W T O R E G I O N A L S E M I N A R O N E L E C T R O N I C C O M M E R C E Geneva, Switzerland 22 April 2002 Revenue Implications Of E-Commerce Government and Private Sector Experiences MALAYSIA Presentation by: Suhaimi Nordin Senior Manager - Borderless Marketing / E-Business Multimedia Development Corporation suhaimi@mdc. com. my

W T O R E G I O N A L S E M I N A R O N E L E C T R O N I C C O M M E R C E Geneva, Switzerland 22 April 2002 Revenue Implications Of E-Commerce Government and Private Sector Experiences MALAYSIA Presentation by: Suhaimi Nordin Senior Manager - Borderless Marketing / E-Business Multimedia Development Corporation suhaimi@mdc. com. my

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 2

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 2

VISION 2020 Vision 2020 – a national vision of creating a developed nation in our own mould • Characteristics of a Vision 2020 society: – Strong moral and ethical values self-regulating and self-managing empowered through information and knowledge based on the concept of the dignity of human-kind • Characteristics of a Vision 2020 economy: – Robust and resilient competitive and dynamic, but with fair and equitable distribution of wealth 3

VISION 2020 Vision 2020 – a national vision of creating a developed nation in our own mould • Characteristics of a Vision 2020 society: – Strong moral and ethical values self-regulating and self-managing empowered through information and knowledge based on the concept of the dignity of human-kind • Characteristics of a Vision 2020 economy: – Robust and resilient competitive and dynamic, but with fair and equitable distribution of wealth 3

Vision of Knowledge-Malaysia by year 2020 • Value creating knowledge products and services • ICT as a sector and information as a commodity t In Economic • Competitive Knowledge Economy e re a pl o e P - - Information Society • Access to information - - Values-based al r Knowledge eg 2020 Society n tio a Knowledge ic er Society un bl m a m En o C an d an y as n g io o at nol m or ech f In T Social • United, moral and • Culture of a life long learning and ethical society innovation • Sustainable quality of life 4

Vision of Knowledge-Malaysia by year 2020 • Value creating knowledge products and services • ICT as a sector and information as a commodity t In Economic • Competitive Knowledge Economy e re a pl o e P - - Information Society • Access to information - - Values-based al r Knowledge eg 2020 Society n tio a Knowledge ic er Society un bl m a m En o C an d an y as n g io o at nol m or ech f In T Social • United, moral and • Culture of a life long learning and ethical society innovation • Sustainable quality of life 4

Multimedia Super Corridor’s Vision – Conceived As the Next Engine of Growth for Malaysia The MSC was set up based on: • The recognition that Malaysia was losing its comparative advantage in its traditional economic sectors; • Need to drive the economy towards higher productivity through technology and high value-added economic activities; • Knowledge Economy and converging technologies presented the best opportunities for socio-economic transformation. • The need for the adoption & application of ICT to enhance national competitiveness and to help bridge the Digital Divide. 5

Multimedia Super Corridor’s Vision – Conceived As the Next Engine of Growth for Malaysia The MSC was set up based on: • The recognition that Malaysia was losing its comparative advantage in its traditional economic sectors; • Need to drive the economy towards higher productivity through technology and high value-added economic activities; • Knowledge Economy and converging technologies presented the best opportunities for socio-economic transformation. • The need for the adoption & application of ICT to enhance national competitiveness and to help bridge the Digital Divide. 5

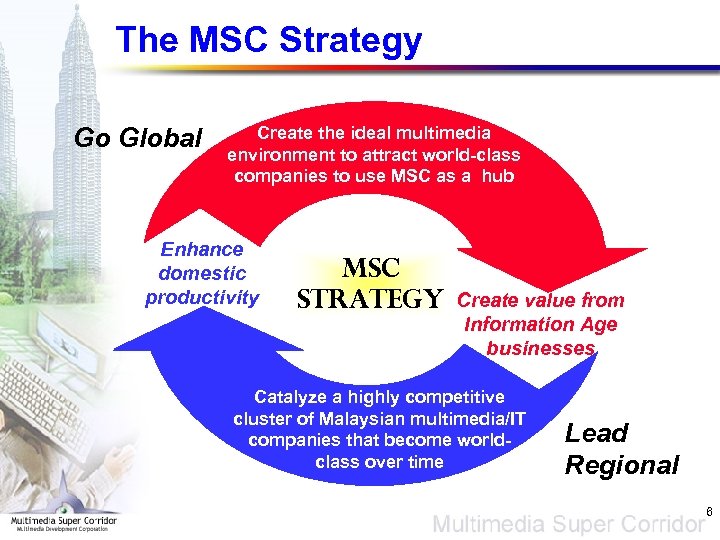

The MSC Strategy Go Global Create the ideal multimedia environment to attract world-class companies to use MSC as a hub Enhance domestic productivity MSC STRATEGY Create value from Information Age businesses Catalyze a highly competitive cluster of Malaysian multimedia/IT companies that become worldclass over time Lead Regional 6

