e95000eb866f484ff51481f9202f980e.ppt

- Количество слайдов: 43

We have Evolved! Now What? Joe Thompson President Independent Beverage Group 843 384 -0828 ibg@hargray. com NBWA 76 th Convention and Trade Show Caesars Palace Las Vegas, NV Oct 1, 2013

We have Evolved! Now What? Joe Thompson President Independent Beverage Group 843 384 -0828 ibg@hargray. com NBWA 76 th Convention and Trade Show Caesars Palace Las Vegas, NV Oct 1, 2013

Independent Beverage Group independentbeveragegroup. com Joe Thompson 843 384 -0828 ibg@hargray. com Corporate Office 125 Old Plantation Way Fayetteville, GA 30214 843 -681 -6333 ibg@hargray. com Jerry Mc. Nabb VP, Shared Services 8766 Charel Rd Blaine, WA 98230 (o) 360 -933 -1440 (c) 360 -961 -2164 jermcn@msn. com Todd Arnold 4370 Crestone Cir. Broomfield, CO 80023 303 410 -7748 toddarnold 88@msn. c om

Independent Beverage Group independentbeveragegroup. com Joe Thompson 843 384 -0828 ibg@hargray. com Corporate Office 125 Old Plantation Way Fayetteville, GA 30214 843 -681 -6333 ibg@hargray. com Jerry Mc. Nabb VP, Shared Services 8766 Charel Rd Blaine, WA 98230 (o) 360 -933 -1440 (c) 360 -961 -2164 jermcn@msn. com Todd Arnold 4370 Crestone Cir. Broomfield, CO 80023 303 410 -7748 toddarnold 88@msn. c om

3 We Have Evolved! Now What? I. Macro Issues II. Mega Distributors III. “Stuck In The Middle With You” IV. IBG’s Distribution System Of The Future Model 2020 V. How Will Industry And Consumers Re-act? VI. Summary

3 We Have Evolved! Now What? I. Macro Issues II. Mega Distributors III. “Stuck In The Middle With You” IV. IBG’s Distribution System Of The Future Model 2020 V. How Will Industry And Consumers Re-act? VI. Summary

4 I. Macro Issues

4 I. Macro Issues

5 I. Macro Issues A. Declining Beer Industry

5 I. Macro Issues A. Declining Beer Industry

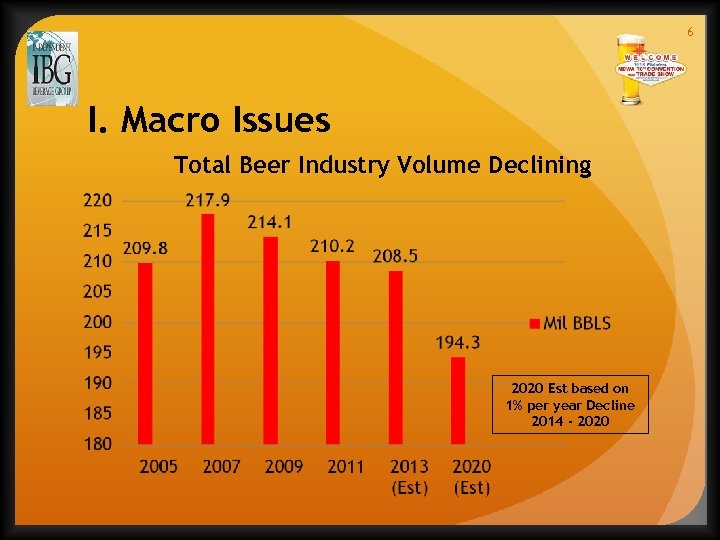

6 I. Macro Issues Total Beer Industry Volume Declining 2020 Est based on 1% per year Decline 2014 - 2020

6 I. Macro Issues Total Beer Industry Volume Declining 2020 Est based on 1% per year Decline 2014 - 2020

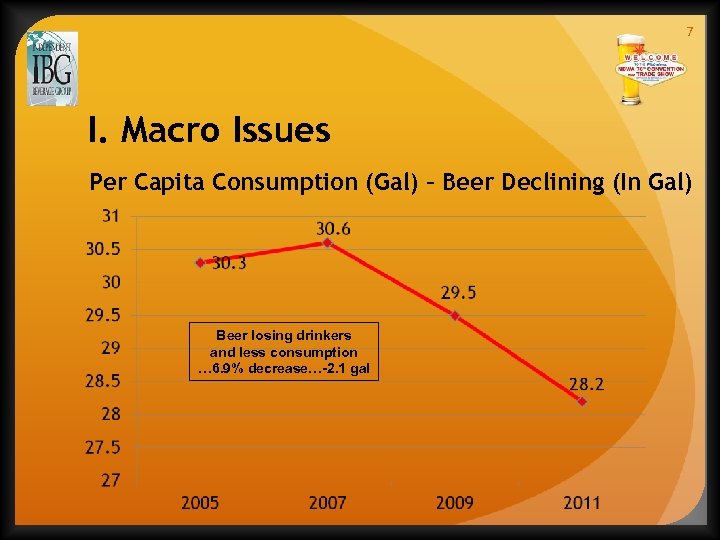

7 I. Macro Issues Per Capita Consumption (Gal) – Beer Declining (In Gal) Beer losing drinkers and less consumption … 6. 9% decrease…-2. 1 gal

7 I. Macro Issues Per Capita Consumption (Gal) – Beer Declining (In Gal) Beer losing drinkers and less consumption … 6. 9% decrease…-2. 1 gal

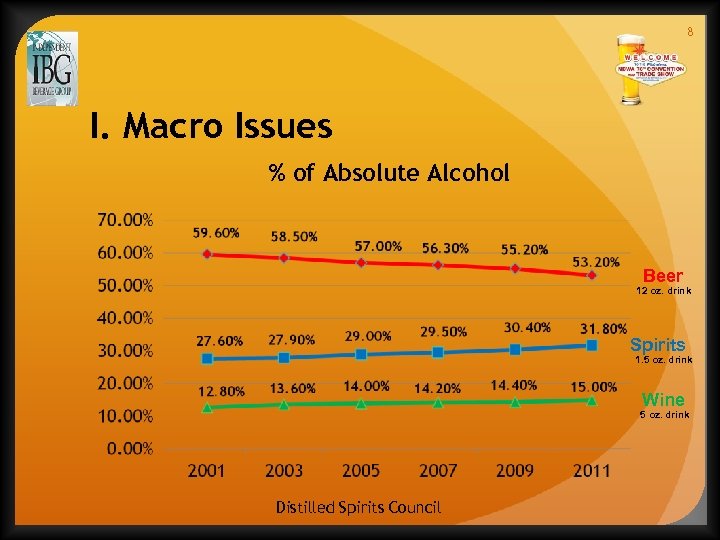

8 I. Macro Issues % of Absolute Alcohol Beer 12 oz. drink Spirits 1. 5 oz. drink Wine 5 oz. drink Distilled Spirits Council

