c5de1aa9400008b0c9035a065695f825.ppt

- Количество слайдов: 32

watsonwyatt. com An Introduction to the Actuarial Profession 21 October 2008

watsonwyatt. com An Introduction to the Actuarial Profession 21 October 2008

Agenda ¾ Introduction / benefit consulting – Mark Cooper ¾ Investment consulting – Iain Douglas ¾ Msc Actuarial Finance – Dr David Mc. Carthy ¾ The profession – Robert Hail Please stop us if you have a question! 2 Copyright © Watson Wyatt Worldwide. All rights reserved

Agenda ¾ Introduction / benefit consulting – Mark Cooper ¾ Investment consulting – Iain Douglas ¾ Msc Actuarial Finance – Dr David Mc. Carthy ¾ The profession – Robert Hail Please stop us if you have a question! 2 Copyright © Watson Wyatt Worldwide. All rights reserved

My Background ¾ Graduated from Imperial with Maths Bsc in 2005 ¾ September 2005 – Joined the Watson Wyatt Graduate Scheme ¾ Ocobter 2006 – commenced Msc Actuarial Finance (part time) at Tanaka business school 3 Copyright © Watson Wyatt Worldwide. All rights reserved

My Background ¾ Graduated from Imperial with Maths Bsc in 2005 ¾ September 2005 – Joined the Watson Wyatt Graduate Scheme ¾ Ocobter 2006 – commenced Msc Actuarial Finance (part time) at Tanaka business school 3 Copyright © Watson Wyatt Worldwide. All rights reserved

What is an actuary? ¾ Statistical heart – Analysing future financial events in the presence of uncertainty ¾ Types of work: – Pricing financial derivatives – Setting premium rates for insurance policies – Advising corporate on pension scheme issues – Recurring theme is dealing with uncertain amounts and timing of future cash flows The ability to communicate clearly difficult topics to nonspecialists is of paramount importance. 4 Copyright © Watson Wyatt Worldwide. All rights reserved

What is an actuary? ¾ Statistical heart – Analysing future financial events in the presence of uncertainty ¾ Types of work: – Pricing financial derivatives – Setting premium rates for insurance policies – Advising corporate on pension scheme issues – Recurring theme is dealing with uncertain amounts and timing of future cash flows The ability to communicate clearly difficult topics to nonspecialists is of paramount importance. 4 Copyright © Watson Wyatt Worldwide. All rights reserved

Most popular first degree subjects studied by new entrants to the profession ¾ Mathematics ¾ Actuarial science ¾ Economics ¾ Finance ¾ Physics ¾ Science ¾ Mathematics - MORSE ¾ Computer science 5 Copyright © Watson Wyatt Worldwide. All rights reserved

Most popular first degree subjects studied by new entrants to the profession ¾ Mathematics ¾ Actuarial science ¾ Economics ¾ Finance ¾ Physics ¾ Science ¾ Mathematics - MORSE ¾ Computer science 5 Copyright © Watson Wyatt Worldwide. All rights reserved

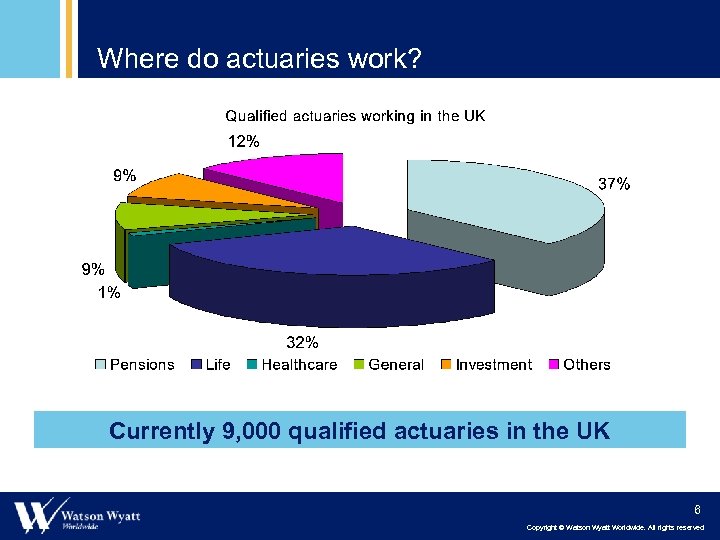

Where do actuaries work? Currently 9, 000 qualified actuaries in the UK 6 Copyright © Watson Wyatt Worldwide. All rights reserved

Where do actuaries work? Currently 9, 000 qualified actuaries in the UK 6 Copyright © Watson Wyatt Worldwide. All rights reserved

