ba2fb4386ff38376b91a021a7cde673f.ppt

- Количество слайдов: 60

Watch and Buy Study 2012

1 The Economic Environment and Consumer sentiment

Economic Environment – gloomy state is well documented

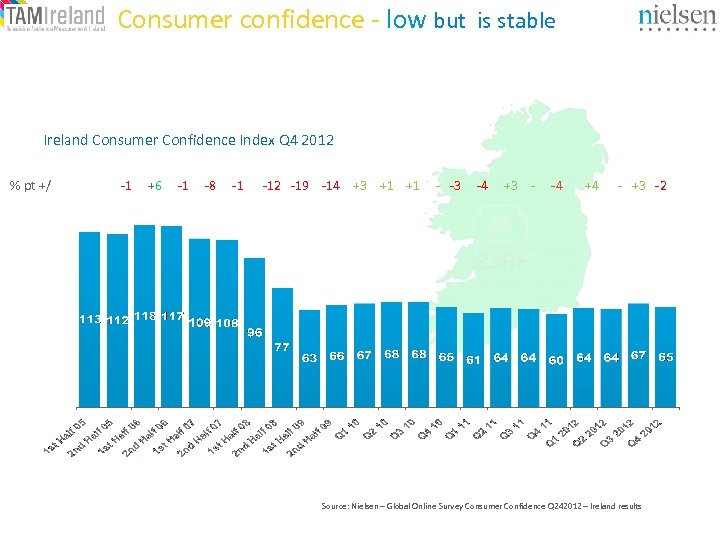

Consumer confidence - low but is stable Ireland Consumer Confidence Index Q 4 2012 % pt +/ -1 +6 -1 -8 -1 -12 -19 -14 +3 +1 +1 - -3 -4 +3 - -4 +4 - +3 -2 Source: Nielsen – Global Online Survey Consumer Confidence Q 242012 – Ireland results

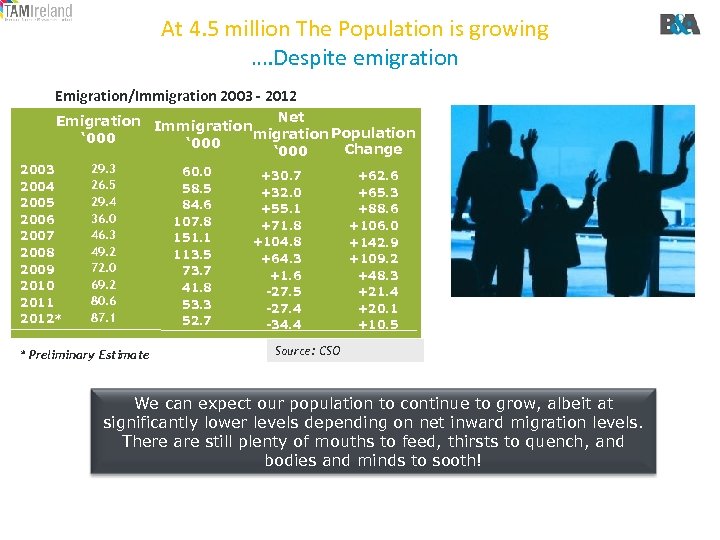

At 4. 5 million The Population is growing …. Despite emigration Emigration/Immigration 2003 - 2012 Net Emigration Immigration Population ‘ 000 Change ‘ 000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012* 29. 3 26. 5 29. 4 36. 0 46. 3 49. 2 72. 0 69. 2 80. 6 87. 1 * Preliminary Estimate 60. 0 58. 5 84. 6 107. 8 151. 1 113. 5 73. 7 41. 8 53. 3 52. 7 +30. 7 +32. 0 +55. 1 +71. 8 +104. 8 +64. 3 +1. 6 -27. 5 -27. 4 -34. 4 +62. 6 +65. 3 +88. 6 +106. 0 +142. 9 +109. 2 +48. 3 +21. 4 +20. 1 +10. 5 Source: CSO We can expect our population to continue to grow, albeit at significantly lower levels depending on net inward migration levels. There are still plenty of mouths to feed, thirsts to quench, and bodies and minds to sooth!

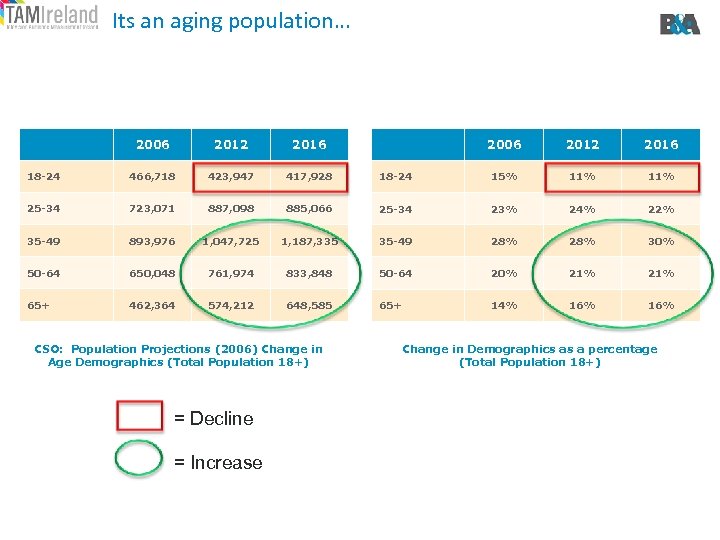

Its an aging population… 2006 2012 2016 18 -24 466, 718 423, 947 417, 928 25 -34 723, 071 887, 098 35 -49 893, 976 50 -64 65+ 2006 2012 2016 18 -24 15% 11% 885, 066 25 -34 23% 24% 22% 1, 047, 725 1, 187, 335 35 -49 28% 30% 650, 048 761, 974 833, 848 50 -64 20% 21% 462, 364 574, 212 648, 585 65+ 14% 16% CSO: Population Projections (2006) Change in Age Demographics (Total Population 18+) = Decline = Increase Change in Demographics as a percentage (Total Population 18+)

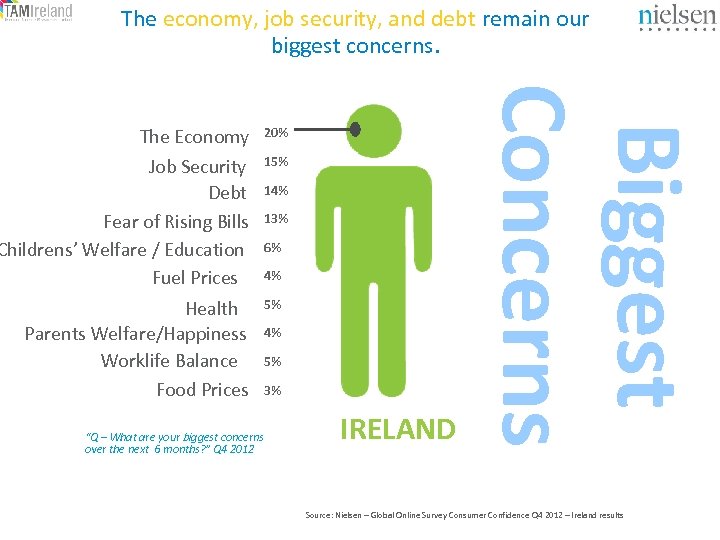

The economy, job security, and debt remain our biggest concerns. Health Parents Welfare/Happiness Worklife Balance Food Prices 20% 15% 14% 13% 6% 4% 5% 3% “Q – What are your biggest concerns over the next 6 months? ” Q 4 2012 IRELAND Biggest Concerns The Economy Job Security Debt Fear of Rising Bills Childrens’ Welfare / Education Fuel Prices Source: Nielsen – Global Online Survey Consumer Confidence Q 4 2012 – Ireland results

