0aa15aa97db190a1fccf25625e7df2d9.ppt

- Количество слайдов: 23

Wal-Mart Argentina: Taking “Everyday Low Prices” Below the Equator Luciene De Paulo Gabriel Szulik Jennifer Pogue Esther Montiel Andy Martin

Agenda • Wal-Mart’s Background and International Expansion • Argentina: Analysis and Entry options • DCF and Cost of Capital Discussion • Recommendation • Q&A • Should Wal-Mart enter Argentina? If so, which entry strategy should it follow?

Wal-Mart: A Successful Story • Last 20 years: – Average ROE of 33% – Average sales growth of 25% • Everyday Low Price Strategy • Advanced Technology • Low Margins and High Volume

Wal-Mart International Strategic focus on international expansion • Stable economies: • Attractive markets: – Canada – Mexico – Argentina – Brazil – China – Exploring opportunities in Europe – Higher expected returns, yet highly volatile

Argentina: the target • Economic Outlook • Retail Market • Methods of Entry

Economic Outlook Positive • • Open economy Law of Convertibility Increasing consumption and GDP levels Inflation controlled

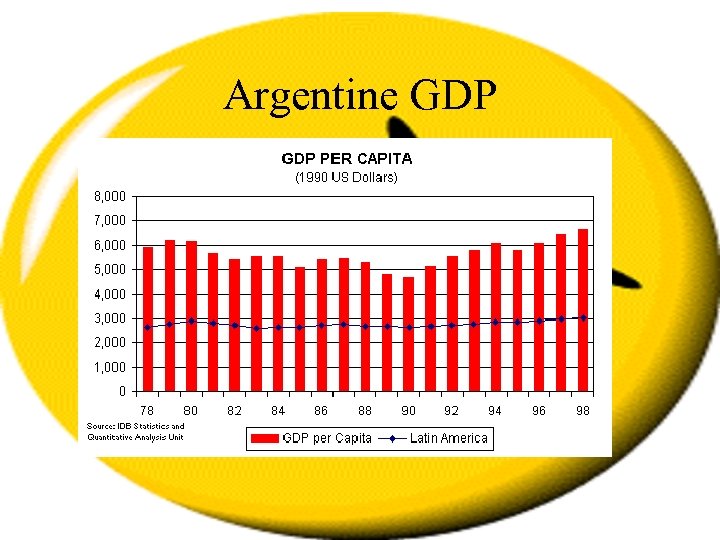

Argentine GDP

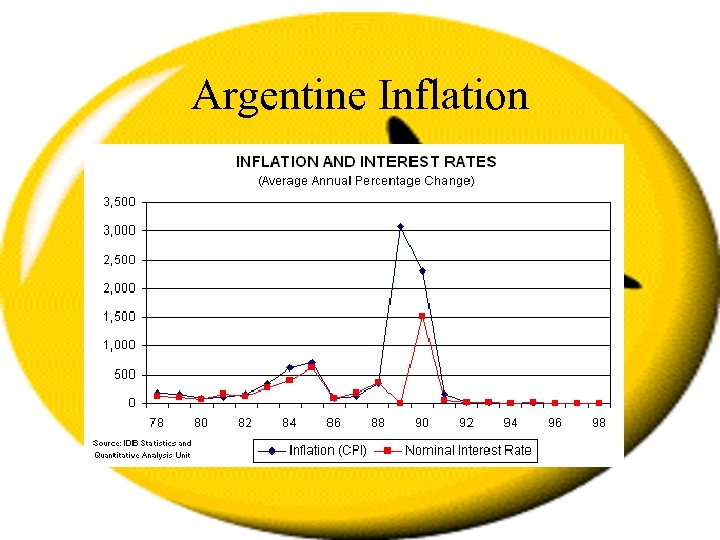

Argentine Inflation

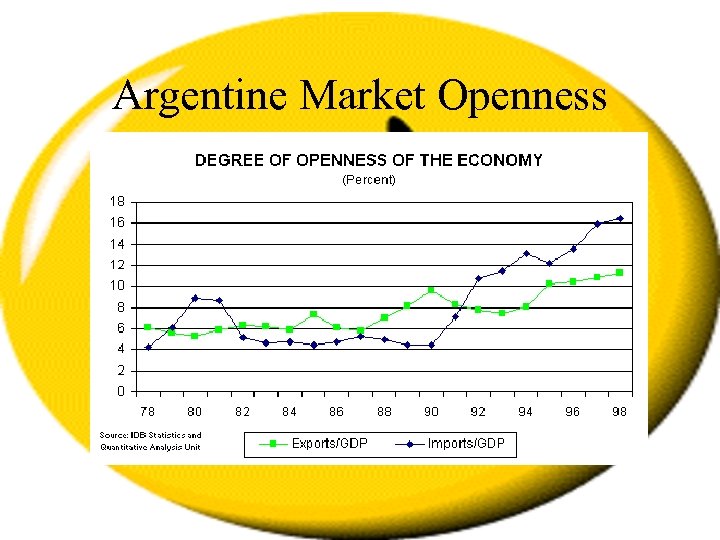

Argentine Market Openness

Retail Market Attractive • Retail market underdeveloped – Only one hyper market chain (Carrefour) • Small businesses threatened by big players • Total retail size in 1993: US$ 67. 9 billion – US$8. 6 billion among supermarkets and hypermarkets • Low distribution and technological capabilities

