89748841d64f5e891b684163bd81e75a.ppt

- Количество слайдов: 52

WELCOME An introduction to the World Customs Organization and its Instruments

WELCOME An introduction to the World Customs Organization and its Instruments

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

The WCO, a change of name In 1994, the Customs Co-operation Council (CCC) adopted the informal working name “World Customs Organization” …to better reflect its worldwide membership Copyright © 2006 /2007 World Customs Organization

The WCO, a change of name In 1994, the Customs Co-operation Council (CCC) adopted the informal working name “World Customs Organization” …to better reflect its worldwide membership Copyright © 2006 /2007 World Customs Organization

The WCO, some brief facts… ▲ As of April 2009 : 174 Members* ▲ Two official languages : English and French** ▲ Headquarters : Brussels, Belgium ▲ Budget for 2008/2009 : € 15 million ▲ Democratic traditions : One Member = One vote * excludes the European Communities which, since July 2007, has rights akin to those of a WCO Member for matters falling within its competences as an interim measure ** increased use of Arabic, Portuguese, Russian and Spanish as « working » languages Copyright © 2006/2007 World Customs Organization

The WCO, some brief facts… ▲ As of April 2009 : 174 Members* ▲ Two official languages : English and French** ▲ Headquarters : Brussels, Belgium ▲ Budget for 2008/2009 : € 15 million ▲ Democratic traditions : One Member = One vote * excludes the European Communities which, since July 2007, has rights akin to those of a WCO Member for matters falling within its competences as an interim measure ** increased use of Arabic, Portuguese, Russian and Spanish as « working » languages Copyright © 2006/2007 World Customs Organization

The WCO, an Organization with global reach… 174 Members divided into 6 regions responsible for processing 98% of international trade Red Yellow Green Maroon Europe Americas Asia Pacific East and Southern Africa Cyan Magenta Copyright © 2006 /2007 World Customs Organization North Africa, Near and Middle East West and Central Africa

The WCO, an Organization with global reach… 174 Members divided into 6 regions responsible for processing 98% of international trade Red Yellow Green Maroon Europe Americas Asia Pacific East and Southern Africa Cyan Magenta Copyright © 2006 /2007 World Customs Organization North Africa, Near and Middle East West and Central Africa

Evolution of Customs Revenue Collection of Import Taxes (duties & excise) Protection of Society

Evolution of Customs Revenue Collection of Import Taxes (duties & excise) Protection of Society

The WCO Mission Statement To enhance the effectiveness and efficiency of Customs administrations …by improving their ability to Apply trade regulations & Trade Facilitation Protect society Collect fiscal revenue . . . which promotes economic prosperity and social development Copyright © 2006/2007 World Customs Organization

The WCO Mission Statement To enhance the effectiveness and efficiency of Customs administrations …by improving their ability to Apply trade regulations & Trade Facilitation Protect society Collect fiscal revenue . . . which promotes economic prosperity and social development Copyright © 2006/2007 World Customs Organization

The WCO’s objective… …to secure the highest degree of harmony and uniformity in Customs systems Copyright © 2006/2007 World Customs Organization

The WCO’s objective… …to secure the highest degree of harmony and uniformity in Customs systems Copyright © 2006/2007 World Customs Organization

The WCO’s key activities I Developing and maintaining international Customs instruments such as the Harmonized System, the Revised Kyoto Convention, the Istanbul Convention, the Nairobi Convention, the Time Release Study, etc. Encouraging uniform application of simplified and harmonized Customs systems and procedures and the increased use of IT as well as the implementation of the WCO Data Model (Single Window) Administering international instruments developed by other multilateral institutions such as the WTO Agreements on Customs Valuation and Origin and the UN Convention on Containers Copyright © 2006/2007 World Customs Organization

The WCO’s key activities I Developing and maintaining international Customs instruments such as the Harmonized System, the Revised Kyoto Convention, the Istanbul Convention, the Nairobi Convention, the Time Release Study, etc. Encouraging uniform application of simplified and harmonized Customs systems and procedures and the increased use of IT as well as the implementation of the WCO Data Model (Single Window) Administering international instruments developed by other multilateral institutions such as the WTO Agreements on Customs Valuation and Origin and the UN Convention on Containers Copyright © 2006/2007 World Customs Organization

