Warm-Up How much are you willing to pay for gas? Would you be happy if the price were less? Why?

Warm-Up How much are you willing to pay for gas? Would you be happy if the price were less? Why?

CONSUMER & PRODUCER SURPLUS Chapter 4: Consumer and Producer Surplus (pages 94 -113)

CONSUMER & PRODUCER SURPLUS Chapter 4: Consumer and Producer Surplus (pages 94 -113)

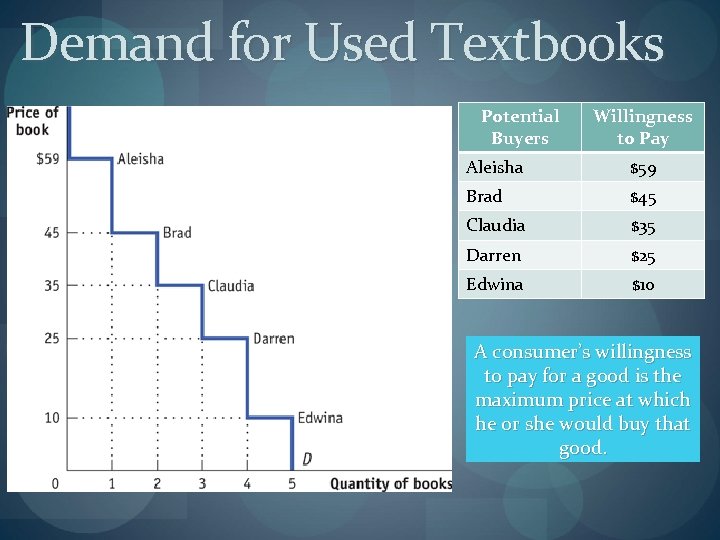

Demand for Used Textbooks Potential Buyers Willingness to Pay Aleisha $59 Brad $45 Claudia $35 Darren $25 Edwina $10 A consumer’s willingness to pay for a good is the maximum price at which he or she would buy that good.

Demand for Used Textbooks Potential Buyers Willingness to Pay Aleisha $59 Brad $45 Claudia $35 Darren $25 Edwina $10 A consumer’s willingness to pay for a good is the maximum price at which he or she would buy that good.

