a4daafe68bfe5e94ced55d0abfd95842.ppt

- Количество слайдов: 23

Washington Perspective: The Changing Legislative Landscape 2010 FIRMA Conference March 28 -April 1, 2010, San Francisco, CA Sally Miller Senior Vice President, CSTI American Bankers Association

Washington Perspective: The Changing Legislative Landscape 2010 FIRMA Conference March 28 -April 1, 2010, San Francisco, CA Sally Miller Senior Vice President, CSTI American Bankers Association

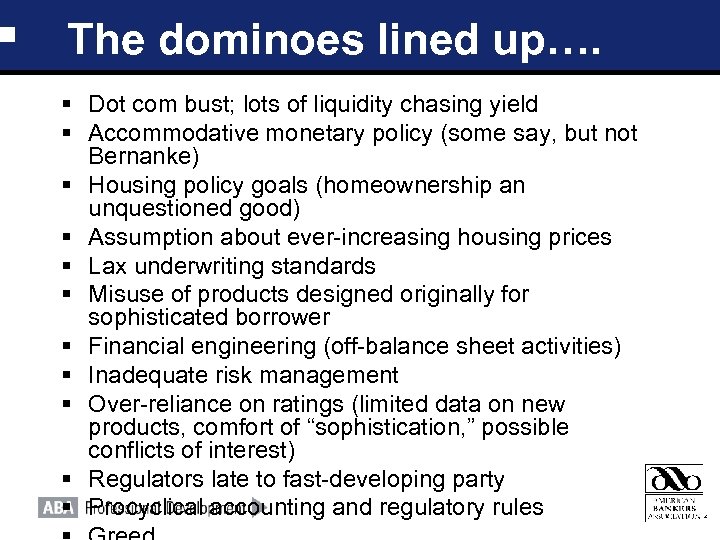

The dominoes lined up…. § Dot com bust; lots of liquidity chasing yield § Accommodative monetary policy (some say, but not Bernanke) § Housing policy goals (homeownership an unquestioned good) § Assumption about ever-increasing housing prices § Lax underwriting standards § Misuse of products designed originally for sophisticated borrower § Financial engineering (off-balance sheet activities) § Inadequate risk management § Over-reliance on ratings (limited data on new products, comfort of “sophistication, ” possible conflicts of interest) § Regulators late to fast-developing party § Procyclical accounting and regulatory rules

The dominoes lined up…. § Dot com bust; lots of liquidity chasing yield § Accommodative monetary policy (some say, but not Bernanke) § Housing policy goals (homeownership an unquestioned good) § Assumption about ever-increasing housing prices § Lax underwriting standards § Misuse of products designed originally for sophisticated borrower § Financial engineering (off-balance sheet activities) § Inadequate risk management § Over-reliance on ratings (limited data on new products, comfort of “sophistication, ” possible conflicts of interest) § Regulators late to fast-developing party § Procyclical accounting and regulatory rules

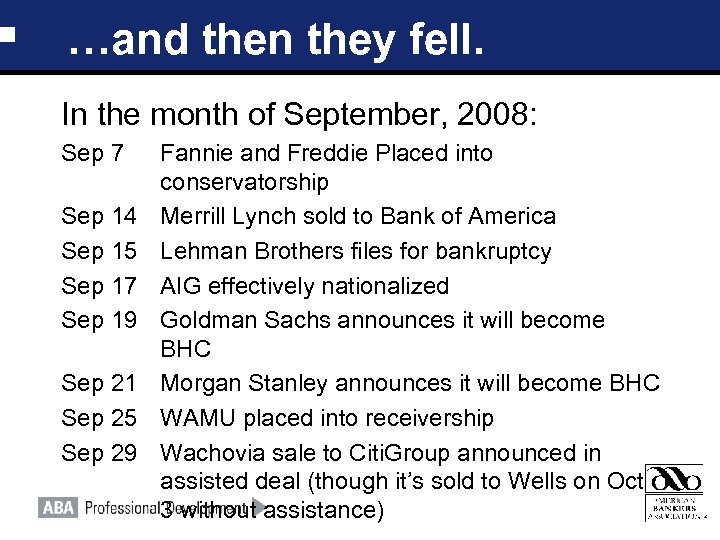

…and then they fell. In the month of September, 2008: Sep 7 Sep 14 Sep 15 Sep 17 Sep 19 Sep 21 Sep 25 Sep 29 Fannie and Freddie Placed into conservatorship Merrill Lynch sold to Bank of America Lehman Brothers files for bankruptcy AIG effectively nationalized Goldman Sachs announces it will become BHC Morgan Stanley announces it will become BHC WAMU placed into receivership Wachovia sale to Citi. Group announced in assisted deal (though it’s sold to Wells on Oct 3 without assistance)