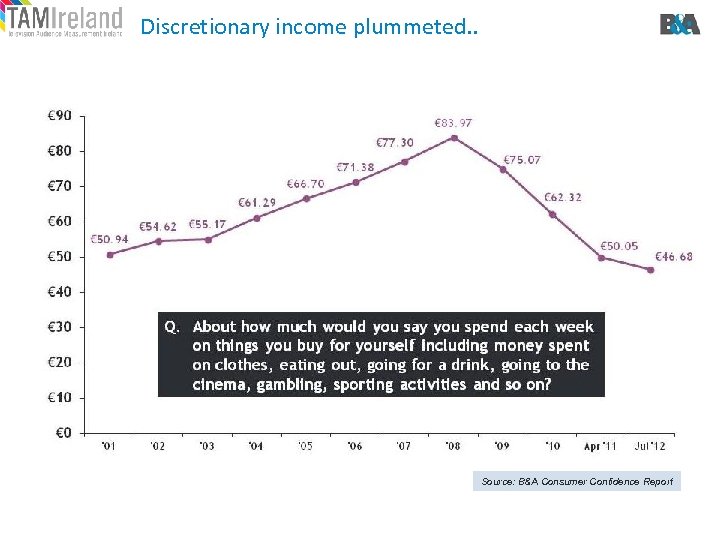

Discretionary income plummeted. . Source: B&A Consumer Confidence Report

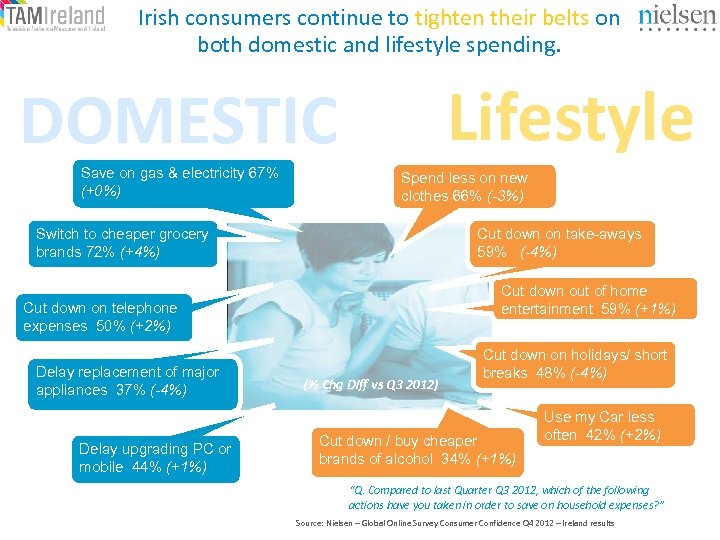

Irish consumers continue to tighten their belts on both domestic and lifestyle spending. Lifestyle DOMESTIC Save on gas & electricity 67% (+0%) Spend less on new clothes 66% (-3%) Switch to cheaper grocery brands 72% (+4%) Cut down on take-aways 59% (-4%) Cut down out of home entertainment 59% (+1%) Cut down on telephone expenses 50% (+2%) Delay replacement of major appliances 37% (-4%) Delay upgrading PC or mobile 44% (+1%) (% Chg Diff vs Q 3 2012) Cut down on holidays/ short breaks 48% (-4%) Cut down / buy cheaper brands of alcohol 34% (+1%) Use my Car less often 42% (+2%) “Q. Compared to last Quarter Q 3 2012, which of the following actions have you taken in order to save on household expenses? ” Source: Nielsen – Global Online Survey Consumer Confidence Q 4 2012 – Ireland results

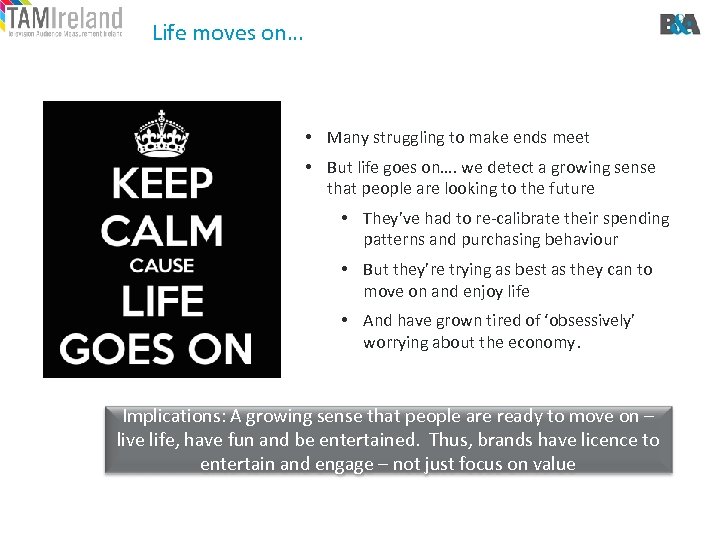

Life moves on… • Many struggling to make ends meet • But life goes on…. we detect a growing sense that people are looking to the future • They’ve had to re-calibrate their spending patterns and purchasing behaviour • But they’re trying as best as they can to move on and enjoy life • And have grown tired of ‘obsessively’ worrying about the economy. Implications: A growing sense that people are ready to move on – live life, have fun and be entertained. Thus, brands have licence to entertain and engage – not just focus on value

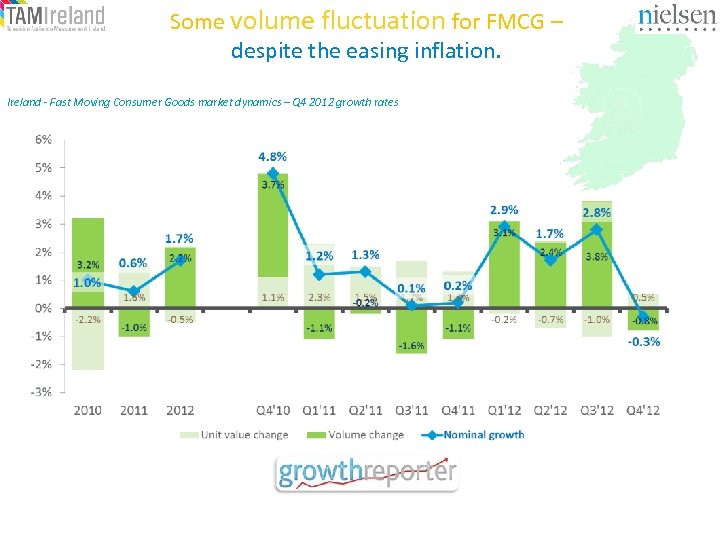

Some volume fluctuation for FMCG – despite the easing inflation. Ireland - Fast Moving Consumer Goods market dynamics – Q 4 2012 growth rates

Consumer sentiment is stable Shoppers cope with increased spend by: – Cutting back – Switching brands – Buying on deal People are ready to move on – with positive attitude

2 Changing Shopping Behaviour

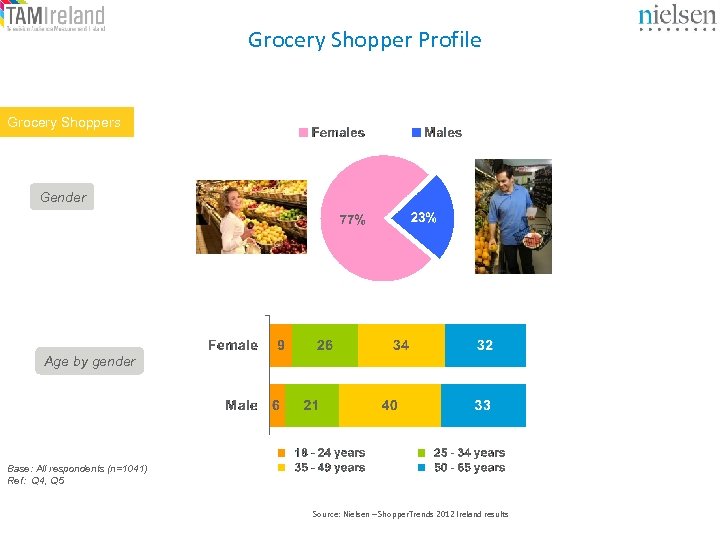

Grocery Shopper Profile Grocery Shoppers Gender Age by gender Base: All respondents (n=1041) Ref: Q 4, Q 5 Source: Nielsen – Shopper. Trends 2012 Ireland results

Divisions are now deeper. . . Whether we look at : . . . People in work versus these people out of work. . . People in the cities versus those in country. . . Affluent versus hard pressed Implications: Make sure that your market information includes a full geographic and demographic spread.

