f8a89d9d361d6827f4f7762b0bf25bfb.ppt

- Количество слайдов: 65

Welcome back Atef Abuelaish 1

Welcome back time for any Question Atef Abuelaish 2

Atef Abuelaish 3

chapter # 08 re. Vie. W Atef Abuelaish 4

chapter 08 accounting for purchases, Atef Abuelaish 5

chapter 08 accounting for purchases, accounts payable, and Atef Abuelaish 6

chapter 08 accounting for purchases, accounts payable, and Atef Abuelaish cash payments 7

Chapter 8 Accounting for Purchases, Accounts Payable and Cash Payments Section 2: Accounts Payable Section Objectives 8 -3 Post from the general journal to the general ledger accounts. 8 -4 Post transactions to the accounts payable subsidiary ledger. 8 -5 Prepare a schedule of accounts payable. 8 -6 Demonstrate a knowledge of the procedures for effective internal control of purchases. 8 -7 Record purchases, sales, returns, cash payments, and cash receipts using the perpetual inventory system. Atef Abuelaish 8

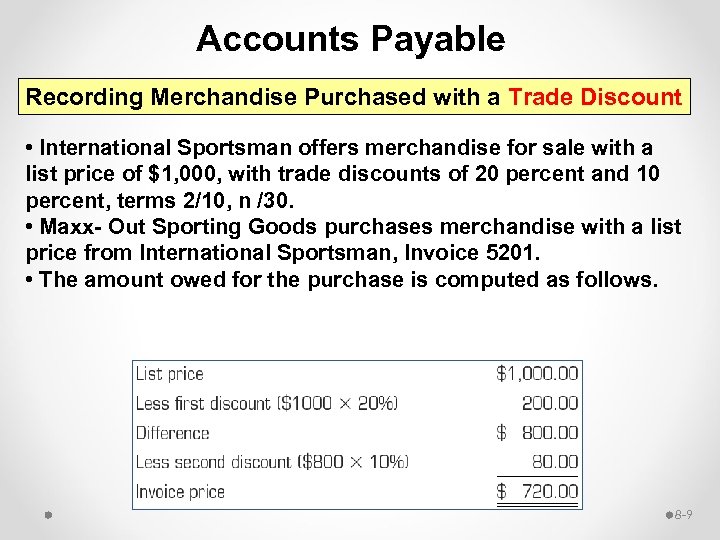

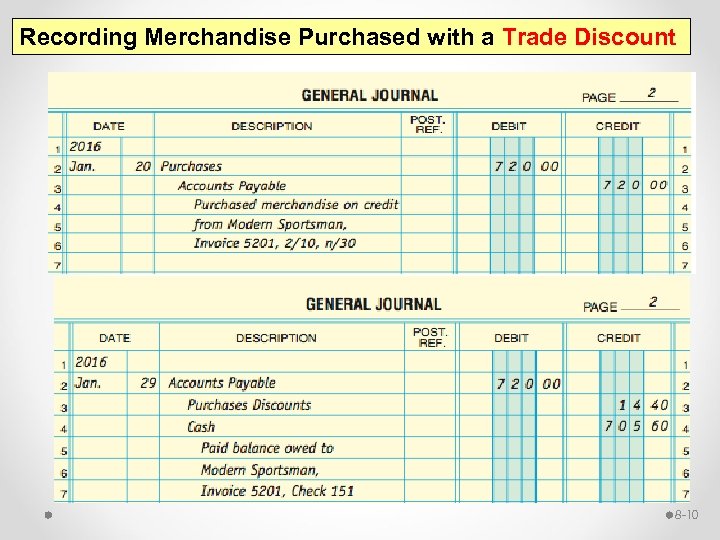

Accounts Payable Recording Merchandise Purchased with a Trade Discount • International Sportsman offers merchandise for sale with a list price of $1, 000, with trade discounts of 20 percent and 10 percent, terms 2/10, n /30. • Maxx- Out Sporting Goods purchases merchandise with a list price from International Sportsman, Invoice 5201. • The amount owed for the purchase is computed as follows. 8 -9

Recording Merchandise Purchased with a Trade Discount 8 -10

Post from the general journal to the general ledger accounts. • Posting to the general ledger is done in the same manner as demonstrated in Chapter 4. 8 -11

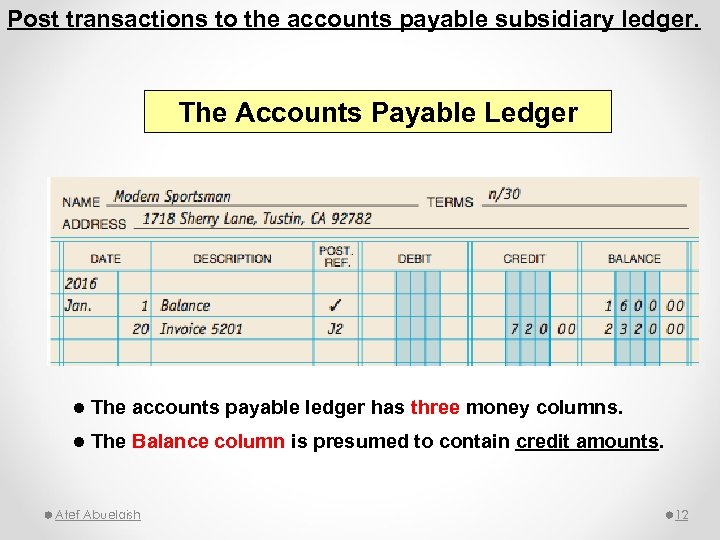

Post transactions to the accounts payable subsidiary ledger. The Accounts Payable Ledger l The accounts payable ledger has three money columns. l The Balance column is presumed to contain credit amounts. Atef Abuelaish 12

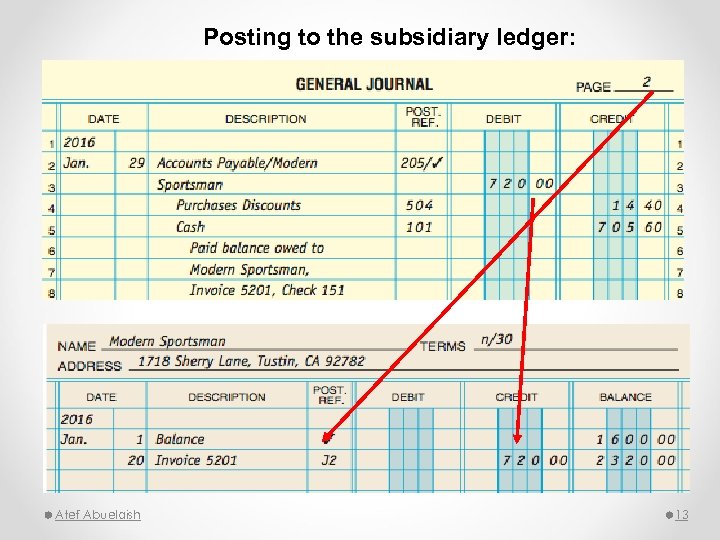

Posting to the subsidiary ledger: Atef Abuelaish 13

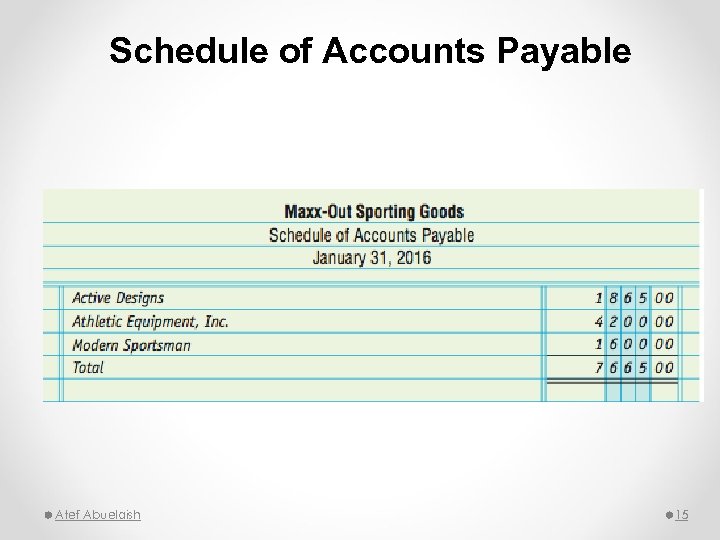

Prepare a schedule of accounts payable. • The total of the individual creditor accounts in the subsidiary ledger must equal the balance of the Accounts Payable control account. • To prove that the control account and the subsidiary ledger are equal, businesses prepare a schedule of accounts payable. Atef Abuelaish 14

