4113bc29a1618d2ff3479e4c0b33d6a2.ppt

- Количество слайдов: 30

Welcome! Home Purchase and Consumer Credit Scoring

Welcome! Home Purchase and Consumer Credit Scoring

Strategy § If you are struggling financially, set a FOCUS goal and write it down. § I will own a house by XX/20 XX § I will pay off my credit cards by X date § Be specific and deliberate in HOW you are going to achieve your goals § I will set up an automatic deduction to save $50 each week to use as my down payment on a house § I will pick 1 credit card and add $75 extra each month until it is paid off, then move to the next card § Set up a Budget § A guide to show where you are and where you want to go, not an unbreakable law § Managing your finances should not be a struggle. The financial areas of your life should be freeing, not restricting.

Strategy § If you are struggling financially, set a FOCUS goal and write it down. § I will own a house by XX/20 XX § I will pay off my credit cards by X date § Be specific and deliberate in HOW you are going to achieve your goals § I will set up an automatic deduction to save $50 each week to use as my down payment on a house § I will pick 1 credit card and add $75 extra each month until it is paid off, then move to the next card § Set up a Budget § A guide to show where you are and where you want to go, not an unbreakable law § Managing your finances should not be a struggle. The financial areas of your life should be freeing, not restricting.

What is the Latte Factor? Based on a simple idea, there’s a financial theory known as the Latte Factor. To put aside only a few dollars per day for your future, rather than purchasing items like lattes, cigarettes, fast food, bottled water, magazines, etc. , an individual can see a difference in his/her finances by no longer living from one paycheck to another. The Latte Factor dictates that an individual can redirect the unnecessary spending to him/herself. Imagine being able to change your destiny by altering bad spending habits as well. The number one step is to identify your Latte Factor and how much it costs you per day. An individual can actually see how much he/she can save in several years.

What is the Latte Factor? Based on a simple idea, there’s a financial theory known as the Latte Factor. To put aside only a few dollars per day for your future, rather than purchasing items like lattes, cigarettes, fast food, bottled water, magazines, etc. , an individual can see a difference in his/her finances by no longer living from one paycheck to another. The Latte Factor dictates that an individual can redirect the unnecessary spending to him/herself. Imagine being able to change your destiny by altering bad spending habits as well. The number one step is to identify your Latte Factor and how much it costs you per day. An individual can actually see how much he/she can save in several years.

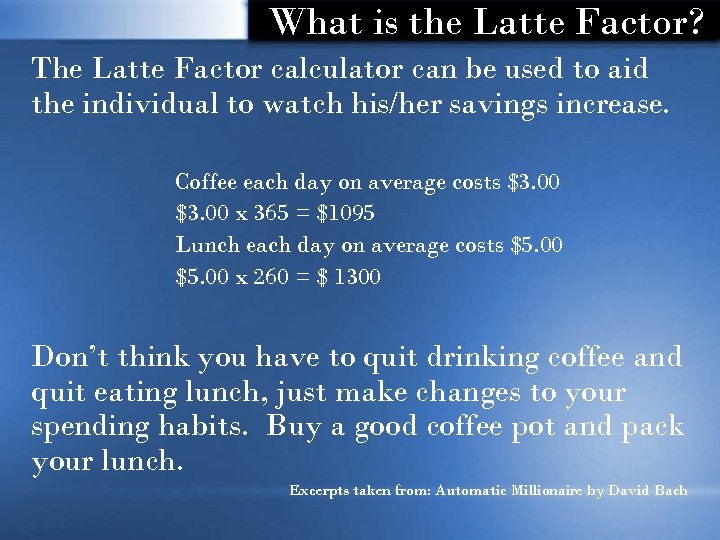

What is the Latte Factor? The Latte Factor calculator can be used to aid the individual to watch his/her savings increase. Coffee each day on average costs $3. 00 x 365 = $1095 Lunch each day on average costs $5. 00 x 260 = $ 1300 Don’t think you have to quit drinking coffee and quit eating lunch, just make changes to your spending habits. Buy a good coffee pot and pack your lunch. Excerpts taken from: Automatic Millionaire by David Bach

What is the Latte Factor? The Latte Factor calculator can be used to aid the individual to watch his/her savings increase. Coffee each day on average costs $3. 00 x 365 = $1095 Lunch each day on average costs $5. 00 x 260 = $ 1300 Don’t think you have to quit drinking coffee and quit eating lunch, just make changes to your spending habits. Buy a good coffee pot and pack your lunch. Excerpts taken from: Automatic Millionaire by David Bach

What is your Latte? s w item fe own a te write d be your Lat tes and at could u ree min ularly th h Take t buy reg ______ t you _ tha _______ _ _______ actor. F ______ _ _ __ __________ _ _ _ __________ ____ _ __________ _ _ __________ ______ _ _ __ __________ __ ______ ______

What is your Latte? s w item fe own a te write d be your Lat tes and at could u ree min ularly th h Take t buy reg ______ t you _ tha _______ _ _______ actor. F ______ _ _ __ __________ _ _ _ __________ ____ _ __________ _ _ __________ ______ _ _ __ __________ __ ______ ______

