c7b09675d5961b46ff74015d6793392c.ppt

- Количество слайдов: 50

We’re all about YOU! Avoiding Fraud

Session Objectives m. Fraud & Scams m. How to protect yourself m. What to do if you are a victim m. Additional Information

Identity Theft It occurs when someone uses your: – Name – Social Security number – Other identifying information … without your permission, to establish new accounts in your name.

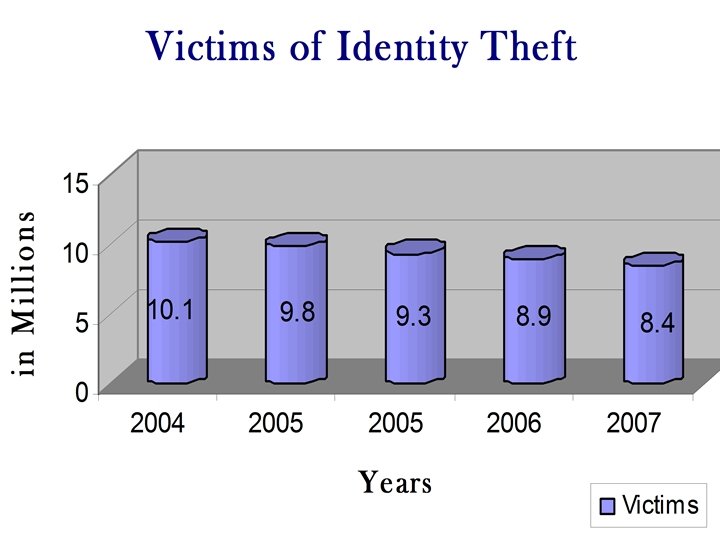

How many victims? • 2003 – 10. 1 Million • 2004 – close to 9. 8 Million • 2005 - 9. 3 Million • 2006 - 8. 9 Million • 2007 - 8. 4 Million – Privacy Rights Clearing House

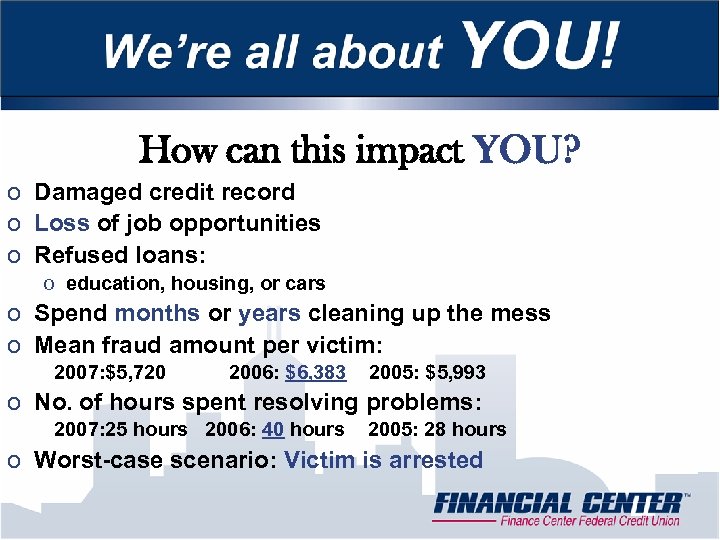

How can this impact YOU? o Damaged credit record o Loss of job opportunities o Refused loans: o education, housing, or cars o Spend months or years cleaning up the mess o Mean fraud amount per victim: 2007: $5, 720 2006: $6, 383 2005: $5, 993 o No. of hours spent resolving problems: 2007: 25 hours 2006: 40 hours 2005: 28 hours o Worst-case scenario: Victim is arrested

Who is most vulnerable? o Ages 18 -24 o Suburban residence o Income ≥ $75, 000 o Ongoing problems: 1/5 of the victims o Justice department

How do crooks get your information? • Misuse by family/friends • Lost/stolen wallets • Theft from mailboxes; dumpster diving • Others (less common): – – – Steal records from employer Shoulder surfing at ATMs or phone booths Pose as landlord to obtain credit report Fill out change of address to divert mail Phishing/ Pharming / Vishing