Schedule of Accounts Payable Atef Abuelaish 15

Demonstrate a knowledge of the procedures for effective internal control of purchases. Atef Abuelaish 16

Internal Control of Purchases The objectives of the controls are to: • Create written proof that purchases and payments are authorized; • Ensure that different people are involved in the process of buying goods, receiving goods, and making payments. Atef Abuelaish 17

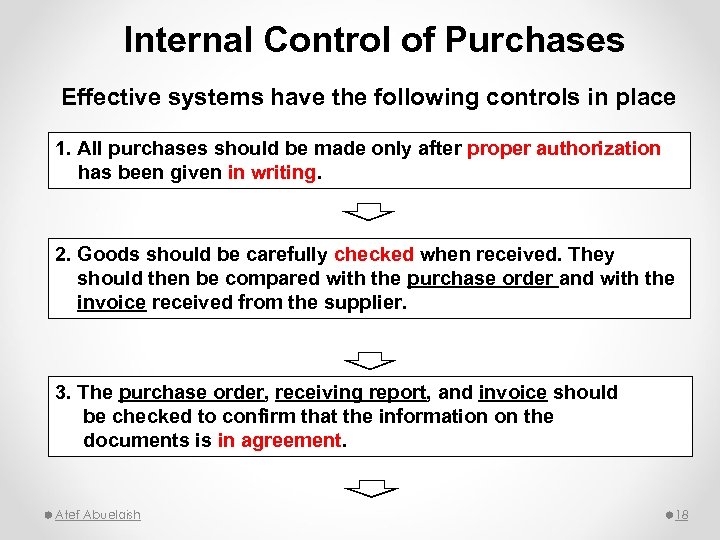

Internal Control of Purchases Effective systems have the following controls in place 1. All purchases should be made only after proper authorization has been given in writing. 2. Goods should be carefully checked when received. They should then be compared with the purchase order and with the invoice received from the supplier. 3. The purchase order, receiving report, and invoice should be checked to confirm that the information on the documents is in agreement. Atef Abuelaish 18

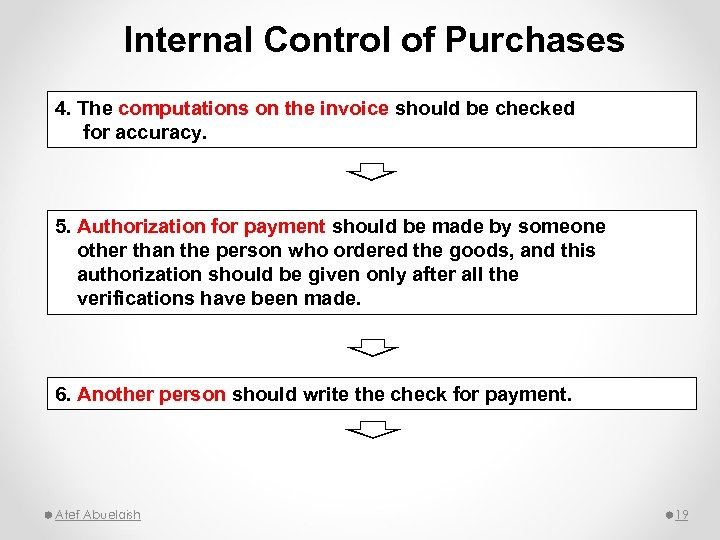

Internal Control of Purchases 4. The computations on the invoice should be checked for accuracy. 5. Authorization for payment should be made by someone other than the person who ordered the goods, and this authorization should be given only after all the verifications have been made. 6. Another person should write the check for payment. Atef Abuelaish 19

Internal Control of Purchases 7. Prenumbered forms should be used for purchase requisitions, purchase orders, and checks. Periodically the numbers of the documents issued should be verified to make sure that all forms can be accounted for. Atef Abuelaish 20

Record purchases, sales, returns, cash payments, and cash receipts using the perpetual inventory system. Atef Abuelaish 21