8 I. Macro Issues % of Absolute Alcohol Beer 12 oz. drink Spirits 1. 5 oz. drink Wine 5 oz. drink Distilled Spirits Council

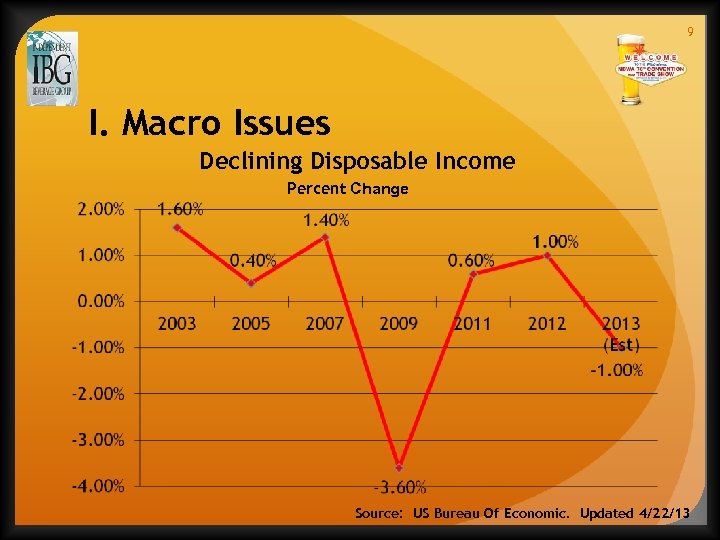

9 I. Macro Issues Declining Disposable Income Percent Change Source: US Bureau Of Economic. Updated 4/22/13

9 I. Macro Issues Declining Disposable Income Percent Change Source: US Bureau Of Economic. Updated 4/22/13

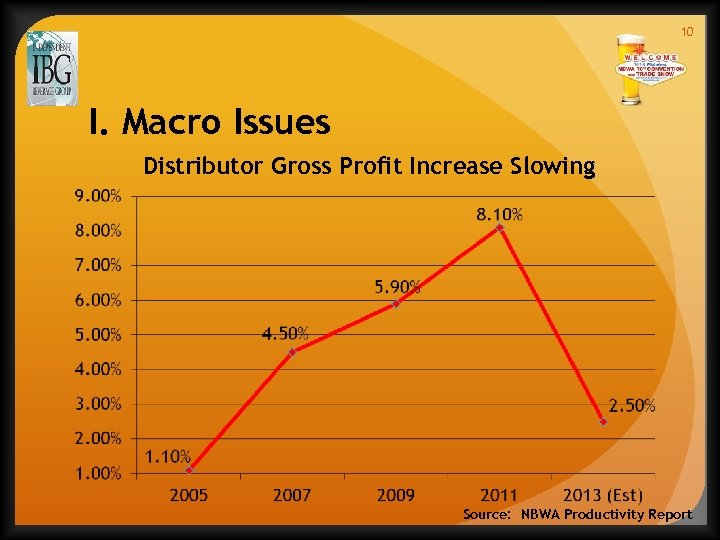

10 I. Macro Issues Distributor Gross Profit Increase Slowing Source: NBWA Productivity Report

10 I. Macro Issues Distributor Gross Profit Increase Slowing Source: NBWA Productivity Report

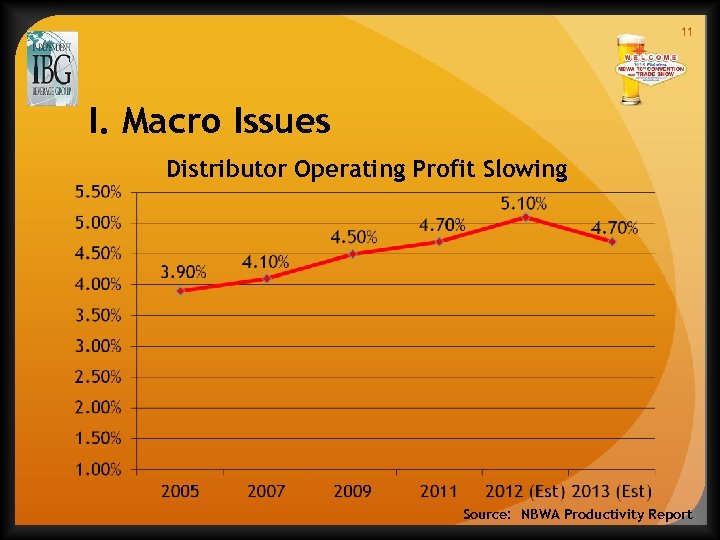

11 I. Macro Issues Distributor Operating Profit Slowing Source: NBWA Productivity Report

11 I. Macro Issues Distributor Operating Profit Slowing Source: NBWA Productivity Report

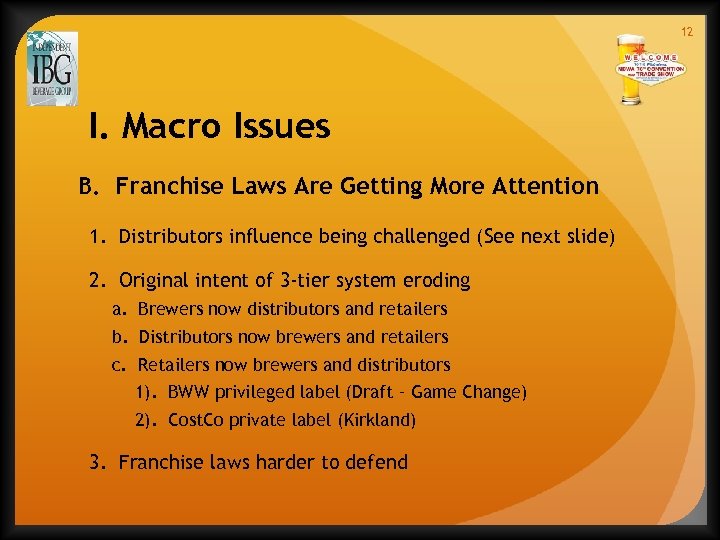

12 I. Macro Issues B. Franchise Laws Are Getting More Attention 1. Distributors influence being challenged (See next slide) 2. Original intent of 3 -tier system eroding a. Brewers now distributors and retailers b. Distributors now brewers and retailers c. Retailers now brewers and distributors 1). BWW privileged label (Draft – Game Change) 2). Cost. Co private label (Kirkland) 3. Franchise laws harder to defend

