16cc8e1c52c0e287dd6b18ea20d11216.ppt

- Количество слайдов: 49

Welcome to Medicare: A, B, C and D Rhonda Whitenack, Public Affairs Specialist, Social Security Administration Robert Grams, Health Insurance Counselor Metropolitan Area Agency on Aging and MN SHIP

What is Medicare? • Health Insurance Program for: – People age 65 and older – People under 65 with a certified disability – People of any age with End-Stage Renal Disease (ESRD) • Permanent kidney failure or kidney transplant – People of any age with ALS (Lou Gehrig’s Disease)

Medicare Parts A thru D • Part A: Hospital Insurance • Part B: Medical Insurance ~~~~~~~~~~~~~~~~~~~~~ • Part C: Medicare Advantage – Option that replaces Original Medicare (Parts A and B) • Part D: Prescription Drug Coverage – Through a Medicare Advantage plan or a Stand Alone Prescription Drug Plan (PDP)

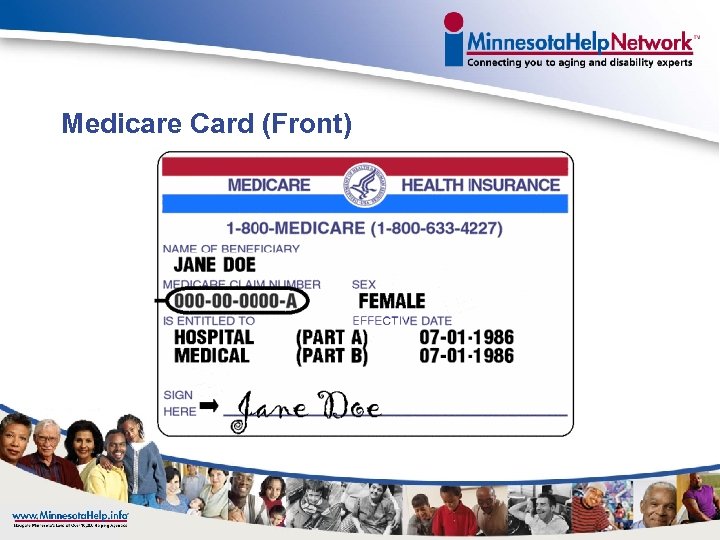

Medicare Card (Front)

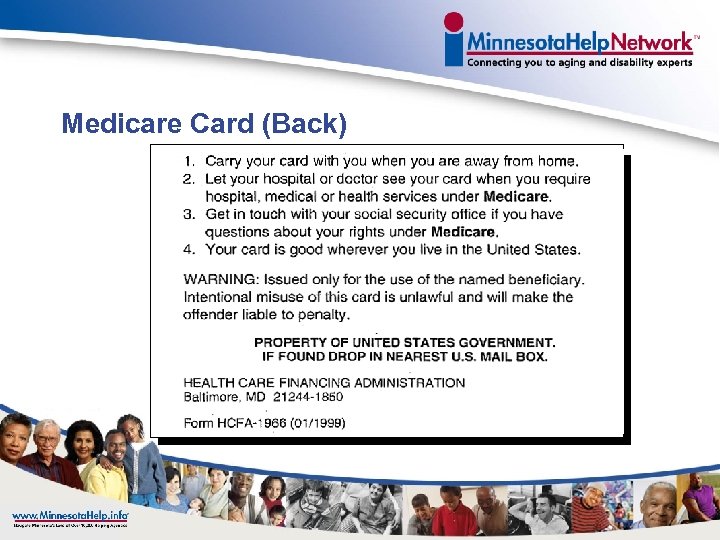

Medicare Card (Back)

Medicare Eligibility Age 65 and Older • May receive Part A premium-free if: – Worked 40+ quarters (at least 10 years) – Spouse of someone with 40 work quarters • May purchase Medicare: – U. S. citizens who have not worked 40 quarters – Legal aliens admitted for permanent residence who have lived in the U. S. for 5+ consecutive years – Also known as “voluntary enrollees”

Other types of Medicare Eligibility • Person under 65 who has received 24+ months of Social Security Disability benefits • Person of any age with End Stage Renal Disease who has had a kidney transplant or who receives regular dialysis • Person of any age with ALS (Lou Gehrig’s Disease)

Types of Medicare Enrollment • Initial Enrollment • Special Enrollment • General Enrollment

