c6575d2e145ec036de021b9ef0a4f1a2.ppt

- Количество слайдов: 42

Washington Representatives Retreat (Day 2) November 30 to December 1 Loews Annapolis Hotel 126 West Street, Annapolis, MD

2 National Health Policy & 2018 Political Outlook National Health Council 2017 Washington Representatives Retreat Annapolis, MD G. William Hoagland Sr. Vice President Bipartisan Policy Center December 1, 2017

3 Federal Budget

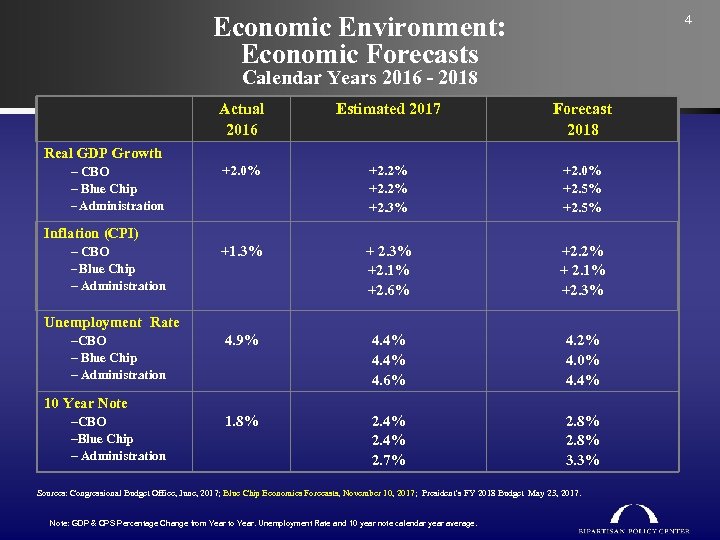

Economic Environment: Economic Forecasts 4 Calendar Years 2016 - 2018 Actual 2016 Estimated 2017 Forecast 2018 +2. 0% +2. 2% +2. 3% +2. 0% +2. 5% +1. 3% + 2. 3% +2. 1% +2. 6% +2. 2% + 2. 1% +2. 3% 4. 9% 4. 4% 4. 6% 4. 2% 4. 0% 4. 4% 1. 8% 2. 4% 2. 7% 2. 8% 3. 3% Real GDP Growth – CBO – Blue Chip – Administration Inflation (CPI) – CBO – Blue Chip – Administration Unemployment Rate –CBO – Blue Chip – Administration 10 Year Note –CBO –Blue Chip – Administration Sources: Congressional Budget Office, June, 2017; Blue Chip Economics Forecasts, November 10, 2017; President’s FY 2018 Budget May 23, 2017. Note: GDP & CPS Percentage Change from Year to Year. Unemployment Rate and 10 year note calendar year average.

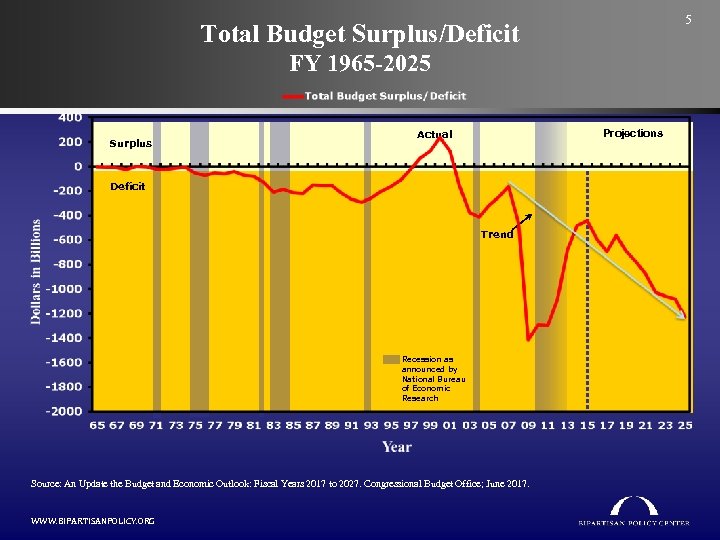

5 Total Budget Surplus/Deficit FY 1965 -2025 Surplus Projections Actual Deficit Trend Recession as announced by National Bureau of Economic Research Source: An Update the Budget and Economic Outlook: Fiscal Years 2017 to 2027. Congressional Budget Office; June 2017. WWW. BIPARTISANPOLICY. ORG

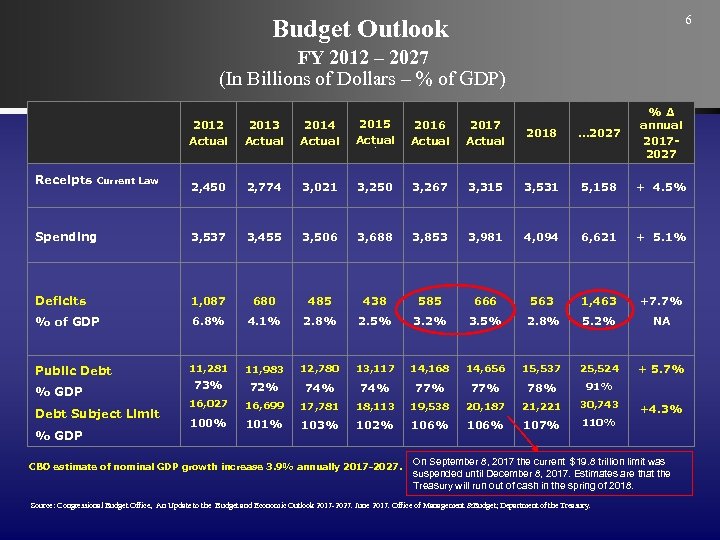

6 Budget Outlook FY 2012 – 2027 (In Billions of Dollars – % of GDP) 2016 Actual 2017 Actual 2018 … 2027 %∆ annual 20172027 3, 250 3, 267 3, 315 3, 531 5, 158 + 4. 5% 3, 506 3, 688 3, 853 3, 981 4, 094 6, 621 + 5. 1% 680 485 438 585 666 563 1, 463 +7. 7% 6. 8% 4. 1% 2. 8% 2. 5% 3. 2% 3. 5% 2. 8% 5. 2% NA 11, 281 11, 983 12, 780 13, 117 14, 168 14, 656 15, 537 25, 524 + 5. 7% 73% 72% 74% 77% 78% 91% 16, 027 16, 699 17, 781 18, 113 19, 538 20, 187 21, 221 30, 743 107% 110% 2012 Actual 2013 Actual 2014 Actual 2015 Actual 2, 450 2, 774 3, 021 Spending 3, 537 3, 455 Deficits 1, 087 % of GDP Public Debt Receipts Current Law % GDP Debt Subject Limit % GDP 100% 101% 103% Ac 102% CBO estimate of nominal GDP growth increase 3. 9% annually 2017 -2027. 106% +4. 3% On September 8, 2017 the current $19. 8 trillion limit was suspended until December 8, 2017. Estimates are that the Treasury will run out of cash in the spring of 2018. Source: Congressional Budget Office, An Update to the Budget and Economic Outlook 2017 -2027. June 2017. Office of Management &Budget; Department of the Treasury.