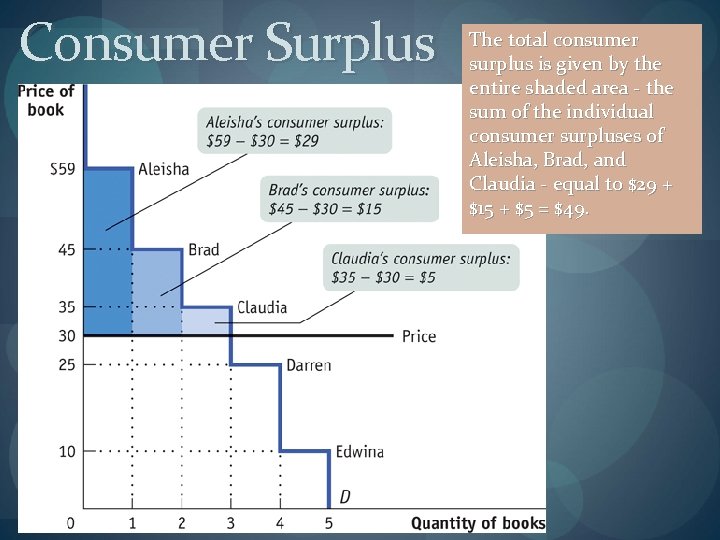

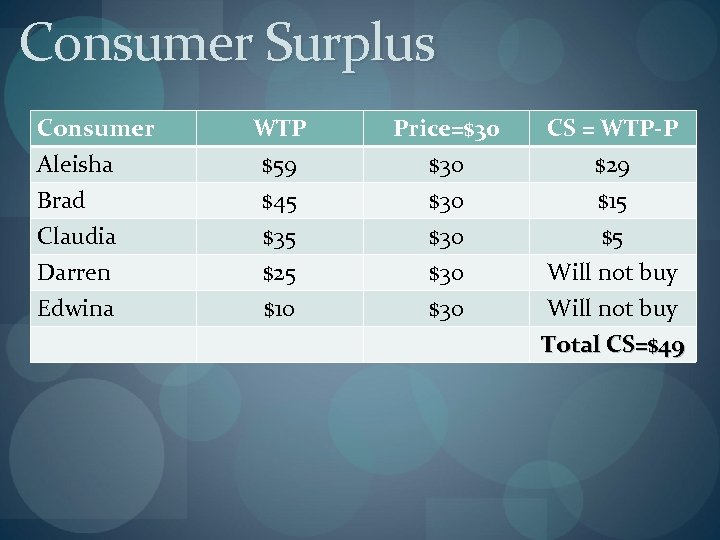

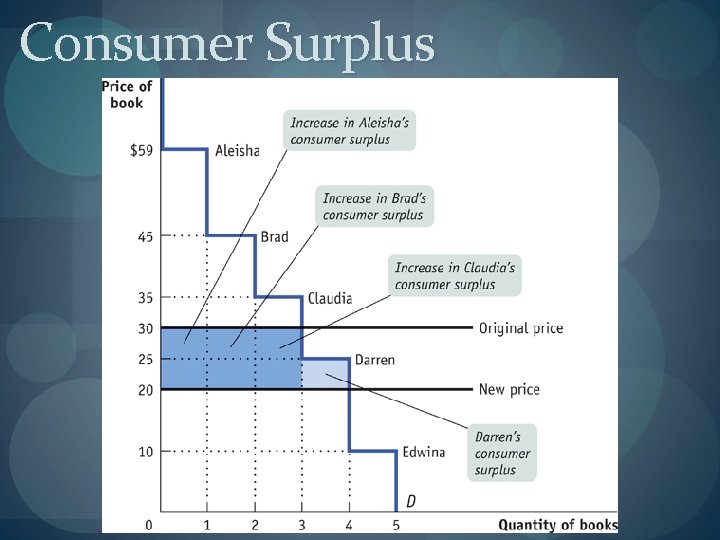

Consumer Surplus The total consumer surplus is given by the entire shaded area - the sum of the individual consumer surpluses of Aleisha, Brad, and Claudia - equal to $29 + $15 + $5 = $49.

Consumer Surplus The total consumer surplus is given by the entire shaded area - the sum of the individual consumer surpluses of Aleisha, Brad, and Claudia - equal to $29 + $15 + $5 = $49.

Consumer Surplus Consumer Aleisha Brad Claudia Darren Edwina WTP $59 $45 $35 $25 $10 Price=$30 $30 $30 CS = WTP-P $29 $15 $5 Will not buy Total CS=$49

Consumer Surplus Consumer Aleisha Brad Claudia Darren Edwina WTP $59 $45 $35 $25 $10 Price=$30 $30 $30 CS = WTP-P $29 $15 $5 Will not buy Total CS=$49

Consumer Surplus

Consumer Surplus

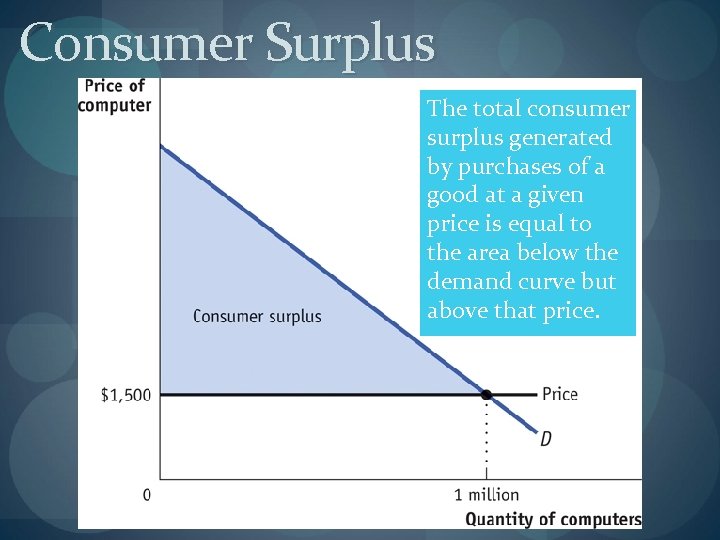

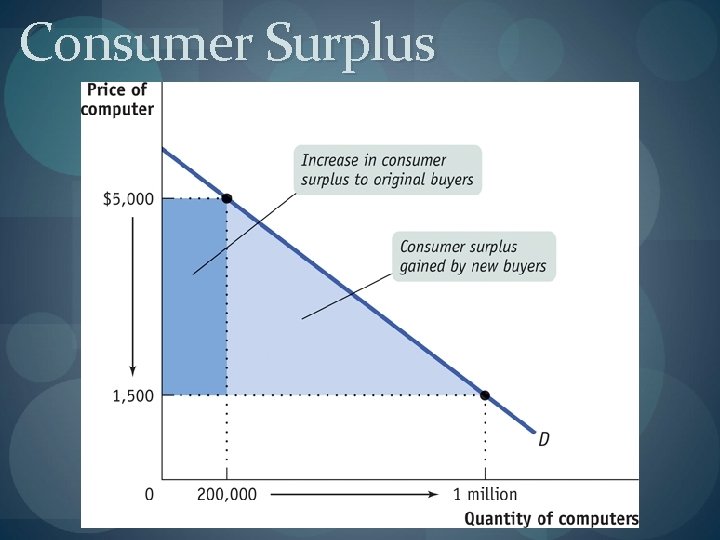

Consumer Surplus The total consumer surplus generated by purchases of a good at a given price is equal to the area below the demand curve but above that price.