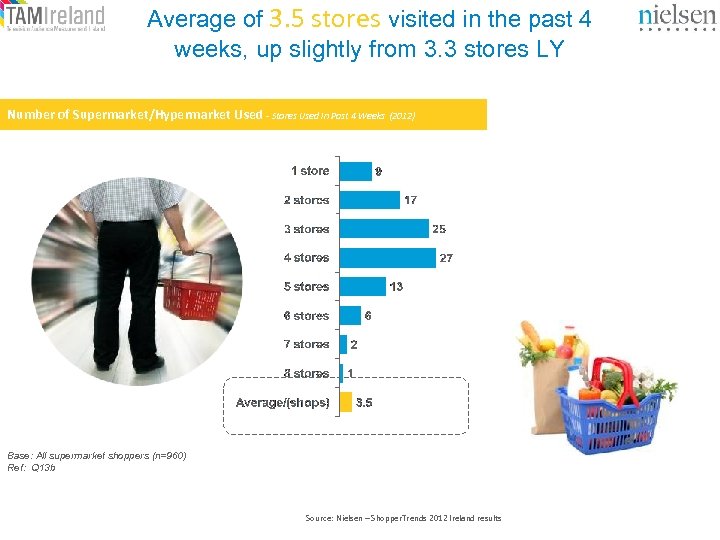

Average of 3. 5 stores visited in the past 4 weeks, up slightly from 3. 3 stores LY Number of Supermarket/Hypermarket Used - Stores Used in Past 4 Weeks (2012) Base: All supermarket shoppers (n=960) Ref: Q 13 b Source: Nielsen – Shopper. Trends 2012 Ireland results

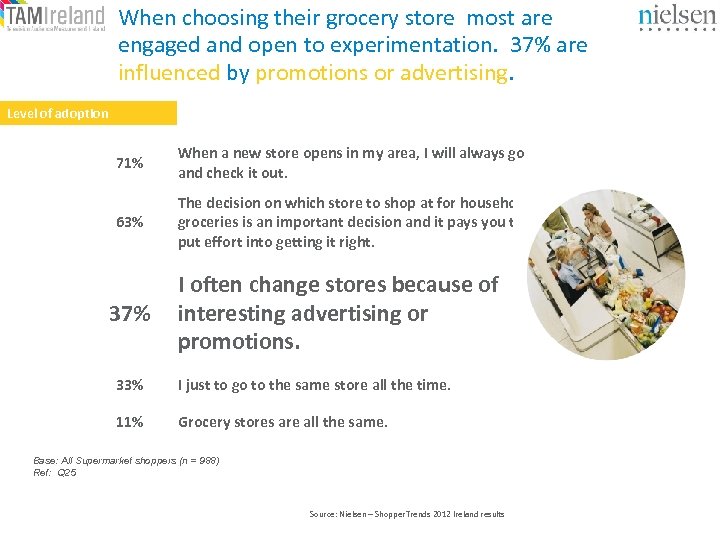

When choosing their grocery store most are engaged and open to experimentation. 37% are influenced by promotions or advertising. Level of adoption 71% When a new store opens in my area, I will always go and check it out. 63% The decision on which store to shop at for household groceries is an important decision and it pays you to put effort into getting it right. 37% I often change stores because of interesting advertising or promotions. 33% I just to go to the same store all the time. 11% Grocery stores are all the same. Base: All Supermarket shoppers (n = 988) Ref: Q 25 Source: Nielsen – Shopper. Trends 2012 Ireland results

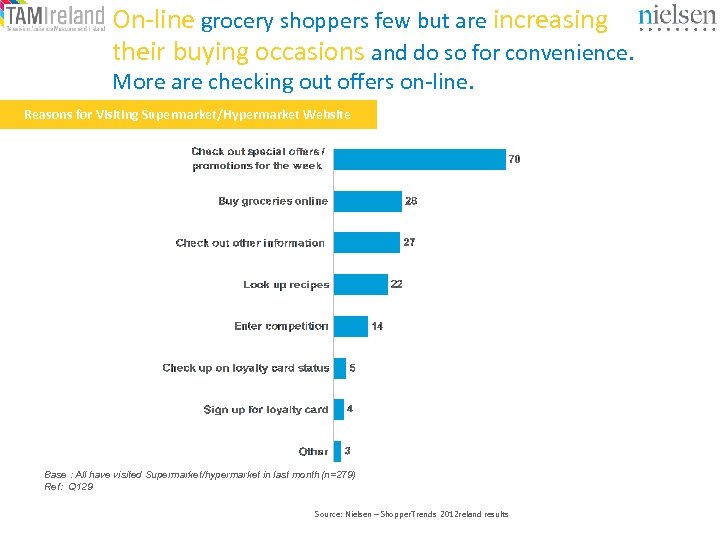

On-line grocery shoppers few but are increasing their buying occasions and do so for convenience. More are checking out offers on-line. Reasons for Visiting Supermarket/Hypermarket Website Base : All have visited Supermarket/hypermarket in last month (n=279) Ref: Q 129 Source: Nielsen – Shopper. Trends 2012 reland results

3 The Search for Value – price & promotions trends

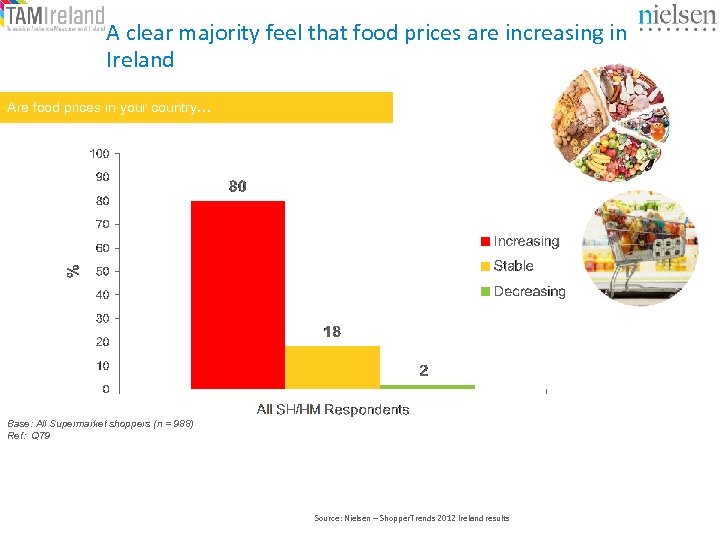

A clear majority feel that food prices are increasing in Ireland Are food prices in your country… Base: All Supermarket shoppers (n = 988) Ref: Q 79 Source: Nielsen – Shopper. Trends 2012 Ireland results

Shoppers still claim to be highly aware of price changes. Base: All Supermarket shoppers (n = 988) Ref: Q 24 Source: Nielsen – Shopper. Trends 2012 Ireland results Ref: Q 24

