14e42ad572557d8e58f7cd83a3973062.ppt

- Количество слайдов: 29

WDCEP Q 2 2011 Progress Report April 2011

WDCEP Q 2 2011 Progress Report April 2011

OVERVIEW Tactical and Practical Mission | Supporting Business Development | Small Business Retention Retail Attraction | Expanded Board Capacity | Outreach | Prospects Special Projects | Budget and Finance | Next WDCEP Q 2 2011 Progress Report | April 2011

OVERVIEW Tactical and Practical Mission | Supporting Business Development | Small Business Retention Retail Attraction | Expanded Board Capacity | Outreach | Prospects Special Projects | Budget and Finance | Next WDCEP Q 2 2011 Progress Report | April 2011

MISSION Jobs, Communications, Collaboration WDCEP Q 2 2011 Progress Report | April 2011

MISSION Jobs, Communications, Collaboration WDCEP Q 2 2011 Progress Report | April 2011

Mission Jobs, Communication, Collaboration • Enhance DC’s economy through jobs creation for DC residents. Increase tax revenues. Retain existing businesses. Attract new businesses. • Serve as an information clearinghouse and research center for prospects, businesses, DC agencies, and community stakeholders. • Tell the story of DC’s economic resurgence and development dynamic in local, regional, national and international markets. WDCEP Q 2 2011 Progress Report | April 2011

Mission Jobs, Communication, Collaboration • Enhance DC’s economy through jobs creation for DC residents. Increase tax revenues. Retain existing businesses. Attract new businesses. • Serve as an information clearinghouse and research center for prospects, businesses, DC agencies, and community stakeholders. • Tell the story of DC’s economic resurgence and development dynamic in local, regional, national and international markets. WDCEP Q 2 2011 Progress Report | April 2011

Mission Jobs, Communication, Collaboration • Brand DC as a vibrant business environment and investment opportunity. • Provide resources to the community that support economic development. • Collaborate and partner with the community’s public and private stakeholders in order to accomplish our goals and leverage our resources. • Serve as a link between the business community and the DC Government. WDCEP Q 2 2011 Progress Report | April 2011

Mission Jobs, Communication, Collaboration • Brand DC as a vibrant business environment and investment opportunity. • Provide resources to the community that support economic development. • Collaborate and partner with the community’s public and private stakeholders in order to accomplish our goals and leverage our resources. • Serve as a link between the business community and the DC Government. WDCEP Q 2 2011 Progress Report | April 2011

SUPPORTING BUSINESS DEVELOPMENT WDCEP Q 2 2011 Progress Report | April 2011

SUPPORTING BUSINESS DEVELOPMENT WDCEP Q 2 2011 Progress Report | April 2011

Supporting Business Development 25 programs, conferences and informational events annually 4, 000+ attendees 3, 0005, 000 - estimated number of people who have watched our programs on TV WDCEP Q 2 2011 Progress Report | April 2011

Supporting Business Development 25 programs, conferences and informational events annually 4, 000+ attendees 3, 0005, 000 - estimated number of people who have watched our programs on TV WDCEP Q 2 2011 Progress Report | April 2011

Supporting Business Development 7, 000 -10, 000 total audience annually WDCEP Q 2 2011 Progress Report | April 2011

Supporting Business Development 7, 000 -10, 000 total audience annually WDCEP Q 2 2011 Progress Report | April 2011