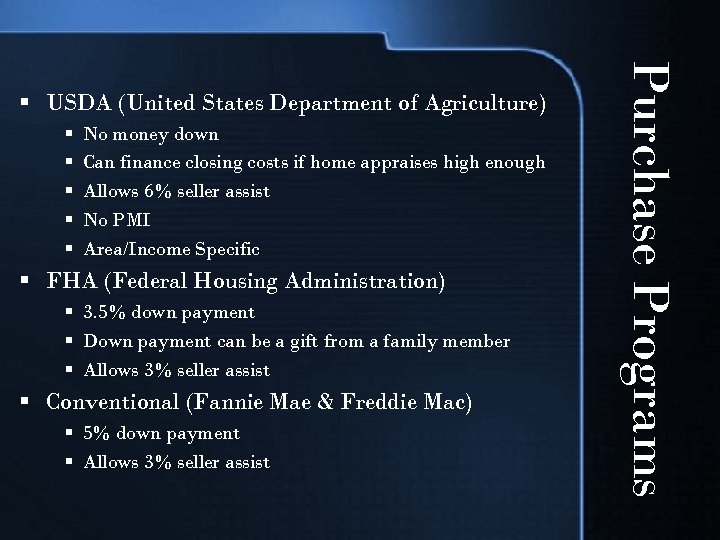

§ § § No money down Can finance closing costs if home appraises high enough Allows 6% seller assist No PMI Area/Income Specific § FHA (Federal Housing Administration) § 3. 5% down payment § Down payment can be a gift from a family member § Allows 3% seller assist § Conventional (Fannie Mae & Freddie Mac) § 5% down payment § Allows 3% seller assist Purchase Programs § USDA (United States Department of Agriculture)

§ § § No money down Can finance closing costs if home appraises high enough Allows 6% seller assist No PMI Area/Income Specific § FHA (Federal Housing Administration) § 3. 5% down payment § Down payment can be a gift from a family member § Allows 3% seller assist § Conventional (Fannie Mae & Freddie Mac) § 5% down payment § Allows 3% seller assist Purchase Programs § USDA (United States Department of Agriculture)

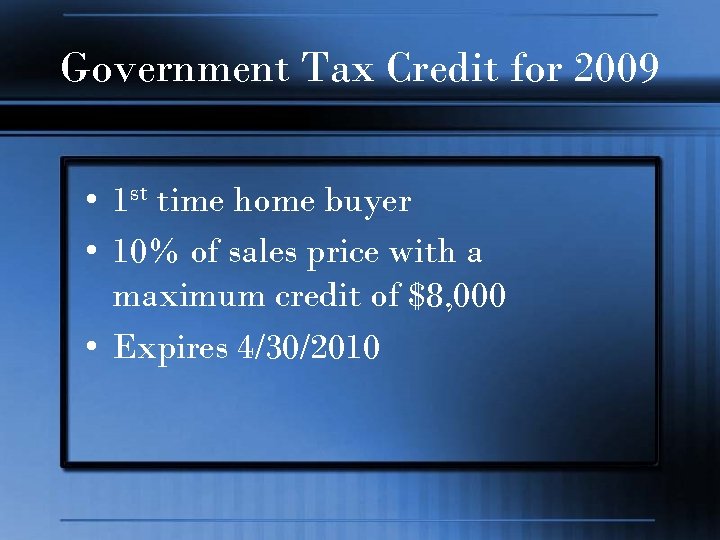

Government Tax Credit for 2009 • 1 st time home buyer • 10% of sales price with a maximum credit of $8, 000 • Expires 4/30/2010

Government Tax Credit for 2009 • 1 st time home buyer • 10% of sales price with a maximum credit of $8, 000 • Expires 4/30/2010

Useful Resources § www. annualcreditreport. com § 1 free credit report per year § All three credit reporting agencies § No credit scores § www. creditcards. com § If you need to establish credit, use this website to obtain a major credit card. § Do not apply for department store charge cards if you are trying to establish credit. § www. myfico. com § With their programs you can monitor your credit report.

Useful Resources § www. annualcreditreport. com § 1 free credit report per year § All three credit reporting agencies § No credit scores § www. creditcards. com § If you need to establish credit, use this website to obtain a major credit card. § Do not apply for department store charge cards if you are trying to establish credit. § www. myfico. com § With their programs you can monitor your credit report.

