target poor at household level • To minimize the rate of exploitation in consumption expenditure made by the poor. • To provide access to good quality and accurate quantity of rice by the target poor through cheaper rates • TO correlate the nutritional improvement in the pregnant women and children with food security initiative

Objectives • To attempt to minimise the “Food Gap” in POP and the Poor • To facilitate for the emergence of ‘Total Food Security’ to the target poor at household level • To minimize the rate of exploitation in consumption expenditure made by the poor. • To provide access to good quality and accurate quantity of rice by the target poor through cheaper rates • TO correlate the nutritional improvement in the pregnant women and children with food security initiative

Rice Credit Line-Reduction in Food Gap • Identifying the gap between the actual requirement of rice per month for each house-hold and the rice availability from FP shop • Consolidating the requirement at VO level • Provision of funds from the CIF @ 90 % of the required funds – 10% being the beneficiary contribution

Rice Credit Line-Reduction in Food Gap • Identifying the gap between the actual requirement of rice per month for each house-hold and the rice availability from FP shop • Consolidating the requirement at VO level • Provision of funds from the CIF @ 90 % of the required funds – 10% being the beneficiary contribution

The Cyclical Process in Rice Credit Line • Procurement of required rice on monthly basis by the VO from open market • Distribute it to SHG members through SHGs • Recovery of money through 3 or 4 installments by the VO from SHGs in the same month with little profit margin

The Cyclical Process in Rice Credit Line • Procurement of required rice on monthly basis by the VO from open market • Distribute it to SHG members through SHGs • Recovery of money through 3 or 4 installments by the VO from SHGs in the same month with little profit margin

The Process • Sitting with the members of each SHG • Analyse the consumption pattern • Arriving at the rate of losses in respect of purchase of each commodity • Find out of the requirement of each member • Implementation in few VOs in each Mandal.

The Process • Sitting with the members of each SHG • Analyse the consumption pattern • Arriving at the rate of losses in respect of purchase of each commodity • Find out of the requirement of each member • Implementation in few VOs in each Mandal.

The facilitation support • Training the VO Executive Committee • Training the CC and Activists in pilot villages • Facilitating the emergence of purchase committee, monitoring committee and recovering committee in each VO. • Introduction of Books of Accounts.

The facilitation support • Training the VO Executive Committee • Training the CC and Activists in pilot villages • Facilitating the emergence of purchase committee, monitoring committee and recovering committee in each VO. • Introduction of Books of Accounts.

Implementation process-the collection of indent • Initially, requirement of each member in each SHG will be collected. • Requirements of the VO will be arrived. • Proposal will be sanctioned and the VO will be SPIA. • The purchase committee procures the rice by conducting market survey in respect of quality and the price of the

Implementation process-the collection of indent • Initially, requirement of each member in each SHG will be collected. • Requirements of the VO will be arrived. • Proposal will be sanctioned and the VO will be SPIA. • The purchase committee procures the rice by conducting market survey in respect of quality and the price of the

Implementation process-the distribution • The distribution committee will distribute to SHG leaders. • The SHG leaders will distribute to each member on the same day. • At every stage of distribution, the acknowledgements will be collected.

Implementation process-the distribution • The distribution committee will distribute to SHG leaders. • The SHG leaders will distribute to each member on the same day. • At every stage of distribution, the acknowledgements will be collected.

Time line • First of every month SHG requirement is collected, • 2 nd to 4 th of every month VO level requirement is collected, • 5 th to 10 th of every month, distribution of rice from the mill to the VO, VO to SHG, SHG to members.

Time line • First of every month SHG requirement is collected, • 2 nd to 4 th of every month VO level requirement is collected, • 5 th to 10 th of every month, distribution of rice from the mill to the VO, VO to SHG, SHG to members.

Time line (contd. . ) • 10 th every month, last date for distribution to the last member and collection of 1 st installment. • 17 th- 2 nd installment, • 24 th , 3 rd installment , • 30 th / 31 st final installment.

Time line (contd. . ) • 10 th every month, last date for distribution to the last member and collection of 1 st installment. • 17 th- 2 nd installment, • 24 th , 3 rd installment , • 30 th / 31 st final installment.