…key activities II Securing and facilitating the movement of goods in the international trade supply chain through the WCO SAFE Framework of Standards to secure and facilitate global trade (implementation of the Authorized Economic Operator system and mutual recognition of such systems) Promoting integrity in Customs through the revised Arusha Declaration on Integrity and the development of tools that assist Members to implement integrity best practices Encouraging Customs-to-Customs co-operation and mutual assistance, and collaborating with international organisations on issues that impact on the global Customs community Copyright © 2006/2007 World Customs Organization

…key activities II Securing and facilitating the movement of goods in the international trade supply chain through the WCO SAFE Framework of Standards to secure and facilitate global trade (implementation of the Authorized Economic Operator system and mutual recognition of such systems) Promoting integrity in Customs through the revised Arusha Declaration on Integrity and the development of tools that assist Members to implement integrity best practices Encouraging Customs-to-Customs co-operation and mutual assistance, and collaborating with international organisations on issues that impact on the global Customs community Copyright © 2006/2007 World Customs Organization

…key activities III Providing sustainable capacity building guidance and assistance to facilitate Customs modernisation initiatives, and to implement international Customs and trade instruments Promoting partnerships between Customs and the international business community Combating transnational organised crime, environmental crime, drug trafficking, money laundering, smuggling, the illicit diamond trade, illegal arms and ammunition, stolen motor vehicles and other Customs offences Copyright © 2006/2007 World Customs Organization.

…key activities III Providing sustainable capacity building guidance and assistance to facilitate Customs modernisation initiatives, and to implement international Customs and trade instruments Promoting partnerships between Customs and the international business community Combating transnational organised crime, environmental crime, drug trafficking, money laundering, smuggling, the illicit diamond trade, illegal arms and ammunition, stolen motor vehicles and other Customs offences Copyright © 2006/2007 World Customs Organization.

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

WTO July Package - Annex D 1. Negotiations shall aim to clarify and improve relevant aspects of Articles V, VIII and X of the GATT 1994 with a view to further expediting the movement, release and clearance of goods, ….

WTO July Package - Annex D 1. Negotiations shall aim to clarify and improve relevant aspects of Articles V, VIII and X of the GATT 1994 with a view to further expediting the movement, release and clearance of goods, ….

WTO July Package - Annex D Due account shall be taken of the relevant work of the WCO and other relevant international organizations in this area. (Shall use relevant international standards or parts as a basis – TN/TF/W/131/Rev. 1)

WTO July Package - Annex D Due account shall be taken of the relevant work of the WCO and other relevant international organizations in this area. (Shall use relevant international standards or parts as a basis – TN/TF/W/131/Rev. 1)

WCO TF Instruments (referred to in the WTO Members’ 3 rd generation proposals) n Revised Kyoto Convention (TN/TF/W/117/Rev. 1, 134, 131/Rev. 1, 140) n Harmonized System (TN/TF/W/126, 131/Rev. 1) n Istanbul Convention (TN/TF/W/ 131/Rev. 1)

WCO TF Instruments (referred to in the WTO Members’ 3 rd generation proposals) n Revised Kyoto Convention (TN/TF/W/117/Rev. 1, 134, 131/Rev. 1, 140) n Harmonized System (TN/TF/W/126, 131/Rev. 1) n Istanbul Convention (TN/TF/W/ 131/Rev. 1)

WCO TF Instruments (referred to in the WTO Members’ 3 rd generation proposals) n Immediate Release Guidelines (TN/TF/W/ 117/Rev. 1) n Time Release Study (TN/TF/W/ 139/Rev. 1)

WCO TF Instruments (referred to in the WTO Members’ 3 rd generation proposals) n Immediate Release Guidelines (TN/TF/W/ 117/Rev. 1) n Time Release Study (TN/TF/W/ 139/Rev. 1)

Revised Koyto Convention (RKC) 4 International Convention on the simplification and harmonization of Customs procedures (Kyoto Convention, adopted in 1973) 4 Revised in 1999 after 4 years revision work (consultation with the private sector) and entered into force in February 2006 – 600 legal provisions 4 Blueprint for Modern Customs procedures å effective controls å facilitate legitimate trade

Revised Koyto Convention (RKC) 4 International Convention on the simplification and harmonization of Customs procedures (Kyoto Convention, adopted in 1973) 4 Revised in 1999 after 4 years revision work (consultation with the private sector) and entered into force in February 2006 – 600 legal provisions 4 Blueprint for Modern Customs procedures å effective controls å facilitate legitimate trade

