23d164105dd9dfd284bd06c627b7366e.ppt

- Количество слайдов: 39

WELCOME CVOS ANNUAL ZONAL REVIEW MEETING SOUTH ZONE(I) PRESENTATION BY CTE’S ORGANISATION CENTRAL VIGILANCE COMMISSION 22/01/2009

WELCOME CVOS ANNUAL ZONAL REVIEW MEETING SOUTH ZONE(I) PRESENTATION BY CTE’S ORGANISATION CENTRAL VIGILANCE COMMISSION 22/01/2009

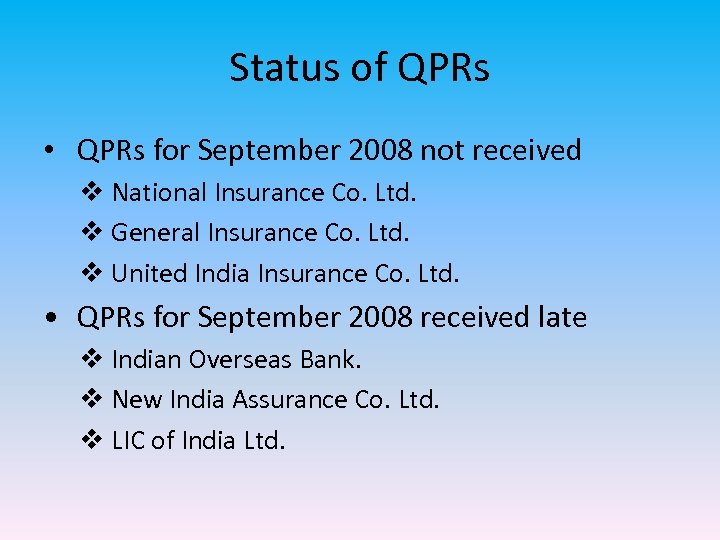

Status of QPRs • QPRs for September 2008 not received v National Insurance Co. Ltd. v General Insurance Co. Ltd. v United India Insurance Co. Ltd. • QPRs for September 2008 received late v Indian Overseas Bank. v New India Assurance Co. Ltd. v LIC of India Ltd.

Status of QPRs • QPRs for September 2008 not received v National Insurance Co. Ltd. v General Insurance Co. Ltd. v United India Insurance Co. Ltd. • QPRs for September 2008 received late v Indian Overseas Bank. v New India Assurance Co. Ltd. v LIC of India Ltd.

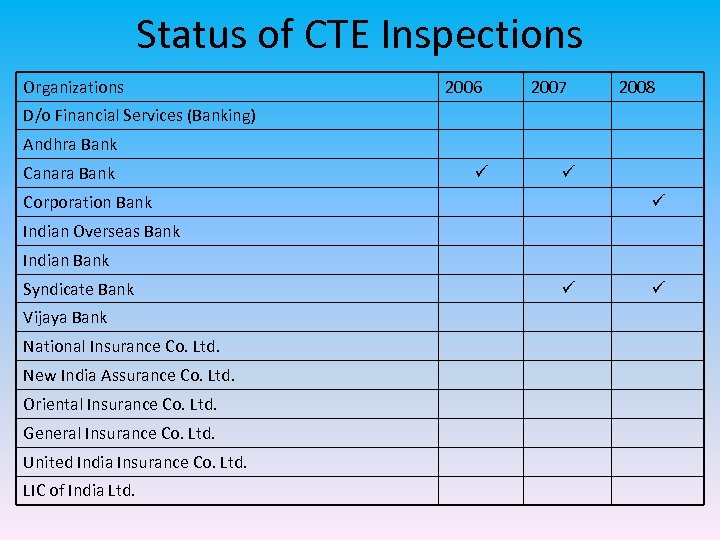

Status of CTE Inspections Organizations 2006 2007 2008 D/o Financial Services (Banking) Andhra Bank Canara Bank ü ü Corporation Bank ü Indian Overseas Bank Indian Bank Syndicate Bank Vijaya Bank National Insurance Co. Ltd. New India Assurance Co. Ltd. Oriental Insurance Co. Ltd. General Insurance Co. Ltd. United India Insurance Co. Ltd. LIC of India Ltd. ü ü

Status of CTE Inspections Organizations 2006 2007 2008 D/o Financial Services (Banking) Andhra Bank Canara Bank ü ü Corporation Bank ü Indian Overseas Bank Indian Bank Syndicate Bank Vijaya Bank National Insurance Co. Ltd. New India Assurance Co. Ltd. Oriental Insurance Co. Ltd. General Insurance Co. Ltd. United India Insurance Co. Ltd. LIC of India Ltd. ü ü

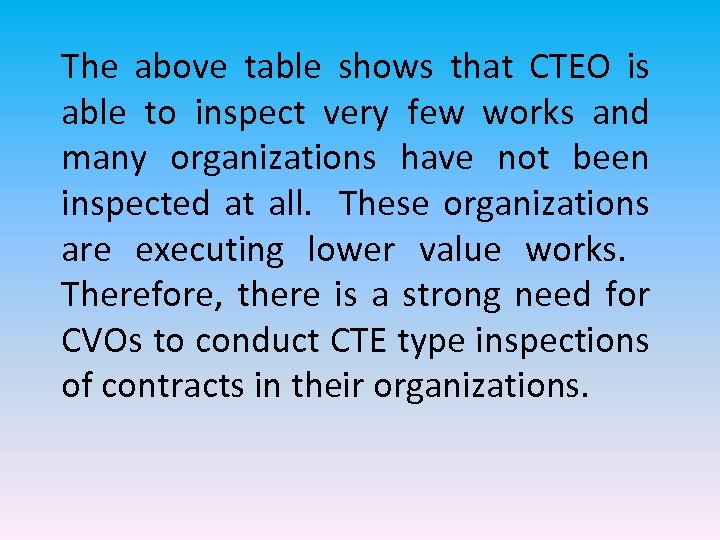

The above table shows that CTEO is able to inspect very few works and many organizations have not been inspected at all. These organizations are executing lower value works. Therefore, there is a strong need for CVOs to conduct CTE type inspections of contracts in their organizations.