Consumer Surplus The total consumer surplus generated by purchases of a good at a given price is equal to the area below the demand curve but above that price.

Consumer Surplus

Consumer Surplus

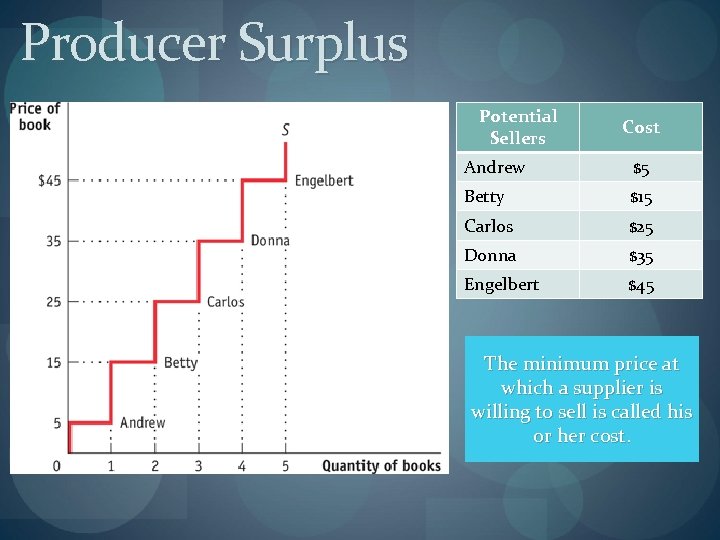

Producer Surplus Potential Sellers Cost Andrew $5 Betty $15 Carlos $25 Donna $35 Engelbert $45 The minimum price at which a supplier is willing to sell is called his or her cost.

Producer Surplus Potential Sellers Cost Andrew $5 Betty $15 Carlos $25 Donna $35 Engelbert $45 The minimum price at which a supplier is willing to sell is called his or her cost.

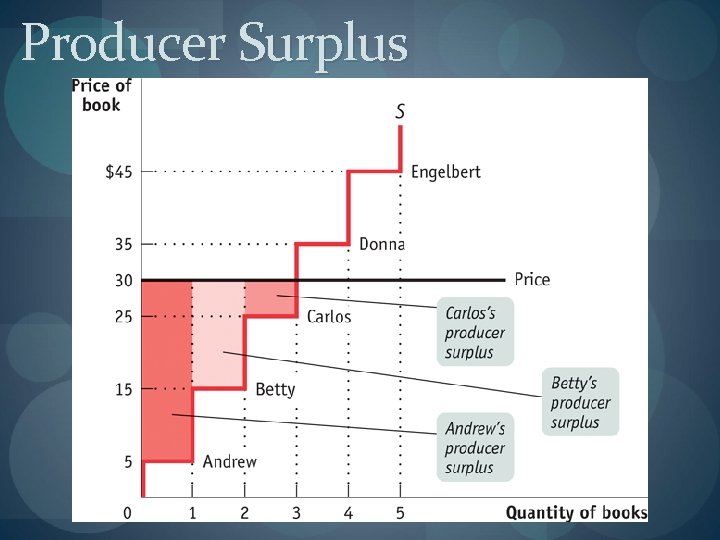

Producer Surplus

Producer Surplus

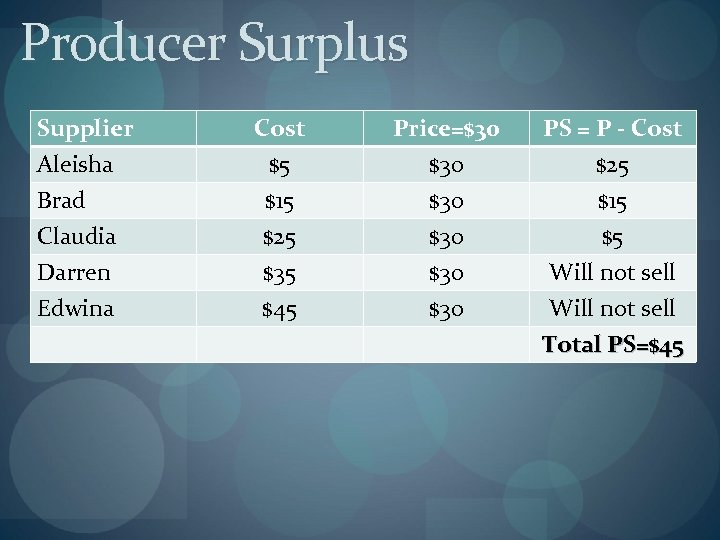

Producer Surplus Supplier Aleisha Brad Claudia Darren Edwina Cost $5 $15 $25 $35 $45 Price=$30 $30 $30 PS = P - Cost $25 $15 $5 Will not sell Total PS=$45

