36c5b71296b72f3432e5b4516ccf98af.ppt

- Количество слайдов: 13

Welcome To Malaysia

Welcome To Malaysia

Snapshot on Malaysia

Snapshot on Malaysia

Snapshot on Malaysia

Snapshot on Malaysia

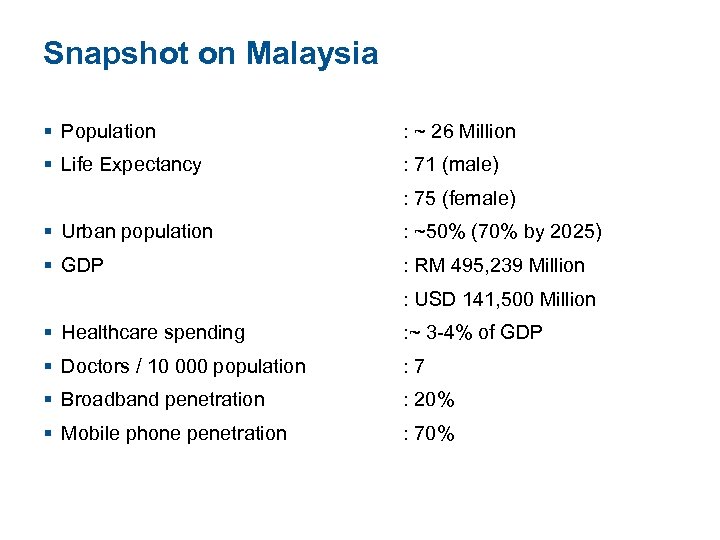

Snapshot on Malaysia § Population : ~ 26 Million § Life Expectancy : 71 (male) : 75 (female) § Urban population : ~50% (70% by 2025) § GDP : RM 495, 239 Million : USD 141, 500 Million § Healthcare spending : ~ 3 -4% of GDP § Doctors / 10 000 population : 7 § Broadband penetration : 20% § Mobile phone penetration : 70%

Snapshot on Malaysia § Population : ~ 26 Million § Life Expectancy : 71 (male) : 75 (female) § Urban population : ~50% (70% by 2025) § GDP : RM 495, 239 Million : USD 141, 500 Million § Healthcare spending : ~ 3 -4% of GDP § Doctors / 10 000 population : 7 § Broadband penetration : 20% § Mobile phone penetration : 70%

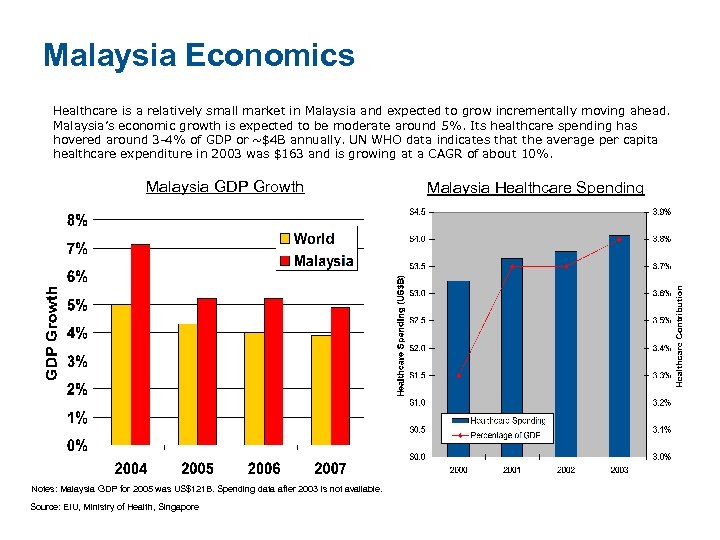

Malaysia Economics Healthcare is a relatively small market in Malaysia and expected to grow incrementally moving ahead. Malaysia’s economic growth is expected to be moderate around 5%. Its healthcare spending has hovered around 3 -4% of GDP or ~$4 B annually. UN WHO data indicates that the average per capita healthcare expenditure in 2003 was $163 and is growing at a CAGR of about 10%. Malaysia GDP Growth Notes: Malaysia GDP for 2005 was US$121 B. Spending data after 2003 is not available. Source: EIU, Ministry of Health, Singapore Malaysia Healthcare Spending

