fff68577fdb6e0edfbee72ca42a95d3b.ppt

- Количество слайдов: 35

WELCo. ME To THE PRESEn. TATIon on

WELCo. ME To THE PRESEn. TATIon on

National Rail Vikas Yojana Government of India has conceived a massive investment plan for rail sector to eliminate capacity bottlenecks on Golden Quadrilateral and Diagonals to provide strategic rail communication links to ports, construction of mega-bridges for improving communication to the hinterland development of multi-modal transport corridors. This initiative has been given the name of National Rail Vikas Yojana. Hon'ble Prime Minister announced the Yojana in his speech delivered on the Independence Day in 2002 and formally launched it on 26 th December, 2002. National Rail Vikas Yojana comprises the following investment planning components: § Strengthening of Golden Quadrilateral and Diagonals connecting the 4 metro cities i. e. Delhi, Mumbai, Chennai and Kolkata. § Providing Rail based port-connectivity and development of corridors to hinterland including multi-modal corridors for movement of containers. § Construction of 4 mega bridges at Patna and Munger on river Ganga, at Bogibeel on river Brahmputra and at Nirmali on river Kosi.

National Rail Vikas Yojana Government of India has conceived a massive investment plan for rail sector to eliminate capacity bottlenecks on Golden Quadrilateral and Diagonals to provide strategic rail communication links to ports, construction of mega-bridges for improving communication to the hinterland development of multi-modal transport corridors. This initiative has been given the name of National Rail Vikas Yojana. Hon'ble Prime Minister announced the Yojana in his speech delivered on the Independence Day in 2002 and formally launched it on 26 th December, 2002. National Rail Vikas Yojana comprises the following investment planning components: § Strengthening of Golden Quadrilateral and Diagonals connecting the 4 metro cities i. e. Delhi, Mumbai, Chennai and Kolkata. § Providing Rail based port-connectivity and development of corridors to hinterland including multi-modal corridors for movement of containers. § Construction of 4 mega bridges at Patna and Munger on river Ganga, at Bogibeel on river Brahmputra and at Nirmali on river Kosi.

About Rail Vikas Nigam Limited (RVNL), is a Special Purpose Vehicle created to undertake project development, mobilization of financial resources and implement projects pertaining to strengthening of Golden Quadrilateral and Port Connectivity. It is the first major non-budgetary initiative for creating rail transport capacity ahead of demand on a commercial format. RVNL has been registered as a company under Companies Act 1956 on 24. 1. 2003. It is a wholly owned Government company under the provisions of Section 617 of Companies Act. Certificate of Incorporation was obtained on 24. 1. 2003.

About Rail Vikas Nigam Limited (RVNL), is a Special Purpose Vehicle created to undertake project development, mobilization of financial resources and implement projects pertaining to strengthening of Golden Quadrilateral and Port Connectivity. It is the first major non-budgetary initiative for creating rail transport capacity ahead of demand on a commercial format. RVNL has been registered as a company under Companies Act 1956 on 24. 1. 2003. It is a wholly owned Government company under the provisions of Section 617 of Companies Act. Certificate of Incorporation was obtained on 24. 1. 2003.

About RVNL is assigned the following functions: Arranging financial resources for the Projects. For this purpose, the RVNL would be authorized to approach the Financial Institutions, Banks, Domestic Market and the Bilateral and Multilateral Funding Agencies. Undertaking project development and execution of works. Creating Project specific SPVs for individual works, if required. Commercialization of projects wherever considered necessary and feasible. The concerned Zonal Railways will undertake the operation and maintenance of the Railway Projects on completion of their execution by the RVNL under a specific financial arrangement. For providing a revenue stream to RVNL, the projects may be done by RVNL on BOT concept, where Ministry of Railways is to pay Access Charge/User Charge.

About RVNL is assigned the following functions: Arranging financial resources for the Projects. For this purpose, the RVNL would be authorized to approach the Financial Institutions, Banks, Domestic Market and the Bilateral and Multilateral Funding Agencies. Undertaking project development and execution of works. Creating Project specific SPVs for individual works, if required. Commercialization of projects wherever considered necessary and feasible. The concerned Zonal Railways will undertake the operation and maintenance of the Railway Projects on completion of their execution by the RVNL under a specific financial arrangement. For providing a revenue stream to RVNL, the projects may be done by RVNL on BOT concept, where Ministry of Railways is to pay Access Charge/User Charge.

Creating Rail Transport ahead of Demand – A model SPV. First major non-budgetary initiative for creating Rail infrastructure on commercial format. Strengthening of Golden Quadrilateral and Diagonals. Providing Rail Based connectivity and development of corridors to hinterland including multi model corridors of for movement of containers. Construction of 4 mega bridges at Patna and Munger on river Ganga, at Bogibeel on river Brahmaputra at Nirmali on river Kosi. Funding model of ADB has got abilities to better contract management to avail the benefits of ‘Economy's of Bulk Purchase’ and ‘Hassle free Funds Flow’.

Creating Rail Transport ahead of Demand – A model SPV. First major non-budgetary initiative for creating Rail infrastructure on commercial format. Strengthening of Golden Quadrilateral and Diagonals. Providing Rail Based connectivity and development of corridors to hinterland including multi model corridors of for movement of containers. Construction of 4 mega bridges at Patna and Munger on river Ganga, at Bogibeel on river Brahmaputra at Nirmali on river Kosi. Funding model of ADB has got abilities to better contract management to avail the benefits of ‘Economy's of Bulk Purchase’ and ‘Hassle free Funds Flow’.

Corporate Mission Creating state of Art rail transport capacity to meet growing demand. Executing projects on fast track basis by adopting international project execution, construction, management practices and standards. To make the Project implementation process, efficient both in terms of cost and time. Adhering to sound business principles and prudent commercial practices to emerge India’s top rail infrastructure PSU. To implement Rail Infrastructure Project on commercial format through various Public Private Partnership models. To achieve International Quality Standards through innovations. To implement Rail Infrastructure Projects on commercial format through various Public Private Partnership Models. To achieve project completions in target time and with best quality. Involving private sector in financing the construction of projects and development of efficient models of Public Private Partnerships with joint venture SPVs with equity participation by Strategic & Financial Investors including funding options from external multilateral agencies like the Asian Development Bank.

Corporate Mission Creating state of Art rail transport capacity to meet growing demand. Executing projects on fast track basis by adopting international project execution, construction, management practices and standards. To make the Project implementation process, efficient both in terms of cost and time. Adhering to sound business principles and prudent commercial practices to emerge India’s top rail infrastructure PSU. To implement Rail Infrastructure Project on commercial format through various Public Private Partnership models. To achieve International Quality Standards through innovations. To implement Rail Infrastructure Projects on commercial format through various Public Private Partnership Models. To achieve project completions in target time and with best quality. Involving private sector in financing the construction of projects and development of efficient models of Public Private Partnerships with joint venture SPVs with equity participation by Strategic & Financial Investors including funding options from external multilateral agencies like the Asian Development Bank.

Corporate Vision To emerge as most efficient rail infrastructure provider with sound financial base and global construction practices for timely completion of projects. Rail Vikas Nigam Limited was set up with twin objectives of mobilization of private and market funds and implement Railway Projects on fast track basis. RVNL has gained significant hands on experience in private partnerships, dealing with multilateral agency like ADB, understanding their procedures and guidelines and utilization of multilateral funds for Railway Projects and execution of large contracts involving significant planning and project management and delivery of projects in a time bound manner The experience gained by RVNL is unique. Challenge before Cont’d…. . Indian Railways is to execute large number of projects on fast track basis to quickly augment capacity on the over saturated network.

