2152bd8553d18355c15d667f5712a12d.ppt

- Количество слайдов: 16

Welcome To Consumer Driven Health Care aka Individual Health Savings Accounts P. L. No. 108 -173, section 223

Welcome To Consumer Driven Health Care aka Individual Health Savings Accounts P. L. No. 108 -173, section 223

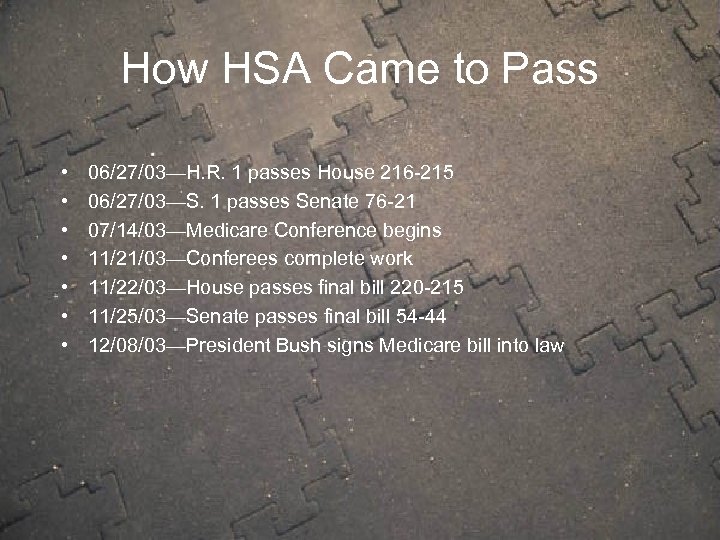

How HSA Came to Pass • • 06/27/03—H. R. 1 passes House 216 -215 06/27/03—S. 1 passes Senate 76 -21 07/14/03—Medicare Conference begins 11/21/03—Conferees complete work 11/22/03—House passes final bill 220 -215 11/25/03—Senate passes final bill 54 -44 12/08/03—President Bush signs Medicare bill into law

How HSA Came to Pass • • 06/27/03—H. R. 1 passes House 216 -215 06/27/03—S. 1 passes Senate 76 -21 07/14/03—Medicare Conference begins 11/21/03—Conferees complete work 11/22/03—House passes final bill 220 -215 11/25/03—Senate passes final bill 54 -44 12/08/03—President Bush signs Medicare bill into law

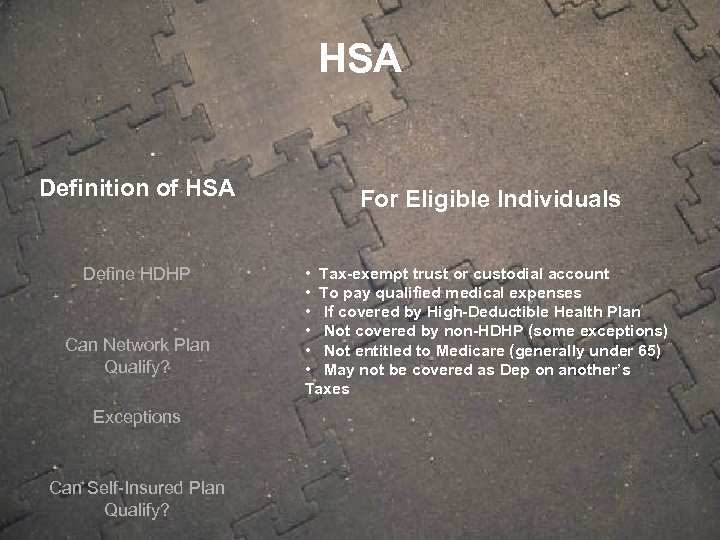

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? For Eligible Individuals • Tax-exempt trust or custodial account • To pay qualified medical expenses • If covered by High-Deductible Health Plan • Not covered by non-HDHP (some exceptions) • Not entitled to Medicare (generally under 65) • May not be covered as Dep on another’s Taxes

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? For Eligible Individuals • Tax-exempt trust or custodial account • To pay qualified medical expenses • If covered by High-Deductible Health Plan • Not covered by non-HDHP (some exceptions) • Not entitled to Medicare (generally under 65) • May not be covered as Dep on another’s Taxes