Producer Surplus Supplier Aleisha Brad Claudia Darren Edwina Cost $5 $15 $25 $35 $45 Price=$30 $30 $30 PS = P - Cost $25 $15 $5 Will not sell Total PS=$45

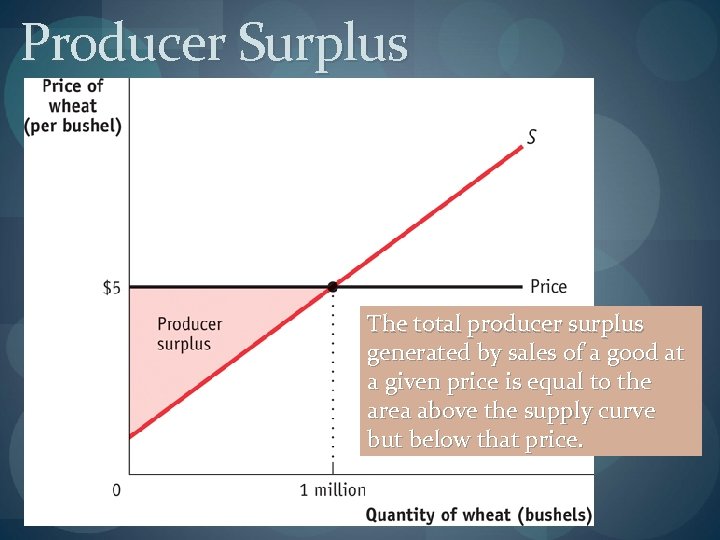

Producer Surplus The total producer surplus generated by sales of a good at a given price is equal to the area above the supply curve but below that price.

Producer Surplus The total producer surplus generated by sales of a good at a given price is equal to the area above the supply curve but below that price.

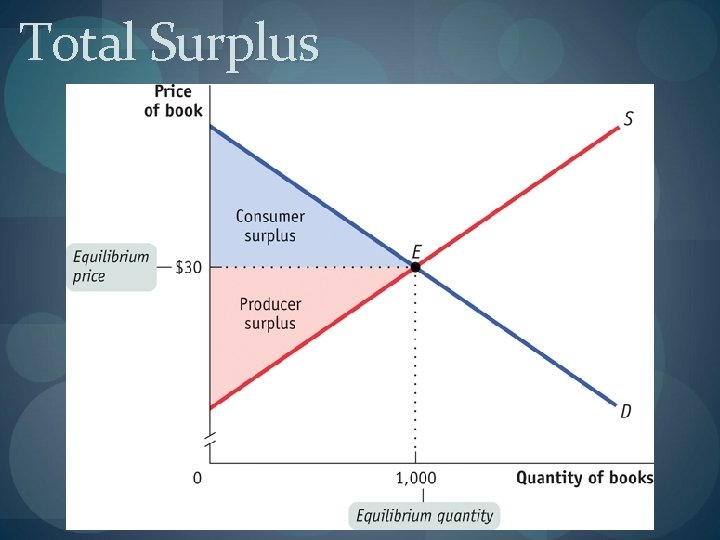

Total Surplus

Total Surplus

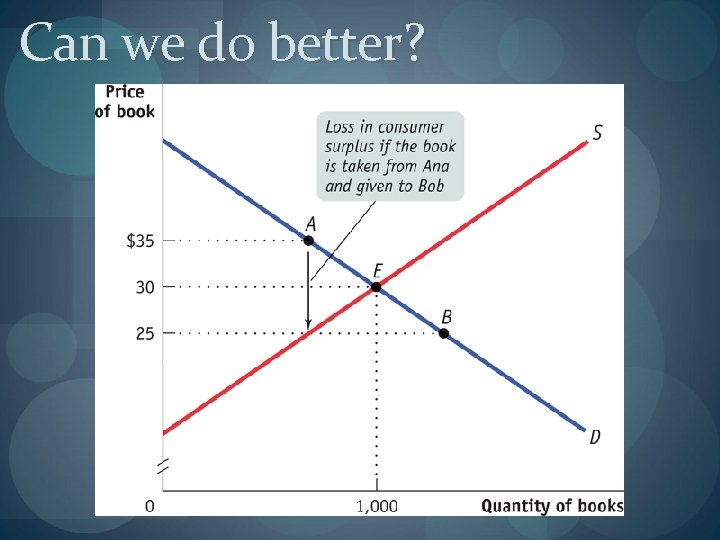

Can we do better?