Initial Enrollment Period • 7 Month Period – 3 months before you are eligible – The month you are eligible • The month you turn 65 OR • The 25 th month you are certified disabled – 3 months after you are eligible

How do I enroll? • If you already receive Social Security or RR Benefits: – Entitled to Medicare the first of the month you turn 65 – Do not need to do anything to enroll • A card will be mailed three months before you turn 65 • If you are not receiving Social Security or RR Benefits: – Apply online or visit your local Social Security Office

When to Waive Part B • You can delay enrolling into Part B and avoid paying the monthly premium until you need it if you are age 65 or older and have health coverage through your or your spouse’s employer or union – Must contact Social Security and inform of your decision – Have a clear understanding of employer’s plan coverage before making this decision – Must be actively employed

Special Enrollment Period for Part B • Can enroll in Part B anytime while covered under the group plan OR • During the 8 month period that begins the month active employment ends or when the group health coverage ends, whichever comes first

General Enrollment Period • January 1 st through March 31 st of every year • Coverage will begin the following July 1 st • Part A Penalty: 10% for voluntary enrollee who does not elect Part A during initial or Special Enrollment Period • Part B Penalty: 10% of the Part B premium charged for every 12 months one was late enrolling

Medicare Part A • In-patient hospital care • Skilled nursing facility (SNF) care • Home health care • Hospice Care

Medicare Part A Premium • Most receive Part A premium-free because they have at least 40 quarters or work credits of Medicarecovered employment • Voluntary enrollees pay: – $248/month if have 30 – 39 quarters of employment – $450/month if have less than 30 quarters of employment – 2012 cost sharing to be announced

Medicare Part A Cost of Coverage • Hospital Coverage – Deductible for days 1 – 60: $1, 132 – Days 61 – 90: $283 co-payment per day – Days 90 – 150: $566 co-payment per day • Skilled Nursing Facility Coverage – No costs for days 1 – 20 – Days 21 – 100: $141. 50 per day • Home Health Care Coverage and Hospice Coverage – No cost for covered services (2012 cost sharing to be announced)

Medicare Part B • Physician Services • Outpatient Services • Ambulance Services • Durable Medical Equipment (DME)

Medicare Part B Cost Sharing • Premium: $115. 40 – Those on Medicare before 2010 who had their premium deducted from the Social Security check continue to pay $96. 50, unless income is greater than $85, 000. 2010 enrollees continue to pay $110. 50 unless income is greater than $85, 000. • Deductible: $162 • Co-insurance: 20% for most services – 45% for mental health services (2012 cost sharing to be announced)

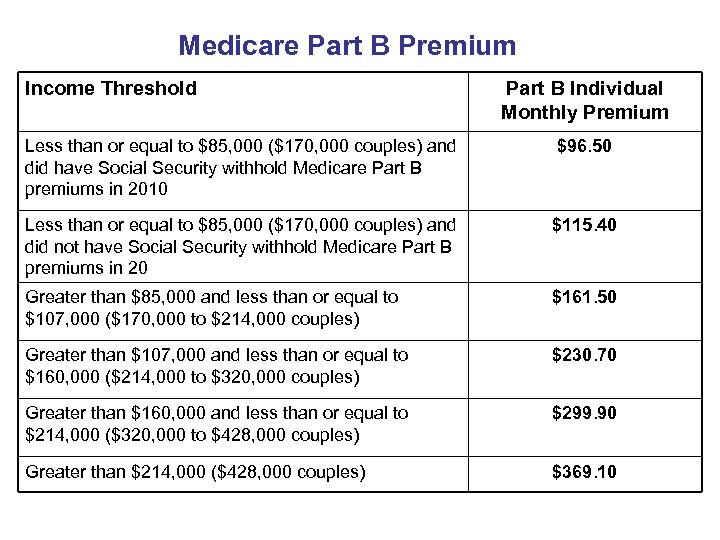

Medicare Part B Premium Income Threshold Part B Individual Monthly Premium Less than or equal to $85, 000 ($170, 000 couples) and did have Social Security withhold Medicare Part B premiums in 2010 $96. 50 Less than or equal to $85, 000 ($170, 000 couples) and did not have Social Security withhold Medicare Part B premiums in 20 $115. 40 Greater than $85, 000 and less than or equal to $107, 000 ($170, 000 to $214, 000 couples) $161. 50 Greater than $107, 000 and less than or equal to $160, 000 ($214, 000 to $320, 000 couples) $230. 70 Greater than $160, 000 and less than or equal to $214, 000 ($320, 000 to $428, 000 couples) $299. 90 Greater than $214, 000 ($428, 000 couples) $369. 10

