bd61c93ae3ca62aaa4797963e29cba25.ppt

- Количество слайдов: 23

Webinar Billing and customer care: powering the quest for higher ARPU Mark H Mortensen and Justin van der Lande 2 November 2011

Billing and Customer Care multi client briefing 2 2011 situation – difficult times ahead, new directions needed Mobile operators l l ARPU too low and going lower as operators dip down low in the ARPU stack, competition increases in saturated markets, and tweens and teens move from voice to texting Mobile video demand (bandwidth!) is increasing through multi media ready smart phones and tablets On the verge of another major investment cycle to LTE – but this time a measured evolution Fixed network operators l l Losing customers to mobile and Over the Top (OTT) providers such as HULU, Netflix, Skype Mobile subsidiaries have propped up the companies’ revenue, outsourced IT operations have helped growth OTT services and net neutrality threatening to make CSPs just broadband pipe providers – whether dumb, semi smart, or smart pipes FTTH deployments may not work out economically in the foreseeable future without government investment. Revenues in many markets not keeping pace with investments required as video demands greater bandwidth, but revenue per bit drops. Operators seek to sustain their profitability through new revenue opportunities from new services, new business models, new partnerships, and the introduction of new technologies. © Analysys Mason Limited 2011

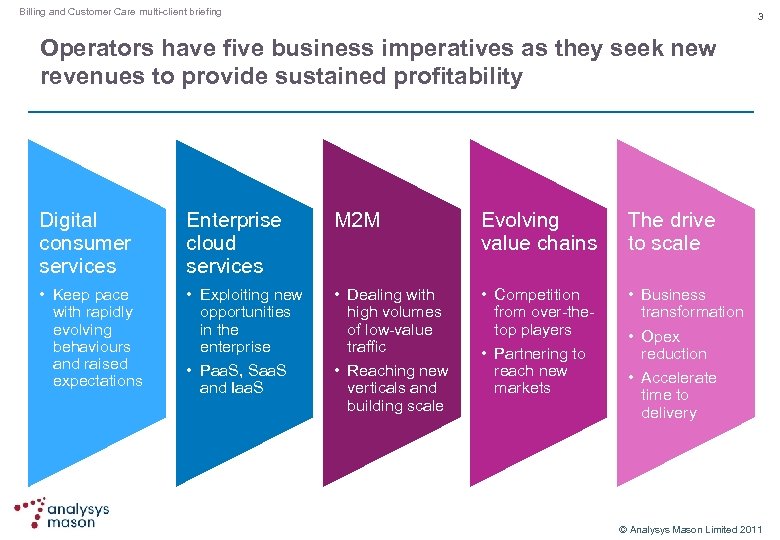

Billing and Customer Care multi client briefing 3 Operators have five business imperatives as they seek new revenues to provide sustained profitability Digital consumer services Enterprise cloud services M 2 M Evolving value chains The drive to scale • Keep pace with rapidly evolving behaviours and raised expectations • Exploiting new opportunities in the enterprise • Paa. S, Saa. S and Iaa. S • Dealing with high volumes of low value traffic • Reaching new verticals and building scale • Competition from over the top players • Partnering to reach new markets • Business transformation • Opex reduction • Accelerate time to delivery Service Provider Strategies © Analysys Mason Limited 2011

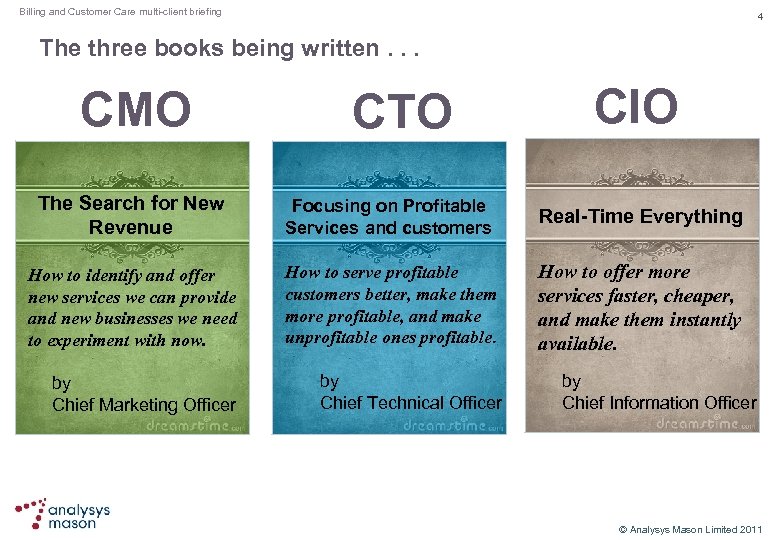

Billing and Customer Care multi client briefing 4 The three books being written. . . CMO CTO CIO The Search for New Revenue Focusing on Profitable Services and customers Real-Time Everything How to identify and offer new services we can provide and new businesses we need to experiment with now. How to serve profitable customers better, make them more profitable, and make unprofitable ones profitable. How to offer more services faster, cheaper, and make them instantly available. by Chief Marketing Officer by Chief Technical Officer by Chief Information Officer © Analysys Mason Limited 2011