Revised Kyoto Convention (RKC) Core provisions and definitions of general application to all Customs procedures in ten Chapters of the General Annex - obligatory Specific Annexes contain Chapters relating to specific procedures (25) - optional Implementation period for Standards/Recommended Practices (3 years) and Transitional Standards (5 years) Detailed Guidelines containing information for - the interpretation of the provisions - the implementation of the provisions - methods of application and best practices

Revised Kyoto Convention (RKC) Core provisions and definitions of general application to all Customs procedures in ten Chapters of the General Annex - obligatory Specific Annexes contain Chapters relating to specific procedures (25) - optional Implementation period for Standards/Recommended Practices (3 years) and Transitional Standards (5 years) Detailed Guidelines containing information for - the interpretation of the provisions - the implementation of the provisions - methods of application and best practices

Revised Kyoto Convention – Management Committee (Article 6 of the Convention) responsible for - securing uniformity in the interpretation - application and in any amendments proposed 59 Contracting Parties (accession process ongoing in many countries) Observers (WCO Members, UN Members – incl. WTO Members, International Organizations and Trade)

Revised Kyoto Convention – Management Committee (Article 6 of the Convention) responsible for - securing uniformity in the interpretation - application and in any amendments proposed 59 Contracting Parties (accession process ongoing in many countries) Observers (WCO Members, UN Members – incl. WTO Members, International Organizations and Trade)

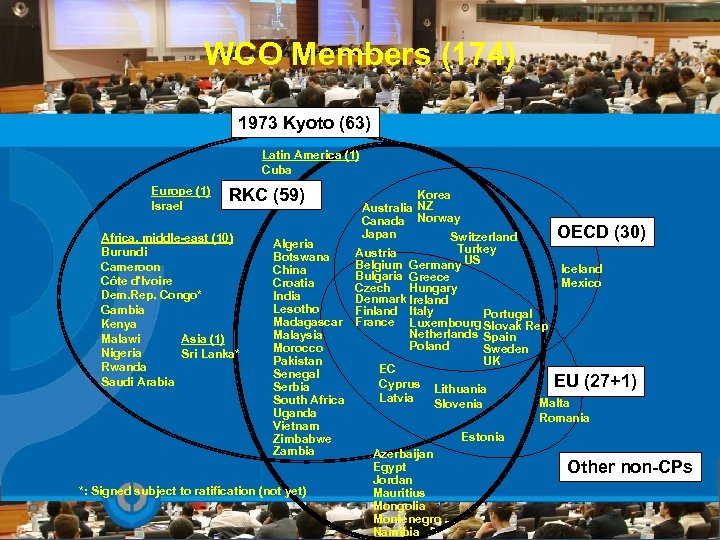

WCO Members (174) 1973 Kyoto (63) Latin America (1) Cuba Europe (1) Israel RKC (59) Korea Australia NZ Canada Norway Japan OECD (30) Switzerland Africa, middle-east (10) Algeria Turkey Burundi Austria Botswana US Belgium Germany Cameroon Iceland China Bulgaria Greece Côte d'Ivoire Mexico Croatia Czech Hungary Dem. Rep. Congo* India Denmark Ireland Lesotho Gambia Finland Italy Portugal Madagascar France Luxembourg Slovak Rep Kenya Netherlands Spain Malaysia Malawi Asia (1) Poland Morocco Sweden Nigeria Sri Lanka* UK Pakistan Rwanda EC Senegal Saudi Arabia EU (27+1) Cyprus Lithuania Serbia Latvia South Africa Malta Slovenia Uganda Romania Vietnam Estonia Zimbabwe Zambia Azerbaijan Egypt Other non-CPs Jordan *: Signed subject to ratification (not yet) Mauritius Mongolia Montenegro Namibia

WCO Members (174) 1973 Kyoto (63) Latin America (1) Cuba Europe (1) Israel RKC (59) Korea Australia NZ Canada Norway Japan OECD (30) Switzerland Africa, middle-east (10) Algeria Turkey Burundi Austria Botswana US Belgium Germany Cameroon Iceland China Bulgaria Greece Côte d'Ivoire Mexico Croatia Czech Hungary Dem. Rep. Congo* India Denmark Ireland Lesotho Gambia Finland Italy Portugal Madagascar France Luxembourg Slovak Rep Kenya Netherlands Spain Malaysia Malawi Asia (1) Poland Morocco Sweden Nigeria Sri Lanka* UK Pakistan Rwanda EC Senegal Saudi Arabia EU (27+1) Cyprus Lithuania Serbia Latvia South Africa Malta Slovenia Uganda Romania Vietnam Estonia Zimbabwe Zambia Azerbaijan Egypt Other non-CPs Jordan *: Signed subject to ratification (not yet) Mauritius Mongolia Montenegro Namibia