Can we do better?

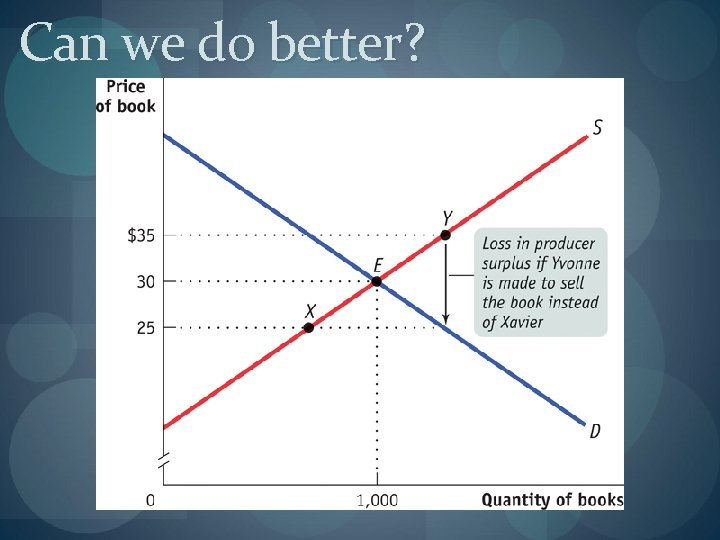

Can we do better?

Can we do better?

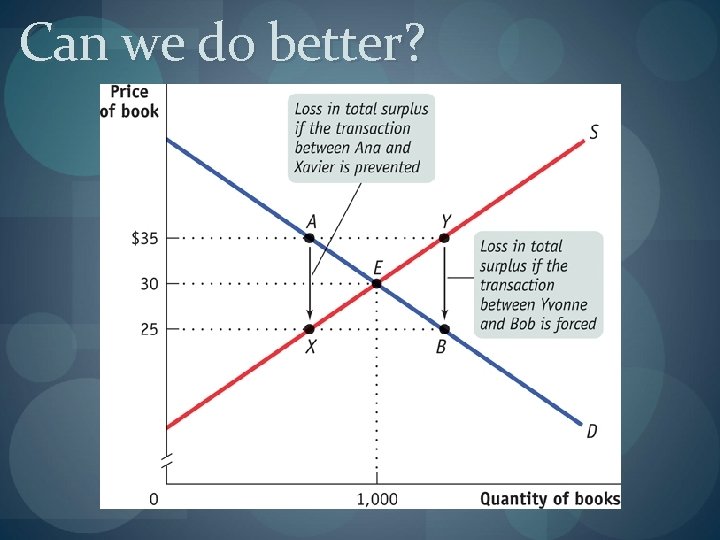

Can we do better?

Can we do better?

EXCISE TAXES AND EFFICIENCY

EXCISE TAXES AND EFFICIENCY

Excise Taxes Tax on each unit of a good or service sold EXAMPLES: Gas tax, cigarette tax Disrupts market efficiency

Excise Taxes Tax on each unit of a good or service sold EXAMPLES: Gas tax, cigarette tax Disrupts market efficiency