Corporate Vision To emerge as most efficient rail infrastructure provider with sound financial base and global construction practices for timely completion of projects. Rail Vikas Nigam Limited was set up with twin objectives of mobilization of private and market funds and implement Railway Projects on fast track basis. RVNL has gained significant hands on experience in private partnerships, dealing with multilateral agency like ADB, understanding their procedures and guidelines and utilization of multilateral funds for Railway Projects and execution of large contracts involving significant planning and project management and delivery of projects in a time bound manner The experience gained by RVNL is unique. Challenge before Cont’d…. . Indian Railways is to execute large number of projects on fast track basis to quickly augment capacity on the over saturated network.

Corporate Vision Keeping in view, likely manifold increase in construction activity and need to implement projects in a tighter time schedule, RVNL will have to play a key role in removing capacity bottlenecks and implementation of projects. Based on the experience gained so far, RVNL need to be assigned the following role in future: RVNL will be assigned large capacity creation programmes viz. removal of capacity bottlenecks on High Density Network, RVNL will play a greater role in creating capacity on Golden Quadrilateral and can be assigned the projects as an outcome of studies being undertaken by RVNL for Freight Corridors on North South, East West, East Corridors, etc. RVNL will be assigned with large Railway Electrification Projects. RVNL will undertake construction of Mega Bridges. Such bridges are ideal candidate for multilateral funding as the same does not involve any Cont’d…. . ROR issue.

Corporate Vision Keeping in view, likely manifold increase in construction activity and need to implement projects in a tighter time schedule, RVNL will have to play a key role in removing capacity bottlenecks and implementation of projects. Based on the experience gained so far, RVNL need to be assigned the following role in future: RVNL will be assigned large capacity creation programmes viz. removal of capacity bottlenecks on High Density Network, RVNL will play a greater role in creating capacity on Golden Quadrilateral and can be assigned the projects as an outcome of studies being undertaken by RVNL for Freight Corridors on North South, East West, East Corridors, etc. RVNL will be assigned with large Railway Electrification Projects. RVNL will undertake construction of Mega Bridges. Such bridges are ideal candidate for multilateral funding as the same does not involve any Cont’d…. . ROR issue.

Corporate Vision Projects to be implemented with multilateral funding such as ADB and World Bank. Projects to be implemented through Public Private Partnership through various models. Construction of about 1000 kms of track every year. Expenditure of about Rs. 3, 000 cr. every year. Full operationalisation of RVNL as Railway Administration under Railways Act, 1989 Section 3(32 b) as per cabinet approval. To bring global construction technology in railway construction, to deliver best quality and to have cost effective design, construction to reduce the life cycle cost of project. Assignment of critical Railway Development Activities, requiring new skills and techniques.

Corporate Vision Projects to be implemented with multilateral funding such as ADB and World Bank. Projects to be implemented through Public Private Partnership through various models. Construction of about 1000 kms of track every year. Expenditure of about Rs. 3, 000 cr. every year. Full operationalisation of RVNL as Railway Administration under Railways Act, 1989 Section 3(32 b) as per cabinet approval. To bring global construction technology in railway construction, to deliver best quality and to have cost effective design, construction to reduce the life cycle cost of project. Assignment of critical Railway Development Activities, requiring new skills and techniques.

Corporate Objectives To undertake and execute successfully the project development pertaining to “Strengthening of Golden Quadrilateral, Port and Hinterland connectivity” and other viable Railway projects. To mobilize financial and human resources for project implementation. Timely execution of projects. To maintain a cost effective organizational set up. To encourage public private participation in rail related projects managed by RVNL. To be an infrastructure Project Management Company committed to sustainable development and environment friendly construction of rail related projects in the country. To acquire, purchase, license, concession or assign rail infrastructure assets including contractual rights and obligations.

Corporate Objectives To undertake and execute successfully the project development pertaining to “Strengthening of Golden Quadrilateral, Port and Hinterland connectivity” and other viable Railway projects. To mobilize financial and human resources for project implementation. Timely execution of projects. To maintain a cost effective organizational set up. To encourage public private participation in rail related projects managed by RVNL. To be an infrastructure Project Management Company committed to sustainable development and environment friendly construction of rail related projects in the country. To acquire, purchase, license, concession or assign rail infrastructure assets including contractual rights and obligations.

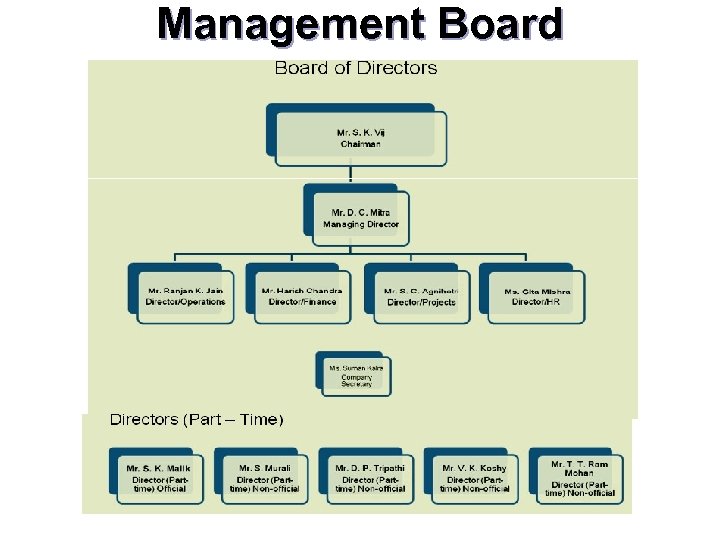

Management Board

Management Board

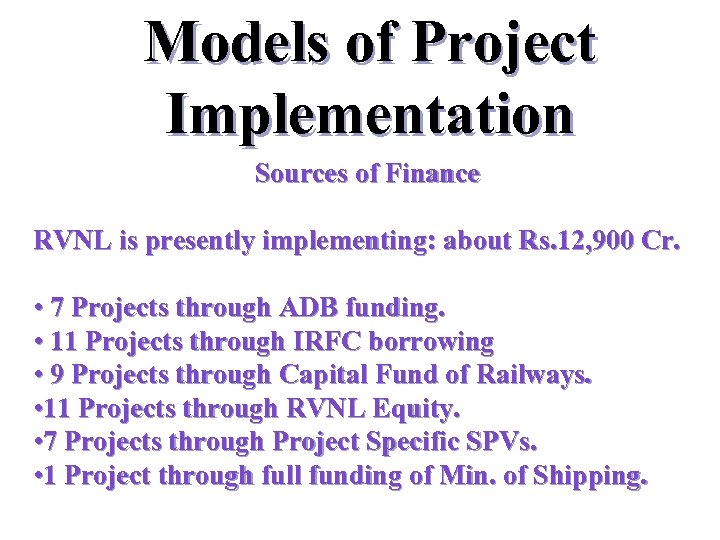

Models of Project Implementation Sources of Finance RVNL is presently implementing: about Rs. 12, 900 Cr. • 7 Projects through ADB funding. • 11 Projects through IRFC borrowing • 9 Projects through Capital Fund of Railways. • 11 Projects through RVNL Equity. • 7 Projects through Project Specific SPVs. • 1 Project through full funding of Min. of Shipping.