The basic model-rice centered • Only rice will be included • Recycling will be for every month or for every six months • One month-procurement from open market or by procuring the paddy • Six months- procurement of paddy, mill it in local rice mill and distribute to SHGs for every six months

The basic model-rice centered • Only rice will be included • Recycling will be for every month or for every six months • One month-procurement from open market or by procuring the paddy • Six months- procurement of paddy, mill it in local rice mill and distribute to SHGs for every six months

The Comprehensive model • The commodity basket includes five commodities- rice, red gram, tamarind, edible oil and red chillies • It will be either one month model or three month model or six month model • In chenchu and other tribal areas the Food Security Basket will comprise 25 -30 commodities-all house hold requirements

The Comprehensive model • The commodity basket includes five commodities- rice, red gram, tamarind, edible oil and red chillies • It will be either one month model or three month model or six month model • In chenchu and other tribal areas the Food Security Basket will comprise 25 -30 commodities-all house hold requirements

Procurement • If rice or paddy, it is at VO level • In respect of red gram, tamarind, edible oil and red chillies it will be at VO level or at MS level or at Area level • At VO level and MS level procurement committees are positioned out of the VO-EC or MS-EC as the case may be • At AREA level the procurement committee is constituted with two members from each MS within that MS

Procurement • If rice or paddy, it is at VO level • In respect of red gram, tamarind, edible oil and red chillies it will be at VO level or at MS level or at Area level • At VO level and MS level procurement committees are positioned out of the VO-EC or MS-EC as the case may be • At AREA level the procurement committee is constituted with two members from each MS within that MS

Recovery • If it is monthly recycling, the recovery will be completed from the members within 3 weeks • If it is 3 month/6 month model, recovery will be completed within 5 months • In monthly model, the instalments will be on weekly basis • In 6 monthly model the instalments will be on monthly basis

Recovery • If it is monthly recycling, the recovery will be completed from the members within 3 weeks • If it is 3 month/6 month model, recovery will be completed within 5 months • In monthly model, the instalments will be on weekly basis • In 6 monthly model the instalments will be on monthly basis

Funds • The corpus of the SHG • The CIF from the VO/MS • The cash credit limit by the bank to the VO

Funds • The corpus of the SHG • The CIF from the VO/MS • The cash credit limit by the bank to the VO

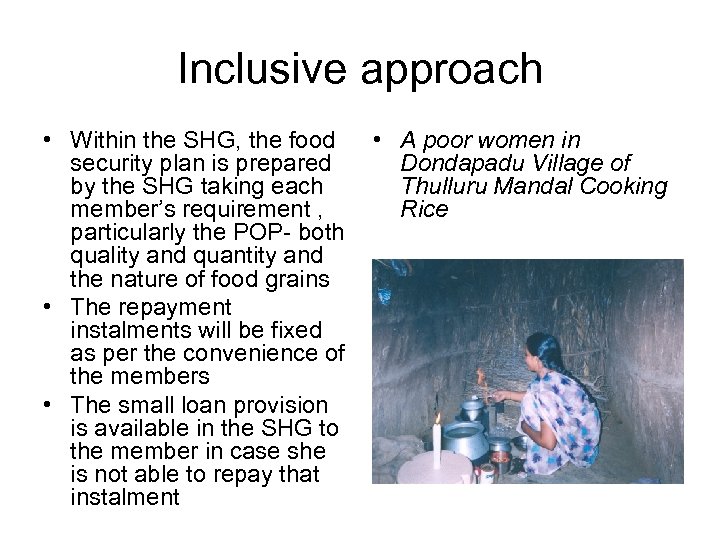

Inclusive approach • Within the SHG, the food • A poor women in security plan is prepared Dondapadu Village of by the SHG taking each Thulluru Mandal Cooking member’s requirement , Rice particularly the POP- both quality and quantity and the nature of food grains • The repayment instalments will be fixed as per the convenience of the members • The small loan provision is available in the SHG to the member in case she is not able to repay that instalment

Inclusive approach • Within the SHG, the food • A poor women in security plan is prepared Dondapadu Village of by the SHG taking each Thulluru Mandal Cooking member’s requirement , Rice particularly the POP- both quality and quantity and the nature of food grains • The repayment instalments will be fixed as per the convenience of the members • The small loan provision is available in the SHG to the member in case she is not able to repay that instalment

