232067c5a2eb0a14930355f0ecb8c32b.ppt

- Количество слайдов: 150

Welcome Professional Development Day 14 September 2010

Today’s Agenda 9. 00 - 9. 15 Licensee Update – Sarah Peterson - Capstone 9. 15 -10. 00 Economic Update – Chris Caton – BT 10. 00 -10. 45 Divorce – untying the knot – Tim Sanderson - CFS 10. 45 -11. 00 Morning Tea 11. 00 -11. 45 Business Insurance – Stephen Kunz – Asteron 11. 45 -12: 30 The Risks to Safe Retirement – Matthew Dempster - AXA 12. 30 -1. 15 Lunch 1. 15 -2. 00 Compliance Update – Rae Stagbouer- Capstone 2. 00 -2. 15 Afternoon Tea 2. 15 -3. 15 Risk Management Workshop – Germana Venturini – MLC 3. 15 Close

Next 15 minutes • • • Business to date Operations C-wrap Research & Training X-Plan Marketing Support Practice Development Professional Standards Next 3 months

Business to date • Adviser numbers are 67 which is 1 behind target • New Lodgment budget is $8 m per month. New Business flows are slowly increasing and we are tracking around budget • Practices are starting to see good new client activity • FUA currently around $2. 0 billon • Authorised Representatives recently appointed: Lynda Taylor - (with Peter Kerr NSW) Darren Foster - VIC

Operations • Hong Kong conference received excellent feedback • Direct Debit facility operating smoothly • Review of lodgement process and associated paperwork has commenced • Development of internal policy and procedures manual • DMS upgrade implementation completed • FUA reporting available to 31/12 /09 with 30/6/10 in progress

• Funds currently approx. $230 m from 45 users • Current review of C-wrap continues with adviser feedback being finalised by 17/9/10. Results will be used to provide rate card improvement with implementation ASAP. • BT Essentials to be included in our product range when Wrap changes implemented.

Research and Training • • • Ongoing review of individual product requests from advisers Arranging Margin Lending Accreditation for advisers Following up advisers for June quarter training registers Drafting case study for September Issued new risk commission schedule Commencing a project which assesses the demand use of SMA/IMA through Capstone practices • Reviewing policies, procedures and training for practices using SMSF’s

Xplan • Enhance the ROA process in line with the revamped SOA • Improve the ‘out of balance’ warning flags for incorrect data feed accounts • Technology survey of Xplan usage, and areas for improvement • Approved Product Lists now available in Xplan IPS for major partners • Incorporating “Super Solver” into standard SOA – Super to Super – Super to Pension

Marketing Support • New Website being developed (include new look, feel and navigation) • Marketing Brand Review • Client Engagement Model (fee for service framework) • PR Strategy (increase profile within Industry) • Development of new guidelines (website; new practices; stationary etc) • Practice assistance – Facebook – Websites – Client Surveys – Marketing Flyers (Practice level) & Marketing Activity

Practice Development New • Developing Professional Referral Support Tools • Developing a Capstone Client Engagement Framework • Developing a Capstone Practice model Ongoing • Completing strategy sessions with practices • Clients Survey’s with practices • Reviewing pricing/segmentation modeling • Adviser Recruitment • Assisting with client base purchases

Professional Standards • Capstone application to vary License to include Margin Lending Facilities • Capstone application for Australian Credit License • Additions to the suite of strategy specific templates (Rollover/Consolidate Super So. A and Income Protection Increase Ro. A) • Adviser audits are well underway • Investment in additional compliance support has delivered results and now enables Capstone to consolidate and drive positive and simplified compliance going forward (through a number of key projects).

Next 3 months • Seeking Increased adviser - client activity with campaign support • Increased recruiting activity with projects in NSW & QLD • Planning for 2010/2011 year completed with actions being implemented by all staff. • December – Margin Lending Accreditation • December – Professional Development Day • December - Christmas Party at Crown

Question Time

Divorce – untying the knot September 2010 Tim Sanderson

Disclaimer This presentation is given by a representative of Colonial First State Investments Limited AFS Licence 232468, ABN 98 002 348 352 (Colonial First State). Colonial First State Investments Limited ABN 98 002 348 352, AFS Licence 232468 (Colonial First State) is the issuer of interests in First. Choice Personal Super, First. Choice Wholesale Personal Super, First. Choice Pension, First. Choice Wholesale Pension and First. Choice Employer Super from the Colonial First State First. Choice Superannuation Trust ABN 26 458 298 557 and interests in the Rollover & Superannuation Fund and the Personal Pension Plan from the Colonial First State Rollover & Superannuation Fund ABN 88 854 638 840 and interests in the Colonial First State Pooled Superannuation Trust ABN 51 982 884 624. The presenter does not receive specific payments or commissions for any advice given in this presentation. The presenter, other employees and directors of Colonial First State receive salaries, bonuses and other benefits from it. Colonial First State receives fees for investments in its products. For further detail please read our Financial Services Guide (FSG) available at colonialfirststate. com. au or by contacting our Investor Service Centre on 13 13 36. All products are issued by Colonial First State Investments Limited. Product Disclosure Statements ( PDSs) describing the products are available from Colonial First State. The relevant PDS should be considered before making a decision about any product. Stocks referred to in this presentation are not a recommendation of any securities. The information is taken from sources which are believed to be accurate but Colonial First State accepts no liability of any kind to any person who relies on the information contained in the presentation. This presentation is for adviser training purposes only and must not be made available to any client. This presentation cannot be used or copied in whole or part without our express written consent. © Colonial First State Investments Limited 2010.

Agenda Who is affected by family law property settlements? Options / tools for splitting assets Identifying and valuing assets Dealing with superannuation settlements Tax and preservation issues

Who is affected? The facts Will affect many clients Around 1/3 of married people A large proportion of the 2 Million people in a de facto relationship Median age at time of divorce 41. 3 for females 44. 2 for males Married for an average of 9 years But will take 3. 5 years on average to divorce

De facto relationships now included Of at least 2 years duration OR…registered under state law OR AND…anywhere but SA* or WA* OR… where there is a child OR OR…where one member has made a substantial contribution * Separate state laws

Options for splitting assets

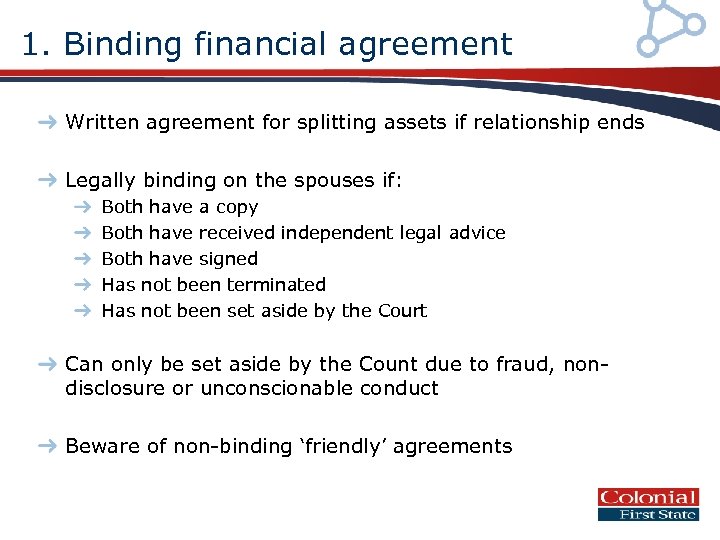

1. Binding financial agreement Written agreement for splitting assets if relationship ends Legally binding on the spouses if: Both have a copy Both have received independent legal advice Both have signed Has not been terminated Has not been set aside by the Court Can only be set aside by the Count due to fraud, nondisclosure or unconscionable conduct Beware of non-binding ‘friendly’ agreements

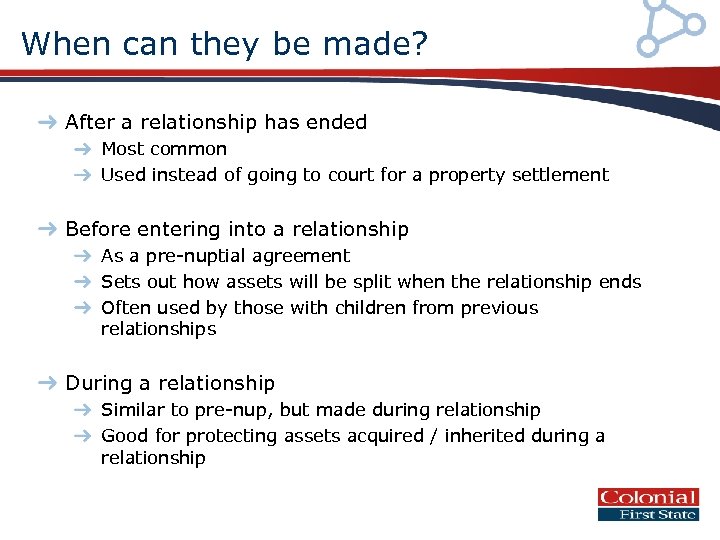

When can they be made? After a relationship has ended Most common Used instead of going to court for a property settlement Before entering into a relationship As a pre-nuptial agreement Sets out how assets will be split when the relationship ends Often used by those with children from previous relationships During a relationship Similar to pre-nup, but made during relationship Good for protecting assets acquired / inherited during a relationship

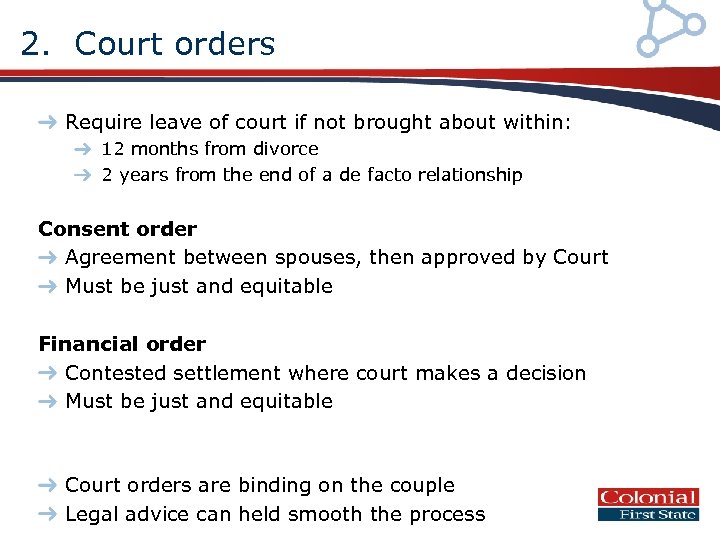

2. Court orders Require leave of court if not brought about within: 12 months from divorce 2 years from the end of a de facto relationship Consent order Agreement between spouses, then approved by Court Must be just and equitable Financial order Contested settlement where court makes a decision Must be just and equitable Court orders are binding on the couple Legal advice can held smooth the process

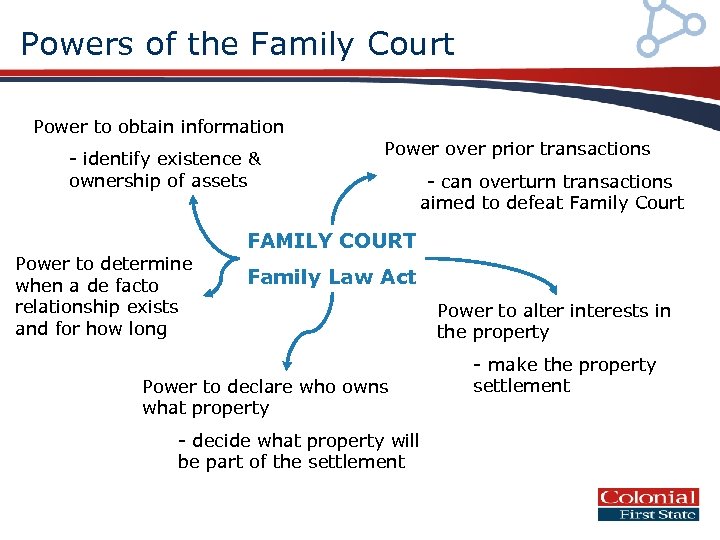

Powers of the Family Court Power to obtain information - identify existence & ownership of assets Power to determine when a de facto relationship exists and for how long Power over prior transactions - can overturn transactions aimed to defeat Family Court FAMILY COURT Family Law Act Power to declare who owns what property - decide what property will be part of the settlement Power to alter interests in the property - make the property settlement

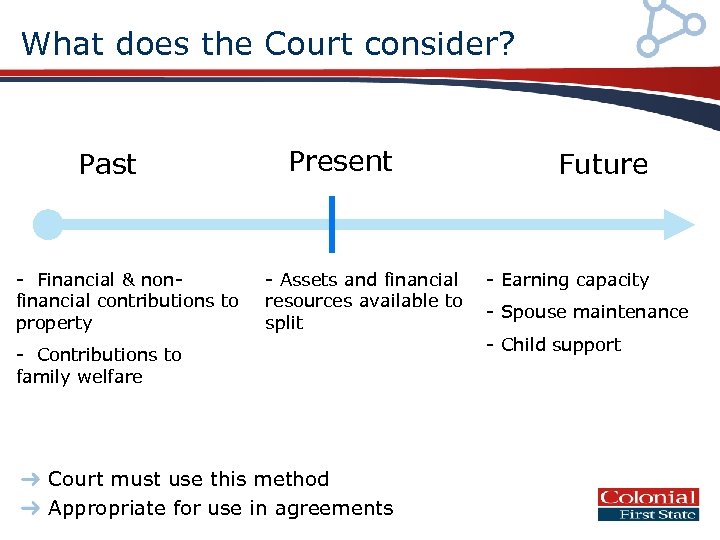

What does the Court consider? Past - Financial & nonfinancial contributions to property - Contributions to family welfare Present Future - Assets and financial - Earning capacity resources available to - Spouse maintenance split - Child support Court must use this method Appropriate for use in agreements

Identifying and valuing assets

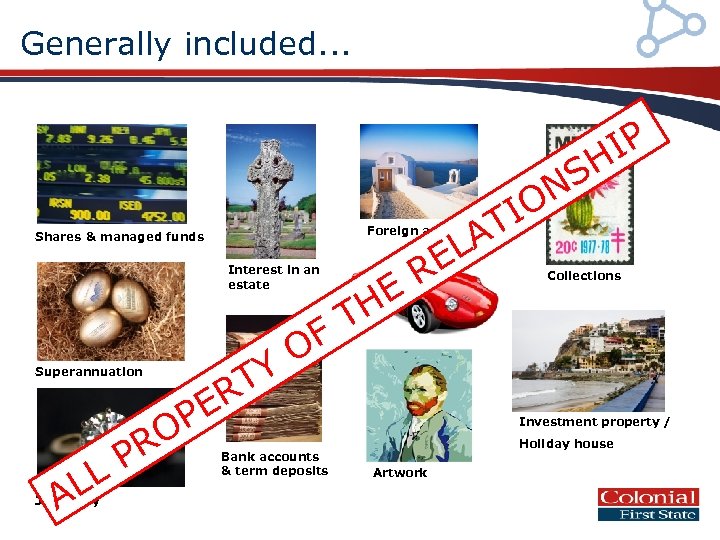

Generally included. . . IP H S N Interest in an estate O Y P O AL Bank accounts & term deposits Collections Cars RT E Superannuation Jewellery R HE T F PR L LA E Foreign assets Shares & managed funds IO T Investment property / Holiday house Artwork

