720ac776f3a25b4ece788ac77e57a2ec.ppt

- Количество слайдов: 30

WALGREEN CO. Matt Byford Brandon Honey Shivam Khanna Joe Vaccaro October 28, 2008

Agenda ► Company Overview ► Macroeconomic Overview ► Industry Overview ► Recent Developments ► Forecasting/Expectations ► Valuation of Walgreens ► Recommendation

Company Overview ► Founded in 1901 by Charles Walgreen § 1 st store was in Chicago ► 226, 000 employees as of 8/31/2007 ► Goal is to have 7, 000 stores open by 2009

Company Overview ► Walgreen company operates retail drug store chains that are engaged in the retail sale of prescription drugs, non-prescription drugs, and general merchandise. ► In 2008, it opened 561 net new stores for a total of 6443 Walgreens in 49 states, District of Columbia, and in Puerto Rico. ► It is the fastest growing retailer in the US, and is the 2 nd largest drugstore chain behind CVS. ► Ranked 44 th on the Fortune 500 list of the largest US-based companies. ► On the list of Fortune’s magazine’s Most Admired Companies in America for the last 14 consecutive years.

Company Overview ► A. G. Mc. Nally § Chairman of the Board since 2008 § Chief Executive Officer since 2008 § Board member sine 1999 ► Gregory Wasson § President and Chief Operating Officer since 2007 ► Jeff Rein retired in October 2008 § Chairman and Chief Executive officer since 2003 ► William Rudolphsen § Senior Vice President and Chief Financial Officer since 2004, new role as Chief Risk Officer ► Has been with Walgreens since 1977

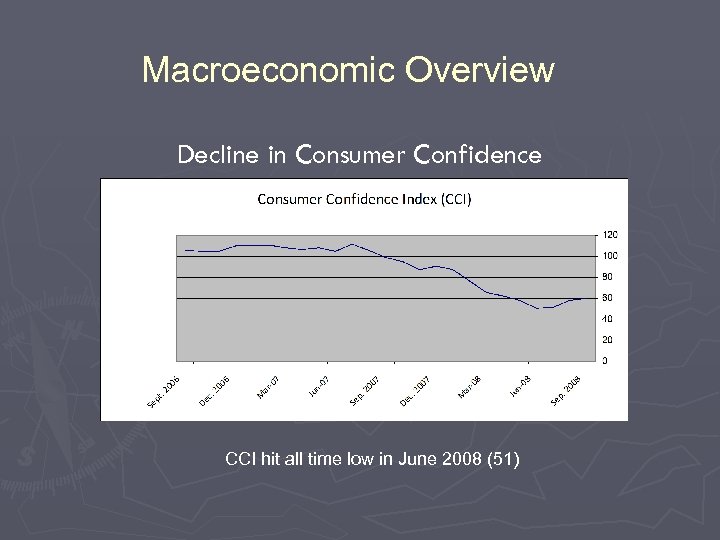

Macroeconomic Overview Decline in Consumer Confidence CCI hit all time low in June 2008 (51)

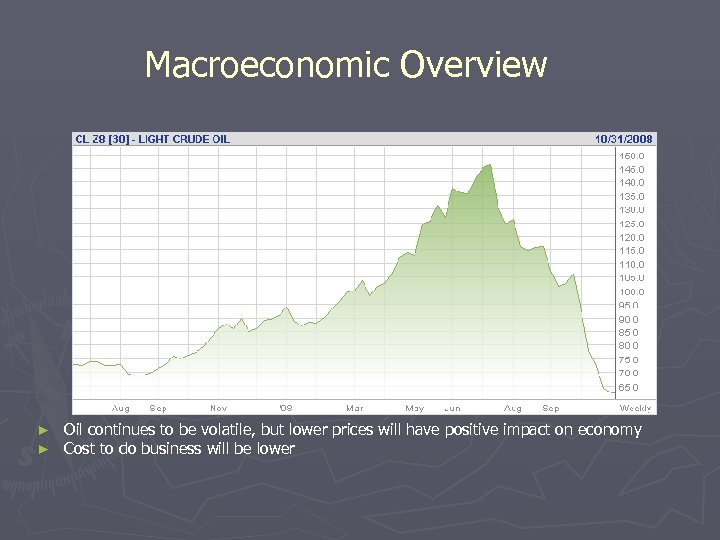

Macroeconomic Overview ► ► Oil continues to be volatile, but lower prices will have positive impact on economy Cost to do business will be lower

