753d544199b21103dafb182810d969b7.ppt

- Количество слайдов: 86

Welcome to Canada International Students

Presentation objectives

Are you a Québec resident?

Residential ties in Québec?

Québec tax obligations

The Québec taxation system

Who is required to file an income tax return

You must file a Québec income tax return if:

What is your residency status?

For more information You may refer to

How to file your income tax return

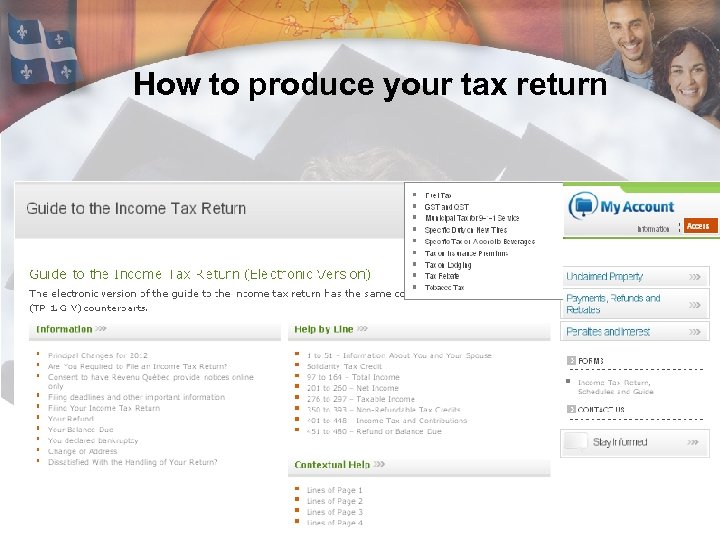

How to produce your tax return

When to file your income tax return

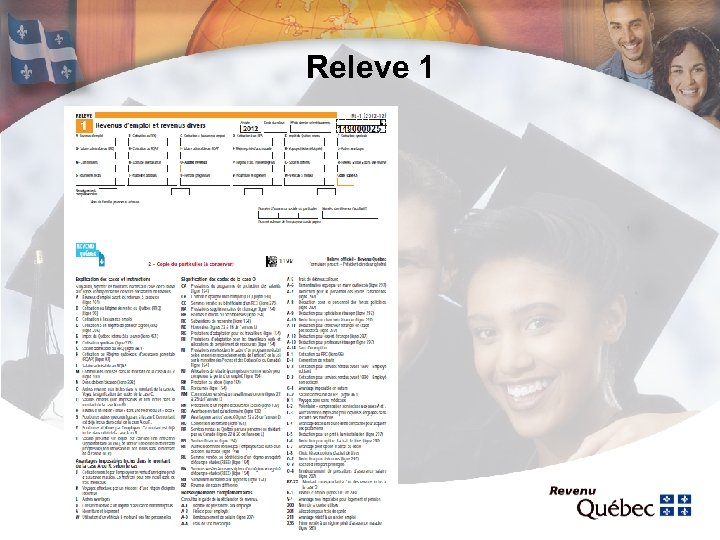

Releve 1

How to file your tax return?