The above table shows that CTEO is able to inspect very few works and many organizations have not been inspected at all. These organizations are executing lower value works. Therefore, there is a strong need for CVOs to conduct CTE type inspections of contracts in their organizations.

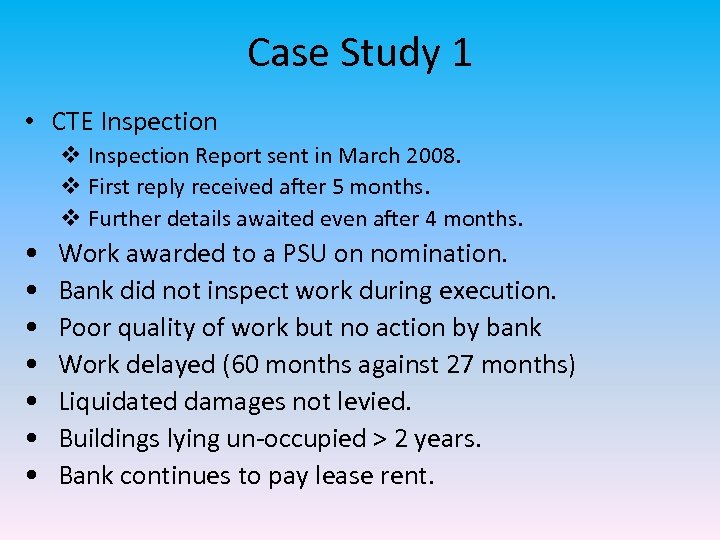

Case Study 1 • CTE Inspection v Inspection Report sent in March 2008. v First reply received after 5 months. v Further details awaited even after 4 months. • • Work awarded to a PSU on nomination. Bank did not inspect work during execution. Poor quality of work but no action by bank Work delayed (60 months against 27 months) Liquidated damages not levied. Buildings lying un-occupied > 2 years. Bank continues to pay lease rent.

Case Study 1 • CTE Inspection v Inspection Report sent in March 2008. v First reply received after 5 months. v Further details awaited even after 4 months. • • Work awarded to a PSU on nomination. Bank did not inspect work during execution. Poor quality of work but no action by bank Work delayed (60 months against 27 months) Liquidated damages not levied. Buildings lying un-occupied > 2 years. Bank continues to pay lease rent.

Case Study 2 • CTE Inspection – March 2005 v 3 paras referred to CVO - July 2007. v Report received - May 2008. v Confirmation of recoveries still awaited. • Abnormal delay in submission of investigation reports by CVO. • Slackness in enforcing recoveries.

Case Study 2 • CTE Inspection – March 2005 v 3 paras referred to CVO - July 2007. v Report received - May 2008. v Confirmation of recoveries still awaited. • Abnormal delay in submission of investigation reports by CVO. • Slackness in enforcing recoveries.

Check points for CVOs • Publicity of tender on web-site. • Contractors are qualified strictly as per PQ criteria. • Tenders are opened in presence of bidders. • Decision on tenders within original validity period. • Verification of Bank Guarantees.

Check points for CVOs • Publicity of tender on web-site. • Contractors are qualified strictly as per PQ criteria. • Tenders are opened in presence of bidders. • Decision on tenders within original validity period. • Verification of Bank Guarantees.

• No change in tender conditions after receipt of bids. • Tenders are sealed and page numbered. • Deployment of technical staff by bidder as per contract conditions. • Proper Insurance Policies. • General workmanship and quality of work with reference to line, level etc.

• No change in tender conditions after receipt of bids. • Tenders are sealed and page numbered. • Deployment of technical staff by bidder as per contract conditions. • Proper Insurance Policies. • General workmanship and quality of work with reference to line, level etc.

MAJOR DEFICIENCIES OBSERVED DETAILED PROJECT REPORT (DPR) • DPR NOT PREPARED AS PER SITE EQUIREMENT. • IFLATED ESTIMATE. • INCOMPLETE DETAILS PROVIDED IN THE DPR LEADING TO DISPUTE AT EXECUTION STAGE.

MAJOR DEFICIENCIES OBSERVED DETAILED PROJECT REPORT (DPR) • DPR NOT PREPARED AS PER SITE EQUIREMENT. • IFLATED ESTIMATE. • INCOMPLETE DETAILS PROVIDED IN THE DPR LEADING TO DISPUTE AT EXECUTION STAGE.

MAJOR DEFICIENCIES OBSERVED CONSULTANCY • APPOINTMENT OF CONSULTANT IN A NON-TRANSPARENT WAY. • SCOPE OF SERVICES NOT DEFINED CLEARLY. • UPPER CEILING FOR CONSULTANCY FEE NOT FIXED. • PAYMENT RELEASED WITHOUT AVAILING FULL SERVICES FROM THE CONSULTANT. • OVER-PAYMENT MADE TO THE CONSULTANT. • PROFESSIONAL LIABILITY INSURANCE NOT TAKEN BY THE CONSULTANT. • TECHNICAL MAN-POWER NOT DEPLOYED BY THE CONSULTANCY FIRM AS PER THE CONTRACT PROVISION.