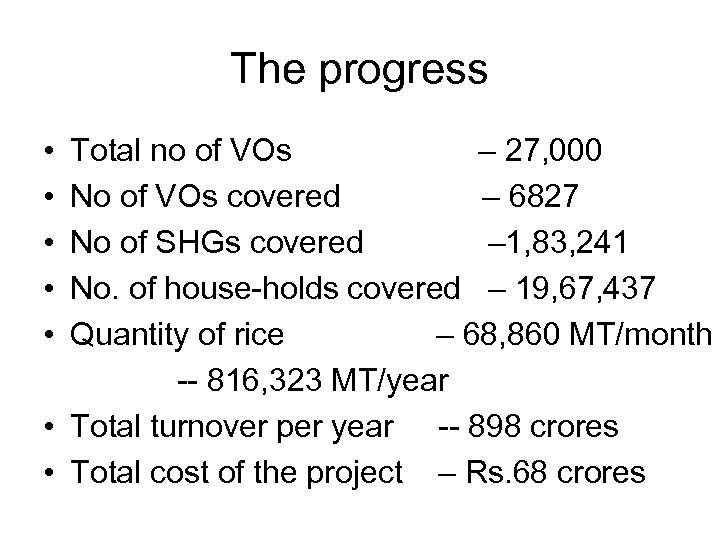

The progress • • • Total no of VOs – 27, 000 No of VOs covered – 6827 No of SHGs covered – 1, 83, 241 No. of house-holds covered – 19, 67, 437 Quantity of rice – 68, 860 MT/month -- 816, 323 MT/year • Total turnover per year -- 898 crores • Total cost of the project – Rs. 68 crores

The progress • • • Total no of VOs – 27, 000 No of VOs covered – 6827 No of SHGs covered – 1, 83, 241 No. of house-holds covered – 19, 67, 437 Quantity of rice – 68, 860 MT/month -- 816, 323 MT/year • Total turnover per year -- 898 crores • Total cost of the project – Rs. 68 crores

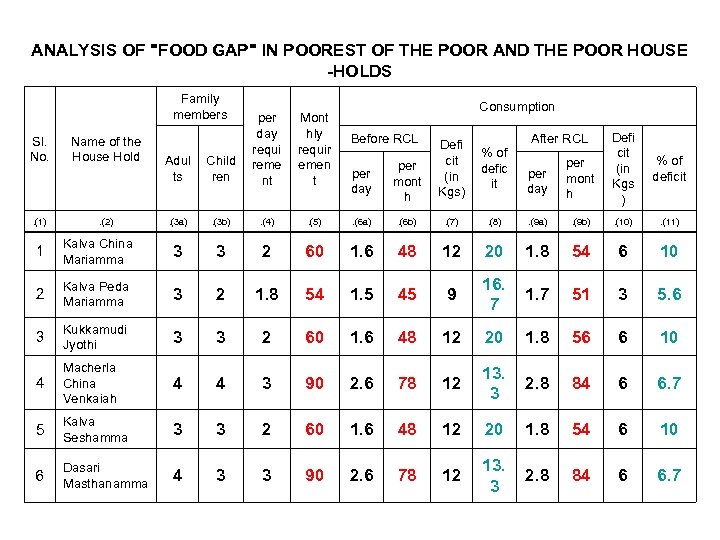

ANALYSIS OF "FOOD GAP" IN POOREST OF THE POOR AND THE POOR HOUSE -HOLDS Family members Sl. No. . (1) Name of the House Hold . (2) Adul ts Child ren per day requi reme nt . (3 a) . (3 b) . (4) Mont hly requir emen t Consumption Before RCL Defi cit (in Kgs) % of defic it per day per mont h . (5) . (6 a) . (6 b) . (7) After RCL Defi cit (in Kgs ) % of deficit per day per mont h . (8) . (9 a) . (9 b) . (10) . (11) 1 Kalva China Mariamma 3 3 2 60 1. 6 48 12 20 1. 8 54 6 10 2 Kalva Peda Mariamma 3 2 1. 8 54 1. 5 45 9 16. 7 1. 7 51 3 5. 6 3 Kukkamudi Jyothi 3 3 2 60 1. 6 48 12 20 1. 8 56 6 10 4 Macherla China Venkaiah 4 4 3 90 2. 6 78 12 13. 3 2. 8 84 6 6. 7 5 Kalva Seshamma 3 3 2 60 1. 6 48 12 20 1. 8 54 6 10 6 Dasari Masthanamma 4 3 3 90 2. 6 78 12 13. 3 2. 8 84 6 6. 7