Key Principles of RKC (I) Transparency and predictability - Rules for providing information - Clear and transparent appeal procedures (Customs, independent authority, courts) Standardization and simplification of goods declaration and supporting documents - Minimum data requirements - Provisional / Incomplete Goods Declaration - Submission by electronic means Simplified procedures for all operators Separating release from clearance procedures

Key Principles of RKC (I) Transparency and predictability - Rules for providing information - Clear and transparent appeal procedures (Customs, independent authority, courts) Standardization and simplification of goods declaration and supporting documents - Minimum data requirements - Provisional / Incomplete Goods Declaration - Submission by electronic means Simplified procedures for all operators Separating release from clearance procedures

Key Principles of RKC (II) “Fast track” procedures for authorized persons with good compliance records such as : release of goods with minimum information to identify goods (with subsequent declaration) Pre-arrival information (prior lodgement and registration of the Goods declaration and supporting documents – cargo declaration) Maximum use of information technology - Use of international standards - Consultation of all relevant parties when introducing computer applications - Electronic commerce methods as an alternative to paper-based requirements

Key Principles of RKC (II) “Fast track” procedures for authorized persons with good compliance records such as : release of goods with minimum information to identify goods (with subsequent declaration) Pre-arrival information (prior lodgement and registration of the Goods declaration and supporting documents – cargo declaration) Maximum use of information technology - Use of international standards - Consultation of all relevant parties when introducing computer applications - Electronic commerce methods as an alternative to paper-based requirements

Key Principles of RKC (III) Minimum necessary controls to ensure compliance Risk management - Identify high risk consignments based on risk analysis (intelligence) - Shift from documentary and physical checks to targeted checks - Facilitation of legitimate trade while maintaining effective control - Effective and efficient deployment of Customs resources Audit based controls - Post-clearance audit

Key Principles of RKC (III) Minimum necessary controls to ensure compliance Risk management - Identify high risk consignments based on risk analysis (intelligence) - Shift from documentary and physical checks to targeted checks - Facilitation of legitimate trade while maintaining effective control - Effective and efficient deployment of Customs resources Audit based controls - Post-clearance audit

Key Principles of RKC (IV) Juxtaposed Customs office and joint controls Co-ordinated intervention - Inspection with other border agencies Partnership with the trade - Formal consultative relationships - Memoranda of Understanding (MOU) Benefits of an effective implementation of the RKC for Economy/Customs/Trade

Key Principles of RKC (IV) Juxtaposed Customs office and joint controls Co-ordinated intervention - Inspection with other border agencies Partnership with the trade - Formal consultative relationships - Memoranda of Understanding (MOU) Benefits of an effective implementation of the RKC for Economy/Customs/Trade

Main Trade Facilitation Techniques Risk Management Programme Risk Assessment Standard and simplfied procedures and practices Pre-arrival Declaration System of appeals Control Techniques Post Entry Audits Maximum use of Information Technology Automation Publication of accurate, up-to-date information & Advance Rulings Partnership with the Trade WORLD CUSTOMS ORGANIZATION

Main Trade Facilitation Techniques Risk Management Programme Risk Assessment Standard and simplfied procedures and practices Pre-arrival Declaration System of appeals Control Techniques Post Entry Audits Maximum use of Information Technology Automation Publication of accurate, up-to-date information & Advance Rulings Partnership with the Trade WORLD CUSTOMS ORGANIZATION

Harmonized System - "HS" is a multipurpose international product Nomenclature developed by the WCO (through the Harmonized System Committee) - Used by more than 200 countries and economies as a basis for their Customs tariffs and for the collection of international trade statistics - 136 countries and the EC have signed the HS Convention (entered into force on 1 January 1988) and are Contracting Parties (April 2009) - Universal economic language and code for goods, and an indispensable tool for international trade - Recommendation (1996) on the introduction of programmes for binding pre-entry classification information DQTCOCT 2001. PPT 4

Harmonized System - "HS" is a multipurpose international product Nomenclature developed by the WCO (through the Harmonized System Committee) - Used by more than 200 countries and economies as a basis for their Customs tariffs and for the collection of international trade statistics - 136 countries and the EC have signed the HS Convention (entered into force on 1 January 1988) and are Contracting Parties (April 2009) - Universal economic language and code for goods, and an indispensable tool for international trade - Recommendation (1996) on the introduction of programmes for binding pre-entry classification information DQTCOCT 2001. PPT 4

