66ae54d3d163fe079293719c00b80db7.ppt

- Количество слайдов: 28

Welcome Members of FAPCCI and other dignitaries 05. 02. 2005

EOUs & INDIRECT TAXES By S. Jaikumar & M. Karthikeyan swamy associates chennai – coimbatore – bangalore - hyderabad

SETTING UP AN EOU F 100 % Export, except permitted DTA. F Manufacture, Service and repair – sans trading. F Any goods – except prohibited items. F Minimum investment of Rs. 1 Crore in P & M, except in certain cases. F Approval by appropriate authority. F Issue of LOP/LOI. F NFEP.

CUSTOMS, CENTRAL EXCISE & SERVICE TAX

F License for PRIVATE BONDED WAREHOUSE under Sec 58 of Customs Act. F Sanction for In bond manufacture under Sec 65 F B 17 Bond. F Central Excise Registration.

Import / Procurement of Raw materials / Capital Goods

F All items, except prohibited items can be imported / procured without payment of duties. (CT 3/PC) F Goods specified in para 6. 6. 1 of FTP are allowed. F Unspecified goods – with the approval of BOA F Self Certification for import of capital goods. FCG to be installed within one year from the date of import or such extended period (Max 5 years) FPeriod of warehousing for CG is 5 years and extendable at the pleasure of Commissioner if the goods are not likely to be deteriorated. FOther goods to be used for manufacture within three Years from the date of import and extendable at the pleasure of Commissioner if the goods are not likely to be deteriorated.

DTA

F Upto 50 % of FOB value of exports (to include physical exports, deemed exports with forex receipt. Deemed export with receipt in INR – under dispute). F 10 % for Gem/Jewellery units. F Concessional rate of duties. F No DTA for motor vehicles, alcoholic liquor, tea etc. F Disposal of rejects – 5% without NFE F Waste and Scrap – As per SION and without NFE F Advance DTA for new units. (to be reconciled with the ACTUAL EXPORTS for the financial year for concession)

NFE

F Formula. F Cumulative Positive NFE for every 5 years. F Capital goods (including technical know-how fee) Amortisation at 10% per year. F Sale of goods to SEZ received in EEFC account. F Certain supplies in DTA. F Supplies to other EOUs, etc.

Certain other entitlements

F IT Exemption. F Exemption from industrial licensing. F Retention of export earnings. F No bank guarantee if the unit is three years old without any blacklisting and has a turnover of 5 Crores. . F Service Tax exemption (? ). F Reimbursement of CST.

Inter unit movements v transfer of manufactured goods permitted from one EOU to another EOU. v Receiving unit would treat the same as imports and the supplying unit would account such transfers for NFE.

Sub contracting

F EOU shall sub contract up to 50% in value terms of the last years overall production with the permission of Customs authorities. Similarly EOU can undertake job work from DTA subject to the condition that the goods would be exported directly from the EOU. Import of materials free of cost for jobbing by EOU permitted, however no DTA clearance shall be allowed. Subcontracting both production and production process through other EOUs permitted without any limit. F Subcontracting abroad permitted with the approval of DC. Scrap arising during job work either to return to the EOU or to be cleared on payment of duty.