HSA Definition of HSA Deductible & OOP Requirements Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? • • $1, 000 Deductible minimum for Individuals $5, 000 OOP Maximum for Individuals $2, 000 Deductible Minimum for Families $10, 000 OOP Maximum for Families Not including 1 st Dollar Preventive Care Can have higher deductibles and lower out-of -pocket expense caps It does not appear you can have a plan with office visit copays and an Rx plan with copays either (awaiting direct answer from IRS)

HSA Definition of HSA Deductible & OOP Requirements Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? • • $1, 000 Deductible minimum for Individuals $5, 000 OOP Maximum for Individuals $2, 000 Deductible Minimum for Families $10, 000 OOP Maximum for Families Not including 1 st Dollar Preventive Care Can have higher deductibles and lower out-of -pocket expense caps It does not appear you can have a plan with office visit copays and an Rx plan with copays either (awaiting direct answer from IRS)

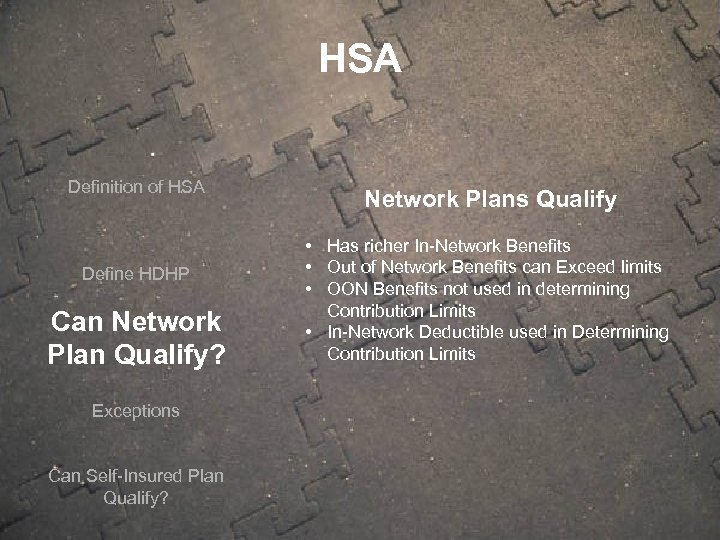

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? Network Plans Qualify • Has richer In-Network Benefits • Out of Network Benefits can Exceed limits • OON Benefits not used in determining Contribution Limits • In-Network Deductible used in Determining Contribution Limits

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plan Qualify? Network Plans Qualify • Has richer In-Network Benefits • Out of Network Benefits can Exceed limits • OON Benefits not used in determining Contribution Limits • In-Network Deductible used in Determining Contribution Limits

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Funded Plan Qualify? Can Still Have: • • • Workers Compensation Plan Coverage Automobile Insurance Coverage Other Property Insurance Tort Liability Insurance Coverage Accident Insurance Dental Insurance Vision Insurance Long Term Care Insurance Daily Hospital Fixed Amount per Day Specified Disease or Illness Coverage

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Funded Plan Qualify? Can Still Have: • • • Workers Compensation Plan Coverage Automobile Insurance Coverage Other Property Insurance Tort Liability Insurance Coverage Accident Insurance Dental Insurance Vision Insurance Long Term Care Insurance Daily Hospital Fixed Amount per Day Specified Disease or Illness Coverage

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plans Qualify? Self-Insured Plans • Employer sponsored Self-Insured Plans Qualify • Must meet Deductible and OOP requirements • Cannot have a deductible for preventive care

HSA Definition of HSA Define HDHP Can Network Plan Qualify? Exceptions Can Self-Insured Plans Qualify? Self-Insured Plans • Employer sponsored Self-Insured Plans Qualify • Must meet Deductible and OOP requirements • Cannot have a deductible for preventive care