MAJOR DEFICIENCIES OBSERVED CONSULTANCY • APPOINTMENT OF CONSULTANT IN A NON-TRANSPARENT WAY. • SCOPE OF SERVICES NOT DEFINED CLEARLY. • UPPER CEILING FOR CONSULTANCY FEE NOT FIXED. • PAYMENT RELEASED WITHOUT AVAILING FULL SERVICES FROM THE CONSULTANT. • OVER-PAYMENT MADE TO THE CONSULTANT. • PROFESSIONAL LIABILITY INSURANCE NOT TAKEN BY THE CONSULTANT. • TECHNICAL MAN-POWER NOT DEPLOYED BY THE CONSULTANCY FIRM AS PER THE CONTRACT PROVISION.

MAJOR DEFICIENCIES OBSERVED CONSULTANCY • TECHNICAL STAFF CHANGED FEEQUENTLY. • AS PROJECT MANAGEMENT CONSULTANT(PMC)– ALLOWED USE OF MATERIALS FROM UN-APPROVED SOURCES. – ALLOWED EXECUTION OF SUB-STANDARD WORK. – CLEARED SUB-STANDARD WORK FOR PAYMENT. – PROPER MEASUREMENT NOT RECORDED. – QUALITY TESTS NOT CONDUCTED AS PER CONTRACT/CODAL PROVISION.

MAJOR DEFICIENCIES OBSERVED CONSULTANCY • TECHNICAL STAFF CHANGED FEEQUENTLY. • AS PROJECT MANAGEMENT CONSULTANT(PMC)– ALLOWED USE OF MATERIALS FROM UN-APPROVED SOURCES. – ALLOWED EXECUTION OF SUB-STANDARD WORK. – CLEARED SUB-STANDARD WORK FOR PAYMENT. – PROPER MEASUREMENT NOT RECORDED. – QUALITY TESTS NOT CONDUCTED AS PER CONTRACT/CODAL PROVISION.

DEFICIENCIES OBSERVED TENDER DOCUMENTS • CONTRADICTORY AND AMBIGUOUS PROVISIONS MADE IN THE TENDER DOCUMENT. • PROVISION IN THE TENDER DOCUMENT NOT AS PER POLICY GUIDELINES. • DRAFT TENDER DOCUMENT NOT APPROVED BY COMPETENT AUTHORITY. • CLAUSES TO DEAL WITH AMBIGUITIES NOT PROVIDED IN THE TENDER DOCUMENT. • NON-RELEVANT DOCUMENTS AND PROVISIONS PROVIDED IN THE TENDER DOCUMENT.

DEFICIENCIES OBSERVED TENDER DOCUMENTS • CONTRADICTORY AND AMBIGUOUS PROVISIONS MADE IN THE TENDER DOCUMENT. • PROVISION IN THE TENDER DOCUMENT NOT AS PER POLICY GUIDELINES. • DRAFT TENDER DOCUMENT NOT APPROVED BY COMPETENT AUTHORITY. • CLAUSES TO DEAL WITH AMBIGUITIES NOT PROVIDED IN THE TENDER DOCUMENT. • NON-RELEVANT DOCUMENTS AND PROVISIONS PROVIDED IN THE TENDER DOCUMENT.

DEFICIENCIES OBSERVED PRE-QUALIFICATION • PRE-QUALIFICATION CRITERIA MADE UNDULY STRINGENT AND THEN RELAXED DURING PQ EVALUATION, SINCE VERY FEW BIDDERS WERE MEETING THE NOTIFIED CRITERIA. • PQ CRITERIA FIXED AFTER OPENING OF THE PQ OFFERS. • PQ CRITERIA NOT APPLIED UNIFORMLY TO ALL THE OFFERS. • PQ CRITERIA MADE TO SUIT THE PARTICULAR FIRM(S).

DEFICIENCIES OBSERVED PRE-QUALIFICATION • PRE-QUALIFICATION CRITERIA MADE UNDULY STRINGENT AND THEN RELAXED DURING PQ EVALUATION, SINCE VERY FEW BIDDERS WERE MEETING THE NOTIFIED CRITERIA. • PQ CRITERIA FIXED AFTER OPENING OF THE PQ OFFERS. • PQ CRITERIA NOT APPLIED UNIFORMLY TO ALL THE OFFERS. • PQ CRITERIA MADE TO SUIT THE PARTICULAR FIRM(S).

DEFICIENCIES OBSERVED INVITATION OF BIDS • TENDERS INVITED IN A NON-TRANSPARENT MANNER WITHOUT PROPER PUBLICITY. • TENDER NOTICE AND COMPLETE TENDER DOCUMENT IN THE DOWNLOADABLE FORM NOT UPLOADED IN THE WEB-SITE. • SHORT NOTICE TENDERS INVITED WITHOUT ANY REAL URGENCY. • BID INVITED ON NOMINATION BASIS EVEN THOUGH THERE IS NO URGENCY AND NUMBER OF POTENTIAL BIDDERS ARE AVAILABLE. • LIMITED TENDERS INVITED FROM OLD PANEL. • AUTHORITY TO RECEIVE THE BIDS AND PLACE NOTIFIED PROPERLY.

DEFICIENCIES OBSERVED INVITATION OF BIDS • TENDERS INVITED IN A NON-TRANSPARENT MANNER WITHOUT PROPER PUBLICITY. • TENDER NOTICE AND COMPLETE TENDER DOCUMENT IN THE DOWNLOADABLE FORM NOT UPLOADED IN THE WEB-SITE. • SHORT NOTICE TENDERS INVITED WITHOUT ANY REAL URGENCY. • BID INVITED ON NOMINATION BASIS EVEN THOUGH THERE IS NO URGENCY AND NUMBER OF POTENTIAL BIDDERS ARE AVAILABLE. • LIMITED TENDERS INVITED FROM OLD PANEL. • AUTHORITY TO RECEIVE THE BIDS AND PLACE NOTIFIED PROPERLY.