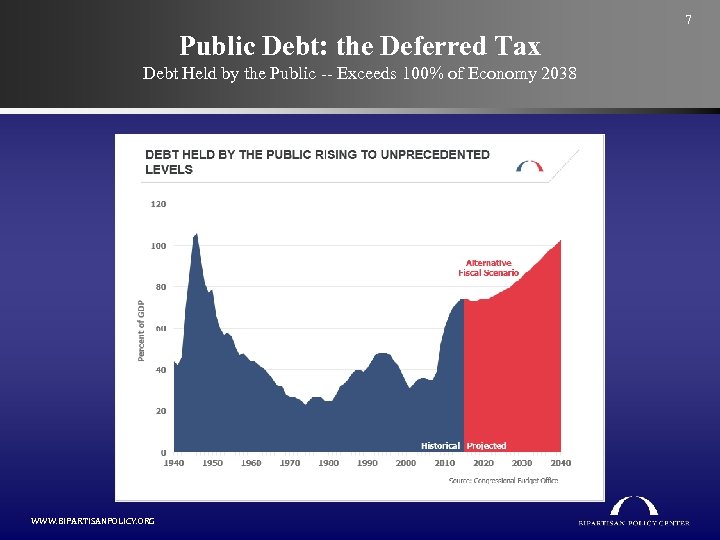

7 Public Debt: the Deferred Tax Debt Held by the Public -- Exceeds 100% of Economy 2038 WWW. BIPARTISANPOLICY. ORG

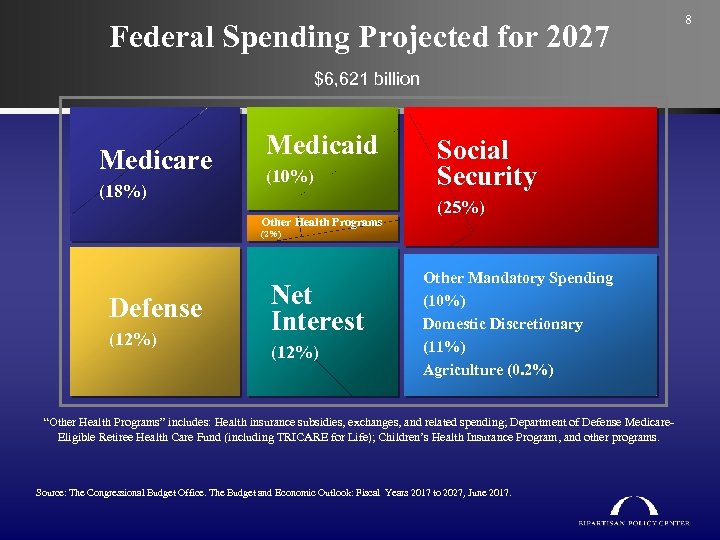

Federal Spending Projected for 2027 $6, 621 billion Medicare (18%) Medicaid (10%) Other Health Programs Social Security (25%) (2%) Defense (12%) Net Interest (12%) Other Mandatory Spending (10%) Domestic Discretionary (11%) Agriculture (0. 2%) “Other Health Programs” includes: Health insurance subsidies, exchanges, and related spending; Department of Defense Medicare. Eligible Retiree Health Care Fund (including TRICARE for Life); Children’s Health Insurance Program, and other programs. Source: The Congressional Budget Office. The Budget and Economic Outlook: Fiscal Years 2017 to 2027, June 2017. 8

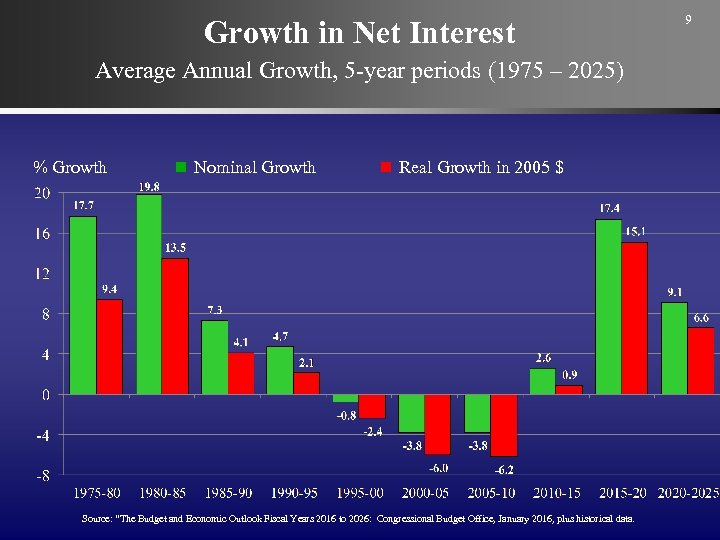

Growth in Net Interest Average Annual Growth, 5 -year periods (1975 – 2025) % Growth Nominal Growth Real Growth in 2005 $ Source: “The Budget and Economic Outlook Fiscal Years 2016 to 2026: Congressional Budget Office, January 2016, plus historical data. 9