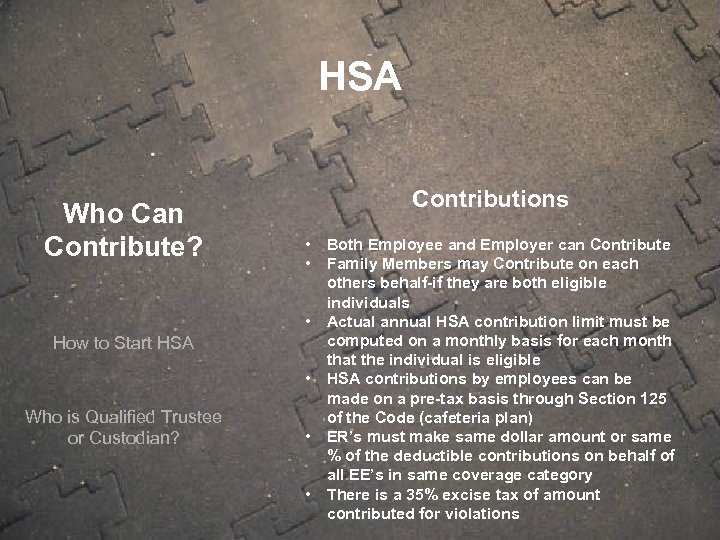

HSA Who Can Contribute? How to Start HSA Who is Qualified Trustee or Custodian? Contributions • Both Employee and Employer can Contribute • Family Members may Contribute on each others behalf-if they are both eligible individuals • Actual annual HSA contribution limit must be computed on a monthly basis for each month that the individual is eligible • HSA contributions by employees can be made on a pre-tax basis through Section 125 of the Code (cafeteria plan) • ER’s must make same dollar amount or same % of the deductible contributions on behalf of all EE’s in same coverage category • There is a 35% excise tax of amount contributed for violations

HSA Who Can Contribute? How to Start HSA Who is Qualified Trustee or Custodian? Contributions • Both Employee and Employer can Contribute • Family Members may Contribute on each others behalf-if they are both eligible individuals • Actual annual HSA contribution limit must be computed on a monthly basis for each month that the individual is eligible • HSA contributions by employees can be made on a pre-tax basis through Section 125 of the Code (cafeteria plan) • ER’s must make same dollar amount or same % of the deductible contributions on behalf of all EE’s in same coverage category • There is a 35% excise tax of amount contributed for violations

HSA Start-Up Who can Contribute? How to Start HSA Who is qualified Trustee or Custodian? • • • Begins January 1, 2004 or later Can start mid-year Same as starting IRA or Archer MSA No permission from IRS needed Can establish HSA without Employer involvement Must use Qualified Trustee or Custodian

HSA Start-Up Who can Contribute? How to Start HSA Who is qualified Trustee or Custodian? • • • Begins January 1, 2004 or later Can start mid-year Same as starting IRA or Archer MSA No permission from IRS needed Can establish HSA without Employer involvement Must use Qualified Trustee or Custodian

HSA Qualified Trustee/Custodian Who can Contribute? How to Start HSA • • • Who is Qualified Trustee or Custodian? Defined in section 408(n) Any Insurance Company Any Bank or similar institution See Regulation 1. 408 -2(e) relating to nonbank trustees Does not have to be same institution that provides the HDHP

HSA Qualified Trustee/Custodian Who can Contribute? How to Start HSA • • • Who is Qualified Trustee or Custodian? Defined in section 408(n) Any Insurance Company Any Bank or similar institution See Regulation 1. 408 -2(e) relating to nonbank trustees Does not have to be same institution that provides the HDHP

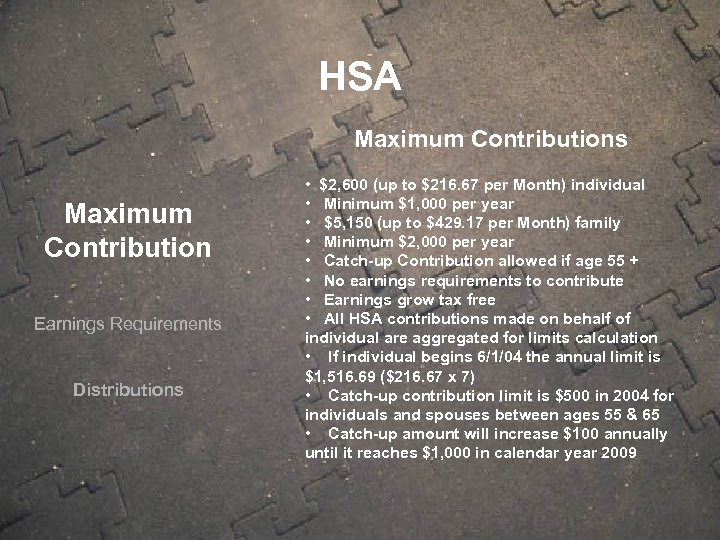

HSA Maximum Contributions Maximum Contribution Earnings Requirements Distributions • $2, 600 (up to $216. 67 per Month) individual • Minimum $1, 000 per year • $5, 150 (up to $429. 17 per Month) family • Minimum $2, 000 per year • Catch-up Contribution allowed if age 55 + • No earnings requirements to contribute • Earnings grow tax free • All HSA contributions made on behalf of individual are aggregated for limits calculation • If individual begins 6/1/04 the annual limit is $1, 516. 69 ($216. 67 x 7) • Catch-up contribution limit is $500 in 2004 for individuals and spouses between ages 55 & 65 • Catch-up amount will increase $100 annually until it reaches $1, 000 in calendar year 2009