How to complete your return

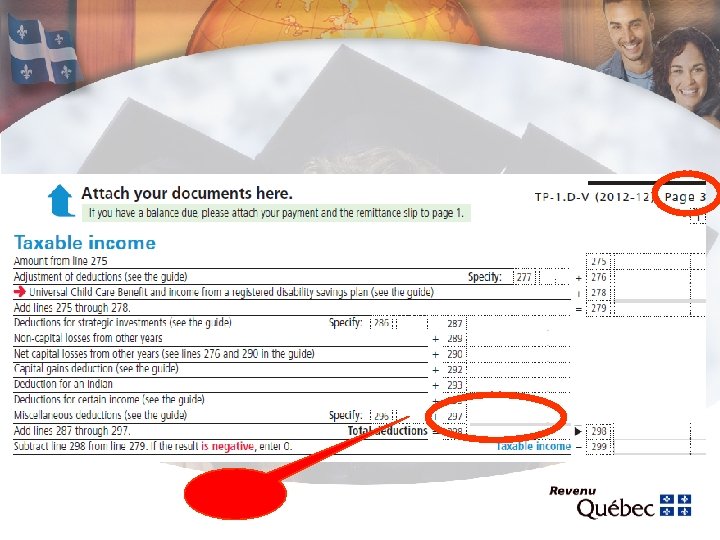

Completing your 2012 Quebec income tax return step by step

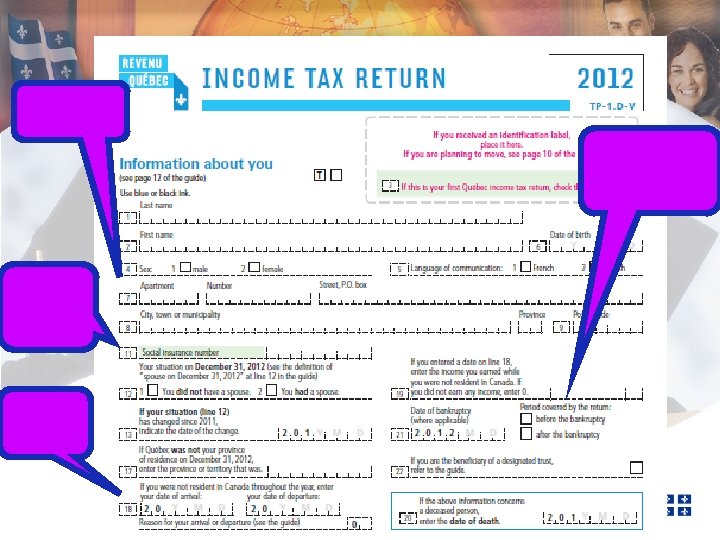

Completing your 2012 Quebec income tax return step by step

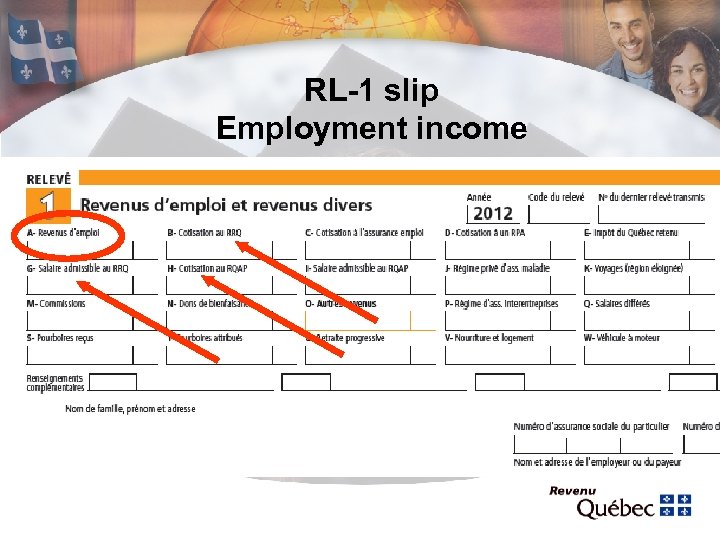

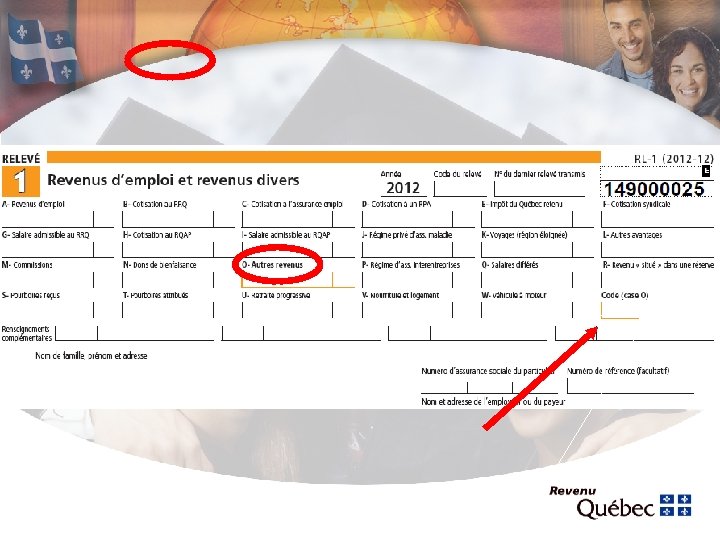

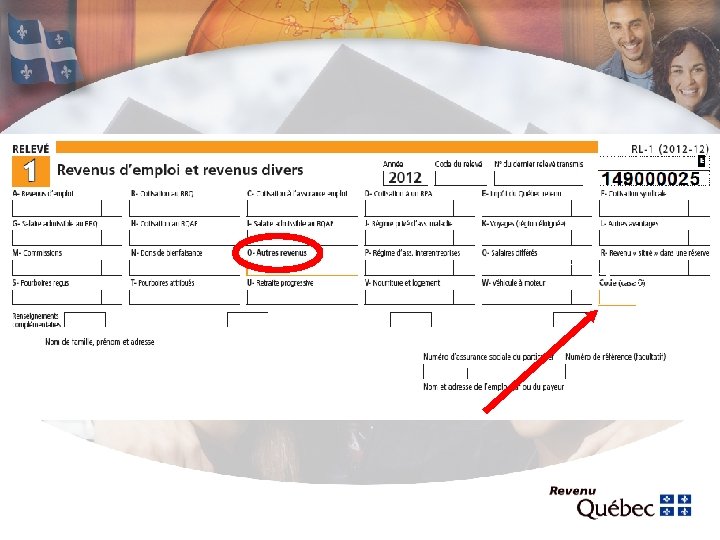

RL-1 slip Employment income