ANALYSIS OF "FOOD GAP" IN POOREST OF THE POOR AND THE POOR HOUSE -HOLDS Family members Sl. No. . (1) Name of the House Hold . (2) Adul ts Child ren per day requi reme nt . (3 a) . (3 b) . (4) Mont hly requir emen t Consumption Before RCL Defi cit (in Kgs) % of defic it per day per mont h . (5) . (6 a) . (6 b) . (7) After RCL Defi cit (in Kgs ) % of deficit per day per mont h . (8) . (9 a) . (9 b) . (10) . (11) 1 Kalva China Mariamma 3 3 2 60 1. 6 48 12 20 1. 8 54 6 10 2 Kalva Peda Mariamma 3 2 1. 8 54 1. 5 45 9 16. 7 1. 7 51 3 5. 6 3 Kukkamudi Jyothi 3 3 2 60 1. 6 48 12 20 1. 8 56 6 10 4 Macherla China Venkaiah 4 4 3 90 2. 6 78 12 13. 3 2. 8 84 6 6. 7 5 Kalva Seshamma 3 3 2 60 1. 6 48 12 20 1. 8 54 6 10 6 Dasari Masthanamma 4 3 3 90 2. 6 78 12 13. 3 2. 8 84 6 6. 7

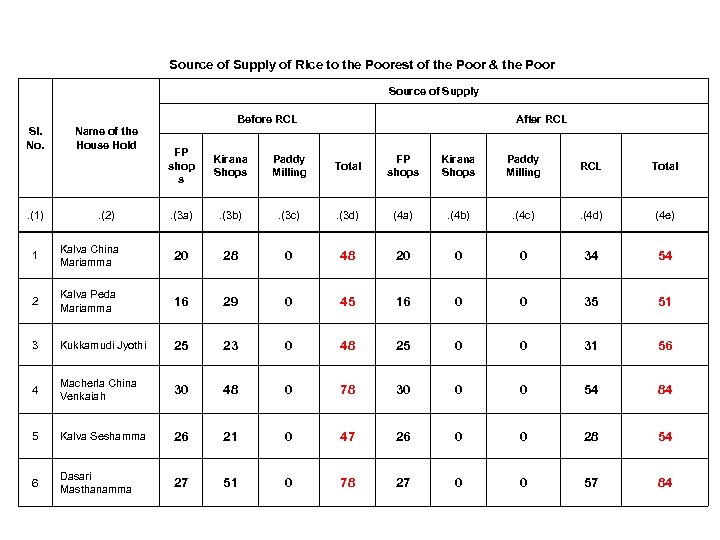

Source of Supply of Rice to the Poorest of the Poor & the Poor Source of Supply Before RCL Sl. No. . (1) Name of the House Hold . (2) After RCL FP shop s Kirana Shops Paddy Milling Total FP shops Kirana Shops Paddy Milling RCL Total . (3 a) . (3 b) . (3 c) . (3 d) (4 a) . (4 b) . (4 c) . (4 d) (4 e) 1 Kalva China Mariamma 20 28 0 48 20 0 0 34 54 2 Kalva Peda Mariamma 16 29 0 45 16 0 0 35 51 3 Kukkamudi Jyothi 25 23 0 48 25 0 0 31 56 4 Macherla China Venkaiah 30 48 0 78 30 0 0 54 84 5 Kalva Seshamma 26 21 0 47 26 0 0 28 54 6 Dasari Masthanamma 27 51 0 78 27 0 0 57 84

Source of Supply of Rice to the Poorest of the Poor & the Poor Source of Supply Before RCL Sl. No. . (1) Name of the House Hold . (2) After RCL FP shop s Kirana Shops Paddy Milling Total FP shops Kirana Shops Paddy Milling RCL Total . (3 a) . (3 b) . (3 c) . (3 d) (4 a) . (4 b) . (4 c) . (4 d) (4 e) 1 Kalva China Mariamma 20 28 0 48 20 0 0 34 54 2 Kalva Peda Mariamma 16 29 0 45 16 0 0 35 51 3 Kukkamudi Jyothi 25 23 0 48 25 0 0 31 56 4 Macherla China Venkaiah 30 48 0 78 30 0 0 54 84 5 Kalva Seshamma 26 21 0 47 26 0 0 28 54 6 Dasari Masthanamma 27 51 0 78 27 0 0 57 84

The Impact • Reduction in “Food Gap” and increase in food intake by the poor • Reduction in price • Increase in real income • Increase in quality • Ensuring “Total Food Security” • Caring for the aged, destitute and pregnant women • Capital formation in VOs and MSs

The Impact • Reduction in “Food Gap” and increase in food intake by the poor • Reduction in price • Increase in real income • Increase in quality • Ensuring “Total Food Security” • Caring for the aged, destitute and pregnant women • Capital formation in VOs and MSs