Malaysia Economics Healthcare is a relatively small market in Malaysia and expected to grow incrementally moving ahead. Malaysia’s economic growth is expected to be moderate around 5%. Its healthcare spending has hovered around 3 -4% of GDP or ~$4 B annually. UN WHO data indicates that the average per capita healthcare expenditure in 2003 was $163 and is growing at a CAGR of about 10%. Malaysia GDP Growth Notes: Malaysia GDP for 2005 was US$121 B. Spending data after 2003 is not available. Source: EIU, Ministry of Health, Singapore Malaysia Healthcare Spending

Malaysia Healthcare Infrastructure Malaysia has at least one government hospital in every major town and city. The rural area is covered by small government clinics. The people travel to the town or city if they need more complicated healthcare. The private sector has many small hospitals mainly in the urban areas. § Hospital source (2005) – Public 128 hospitals, 35, 210 beds (average 275 beds/hospital) – Private 226 hospitals, ~13000 beds (48 beds/ hospital) § Number of doctors – 18, 191 doctors (2003) – 1, 934 rural government clinics (2003) Source: Ministry of Health, Malaysia; IDC Analysis;

Malaysia Healthcare Infrastructure Malaysia has at least one government hospital in every major town and city. The rural area is covered by small government clinics. The people travel to the town or city if they need more complicated healthcare. The private sector has many small hospitals mainly in the urban areas. § Hospital source (2005) – Public 128 hospitals, 35, 210 beds (average 275 beds/hospital) – Private 226 hospitals, ~13000 beds (48 beds/ hospital) § Number of doctors – 18, 191 doctors (2003) – 1, 934 rural government clinics (2003) Source: Ministry of Health, Malaysia; IDC Analysis;

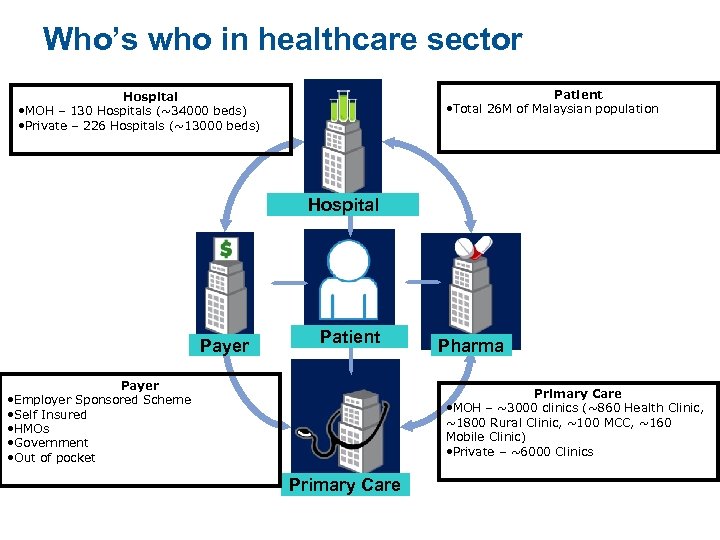

Who’s who in healthcare sector Patient • Total 26 M of Malaysian population Hospital • MOH – 130 Hospitals (~34000 beds) • Private – 226 Hospitals (~13000 beds) Hospital Payer • Employer Sponsored Scheme • Self Insured • HMOs • Government • Out of pocket *include quasi government institution Patient Pharma Primary Care • MOH – ~3000 clinics (~860 Health Clinic, ~1800 Rural Clinic, ~100 MCC, ~160 Mobile Clinic) • Private – ~6000 Clinics Healthcare Provider Primary Care

Who’s who in healthcare sector Patient • Total 26 M of Malaysian population Hospital • MOH – 130 Hospitals (~34000 beds) • Private – 226 Hospitals (~13000 beds) Hospital Payer • Employer Sponsored Scheme • Self Insured • HMOs • Government • Out of pocket *include quasi government institution Patient Pharma Primary Care • MOH – ~3000 clinics (~860 Health Clinic, ~1800 Rural Clinic, ~100 MCC, ~160 Mobile Clinic) • Private – ~6000 Clinics Healthcare Provider Primary Care