What is the HS ? 21 SECTIONS of goods grouped together into sectors 96 CHAPTERS 1, 221 4 -digit headings (2007 Version). Goods are arranged in the HS in order of their degree of manufacture 5, 052 6 -digit subheadings (2007 Version) and General Interpretative Rules DQTCOCT 2001. PPT 6

What is the HS ? 21 SECTIONS of goods grouped together into sectors 96 CHAPTERS 1, 221 4 -digit headings (2007 Version). Goods are arranged in the HS in order of their degree of manufacture 5, 052 6 -digit subheadings (2007 Version) and General Interpretative Rules DQTCOCT 2001. PPT 6

What is the HS ? The goods - their description - 6 -digit subheadings : Dolls 9502. 10 Lawn-tennis rackets 9506. 51 Yogurt 0403. 10 DQTCOCT 2001. PPT 6

What is the HS ? The goods - their description - 6 -digit subheadings : Dolls 9502. 10 Lawn-tennis rackets 9506. 51 Yogurt 0403. 10 DQTCOCT 2001. PPT 6

Istanbul Convention / ATA System - No duties and taxes collected for the temporary importation of goods - Covered by an internationally valid guarantee system - ATA Carnet replaces national Customs formalities - Istanbul Convention merges 13 existing temporary admission agreements into a single instrument - 54 Contracting Parties - entered into force on 27 November 1993 27 November

Istanbul Convention / ATA System - No duties and taxes collected for the temporary importation of goods - Covered by an internationally valid guarantee system - ATA Carnet replaces national Customs formalities - Istanbul Convention merges 13 existing temporary admission agreements into a single instrument - 54 Contracting Parties - entered into force on 27 November 1993 27 November

Istanbul Convention / ATA System - First half of 2008, 865 ATA Carnets were issued for goods representing a total value of US$ 11, 747, 130 - During the corresponding period of 2007, 83, 712 ATA Carnets were issued for goods representing a total value of US$ 9, 163, 847, 511 - e-ATA Carnet initiative

Istanbul Convention / ATA System - First half of 2008, 865 ATA Carnets were issued for goods representing a total value of US$ 11, 747, 130 - During the corresponding period of 2007, 83, 712 ATA Carnets were issued for goods representing a total value of US$ 9, 163, 847, 511 - e-ATA Carnet initiative

Immediate Release Guidelines (adopted in June 2003) Identification of a set of data that was to be provided for grant of release of goods as well as procedures to be followed (4 categories of goods) Submission of cargo information in advance of the arrival of the goods for risk assessment purposes Clarification of coverage All operators All means of transport Promoted by the international business community

Immediate Release Guidelines (adopted in June 2003) Identification of a set of data that was to be provided for grant of release of goods as well as procedures to be followed (4 categories of goods) Submission of cargo information in advance of the arrival of the goods for risk assessment purposes Clarification of coverage All operators All means of transport Promoted by the international business community

Time Release Study = to measure the average time taken between the arrival of the goods and their release, and at each intervening step (including intervention by agencies other than Customs) n Useful tool: üto identify problems and bottlenecks; and üto stimulate efforts to improve the efficiency and effectiveness üIT software available ( + training) üWCO Web-based service is available üWidely used by WCO Members (regional approach)

Time Release Study = to measure the average time taken between the arrival of the goods and their release, and at each intervening step (including intervention by agencies other than Customs) n Useful tool: üto identify problems and bottlenecks; and üto stimulate efforts to improve the efficiency and effectiveness üIT software available ( + training) üWCO Web-based service is available üWidely used by WCO Members (regional approach)

Parties involved (example) Manifest from the ship Payment of the duty/tax by the importer Import licence from the Trade Board Arrival of vessels Lodge import declaration with Customs Technical conformity certificate from the Standard Board Receipt issued by the bank Lodge import declaration with Customs Obtain import permission Delivery of goods from Customs storage

Parties involved (example) Manifest from the ship Payment of the duty/tax by the importer Import licence from the Trade Board Arrival of vessels Lodge import declaration with Customs Technical conformity certificate from the Standard Board Receipt issued by the bank Lodge import declaration with Customs Obtain import permission Delivery of goods from Customs storage

Feb 1991 Mar 2001 47. 6 31. 1 94. 5 37. 8 4. 9 26. 1 - 81% (Hours) ARRIVAL - TRANSFER INTO HOZEI AREA - DECLARATION - PERMISSION Source: Customs and Tariff Bureau, Ministry of Finance, Japan