Medicare Covered Preventative Services • • • NEW Annual Medicare Wellness Visit Welcome to Medicare physical Bone Mass Measurements Cardiovascular Screening Colorectal Cancer Screening Diabetes Screening Immunizations: Flu, Hepatitis B, Pneumococcal Mammograms Pap Test and Pelvic Exam Prostate Cancer Screening

Medicare Covered Items and Services Listing limited to frequently asked about items and services • Ambulance Services – when medically necessary • Diabetic Supplies – glucose testing monitors, test strips, etc. • Durable Medical Equipment – walkers, wheelchairs, oxygen • Emergency Room Services • Eyeglasses – After special cataract surgery

Medicare Covered Items and Services Listing limited to frequently asked about items and services cont. • Foot Exams/Treatment – If diabetes related & meet certain conditions • Kidney Dialysis Services • Prescription Drugs – A limited number of drugs are covered under Part B • Prosthetic/Orthotic Items • Second Surgical Opinions • Tests – X-rays, MRIs, CT Scans, EKGs

Services Not Covered by Medicare • • Dental Care and Dentures Health care outside the U. S. Hearing Aids and Hearing Exams Orthopedic Shoes Routine foot care, eye care and physical exams Long-term Care Shots – except those for prevention

Medicare Summary Notice (MSN) • In Original Medicare, an MSN is issued every 3 months if Part A or Part B services were provided • It is not a bill • Shows the amount that will be owed to the provider after Medicare has paid – “You may be billed” field • Includes instructions on how to file an appeal

Medicare Summary Notice and Medicare Fraud • Review MSN when received for: – – Procedure/services provided Amount you may owe the provider Provider name Dates of Service • You may appeal discrepancies within 120 days • If you feel you have been a victim of fraud and intentionally billed incorrectly: – Call the provider to discuss issue – Call the Senior Link. Age Line® to file a report

Original Medicare • Medicare Part A and B – Fee-for-service plan managed by Federal Government – Use your red, white and blue card when receiving services – Can go to any doctor or hospital that accepts Medicare – Must pay deductibles and co-insurance or co-payment amounts

Medigap Insurance • • • Supplements Original Medicare Must have Parts A and B to buy a Medigap policy Sold by private insurance companies Minimum benefit levels are mandated by Minnesota law Covers costs or “gaps in coverage” that Medicare does not pay • Must pay a monthly premium

Standardized Medigap Plans in Minnesota • Basic Plan Coverage: – – – – Medicare Part A co-insurance Part B co-insurance Blood – 1 st three pints/year 80% of emergency foreign travel 45% of most outpatient mental health services 20% of physical therapy State mandated benefits

Standardized Medigap Plans in Minnesota • Optional Riders: – Medicare Part A deductible – Part B annual deductible – Excess Rider – Preventive Care Rider • Additional Medigap Policies: – – Extended Basic Plan K Plan L Plan M – Plan N – High Deductible Plan F

When to Buy a Medigap Policy • Open Enrollment Period – Starts the month you are 65 or the 25 th month of certified disability and enrolled in Part B – Lasts 6 months • During the Open Enrollment Period the company cannot: – Deny you any Medigap policy it sells – Make you wait for coverage to start, with some exceptions – Charge you more for a policy because of existing health problems

Cost Plans • • • Available in limited areas May be able to join even if you only have Medicare Part B Can join anytime plan is accepting new members Can leave and return to Original Medicare at any time May see a non-network provider – Services are then covered under Original Medicare • Can get Medicare prescription drug coverage

Medicare Part C: Medicare Advantage • Provided by private insurance companies approved by Medicare – May only receive coverage through the Medicare Advantage plan • Most charge a monthly premium – Must still pay your Medicare Part B premium • May include Part D • May include extra benefits, such as hearing and vision

Medicare Advantage Plans cont. • In some cases, you must take the drug coverage that is included with the plan – You may not choose a Stand Alone Part D plan • Cannot have a Medigap policy • Are responsible for the co-pays and co-insurance set by the plan • May have a network of doctors you must use

Enrollment in a Medicare Advantage Plan • • Must live in the service area of the plan you would like to join Must have Medicare Part A and B Cannot have End-Stage Renal Disease NEW – Beginning Fall 2011, the Annual Open Enrollment Period will change to October 15 – December 7 (plan effective date January 1, 2012)