12 I. Macro Issues B. Franchise Laws Are Getting More Attention 1. Distributors influence being challenged (See next slide) 2. Original intent of 3 -tier system eroding a. Brewers now distributors and retailers b. Distributors now brewers and retailers c. Retailers now brewers and distributors 1). BWW privileged label (Draft – Game Change) 2). Cost. Co private label (Kirkland) 3. Franchise laws harder to defend

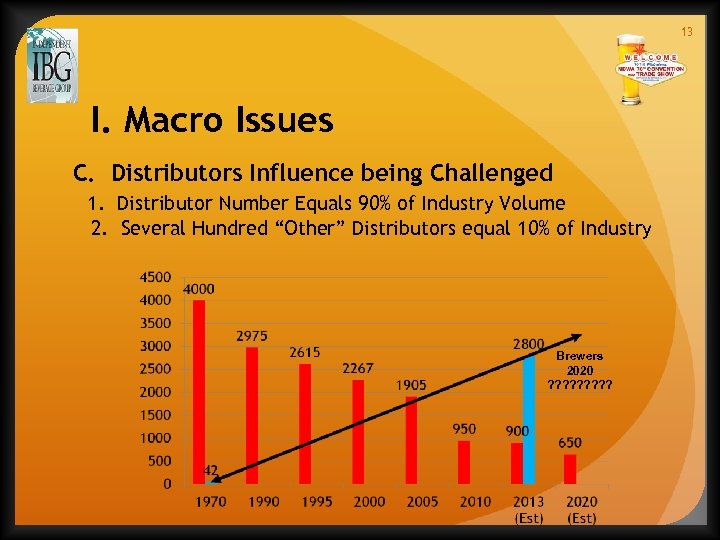

13 I. Macro Issues C. Distributors Influence being Challenged 1. Distributor Number Equals 90% of Industry Volume 2. Several Hundred “Other” Distributors equal 10% of Industry Brewers 2020 ? ? ? ? ?

13 I. Macro Issues C. Distributors Influence being Challenged 1. Distributor Number Equals 90% of Industry Volume 2. Several Hundred “Other” Distributors equal 10% of Industry Brewers 2020 ? ? ? ? ?

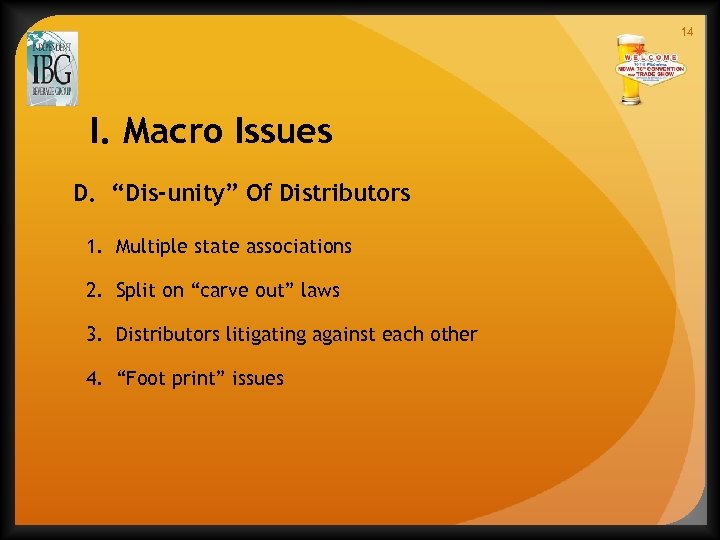

14 I. Macro Issues D. “Dis-unity” Of Distributors 1. Multiple state associations 2. Split on “carve out” laws 3. Distributors litigating against each other 4. “Foot print” issues

14 I. Macro Issues D. “Dis-unity” Of Distributors 1. Multiple state associations 2. Split on “carve out” laws 3. Distributors litigating against each other 4. “Foot print” issues

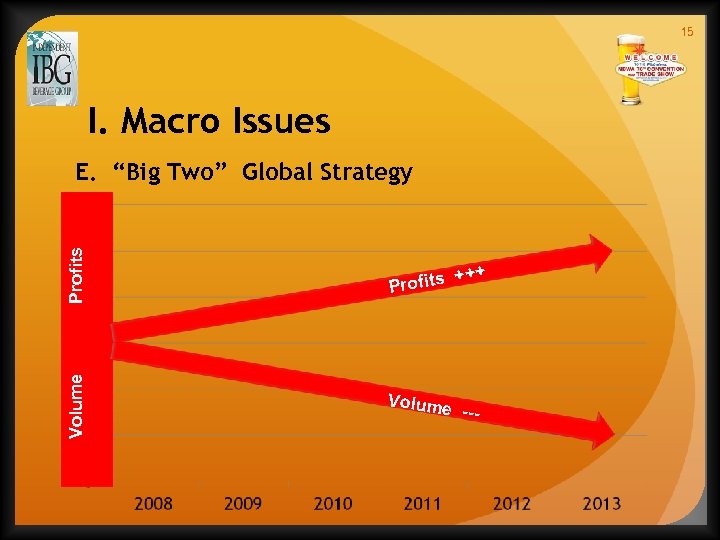

15 I. Macro Issues Profits Volume E. “Big Two” Global Strategy Volume +++ ---

15 I. Macro Issues Profits Volume E. “Big Two” Global Strategy Volume +++ ---

II. Mega Distributors

II. Mega Distributors

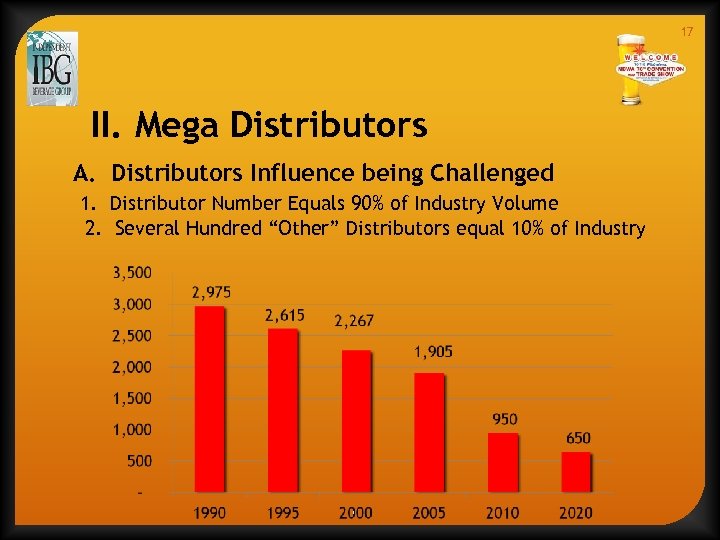

17 II. Mega Distributors A. Distributors Influence being Challenged 1. Distributor Number Equals 90% of Industry Volume 2. Several Hundred “Other” Distributors equal 10% of Industry