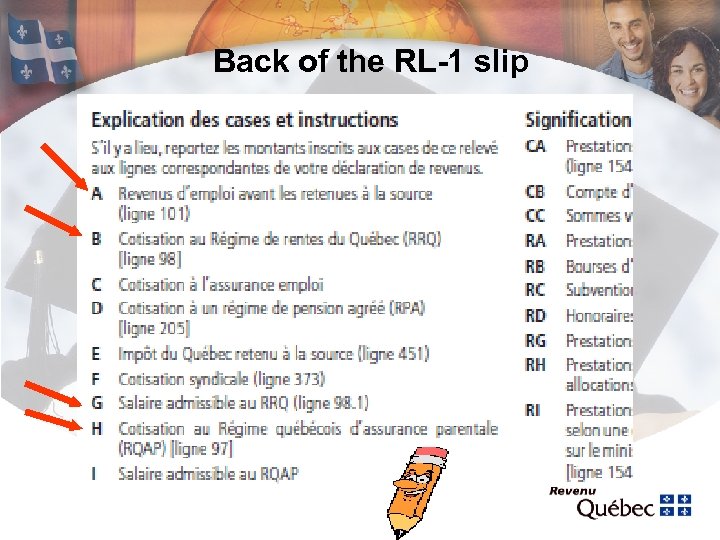

Back of the RL-1 slip

Employment income

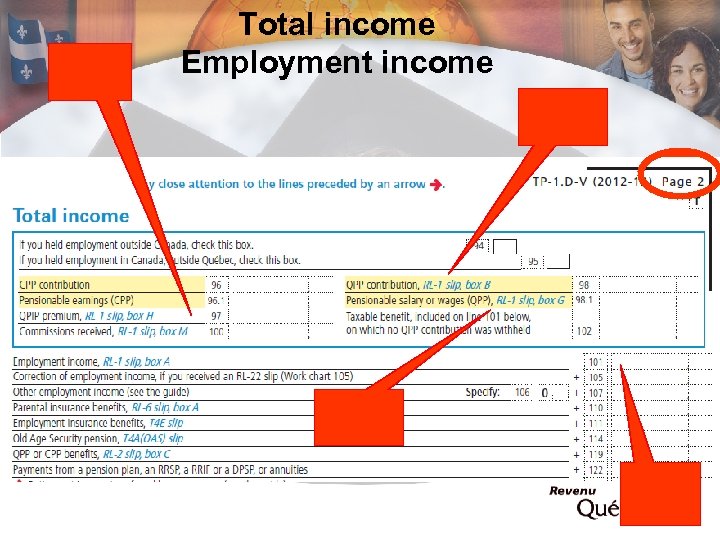

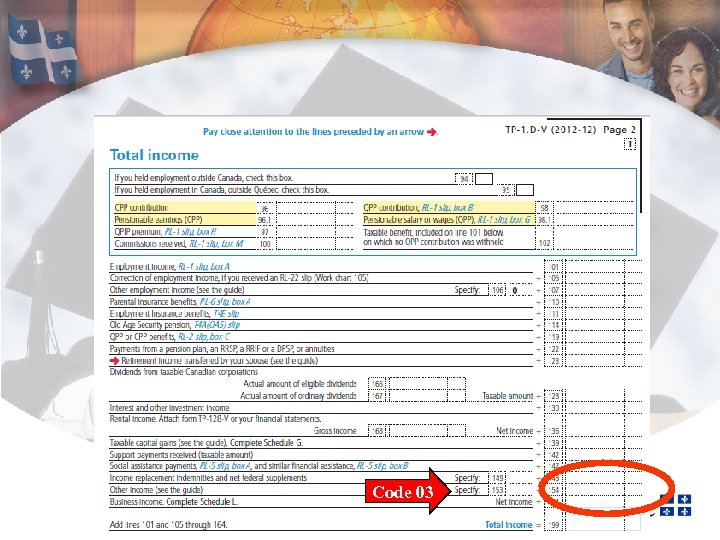

Total income Employment income

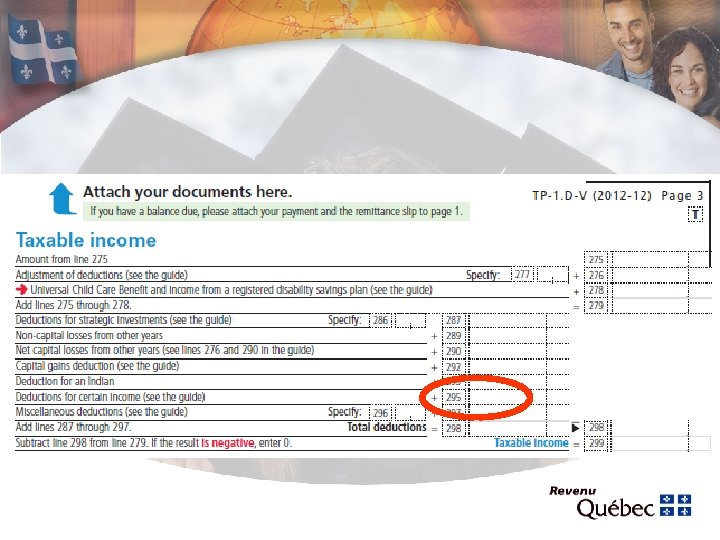

Foreign researchers on a post-doctoral internship

Deduction for workers

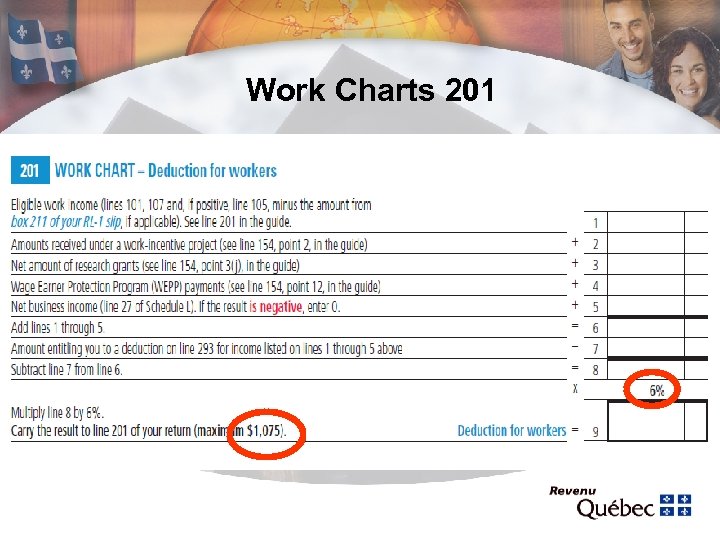

Work Charts 201

