249380604de68bbbf8a291cea6af2441.ppt

- Количество слайдов: 45

Welcome Client Facilities Management Forum

Welcome Client Facilities Management Forum

Attendees · Ian Fielder (IF) BIFM · Steve Riches (SR) AON · Richard Trafford (RT) RBS · Jane Bell (JB) BIFM · If Price (IP) Sheffield Hallam University · Geoff Wilson (GW) IBM · Fred Child (FC) Nationwide · Stan Mitchell (SM) Ark e-management · Gerry Headley (GH) Scots Parliament · Jeff Dixon (GD) · Peter Mc. Lennan (PMc. L) University College London · Roger Tanner (RT) Strategem Consulting · Ed Finch/ Paula (EF)(P) University of Reading · John Hinks (JH) RBS · Stephen Bradley (SB) AMA

Attendees · Ian Fielder (IF) BIFM · Steve Riches (SR) AON · Richard Trafford (RT) RBS · Jane Bell (JB) BIFM · If Price (IP) Sheffield Hallam University · Geoff Wilson (GW) IBM · Fred Child (FC) Nationwide · Stan Mitchell (SM) Ark e-management · Gerry Headley (GH) Scots Parliament · Jeff Dixon (GD) · Peter Mc. Lennan (PMc. L) University College London · Roger Tanner (RT) Strategem Consulting · Ed Finch/ Paula (EF)(P) University of Reading · John Hinks (JH) RBS · Stephen Bradley (SB) AMA

The Innovation Imperative? John Hinks Innovation Manager RBS Group Workplace Operations

The Innovation Imperative? John Hinks Innovation Manager RBS Group Workplace Operations

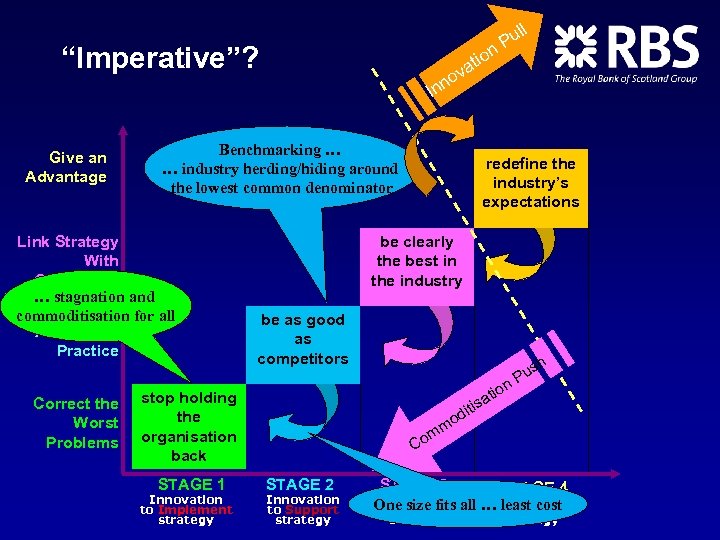

“Imperative”? Give an Advantage v no In Benchmarking … … industry herding/hiding around the lowest common denominator Link Strategy With Operations … stagnation and commoditisation for all Adopt best Practice Correct the Worst Problems n tio a Innovation to Implement strategy redefine the industry’s expectations be clearly the best in the industry be as good as competitors u n. P sh o ati is stop holding the organisation back STAGE 1 ull P it od m m Co STAGE 2 Innovation to Support strategy STAGE 3 STAGE 4 Innovation all … least cost Innovation One size fits to Drives strategy

“Imperative”? Give an Advantage v no In Benchmarking … … industry herding/hiding around the lowest common denominator Link Strategy With Operations … stagnation and commoditisation for all Adopt best Practice Correct the Worst Problems n tio a Innovation to Implement strategy redefine the industry’s expectations be clearly the best in the industry be as good as competitors u n. P sh o ati is stop holding the organisation back STAGE 1 ull P it od m m Co STAGE 2 Innovation to Support strategy STAGE 3 STAGE 4 Innovation all … least cost Innovation One size fits to Drives strategy

Some Observations · The experience economy is upon us, and is changing core business expectations · The “ 80 -85%” industry · Fewer, higher quality suppliers available to co-develop with · Exacerbated by difficulties with recruitment and retention of skilled labour lie at the heart of meeting quality aspirations · Innovation is only part of the solution to achieving a 100% industry · Contract structures and “managing what we can measure” don’t encourage step change innovations · Lack of reinvestment of efficiency gains is probably everyone’s fault… · … it is effectiveness that matters more for step change though · The “poverty trap” of least cost and commoditisation · It’s an attitude thing … need for a paradigm shift?