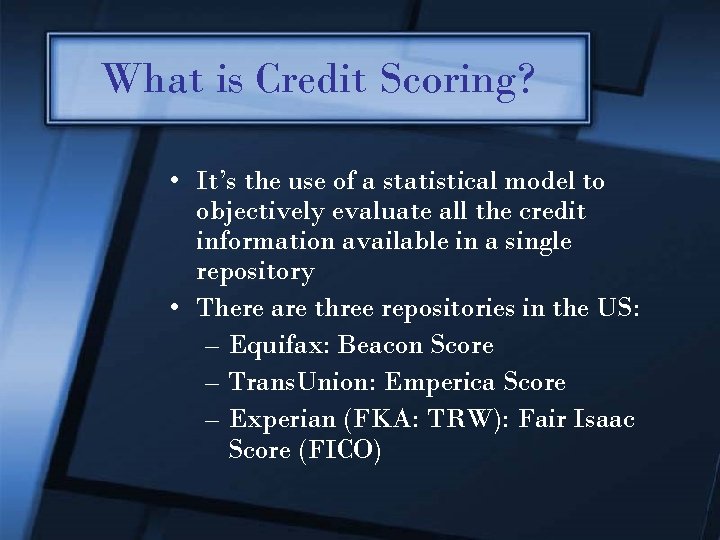

What is Credit Scoring? • It’s the use of a statistical model to objectively evaluate all the credit information available in a single repository • There are three repositories in the US: – Equifax: Beacon Score – Trans. Union: Emperica Score – Experian (FKA: TRW): Fair Isaac Score (FICO)

What is Credit Scoring? • It’s the use of a statistical model to objectively evaluate all the credit information available in a single repository • There are three repositories in the US: – Equifax: Beacon Score – Trans. Union: Emperica Score – Experian (FKA: TRW): Fair Isaac Score (FICO)

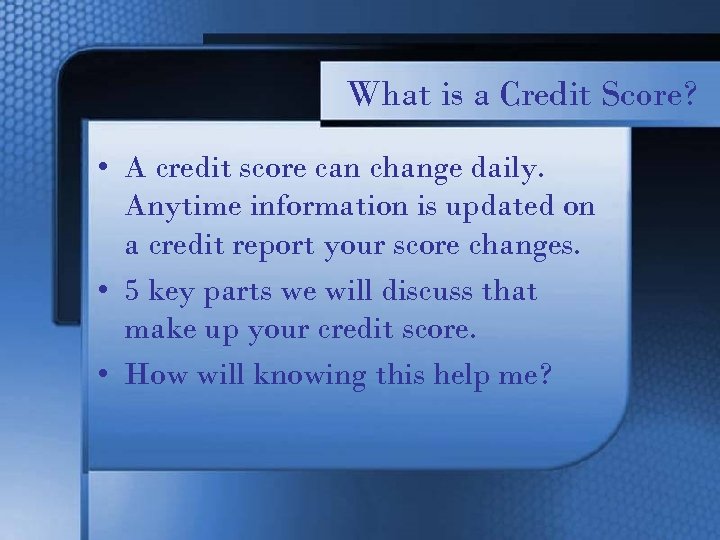

What is a Credit Score? • A credit score can change daily. Anytime information is updated on a credit report your score changes. • 5 key parts we will discuss that make up your credit score. • How will knowing this help me?

What is a Credit Score? • A credit score can change daily. Anytime information is updated on a credit report your score changes. • 5 key parts we will discuss that make up your credit score. • How will knowing this help me?

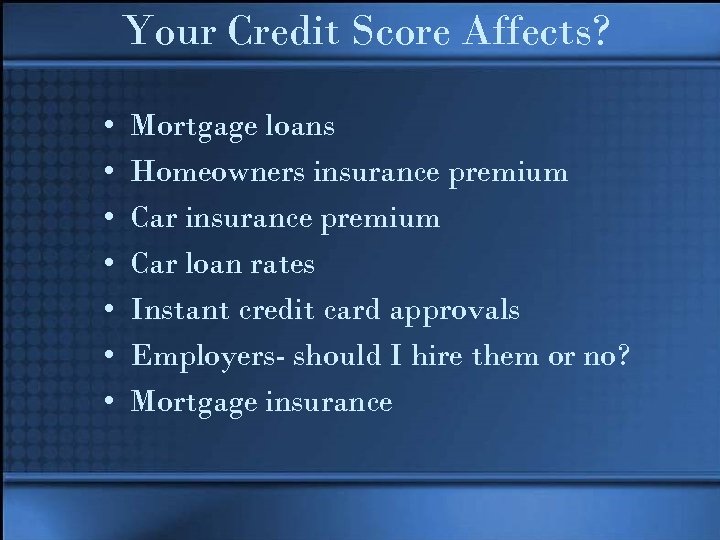

Your Credit Score Affects? • • Mortgage loans Homeowners insurance premium Car loan rates Instant credit card approvals Employers- should I hire them or no? Mortgage insurance

Your Credit Score Affects? • • Mortgage loans Homeowners insurance premium Car loan rates Instant credit card approvals Employers- should I hire them or no? Mortgage insurance