The MSC Strategy Go Global Create the ideal multimedia environment to attract world-class companies to use MSC as a hub Enhance domestic productivity MSC STRATEGY Create value from Information Age businesses Catalyze a highly competitive cluster of Malaysian multimedia/IT companies that become worldclass over time Lead Regional 6

The MSC – More Than Just a Technology Park KLCC PETALING JAYA • 15 x 50 km Corridor South of Kuala Lumpur • Special Cyberlaws, policies and practices tailored to enable smart partners to achieve maximum benefits of multimedia SHAH ALAM KLANG E SS W H W AY km KAJANG -S D IC H O H D E UT X S W A C EN R J AY PUTRA A L IN K BANDAR BARU BANGI BERANANG P K RE IN S SW A Y PULAU CAREY 20 BANTING TELOK DATOK km BANDAR SALAK TINGGI R A IL W AY L AIRPORT CITY EX AL TH T S OU Y TH - S H X Y E E UT LE PR SO A KL L VA NG W AY P R E SS SEMENYIH NO R E TELOK PANGLIMA GARANG COUNTRY HEIGHTS ER L AL PR RT AH EX NO • World class infrastructure and next generation 2. 5 - 10 Gb multimedia network • MDC - a premier onestop shop to facilitate and promote the development and investment in the MSC PULAU INDAH SH AM AY 25 AT PELABUHAN KLANG W AY G F ED ER AL HI G H E D H IG K LA N KL - BANDAR BARU NILAI KLIA W E ST C O A SEPANG ST H IG HW SEREMBAN AY PORT DICKSON 7

The MSC – More Than Just a Technology Park KLCC PETALING JAYA • 15 x 50 km Corridor South of Kuala Lumpur • Special Cyberlaws, policies and practices tailored to enable smart partners to achieve maximum benefits of multimedia SHAH ALAM KLANG E SS W H W AY km KAJANG -S D IC H O H D E UT X S W A C EN R J AY PUTRA A L IN K BANDAR BARU BANGI BERANANG P K RE IN S SW A Y PULAU CAREY 20 BANTING TELOK DATOK km BANDAR SALAK TINGGI R A IL W AY L AIRPORT CITY EX AL TH T S OU Y TH - S H X Y E E UT LE PR SO A KL L VA NG W AY P R E SS SEMENYIH NO R E TELOK PANGLIMA GARANG COUNTRY HEIGHTS ER L AL PR RT AH EX NO • World class infrastructure and next generation 2. 5 - 10 Gb multimedia network • MDC - a premier onestop shop to facilitate and promote the development and investment in the MSC PULAU INDAH SH AM AY 25 AT PELABUHAN KLANG W AY G F ED ER AL HI G H E D H IG K LA N KL - BANDAR BARU NILAI KLIA W E ST C O A SEPANG ST H IG HW SEREMBAN AY PORT DICKSON 7

MSC Flagship Applications Smart Schools Multipurpose Card Electronic Government OBJECTIVES To Improve: • Access - any time, any where, any means Telehealth • Convenience – inline to online R&D Cluster • Efficiency Borderless Marketing Centre E-Business Worldwide Manufacturing Web 8

MSC Flagship Applications Smart Schools Multipurpose Card Electronic Government OBJECTIVES To Improve: • Access - any time, any where, any means Telehealth • Convenience – inline to online R&D Cluster • Efficiency Borderless Marketing Centre E-Business Worldwide Manufacturing Web 8

Progress To-date • 670 MSC Status companies, 50 world class • Government Multi-Purpose Card (GMPC) Flagship Application Roll-Out • Growing investments in technology and high value-added economic activities • Rapid growth in sales and exports • New knowledge-based employment opportunities created • Growth in institutions of higher learning and supply of knowledge workers • Growth in SME participation • Spin-offs to economy including productivity increases 9

Progress To-date • 670 MSC Status companies, 50 world class • Government Multi-Purpose Card (GMPC) Flagship Application Roll-Out • Growing investments in technology and high value-added economic activities • Rapid growth in sales and exports • New knowledge-based employment opportunities created • Growth in institutions of higher learning and supply of knowledge workers • Growth in SME participation • Spin-offs to economy including productivity increases 9