…and then they fell. In the month of September, 2008: Sep 7 Sep 14 Sep 15 Sep 17 Sep 19 Sep 21 Sep 25 Sep 29 Fannie and Freddie Placed into conservatorship Merrill Lynch sold to Bank of America Lehman Brothers files for bankruptcy AIG effectively nationalized Goldman Sachs announces it will become BHC Morgan Stanley announces it will become BHC WAMU placed into receivership Wachovia sale to Citi. Group announced in assisted deal (though it’s sold to Wells on Oct 3 without assistance)

Which led to…

Which led to…

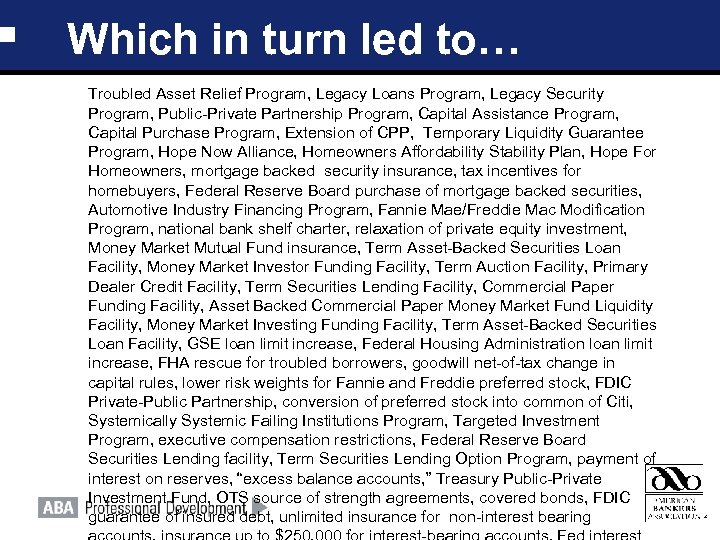

Which in turn led to… Troubled Asset Relief Program, Legacy Loans Program, Legacy Security Program, Public-Private Partnership Program, Capital Assistance Program, Capital Purchase Program, Extension of CPP, Temporary Liquidity Guarantee Program, Hope Now Alliance, Homeowners Affordability Stability Plan, Hope For Homeowners, mortgage backed security insurance, tax incentives for homebuyers, Federal Reserve Board purchase of mortgage backed securities, Automotive Industry Financing Program, Fannie Mae/Freddie Mac Modification Program, national bank shelf charter, relaxation of private equity investment, Money Market Mutual Fund insurance, Term Asset-Backed Securities Loan Facility, Money Market Investor Funding Facility, Term Auction Facility, Primary Dealer Credit Facility, Term Securities Lending Facility, Commercial Paper Funding Facility, Asset Backed Commercial Paper Money Market Fund Liquidity Facility, Money Market Investing Funding Facility, Term Asset-Backed Securities Loan Facility, GSE loan limit increase, Federal Housing Administration loan limit increase, FHA rescue for troubled borrowers, goodwill net-of-tax change in capital rules, lower risk weights for Fannie and Freddie preferred stock, FDIC Private-Public Partnership, conversion of preferred stock into common of Citi, Systemically Systemic Failing Institutions Program, Targeted Investment Program, executive compensation restrictions, Federal Reserve Board Securities Lending facility, Term Securities Lending Option Program, payment of interest on reserves, “excess balance accounts, ” Treasury Public-Private Investment Fund, OTS source of strength agreements, covered bonds, FDIC guarantee of insured debt, unlimited insurance for non-interest bearing