10 Immediate & Longer-Term Challenge

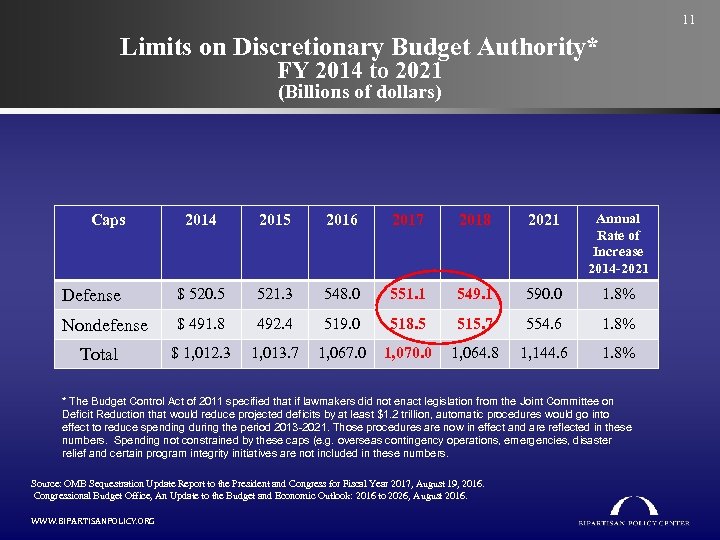

11 Limits on Discretionary Budget Authority* FY 2014 to 2021 (Billions of dollars) 2014 2015 2016 2017 2018 2021 Annual Rate of Increase 2014 -2021 Defense $ 520. 5 521. 3 548. 0 551. 1 549. 1 590. 0 1. 8% Nondefense $ 491. 8 492. 4 519. 0 518. 5 515. 7 554. 6 1. 8% $ 1, 012. 3 1, 013. 7 1, 067. 0 1, 070. 0 1, 064. 8 1, 144. 6 1. 8% Caps Total * The Budget Control Act of 2011 specified that if lawmakers did not enact legislation from the Joint Committee on Deficit Reduction that would reduce projected deficits by at least $1. 2 trillion, automatic procedures would go into effect to reduce spending during the period 2013 -2021. Those procedures are now in effect and are reflected in these numbers. Spending not constrained by these caps (e. g. overseas contingency operations, emergencies, disaster relief and certain program integrity initiatives are not included in these numbers. Source: OMB Sequestration Update Report to the President and Congress for Fiscal Year 2017, August 19, 2016. Congressional Budget Office, An Update to the Budget and Economic Outlook: 2016 to 2026, August 2016. WWW. BIPARTISANPOLICY. ORG

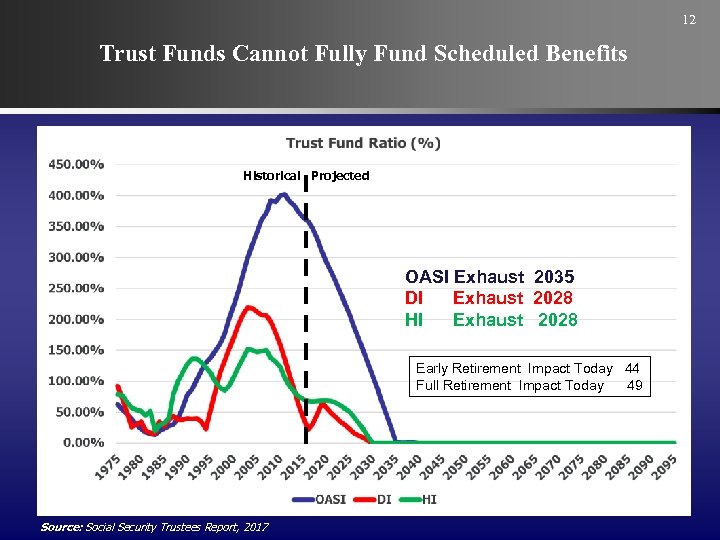

12 Trust Funds Cannot Fully Fund Scheduled Benefits Historical Projected OASI Exhaust 2035 DI Exhaust 2028 HI Exhaust 2028 Early Retirement Impact Today 44 Full Retirement Impact Today 49 Source: Social Security Trustees Report, 2017

13 2017/18 Health Care Policy

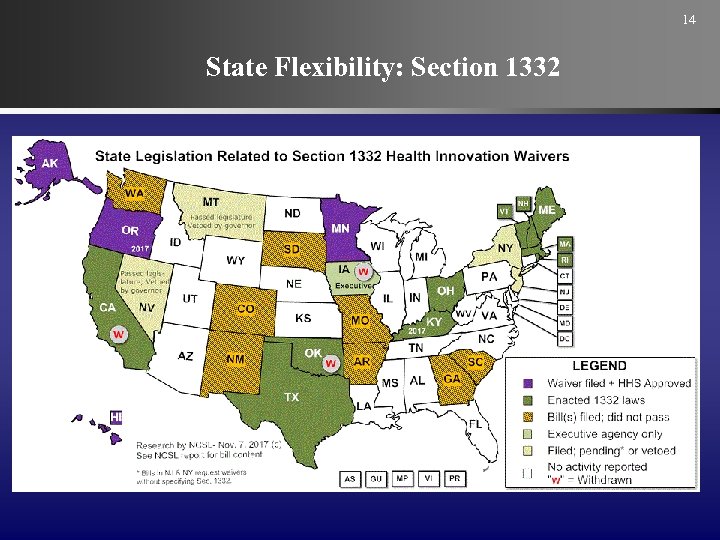

14 State Flexibility: Section 1332

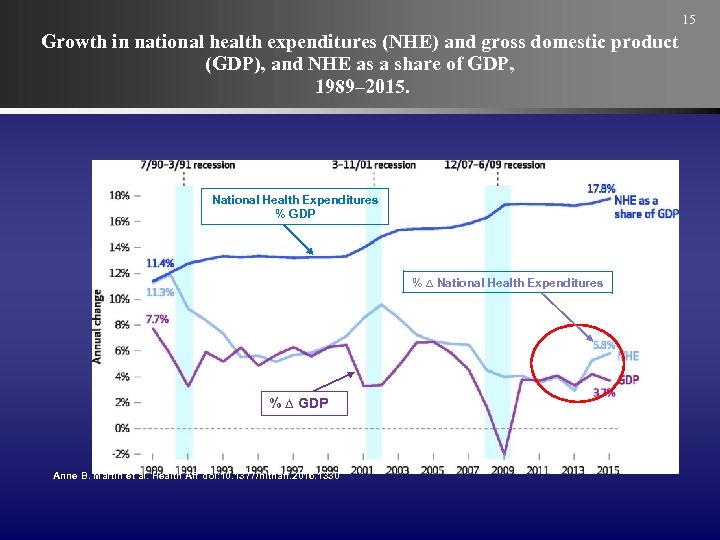

15 Growth in national health expenditures (NHE) and gross domestic product (GDP), and NHE as a share of GDP, 1989– 2015. National Health Expenditures % GDP % ∆ National Health Expenditures % ∆ GDP Anne B. Martin et al. Health Aff doi: 10. 1377/hlthaff. 2016. 1330