17 II. Mega Distributors A. Distributors Influence being Challenged 1. Distributor Number Equals 90% of Industry Volume 2. Several Hundred “Other” Distributors equal 10% of Industry

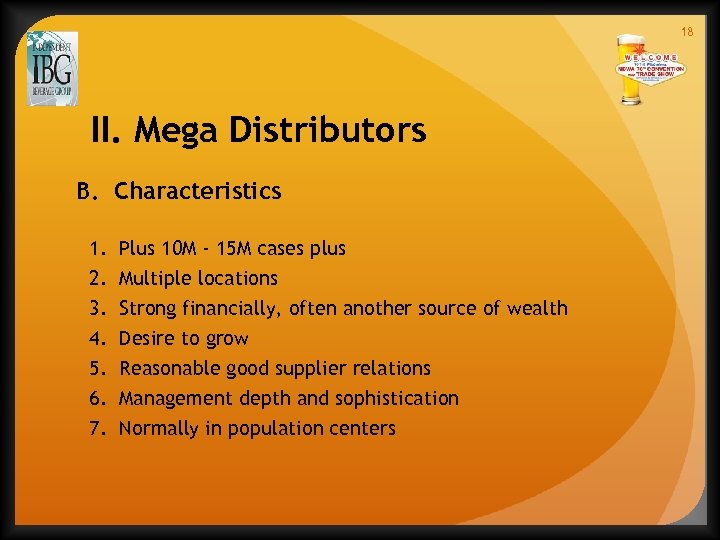

18 II. Mega Distributors B. Characteristics 1. 2. 3. 4. 5. 6. 7. Plus 10 M - 15 M cases plus Multiple locations Strong financially, often another source of wealth Desire to grow Reasonable good supplier relations Management depth and sophistication Normally in population centers

18 II. Mega Distributors B. Characteristics 1. 2. 3. 4. 5. 6. 7. Plus 10 M - 15 M cases plus Multiple locations Strong financially, often another source of wealth Desire to grow Reasonable good supplier relations Management depth and sophistication Normally in population centers

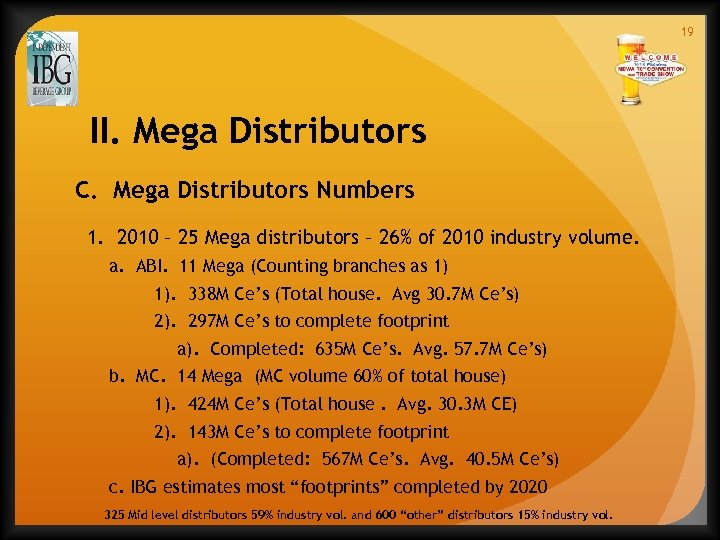

19 II. Mega Distributors C. Mega Distributors Numbers 1. 2010 – 25 Mega distributors – 26% of 2010 industry volume. a. ABI. 11 Mega (Counting branches as 1) 1). 338 M Ce’s (Total house. Avg 30. 7 M Ce’s) 2). 297 M Ce’s to complete footprint a). Completed: 635 M Ce’s. Avg. 57. 7 M Ce’s) b. MC. 14 Mega (MC volume 60% of total house) 1). 424 M Ce’s (Total house. Avg. 30. 3 M CE) 2). 143 M Ce’s to complete footprint a). (Completed: 567 M Ce’s. Avg. 40. 5 M Ce’s) c. IBG estimates most “footprints” completed by 2020 325 Mid level distributors 59% industry vol. and 600 “other” distributors 15% industry vol.

19 II. Mega Distributors C. Mega Distributors Numbers 1. 2010 – 25 Mega distributors – 26% of 2010 industry volume. a. ABI. 11 Mega (Counting branches as 1) 1). 338 M Ce’s (Total house. Avg 30. 7 M Ce’s) 2). 297 M Ce’s to complete footprint a). Completed: 635 M Ce’s. Avg. 57. 7 M Ce’s) b. MC. 14 Mega (MC volume 60% of total house) 1). 424 M Ce’s (Total house. Avg. 30. 3 M CE) 2). 143 M Ce’s to complete footprint a). (Completed: 567 M Ce’s. Avg. 40. 5 M Ce’s) c. IBG estimates most “footprints” completed by 2020 325 Mid level distributors 59% industry vol. and 600 “other” distributors 15% industry vol.