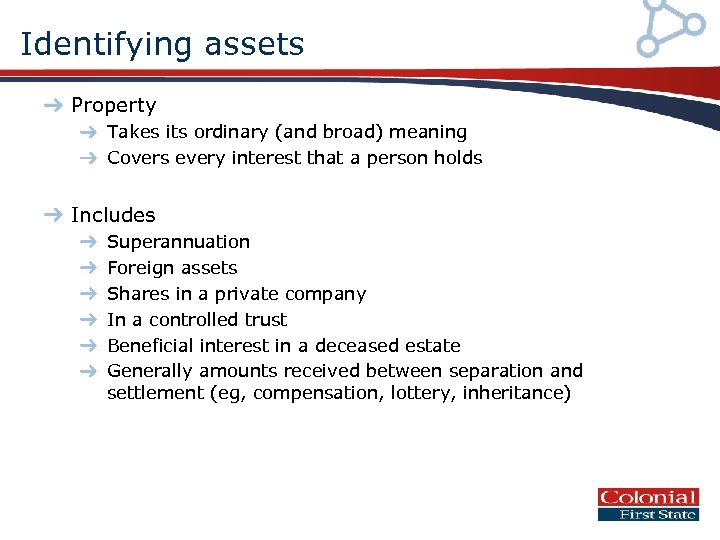

Identifying assets Property Takes its ordinary (and broad) meaning Covers every interest that a person holds Includes Superannuation Foreign assets Shares in a private company In a controlled trust Beneficial interest in a deceased estate Generally amounts received between separation and settlement (eg, compensation, lottery, inheritance)

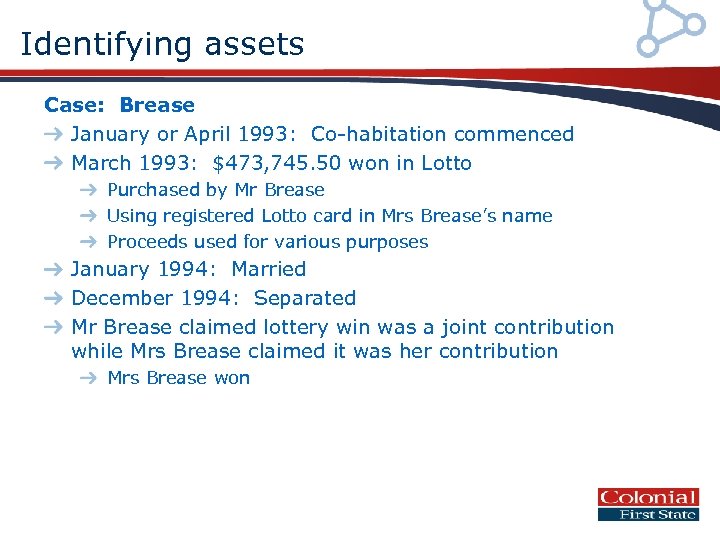

Identifying assets Case: Brease January or April 1993: Co-habitation commenced March 1993: $473, 745. 50 won in Lotto Purchased by Mr Brease Using registered Lotto card in Mrs Brease’s name Proceeds used for various purposes January 1994: Married December 1994: Separated Mr Brease claimed lottery win was a joint contribution while Mrs Brease claimed it was her contribution Mrs Brease won

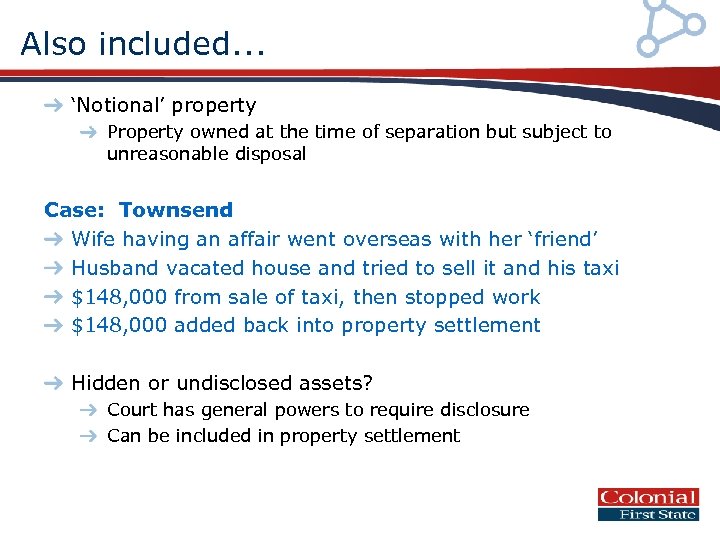

Also included. . . ‘Notional’ property Property owned at the time of separation but subject to unreasonable disposal Case: Townsend Wife having an affair went overseas with her ‘friend’ Husband vacated house and tried to sell it and his taxi $148, 000 from sale of taxi, then stopped work $148, 000 added back into property settlement Hidden or undisclosed assets? Court has general powers to require disclosure Can be included in property settlement

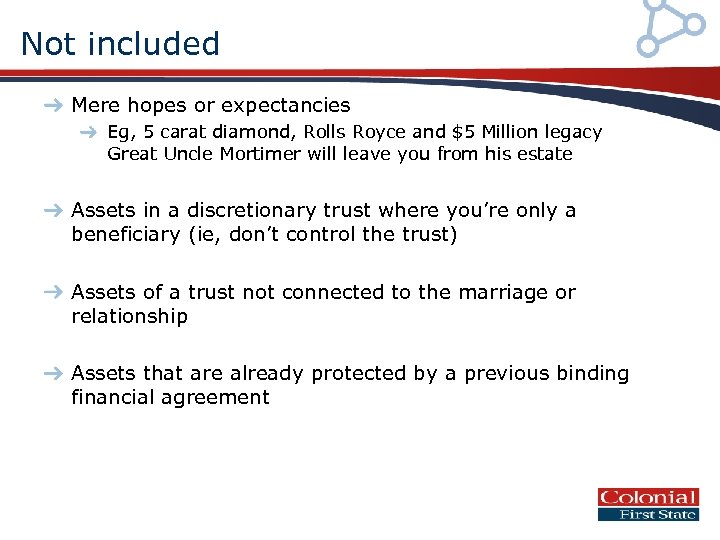

Not included Mere hopes or expectancies Eg, 5 carat diamond, Rolls Royce and $5 Million legacy Great Uncle Mortimer will leave you from his estate Assets in a discretionary trust where you’re only a beneficiary (ie, don’t control the trust) Assets of a trust not connected to the marriage or relationship Assets that are already protected by a previous binding financial agreement

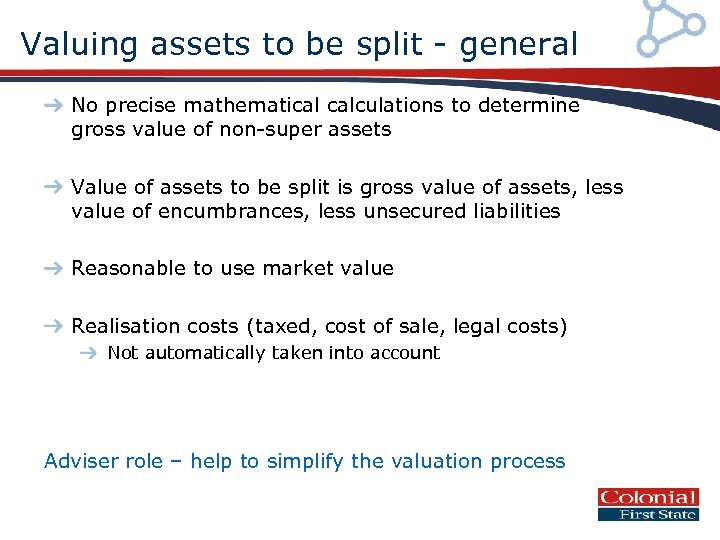

Valuing assets to be split - general No precise mathematical calculations to determine gross value of non-super assets Value of assets to be split is gross value of assets, less value of encumbrances, less unsecured liabilities Reasonable to use market value Realisation costs (taxed, cost of sale, legal costs) Not automatically taken into account Adviser role – help to simplify the valuation process

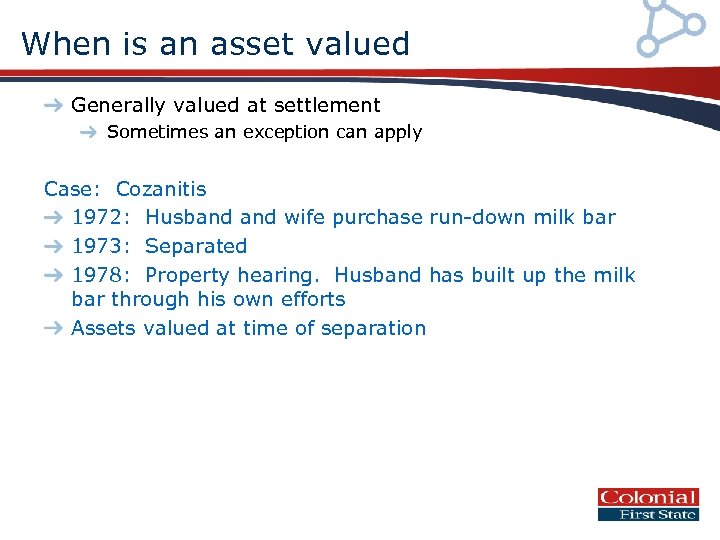

When is an asset valued Generally valued at settlement Sometimes an exception can apply Case: Cozanitis 1972: Husband wife purchase run-down milk bar 1973: Separated 1978: Property hearing. Husband has built up the milk bar through his own efforts Assets valued at time of separation

Superannuation family law splits

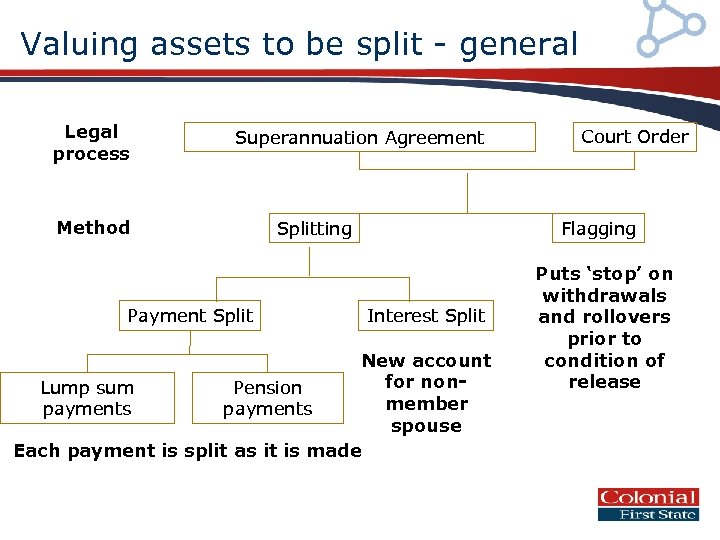

Valuing assets to be split - general Legal process Superannuation Agreement Method Payment Splitting Court Order Flagging Interest Split New account for non. Lump sum Pension member payments spouse Each payment is split as it is made Puts ‘stop’ on withdrawals and rollovers prior to condition of release

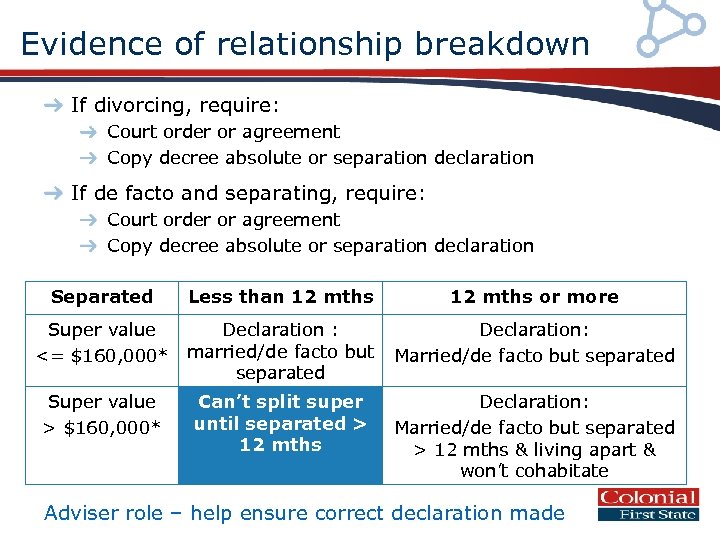

Evidence of relationship breakdown If divorcing, require: Court order or agreement Copy decree absolute or separation declaration If de facto and separating, require: Court order or agreement Copy decree absolute or separation declaration Separated Less than 12 mths or more Super value Declaration : Declaration: <= $160, 000* married/de facto but Married/de facto but separated Super value > $160, 000* Can’t split super until separated > 12 mths Declaration: Married/de facto but separated > 12 mths & living apart & won’t cohabitate Adviser role – help ensure correct declaration made

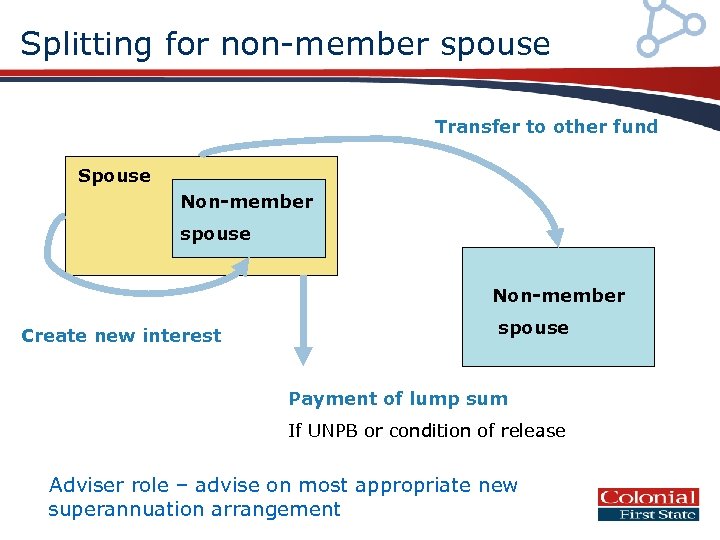

Splitting for non-member spouse Transfer to other fund Spouse Non-member spouse Non-member Create new interest spouse Payment of lump sum If UNPB or condition of release Adviser role – advise on most appropriate new superannuation arrangement

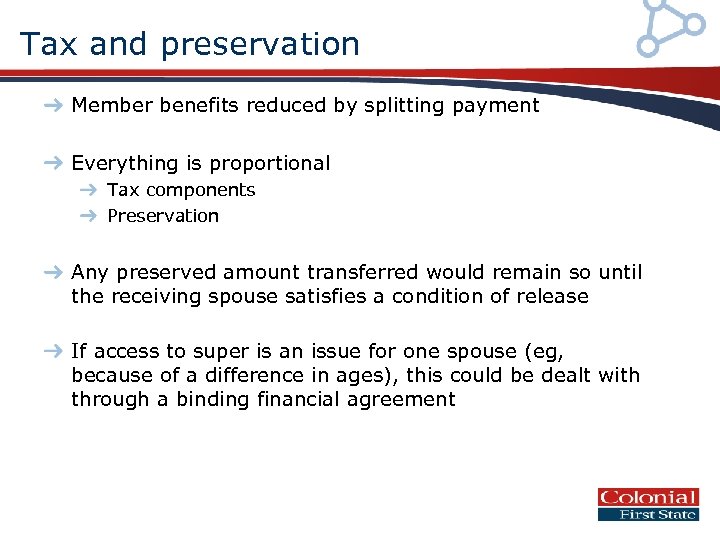

Tax and preservation Member benefits reduced by splitting payment Everything is proportional Tax components Preservation Any preserved amount transferred would remain so until the receiving spouse satisfies a condition of release If access to super is an issue for one spouse (eg, because of a difference in ages), this could be dealt with through a binding financial agreement