World Class Companies With Regional Initiatives in the MSC 10

World Class Companies With Regional Initiatives in the MSC 10

Other World Class Companies in the MSC 11

Other World Class Companies in the MSC 11

The MSC Vision: From Here To 2020 Phase 2 Phase 1 Successfully create the Multimedia Super Corridor 1996 • 1 Corridor Link the MSC to other cybercities in Malaysia and worldwide Phase 3 Leapfrog into leadership in the Knowledge Economy Transform Malaysia into a knowledge society 2003 2010 • Web of corridors • All of Malaysia 2020 • 50 world-class companies • 250 world-class companies • 500 world-class companies • Launch 7 flagship applications • Set global standards in flagship applications • Global test-bed for new multimedia applications • World-leading framework of cyberlaws • Harmonized global framework of cyberlaws • International Cyber. Court of Justice in MSC • Cyberjaya as world • 12 intelligent cities leading intelligent linked to global • 4 -5 intelligent cities city information highway linked to other global cybercities 12

The MSC Vision: From Here To 2020 Phase 2 Phase 1 Successfully create the Multimedia Super Corridor 1996 • 1 Corridor Link the MSC to other cybercities in Malaysia and worldwide Phase 3 Leapfrog into leadership in the Knowledge Economy Transform Malaysia into a knowledge society 2003 2010 • Web of corridors • All of Malaysia 2020 • 50 world-class companies • 250 world-class companies • 500 world-class companies • Launch 7 flagship applications • Set global standards in flagship applications • Global test-bed for new multimedia applications • World-leading framework of cyberlaws • Harmonized global framework of cyberlaws • International Cyber. Court of Justice in MSC • Cyberjaya as world • 12 intelligent cities leading intelligent linked to global • 4 -5 intelligent cities city information highway linked to other global cybercities 12

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 13

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 13

E-Business Within MSC Status Companies 1997 1998 1999 2000 2001 6 20 34 86 138 245* 94 197 300 429 621 700* Percentage of ECommerce related businesses 6% 10% 11% 20% 22% 35%* Companies with own transaction capabilities 0 1 3 15 33 50* Developing solutions to enable E-Commerce 6 19 32 71 105 195* Indicator MSC Status Co. directly involved in E-Commerce Businesses / No of MSC Status Companies 2002 Forecast* 14

E-Business Within MSC Status Companies 1997 1998 1999 2000 2001 6 20 34 86 138 245* 94 197 300 429 621 700* Percentage of ECommerce related businesses 6% 10% 11% 20% 22% 35%* Companies with own transaction capabilities 0 1 3 15 33 50* Developing solutions to enable E-Commerce 6 19 32 71 105 195* Indicator MSC Status Co. directly involved in E-Commerce Businesses / No of MSC Status Companies 2002 Forecast* 14

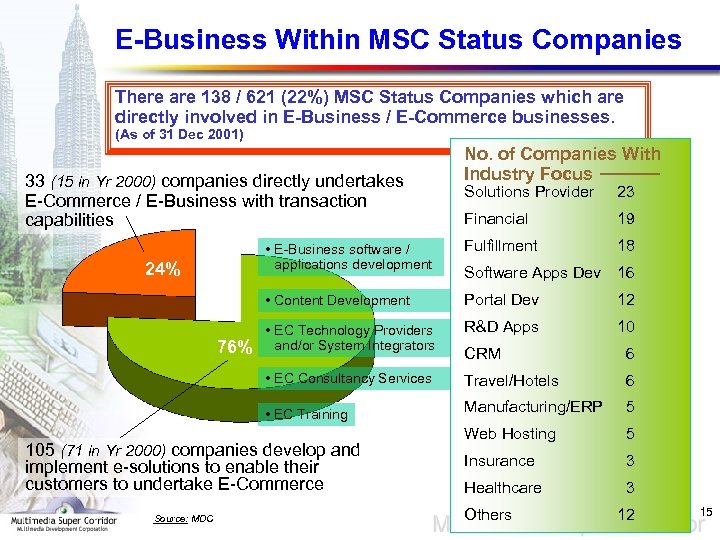

E-Business Within MSC Status Companies There are 138 / 621 (22%) MSC Status Companies which are directly involved in E-Business / E-Commerce businesses. (As of 31 Dec 2001) 33 (15 in Yr 2000) companies directly undertakes E-Commerce / E-Business with transaction capabilities No. of Companies With Industry Focus Financial 19 Fulfillment 18 Software Apps Dev 16 • Content Development Portal Dev 12 • EC Technology Providers and/or System Integrators R&D Apps 10 CRM 6 • EC Consultancy Services Travel/Hotels 6 • EC Training 76% 23 • E-Business software / applications development 24% Solutions Provider Manufacturing/ERP 5 Web Hosting 5 Insurance 3 Healthcare 3 105 (71 in Yr 2000) companies develop and implement e-solutions to enable their customers to undertake E-Commerce Source: MDC Others 12 15

