70aeea1200ed57466d19c16ed75b798d.ppt

- Количество слайдов: 169

Welcome Professional Development Day 19 March 2010

Welcome Professional Development Day 19 March 2010

Today’s Agenda 9. 00 - 9. 45 The underinsurance problem in Australia – Warwick Gribble/Nick Blue - BT 9. 45 -10. 30 Defensive Funds – More Risk Than You Thought – Chris Clayton – CFS 10. 30 -10. 45 Morning Tea 10. 45 -11. 30 It’s all in the Structure – Kevin Barnes - ING 11. 30 -12. 10 Compliance Update – Rae Stagbouer- Capstone 12. 10 -12: 30 Licensee Update – Grant O’Riley - Capstone 12. 30 -1. 15 Lunch 1. 15 -2. 00 Creating A Marketing Culture – Joe Ferry-Gibson - AXA 2. 00 -2. 45 Economic Update – Claire Harding – Australian Unity 2. 45 -3. 00 Afternoon Tea 3. 00 -3. 45 China’s future growth and the impact on Australia - Robin Young – Black. Rock 3. 45 Close

Today’s Agenda 9. 00 - 9. 45 The underinsurance problem in Australia – Warwick Gribble/Nick Blue - BT 9. 45 -10. 30 Defensive Funds – More Risk Than You Thought – Chris Clayton – CFS 10. 30 -10. 45 Morning Tea 10. 45 -11. 30 It’s all in the Structure – Kevin Barnes - ING 11. 30 -12. 10 Compliance Update – Rae Stagbouer- Capstone 12. 10 -12: 30 Licensee Update – Grant O’Riley - Capstone 12. 30 -1. 15 Lunch 1. 15 -2. 00 Creating A Marketing Culture – Joe Ferry-Gibson - AXA 2. 00 -2. 45 Economic Update – Claire Harding – Australian Unity 2. 45 -3. 00 Afternoon Tea 3. 00 -3. 45 China’s future growth and the impact on Australia - Robin Young – Black. Rock 3. 45 Close

Australia’s underinsurance problem Capstone PD days – March 2010

Australia’s underinsurance problem Capstone PD days – March 2010

Background on today’s presentation 5

Background on today’s presentation 5

Agenda 1. Australia’s underinsurance problem 2. Why have we as an industry been slow to address this issue 3. Possible solutions to make it easier to write risk 6

Agenda 1. Australia’s underinsurance problem 2. Why have we as an industry been slow to address this issue 3. Possible solutions to make it easier to write risk 6

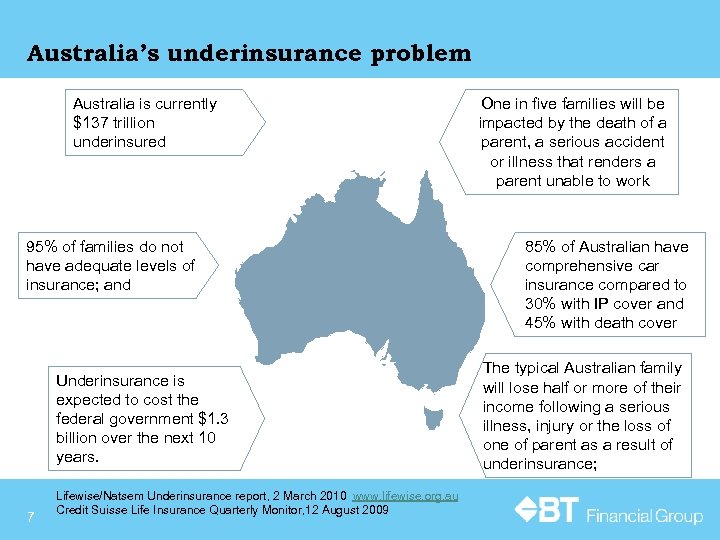

Australia’s underinsurance problem Australia is currently $137 trillion underinsured 95% of families do not have adequate levels of insurance; and Underinsurance is expected to cost the federal government $1. 3 billion over the next 10 years. 7 Lifewise/Natsem Underinsurance report, 2 March 2010 www. lifewise. org. au Credit Suisse Life Insurance Quarterly Monitor, 12 August 2009 One in five families will be impacted by the death of a parent, a serious accident or illness that renders a parent unable to work 85% of Australian have comprehensive car insurance compared to 30% with IP cover and 45% with death cover The typical Australian family will lose half or more of their income following a serious illness, injury or the loss of one of parent as a result of underinsurance;

Australia’s underinsurance problem Australia is currently $137 trillion underinsured 95% of families do not have adequate levels of insurance; and Underinsurance is expected to cost the federal government $1. 3 billion over the next 10 years. 7 Lifewise/Natsem Underinsurance report, 2 March 2010 www. lifewise. org. au Credit Suisse Life Insurance Quarterly Monitor, 12 August 2009 One in five families will be impacted by the death of a parent, a serious accident or illness that renders a parent unable to work 85% of Australian have comprehensive car insurance compared to 30% with IP cover and 45% with death cover The typical Australian family will lose half or more of their income following a serious illness, injury or the loss of one of parent as a result of underinsurance;

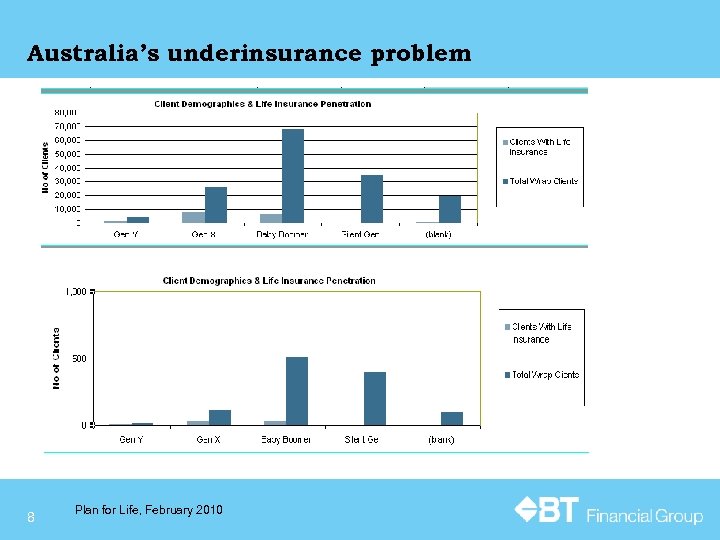

Australia’s underinsurance problem 8 Plan for Life, February 2010

Australia’s underinsurance problem 8 Plan for Life, February 2010

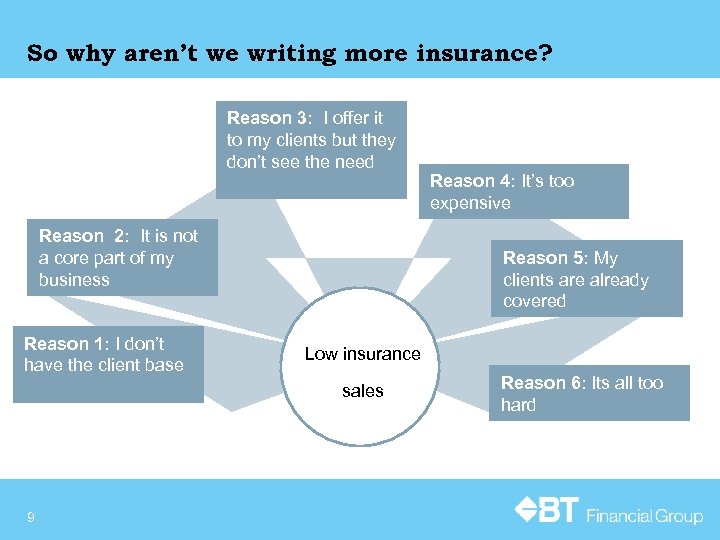

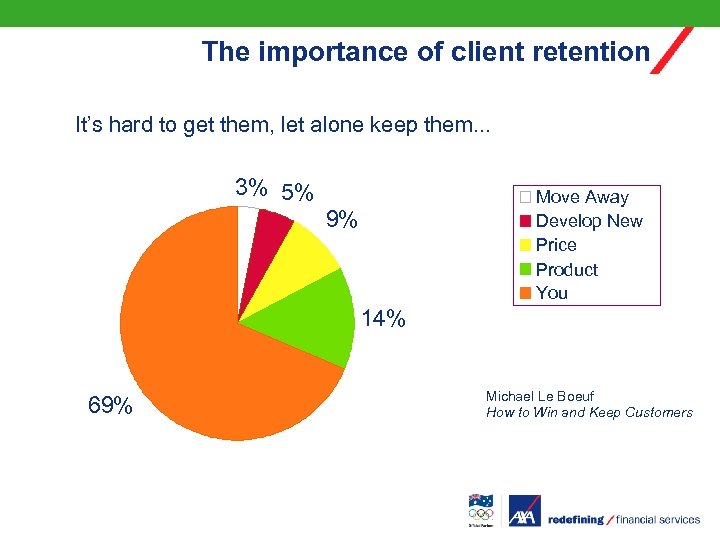

So why aren’t we writing more insurance? Reason 3: I offer it to my clients but they don’t see the need Reason 2: It is not a core part of my business Reason 1: I don’t have the client base Reason 5: My clients are already covered Low insurance sales 9 Reason 4: It’s too expensive Reason 6: Its all too hard

So why aren’t we writing more insurance? Reason 3: I offer it to my clients but they don’t see the need Reason 2: It is not a core part of my business Reason 1: I don’t have the client base Reason 5: My clients are already covered Low insurance sales 9 Reason 4: It’s too expensive Reason 6: Its all too hard

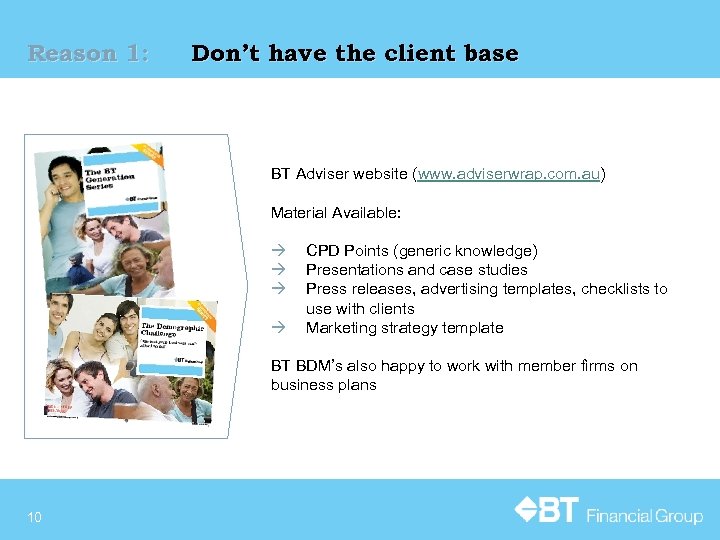

Reason 1: Don’t have the client base BT Adviser website (www. adviserwrap. com. au) Material Available: CPD Points (generic knowledge) Presentations and case studies Press releases, advertising templates, checklists to use with clients Marketing strategy template BT BDM’s also happy to work with member firms on business plans 10

Reason 1: Don’t have the client base BT Adviser website (www. adviserwrap. com. au) Material Available: CPD Points (generic knowledge) Presentations and case studies Press releases, advertising templates, checklists to use with clients Marketing strategy template BT BDM’s also happy to work with member firms on business plans 10

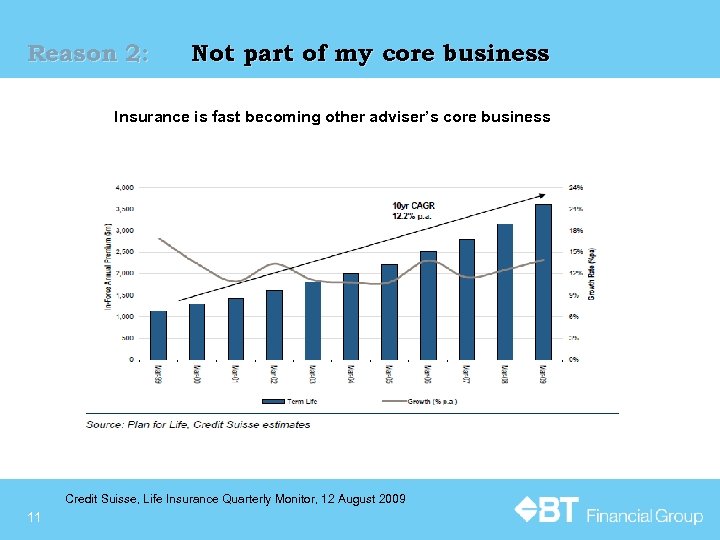

Reason 2: Not part of my core business Insurance is fast becoming other adviser’s core business Credit Suisse, Life Insurance Quarterly Monitor, 12 August 2009 11

Reason 2: Not part of my core business Insurance is fast becoming other adviser’s core business Credit Suisse, Life Insurance Quarterly Monitor, 12 August 2009 11

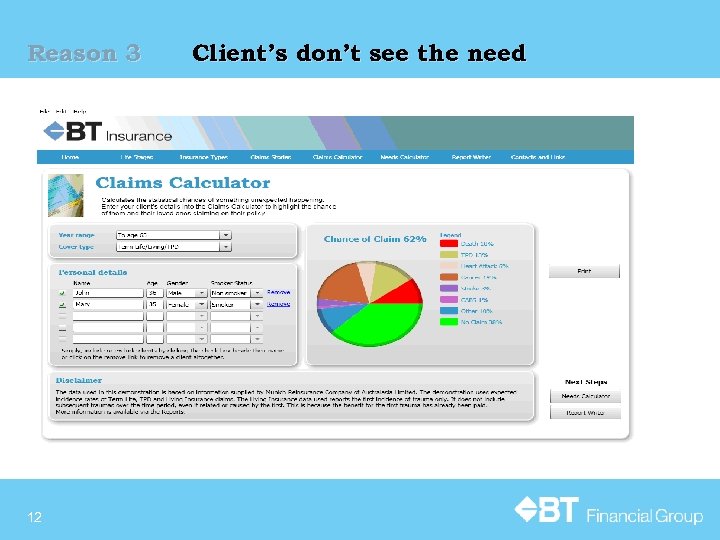

Reason 3 12 Client’s don’t see the need

Reason 3 12 Client’s don’t see the need

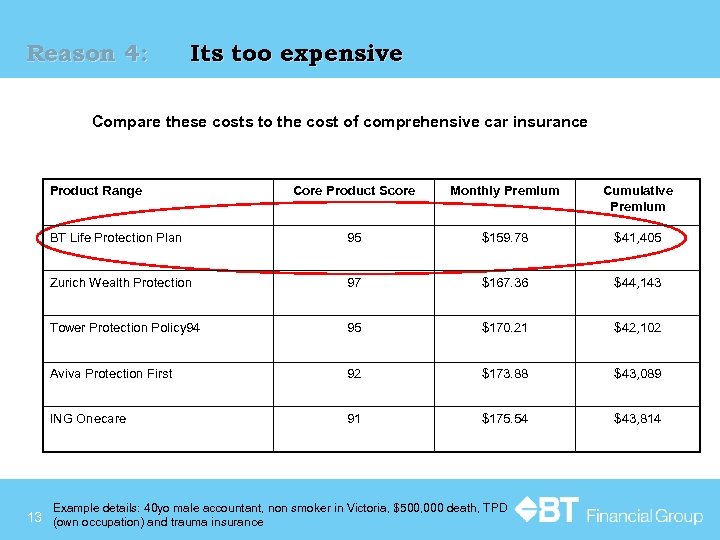

Reason 4: Its too expensive Compare these costs to the cost of comprehensive car insurance Product Range Core Product Score Monthly Premium Cumulative Premium BT Life Protection Plan 95 $159. 78 $41, 405 Zurich Wealth Protection 97 $167. 36 $44, 143 Tower Protection Policy 94 95 $170. 21 $42, 102 Aviva Protection First 92 $173. 88 $43, 089 ING Onecare 91 $175. 54 $43, 814 Example details: 40 yo male accountant, non smoker in Victoria, $500, 000 death, TPD 13 (own occupation) and trauma insurance

Reason 4: Its too expensive Compare these costs to the cost of comprehensive car insurance Product Range Core Product Score Monthly Premium Cumulative Premium BT Life Protection Plan 95 $159. 78 $41, 405 Zurich Wealth Protection 97 $167. 36 $44, 143 Tower Protection Policy 94 95 $170. 21 $42, 102 Aviva Protection First 92 $173. 88 $43, 089 ING Onecare 91 $175. 54 $43, 814 Example details: 40 yo male accountant, non smoker in Victoria, $500, 000 death, TPD 13 (own occupation) and trauma insurance