Billing and Customer Care multi client briefing 5 These three affect future customer-facing operations The Search for New Revenue • New services needed – quickly! Requires flexible, configurable BSS systems. • Policy management enables differentiated services – with mass customization. • New business opportunities will require BSS and OSS functions. Many from extending existing systems. Focusing on Profitable Services and customers • Serving high ARPU SME/SMB customers well • Understanding customers’ desires and offering them customised services • Managing the customer experience. Real-Time Everything • Implementing new services via the service layer is faster than changing the operations and BSS/OSSs • Time is REAL Transactions are ACCURATE Services are CUSTOMise. D. Self care, e. Care, self serve analytics, etc. © Analysys Mason Limited 2011

Billing and Customer Care multi client briefing 6 Customer-facing operations must adapt to the new requirements Customer Care Billing l l l Provide differentiated, customised services configured and controlled by policies in real time Gather and analyse massive data sets for enhanced marketing, sales, and operations l l Provide new billing solutions for mobile data, cloud and low costs M 2 M services l Provide new billing solutions for new infrastructure such as LTE l Convergent billing solutions to help reduce the mass of billing systems l Introduce new services quickly, including more third-party content, with master catalogues and product lifecycle management Market, sell, and service complex service bundles using multichannel marketing and order orchestration Increase ARPU through microsegmented and personalised offers Reduce support costs through self service Holistically manage the customers’ unique experiences and expectations. © Analysys Mason Limited 2011

Billing and Customer Care multi client briefing 7 BILLING JUSTIN VAN DER LANDE © Analysys Mason Limited 2011

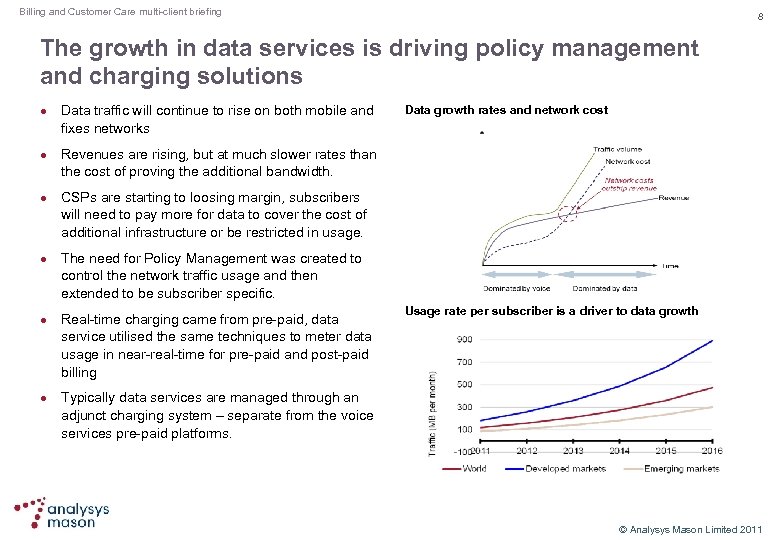

Billing and Customer Care multi client briefing 8 The growth in data services is driving policy management and charging solutions l l l Data traffic will continue to rise on both mobile and fixes networks Data growth rates and network cost Revenues are rising, but at much slower rates than the cost of proving the additional bandwidth. CSPs are starting to loosing margin, subscribers will need to pay more for data to cover the cost of additional infrastructure or be restricted in usage. The need for Policy Management was created to control the network traffic usage and then extended to be subscriber specific. Real time charging came from pre paid, data service utilised the same techniques to meter data usage in near real time for pre paid and post paid billing Usage rate per subscriber is a driver to data growth Typically data services are managed through an adjunct charging system – separate from the voice services pre paid platforms. © Analysys Mason Limited 2011