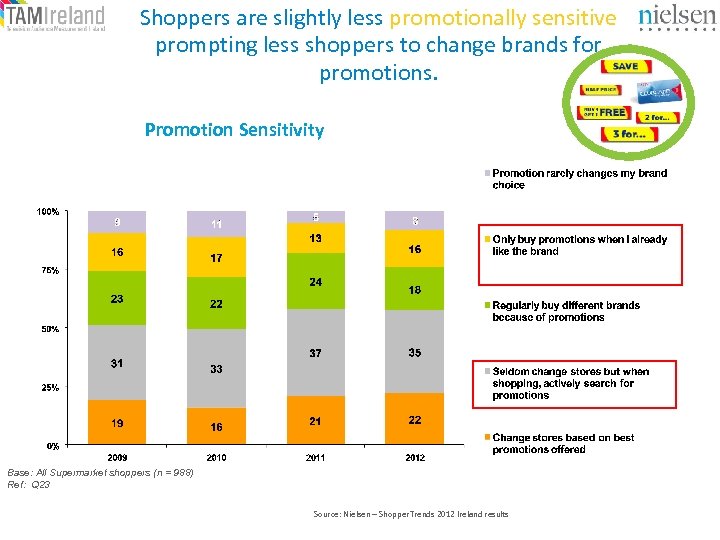

Shoppers are slightly less promotionally sensitive prompting less shoppers to change brands for promotions. Promotion Sensitivity Base: All Supermarket shoppers (n = 988) Ref: Q 23 Source: Nielsen – Shopper. Trends 2012 Ireland results

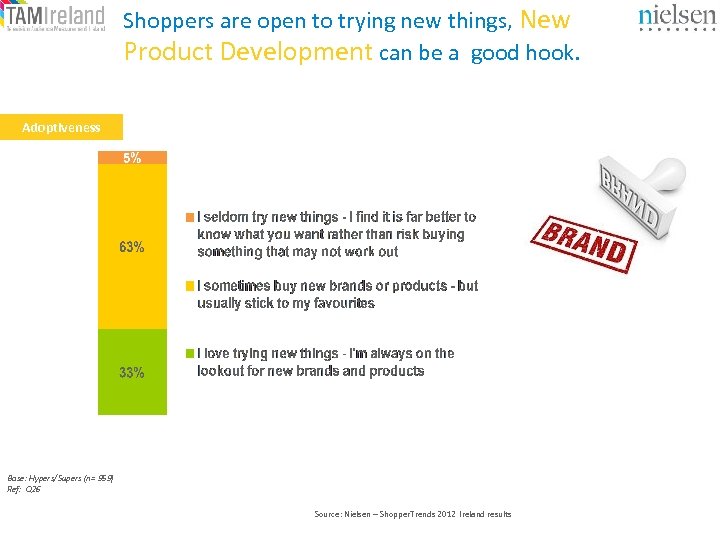

Shoppers are open to trying new things, New Product Development can be a good hook. Adoptiveness Base: Hypers/Supers (n= 959) Ref: Q 26 Source: Nielsen – Shopper. Trends 2012 Ireland results

Make your promotions work much harder 75% of shoppers will change brands or stores based on promotions 63% of shoppers agree that: The decision on which store to shop at for household groceries is an important decision and it pays you to put effort into getting it right. 37% of shoppers agree that: I often change stores because of interesting advertising or Promotions. TELL THEM ABOUT IT

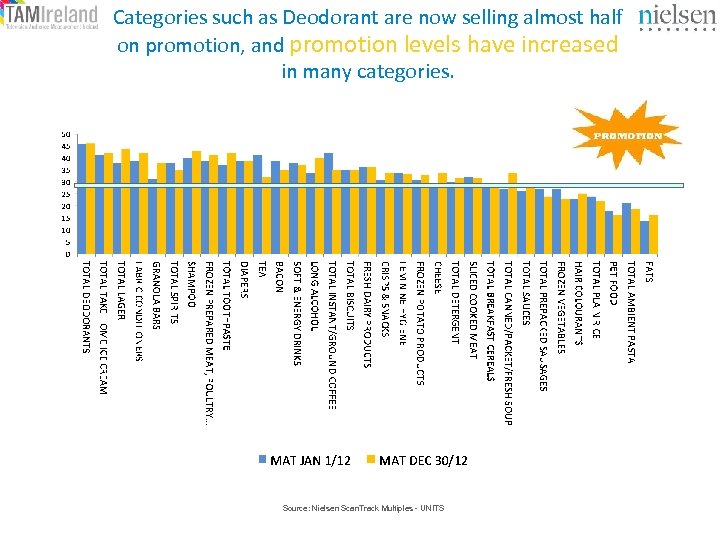

Categories such as Deodorant are now selling almost half on promotion, and promotion levels have increased in many categories. Source: Nielsen Scan. Track Multiples - UNITS

Resist Temptation To Chase Price Sensitive Shoppers Everywhere. • Price is the key driver of profit • Margin conceded will be very hard to recover later • Price cuts can be matched & neutralised by competitors • Lower prices erode consumer perceptions of value • Narrower profit margins lead to reduced investment in innovation and brand building Source: Nielsen AAC Checkout Conference 2010

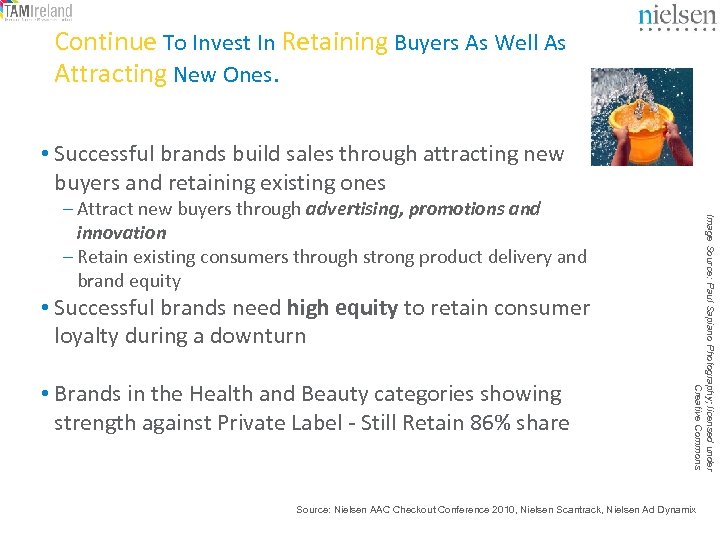

Continue To Invest In Retaining Buyers As Well As Attracting New Ones. • Successful brands build sales through attracting new buyers and retaining existing ones • Successful brands need high equity to retain consumer loyalty during a downturn • Brands in the Health and Beauty categories showing strength against Private Label - Still Retain 86% share Image Source: Paul Sapiano Photography; licensed under Creative Commons – Attract new buyers through advertising, promotions and innovation – Retain existing consumers through strong product delivery and brand equity Source: Nielsen AAC Checkout Conference 2010, Nielsen Scantrack, Nielsen Ad Dynamix

4 The Search for Value – Discounters continue to grow

Discounters still win on lowest priced store perceptions. Lowest Price Store Base: All Supermarket shoppers (2010 n=1008, 2011 n = 959) Ref: Q 20 Source: Nielsen – Shopper. Trends 2011 Ireland results