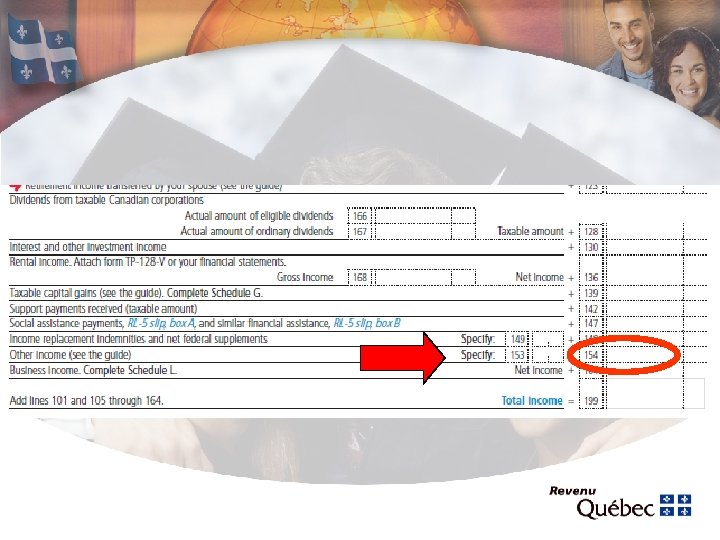

Code 03

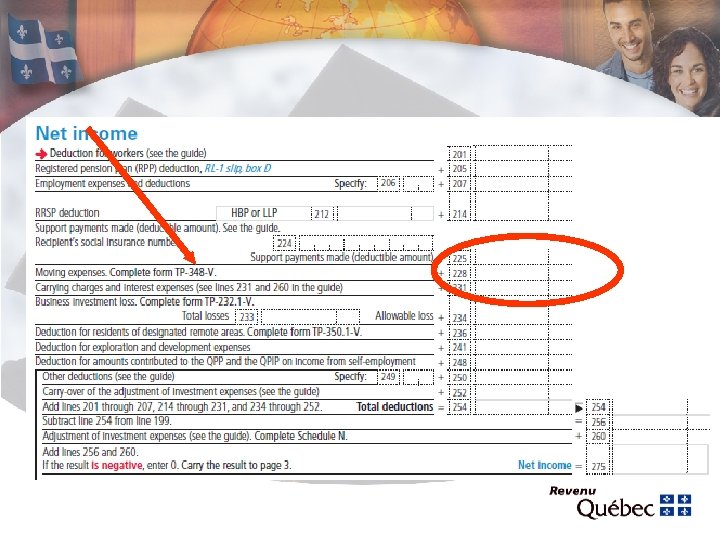

Moving expenses

International students and moving expenses

Tax credits

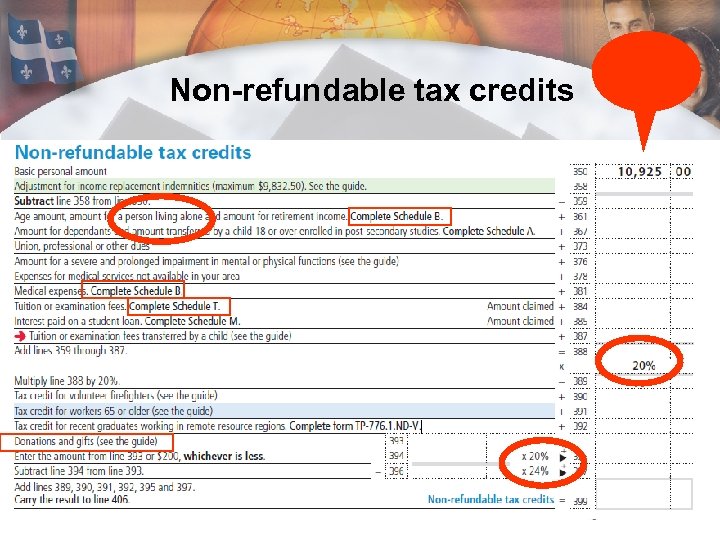

Non-refundable tax credits

Non-refundable tax credits

Non-refundable tax credits

Non-refundable tax credits

Person living alone

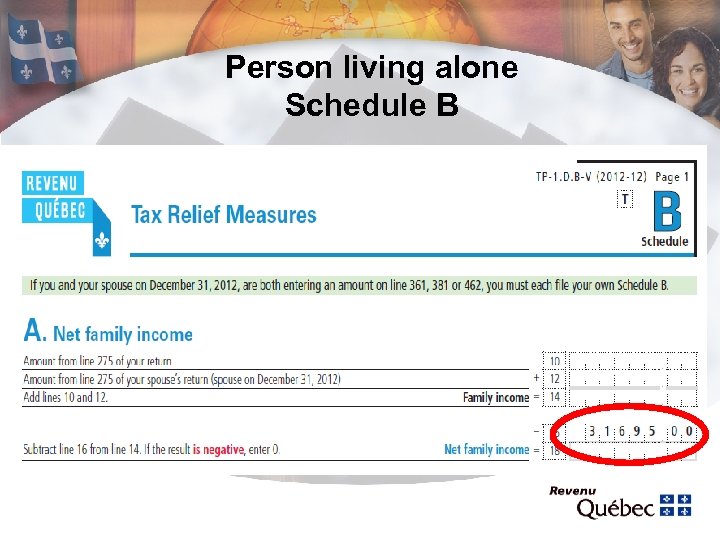