Some Observations · The experience economy is upon us, and is changing core business expectations · The “ 80 -85%” industry · Fewer, higher quality suppliers available to co-develop with · Exacerbated by difficulties with recruitment and retention of skilled labour lie at the heart of meeting quality aspirations · Innovation is only part of the solution to achieving a 100% industry · Contract structures and “managing what we can measure” don’t encourage step change innovations · Lack of reinvestment of efficiency gains is probably everyone’s fault… · … it is effectiveness that matters more for step change though · The “poverty trap” of least cost and commoditisation · It’s an attitude thing … need for a paradigm shift?

Looking at Ourselves? · It’s an attitude thing … need for a paradigm shift? · Client commitment to innovation and creativity has to be deep and genuine · Customer readiness is critical to achieving innovation potential · Plus, the aspiration to be a testing ground for ideas · Committing to embedding relies on the core business shifting paradigm too. . . · … and recognition that moving forward may involve some failures · … but we can learn from those · All stakeholders must have the appetite for the journey · Alternative is death by a thousands cuts of incremental cost savings oriented ‘innovation’ (“are we there yet? ”. . . )

Looking at Ourselves? · It’s an attitude thing … need for a paradigm shift? · Client commitment to innovation and creativity has to be deep and genuine · Customer readiness is critical to achieving innovation potential · Plus, the aspiration to be a testing ground for ideas · Committing to embedding relies on the core business shifting paradigm too. . . · … and recognition that moving forward may involve some failures · … but we can learn from those · All stakeholders must have the appetite for the journey · Alternative is death by a thousands cuts of incremental cost savings oriented ‘innovation’ (“are we there yet? ”. . . )

The Prisoners Dilemma? · There is work to do on both sides · There is scope for recombinative and incremental innovations, but for step-change as well we need to nurture both the “ 80 -85%” industry head and the commoditised “ 60%” industry tail. . . · We can help put the conditions in place for change … · … and there is a potential pot of gold from creating a virtuous innovation circle… · but innovation requires a commitment to a journey not just a destination · but there is a risk of not addressing this · and if we do not respond to the innovators in the industry then we all stand to lose

The Prisoners Dilemma? · There is work to do on both sides · There is scope for recombinative and incremental innovations, but for step-change as well we need to nurture both the “ 80 -85%” industry head and the commoditised “ 60%” industry tail. . . · We can help put the conditions in place for change … · … and there is a potential pot of gold from creating a virtuous innovation circle… · but innovation requires a commitment to a journey not just a destination · but there is a risk of not addressing this · and if we do not respond to the innovators in the industry then we all stand to lose

Today · An opportunity to compare notes and see if there are common concerns? · Scope to agree to common themes for engaging the wider client base? · Ideas for finding and engaging with the innovators in the industry?

Today · An opportunity to compare notes and see if there are common concerns? · Scope to agree to common themes for engaging the wider client base? · Ideas for finding and engaging with the innovators in the industry?

Discussion Pre-Coffee Client Facilities Management Forum

Discussion Pre-Coffee Client Facilities Management Forum

Discussion Pre-Coffee • (IF) Some common themes: The Procurement Process • ‘Intent to Innovate’ in suppliers frequently appears to be there. • Is innovation a victim of procurement process? • Suppliers indicate that cost… drives out Best Practice and Innovation. Similarly, training investment… • (GD) ‘They would say that anyway’ • Now looking for innovation to be used to help derive savings; We need participation and communication to achieve this. • Ideas already coming forward for the partnership to achieve this. • Need to protect from procurers (IF) on incentivised cost drive down • (IF) Economic, Procurement as drivers

Discussion Pre-Coffee • (IF) Some common themes: The Procurement Process • ‘Intent to Innovate’ in suppliers frequently appears to be there. • Is innovation a victim of procurement process? • Suppliers indicate that cost… drives out Best Practice and Innovation. Similarly, training investment… • (GD) ‘They would say that anyway’ • Now looking for innovation to be used to help derive savings; We need participation and communication to achieve this. • Ideas already coming forward for the partnership to achieve this. • Need to protect from procurers (IF) on incentivised cost drive down • (IF) Economic, Procurement as drivers

Discussion Pre-Coffee • (IP) Procurement teams will buy services at peak prices from the Grade A suppliers that are perceived as bringing forward unique knowledge. • FM has tracked itself into the corner of only bringing commodities, not unique services. • (GW) Autonomy to undertake innovation and investment in innovation are a client decision, and need investment to get this “Cheapest price, yes, but do I have innovation within the package before we price it? ” • (IF) Client may be fearful of this. Suppliers may withhold innovation.