A crook has your info. Now what? Use your name to: Ø Open new accounts Ø change billing address Ø ring up charges before your mail catches up to you Ø Take out loans, buy a car, or establish phone service Ø Authorize electronic transfers Ø drain your account Ø File for bankruptcy to avoid paying debts Ø Pretend to be you during an arrest

Skimming o Switched o Collect o Clone

Skimming Devices

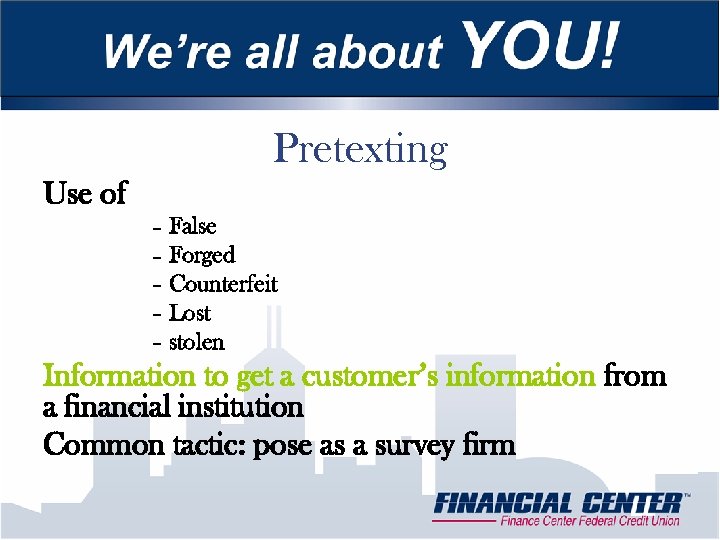

Pretexting Use of – False – Forged – Counterfeit – Lost – stolen Information to get a customer’s information from a financial institution Common tactic: pose as a survey firm

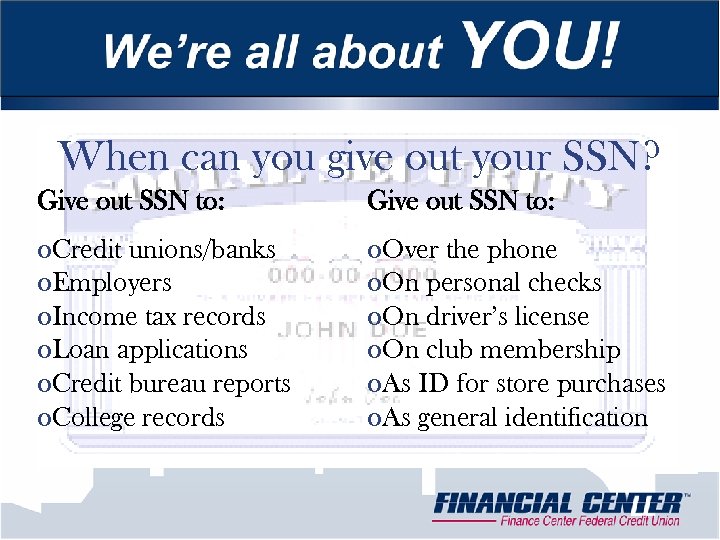

When can you give out your SSN? Give out SSN to: o. Credit unions/banks o. Employers o. Income tax records o. Loan applications o. Credit bureau reports o. College records o. Over the phone o. On personal checks o. On driver’s license o. On club membership o. As ID for store purchases o. As general identification

