5d739ef9104cbd74aad732a4b1235a96.ppt

- Количество слайдов: 40

Washington Update NECC March 11, 2013

Washington Update NECC March 11, 2013

Today’s Update • 2012 Elections • Fiscal Cliff(s) • Regulatory and Legislative Issues

Today’s Update • 2012 Elections • Fiscal Cliff(s) • Regulatory and Legislative Issues

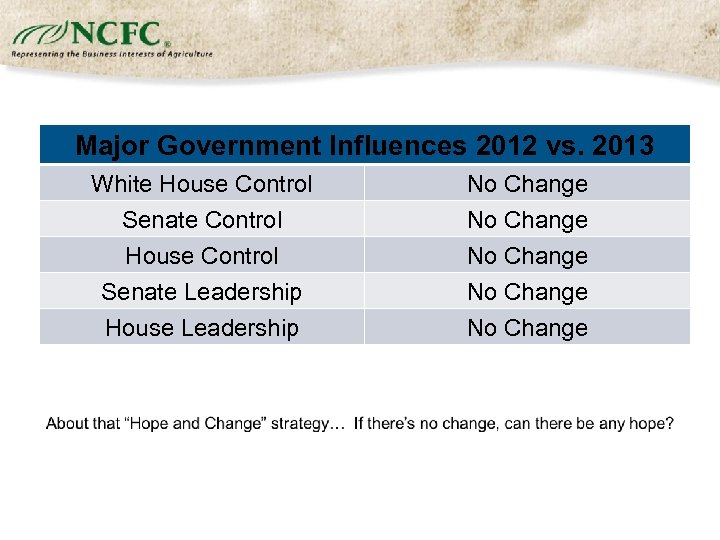

Major Government Influences 2012 vs. 2013 White House Control No Change Senate Control House Control Senate Leadership House Leadership No Change

Major Government Influences 2012 vs. 2013 White House Control No Change Senate Control House Control Senate Leadership House Leadership No Change

The end result doesn’t seem to change…

The end result doesn’t seem to change…

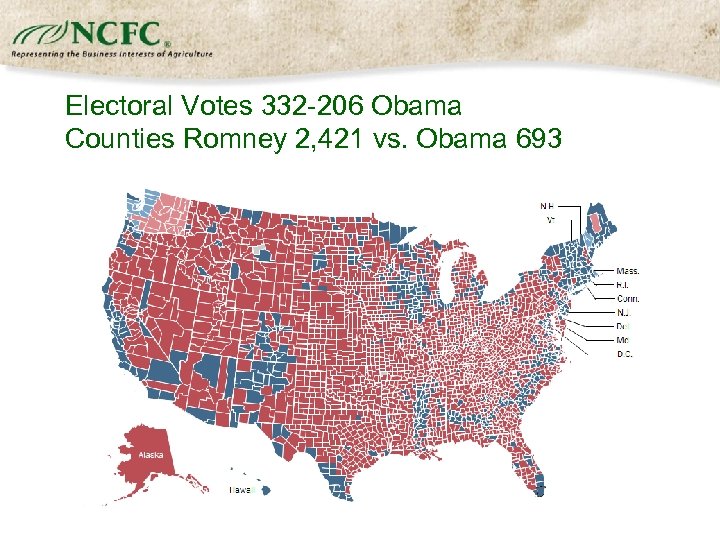

Electoral Votes 332 -206 Obama Counties Romney 2, 421 vs. Obama 693

Electoral Votes 332 -206 Obama Counties Romney 2, 421 vs. Obama 693

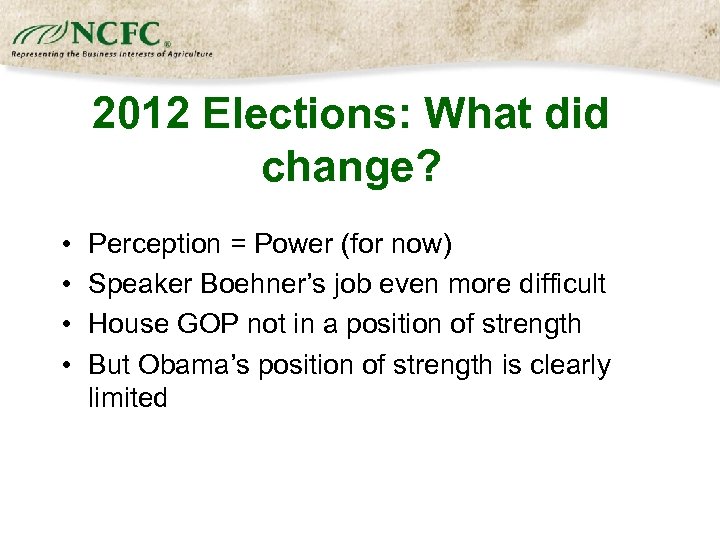

2012 Elections: What did change? • • Perception = Power (for now) Speaker Boehner’s job even more difficult House GOP not in a position of strength But Obama’s position of strength is clearly limited

2012 Elections: What did change? • • Perception = Power (for now) Speaker Boehner’s job even more difficult House GOP not in a position of strength But Obama’s position of strength is clearly limited