Discussion Pre-Coffee • (IP) Procurement teams will buy services at peak prices from the Grade A suppliers that are perceived as bringing forward unique knowledge. • FM has tracked itself into the corner of only bringing commodities, not unique services. • (GW) Autonomy to undertake innovation and investment in innovation are a client decision, and need investment to get this “Cheapest price, yes, but do I have innovation within the package before we price it? ” • (IF) Client may be fearful of this. Suppliers may withhold innovation.

Discussion Pre-Coffee • (RT) Reverse Auctions not very well received by industry. Perceived a lowest cost, but this was not the case. Role is on due diligence to based decisions on value not cost (procurers often tended to focus on cost not value). Now in turn-around. • Whole industry needs to wake up to Client FM acting as an intelligent client and procuring what want on basis of value not cost • For example, Nissan - suppliers know that they need to invest to get innovation and to survive a very tough industry. Still works without a formal contract, just using a very specific SLA (inc. . JIT) and working in a partnership. JCI made this work successfully. • (SM) plus manufacturers invest heavily in suppliers, this is one difference. This also helps achieve a seamless arrangement. • So innovation is out there even in tough markets - key is how to develop the same sort of arrangement to get it in FM.

Discussion Pre-Coffee • (RT) Reverse Auctions not very well received by industry. Perceived a lowest cost, but this was not the case. Role is on due diligence to based decisions on value not cost (procurers often tended to focus on cost not value). Now in turn-around. • Whole industry needs to wake up to Client FM acting as an intelligent client and procuring what want on basis of value not cost • For example, Nissan - suppliers know that they need to invest to get innovation and to survive a very tough industry. Still works without a formal contract, just using a very specific SLA (inc. . JIT) and working in a partnership. JCI made this work successfully. • (SM) plus manufacturers invest heavily in suppliers, this is one difference. This also helps achieve a seamless arrangement. • So innovation is out there even in tough markets - key is how to develop the same sort of arrangement to get it in FM.

Discussion Pre-Coffee • (IP) contrast of inflexibility other than in a few organisations with buying unique knowledge. Much of frontline suppliers FM and internal FM are not bringing the business critical unique value to the table. Hence FM services are being sold as a lowest common denominator commodity, not a unique value service. Hence it is undervalued. • (GW) Acts as translator of business needs • Lack of standardisation in industry as a blocker. No SLA or terms/ rates standardised. Blocks Client FM scope to offer choices to core business. Need for common way forward. • (IP) there needs to be a distinction between (GW) “what do you want? ” versus accountant’s more successful “ what you need” approach • (IF) Similarity to HR - internal KPIs emphasis on communicating with the core business. • (IP) Difficulty of explaining the uniqueness of the service continue, and FM remains taxed to explain to the business in the terms of the business.

Discussion Pre-Coffee • (IP) contrast of inflexibility other than in a few organisations with buying unique knowledge. Much of frontline suppliers FM and internal FM are not bringing the business critical unique value to the table. Hence FM services are being sold as a lowest common denominator commodity, not a unique value service. Hence it is undervalued. • (GW) Acts as translator of business needs • Lack of standardisation in industry as a blocker. No SLA or terms/ rates standardised. Blocks Client FM scope to offer choices to core business. Need for common way forward. • (IP) there needs to be a distinction between (GW) “what do you want? ” versus accountant’s more successful “ what you need” approach • (IF) Similarity to HR - internal KPIs emphasis on communicating with the core business. • (IP) Difficulty of explaining the uniqueness of the service continue, and FM remains taxed to explain to the business in the terms of the business.

Discussion Pre-Coffee • (FC) distinction between change and innovation - looking for something completely different. Knowledge sharing within contracts do not offer true innovation • (JB to GD) Is innovation only an engine to just drive down cost…? • (GD) Need to innovate to grow the business. For example, bringing 3 businesses together, more from less space, different project management. Innovation is trying to meet the changing business needs. Cost is important not primary. • (SM) Efficiency and Effectiveness, cost is one dimension only? • (GD) Teams are already as tight as can get them. Not thinking time now… • (GW) 5 years fixed price contract, meanwhile business moved from 5 year to 3 year to 1 year to 3 month horizon…. Dilemma. Getting speed of response from industry is a key issue.

Discussion Pre-Coffee • (FC) distinction between change and innovation - looking for something completely different. Knowledge sharing within contracts do not offer true innovation • (JB to GD) Is innovation only an engine to just drive down cost…? • (GD) Need to innovate to grow the business. For example, bringing 3 businesses together, more from less space, different project management. Innovation is trying to meet the changing business needs. Cost is important not primary. • (SM) Efficiency and Effectiveness, cost is one dimension only? • (GD) Teams are already as tight as can get them. Not thinking time now… • (GW) 5 years fixed price contract, meanwhile business moved from 5 year to 3 year to 1 year to 3 month horizon…. Dilemma. Getting speed of response from industry is a key issue.