Strategy ► Organic store growth ► Relocate, remodel ► Densely-populated areas like Southern California and Northeast Invest heavily in high-tech store and distribution systems which drive service up and costs down ► Acquisitions where there are synergies ► Healthcare offerings beyond that of a traditional pharmacy ► § Offer an online drugstore web site totally integrated with retail stores § Take Care Healthcare Systems ► ► Increase market share in front-end of stores Must continue to find ways to leverage the benefits of scale without losing the ability to react quickly to changes in customer needs

Strategy ► Growth § Walgreens is currently increasing their net stores operated by approximately 1 store every 16 hours § The company, which currently operates 6, 443 stores, plans to operate at least 7, 000 stores by 2009 ►See room for organic growth to 13, 000 stores

Innovations ► Introduced freestanding stores in early 1990 s with drive thru pharmacies ►Today, more than 80% of Walgreen Co. ’s stores have drive thru pharmacies ► Nation-wide 1 hour photo service ►Available at more than 98% of stores ► Touch tone prescription refills ► 50% of people live within 2 miles of a Walgreens

Drug Store Industry ► Highly Competitive Industry § Competition with other drugstore chains, independent drugstores, mail order prescription providers, internet pharmacies § Other competitors include various grocery stores, mass merchants, and dollar stores ► Main competitors: § CVS Corp. (CVS) § Rite Aid Corp. (RAD) § Wal-Mart (WMT) ► Pharmaceutical more than grocery department ► Now offers a $4 generic prescription plan § Drugstore. com

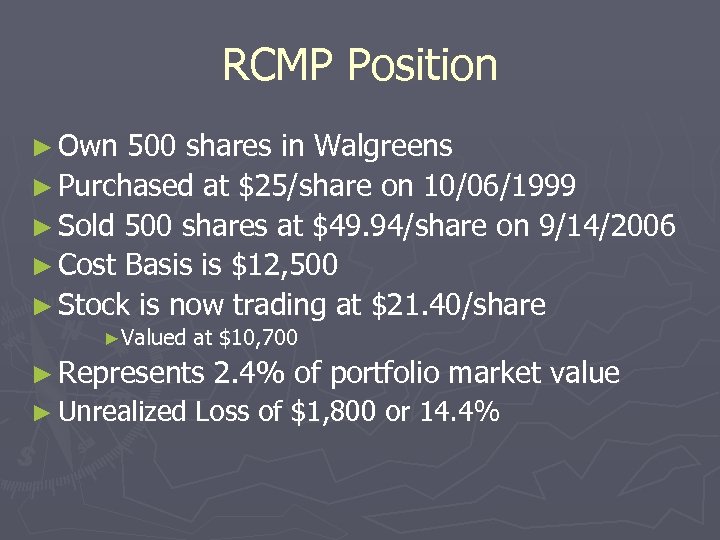

RCMP Position ► Own 500 shares in Walgreens ► Purchased at $25/share on 10/06/1999 ► Sold 500 shares at $49. 94/share on 9/14/2006 ► Cost Basis is $12, 500 ► Stock is now trading at $21. 40/share ►Valued at $10, 700 ► Represents 2. 4% of portfolio market value ► Unrealized Loss of $1, 800 or 14. 4%

Shareholder Base ► 67% of shares owned by institutional investors ► 125, 000 shares sold by insiders in last 6 months