Feb 1991 Mar 2001 47. 6 31. 1 94. 5 37. 8 4. 9 26. 1 - 81% (Hours) ARRIVAL - TRANSFER INTO HOZEI AREA - DECLARATION - PERMISSION Source: Customs and Tariff Bureau, Ministry of Finance, Japan

Other relevant WCO TF Instruments n The SAFE Framework of Standards to secure and facilitate global trade n The WCO Data Model (Version 3)

Other relevant WCO TF Instruments n The SAFE Framework of Standards to secure and facilitate global trade n The WCO Data Model (Version 3)

SAFE Framework of Standards Ø Adopted by the Council in June 2005 (revised in 2007) and mainly developed according to the RKC principles Ø To date, 155 of the WCO’s 174 Members have signed a “letter of intent” to implement the SAFE Fo. S Ø The principles of SAFE are found in different Customs legislation (AEO Programme) Ø Columbus Programme to implement the SAFE Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

SAFE Framework of Standards Ø Adopted by the Council in June 2005 (revised in 2007) and mainly developed according to the RKC principles Ø To date, 155 of the WCO’s 174 Members have signed a “letter of intent” to implement the SAFE Fo. S Ø The principles of SAFE are found in different Customs legislation (AEO Programme) Ø Columbus Programme to implement the SAFE Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

Objectives of the SAFE Fo. S Ø Establish standards that provide supply chain security and facilitation to goods being traded internationally; Ø Enable integrated supply chain management for all modes of transport; Ø Strengthen networking arrangements between Customs administrations to improve their capability to detect high-risk consignments; Ø Promote co-operation between the Customs and business communities; Ø Champion the seamless movement of goods through secure international trade supply chains. Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

Objectives of the SAFE Fo. S Ø Establish standards that provide supply chain security and facilitation to goods being traded internationally; Ø Enable integrated supply chain management for all modes of transport; Ø Strengthen networking arrangements between Customs administrations to improve their capability to detect high-risk consignments; Ø Promote co-operation between the Customs and business communities; Ø Champion the seamless movement of goods through secure international trade supply chains. Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

The Core Principles Ø Advance electronic information Ø Common Risk management approach; 27 key data elements Ø Inspection of high-risk cargo at port of origin; export controls + Use of modern technologies (scanners, e-seals, …) Ø Enhanced trade facilitation for legitimate trade; Authorized Economic Operator (AEO) concept Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

The Core Principles Ø Advance electronic information Ø Common Risk management approach; 27 key data elements Ø Inspection of high-risk cargo at port of origin; export controls + Use of modern technologies (scanners, e-seals, …) Ø Enhanced trade facilitation for legitimate trade; Authorized Economic Operator (AEO) concept Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

Structures: 2 Pillars / 17 Standards Ø Pillar 1: Customs-to-Customs Cooperation; Using Commonly Accepted Standards to both secure and facilitate trade (11 Standards) Ø Pillar 2: Customs-to-Business Partnership; Identify secure business partners / Offer tangible benefits (6 Standards) + AEO Guidelines Ø Importance of Co-ordinated Border Management and the Single Window concept Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

Structures: 2 Pillars / 17 Standards Ø Pillar 1: Customs-to-Customs Cooperation; Using Commonly Accepted Standards to both secure and facilitate trade (11 Standards) Ø Pillar 2: Customs-to-Business Partnership; Identify secure business partners / Offer tangible benefits (6 Standards) + AEO Guidelines Ø Importance of Co-ordinated Border Management and the Single Window concept Copyright © 2005 World Customs Organization. All rights reserved. Requests and inquiries concerning translation, reproduction and adaptation rights should be addressed to copyright@wcoomd. org.

WCO Data Model = maximum framework of standardized sets of data & electronic messages (EDIFACT & XML) to complete border procedures 1996 to 2002 G 7 Initiative (WCO Data Model is a continuing effort to standardize, harmonize and reduce Customs data requirements initiated by the G 7) Version 1. 0 – the Data Sets (2002) Version 1. 1 – security concern (2003) Version 2. 0 – modelling, conveyances and Customs transit (2005)

WCO Data Model = maximum framework of standardized sets of data & electronic messages (EDIFACT & XML) to complete border procedures 1996 to 2002 G 7 Initiative (WCO Data Model is a continuing effort to standardize, harmonize and reduce Customs data requirements initiated by the G 7) Version 1. 0 – the Data Sets (2002) Version 1. 1 – security concern (2003) Version 2. 0 – modelling, conveyances and Customs transit (2005)