Discussion Pre-Coffee • (FC) 80% of change and innovation driven by client and then brought to fruition by partnering with the FM delivery teams from the suppliers. • How do we bring in knowledge then? . • (RT) How do partner suppliers bring forward new levels of knowledge - is embedding one answer?

Discussion Pre-Coffee • (FC) 80% of change and innovation driven by client and then brought to fruition by partnering with the FM delivery teams from the suppliers. • How do we bring in knowledge then? . • (RT) How do partner suppliers bring forward new levels of knowledge - is embedding one answer?

The Scenario Client Facilities Management Forum Prof. Roger Tanner

The Scenario Client Facilities Management Forum Prof. Roger Tanner

The Scenario - Lessons from NHS • Unprecedented rate of change but manage on the basis of the past. Conservatism is alive and well! • Low risk more of the same decisions predominate… • Not sustainable, how long can we go on like this? ! • Pressures Causing Demand Increase: Complexity is great … more options and expectations, more technology, new subsectors, rising customer expectations and demands… • Pressures Causing Demand Fall: In-patient accommodation reducing… complementary therapies, emerging new providers complementing mainstream (e. g, pharmacies) … new drugs and technologies cutting down conventional NHS concepts… lengths of stay reducing… day case rates increasing. . Less unused time for beds. . New players entering… primary care input increasing.

The Scenario - Lessons from NHS • Unprecedented rate of change but manage on the basis of the past. Conservatism is alive and well! • Low risk more of the same decisions predominate… • Not sustainable, how long can we go on like this? ! • Pressures Causing Demand Increase: Complexity is great … more options and expectations, more technology, new subsectors, rising customer expectations and demands… • Pressures Causing Demand Fall: In-patient accommodation reducing… complementary therapies, emerging new providers complementing mainstream (e. g, pharmacies) … new drugs and technologies cutting down conventional NHS concepts… lengths of stay reducing… day case rates increasing. . Less unused time for beds. . New players entering… primary care input increasing.

The Scenario - Lessons from NHS • Major players entering the PFI market during the last decade • NHS inward focus and belief in self specialism… PFI was about introducing innovation. • But now have provides with innovation and in house saying we can’t be taught anything • NHS FM not linked to the core business. . Subservient to clinical. Don’t believe can be innovative, await being told by clinicians. Same as GW point. Clinicians oftener more conservative than the FMs!! • So… what scope.

The Scenario - Lessons from NHS • Major players entering the PFI market during the last decade • NHS inward focus and belief in self specialism… PFI was about introducing innovation. • But now have provides with innovation and in house saying we can’t be taught anything • NHS FM not linked to the core business. . Subservient to clinical. Don’t believe can be innovative, await being told by clinicians. Same as GW point. Clinicians oftener more conservative than the FMs!! • So… what scope.

The Scenario - Lessons from NHS • Huge amount of uncertainty. Yet forecasting is based on past performance. (how many more beds. . Predominates) • Consumerism and expectations about NHS continue. • All major government decisions now have extensive public engagement. Major supplier players entering NHS with desire to eliminate the internal NHS FM. Issue is how to manage the major threat to the Client FM and they going direct to the clinicians.

The Scenario - Lessons from NHS • Huge amount of uncertainty. Yet forecasting is based on past performance. (how many more beds. . Predominates) • Consumerism and expectations about NHS continue. • All major government decisions now have extensive public engagement. Major supplier players entering NHS with desire to eliminate the internal NHS FM. Issue is how to manage the major threat to the Client FM and they going direct to the clinicians.

The Scenario - Dimensions • Demographic changes. . . • Workforce: Population forecasts suggest 40, 00 less in Grampian alone in the workforce (the 20 -59 age group across 2002 -2018). NHS will compete with Oil industry in this area. Have GOT to be innovative to sustain NHS in that context. • Capital Investment: public funding (not PFI increasing at enormous rate. Approaching £ 500 m pa new capital. • Add in PPP PFI as well, then circa £ 1 bn in total new capital scope… probably annually across next decade. • Massive programme of building and NHS extension • What if wrong FM skills and get say 10% error of investment on lost options or lost potential VFM through innovation.

The Scenario - Dimensions • Demographic changes. . . • Workforce: Population forecasts suggest 40, 00 less in Grampian alone in the workforce (the 20 -59 age group across 2002 -2018). NHS will compete with Oil industry in this area. Have GOT to be innovative to sustain NHS in that context. • Capital Investment: public funding (not PFI increasing at enormous rate. Approaching £ 500 m pa new capital. • Add in PPP PFI as well, then circa £ 1 bn in total new capital scope… probably annually across next decade. • Massive programme of building and NHS extension • What if wrong FM skills and get say 10% error of investment on lost options or lost potential VFM through innovation.