E-Business Within MSC Status Companies There are 138 / 621 (22%) MSC Status Companies which are directly involved in E-Business / E-Commerce businesses. (As of 31 Dec 2001) 33 (15 in Yr 2000) companies directly undertakes E-Commerce / E-Business with transaction capabilities No. of Companies With Industry Focus Financial 19 Fulfillment 18 Software Apps Dev 16 • Content Development Portal Dev 12 • EC Technology Providers and/or System Integrators R&D Apps 10 CRM 6 • EC Consultancy Services Travel/Hotels 6 • EC Training 76% 23 • E-Business software / applications development 24% Solutions Provider Manufacturing/ERP 5 Web Hosting 5 Insurance 3 Healthcare 3 105 (71 in Yr 2000) companies develop and implement e-solutions to enable their customers to undertake E-Commerce Source: MDC Others 12 15

asiatravelmart. com Highlight: • Asia. Travel. Mart is a one-stop travel shop for hotels, air tickets, tour packages and other travel products • Offers more than 60, 000 products from over 3, 000 travel suppliers in more than 100 countries • Also, offers mobile-commerce transactions to WAP users (world’s first). • Awards, including PATA Gold 2000, Internet World Asia Industry Award, PIKOM Award and APMITTA Award 16

asiatravelmart. com Highlight: • Asia. Travel. Mart is a one-stop travel shop for hotels, air tickets, tour packages and other travel products • Offers more than 60, 000 products from over 3, 000 travel suppliers in more than 100 countries • Also, offers mobile-commerce transactions to WAP users (world’s first). • Awards, including PATA Gold 2000, Internet World Asia Industry Award, PIKOM Award and APMITTA Award 16

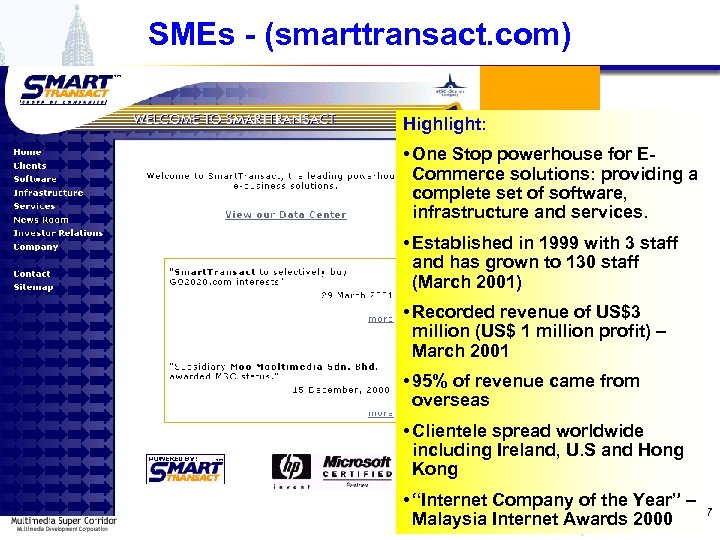

SMEs - (smarttransact. com) Highlight: • One Stop powerhouse for ECommerce solutions: providing a complete set of software, infrastructure and services. • Established in 1999 with 3 staff and has grown to 130 staff (March 2001) • Recorded revenue of US$3 million (US$ 1 million profit) – March 2001 • 95% of revenue came from overseas • Clientele spread worldwide including Ireland, U. S and Hong Kong • “Internet Company of the Year” – 17 Malaysia Internet Awards 2000

SMEs - (smarttransact. com) Highlight: • One Stop powerhouse for ECommerce solutions: providing a complete set of software, infrastructure and services. • Established in 1999 with 3 staff and has grown to 130 staff (March 2001) • Recorded revenue of US$3 million (US$ 1 million profit) – March 2001 • 95% of revenue came from overseas • Clientele spread worldwide including Ireland, U. S and Hong Kong • “Internet Company of the Year” – 17 Malaysia Internet Awards 2000