Which in turn led to… Troubled Asset Relief Program, Legacy Loans Program, Legacy Security Program, Public-Private Partnership Program, Capital Assistance Program, Capital Purchase Program, Extension of CPP, Temporary Liquidity Guarantee Program, Hope Now Alliance, Homeowners Affordability Stability Plan, Hope For Homeowners, mortgage backed security insurance, tax incentives for homebuyers, Federal Reserve Board purchase of mortgage backed securities, Automotive Industry Financing Program, Fannie Mae/Freddie Mac Modification Program, national bank shelf charter, relaxation of private equity investment, Money Market Mutual Fund insurance, Term Asset-Backed Securities Loan Facility, Money Market Investor Funding Facility, Term Auction Facility, Primary Dealer Credit Facility, Term Securities Lending Facility, Commercial Paper Funding Facility, Asset Backed Commercial Paper Money Market Fund Liquidity Facility, Money Market Investing Funding Facility, Term Asset-Backed Securities Loan Facility, GSE loan limit increase, Federal Housing Administration loan limit increase, FHA rescue for troubled borrowers, goodwill net-of-tax change in capital rules, lower risk weights for Fannie and Freddie preferred stock, FDIC Private-Public Partnership, conversion of preferred stock into common of Citi, Systemically Systemic Failing Institutions Program, Targeted Investment Program, executive compensation restrictions, Federal Reserve Board Securities Lending facility, Term Securities Lending Option Program, payment of interest on reserves, “excess balance accounts, ” Treasury Public-Private Investment Fund, OTS source of strength agreements, covered bonds, FDIC guarantee of insured debt, unlimited insurance for non-interest bearing

So what have we learned? There are cracks in the system, including: – Unregulated lenders – Inattention to correlated risks – Inability to resolve large nonbank FIs – Perceived emphasis on safety and soundness at expense of consumer protection – Insufficient prudential safeguards in largest FIs – Inadequate regulation of derivatives and other off-balance sheet activities

So what have we learned? There are cracks in the system, including: – Unregulated lenders – Inattention to correlated risks – Inability to resolve large nonbank FIs – Perceived emphasis on safety and soundness at expense of consumer protection – Insufficient prudential safeguards in largest FIs – Inadequate regulation of derivatives and other off-balance sheet activities

How would legislation fix these? By an extreme makeover: – – – – Systemic Risk Oversight Supervision of Systemically Significant Institutions Resolution of Systemically Significant Institutions Consumer Financial Protection Agency Consolidation Charter Consolidation Plus a lot else (securitization; ratings agency reform; insurance reform, etc. )

How would legislation fix these? By an extreme makeover: – – – – Systemic Risk Oversight Supervision of Systemically Significant Institutions Resolution of Systemically Significant Institutions Consumer Financial Protection Agency Consolidation Charter Consolidation Plus a lot else (securitization; ratings agency reform; insurance reform, etc. )

Systemic Risk Oversight Objective: Look for correlated risks that threaten the economy Options: • Form a new Oversight Council with limited powers (House) • Form a new agency with full powers (Dodd bill) • Vest existing agency with expanded authority (Fed most often mentioned) Issues: • How much authority should systemic risk overseer have? • Distract the Fed from conduct of monetary policy?

Systemic Risk Oversight Objective: Look for correlated risks that threaten the economy Options: • Form a new Oversight Council with limited powers (House) • Form a new agency with full powers (Dodd bill) • Vest existing agency with expanded authority (Fed most often mentioned) Issues: • How much authority should systemic risk overseer have? • Distract the Fed from conduct of monetary policy?