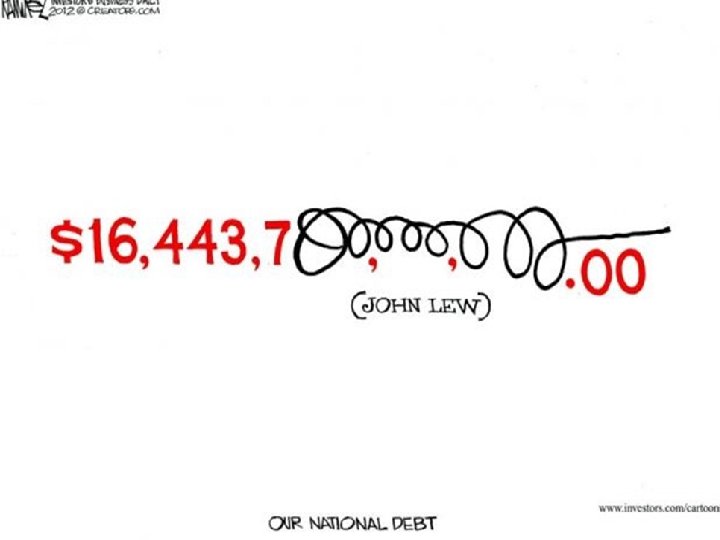

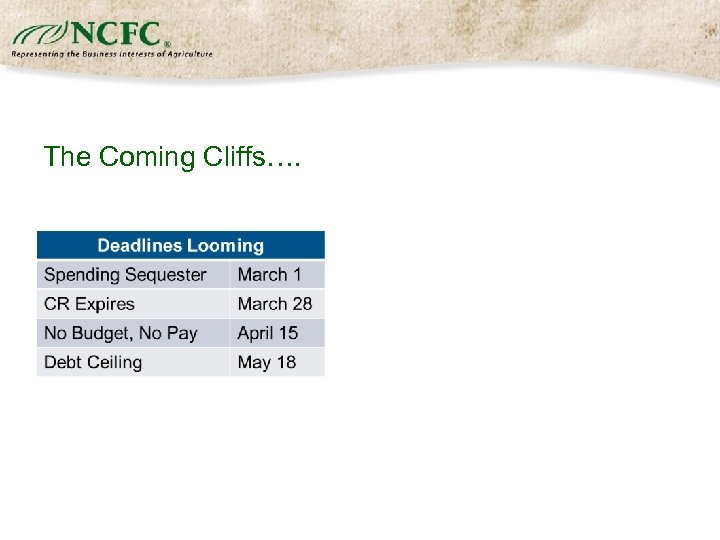

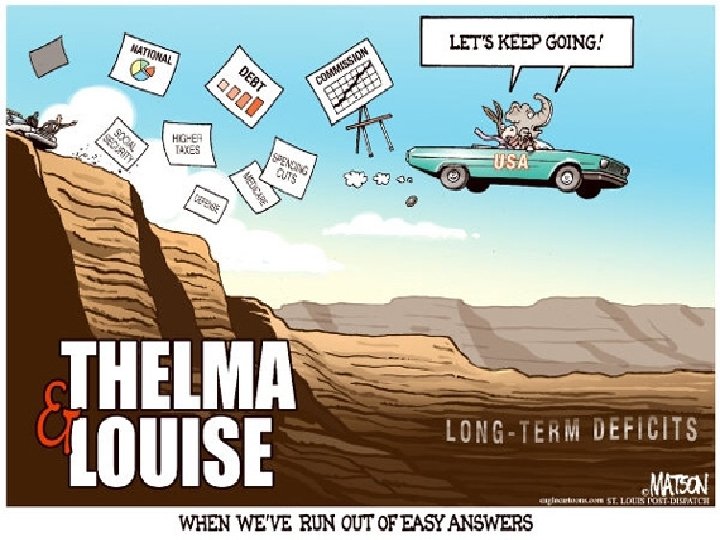

The Coming Cliffs….

The Coming Cliffs….

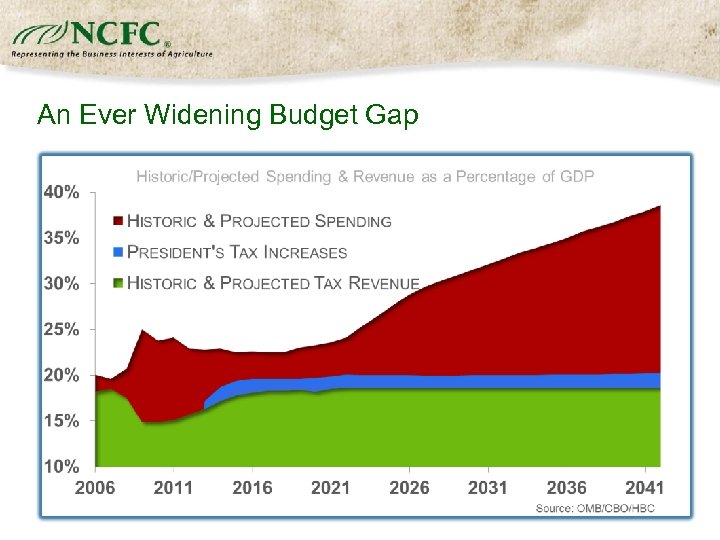

An Ever Widening Budget Gap

An Ever Widening Budget Gap

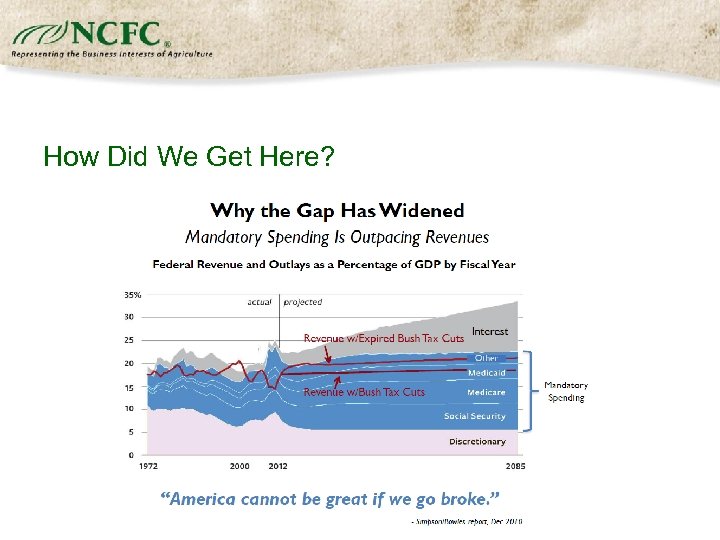

How Did We Get Here?