HSA Maximum Contributions Maximum Contribution Earnings Requirements Distributions • $2, 600 (up to $216. 67 per Month) individual • Minimum $1, 000 per year • $5, 150 (up to $429. 17 per Month) family • Minimum $2, 000 per year • Catch-up Contribution allowed if age 55 + • No earnings requirements to contribute • Earnings grow tax free • All HSA contributions made on behalf of individual are aggregated for limits calculation • If individual begins 6/1/04 the annual limit is $1, 516. 69 ($216. 67 x 7) • Catch-up contribution limit is $500 in 2004 for individuals and spouses between ages 55 & 65 • Catch-up amount will increase $100 annually until it reaches $1, 000 in calendar year 2009

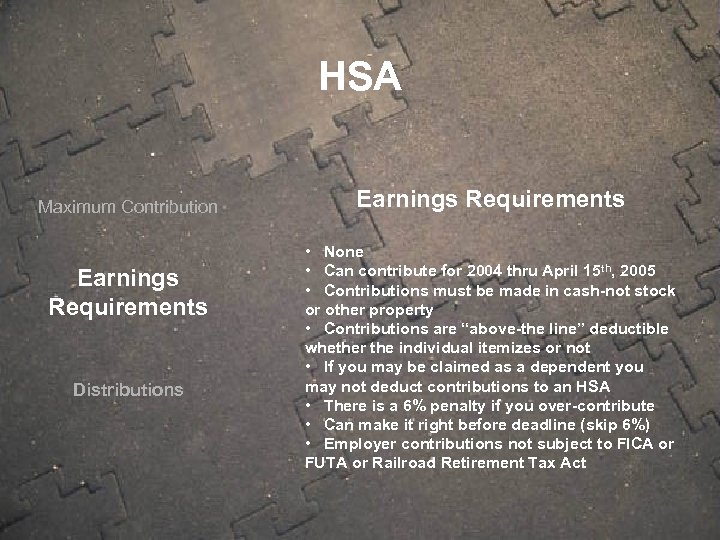

HSA Maximum Contribution Earnings Requirements Distributions Earnings Requirements • None • Can contribute for 2004 thru April 15 th, 2005 • Contributions must be made in cash-not stock or other property • Contributions are “above-the line” deductible whether the individual itemizes or not • If you may be claimed as a dependent you may not deduct contributions to an HSA • There is a 6% penalty if you over-contribute • Can make it right before deadline (skip 6%) • Employer contributions not subject to FICA or FUTA or Railroad Retirement Tax Act

HSA Maximum Contribution Earnings Requirements Distributions Earnings Requirements • None • Can contribute for 2004 thru April 15 th, 2005 • Contributions must be made in cash-not stock or other property • Contributions are “above-the line” deductible whether the individual itemizes or not • If you may be claimed as a dependent you may not deduct contributions to an HSA • There is a 6% penalty if you over-contribute • Can make it right before deadline (skip 6%) • Employer contributions not subject to FICA or FUTA or Railroad Retirement Tax Act