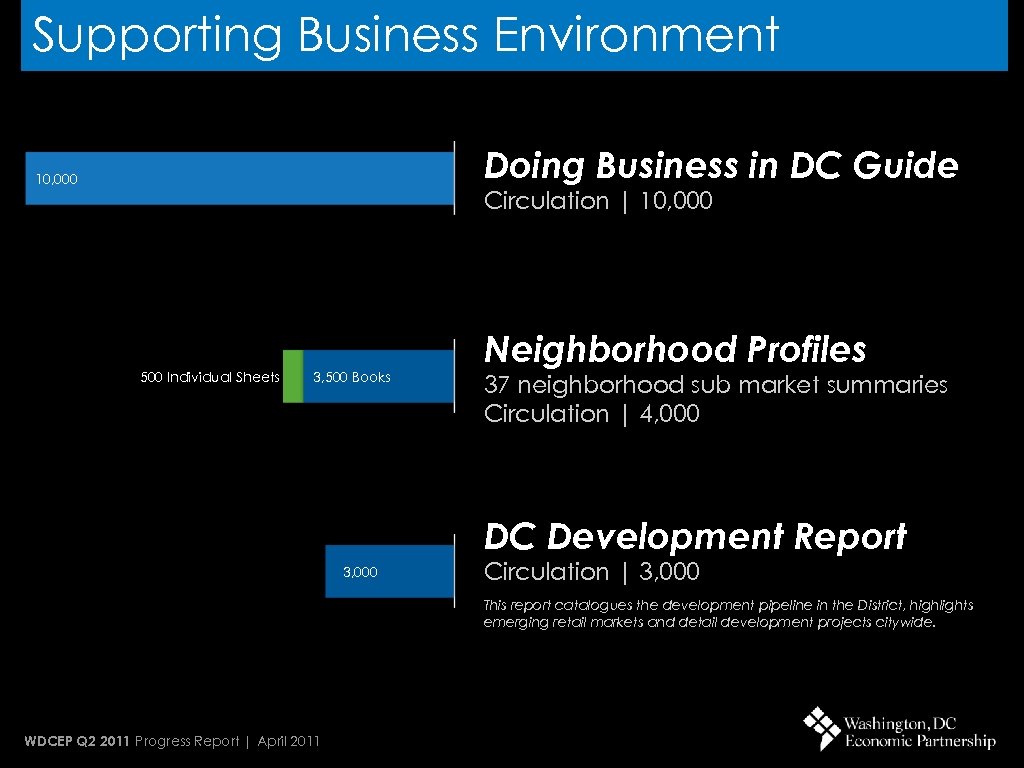

Supporting Business Environment Doing Business in DC Guide 10, 000 Circulation | 10, 000 500 Individual Sheets 3, 500 Books Neighborhood Profiles 37 neighborhood sub market summaries Circulation | 4, 000 DC Development Report 3, 000 Circulation | 3, 000 This report catalogues the development pipeline in the District, highlights emerging retail markets and detail development projects citywide. WDCEP Q 2 2011 Progress Report | April 2011

Supporting Business Environment Doing Business in DC Guide 10, 000 Circulation | 10, 000 500 Individual Sheets 3, 500 Books Neighborhood Profiles 37 neighborhood sub market summaries Circulation | 4, 000 DC Development Report 3, 000 Circulation | 3, 000 This report catalogues the development pipeline in the District, highlights emerging retail markets and detail development projects citywide. WDCEP Q 2 2011 Progress Report | April 2011

SMALL BUSINESS RETENTION DC Business Profile | DC Small & Micro Business Profile | Small Business Initiatives WDCEP Q 2 2011 Progress Report | April 2011

SMALL BUSINESS RETENTION DC Business Profile | DC Small & Micro Business Profile | Small Business Initiatives WDCEP Q 2 2011 Progress Report | April 2011

Small Business Retention DC has 43, 300 businesses that employ about 538, 000 individuals WDCEP Q 2 2011 Progress Report | April 2011 DC Business Profile

Small Business Retention DC has 43, 300 businesses that employ about 538, 000 individuals WDCEP Q 2 2011 Progress Report | April 2011 DC Business Profile

Small Business Retention DC Business Profile On average, District businesses have been in operation for nine years and gross $1 M WDCEP Q 2 2011 Progress Report | April 2011

Small Business Retention DC Business Profile On average, District businesses have been in operation for nine years and gross $1 M WDCEP Q 2 2011 Progress Report | April 2011