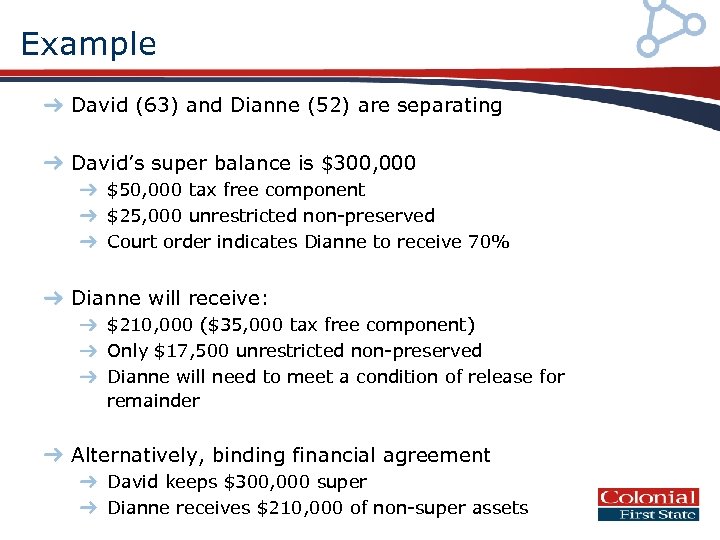

Example David (63) and Dianne (52) are separating David’s super balance is $300, 000 $50, 000 tax free component $25, 000 unrestricted non-preserved Court order indicates Dianne to receive 70% Dianne will receive: $210, 000 ($35, 000 tax free component) Only $17, 500 unrestricted non-preserved Dianne will need to meet a condition of release for remainder Alternatively, binding financial agreement David keeps $300, 000 super Dianne receives $210, 000 of non-super assets

Summary Understand divorce / separation process Ensure client’s actions are not in conflict with the Family Court Assist in identifying and valuing assets Provide post-settlement advice strategies Incorporate family law issues in initial and ongoing advice

First. Tech team 13 18 36 firsttech@colonialfirststate. com. au

Key Person and Buy/Sell Technical Services September 2010

Important information – The information contained in this presentation is intended to provide a brief outline of legislation applicable to superannuation funds and taxation laws at 1 September 2010. – It is based on our understanding of the present laws and Government announcements and the assumption that they will continue. – These are general statements and should be relied upon as a guide only, as an individual’s circumstances can be quite different. You should seek advice about how the relevant laws impact on your particular circumstances. – The rates of return and inflation used in the projections are estimates only and are intended to be only a guide to future performance. No guarantee of investment performance is given or implied through the use of these projections and actual returns will differ from those indicated. Past performance should not be taken as a guide to future performance. – We recommend that you refer to the relevant Product Disclosure Statement where reference is made to a particular product before taking any action. – Suncorp Portfolio Services Limited. ABN 61 063 427 958. AFS No 237905

Key Person and Buy/Sell insurance – These slides accompany the Asteron “Business owners reference guide” Ø The “Business owners reference guide” explains various topics in key person and buy/sell insurance • They also accompany Asteron’s “Guide to key person insurance” and “Guide to Buy/Sell Insurance” which outline a 5 step process to implementing business insurance

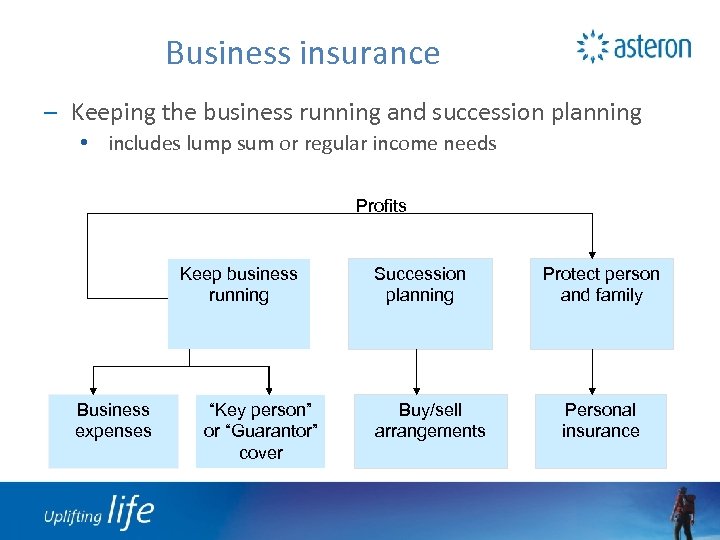

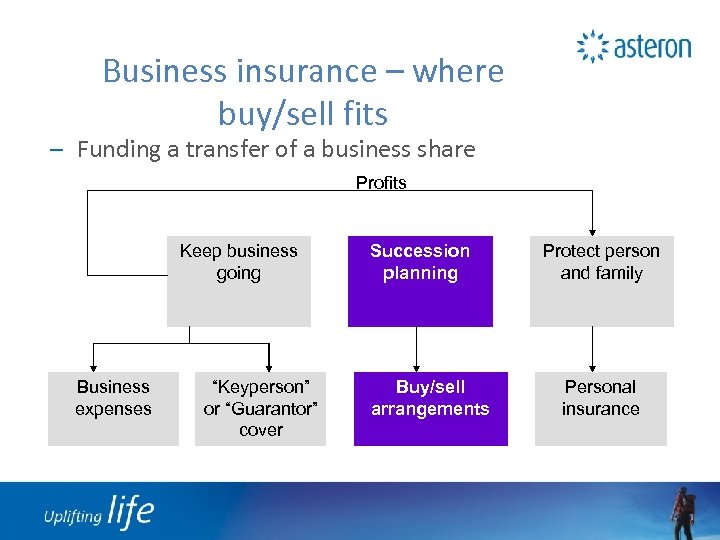

Business insurance – Keeping the business running and succession planning • includes lump sum or regular income needs Profits Keep business running Business expenses “Key person” or “Guarantor” cover Succession planning Buy/sell arrangements Protect person and family Personal insurance

Who is a key person ? – Someone whose presence: • • • Page 4 Creates cost savings Generates revenue Adds goodwill Provides access to credit Has relationships with the customers

Alternatives to key person insurance – – – Use available cash flow Sell business assets Borrow cash Use personal assets Self insure Page 6

Products used – Life – Total and permanent incapacity – Trauma Page 6

Valuing a key person – Use the Fact Sheet “Business insurance – how much cover is needed” • depends on whether it is a revenue or capital purpose • look to what will be affected by the loss of the person § For revenue purpose options include multiple of salary, multiple of gross/net profit or cost in replacement § For capital purpose look to the debt or guarantee to be covered Page 7

Insurance considerations – For key person linked policies may be suitable as the loss to the business occurs on either death, disability or trauma – Stepped premiums may be suitable for shorter periods of insurance/level premiums for longer periods – The underwriter needs to be comfortable with the contribution of the person to the business and the method of valuation Page 8

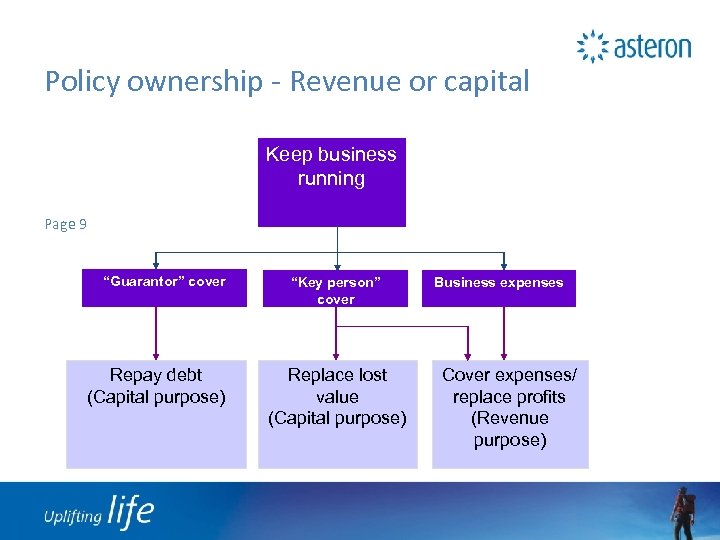

Policy ownership - Revenue or capital Keep business running Page 9 “Guarantor” cover Repay debt (Capital purpose) “Key person” cover Replace lost value (Capital purpose) Business expenses Cover expenses/ replace profits (Revenue purpose)

Revenue purpose – Revenue affects business profitability (P&L statement) • Replace revenue generated by the key person • Pay extra costs to replace person Continues profitability to stabilise business P&L – How much cover is needed? • What is the impact of that person not coming to work Page 10

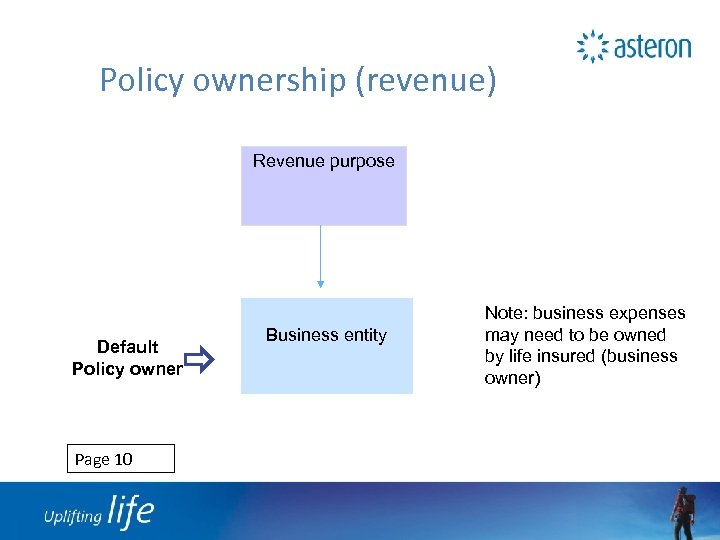

Policy ownership (revenue) Revenue purpose Default Policy owner Page 10 Business entity Note: business expenses may need to be owned by life insured (business owner)

Capital purpose – Capital – value of business (balance sheet) • May reduce value of goodwill • May be more difficult to secure credit • Lenders may want loans to be repaid • Loans may move to default ð improve balance sheet to stabilise business and ease cash flow Page 11

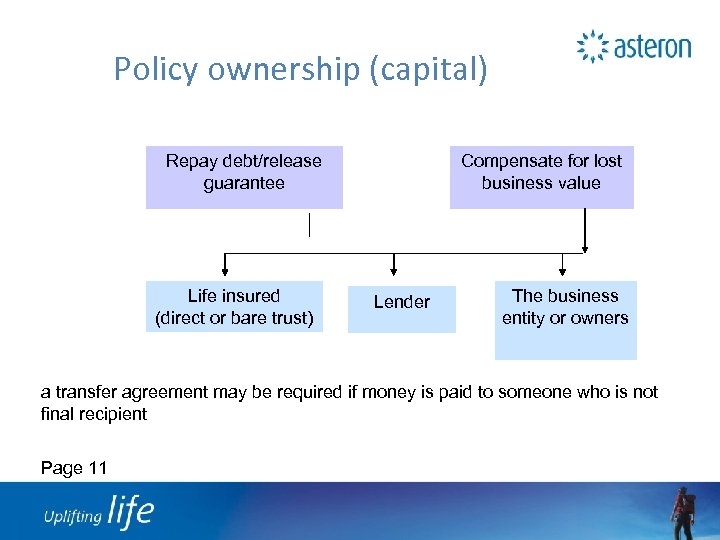

Policy ownership (capital) Repay debt/release guarantee Life insured (direct or bare trust) Compensate for lost business value Lender The business entity or owners a transfer agreement may be required if money is paid to someone who is not final recipient Page 11

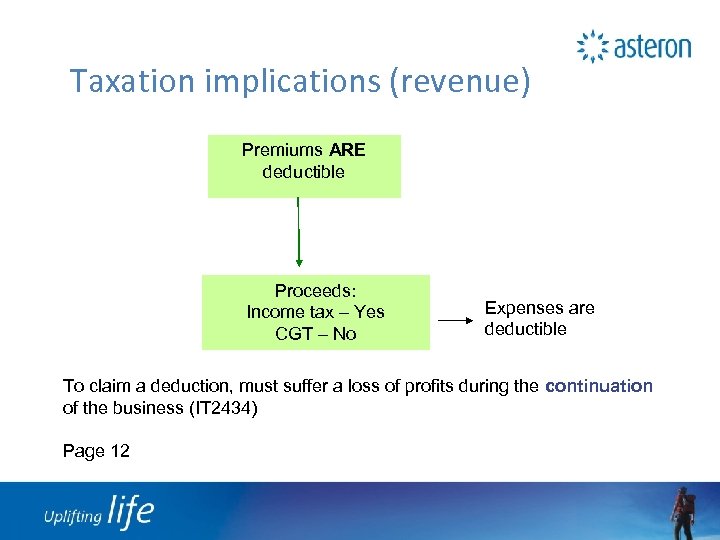

Taxation implications (revenue) Premiums ARE deductible Proceeds: Income tax – Yes CGT – No Expenses are deductible To claim a deduction, must suffer a loss of profits during the continuation of the business (IT 2434) Page 12

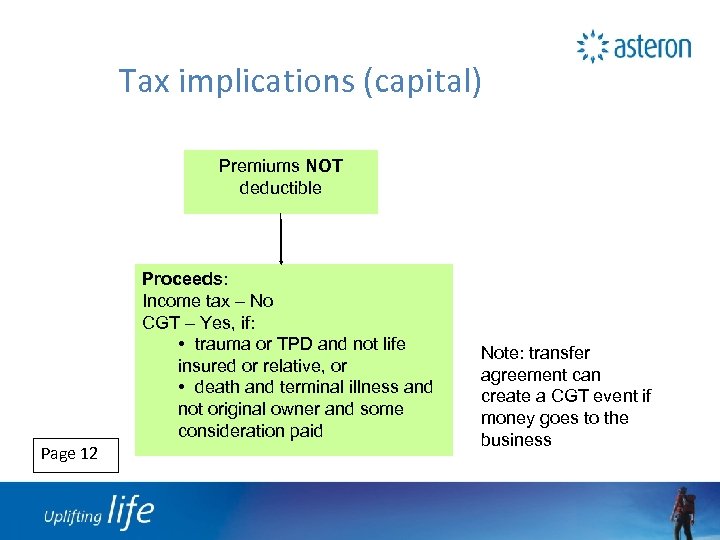

Tax implications (capital) Premiums NOT deductible Proceeds: Income tax – No CGT – Yes, if: • trauma or TPD and not life insured or relative, or • death and terminal illness and not original owner and some consideration paid Page 12 Note: transfer agreement can create a CGT event if money goes to the business