Actuarial Education ¾ Currently there are 15 exams you must pass before you are a qualified actuary – Range of skills tested, some technical others more applied (wordy) ¾ Typical qualification time: 4 – 7 years ¾ Alternative exam paths available – Imperial Msc Actuarial Finance – Various other post grad courses Employer provides generous study package 7 Copyright © Watson Wyatt Worldwide. All rights reserved

Actuarial Education ¾ Currently there are 15 exams you must pass before you are a qualified actuary – Range of skills tested, some technical others more applied (wordy) ¾ Typical qualification time: 4 – 7 years ¾ Alternative exam paths available – Imperial Msc Actuarial Finance – Various other post grad courses Employer provides generous study package 7 Copyright © Watson Wyatt Worldwide. All rights reserved

Why Consultancy? ¾ Variety ¾ Relationship management ¾ Solution focused ¾ Challenge ¾ It pays well! 8 Copyright © Watson Wyatt Worldwide. All rights reserved

Why Consultancy? ¾ Variety ¾ Relationship management ¾ Solution focused ¾ Challenge ¾ It pays well! 8 Copyright © Watson Wyatt Worldwide. All rights reserved

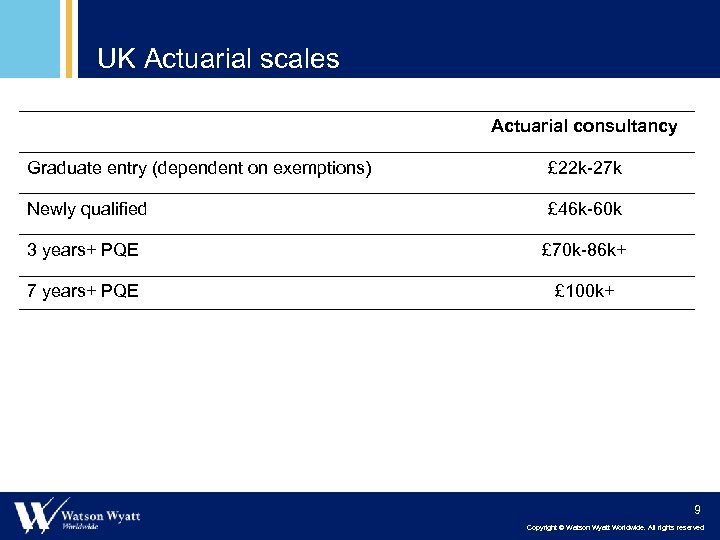

UK Actuarial scales Actuarial consultancy Graduate entry (dependent on exemptions) £ 22 k-27 k Newly qualified £ 46 k-60 k 3 years+ PQE £ 70 k-86 k+ 7 years+ PQE £ 100 k+ 9 Copyright © Watson Wyatt Worldwide. All rights reserved

UK Actuarial scales Actuarial consultancy Graduate entry (dependent on exemptions) £ 22 k-27 k Newly qualified £ 46 k-60 k 3 years+ PQE £ 70 k-86 k+ 7 years+ PQE £ 100 k+ 9 Copyright © Watson Wyatt Worldwide. All rights reserved

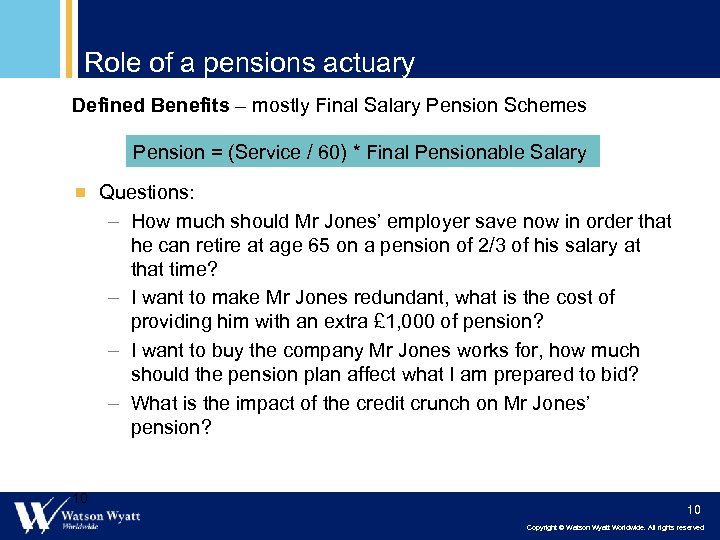

Role of a pensions actuary Defined Benefits – mostly Final Salary Pension Schemes Pension = (Service / 60) * Final Pensionable Salary ¾ Questions: – How much should Mr Jones’ employer save now in order that he can retire at age 65 on a pension of 2/3 of his salary at that time? – I want to make Mr Jones redundant, what is the cost of providing him with an extra £ 1, 000 of pension? – I want to buy the company Mr Jones works for, how much should the pension plan affect what I am prepared to bid? – What is the impact of the credit crunch on Mr Jones’ pension? 10 10 Copyright © Watson Wyatt Worldwide. All rights reserved