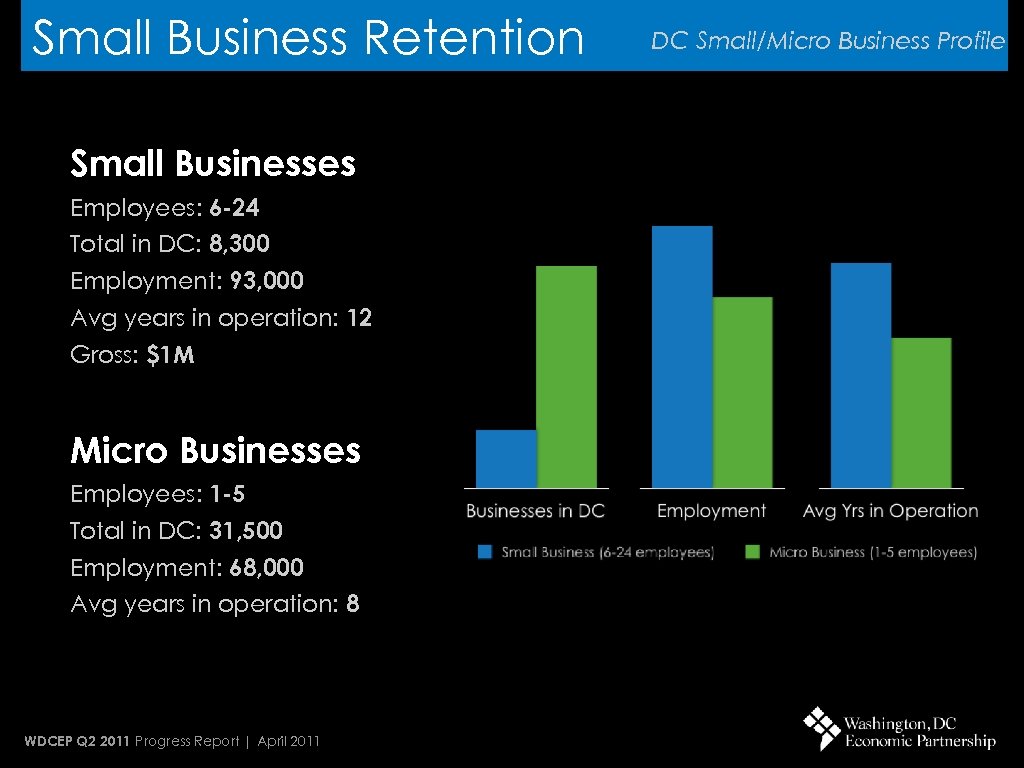

Small Business Retention Small Businesses Employees: 6 -24 Total in DC: 8, 300 Employment: 93, 000 Avg years in operation: 12 Gross: $1 M Micro Businesses Employees: 1 -5 Total in DC: 31, 500 Employment: 68, 000 Avg years in operation: 8 WDCEP Q 2 2011 Progress Report | April 2011 DC Small/Micro Business Profile

Small Business Retention Small Businesses Employees: 6 -24 Total in DC: 8, 300 Employment: 93, 000 Avg years in operation: 12 Gross: $1 M Micro Businesses Employees: 1 -5 Total in DC: 31, 500 Employment: 68, 000 Avg years in operation: 8 WDCEP Q 2 2011 Progress Report | April 2011 DC Small/Micro Business Profile

WDCEP Small Business initiatives Suite of Programs Doing Business in DC Guide Circulation | 10, 000 Doing. Business 2. 0 7 programs | Initial Start Up Consideration, Business Financing, Business Registration & Licensing, Business Taxes, Finding Talent & Labor, Business Insurance, Starting a Franchise 236 attendees | 4. 5 hours of content for You. Tube and Channel 16 WDCEP Business Plan Competition $100, 000 capital investment +$29, 000 in pro-bono services Small Business Awards 3 awards | Small Business of the Year; 100 Year Old Business of the Year; Small Business of the Year WDCEP Q 2 2011 Progress Report | April 2011

WDCEP Small Business initiatives Suite of Programs Doing Business in DC Guide Circulation | 10, 000 Doing. Business 2. 0 7 programs | Initial Start Up Consideration, Business Financing, Business Registration & Licensing, Business Taxes, Finding Talent & Labor, Business Insurance, Starting a Franchise 236 attendees | 4. 5 hours of content for You. Tube and Channel 16 WDCEP Business Plan Competition $100, 000 capital investment +$29, 000 in pro-bono services Small Business Awards 3 awards | Small Business of the Year; 100 Year Old Business of the Year; Small Business of the Year WDCEP Q 2 2011 Progress Report | April 2011

WDCEP Small Business initiatives New/Proposed Broadband Access for Small Business $75, 000 grant Kauffman Foundation Fastrac Training $150, 000 grant 200+ merchants trained | New Venture, Expanding Venture; Tech Venture WDCEP Q 2 2011 Progress Report | April 2011

WDCEP Small Business initiatives New/Proposed Broadband Access for Small Business $75, 000 grant Kauffman Foundation Fastrac Training $150, 000 grant 200+ merchants trained | New Venture, Expanding Venture; Tech Venture WDCEP Q 2 2011 Progress Report | April 2011

RETAIL ATTRACTION Taxes & Jobs | Metrics WDCEP Q 2 2011 Progress Report | April 2011