WCO Data Model - Version 3. 0 – response, XML, data structure, more transit, Other Government Agencies / SW (2009) └> Customs Procedures (IM, EX, Transit / TIR, CR) └> Supports “Single Window” environment - Incorporates “OGA” data - agriculture, food safety, hazardous waste (Basel Conv. ) - Also looks at response messages and an increased scope for Customs transit - Considers the implications of XML, refinement of our models and basic data structures - WCO Recommendation on the use of the WCO DM to be adopted in June 2009

WCO Data Model - Version 3. 0 – response, XML, data structure, more transit, Other Government Agencies / SW (2009) └> Customs Procedures (IM, EX, Transit / TIR, CR) └> Supports “Single Window” environment - Incorporates “OGA” data - agriculture, food safety, hazardous waste (Basel Conv. ) - Also looks at response messages and an increased scope for Customs transit - Considers the implications of XML, refinement of our models and basic data structures - WCO Recommendation on the use of the WCO DM to be adopted in June 2009

WCO Data Model ü Compatible with ISO, UN/CEFACT and other international codes ü Key for effective and efficient for B 2 G and G 2 G exchange and sharing of information - Trade and Transport organizations involved in its development / maintenance ü Standardized and harmonized information requirements and procedures are essential └> common understanding └> effective and efficient └> all parties in the international cross-border movement WCO Data Model provides this common understanding

WCO Data Model ü Compatible with ISO, UN/CEFACT and other international codes ü Key for effective and efficient for B 2 G and G 2 G exchange and sharing of information - Trade and Transport organizations involved in its development / maintenance ü Standardized and harmonized information requirements and procedures are essential └> common understanding └> effective and efficient └> all parties in the international cross-border movement WCO Data Model provides this common understanding

WCO Data Model – Some of the benefits ü Seamless transaction / faster release (single, global data set and uniform electronic messages to conduct business) ü more effective exchange of information between export and import ü aligned export and import data requirements (export information reused at import) ü includes data requirements of other governmental regulatory authorities (eliminating redundancies and differences) └> Single Window environment └> traders to submit information only once

WCO Data Model – Some of the benefits ü Seamless transaction / faster release (single, global data set and uniform electronic messages to conduct business) ü more effective exchange of information between export and import ü aligned export and import data requirements (export information reused at import) ü includes data requirements of other governmental regulatory authorities (eliminating redundancies and differences) └> Single Window environment └> traders to submit information only once

Evolution of WCO standards (not exhaustive) Harmonization of coding and data Data Model Version 3. 0 (2009) HS Convention (2007) Data Model Version 2. 0 (2005) Resolution on UCR and Implementation Guide (2004) HS Convention (2002) Data Model Version 1. 1 (2003) Data Model Version 1. 0 (2002) HS Convention (1997) HS Convention (1988) Standardization of procedures Simplification and modernization of procedures Support tools for national TF initiatives AEO Guidelines (2007) Post-clearance audit Guidelines (2006) Diagnostic Framework* (Guide) (2003) SAFE Framework of Standards (2005) ICT Guidelines (2004) Immediate Release Guidelines (2003) Risk Management Guide (2003) Recommendation on the use of WWW (1999) Time Release Study (2003) Benchmarking Manual (Guide) (2003) Revised Kyoto Convention and its Guidelines(1999) Recommendation on Pre-entry classification (1996) Guidelines for Express Consignments Clearance (1993) Istanbul Convention (1990) Kyoto Convention (1973) ATA Convention (1963) Convention establishing a CCC (1950) *Diagnostic Framework is a living document and contains entire Customs themes, including the TF

Evolution of WCO standards (not exhaustive) Harmonization of coding and data Data Model Version 3. 0 (2009) HS Convention (2007) Data Model Version 2. 0 (2005) Resolution on UCR and Implementation Guide (2004) HS Convention (2002) Data Model Version 1. 1 (2003) Data Model Version 1. 0 (2002) HS Convention (1997) HS Convention (1988) Standardization of procedures Simplification and modernization of procedures Support tools for national TF initiatives AEO Guidelines (2007) Post-clearance audit Guidelines (2006) Diagnostic Framework* (Guide) (2003) SAFE Framework of Standards (2005) ICT Guidelines (2004) Immediate Release Guidelines (2003) Risk Management Guide (2003) Recommendation on the use of WWW (1999) Time Release Study (2003) Benchmarking Manual (Guide) (2003) Revised Kyoto Convention and its Guidelines(1999) Recommendation on Pre-entry classification (1996) Guidelines for Express Consignments Clearance (1993) Istanbul Convention (1990) Kyoto Convention (1973) ATA Convention (1963) Convention establishing a CCC (1950) *Diagnostic Framework is a living document and contains entire Customs themes, including the TF