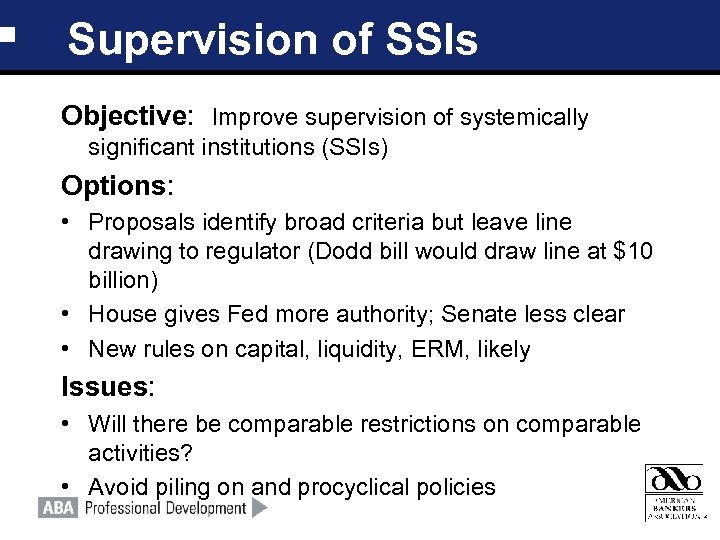

Supervision of SSIs Objective: Improve supervision of systemically significant institutions (SSIs) Options: • Proposals identify broad criteria but leave line drawing to regulator (Dodd bill would draw line at $10 billion) • House gives Fed more authority; Senate less clear • New rules on capital, liquidity, ERM, likely Issues: • Will there be comparable restrictions on comparable activities? • Avoid piling on and procyclical policies

Supervision of SSIs Objective: Improve supervision of systemically significant institutions (SSIs) Options: • Proposals identify broad criteria but leave line drawing to regulator (Dodd bill would draw line at $10 billion) • House gives Fed more authority; Senate less clear • New rules on capital, liquidity, ERM, likely Issues: • Will there be comparable restrictions on comparable activities? • Avoid piling on and procyclical policies

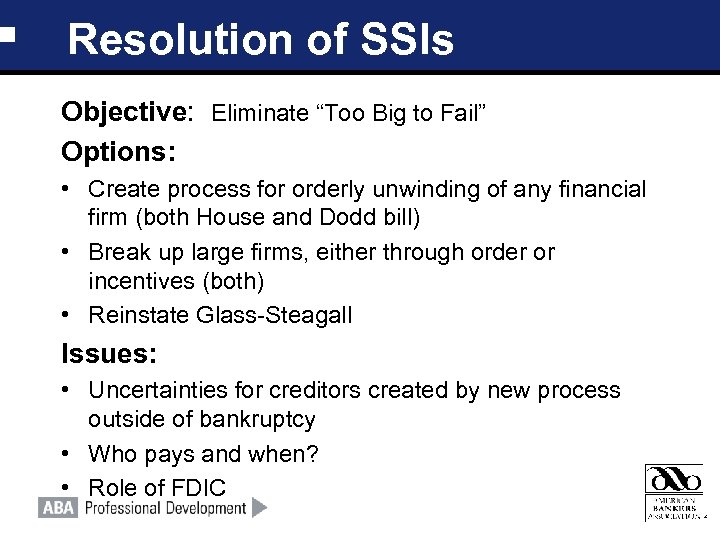

Resolution of SSIs Objective: Eliminate “Too Big to Fail” Options: • Create process for orderly unwinding of any financial firm (both House and Dodd bill) • Break up large firms, either through order or incentives (both) • Reinstate Glass-Steagall Issues: • Uncertainties for creditors created by new process outside of bankruptcy • Who pays and when? • Role of FDIC

Resolution of SSIs Objective: Eliminate “Too Big to Fail” Options: • Create process for orderly unwinding of any financial firm (both House and Dodd bill) • Break up large firms, either through order or incentives (both) • Reinstate Glass-Steagall Issues: • Uncertainties for creditors created by new process outside of bankruptcy • Who pays and when? • Role of FDIC

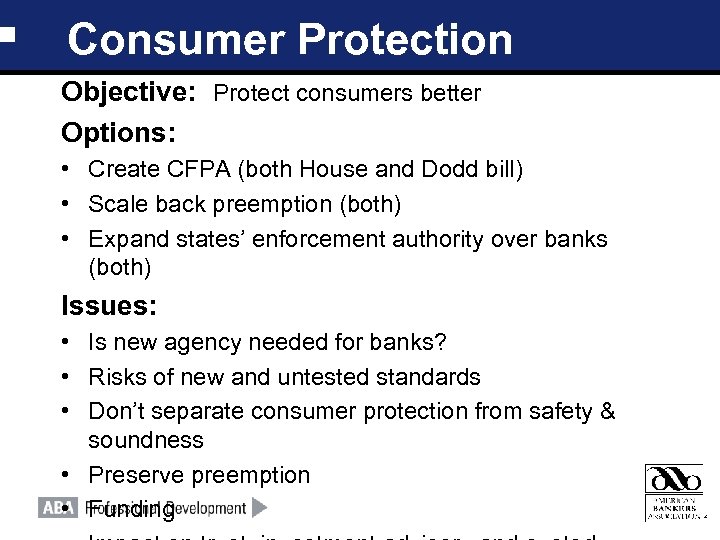

Consumer Protection Objective: Protect consumers better Options: • Create CFPA (both House and Dodd bill) • Scale back preemption (both) • Expand states’ enforcement authority over banks (both) Issues: • Is new agency needed for banks? • Risks of new and untested standards • Don’t separate consumer protection from safety & soundness • Preserve preemption • Funding