CHECK POINTS IN EXECUTION STAGE 1. 2. 3. 4. 5. 6. 7. 8. 9. AGREEMENT IS AS PER THE BID ACCEPTED. AGREEMENT IS SIGNED & SEALED PROPERLY. BANK GUARANTEES ARE VERIFIED AND TIMELY RENEWED. CONDITIONS REGARDING INSURANCE POLICIES, PERFORMANCE GUARANTEES, LABOUR LICENCE etc. ARE COMPLIED. NO UNWARRANTED DEVIATIONS DONE. VARIOUS RECOVERIES ARE MADE AS PER CONTRACT. PROPER RECORD OF HINDRANCE MAINTAINED. TECHNICAL STAFF DEPLOYED AS PER CONTRACT PROVISION. MANDATORY TESTS CARRIED OUT. 15

CHECK POINTS IN EXECUTION STAGE 1. 2. 3. 4. 5. 6. 7. 8. 9. AGREEMENT IS AS PER THE BID ACCEPTED. AGREEMENT IS SIGNED & SEALED PROPERLY. BANK GUARANTEES ARE VERIFIED AND TIMELY RENEWED. CONDITIONS REGARDING INSURANCE POLICIES, PERFORMANCE GUARANTEES, LABOUR LICENCE etc. ARE COMPLIED. NO UNWARRANTED DEVIATIONS DONE. VARIOUS RECOVERIES ARE MADE AS PER CONTRACT. PROPER RECORD OF HINDRANCE MAINTAINED. TECHNICAL STAFF DEPLOYED AS PER CONTRACT PROVISION. MANDATORY TESTS CARRIED OUT. 15

DEFICIENCIES OBSERVED EVALUATION OF BIDS AND AWARD OF CONTRACT • UNDUE DELAY IN EVALUATION OF THE BIDS AND AWARD OF THE CONTRACT. • AMBIGUITY IN THE BID NOT DEALT AS PER PROVISION IN THE TENDER DOCUMENT AND UNDUE FINANCIAL BENEFIT RUNNING INTO CRORES OF RUPEES EXTENDED TO THE LOWEST BIDDER. • CURRENT MARKET RATE ANALYSIS OF THE RATE NOT DONE TO ASSESS THE REASONABLENESS OF THE LOWEST BID. • WORK AWARDED AT MUCH HIGHER COST THAN WHAT COULD BE JUSTIFIED BASED ON THE CURRENT MARKET RATES.

DEFICIENCIES OBSERVED EVALUATION OF BIDS AND AWARD OF CONTRACT • UNDUE DELAY IN EVALUATION OF THE BIDS AND AWARD OF THE CONTRACT. • AMBIGUITY IN THE BID NOT DEALT AS PER PROVISION IN THE TENDER DOCUMENT AND UNDUE FINANCIAL BENEFIT RUNNING INTO CRORES OF RUPEES EXTENDED TO THE LOWEST BIDDER. • CURRENT MARKET RATE ANALYSIS OF THE RATE NOT DONE TO ASSESS THE REASONABLENESS OF THE LOWEST BID. • WORK AWARDED AT MUCH HIGHER COST THAN WHAT COULD BE JUSTIFIED BASED ON THE CURRENT MARKET RATES.

DEFICIENCIES OBSERVED COMPLIANCE OF THE CONTRACT CONDITIONS • CONTRACT DOCUMENT MADE AT VARIANCE WITH THE TENDER DOCUMENTS, RESULTING INTO UNDUE FINANCIAL BENEFIT TO THE CONTRACTOR. • IN ‘DESIGN AND CONSTRUCT’ CONTRACT, PROFESSIONAL INDEMNITY INSURANCE NOT TAKEN BY THE CONTRACTOR, RESULTING IN UNDUE FINANCIAL BENEFIT TO THE CONTRACTOR BY WAY OF SAVING OF PREMIUM AMOUNT BESIDES DISADVANTAGE TO THE ORGANIZATION. • VARIOUS OTHER INSURANCE POLICIES SUCH AS ‘CONTRACTOR’S ALL RISK POLICY’, THIRD PARTY INSURANCE, PLANT AND MACHINERY INSURANCE, WORKMAN’S COMPENSATION POLICY ETC. NOT TAKEN BY THE CONTRACTORS. • BANK GUARANTEES SUBMITTED BY THE CONTRACTORS NOT VERIFIED INDEPENDENTLY FROM THE ISSUING BANK. • WORK DELAYED UNDULY AND NO ACTION TAKEN AGAINST THE CONTRACTOR.

DEFICIENCIES OBSERVED COMPLIANCE OF THE CONTRACT CONDITIONS • CONTRACT DOCUMENT MADE AT VARIANCE WITH THE TENDER DOCUMENTS, RESULTING INTO UNDUE FINANCIAL BENEFIT TO THE CONTRACTOR. • IN ‘DESIGN AND CONSTRUCT’ CONTRACT, PROFESSIONAL INDEMNITY INSURANCE NOT TAKEN BY THE CONTRACTOR, RESULTING IN UNDUE FINANCIAL BENEFIT TO THE CONTRACTOR BY WAY OF SAVING OF PREMIUM AMOUNT BESIDES DISADVANTAGE TO THE ORGANIZATION. • VARIOUS OTHER INSURANCE POLICIES SUCH AS ‘CONTRACTOR’S ALL RISK POLICY’, THIRD PARTY INSURANCE, PLANT AND MACHINERY INSURANCE, WORKMAN’S COMPENSATION POLICY ETC. NOT TAKEN BY THE CONTRACTORS. • BANK GUARANTEES SUBMITTED BY THE CONTRACTORS NOT VERIFIED INDEPENDENTLY FROM THE ISSUING BANK. • WORK DELAYED UNDULY AND NO ACTION TAKEN AGAINST THE CONTRACTOR.

