Welcome to 2008 Analysts Presentation

Welcome to 2008 Analysts Presentation

PRESENTERS: • Mike Wylie - Chairman • Louwtjie Nel - CEO • Kobie Botha - EXCO, MD Roads & Earthworks • Paul Foley - EXCO, MD Civil & Building • Savannah Maziya - Main Board non-executive

PRESENTERS: • Mike Wylie - Chairman • Louwtjie Nel - CEO • Kobie Botha - EXCO, MD Roads & Earthworks • Paul Foley - EXCO, MD Civil & Building • Savannah Maziya - Main Board non-executive

AGENDA: 1. BEE - Mike Wylie 2. Company structure - Mike Wylie 3. Current contracts - Paul Foley & Kobie Botha 4. Prospects - Louwtjie Nel 5. Industrial - Mike Wylie 6. Financial highlights - Savannah Maziya

AGENDA: 1. BEE - Mike Wylie 2. Company structure - Mike Wylie 3. Current contracts - Paul Foley & Kobie Botha 4. Prospects - Louwtjie Nel 5. Industrial - Mike Wylie 6. Financial highlights - Savannah Maziya

COMPANY STRUCTURE

COMPANY STRUCTURE

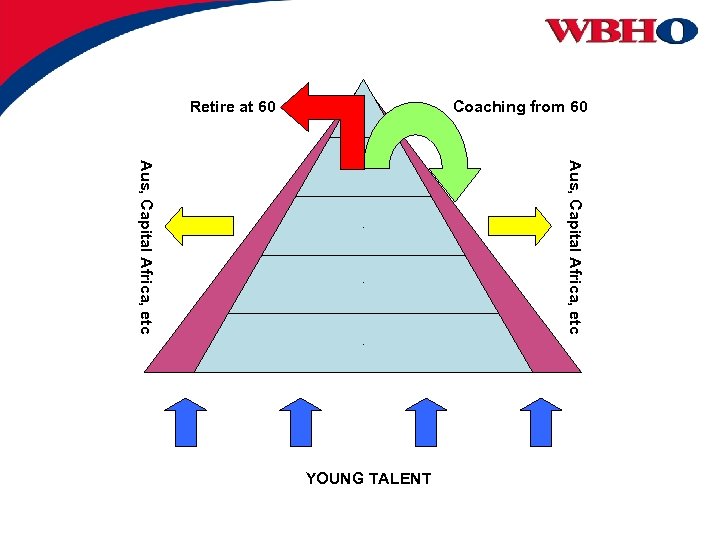

. . YOUNG TALENT Aus, Capital Africa, etc . Coaching from 60. Retire at 60

. . YOUNG TALENT Aus, Capital Africa, etc . Coaching from 60. Retire at 60

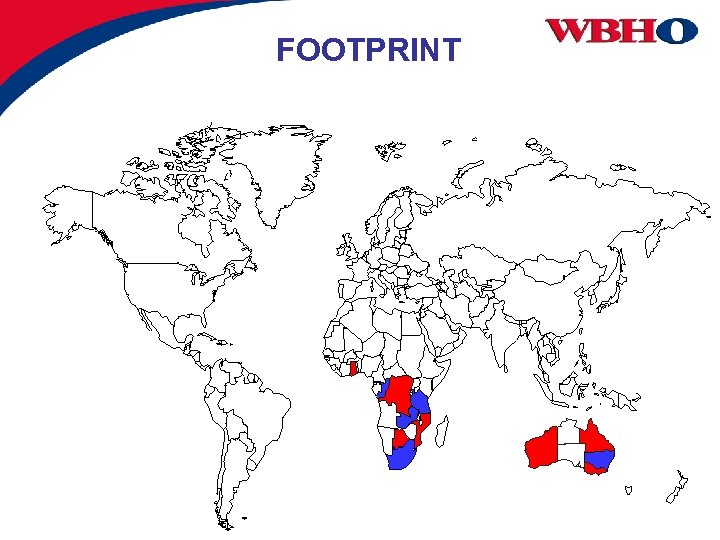

FOOTPRINT

FOOTPRINT

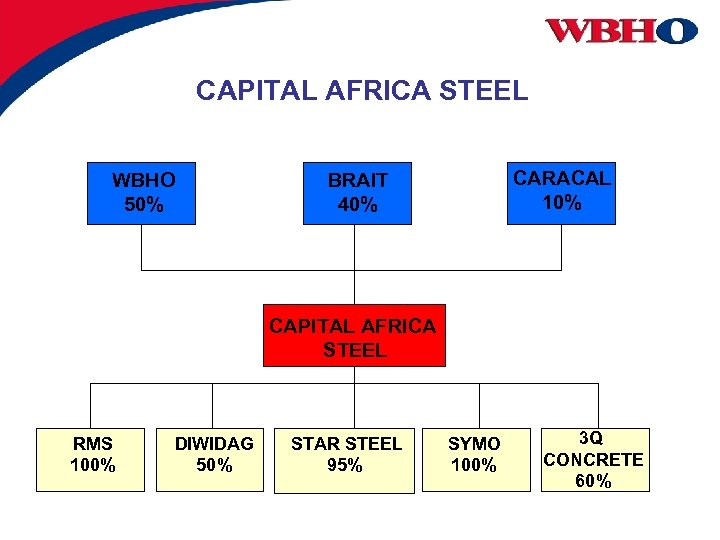

INDUSTRIAL

INDUSTRIAL

CAPITAL AFRICA STEEL WBHO 50% CARACAL 10% BRAIT 40% CAPITAL AFRICA STEEL RMS 100% DIWIDAG 50% STAR STEEL 95% SYMO 100% 3 Q CONCRETE 60%

CAPITAL AFRICA STEEL WBHO 50% CARACAL 10% BRAIT 40% CAPITAL AFRICA STEEL RMS 100% DIWIDAG 50% STAR STEEL 95% SYMO 100% 3 Q CONCRETE 60%

PROSPECTS

PROSPECTS