Models of Project Implementation Sources of Finance RVNL is presently implementing: about Rs. 12, 900 Cr. • 7 Projects through ADB funding. • 11 Projects through IRFC borrowing • 9 Projects through Capital Fund of Railways. • 11 Projects through RVNL Equity. • 7 Projects through Project Specific SPVs. • 1 Project through full funding of Min. of Shipping.

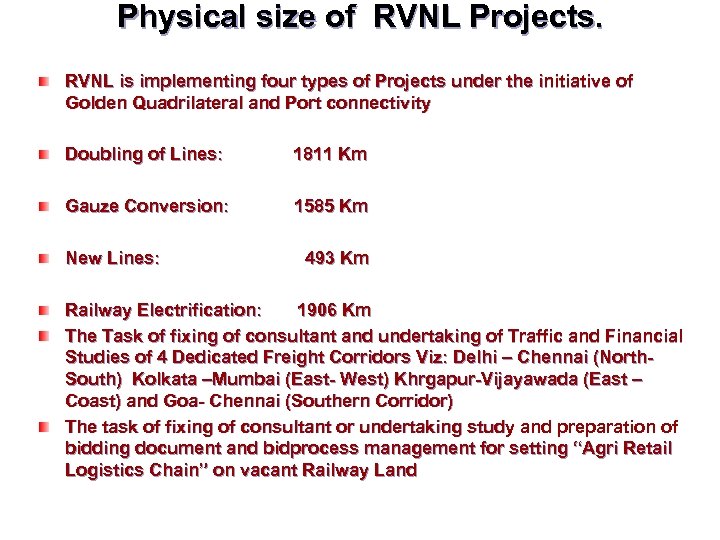

Physical size of RVNL Projects. RVNL is implementing four types of Projects under the initiative of Golden Quadrilateral and Port connectivity Doubling of Lines: 1811 Km Gauze Conversion: 1585 Km New Lines: 493 Km Railway Electrification: 1906 Km The Task of fixing of consultant and undertaking of Traffic and Financial Studies of 4 Dedicated Freight Corridors Viz: Delhi – Chennai (North. South) Kolkata –Mumbai (East- West) Khrgapur-Vijayawada (East – Coast) and Goa- Chennai (Southern Corridor) The task of fixing of consultant or undertaking study and preparation of bidding document and bidprocess management for setting “Agri Retail Logistics Chain” on vacant Railway Land

Physical size of RVNL Projects. RVNL is implementing four types of Projects under the initiative of Golden Quadrilateral and Port connectivity Doubling of Lines: 1811 Km Gauze Conversion: 1585 Km New Lines: 493 Km Railway Electrification: 1906 Km The Task of fixing of consultant and undertaking of Traffic and Financial Studies of 4 Dedicated Freight Corridors Viz: Delhi – Chennai (North. South) Kolkata –Mumbai (East- West) Khrgapur-Vijayawada (East – Coast) and Goa- Chennai (Southern Corridor) The task of fixing of consultant or undertaking study and preparation of bidding document and bidprocess management for setting “Agri Retail Logistics Chain” on vacant Railway Land

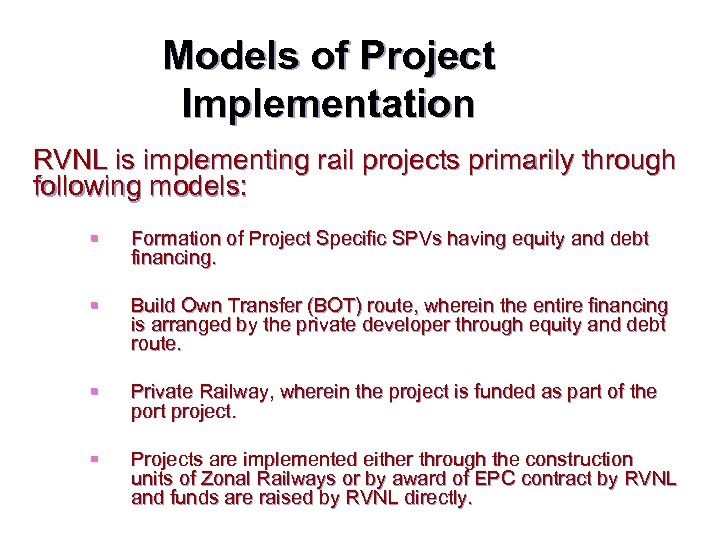

Models of Project Implementation RVNL is implementing rail projects primarily through following models: § Formation of Project Specific SPVs having equity and debt financing. § Build Own Transfer (BOT) route, wherein the entire financing is arranged by the private developer through equity and debt route. § Private Railway, wherein the project is funded as part of the port project. § Projects are implemented either through the construction units of Zonal Railways or by award of EPC contract by RVNL and funds are raised by RVNL directly.

Models of Project Implementation RVNL is implementing rail projects primarily through following models: § Formation of Project Specific SPVs having equity and debt financing. § Build Own Transfer (BOT) route, wherein the entire financing is arranged by the private developer through equity and debt route. § Private Railway, wherein the project is funded as part of the port project. § Projects are implemented either through the construction units of Zonal Railways or by award of EPC contract by RVNL and funds are raised by RVNL directly.

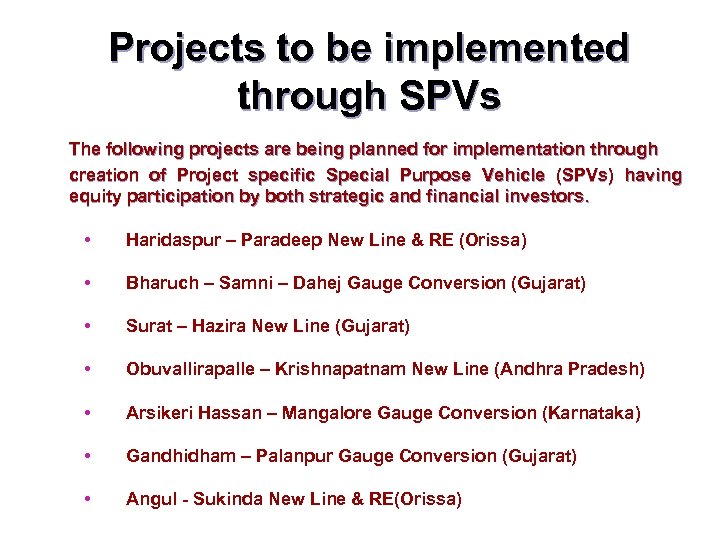

Projects to be implemented through SPVs The following projects are being planned for implementation through creation of Project specific Special Purpose Vehicle (SPVs) having equity participation by both strategic and financial investors. • Haridaspur – Paradeep New Line & RE (Orissa) • Bharuch – Samni – Dahej Gauge Conversion (Gujarat) • Surat – Hazira New Line (Gujarat) • Obuvallirapalle – Krishnapatnam New Line (Andhra Pradesh) • Arsikeri Hassan – Mangalore Gauge Conversion (Karnataka) • Gandhidham – Palanpur Gauge Conversion (Gujarat) • Angul - Sukinda New Line & RE(Orissa)

Projects to be implemented through SPVs The following projects are being planned for implementation through creation of Project specific Special Purpose Vehicle (SPVs) having equity participation by both strategic and financial investors. • Haridaspur – Paradeep New Line & RE (Orissa) • Bharuch – Samni – Dahej Gauge Conversion (Gujarat) • Surat – Hazira New Line (Gujarat) • Obuvallirapalle – Krishnapatnam New Line (Andhra Pradesh) • Arsikeri Hassan – Mangalore Gauge Conversion (Karnataka) • Gandhidham – Palanpur Gauge Conversion (Gujarat) • Angul - Sukinda New Line & RE(Orissa)