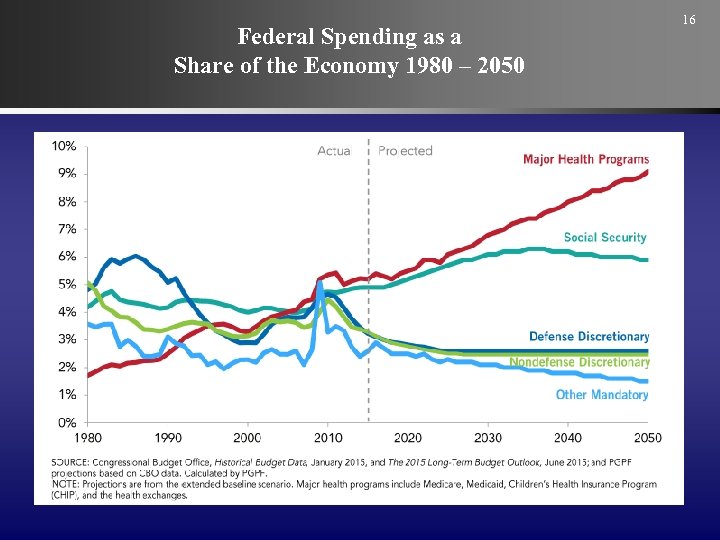

Federal Spending as a Share of the Economy 1980 – 2050 16

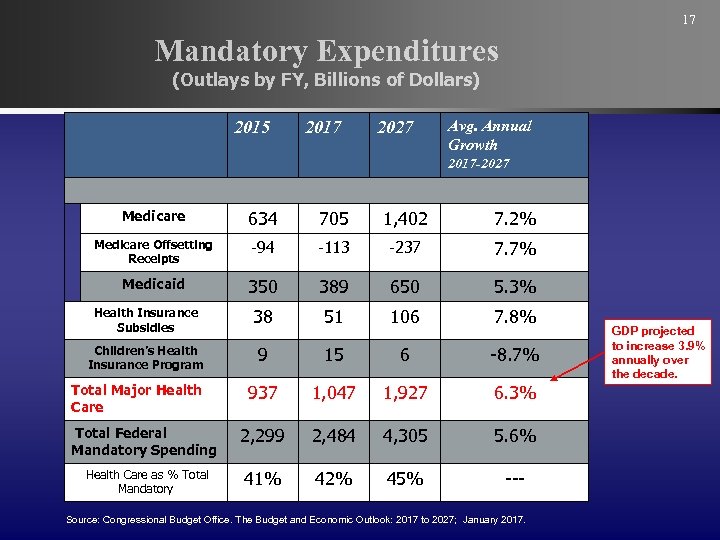

17 Mandatory Expenditures (Outlays by FY, Billions of Dollars) 2015 2017 2027 Avg. Annual Growth 2017 -2027 Medicare 634 705 1, 402 7. 2% Medicare Offsetting Receipts -94 -113 -237 7. 7% Medicaid 350 389 650 5. 3% Health Insurance Subsidies 38 51 106 7. 8% Children’s Health Insurance Program 9 15 6 -8. 7% 937 1, 047 1, 927 6. 3% Total Federal Mandatory Spending 2, 299 2, 484 4, 305 5. 6% Health Care as % Total Mandatory 41% 42% 45% --- Total Major Health Care Source: Congressional Budget Office. The Budget and Economic Outlook: 2017 to 2027; January 2017. GDP projected to increase 3. 9% annually over the decade.

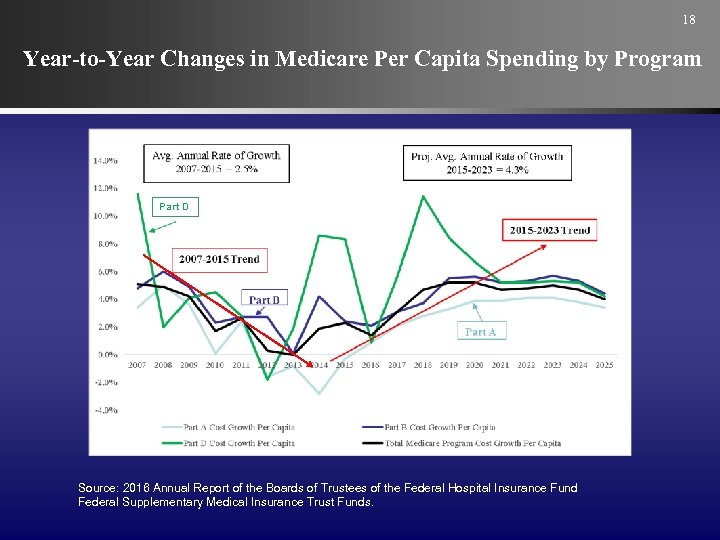

18 Year-to-Year Changes in Medicare Per Capita Spending by Program Part D Source: 2016 Annual Report of the Boards of Trustees of the Federal Hospital Insurance Fund Federal Supplementary Medical Insurance Trust Funds.

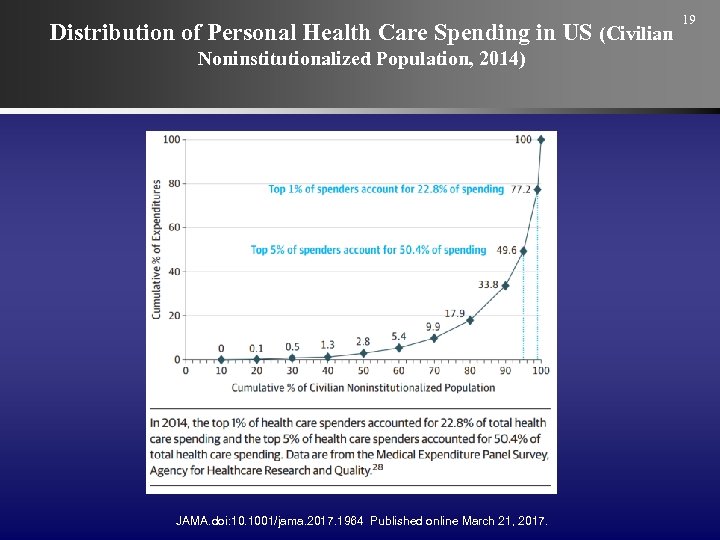

Distribution of Personal Health Care Spending in US (Civilian Noninstitutionalized Population, 2014) JAMA. doi: 10. 1001/jama. 2017. 1964 Published online March 21, 2017. 19