Medicare Advantage Disenrollment Period • January 1, 2012 – February 15, 2012 • During this new Medicare Advantage Disenrollment period: – Beneficiaries can disenroll from a Medicare Advantage plan and switch to Original Medicare – Beneficiaries can enroll in a Stand Alone PDP plan when returning to Original Medicare – Beneficiaries enrolled in a Medicare Advantage plan cannot switch to another Medicare Advantage plan – Beneficiaries in Original Medicare cannot enroll in a Medicare Advantage plan

Medicare Advantage Plan Options in Minnesota • • Health Maintenance Organizations (HMO) Preferred Provider Organization Plans (PPO) Private Fee-for-Service Plans (PFFS) Special Needs Plans (SNPs)

Things to Consider When Choosing a Plan • • Cost Benefits Doctor & Hospital Choice Travel Prescription Drugs Pharmacy Choice Quality of Care

Medicare Part D – Prescription Drug Coverage • Began January 1, 2006 • Coverage is through a Stand Alone prescription drug coverage or as part of a Medicare Advantage Plan – Plans are offered by private insurance companies approved by Medicare • Separate monthly premium for most plans • Must have Medicare Part A, Part B or both • Is a voluntary benefit – However, if you do not enroll when first eligible you may face a penalty later

Medicare Part D Enrollment Periods • Initial Enrollment Period (IEP) – 7 month period starting 3 months before the month of 65 th birthday or 25 th month of certified disability • Annual Open Enrollment Period (OEP) – – November 15 though December 31 Coverage is effective January 1 of following year Beneficiaries may join, drop or switch coverage NEW! Beginning Fall 2011, Annual Election Period will change to October 15 – December 7 • Special Enrollment Period (SEP) – Moving, plan leaves the market, dual eligible, loss of creditable coverage

Late Enrollment Penalty • People who do not join a Part D plan when they are eligible may pay a penalty – Add 1% of the national base premium for each month you should have had a plan, but did not enroll – Must pay the penalty as long as you are enrolled in a Part D plan • Penalty does not apply to those who have creditable coverage or if you have dual eligibility – You are a dual eligible if you receive Medicare and are on Medical Assistance or a Medicare Savings Program

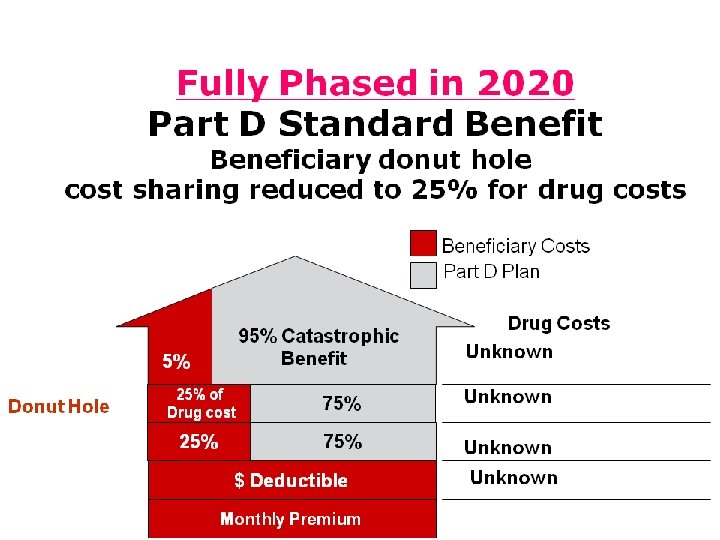

2012 Standard Benefit for Medicare Part D: You Pay • • Monthly Premium Deductible: $320 Initial Coverage Limit: 25% co-insurance per prescription drug Donut Hole: 100% of prescription drugs once you and the plan both pay $2, 930. 01. 50% discount on brand name and 14% discount on generic drugs purchased while the beneficiary is in the donut hole. • Catastrophic Coverage: 5% co-insurance per drug after you pay $4, 700 out of pocket *Plans may have a lower deductible or set their own co-pays/coinsurance. It is important to compare plans when deciding.