PROSPECTS Roads & Civils • SANRAL and Provincial Roads - R 50 B • DWAF – new and refurbished dams -R 1 B • Transnet and Portnet - R 40 B • Gas and petroleum pipelines -R 9 B • ACSA airports -R 8 B • Mining and infrastructure RSA, Ghana, DRC, Zambia -R 1 B

PROSPECTS Roads & Civils • SANRAL and Provincial Roads - R 50 B • DWAF – new and refurbished dams -R 1 B • Transnet and Portnet - R 40 B • Gas and petroleum pipelines -R 9 B • ACSA airports -R 8 B • Mining and infrastructure RSA, Ghana, DRC, Zambia -R 1 B

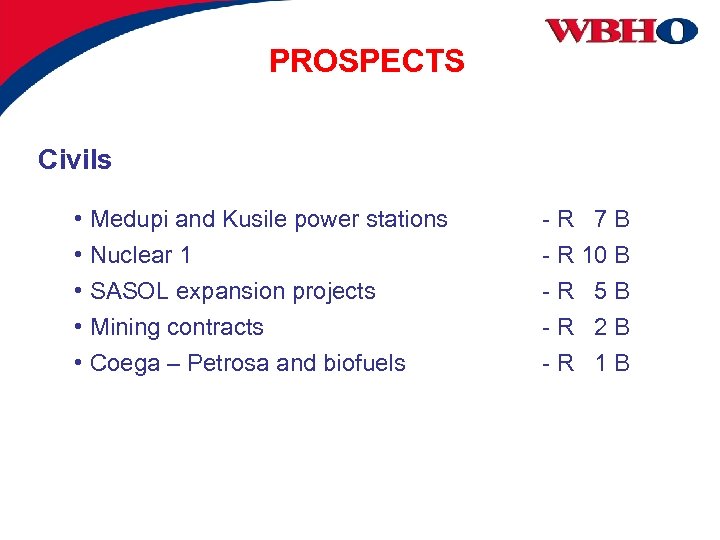

PROSPECTS Civils • Medupi and Kusile power stations • Nuclear 1 • SASOL expansion projects • Mining contracts • Coega – Petrosa and biofuels -R 7 B - R 10 B -R 5 B -R 2 B -R 1 B

PROSPECTS Civils • Medupi and Kusile power stations • Nuclear 1 • SASOL expansion projects • Mining contracts • Coega – Petrosa and biofuels -R 7 B - R 10 B -R 5 B -R 2 B -R 1 B

PROSPECTS Building • PPP’s – Healthcare and prisons • ACSA – Midfields • Retail – Upgrades and regional malls • Corporate office blocks • Hotels • Convention centres • Government – National archives • UAE, Mauritius, Zambia - R 10 B - R 20 B -R 7 B -R 1 B -R 2 B

PROSPECTS Building • PPP’s – Healthcare and prisons • ACSA – Midfields • Retail – Upgrades and regional malls • Corporate office blocks • Hotels • Convention centres • Government – National archives • UAE, Mauritius, Zambia - R 10 B - R 20 B -R 7 B -R 1 B -R 2 B

PROSPECTS Probuild • Retail • Commercial • Residential • Airports • Education -R 4 B -R 7 B -R 3 B

PROSPECTS Probuild • Retail • Commercial • Residential • Airports • Education -R 4 B -R 7 B -R 3 B