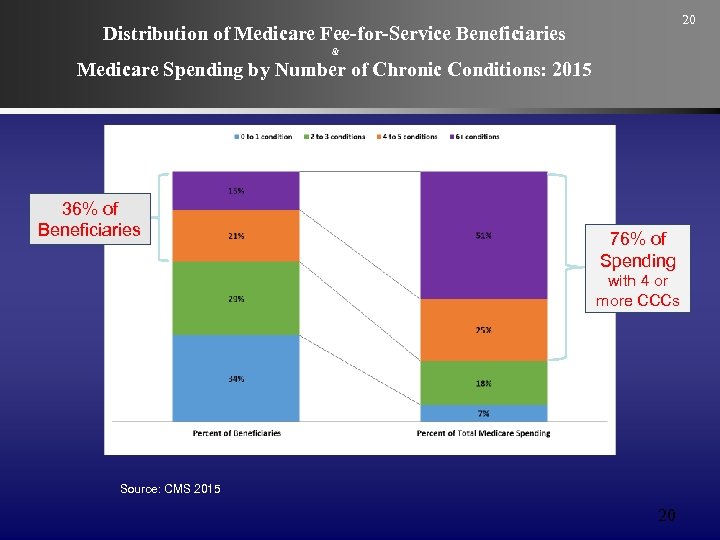

20 Distribution of Medicare Fee-for-Service Beneficiaries & Medicare Spending by Number of Chronic Conditions: 2015 36% of Beneficiaries 76% of Spending with 4 or more CCCs Source: CMS 2015 20

21 21 2018 Political Setting

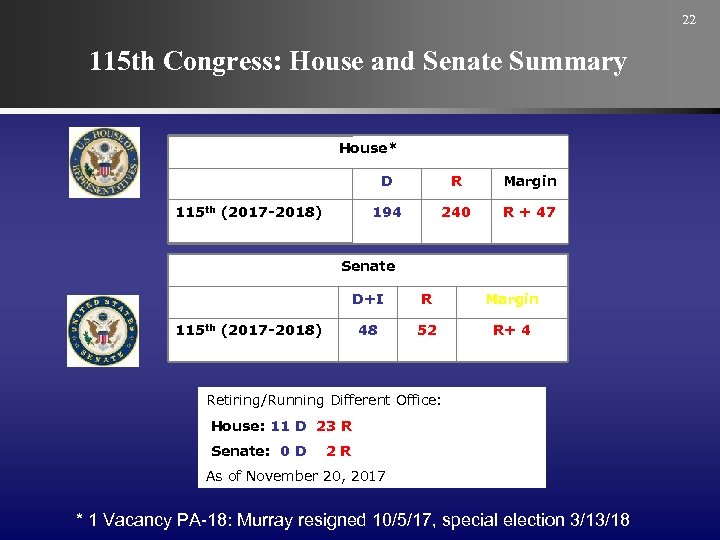

22 115 th Congress: House and Senate Summary House* D Margin 194 115 th (2017 -2018) R 240 R + 47 Senate D+I Margin 48 115 th (2017 -2018) R 52 R+ 4 Retiring/Running Different Office: House: 11 D 23 R Senate: 0 D 2 R As of November 20, 2017 * 1 Vacancy PA-18: Murray resigned 10/5/17, special election 3/13/18

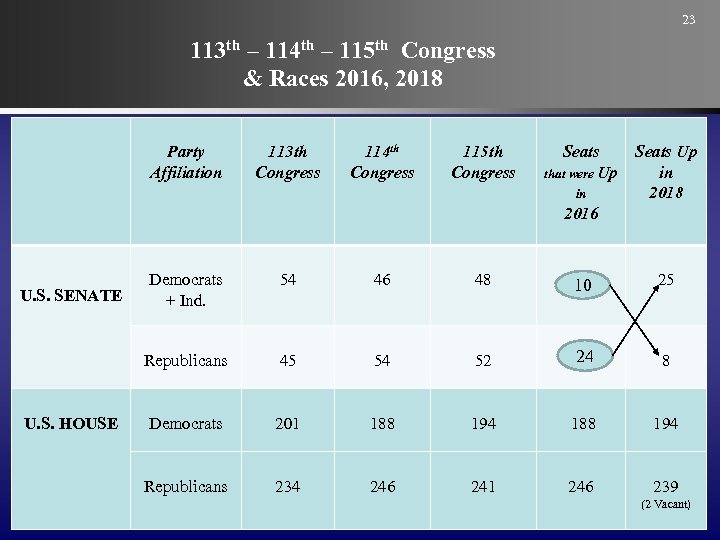

23 113 th – 114 th – 115 th Congress & Races 2016, 2018 Party Affiliation 113 th Congress 114 th Congress 115 th Congress Seats that were Up in Seats Up in 2018 2016 U. S. HOUSE 54 46 48 1010 10 25 Republicans U. S. SENATE Democrats + Ind. 45 54 52 24 24 8 Democrats 201 188 194 Republicans 234 246 241 246 239 (2 Vacant)

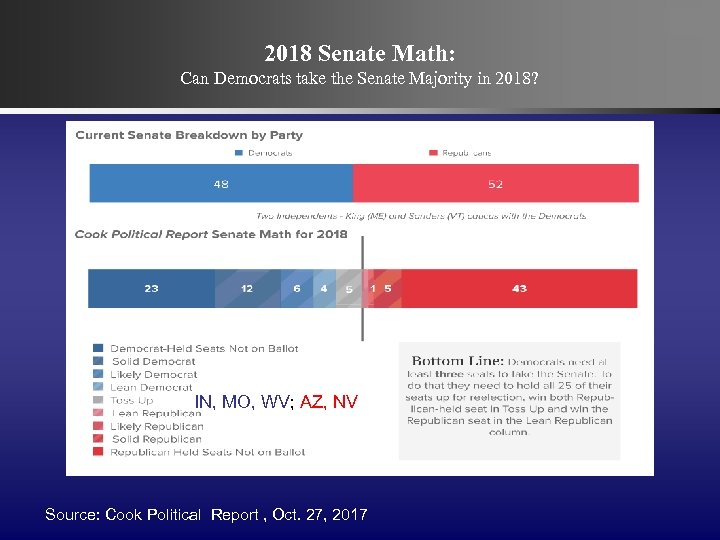

24 2018 Senate Math: Can Democrats take the Senate Majority in 2018? IN, MO, WV; AZ, NV Source: Cook Political Report , Oct. 27, 2017