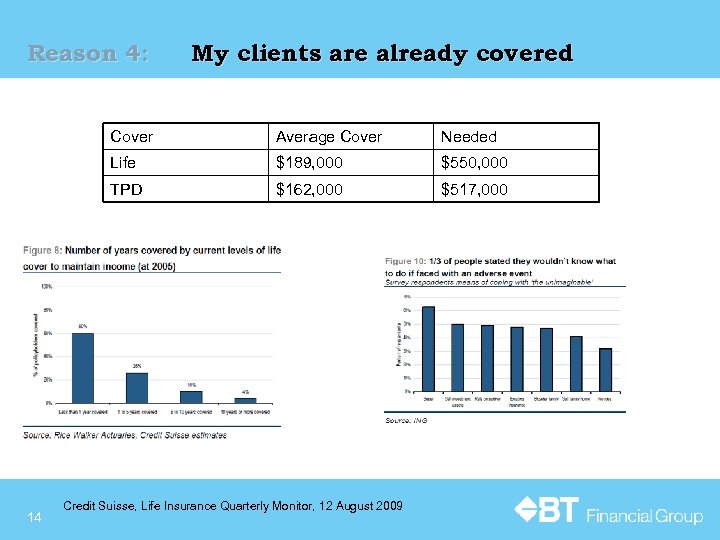

Reason 4: My clients are already covered Cover Needed Life $189, 000 $550, 000 TPD 14 Average Cover $162, 000 $517, 000 Credit Suisse, Life Insurance Quarterly Monitor, 12 August 2009

Reason 4: My clients are already covered Cover Needed Life $189, 000 $550, 000 TPD 14 Average Cover $162, 000 $517, 000 Credit Suisse, Life Insurance Quarterly Monitor, 12 August 2009

Reason 5: Its all too hard 15

Reason 5: Its all too hard 15

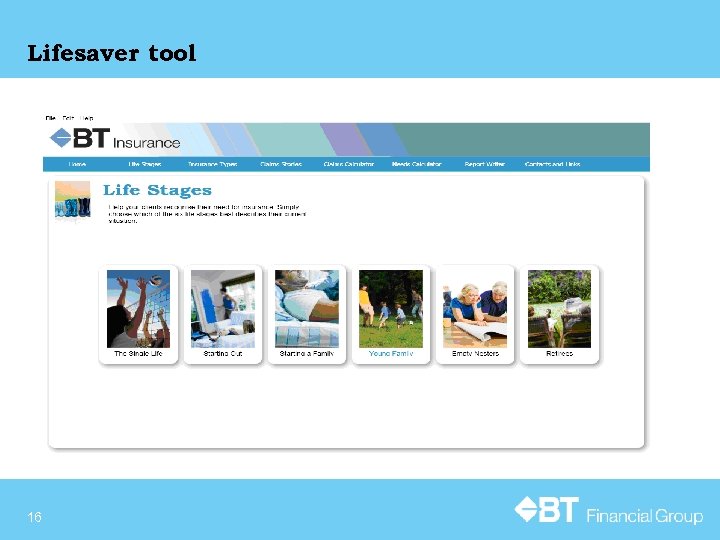

Lifesaver tool 16

Lifesaver tool 16

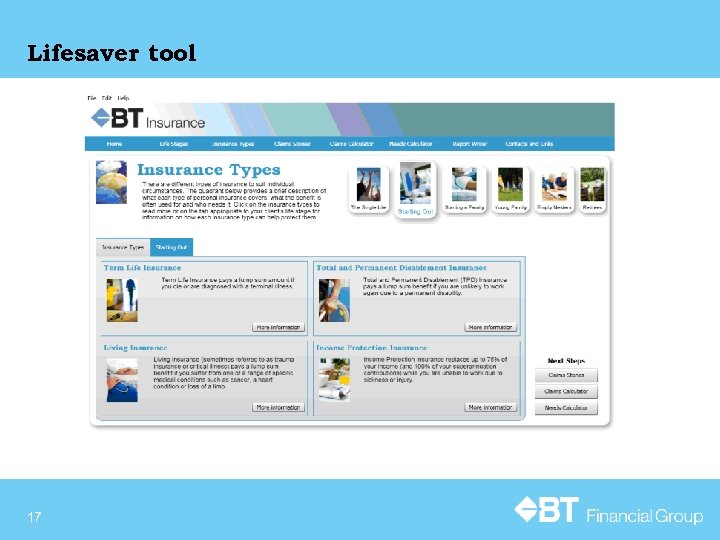

Lifesaver tool 17

Lifesaver tool 17

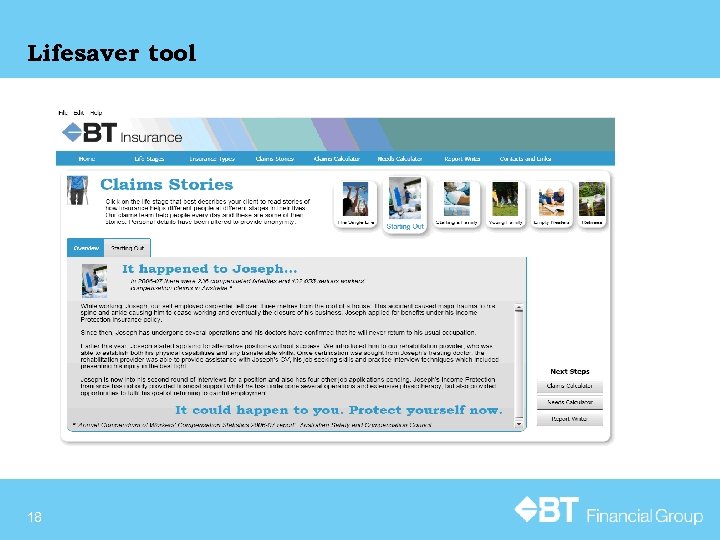

Lifesaver tool 18

Lifesaver tool 18

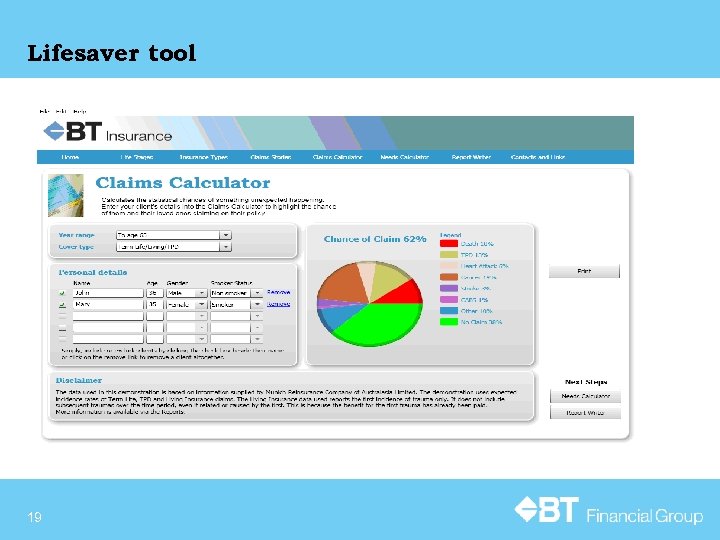

Lifesaver tool 19

Lifesaver tool 19

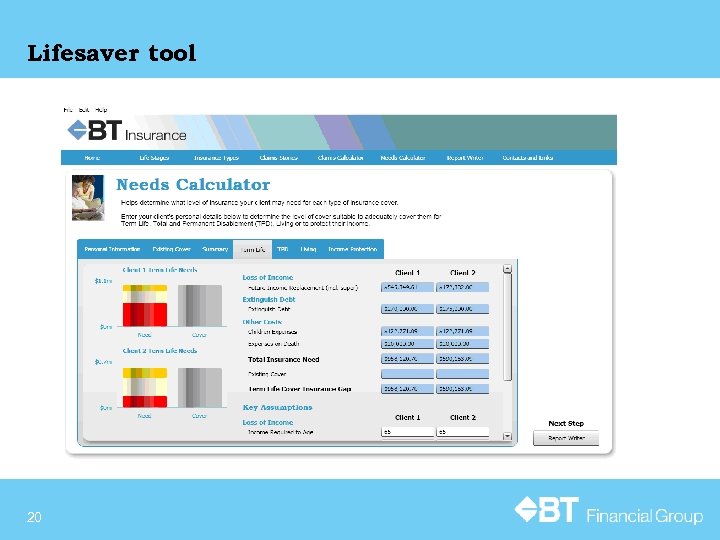

Lifesaver tool 20

Lifesaver tool 20

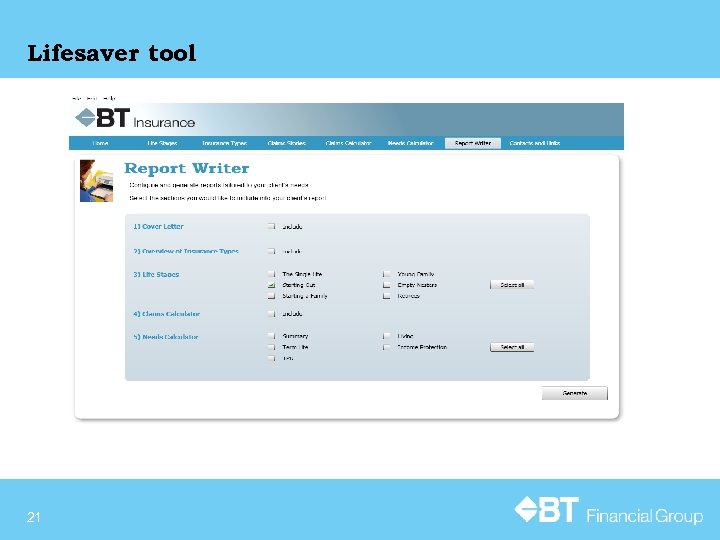

Lifesaver tool 21

Lifesaver tool 21

Presenters An Acadian Chris Clayton CEO Asset Management (Australia) Presentation for Capstone PD Day 19 th March, 2010 This presentation contains confidential and proprietary information of Acadian Asset Management (Australia). This presentation may not be reproduced or disseminated in whole or in part without the prior written consent of Acadian Asset Management (Australia) Limited. © Acadian Asset Management (Australia) Limited 2010. All rights reserved

Presenters An Acadian Chris Clayton CEO Asset Management (Australia) Presentation for Capstone PD Day 19 th March, 2010 This presentation contains confidential and proprietary information of Acadian Asset Management (Australia). This presentation may not be reproduced or disseminated in whole or in part without the prior written consent of Acadian Asset Management (Australia) Limited. © Acadian Asset Management (Australia) Limited 2010. All rights reserved

Defensive Funds: More risk than you thought? 24 Adviser use only

Defensive Funds: More risk than you thought? 24 Adviser use only

Disclaimer Acadian Asset Management (Australia) Limited ABN 41 114 200 127 AFS Licence 291872 (Acadian) is an Australian based asset management firm. Acadian is a joint venture between Acadian Asset Management LLC, a Boston based investment management and Colonial First State. Our investment team manages portfolios comprised of Australian stocks on behalf of retail and wholesale investors using the investment process and approach developed by Acadian Asset Management LLC Boston. This presentation is given by a representative of Acadian. The presenter does not receive specific payments or commissions for any advice given in this presentation. The presenter, other employees and directors of Acadian receive salaries, bonuses and other benefits from it. Acadian receives fees for investments in its products. For further detail please read our Financial Services Guide (FSG) available at colonialfirststate. com. au or by contacting Colonial First State Investment Limited’s Investor Service Centre on 13 13 36. Investments in the Acadian Wholesale Quant Yield Fund are offered by Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468. Product Disclosure Statements (PDS) and Information Memoranda (IM) are available from Acadian. Investors should consider the relevant PDS or IM before making an investment decision. This presentation is for adviser use only. The information is taken from sources which are believed to be accurate but Acadian accepts no liability of any kind to any person who relies on the information contained in the presentation. This presentation cannot be used or copied in whole or part without our express written consent. © Acadian Asset Management (Australia) Limited 2009. 25 Adviser use only

Disclaimer Acadian Asset Management (Australia) Limited ABN 41 114 200 127 AFS Licence 291872 (Acadian) is an Australian based asset management firm. Acadian is a joint venture between Acadian Asset Management LLC, a Boston based investment management and Colonial First State. Our investment team manages portfolios comprised of Australian stocks on behalf of retail and wholesale investors using the investment process and approach developed by Acadian Asset Management LLC Boston. This presentation is given by a representative of Acadian. The presenter does not receive specific payments or commissions for any advice given in this presentation. The presenter, other employees and directors of Acadian receive salaries, bonuses and other benefits from it. Acadian receives fees for investments in its products. For further detail please read our Financial Services Guide (FSG) available at colonialfirststate. com. au or by contacting Colonial First State Investment Limited’s Investor Service Centre on 13 13 36. Investments in the Acadian Wholesale Quant Yield Fund are offered by Colonial First State Investments Limited ABN 98 002 348 352 AFS Licence 232468. Product Disclosure Statements (PDS) and Information Memoranda (IM) are available from Acadian. Investors should consider the relevant PDS or IM before making an investment decision. This presentation is for adviser use only. The information is taken from sources which are believed to be accurate but Acadian accepts no liability of any kind to any person who relies on the information contained in the presentation. This presentation cannot be used or copied in whole or part without our express written consent. © Acadian Asset Management (Australia) Limited 2009. 25 Adviser use only

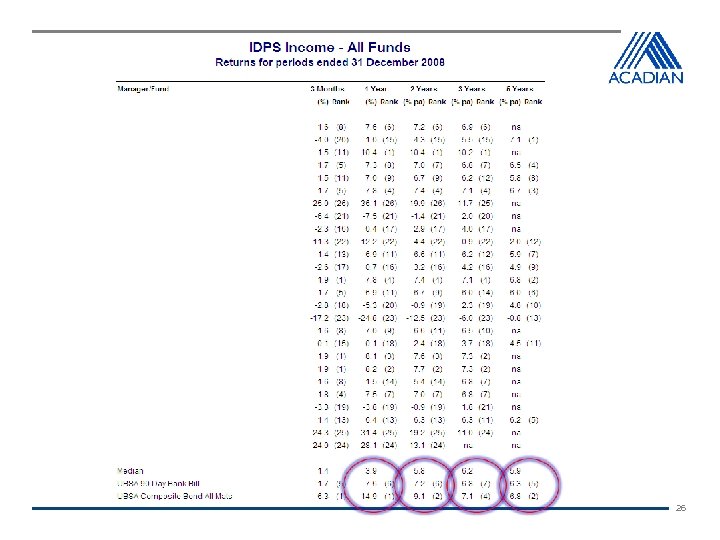

26

26

What’s going on with Defensive Funds? Definition of defensive strategy = capital stability, income, and low correlation with growth assets. Traditionally Defensive assets were primarily cash and bonds. The definition of a Defensive Fund has blurred – more total return focus, less income focus. This led to many funds to target capital appreciation. At a portfolio level the correlation between Defensive Funds and growth assets has increased. 27 Adviser use only

What’s going on with Defensive Funds? Definition of defensive strategy = capital stability, income, and low correlation with growth assets. Traditionally Defensive assets were primarily cash and bonds. The definition of a Defensive Fund has blurred – more total return focus, less income focus. This led to many funds to target capital appreciation. At a portfolio level the correlation between Defensive Funds and growth assets has increased. 27 Adviser use only

What’s going on with Defensive Funds? Back to basics: When growth assets fall in value, defensive assets should remain stable… …but it would be nice if our defensive assets worked harder. 28 Adviser use only

What’s going on with Defensive Funds? Back to basics: When growth assets fall in value, defensive assets should remain stable… …but it would be nice if our defensive assets worked harder. 28 Adviser use only

What’s a defensive fund? A strategy that provides stable, consistent returns with low correlation to growth assets. It is not the part of the portfolio used to chase returns – returns are secondary to capital security. 29

What’s a defensive fund? A strategy that provides stable, consistent returns with low correlation to growth assets. It is not the part of the portfolio used to chase returns – returns are secondary to capital security. 29

Fixed Interest What is a Government bond? Loan to either Federal or State Government Varying range of maturities, eg 3 yr, 5 yr, 10 yr Fixed interest payments Interest paid every 6 months Low risk if held to maturity 30 Adviser use only

Fixed Interest What is a Government bond? Loan to either Federal or State Government Varying range of maturities, eg 3 yr, 5 yr, 10 yr Fixed interest payments Interest paid every 6 months Low risk if held to maturity 30 Adviser use only

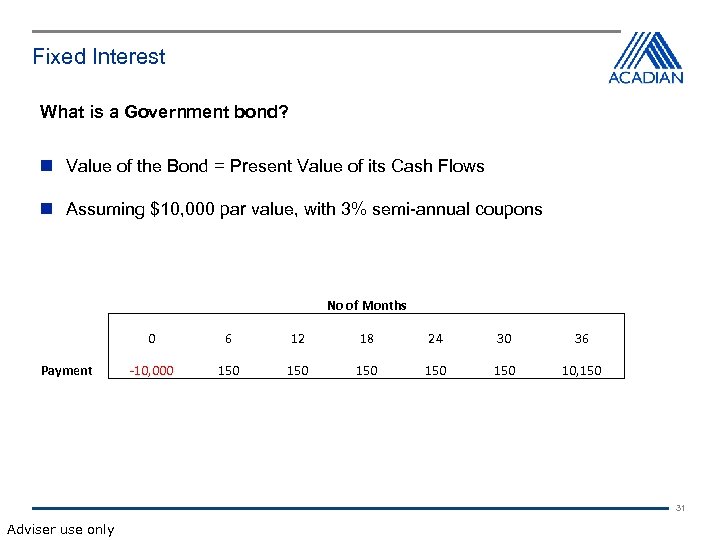

Fixed Interest What is a Government bond? Value of the Bond = Present Value of its Cash Flows Assuming $10, 000 par value, with 3% semi-annual coupons No of Months 0 Payment 6 12 18 24 30 36 -10, 000 150 150 10, 150 31 Adviser use only