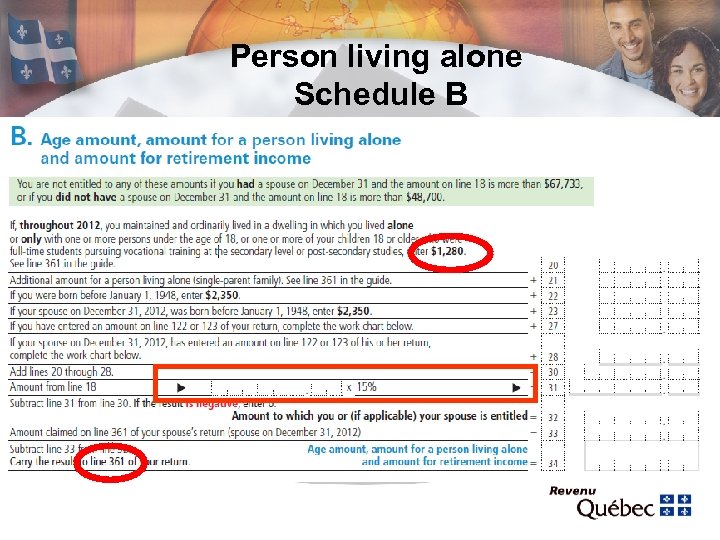

Person living alone Schedule B

Person living alone Schedule B

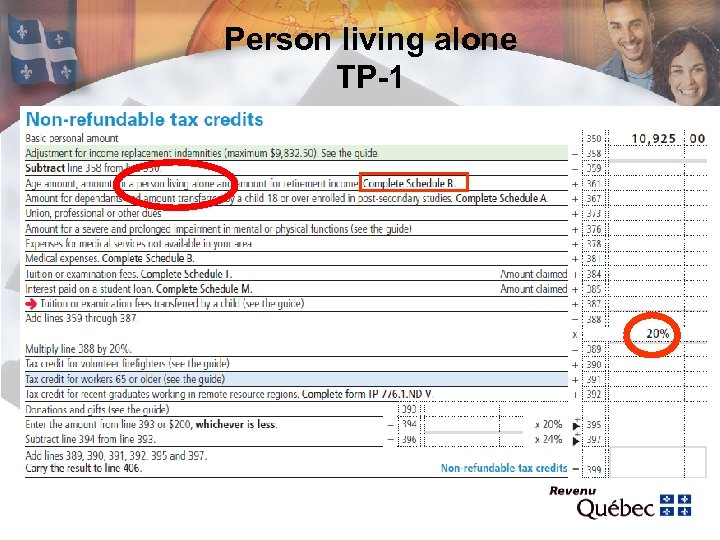

Person living alone TP-1

Medical expenses

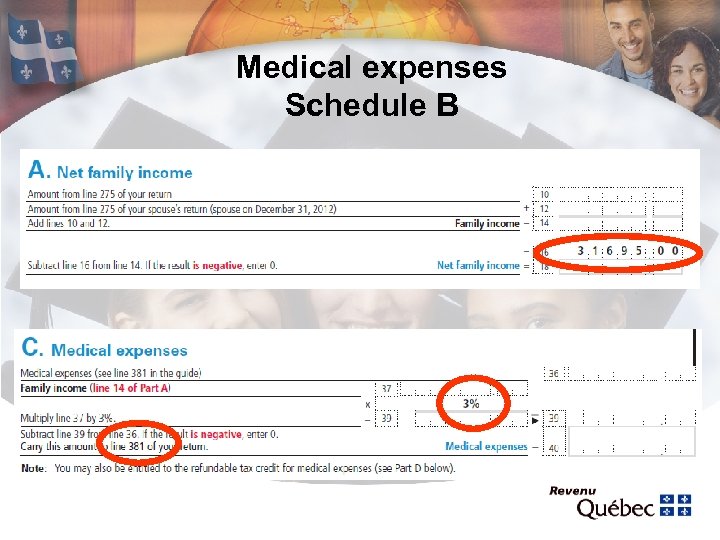

Medical expenses Schedule B

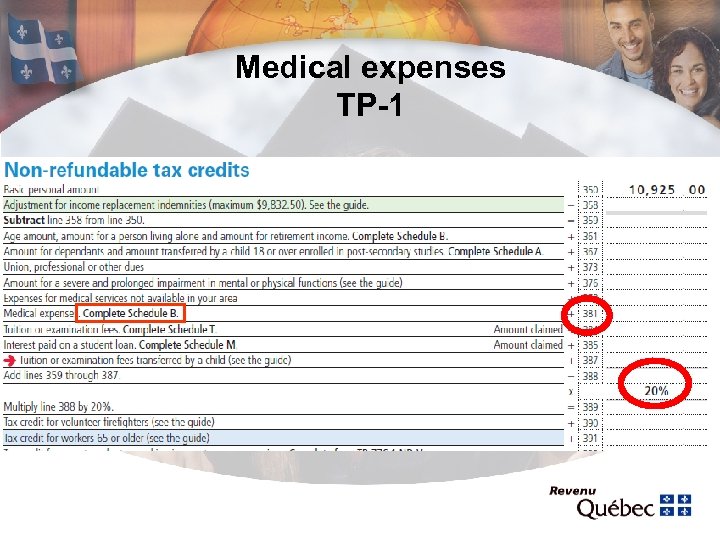

Medical expenses TP-1

Tuition or examination fees