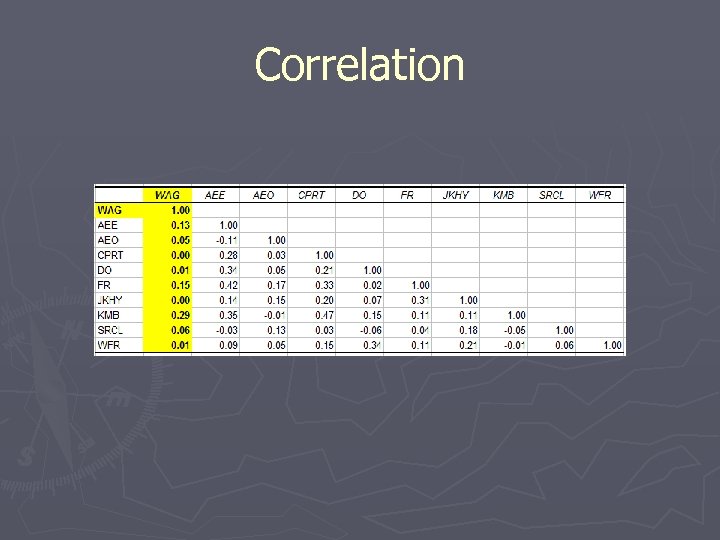

Correlation

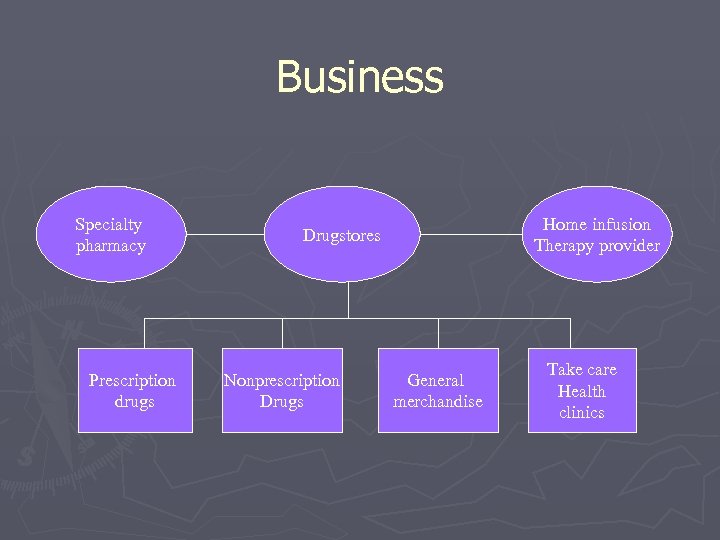

Business Specialty pharmacy Prescription drugs Home infusion Therapy provider Drugstores Nonprescription Drugs General merchandise Take care Health clinics

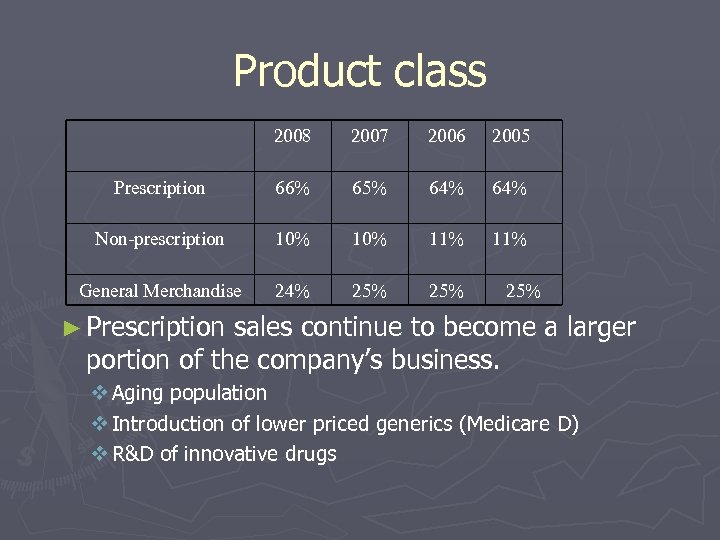

Product class 2008 2007 2006 2005 Prescription 66% 65% 64% Non-prescription 10% 11% General Merchandise 24% 25% 25% ► Prescription sales continue to become a larger portion of the company’s business. v Aging population v Introduction of lower priced generics (Medicare D) v R&D of innovative drugs