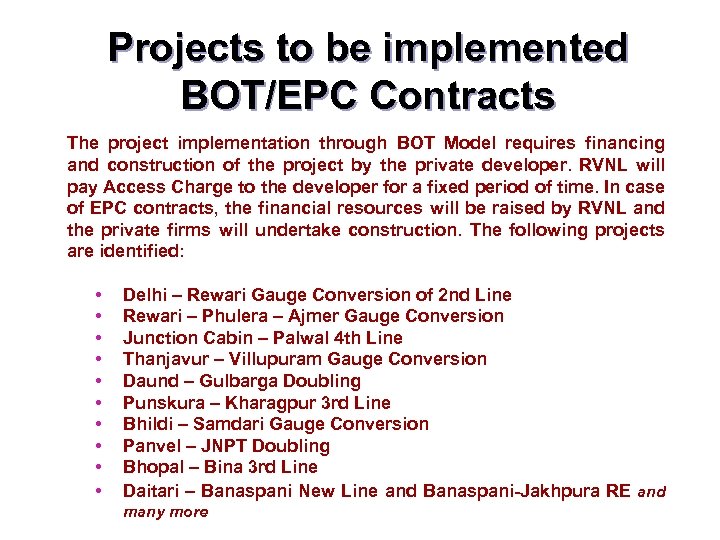

Projects to be implemented BOT/EPC Contracts The project implementation through BOT Model requires financing and construction of the project by the private developer. RVNL will pay Access Charge to the developer for a fixed period of time. In case of EPC contracts, the financial resources will be raised by RVNL and the private firms will undertake construction. The following projects are identified: • • • Delhi – Rewari Gauge Conversion of 2 nd Line Rewari – Phulera – Ajmer Gauge Conversion Junction Cabin – Palwal 4 th Line Thanjavur – Villupuram Gauge Conversion Daund – Gulbarga Doubling Punskura – Kharagpur 3 rd Line Bhildi – Samdari Gauge Conversion Panvel – JNPT Doubling Bhopal – Bina 3 rd Line Daitari – Banaspani New Line and Banaspani-Jakhpura RE and many more

Projects to be implemented BOT/EPC Contracts The project implementation through BOT Model requires financing and construction of the project by the private developer. RVNL will pay Access Charge to the developer for a fixed period of time. In case of EPC contracts, the financial resources will be raised by RVNL and the private firms will undertake construction. The following projects are identified: • • • Delhi – Rewari Gauge Conversion of 2 nd Line Rewari – Phulera – Ajmer Gauge Conversion Junction Cabin – Palwal 4 th Line Thanjavur – Villupuram Gauge Conversion Daund – Gulbarga Doubling Punskura – Kharagpur 3 rd Line Bhildi – Samdari Gauge Conversion Panvel – JNPT Doubling Bhopal – Bina 3 rd Line Daitari – Banaspani New Line and Banaspani-Jakhpura RE and many more

Projects being developed as PPP Model - Railways OBVP- KP New BG line connecting to a Private Port Company having strategic Partners with GOAP, MMTC, Krishnapatnam Port Company and Brahmani Steels on this system.

Projects being developed as PPP Model - Railways OBVP- KP New BG line connecting to a Private Port Company having strategic Partners with GOAP, MMTC, Krishnapatnam Port Company and Brahmani Steels on this system.

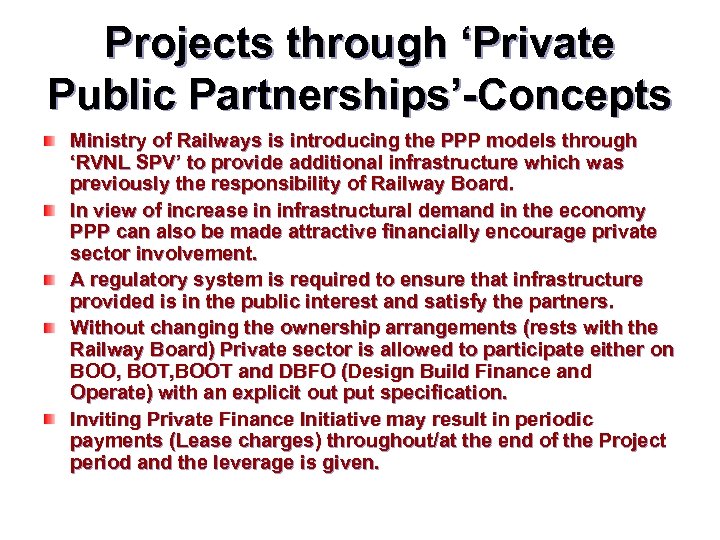

Projects through ‘Private Public Partnerships’-Concepts Ministry of Railways is introducing the PPP models through ‘RVNL SPV’ to provide additional infrastructure which was previously the responsibility of Railway Board. In view of increase in infrastructural demand in the economy PPP can also be made attractive financially encourage private sector involvement. A regulatory system is required to ensure that infrastructure provided is in the public interest and satisfy the partners. Without changing the ownership arrangements (rests with the Railway Board) Private sector is allowed to participate either on BOO, BOT, BOOT and DBFO (Design Build Finance and Operate) with an explicit out put specification. Inviting Private Finance Initiative may result in periodic payments (Lease charges) throughout/at the end of the Project period and the leverage is given.

Projects through ‘Private Public Partnerships’-Concepts Ministry of Railways is introducing the PPP models through ‘RVNL SPV’ to provide additional infrastructure which was previously the responsibility of Railway Board. In view of increase in infrastructural demand in the economy PPP can also be made attractive financially encourage private sector involvement. A regulatory system is required to ensure that infrastructure provided is in the public interest and satisfy the partners. Without changing the ownership arrangements (rests with the Railway Board) Private sector is allowed to participate either on BOO, BOT, BOOT and DBFO (Design Build Finance and Operate) with an explicit out put specification. Inviting Private Finance Initiative may result in periodic payments (Lease charges) throughout/at the end of the Project period and the leverage is given.

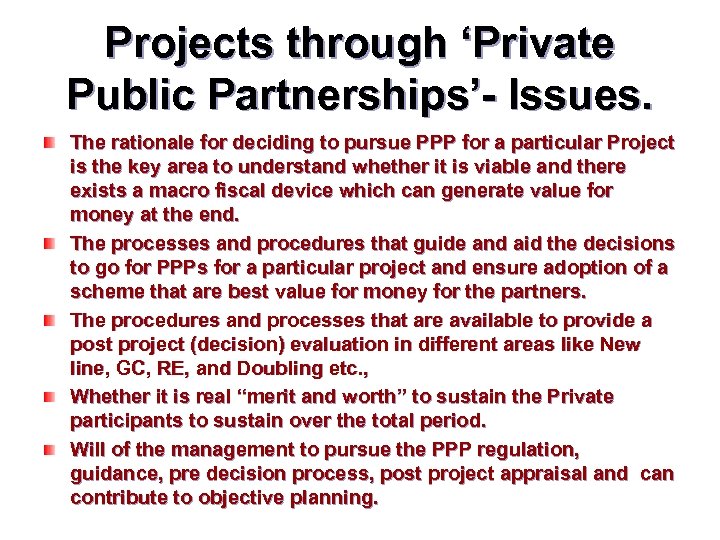

Projects through ‘Private Public Partnerships’- Issues. The rationale for deciding to pursue PPP for a particular Project is the key area to understand whether it is viable and there exists a macro fiscal device which can generate value for money at the end. The processes and procedures that guide and aid the decisions to go for PPPs for a particular project and ensure adoption of a scheme that are best value for money for the partners. The procedures and processes that are available to provide a post project (decision) evaluation in different areas like New line, GC, RE, and Doubling etc. , Whether it is real “merit and worth” to sustain the Private participants to sustain over the total period. Will of the management to pursue the PPP regulation, guidance, pre decision process, post project appraisal and can contribute to objective planning.