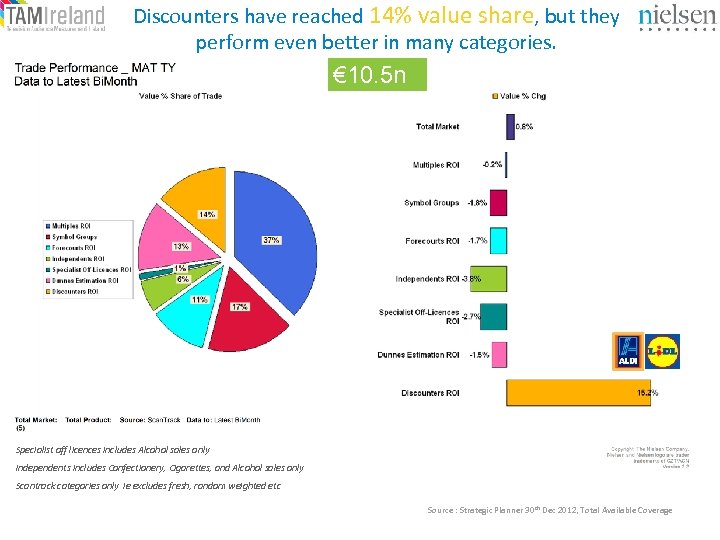

Discounters have reached 14% value share, but they perform even better in many categories. € 10. 5 n Specialist off licences includes Alcohol sales only Independents includes Confectionery, Cigarettes, and Alcohol sales only Scantrack categories only ie excludes fresh, random weighted etc Source : Strategic Planner 30 th Dec 2012, Total Available Coverage

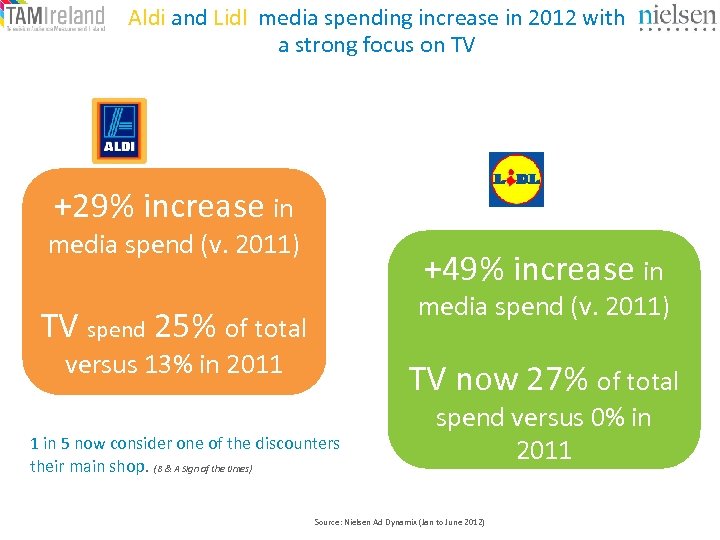

Aldi and Lidl media spending increase in 2012 with a strong focus on TV +29% increase in media spend (v. 2011) +49% increase in media spend (v. 2011) TV spend 25% of total versus 13% in 2011 TV now 27% of total 1 in 5 now consider one of the discounters their main shop. (B & A Sign of the times) spend versus 0% in 2011 Source: Nielsen Ad Dynamix (Jan to June 2012)

5 The Search for Value – Private Label continue to grow

Private Label in Numbers € 2. 2 billion the MAT Value of Private Label Branded products € 8. 2 Worth billion 22% the Value Share Private Label currently has € 168 million the amount Private Label has grown in the last year +7. 8% Categories included are – Alcohol, LAD, Sprits, Bakery, Cigarettes, Canned Food, Grocery, Chilled/Frozen Food, Household, Health & Beauty, Confectionery and the rate of Value Growth of Private Tobacco Label Year on Year Source : Strategic Planner 30 th Dec 2012, Total Available Coverage Branded declining at -1% value Year on Year

Increased advertising of Private Label by the retailers, focussing on quality and value for money. The new Supervalu Range Aldi – ‘Like brands. Only cheaper. ’ Tesco – new ‘Everyday Value’ range Own Label “brand building” by the Retailers focussing on quality and value for money Source: Nielsen Media 2012 Lidl – ‘Quality for Less’

Private Label remains weakest in Health & Beauty and Alcohol, categories where there is some of the highest investment in brand equity. Frozen 52% Share Household 36% Share Bakery 26% Share Grocery 37% Share Wine 15% Share Confectionary 18% Share Health & Beauty 14% Share Source : Strategic Planner 30 th Dec 2012, Total Available Coverage

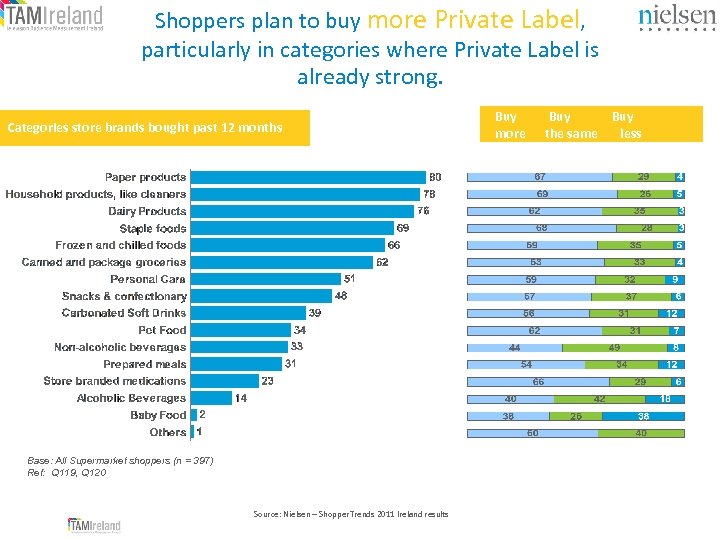

Shoppers plan to buy more Private Label, particularly in categories where Private Label is already strong. Categories store brands bought past 12 months Base: All Supermarket shoppers (n = 397) Ref: Q 119, Q 120 Source: Nielsen – Shopper. Trends 2011 Ireland results Buy more Buy the same less

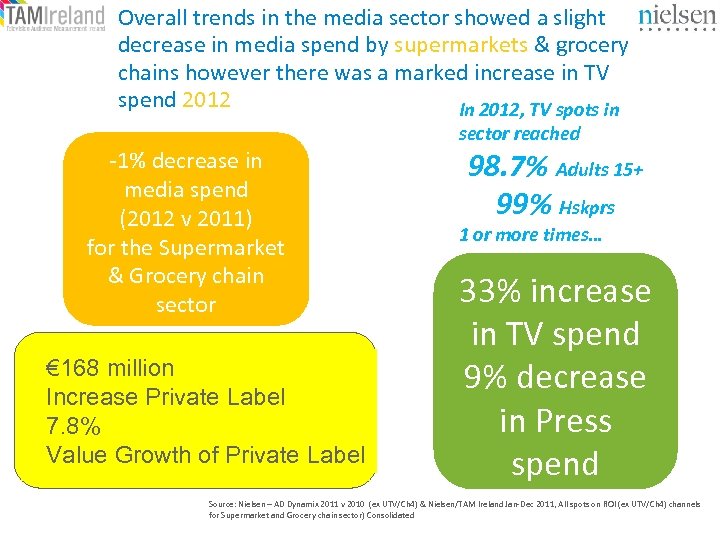

Overall trends in the media sector showed a slight decrease in media spend by supermarkets & grocery chains however there was a marked increase in TV spend 2012 In 2012, TV spots in -1% decrease in media spend (2012 v 2011) for the Supermarket & Grocery chain sector € 168 million Increase Private Label 7. 8% Value Growth of Private Label sector reached 98. 7% Adults 15+ 99% Hskprs 1 or more times… 33% increase in TV spend 9% decrease in Press spend Source: Nielsen – AD Dynamix 2011 v 2010 (ex UTV/Ch 4) & Nielsen/TAM Ireland Jan-Dec 2011, All spots on ROI (ex UTV/Ch 4) channels for Supermarket and Grocery chain sector) Consolidated