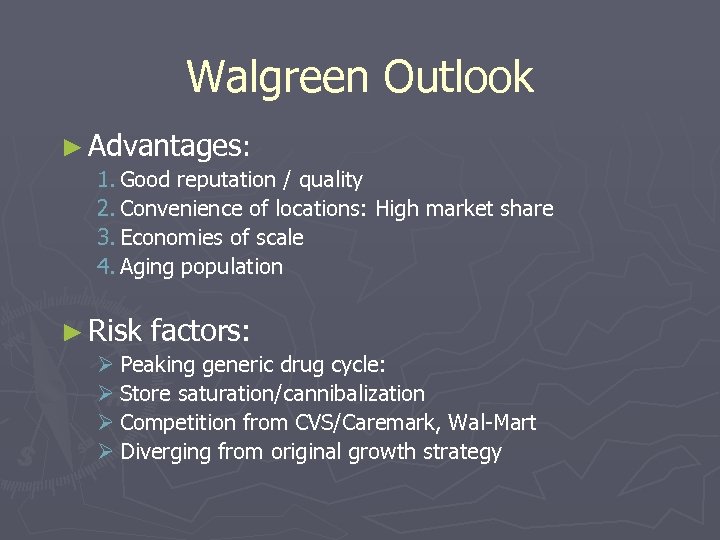

Walgreen Outlook ► Advantages: 1. Good reputation / quality 2. Convenience of locations: High market share 3. Economies of scale 4. Aging population ► Risk factors: Ø Peaking generic drug cycle: Ø Store saturation/cannibalization Ø Competition from CVS/Caremark, Wal-Mart Ø Diverging from original growth strategy

Porters Five Forces: Retail Drug Industry ► Rivalry: High § § § Competitive Industry Direct mail pharmacy benefit managers Grocery stores & big box retailers ► Threat of Substitutes: Low ► Bargaining Power of Buyers: Moderate ► Bargaining Power of Suppliers: Moderate ► Barriers to Entry: Moderate § Few alternative choices for products sold at Walgreens/Drug Retailers § Insurance companies § Walgreens receives premium prices for front end convenience items § Watch government regulations / upcoming election § High initial capital expenditures & supplier relationship required

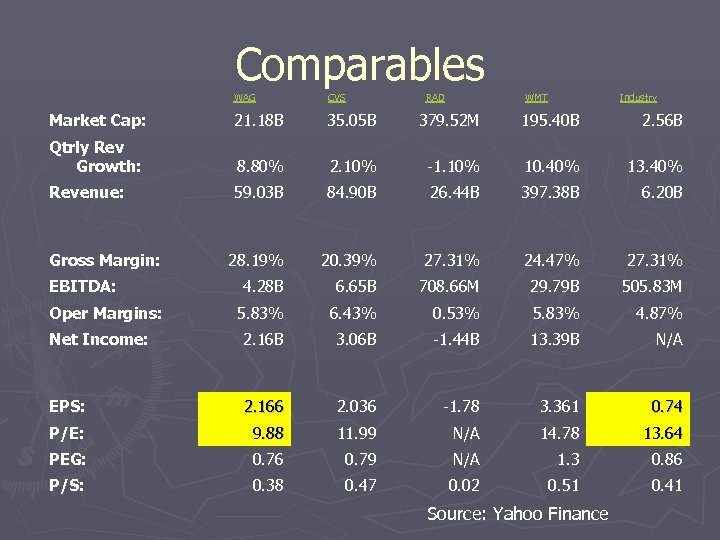

Comparables WAG CVS Market Cap: 21. 18 B 35. 05 B 379. 52 M 195. 40 B 2. 56 B Qtrly Rev Growth: 8. 80% 2. 10% -1. 10% 10. 40% 13. 40% Revenue: 59. 03 B 84. 90 B 26. 44 B 397. 38 B 6. 20 B 28. 19% 20. 39% 27. 31% 24. 47% 27. 31% 4. 28 B 6. 65 B 708. 66 M 29. 79 B 505. 83 M 5. 83% 6. 43% 0. 53% 5. 83% 4. 87% Net Income: 2. 16 B 3. 06 B -1. 44 B 13. 39 B N/A EPS: 2. 166 2. 036 -1. 78 3. 361 0. 74 P/E: 9. 88 11. 99 N/A 14. 78 13. 64 PEG: 0. 76 0. 79 N/A 1. 3 0. 86 P/S: 0. 38 0. 47 0. 02 0. 51 0. 41 Gross Margin: EBITDA: Oper Margins: RAD WMT Industry Source: Yahoo Finance