Market Considerations • • Families shop together People buy smaller items, more often Fewer car owners than U. S. Corrupt local business environment relationships with suppliers and politicians necessary Wal-Mart may need a local partner…

Methods of Entry 1. Wal-Mart entering on its own, building stores from scratch 2. Acquisition of a local retailer 3. Joint Venture

Disco S. A. : A Possible Partner • • • Largest retailer: 57 branches 4 th retailer in sales revenue: US$805 MM in 1993 Outstanding geographic locations Highly competitive prices Strong financials, profitable local established retailer • Smaller stores than a typical Wal-Mart Supercenter

Evaluation of risks • Political – Import controls – Democracy level – Corruption – Taxes • Economic – Exchange rate – Inflation

Evaluation of risks (cont. ) • Financial – Interest rates – Banking system • Industry risks – Consumer default risk

Specific risks of the project • Individual entry – Limited leverage with suppliers – Cultural differences – Local opposition • Acquisition – Buying inefficiencies • Joint Venture – Partner inability to pay – Partner reliability

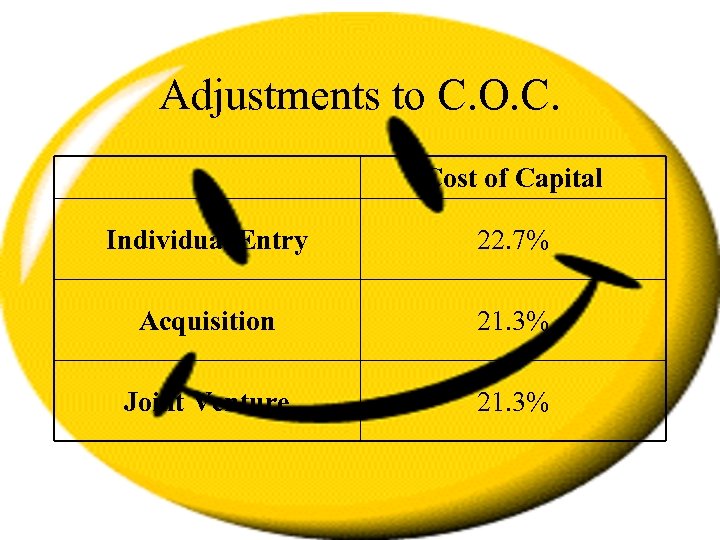

Adjustments to C. O. C. Cost of Capital Individual Entry 22. 7% Acquisition 21. 3% Joint Venture 21. 3%