DEFICIENCIES OBSERVED QUALITY • CONTRACT PROVIDED FOR DESIGN MIX CONCRETE, WHEREAS AT SITE BATCHING PLANT OR OTHER WEIGHING MECHANISM NOT INSTALLED AT SITE, RESULTING IN POOR QUALITY OF CONCRETE. • SUB-STANDARD MATERIALS USED IN THE WORK. • POOR QUALITY OF SHUTTERING USED RESULTING IN BULGING ETC. IN THE CONCRETE STRUCTURES. • CONCRETE PLACEMENT AND COMPACTION NOT DONE PROPERLY RESULTING INTO HONEYCOMBING IN THE CONCRETE STRUCTURE. • REINFORCEMENT NOT PLACED PROPERLY. • MATERIAL FOR UNAPPROVED SOURCES USED IN THE WORK.

DEFICIENCIES OBSERVED QUALITY • CONTRACT PROVIDED FOR DESIGN MIX CONCRETE, WHEREAS AT SITE BATCHING PLANT OR OTHER WEIGHING MECHANISM NOT INSTALLED AT SITE, RESULTING IN POOR QUALITY OF CONCRETE. • SUB-STANDARD MATERIALS USED IN THE WORK. • POOR QUALITY OF SHUTTERING USED RESULTING IN BULGING ETC. IN THE CONCRETE STRUCTURES. • CONCRETE PLACEMENT AND COMPACTION NOT DONE PROPERLY RESULTING INTO HONEYCOMBING IN THE CONCRETE STRUCTURE. • REINFORCEMENT NOT PLACED PROPERLY. • MATERIAL FOR UNAPPROVED SOURCES USED IN THE WORK.

CHECK POINTS FOR PRE-TENDER STAGE 1. 2. 3. 4. 5. FEASIBILITY STUDY IS DONE. PROJECT IS DULY SANCTIONED. DETAILED PROJECT REPORT(DPR)/ESTIMATE IS VETTED AT APPROPRIATE LEVEL. CONSULTANTS ARE APPOINTED IN A TRANSPARENT MANNER. DRAFT TENDER DOCUMENT IS VETTED AT APPROPRIATE LEVEL. 19

CHECK POINTS FOR PRE-TENDER STAGE 1. 2. 3. 4. 5. FEASIBILITY STUDY IS DONE. PROJECT IS DULY SANCTIONED. DETAILED PROJECT REPORT(DPR)/ESTIMATE IS VETTED AT APPROPRIATE LEVEL. CONSULTANTS ARE APPOINTED IN A TRANSPARENT MANNER. DRAFT TENDER DOCUMENT IS VETTED AT APPROPRIATE LEVEL. 19

CHECK POINTS FOR TENDER STAGE 1. TRANSPARENT PRE-QUALIFICATION CRITERIA AND EVALUATION AS PER NOTIFIED CRITERIA. 2. PQ EVALUATION IS BASED ON DOCUMENTARY PROOF. 3. MODE OF TENDER(OPEN, LIMITED OR NOMINATION BASIS) AS PER ORGANISATION’s POLICY. 4. TRANSPARENCY IN PREPARATION OF PANEL & REGULAR IN CASE OF LIMITED TENDERS. 5. ADEQUATE / WIDE / WEB PUBLICITY. 6. OPENING OF TENDERS IN PRESENCE OF BIDDERS. 7. BIDS OPENED ARE SIGNED BY ALL THE MEMBERS OF TENDER COMMITTEE AND ALL THE CORRECTIONS IN THE BIDS ARE ATTESTED &SUMMARISED BY TENDER COMMITTEE. 8. BIDS EVALUATED PROPERLY AND AMBIGUITIES ARE DEALT AS PER PROVISION IN THE TENDER DOCUMENT. 9. ON THE SPOT SUMMARY OF BIDS. 10. CONDITIONS OF THE TENDER ARE NOT ALTERED AFTER OPENING OF PRICE BIDS 20

CHECK POINTS FOR TENDER STAGE 1. TRANSPARENT PRE-QUALIFICATION CRITERIA AND EVALUATION AS PER NOTIFIED CRITERIA. 2. PQ EVALUATION IS BASED ON DOCUMENTARY PROOF. 3. MODE OF TENDER(OPEN, LIMITED OR NOMINATION BASIS) AS PER ORGANISATION’s POLICY. 4. TRANSPARENCY IN PREPARATION OF PANEL & REGULAR IN CASE OF LIMITED TENDERS. 5. ADEQUATE / WIDE / WEB PUBLICITY. 6. OPENING OF TENDERS IN PRESENCE OF BIDDERS. 7. BIDS OPENED ARE SIGNED BY ALL THE MEMBERS OF TENDER COMMITTEE AND ALL THE CORRECTIONS IN THE BIDS ARE ATTESTED &SUMMARISED BY TENDER COMMITTEE. 8. BIDS EVALUATED PROPERLY AND AMBIGUITIES ARE DEALT AS PER PROVISION IN THE TENDER DOCUMENT. 9. ON THE SPOT SUMMARY OF BIDS. 10. CONDITIONS OF THE TENDER ARE NOT ALTERED AFTER OPENING OF PRICE BIDS 20

• Continued---CTE(VR)

• Continued---CTE(VR)

WELCOME

WELCOME

South Zone (22. 01. 2009) • A Bank has awarded a contract in 2006 to vendor M/s X, at a cost of Rs. 8. 70 crores for supply, installation & commissioning of three numbers each of SUN Fire E 6900 Servers and SUN Stor. Edge 3510 FC arrays and related hardware and software at its Data Centre and Disaster Recovery (DR) Site. The case was intensively examined during Aug’ 2008.

South Zone (22. 01. 2009) • A Bank has awarded a contract in 2006 to vendor M/s X, at a cost of Rs. 8. 70 crores for supply, installation & commissioning of three numbers each of SUN Fire E 6900 Servers and SUN Stor. Edge 3510 FC arrays and related hardware and software at its Data Centre and Disaster Recovery (DR) Site. The case was intensively examined during Aug’ 2008.