The Scenario - Issues • Frustrations at speed of projects coming in stream • Plus the (FM) inability to handle the 10 -20% rev cost tail consequential for the FM. • Question is, how do we manage the challenge of innovatively impacting on core business…. ? • How do we use FM to impact on the 75% spend value, not on the FM budget. This would be unique knowledge applied? • So, the challenge is can FM impact on the core business? • Managing innovation is about knowledge, skill and control of risks… Control of risk • Need fewer rules if we want to be innovative. • Express gains in terms of health improvement, for example as benefits of innovation in FM. .

The Scenario - Issues • Frustrations at speed of projects coming in stream • Plus the (FM) inability to handle the 10 -20% rev cost tail consequential for the FM. • Question is, how do we manage the challenge of innovatively impacting on core business…. ? • How do we use FM to impact on the 75% spend value, not on the FM budget. This would be unique knowledge applied? • So, the challenge is can FM impact on the core business? • Managing innovation is about knowledge, skill and control of risks… Control of risk • Need fewer rules if we want to be innovative. • Express gains in terms of health improvement, for example as benefits of innovation in FM. .

The Scenario - Issues • Connecting with core business improves the patient journey. The healing environment can impact on length of stay and therefore throughput of the core NHS. But very few people addressing this • Need for compatibility of innovations with stakeholders • For example, public associate good NHS service with buildings. . Not necessarily so! • Distinction between delivering services and having good buildings. Need to convince the clinicians that client FM can assist with the provision of better services, not just good buildings. • How to learn from the future before it happens. . .

The Scenario - Issues • Connecting with core business improves the patient journey. The healing environment can impact on length of stay and therefore throughput of the core NHS. But very few people addressing this • Need for compatibility of innovations with stakeholders • For example, public associate good NHS service with buildings. . Not necessarily so! • Distinction between delivering services and having good buildings. Need to convince the clinicians that client FM can assist with the provision of better services, not just good buildings. • How to learn from the future before it happens. . .

The Scenario - Delivering Innovation • Needs Include: Training & Education; Shared Resources, Learning from Best practice • Problems: Staff Morale: Silos; Lack of Common understanding of definitions; lack of general mgt expertise; lack of performance measurement credibility • Need to have a long term vision … • Evidence based research needed … • Knowledge management … • Creativity … • Effective Decision Making. . . • Customer Engagement. . . • Fast Track Implementation … • Continuous Improvements and Evaluation (not done) … • Management of Change. . . • Future Proofing. . .

The Scenario - Delivering Innovation • Needs Include: Training & Education; Shared Resources, Learning from Best practice • Problems: Staff Morale: Silos; Lack of Common understanding of definitions; lack of general mgt expertise; lack of performance measurement credibility • Need to have a long term vision … • Evidence based research needed … • Knowledge management … • Creativity … • Effective Decision Making. . . • Customer Engagement. . . • Fast Track Implementation … • Continuous Improvements and Evaluation (not done) … • Management of Change. . . • Future Proofing. . .

The Scenario - Why? • Planning Services as well as Buildings! • Preparing for Possible Futures • Prepare to Change Rapidly • Good for Changing Mind Sets • Prepare Multiple Futures and Using Scenarios to Imagine the Possible Futures • Use as a learning tool. • Imagining the possibility of the impossible.

The Scenario - Why? • Planning Services as well as Buildings! • Preparing for Possible Futures • Prepare to Change Rapidly • Good for Changing Mind Sets • Prepare Multiple Futures and Using Scenarios to Imagine the Possible Futures • Use as a learning tool. • Imagining the possibility of the impossible.

The Scenario - Types • BAU • Transformation - ‘the great turning’ • Downsizing • Upsizing • etc… • NHS Grampian Scenarios indicate a wide range of implications between most extreme scenarios. . Massive increase versus massive increase. . . • Combining innovation and change as well as cost extraction?

The Scenario - Types • BAU • Transformation - ‘the great turning’ • Downsizing • Upsizing • etc… • NHS Grampian Scenarios indicate a wide range of implications between most extreme scenarios. . Massive increase versus massive increase. . . • Combining innovation and change as well as cost extraction?

Discussion

Discussion

Discussion • Need to draw the distinction between savings on FM and savings on business through FM innovation • (IF) Small changes impacting on major core business issues can gross up significantly and yield core business leverage from FM innovation. • (GW) Core Business - stopping investment cycles ‘because better at keeping portfolio going; but building up problems/ backlog over a depreciating asset portfolio with a backlog maintenance implication. • (GH) Need for Thinking Time and basics such as Asset Register/ Helpdesk investments. How do achieve sparkling maintenance rates without access to maintain? Different relationships role of the building. • (IF) Quality Thinking Time needed for the Client FM, plus how train for blue-sky thinking.