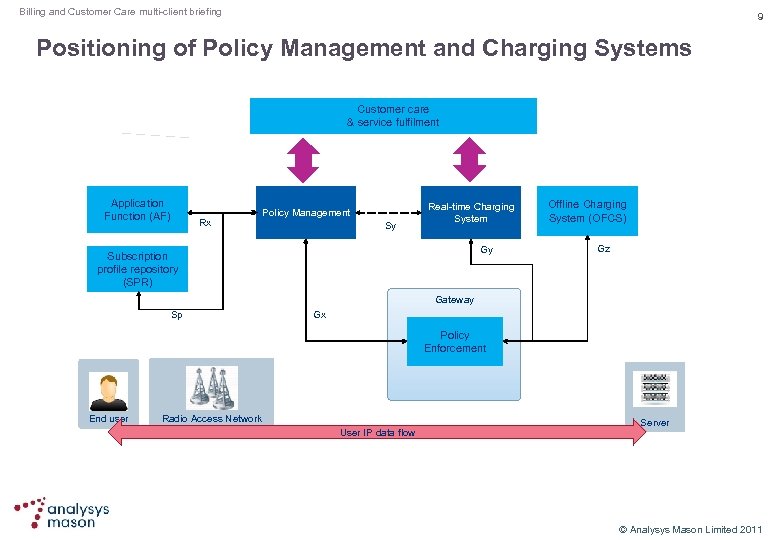

Billing and Customer Care multi client briefing 9 Positioning of Policy Management and Charging Systems Customer care & service fulfilment Application Function (AF) Rx Policy Management Sy Real time Charging System Gy Subscription profile repository (SPR) Offline Charging System (OFCS) Gz Gateway Sp Gx Policy Enforcement End user Radio Access Network User IP data flow Server © Analysys Mason Limited 2011

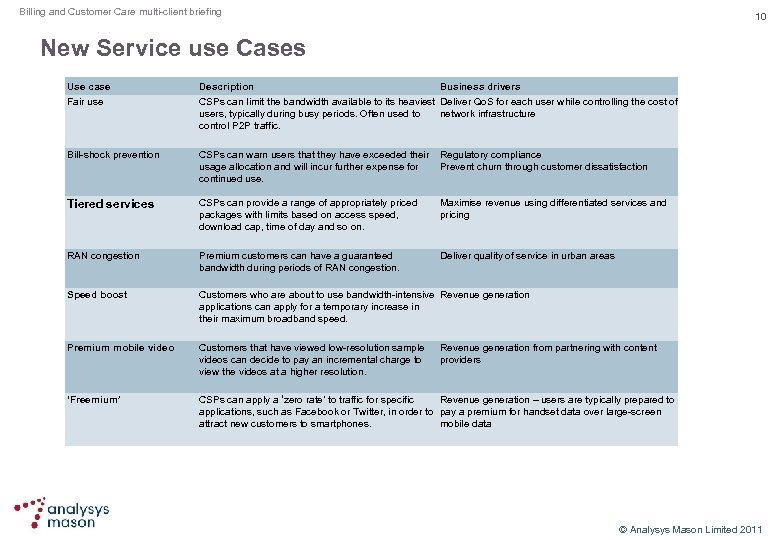

Billing and Customer Care multi client briefing 10 New Service use Cases Use case Description Business drivers Fair use CSPs can limit the bandwidth available to its heaviest Deliver Qo. S for each user while controlling the cost of users, typically during busy periods. Often used to network infrastructure control P 2 P traffic. Bill shock prevention CSPs can warn users that they have exceeded their Regulatory compliance usage allocation and will incur further expense for Prevent churn through customer dissatisfaction continued use. Tiered services CSPs can provide a range of appropriately priced packages with limits based on access speed, download cap, time of day and so on. Maximise revenue using differentiated services and pricing RAN congestion Premium customers can have a guaranteed bandwidth during periods of RAN congestion. Deliver quality of service in urban areas Speed boost Customers who are about to use bandwidth intensive Revenue generation applications can apply for a temporary increase in their maximum broadband speed. Premium mobile video Customers that have viewed low resolution sample videos can decide to pay an incremental charge to view the videos at a higher resolution. ‘Freemium’ CSPs can apply a ‘zero rate’ to traffic for specific Revenue generation – users are typically prepared to applications, such as Facebook or Twitter, in order to pay a premium for handset data over large screen attract new customers to smartphones. mobile data Revenue generation from partnering with content providers © Analysys Mason Limited 2011

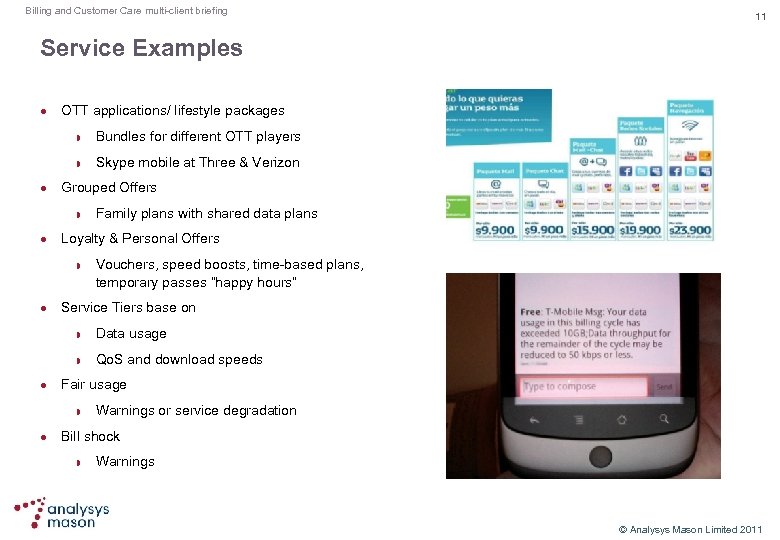

Billing and Customer Care multi client briefing 11 Service Examples l OTT applications/ lifestyle packages l Bundles for different OTT players Skype mobile at Three & Verizon Grouped Offers l Loyalty & Personal Offers l Family plans with shared data plans Vouchers, speed boosts, time based plans, temporary passes “happy hours” Service Tiers base on l Data usage Qo. S and download speeds Fair usage l Warnings or service degradation Bill shock Warnings © Analysys Mason Limited 2011