Fixed Interest What is a Government bond? Value of the Bond = Present Value of its Cash Flows Assuming $10, 000 par value, with 3% semi-annual coupons No of Months 0 Payment 6 12 18 24 30 36 -10, 000 150 150 10, 150 31 Adviser use only

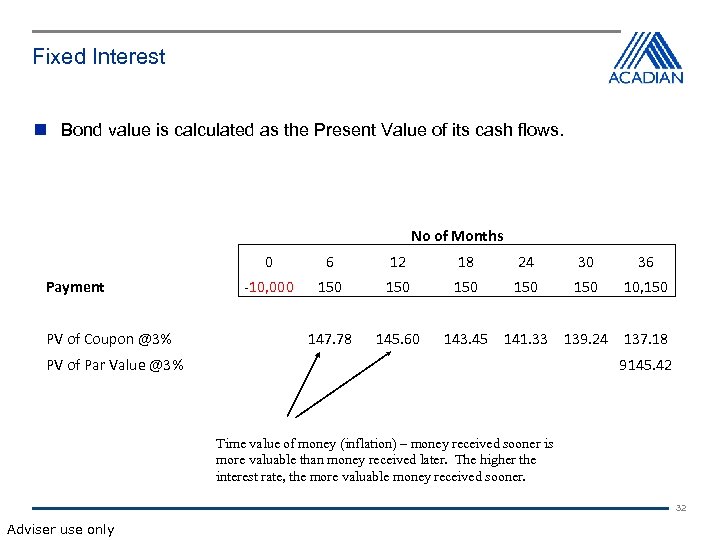

Fixed Interest Bond value is calculated as the Present Value of its cash flows. No of Months 0 Payment PV of Coupon @3% 6 12 18 24 30 36 -10, 000 150 150 10, 150 147. 78 145. 60 143. 45 141. 33 139. 24 137. 18 PV of Par Value @3% 9145. 42 Time value of money (inflation) – money received sooner is more valuable than money received later. The higher the interest rate, the more valuable money received sooner. 32 Adviser use only

Fixed Interest Bond value is calculated as the Present Value of its cash flows. No of Months 0 Payment PV of Coupon @3% 6 12 18 24 30 36 -10, 000 150 150 10, 150 147. 78 145. 60 143. 45 141. 33 139. 24 137. 18 PV of Par Value @3% 9145. 42 Time value of money (inflation) – money received sooner is more valuable than money received later. The higher the interest rate, the more valuable money received sooner. 32 Adviser use only

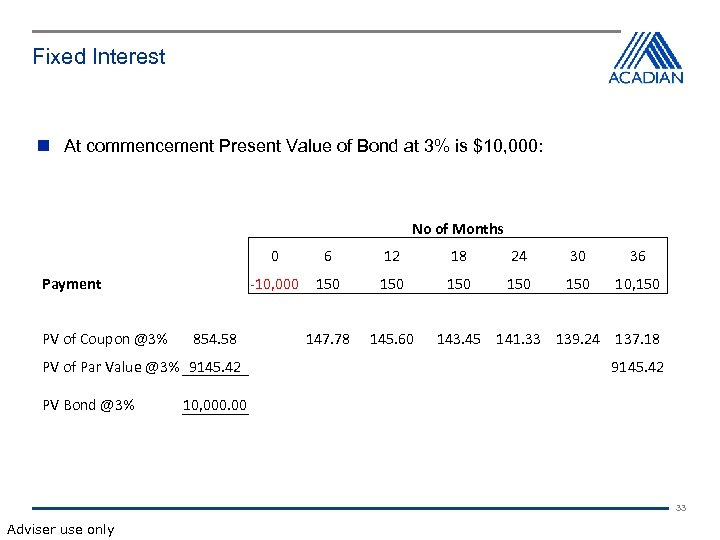

Fixed Interest At commencement Present Value of Bond at 3% is $10, 000: No of Months 0 Payment PV of Coupon @3% -10, 000 150 854. 58 PV of Par Value @3% 9145. 42 PV Bond @3% 6 147. 78 12 18 24 30 36 150 10, 150 145. 60 143. 45 141. 33 139. 24 137. 18 9145. 42 10, 000. 00 33 Adviser use only

Fixed Interest At commencement Present Value of Bond at 3% is $10, 000: No of Months 0 Payment PV of Coupon @3% -10, 000 150 854. 58 PV of Par Value @3% 9145. 42 PV Bond @3% 6 147. 78 12 18 24 30 36 150 10, 150 145. 60 143. 45 141. 33 139. 24 137. 18 9145. 42 10, 000. 00 33 Adviser use only

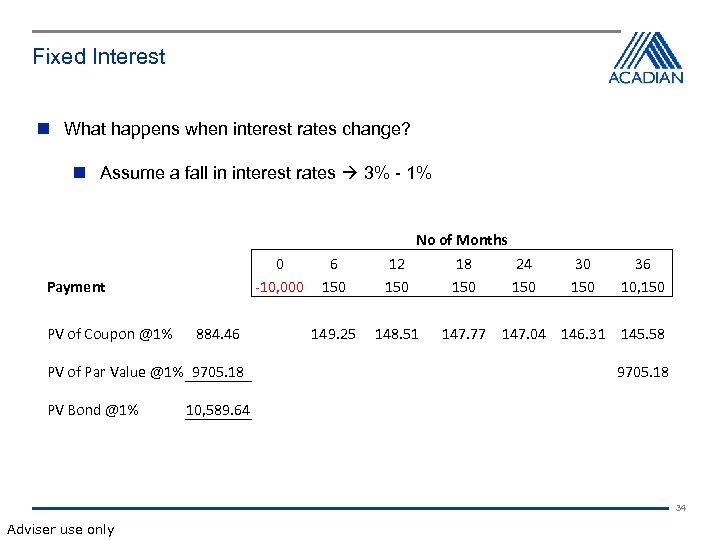

Fixed Interest What happens when interest rates change? Assume a fall in interest rates 3% - 1% 0 6 -10, 000 150 Payment PV of Coupon @1% 884. 46 PV of Par Value @1% 9705. 18 PV Bond @1% 149. 25 No of Months 12 18 24 150 150 148. 51 30 150 36 10, 150 147. 77 147. 04 146. 31 145. 58 9705. 18 10, 589. 64 34 Adviser use only

Fixed Interest What happens when interest rates change? Assume a fall in interest rates 3% - 1% 0 6 -10, 000 150 Payment PV of Coupon @1% 884. 46 PV of Par Value @1% 9705. 18 PV Bond @1% 149. 25 No of Months 12 18 24 150 150 148. 51 30 150 36 10, 150 147. 77 147. 04 146. 31 145. 58 9705. 18 10, 589. 64 34 Adviser use only

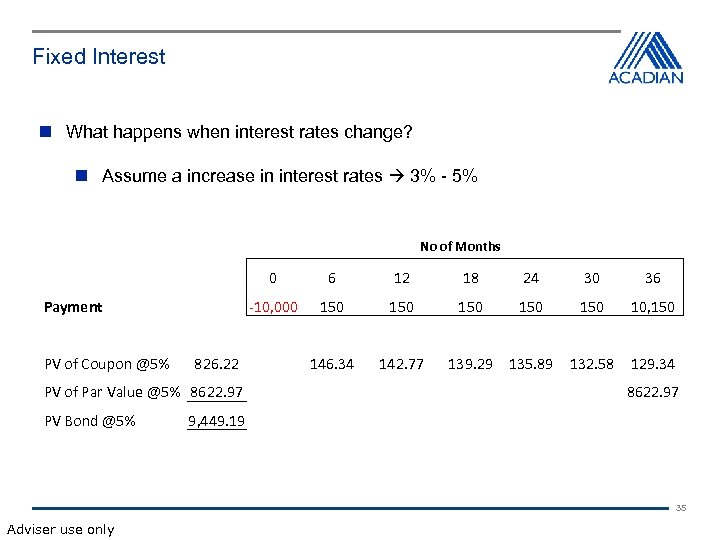

Fixed Interest What happens when interest rates change? Assume a increase in interest rates 3% - 5% No of Months 0 PV of Coupon @5% 826. 22 PV of Par Value @5% 8622. 97 PV Bond @5% 12 18 24 30 36 -10, 000 Payment 6 150 150 10, 150 146. 34 142. 77 139. 29 135. 89 132. 58 129. 34 8622. 97 9, 449. 19 35 Adviser use only

Fixed Interest What happens when interest rates change? Assume a increase in interest rates 3% - 5% No of Months 0 PV of Coupon @5% 826. 22 PV of Par Value @5% 8622. 97 PV Bond @5% 12 18 24 30 36 -10, 000 Payment 6 150 150 10, 150 146. 34 142. 77 139. 29 135. 89 132. 58 129. 34 8622. 97 9, 449. 19 35 Adviser use only

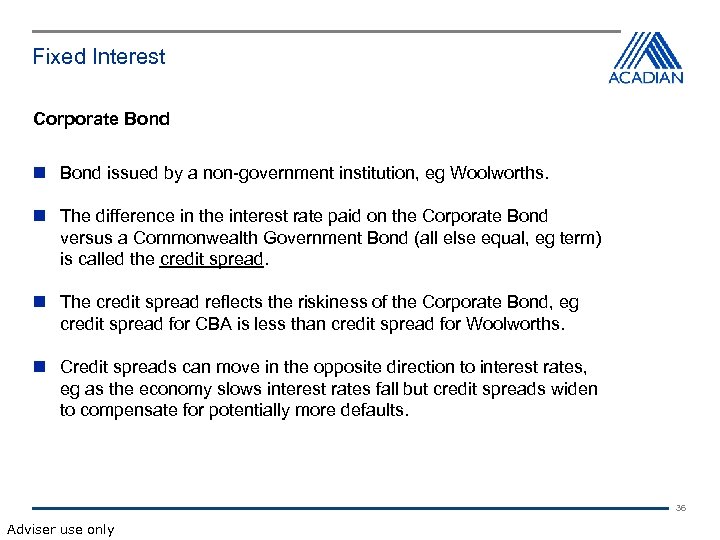

Fixed Interest Corporate Bond issued by a non-government institution, eg Woolworths. The difference in the interest rate paid on the Corporate Bond versus a Commonwealth Government Bond (all else equal, eg term) is called the credit spread. The credit spread reflects the riskiness of the Corporate Bond, eg credit spread for CBA is less than credit spread for Woolworths. Credit spreads can move in the opposite direction to interest rates, eg as the economy slows interest rates fall but credit spreads widen to compensate for potentially more defaults. 36 Adviser use only

Fixed Interest Corporate Bond issued by a non-government institution, eg Woolworths. The difference in the interest rate paid on the Corporate Bond versus a Commonwealth Government Bond (all else equal, eg term) is called the credit spread. The credit spread reflects the riskiness of the Corporate Bond, eg credit spread for CBA is less than credit spread for Woolworths. Credit spreads can move in the opposite direction to interest rates, eg as the economy slows interest rates fall but credit spreads widen to compensate for potentially more defaults. 36 Adviser use only

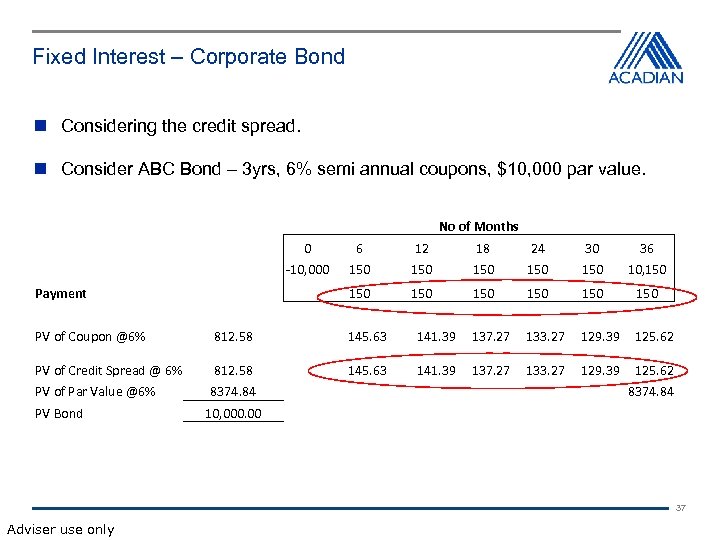

Fixed Interest – Corporate Bond Considering the credit spread. Consider ABC Bond – 3 yrs, 6% semi annual coupons, $10, 000 par value. No of Months 0 12 18 24 30 36 -10, 000 150 150 10, 150 Payment 6 150 150 150 PV of Coupon @6% 812. 58 145. 63 141. 39 137. 27 133. 27 129. 39 125. 62 PV of Credit Spread @ 6% 812. 58 145. 63 141. 39 137. 27 133. 27 129. 39 125. 62 PV of Par Value @6% 8374. 84 PV Bond 8374. 84 10, 000. 00 37 Adviser use only

Fixed Interest – Corporate Bond Considering the credit spread. Consider ABC Bond – 3 yrs, 6% semi annual coupons, $10, 000 par value. No of Months 0 12 18 24 30 36 -10, 000 150 150 10, 150 Payment 6 150 150 150 PV of Coupon @6% 812. 58 145. 63 141. 39 137. 27 133. 27 129. 39 125. 62 PV of Credit Spread @ 6% 812. 58 145. 63 141. 39 137. 27 133. 27 129. 39 125. 62 PV of Par Value @6% 8374. 84 PV Bond 8374. 84 10, 000. 00 37 Adviser use only

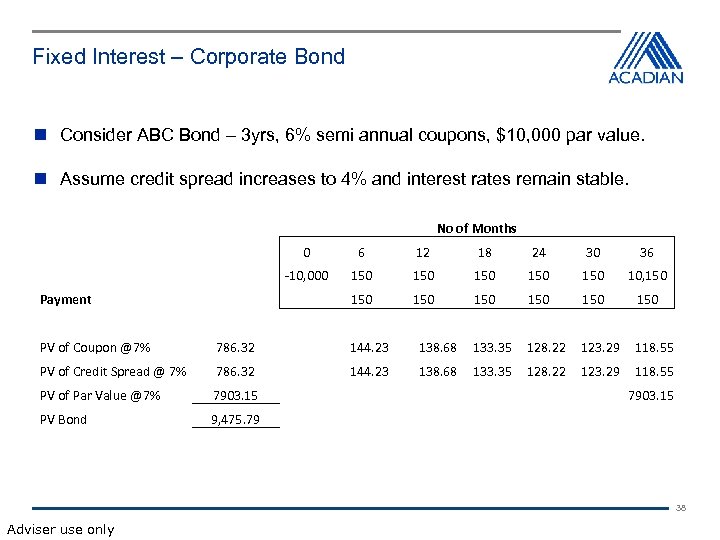

Fixed Interest – Corporate Bond Consider ABC Bond – 3 yrs, 6% semi annual coupons, $10, 000 par value. Assume credit spread increases to 4% and interest rates remain stable. No of Months 0 12 18 24 30 36 -10, 000 150 150 10, 150 Payment 6 150 150 150 PV of Coupon @7% 786. 32 144. 23 138. 68 133. 35 128. 22 123. 29 118. 55 PV of Credit Spread @ 7% 786. 32 144. 23 138. 68 133. 35 128. 22 123. 29 118. 55 PV of Par Value @7% 7903. 15 PV Bond 9, 475. 79 7903. 15 38 Adviser use only

Fixed Interest – Corporate Bond Consider ABC Bond – 3 yrs, 6% semi annual coupons, $10, 000 par value. Assume credit spread increases to 4% and interest rates remain stable. No of Months 0 12 18 24 30 36 -10, 000 150 150 10, 150 Payment 6 150 150 150 PV of Coupon @7% 786. 32 144. 23 138. 68 133. 35 128. 22 123. 29 118. 55 PV of Credit Spread @ 7% 786. 32 144. 23 138. 68 133. 35 128. 22 123. 29 118. 55 PV of Par Value @7% 7903. 15 PV Bond 9, 475. 79 7903. 15 38 Adviser use only

Fixed Interest Summary As the “market” prices in changes to interest rates and credit spreads the Bond price will change – it does not need to be an official RBA change. If the market expects an increase in interest rates or credit spreads the price of the bond falls. Visa versa. The longer the term to maturity the more sensitive a bond is to interest rate changes. 39 Adviser use only

Fixed Interest Summary As the “market” prices in changes to interest rates and credit spreads the Bond price will change – it does not need to be an official RBA change. If the market expects an increase in interest rates or credit spreads the price of the bond falls. Visa versa. The longer the term to maturity the more sensitive a bond is to interest rate changes. 39 Adviser use only

Fixed Interest Summary Credit spreads and interest rates can move in the opposite direction. The higher the credit spread the more correlated to equity markets. Credit Funds often strip out the interest rate effect and just keep the credit spread effect – this increases correlation to equity markets and removes the defensive nature associated with falling interest rates. 40 Adviser use only

Fixed Interest Summary Credit spreads and interest rates can move in the opposite direction. The higher the credit spread the more correlated to equity markets. Credit Funds often strip out the interest rate effect and just keep the credit spread effect – this increases correlation to equity markets and removes the defensive nature associated with falling interest rates. 40 Adviser use only

Increasing Returns – Two Options Long term investment returns can be improved through both/either: 1. Exposure to risky assets (market risk): Adding assets with higher long term expected returns increases the overall portfolio’s expected long term return. (example: adding equities to cash) Adding assets with higher long term expected returns increases volatility. These risky assets can dominate overall volatility. 2. Exposure to manager risk: Allowing an investment manager to take positions away from the benchmark will increase risk, and, if the manager has skill, increase return. Manager risk is more controllable than market risk. 41 Adviser use only