Role of a pensions actuary Defined Benefits – mostly Final Salary Pension Schemes Pension = (Service / 60) * Final Pensionable Salary ¾ Questions: – How much should Mr Jones’ employer save now in order that he can retire at age 65 on a pension of 2/3 of his salary at that time? – I want to make Mr Jones redundant, what is the cost of providing him with an extra £ 1, 000 of pension? – I want to buy the company Mr Jones works for, how much should the pension plan affect what I am prepared to bid? – What is the impact of the credit crunch on Mr Jones’ pension? 10 10 Copyright © Watson Wyatt Worldwide. All rights reserved

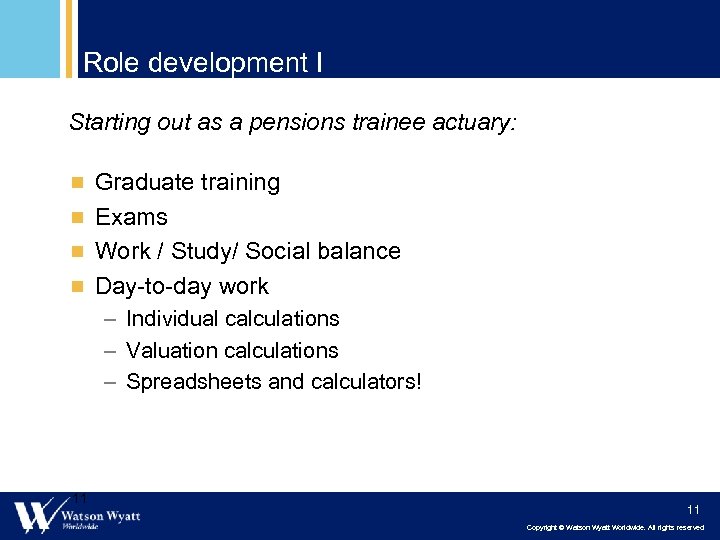

Role development I Starting out as a pensions trainee actuary: ¾ Graduate training ¾ Exams ¾ Work / Study/ Social balance ¾ Day-to-day work – Individual calculations – Valuation calculations – Spreadsheets and calculators! 11 11 Copyright © Watson Wyatt Worldwide. All rights reserved

Role development I Starting out as a pensions trainee actuary: ¾ Graduate training ¾ Exams ¾ Work / Study/ Social balance ¾ Day-to-day work – Individual calculations – Valuation calculations – Spreadsheets and calculators! 11 11 Copyright © Watson Wyatt Worldwide. All rights reserved

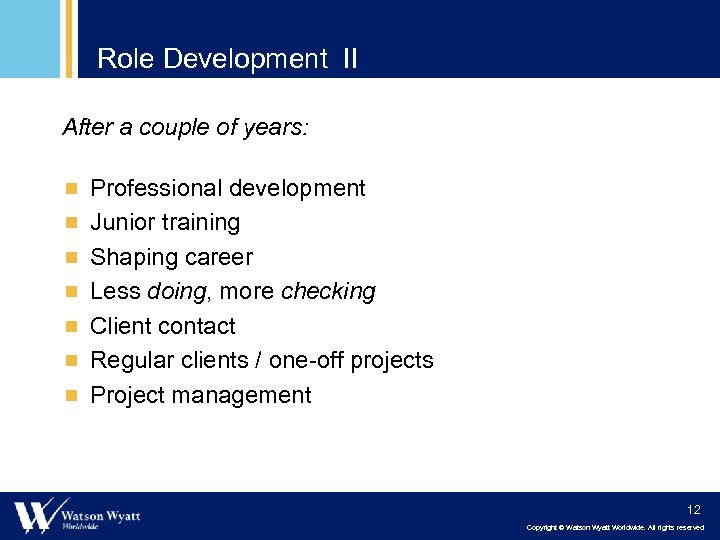

Role Development II After a couple of years: ¾ Professional development ¾ Junior training ¾ Shaping career ¾ Less doing, more checking ¾ Client contact ¾ Regular clients / one-off projects ¾ Project management 12 Copyright © Watson Wyatt Worldwide. All rights reserved