Projects through ‘Private Public Partnerships’- Issues. The rationale for deciding to pursue PPP for a particular Project is the key area to understand whether it is viable and there exists a macro fiscal device which can generate value for money at the end. The processes and procedures that guide and aid the decisions to go for PPPs for a particular project and ensure adoption of a scheme that are best value for money for the partners. The procedures and processes that are available to provide a post project (decision) evaluation in different areas like New line, GC, RE, and Doubling etc. , Whether it is real “merit and worth” to sustain the Private participants to sustain over the total period. Will of the management to pursue the PPP regulation, guidance, pre decision process, post project appraisal and can contribute to objective planning.

Projects being developed as Private Railways Vallarpadiam - Idapalli New Line (Kerala)

Projects being developed as Private Railways Vallarpadiam - Idapalli New Line (Kerala)

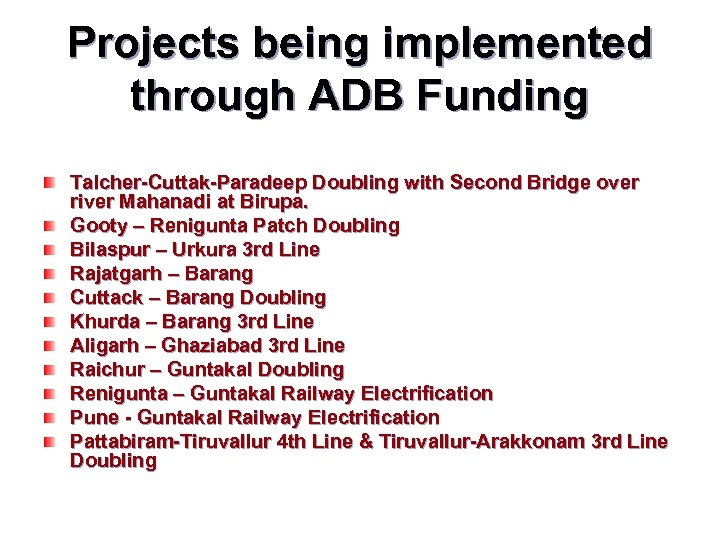

Projects being implemented through ADB Funding Talcher-Cuttak-Paradeep Doubling with Second Bridge over river Mahanadi at Birupa. Gooty – Renigunta Patch Doubling Bilaspur – Urkura 3 rd Line Rajatgarh – Barang Cuttack – Barang Doubling Khurda – Barang 3 rd Line Aligarh – Ghaziabad 3 rd Line Raichur – Guntakal Doubling Renigunta – Guntakal Railway Electrification Pune - Guntakal Railway Electrification Pattabiram-Tiruvallur 4 th Line & Tiruvallur-Arakkonam 3 rd Line Doubling

Projects being implemented through ADB Funding Talcher-Cuttak-Paradeep Doubling with Second Bridge over river Mahanadi at Birupa. Gooty – Renigunta Patch Doubling Bilaspur – Urkura 3 rd Line Rajatgarh – Barang Cuttack – Barang Doubling Khurda – Barang 3 rd Line Aligarh – Ghaziabad 3 rd Line Raichur – Guntakal Doubling Renigunta – Guntakal Railway Electrification Pune - Guntakal Railway Electrification Pattabiram-Tiruvallur 4 th Line & Tiruvallur-Arakkonam 3 rd Line Doubling

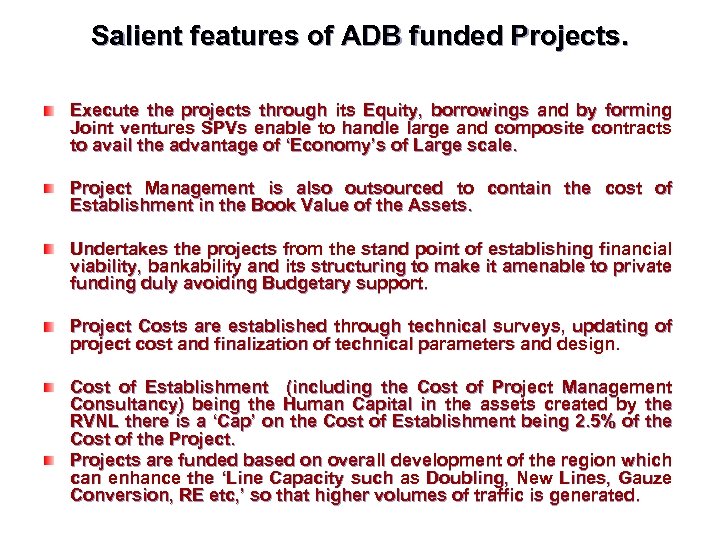

Salient features of ADB funded Projects. Execute the projects through its Equity, borrowings and by forming Joint ventures SPVs enable to handle large and composite contracts to avail the advantage of ‘Economy’s of Large scale. Project Management is also outsourced to contain the cost of Establishment in the Book Value of the Assets. Undertakes the projects from the stand point of establishing financial viability, bankability and its structuring to make it amenable to private funding duly avoiding Budgetary support. Project Costs are established through technical surveys, updating of project cost and finalization of technical parameters and design. Cost of Establishment (including the Cost of Project Management Consultancy) being the Human Capital in the assets created by the RVNL there is a ‘Cap’ on the Cost of Establishment being 2. 5% of the Cost of the Projects are funded based on overall development of the region which can enhance the ‘Line Capacity such as Doubling, New Lines, Gauze Conversion, RE etc, ’ so that higher volumes of traffic is generated.

Salient features of ADB funded Projects. Execute the projects through its Equity, borrowings and by forming Joint ventures SPVs enable to handle large and composite contracts to avail the advantage of ‘Economy’s of Large scale. Project Management is also outsourced to contain the cost of Establishment in the Book Value of the Assets. Undertakes the projects from the stand point of establishing financial viability, bankability and its structuring to make it amenable to private funding duly avoiding Budgetary support. Project Costs are established through technical surveys, updating of project cost and finalization of technical parameters and design. Cost of Establishment (including the Cost of Project Management Consultancy) being the Human Capital in the assets created by the RVNL there is a ‘Cap’ on the Cost of Establishment being 2. 5% of the Cost of the Projects are funded based on overall development of the region which can enhance the ‘Line Capacity such as Doubling, New Lines, Gauze Conversion, RE etc, ’ so that higher volumes of traffic is generated.