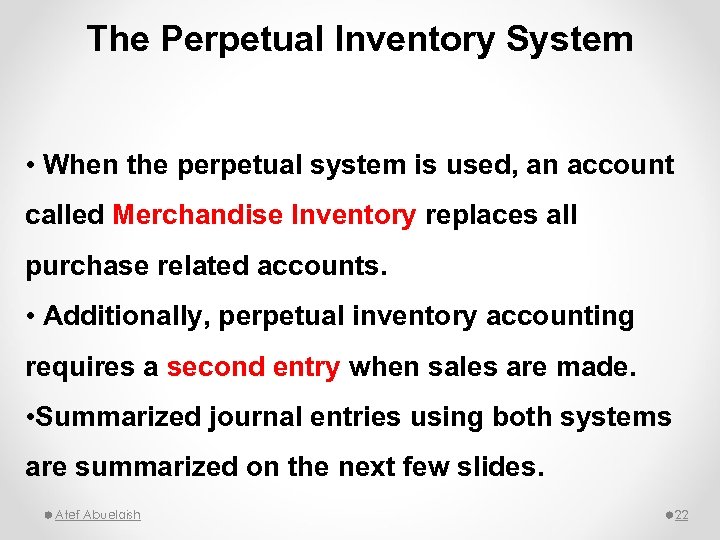

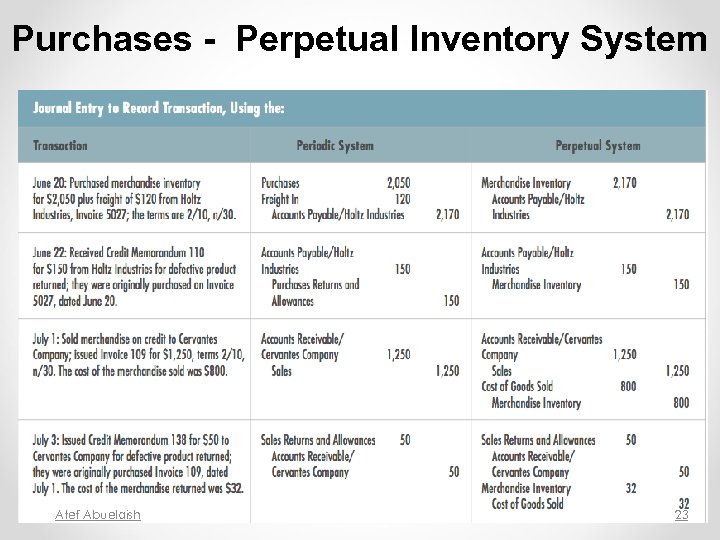

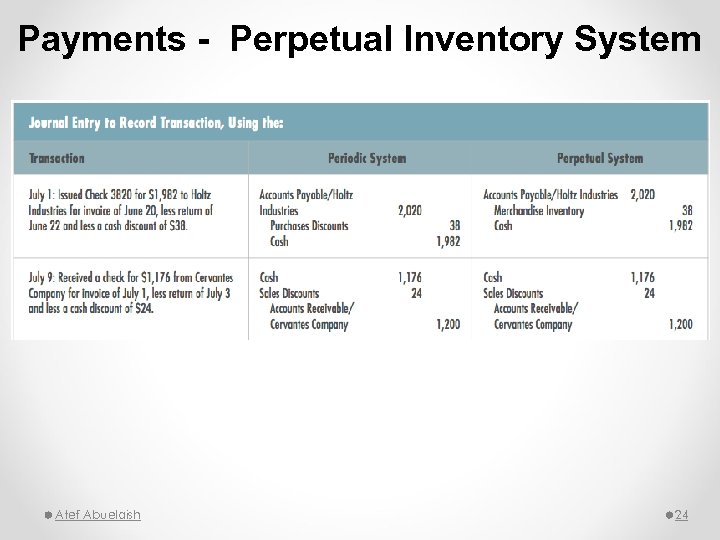

The Perpetual Inventory System • When the perpetual system is used, an account called Merchandise Inventory replaces all purchase related accounts. • Additionally, perpetual inventory accounting requires a second entry when sales are made. • Summarized journal entries using both systems are summarized on the next few slides. Atef Abuelaish 22

Purchases - Perpetual Inventory System Atef Abuelaish 23

Payments - Perpetual Inventory System Atef Abuelaish 24

chapter 09 cash Chapter 9 Section 1: Cash Receipts Section Objective 9 -1 Account for cash short or over. Atef Abuelaish 25

The type of cash receipts depends on the nature of the business. l Supermarkets receive checks as well as currency and coins. l Department stores receive checks in the mail from charge account customers. l Wholesalers usually receive cash in the form of checks. Atef Abuelaish 26

Account for Cash Short or Over. l Occasionally errors occur when making change. l The cash in the cash register is either more or less than the cash listed on the cash register tape. l When cash receipts are more than the sales as per the cash register tape, cash is over. l When cash receipts are less than the sales as per the cash register tape, cash is short. Atef Abuelaish 27

Account for Cash Short or Over l Cash tends to be short more often than over because customers are more likely to notice and complain if they receive too little change. l Cash short or over amounts are recorded in the Cash Short or Over account l A credit balance in the account is an overage, that is treated as revenue. l Similarly if there is a debit balance in the account, there is a shortage ( treated as expense). Atef Abuelaish 28

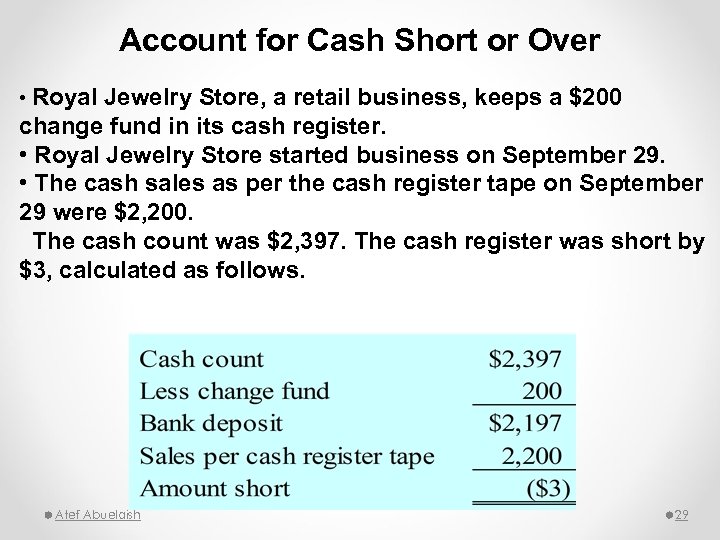

Account for Cash Short or Over • Royal Jewelry Store, a retail business, keeps a $200 change fund in its cash register. • Royal Jewelry Store started business on September 29. • The cash sales as per the cash register tape on September 29 were $2, 200. The cash count was $2, 397. The cash register was short by $3, calculated as follows. Atef Abuelaish 29

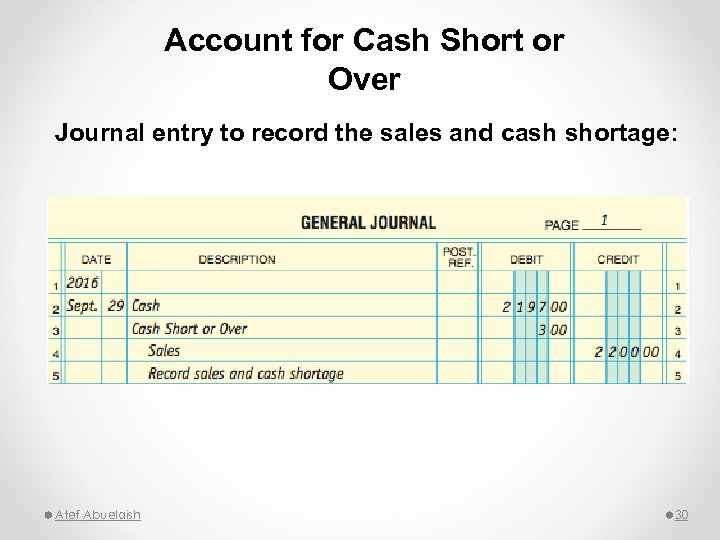

Account for Cash Short or Over Journal entry to record the sales and cash shortage: Atef Abuelaish 30

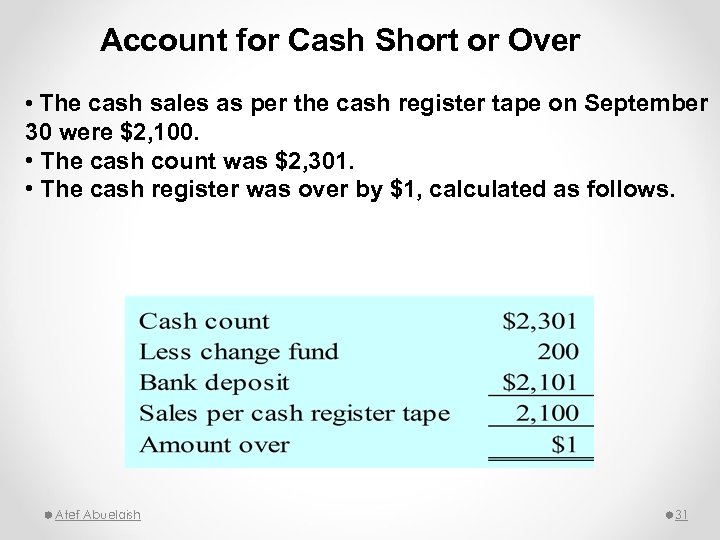

Account for Cash Short or Over • The cash sales as per the cash register tape on September 30 were $2, 100. • The cash count was $2, 301. • The cash register was over by $1, calculated as follows. Atef Abuelaish 31