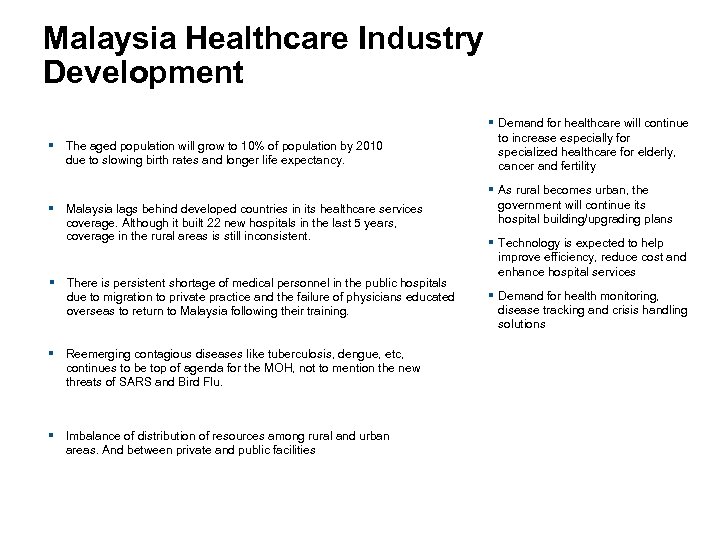

Malaysia Healthcare Industry Development § The aged population will grow to 10% of population by 2010 due to slowing birth rates and longer life expectancy. § Malaysia lags behind developed countries in its healthcare services coverage. Although it built 22 new hospitals in the last 5 years, coverage in the rural areas is still inconsistent. § There is persistent shortage of medical personnel in the public hospitals due to migration to private practice and the failure of physicians educated overseas to return to Malaysia following their training. § Reemerging contagious diseases like tuberculosis, dengue, etc, continues to be top of agenda for the MOH, not to mention the new threats of SARS and Bird Flu. § Imbalance of distribution of resources among rural and urban areas. And between private and public facilities § Demand for healthcare will continue to increase especially for specialized healthcare for elderly, cancer and fertility § As rural becomes urban, the government will continue its hospital building/upgrading plans § Technology is expected to help improve efficiency, reduce cost and enhance hospital services § Demand for health monitoring, disease tracking and crisis handling solutions

Malaysia Healthcare Industry Development § The aged population will grow to 10% of population by 2010 due to slowing birth rates and longer life expectancy. § Malaysia lags behind developed countries in its healthcare services coverage. Although it built 22 new hospitals in the last 5 years, coverage in the rural areas is still inconsistent. § There is persistent shortage of medical personnel in the public hospitals due to migration to private practice and the failure of physicians educated overseas to return to Malaysia following their training. § Reemerging contagious diseases like tuberculosis, dengue, etc, continues to be top of agenda for the MOH, not to mention the new threats of SARS and Bird Flu. § Imbalance of distribution of resources among rural and urban areas. And between private and public facilities § Demand for healthcare will continue to increase especially for specialized healthcare for elderly, cancer and fertility § As rural becomes urban, the government will continue its hospital building/upgrading plans § Technology is expected to help improve efficiency, reduce cost and enhance hospital services § Demand for health monitoring, disease tracking and crisis handling solutions

Malaysia Healthcare Initiative § From 2000 -2005 it has built 22 new hospitals and expanded its rural/mobile clinics to enhance healthcare coverage and services. § Implemented Hospital Information System in 13 government hospitals. § Implemented primary care system in 52 primary care clinics and 2 hospitals (as a hub) § Implemented various back end system on health regulatory management. Food Quality System, Drug Registration, Drug approval & Notification of infectious disease. Source: Various news reports; Ninth Malaysia Plan 2006 -2010; ;

Malaysia Healthcare Initiative § From 2000 -2005 it has built 22 new hospitals and expanded its rural/mobile clinics to enhance healthcare coverage and services. § Implemented Hospital Information System in 13 government hospitals. § Implemented primary care system in 52 primary care clinics and 2 hospitals (as a hub) § Implemented various back end system on health regulatory management. Food Quality System, Drug Registration, Drug approval & Notification of infectious disease. Source: Various news reports; Ninth Malaysia Plan 2006 -2010; ;