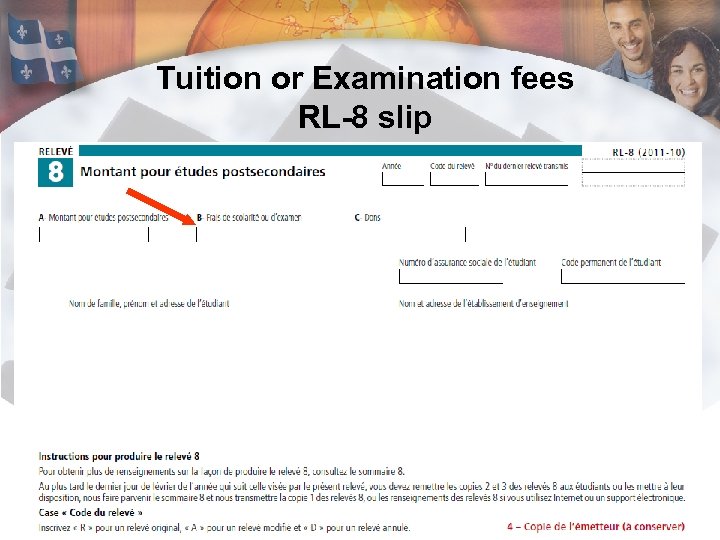

Tuition or Examination fees RL-8 slip

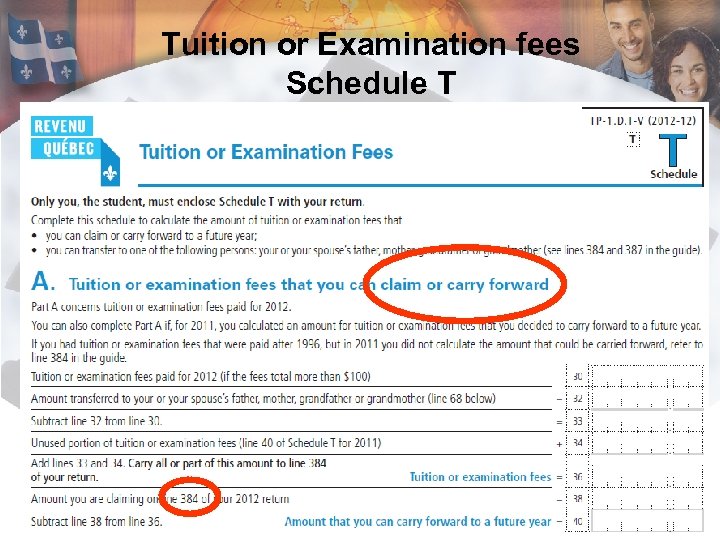

Tuition or Examination fees Schedule T

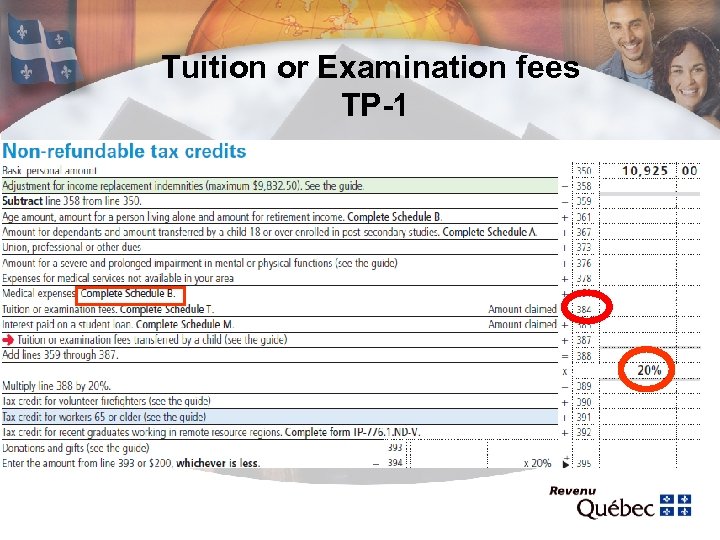

Tuition or Examination fees TP-1

Income tax and contributions

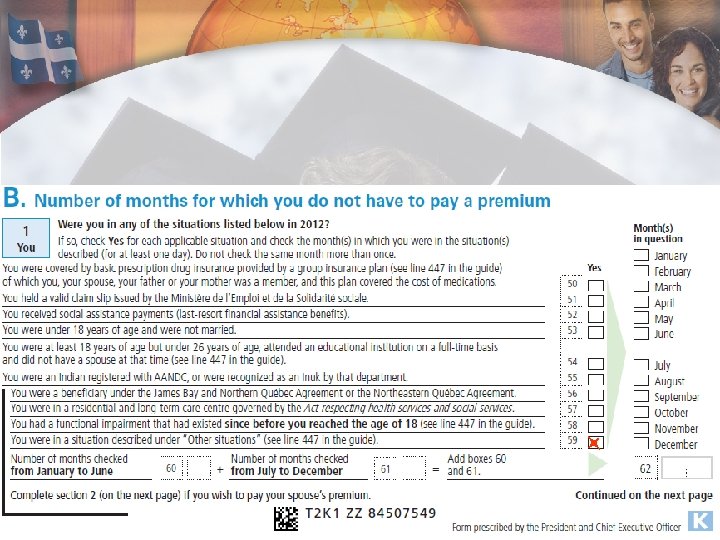

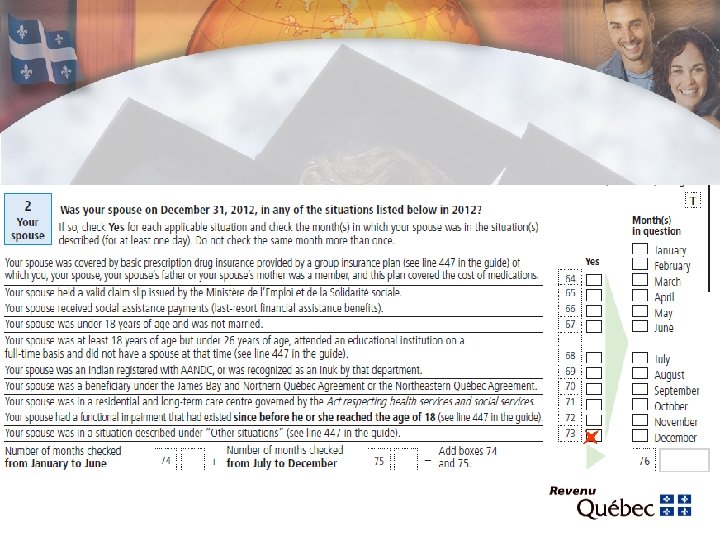

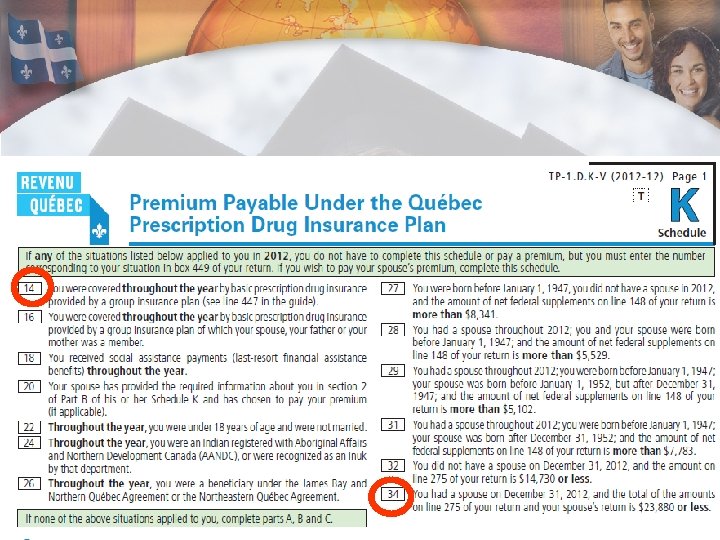