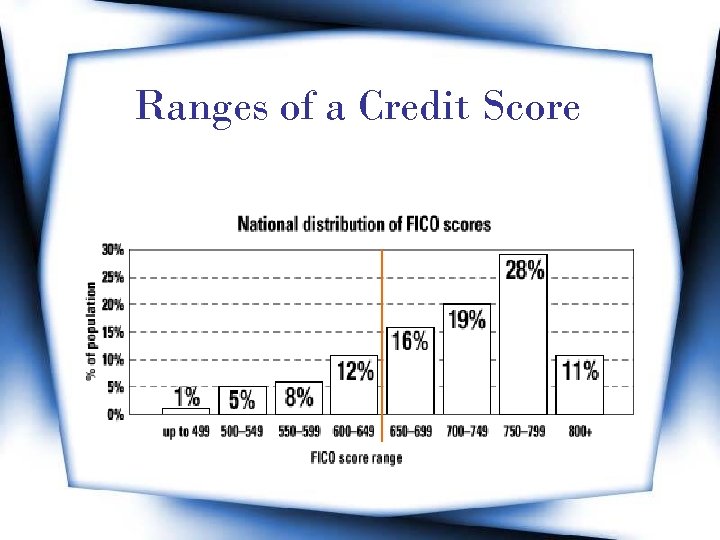

Ranges of a Credit Score

Ranges of a Credit Score

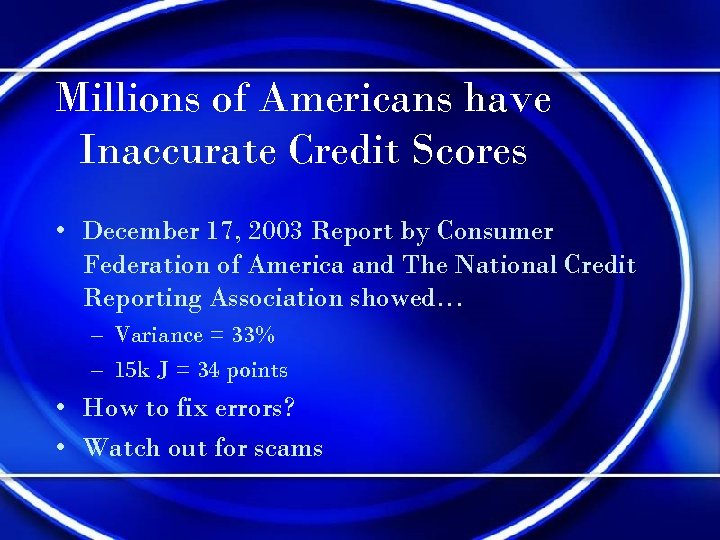

Millions of Americans have Inaccurate Credit Scores • December 17, 2003 Report by Consumer Federation of America and The National Credit Reporting Association showed… – Variance = 33% – 15 k J = 34 points • How to fix errors? • Watch out for scams

Millions of Americans have Inaccurate Credit Scores • December 17, 2003 Report by Consumer Federation of America and The National Credit Reporting Association showed… – Variance = 33% – 15 k J = 34 points • How to fix errors? • Watch out for scams

How the Credit Score Affects Loan Programs 660 -850 620 -659 600 -619 580 -599 540 -579 500 -539 300 -499 No Score

How the Credit Score Affects Loan Programs 660 -850 620 -659 600 -619 580 -599 540 -579 500 -539 300 -499 No Score

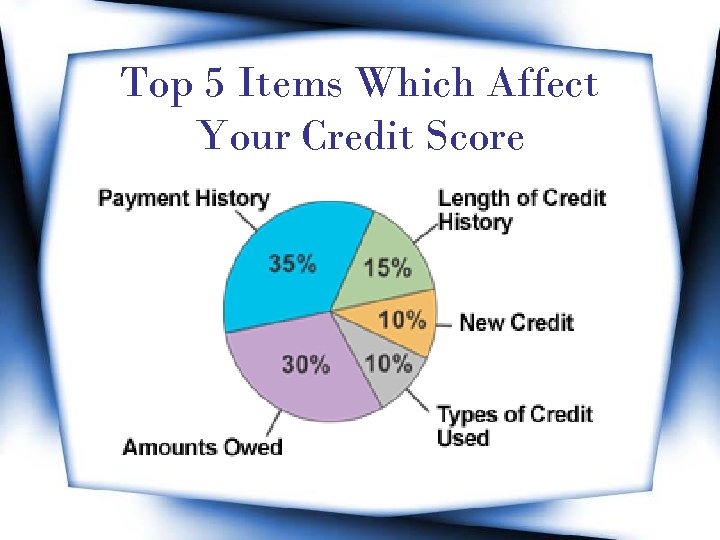

Top 5 Items Which Affect Your Credit Score

Top 5 Items Which Affect Your Credit Score

Top 5 Items Which Affect Your Credit Score 1. 35% How you pay your bills – How often its late, how late it is and when was it late? The majority of focus is placed on last 2 years (most recent 11 months more sensitive with current lates most sensitive) Excluding BK and FC • • • – Example: True or False: 30 day late 4 months ago will hurt your score more than a 30 day late 3 years ago. Example: True or False: a current 30 day late will hurt your score more than a 30 day late 4 months ago Example: True or False: a few 30 day lates 4 months ago will hurt your score more than a 90 day 26 months ago Time frame items stay on your credit report