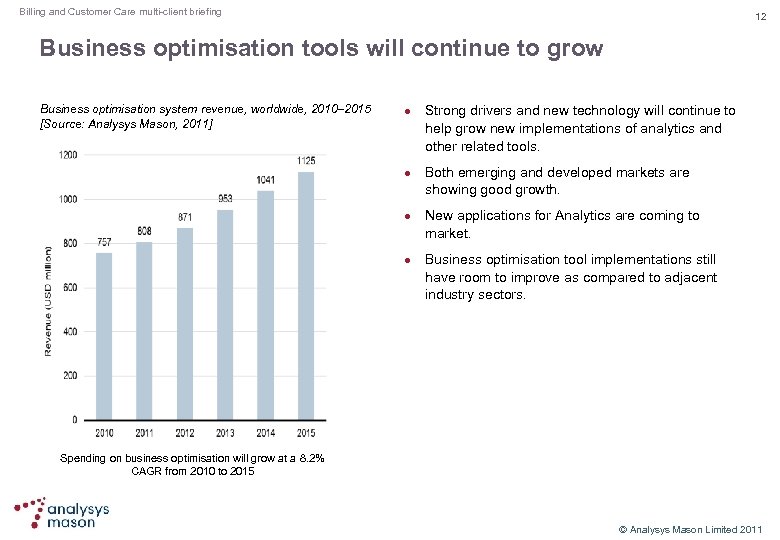

Billing and Customer Care multi client briefing 12 Business optimisation tools will continue to grow Business optimisation system revenue, worldwide, 2010– 2015 [Source: Analysys Mason, 2011] l l Strong drivers and new technology will continue to help grow new implementations of analytics and other related tools. Both emerging and developed markets are showing good growth. New applications for Analytics are coming to market. Business optimisation tool implementations still have room to improve as compared to adjacent industry sectors. Spending on business optimisation will grow at a 8. 2% CAGR from 2010 to 2015 © Analysys Mason Limited 2011

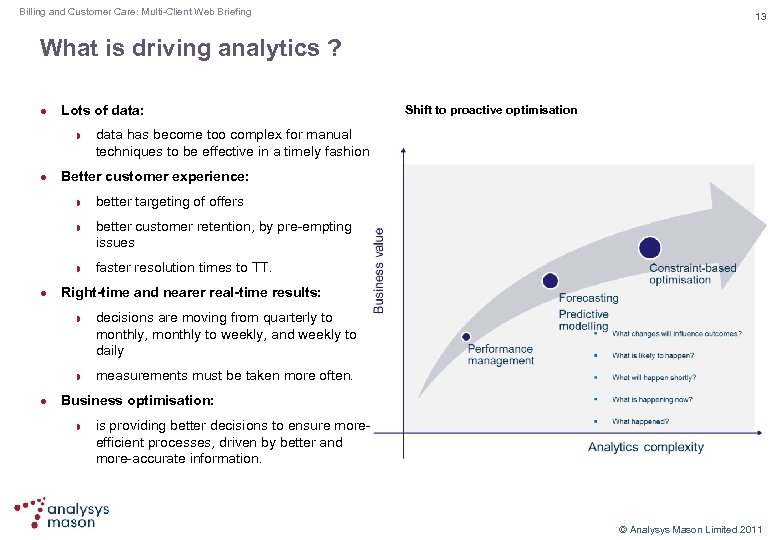

Billing and Customer Care: Multi Client Web Briefing 13 What is driving analytics ? l Lots of data: l better targeting of offers better customer retention, by pre empting issues faster resolution times to TT. Right-time and nearer real-time results: l data has become too complex for manual techniques to be effective in a timely fashion Better customer experience: l Shift to proactive optimisation decisions are moving from quarterly to monthly, monthly to weekly, and weekly to daily measurements must be taken more often. Business optimisation: is providing better decisions to ensure more efficient processes, driven by better and more accurate information. © Analysys Mason Limited 2011