Role Development II After a couple of years: ¾ Professional development ¾ Junior training ¾ Shaping career ¾ Less doing, more checking ¾ Client contact ¾ Regular clients / one-off projects ¾ Project management 12 Copyright © Watson Wyatt Worldwide. All rights reserved

watsonwyatt. com Investment Consulting Iain Douglas

watsonwyatt. com Investment Consulting Iain Douglas

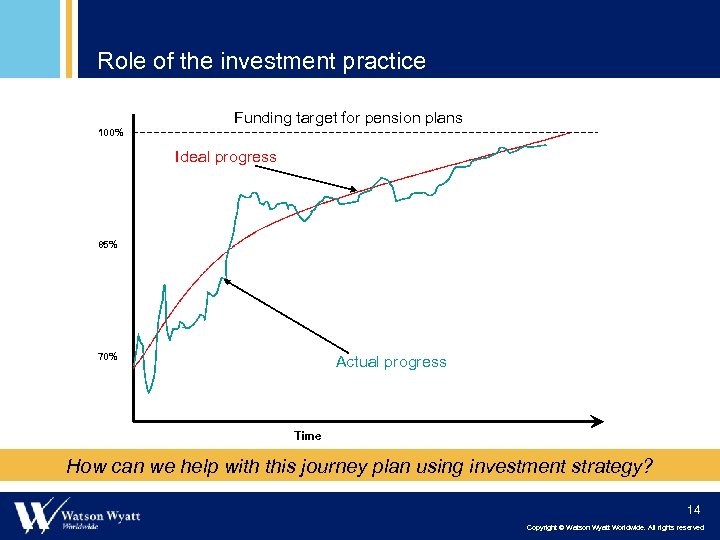

Role of the investment practice Funding target for pension plans 100% Ideal progress 85% 70% Actual progress Time How can we help with this journey plan using investment strategy? 14 Copyright © Watson Wyatt Worldwide. All rights reserved

Role of the investment practice Funding target for pension plans 100% Ideal progress 85% 70% Actual progress Time How can we help with this journey plan using investment strategy? 14 Copyright © Watson Wyatt Worldwide. All rights reserved

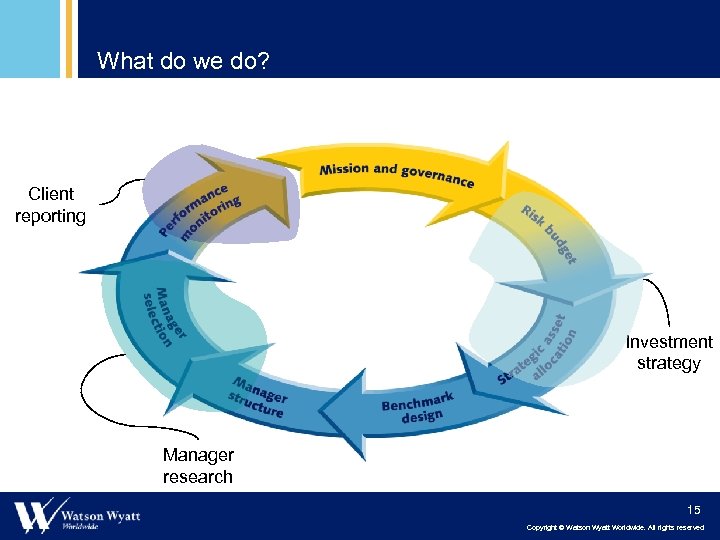

What do we do? Client reporting Investment strategy Manager research 15 Copyright © Watson Wyatt Worldwide. All rights reserved

What do we do? Client reporting Investment strategy Manager research 15 Copyright © Watson Wyatt Worldwide. All rights reserved

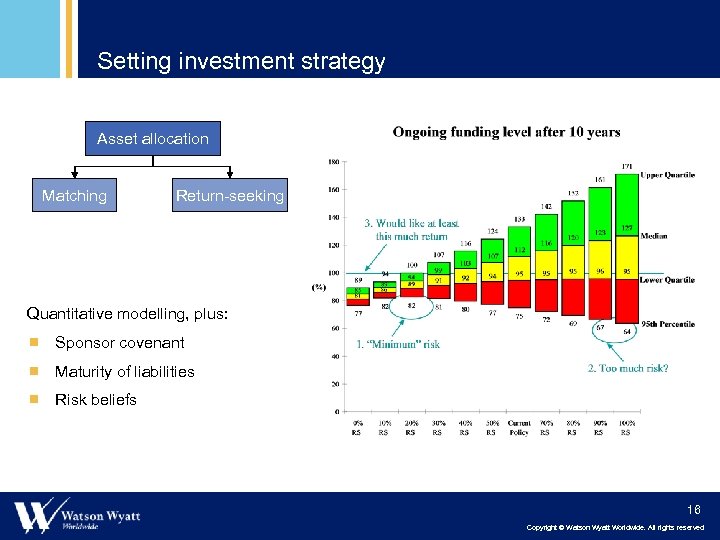

Setting investment strategy Asset allocation Matching Return-seeking Quantitative modelling, plus: ¾ Sponsor covenant ¾ Maturity of liabilities ¾ Risk beliefs 16 Copyright © Watson Wyatt Worldwide. All rights reserved