Discussion • Need to draw the distinction between savings on FM and savings on business through FM innovation • (IF) Small changes impacting on major core business issues can gross up significantly and yield core business leverage from FM innovation. • (GW) Core Business - stopping investment cycles ‘because better at keeping portfolio going; but building up problems/ backlog over a depreciating asset portfolio with a backlog maintenance implication. • (GH) Need for Thinking Time and basics such as Asset Register/ Helpdesk investments. How do achieve sparkling maintenance rates without access to maintain? Different relationships role of the building. • (IF) Quality Thinking Time needed for the Client FM, plus how train for blue-sky thinking.

Discussion • (PMc. L) Manufacturing analogies predominate but FM is actually a service business? For example, learn more from customers by engaging with customers where you trade through your space. FM akin to a service operations manager. • Paradigm shift needed to a service delivery model and how to help the organisation attract or retain customers through the buildings. The customer issue is key. • (IP) 110% is dangerous, especially at bottlenecks. • How to switch this around to FM bottlenecks. • Perhaps business at 110% of time is the bottleneck… • Maybe 110% is blocking efficiency of the whole business if it is at the bottleneck. • ‘The Goal’ - Lee Goldrat? • (GD) Key is having skills to plug the gap… especially where knowledge lies with the FM.

Discussion • (PMc. L) Manufacturing analogies predominate but FM is actually a service business? For example, learn more from customers by engaging with customers where you trade through your space. FM akin to a service operations manager. • Paradigm shift needed to a service delivery model and how to help the organisation attract or retain customers through the buildings. The customer issue is key. • (IP) 110% is dangerous, especially at bottlenecks. • How to switch this around to FM bottlenecks. • Perhaps business at 110% of time is the bottleneck… • Maybe 110% is blocking efficiency of the whole business if it is at the bottleneck. • ‘The Goal’ - Lee Goldrat? • (GD) Key is having skills to plug the gap… especially where knowledge lies with the FM.

Discussion • (JB) Do we need to shift focus altogether? • (RT) Time difficulties for rethinking positions • (IF) Limited training of core business, limited language • Is the lack of business language that is creating the blockage? • (GH) Use of consistent language as a great aid. • (JB) Challenge of getting things happening, getting a connection to the core business. Ambassadorial role needed in getting scope illustrated to all. • (SM) How many of the Client FM have had the business management and strategy development to make the value add…

Discussion • (JB) Do we need to shift focus altogether? • (RT) Time difficulties for rethinking positions • (IF) Limited training of core business, limited language • Is the lack of business language that is creating the blockage? • (GH) Use of consistent language as a great aid. • (JB) Challenge of getting things happening, getting a connection to the core business. Ambassadorial role needed in getting scope illustrated to all. • (SM) How many of the Client FM have had the business management and strategy development to make the value add…

Discussion • (JB) Is it always possible to take people into this mind shift as drivers of innovation? Can PFI solve this? • (RT) Not really - recycling of folk happening. A key need for the right people. • (GW) Silos form narrowness. But deep. Articulate advantage. • Afternoon Sessions • (RT) Learning lessons from other industries. Capturing Knowledge back into in-house team. • (EF/P) Vulnerability to suppliers. Capturing Knowledge back into in-house team.

Discussion • (JB) Is it always possible to take people into this mind shift as drivers of innovation? Can PFI solve this? • (RT) Not really - recycling of folk happening. A key need for the right people. • (GW) Silos form narrowness. But deep. Articulate advantage. • Afternoon Sessions • (RT) Learning lessons from other industries. Capturing Knowledge back into in-house team. • (EF/P) Vulnerability to suppliers. Capturing Knowledge back into in-house team.

Lessons from Other Industries Group

Lessons from Other Industries Group

Lessons from Other Industries • Scope • All sectors are process driven • What processes are business critical • Time and resources needed to use knowledge • Need to identify endeavours • infrastructure has to be in place to support the use of knowledge. • BIFM training should be client-led.

Lessons from Other Industries • Scope • All sectors are process driven • What processes are business critical • Time and resources needed to use knowledge • Need to identify endeavours • infrastructure has to be in place to support the use of knowledge. • BIFM training should be client-led.