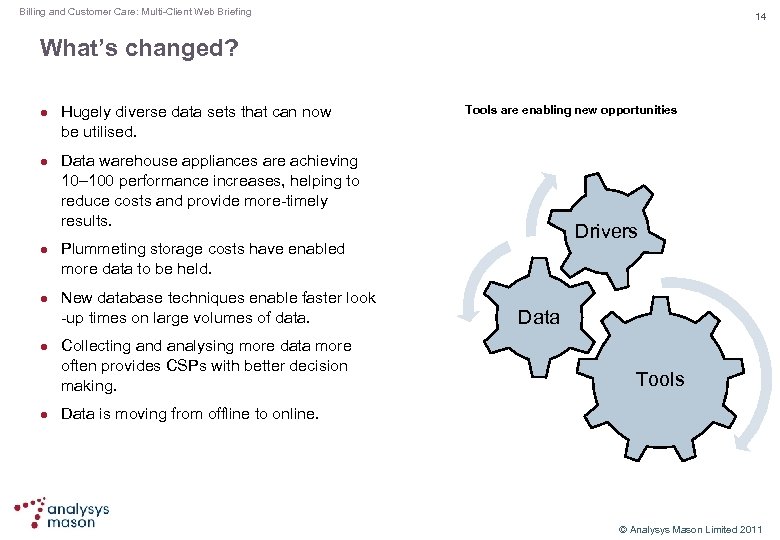

Billing and Customer Care: Multi Client Web Briefing 14 What’s changed? l l l Hugely diverse data sets that can now be utilised. Tools are enabling new opportunities Data warehouse appliances are achieving 10– 100 performance increases, helping to reduce costs and provide more timely results. Drivers Plummeting storage costs have enabled more data to be held. New database techniques enable faster look up times on large volumes of data. Collecting and analysing more data more often provides CSPs with better decision making. Data Tools Data is moving from offline to online. © Analysys Mason Limited 2011

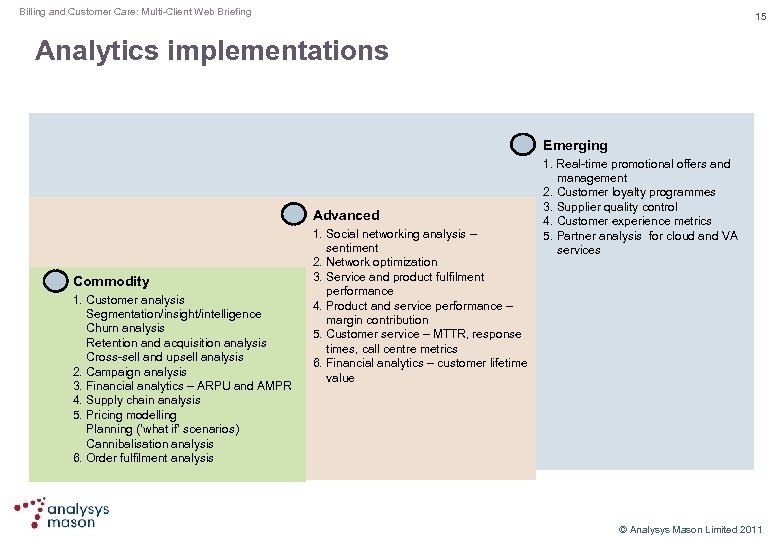

Billing and Customer Care: Multi Client Web Briefing 15 Analytics implementations Emerging Advanced Commodity 1. Customer analysis Segmentation/insight/intelligence Churn analysis Retention and acquisition analysis Cross sell and upsell analysis 2. Campaign analysis 3. Financial analytics – ARPU and AMPR 4. Supply chain analysis 5. Pricing modelling Planning (‘what if’ scenarios) Cannibalisation analysis 6. Order fulfilment analysis 1. Social networking analysis – sentiment 2. Network optimization 3. Service and product fulfilment performance 4. Product and service performance – margin contribution 5. Customer service – MTTR, response times, call centre metrics 6. Financial analytics – customer lifetime value 1. Real time promotional offers and management 2. Customer loyalty programmes 3. Supplier quality control 4. Customer experience metrics 5. Partner analysis for cloud and VA services © Analysys Mason Limited 2011

Billing and Customer Care: Multi Client Web Briefing 16 CUSTOMER CARE MARK H MORTENSEN © Analysys Mason Limited 2011