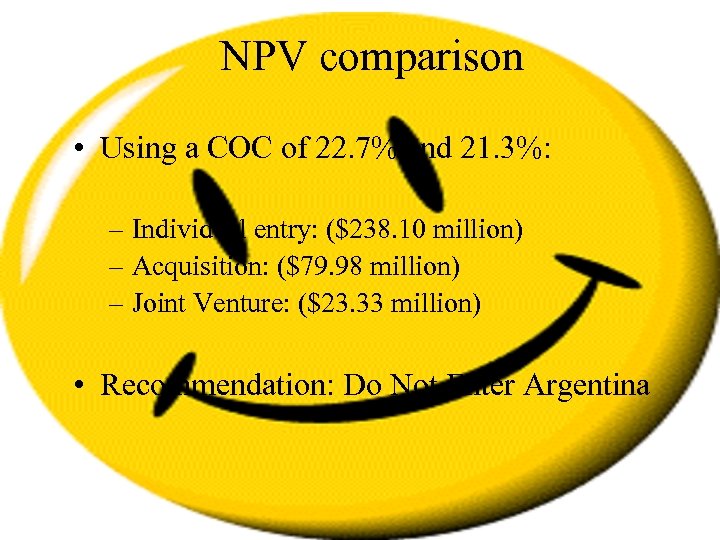

NPV comparison • Using a COC of 22. 7% and 21. 3%: – Individual entry: ($238. 10 million) – Acquisition: ($79. 98 million) – Joint Venture: ($23. 33 million) • Recommendation: Do Not Enter Argentina

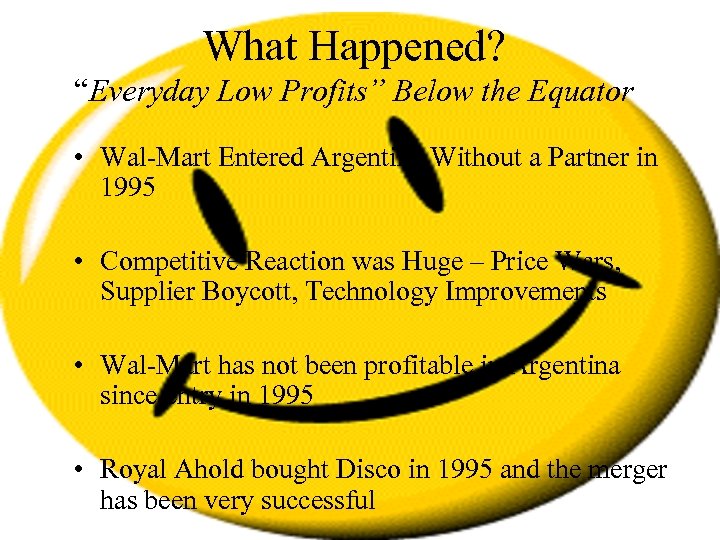

What Happened? “Everyday Low Profits” Below the Equator • Wal-Mart Entered Argentina Without a Partner in 1995 • Competitive Reaction was Huge – Price Wars, Supplier Boycott, Technology Improvements • Wal-Mart has not been profitable in Argentina since entry in 1995 • Royal Ahold bought Disco in 1995 and the merger has been very successful