Setting investment strategy Asset allocation Matching Return-seeking Quantitative modelling, plus: ¾ Sponsor covenant ¾ Maturity of liabilities ¾ Risk beliefs 16 Copyright © Watson Wyatt Worldwide. All rights reserved

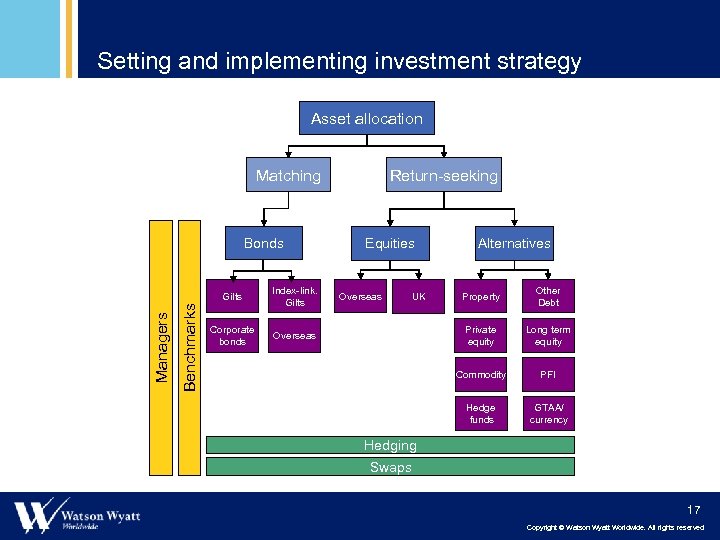

Setting and implementing investment strategy Setting and implementing strategy Asset allocation Matching Bonds Benchmarks Managers Gilts Index-link. Gilts Corporate bonds Return-seeking Equities Overseas Alternatives Other Debt Long term equity Commodity PFI Hedge funds UK Property Private equity Overseas GTAA/ currency Hedging Swaps 17 Copyright © Watson Wyatt Worldwide. All rights reserved

Setting and implementing investment strategy Setting and implementing strategy Asset allocation Matching Bonds Benchmarks Managers Gilts Index-link. Gilts Corporate bonds Return-seeking Equities Overseas Alternatives Other Debt Long term equity Commodity PFI Hedge funds UK Property Private equity Overseas GTAA/ currency Hedging Swaps 17 Copyright © Watson Wyatt Worldwide. All rights reserved

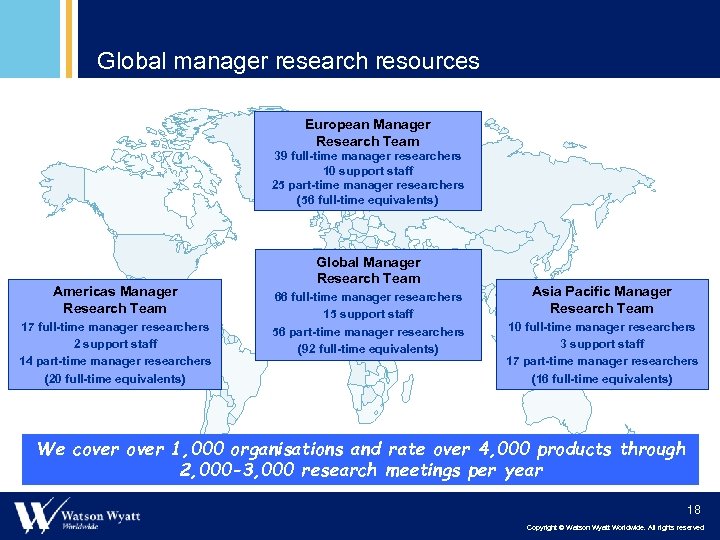

Global manager research resources European Manager Research Team 39 full-time manager researchers 10 support staff 25 part-time manager researchers (56 full-time equivalents) Americas Manager Research Team 17 full-time manager researchers 2 support staff 14 part-time manager researchers (20 full-time equivalents) Global Manager Research Team 66 full-time manager researchers 15 support staff 56 part-time manager researchers (92 full-time equivalents) Asia- Pacific Manager Research Team 10 full-time manager researchers 3 support staff 17 part-time manager researchers (16 full-time equivalents) We cover 1, 000 organisations and rate over 4, 000 products through 2, 000 -3, 000 research meetings per year 18 Copyright © Watson Wyatt Worldwide. All rights reserved

Global manager research resources European Manager Research Team 39 full-time manager researchers 10 support staff 25 part-time manager researchers (56 full-time equivalents) Americas Manager Research Team 17 full-time manager researchers 2 support staff 14 part-time manager researchers (20 full-time equivalents) Global Manager Research Team 66 full-time manager researchers 15 support staff 56 part-time manager researchers (92 full-time equivalents) Asia- Pacific Manager Research Team 10 full-time manager researchers 3 support staff 17 part-time manager researchers (16 full-time equivalents) We cover 1, 000 organisations and rate over 4, 000 products through 2, 000 -3, 000 research meetings per year 18 Copyright © Watson Wyatt Worldwide. All rights reserved