Framing and Evaluation of Technical Bids. Irrespective of the system of submission of Bids either in TWO PACKET or SINGLE PACKET which is decided on the merits of each case ‘Evaluation of Technical Bid’ is the KEY selection process. Technical experience which is in accordance with the ITB has to be established by the bidders with the proof of documentation. The Key factors such as Capacity to take up the Major Bridges, Track Linking, Electrification of Line, Building of Sub-stations, arrangement of solid state inter locking (S&T) works etc. , are evaluated in detail. The Bid selection on the basis of Technical Personnel and their experience is also given equal importance on the related Key factors. Capacity of the Agency with regard to availability of his Plant & Machinery such as Mobile Welding Plants, Road vehicles, Machinery, and workshops available with regard to their capacity and present Load with in the period of execution of Project. Unless the Bid is certified as substantially qualified the same is rejected due to non fulfilling the ‘Technical suitability’ and the merits of financial bid should not influence the selection. (in case of Two Packet system the financial bids are not opened and entire bid is rejected)

Framing and Evaluation of Technical Bids. Irrespective of the system of submission of Bids either in TWO PACKET or SINGLE PACKET which is decided on the merits of each case ‘Evaluation of Technical Bid’ is the KEY selection process. Technical experience which is in accordance with the ITB has to be established by the bidders with the proof of documentation. The Key factors such as Capacity to take up the Major Bridges, Track Linking, Electrification of Line, Building of Sub-stations, arrangement of solid state inter locking (S&T) works etc. , are evaluated in detail. The Bid selection on the basis of Technical Personnel and their experience is also given equal importance on the related Key factors. Capacity of the Agency with regard to availability of his Plant & Machinery such as Mobile Welding Plants, Road vehicles, Machinery, and workshops available with regard to their capacity and present Load with in the period of execution of Project. Unless the Bid is certified as substantially qualified the same is rejected due to non fulfilling the ‘Technical suitability’ and the merits of financial bid should not influence the selection. (in case of Two Packet system the financial bids are not opened and entire bid is rejected)

Framing and Evaluation of Financial Bids. Besides Bid Security and Performance Security other Financial criterion such as Worth of the Bidder is to be established for framing and selection of bids for assessing the financial capacity. Average Annual turnover of the bidder for the last 5 years and commitments for the next 3 years of the bidder are also ensured to see that the bidder has capacity towards working capital to take up the work. Audited Balance sheets and Revenue Accounts are verified that the bidder is solvent and is a running concern and has financial interests to sustain in the trade. The Bid selection on the basis of quotation of rates on each Schedule or phase of work in co relation with the workability of rates to see that execution is ensured with out termination is given equal importance on the related Key factors of work. Capacity of the Agency with regard to existing commitments, and Net Worth of the firm with regard to his capacity on the present Liability with in the period of Project completion. For the selection of bids the L 1 need not be a successful bidder unless it is established his Technical bid substantially qualified to execute the work as per the project objectives. s

Framing and Evaluation of Financial Bids. Besides Bid Security and Performance Security other Financial criterion such as Worth of the Bidder is to be established for framing and selection of bids for assessing the financial capacity. Average Annual turnover of the bidder for the last 5 years and commitments for the next 3 years of the bidder are also ensured to see that the bidder has capacity towards working capital to take up the work. Audited Balance sheets and Revenue Accounts are verified that the bidder is solvent and is a running concern and has financial interests to sustain in the trade. The Bid selection on the basis of quotation of rates on each Schedule or phase of work in co relation with the workability of rates to see that execution is ensured with out termination is given equal importance on the related Key factors of work. Capacity of the Agency with regard to existing commitments, and Net Worth of the firm with regard to his capacity on the present Liability with in the period of Project completion. For the selection of bids the L 1 need not be a successful bidder unless it is established his Technical bid substantially qualified to execute the work as per the project objectives. s

Special features of RVNL Contracts. The Contract Management is unique in RVNL contracts and each contract is governed by the its own Special/Particular conditions of the contract. As a policy Global Tenders are called inviting International Participants having Multinational experience and the value of bids can be quoted in INRs/ American dollars. A pre bid meeting will be conducted inviting all possible participants about the modalities of implementation and execution of the Project along with the Technical details of the Project. A 3 Tier system of Bid evaluation is in place to ensure that Bid selection and choice of Agency is arrived at based on the critical Technical evaluation. The in- built system of Bid evaluation ensures that selection is more transparent and the Agency has got equal responsibility to complete the works as per Targets failing in which payable compensations equal to revenue losses are laid. To balance the losses to the Agency on delays due to non availability of Land, Designs from the employer, and other site arrangements the ‘Employer’ is also bound to pay the compensations as per the conditions.

Special features of RVNL Contracts. The Contract Management is unique in RVNL contracts and each contract is governed by the its own Special/Particular conditions of the contract. As a policy Global Tenders are called inviting International Participants having Multinational experience and the value of bids can be quoted in INRs/ American dollars. A pre bid meeting will be conducted inviting all possible participants about the modalities of implementation and execution of the Project along with the Technical details of the Project. A 3 Tier system of Bid evaluation is in place to ensure that Bid selection and choice of Agency is arrived at based on the critical Technical evaluation. The in- built system of Bid evaluation ensures that selection is more transparent and the Agency has got equal responsibility to complete the works as per Targets failing in which payable compensations equal to revenue losses are laid. To balance the losses to the Agency on delays due to non availability of Land, Designs from the employer, and other site arrangements the ‘Employer’ is also bound to pay the compensations as per the conditions.

Particular conditions of RVNL Contracts. The Contract conditions should stipulate the “Minimum Interim Certificate” by not less than Rs. 6/7/8 Crores of the contract value. Contract shall be insured covering the Employer’s risk to the extant of 40% value of the Contract. Work has to be certified for its completion by the PMC which is directly under it supervision and the release of the payments. Defects notification period provides guarantees to the employer for the defective work and the responsibility of the Agency to make good the work as per the directives of the employer. The cost of the PMC contract shall be regulated to the 3. 5 to 4. 0% of the value of the each contract. The validity of the PMC shall be so regulated that it shall cover the currency of the main contract including the ‘Defect Liability period’. The built in conditions shall take into account the Custody of the Materials at the site and insurance coverage includes Physical Work in Progress with the employer.

Particular conditions of RVNL Contracts. The Contract conditions should stipulate the “Minimum Interim Certificate” by not less than Rs. 6/7/8 Crores of the contract value. Contract shall be insured covering the Employer’s risk to the extant of 40% value of the Contract. Work has to be certified for its completion by the PMC which is directly under it supervision and the release of the payments. Defects notification period provides guarantees to the employer for the defective work and the responsibility of the Agency to make good the work as per the directives of the employer. The cost of the PMC contract shall be regulated to the 3. 5 to 4. 0% of the value of the each contract. The validity of the PMC shall be so regulated that it shall cover the currency of the main contract including the ‘Defect Liability period’. The built in conditions shall take into account the Custody of the Materials at the site and insurance coverage includes Physical Work in Progress with the employer.

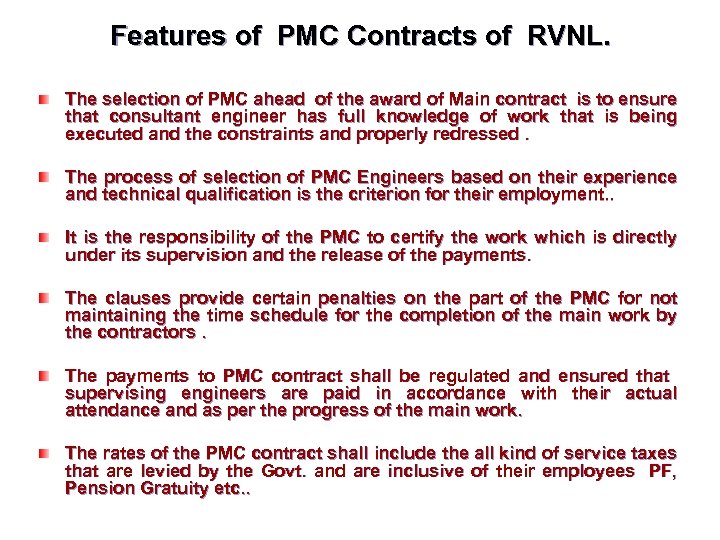

Features of PMC Contracts of RVNL. The selection of PMC ahead of the award of Main contract is to ensure that consultant engineer has full knowledge of work that is being executed and the constraints and properly redressed. The process of selection of PMC Engineers based on their experience and technical qualification is the criterion for their employment. . It is the responsibility of the PMC to certify the work which is directly under its supervision and the release of the payments. The clauses provide certain penalties on the part of the PMC for not maintaining the time schedule for the completion of the main work by the contractors. The payments to PMC contract shall be regulated and ensured that supervising engineers are paid in accordance with their actual attendance and as per the progress of the main work. The rates of the PMC contract shall include the all kind of service taxes that are levied by the Govt. and are inclusive of their employees PF, Pension Gratuity etc. .