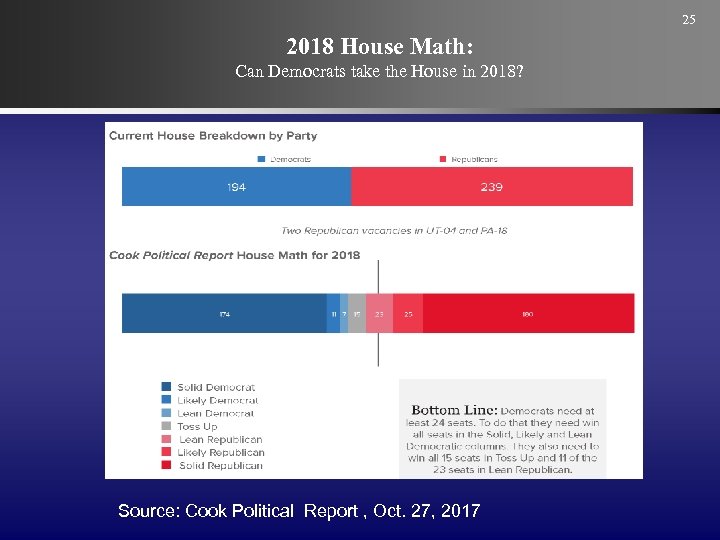

25 2018 House Math: Can Democrats take the House in 2018? Source: Cook Political Report , Oct. 27, 2017

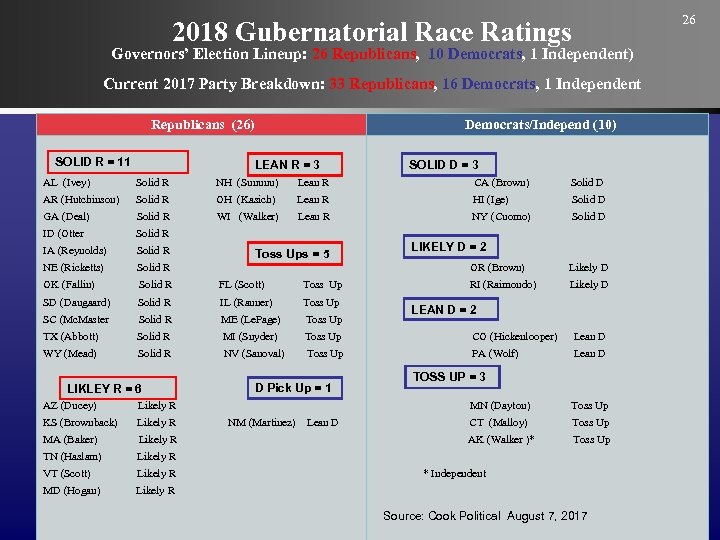

26 2018 Gubernatorial Race Ratings Governors’ Election Lineup: 26 Republicans, 10 Democrats, 1 Independent) Current 2017 Party Breakdown: 33 Republicans, 16 Democrats, 1 Independent Republicans (26) SOLID R = 11 Democrats/Independ (10) LEAN R = 3 SOLID D = 3 AL (Ivey) Solid R NH (Sununu) Lean R CA (Brown) Solid D AR (Hutchinson) Solid R OH (Kasich) Lean R HI (Ige) Solid D GA (Deal) Solid R WI (Walker) Lean R NY (Cuomo) Solid D ID (Otter Solid R IA (Reynolds) Solid R NE (Ricketts) Solid R OK (Fallin) Solid R FL (Scott) Toss Up SD (Daugaard) Solid R IL (Rauner) Toss Up SC (Mc. Master Solid R ME (Le. Page) Toss Up TX (Abbott) Solid R MI (Snyder) Toss Up CO (Hickenlooper) Lean D WY (Mead) Solid R NV (Sanoval) Toss Up PA (Wolf) Lean D LIKLEY R = 6 AZ (Ducey) Likely R MA (Baker) Likely R TN (Haslam) Likely R MD (Hogan) D Pick Up = 1 Likely D RI (Raimondo) Likely D LEAN D = 2 TOSS UP = 3 Likely R VT (Scott) LIKELY D = 2 OR (Brown) Likely R KS (Brownback) Toss Ups = 5 MN (Dayton) Likely R NM (Martinez) Lean D Toss Up CT (Malloy) Toss Up AK (Walker )* Toss Up * Independent Source: Cook Political August 7, 2017

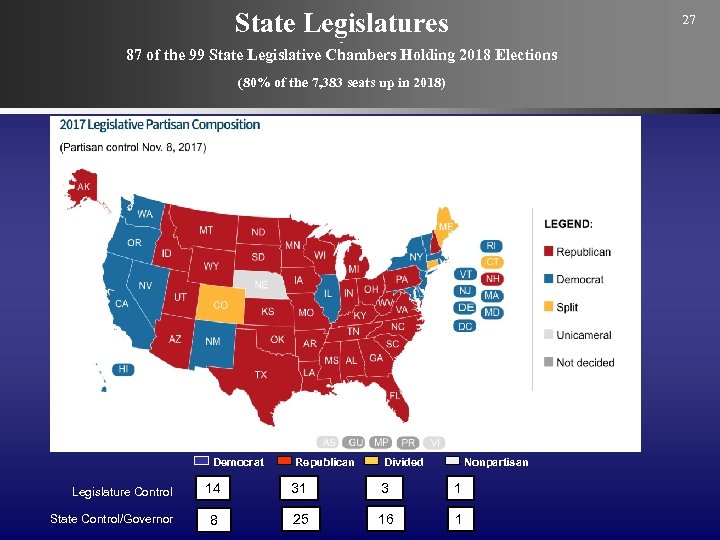

State Legislatures 27 - 87 of the 99 State Legislative Chambers Holding 2018 Elections (80% of the 7, 383 seats up in 2018) Democrat Republican Divided Nonpartisan Legislature Control 14 31 3 1 State Control/Governor 8 25 16 1