How Did We Get Here?

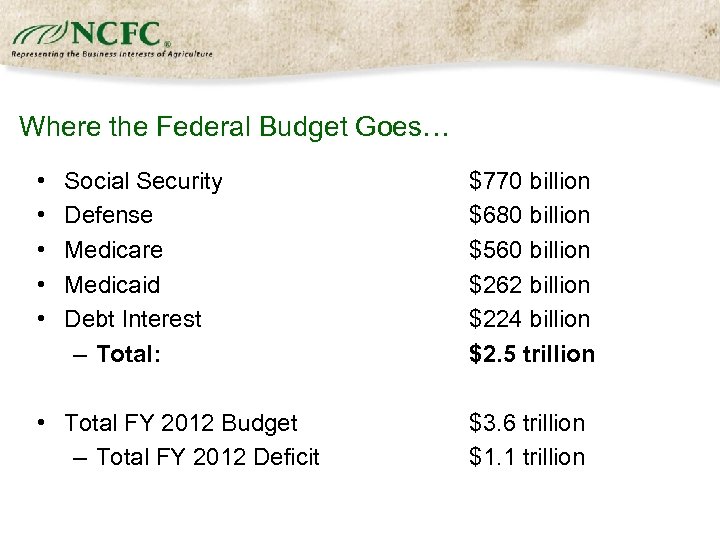

Where the Federal Budget Goes… • • • Social Security Defense Medicare Medicaid Debt Interest – Total: • Total FY 2012 Budget – Total FY 2012 Deficit $770 billion $680 billion $560 billion $262 billion $224 billion $2. 5 trillion $3. 6 trillion $1. 1 trillion

Where the Federal Budget Goes… • • • Social Security Defense Medicare Medicaid Debt Interest – Total: • Total FY 2012 Budget – Total FY 2012 Deficit $770 billion $680 billion $560 billion $262 billion $224 billion $2. 5 trillion $3. 6 trillion $1. 1 trillion

The President’s Balanced Budget/Deficit Reduction Plan/ Deficit Reduction Plan This page left intentionally blank.

The President’s Balanced Budget/Deficit Reduction Plan/ Deficit Reduction Plan This page left intentionally blank.

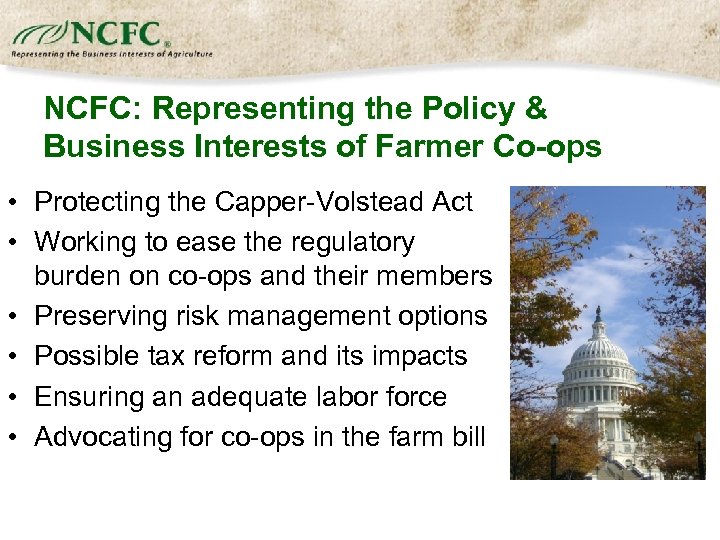

NCFC: Representing the Policy & Business Interests of Farmer Co-ops • Protecting the Capper-Volstead Act • Working to ease the regulatory burden on co-ops and their members • Preserving risk management options • Possible tax reform and its impacts • Ensuring an adequate labor force • Advocating for co-ops in the farm bill

NCFC: Representing the Policy & Business Interests of Farmer Co-ops • Protecting the Capper-Volstead Act • Working to ease the regulatory burden on co-ops and their members • Preserving risk management options • Possible tax reform and its impacts • Ensuring an adequate labor force • Advocating for co-ops in the farm bill