South Zone (22. 01. 2009) • In this case, Bank involved as many as four Consultants. • While the appointment of M/s C-DAC was through a process of competitive bidding, the other three consultants were engaged after having direct discussions with them. • Selection process by nomination without a tender process, lacks transparency, and could encourage unacceptable practices.

South Zone (22. 01. 2009) • In this case, Bank involved as many as four Consultants. • While the appointment of M/s C-DAC was through a process of competitive bidding, the other three consultants were engaged after having direct discussions with them. • Selection process by nomination without a tender process, lacks transparency, and could encourage unacceptable practices.

South Zone (22. 01. 2009) • In the case of appointment of M/s C-DAC, Bank had floated a limited tender enquiry to five organizations out of which, Bank got three offers. Out of these three offers, two offers were disqualified for not meeting the tender eligibility criteria. • Apparently, the Bank had not verified the credentials of the prospective bidders before issuing limited tender. Instead of inviting bids through open tendering, a limited tender enquiry was issued to the firms who did not have the requisite experience and other eligibility conditions, mentioned in the tender.

South Zone (22. 01. 2009) • In the case of appointment of M/s C-DAC, Bank had floated a limited tender enquiry to five organizations out of which, Bank got three offers. Out of these three offers, two offers were disqualified for not meeting the tender eligibility criteria. • Apparently, the Bank had not verified the credentials of the prospective bidders before issuing limited tender. Instead of inviting bids through open tendering, a limited tender enquiry was issued to the firms who did not have the requisite experience and other eligibility conditions, mentioned in the tender.

South Zone (22. 01. 2009) • In the 1 st tender, though the qualification criteria was specified and apparently, all the 4 bidders met with these qualifying conditions, this tender was discharged as – • i) demand drafts towards the cost of tender documents and EMD, submitted by two of the bidders, M/s A and M/s B, had consecutive serial numbers issued by CITI Bank on ING Vysya Bank and ii) the track record of all the vendors except M/s W did not show any experience in installing servers of equivalent capacity.

South Zone (22. 01. 2009) • In the 1 st tender, though the qualification criteria was specified and apparently, all the 4 bidders met with these qualifying conditions, this tender was discharged as – • i) demand drafts towards the cost of tender documents and EMD, submitted by two of the bidders, M/s A and M/s B, had consecutive serial numbers issued by CITI Bank on ING Vysya Bank and ii) the track record of all the vendors except M/s W did not show any experience in installing servers of equivalent capacity.

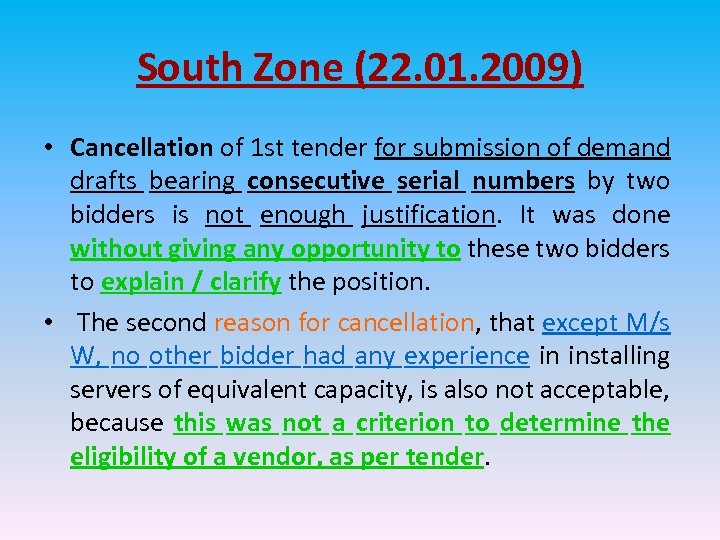

South Zone (22. 01. 2009) • Cancellation of 1 st tender for submission of demand drafts bearing consecutive serial numbers by two bidders is not enough justification. It was done without giving any opportunity to these two bidders to explain / clarify the position. • The second reason for cancellation, that except M/s W, no other bidder had any experience in installing servers of equivalent capacity, is also not acceptable, because this was not a criterion to determine the eligibility of a vendor, as per tender.

South Zone (22. 01. 2009) • Cancellation of 1 st tender for submission of demand drafts bearing consecutive serial numbers by two bidders is not enough justification. It was done without giving any opportunity to these two bidders to explain / clarify the position. • The second reason for cancellation, that except M/s W, no other bidder had any experience in installing servers of equivalent capacity, is also not acceptable, because this was not a criterion to determine the eligibility of a vendor, as per tender.

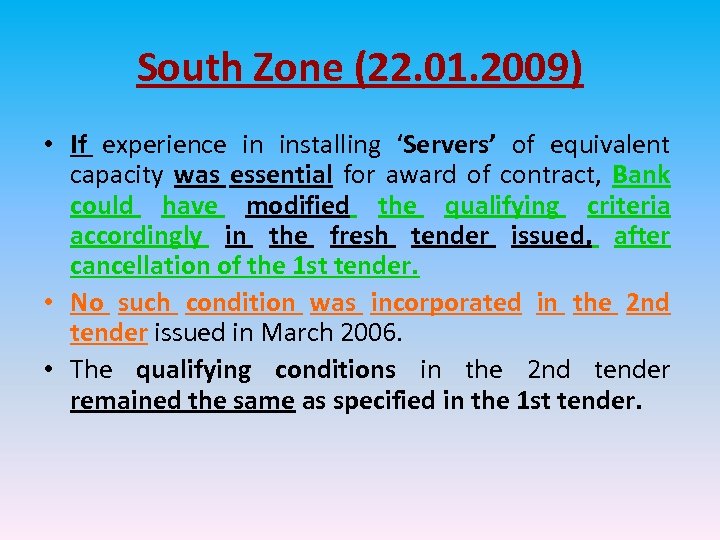

South Zone (22. 01. 2009) • If experience in installing ‘Servers’ of equivalent capacity was essential for award of contract, Bank could have modified the qualifying criteria accordingly in the fresh tender issued, after cancellation of the 1 st tender. • No such condition was incorporated in the 2 nd tender issued in March 2006. • The qualifying conditions in the 2 nd tender remained the same as specified in the 1 st tender.