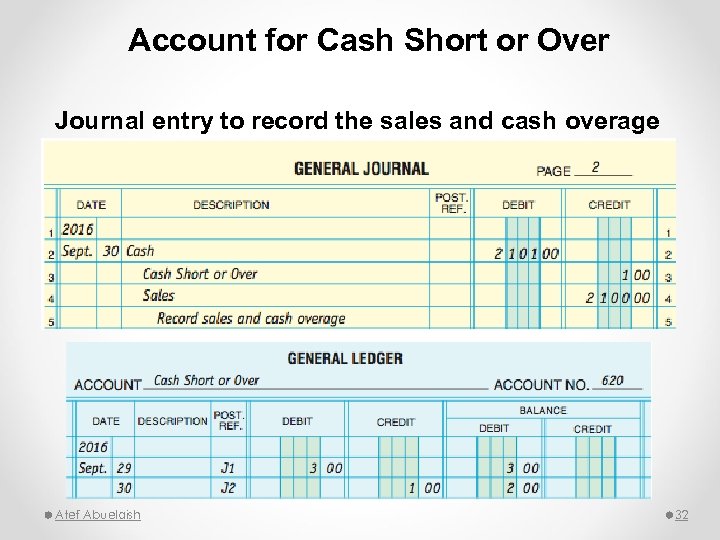

Account for Cash Short or Over Journal entry to record the sales and cash overage Atef Abuelaish 32

Cash Received on Account • Generally a business makes sales on account and bills customers once after a specified period (say, a month. ) • It sends a statement of account that shows the transactions during the month and the balance owed. • Checks from credit customers are journalized and posted, and then the checks are deposited in the bank. Atef Abuelaish 33

Promissory Note A promissory note is a written promise to pay a specified amount of money on a certain date. Promissory notes are specified interest bearing notes. They are used by businesses to extent credit. Also used to replace an accounts receivable balance when an account is overdue. Atef Abuelaish 34

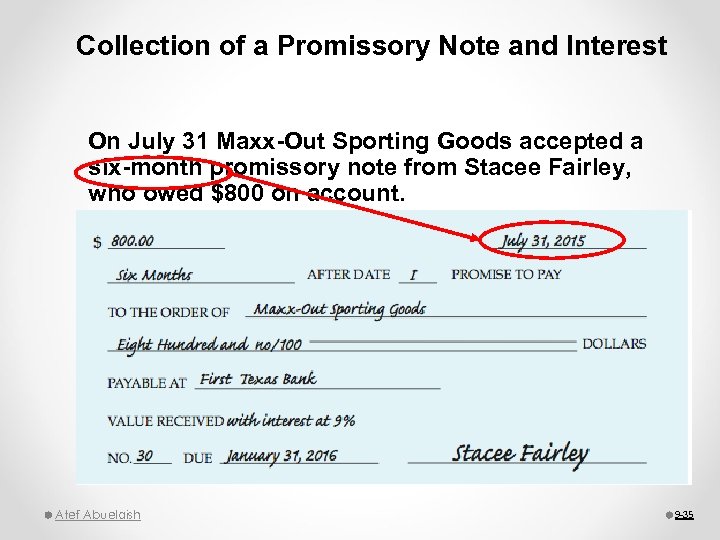

Collection of a Promissory Note and Interest On July 31 Maxx-Out Sporting Goods accepted a six-month promissory note from Stacee Fairley, who owed $800 on account. Atef Abuelaish 9 -35

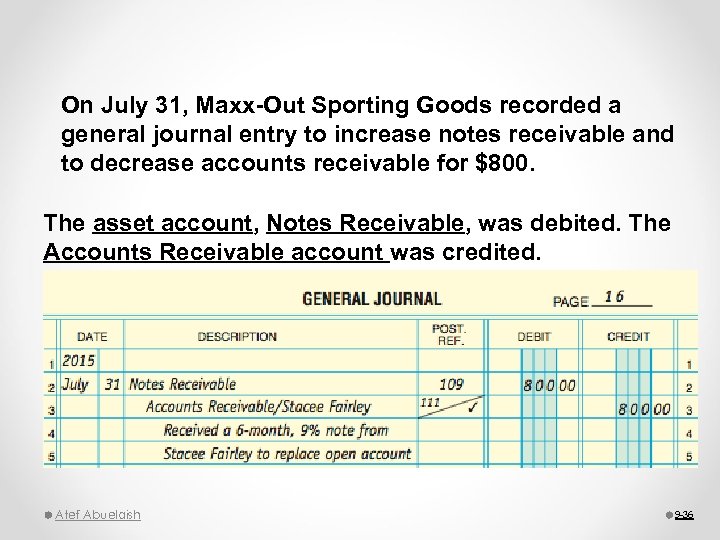

On July 31, Maxx-Out Sporting Goods recorded a general journal entry to increase notes receivable and to decrease accounts receivable for $800. The asset account, Notes Receivable, was debited. The Accounts Receivable account was credited. Atef Abuelaish 9 -36

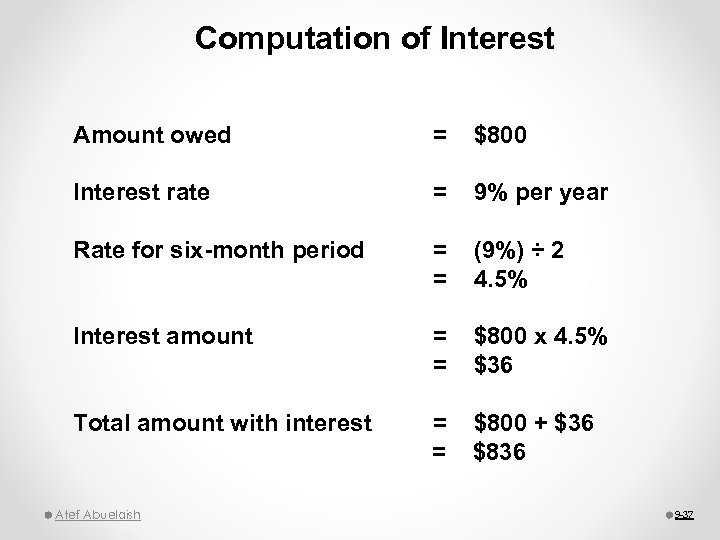

Computation of Interest Amount owed = $800 Interest rate = 9% per year Rate for six-month period = = (9%) ÷ 2 4. 5% Interest amount = = $800 x 4. 5% $36 Total amount with interest = = $800 + $36 $836 Atef Abuelaish 9 -37

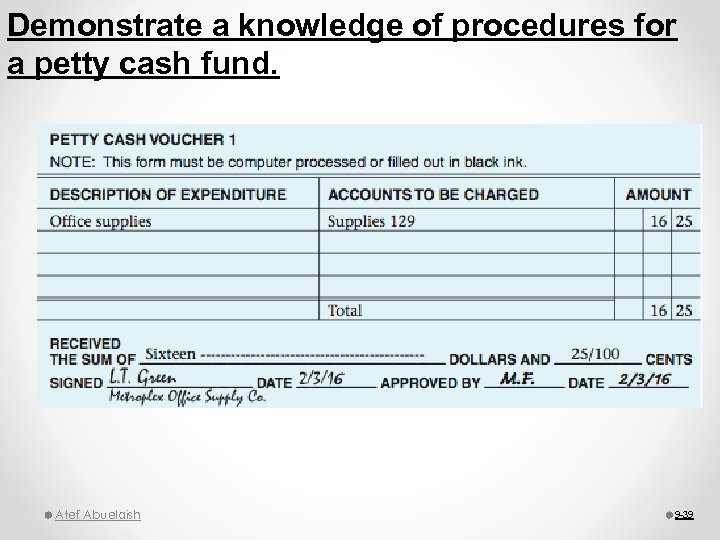

Chapter 9 cash Section 2: Petty Cash and Internal Controls for Cash Section Objectives 9 -2 Demonstrate a knowledge of procedures for a petty cash fund. 9 -3 Demonstrate a knowledge of internal control routines for cash. Atef Abuelaish 9 -38

Demonstrate a knowledge of procedures for a petty cash fund. Atef Abuelaish 9 -39