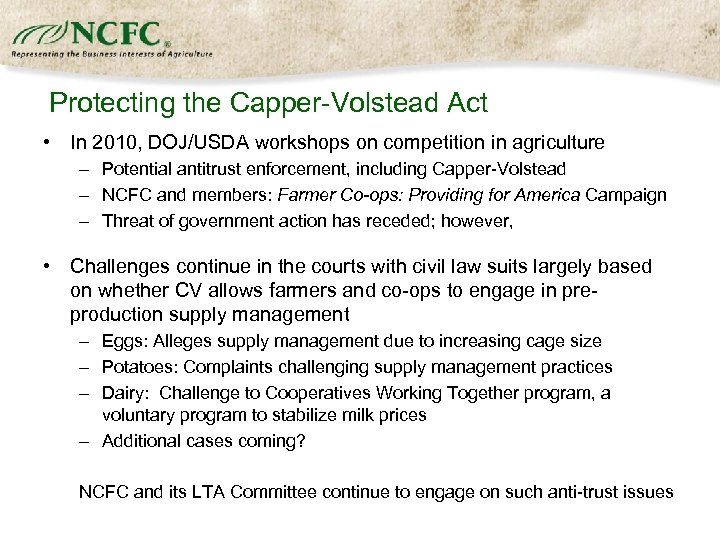

Protecting the Capper-Volstead Act • In 2010, DOJ/USDA workshops on competition in agriculture – Potential antitrust enforcement, including Capper-Volstead – NCFC and members: Farmer Co-ops: Providing for America Campaign – Threat of government action has receded; however, • Challenges continue in the courts with civil law suits largely based on whether CV allows farmers and co-ops to engage in preproduction supply management – Eggs: Alleges supply management due to increasing cage size – Potatoes: Complaints challenging supply management practices – Dairy: Challenge to Cooperatives Working Together program, a voluntary program to stabilize milk prices – Additional cases coming? NCFC and its LTA Committee continue to engage on such anti-trust issues

Protecting the Capper-Volstead Act • In 2010, DOJ/USDA workshops on competition in agriculture – Potential antitrust enforcement, including Capper-Volstead – NCFC and members: Farmer Co-ops: Providing for America Campaign – Threat of government action has receded; however, • Challenges continue in the courts with civil law suits largely based on whether CV allows farmers and co-ops to engage in preproduction supply management – Eggs: Alleges supply management due to increasing cage size – Potatoes: Complaints challenging supply management practices – Dairy: Challenge to Cooperatives Working Together program, a voluntary program to stabilize milk prices – Additional cases coming? NCFC and its LTA Committee continue to engage on such anti-trust issues

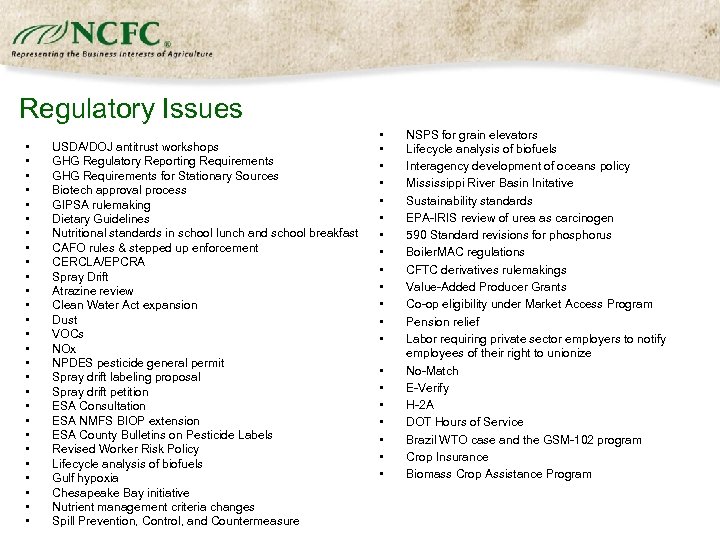

Regulatory Issues • • • • • • • USDA/DOJ antitrust workshops GHG Regulatory Reporting Requirements GHG Requirements for Stationary Sources Biotech approval process GIPSA rulemaking Dietary Guidelines Nutritional standards in school lunch and school breakfast CAFO rules & stepped up enforcement CERCLA/EPCRA Spray Drift Atrazine review Clean Water Act expansion Dust VOCs NOx NPDES pesticide general permit Spray drift labeling proposal Spray drift petition ESA Consultation ESA NMFS BIOP extension ESA County Bulletins on Pesticide Labels Revised Worker Risk Policy Lifecycle analysis of biofuels Gulf hypoxia Chesapeake Bay initiative Nutrient management criteria changes Spill Prevention, Control, and Countermeasure • • • • • NSPS for grain elevators Lifecycle analysis of biofuels Interagency development of oceans policy Mississippi River Basin Initative Sustainability standards EPA-IRIS review of urea as carcinogen 590 Standard revisions for phosphorus Boiler. MAC regulations CFTC derivatives rulemakings Value-Added Producer Grants Co-op eligibility under Market Access Program Pension relief Labor requiring private sector employers to notify employees of their right to unionize No-Match E-Verify H-2 A DOT Hours of Service Brazil WTO case and the GSM-102 program Crop Insurance Biomass Crop Assistance Program

Regulatory Issues • • • • • • • USDA/DOJ antitrust workshops GHG Regulatory Reporting Requirements GHG Requirements for Stationary Sources Biotech approval process GIPSA rulemaking Dietary Guidelines Nutritional standards in school lunch and school breakfast CAFO rules & stepped up enforcement CERCLA/EPCRA Spray Drift Atrazine review Clean Water Act expansion Dust VOCs NOx NPDES pesticide general permit Spray drift labeling proposal Spray drift petition ESA Consultation ESA NMFS BIOP extension ESA County Bulletins on Pesticide Labels Revised Worker Risk Policy Lifecycle analysis of biofuels Gulf hypoxia Chesapeake Bay initiative Nutrient management criteria changes Spill Prevention, Control, and Countermeasure • • • • • NSPS for grain elevators Lifecycle analysis of biofuels Interagency development of oceans policy Mississippi River Basin Initative Sustainability standards EPA-IRIS review of urea as carcinogen 590 Standard revisions for phosphorus Boiler. MAC regulations CFTC derivatives rulemakings Value-Added Producer Grants Co-op eligibility under Market Access Program Pension relief Labor requiring private sector employers to notify employees of their right to unionize No-Match E-Verify H-2 A DOT Hours of Service Brazil WTO case and the GSM-102 program Crop Insurance Biomass Crop Assistance Program