28 A House Divided

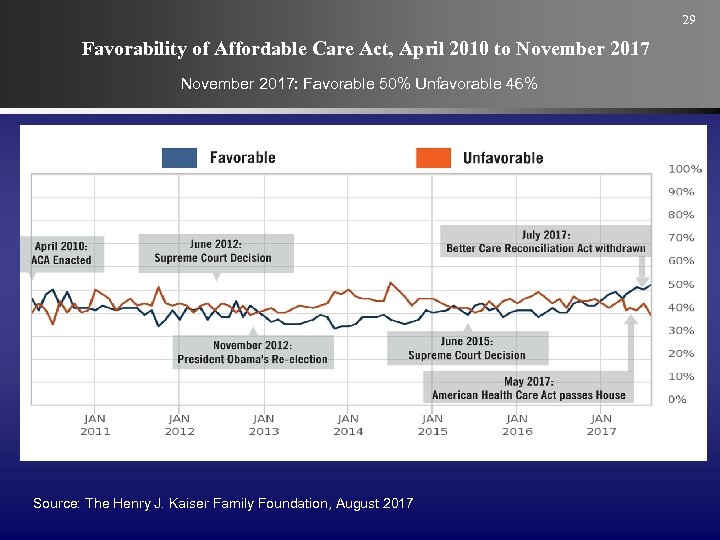

29 Favorability of Affordable Care Act, April 2010 to November 2017: Favorable 50% Unfavorable 46% Source: The Henry J. Kaiser Family Foundation, August 2017

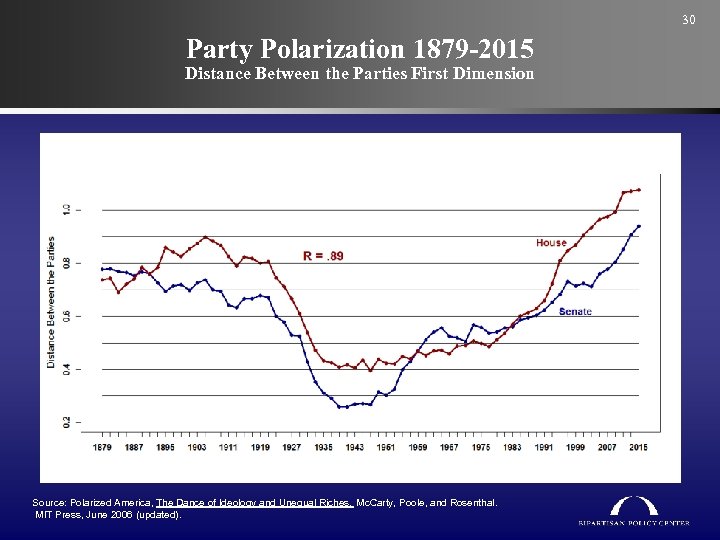

30 Party Polarization 1879 -2015 Distance Between the Parties First Dimension Source: Polarized America, The Dance of Ideology and Unequal Riches. Mc. Carty, Poole, and Rosenthal. MIT Press, June 2006 (updated).

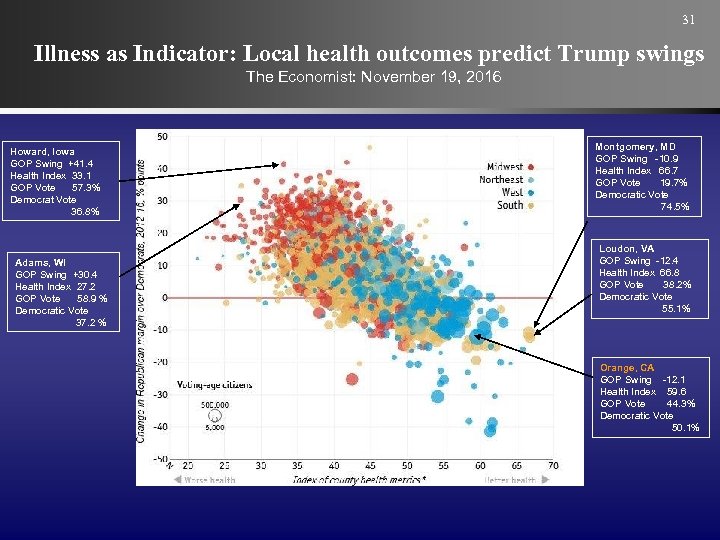

31 Illness as Indicator: Local health outcomes predict Trump swings The Economist: November 19, 2016 Howard, Iowa GOP Swing +41. 4 Health Index 33. 1 GOP Vote 57. 3% Democrat Vote 36. 8% Adams, WI GOP Swing +30. 4 Health Index 27. 2 GOP Vote 58. 9 % Democratic Vote 37. 2 % Montgomery, MD GOP Swing -10. 9 Health Index 66. 7 GOP Vote 19. 7% Democratic Vote 74. 5% Loudon, VA GOP Swing -12. 4 Health Index 66. 8 GOP Vote 38. 2% Democratic Vote 55. 1% Orange, CA GOP Swing -12. 1 Health Index 59. 6 GOP Vote 44. 3% Democratic Vote 50. 1%

32

Tax Reform Impact on Health Care and Health Care Organizations 12/1/2017 Copyright © 2017 Holland & Knight LLP. All Rights Reserved

Drivers » Trump Campaigned on it » Republican leaders in both House and Senate and the Trump Administration are aligned on most elements (came to terms over the summer). » Desperate Need for a signature accomplishment » Genuine belief that U. S. corporate code is in need of significant reform » Republicans like to cut taxes. 34

Parameters » FY 2018 budget resolution allows net tax cut of $1. 5 trillion over the ten years. » Bipartisan road was not taken on this bill – Must use budget reconciliation and its constraints ˗ Byrd Rule strikes "extraneous" matters from reconciliation bills; ˗ Cannot exceed the $1. 5 Trillion allowance ˗ Cannot increase the federal deficit outside the budget window » PAYGO Scorecard – debt increase triggers a sequester – ˗ Waiver needed » $1. 5 Trillion Sticker Price does not account for gimmicks – this is more like a $2. 5 Trillion Package 35

Tax Cut and Jobs Act in a Nutshell » A corporate and small business tax cut/reform bill … ˗ Cuts corporate from 35 to 20%, ˗ Changes the nature of global corporate taxation ˗ Accelerated expensing ˗ Preferential treatment for pass through income ˗ Corporate Changes are permanent » … With an Individual Tax Sidecar ˗ Slightly reduced marginal tax rates ˗ Major shift out of itemized deductions • Current Personal Exemption and Standard Deduction merged into much larger standard deduction ($12, 000, $18, 000, $24, 000) ˗ Many credits and deductions eliminated or curbed (more in House) ˗ Estate Tax Changes ˗ Alternative Minimum Tax ˗ Many Items expire 36