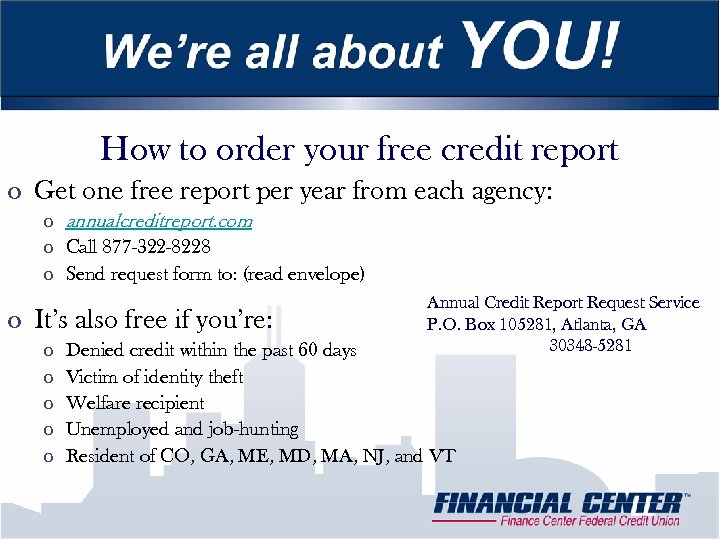

How to order your free credit report o Get one free report per year from each agency: o annualcreditreport. com o Call 877 -322 -8228 o Send request form to: (read envelope) o It’s also free if you’re: o o o Annual Credit Report Request Service P. O. Box 105281, Atlanta, GA 30348 -5281 Denied credit within the past 60 days Victim of identity theft Welfare recipient Unemployed and job-hunting Resident of CO, GA, ME, MD, MA, NJ, and VT

What is spamming? Sending unsolicited e-mail indiscriminately to multiple mailing lists, individuals, or newsgroups

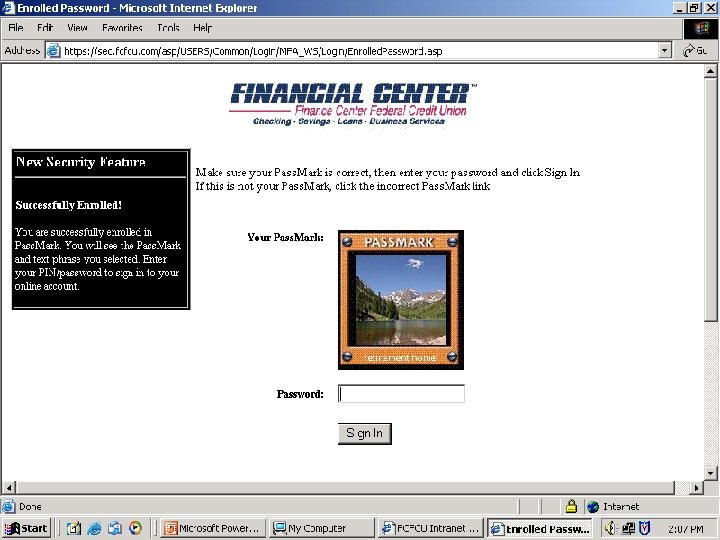

What is spoofing? Creating a replica of a legitimate Web page to fool you into submitting personal, financial, or password data

What is phishing? Luring victims to a fake web site through spam. See current scams at antiphishing. org