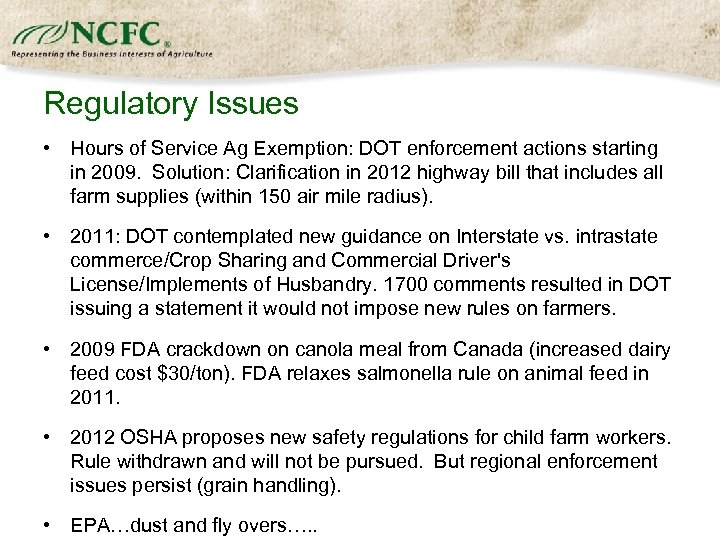

Regulatory Issues • Hours of Service Ag Exemption: DOT enforcement actions starting in 2009. Solution: Clarification in 2012 highway bill that includes all farm supplies (within 150 air mile radius). • 2011: DOT contemplated new guidance on Interstate vs. intrastate commerce/Crop Sharing and Commercial Driver's License/Implements of Husbandry. 1700 comments resulted in DOT issuing a statement it would not impose new rules on farmers. • 2009 FDA crackdown on canola meal from Canada (increased dairy feed cost $30/ton). FDA relaxes salmonella rule on animal feed in 2011. • 2012 OSHA proposes new safety regulations for child farm workers. Rule withdrawn and will not be pursued. But regional enforcement issues persist (grain handling). • EPA…dust and fly overs…. .

Regulatory Issues • Hours of Service Ag Exemption: DOT enforcement actions starting in 2009. Solution: Clarification in 2012 highway bill that includes all farm supplies (within 150 air mile radius). • 2011: DOT contemplated new guidance on Interstate vs. intrastate commerce/Crop Sharing and Commercial Driver's License/Implements of Husbandry. 1700 comments resulted in DOT issuing a statement it would not impose new rules on farmers. • 2009 FDA crackdown on canola meal from Canada (increased dairy feed cost $30/ton). FDA relaxes salmonella rule on animal feed in 2011. • 2012 OSHA proposes new safety regulations for child farm workers. Rule withdrawn and will not be pursued. But regional enforcement issues persist (grain handling). • EPA…dust and fly overs…. .

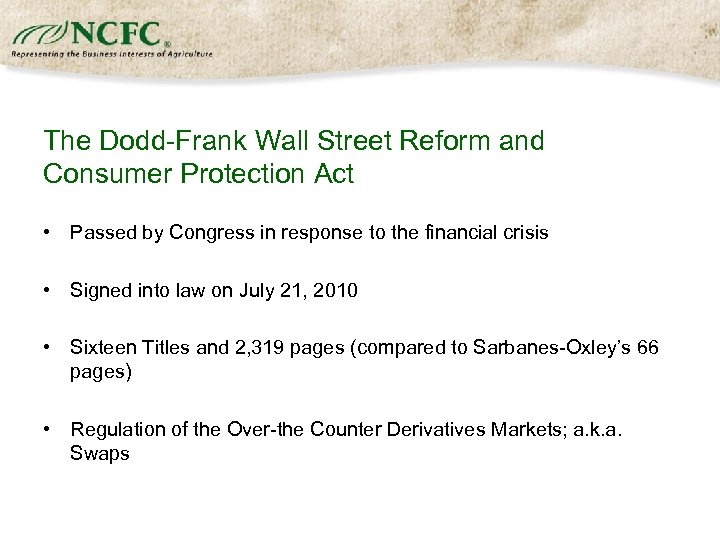

The Dodd-Frank Wall Street Reform and Consumer Protection Act • Passed by Congress in response to the financial crisis • Signed into law on July 21, 2010 • Sixteen Titles and 2, 319 pages (compared to Sarbanes-Oxley’s 66 pages) • Regulation of the Over-the Counter Derivatives Markets; a. k. a. Swaps

The Dodd-Frank Wall Street Reform and Consumer Protection Act • Passed by Congress in response to the financial crisis • Signed into law on July 21, 2010 • Sixteen Titles and 2, 319 pages (compared to Sarbanes-Oxley’s 66 pages) • Regulation of the Over-the Counter Derivatives Markets; a. k. a. Swaps