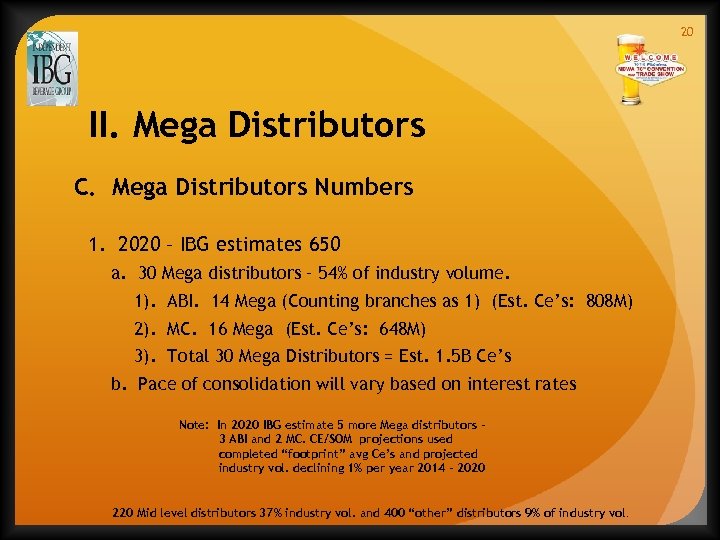

20 II. Mega Distributors C. Mega Distributors Numbers 1. 2020 – IBG estimates 650 a. 30 Mega distributors – 54% of industry volume. 1). ABI. 14 Mega (Counting branches as 1) (Est. Ce’s: 808 M) 2). MC. 16 Mega (Est. Ce’s: 648 M) 3). Total 30 Mega Distributors = Est. 1. 5 B Ce’s b. Pace of consolidation will vary based on interest rates Note: In 2020 IBG estimate 5 more Mega distributors 3 ABI and 2 MC. CE/SOM projections used completed “footprint” avg Ce’s and projected industry vol. declining 1% per year 2014 - 2020 220 Mid level distributors 37% industry vol. and 400 “other” distributors 9% of industry vol.

20 II. Mega Distributors C. Mega Distributors Numbers 1. 2020 – IBG estimates 650 a. 30 Mega distributors – 54% of industry volume. 1). ABI. 14 Mega (Counting branches as 1) (Est. Ce’s: 808 M) 2). MC. 16 Mega (Est. Ce’s: 648 M) 3). Total 30 Mega Distributors = Est. 1. 5 B Ce’s b. Pace of consolidation will vary based on interest rates Note: In 2020 IBG estimate 5 more Mega distributors 3 ABI and 2 MC. CE/SOM projections used completed “footprint” avg Ce’s and projected industry vol. declining 1% per year 2014 - 2020 220 Mid level distributors 37% industry vol. and 400 “other” distributors 9% of industry vol.

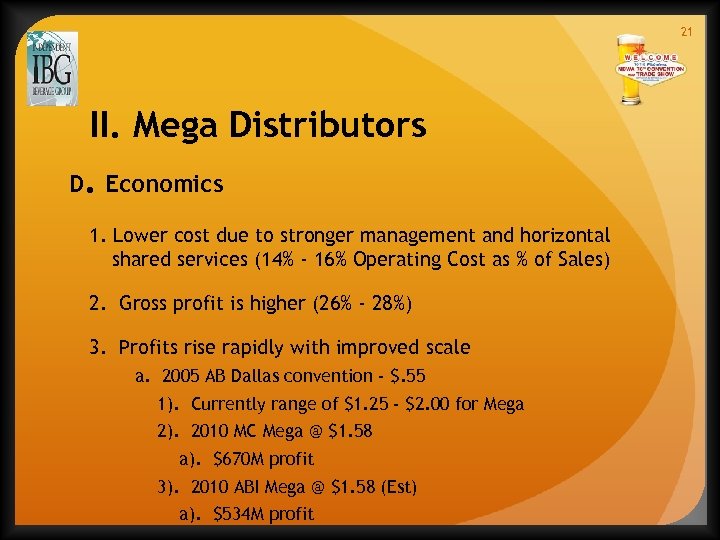

21 II. Mega Distributors D. Economics 1. Lower cost due to stronger management and horizontal shared services (14% - 16% Operating Cost as % of Sales) 2. Gross profit is higher (26% - 28%) 3. Profits rise rapidly with improved scale a. 2005 AB Dallas convention - $. 55 1). Currently range of $1. 25 - $2. 00 for Mega 2). 2010 MC Mega @ $1. 58 a). $670 M profit 3). 2010 ABI Mega @ $1. 58 (Est) a). $534 M profit

21 II. Mega Distributors D. Economics 1. Lower cost due to stronger management and horizontal shared services (14% - 16% Operating Cost as % of Sales) 2. Gross profit is higher (26% - 28%) 3. Profits rise rapidly with improved scale a. 2005 AB Dallas convention - $. 55 1). Currently range of $1. 25 - $2. 00 for Mega 2). 2010 MC Mega @ $1. 58 a). $670 M profit 3). 2010 ABI Mega @ $1. 58 (Est) a). $534 M profit

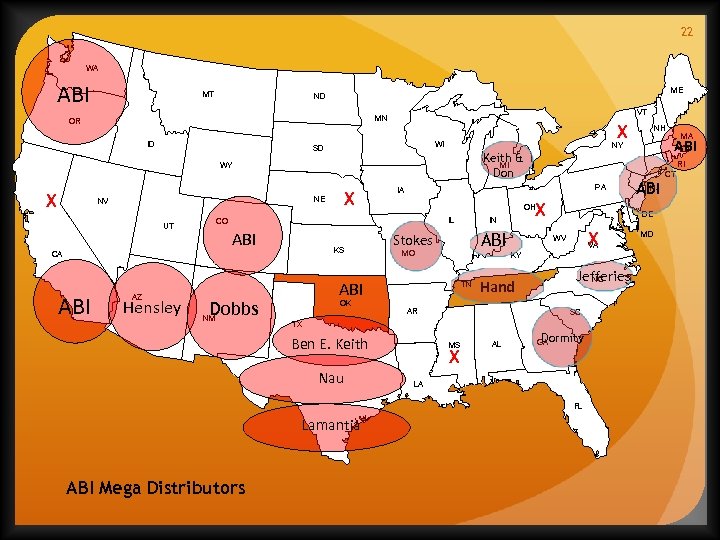

22 WA ABI MT ME ND VT MN OR ID X WI SD Keith & MI Don X NE UT CA ABI AZ Hensley X PA Dobbs NM KS ABI Stokes MO TN X WV Hand AR VA Jefferies NC SC TX Ben E. Keith Nau MS X AL Dormity GA LA FL Lamantia ABI Mega Distributors NJ ABI DE KY ABI OK X OH IN IL ABI RI CT IA CO MA ABI NY WY NV NH MD

22 WA ABI MT ME ND VT MN OR ID X WI SD Keith & MI Don X NE UT CA ABI AZ Hensley X PA Dobbs NM KS ABI Stokes MO TN X WV Hand AR VA Jefferies NC SC TX Ben E. Keith Nau MS X AL Dormity GA LA FL Lamantia ABI Mega Distributors NJ ABI DE KY ABI OK X OH IN IL ABI RI CT IA CO MA ABI NY WY NV NH MD