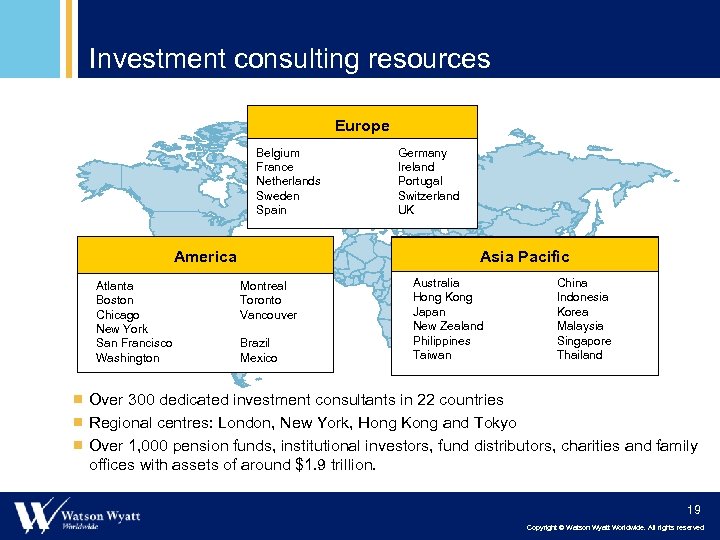

Investment consulting resources Europe Belgium France Netherlands Sweden Spain Asia Pacific America Atlanta Boston Chicago New York San Francisco Washington Germany Ireland Portugal Switzerland UK Montreal Toronto Vancouver Brazil Mexico Australia Hong Kong Japan New Zealand Philippines Taiwan China Indonesia Korea Malaysia Singapore Thailand ¾ Over 300 dedicated investment consultants in 22 countries ¾ Regional centres: London, New York, Hong Kong and Tokyo ¾ Over 1, 000 pension funds, institutional investors, fund distributors, charities and family offices with assets of around $1. 9 trillion. 19 Copyright © Watson Wyatt Worldwide. All rights reserved

Investment consulting resources Europe Belgium France Netherlands Sweden Spain Asia Pacific America Atlanta Boston Chicago New York San Francisco Washington Germany Ireland Portugal Switzerland UK Montreal Toronto Vancouver Brazil Mexico Australia Hong Kong Japan New Zealand Philippines Taiwan China Indonesia Korea Malaysia Singapore Thailand ¾ Over 300 dedicated investment consultants in 22 countries ¾ Regional centres: London, New York, Hong Kong and Tokyo ¾ Over 1, 000 pension funds, institutional investors, fund distributors, charities and family offices with assets of around $1. 9 trillion. 19 Copyright © Watson Wyatt Worldwide. All rights reserved

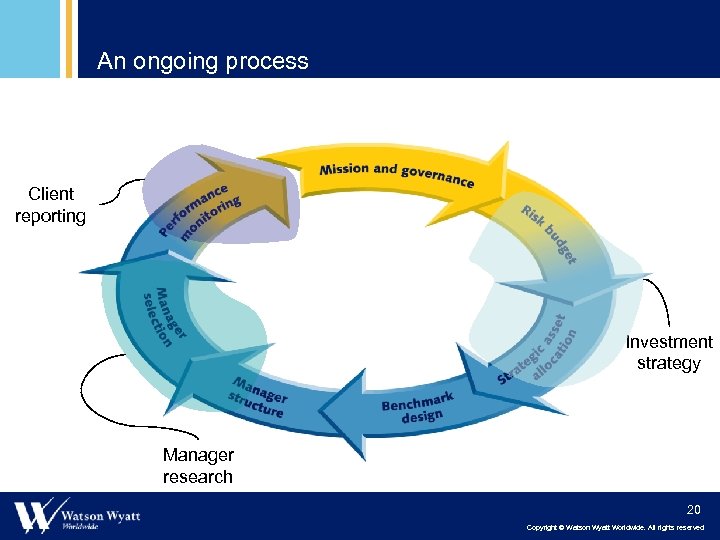

An ongoing process Client reporting Investment strategy Manager research 20 Copyright © Watson Wyatt Worldwide. All rights reserved

An ongoing process Client reporting Investment strategy Manager research 20 Copyright © Watson Wyatt Worldwide. All rights reserved

watsonwyatt. com Msc Actuarial Finance Imperial College Business School Dr David Mc. Carthy

watsonwyatt. com Msc Actuarial Finance Imperial College Business School Dr David Mc. Carthy

The Actuarial Profession Robert Hails Council Member, Institute of Actuaries October 2008 22