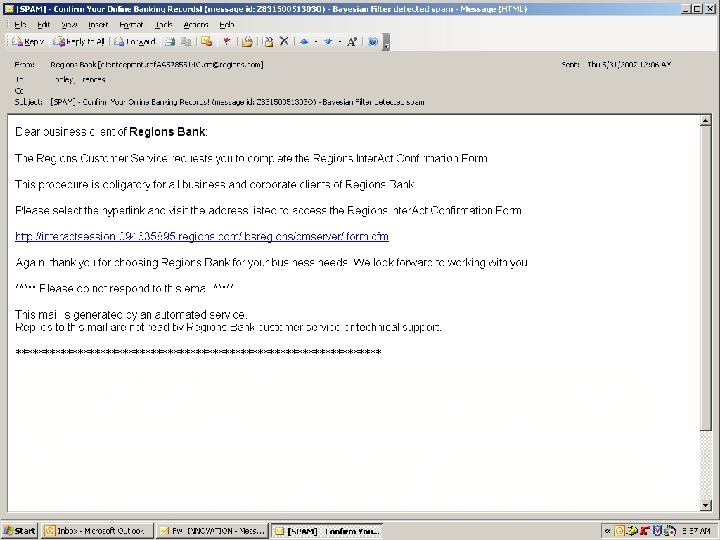

It’s probably a phishing attack! Beware e-mail messages that: o Use a generic greeting o (“Dear Visa customers” or “Dear friend”) o Refer to an urgent problem o State that your account will be shut down unless you reconfirm your billing information o Urge you to click on a link within a message you weren’t expecting Phishing in the World

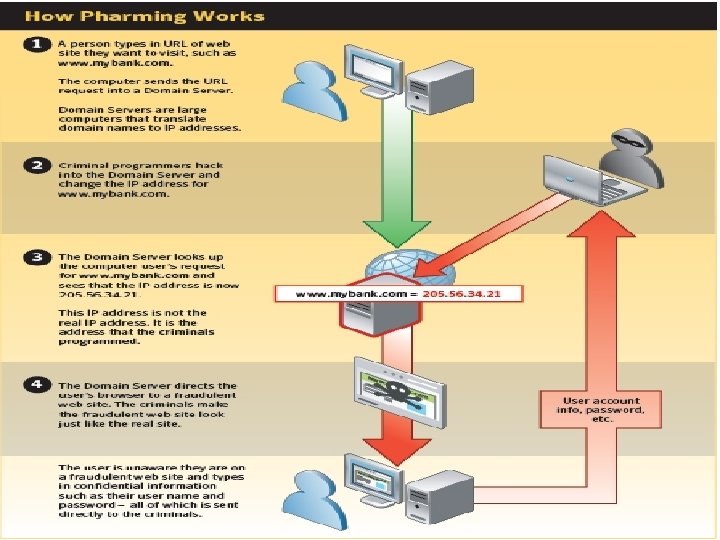

Pharming o Practice of redirecting Internet domain name requests to illegitimate Web sites. o To capture your personal information and commit ID theft. o Differs from phishing in how you’re redirected. (through technical means)

Pharming can occur 4 ways o Static domain name spoofing (Misspellings: vvestcu. org vs. westcu. org) o Malicious software—Malware (Viruses and Trojans redirect you to the false site) o Domain hijacking (Hacker hijacks legitimate site and redirects all traffic) o DNS poisoning (most dangerous) (You enter correct URL, but poisoned server redirects)

Receive unfamiliar bills No mail credit card/financial statements stop arriving or have fraudulent charges Denied credit Signs you are a victim Oftentimes, there aren’t any! collection agencies try to collect

Even if there are no warning signs You should: o Check your credit report anyway! o Beware of e-mails and web sites offering “free” credit reports o Don’t give your SSN just to get a free report

If you are a victim o Place fraud alert on your credit reports. o Contact FTC’s ID Theft Hotline at 877 -IDTHEFT. o Close affected accounts. Use FTC’s “ID theft affidavit” at ftc. gov/idtheft. o Follow each conversation with a certified letter, return receipt requested; keep copies. o File a police report where ID theft took place. o Get copies of police reports and send to creditors.