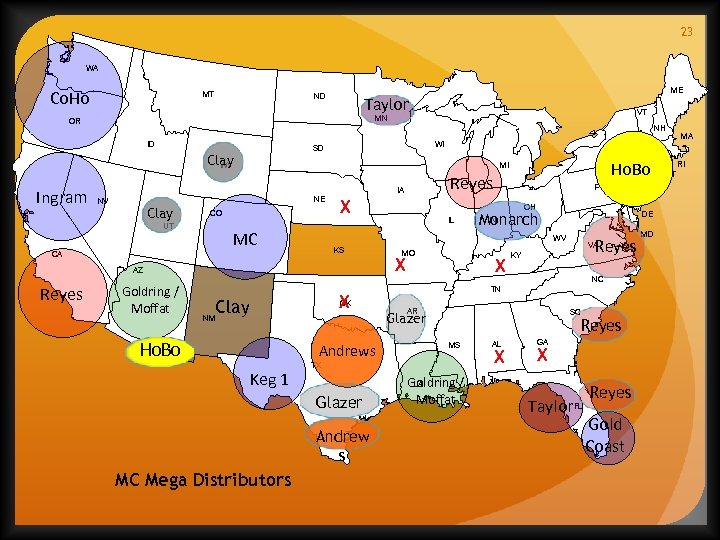

23 WA Co. Ho MT ME ND Taylor NH ID WI SD Clay WY Ingram CA CO MC X KS OK X Clay NM Ho. Bo Andrews Keg 1 OH IL MO X Andrew s Reyes VA KY NC TN AR SC Glazer Reyes MS LA Goldring / Moffat AL X NJ DE Monarch IN X TX Glazer MC Mega Distributors PA WV AZ Goldring / Moffat Ho. Bo Reyes IA Clay NY MI NE NV UT Reyes VT MN OR GA X Taylor Reyes FL Gold Coast MD MA RI CT

23 WA Co. Ho MT ME ND Taylor NH ID WI SD Clay WY Ingram CA CO MC X KS OK X Clay NM Ho. Bo Andrews Keg 1 OH IL MO X Andrew s Reyes VA KY NC TN AR SC Glazer Reyes MS LA Goldring / Moffat AL X NJ DE Monarch IN X TX Glazer MC Mega Distributors PA WV AZ Goldring / Moffat Ho. Bo Reyes IA Clay NY MI NE NV UT Reyes VT MN OR GA X Taylor Reyes FL Gold Coast MD MA RI CT

24 WA MT Sheehan ME ND VT MN OR ID NH Sheehan WI WY RI MI Sheehan PA IA NE NV OH CO IL UT KS MO VA Sheehan KY NC TN NM AR SC MS AL GA TX LA FL Craft Mega Distributors NJ MD WV AZ OK CT DE IN Sheehan CA Sheehan MA NY Sheehan SD

24 WA MT Sheehan ME ND VT MN OR ID NH Sheehan WI WY RI MI Sheehan PA IA NE NV OH CO IL UT KS MO VA Sheehan KY NC TN NM AR SC MS AL GA TX LA FL Craft Mega Distributors NJ MD WV AZ OK CT DE IN Sheehan CA Sheehan MA NY Sheehan SD

25 III. “Stuck In The Middle With You”

25 III. “Stuck In The Middle With You”

26 III. “Stuck In The Middle With You” A. 15% Operating Cost as a % of Sales 1. IBG at Beer Marketers Insights conference 2005 2. ABI/MC cost cutting gave distributors window to reduce costs 3. Rapid growth of SKU’s and brands now adding costs 4. Wine and Spirits/soft drinks and waters/energy drinks now being added to distributors portfolios a. Distributor attitude - easy way to add revenue 1). Survival tactic for declining distributors

26 III. “Stuck In The Middle With You” A. 15% Operating Cost as a % of Sales 1. IBG at Beer Marketers Insights conference 2005 2. ABI/MC cost cutting gave distributors window to reduce costs 3. Rapid growth of SKU’s and brands now adding costs 4. Wine and Spirits/soft drinks and waters/energy drinks now being added to distributors portfolios a. Distributor attitude - easy way to add revenue 1). Survival tactic for declining distributors

27 III. “Stuck In The Middle With You” B. Are “Value Added” Benefits Being Provided? 1. 2. 3. 4. “Distributors are just order takers” “All distributors do is deliver beer – “Are we getting what we pay for? ” “I keep getting new brands and packages but there are not any more hours in my work day” 5. “My market is different…they don’t understand” 6. “They are not the only supplier I have and besides, they get more time than they deserve”

27 III. “Stuck In The Middle With You” B. Are “Value Added” Benefits Being Provided? 1. 2. 3. 4. “Distributors are just order takers” “All distributors do is deliver beer – “Are we getting what we pay for? ” “I keep getting new brands and packages but there are not any more hours in my work day” 5. “My market is different…they don’t understand” 6. “They are not the only supplier I have and besides, they get more time than they deserve”

28 III. “Stuck In The Middle With You” C. What are “Value Added” Benefits? Selling multiple displays – multiple locations – out of section…… Cross merchandising programs/POS placement – custom localized POS, stimulate senses – sight, sound, smell…… Develop in -store relationships – “mini” business reviews, local industry updates, pitches for incremental cooler space, in-store price features…… “Hand sell” – develop in-store sampling programs Etc, Etc!!!

28 III. “Stuck In The Middle With You” C. What are “Value Added” Benefits? Selling multiple displays – multiple locations – out of section…… Cross merchandising programs/POS placement – custom localized POS, stimulate senses – sight, sound, smell…… Develop in -store relationships – “mini” business reviews, local industry updates, pitches for incremental cooler space, in-store price features…… “Hand sell” – develop in-store sampling programs Etc, Etc!!!

29 III. “Stuck In The Middle With You” D. Challenge: How To Add Complexity, Contain Costs And Provide “Value Added” Benefits Effectively?

29 III. “Stuck In The Middle With You” D. Challenge: How To Add Complexity, Contain Costs And Provide “Value Added” Benefits Effectively?