Top 5 Items Which Affect Your Credit Score 1. 35% How you pay your bills – How often its late, how late it is and when was it late? The majority of focus is placed on last 2 years (most recent 11 months more sensitive with current lates most sensitive) Excluding BK and FC • • • – Example: True or False: 30 day late 4 months ago will hurt your score more than a 30 day late 3 years ago. Example: True or False: a current 30 day late will hurt your score more than a 30 day late 4 months ago Example: True or False: a few 30 day lates 4 months ago will hurt your score more than a 90 day 26 months ago Time frame items stay on your credit report

Top 5 Items Which Affect Your Credit Score 1. 35 % How you pay your bills (continued) – – – Collections: Caution! (if old leave alone) Collections: if purchased by another collection company it will hurt score (ITT, Household, Sherman Acq. ) Public records (judgments/liens/ bankruptcy etc)- same as bills. The severity and recently hurts score. (If its old leave it alone!) Public records: use date of last activity Stories of paying off collections or public records and score lowering?

Top 5 Items Which Affect Your Credit Score 1. 35 % How you pay your bills (continued) – – – Collections: Caution! (if old leave alone) Collections: if purchased by another collection company it will hurt score (ITT, Household, Sherman Acq. ) Public records (judgments/liens/ bankruptcy etc)- same as bills. The severity and recently hurts score. (If its old leave it alone!) Public records: use date of last activity Stories of paying off collections or public records and score lowering?

Top 5 Items Which Affect Your Credit Score 2. 30% Credit Utilization – – The amount owed on all accounts Revolving only: amount of current balances in relationship to high credit limit individually and collectively The percentage owed on open installment loans Amount owing on specific types of accounts

Top 5 Items Which Affect Your Credit Score 2. 30% Credit Utilization – – The amount owed on all accounts Revolving only: amount of current balances in relationship to high credit limit individually and collectively The percentage owed on open installment loans Amount owing on specific types of accounts

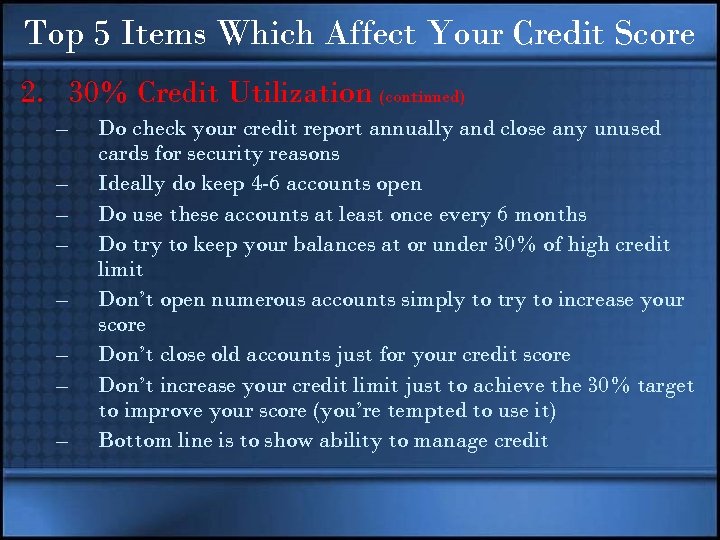

Top 5 Items Which Affect Your Credit Score 2. 30% Credit Utilization (continued) – – – – Do check your credit report annually and close any unused cards for security reasons Ideally do keep 4 -6 accounts open Do use these accounts at least once every 6 months Do try to keep your balances at or under 30% of high credit limit Don’t open numerous accounts simply to try to increase your score Don’t close old accounts just for your credit score Don’t increase your credit limit just to achieve the 30% target to improve your score (you’re tempted to use it) Bottom line is to show ability to manage credit

Top 5 Items Which Affect Your Credit Score 2. 30% Credit Utilization (continued) – – – – Do check your credit report annually and close any unused cards for security reasons Ideally do keep 4 -6 accounts open Do use these accounts at least once every 6 months Do try to keep your balances at or under 30% of high credit limit Don’t open numerous accounts simply to try to increase your score Don’t close old accounts just for your credit score Don’t increase your credit limit just to achieve the 30% target to improve your score (you’re tempted to use it) Bottom line is to show ability to manage credit