5 Winning Categories in the Recession

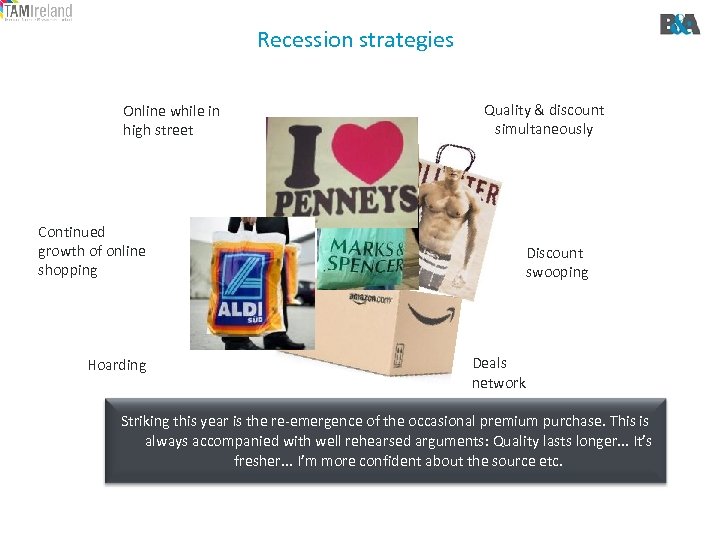

Recession strategies Online while in high street Quality & discount simultaneously Continued growth of online shopping Hoarding Discount swooping Deals network Striking this year is the re-emergence of the occasional premium purchase. This is always accompanied with well rehearsed arguments: Quality lasts longer. . . It’s fresher. . . I’m more confident about the source etc.

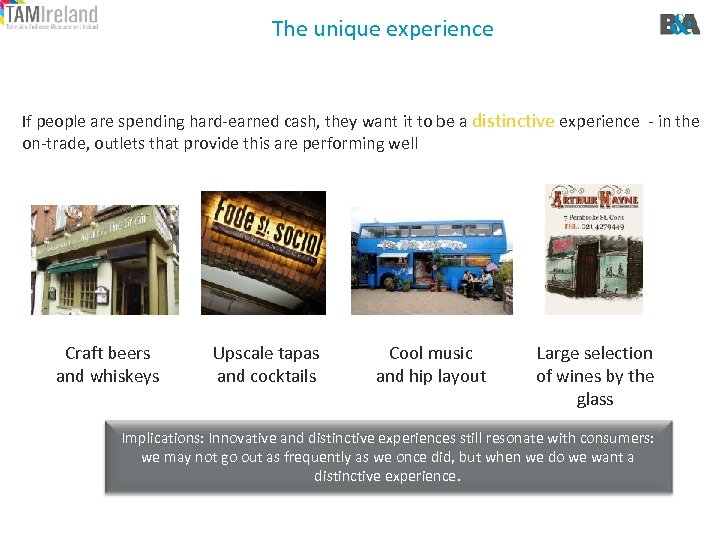

Trends: Quality. The unique experience and distinctive experiences are liked If people are spending hard-earned cash, they want it to be a distinctive experience - in the on-trade, outlets that provide this are performing well Craft beers and whiskeys Upscale tapas and cocktails Cool music and hip layout Large selection of wines by the glass Implications: Innovative and distinctive experiences still resonate with consumers: we may not go out as frequently as we once did, but when we do we want a distinctive experience.

Quality seeking • Although somewhat ‘counter culture’ we find many are now driven to find better quality. . . – To ensure a limited budget is not wasted – And the product lasts longer Implications: a quality platform has relevance, particularly when it is paired with improved value or the assurance of lower risk for the buyer.

Rooted and traceability Trends: Transparencyand authentic • There is interest in food and ingredients that are: • • Produced in Ireland • • Fully traceable Have the Bord Bia Quality Mark Heightened in the wake of the horse burger scare. Implications: High value, price and taste remain key factors, there is growing awareness of and interest in the idea of where our food comes from and how it is produced.

Online and high street overlap Trends: The Re-birth of the high street? • Many have predicted the death of the high street. • Some big brands have gone already. • Yet we anticipate a shift rather than a demise. • Neither retail spaces nor online will be fully independent • High street is the ‘show-room’ for online purchase • Social media discussion directs high street store selection Implications: Retail spaces can increasingly become spaces in which to engage consumers, involving them in the brand experience – rather than just selling the product

6 Winning Brands in the Recession

Some brands have successfully gained share in tough times – New Product Development, promotions, and media investments are the drivers. BEN & JERRYS TAKE HOME ICE CREAM +2. 2% Nivea IN DEODRANT +1. 1% Surf IN LAUNDRY DETERGENT +1. 1% MC CAIN IN FROZEN CHIPS +1. 3% Philadelphia IN CREAM CHEESE +3. 1% BIRDSEYE IN FROZ FISH+1. 9% KENCO IN SOLUBLE COFFEE + 3% ORAL B IN TOOTHPASTE +5. 1% VALUE share points gained MAT to Jan 2013, Scantrack

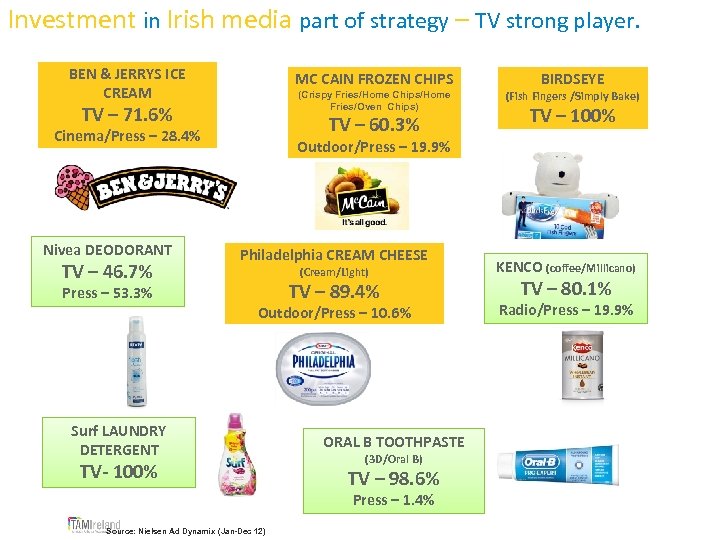

Investment in Irish media part of strategy – TV strong player. BEN & JERRYS ICE CREAM MC CAIN FROZEN CHIPS (Crispy Fries/Home Chips/Home Fries/Oven Chips) TV – 71. 6% TV – 60. 3% Cinema/Press – 28. 4% Nivea DEODORANT BIRDSEYE (Fish Fingers /Simply Bake) TV – 100% Outdoor/Press – 19. 9% Philadelphia CREAM CHEESE (Cream/Light) KENCO (coffee/Millicano) Outdoor/Press – 10. 6% TV – 46. 7% Radio/Press – 19. 9% Press – 53. 3% Surf LAUNDRY DETERGENT TV- 100% TV – 89. 4% ORAL B TOOTHPASTE (3 D/Oral B) TV – 98. 6% Press – 1. 4% Source: Nielsen Ad Dynamix (Jan-Dec 12) TV – 80. 1%

7 Viewing Trends

Brands still need TV! • In the rush to put more advertising spend online, perhaps we need a bit of perspective: – Major online brands are using traditional media to extend their reach (Done Deal this year for example). – And most consumers still recall big TV campaigns before they mention any online advertising. “When I watch a Marks & Spencer ad I am literally sitting at the television. I want to get into the television just to taste that food because of how they made it look”. Implications: TV is still where brands build connections.