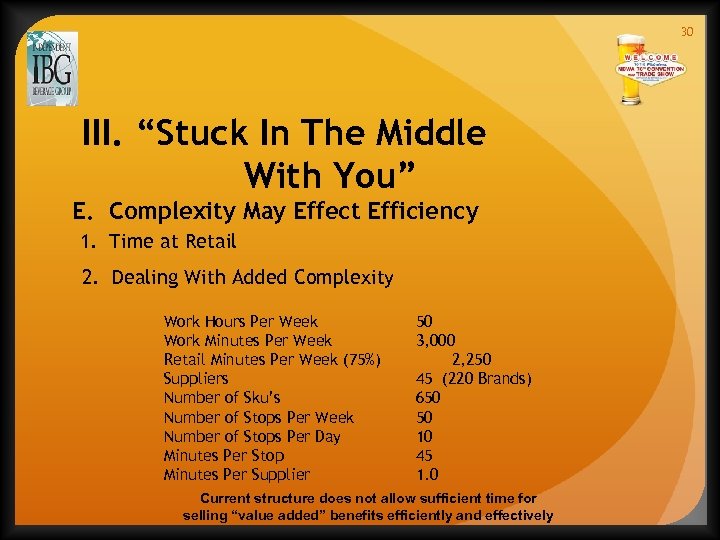

30 III. “Stuck In The Middle With You” E. Complexity May Effect Efficiency 1. Time at Retail 2. Dealing With Added Complexity Work Hours Per Week Work Minutes Per Week Retail Minutes Per Week (75%) Suppliers Number of Sku’s Number of Stops Per Week Number of Stops Per Day Minutes Per Stop Minutes Per Supplier 50 3, 000 2, 250 45 (220 Brands) 650 50 10 45 1. 0 Current structure does not allow sufficient time for selling “value added” benefits efficiently and effectively

30 III. “Stuck In The Middle With You” E. Complexity May Effect Efficiency 1. Time at Retail 2. Dealing With Added Complexity Work Hours Per Week Work Minutes Per Week Retail Minutes Per Week (75%) Suppliers Number of Sku’s Number of Stops Per Week Number of Stops Per Day Minutes Per Stop Minutes Per Supplier 50 3, 000 2, 250 45 (220 Brands) 650 50 10 45 1. 0 Current structure does not allow sufficient time for selling “value added” benefits efficiently and effectively

31 III. “Stuck In The Middle With You” F. IBG’s Conclusion: Current Distributor Model Must Be Changed • Suppliers Question Value Added Benefits • Retailers giving Wine and Spirits More Attention • Consumers Drinking Less Beer!

31 III. “Stuck In The Middle With You” F. IBG’s Conclusion: Current Distributor Model Must Be Changed • Suppliers Question Value Added Benefits • Retailers giving Wine and Spirits More Attention • Consumers Drinking Less Beer!

32 IV. IBG’s Distribution System Of The Future – Model 2020

32 IV. IBG’s Distribution System Of The Future – Model 2020

33 IV. IBG’s Distribution System Of The Future – Model 2020 A. Multi-Category – Add Revenue Per Stop 1. Suppliers, retailers and consumers constantly evolving a. The pace of change is accelerating 2. Distributors will diversify portfolios a. Beer – energy drinks – water – soft drinks -wine – spirits health drinks 3. Adds significant complexity

33 IV. IBG’s Distribution System Of The Future – Model 2020 A. Multi-Category – Add Revenue Per Stop 1. Suppliers, retailers and consumers constantly evolving a. The pace of change is accelerating 2. Distributors will diversify portfolios a. Beer – energy drinks – water – soft drinks -wine – spirits health drinks 3. Adds significant complexity

34 IV. IBG’s Distribution System Of The Future – Model 2020 B. More Effective (E-Commerce) 1. Replenishment function (order taking) must change. Transition “order taking” from pre-sales person to retailers thru technology a. Web based b. Tell-sell c. Twitter/e-mail/fax, etc (IBG puts order replenishments at 50 – 60% of pre-sales time in the account)

34 IV. IBG’s Distribution System Of The Future – Model 2020 B. More Effective (E-Commerce) 1. Replenishment function (order taking) must change. Transition “order taking” from pre-sales person to retailers thru technology a. Web based b. Tell-sell c. Twitter/e-mail/fax, etc (IBG puts order replenishments at 50 – 60% of pre-sales time in the account)

35 IV. IBG’s Distribution System Of The Future – Model 2020 C. More Efficient 1. 48 hour delivery 2. Automated warehouse functions a. Computerized “picking system”

35 IV. IBG’s Distribution System Of The Future – Model 2020 C. More Efficient 1. 48 hour delivery 2. Automated warehouse functions a. Computerized “picking system”

36 IV. IBG’s Distribution System Of The Future – Model 2020 D. “Gigantic” Attitude Adjustment 1. Current attitude for most is “Our job (distributor) is to get the product on the shelf. Your job (supplier) is to get it off the shelf” 2. New model focuses on “retailization”. In-outlet marketing of a consumer product. a. New account manager is responsible for creating a dynamic purchase environment that emphasizes brand development… including “pull”! 1). Extensive time and training 2). Most current pre-sales people will not make the cut! 3. Account managers become exclusively “value added”

36 IV. IBG’s Distribution System Of The Future – Model 2020 D. “Gigantic” Attitude Adjustment 1. Current attitude for most is “Our job (distributor) is to get the product on the shelf. Your job (supplier) is to get it off the shelf” 2. New model focuses on “retailization”. In-outlet marketing of a consumer product. a. New account manager is responsible for creating a dynamic purchase environment that emphasizes brand development… including “pull”! 1). Extensive time and training 2). Most current pre-sales people will not make the cut! 3. Account managers become exclusively “value added”

37 V. How Will Industry and Consumers Re -act

37 V. How Will Industry and Consumers Re -act

38 V. How Will Industry and Consumers Re-act A. Suppliers 1. Initially, most will be apprehensive and cynical 2. Will slowly begin to embrace change as they see results 3. Will need to adjust their model to succeed in a more dynamic, fast paced, sophisticated distributor network 4. May have to subsidize distributors willing to change but with insufficient resources – manpower, facilities, “back room” systems, etc. – to handle the change 5. Will have to patiently work with distributors that are reluctant to change

38 V. How Will Industry and Consumers Re-act A. Suppliers 1. Initially, most will be apprehensive and cynical 2. Will slowly begin to embrace change as they see results 3. Will need to adjust their model to succeed in a more dynamic, fast paced, sophisticated distributor network 4. May have to subsidize distributors willing to change but with insufficient resources – manpower, facilities, “back room” systems, etc. – to handle the change 5. Will have to patiently work with distributors that are reluctant to change