Malaysia Healthcare Initiative § In the 9 th Malaysian Plan 2006 -2010, the government has announced a further RM 1. 5 B plan to build new and upgrade IT facilities – To implement Hospital Information System in more government hospitals – Upgrading of population health surveillance, water and pollution monitoring and establishment of national registry for communicable diseases through IT. – To extend the primary care system to all clinic under government § Understudy on healthcare financing model is on going, with assistance § Understudy on EHR / PHR is on going. The plan is to connect all wired hospital to a central repository of Lifetime Health Record. § Various HIS projects within private hospitals. The area of interest are mainly patient administration system, financial, HR and inventory

Malaysia Healthcare Initiative § In the 9 th Malaysian Plan 2006 -2010, the government has announced a further RM 1. 5 B plan to build new and upgrade IT facilities – To implement Hospital Information System in more government hospitals – Upgrading of population health surveillance, water and pollution monitoring and establishment of national registry for communicable diseases through IT. – To extend the primary care system to all clinic under government § Understudy on healthcare financing model is on going, with assistance § Understudy on EHR / PHR is on going. The plan is to connect all wired hospital to a central repository of Lifetime Health Record. § Various HIS projects within private hospitals. The area of interest are mainly patient administration system, financial, HR and inventory

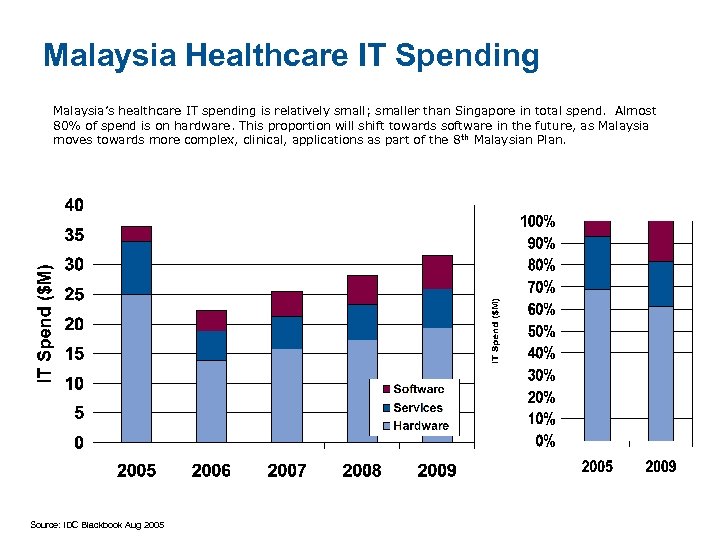

Malaysia Healthcare IT Spending Malaysia’s healthcare IT spending is relatively small; smaller than Singapore in total spend. Almost 80% of spend is on hardware. This proportion will shift towards software in the future, as Malaysia moves towards more complex, clinical, applications as part of the 8 th Malaysian Plan. Source: IDC Blackbook Aug 2005

Malaysia Healthcare IT Spending Malaysia’s healthcare IT spending is relatively small; smaller than Singapore in total spend. Almost 80% of spend is on hardware. This proportion will shift towards software in the future, as Malaysia moves towards more complex, clinical, applications as part of the 8 th Malaysian Plan. Source: IDC Blackbook Aug 2005

Health Informatics Activities in Malaysia § Participant in health Informatics – Malaysia Health Informatics Association (formed in 1999) – HL 7 formation committee (formed in 2005) – SIRIM (Standard And Industrial Research Institute Malaysia). Malaysia ISO equivalent. § Conferences and meeting. – Various seminars and meeting organized by MHIA, government and private sector. – HL 7 seminar in 2005 (attended by 50 attendees) – HL 7 tutorial in 2006 (attended by 300 attendees) § HL 7 affiliate status – Outcome of seminars and tutorial led to temporary HL 7 committee – Petition submitted to HL 7. – Submitted registration of HL 7 body to Malaysia Registrar of Society.

Health Informatics Activities in Malaysia § Participant in health Informatics – Malaysia Health Informatics Association (formed in 1999) – HL 7 formation committee (formed in 2005) – SIRIM (Standard And Industrial Research Institute Malaysia). Malaysia ISO equivalent. § Conferences and meeting. – Various seminars and meeting organized by MHIA, government and private sector. – HL 7 seminar in 2005 (attended by 50 attendees) – HL 7 tutorial in 2006 (attended by 300 attendees) § HL 7 affiliate status – Outcome of seminars and tutorial led to temporary HL 7 committee – Petition submitted to HL 7. – Submitted registration of HL 7 body to Malaysia Registrar of Society.