The Actuarial Profession Robert Hails Council Member, Institute of Actuaries October 2008 22

Role of the Actuarial Profession § Provides § § § qualifications… …and continuing education “Learned society” Promotes profession Regulates conduct Disciplines miscreants Serves public interest 23

Role of the Actuarial Profession § Provides § § § qualifications… …and continuing education “Learned society” Promotes profession Regulates conduct Disciplines miscreants Serves public interest 23

Our strategy To support members throughout their careers so they have the skills, attributes and knowledge appropriate for the evolving needs of the UK financial sector, primarily as quantitative risk professionals. 24

Our strategy To support members throughout their careers so they have the skills, attributes and knowledge appropriate for the evolving needs of the UK financial sector, primarily as quantitative risk professionals. 24

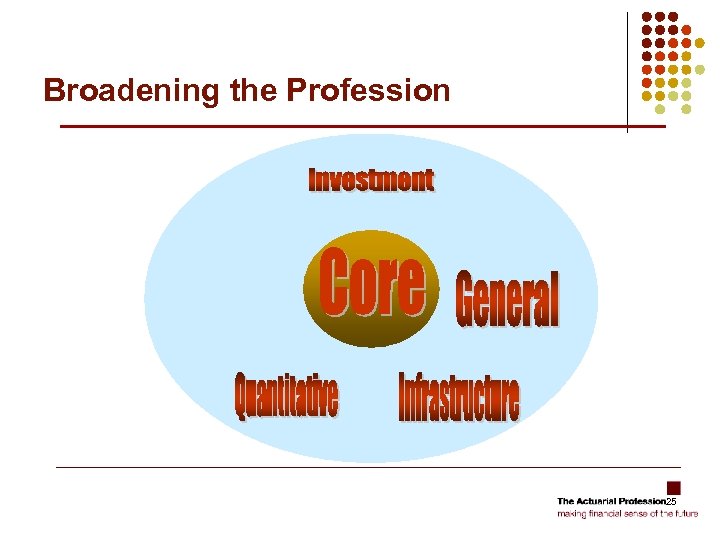

Broadening the Profession 25

Broadening the Profession 25

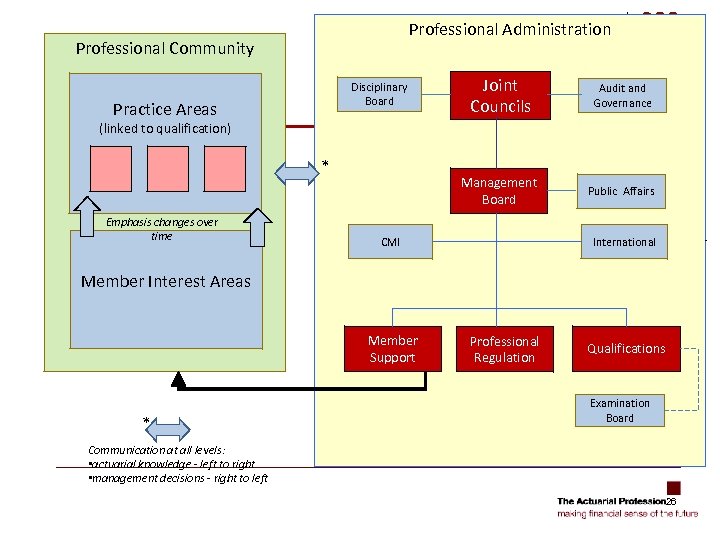

Professional Administration Professional Community Practice Areas Joint Councils Audit and Governance Management Board Disciplinary Board Public Affairs (linked to qualification) * Emphasis changes over time CMI International Member Interest Areas Member Support * Professional Regulation Qualifications Examination Board Communication at all levels: • actuarial knowledge - left to right • management decisions - right to left 26

Professional Administration Professional Community Practice Areas Joint Councils Audit and Governance Management Board Disciplinary Board Public Affairs (linked to qualification) * Emphasis changes over time CMI International Member Interest Areas Member Support * Professional Regulation Qualifications Examination Board Communication at all levels: • actuarial knowledge - left to right • management decisions - right to left 26