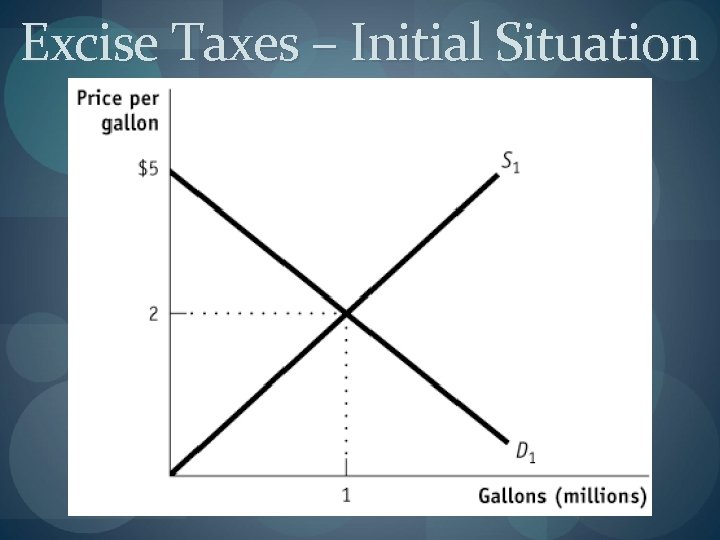

Excise Taxes – Initial Situation

Excise Taxes – Initial Situation

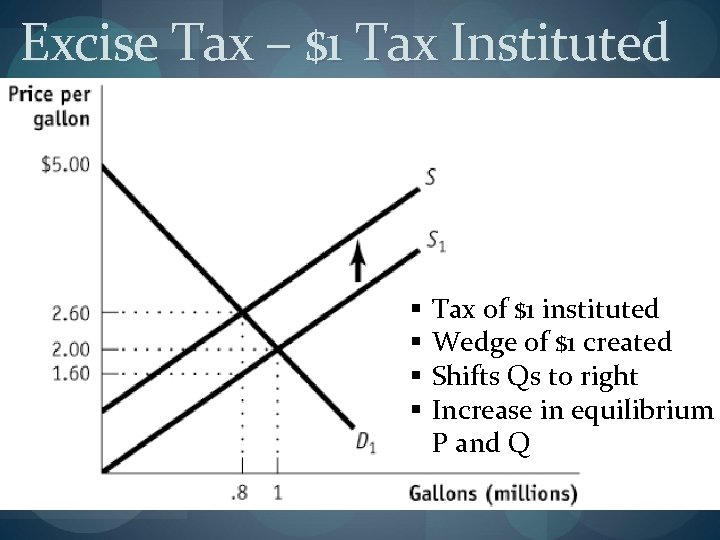

Excise Tax – $1 Tax Instituted § § Tax of $1 instituted Wedge of $1 created Shifts Qs to right Increase in equilibrium P and Q

Excise Tax – $1 Tax Instituted § § Tax of $1 instituted Wedge of $1 created Shifts Qs to right Increase in equilibrium P and Q

Excise Taxes Price paid by consumers/suppliers called TAX INCIDENCE Wedge = size of tax Size of tax incidence depends on elasticity

Excise Taxes Price paid by consumers/suppliers called TAX INCIDENCE Wedge = size of tax Size of tax incidence depends on elasticity

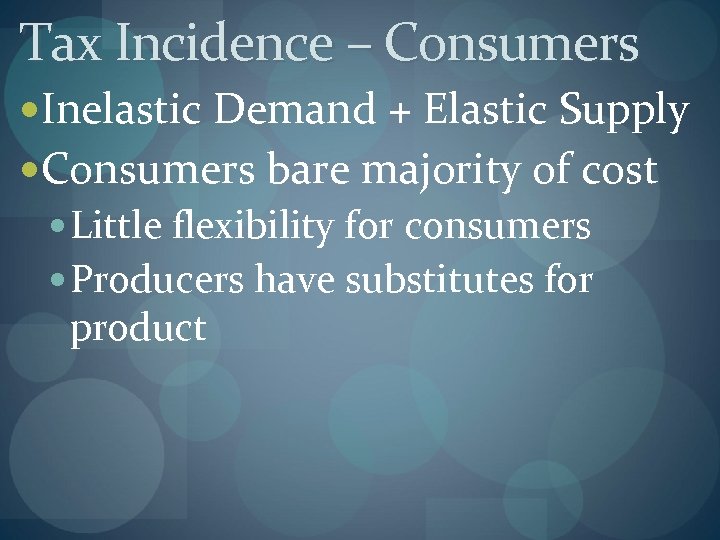

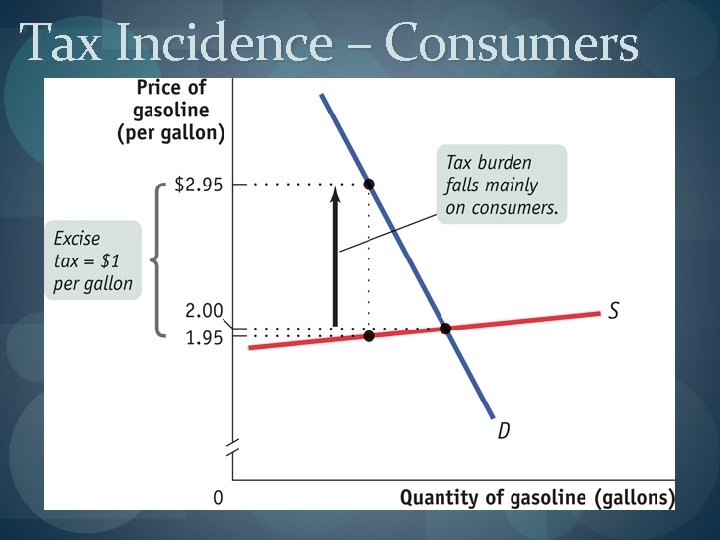

Tax Incidence – Consumers Inelastic Demand + Elastic Supply Consumers bare majority of cost Little flexibility for consumers Producers have substitutes for product