Features of PMC Contracts of RVNL. The selection of PMC ahead of the award of Main contract is to ensure that consultant engineer has full knowledge of work that is being executed and the constraints and properly redressed. The process of selection of PMC Engineers based on their experience and technical qualification is the criterion for their employment. . It is the responsibility of the PMC to certify the work which is directly under its supervision and the release of the payments. The clauses provide certain penalties on the part of the PMC for not maintaining the time schedule for the completion of the main work by the contractors. The payments to PMC contract shall be regulated and ensured that supervising engineers are paid in accordance with their actual attendance and as per the progress of the main work. The rates of the PMC contract shall include the all kind of service taxes that are levied by the Govt. and are inclusive of their employees PF, Pension Gratuity etc. .

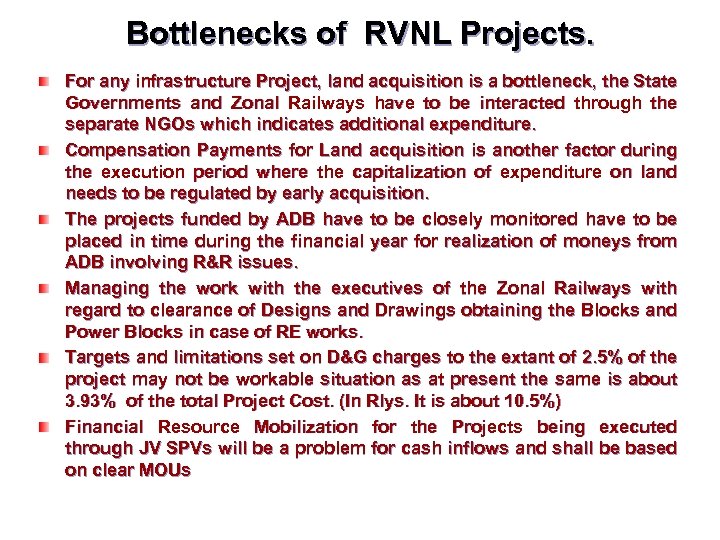

Bottlenecks of RVNL Projects. For any infrastructure Project, land acquisition is a bottleneck, the State Governments and Zonal Railways have to be interacted through the separate NGOs which indicates additional expenditure. Compensation Payments for Land acquisition is another factor during the execution period where the capitalization of expenditure on land needs to be regulated by early acquisition. The projects funded by ADB have to be closely monitored have to be placed in time during the financial year for realization of moneys from ADB involving R&R issues. Managing the work with the executives of the Zonal Railways with regard to clearance of Designs and Drawings obtaining the Blocks and Power Blocks in case of RE works. Targets and limitations set on D&G charges to the extant of 2. 5% of the project may not be workable situation as at present the same is about 3. 93% of the total Project Cost. (In Rlys. It is about 10. 5%) Financial Resource Mobilization for the Projects being executed through JV SPVs will be a problem for cash inflows and shall be based on clear MOUs

Bottlenecks of RVNL Projects. For any infrastructure Project, land acquisition is a bottleneck, the State Governments and Zonal Railways have to be interacted through the separate NGOs which indicates additional expenditure. Compensation Payments for Land acquisition is another factor during the execution period where the capitalization of expenditure on land needs to be regulated by early acquisition. The projects funded by ADB have to be closely monitored have to be placed in time during the financial year for realization of moneys from ADB involving R&R issues. Managing the work with the executives of the Zonal Railways with regard to clearance of Designs and Drawings obtaining the Blocks and Power Blocks in case of RE works. Targets and limitations set on D&G charges to the extant of 2. 5% of the project may not be workable situation as at present the same is about 3. 93% of the total Project Cost. (In Rlys. It is about 10. 5%) Financial Resource Mobilization for the Projects being executed through JV SPVs will be a problem for cash inflows and shall be based on clear MOUs

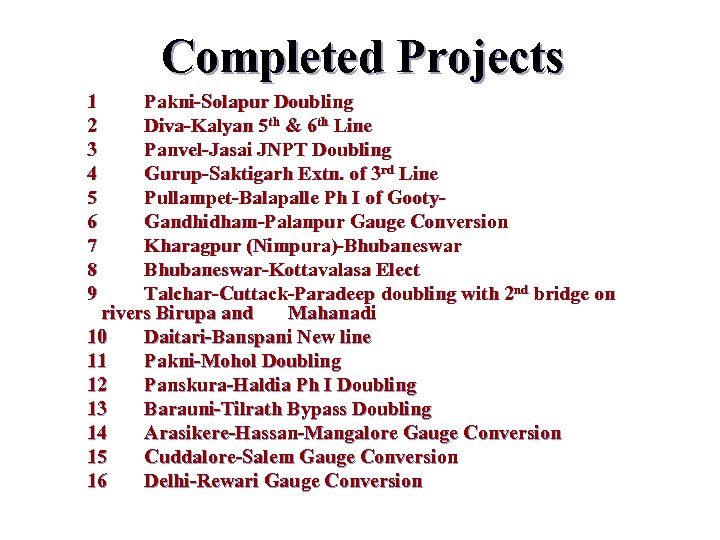

Completed Projects 1 Pakni-Solapur Doubling 2 Diva-Kalyan 5 th & 6 th Line 3 Panvel-Jasai JNPT Doubling 4 Gurup-Saktigarh Extn. of 3 rd Line 5 Pullampet-Balapalle Ph I of Gooty- 6 Gandhidham-Palanpur Gauge Conversion 7 Kharagpur (Nimpura)-Bhubaneswar 8 Bhubaneswar-Kottavalasa Elect 9 Talchar-Cuttack-Paradeep doubling with 2 nd bridge on rivers Birupa and Mahanadi 10 Daitari-Banspani New line 11 Pakni-Mohol Doubling 12 Panskura-Haldia Ph I Doubling 13 Barauni-Tilrath Bypass Doubling 14 Arasikere-Hassan-Mangalore Gauge Conversion 15 Cuddalore-Salem Gauge Conversion 16 Delhi-Rewari Gauge Conversion

Completed Projects 1 Pakni-Solapur Doubling 2 Diva-Kalyan 5 th & 6 th Line 3 Panvel-Jasai JNPT Doubling 4 Gurup-Saktigarh Extn. of 3 rd Line 5 Pullampet-Balapalle Ph I of Gooty- 6 Gandhidham-Palanpur Gauge Conversion 7 Kharagpur (Nimpura)-Bhubaneswar 8 Bhubaneswar-Kottavalasa Elect 9 Talchar-Cuttack-Paradeep doubling with 2 nd bridge on rivers Birupa and Mahanadi 10 Daitari-Banspani New line 11 Pakni-Mohol Doubling 12 Panskura-Haldia Ph I Doubling 13 Barauni-Tilrath Bypass Doubling 14 Arasikere-Hassan-Mangalore Gauge Conversion 15 Cuddalore-Salem Gauge Conversion 16 Delhi-Rewari Gauge Conversion