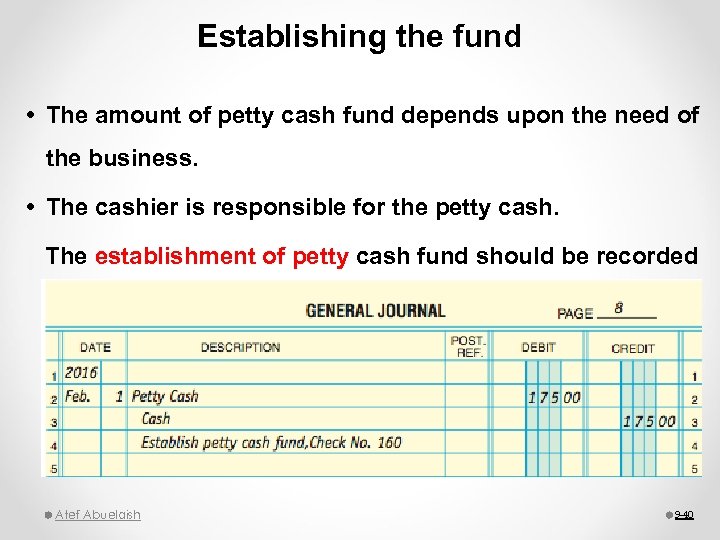

Establishing the fund The amount of petty cash fund depends upon the need of the business. The cashier is responsible for the petty cash. The establishment of petty cash fund should be recorded as: Atef Abuelaish 9 -40

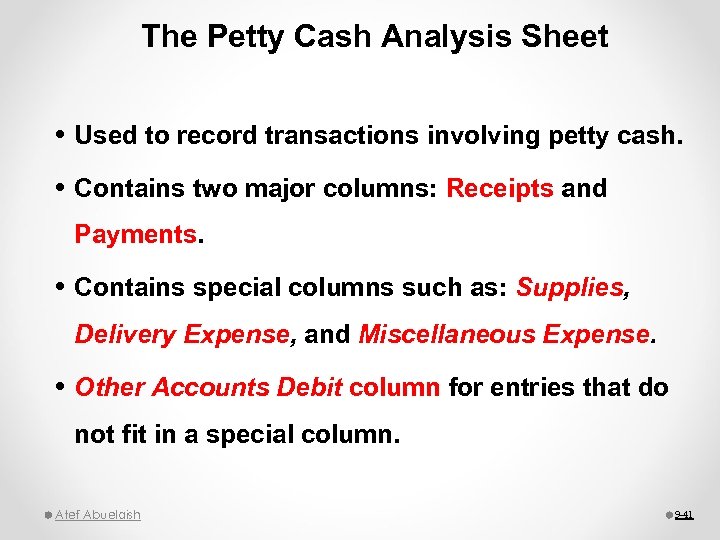

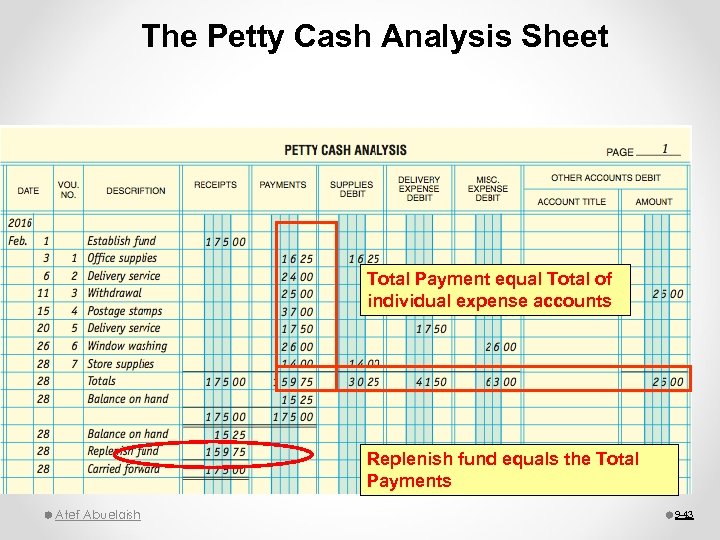

The Petty Cash Analysis Sheet Used to record transactions involving petty cash. Contains two major columns: Receipts and Payments. Contains special columns such as: Supplies, Delivery Expense, and Miscellaneous Expense. Other Accounts Debit column for entries that do not fit in a special column. Atef Abuelaish 9 -41

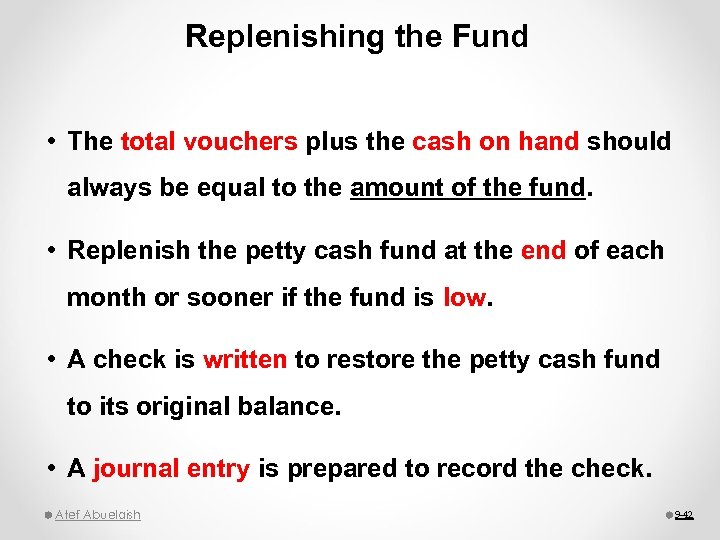

Replenishing the Fund • The total vouchers plus the cash on hand should always be equal to the amount of the fund. • Replenish the petty cash fund at the end of each month or sooner if the fund is low. • A check is written to restore the petty cash fund to its original balance. • A journal entry is prepared to record the check. Atef Abuelaish 9 -42

The Petty Cash Analysis Sheet Total Payment equal Total of individual expense accounts Replenish fund equals the Total Payments Atef Abuelaish 9 -43

Internal Control Procedures The following internal control procedures apply to petty cash: 1. Use the petty cash fund only for small payments that cannot conveniently be made by check. 2. Limit the amount set aside for petty cash to the approximate amount needed to cover one month's payments from the fund. 3. Write petty cash fund checks to the person in charge of the fund, not to the order of "Cash. " Atef Abuelaish 9 -44

Internal Control Procedures 4. Assign one person to control the petty cash fund. This person has sole control of the money and is the only one authorized to make payments from the fund. 5. Keep petty cash in a safe, a locked cash box, or a locked drawer. 6. Obtain a petty cash voucher for each payment. The voucher should be signed by the person who receives the money and should show the payment details. This provides an audit trail for the fund. Atef Abuelaish 9 -45

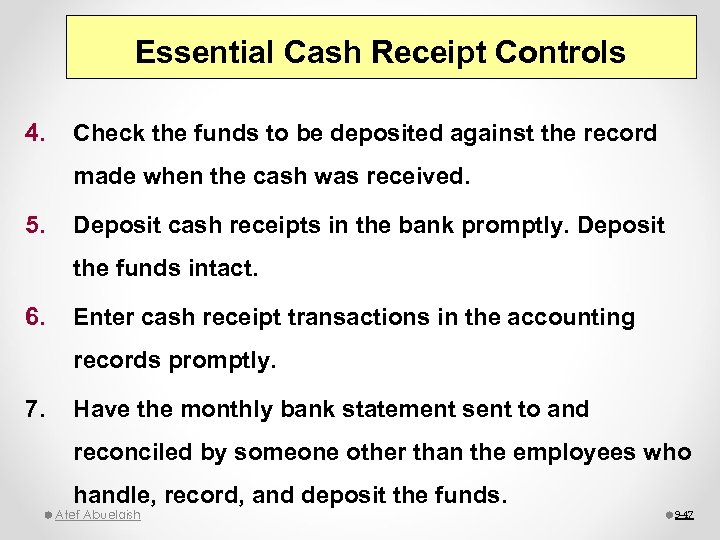

Demonstrate a knowledge of internal control routines for cash. Essential Cash Receipt Controls 1. Have only designated employees receive and handle cash. In some businesses employees handling cash are bonded. 2. Keep cash receipts in a cash register, a locked cash drawer, or a safe while they are on the premises. 3. Make a record of all cash receipts as the funds come into the business. Atef Abuelaish 9 -46