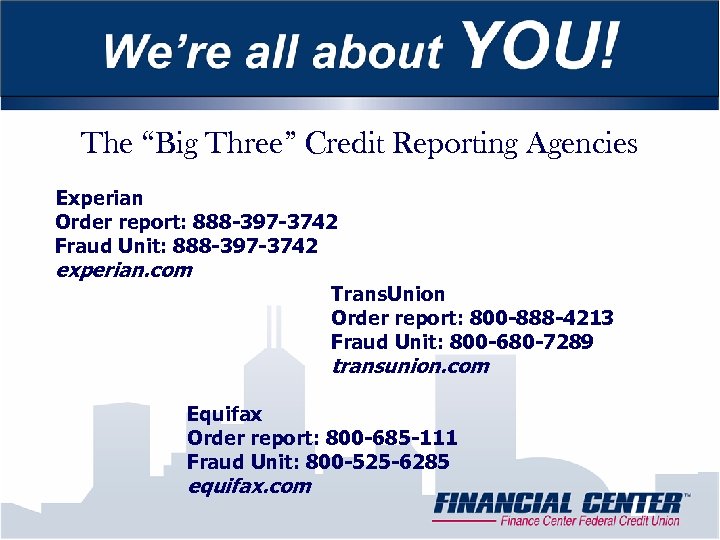

The “Big Three” Credit Reporting Agencies Experian Order report: 888 -397 -3742 Fraud Unit: 888 -397 -3742 experian. com Trans. Union Order report: 800 -888 -4213 Fraud Unit: 800 -680 -7289 transunion. com Equifax Order report: 800 -685 -111 Fraud Unit: 800 -525 -6285 equifax. com

What else do you need to know?

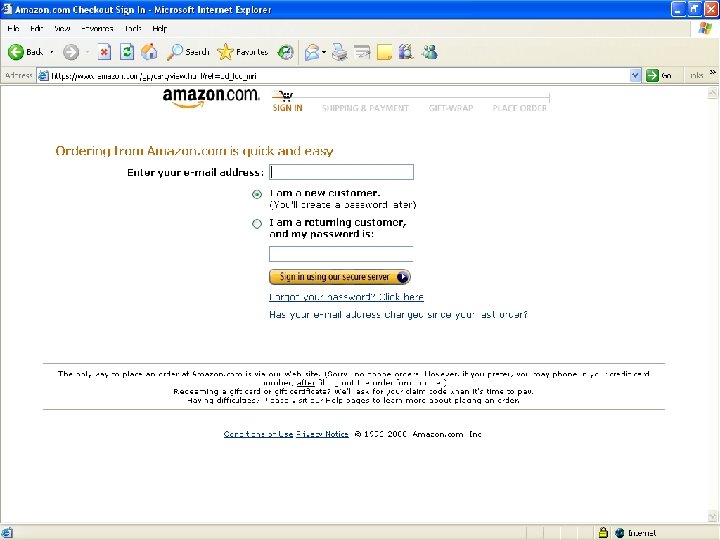

Internet Fraud – Shop Safely Online o Shop only with companies you know. o Pay only with credit card, or with third-party intermediary o you have some protections if merchandise is defective, not as described, or is not received at all o URL must change from http: // to https: //. o Track online purchases easily: Use separate credit card o Use secure browser (look for closed padlock or unbroken key at bottom of browser window—not payment page).

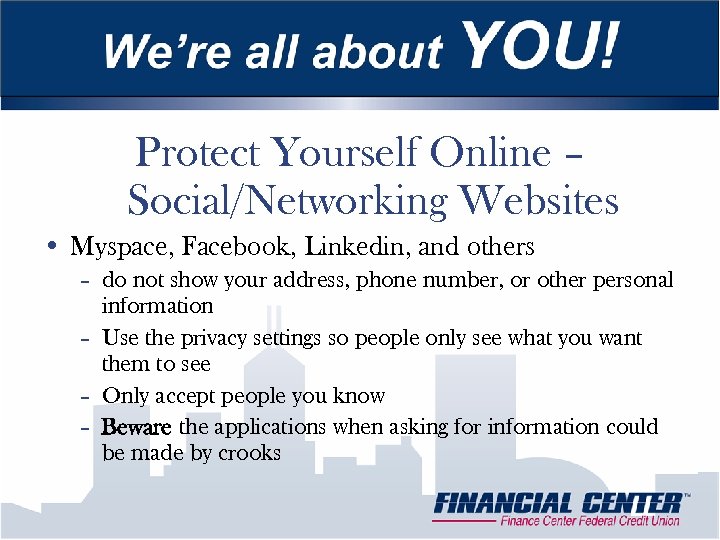

Protect Yourself Online – Social/Networking Websites • Myspace, Facebook, Linkedin, and others – do not show your address, phone number, or other personal information – Use the privacy settings so people only see what you want them to see – Only accept people you know – Beware the applications when asking for information could be made by crooks