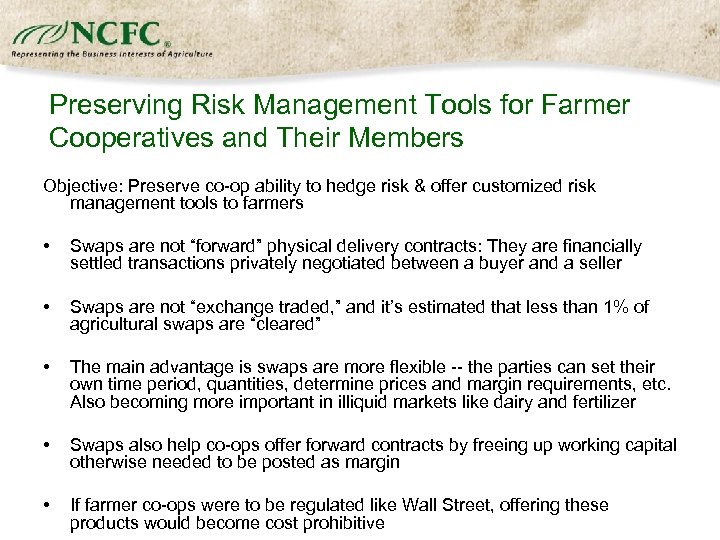

Preserving Risk Management Tools for Farmer Cooperatives and Their Members Objective: Preserve co-op ability to hedge risk & offer customized risk management tools to farmers • Swaps are not “forward” physical delivery contracts: They are financially settled transactions privately negotiated between a buyer and a seller • Swaps are not “exchange traded, ” and it’s estimated that less than 1% of agricultural swaps are “cleared” • The main advantage is swaps are more flexible -- the parties can set their own time period, quantities, determine prices and margin requirements, etc. Also becoming more important in illiquid markets like dairy and fertilizer • Swaps also help co-ops offer forward contracts by freeing up working capital otherwise needed to be posted as margin • If farmer co-ops were to be regulated like Wall Street, offering these products would become cost prohibitive

Preserving Risk Management Tools for Farmer Cooperatives and Their Members Objective: Preserve co-op ability to hedge risk & offer customized risk management tools to farmers • Swaps are not “forward” physical delivery contracts: They are financially settled transactions privately negotiated between a buyer and a seller • Swaps are not “exchange traded, ” and it’s estimated that less than 1% of agricultural swaps are “cleared” • The main advantage is swaps are more flexible -- the parties can set their own time period, quantities, determine prices and margin requirements, etc. Also becoming more important in illiquid markets like dairy and fertilizer • Swaps also help co-ops offer forward contracts by freeing up working capital otherwise needed to be posted as margin • If farmer co-ops were to be regulated like Wall Street, offering these products would become cost prohibitive