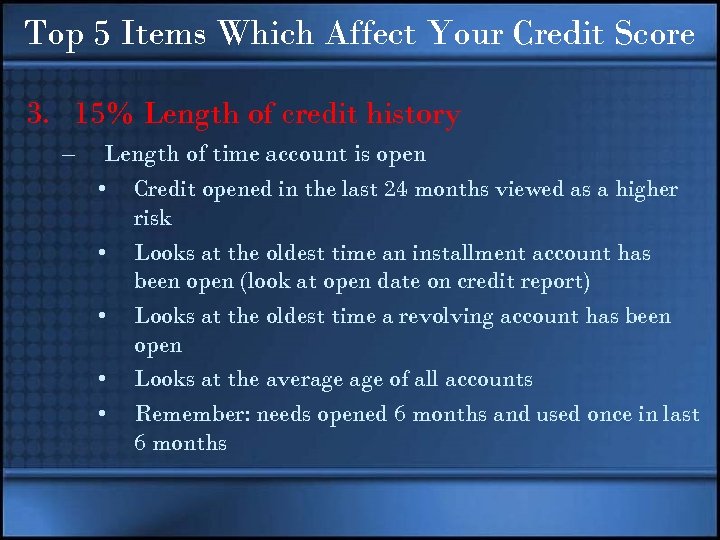

Top 5 Items Which Affect Your Credit Score 3. 15% Length of credit history – Length of time account is open • Credit opened in the last 24 months viewed as a higher risk • Looks at the oldest time an installment account has been open (look at open date on credit report) • Looks at the oldest time a revolving account has been open • Looks at the average of all accounts • Remember: needs opened 6 months and used once in last 6 months

Top 5 Items Which Affect Your Credit Score 3. 15% Length of credit history – Length of time account is open • Credit opened in the last 24 months viewed as a higher risk • Looks at the oldest time an installment account has been open (look at open date on credit report) • Looks at the oldest time a revolving account has been open • Looks at the average of all accounts • Remember: needs opened 6 months and used once in last 6 months

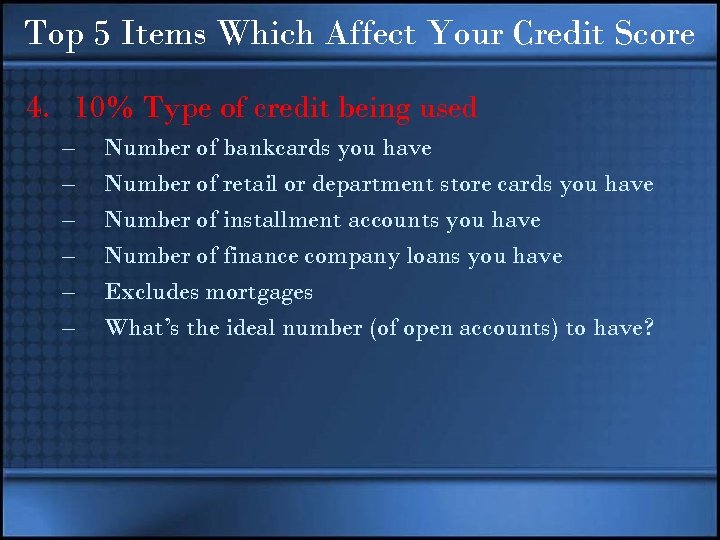

Top 5 Items Which Affect Your Credit Score 4. 10% Type of credit being used – – – Number of bankcards you have Number of retail or department store cards you have Number of installment accounts you have Number of finance company loans you have Excludes mortgages What’s the ideal number (of open accounts) to have?

Top 5 Items Which Affect Your Credit Score 4. 10% Type of credit being used – – – Number of bankcards you have Number of retail or department store cards you have Number of installment accounts you have Number of finance company loans you have Excludes mortgages What’s the ideal number (of open accounts) to have?

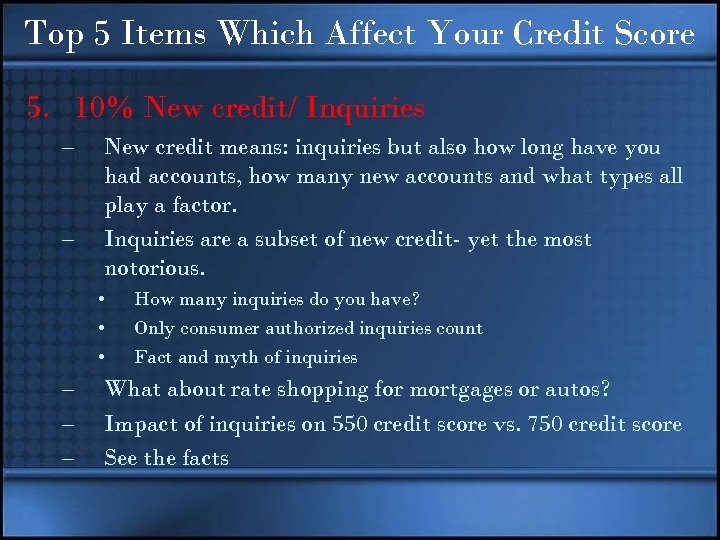

Top 5 Items Which Affect Your Credit Score 5. 10% New credit/ Inquiries – – New credit means: inquiries but also how long have you had accounts, how many new accounts and what types all play a factor. Inquiries are a subset of new credit- yet the most notorious. • • • – – – How many inquiries do you have? Only consumer authorized inquiries count Fact and myth of inquiries What about rate shopping for mortgages or autos? Impact of inquiries on 550 credit score vs. 750 credit score See the facts

Top 5 Items Which Affect Your Credit Score 5. 10% New credit/ Inquiries – – New credit means: inquiries but also how long have you had accounts, how many new accounts and what types all play a factor. Inquiries are a subset of new credit- yet the most notorious. • • • – – – How many inquiries do you have? Only consumer authorized inquiries count Fact and myth of inquiries What about rate shopping for mortgages or autos? Impact of inquiries on 550 credit score vs. 750 credit score See the facts