RETAIL ATTRACTION Taxes & Jobs | Metrics WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction Taxes and Jobs • The District “leaks” $1 B per year in retail spending. • The District is “understored”. 8. 6 sq. ft. of retail person in DC vs the national avg. of 23. 4 sq. ft. • The District would need to add 8 M sq. ft to achieve national avg. (8. 6 X 600 k=5. 16 M sq. ft. ) (23. 4 x 600 k=14. 04 M sq. ft. ) | (Social Compact & 2006 Comprehensive Plan) WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction Taxes and Jobs • The District “leaks” $1 B per year in retail spending. • The District is “understored”. 8. 6 sq. ft. of retail person in DC vs the national avg. of 23. 4 sq. ft. • The District would need to add 8 M sq. ft to achieve national avg. (8. 6 X 600 k=5. 16 M sq. ft. ) (23. 4 x 600 k=14. 04 M sq. ft. ) | (Social Compact & 2006 Comprehensive Plan) WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction Metrics • Taxable retail and restaurant sales have grown by more than 50% from 2000 -2008. An increase of $3. 9 B to $11. 2 B resulting in tax collections of $770 M+. • The WDCEP markets 7. 0 M+ sq. ft. of retail. • This supports 12, 000+ new jobs in DC. (ICSC ratio of 550 sq. ft. per employee. ) WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction Metrics • Taxable retail and restaurant sales have grown by more than 50% from 2000 -2008. An increase of $3. 9 B to $11. 2 B resulting in tax collections of $770 M+. • The WDCEP markets 7. 0 M+ sq. ft. of retail. • This supports 12, 000+ new jobs in DC. (ICSC ratio of 550 sq. ft. per employee. ) WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction / Grocery Metrics WDCEP supported the delivery of 15 new grocery stores since 2000 Harris Teeter | Safeway | Giant | Yes! Organics | Whole Foods | Trader Joe’s Catalytic effect? WDCEP Q 2 2011 Progress Report | April 2011

Retail Attraction / Grocery Metrics WDCEP supported the delivery of 15 new grocery stores since 2000 Harris Teeter | Safeway | Giant | Yes! Organics | Whole Foods | Trader Joe’s Catalytic effect? WDCEP Q 2 2011 Progress Report | April 2011

OUTREACH Targeted Audiences | Special Projects WDCEP Q 2 2011 Progress Report | April 2011

OUTREACH Targeted Audiences | Special Projects WDCEP Q 2 2011 Progress Report | April 2011

Outreach Targeted Audiences/Topics DC Revenue Bond Program FASB Legislation and Enterprise Incentives DC Economic Development Outlook 400 attendees | $29, 000 | 4 hours content for You. Tube and Channel 16 WDCEP Q 2 2011 Progress Report | April 2011

Outreach Targeted Audiences/Topics DC Revenue Bond Program FASB Legislation and Enterprise Incentives DC Economic Development Outlook 400 attendees | $29, 000 | 4 hours content for You. Tube and Channel 16 WDCEP Q 2 2011 Progress Report | April 2011

Prospects | Special Projects | Budget & Finance WDCEP Q 2 2011 Progress Report | April 2011

Prospects | Special Projects | Budget & Finance WDCEP Q 2 2011 Progress Report | April 2011

Outreach Special Projects • Urban Land Institute Fall Conference • Ward 5 Economic Summit • DCBIA Programs • GWHCC Economic Programs Other • Convener 30+ meetings • the notebook monthly newsletter | circulation: 6, 000 WDCEP Q 2 2011 Progress Report | April 2011

Outreach Special Projects • Urban Land Institute Fall Conference • Ward 5 Economic Summit • DCBIA Programs • GWHCC Economic Programs Other • Convener 30+ meetings • the notebook monthly newsletter | circulation: 6, 000 WDCEP Q 2 2011 Progress Report | April 2011

Prospects • WDCEP is currently tracking 200+ companies for relocation, startup or expansion. • We track 1, 250+ economic development projects annually. • We promote 300+ retail/small business opportunities in DC annually. • CEO Survey launches April 15. WDCEP Q 2 2011 Progress Report | April 2011

Prospects • WDCEP is currently tracking 200+ companies for relocation, startup or expansion. • We track 1, 250+ economic development projects annually. • We promote 300+ retail/small business opportunities in DC annually. • CEO Survey launches April 15. WDCEP Q 2 2011 Progress Report | April 2011