Increasing Returns – Two Options Long term investment returns can be improved through both/either: 1. Exposure to risky assets (market risk): Adding assets with higher long term expected returns increases the overall portfolio’s expected long term return. (example: adding equities to cash) Adding assets with higher long term expected returns increases volatility. These risky assets can dominate overall volatility. 2. Exposure to manager risk: Allowing an investment manager to take positions away from the benchmark will increase risk, and, if the manager has skill, increase return. Manager risk is more controllable than market risk. 41 Adviser use only

Adding other Asset Classes to Increase Return Exposure to risky assets (market risk) The expected returns of a cash-type portfolio can be enhanced with the inclusion of an investment in equity. The inclusion of equity will also increase the level of risk. This approach does not reflect a manager’s skill. The portfolio’s risk and return is totally driven by exposure to the two different asset classes. 42 Adviser use only

Adding other Asset Classes to Increase Return Exposure to risky assets (market risk) The expected returns of a cash-type portfolio can be enhanced with the inclusion of an investment in equity. The inclusion of equity will also increase the level of risk. This approach does not reflect a manager’s skill. The portfolio’s risk and return is totally driven by exposure to the two different asset classes. 42 Adviser use only

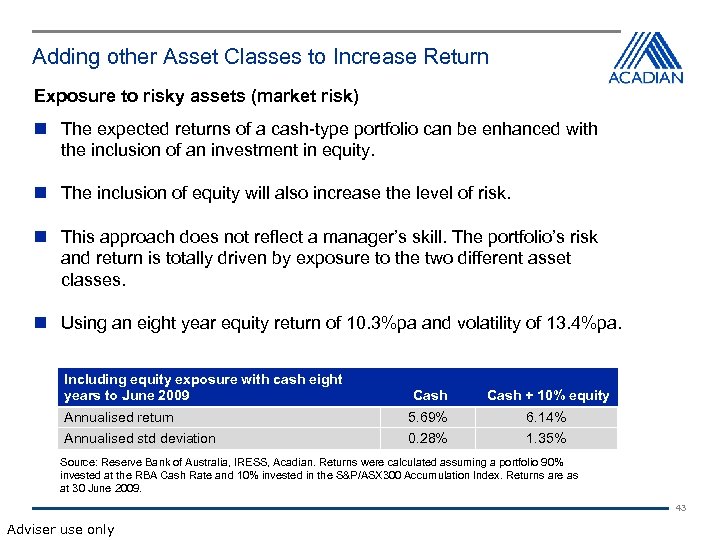

Adding other Asset Classes to Increase Return Exposure to risky assets (market risk) The expected returns of a cash-type portfolio can be enhanced with the inclusion of an investment in equity. The inclusion of equity will also increase the level of risk. This approach does not reflect a manager’s skill. The portfolio’s risk and return is totally driven by exposure to the two different asset classes. Using an eight year equity return of 10. 3%pa and volatility of 13. 4%pa. Including equity exposure with cash eight years to June 2009 Cash + 10% equity Annualised return 5. 69% 6. 14% Annualised std deviation 0. 28% 1. 35% Source: Reserve Bank of Australia, IRESS, Acadian. Returns were calculated assuming a portfolio 90% invested at the RBA Cash Rate and 10% invested in the S&P/ASX 300 Accumulation Index. Returns are as at 30 June 2009. 43 Adviser use only

Adding other Asset Classes to Increase Return Exposure to risky assets (market risk) The expected returns of a cash-type portfolio can be enhanced with the inclusion of an investment in equity. The inclusion of equity will also increase the level of risk. This approach does not reflect a manager’s skill. The portfolio’s risk and return is totally driven by exposure to the two different asset classes. Using an eight year equity return of 10. 3%pa and volatility of 13. 4%pa. Including equity exposure with cash eight years to June 2009 Cash + 10% equity Annualised return 5. 69% 6. 14% Annualised std deviation 0. 28% 1. 35% Source: Reserve Bank of Australia, IRESS, Acadian. Returns were calculated assuming a portfolio 90% invested at the RBA Cash Rate and 10% invested in the S&P/ASX 300 Accumulation Index. Returns are as at 30 June 2009. 43 Adviser use only

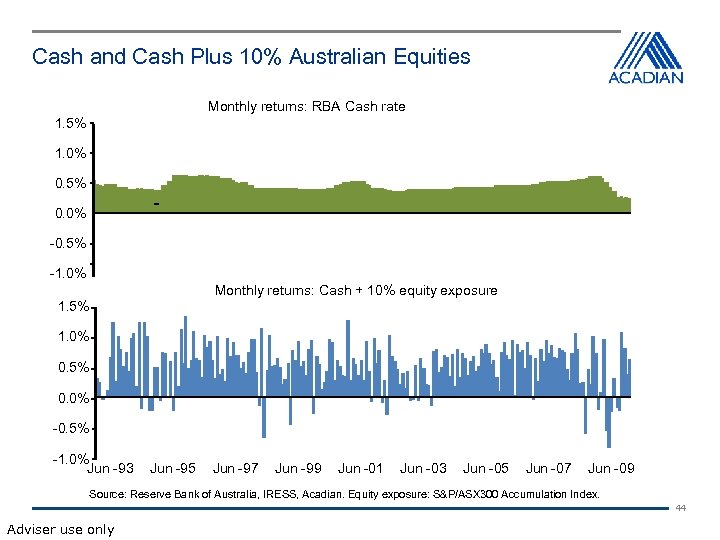

Cash and Cash Plus 10% Australian Equities Monthly returns: RBA Cash rate 1. 5% 1. 0% 0. 5% 0. 0% -0. 5% -1. 0% Monthly returns: Cash + 10% equity exposure 1. 5% 1. 0% 0. 5% 0. 0% -0. 5% -1. 0% Jun -93 Jun -95 Jun -97 Jun -99 Jun -01 Jun -03 Jun -05 Jun -07 Jun -09 Source: Reserve Bank of Australia, IRESS, Acadian. Equity exposure: S&P/ASX 300 Accumulation Index. 44 Adviser use only

Cash and Cash Plus 10% Australian Equities Monthly returns: RBA Cash rate 1. 5% 1. 0% 0. 5% 0. 0% -0. 5% -1. 0% Monthly returns: Cash + 10% equity exposure 1. 5% 1. 0% 0. 5% 0. 0% -0. 5% -1. 0% Jun -93 Jun -95 Jun -97 Jun -99 Jun -01 Jun -03 Jun -05 Jun -07 Jun -09 Source: Reserve Bank of Australia, IRESS, Acadian. Equity exposure: S&P/ASX 300 Accumulation Index. 44 Adviser use only

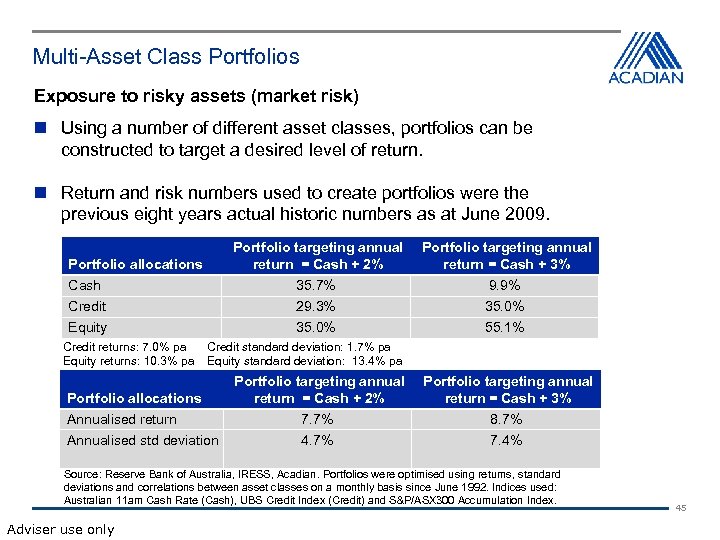

Multi-Asset Class Portfolios Exposure to risky assets (market risk) Using a number of different asset classes, portfolios can be constructed to target a desired level of return. Return and risk numbers used to create portfolios were the previous eight years actual historic numbers as at June 2009. Portfolio targeting annual return = Cash + 2% Portfolio targeting annual return = Cash + 3% Cash 35. 7% 9. 9% Credit 29. 3% 35. 0% Equity 35. 0% 55. 1% Portfolio allocations Credit returns: 7. 0% pa Credit standard deviation: 1. 7% pa Equity returns: 10. 3% pa Equity standard deviation: 13. 4% pa Portfolio targeting annual return = Cash + 2% Portfolio targeting annual return = Cash + 3% Annualised return 7. 7% 8. 7% Annualised std deviation 4. 7% 7. 4% Portfolio allocations Source: Reserve Bank of Australia, IRESS, Acadian. Portfolios were optimised using returns, standard deviations and correlations between asset classes on a monthly basis since June 1992. Indices used: Australian 11 am Cash Rate (Cash), UBS Credit Index (Credit) and S&P/ASX 300 Accumulation Index. Adviser use only 45

Multi-Asset Class Portfolios Exposure to risky assets (market risk) Using a number of different asset classes, portfolios can be constructed to target a desired level of return. Return and risk numbers used to create portfolios were the previous eight years actual historic numbers as at June 2009. Portfolio targeting annual return = Cash + 2% Portfolio targeting annual return = Cash + 3% Cash 35. 7% 9. 9% Credit 29. 3% 35. 0% Equity 35. 0% 55. 1% Portfolio allocations Credit returns: 7. 0% pa Credit standard deviation: 1. 7% pa Equity returns: 10. 3% pa Equity standard deviation: 13. 4% pa Portfolio targeting annual return = Cash + 2% Portfolio targeting annual return = Cash + 3% Annualised return 7. 7% 8. 7% Annualised std deviation 4. 7% 7. 4% Portfolio allocations Source: Reserve Bank of Australia, IRESS, Acadian. Portfolios were optimised using returns, standard deviations and correlations between asset classes on a monthly basis since June 1992. Indices used: Australian 11 am Cash Rate (Cash), UBS Credit Index (Credit) and S&P/ASX 300 Accumulation Index. Adviser use only 45

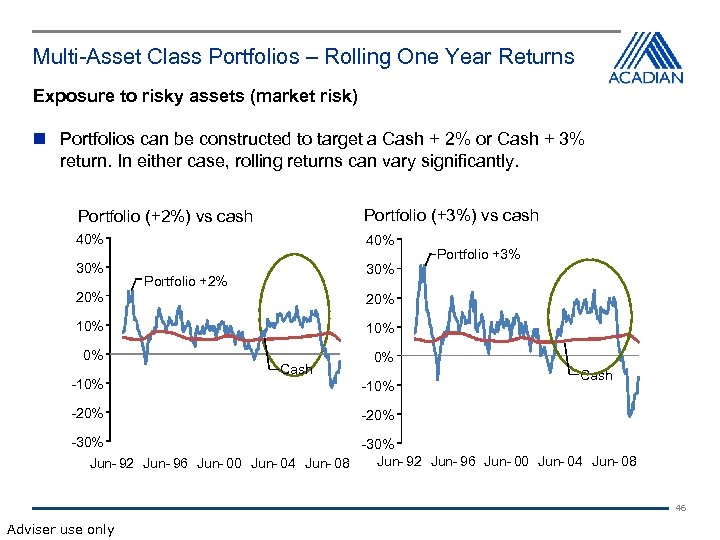

Multi-Asset Class Portfolios – Rolling One Year Returns Exposure to risky assets (market risk) Portfolios can be constructed to target a Cash + 2% or Cash + 3% return. In either case, rolling returns can vary significantly. Portfolio (+2%) vs cash Portfolio (+3%) vs cash 40% 30% Portfolio +2% 20% 10% Portfolio +3% 10% 0% -10% -20% Cash 0% -10% Cash -20% -30% Jun 92 Jun 96 Jun 00 Jun 04 Jun 08 46 Adviser use only

Multi-Asset Class Portfolios – Rolling One Year Returns Exposure to risky assets (market risk) Portfolios can be constructed to target a Cash + 2% or Cash + 3% return. In either case, rolling returns can vary significantly. Portfolio (+2%) vs cash Portfolio (+3%) vs cash 40% 30% Portfolio +2% 20% 10% Portfolio +3% 10% 0% -10% -20% Cash 0% -10% Cash -20% -30% Jun 92 Jun 96 Jun 00 Jun 04 Jun 08 46 Adviser use only

Adding Manager Risk to Increase Returns Exposure to manager risk An alternative is to improve return by relying on the investment manager’s skill (eg stock selection, duration position etc). Key value of adding manager risk is the potential for additional investment returns that are not correlated to the markets. Need to be careful that adding manager risk does not also add market risk. For example, a long stock position adds manager skills and market risk. 47 Adviser use only

Adding Manager Risk to Increase Returns Exposure to manager risk An alternative is to improve return by relying on the investment manager’s skill (eg stock selection, duration position etc). Key value of adding manager risk is the potential for additional investment returns that are not correlated to the markets. Need to be careful that adding manager risk does not also add market risk. For example, a long stock position adds manager skills and market risk. 47 Adviser use only

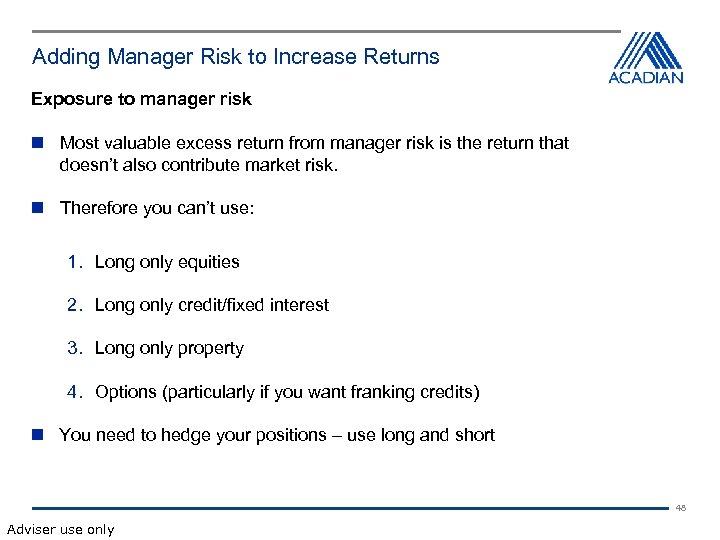

Adding Manager Risk to Increase Returns Exposure to manager risk Most valuable excess return from manager risk is the return that doesn’t also contribute market risk. Therefore you can’t use: 1. Long only equities 2. Long only credit/fixed interest 3. Long only property 4. Options (particularly if you want franking credits) You need to hedge your positions – use long and short 48 Adviser use only

Adding Manager Risk to Increase Returns Exposure to manager risk Most valuable excess return from manager risk is the return that doesn’t also contribute market risk. Therefore you can’t use: 1. Long only equities 2. Long only credit/fixed interest 3. Long only property 4. Options (particularly if you want franking credits) You need to hedge your positions – use long and short 48 Adviser use only

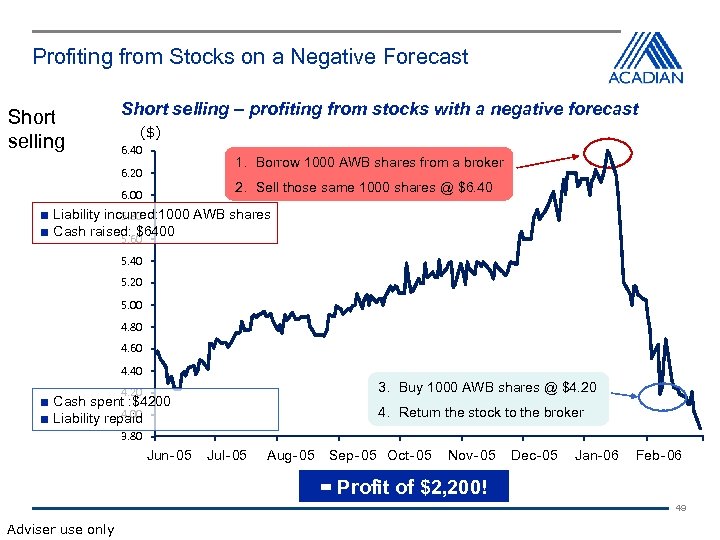

Profiting from Stocks on a Negative Forecast Short selling – profiting from stocks with a negative forecast ($) 6. 40 1. Borrow 1000 AWB shares from a broker 6. 20 2. Sell those same 1000 shares @ $6. 40 6. 00 ■ Liability incurred: 1000 AWB shares 5. 80 ■ Cash raised: $6400 5. 60 5. 40 5. 20 5. 00 4. 80 4. 60 4. 40 3. Buy 1000 AWB shares @ $4. 20 ■ Cash spent : $4200 4. 00 ■ Liability repaid 4. Return the stock to the broker 3. 80 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec -05 Jan-06 Feb-06 = Profit of $2, 200! 49 Adviser use only