39 V. How Will Industry and Consumers Re-act B. Distributors 1. 75% of distributors (by vol) will embrace change 2. Mega distributors will lead the charge. Will set “best practice” benchmarks a. “Best in class” management b. Strong financial commitment 3. Some Distributors will embrace the change but face resource obstacles a. Management limitations b. Financial limitations 4. Some distributors will do nothing but complain. “It’s not the way we used to do it!” 5. Some distributors will sell

39 V. How Will Industry and Consumers Re-act B. Distributors 1. 75% of distributors (by vol) will embrace change 2. Mega distributors will lead the charge. Will set “best practice” benchmarks a. “Best in class” management b. Strong financial commitment 3. Some Distributors will embrace the change but face resource obstacles a. Management limitations b. Financial limitations 4. Some distributors will do nothing but complain. “It’s not the way we used to do it!” 5. Some distributors will sell

40 V. How Will Industry and Consumers Re-act C. Retailers 1. Retailers will prefer new method of ordering, selling and delivery (After adjustment period) a. Retailers believe distributors sell too much, too little or the wrong item b. Retailers look at current pre-sale people as “over paid” labor c. Retailers will respect account managers that enhance their customers shopping experience D. Increased respect = increased confidence = increased “share of store” (increased brands/sku’s/space/programs) = increased sales

40 V. How Will Industry and Consumers Re-act C. Retailers 1. Retailers will prefer new method of ordering, selling and delivery (After adjustment period) a. Retailers believe distributors sell too much, too little or the wrong item b. Retailers look at current pre-sale people as “over paid” labor c. Retailers will respect account managers that enhance their customers shopping experience D. Increased respect = increased confidence = increased “share of store” (increased brands/sku’s/space/programs) = increased sales

41 V. How Will Industry and Consumers Re-act D. Consumers 1. Consumers will re-act positively to an enhanced shopping experience 2. Consumers will be attracted to “localized” in-store activities created by a local rep with knowledge of local events and other social (beer drinking) occasions 3. Consumers will respond to invitations to try products delivered in an interesting, creative, informative and interactive way 4. Beer will once again be an exciting, creative, cool , cutting edge, fun beverage of moderation!

41 V. How Will Industry and Consumers Re-act D. Consumers 1. Consumers will re-act positively to an enhanced shopping experience 2. Consumers will be attracted to “localized” in-store activities created by a local rep with knowledge of local events and other social (beer drinking) occasions 3. Consumers will respond to invitations to try products delivered in an interesting, creative, informative and interactive way 4. Beer will once again be an exciting, creative, cool , cutting edge, fun beverage of moderation!

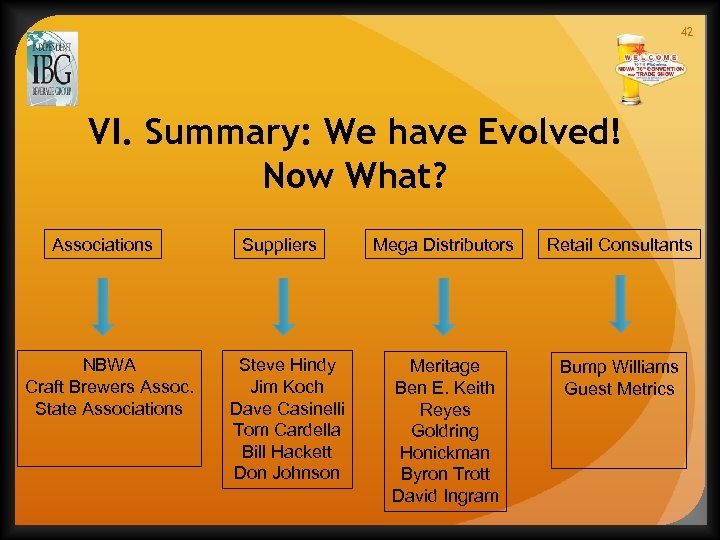

42 VI. Summary: We have Evolved! Now What? Associations NBWA Craft Brewers Assoc. State Associations Suppliers Steve Hindy Jim Koch Dave Casinelli Tom Cardella Bill Hackett Don Johnson Mega Distributors Retail Consultants Meritage Ben E. Keith Reyes Goldring Honickman Byron Trott David Ingram Bump Williams Guest Metrics

42 VI. Summary: We have Evolved! Now What? Associations NBWA Craft Brewers Assoc. State Associations Suppliers Steve Hindy Jim Koch Dave Casinelli Tom Cardella Bill Hackett Don Johnson Mega Distributors Retail Consultants Meritage Ben E. Keith Reyes Goldring Honickman Byron Trott David Ingram Bump Williams Guest Metrics

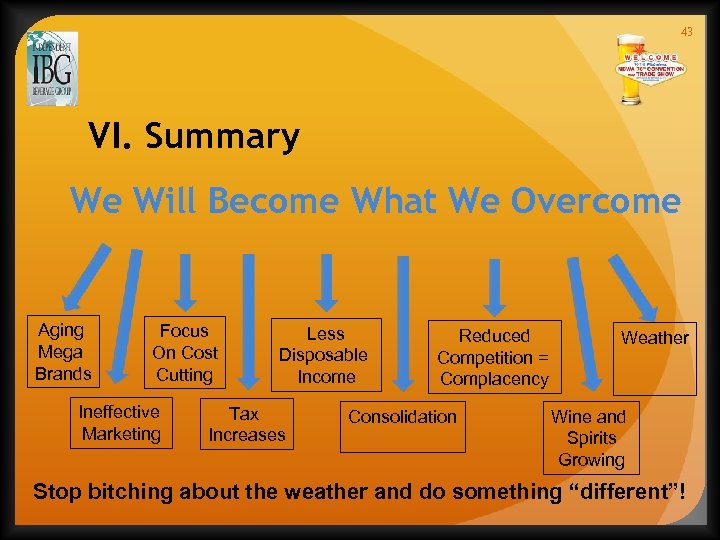

43 VI. Summary We Will Become What We Overcome Aging Mega Brands Focus On Cost Cutting Ineffective Marketing Less Disposable Income Tax Increases Reduced Competition = Complacency Consolidation Weather Wine and Spirits Growing Stop bitching about the weather and do something “different”!

43 VI. Summary We Will Become What We Overcome Aging Mega Brands Focus On Cost Cutting Ineffective Marketing Less Disposable Income Tax Increases Reduced Competition = Complacency Consolidation Weather Wine and Spirits Growing Stop bitching about the weather and do something “different”!