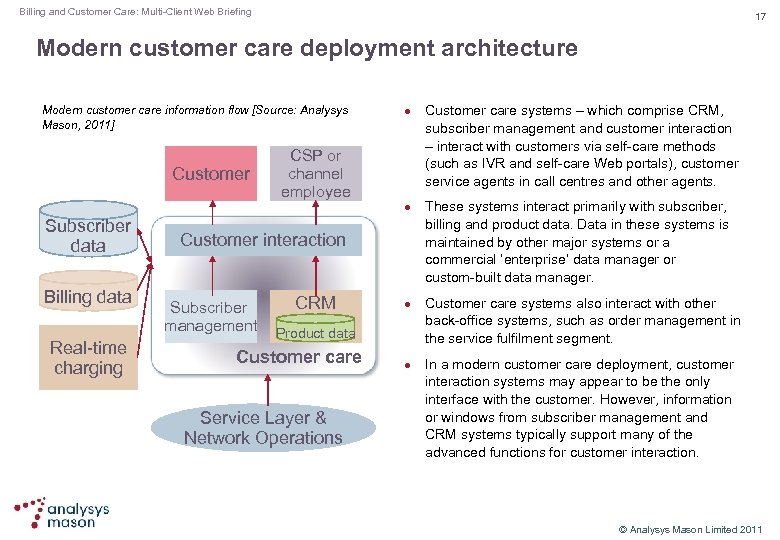

Billing and Customer Care: Multi Client Web Briefing 17 Modern customer care deployment architecture Modern customer care information flow [Source: Analysys Mason, 2011] Customer l CSP or channel employee l Subscriber data Billing data Real time charging Customer interaction Subscriber management CRM l Product data Customer care Service Layer & Network Operations l Customer care systems – which comprise CRM, subscriber management and customer interaction – interact with customers via self care methods (such as IVR and self care Web portals), customer service agents in call centres and other agents. These systems interact primarily with subscriber, billing and product data. Data in these systems is maintained by other major systems or a commercial ‘enterprise’ data manager or custom built data manager. Customer care systems also interact with other back office systems, such as order management in the service fulfilment segment. In a modern customer care deployment, customer interaction systems may appear to be the only interface with the customer. However, information or windows from subscriber management and CRM systems typically support many of the advanced functions for customer interaction. © Analysys Mason Limited 2011

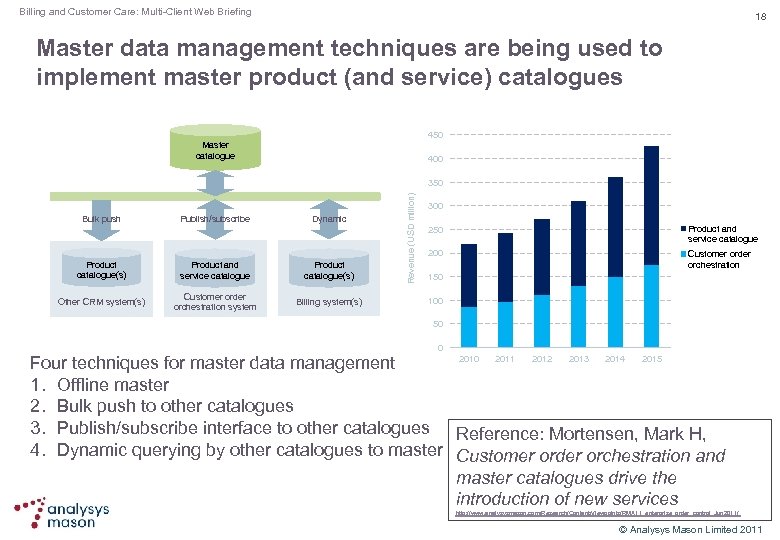

Billing and Customer Care: Multi Client Web Briefing 18 Master data management techniques are being used to implement master product (and service) catalogues 450 Master catalogue 400 Bulk push Publish/subscribe Dynamic Product catalogue(s) Product and service catalogue Product catalogue(s) Other CRM system(s) Customer order orchestration system Billing system(s) Revenue (USD million) 350 300 250 Product and service catalogue 200 Customer order orchestration 150 100 50 0 2011 2012 2013 2014 2015 Four techniques for master data management 1. Offline master 2. Bulk push to other catalogues 3. Publish/subscribe interface to other catalogues Reference: Mortensen, Mark H, 4. Dynamic querying by other catalogues to master Customer order orchestration and master catalogues drive the introduction of new services http: //www. analysysmason. com/Research/Content/Viewpoints/RMA 11_enterprise_order_control_Jun 2011/ © Analysys Mason Limited 2011