Profiting from Stocks on a Negative Forecast Short selling – profiting from stocks with a negative forecast ($) 6. 40 1. Borrow 1000 AWB shares from a broker 6. 20 2. Sell those same 1000 shares @ $6. 40 6. 00 ■ Liability incurred: 1000 AWB shares 5. 80 ■ Cash raised: $6400 5. 60 5. 40 5. 20 5. 00 4. 80 4. 60 4. 40 3. Buy 1000 AWB shares @ $4. 20 ■ Cash spent : $4200 4. 00 ■ Liability repaid 4. Return the stock to the broker 3. 80 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec -05 Jan-06 Feb-06 = Profit of $2, 200! 49 Adviser use only

Market Neutral Investing Exposure to manager risk Concept of matching risks in long portfolio with risks in short portfolio is called market neutral investing. Total risk can be controlled by deciding on size of individual stock positions, size of sector positions etc. Long side of an Australian equity market neutral portfolio also delivers franking credits. 50 Adviser use only

Market Neutral Investing Exposure to manager risk Concept of matching risks in long portfolio with risks in short portfolio is called market neutral investing. Total risk can be controlled by deciding on size of individual stock positions, size of sector positions etc. Long side of an Australian equity market neutral portfolio also delivers franking credits. 50 Adviser use only

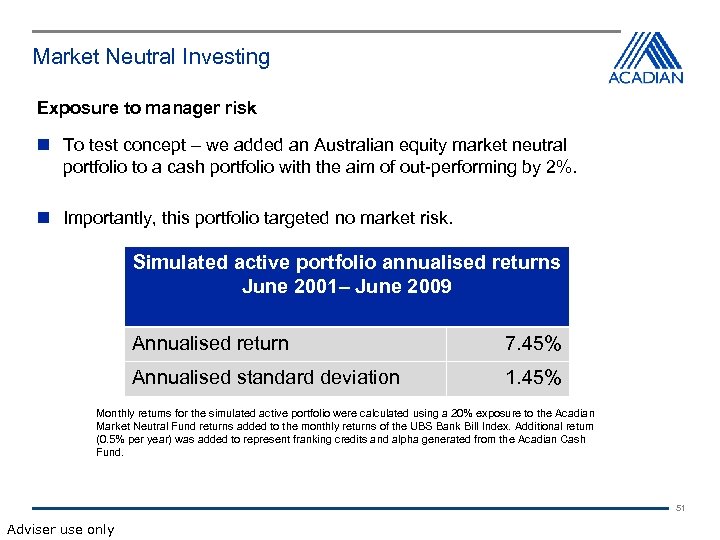

Market Neutral Investing Exposure to manager risk To test concept – we added an Australian equity market neutral portfolio to a cash portfolio with the aim of out-performing by 2%. Importantly, this portfolio targeted no market risk. Simulated active portfolio annualised returns June 2001– June 2009 Annualised return 7. 45% Annualised standard deviation 1. 45% Monthly returns for the simulated active portfolio were calculated using a 20% exposure to the Acadian Market Neutral Fund returns added to the monthly returns of the UBS Bank Bill Index. Additional return (0. 5% per year) was added to represent franking credits and alpha generated from the Acadian Cash Fund. 51 Adviser use only

Market Neutral Investing Exposure to manager risk To test concept – we added an Australian equity market neutral portfolio to a cash portfolio with the aim of out-performing by 2%. Importantly, this portfolio targeted no market risk. Simulated active portfolio annualised returns June 2001– June 2009 Annualised return 7. 45% Annualised standard deviation 1. 45% Monthly returns for the simulated active portfolio were calculated using a 20% exposure to the Acadian Market Neutral Fund returns added to the monthly returns of the UBS Bank Bill Index. Additional return (0. 5% per year) was added to represent franking credits and alpha generated from the Acadian Cash Fund. 51 Adviser use only

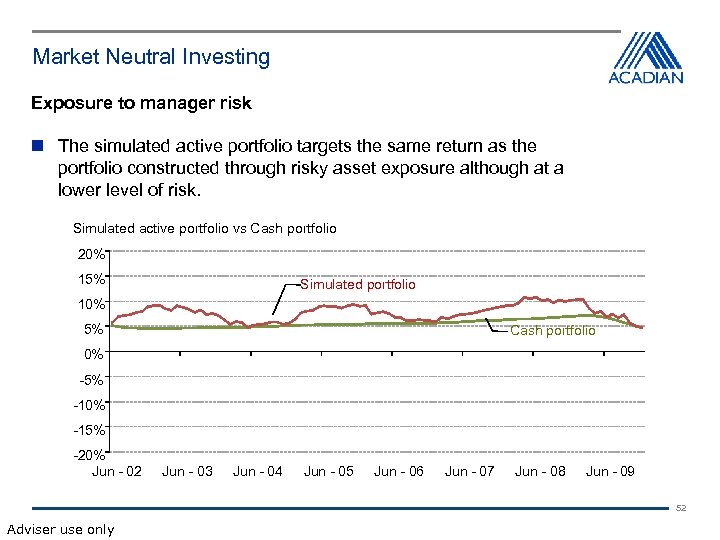

Market Neutral Investing Exposure to manager risk The simulated active portfolio targets the same return as the portfolio constructed through risky asset exposure although at a lower level of risk. Simulated active portfolio vs Cash portfolio 20% 15% Simulated portfolio 10% 5% Cash portfolio 0% -5% -10% -15% -20% Jun - 02 Jun - 03 Jun - 04 Jun - 05 Jun - 06 Jun - 07 Jun - 08 Jun - 09 52 Adviser use only

Market Neutral Investing Exposure to manager risk The simulated active portfolio targets the same return as the portfolio constructed through risky asset exposure although at a lower level of risk. Simulated active portfolio vs Cash portfolio 20% 15% Simulated portfolio 10% 5% Cash portfolio 0% -5% -10% -15% -20% Jun - 02 Jun - 03 Jun - 04 Jun - 05 Jun - 06 Jun - 07 Jun - 08 Jun - 09 52 Adviser use only

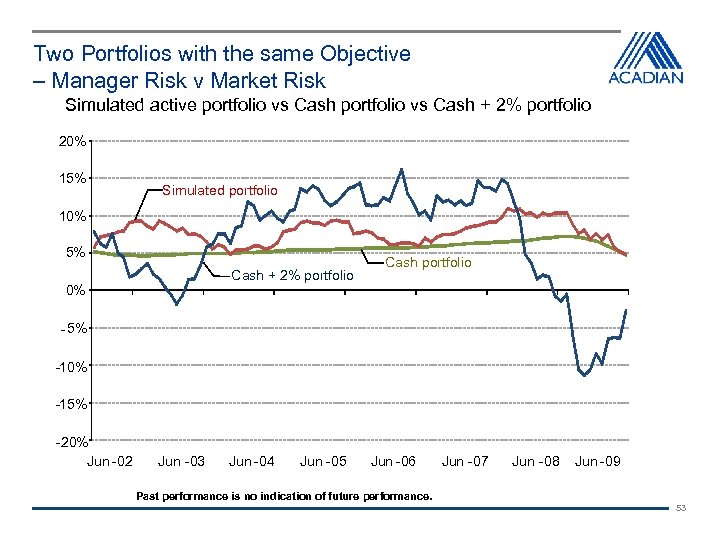

Two Portfolios with the same Objective – Manager Risk v Market Risk Simulated active portfolio vs Cash + 2% portfolio 20% 15% Simulated portfolio 10% 5% Cash + 2% portfolio 0% Cash portfolio - 5% -10% -15% -20% Jun -02 Jun -03 Jun -04 Jun -05 Jun -06 Past performance is no indication of future performance. Jun -07 Jun -08 Jun -09 53

Two Portfolios with the same Objective – Manager Risk v Market Risk Simulated active portfolio vs Cash + 2% portfolio 20% 15% Simulated portfolio 10% 5% Cash + 2% portfolio 0% Cash portfolio - 5% -10% -15% -20% Jun -02 Jun -03 Jun -04 Jun -05 Jun -06 Past performance is no indication of future performance. Jun -07 Jun -08 Jun -09 53

Yield Strategy: without market exposure Objective The strategy aims to provide better than cash returns by generating alpha and taxation benefits with low volatility and minimal market exposure. ■ Targets 2 - 3% p. a. above cash including franking credits ■ Consistently positive quarterly return ■ Annual standard deviation less than 3% ■ Targets low correlation to growth assets 54 Adviser use only

Yield Strategy: without market exposure Objective The strategy aims to provide better than cash returns by generating alpha and taxation benefits with low volatility and minimal market exposure. ■ Targets 2 - 3% p. a. above cash including franking credits ■ Consistently positive quarterly return ■ Annual standard deviation less than 3% ■ Targets low correlation to growth assets 54 Adviser use only

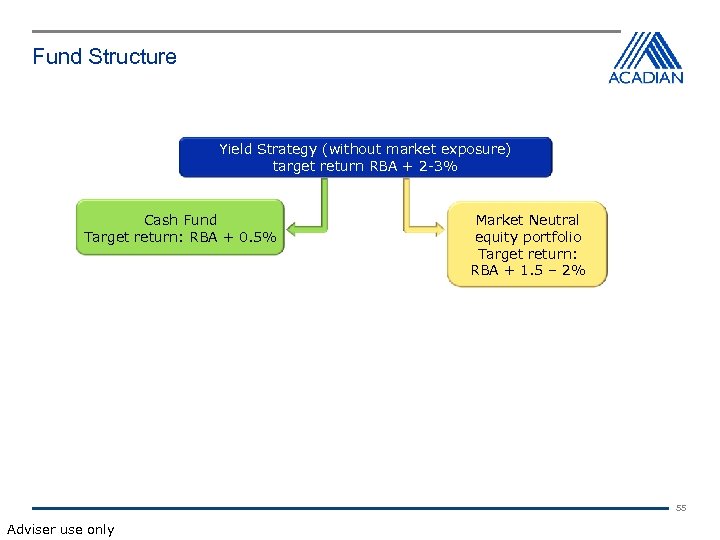

Fund Structure Yield Strategy (without market exposure) target return RBA + 2 -3% Cash Fund Target return: RBA + 0. 5% Market Neutral equity portfolio Target return: RBA + 1. 5 – 2% 55 Adviser use only

Fund Structure Yield Strategy (without market exposure) target return RBA + 2 -3% Cash Fund Target return: RBA + 0. 5% Market Neutral equity portfolio Target return: RBA + 1. 5 – 2% 55 Adviser use only

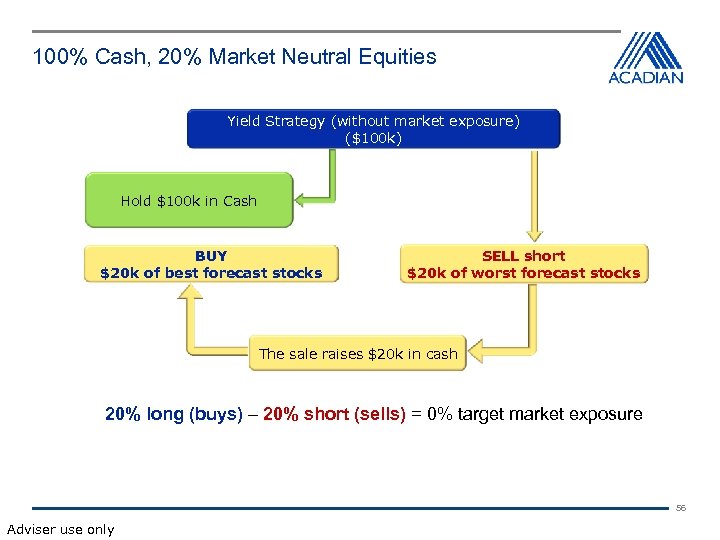

100% Cash, 20% Market Neutral Equities Yield Strategy (without market exposure) ($100 k) Hold $100 k in Cash BUY $20 k of best forecast stocks SELL short $20 k of worst forecast stocks The sale raises $20 k in cash 20% long (buys) – 20% short (sells) = 0% target market exposure 56 Adviser use only

100% Cash, 20% Market Neutral Equities Yield Strategy (without market exposure) ($100 k) Hold $100 k in Cash BUY $20 k of best forecast stocks SELL short $20 k of worst forecast stocks The sale raises $20 k in cash 20% long (buys) – 20% short (sells) = 0% target market exposure 56 Adviser use only

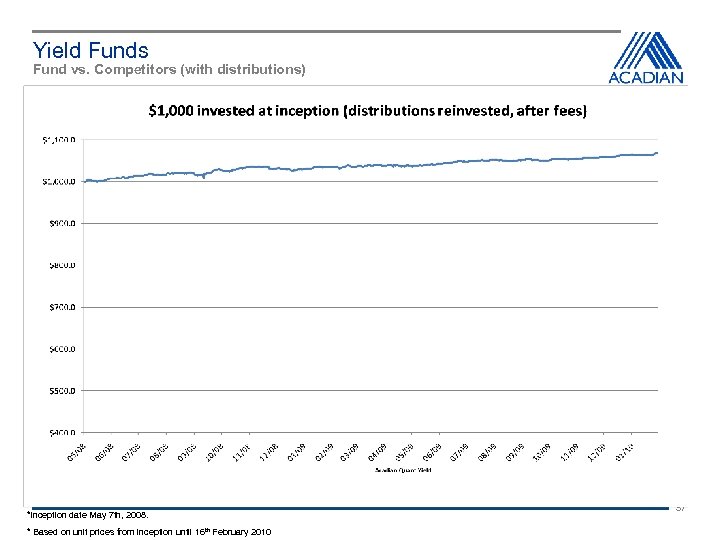

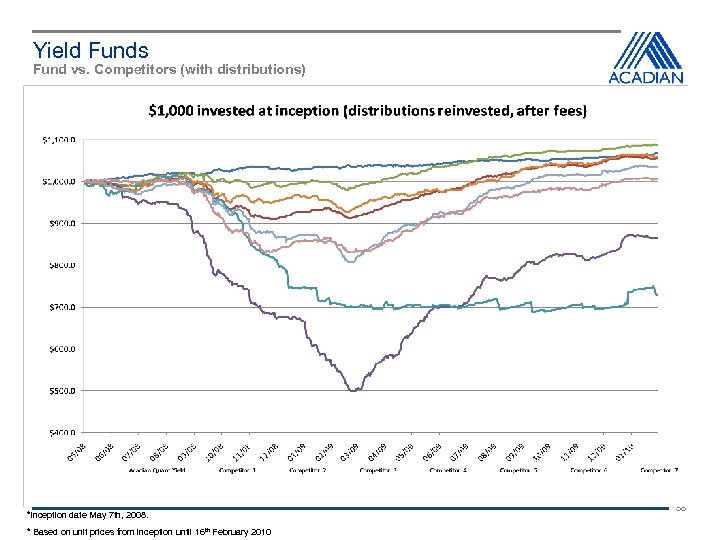

Yield Funds Fund vs. Competitors (with distributions) *Inception date May 7 th, 2008. * Based on unit prices from inception until 16 th February 2010 57

Yield Funds Fund vs. Competitors (with distributions) *Inception date May 7 th, 2008. * Based on unit prices from inception until 16 th February 2010 57

Yield Funds Fund vs. Competitors (with distributions) *Inception date May 7 th, 2008. * Based on unit prices from inception until 16 th February 2010 58

Yield Funds Fund vs. Competitors (with distributions) *Inception date May 7 th, 2008. * Based on unit prices from inception until 16 th February 2010 58

Conclusion Decide whether you want capital stability or higher return – you can’t have both. If you want capital stability, it’s very difficult to add risky markets and be confident of your objective in all market cycles. When there is a temptation to increase the return on your defensive assets, perhaps you should simply increase the allocation to growth assets – rather than increase risk on the defensive assets. Manager risk is more controllable than market risk. 59 Adviser use only

Conclusion Decide whether you want capital stability or higher return – you can’t have both. If you want capital stability, it’s very difficult to add risky markets and be confident of your objective in all market cycles. When there is a temptation to increase the return on your defensive assets, perhaps you should simply increase the allocation to growth assets – rather than increase risk on the defensive assets. Manager risk is more controllable than market risk. 59 Adviser use only

It’s all in the structure An investigation into life policy ownership Kevin Barnes Business Development Manager www. ing. com. au VIC March 2010

It’s all in the structure An investigation into life policy ownership Kevin Barnes Business Development Manager www. ing. com. au VIC March 2010

Agenda • Explore the different types of policy ownership structures for life insurance • See how each structure will respond to different scenarios • Help you come up with your own decisions on what type of structure will work for your individual clients 61

Agenda • Explore the different types of policy ownership structures for life insurance • See how each structure will respond to different scenarios • Help you come up with your own decisions on what type of structure will work for your individual clients 61

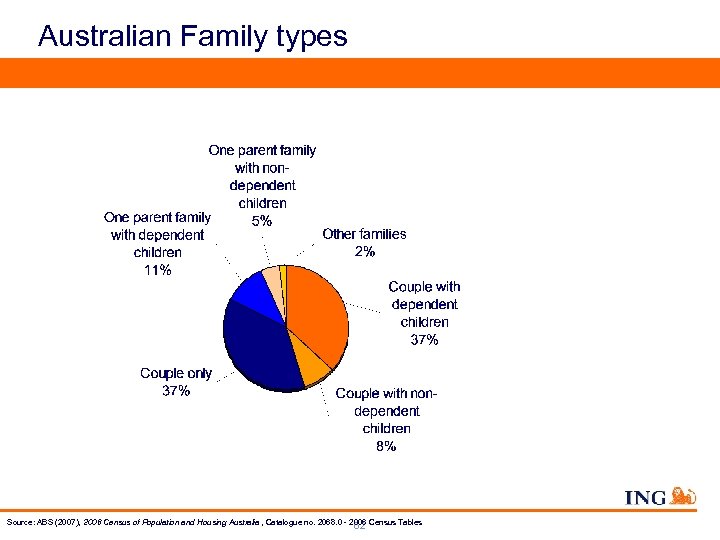

Australian Family types Source: ABS (2007), 2006 Census of Population and Housing Australia , Catalogue no. 2068. 0 - 2006 Census Tables 62