Protect Yourself o On the Phone o Ask why they need it o Never give out personal info or authorize payment (unless you initiated the call and trust the company) o Hang up if necessary o Online Transactions o Make sure it is secure – https: // and a closed padlock o Verified by VISA and/or Master. Card’s Secure Code o Shred o All documents with personal/financial information

Protect Yourself o Review statements and credit report o Annually – credit report o Account statements: by mail – monthly; online – more often o Mail from locked mailbox or post office o Stop mail while out of town o Shoulder Surfers o Be aware of your surroundings

Protect Yourself o E-mail o Only open attachments you are expecting o Do not click on links from unfamiliar senders o Use strong passwords (letter- both upper and lower, numbers and symbols) o Avoid automatic log-in o Computer o Install and keep updated o Virus software o Firewall software o Spyware detection/removal o Spam blocker – antiphishing. org o Secure browser – for online transactions

Protect Yourself o Passwords o Don’t use recognizable information (age, phone number, SSN, birthday) o Memorize them – do not keep them written down o Safeguard – all personal information (SSN card, bank statements, checks, purse) o Do not carry it around with you o Personal Information o Give out on a need to know and trusted basis o Do not leave receipts o They can contain your credit card information

Protect Yourself o Keep name off prescreened lists o 888 -5 opt-out o Optoutprescreen. com o Electronic deposit o Paychecks, dividends, pension, SS payments, and tax refunds

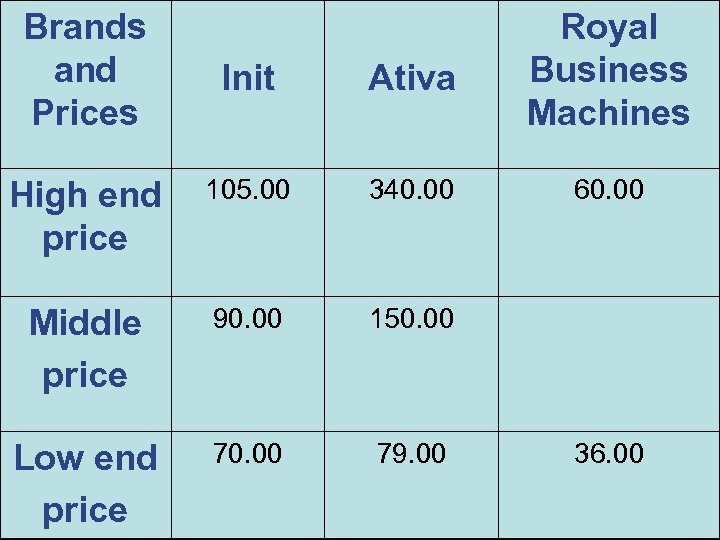

Brands and Prices Init Ativa Useful Purchases • Cross cut shredder High end 105. 00 – Prices $40 and up price paper, cds, credit cards – Shred 340. 00 Royal Business Machines 60. 00 – Top brands and prices: 90. 00 Middleware software • Anti-spy – Mc. Afee price – Symantic 150. 00 – Webroot Low end price 70. 00 79. 00 36. 00

Check Fraud o The manipulation of checks to deceive an innocent victim expecting value in exchange for their money o http: //www. ckfraud. org/ckfraud. html#check