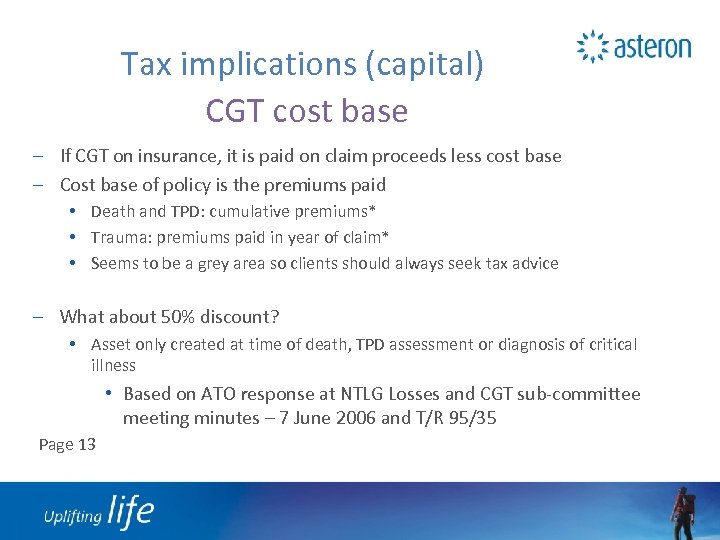

Tax implications (capital) CGT cost base – If CGT on insurance, it is paid on claim proceeds less cost base – Cost base of policy is the premiums paid • Death and TPD: cumulative premiums* • Trauma: premiums paid in year of claim* • Seems to be a grey area so clients should always seek tax advice – What about 50% discount? • Asset only created at time of death, TPD assessment or diagnosis of critical illness • Based on ATO response at NTLG Losses and CGT sub-committee meeting minutes – 7 June 2006 and T/R 95/35 Page 13

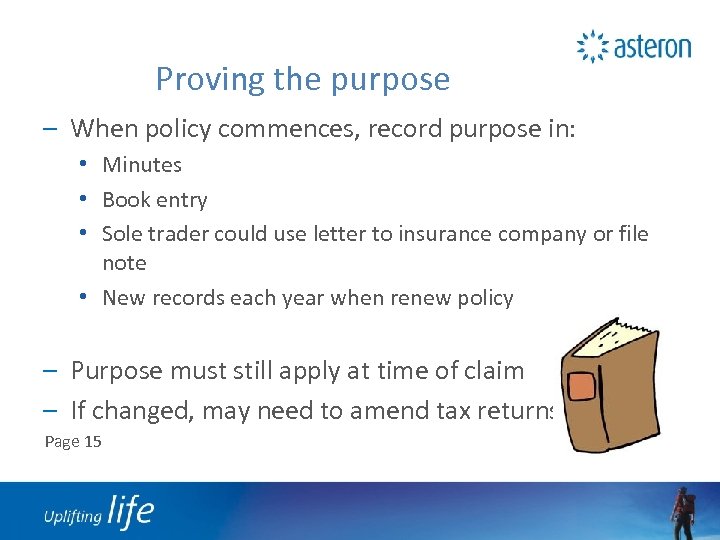

Proving the purpose – When policy commences, record purpose in: • Minutes • Book entry • Sole trader could use letter to insurance company or file note • New records each year when renew policy – Purpose must still apply at time of claim – If changed, may need to amend tax returns Page 15

Business insurance – where buy/sell fits – Funding a transfer of a business share Profits Keep business going Business expenses “Keyperson” or “Guarantor” cover Succession planning Buy/sell arrangements Protect person and family Personal insurance

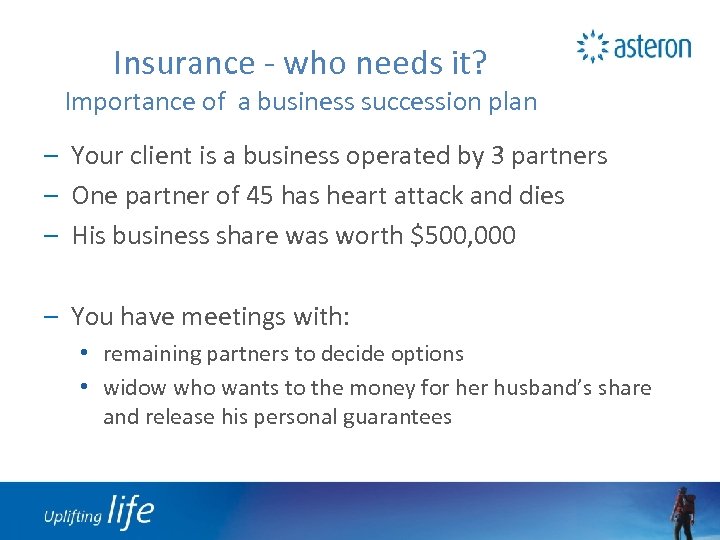

Insurance - who needs it? Importance of a business succession plan – Your client is a business operated by 3 partners – One partner of 45 has heart attack and dies – His business share was worth $500, 000 – You have meetings with: • remaining partners to decide options • widow who wants to the money for her husband’s share and release his personal guarantees

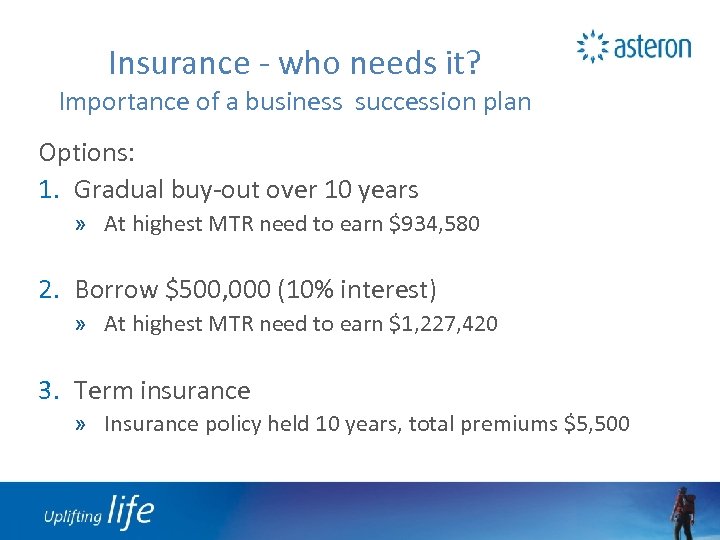

Insurance - who needs it? Importance of a business succession plan Options: 1. Gradual buy-out over 10 years » At highest MTR need to earn $934, 580 2. Borrow $500, 000 (10% interest) » At highest MTR need to earn $1, 227, 420 3. Term insurance » Insurance policy held 10 years, total premiums $5, 500

Business succession plans – For any business with two or more principals • Death, serious illness or incapacity can lead to closure of the business, forced sale or less than fair value for the business share – Agreement needs to • incorporate disposal of business share, ongoing operation • be drawn up with professional advice on form and content – Aim is to • maximise value of business/provide exit strategy/continuity/certainty Page 21

Business succession plans – A business succession plan has two elements • transfer (legal) agreement • funding mechanism Page 23

Transfer agreements • Drafted by solicitor • Sets out the rules for the transfer of business § What trigger events and when » What causes a transfer/timing /differing conditions § How business valued » industry multiples/net assets or book value/ capitalised future earnings/appraised value/agreed value » see the Fact Sheet “Business insurance – how much cover is needed? ” § Procedures for transfer » timing/handover § Mandatory or put/call options Page 23

Options to trigger a transfer – Mandatory option • Buy/sell forces transfer when trigger event happens • CGT event may occur when agreement signed (depends on wording for conditions precedent) – Put/call options • Either party can choose to enforce a transfer • CGT event occurs when transfer happens • May provide flexibility, especially for critical illness events Page 24

Funding mechanism • Provides cash for buy out • Match events to funding mechanisms § Life insurance for death, TPD and critical illness § Savings/loans/gradual buy-out /realising business or personal assets for retirement or resignation • Need to review insurance regularly to manage funding gaps Page 23

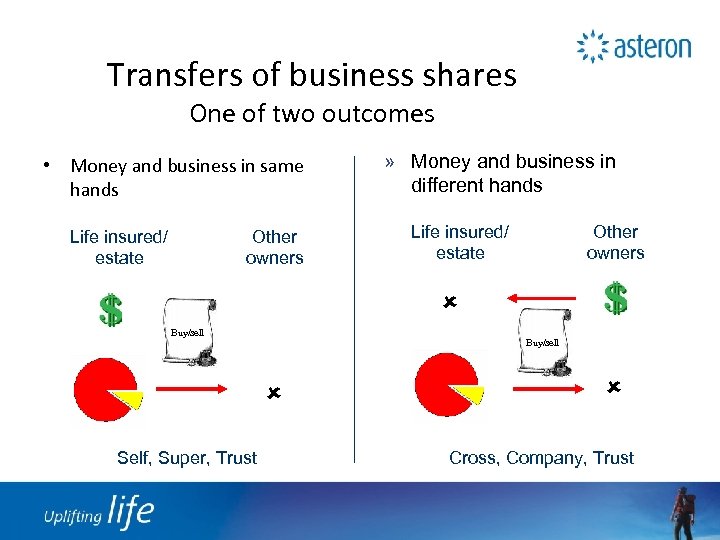

Transfers of business shares One of two outcomes • Money and business in same hands Life insured/ estate Other owners » Money and business in different hands Life insured/ estate Other owners Buy/sell Self, Super, Trust Cross, Company, Trust

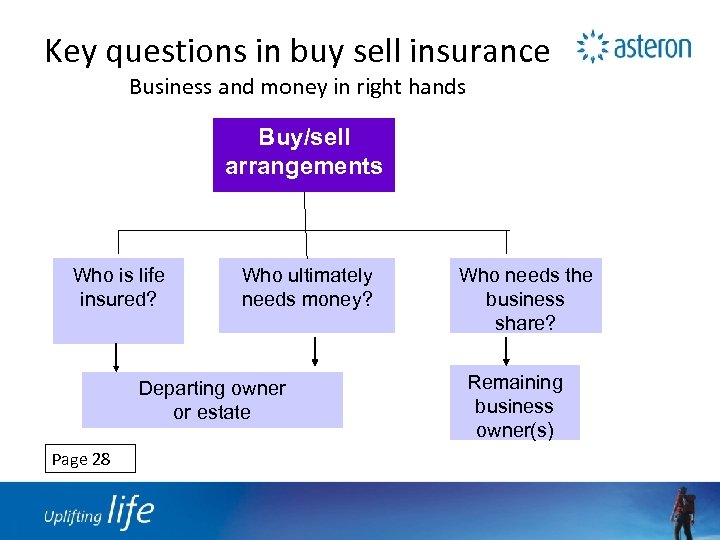

Key questions in buy sell insurance Business and money in right hands Buy/sell arrangements Who is life insured? Who ultimately needs money? Departing owner or estate Page 28 Who needs the business share? Remaining business owner(s)

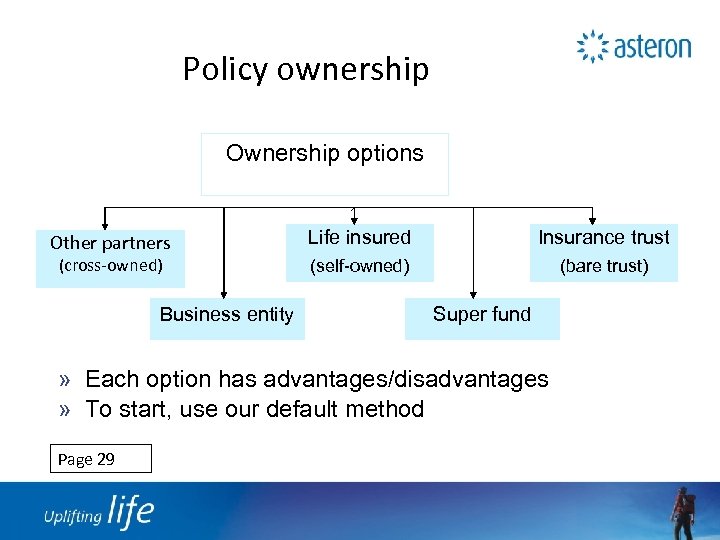

Policy ownership Ownership options Other partners (cross-owned) Business entity Life insured Insurance trust (self-owned) (bare trust) Super fund » Each option has advantages/disadvantages » To start, use our default method Page 29

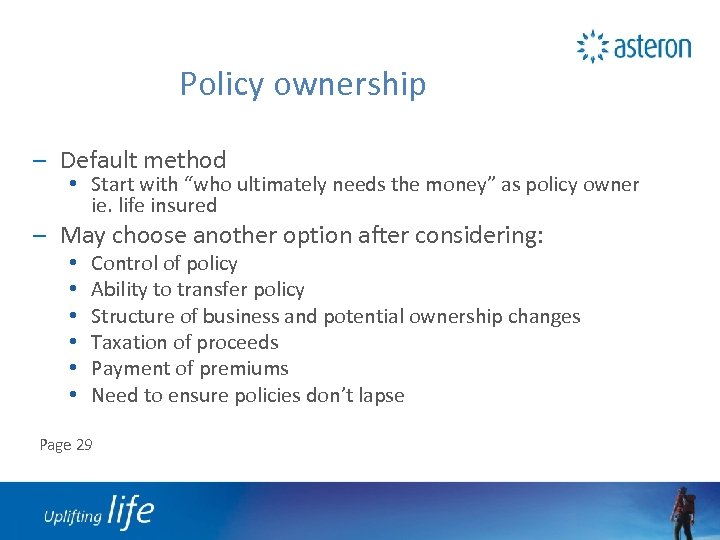

Policy ownership – Default method • Start with “who ultimately needs the money” as policy owner ie. life insured – May choose another option after considering: • • • Control of policy Ability to transfer policy Structure of business and potential ownership changes Taxation of proceeds Payment of premiums Need to ensure policies don’t lapse Page 29

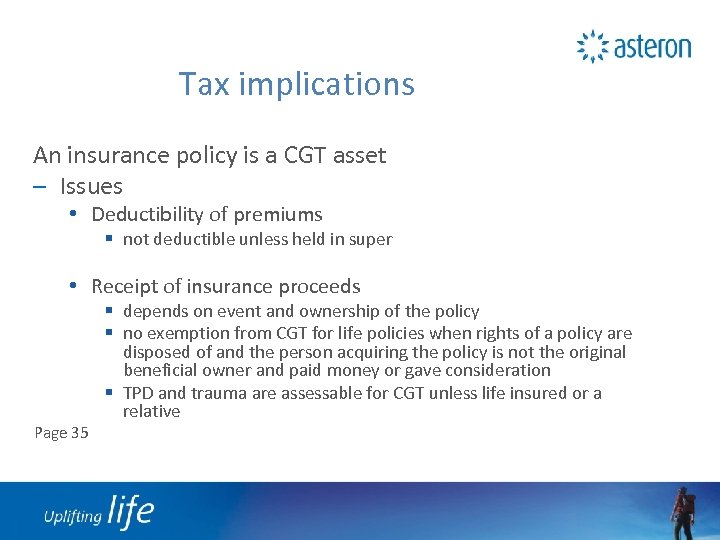

Tax implications An insurance policy is a CGT asset – Issues • Deductibility of premiums § not deductible unless held in super • Receipt of insurance proceeds Page 35 § depends on event and ownership of the policy § no exemption from CGT for life policies when rights of a policy are disposed of and the person acquiring the policy is not the original beneficial owner and paid money or gave consideration § TPD and trauma are assessable for CGT unless life insured or a relative