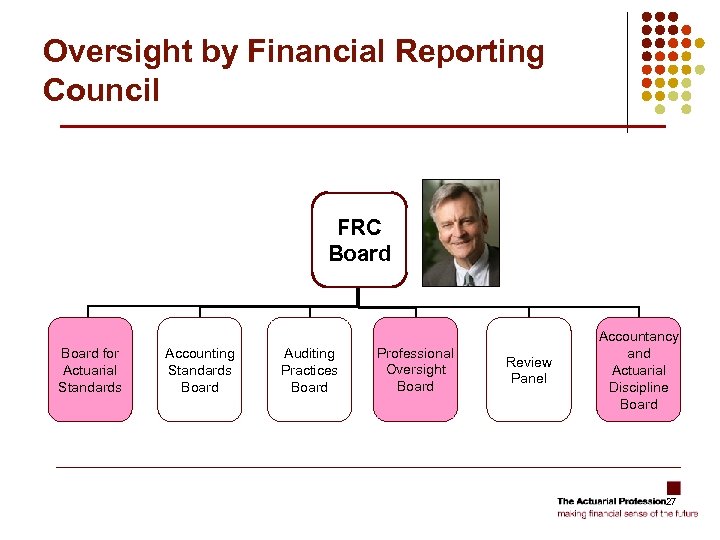

Oversight by Financial Reporting Council FRC Board for Actuarial Standards Accounting Standards Board Auditing Practices Board Professional Oversight Board Review Panel Accountancy and Actuarial Discipline Board 27

Oversight by Financial Reporting Council FRC Board for Actuarial Standards Accounting Standards Board Auditing Practices Board Professional Oversight Board Review Panel Accountancy and Actuarial Discipline Board 27

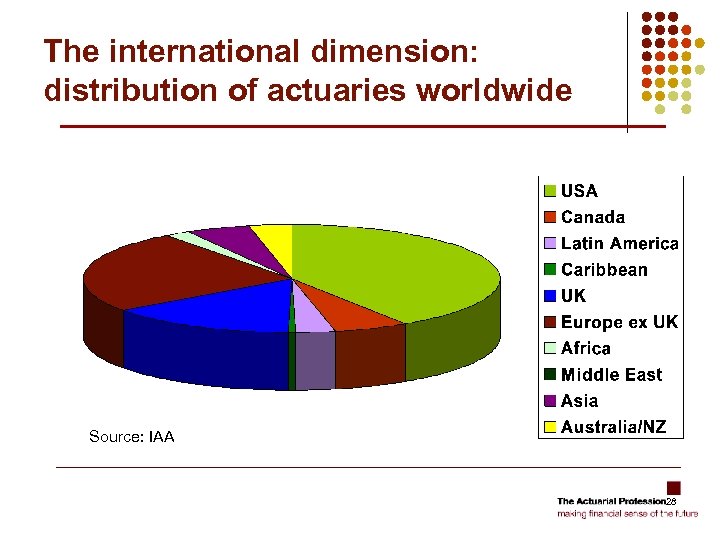

The international dimension: distribution of actuaries worldwide Source: IAA 28

The international dimension: distribution of actuaries worldwide Source: IAA 28

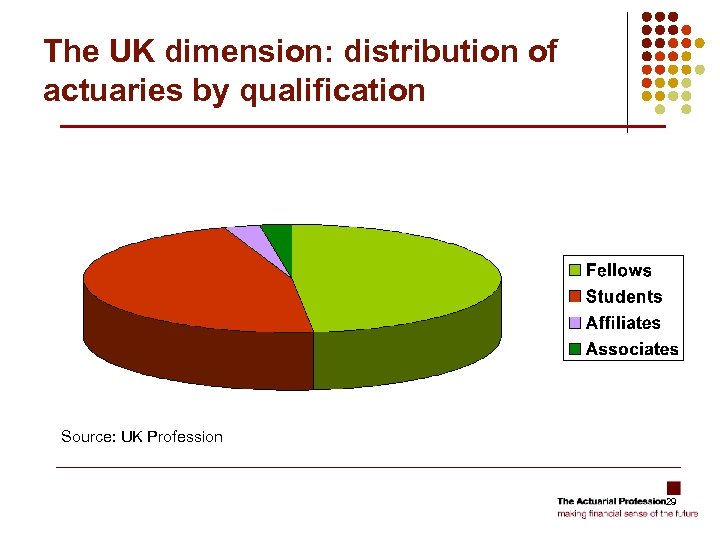

The UK dimension: distribution of actuaries by qualification Source: UK Profession 29

The UK dimension: distribution of actuaries by qualification Source: UK Profession 29

Current issues § Broadening range of § § services to members Strengthening links with universities Promoting Associate qualification Expanding role in risk management Encouraging new structure to provide member support 30

Current issues § Broadening range of § § services to members Strengthening links with universities Promoting Associate qualification Expanding role in risk management Encouraging new structure to provide member support 30

Actuaries are: “Dedicated, skilled professionals providing important and useful advice, with commitment, integrity and a strong sense of duty” Sir Derek Morris, March 2004 31

Actuaries are: “Dedicated, skilled professionals providing important and useful advice, with commitment, integrity and a strong sense of duty” Sir Derek Morris, March 2004 31

The Actuarial Profession Robert Hails Council Member, Institute of Actuaries October 2008 32

The Actuarial Profession Robert Hails Council Member, Institute of Actuaries October 2008 32