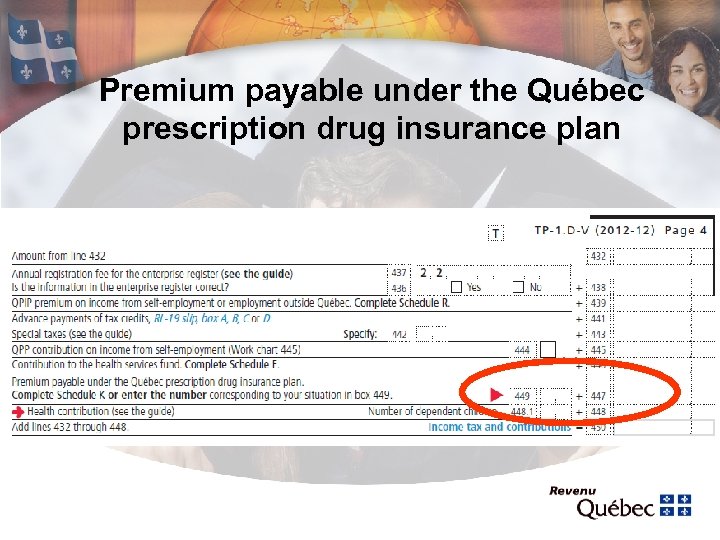

Premium payable under the Québec prescription drug insurance plan

Health contribution line 448

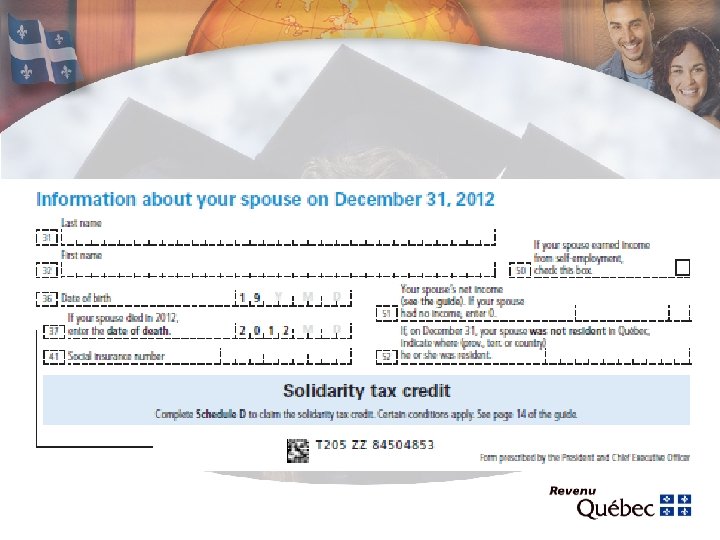

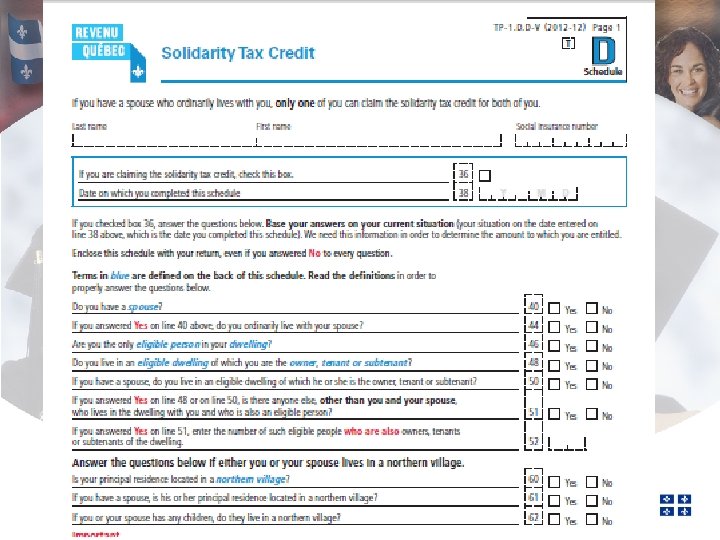

Solidarity Tax Credit Scedule D

Solidarity Tax Credit Eligibility

Solidarity Tax Credit

Solidarity Tax Credit July 2011 -June 2013

Tax treaties