Australian Family types Source: ABS (2007), 2006 Census of Population and Housing Australia , Catalogue no. 2068. 0 - 2006 Census Tables 62

Choosing the right ownership structure Is there a RIGHT ownership structure? Cross ownership Joint ownership Self ownership Super ownership Business ownership 63

Choosing the right ownership structure Is there a RIGHT ownership structure? Cross ownership Joint ownership Self ownership Super ownership Business ownership 63

Case Study Jack and Joyce Lang • Married for 10 years • They have two children – Justin age 9 and Josie age 6 • They own a local café where Jack works full-time and Joyce 3 times a week 64

Case Study Jack and Joyce Lang • Married for 10 years • They have two children – Justin age 9 and Josie age 6 • They own a local café where Jack works full-time and Joyce 3 times a week 64

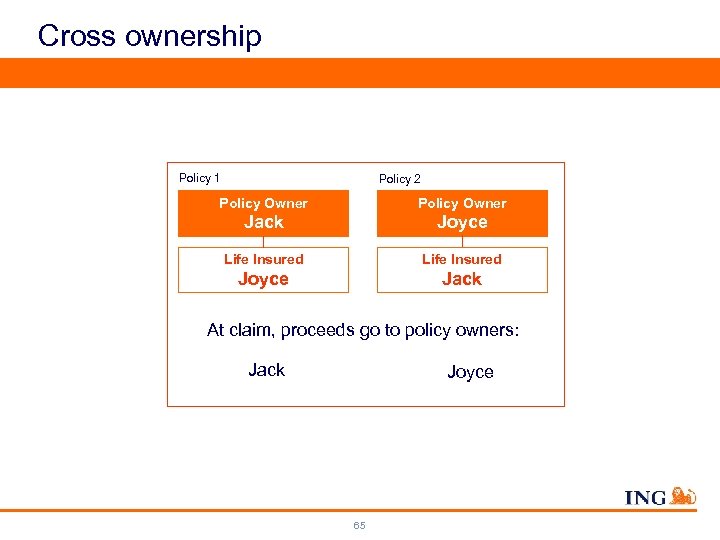

Cross ownership Policy 1 Policy 2 Policy Owner Jack Joyce Life Insured Joyce Jack At claim, proceeds go to policy owners: Jack Joyce 65

Cross ownership Policy 1 Policy 2 Policy Owner Jack Joyce Life Insured Joyce Jack At claim, proceeds go to policy owners: Jack Joyce 65

Case Study Jack and Joyce Lang • Married for 10 years • They have two children – Justin age 9 and Josie age 6 • They own a local café where Jack works full-time and Joyce 3 times a week But what if there are relationship troubles? 66

Case Study Jack and Joyce Lang • Married for 10 years • They have two children – Justin age 9 and Josie age 6 • They own a local café where Jack works full-time and Joyce 3 times a week But what if there are relationship troubles? 66

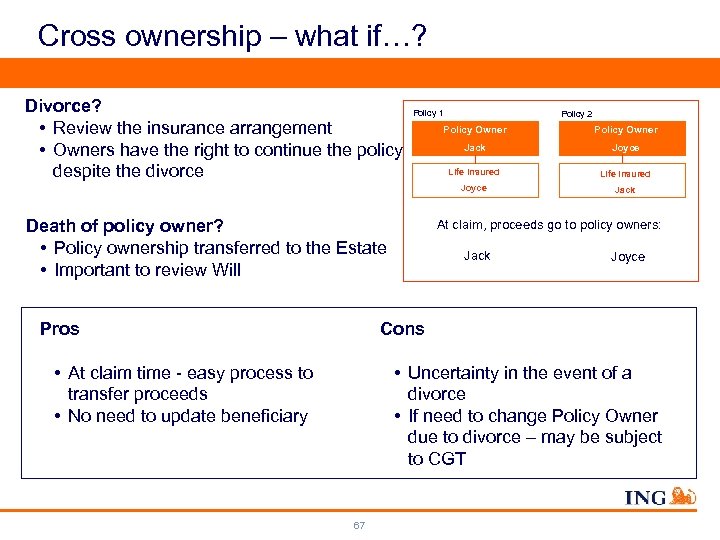

Cross ownership – what if…? Divorce? Policy 1 Policy Owner • Review the insurance arrangement Jack • Owners have the right to continue the policy Life Insured despite the divorce Joyce Death of policy owner? • Policy ownership transferred to the Estate • Important to review Will Pros Policy 2 Policy Owner Joyce Life Insured Jack At claim, proceeds go to policy owners: Jack Joyce Cons • At claim time - easy process to transfer proceeds • No need to update beneficiary • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT 67

Cross ownership – what if…? Divorce? Policy 1 Policy Owner • Review the insurance arrangement Jack • Owners have the right to continue the policy Life Insured despite the divorce Joyce Death of policy owner? • Policy ownership transferred to the Estate • Important to review Will Pros Policy 2 Policy Owner Joyce Life Insured Jack At claim, proceeds go to policy owners: Jack Joyce Cons • At claim time - easy process to transfer proceeds • No need to update beneficiary • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT 67

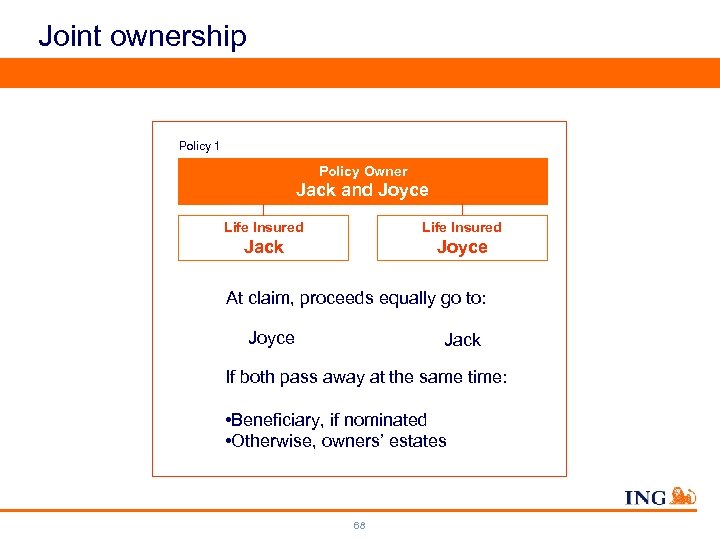

Joint ownership Policy 1 Policy Owner Jack and Joyce Life Insured Jack Joyce At claim, proceeds equally go to: Joyce Jack If both pass away at the same time: • Beneficiary, if nominated • Otherwise, owners’ estates 68

Joint ownership Policy 1 Policy Owner Jack and Joyce Life Insured Jack Joyce At claim, proceeds equally go to: Joyce Jack If both pass away at the same time: • Beneficiary, if nominated • Otherwise, owners’ estates 68

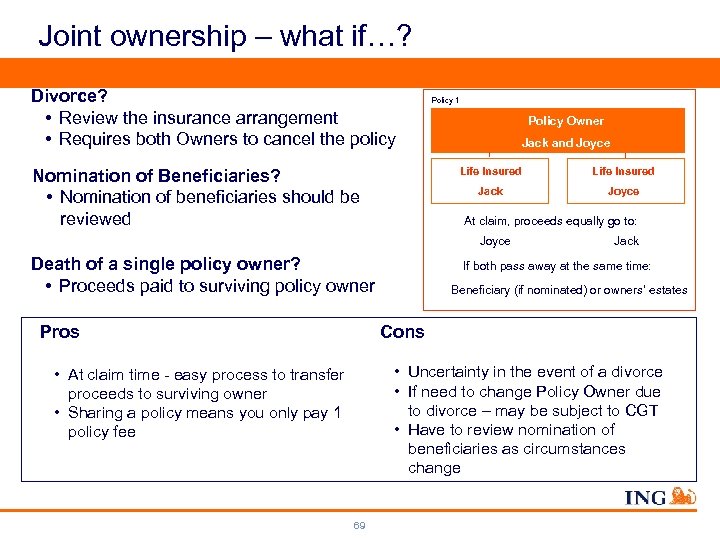

Joint ownership – what if…? Divorce? • Review the insurance arrangement • Requires both Owners to cancel the policy Policy 1 Policy Owner Jack and Joyce Life Insured Jack Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed Joyce At claim, proceeds equally go to: Joyce Death of a single policy owner? • Proceeds paid to surviving policy owner Pros Jack If both pass away at the same time: Beneficiary (if nominated) or owners’ estates Cons • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT • Have to review nomination of beneficiaries as circumstances change • At claim time - easy process to transfer proceeds to surviving owner • Sharing a policy means you only pay 1 policy fee 69

Joint ownership – what if…? Divorce? • Review the insurance arrangement • Requires both Owners to cancel the policy Policy 1 Policy Owner Jack and Joyce Life Insured Jack Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed Joyce At claim, proceeds equally go to: Joyce Death of a single policy owner? • Proceeds paid to surviving policy owner Pros Jack If both pass away at the same time: Beneficiary (if nominated) or owners’ estates Cons • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT • Have to review nomination of beneficiaries as circumstances change • At claim time - easy process to transfer proceeds to surviving owner • Sharing a policy means you only pay 1 policy fee 69

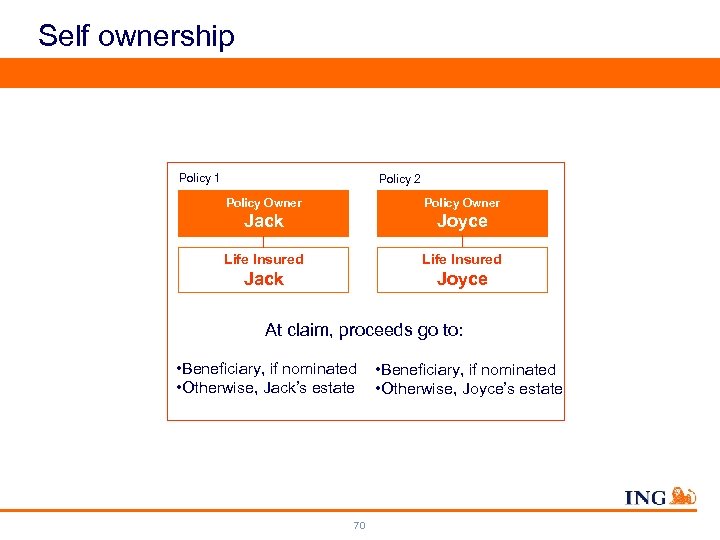

Self ownership Policy 1 Policy 2 Policy Owner Jack Joyce Life Insured Jack Joyce At claim, proceeds go to: • Beneficiary, if nominated • Otherwise, Jack’s estate 70 • Beneficiary, if nominated • Otherwise, Joyce’s estate

Self ownership Policy 1 Policy 2 Policy Owner Jack Joyce Life Insured Jack Joyce At claim, proceeds go to: • Beneficiary, if nominated • Otherwise, Jack’s estate 70 • Beneficiary, if nominated • Otherwise, Joyce’s estate

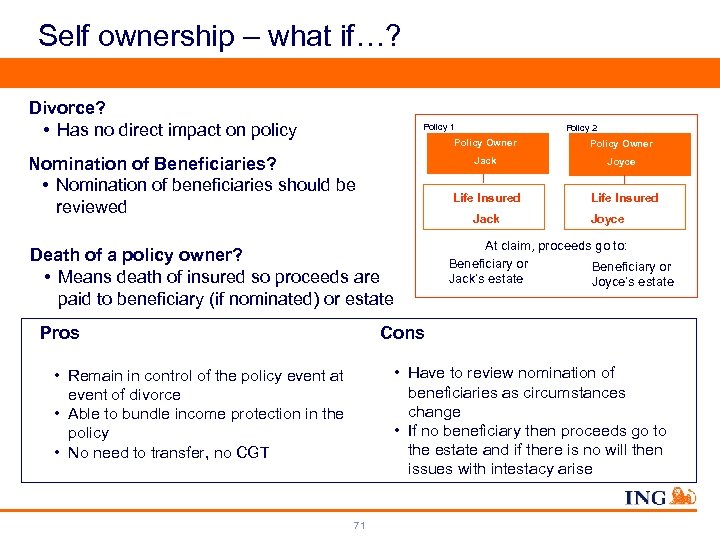

Self ownership – what if…? Divorce? • Has no direct impact on policy Policy 1 Policy 2 Policy Owner Jack Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed Joyce Life Insured Jack Life Insured Joyce At claim, proceeds go to: Beneficiary or Jack’s estate Joyce’s estate Death of a policy owner? • Means death of insured so proceeds are paid to beneficiary (if nominated) or estate Pros Policy Owner Cons • Have to review nomination of beneficiaries as circumstances change • If no beneficiary then proceeds go to the estate and if there is no will then issues with intestacy arise • Remain in control of the policy event at event of divorce • Able to bundle income protection in the policy • No need to transfer, no CGT 71

Self ownership – what if…? Divorce? • Has no direct impact on policy Policy 1 Policy 2 Policy Owner Jack Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed Joyce Life Insured Jack Life Insured Joyce At claim, proceeds go to: Beneficiary or Jack’s estate Joyce’s estate Death of a policy owner? • Means death of insured so proceeds are paid to beneficiary (if nominated) or estate Pros Policy Owner Cons • Have to review nomination of beneficiaries as circumstances change • If no beneficiary then proceeds go to the estate and if there is no will then issues with intestacy arise • Remain in control of the policy event at event of divorce • Able to bundle income protection in the policy • No need to transfer, no CGT 71

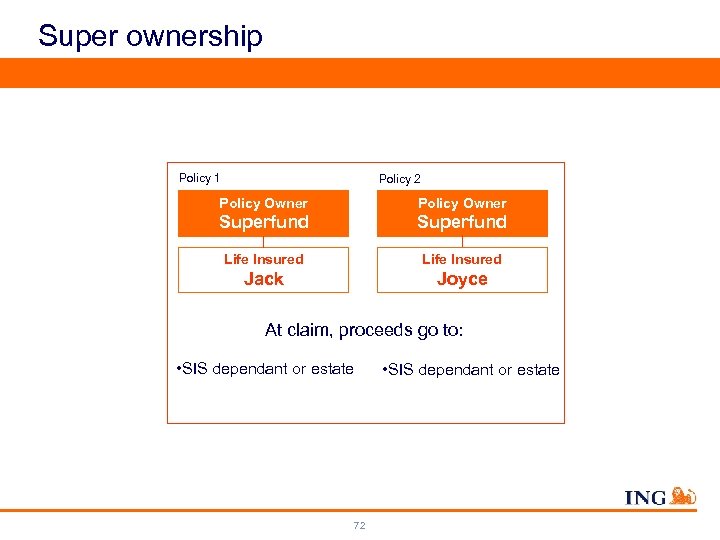

Super ownership Policy 1 Policy 2 Policy Owner Superfund Life Insured Jack Joyce At claim, proceeds go to: • SIS dependant or estate 72

Super ownership Policy 1 Policy 2 Policy Owner Superfund Life Insured Jack Joyce At claim, proceeds go to: • SIS dependant or estate 72

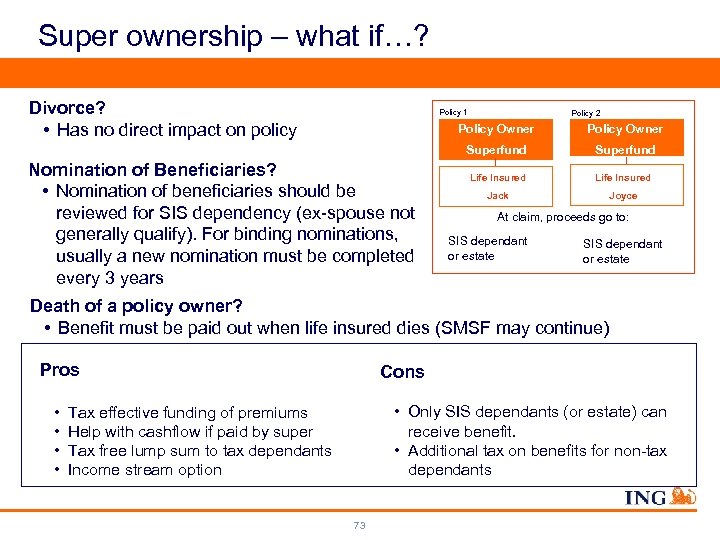

Super ownership – what if…? Divorce? • Has no direct impact on policy Policy 1 Policy 2 Policy Owner Superfund Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed for SIS dependency (ex-spouse not generally qualify). For binding nominations, usually a new nomination must be completed every 3 years Policy Owner Superfund Life Insured Jack Joyce At claim, proceeds go to: SIS dependant or estate Death of a policy owner? • Benefit must be paid out when life insured dies (SMSF may continue) Pros • • Cons • Only SIS dependants (or estate) can receive benefit. • Additional tax on benefits for non-tax dependants Tax effective funding of premiums Help with cashflow if paid by super Tax free lump sum to tax dependants Income stream option 73