Consumer Protection Objective: Protect consumers better Options: • Create CFPA (both House and Dodd bill) • Scale back preemption (both) • Expand states’ enforcement authority over banks (both) Issues: • Is new agency needed for banks? • Risks of new and untested standards • Don’t separate consumer protection from safety & soundness • Preserve preemption • Funding

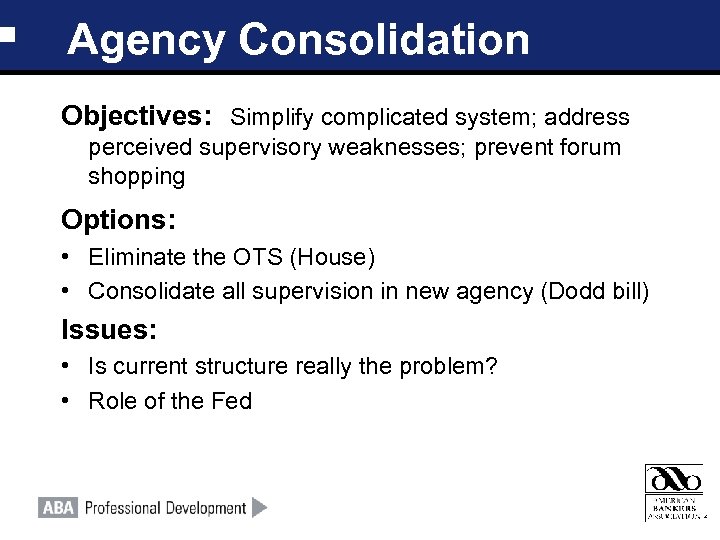

Agency Consolidation Objectives: Simplify complicated system; address perceived supervisory weaknesses; prevent forum shopping Options: • Eliminate the OTS (House) • Consolidate all supervision in new agency (Dodd bill) Issues: • Is current structure really the problem? • Role of the Fed

Agency Consolidation Objectives: Simplify complicated system; address perceived supervisory weaknesses; prevent forum shopping Options: • Eliminate the OTS (House) • Consolidate all supervision in new agency (Dodd bill) Issues: • Is current structure really the problem? • Role of the Fed

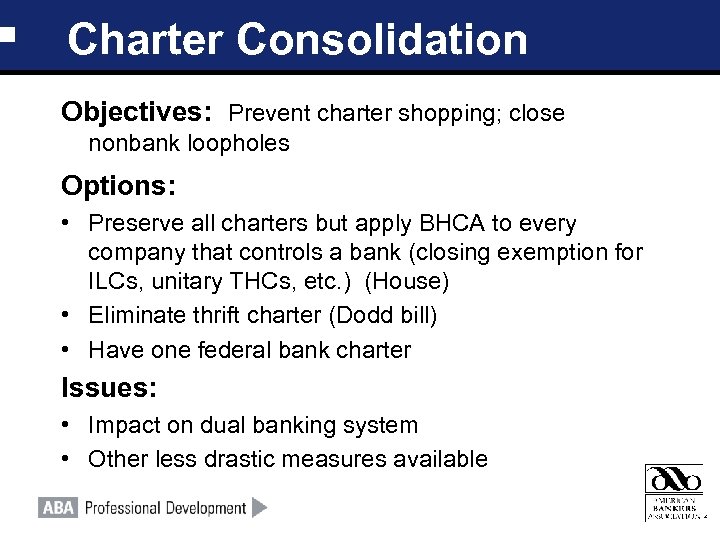

Charter Consolidation Objectives: Prevent charter shopping; close nonbank loopholes Options: • Preserve all charters but apply BHCA to every company that controls a bank (closing exemption for ILCs, unitary THCs, etc. ) (House) • Eliminate thrift charter (Dodd bill) • Have one federal bank charter Issues: • Impact on dual banking system • Other less drastic measures available