Essential Cash Receipt Controls 4. Check the funds to be deposited against the record made when the cash was received. 5. Deposit cash receipts in the bank promptly. Deposit the funds intact. 6. Enter cash receipt transactions in the accounting records promptly. 7. Have the monthly bank statement sent to and reconciled by someone other than the employees who handle, record, and deposit the funds. Atef Abuelaish 9 -47

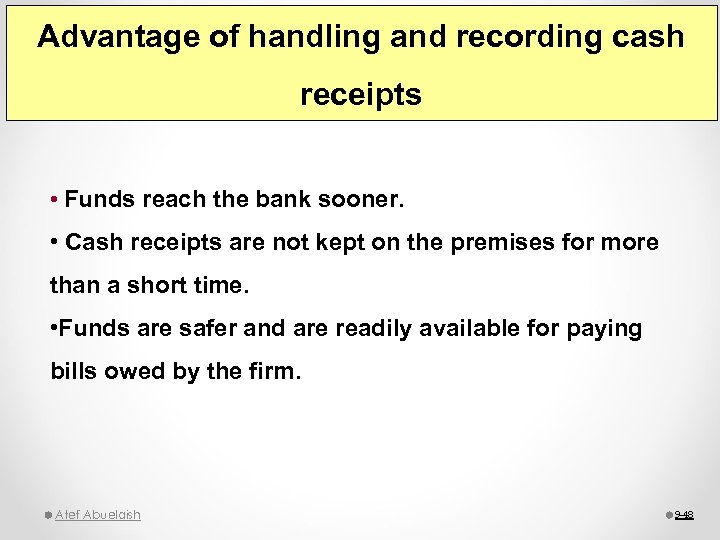

Advantage of handling and recording cash receipts • Funds reach the bank sooner. • Cash receipts are not kept on the premises for more than a short time. • Funds are safer and are readily available for paying bills owed by the firm. Atef Abuelaish 9 -48

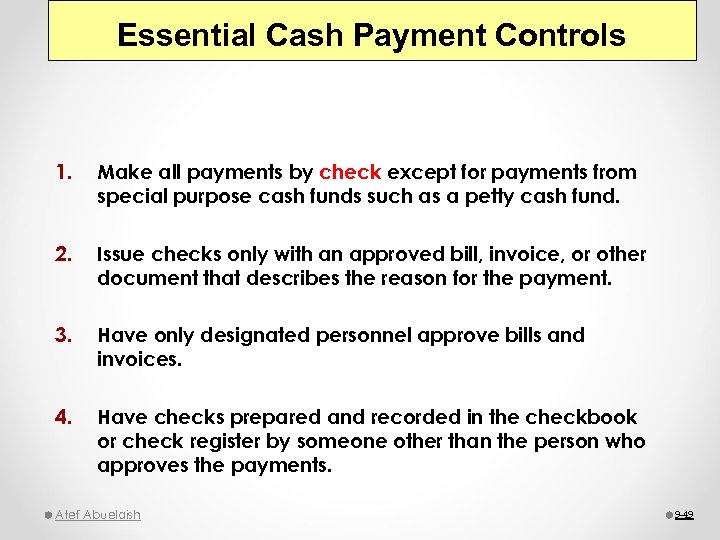

Essential Cash Payment Controls 1. Make all payments by check except for payments from special purpose cash funds such as a petty cash fund. 2. Issue checks only with an approved bill, invoice, or other document that describes the reason for the payment. 3. Have only designated personnel approve bills and invoices. 4. Have checks prepared and recorded in the checkbook or check register by someone other than the person who approves the payments. Atef Abuelaish 9 -49

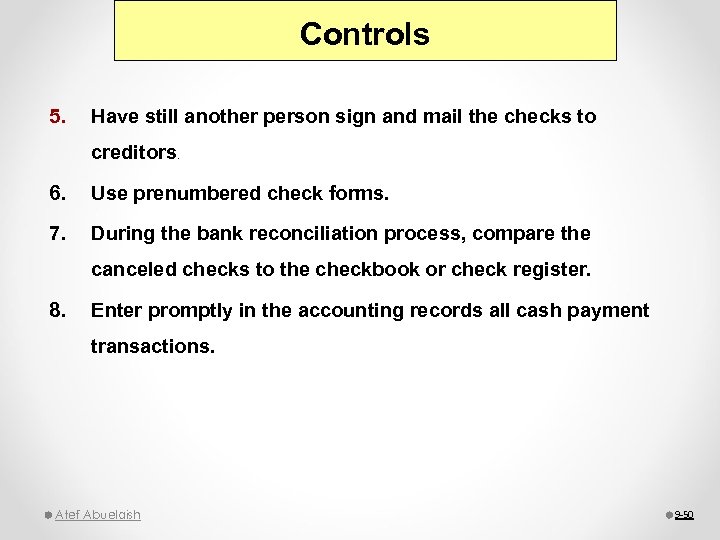

Controls 5. Have still another person sign and mail the checks to creditors. 6. Use prenumbered check forms. 7. During the bank reconciliation process, compare the canceled checks to the checkbook or check register. 8. Enter promptly in the accounting records all cash payment transactions. Atef Abuelaish 9 -50

Chapter cash 9 Section 3: Banking Procedures Section Objectives 9 -4 Write a check, endorse checks, prepare a bank deposit slip, and maintain a checkbook balance. 9 -5 Reconcile the monthly bank statement. 9 -6 Record any adjusting entries required from the bank reconciliation. 9 -7 Understand how businesses use online banking to manage cash activities. Atef Abuelaish 9 -51

Objective 9 -4 Write a check, endorse checks, prepare a bank deposit slip, and maintain a checkbook balance. Atef Abuelaish 9 -52