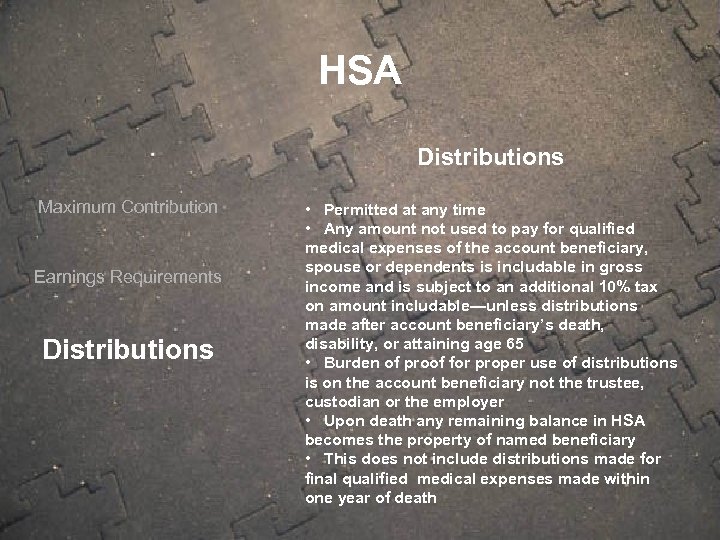

HSA Distributions Maximum Contribution Earnings Requirements Distributions • Permitted at any time • Any amount not used to pay for qualified medical expenses of the account beneficiary, spouse or dependents is includable in gross income and is subject to an additional 10% tax on amount includable—unless distributions made after account beneficiary’s death, disability, or attaining age 65 • Burden of proof for proper use of distributions is on the account beneficiary not the trustee, custodian or the employer • Upon death any remaining balance in HSA becomes the property of named beneficiary • This does not include distributions made for final qualified medical expenses made within one year of death

HSA Distributions Maximum Contribution Earnings Requirements Distributions • Permitted at any time • Any amount not used to pay for qualified medical expenses of the account beneficiary, spouse or dependents is includable in gross income and is subject to an additional 10% tax on amount includable—unless distributions made after account beneficiary’s death, disability, or attaining age 65 • Burden of proof for proper use of distributions is on the account beneficiary not the trustee, custodian or the employer • Upon death any remaining balance in HSA becomes the property of named beneficiary • This does not include distributions made for final qualified medical expenses made within one year of death

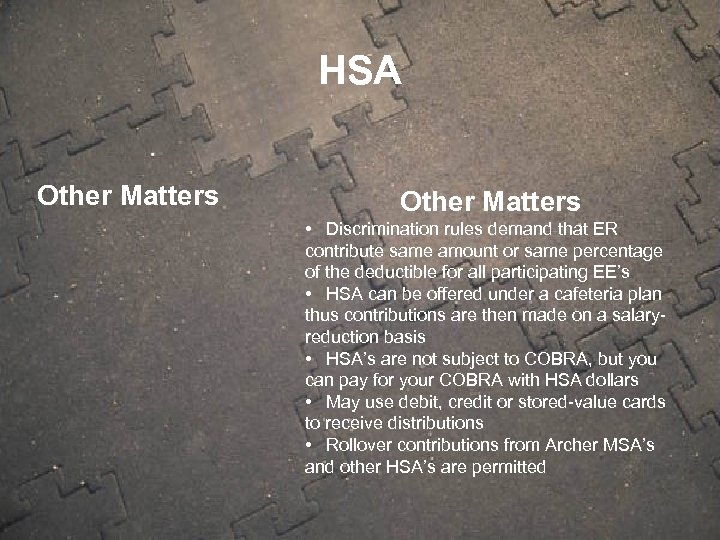

HSA Other Matters • Discrimination rules demand that ER contribute same amount or same percentage of the deductible for all participating EE’s • HSA can be offered under a cafeteria plan thus contributions are then made on a salaryreduction basis • HSA’s are not subject to COBRA, but you can pay for your COBRA with HSA dollars • May use debit, credit or stored-value cards to receive distributions • Rollover contributions from Archer MSA’s and other HSA’s are permitted

HSA Other Matters • Discrimination rules demand that ER contribute same amount or same percentage of the deductible for all participating EE’s • HSA can be offered under a cafeteria plan thus contributions are then made on a salaryreduction basis • HSA’s are not subject to COBRA, but you can pay for your COBRA with HSA dollars • May use debit, credit or stored-value cards to receive distributions • Rollover contributions from Archer MSA’s and other HSA’s are permitted

Three Big Tax Advantages • Pre-tax contributions • Earnings tax-free • Distributions not taxable upon withdrawal for appropriate expenses Better treatment than a 401(k) plan

Three Big Tax Advantages • Pre-tax contributions • Earnings tax-free • Distributions not taxable upon withdrawal for appropriate expenses Better treatment than a 401(k) plan

HSA’s Sales Expectations? How do you feel about HSA’s? Who do you think will buy them?

HSA’s Sales Expectations? How do you feel about HSA’s? Who do you think will buy them?