Charter Consolidation Objectives: Prevent charter shopping; close nonbank loopholes Options: • Preserve all charters but apply BHCA to every company that controls a bank (closing exemption for ILCs, unitary THCs, etc. ) (House) • Eliminate thrift charter (Dodd bill) • Have one federal bank charter Issues: • Impact on dual banking system • Other less drastic measures available

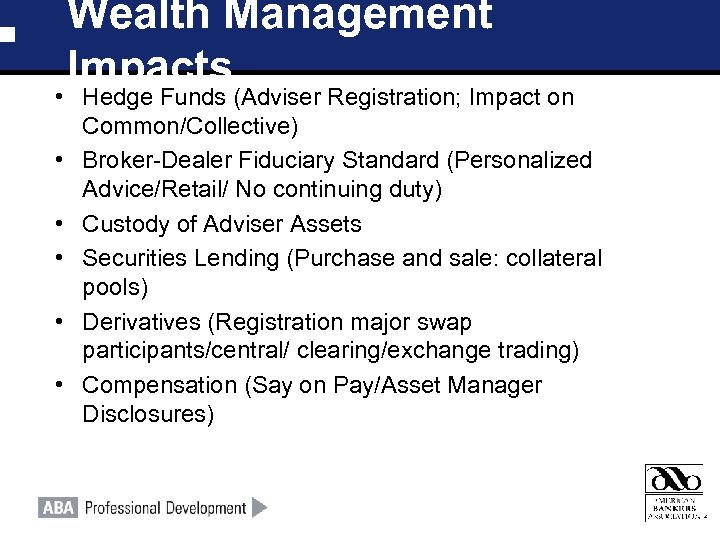

Wealth Management Impacts • Hedge Funds (Adviser Registration; Impact on Common/Collective) • Broker-Dealer Fiduciary Standard (Personalized Advice/Retail/ No continuing duty) • Custody of Adviser Assets • Securities Lending (Purchase and sale: collateral pools) • Derivatives (Registration major swap participants/central/ clearing/exchange trading) • Compensation (Say on Pay/Asset Manager Disclosures)

Wealth Management Impacts • Hedge Funds (Adviser Registration; Impact on Common/Collective) • Broker-Dealer Fiduciary Standard (Personalized Advice/Retail/ No continuing duty) • Custody of Adviser Assets • Securities Lending (Purchase and sale: collateral pools) • Derivatives (Registration major swap participants/central/ clearing/exchange trading) • Compensation (Say on Pay/Asset Manager Disclosures)

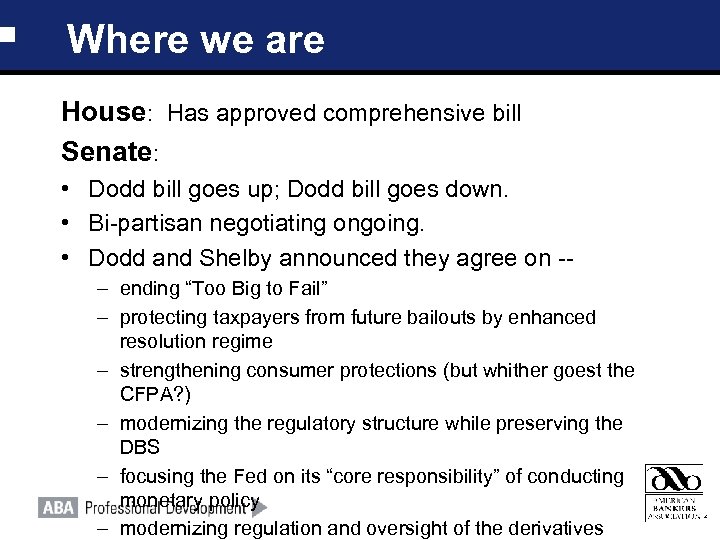

Where we are House: Has approved comprehensive bill Senate: • Dodd bill goes up; Dodd bill goes down. • Bi-partisan negotiating ongoing. • Dodd and Shelby announced they agree on -– ending “Too Big to Fail” – protecting taxpayers from future bailouts by enhanced resolution regime – strengthening consumer protections (but whither goest the CFPA? ) – modernizing the regulatory structure while preserving the DBS – focusing the Fed on its “core responsibility” of conducting monetary policy – modernizing regulation and oversight of the derivatives