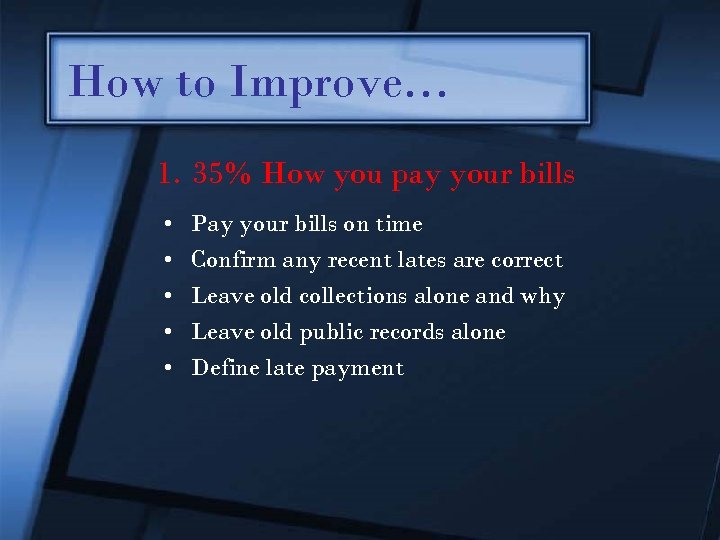

How to Improve… 1. 35% How you pay your bills • • • Pay your bills on time Confirm any recent lates are correct Leave old collections alone and why Leave old public records alone Define late payment

How to Improve… 1. 35% How you pay your bills • • • Pay your bills on time Confirm any recent lates are correct Leave old collections alone and why Leave old public records alone Define late payment

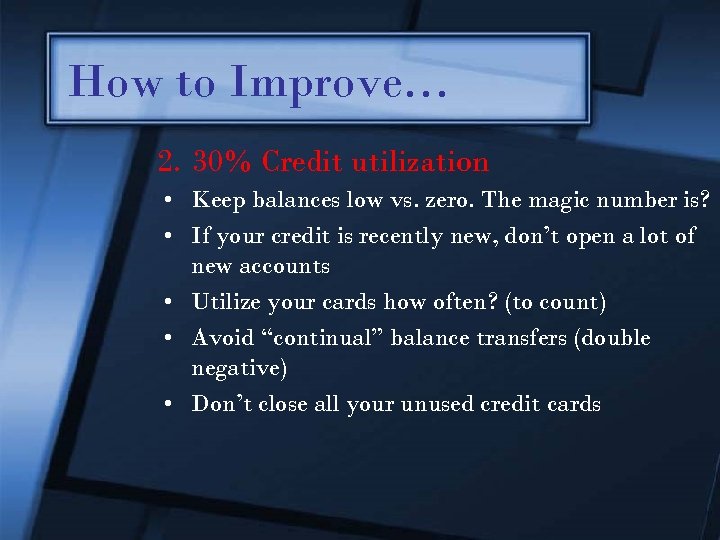

How to Improve… 2. 30% Credit utilization • Keep balances low vs. zero. The magic number is? • If your credit is recently new, don’t open a lot of new accounts • Utilize your cards how often? (to count) • Avoid “continual” balance transfers (double negative) • Don’t close all your unused credit cards

How to Improve… 2. 30% Credit utilization • Keep balances low vs. zero. The magic number is? • If your credit is recently new, don’t open a lot of new accounts • Utilize your cards how often? (to count) • Avoid “continual” balance transfers (double negative) • Don’t close all your unused credit cards

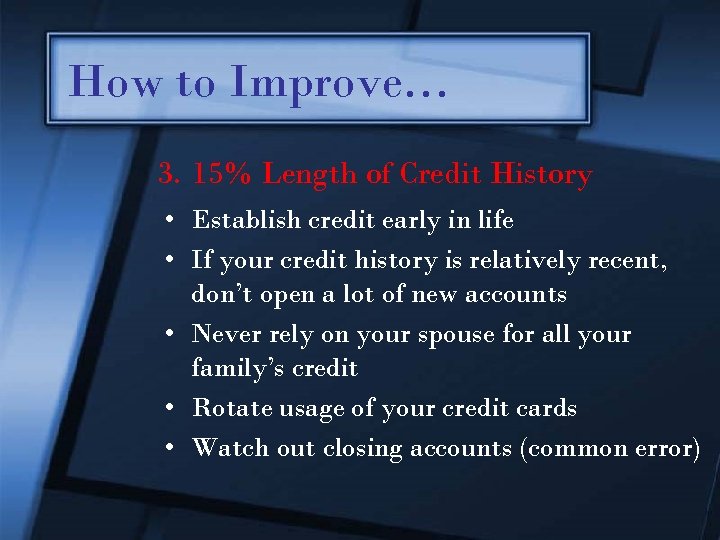

How to Improve… 3. 15% Length of Credit History • Establish credit early in life • If your credit history is relatively recent, don’t open a lot of new accounts • Never rely on your spouse for all your family’s credit • Rotate usage of your credit cards • Watch out closing accounts (common error)