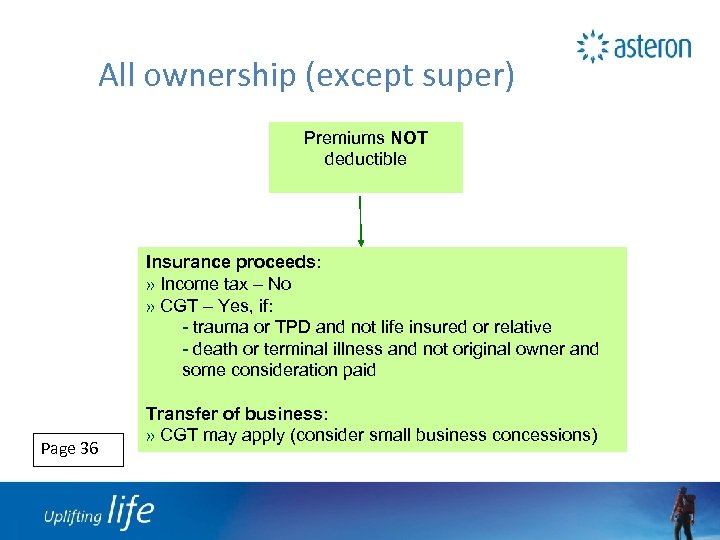

All ownership (except super) Premiums NOT deductible Insurance proceeds: » Income tax – No » CGT – Yes, if: - trauma or TPD and not life insured or relative - death or terminal illness and not original owner and some consideration paid Page 36 Transfer of business: » CGT may apply (consider small business concessions)

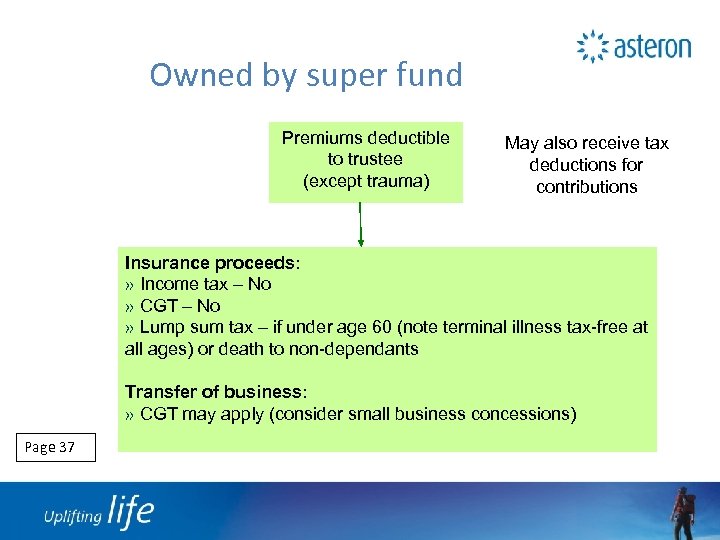

Owned by super fund Premiums deductible to trustee (except trauma) May also receive tax deductions for contributions Insurance proceeds: » Income tax – No » CGT – No » Lump sum tax – if under age 60 (note terminal illness tax-free at all ages) or death to non-dependants Transfer of business: » CGT may apply (consider small business concessions) Page 37

Tax implications Payment of premiums – Policy owner is responsible to pay premiums – In practice, often the business who pays – Decisions: • Who pays • How to apportion costs (especially if premiums vary widely) • Tax and accounting implications (eg non-deductible expense, FBT, deemed dividend for company)

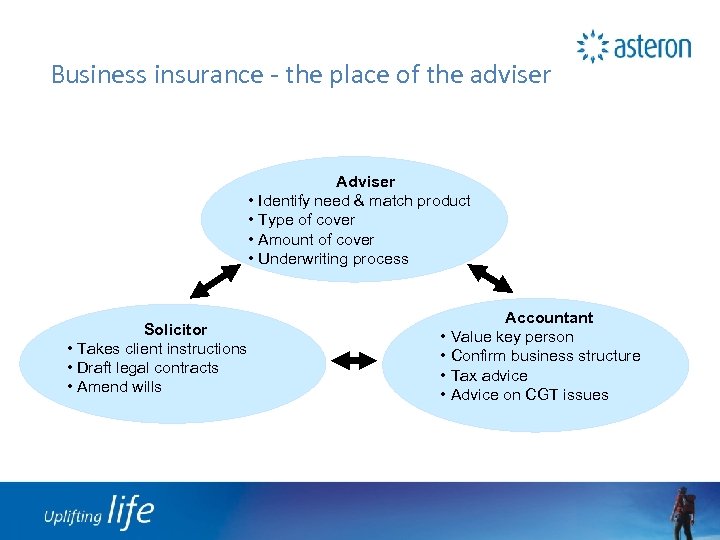

Business insurance - the place of the adviser Adviser • Identify need & match product • Type of cover • Amount of cover • Underwriting process Solicitor • Takes client instructions • Draft legal contracts • Amend wills Accountant • Value key person • Confirm business structure • Tax advice • Advice on CGT issues

The risks to safe retirement. Capstone PD Day September 2010

Overview ¾ Retirees – the size of the opportunity ¾ The risks specific to retirees ¾ The implications for advice

The Game has Changed May 8

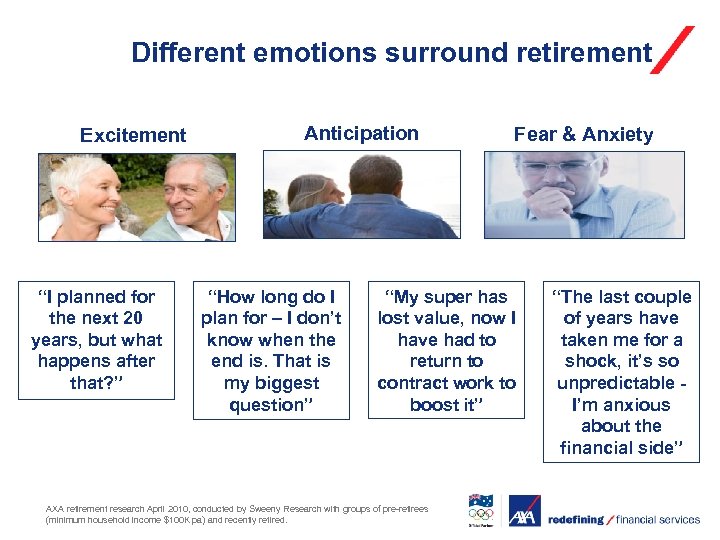

Different emotions surround retirement Excitement “I planned for the next 20 years, but what happens after that? ” Anticipation “How long do I plan for – I don’t know when the end is. That is my biggest question” Fear & Anxiety “My super has lost value, now I have had to return to contract work to boost it” AXA retirement research April 2010, conducted by Sweeny Research with groups of pre-retirees (minimum household income $100 K pa) and recently retired. “The last couple of years have taken me for a shock, it’s so unpredictable I’m anxious about the financial side”

Risks that are specific to retirees

The key risks and challenges in retirement ¾ L…………. ¾ ¾ I…………. . V…………. E…………. T………….

The key risks and challenges in retirement ¾ Longevity ¾ ¾ Inflation Volatility Emotion Timing

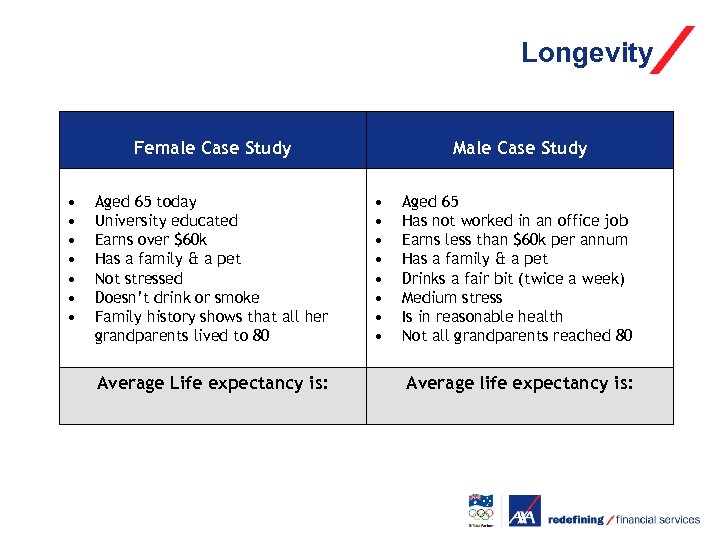

Longevity Female Case Study • • Aged 65 today University educated Earns over $60 k Has a family & a pet Not stressed Doesn’t drink or smoke Family history shows that all her grandparents lived to 80 Average Life expectancy is: Male Case Study • • Aged 65 Has not worked in an office job Earns less than $60 k per annum Has a family & a pet Drinks a fair bit (twice a week) Medium stress Is in reasonable health Not all grandparents reached 80 Average life expectancy is:

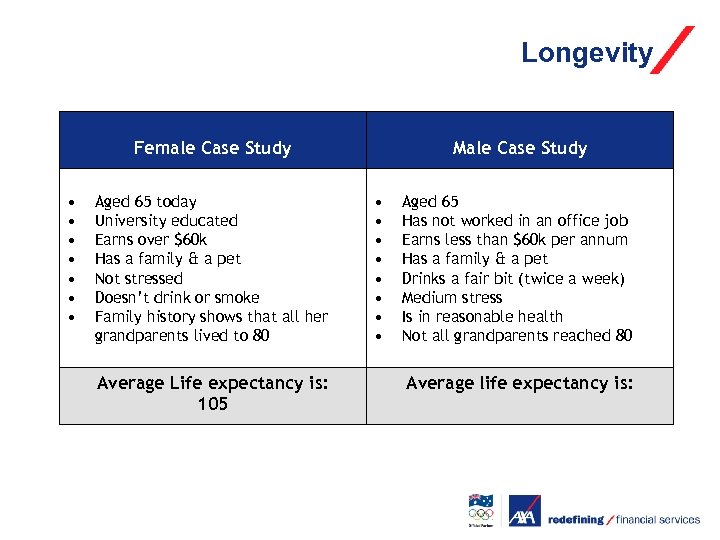

Longevity Female Case Study • • Aged 65 today University educated Earns over $60 k Has a family & a pet Not stressed Doesn’t drink or smoke Family history shows that all her grandparents lived to 80 Average Life expectancy is: 105 Male Case Study • • Aged 65 Has not worked in an office job Earns less than $60 k per annum Has a family & a pet Drinks a fair bit (twice a week) Medium stress Is in reasonable health Not all grandparents reached 80 Average life expectancy is:

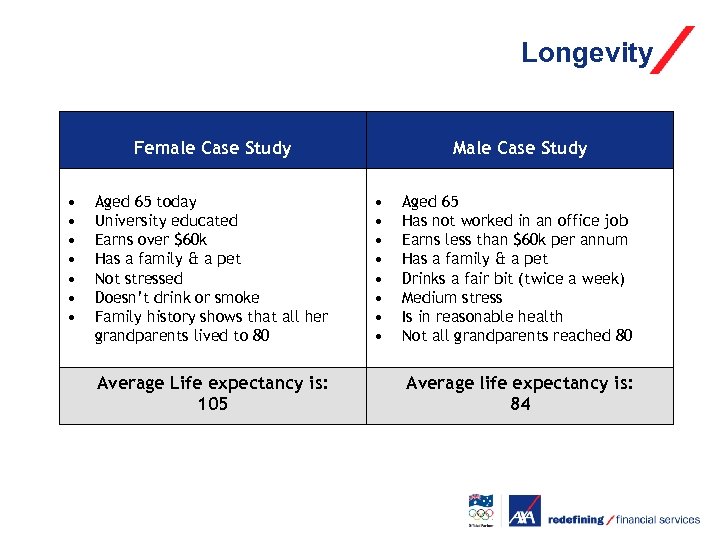

Longevity Female Case Study • • Aged 65 today University educated Earns over $60 k Has a family & a pet Not stressed Doesn’t drink or smoke Family history shows that all her grandparents lived to 80 Average Life expectancy is: 105 Male Case Study • • Aged 65 Has not worked in an office job Earns less than $60 k per annum Has a family & a pet Drinks a fair bit (twice a week) Medium stress Is in reasonable health Not all grandparents reached 80 Average life expectancy is: 84

Modelling tool www. mercerwealthsolutions. com. au/planningtools/life-expectancy

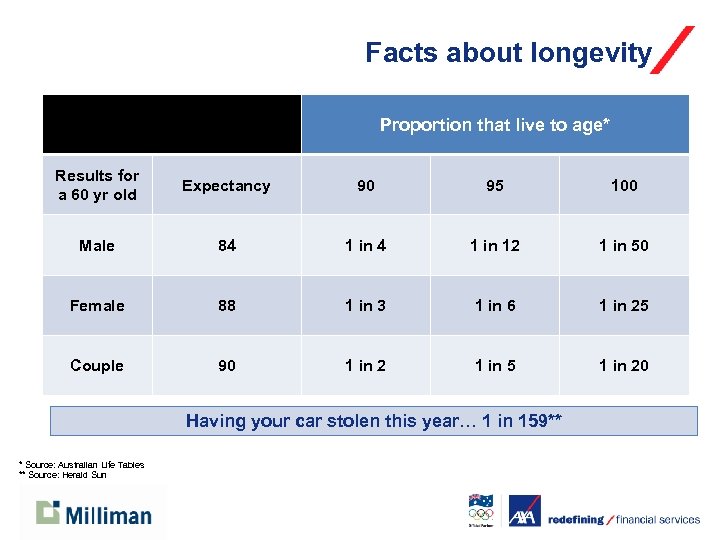

Facts about longevity Proportion that live to age* Results for a 60 yr old Expectancy 90 95 100 Male 84 1 in 12 1 in 50 Female 88 1 in 3 1 in 6 1 in 25 Couple 90 1 in 2 1 in 5 1 in 20 Having your car stolen this year… 1 in 159** * Source: Australian Life Tables ** Source: Herald Sun

Life Expectancy Key areas to consider when determining life expectancy are: 1. The person: age, gender, blood pressure, cholesterol, wage (tangibles) 2. Lifestyle: activity, attitudes and diet 3. Habits: drinking and smoking, plus driving, living alone or having pets 4. Education and work type 5. Family history, longevity

Life Expectancy Don’t forget: ¾ Life expectancy improves with time ¾ Beware of averages