Super ownership – what if…? Divorce? • Has no direct impact on policy Policy 1 Policy 2 Policy Owner Superfund Nomination of Beneficiaries? • Nomination of beneficiaries should be reviewed for SIS dependency (ex-spouse not generally qualify). For binding nominations, usually a new nomination must be completed every 3 years Policy Owner Superfund Life Insured Jack Joyce At claim, proceeds go to: SIS dependant or estate Death of a policy owner? • Benefit must be paid out when life insured dies (SMSF may continue) Pros • • Cons • Only SIS dependants (or estate) can receive benefit. • Additional tax on benefits for non-tax dependants Tax effective funding of premiums Help with cashflow if paid by super Tax free lump sum to tax dependants Income stream option 73

Direction of super benefits • Superannuation fund ownership • Trustee may be bound to pay particular beneficiaries or may retain discretion • Nominated beneficiaries • Binding • Non-binding • Trustee discretion • Trustee may be bound to pay benefit in a particular form or may retain discretion • Lump sum • Pension 74

Direction of super benefits • Superannuation fund ownership • Trustee may be bound to pay particular beneficiaries or may retain discretion • Nominated beneficiaries • Binding • Non-binding • Trustee discretion • Trustee may be bound to pay benefit in a particular form or may retain discretion • Lump sum • Pension 74

Binding death benefit nomination • Binding nomination locks in payment to nominated beneficiary(s) • Binding nomination becomes invalid if: • it has not been signed, witnessed or amended within 3 years or • the person nominated was not a dependant of the member at time of death or • the proportion of the benefit to be paid to each person was not clear • Nominated beneficiary limited to dependants and estate • Non-lapsing binding nominations available with some superannuation funds 75

Binding death benefit nomination • Binding nomination locks in payment to nominated beneficiary(s) • Binding nomination becomes invalid if: • it has not been signed, witnessed or amended within 3 years or • the person nominated was not a dependant of the member at time of death or • the proportion of the benefit to be paid to each person was not clear • Nominated beneficiary limited to dependants and estate • Non-lapsing binding nominations available with some superannuation funds 75

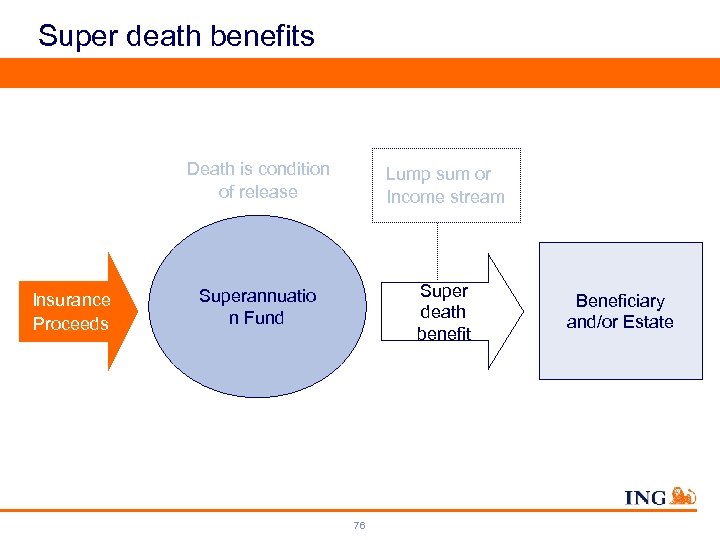

Super death benefits Death is condition of release Insurance Proceeds Lump sum or Income stream Superannuatio n Fund Super death benefit 76 Beneficiary and/or Estate

Super death benefits Death is condition of release Insurance Proceeds Lump sum or Income stream Superannuatio n Fund Super death benefit 76 Beneficiary and/or Estate

Who can receive a super death benefit • Upon death, account balance plus any attached insurance can be paid to a SIS dependant • Legal, defacto, same-sex spouse (excludes ex-spouse) • Child of any age • Person financially dependant on deceased at death • Financial contribution “necessary and relied on” to maintain the person's normal standard of living • Person who has an interdependency relationship • Close personal relationship • Live together • Domestic support, financial support + personal care • Legal personal representative 77

Who can receive a super death benefit • Upon death, account balance plus any attached insurance can be paid to a SIS dependant • Legal, defacto, same-sex spouse (excludes ex-spouse) • Child of any age • Person financially dependant on deceased at death • Financial contribution “necessary and relied on” to maintain the person's normal standard of living • Person who has an interdependency relationship • Close personal relationship • Live together • Domestic support, financial support + personal care • Legal personal representative 77

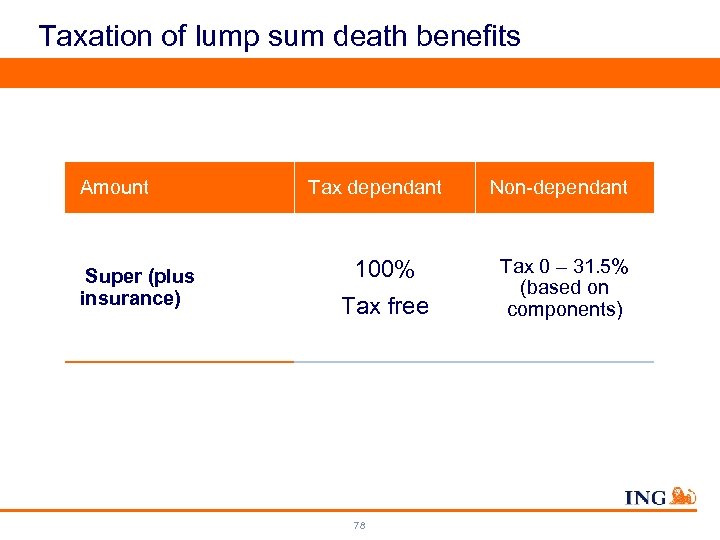

Taxation of lump sum death benefits Amount Super (plus insurance) Tax dependant 100% Tax free 78 Non-dependant Tax 0 – 31. 5% (based on components)

Taxation of lump sum death benefits Amount Super (plus insurance) Tax dependant 100% Tax free 78 Non-dependant Tax 0 – 31. 5% (based on components)

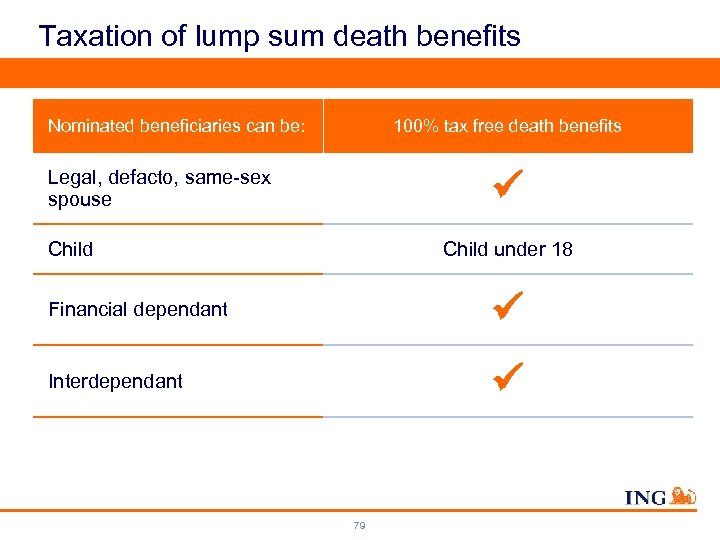

Taxation of lump sum death benefits Nominated beneficiaries can be: 100% tax free death benefits Legal, defacto, same-sex spouse Child under 18 Financial dependant Interdependant 79

Taxation of lump sum death benefits Nominated beneficiaries can be: 100% tax free death benefits Legal, defacto, same-sex spouse Child under 18 Financial dependant Interdependant 79

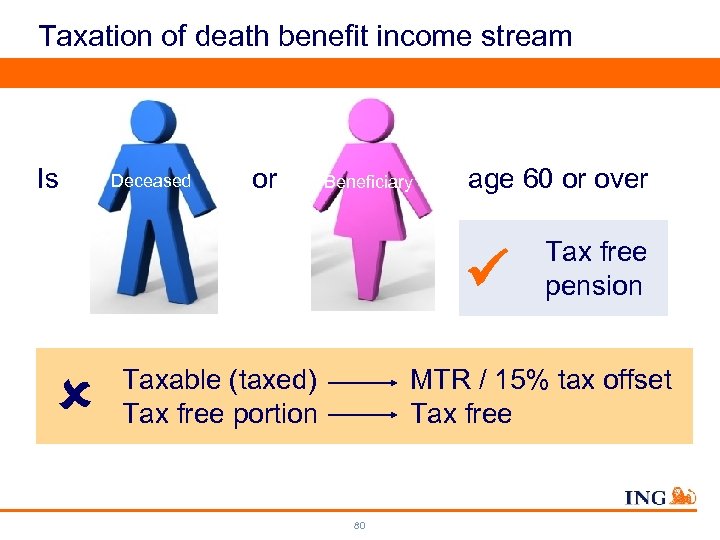

Taxation of death benefit income stream Is Deceased or Beneficiary age 60 or over Taxable (taxed) Tax free portion Tax free pension MTR / 15% tax offset Tax free 80

Taxation of death benefit income stream Is Deceased or Beneficiary age 60 or over Taxable (taxed) Tax free portion Tax free pension MTR / 15% tax offset Tax free 80

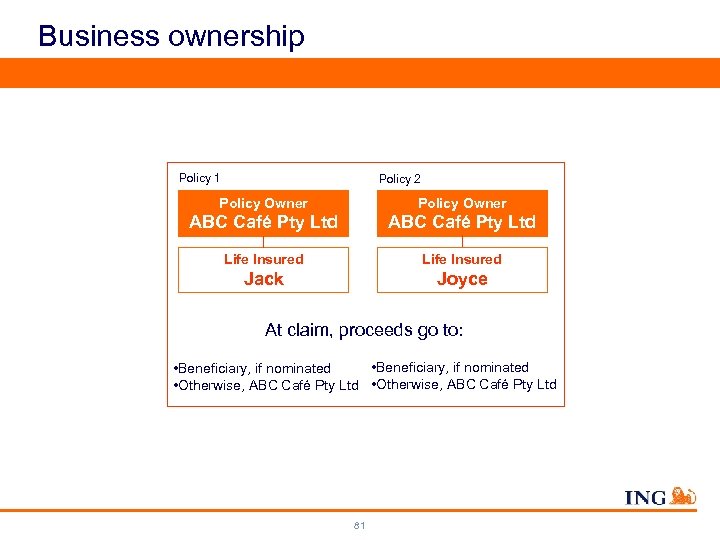

Business ownership Policy 1 Policy 2 Policy Owner ABC Café Pty Ltd Life Insured Jack Joyce At claim, proceeds go to: • Beneficiary, if nominated • Otherwise, ABC Café Pty Ltd 81

Business ownership Policy 1 Policy 2 Policy Owner ABC Café Pty Ltd Life Insured Jack Joyce At claim, proceeds go to: • Beneficiary, if nominated • Otherwise, ABC Café Pty Ltd 81

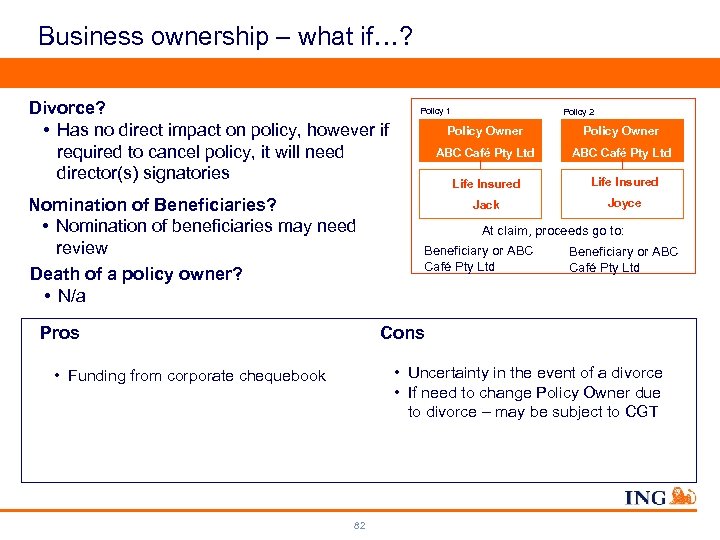

Business ownership – what if…? Divorce? • Has no direct impact on policy, however if required to cancel policy, it will need director(s) signatories Nomination of Beneficiaries? • Nomination of beneficiaries may need review Death of a policy owner? • N/a Pros Policy 1 Policy 2 Policy Owner ABC Café Pty Ltd Life Insured Jack Joyce At claim, proceeds go to: Beneficiary or ABC Café Pty Ltd Cons • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT • Funding from corporate chequebook 82

Business ownership – what if…? Divorce? • Has no direct impact on policy, however if required to cancel policy, it will need director(s) signatories Nomination of Beneficiaries? • Nomination of beneficiaries may need review Death of a policy owner? • N/a Pros Policy 1 Policy 2 Policy Owner ABC Café Pty Ltd Life Insured Jack Joyce At claim, proceeds go to: Beneficiary or ABC Café Pty Ltd Cons • Uncertainty in the event of a divorce • If need to change Policy Owner due to divorce – may be subject to CGT • Funding from corporate chequebook 82

What about TPD & Trauma? TPD • Can be owned under the different ownership structures • If under super, “Own Occupation” definition may not meet the permanent incapacity condition of release • CGT may arise when owned by company Trauma • Not commonly available under super as may not meet a condition of release • CGT may arise when owned by company 83

What about TPD & Trauma? TPD • Can be owned under the different ownership structures • If under super, “Own Occupation” definition may not meet the permanent incapacity condition of release • CGT may arise when owned by company Trauma • Not commonly available under super as may not meet a condition of release • CGT may arise when owned by company 83

What about Income Protection? • Income Protection can only be owned by the life insured or by a super fund, including a SMSF • Tax deduction applies under both ownership structures • Assessed as income under both ownership structures 84

What about Income Protection? • Income Protection can only be owned by the life insured or by a super fund, including a SMSF • Tax deduction applies under both ownership structures • Assessed as income under both ownership structures 84

Ownership matrix Cross Self Joint Super Business Life TPD Trauma Income Protection (SMSF) 85

Ownership matrix Cross Self Joint Super Business Life TPD Trauma Income Protection (SMSF) 85

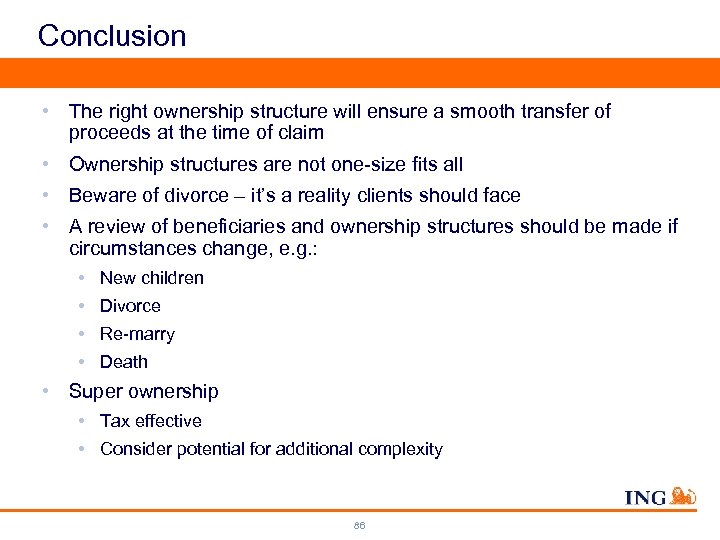

Conclusion • The right ownership structure will ensure a smooth transfer of proceeds at the time of claim • Ownership structures are not one-size fits all • Beware of divorce – it’s a reality clients should face • A review of beneficiaries and ownership structures should be made if circumstances change, e. g. : • New children • Divorce • Re-marry • Death • Super ownership • Tax effective • Consider potential for additional complexity 86

Conclusion • The right ownership structure will ensure a smooth transfer of proceeds at the time of claim • Ownership structures are not one-size fits all • Beware of divorce – it’s a reality clients should face • A review of beneficiaries and ownership structures should be made if circumstances change, e. g. : • New children • Divorce • Re-marry • Death • Super ownership • Tax effective • Consider potential for additional complexity 86

Disclaimer This information is current as at the date of this presentation and may be subject to change. The presentation is for adviser use only and has been developed without taking into account a potential policy owner’s objectives, financial situation or needs. Before making a decision based on this presentation, a potential policy holder should consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. Before acquiring and deciding whether to continue to hold a One. Care policy, a potential policy owner should refer to the current One. Care Product Disclosure Statement (PDS) available at www. ing. com. au No part of this presentation may be produced without prior written permission of ING Life Limited (ABN 33 009 657 176, AFSL 238341). 87

Disclaimer This information is current as at the date of this presentation and may be subject to change. The presentation is for adviser use only and has been developed without taking into account a potential policy owner’s objectives, financial situation or needs. Before making a decision based on this presentation, a potential policy holder should consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. Before acquiring and deciding whether to continue to hold a One. Care policy, a potential policy owner should refer to the current One. Care Product Disclosure Statement (PDS) available at www. ing. com. au No part of this presentation may be produced without prior written permission of ING Life Limited (ABN 33 009 657 176, AFSL 238341). 87

March PD Day Compliance Update Presenter: Rae Stagbouer Professional Standards Officer Friday 19 th March 2010

March PD Day Compliance Update Presenter: Rae Stagbouer Professional Standards Officer Friday 19 th March 2010

Agenda • New Word templates available online at: www. capstonefp. com. au • Tax Agent Services (TAS) regime • Margin Lending Legislation • Australian Credit License (ACL) update • FOS new Terms of Reference • The New Audit Process and Reporting

Agenda • New Word templates available online at: www. capstonefp. com. au • Tax Agent Services (TAS) regime • Margin Lending Legislation • Australian Credit License (ACL) update • FOS new Terms of Reference • The New Audit Process and Reporting

New Word templates available online Two new strategy specific So. A templates are available online that have the 2010 Generic So. A as it’s base: ►Transition To Retirement (TTR) and ►Risk Only Please take the time to have a look and feel free to pass on any feedback to either Richard Le or Rae Stagbouer

New Word templates available online Two new strategy specific So. A templates are available online that have the 2010 Generic So. A as it’s base: ►Transition To Retirement (TTR) and ►Risk Only Please take the time to have a look and feel free to pass on any feedback to either Richard Le or Rae Stagbouer

Tax Agent Services (TAS) regime The new regime applied from 1 March 2010 From 1 st March the Australian Taxation office has introduced a new framework which governs the way in which tax advice can be provided. It is intended to raise the current standard and offer taxpayers increased protection.