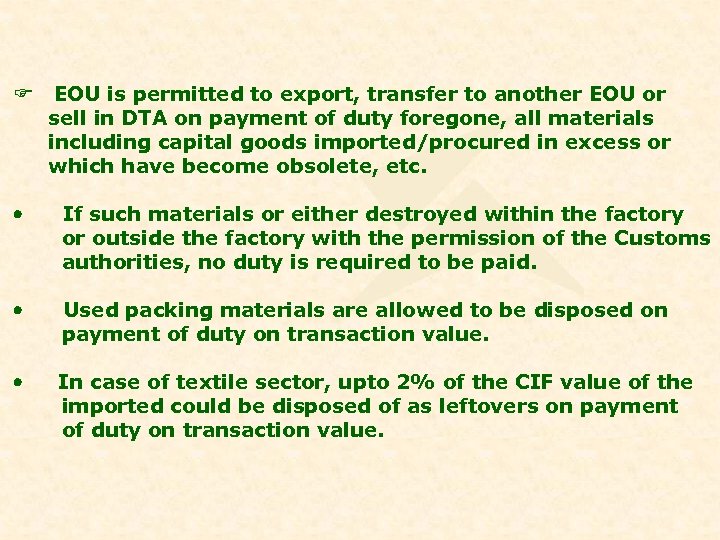

Sale of unutilised material

F EOU is permitted to export, transfer to another EOU or sell in DTA on payment of duty foregone, all materials including capital goods imported/procured in excess or which have become obsolete, etc. · If such materials or either destroyed within the factory or outside the factory with the permission of the Customs authorities, no duty is required to be paid. · Used packing materials are allowed to be disposed on payment of duty on transaction value. · In case of textile sector, upto 2% of the CIF value of the imported could be disposed of as leftovers on payment of duty on transaction value.

Fast Track Scheme

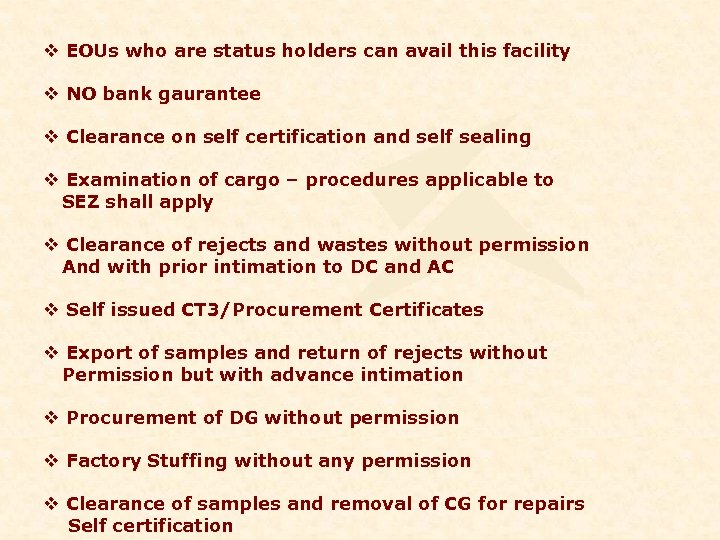

v EOUs who are status holders can avail this facility v NO bank gaurantee v Clearance on self certification and self sealing v Examination of cargo – procedures applicable to SEZ shall apply v Clearance of rejects and wastes without permission And with prior intimation to DC and AC v Self issued CT 3/Procurement Certificates v Export of samples and return of rejects without Permission but with advance intimation v Procurement of DG without permission v Factory Stuffing without any permission v Clearance of samples and removal of CG for repairs Self certification

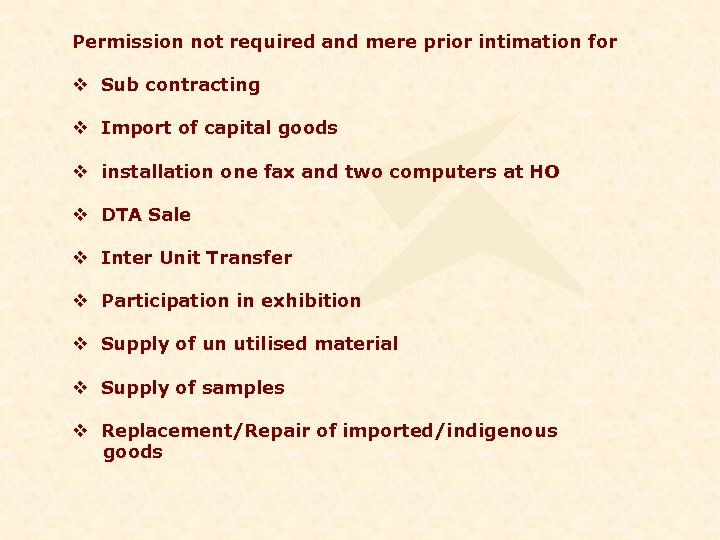

Permission not required and mere prior intimation for v Sub contracting v Import of capital goods v installation one fax and two computers at HO v DTA Sale v Inter Unit Transfer v Participation in exhibition v Supply of un utilised material v Supply of samples v Replacement/Repair of imported/indigenous goods