South Zone (22. 01. 2009) • If experience in installing ‘Servers’ of equivalent capacity was essential for award of contract, Bank could have modified the qualifying criteria accordingly in the fresh tender issued, after cancellation of the 1 st tender. • No such condition was incorporated in the 2 nd tender issued in March 2006. • The qualifying conditions in the 2 nd tender remained the same as specified in the 1 st tender.

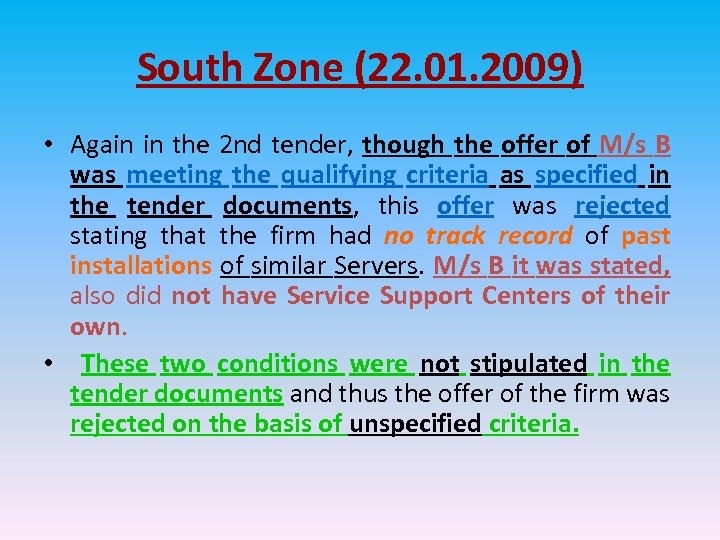

South Zone (22. 01. 2009) • Again in the 2 nd tender, though the offer of M/s B was meeting the qualifying criteria as specified in the tender documents, this offer was rejected stating that the firm had no track record of past installations of similar Servers. M/s B it was stated, also did not have Service Support Centers of their own. • These two conditions were not stipulated in the tender documents and thus the offer of the firm was rejected on the basis of unspecified criteria.

South Zone (22. 01. 2009) • Again in the 2 nd tender, though the offer of M/s B was meeting the qualifying criteria as specified in the tender documents, this offer was rejected stating that the firm had no track record of past installations of similar Servers. M/s B it was stated, also did not have Service Support Centers of their own. • These two conditions were not stipulated in the tender documents and thus the offer of the firm was rejected on the basis of unspecified criteria.

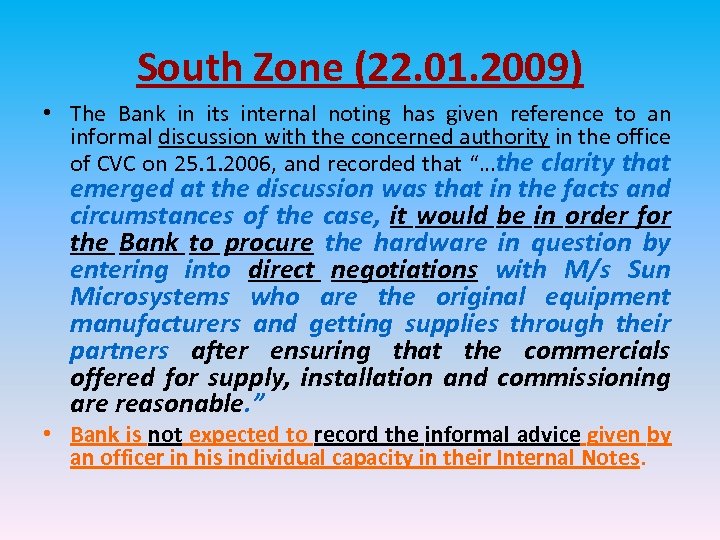

South Zone (22. 01. 2009) • The Bank in its internal noting has given reference to an informal discussion with the concerned authority in the office of CVC on 25. 1. 2006, and recorded that “…the clarity that emerged at the discussion was that in the facts and circumstances of the case, it would be in order for the Bank to procure the hardware in question by entering into direct negotiations with M/s Sun Microsystems who are the original equipment manufacturers and getting supplies through their partners after ensuring that the commercials offered for supply, installation and commissioning are reasonable. ” • Bank is not expected to record the informal advice given by an officer in his individual capacity in their Internal Notes.

South Zone (22. 01. 2009) • The Bank in its internal noting has given reference to an informal discussion with the concerned authority in the office of CVC on 25. 1. 2006, and recorded that “…the clarity that emerged at the discussion was that in the facts and circumstances of the case, it would be in order for the Bank to procure the hardware in question by entering into direct negotiations with M/s Sun Microsystems who are the original equipment manufacturers and getting supplies through their partners after ensuring that the commercials offered for supply, installation and commissioning are reasonable. ” • Bank is not expected to record the informal advice given by an officer in his individual capacity in their Internal Notes.

South Zone (22. 01. 2009) • As far as – Informal discussions with the concerned authority in the office of Central Vigilance Commission is concerned, • Commission does not approve of taking cognizance of such informal discussions unless the same are confirmed in writing by the Commission.

South Zone (22. 01. 2009) • As far as – Informal discussions with the concerned authority in the office of Central Vigilance Commission is concerned, • Commission does not approve of taking cognizance of such informal discussions unless the same are confirmed in writing by the Commission.