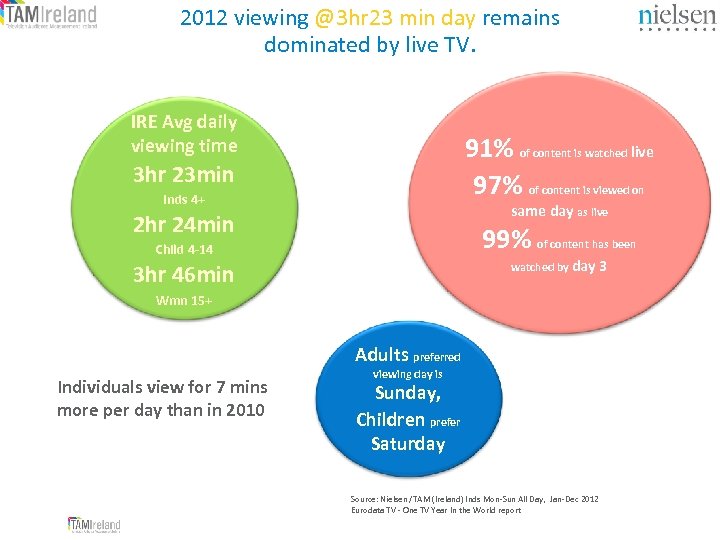

2012 viewing @3 hr 23 min day remains dominated by live TV. IRE Avg daily viewing time 91% of content is watched live 97% of content is viewed on 3 hr 23 min Inds 4+ same day as live 2 hr 24 min 99% of content has been Child 4 -14 watched by day 3 hr 46 min Wmn 15+ Adults preferred Individuals view for 7 mins more per day than in 2010 viewing day is Sunday, Children prefer Saturday Source: Nielsen /TAM (Ireland) Inds Mon-Sun All Day, Jan-Dec 2012 Eurodata TV - One TV Year In the World report 3

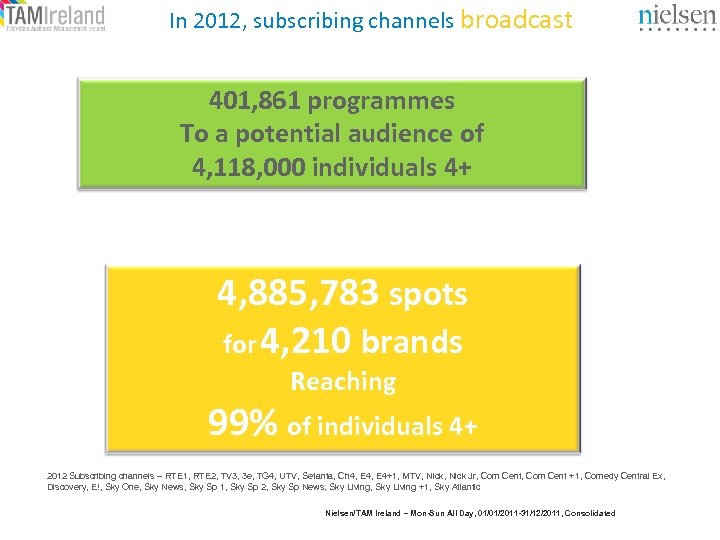

In 2012, subscribing channels broadcast 401, 861 programmes To a potential audience of 4, 118, 000 individuals 4+ 4, 885, 783 spots for 4, 210 brands Reaching 99% of individuals 4+ 2012 Subscribing channels – RTE 1, RTE 2, TV 3, 3 e, TG 4, UTV, Setanta, Ch 4, E 4+1, MTV, Nick Jr, Com Cent +1, Comedy Central Ex, Discovery, E!, Sky One, Sky News, Sky Sp 1, Sky Sp 2, Sky Sp News, Sky Living +1, Sky Atlantic Nielsen/TAM Ireland – Mon-Sun All Day, 01/01/2011 -31/12/2011, Consolidated

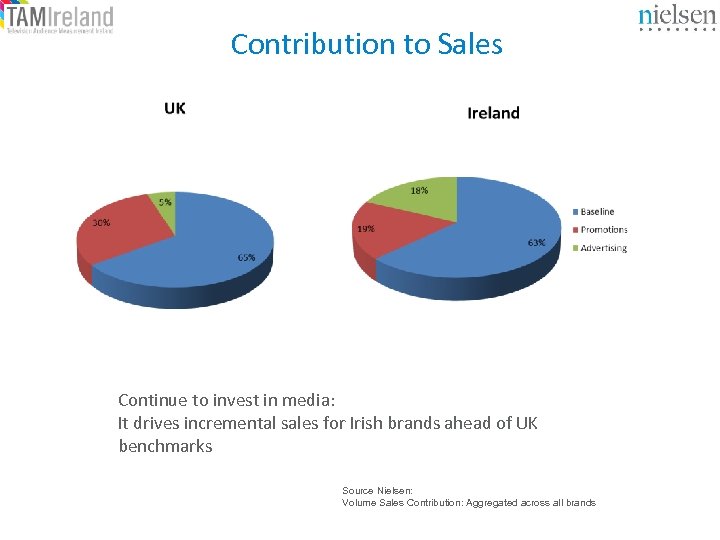

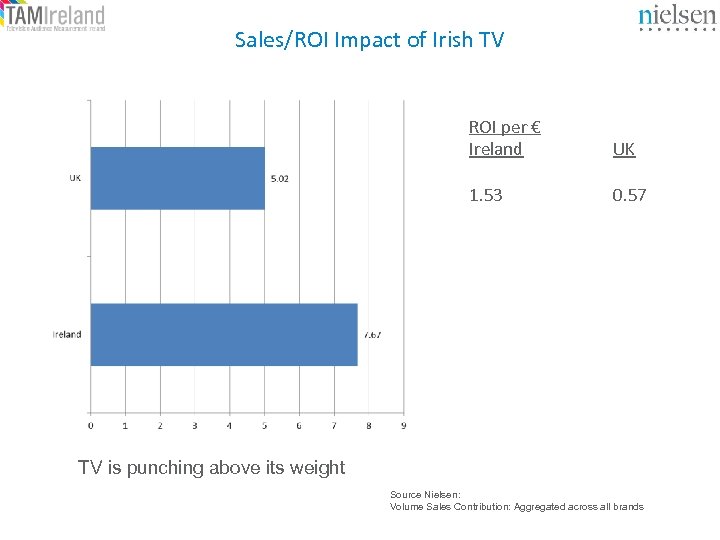

Contribution to Sales Continue to invest in media: It drives incremental sales for Irish brands ahead of UK benchmarks Source Nielsen: Volume Sales Contribution: Aggregated across all brands

Sales/ROI Impact of Irish TV ROI per € Ireland UK 1. 53 0. 57 TV is punching above its weight Source Nielsen: Volume Sales Contribution: Aggregated across all brands

8 Advertising Trends

Irish consumers place higher trust in advertising such as TV and press ads than the EU average. Q. To what extent do you trust the following forms of advertising/recommendation? 64 Branded Websites 44 Editorial content such as newspaper articles 47 Emails I signed up for 39 Brand sponsorships 31 Ads on TV 29 44 Ads in magazines 28 43 Billboards and other outdoor advertising 29 41 Ads in newspapers 29 45 Ads on radio 26 45 Ads before movies 25 40 TV Program product placements 23 31 Ads served in search engine results 30 30 Online video ads 22 24 Ads on social networks 22 24 Online banner ads 19 18 Display ads (Video or banner) on mobile devices (smartphones, tablet devices - i. e. , ipad) 18 22 Text (SMS) ads on mobile phones 17 22 96 65 56 66 57 42 IRELAND AVERAGE 89 Consumer opinions posted online EU AVERAGE Recommendations from people I know Percentage of respondents answering "trust completely" or "trust somewhat") Source: Nielsen Global Trust in Advertising Online Survey 2011