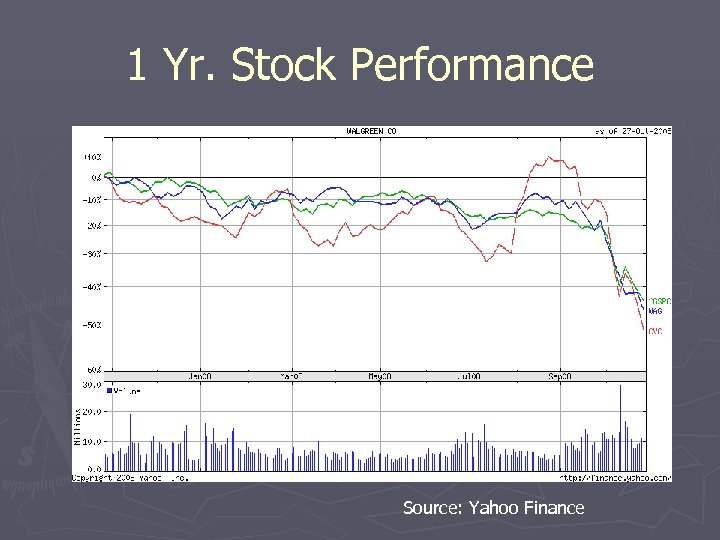

1 Yr. Stock Performance Source: Yahoo Finance

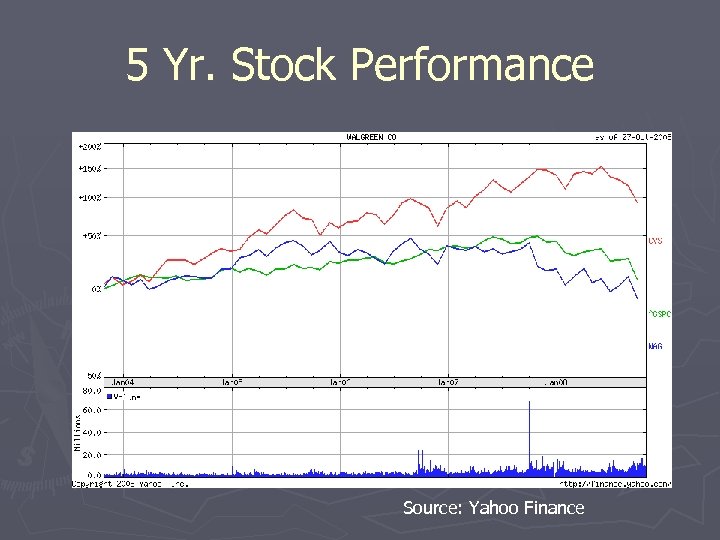

5 Yr. Stock Performance Source: Yahoo Finance

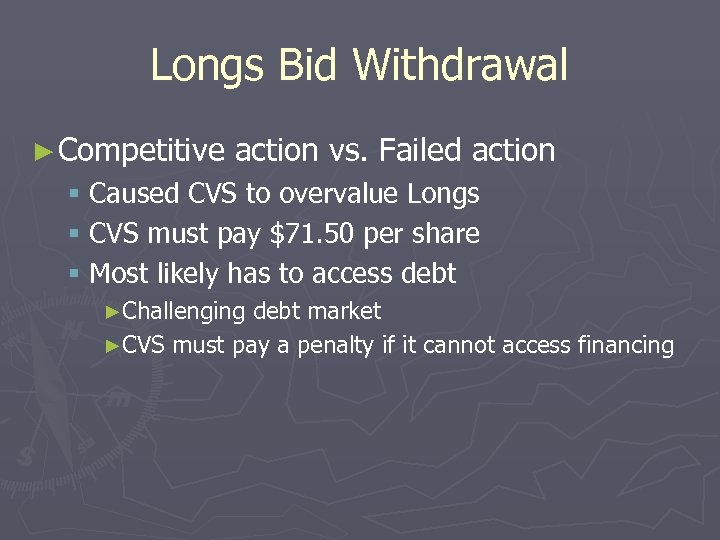

Longs Bid Withdrawal ► Competitive action vs. Failed action § Caused CVS to overvalue Longs § CVS must pay $71. 50 per share § Most likely has to access debt ►Challenging debt market ►CVS must pay a penalty if it cannot access financing