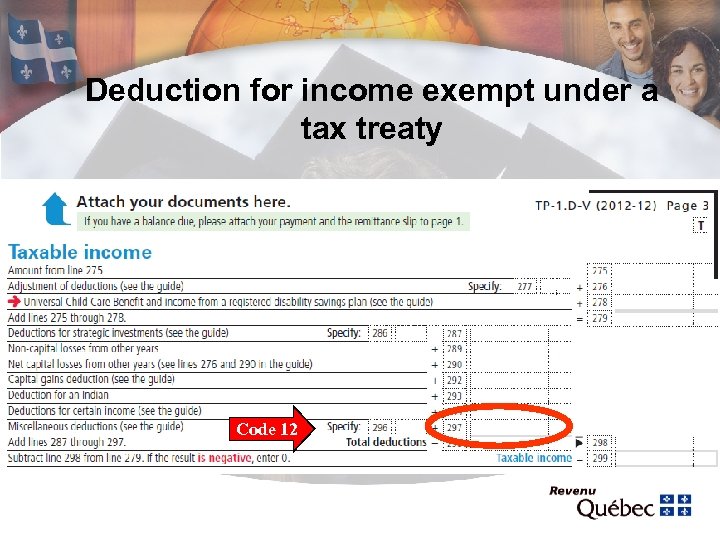

Deduction for income exempt under a tax treaty Code 12

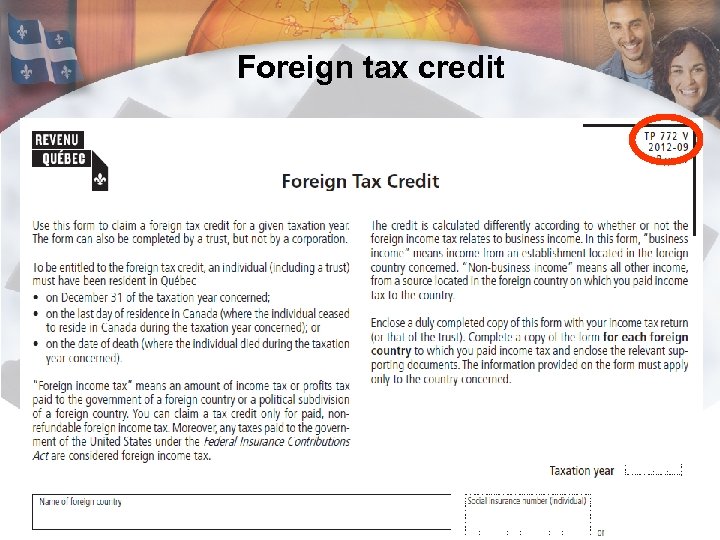

Foreign tax credit

Foreign tax credit

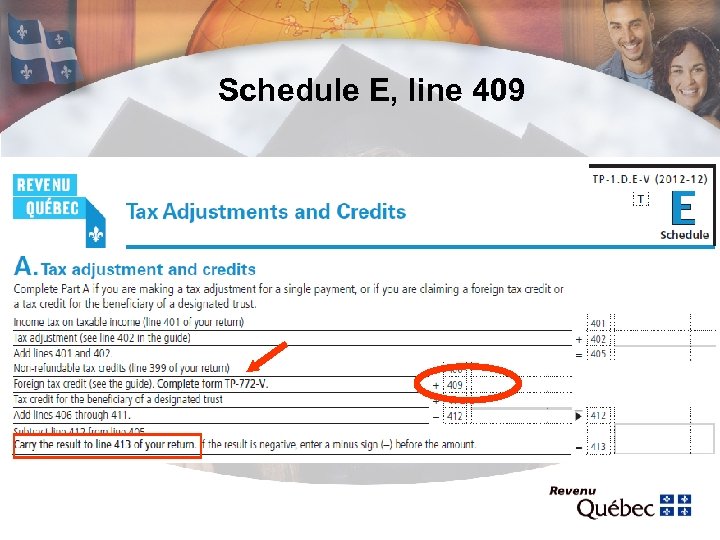

Schedule E, line 409

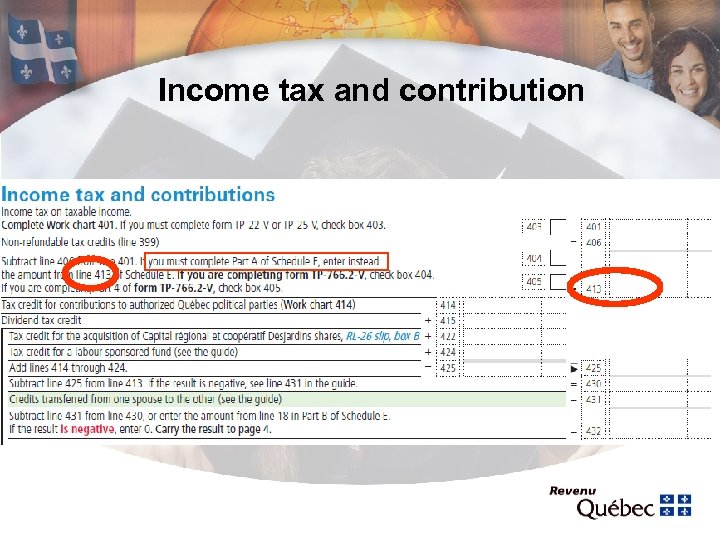

Income tax and contribution

Filing deadlines

Thank you

753d544199b21103dafb182810d969b7.ppt