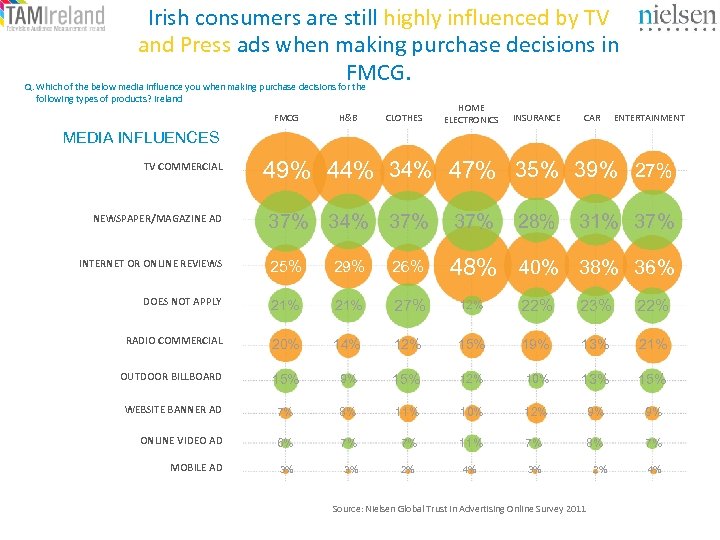

Irish consumers are still highly influenced by TV and Press ads when making purchase decisions in FMCG. Q. Which of the below media influence you when making purchase decisions for the following types of products? Ireland FMCG H&B CLOTHES HOME ELECTRONICS INSURANCE CAR ENTERTAINMENT MEDIA INFLUENCES TV COMMERCIAL 49% 44% 34% 47% 35% 39% 27% 34% 37% INTERNET OR ONLINE REVIEWS 25% 29% 26% 48% 40% 38% 36% DOES NOT APPLY 21% 27% 12% 23% 22% RADIO COMMERCIAL 20% 14% 12% 15% 19% 13% 21% OUTDOOR BILLBOARD 15% 9% 15% 12% 10% 13% 15% WEBSITE BANNER AD 7% 8% 11% 10% 12% 9% 9% ONLINE VIDEO AD 6% 7% 7% 11% 7% 8% 7% MOBILE AD 3% 3% 2% 4% 3% NEWSPAPER/MAGAZINE AD 28% 31% 37% Source: Nielsen Global Trust in Advertising Online Survey 2011 2% 4%

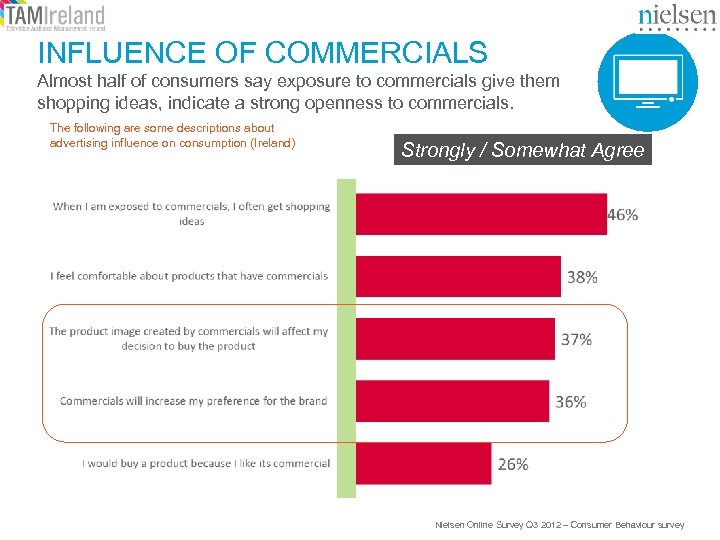

INFLUENCE OF COMMERCIALS Almost half of consumers say exposure to commercials give them shopping ideas, indicate a strong openness to commercials. The following are some descriptions about advertising influence on consumption (Ireland) Strongly / Somewhat Agree Nielsen Online Survey Q 3 2012 – Consumer Behaviour survey

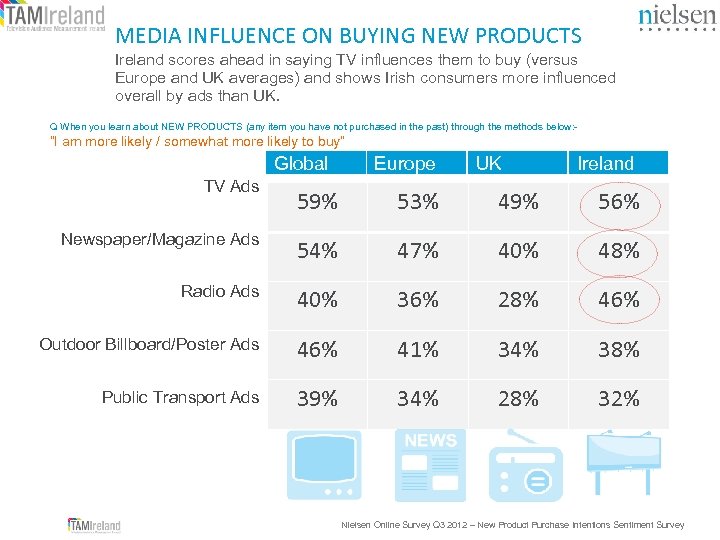

MEDIA INFLUENCE ON BUYING NEW PRODUCTS Ireland scores ahead in saying TV influences them to buy (versus Europe and UK averages) and shows Irish consumers more influenced overall by ads than UK. Q When you learn about NEW PRODUCTS (any item you have not purchased in the past) through the methods below: - “I am more likely / somewhat more likely to buy” Global TV Ads Europe UK Ireland 59% 53% 49% 56% Newspaper/Magazine Ads 54% 47% 40% 48% Radio Ads 40% 36% 28% 46% Outdoor Billboard/Poster Ads 46% 41% 34% 38% Public Transport Ads 39% 34% 28% 32% Nielsen Online Survey Q 3 2012 – New Product Purchase Intentions Sentiment Survey

We need to be flexible…. • We need to recognise that recession behaviour has ‘matured’. • Stimulate with the character of a brand online and offline. • Provide multiple routes to retail with effective links between the high street and online in both directions. • People are suspicious of fake offers and fake Irishness. We need to reassure and build trust through the ‘patina of the real’. And Enhance our brand dialogue…. . • The character of a brand should come through clearly – Tone of voice has become particularly important in registering credibility • Impact and memorability are enhanced with novel content: – In essence we must pay for attention with something entertaining • Clarity on quality is critical. Ideally tell stories that support this message. Essentially this is about building a convincing brand story based on authenticity

In conclusion… • Price promotions are important but brands growing share those investing in advertising and in particular TV • Brand equity has big value – tell them a story • Retailers growing in share investing in compelling marketing for their pricing and private label ranges • Brand owners must continue to brand build – need to differentiate from private label to succeed • Live TV viewing still dominates • TV is a trusted source and key influencer of consumers

About the Nielsen Global Consumer Survey • The Nielsen Global Survey reaches over 28, 000 Internet users around the world every three months – representing a global online population of close to one billion consumers. The survey was established in 2005 and is used to gauge consumer sentiment in the economy, follow consumers spending intentions and monitor changing habits. The survey currently spans 56 countries across 15 time zones. The Nielsen survey is the largest of its kind to reveal global insights on emerging trends in the consumer packaged goods and media industries. The findings are used by international FMCG companies, retailers and media news outlets to keep a pulse on consumer’s attitudes and behaviors as it relates to the ever-changing retail, media and technology landscape. Each quarter, Nielsen reports Consumer Confidence Index results. Twice annually, topical questions on consumers’ watch and buy habits are included. • The Quarter 2 Survey was fielded from May 4 - May 21, 2012 • Irish respondents 500 About the Nielsen European Growth Reporter • Compares overall market dynamics (value and unit growth) in the Fast Moving Consumer Goods sector across Europe. • Is based on the sales tracking Nielsen performs in every European market. • Covers sales in grocery, hypermarket, supermarket, discount and convenience channels • Is based on the widest possible basket of product categories that are continuously tracked by Nielsen in each of these countries and channels

ba2fb4386ff38376b91a021a7cde673f.ppt