South Zone (22. 01. 2009) • Tender was issued for ‘Sun specific’ products inviting bids from the authorized dealers of Sun Microsystems, as Sun does not directly sell their products, but sell through their partners who have professionals trained on SUN Systems. • Open tender was issued to get multiple bids for the purpose of price comparison. However, only two weeks time was given for submission of bids and copy of tender notice was not sent to known vendors as advance intimation. This, perhaps was one of the reasons for getting only two offers in the 2 nd tender.

South Zone (22. 01. 2009) • Tender was issued for ‘Sun specific’ products inviting bids from the authorized dealers of Sun Microsystems, as Sun does not directly sell their products, but sell through their partners who have professionals trained on SUN Systems. • Open tender was issued to get multiple bids for the purpose of price comparison. However, only two weeks time was given for submission of bids and copy of tender notice was not sent to known vendors as advance intimation. This, perhaps was one of the reasons for getting only two offers in the 2 nd tender.

South Zone (22. 01. 2009) Further, out of these two offers, the offer of one firm, M/s B was rejected on the basis of unspecified criteria. Bank was left with only one offer and hence, there was no competition. Lack of advance intimation to the prospective bidders and insufficient time for submission of bids, defeated the whole purpose of open tendering. • Bank also could not establish the reasonableness of the price. Bank should have compared the prices of Sun products, with the products of other manufacturers on the basis of some standard benchmarks like transaction processing ratings done by third party benchmarking agencies.

South Zone (22. 01. 2009) Further, out of these two offers, the offer of one firm, M/s B was rejected on the basis of unspecified criteria. Bank was left with only one offer and hence, there was no competition. Lack of advance intimation to the prospective bidders and insufficient time for submission of bids, defeated the whole purpose of open tendering. • Bank also could not establish the reasonableness of the price. Bank should have compared the prices of Sun products, with the products of other manufacturers on the basis of some standard benchmarks like transaction processing ratings done by third party benchmarking agencies.

South Zone (22. 01. 2009) • As per tender and the purchase order, the Systems to be supplied were to be insured by the vendor against all risks of loss or damage from the date of shipment, till such time it is delivered at the Bank site. • Apparently, the details of insurance taken by the firm M/s W were not checked / verified by the Bank at the time of taking delivery of the consignment and / or making payment.

South Zone (22. 01. 2009) • As per tender and the purchase order, the Systems to be supplied were to be insured by the vendor against all risks of loss or damage from the date of shipment, till such time it is delivered at the Bank site. • Apparently, the details of insurance taken by the firm M/s W were not checked / verified by the Bank at the time of taking delivery of the consignment and / or making payment.

South Zone (22. 01. 2009) • A Bank has awarded a contract in June 2008, to M/s W at a cost of Rs. 21. 49 crores for the supply, installation, commissioning of hardware & software and administration, maintenance & support, for implementation of an End to End Enterprise Data Warehouse and Business Intelligence Solution. The case was intensively examined during Oct-Nov ’ 2008.

South Zone (22. 01. 2009) • A Bank has awarded a contract in June 2008, to M/s W at a cost of Rs. 21. 49 crores for the supply, installation, commissioning of hardware & software and administration, maintenance & support, for implementation of an End to End Enterprise Data Warehouse and Business Intelligence Solution. The case was intensively examined during Oct-Nov ’ 2008.

South Zone (22. 01. 2009) • Offers of some firms were rejected as their names were not indicated as vendor/SI (system integrator) /consortium partner, in the references given by them. The name of M/s W, the successful bidder, was also not indicated in the references given by them. Another reference of LIC given by M/s W considered, was also not meeting the eligibility conditions fully.

South Zone (22. 01. 2009) • Offers of some firms were rejected as their names were not indicated as vendor/SI (system integrator) /consortium partner, in the references given by them. The name of M/s W, the successful bidder, was also not indicated in the references given by them. Another reference of LIC given by M/s W considered, was also not meeting the eligibility conditions fully.

South Zone (22. 01. 2009) • M/s T, another technically qualified bidder, had given references that were also not meeting the eligibility conditions fully. • Offer of M/s H was rejected after presentation, since analytical CRM quoted by the vendor was not implemented in any Bank in India. • The offer of M/s H should have been rejected at the initial stage itself and firm should not have been called for presentation, if the analytical CRM offered by M/s H was not acceptable. • Further, various parameters that were to be considered for evaluation during presentation, were not specified in the RFP document.

South Zone (22. 01. 2009) • M/s T, another technically qualified bidder, had given references that were also not meeting the eligibility conditions fully. • Offer of M/s H was rejected after presentation, since analytical CRM quoted by the vendor was not implemented in any Bank in India. • The offer of M/s H should have been rejected at the initial stage itself and firm should not have been called for presentation, if the analytical CRM offered by M/s H was not acceptable. • Further, various parameters that were to be considered for evaluation during presentation, were not specified in the RFP document.

South Zone (22. 01. 2009) • 80% payment amounting to Rs. 4. 31 crore, was released without any inspection. • As per Purchase Order terms, it was to be released only upon delivery and submission of various documents including inspection certificate issued by the nominated inspection agency; and the Supplier's factory inspection report. • (i. e. - Contract terms were not followed, & vendor benefited by early release of payment)

South Zone (22. 01. 2009) • 80% payment amounting to Rs. 4. 31 crore, was released without any inspection. • As per Purchase Order terms, it was to be released only upon delivery and submission of various documents including inspection certificate issued by the nominated inspection agency; and the Supplier's factory inspection report. • (i. e. - Contract terms were not followed, & vendor benefited by early release of payment)

South Zone (22. 01. 2009) THANK YOU

South Zone (22. 01. 2009) THANK YOU