Medicare Part D Premiums • Higher income beneficiaries will pay higher Medicare Part D monthly premiums – $85, 000 individuals – $170, 000 couples – Not indexed for inflation • Waiting for additional information from CMS

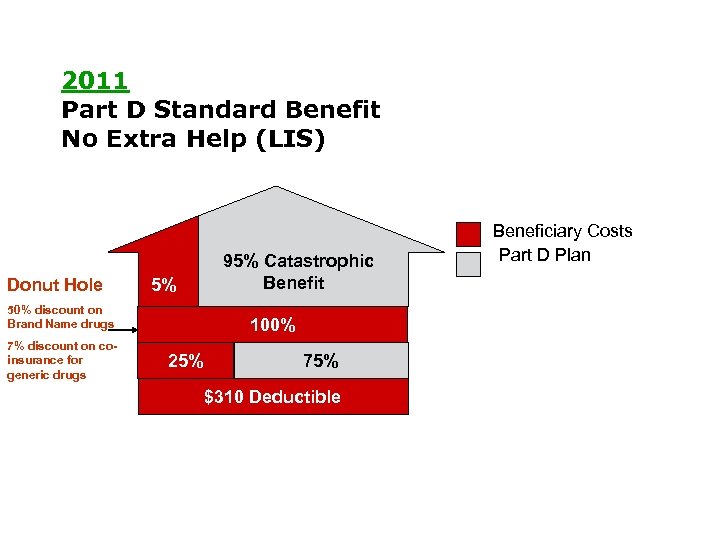

2011 Part D Standard Benefit No Extra Help (LIS) Donut Hole 5% 50% discount on Brand Name drugs 7% discount on coinsurance for generic drugs 95% Catastrophic Benefit 100% 25% 75% $310 Deductible Beneficiary Costs Part D Plan

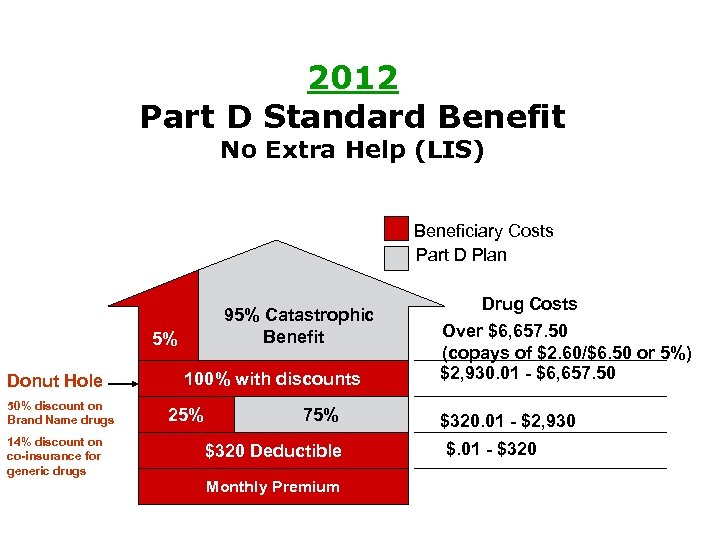

2012 Part D Standard Benefit No Extra Help (LIS) Beneficiary Costs Part D Plan 95% Catastrophic Benefit 5% Donut Hole 50% discount on Brand Name drugs 14% discount on co-insurance for generic drugs 100% with discounts 25% 75% $320 Deductible Monthly Premium Drug Costs Over $6, 657. 50 (copays of $2. 60/$6. 50 or 5%) $2, 930. 01 - $6, 657. 50 $320. 01 - $2, 930 $. 01 - $320

Extra Help Paying for Part D Costs • • Administered by Social Security Administration Helps pay for Medicare Part D cost sharing Full and Partial LIS are available Must complete application and send to SSA or complete online application at www. ssa. gov • Income must be below 150% of FPG or $1, 362/single or $1, 839/couple • Assets must be below $12, 640 for single and $25, 260 for a couple

Additional Extra Help is Available • Medicare Savings Programs – QMB – SLMB – QI-1 • Medical Assistance Send completed application to your county – Application assistance is available through Senior Link. Age Line®

Minnesota. Help Network™ is here to help you • • • Senior Link. Age Line® 1 -800 -333 -2433 Disability Linkage Line ® 1 -866 -333 -2466 Veterans Linkage Line ™ 1 -888 -Link. Vet www. Minnesota. Help. info ® http: //longtermcarechoices. minnesotahelp. info/ Local community based sites throughout Minnesota

Questions or Comments?

16cc8e1c52c0e287dd6b18ea20d11216.ppt