FINANCIAL HIGHLIGHTS

FINANCIAL HIGHLIGHTS

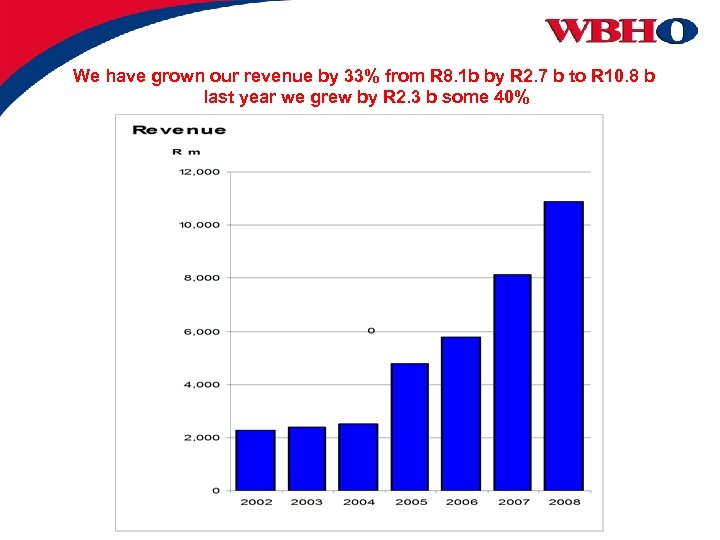

We have grown our revenue by 33% from R 8. 1 b by R 2. 7 b to R 10. 8 b last year we grew by R 2. 3 b some 40%

We have grown our revenue by 33% from R 8. 1 b by R 2. 7 b to R 10. 8 b last year we grew by R 2. 3 b some 40%

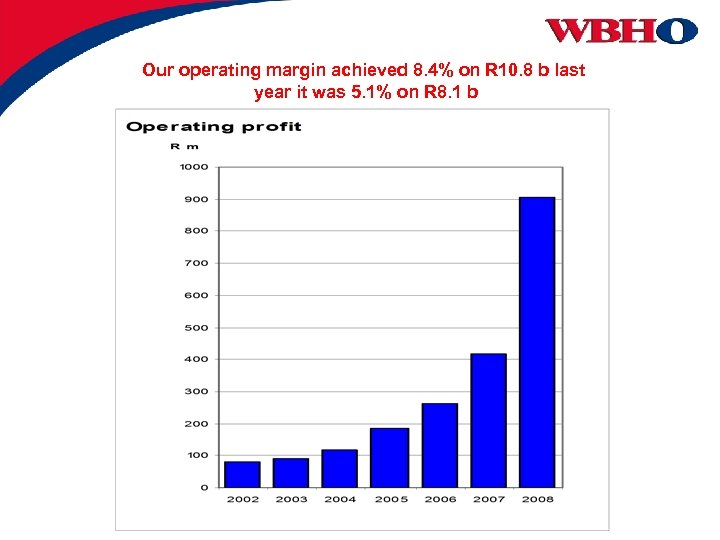

Our operating margin achieved 8. 4% on R 10. 8 b last year it was 5. 1% on R 8. 1 b

Our operating margin achieved 8. 4% on R 10. 8 b last year it was 5. 1% on R 8. 1 b

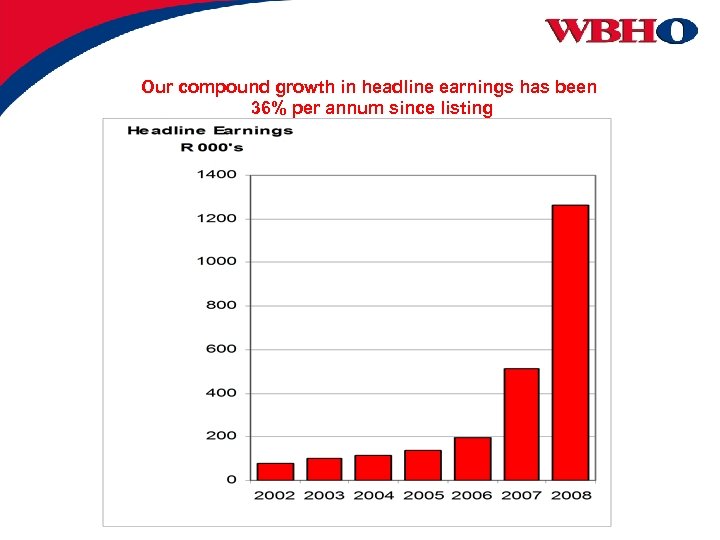

Our compound growth in headline earnings has been 36% per annum since listing

Our compound growth in headline earnings has been 36% per annum since listing

HIGHLIGHTS • WBHO’s earnings per share have improved by 160% • In January 2008 we restructured CAS and reduced our investment to 50%, giving rise to R 93 m profit and CAS then became an associate • Headline earnings per share up 147% after adding back impairment of goodwill and deducting the profit on the sale of CAS and profit on the sale of assets • Balance sheet and cash balances remain strong

HIGHLIGHTS • WBHO’s earnings per share have improved by 160% • In January 2008 we restructured CAS and reduced our investment to 50%, giving rise to R 93 m profit and CAS then became an associate • Headline earnings per share up 147% after adding back impairment of goodwill and deducting the profit on the sale of CAS and profit on the sale of assets • Balance sheet and cash balances remain strong

RELY ON OUR ABILITY QUESTIONS ?

RELY ON OUR ABILITY QUESTIONS ?