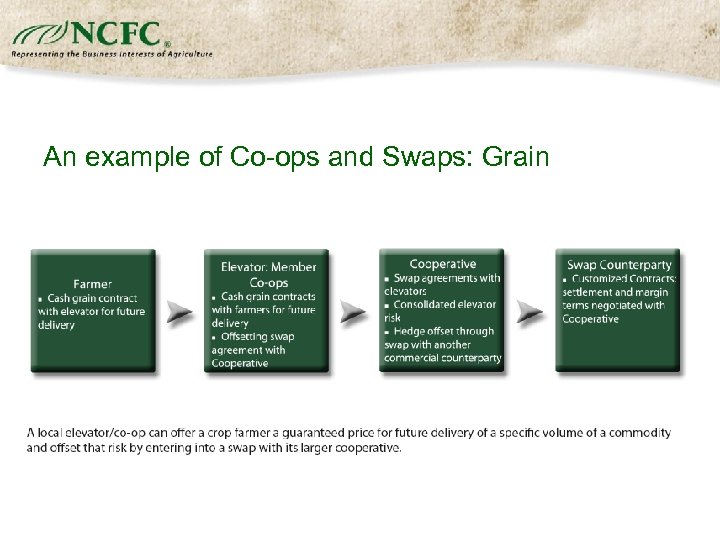

An example of Co-ops and Swaps: Grain

An example of Co-ops and Swaps: Grain

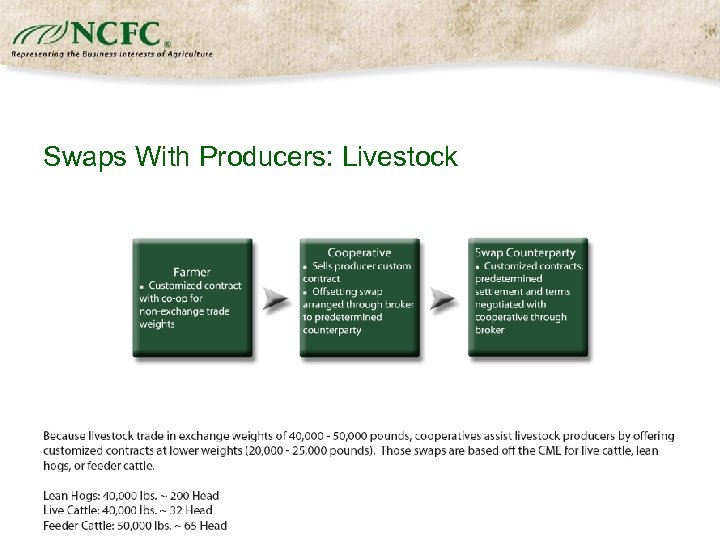

Swaps With Producers: Livestock

Swaps With Producers: Livestock

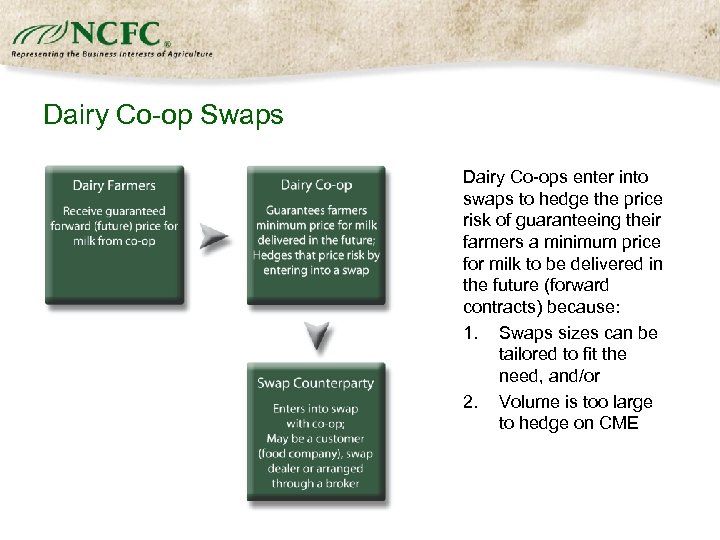

Dairy Co-op Swaps Dairy Co-ops enter into swaps to hedge the price risk of guaranteeing their farmers a minimum price for milk to be delivered in the future (forward contracts) because: 1. Swaps sizes can be tailored to fit the need, and/or 2. Volume is too large to hedge on CME

Dairy Co-op Swaps Dairy Co-ops enter into swaps to hedge the price risk of guaranteeing their farmers a minimum price for milk to be delivered in the future (forward contracts) because: 1. Swaps sizes can be tailored to fit the need, and/or 2. Volume is too large to hedge on CME

Dodd-Frank Implementation NCFC’s greatest concern was the uncertainty surrounding the “entity definitions” rule. – Some activities of co-ops were captured under the “swap dealer” definition contained in the proposed regulations If farmer co-ops were to be classified as dealers, increased regulatory costs would have made providing those risk management services uneconomical – leaving co-ops, their farmers and customers fewer risk management tools to weather highly volatile commodity markets.

Dodd-Frank Implementation NCFC’s greatest concern was the uncertainty surrounding the “entity definitions” rule. – Some activities of co-ops were captured under the “swap dealer” definition contained in the proposed regulations If farmer co-ops were to be classified as dealers, increased regulatory costs would have made providing those risk management services uneconomical – leaving co-ops, their farmers and customers fewer risk management tools to weather highly volatile commodity markets.

Dodd-Frank Implementation Final “Entities” Definition Voted on by CFTC/SEC last April – The determination of whether a person is a swap dealer excludes swaps between a cooperative – including agricultural cooperatives and cooperative financial institutions – and its members – Entering into a swap for the purpose of hedging a physical position is not swap dealing – De minimis Exception: the aggregate gross notional amount of the swaps entered into over the prior 12 months in connection with “dealing activities” must not exceed $8 billion/$3 billion

Dodd-Frank Implementation Final “Entities” Definition Voted on by CFTC/SEC last April – The determination of whether a person is a swap dealer excludes swaps between a cooperative – including agricultural cooperatives and cooperative financial institutions – and its members – Entering into a swap for the purpose of hedging a physical position is not swap dealing – De minimis Exception: the aggregate gross notional amount of the swaps entered into over the prior 12 months in connection with “dealing activities” must not exceed $8 billion/$3 billion

Dodd-Frank Implementation Looking Ahead – Most of the regulations have yet to go into effect – compliance issues – The big question is whether or not costs will allow the OTC market to remain viable • Reporting and recordkeeping issues (April for end users) • Capital and margin requirements for “dealers” • Will liquidity dry up? Ultimate costs of regulations unknown

Dodd-Frank Implementation Looking Ahead – Most of the regulations have yet to go into effect – compliance issues – The big question is whether or not costs will allow the OTC market to remain viable • Reporting and recordkeeping issues (April for end users) • Capital and margin requirements for “dealers” • Will liquidity dry up? Ultimate costs of regulations unknown

Other CFTC Issues • Proposed Customer Protection Rule – In response to MF Global/Peregrine – Will margin/hedging costs increase? • CFTC Reauthorization in 2013 – House/Senate Ag Committee hearings – Attempts to address Dodd-Frank • Will Chairman Gensler stay?

Other CFTC Issues • Proposed Customer Protection Rule – In response to MF Global/Peregrine – Will margin/hedging costs increase? • CFTC Reauthorization in 2013 – House/Senate Ag Committee hearings – Attempts to address Dodd-Frank • Will Chairman Gensler stay?

Immigration Reform State-of-Play: Best Chance in Years – Latino vote delivers for Obama – Senate’s Bipartisan Gang of 8 working on comprehensive reform package (includes place marker for an ag piece) – House working on legislation, including ag provisions

Immigration Reform State-of-Play: Best Chance in Years – Latino vote delivers for Obama – Senate’s Bipartisan Gang of 8 working on comprehensive reform package (includes place marker for an ag piece) – House working on legislation, including ag provisions

Ag Workforce Coalition Proposal The proposal includes: • Opportunity for earned adjustment of status by current agricultural employees who presently lack legal status • Ensures that all types of producers—including both those with seasonal labor needs and ones with year-round labor needs—have access to the workforce they need • Guest worker program to ensure an adequate farm workforce in the future

Ag Workforce Coalition Proposal The proposal includes: • Opportunity for earned adjustment of status by current agricultural employees who presently lack legal status • Ensures that all types of producers—including both those with seasonal labor needs and ones with year-round labor needs—have access to the workforce they need • Guest worker program to ensure an adequate farm workforce in the future

AWC Website: agworkforcecoalition. org

AWC Website: agworkforcecoalition. org

Tax Issues • NCFC tax priorities as Congress turns to reforming the Code: – Maintain Subchapter T of the Internal Revenue Code and related regulations. – Maintain Patronage Dividend Deduction. – Oppose repeal of the Section 199 Deduction for Domestic Production Activities Income. – Oppose Repeal of the Deduction for Interest on Debt. – Oppose Repeal of LIFO Accounting Method. – Oppose Repeal of Lower of Cost or Market Accounting Method. – Farmer Cooperatives Should Not Be Treated as “Passthrough” Entities.