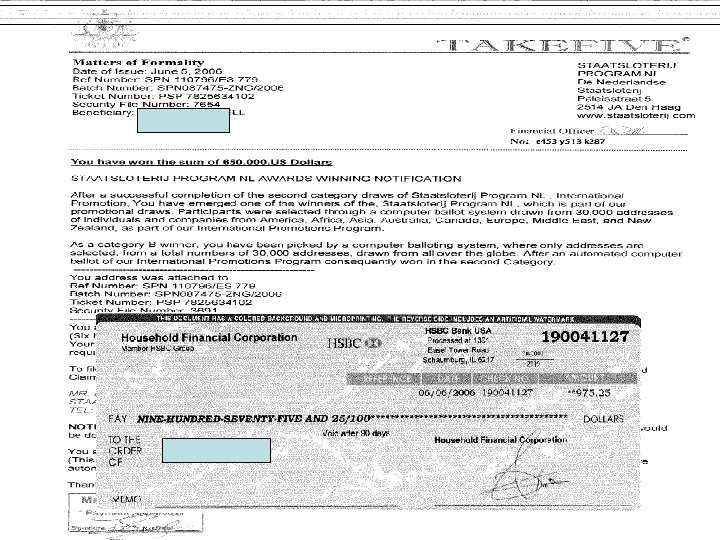

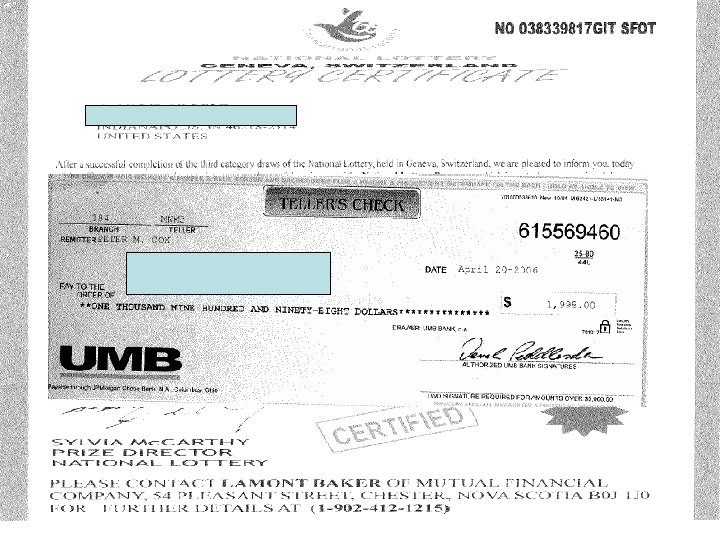

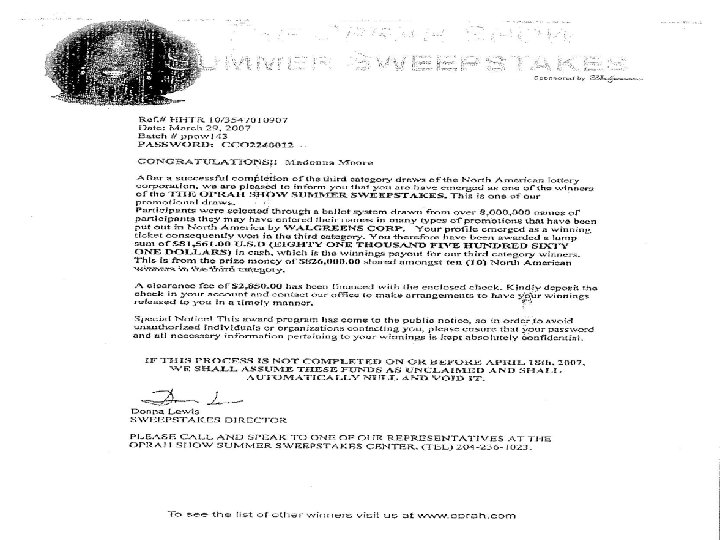

or could cost you plenty! Every day, thousands of Americans receive sweepstakes offers, but not all of them are legitimate. How can you tell the difference between a real sweepstakes and a scam? Legitimate sweepstakes are fun and free. They specify that no purchase is needed to win and buying a product will not increase your chances of winning-you never have to pay to collect a prize. Remember: You do not have to pay to enter a sweepstakes or collect a prize. If you're asked to pay, the sweepstakes is a scam.