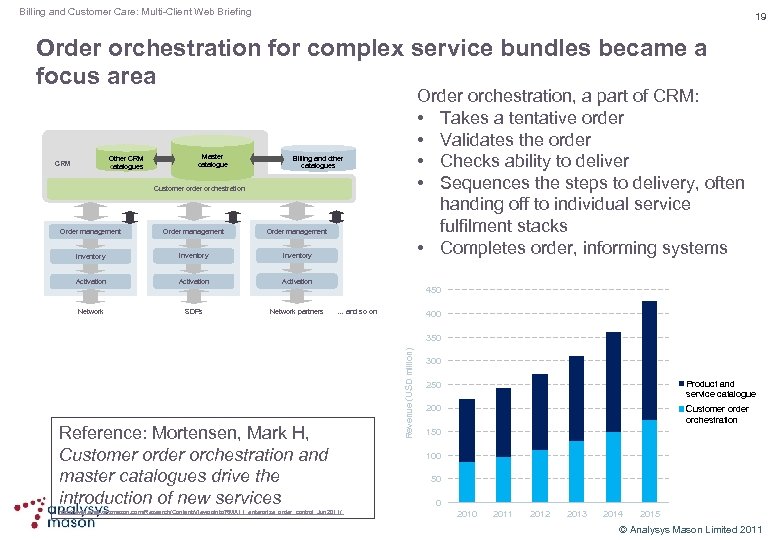

Billing and Customer Care: Multi Client Web Briefing 19 Order orchestration for complex service bundles became a focus area Other CRM catalogues CRM Master catalogue Order orchestration, a part of CRM: • Takes a tentative order • Validates the order • Checks ability to deliver • Sequences the steps to delivery, often handing off to individual service fulfilment stacks • Completes order, informing systems Billing and other catalogues Customer order orchestration Order management Inventory Activation Network SDPs Network partners 450 … and so on 400 Reference: Mortensen, Mark H, Customer order orchestration and master catalogues drive the introduction of new services http: //www. analysysmason. com/Research/Content/Viewpoints/RMA 11_enterprise_order_control_Jun 2011/ Revenue (USD million) 350 300 250 Product and service catalogue 200 Customer order orchestration 150 100 50 0 2011 2012 2013 2014 2015 © Analysys Mason Limited 2011

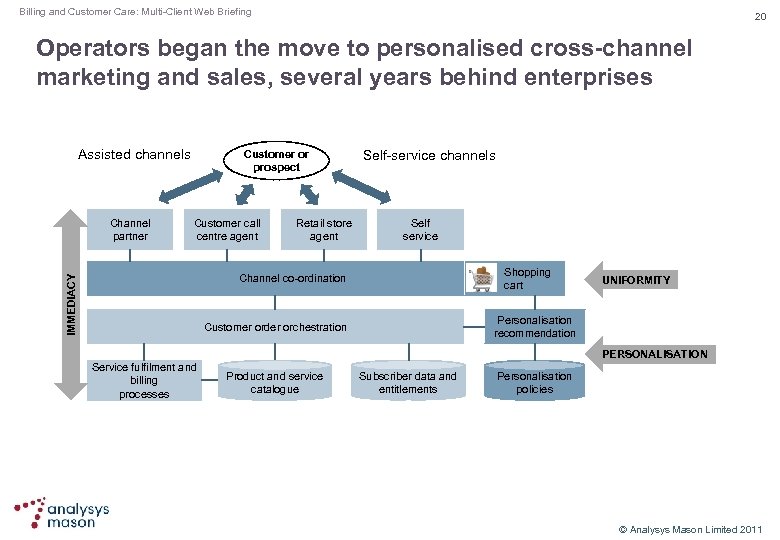

Billing and Customer Care: Multi Client Web Briefing 20 Operators began the move to personalised cross-channel marketing and sales, several years behind enterprises Assisted channels Channel partner Customer or prospect Customer call centre agent Retail store agent Self service channels Self service Shopping cart IMMEDIACY Channel co ordination UNIFORMITY Personalisation recommendation Customer order orchestration PERSONALISATION Service fulfilment and billing processes Product and service catalogue Subscriber data and entitlements Personalisation policies © Analysys Mason Limited 2011

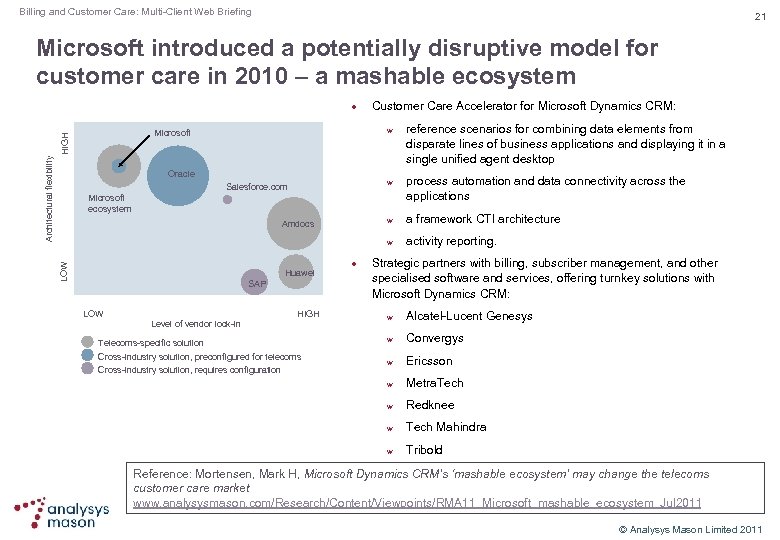

Billing and Customer Care: Multi Client Web Briefing 21 Microsoft introduced a potentially disruptive model for customer care in 2010 – a mashable ecosystem l w Microsoft HIGH Architectural flexibility Customer Care Accelerator for Microsoft Dynamics CRM: Oracle w Salesforce. com Microsoft ecosystem reference scenarios for combining data elements from disparate lines of business applications and displaying it in a single unified agent desktop process automation and data connectivity across the applications w LOW Huawei SAP LOW HIGH l a framework CTI architecture w Amdocs activity reporting. Strategic partners with billing, subscriber management, and other specialised software and services, offering turnkey solutions with Microsoft Dynamics CRM: Alcatel Lucent Genesys w Convergys w Ericsson Metra. Tech w Redknee w Tech Mahindra w Telecoms specific solution Cross industry solution, preconfigured for telecoms Cross industry solution, requires configuration w w Level of vendor lock in Tribold Reference: Mortensen, Mark H, Microsoft Dynamics CRM’s ‘mashable ecosystem’ may change the telecoms customer care market www. analysysmason. com/Research/Content/Viewpoints/RMA 11_Microsoft_mashable_ecosystem_Jul 2011 © Analysys Mason Limited 2011