Tax Agent Services (TAS) regime The new regime applied from 1 March 2010 From 1 st March the Australian Taxation office has introduced a new framework which governs the way in which tax advice can be provided. It is intended to raise the current standard and offer taxpayers increased protection.

TAS regime The FPA is seeking direction from the Taxation Practitioners Board (TPB) regarding ambiguity in the Act. The main question is: Does the ancillary tax advice, commonly given by Financial Advisers, constitute tax advice and so require them to register with the TPB? After consulting the FPA we were directed to seek further advice from our legal advisors until such time as the FPA, TPB and Treasury are able to come to an mutual understanding. We consulted Legal and based on this advice have adopted the stance that the ancillary tax advice provided by our members does not constitutes tax

TAS regime The FPA is seeking direction from the Taxation Practitioners Board (TPB) regarding ambiguity in the Act. The main question is: Does the ancillary tax advice, commonly given by Financial Advisers, constitute tax advice and so require them to register with the TPB? After consulting the FPA we were directed to seek further advice from our legal advisors until such time as the FPA, TPB and Treasury are able to come to an mutual understanding. We consulted Legal and based on this advice have adopted the stance that the ancillary tax advice provided by our members does not constitutes tax

TAS regime - detail FROM THE EXPLANATORY MEMORANDUM 2. 36 Where it is reasonable to expect that advice is to be relied upon for purposes other than to satisfy tax obligations (e. g. , for the preparation and lodgement of a return), such as making an informed financial or business decision, assessing risks or determining income tax provisions in an audited account, the advice is not a tax agent service. This applies to, for example, certain advice provided by a financial services licensee under the Corporations Act 2001 on the tax implications of financial products or financial transactions, or advice relating to ascertaining tax liabilities for the purpose of calculating a future income stream. It would also include advice provided by an actuary on a risk assessment of a particular product or entity that takes

TAS regime - detail FROM THE EXPLANATORY MEMORANDUM 2. 36 Where it is reasonable to expect that advice is to be relied upon for purposes other than to satisfy tax obligations (e. g. , for the preparation and lodgement of a return), such as making an informed financial or business decision, assessing risks or determining income tax provisions in an audited account, the advice is not a tax agent service. This applies to, for example, certain advice provided by a financial services licensee under the Corporations Act 2001 on the tax implications of financial products or financial transactions, or advice relating to ascertaining tax liabilities for the purpose of calculating a future income stream. It would also include advice provided by an actuary on a risk assessment of a particular product or entity that takes

National Margin Lending Regime ASIC have amended the regulatory obligations to include new conduct and disclosure requirements for all AFSLs in relation to the national margin lending regime and it will take effect from January 2011. The Act requires (among other things): – issuers and advisers of margin lending facilities to be licensed by ASIC under an Australian financial services (AFS) licence; – advisers to only provide advice that is appropriate to the client's individual circumstances; – margin lenders to meet new responsible lending requirements; – consumers to have access to external dispute resolution services; and – clarity around responsibility for notifying clients in the case of a margin call.

National Margin Lending Regime ASIC have amended the regulatory obligations to include new conduct and disclosure requirements for all AFSLs in relation to the national margin lending regime and it will take effect from January 2011. The Act requires (among other things): – issuers and advisers of margin lending facilities to be licensed by ASIC under an Australian financial services (AFS) licence; – advisers to only provide advice that is appropriate to the client's individual circumstances; – margin lenders to meet new responsible lending requirements; – consumers to have access to external dispute resolution services; and – clarity around responsibility for notifying clients in the case of a margin call.

Margin Lending - details Issuers and advisers of margin lending facilities to be licensed by ASIC under an Australian financial services (AFS) licence; Capstone Financial planning has already started the process to vary our existing AFS License to include the provision of advice on Margin Lending.

Margin Lending - details Issuers and advisers of margin lending facilities to be licensed by ASIC under an Australian financial services (AFS) licence; Capstone Financial planning has already started the process to vary our existing AFS License to include the provision of advice on Margin Lending.

Margin Lending - details Advisers to only provide advice that is appropriate to the client's individual circumstances; This issue has been addressed by ASIC by updating RG 146 to include guidance of the training requirements for Margin Lending to categorise it as a Tier 1 product. The consequence is that all advisers who wish to provide Margin Lending advice must undertake specialist knowledge training in order to provide advice on these products after

Margin Lending - details Advisers to only provide advice that is appropriate to the client's individual circumstances; This issue has been addressed by ASIC by updating RG 146 to include guidance of the training requirements for Margin Lending to categorise it as a Tier 1 product. The consequence is that all advisers who wish to provide Margin Lending advice must undertake specialist knowledge training in order to provide advice on these products after

Margin Lending – details cont Margin lenders to meet new responsible lending requirements; This point only applies to Margin Lending Facilities and does not apply to Advisers Consumers to have access to external dispute resolution services; and As representatives of Capstone Financial Services your customers already have access to an external dispute resolution service through the Financial Ombudsman Service (FOS). Clarity around responsibility for notifying clients in the case of a margin call This point is specific to information within the PDS and does not apply to Advisers The main point is that ASIC now consider Margin Lending as a Financial Product and expect it to be treated as such.

Margin Lending – details cont Margin lenders to meet new responsible lending requirements; This point only applies to Margin Lending Facilities and does not apply to Advisers Consumers to have access to external dispute resolution services; and As representatives of Capstone Financial Services your customers already have access to an external dispute resolution service through the Financial Ombudsman Service (FOS). Clarity around responsibility for notifying clients in the case of a margin call This point is specific to information within the PDS and does not apply to Advisers The main point is that ASIC now consider Margin Lending as a Financial Product and expect it to be treated as such.

Australian Credit License (ACL) You may already be aware that ASIC is in the process of releasing new regulatory guidance on the implementation of the National Consumer Credit Protection Act. There by extending the powers of ASIC to be the regulator of this credit framework and enhancing their enforcement powers. Capstone Financial Planning will in April, register for an Australian Credit License. This will allow our Advisers to provide advice on credit related strategies. There as yet, no additional requirements for Advisers or the advice they provide to their clients. We will release any information to you if and when this changes.

Australian Credit License (ACL) You may already be aware that ASIC is in the process of releasing new regulatory guidance on the implementation of the National Consumer Credit Protection Act. There by extending the powers of ASIC to be the regulator of this credit framework and enhancing their enforcement powers. Capstone Financial Planning will in April, register for an Australian Credit License. This will allow our Advisers to provide advice on credit related strategies. There as yet, no additional requirements for Advisers or the advice they provide to their clients. We will release any information to you if and when this changes.

FOS new Terms of Reference The Financial Ombudsman Services new Terms of Reference came into effect on 1 January 2010. They apply to disputes lodged on or after that date. • Monetary Limit for a claim is now $500, 000 • Investment disputes capped at $150, 000 until January 2012 • Investment disputes cap will increase to $280, 000 after January 2012 • Consequential and non-financial loss are now claimable and are capped at $3, 000 each. • New FOS brochure available and check out all the changes online

FOS new Terms of Reference The Financial Ombudsman Services new Terms of Reference came into effect on 1 January 2010. They apply to disputes lodged on or after that date. • Monetary Limit for a claim is now $500, 000 • Investment disputes capped at $150, 000 until January 2012 • Investment disputes cap will increase to $280, 000 after January 2012 • Consequential and non-financial loss are now claimable and are capped at $3, 000 each. • New FOS brochure available and check out all the changes online

New Audit Process and Reporting As of January this year the Compliance Team has made improvements to the process and reporting for all Adviser Audits. Ø Additional notice of an Audit; Ø Enhanced communication regarding the requirements, expectations and the process that will be undertaken; Ø Improved Reporting methods; Ø Timely provision of Reports; Ø Increased availability for the management of exceptions.

New Audit Process and Reporting As of January this year the Compliance Team has made improvements to the process and reporting for all Adviser Audits. Ø Additional notice of an Audit; Ø Enhanced communication regarding the requirements, expectations and the process that will be undertaken; Ø Improved Reporting methods; Ø Timely provision of Reports; Ø Increased availability for the management of exceptions.

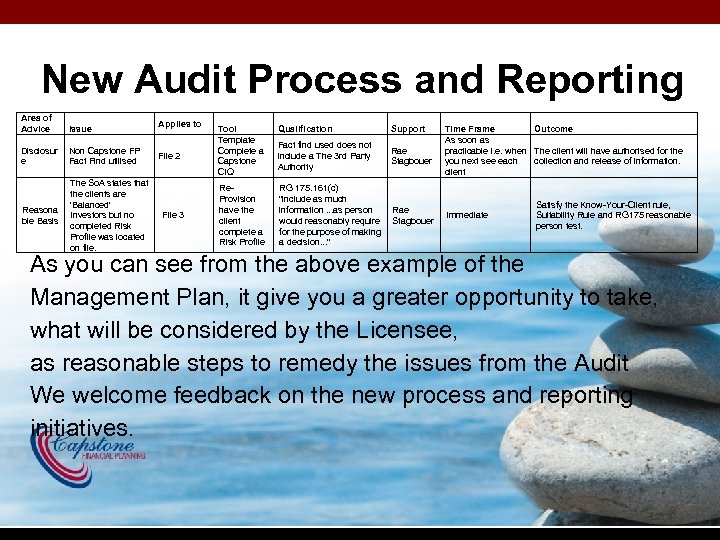

New Audit Process and Reporting Area of Advice Issue Disclosur e Non Capstone FP Fact Find utilised Reasona ble Basis The So. A states that the clients are 'Balanced' Investors but no File 3 completed Risk Profile was located on file. Applies to File 2 Tool Qualification Template Fact find used does not Complete a include a The 3 rd Party Capstone Authority CIQ Re. Provision have the client complete a Risk Profile Support Rae Stagbouer RG 175. 161(c) "include as much information. . . as person Rae would reasonably require Stagbouer for the purpose of making a decision. . . " Time Frame Outcome As soon as practicable i. e. when The client will have authorised for the you next see each collection and release of information. client Immediate Satisfy the Know-Your-Client rule, Suitability Rule and RG 175 reasonable person test. As you can see from the above example of the Management Plan, it give you a greater opportunity to take, what will be considered by the Licensee, as reasonable steps to remedy the issues from the Audit We welcome feedback on the new process and reporting initiatives.

New Audit Process and Reporting Area of Advice Issue Disclosur e Non Capstone FP Fact Find utilised Reasona ble Basis The So. A states that the clients are 'Balanced' Investors but no File 3 completed Risk Profile was located on file. Applies to File 2 Tool Qualification Template Fact find used does not Complete a include a The 3 rd Party Capstone Authority CIQ Re. Provision have the client complete a Risk Profile Support Rae Stagbouer RG 175. 161(c) "include as much information. . . as person Rae would reasonably require Stagbouer for the purpose of making a decision. . . " Time Frame Outcome As soon as practicable i. e. when The client will have authorised for the you next see each collection and release of information. client Immediate Satisfy the Know-Your-Client rule, Suitability Rule and RG 175 reasonable person test. As you can see from the above example of the Management Plan, it give you a greater opportunity to take, what will be considered by the Licensee, as reasonable steps to remedy the issues from the Audit We welcome feedback on the new process and reporting initiatives.

Question Time

Question Time

Welcome Professional Development Day 19 March 2010

Welcome Professional Development Day 19 March 2010

Next 20 minutes • • • Business to date Operations C-wrap Research & Training X-Plan Marketing Support Practice Development Professional Standards Next 3 months

Next 20 minutes • • • Business to date Operations C-wrap Research & Training X-Plan Marketing Support Practice Development Professional Standards Next 3 months

Business to date • Adviser numbers are 68 which is 2 behind target • New Lodgment budget is $12 m per month. July – December average was $9 m of new lodgments per month Last two months average is $10 m • New Business flows are increasing with cash transitioning back into managed funds and equities markets. • We are also starting to see quite good new client activity • FUA currently $1. 8+ billon and growing • Advisers recently appointed: Auden Harrop – (Robert Crowe’s office in Melbourne)

Business to date • Adviser numbers are 68 which is 2 behind target • New Lodgment budget is $12 m per month. July – December average was $9 m of new lodgments per month Last two months average is $10 m • New Business flows are increasing with cash transitioning back into managed funds and equities markets. • We are also starting to see quite good new client activity • FUA currently $1. 8+ billon and growing • Advisers recently appointed: Auden Harrop – (Robert Crowe’s office in Melbourne)

Operations • Commission system “clean up” to ensure maximum auto loading of commission payments • Direct Debit facility in final stages of testing with launch to all practices in 3 -4 weeks • Individual practices DMS clean up for reporting purposes • Finalising Licensee audit policy and procedures requirements

Operations • Commission system “clean up” to ensure maximum auto loading of commission payments • Direct Debit facility in final stages of testing with launch to all practices in 3 -4 weeks • Individual practices DMS clean up for reporting purposes • Finalising Licensee audit policy and procedures requirements

• Funds currently approx. $220 m from 45 users • Current review of C-wrap continues with BT recently conducting an adviser survey. Results will be used to secure improvements at tier pricing and relationship pricing. • Reviewing the possibility of including BT Essentials in our product range

• Funds currently approx. $220 m from 45 users • Current review of C-wrap continues with BT recently conducting an adviser survey. Results will be used to secure improvements at tier pricing and relationship pricing. • Reviewing the possibility of including BT Essentials in our product range

Research and Training • Ongoing review of individual product requests from advisers • Researching possible topics for the next specialist training day in April – your input is needed • Continued review of adviser CPD points for the last triennium. Advisers with insufficient points will be notified • Following up advisers for September/December training registers • Reviewing training and future education requirements for advisers giving Margin Lending advice • Drafting case study for April

Research and Training • Ongoing review of individual product requests from advisers • Researching possible topics for the next specialist training day in April – your input is needed • Continued review of adviser CPD points for the last triennium. Advisers with insufficient points will be notified • Following up advisers for September/December training registers • Reviewing training and future education requirements for advisers giving Margin Lending advice • Drafting case study for April

Xplan • Development of new So. A wizard and template has been a priority. Currently in final stages of testing with around 8 practices with positive feedback and excellent suggestions. We expect to release templates to all practices in 4 weeks • Continued transition to direct system feed – enhanced accuracy, as stability increases more feeds to come • Developing workflow task management – new threads and tasks in Xplan to handle different levels of service agreements with clients • Trial process of direct debit wizard, template and process • AML forms added to client quick merge

Xplan • Development of new So. A wizard and template has been a priority. Currently in final stages of testing with around 8 practices with positive feedback and excellent suggestions. We expect to release templates to all practices in 4 weeks • Continued transition to direct system feed – enhanced accuracy, as stability increases more feeds to come • Developing workflow task management – new threads and tasks in Xplan to handle different levels of service agreements with clients • Trial process of direct debit wizard, template and process • AML forms added to client quick merge

Marketing Support • • • Registration and Communication material for 2010 conference has been issued. Please help by responding to the initial registration deadline of 31/3/10 Finalisation of online web based ordering system for marketing materials and stationary Individual practice requests Next edition of informed investor due out the week commencing April 19 Electronic C-wrap client brochure available within 2 weeks New marketing materials for Next Generation and Redundancies

Marketing Support • • • Registration and Communication material for 2010 conference has been issued. Please help by responding to the initial registration deadline of 31/3/10 Finalisation of online web based ordering system for marketing materials and stationary Individual practice requests Next edition of informed investor due out the week commencing April 19 Electronic C-wrap client brochure available within 2 weeks New marketing materials for Next Generation and Redundancies

Practice Development • • • Continuing to assess Ripoll and Cooper Review implications Completing strategy sessions with practices Client Survey Prospects with practices Reviewing pricing/segmentation modeling Adviser Recruitment Assisting with client base purchases

Practice Development • • • Continuing to assess Ripoll and Cooper Review implications Completing strategy sessions with practices Client Survey Prospects with practices Reviewing pricing/segmentation modeling Adviser Recruitment Assisting with client base purchases