Tax Issues • NCFC tax priorities as Congress turns to reforming the Code: – Maintain Subchapter T of the Internal Revenue Code and related regulations. – Maintain Patronage Dividend Deduction. – Oppose repeal of the Section 199 Deduction for Domestic Production Activities Income. – Oppose Repeal of the Deduction for Interest on Debt. – Oppose Repeal of LIFO Accounting Method. – Oppose Repeal of Lower of Cost or Market Accounting Method. – Farmer Cooperatives Should Not Be Treated as “Passthrough” Entities.

Trade • Trans-Pacific Partnership – will Japan join? • U. S. -EU to begin Free Trade Agreement negotiations • When will President Obama ask for Trade Promotion Authority? Transportation • Safe and Efficient Transportation Act (SETA) Reintroduced – Would increases maximum truck weights from 80, 000 lbs to 97, 000 lbs

Trade • Trans-Pacific Partnership – will Japan join? • U. S. -EU to begin Free Trade Agreement negotiations • When will President Obama ask for Trade Promotion Authority? Transportation • Safe and Efficient Transportation Act (SETA) Reintroduced – Would increases maximum truck weights from 80, 000 lbs to 97, 000 lbs

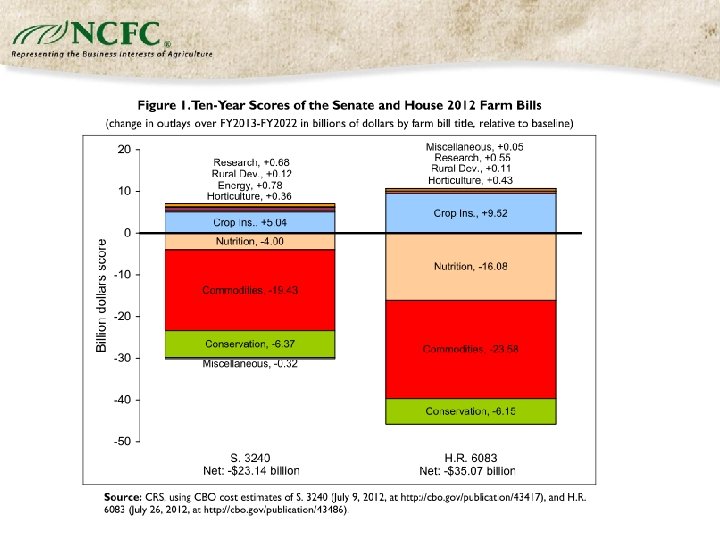

Three Failed Attempts to Pass a Farm Bill in 112 th Congress Round 1: Super Committee Round 2: Senate and House Ag Committee Bills Passed Round 3: Lame Duck Session

Three Failed Attempts to Pass a Farm Bill in 112 th Congress Round 1: Super Committee Round 2: Senate and House Ag Committee Bills Passed Round 3: Lame Duck Session

Farm Bill: Round #4? Simply repeating what we did last year is a recipe to get the same result. • Notable Obstacles to Success: – Overshadowed by other, more pressing priorities – Division among the ranks – A quiet grassroots

Farm Bill: Round #4? Simply repeating what we did last year is a recipe to get the same result. • Notable Obstacles to Success: – Overshadowed by other, more pressing priorities – Division among the ranks – A quiet grassroots

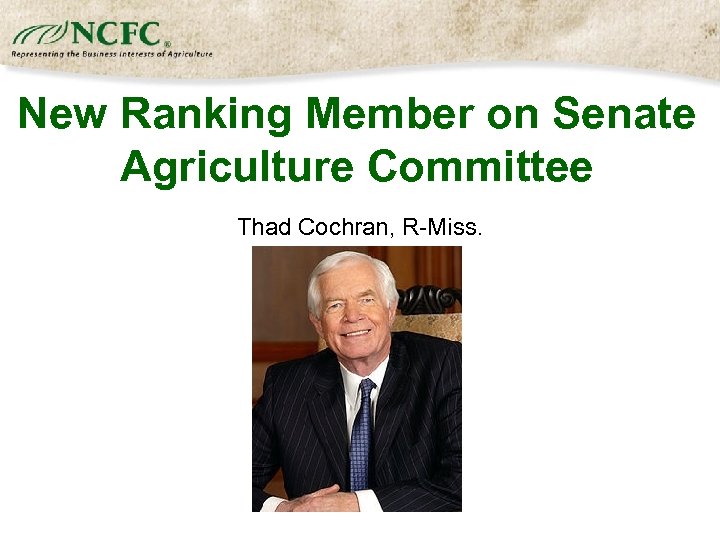

New Ranking Member on Senate Agriculture Committee Thad Cochran, R-Miss.

New Ranking Member on Senate Agriculture Committee Thad Cochran, R-Miss.

Thank you!

Thank you!