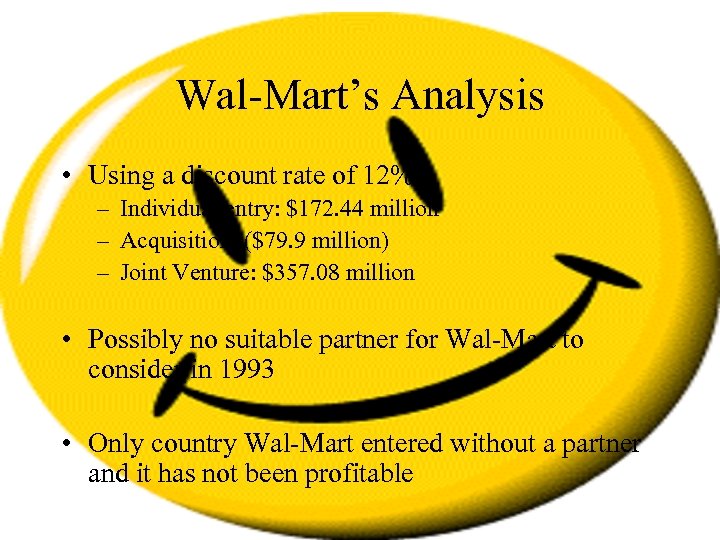

Wal-Mart’s Analysis • Using a discount rate of 12%: – Individual entry: $172. 44 million – Acquisition: ($79. 9 million) – Joint Venture: $357. 08 million • Possibly no suitable partner for Wal-Mart to consider in 1993 • Only country Wal-Mart entered without a partner and it has not been profitable

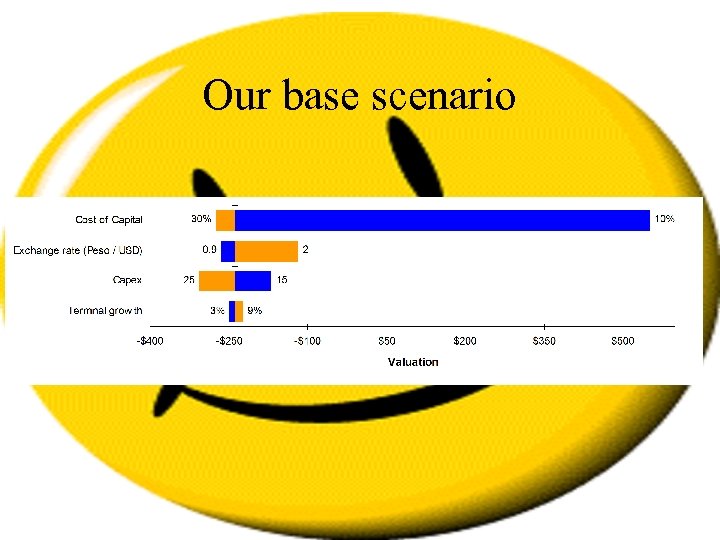

Our base scenario

Q&A

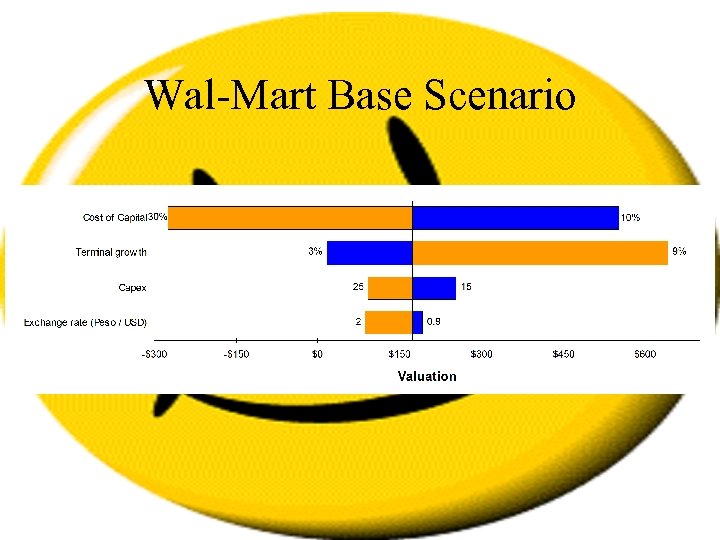

Wal-Mart Base Scenario

0aa15aa97db190a1fccf25625e7df2d9.ppt