Where we are House: Has approved comprehensive bill Senate: • Dodd bill goes up; Dodd bill goes down. • Bi-partisan negotiating ongoing. • Dodd and Shelby announced they agree on -– ending “Too Big to Fail” – protecting taxpayers from future bailouts by enhanced resolution regime – strengthening consumer protections (but whither goest the CFPA? ) – modernizing the regulatory structure while preserving the DBS – focusing the Fed on its “core responsibility” of conducting monetary policy – modernizing regulation and oversight of the derivatives

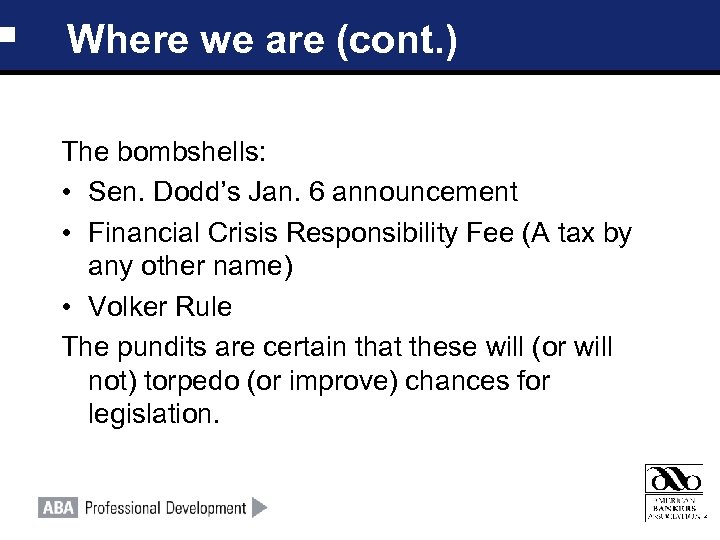

Where we are (cont. ) The bombshells: • Sen. Dodd’s Jan. 6 announcement • Financial Crisis Responsibility Fee (A tax by any other name) • Volker Rule The pundits are certain that these will (or will not) torpedo (or improve) chances for legislation.

Where we are (cont. ) The bombshells: • Sen. Dodd’s Jan. 6 announcement • Financial Crisis Responsibility Fee (A tax by any other name) • Volker Rule The pundits are certain that these will (or will not) torpedo (or improve) chances for legislation.

Where we are (cont. ) So what will happen?

Where we are (cont. ) So what will happen?

Parting wisdom: “You’ve got to be very careful if you don’t know where you are going, because you might not get there. ” Yogi Berra

Parting wisdom: “You’ve got to be very careful if you don’t know where you are going, because you might not get there. ” Yogi Berra

Addendum- in the interest of delivering what was promised!

Addendum- in the interest of delivering what was promised!

Tax • Estate and GST –Carry-over –States response • Gift Tax • Compromise

Tax • Estate and GST –Carry-over –States response • Gift Tax • Compromise

Tax (cont. ) • Report of Foreign Bank and Financial Accounts (FBAR) – Owners and signing authority over foreign financial accounts – Foreign financial accounts – Bank, Brokerage, Mutual Funds – Valued>$10, 000

Tax (cont. ) • Report of Foreign Bank and Financial Accounts (FBAR) – Owners and signing authority over foreign financial accounts – Foreign financial accounts – Bank, Brokerage, Mutual Funds – Valued>$10, 000

Tax (cont. ) • Cost basis Reporting – Stock-purchased after 12/31/10 – Mutual funds- purchased after 12/31/11 – Bonds- purchased after 12/31/12 • Unbundling of Trust Fees

Tax (cont. ) • Cost basis Reporting – Stock-purchased after 12/31/10 – Mutual funds- purchased after 12/31/11 – Bonds- purchased after 12/31/12 • Unbundling of Trust Fees

Questions? Sally Miller smiller@aba. com (202) 663 -5325

Questions? Sally Miller smiller@aba. com (202) 663 -5325