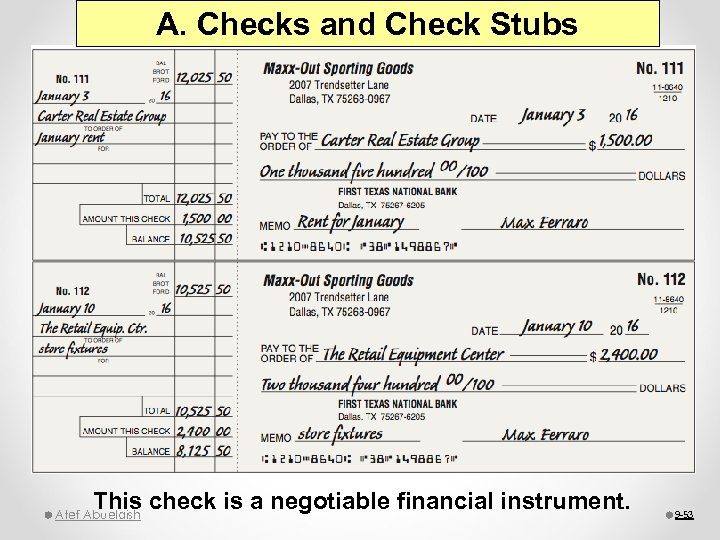

A. Checks and Check Stubs This check is a negotiable financial instrument. Atef Abuelaish 9 -53

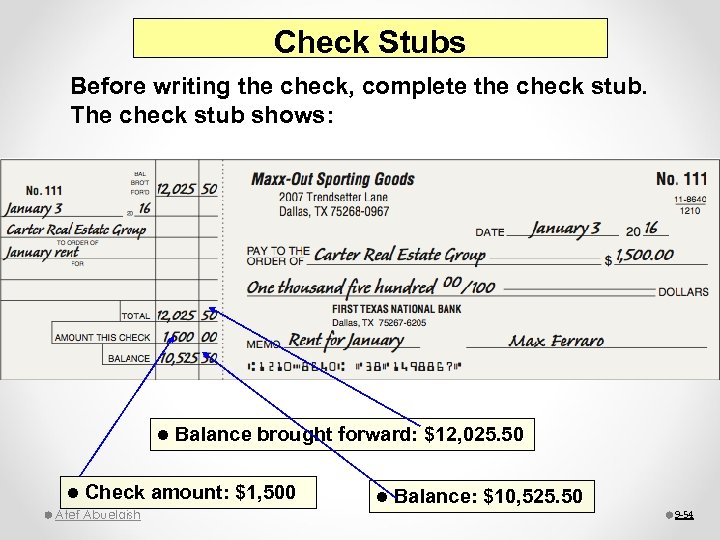

Check Stubs Before writing the check, complete the check stub. The check stub shows: l l Balance brought forward: $12, 025. 50 Check amount: $1, 500 Atef Abuelaish l Balance: $10, 525. 50 9 -54

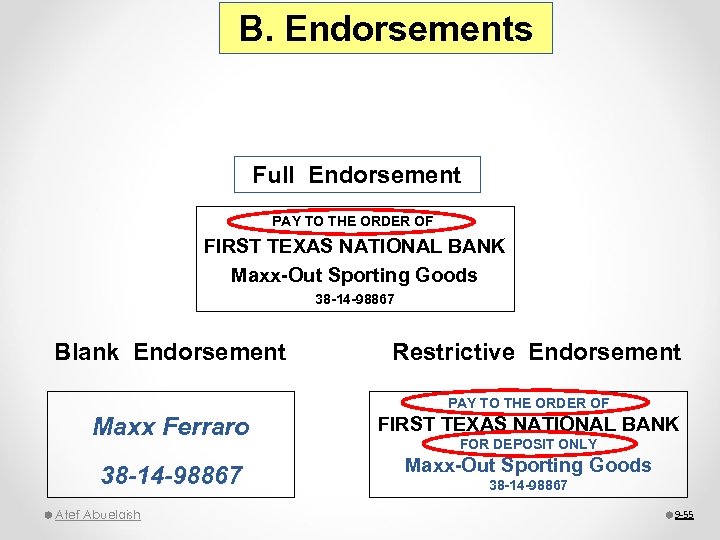

B. Endorsements Full Endorsement PAY TO THE ORDER OF FIRST TEXAS NATIONAL BANK Maxx-Out Sporting Goods 38 -14 -98867 Blank Endorsement Restrictive Endorsement PAY TO THE ORDER OF Maxx Ferraro FIRST TEXAS NATIONAL BANK 38 -14 -98867 Maxx-Out Sporting Goods Atef Abuelaish FOR DEPOSIT ONLY 38 -14 -98867 9 -55

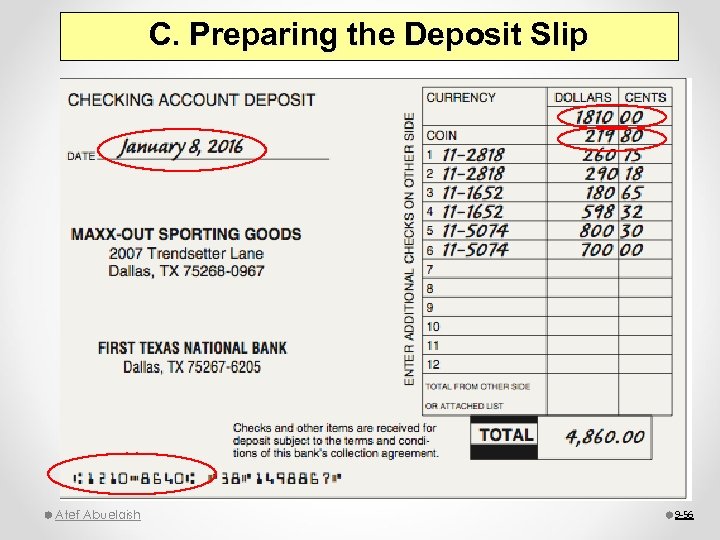

C. Preparing the Deposit Slip Atef Abuelaish 9 -56

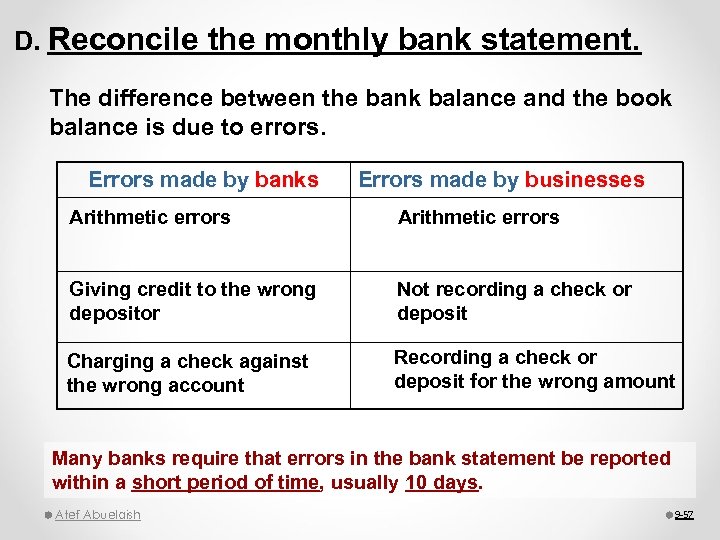

D. Reconcile the monthly bank statement. The difference between the bank balance and the book balance is due to errors. Errors made by banks Errors made by businesses Arithmetic errors Giving credit to the wrong depositor Not recording a check or deposit Charging a check against the wrong account Recording a check or deposit for the wrong amount Many banks require that errors in the bank statement be reported within a short period of time, usually 10 days. Atef Abuelaish 9 -57

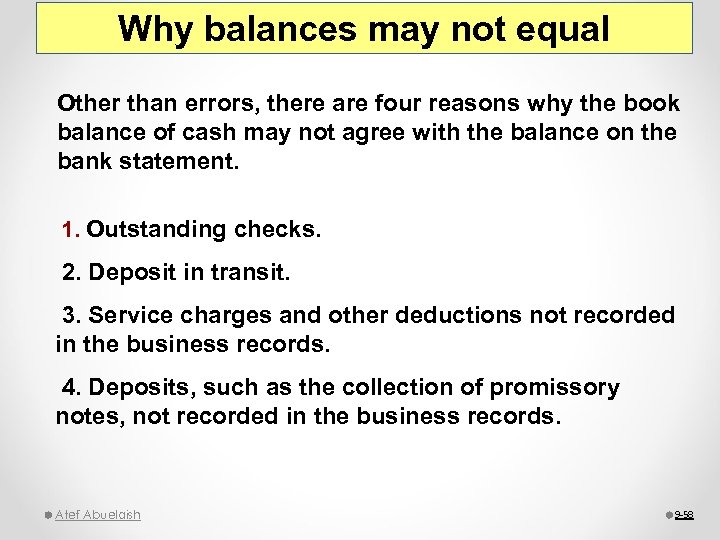

Why balances may not equal Other than errors, there are four reasons why the book balance of cash may not agree with the balance on the bank statement. 1. Outstanding checks. 2. Deposit in transit. 3. Service charges and other deductions not recorded in the business records. 4. Deposits, such as the collection of promissory notes, not recorded in the business records. Atef Abuelaish 9 -58