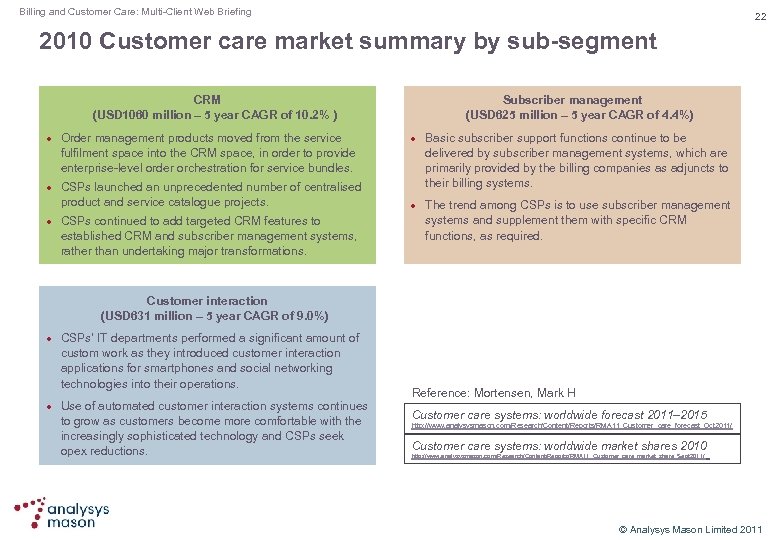

Billing and Customer Care: Multi Client Web Briefing 22 2010 Customer care market summary by sub-segment CRM (USD 1060 million – 5 year CAGR of 10. 2% ) l l l Order management products moved from the service fulfilment space into the CRM space, in order to provide enterprise level order orchestration for service bundles. CSPs launched an unprecedented number of centralised product and service catalogue projects. CSPs continued to add targeted CRM features to established CRM and subscriber management systems, rather than undertaking major transformations. Subscriber management (USD 625 million – 5 year CAGR of 4. 4%) l l Basic subscriber support functions continue to be delivered by subscriber management systems, which are primarily provided by the billing companies as adjuncts to their billing systems. The trend among CSPs is to use subscriber management systems and supplement them with specific CRM functions, as required. Customer interaction (USD 631 million – 5 year CAGR of 9. 0%) l l CSPs’ IT departments performed a significant amount of custom work as they introduced customer interaction applications for smartphones and social networking technologies into their operations. Use of automated customer interaction systems continues to grow as customers become more comfortable with the increasingly sophisticated technology and CSPs seek opex reductions. Reference: Mortensen, Mark H Customer care systems: worldwide forecast 2011– 2015 http: //www. analysysmason. com/Research/Content/Reports/RMA 11_Customer_care_forecast_Oct 2011/ Customer care systems: worldwide market shares 2010 http: //www. analysysmason. com/Research/Content/Reports/RMA 11_Customer_care_market_share_Sept 2011/ © Analysys Mason Limited 2011

Billing and Customer Care: Multi Client Web Briefing 23 Authors Justin van der Lande (Senior Analyst) is lead analyst for Analysys Mason’s Billing research programme, which is part of the Telecoms Software research stream. His primary areas of specialisation include converged billing systems, billing strategies and business analytics for mobile data services. He also provides project management for large scale projects within our Telecoms Software research. Justin has more than 20 years’ experience in the communications industry in software development, marketing and research. He has held senior positions at NCR/AT&T, Micromuse (IBM), Granite Systems (Telcordia) and at the TM Forum. Justin holds a BSc in Management Science and Computer Studies from the University of Wales. He is located in Analysys Mason’s London office. Mark H. Mortensen (Principal Analyst) is the lead analyst for Analysys Mason's Customer Care and Service Fulfilment research programmes, which are part of the Telecoms Software research stream. The first 20 years of Mark's career were spent at Bell Laboratories, where he specialised in starting software products for new markets and network technologies and in the interaction of software with the underlying network hardware. Mark was Chief Scientist of Management Systems at Bell Labs, and has also been president of his own OSS strategy consulting company, CMO at the inventory specialist Granite Systems, VP of Product Strategy at Telcordia Technologies, and SVP of Marketing at a network planning software vendor. Mark holds an MPhil and Ph. D in physics from Yale University and has received two AT&T Architecture awards for innovative software solutions. He is also an adjunct faculty member at UMass Lowell in strategic management. Mark resides somewhere north of Boston. © Analysys Mason Limited 2011

bd61c93ae3ca62aaa4797963e29cba25.ppt