Special Projects Broadband for Small business/OCTO Grant Agency Collaboration Comprehensive Economic Development Strategy Federal Partner | Pipeline for funding for ED projects actionomics Ward 8 Major initiatives | partner with GWU Sunderland England Tech Trade Mission Need for FDI support Critical Success Factors Analysis of Small Business Success Adjacent to Urban Big Box WDCEP Q 2 2011 Progress Report | April 2011

Special Projects Broadband for Small business/OCTO Grant Agency Collaboration Comprehensive Economic Development Strategy Federal Partner | Pipeline for funding for ED projects actionomics Ward 8 Major initiatives | partner with GWU Sunderland England Tech Trade Mission Need for FDI support Critical Success Factors Analysis of Small Business Success Adjacent to Urban Big Box WDCEP Q 2 2011 Progress Report | April 2011

Budget & Financing Forecasting • The DC portion of the Partnership funding has decreased from $2. 2 M to $750, 000 since 2007. • Only 9% of all of the IEDC members surveyed in February of 2011 have a budget reduction of 25%. 45% of Economic Development Partnerships nationwide have budget increases for 2011 and 2012. • Baseline Budget for the WDCEP is $1. 5 M • The private sector matches the District sponsorship to WDCEP at a rate of 30 -40%. This sponsorship match sets the standard for DC partnership and programming investments. • Prince George’s County announced on March 15, 2011 a $50 M fund to attract retailers and businesses to the county. • Maryland announced a $100, 000 cyber tech venture fund. WDCEP Q 2 2011 Progress Report | April 2011

Budget & Financing Forecasting • The DC portion of the Partnership funding has decreased from $2. 2 M to $750, 000 since 2007. • Only 9% of all of the IEDC members surveyed in February of 2011 have a budget reduction of 25%. 45% of Economic Development Partnerships nationwide have budget increases for 2011 and 2012. • Baseline Budget for the WDCEP is $1. 5 M • The private sector matches the District sponsorship to WDCEP at a rate of 30 -40%. This sponsorship match sets the standard for DC partnership and programming investments. • Prince George’s County announced on March 15, 2011 a $50 M fund to attract retailers and businesses to the county. • Maryland announced a $100, 000 cyber tech venture fund. WDCEP Q 2 2011 Progress Report | April 2011

• Real Estate News • Washington leads nation in drawing major retailers • By: Liz Farmer 05/09/11 8: 05 PM Examiner Staff Writer @Liz. Farmer. DC • The Washington area’s speedy recovery and urban revival is drawing retailers like Safeway, Walmart, Target and Harris Teeter as major chains return to cities. – Andrew Harnik/Examiner file • The Washington region led the nation last year in luring major retailers and will continue to dominate this year as large stores repackage themselves for the now-lucrative urban market, a new report says. The area's speedy recovery and urban revival is drawing retailers like Walmart, Target and Harris Teeter as major chains return to cities more than 50 years after packing up and leaving downtown neighborhoods. • "There's only one place in America with more spending power than stores to spend it in and that is basically in our downtowns and cities, " said Ed Mc. Mahon, senior resident fellow at the Urban Land Institute. • 28

• Real Estate News • Washington leads nation in drawing major retailers • By: Liz Farmer 05/09/11 8: 05 PM Examiner Staff Writer @Liz. Farmer. DC • The Washington area’s speedy recovery and urban revival is drawing retailers like Safeway, Walmart, Target and Harris Teeter as major chains return to cities. – Andrew Harnik/Examiner file • The Washington region led the nation last year in luring major retailers and will continue to dominate this year as large stores repackage themselves for the now-lucrative urban market, a new report says. The area's speedy recovery and urban revival is drawing retailers like Walmart, Target and Harris Teeter as major chains return to cities more than 50 years after packing up and leaving downtown neighborhoods. • "There's only one place in America with more spending power than stores to spend it in and that is basically in our downtowns and cities, " said Ed Mc. Mahon, senior resident fellow at the Urban Land Institute. • 28

NEXT Business Plan Competition | Ward 8 Summit | ICSC Las Vegas | EDA Grant: St E’s Workforce Development Center | Kaufman Foundation/Walmart Fastrac Program | Small Business Awards WDCEP Q 2 2011 Progress Report | April 2011

NEXT Business Plan Competition | Ward 8 Summit | ICSC Las Vegas | EDA Grant: St E’s Workforce Development Center | Kaufman Foundation/Walmart Fastrac Program | Small Business Awards WDCEP Q 2 2011 Progress Report | April 2011