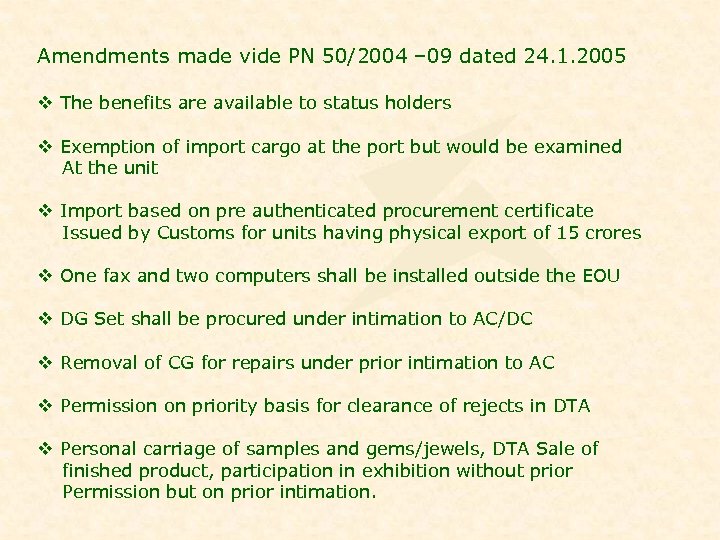

Amendments made vide PN 50/2004 – 09 dated 24. 1. 2005 v The benefits are available to status holders v Exemption of import cargo at the port but would be examined At the unit v Import based on pre authenticated procurement certificate Issued by Customs for units having physical export of 15 crores v One fax and two computers shall be installed outside the EOU v DG Set shall be procured under intimation to AC/DC v Removal of CG for repairs under prior intimation to AC v Permission on priority basis for clearance of rejects in DTA v Personal carriage of samples and gems/jewels, DTA Sale of finished product, participation in exhibition without prior Permission but on prior intimation.

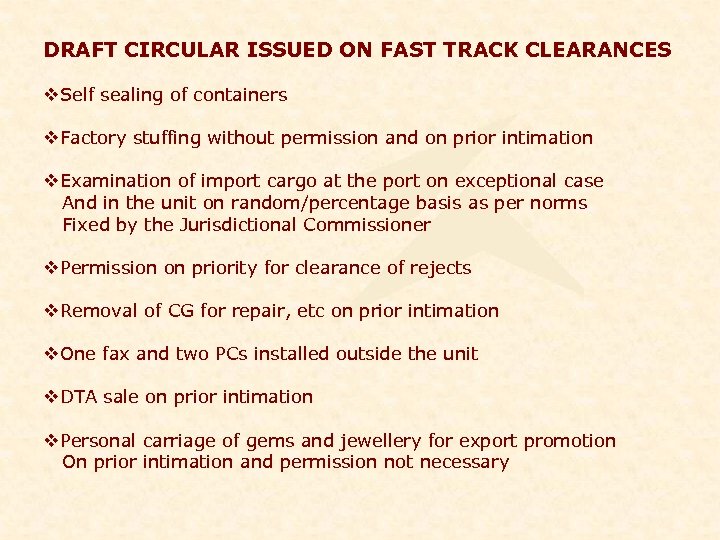

DRAFT CIRCULAR ISSUED ON FAST TRACK CLEARANCES v. Self sealing of containers v. Factory stuffing without permission and on prior intimation v. Examination of import cargo at the port on exceptional case And in the unit on random/percentage basis as per norms Fixed by the Jurisdictional Commissioner v. Permission on priority for clearance of rejects v. Removal of CG for repair, etc on prior intimation v. One fax and two PCs installed outside the unit v. DTA sale on prior intimation v. Personal carriage of gems and jewellery for export promotion On prior intimation and permission not necessary

Cenvat Credit and EOUs

Procurement of Petroleum products

Service Tax

THANKS

Swamy associates 21/8 Rams Flats Ashoka Avenue Directors Colony Kodambakkam Chennai 600 024. Ph: 044 -24811147 Fax : 044 -24733344 Swamy associates 493 – 17 th G Main 6 th Block Koramangala Bangalore 560 095. Ph: 080 -51303434 Swamy associates 4 E Radhekrishna Apartments 33 Sarojini Street Ram Nagar Coimbatore 641 009 Ph: 0422 -5377669 Fax : 0422 -5378622 Swamy associates H. No. 3 -6 -659, Flat No. 3 C Anushka Enclave Street No. 9 Himayat Nagar Hyderabad - 500 029. Ph: 040 - 55526879

66ae54d3d163fe079293719c00b80db7.ppt