Tax Incidence – Consumers Inelastic Demand + Elastic Supply Consumers bare majority of cost Little flexibility for consumers Producers have substitutes for product

Tax Incidence – Consumers

Tax Incidence – Consumers

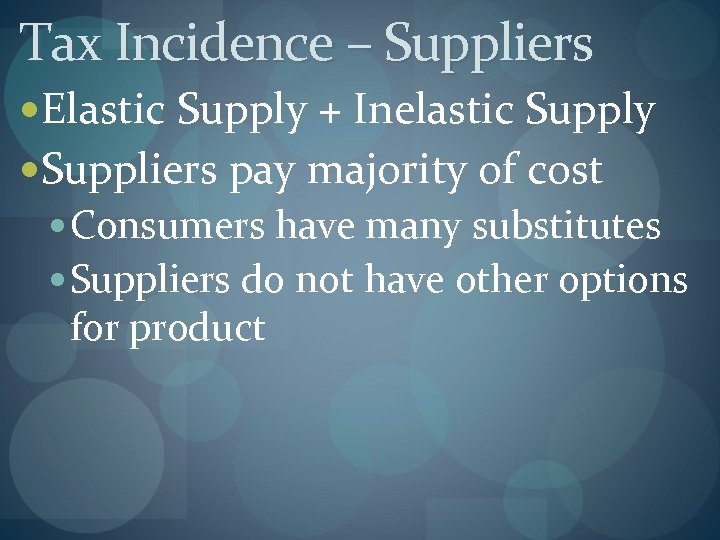

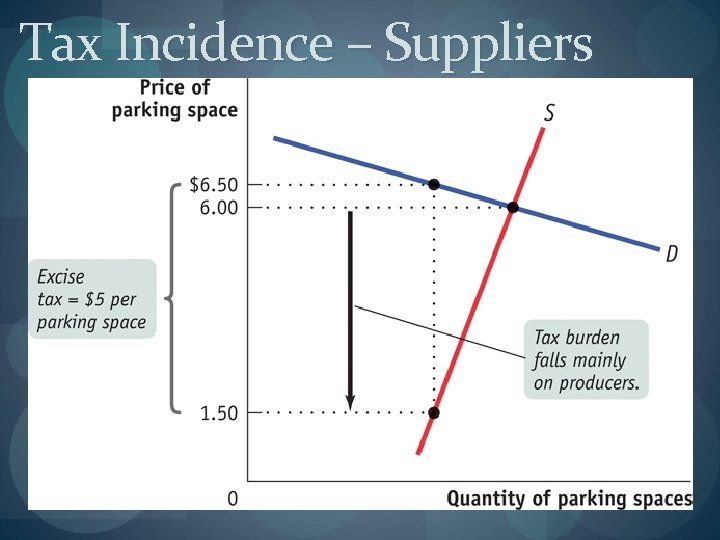

Tax Incidence – Suppliers Elastic Supply + Inelastic Supply Suppliers pay majority of cost Consumers have many substitutes Suppliers do not have other options for product

Tax Incidence – Suppliers Elastic Supply + Inelastic Supply Suppliers pay majority of cost Consumers have many substitutes Suppliers do not have other options for product

Tax Incidence – Suppliers

Tax Incidence – Suppliers

Benefits and Costs … Revenue for government Necessary for gov’t to function Pays for parks, roads, fire, police, etc.

Benefits and Costs … Revenue for government Necessary for gov’t to function Pays for parks, roads, fire, police, etc.

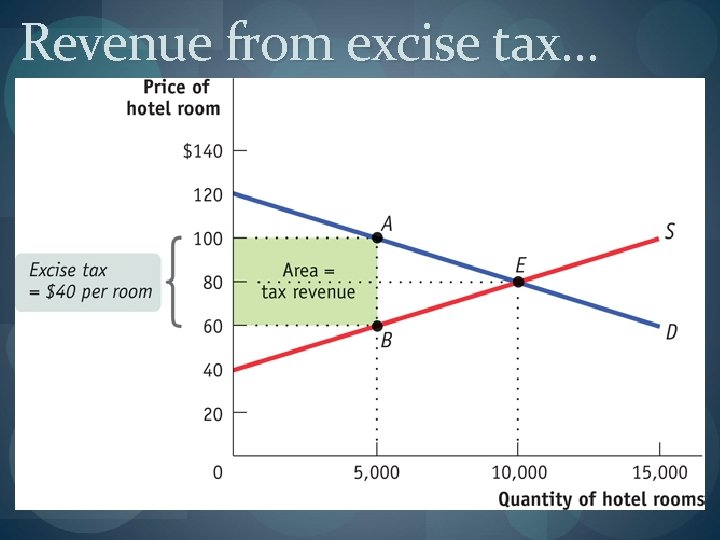

Revenue from excise tax…

Revenue from excise tax…

Benefits and Costs … Revenue for government Necessary for gov’t to function Pays for parks, roads, fire, police, etc. Deadweight loss Lost transactions eliminate producer and consumer surplus