Lessons from Other Industries • Barriers • can’t stop to take time out • lack of culture of innovation • risk of failure/ unknown • no time for failure • lack of stories from our own world • sharing knowledge is acceptable

Lessons from Other Industries • Barriers • can’t stop to take time out • lack of culture of innovation • risk of failure/ unknown • no time for failure • lack of stories from our own world • sharing knowledge is acceptable

Lessons from Other Industries • Overcoming Barriers • changing culture • alignment of values • focus on leadership rather than just management • selective hiring from other industries? • first turn of the centrifuge is critical

Lessons from Other Industries • Overcoming Barriers • changing culture • alignment of values • focus on leadership rather than just management • selective hiring from other industries? • first turn of the centrifuge is critical

Lessons from Other Industries • From Knowledge to Benefit • can’t stop to take time out • structure needed • need to be flexible how knowledge is used • benefit must be to the customer

Lessons from Other Industries • From Knowledge to Benefit • can’t stop to take time out • structure needed • need to be flexible how knowledge is used • benefit must be to the customer

Lessons from Other Industries • Action Plan • we do need to continue the discussion! • we need to commit to a journey • cannot do it alone as clients • client led group needs to be proactive in developing a way forward for BIFM • Forum should drive BIFM as a conduit • getting examples disseminated • size of the forum should be big enough to influence industry; look to client corporates? • bring a buddy for the next forum meeting? • need to start communicating today’s outcomes now!

Lessons from Other Industries • Action Plan • we do need to continue the discussion! • we need to commit to a journey • cannot do it alone as clients • client led group needs to be proactive in developing a way forward for BIFM • Forum should drive BIFM as a conduit • getting examples disseminated • size of the forum should be big enough to influence industry; look to client corporates? • bring a buddy for the next forum meeting? • need to start communicating today’s outcomes now!

Vulnerability to Suppliers Group

Vulnerability to Suppliers Group

Vulnerability to Suppliers • US Military supply chain and network analysis for vulnerability • hierarchy more vulnerable than typology • vulnerability and survivability not an issue in FM sector • (1) many of the services than are procured from outsourced providers are already commoditised, and therefore suppliers are switchable • (2) not all the business activities are business critical in the same context as the military • (3) emphasis should be on modelling risk so that vulnerability chains are removed (someone else’s problem). Oil industry example (H&S for example) then we are all involved. Here the risk is not outsourced. • Capturing knowledge from the industry (not a networking model needed) • Uniqueness of buildings mandates period of training/ familiarisation with specific buildings. • How to capture this for repetition? Structured methods will need IP consideration to be taken into place (within the contract as a distinct contract issue)? Scope in construction industry perhaps?

Vulnerability to Suppliers • US Military supply chain and network analysis for vulnerability • hierarchy more vulnerable than typology • vulnerability and survivability not an issue in FM sector • (1) many of the services than are procured from outsourced providers are already commoditised, and therefore suppliers are switchable • (2) not all the business activities are business critical in the same context as the military • (3) emphasis should be on modelling risk so that vulnerability chains are removed (someone else’s problem). Oil industry example (H&S for example) then we are all involved. Here the risk is not outsourced. • Capturing knowledge from the industry (not a networking model needed) • Uniqueness of buildings mandates period of training/ familiarisation with specific buildings. • How to capture this for repetition? Structured methods will need IP consideration to be taken into place (within the contract as a distinct contract issue)? Scope in construction industry perhaps?

Innovation at RBS Group Workplace Operations

Innovation at RBS Group Workplace Operations

RBS GWO Innovation Case Study • Innovation as a Competitiveness Issue • “It’s a people thing …” Innovation an integral part of the way of working • Visible commitment to investment in innovation (manager role) • Business Advantage by Doing Different Things (not just doing things differently) • Looking over The Horizon • Make a Unique & Irreplaceable Business Contribution - Intellectual Capital • Making it easy for people to propose innovative ideas (Inncuvators/ seedcorn) • Talking and Thinking The Business of The Business • Visibility - Narrative-Based Enquiry Techniques • Effectiveness before Efficiency • Workplace Innovation Centre (Service Innovation theme) • Blue Sky - RBS Ph. D Challenge • Time, Priority, Culture on Innovation and Shadowing/ Piloting • Reward innovativeness, not just Innovations Tom Stewart - The Wealth of Knowledge

RBS GWO Innovation Case Study • Innovation as a Competitiveness Issue • “It’s a people thing …” Innovation an integral part of the way of working • Visible commitment to investment in innovation (manager role) • Business Advantage by Doing Different Things (not just doing things differently) • Looking over The Horizon • Make a Unique & Irreplaceable Business Contribution - Intellectual Capital • Making it easy for people to propose innovative ideas (Inncuvators/ seedcorn) • Talking and Thinking The Business of The Business • Visibility - Narrative-Based Enquiry Techniques • Effectiveness before Efficiency • Workplace Innovation Centre (Service Innovation theme) • Blue Sky - RBS Ph. D Challenge • Time, Priority, Culture on Innovation and Shadowing/ Piloting • Reward innovativeness, not just Innovations Tom Stewart - The Wealth of Knowledge