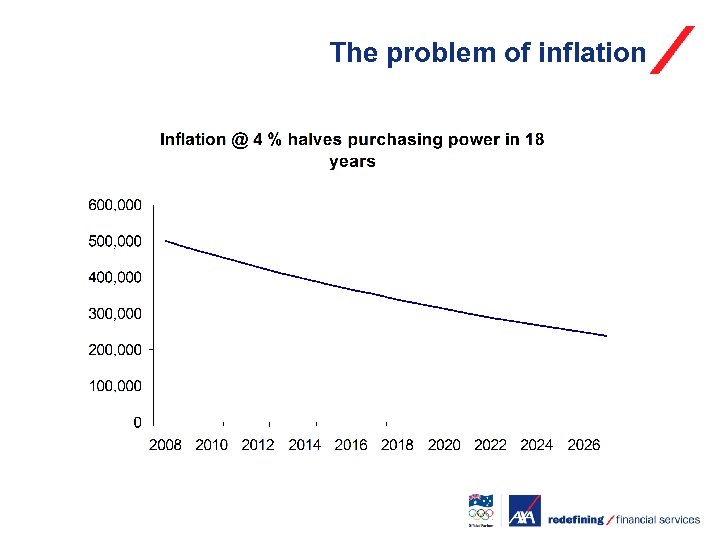

The problem of inflation

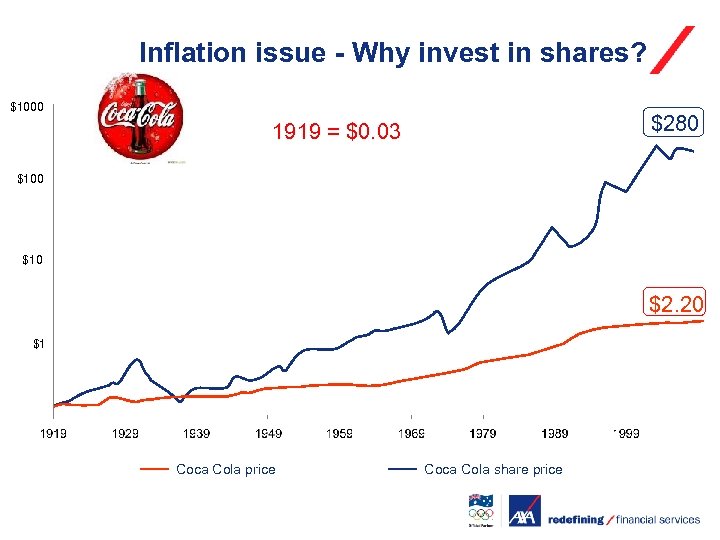

Inflation issue - Why invest in shares? $1000 $280 1919 = $0. 03 $100 $10 $2. 20 $1 Coca Cola price Coca Cola share price

The challenge with conservative investing Inflation ¾ The need for growth assets ¾ The 10 / 30 / 60 rule ¾ Retirement time horizon is uncertain ¾ Keep pace with inflation

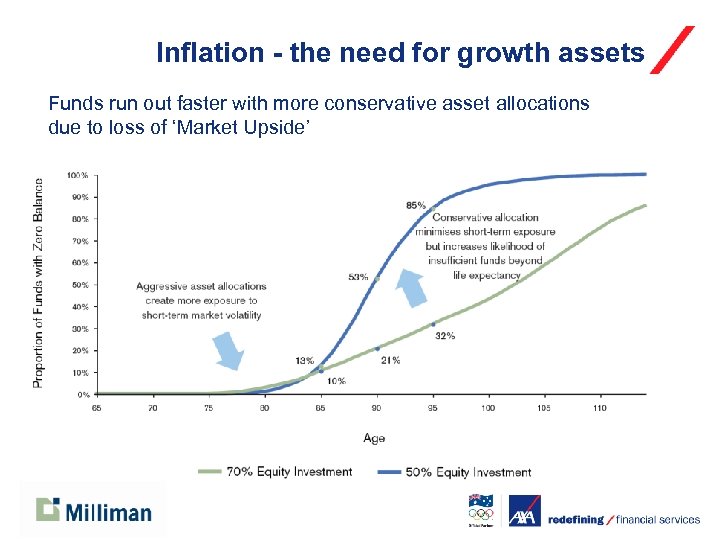

Inflation - the need for growth assets Funds run out faster with more conservative asset allocations due to loss of ‘Market Upside’

The price for growth: Volatility ¾ Switching to cash ¾ Regret risk ¾ Products & advice can help alleviate

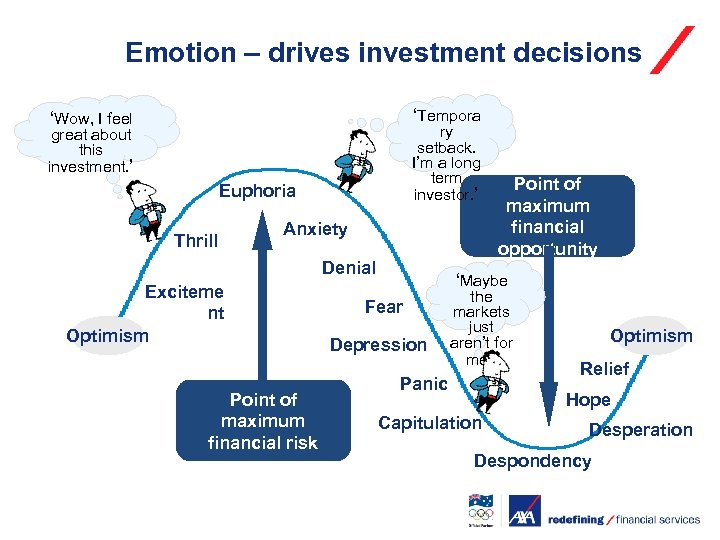

Emotion – can get the better of investors

Emotion – drives investment decisions ‘Tempora ‘Wow, I feel ry setback. I’m a long term investor. ’ great about this investment. ’ Euphoria Thrill Anxiety Denial Exciteme nt Optimism Point of maximum financial risk Point of maximum financial opportunity ‘Maybe Fear Depression the markets just aren’t for me. ’ Panic Optimism Relief Hope Capitulation Desperation Despondency

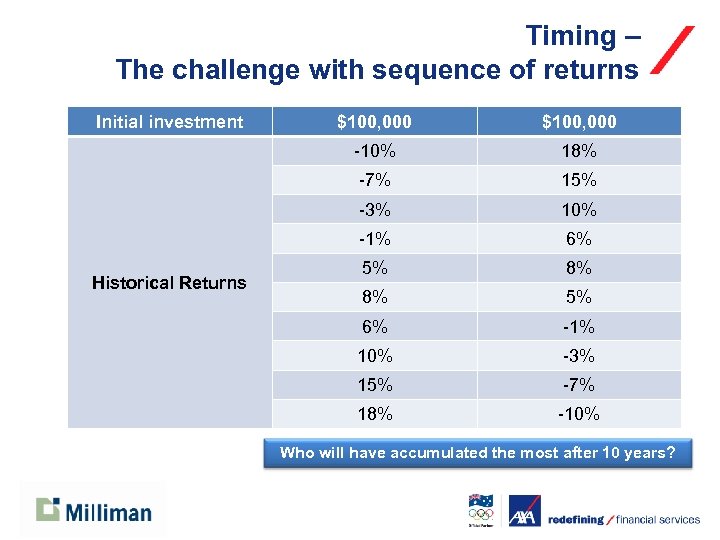

Timing – The challenge with sequence of returns Initial investment $100, 000 -10% 18% -7% 15% -3% 10% -1% Historical Returns $100, 000 6% 5% 8% 8% 5% 6% -1% 10% -3% 15% -7% 18% -10% Who will have accumulated the most after 10 years?

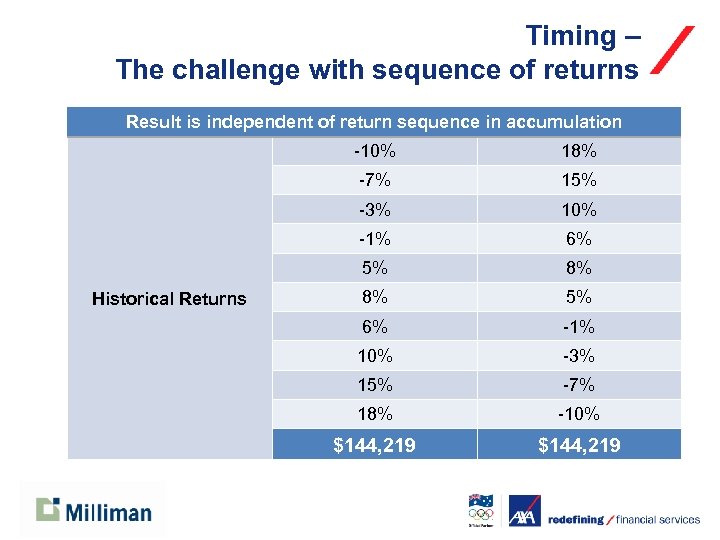

Timing – The challenge with sequence of returns Initial investment 100, 000 Result is independent of return sequence in accumulation -10% -7% 15% -3% 10% -1% 6% 5% Historical Returns 18% 8% 8% 5% 6% -1% 10% -3% 15% -7% 18% -10% $144, 219

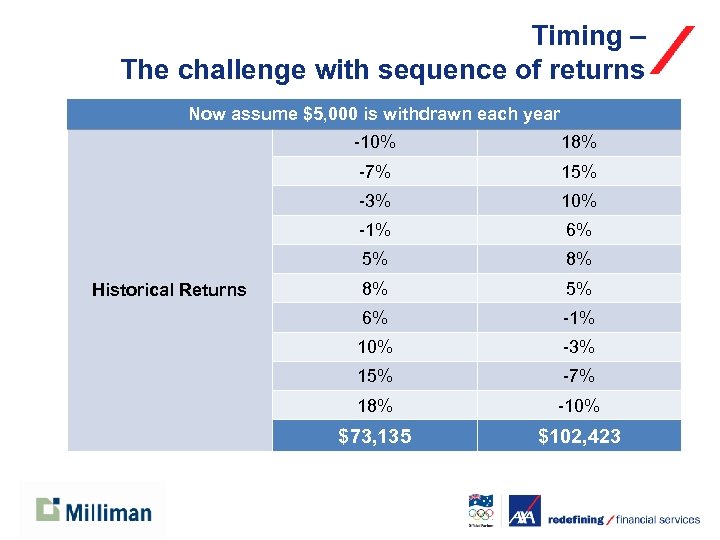

Timing – The challenge with sequence of returns Initial investment 100, 000 Now assume $5, 000 is withdrawn each year -10% -7% 15% -3% 10% -1% 6% 5% Historical Returns 18% 8% 8% 5% 6% -1% 10% -3% 15% -7% 18% -10% $73, 135 $102, 423

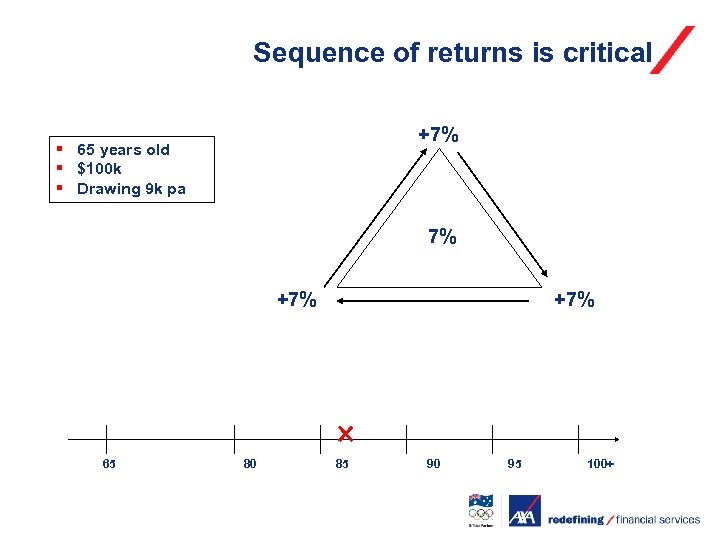

Sequence of returns is critical +7% § 65 years old § $100 k § Drawing 9 k pa 7% +7% 65 80 +7% 85 90 95 100+

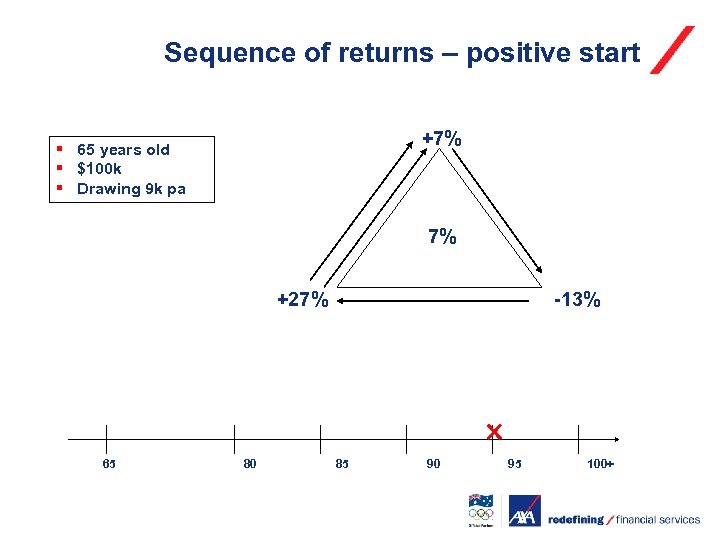

Sequence of returns – positive start +7% § 65 years old § $100 k § Drawing 9 k pa 7% +27% 65 80 -13% 85 90 95 100+

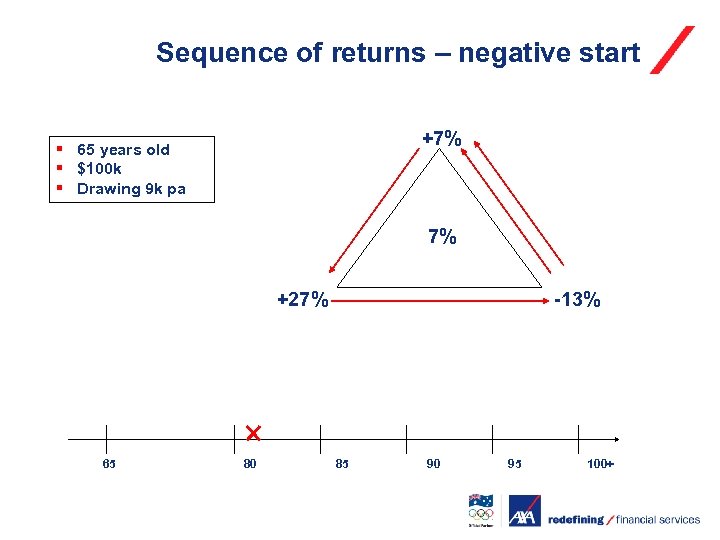

Sequence of returns – negative start +7% § 65 years old § $100 k § Drawing 9 k pa 7% +27% 65 80 -13% 85 90 95 100+

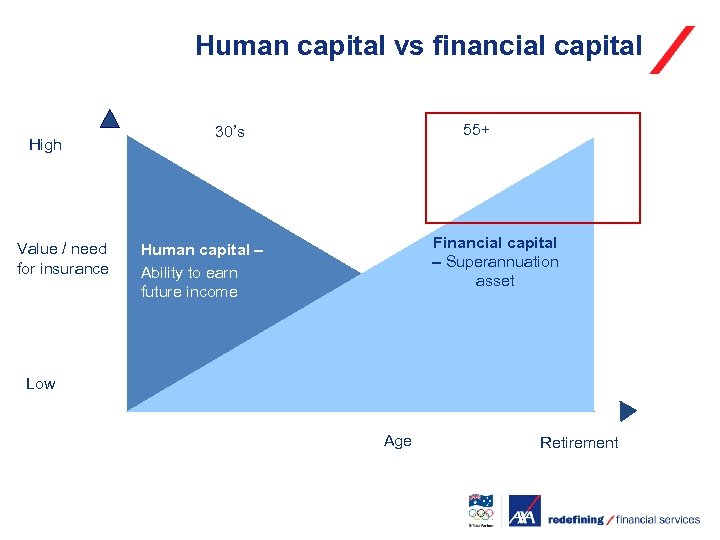

Human capital vs financial capital High Value / need for insurance 55+ 30’s Financial capital – Superannuation asset Human capital – Ability to earn future income Low Age Retirement

Thank you

Disclaimer The information contained in this presentation does not constitute personal investment advice and has been prepared without taking into account the financial objectives or risk tolerances of any particular individual or group. It is current as at the time of publication being June 2010 and is subject to change without notice. While the sources of material used in this presentation are considered to be reliable, responsibility is not accepted for any inaccuracies, errors or omissions. Individuals contemplating making an investment decision should seek professional financial advice and assistance as these decisions are complex and should only be made after consideration of personal financial objectives and risk tolerances. Both AXA and Alliance. Bernstein (we or us) provide financial products and services that involve investing in shares and we derive financial benefit from these products and services. Past performance is not necessarily indicative of future performance.