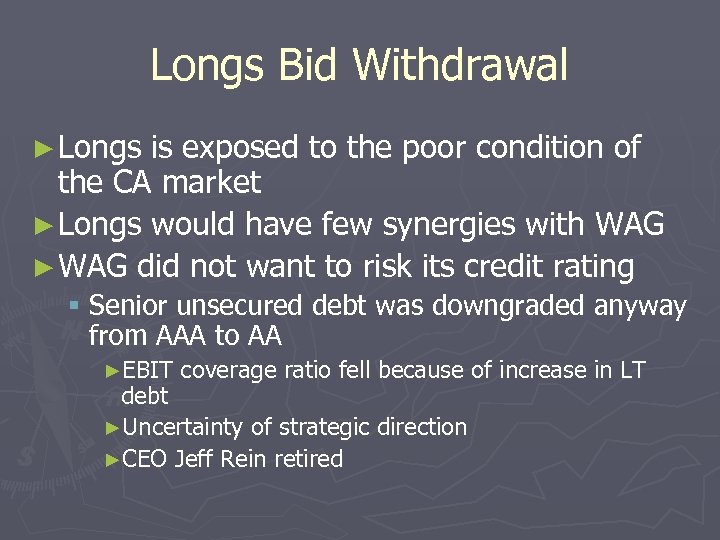

Longs Bid Withdrawal ► Longs is exposed to the poor condition of the CA market ► Longs would have few synergies with WAG ► WAG did not want to risk its credit rating § Senior unsecured debt was downgraded anyway from AAA to AA ►EBIT coverage ratio fell because of increase in LT debt ►Uncertainty of strategic direction ►CEO Jeff Rein retired

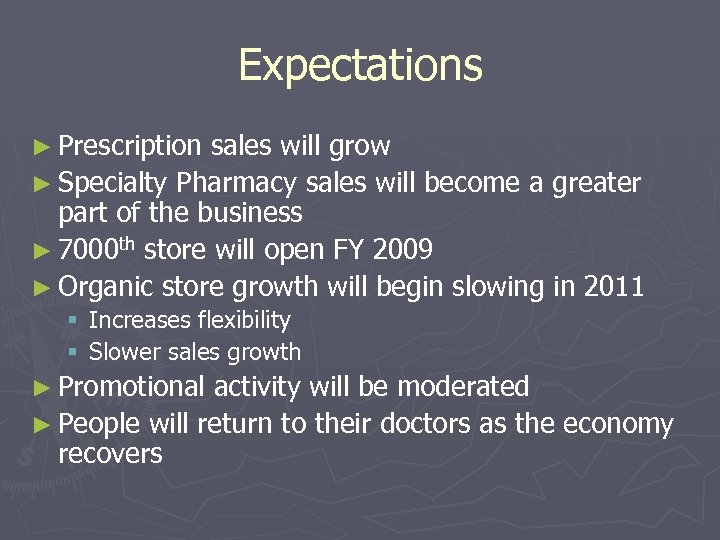

Expectations ► Prescription sales will grow ► Specialty Pharmacy sales will become a greater part of the business ► 7000 th store will open FY 2009 ► Organic store growth will begin slowing in 2011 § Increases flexibility § Slower sales growth ► Promotional activity will be moderated ► People will return to their doctors as the economy recovers

Generic Drugs Expectations ► Greater use of generic drugs as baby boomers retire and receive a fixed income ► A significant amount of brand name drugs are expected to come off of patent between 2009 -2011 § Currently, WAG is in a valley ►There were few brand name drugs coming off of patent in 2008 § Expect a peak within the next 3 years

Expectations ► A new CEO is expected to lead Walgreens § Upside potential ► Possible political effects with more affordable health care coming from different plans

Valuation – DCF Analysis ► Cost of equity = 7. 6% ► Cost of debt = 5. 36% ► Wacc = 7. 35% ► Long term growth = 3% ► Stock Price = 23. 55

Comparable’s data ► Strong profitability margins; expected decline over 5 years ► Strong Return on Equity, Return on Asset numbers; expected decline ► Implied growth through PEG ratio lower than industry average ► P/E ratio is lower than market and industry average

EVA Analysis ► Strong Return on Average Invested Capital, expected decline going forward

Recommendation ► Hold the stock at this price. People have over-reacted and this has pushed the stock price down. Company is well positioned as compared to it’s peers ► New CEO could put the company back on track.

720ac776f3a25b4ece788ac77e57a2ec.ppt