RBS GWO Innovation Case Study • Customer Capital focus • Development of Intellectual Capital • Innovation Council and Innovation Ambassadors • Champions, Innovation Challenges, Reinforcement Behaviours • Innovation Round Table - Suppler Innovation Management HW /Reading • Managing Expertise as well as knowledge - learning from each other • Link People Development, Innovation, & Education - Eng. D, MSc, Masterclass

RBS GWO Innovation Case Study • Customer Capital focus • Development of Intellectual Capital • Innovation Council and Innovation Ambassadors • Champions, Innovation Challenges, Reinforcement Behaviours • Innovation Round Table - Suppler Innovation Management HW /Reading • Managing Expertise as well as knowledge - learning from each other • Link People Development, Innovation, & Education - Eng. D, MSc, Masterclass

Summary of The Day

Summary of The Day

Summary of the Day • Scope for private sector to learn from the public sector (NHS example) • As a Client Forum it was engineered in recognition by BIFM of specific and different needs to suppliers. • Looked at who the drivers for the industry were. Clients as the driver. • Feedback capturing - is there a need for a wider Client Forum? • A case study on Innovation in RBS - thinking, innovation, and implementation… • Leadership-not-Management a key message for BIFM

Summary of the Day • Scope for private sector to learn from the public sector (NHS example) • As a Client Forum it was engineered in recognition by BIFM of specific and different needs to suppliers. • Looked at who the drivers for the industry were. Clients as the driver. • Feedback capturing - is there a need for a wider Client Forum? • A case study on Innovation in RBS - thinking, innovation, and implementation… • Leadership-not-Management a key message for BIFM

Summary of the Day • Needs development and to be taken forward. Needs a wider client base for the views to grow and the word to spread • Great ideas - interested in how the supplier view emerges before going forward. • Thinking time, good use of time. Useful, interested in progressing. • Lived up to aspirations. Is business critical from the FM perspective; with client driving BIFM not vice versa. Scope for tangible and real outputs for client FM organisations through BIFM as a conduit, and hope to see if go forward to generate real Intellectual Capital for the FM sector. • Don’t stop the momentum or the enthusiasm. Lots of good work, keep it going. • Great enthusiasm for the potential of BIFM. Encourage innovation is not something that follows down single channels it is a network issue, BIFM reinforcing of innovation network opportunities.

Summary of the Day • Needs development and to be taken forward. Needs a wider client base for the views to grow and the word to spread • Great ideas - interested in how the supplier view emerges before going forward. • Thinking time, good use of time. Useful, interested in progressing. • Lived up to aspirations. Is business critical from the FM perspective; with client driving BIFM not vice versa. Scope for tangible and real outputs for client FM organisations through BIFM as a conduit, and hope to see if go forward to generate real Intellectual Capital for the FM sector. • Don’t stop the momentum or the enthusiasm. Lots of good work, keep it going. • Great enthusiasm for the potential of BIFM. Encourage innovation is not something that follows down single channels it is a network issue, BIFM reinforcing of innovation network opportunities.

Summary of the Day • Networking benefits keen to hear what industry says. Encourage a similar approach to the bid FM suppliers. Useful for the educational link. • Good day. FM has got to start thinking of its business customers, not the internal business units. If Fm is not explaining its value tot he real customers. Re-examining the narratives and the views between people’s ears. • Valuable interesting themes that need to built upon. Need to keep momentum up and a focus on what is coming out of it - to go beyond a social network. • Acknowledging similarity of problems useful, now need to get suppliers round the table too. Potential. • Valuable as a listening exercise to ensure relevance of research directions. • Interested in mutual learning/ exchanges scope. Would like to see the NHS and other public sector major clients involved. • All to provide a one-liner on the outcome from the day.

Summary of the Day • Networking benefits keen to hear what industry says. Encourage a similar approach to the bid FM suppliers. Useful for the educational link. • Good day. FM has got to start thinking of its business customers, not the internal business units. If Fm is not explaining its value tot he real customers. Re-examining the narratives and the views between people’s ears. • Valuable interesting themes that need to built upon. Need to keep momentum up and a focus on what is coming out of it - to go beyond a social network. • Acknowledging similarity of problems useful, now need to get suppliers round the table too. Potential. • Valuable as a listening exercise to ensure relevance of research directions. • Interested in mutual learning/ exchanges scope. Would like to see the NHS and other public sector major clients involved. • All to provide a one-liner on the outcome from the day.