September PD Day Compliance Update Presenter: Rae Stagbouer Professional Standards Officer Tuesday 14 th September 2010

Agenda • Templates • Margin Lending update • Australian Credit License (ACL) update • Compliance Review Trends

Templates New strategy specific advice templates available: Ø So. A – Superannuation Rollover/Consolidation Ø Ro. A – Income Protection Increase Please take the time to have a look and feel free to pass on any feedback to either Richard Le or Rae Stagbouer

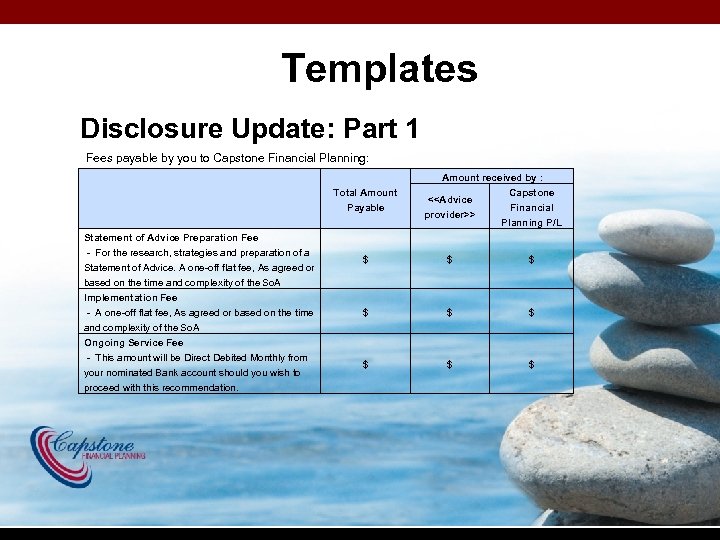

Templates Disclosure Update: Part 1 Fees payable by you to Capstone Financial Planning: Total Amount Payable Amount received by : Capstone <<Advice Financial provider>> Planning P/L Statement of Advice Preparation Fee - For the research, strategies and preparation of a Statement of Advice. A one-off flat fee, As agreed or based on the time and complexity of the So. A Implementation Fee - A one-off flat fee, As agreed or based on the time and complexity of the So. A Ongoing Service Fee - This amount will be Direct Debited Monthly from your nominated Bank account should you wish to proceed with this recommendation. $ $ $ $ $

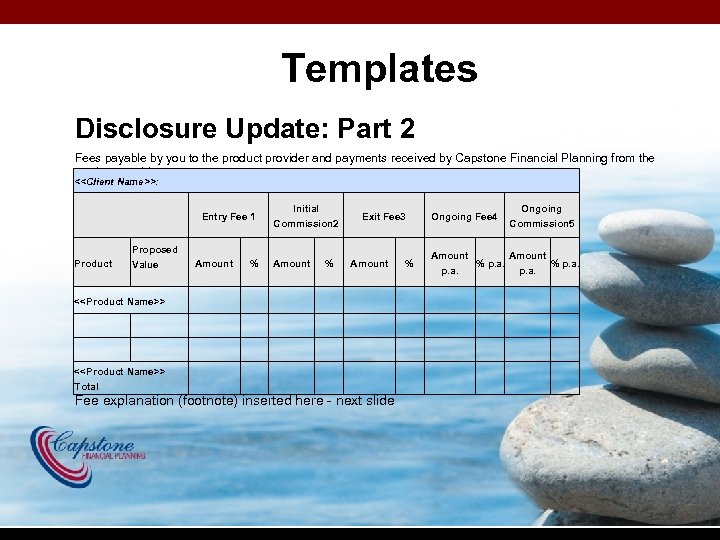

Templates Disclosure Update: Part 2 Fees payable by you to the product provider and payments received by Capstone Financial Planning from the product provider: <<Client Name>>: Entry Fee 1 Product Proposed Value Amount % Initial Commission 2 Amount % Exit Fee 3 Amount <<Product Name>> Total Fee explanation (footnote) inserted here - next slide % Ongoing Fee 4 Ongoing Commission 5 Amount % p. a.

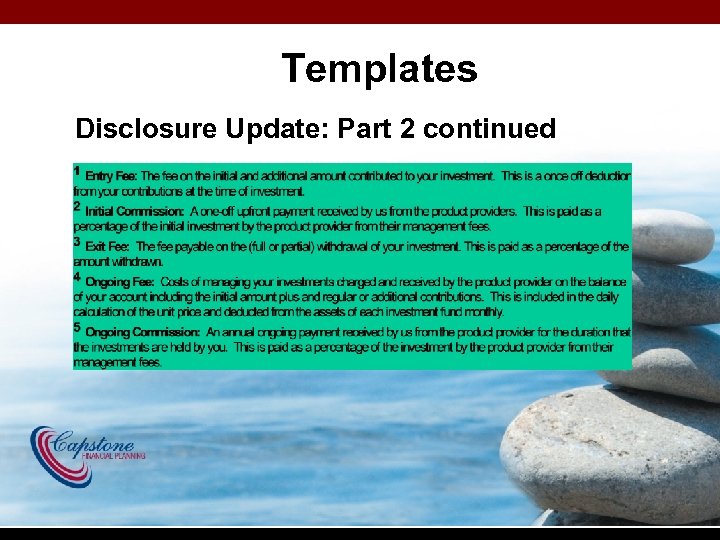

Templates Disclosure Update: Part 2 continued

Templates List of available variations: So. A Ø Ø Generic Superannuation Rollover/Consolidation Transition to Retirement Risk Only Ro. A Ø Ø Ø Additional Investment Rebalance Withdrawal No change Income Protection Increase

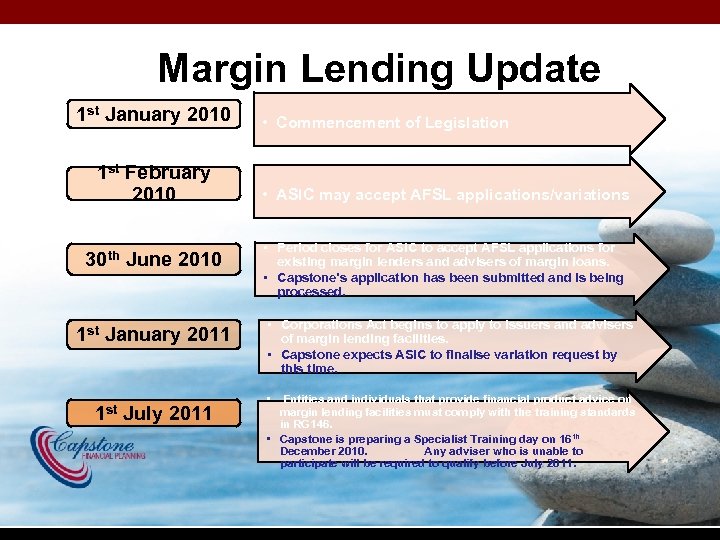

Margin Lending Update 1 st January 2010 1 st February 2010 30 th June 2010 1 st January 2011 1 st July 2011 • Commencement of Legislation • ASIC may accept AFSL applications/variations • Period closes for ASIC to accept AFSL applications for existing margin lenders and advisers of margin loans. • Capstone’s application has been submitted and is being processed. • Corporations Act begins to apply to issuers and advisers of margin lending facilities. • Capstone expects ASIC to finalise variation request by this time. • Entities and individuals that provide financial product advice on margin lending facilities must comply with the training standards in RG 146. • Capstone is preparing a Specialist Training day on 16 th December 2010. Any adviser who is unable to participate will be required to qualify before July 2011.

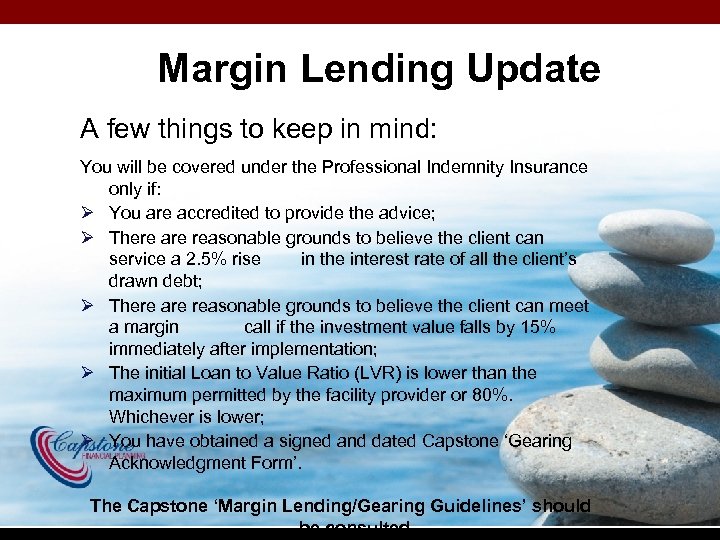

Margin Lending Update A few things to keep in mind: You will be covered under the Professional Indemnity Insurance only if: Ø You are accredited to provide the advice; Ø There are reasonable grounds to believe the client can service a 2. 5% rise in the interest rate of all the client’s drawn debt; Ø There are reasonable grounds to believe the client can meet a margin call if the investment value falls by 15% immediately after implementation; Ø The initial Loan to Value Ratio (LVR) is lower than the maximum permitted by the facility provider or 80%. Whichever is lower; Ø You have obtained a signed and dated Capstone ‘Gearing Acknowledgment Form’. The Capstone ‘Margin Lending/Gearing Guidelines’ should be consulted

Australian Credit License Regime Some background: Ø The Consumer Credit Reforms came into effect on 1 st July 2010. Ø ASIC is now the regulating body of all credit activities. Ø Anyone who engages in credit activities must either: apply for an Australian Credit License OR be an Australian Credit Representative (ACR) by 30 th needs Who June 2011. to be licensed? Ø Credit Providers ( lenders and lessors); and Ø Providers of Credit Services including intermediaries. o Providing Credit Assistance – most likely way Adviser’s would be captured; and/or o Acting as an Intermediary.

Australian Credit License Regime When are you providing credit assistance? : Ø If you suggest that the consumer: Apply for a particular credit contract with a particular lender or apply for a particular consumer lease with a particular lessor; Apply for an increase to their credit limit on a particular credit contract; or Remain in their current credit contract or consumer lease; or Ø If you assist a consumer to: Apply for a particular credit contract with a particular lender, or apply for a particular consumer lease with a particular lessor; or Apply for an increase to their credit limit on a particular credit contract.

Australian Credit License Regime Examples: Advisers will often provide budgeting and debt management advice when providing personal financial advice. This may involve considering particular credit products or providers. This advice will not always be credit assistance even though a particular course of action may be suggested. The following examples illustrate different situations in which financial advice may or may not be credit assistance.

Australian Credit License Regime Example 1: You recommend that your client: 1. Make extra payments to pay off their loans faster; or 2. Repay more than the minimum monthly payment on their credit cards; These action are not credit assistance. Example 2: You recommend that your client consolidate their credit cards to a specific card with a low interest rate - This is credit assistance. If in contrast, you recommend that your client review their multiple credit cards; consider cancelling them all, and then find the cheapest card suitable to the consumer’s needs – this is not credit assistance.

Australian Credit License Regime Example 3: If you prepare a financial plan which presupposes the continuation of an existing home loan - this is not credit assistance. If in contrast, your recommendations advise the client to continue their current home loan - that is credit assistance. A few things to keep in mind: A recommendation: ØTo hold a particular credit product – is credit assistance; or ØTo hold a particular type of credit product - is credit assistance. We will keep you up to date with Training and other requirements.

Compliance Review Trends Initial meeting Strategy Analysis/Development Recommendations Implementation Review/Ongoing Service FGS and Privacy Policy Modeling So. A / Ro. A Execution Only Form Ongoing service proposition Client Information Questionnaire Needs Analysis Summary of personal & financial circumstance Authority to proceed Agreed service level agreements Establish and document goals and objectives Identifying strategic opportunities Summary of Goals and Objectives & Risk Profile Application forms Updated personal and financial information File notes Identifying financial issues Reasonable basis – strategy and product Fund manager confirmations Further advice Alternative strategies Replacement product information File notes Remuneration, fees and charges Conflicts of Interest File notes

Question Time

Risk Management in Financial Services Presented by Germana Venturini MLC – Business Consulting

Agenda • What is risk management? • The risk management process • Common risks • Managing risk • Summary Slide 128

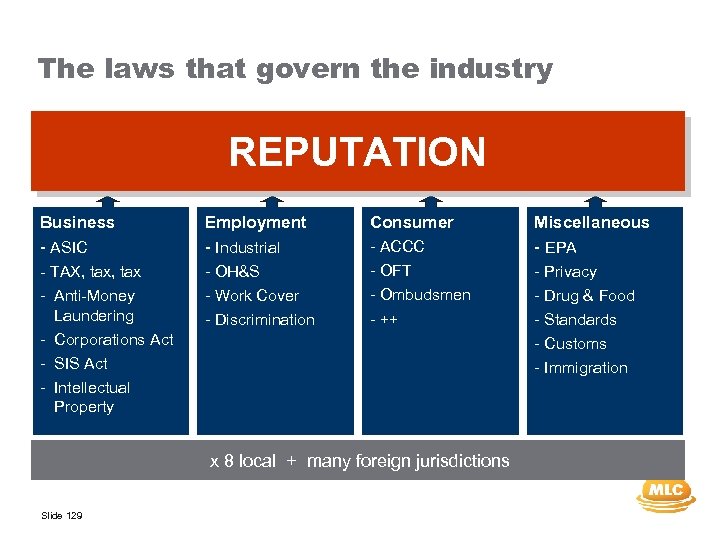

The laws that govern the industry Regulated REPUTATION Business - ASIC - TAX, tax - Anti-Money Laundering - Corporations Act - SIS Act - Intellectual Property Employment - Industrial - OH&S - Work Cover - Discrimination Consumer - ACCC - OFT - Ombudsmen - ++ x 8 local + many foreign jurisdictions Slide 129 Miscellaneous - EPA - Privacy - Drug & Food - Standards - Customs - Immigration

Our environment Think about… What are the issues you are concerned about in your business? Slide 130

What is risk management? • Risk management is not new – decisions are made on a daily basis • The future is uncertain, managing risk involves: – assessing the impact of risk(s) – deciding a course of action to suit your appetite or tolerance for risks • Expertise and experience is required to understand assumptions and methodologies behind the risk management process Slide 131