Credit Card Fraudulent use of another person’s credit card and number

Telemarketing Fraud refers to any scheme to defraud in which the persons carrying out the scheme use the telephone as their primary means of communicating with prospective victims and trying to persuade them to send money to the scheme.

More Resources Federal Trade Commission CRC-240 Washington, D. C. 20580 877 -IDTHEFT (toll-free) www. consumer. gov/idtheft o. Better Business Bureau bbbonline. org o. Anti-Phishing Working Group antiphishing. org o. Privacy Rights Clearinghouse privacyrights. org

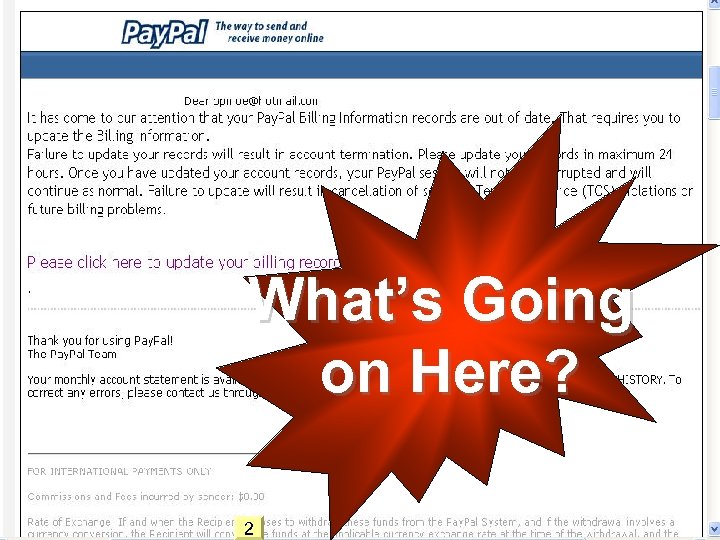

The news of my father death, and my uncle, s involvement in an air crash in december 2002 while on a business trip to benin republic caused my mother heartfailure and other related complications of which she later died in the hospital After we have spent a lot of money on her. SCAMMED! What’s Going on Here? Before our mother died, she told us that our father deposited some money which he made from diamond sales and contracts at this bank here in Ivory Coast and that we should pray and find a trust worthy foreign business partner who would help us to transfer and invest this money in profitable business venture overseas. She told us to do this quickly so that we can leave Ivory Coast and, then settle down abroad. She gave 5 -N us the bank document to prove the 1 2

1 of 7 Dealing With Deception You walk up to an ATM and a guy who appears to be waiting his turn walks up behind you. But he’s uncomfortably close—right over your shoulder—as you get ready to enter your PIN. What should you do? 5 -O-1

2 of 7 Dealing With Deception You’re at a cash register in a store and have given the clerk your credit card. She holds on to it, probably to verify your signature. But then she says she needs to grab something from the back and starts to walk away with your card in hand. What should you do? 5 -O-2

3 of 7 Dealing With Deception A caller says she’s from your credit card company and wants to offer you a higher credit limit for being such a good customer. You reply, “Great, what do I have to do? ” And she tells you to give her your Social Security number for verification. What should you do? 5 -O-3

4 of 7 Dealing With Deception You’ve found a pair of shoes at a great price on a Web site you just found. You start the check-out process and notice that the padlock at the bottom of your computer screen is open and that the Web page address starts with “http” instead of “https. ” What should you do? 5 -O-4

5 of 7 Dealing with Deception • You get an E-mail from an online bookstore you frequently buy from. It says that the credit card on your account has expired and gives you a link to update your information. What should you do? 5 -O-5

6 of 7 Dealing With Deception Your friend sends you an E-mail about cool new software that lets you share music with others for free. He sends you the link to download the software, which is from a site you’ve never heard of. What should you do? 5 -O-6

7 of 7 Dealing With Deception You’re upset about losing in an online auction. But then you get an E-mail stating the winner backed out and that you can have the item if you still want it, and to just send your credit card information via Email. What should you do? 5 -O-7

c7b09675d5961b46ff74015d6793392c.ppt