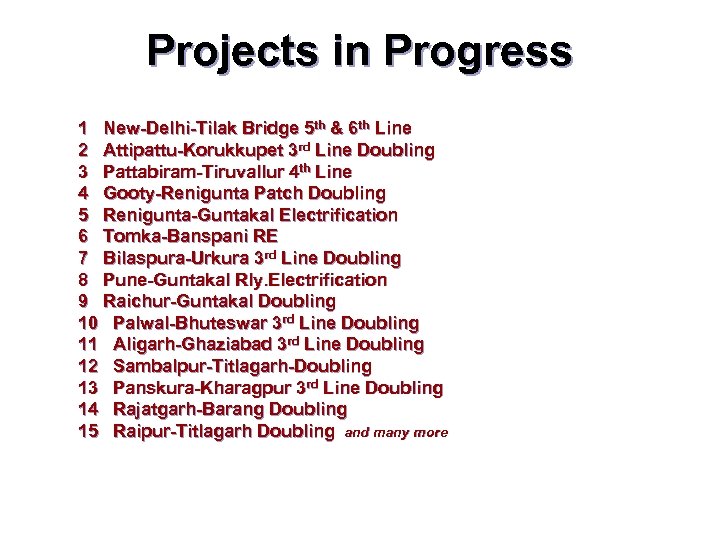

Projects in Progress 1 New-Delhi-Tilak Bridge 5 th & 6 th Line 2 Attipattu-Korukkupet 3 rd Line Doubling 3 Pattabiram-Tiruvallur 4 th Line 4 Gooty-Renigunta Patch Doubling 5 Renigunta-Guntakal Electrification 6 Tomka-Banspani RE 7 Bilaspura-Urkura 3 rd Line Doubling 8 Pune-Guntakal Rly. Electrification 9 Raichur-Guntakal Doubling 10 Palwal-Bhuteswar 3 rd Line Doubling 11 Aligarh-Ghaziabad 3 rd Line Doubling 12 Sambalpur-Titlagarh-Doubling 13 Panskura-Kharagpur 3 rd Line Doubling 14 Rajatgarh-Barang Doubling 15 Raipur-Titlagarh Doubling and many more

Projects in Progress 1 New-Delhi-Tilak Bridge 5 th & 6 th Line 2 Attipattu-Korukkupet 3 rd Line Doubling 3 Pattabiram-Tiruvallur 4 th Line 4 Gooty-Renigunta Patch Doubling 5 Renigunta-Guntakal Electrification 6 Tomka-Banspani RE 7 Bilaspura-Urkura 3 rd Line Doubling 8 Pune-Guntakal Rly. Electrification 9 Raichur-Guntakal Doubling 10 Palwal-Bhuteswar 3 rd Line Doubling 11 Aligarh-Ghaziabad 3 rd Line Doubling 12 Sambalpur-Titlagarh-Doubling 13 Panskura-Kharagpur 3 rd Line Doubling 14 Rajatgarh-Barang Doubling 15 Raipur-Titlagarh Doubling and many more

About RVNL Vigilance Unit, Rail Vikas Nigam Limited is the nodal section for handling all vigilance matters of the Rail Vikas Nigam Limited. The Chief Vigilance Officer heads this unit. The CVO is assisted by two Assistant Managers. The vigilance unit works under the Ministry of Railways and coordinates with Central Vigilance Commission (CVC).

About RVNL Vigilance Unit, Rail Vikas Nigam Limited is the nodal section for handling all vigilance matters of the Rail Vikas Nigam Limited. The Chief Vigilance Officer heads this unit. The CVO is assisted by two Assistant Managers. The vigilance unit works under the Ministry of Railways and coordinates with Central Vigilance Commission (CVC).

Role of Vigilance The role of vigilance in RVNL is multifarious. It undertakes preventive vigilance, punitive vigilance and system improvement. The Vigilance Unit also arranges Vigilance Awareness programmes. The Vigilance Unit organizes Vigilance Awareness Week celebrated every year as per guidelines of CVC. Vigilance Bulletins are also published regularly providing information on vigilance awareness.

Role of Vigilance The role of vigilance in RVNL is multifarious. It undertakes preventive vigilance, punitive vigilance and system improvement. The Vigilance Unit also arranges Vigilance Awareness programmes. The Vigilance Unit organizes Vigilance Awareness Week celebrated every year as per guidelines of CVC. Vigilance Bulletins are also published regularly providing information on vigilance awareness.

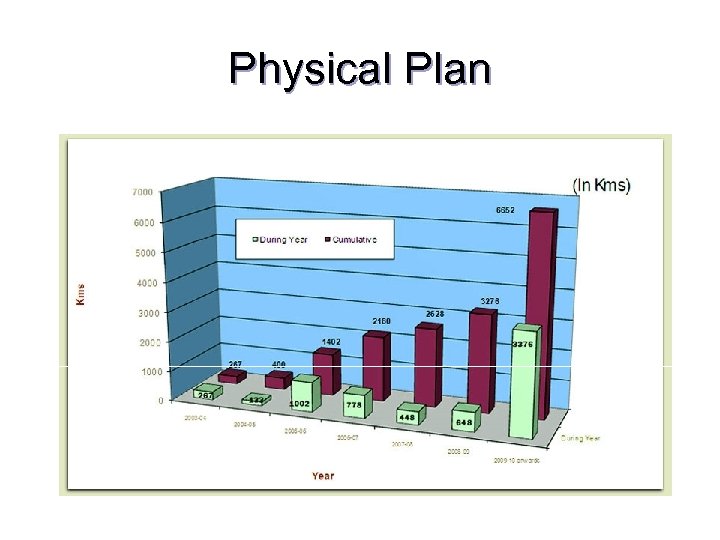

Physical Plan

Physical Plan

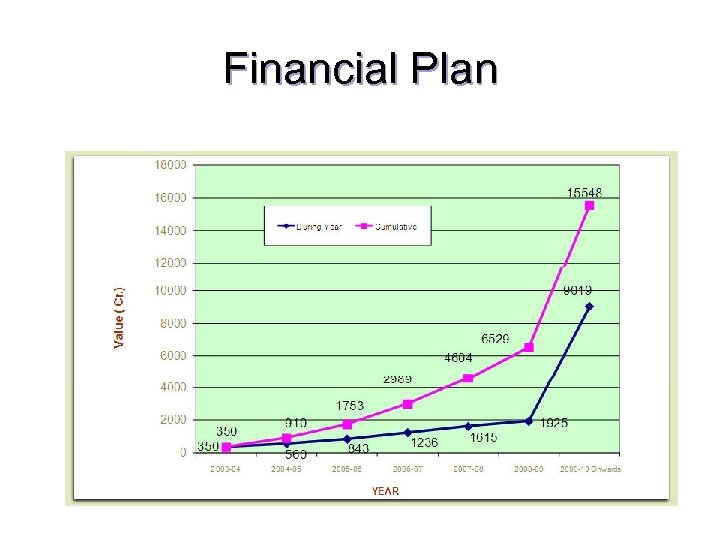

Financial Plan

Financial Plan