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

Structure of the presentation 1. The World Customs Organization in brief 2. The WCO Trade Facilitation Instruments / Standards 3. The WCO – WTO relationship in the context of the WTO TFNG Copyright © 2006 /2007 World Customs Organization

Modalities of TF negotiations q Trade facilitation needs and priorities q TA/CB during and after the negotiations q Collaborative capacity building efforts by international organizations (Annex D Organizations = IMF, OECD, UNCTAD, WCO, World Bank) q Due account to the relevant work of the WCO

Modalities of TF negotiations q Trade facilitation needs and priorities q TA/CB during and after the negotiations q Collaborative capacity building efforts by international organizations (Annex D Organizations = IMF, OECD, UNCTAD, WCO, World Bank) q Due account to the relevant work of the WCO

WCO: Guiding Principles q Participation of Customs administrations in preparing national positions q Enhanced co-operation in the work of the WCO and WTO q Involvement of other border agencies q Need for full support for Customs capacity building efforts q Compatible and complementary relationship between the work of the two Organizations

WCO: Guiding Principles q Participation of Customs administrations in preparing national positions q Enhanced co-operation in the work of the WCO and WTO q Involvement of other border agencies q Need for full support for Customs capacity building efforts q Compatible and complementary relationship between the work of the two Organizations

WCO work in this area q Promotion of Customs engagement (message, letters, WCO meeting documents, briefing sessions, …) q Contribution to the negotiation process q Provision of technical inputs q Promotion of compatibility of WCO instruments (WCO tools to implement WTO principles)

WCO work in this area q Promotion of Customs engagement (message, letters, WCO meeting documents, briefing sessions, …) q Contribution to the negotiation process q Provision of technical inputs q Promotion of compatibility of WCO instruments (WCO tools to implement WTO principles)

WCO work in this area q Provision of resource persons OECD TF Cost survey World Bank TF Needs identification WTO Regional Workshops, … q Capacity Building (WTO TF Needs Assessment) – extended pool of WCO experts – participation of the WCO in more than 20 NA workshops

WCO work in this area q Provision of resource persons OECD TF Cost survey World Bank TF Needs identification WTO Regional Workshops, … q Capacity Building (WTO TF Needs Assessment) – extended pool of WCO experts – participation of the WCO in more than 20 NA workshops

Possible Customs gains q High and sustained political commitment to Customs reform and modernization q Receive TA/CB support q Compatible and complementary relationship with WCO work q Better understanding of Customs by others

Possible Customs gains q High and sustained political commitment to Customs reform and modernization q Receive TA/CB support q Compatible and complementary relationship with WCO work q Better understanding of Customs by others

WTO vis-à-vis WCO TF Instruments q q WTO rules set high principles while the WCO instruments provide implementation tools of these high principles with detailed standards Consistency of the measures negotiated at the WTO vis-à-vis the WCO instruments - the majority of the proposed WTO texts are compatible with the WCO instruments - a minority of the WTO measures do not currently appear to be covered by WCO instruments Scope of many proposals is wider than Customs (involvement of other border agencies) q

WTO vis-à-vis WCO TF Instruments q q WTO rules set high principles while the WCO instruments provide implementation tools of these high principles with detailed standards Consistency of the measures negotiated at the WTO vis-à-vis the WCO instruments - the majority of the proposed WTO texts are compatible with the WCO instruments - a minority of the WTO measures do not currently appear to be covered by WCO instruments Scope of many proposals is wider than Customs (involvement of other border agencies) q

Thierry Piraux Telephone : +32 (0)2 209 93 44 Fax : +32 (0)2 209 94 93 thierry. piraux@wcoomd. org www. wcoomd. org ____________________________________________________ WCO Publications Service WCO Information Service publications@wcoomd. org information@wcoomd. org Copyright © 2006/2007 World Customs Organization

Thierry Piraux Telephone : +32 (0)2 209 93 44 Fax : +32 (0)2 209 94 93 thierry. piraux@wcoomd. org www. wcoomd. org ____________________________________________________ WCO Publications Service WCO Information Service publications@wcoomd. org information@wcoomd. org Copyright © 2006/2007 World Customs Organization