Major Issues/Cat Herding » What if assumptions of Revenue Growth Don’t Materialize? ˗ Deficit Hawks (Corker, Flake, Lankford) = trigger » Senate Repeal of the Individual Health Insurance Tax Penalty ˗ Health Care Supporters (Collins) = Reinsurance fund, Alexander-Murray (CSRs) » Not as Good for Small Business as Big Business ˗ Increase the Pass Through Income Exemption (Daines, Johnson) » Non-Deductibility of State/Local Income Taxes ˗ Retain $10, 000 of property tax (Collins, many suburban House members) » Charitables, Bonds, Higher Education, Mortgage Interest …. . 37

Focus Issues A. B. C. D. Bond Provisions SALT Tuition Assistance / Research & Health Care Non-Profit Related 38

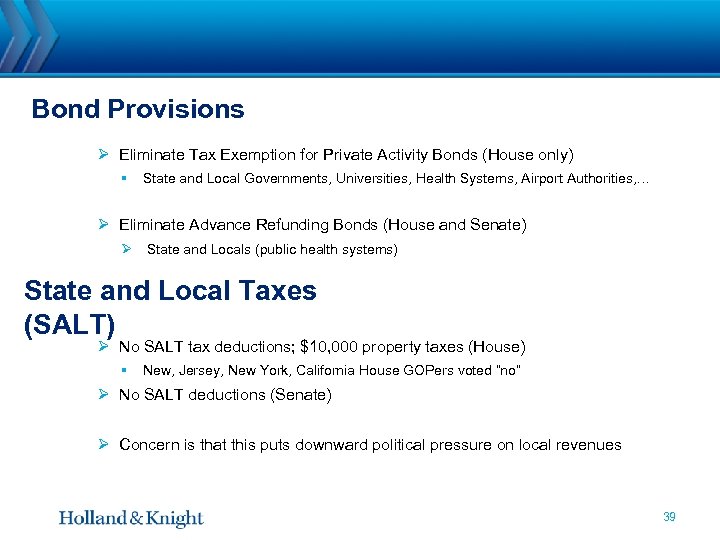

Bond Provisions Ø Eliminate Tax Exemption for Private Activity Bonds (House only) § State and Local Governments, Universities, Health Systems, Airport Authorities, … Ø Eliminate Advance Refunding Bonds (House and Senate) Ø State and Locals (public health systems) State and Local Taxes (SALT) Ø No SALT tax deductions; $10, 000 property taxes (House) § New, Jersey, New York, California House GOPers voted “no” Ø No SALT deductions (Senate) Ø Concern is that this puts downward political pressure on local revenues 39

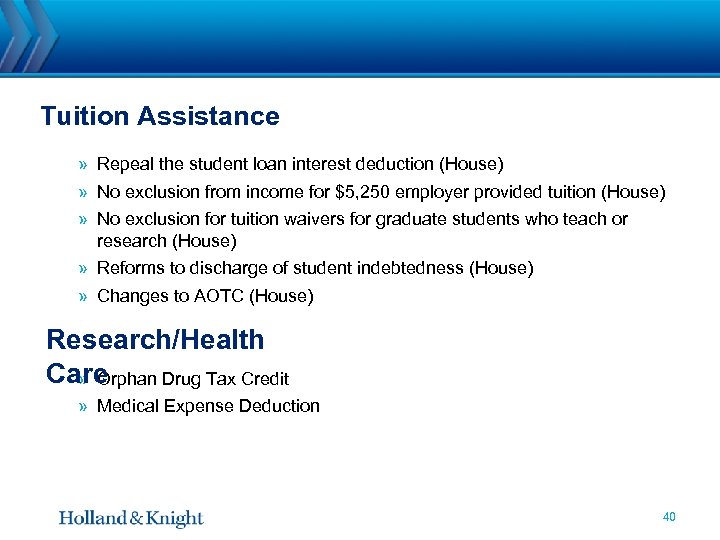

Tuition Assistance » Repeal the student loan interest deduction (House) » No exclusion from income for $5, 250 employer provided tuition (House) » No exclusion for tuition waivers for graduate students who teach or research (House) » Reforms to discharge of student indebtedness (House) » Changes to AOTC (House) Research/Health Care » Orphan Drug Tax Credit » Medical Expense Deduction 40

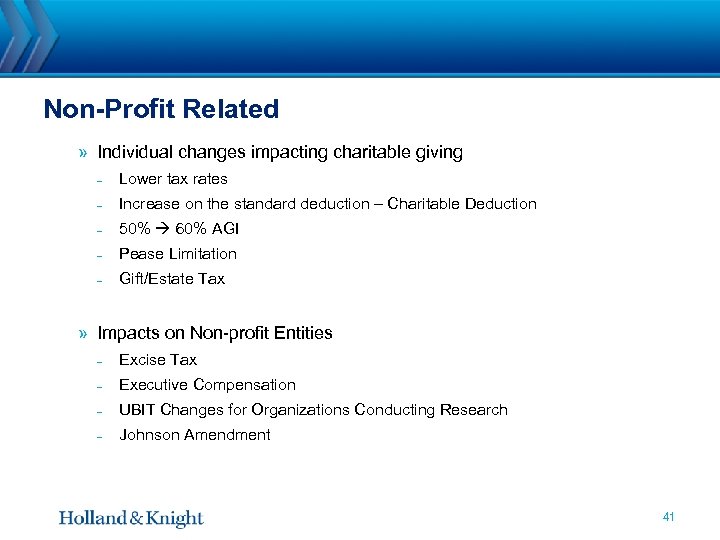

Non-Profit Related » Individual changes impacting charitable giving ˗ Lower tax rates ˗ Increase on the standard deduction – Charitable Deduction ˗ 50% 60% AGI ˗ Pease Limitation ˗ Gift/Estate Tax » Impacts on Non-profit Entities ˗ Excise Tax ˗ Executive Compensation ˗ UBIT Changes for Organizations Conducting Research ˗ Johnson Amendment 41

Contact Slide Sample » Robert Bradner, Robert. Brader@hklaw. com 42

c6575d2e145ec036de021b9ef0a4f1a2.ppt