Benefits and Costs … Revenue for government Necessary for gov’t to function Pays for parks, roads, fire, police, etc. Deadweight loss Lost transactions eliminate producer and consumer surplus

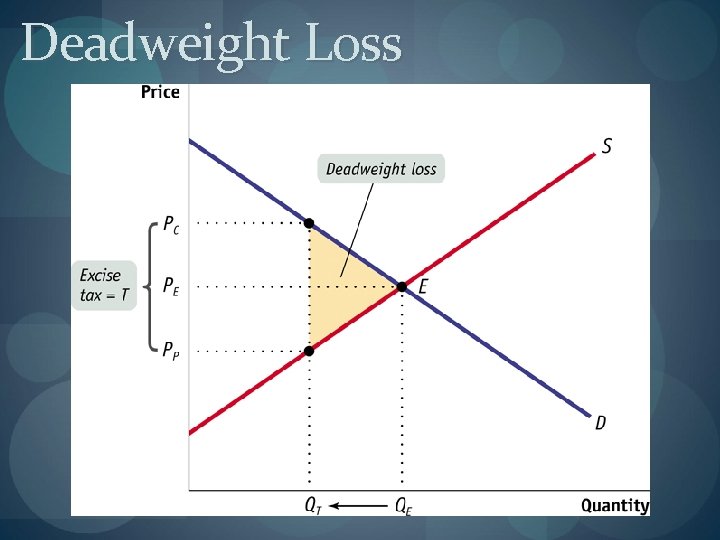

Deadweight Loss

Deadweight Loss

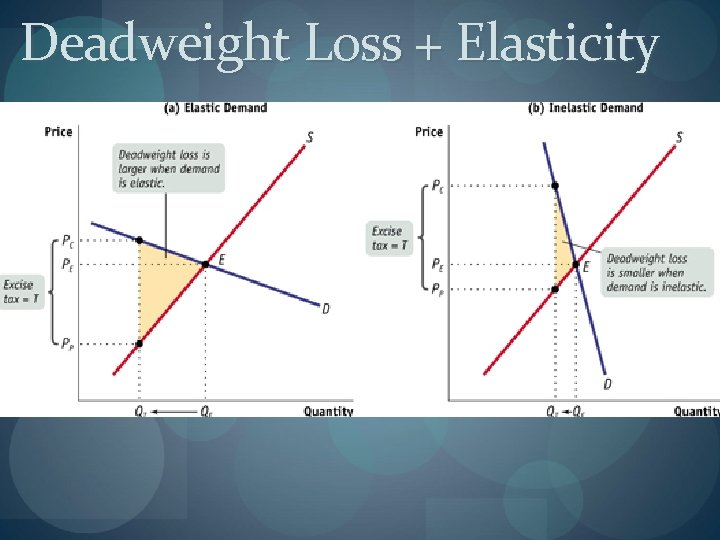

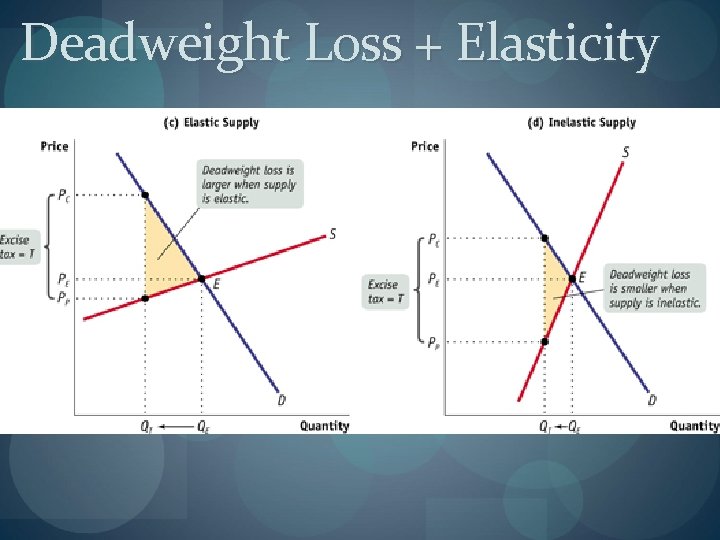

Deadweight Loss + Elasticity

Deadweight Loss + Elasticity

Deadweight Loss + Elasticity

Deadweight Loss + Elasticity