How to Improve… 3. 15% Length of Credit History • Establish credit early in life • If your credit history is relatively recent, don’t open a lot of new accounts • Never rely on your spouse for all your family’s credit • Rotate usage of your credit cards • Watch out closing accounts (common error)

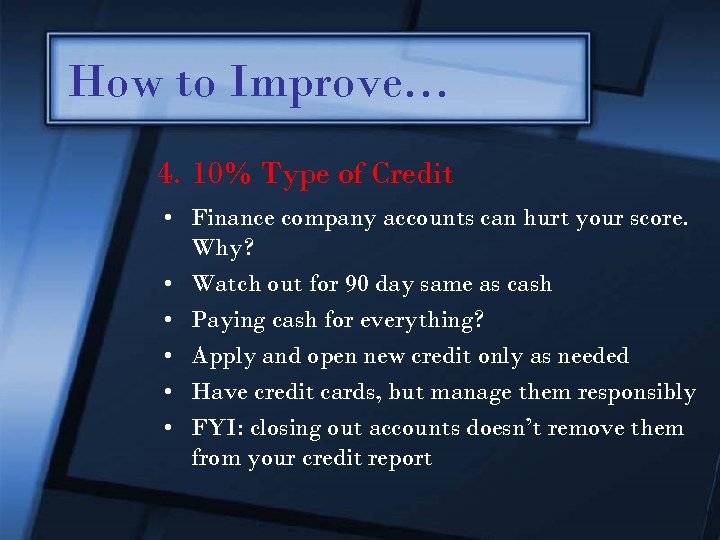

How to Improve… 4. 10% Type of Credit • Finance company accounts can hurt your score. Why? • Watch out for 90 day same as cash • Paying cash for everything? • Apply and open new credit only as needed • Have credit cards, but manage them responsibly • FYI: closing out accounts doesn’t remove them from your credit report

How to Improve… 4. 10% Type of Credit • Finance company accounts can hurt your score. Why? • Watch out for 90 day same as cash • Paying cash for everything? • Apply and open new credit only as needed • Have credit cards, but manage them responsibly • FYI: closing out accounts doesn’t remove them from your credit report

How to Improve… 5. 10% New Credit/ Inquiries • • Do marketing inquiries count? Repeated inquiries with same company Shopping for mortgages or auto (buffer period) Shop for mortgages and auto loans within specific time period • Apply and open new credit only as needed • Request your credit report directly • Law in Affect

How to Improve… 5. 10% New Credit/ Inquiries • • Do marketing inquiries count? Repeated inquiries with same company Shopping for mortgages or auto (buffer period) Shop for mortgages and auto loans within specific time period • Apply and open new credit only as needed • Request your credit report directly • Law in Affect

How to Dispute Your Credit • Mistakes happen a lot! • How mistakes happen – Applied for credit under different names – Clerical error entering information – Person gave incorrect SSN – Payment was mistakenly applied to wrong account • Identity theft #1 in 2003 – In 2007 estimated losses of 49. 3 Billion • Free dispute method • Rapid Re-scoring method

How to Dispute Your Credit • Mistakes happen a lot! • How mistakes happen – Applied for credit under different names – Clerical error entering information – Person gave incorrect SSN – Payment was mistakenly applied to wrong account • Identity theft #1 in 2003 – In 2007 estimated losses of 49. 3 Billion • Free dispute method • Rapid Re-scoring method

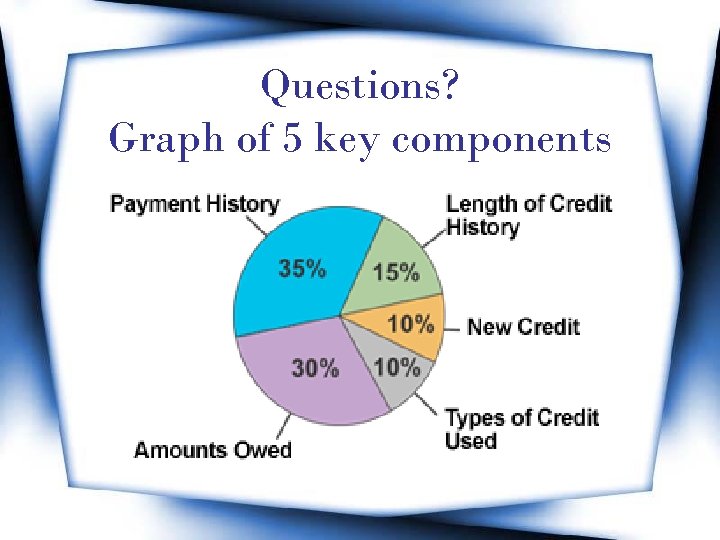

Questions? Graph of 5 key components

Questions? Graph of 5 key components

Thank you for coming!

Thank you for coming!