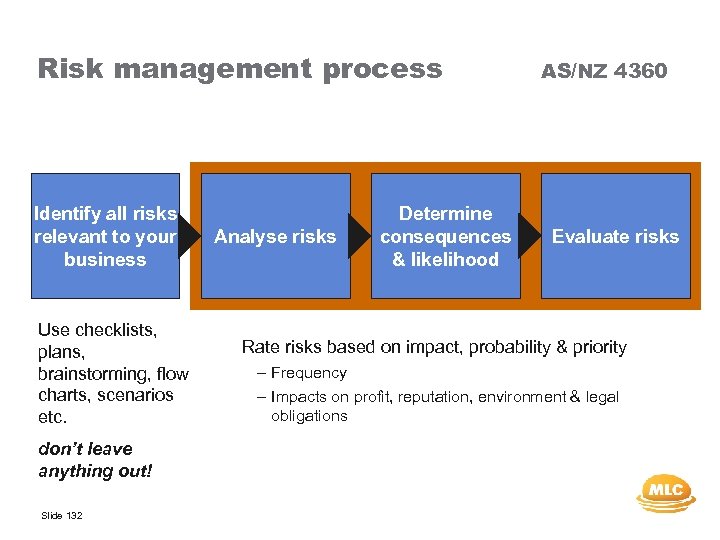

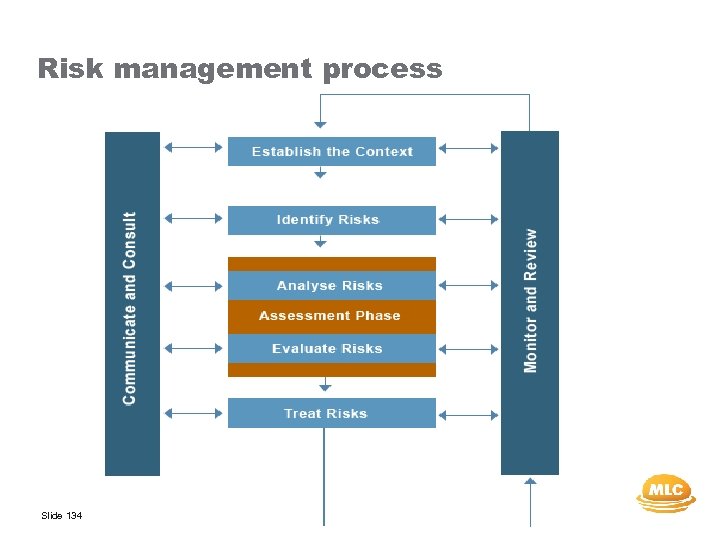

Risk management process Identify all risks relevant to your business Use checklists, plans, brainstorming, flow charts, scenarios etc. don’t leave anything out! Slide 132 Analyse risks Determine consequences & likelihood AS/NZ 4360 Evaluate risks Rate risks based on impact, probability & priority – Frequency – Impacts on profit, reputation, environment & legal obligations

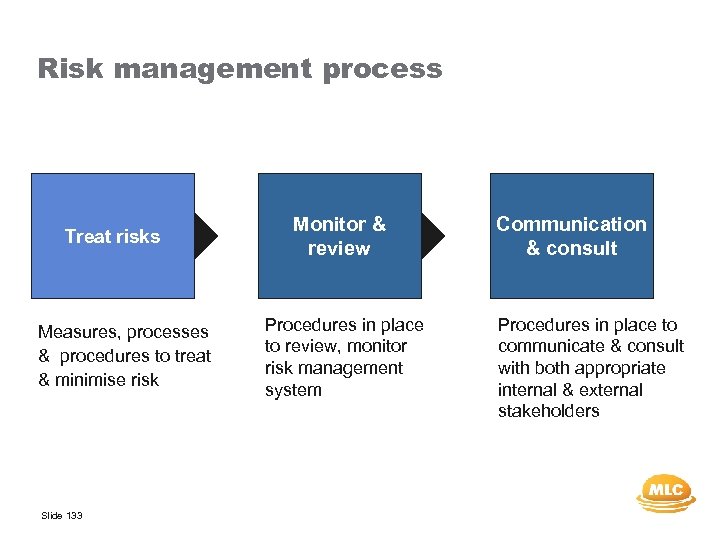

Risk management process Treat risks Measures, processes & procedures to treat & minimise risk Slide 133 Monitor & review Procedures in place to review, monitor risk management system Communication & consult Procedures in place to communicate & consult with both appropriate internal & external stakeholders

Risk management process Slide 134

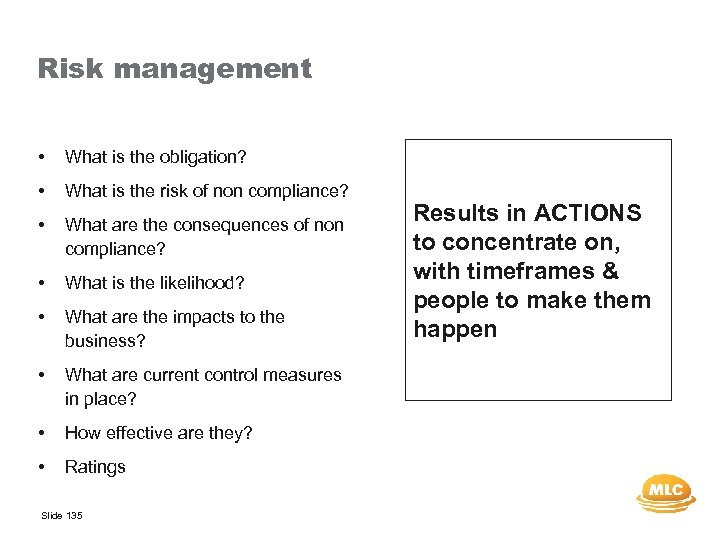

Risk management • What is the obligation? • What is the risk of non compliance? • What are the consequences of non compliance? • What is the likelihood? • What are the impacts to the business? • What are current control measures in place? • How effective are they? • Ratings Slide 135 Results in ACTIONS to concentrate on, with timeframes & people to make them happen

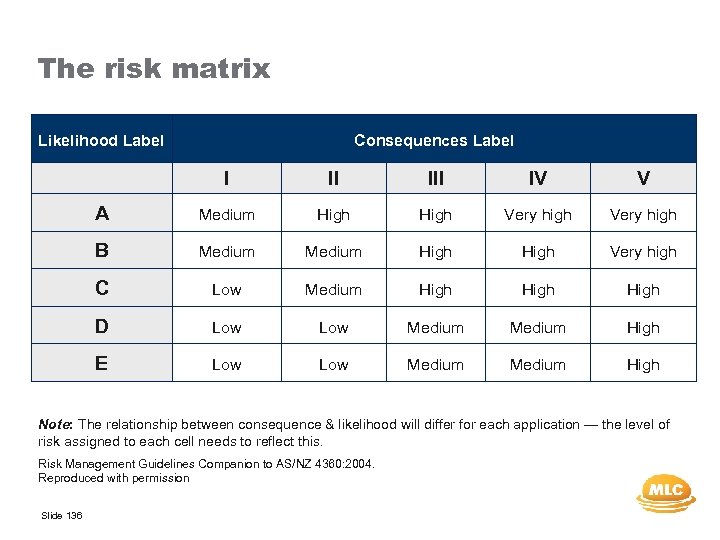

The risk matrix Likelihood Label Consequences Label I II IV V A Medium High Very high B Medium High Very high C Low Medium High D Low Medium High E Low Medium High Note: The relationship between consequence & likelihood will differ for each application — the level of risk assigned to each cell needs to reflect this. Risk Management Guidelines Companion to AS/NZ 4360: 2004. Reproduced with permission Slide 136

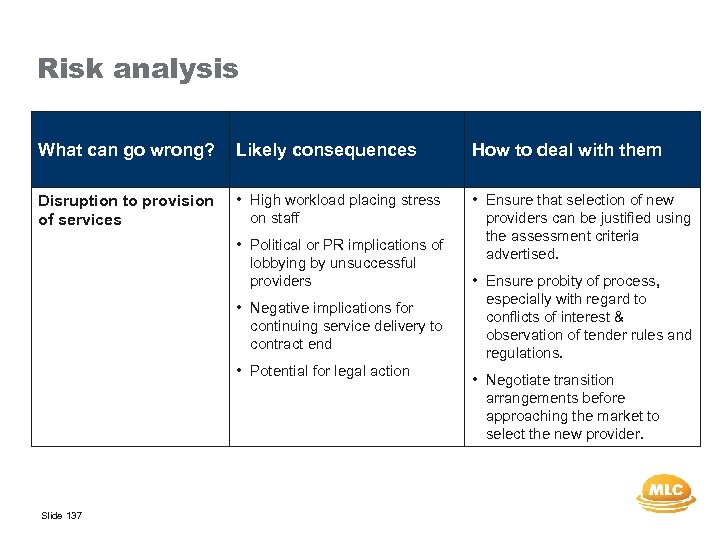

Risk analysis What can go wrong? Likely consequences How to deal with them Disruption to provision of services • High workload placing stress on staff • Ensure that selection of new providers can be justified using the assessment criteria advertised. • Political or PR implications of lobbying by unsuccessful providers • Negative implications for continuing service delivery to contract end • Potential for legal action Slide 137 • Ensure probity of process, especially with regard to conflicts of interest & observation of tender rules and regulations. • Negotiate transition arrangements before approaching the market to select the new provider.

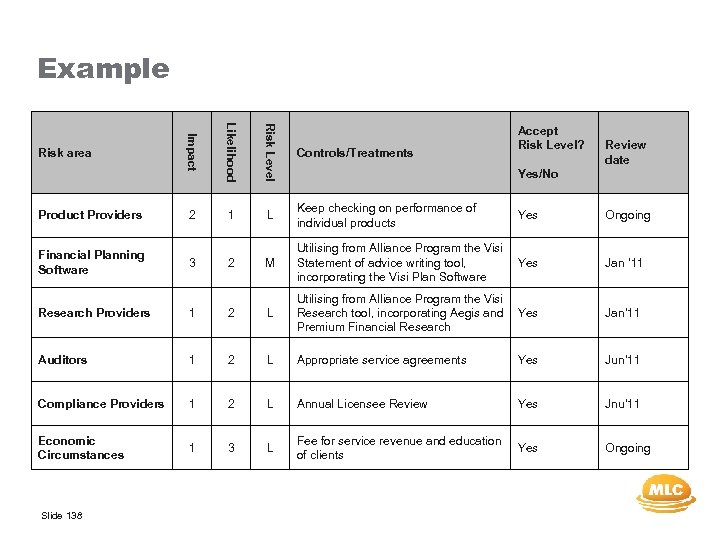

Example Impact Likelihood Risk Level Product Providers 2 1 L Keep checking on performance of individual products Yes Ongoing Financial Planning Software 3 2 M Utilising from Alliance Program the Visi Statement of advice writing tool, incorporating the Visi Plan Software Yes Jan ’ 11 Yes Jan’ 11 Risk area Controls/Treatments Accept Risk Level? Review date Yes/No Research Providers 1 2 L Utilising from Alliance Program the Visi Research tool, incorporating Aegis and Premium Financial Research Auditors 1 2 L Appropriate service agreements Yes Jun’ 11 Compliance Providers 1 2 L Annual Licensee Review Yes Jnu’ 11 Economic Circumstances 1 3 L Fee for service revenue and education of clients Yes Ongoing Slide 138

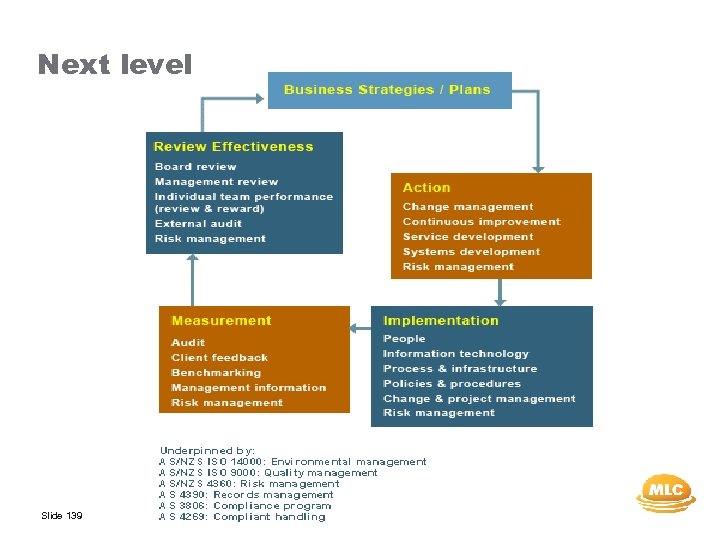

Next level Slide 139

Types of risk Operational • The risk of loss within any part of the organisation, occurring as a result of : – Inadequate operational policy and procedures including systems, controls and infrastructure – Human error and management failure – Fraudulent or intentional acts (internal & external) – Unmanaged and uncontrollable events which impact on the operational activities • Why does it occur? – Poor information – Skills – lack of control Slide 140

Types of risk Legal / regulatory • The risk that you are not complying with your legal obligations – Corps Act inc FSRA, TPA, MIA, Banking Act, RBA Act, Fin Transactions Reports Act, Privacy, Credit Code, Common Law, OHAS, Employment • Law changes • Ambiguity Slide 141

Legal / regulatory risk • Non compliance with legal obligations – Failure to comply could lead to loss of business, personal liability, criminal sanctions, fines, adverse publicity, conditions imposed – Such risks need to be identified, managed and monitored • Unenforceable legal rights – Entails loss of legal rights such as relying on a legal contract – Legal rights need to be identified and appropriate measures taken to ensure adequately utilised and protected Slide 142

Difficulties of legal risk management • Complexity of laws – Corporations Act, RG, APRA, ASX • Constant changes to keep up with technology • Uncertainty in the law – lack of precise definition, different interpretation “must take reasonable steps, adequate arrangements, advice must be appropriate” • Deficient internal procedures • Different laws in different jurisdictions • Technological changes Slide 143

Types of risk Reputation • The risk that an organisation’s reputation or good name will be impacted • A consequence of operational risk exposure Ethical • Risk of engaging in unethical behaviour Slide 144

How can risks be managed? • Management controls accountability • Compliance controls • Policies & procedures • Training - initial & ongoing • Keeping abreast with changes Slide 145 • Segregation of duties • Adequate skilled resources • Internal & external audit • Disaster recovery plan

Managing operational risk • Clear business planning and objectives • Evaluation of business processes – Qualitative techniques - eg. process maps are useful – Quantitative techniques • Establishment of policies and controls • KPIs Slide 146

Reputation risk management considerations • Damage to reputation usually results from failure to manage other risks – market, credit, operation or legal risks. • A ruined reputation can result from the actions of one individual in the business - segregation of duties • • Slide 147 Understand stakeholder expectations Communication • • Consistent enforcement of controls • on governance, compliance Open culture - clear values & vision • Reward & recognition systems linked to business goals Training & corrective action Business continuity & crisis management plan Robust risk management system

Risk Management The art of risk management it to “pick important problems and fix them” Slide 148

Summary • Understand risk management • Identify key risks in your business and how you are going to deal with them WHAT ACTIONS DO YOU NEED TO TAKE FROM TODAY? Slide 149

Questions ? ? Slide 150

232067c5a2eb0a14930355f0ecb8c32b.ppt