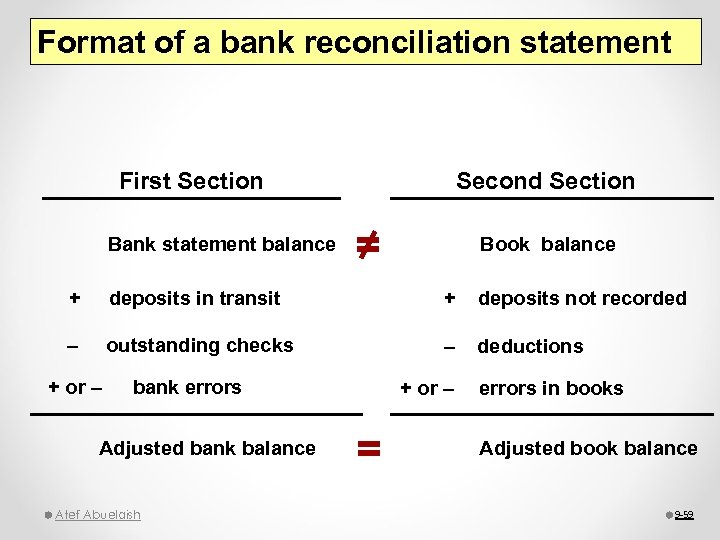

Format of a bank reconciliation statement First Section Bank statement balance Second Section = Book balance + deposits in transit + deposits not recorded – outstanding checks – deductions + or – bank errors Adjusted bank balance Atef Abuelaish + or – = errors in books Adjusted book balance 9 -59

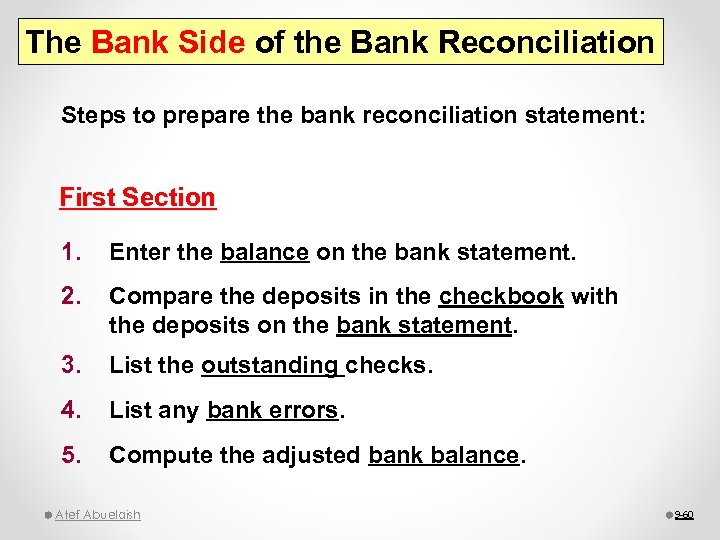

The Bank Side of the Bank Reconciliation Steps to prepare the bank reconciliation statement: First Section 1. Enter the balance on the bank statement. 2. Compare the deposits in the checkbook with the deposits on the bank statement. 3. List the outstanding checks. 4. List any bank errors. 5. Compute the adjusted bank balance. Atef Abuelaish 9 -60

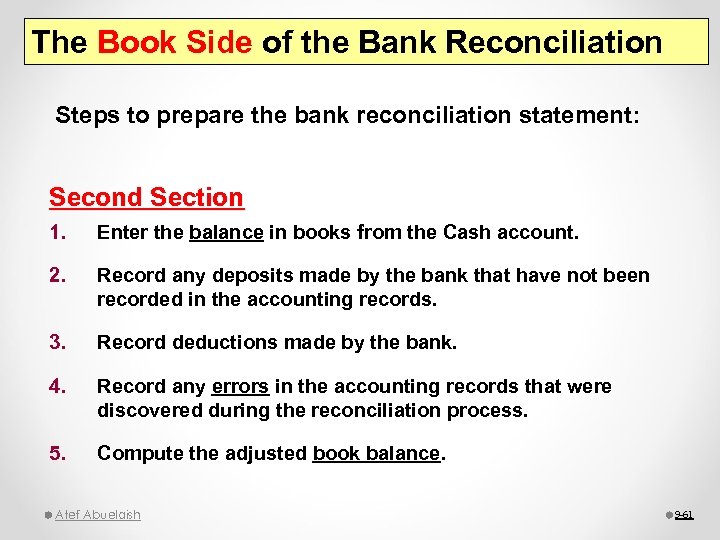

The Book Side of the Bank Reconciliation Steps to prepare the bank reconciliation statement: Second Section 1. Enter the balance in books from the Cash account. 2. Record any deposits made by the bank that have not been recorded in the accounting records. 3. Record deductions made by the bank. 4. Record any errors in the accounting records that were discovered during the reconciliation process. 5. Compute the adjusted book balance. Atef Abuelaish 9 -61

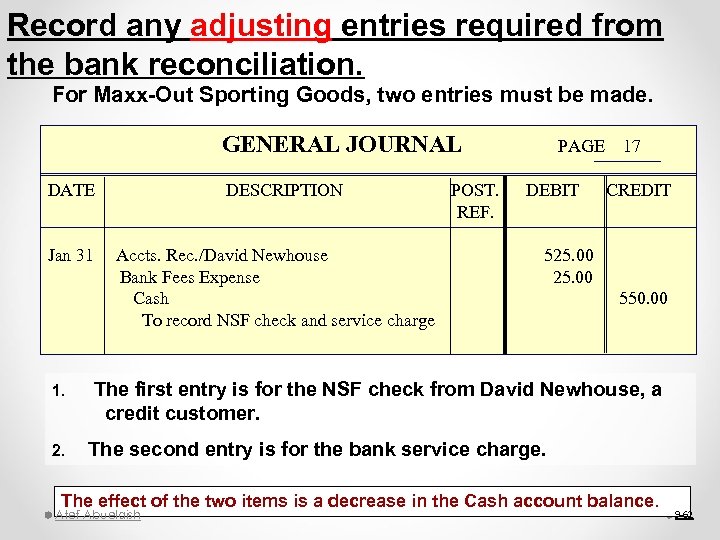

Record any adjusting entries required from the bank reconciliation. For Maxx-Out Sporting Goods, two entries must be made. GENERAL JOURNAL DATE Jan 31 1. 2. DESCRIPTION Accts. Rec. /David Newhouse Bank Fees Expense Cash To record NSF check and service charge POST. REF. PAGE DEBIT 17 CREDIT 525. 00 550. 00 The first entry is for the NSF check from David Newhouse, a credit customer. The second entry is for the bank service charge. The effect of the two items is a decrease in the Cash account balance. Atef Abuelaish 9 -62

Understand how businesses can use online banking to manage cash activities. Using On-line Banking Many businesses now manage many transactions online: Electronic Funds Transfers – EFT’s Payments to government agencies Payments from customers Payments to vendors Atef Abuelaish 9 -63

Homework assignment Ø Using Connect – 6 Questions for 50 Points for Chapter 09. Ø Prepare chapter 10 “Payroll Computations, Records, and Payment. ” Payment Happiness is having all homework up to date Atef Abuelaish 64

Thank you and See You On Thursday at the Same Time, Take Care Atef Abuelaish 65

f8a89d9d361d6827f4f7762b0bf25bfb.ppt