SMEs - (watchesplanet. com) Highlight: • Malaysian watch e-tailer (B 2 C) Watches are Duty-Free items • Started in 1998 with a capital of US$65, 800, Year 2000 sales was US$1. 1 million. • Offers over 5, 000 watches from 60 brands. Price average US$100 – US$2, 000 • 75% customers from North America 18

SMEs - (watchesplanet. com) Highlight: • Malaysian watch e-tailer (B 2 C) Watches are Duty-Free items • Started in 1998 with a capital of US$65, 800, Year 2000 sales was US$1. 1 million. • Offers over 5, 000 watches from 60 brands. Price average US$100 – US$2, 000 • 75% customers from North America 18

Growth of Internet Subscribers in Malaysia (1995 -2005) (‘ 000 million) Projected growth 7, 000 An Internet penetration of 20% of population will spur the growth of E-Commerce in Malaysia 6, 000 6, 005 5, 525 4, 837 5, 000 4, 225 4, 000 3, 111 3, 000 1, 852 2, 000 892 1, 000 25 90 '95 '96 210 442 0 '97 '98 '99 '00 '01 '02 '03 '04 '05 Year (1995 – 2000) Source : MECRA (TMnet, Jaring, Maxis. Net, Time. Net), PIKOM, MDC, MECM 19

Growth of Internet Subscribers in Malaysia (1995 -2005) (‘ 000 million) Projected growth 7, 000 An Internet penetration of 20% of population will spur the growth of E-Commerce in Malaysia 6, 000 6, 005 5, 525 4, 837 5, 000 4, 225 4, 000 3, 111 3, 000 1, 852 2, 000 892 1, 000 25 90 '95 '96 210 442 0 '97 '98 '99 '00 '01 '02 '03 '04 '05 Year (1995 – 2000) Source : MECRA (TMnet, Jaring, Maxis. Net, Time. Net), PIKOM, MDC, MECM 19

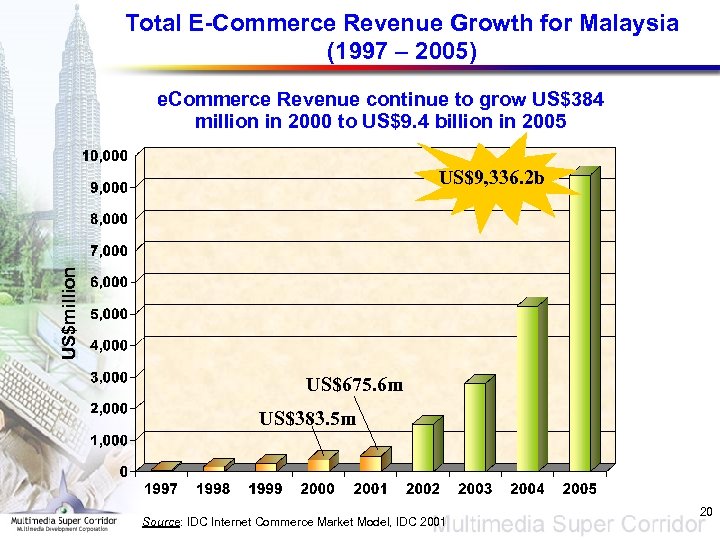

Total E-Commerce Revenue Growth for Malaysia (1997 – 2005) e. Commerce Revenue continue to grow US$384 million in 2000 to US$9. 4 billion in 2005 US$million US$9, 336. 2 b US$675. 6 m US$383. 5 m Source: IDC Internet Commerce Market Model, IDC 2001 20

Total E-Commerce Revenue Growth for Malaysia (1997 – 2005) e. Commerce Revenue continue to grow US$384 million in 2000 to US$9. 4 billion in 2005 US$million US$9, 336. 2 b US$675. 6 m US$383. 5 m Source: IDC Internet Commerce Market Model, IDC 2001 20

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 21

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 21

E-Commerce – Lessons Learnt There are many definitions for E-commerce. Examples: “The electronic exchange of information goods, services and payments” but underneath the surface E-commerce is also: …the digitization of information. . . Internetworking of human ingenuity creating a new socio-economic transformation …propelled by BRAINS instead of BRAWN …driven off by both technology push and business pull …the foundation of a new economic order Nations need to identify clusters for industrial development and reposition themselves to be at the centre of the virtual marketspace… 22

E-Commerce – Lessons Learnt There are many definitions for E-commerce. Examples: “The electronic exchange of information goods, services and payments” but underneath the surface E-commerce is also: …the digitization of information. . . Internetworking of human ingenuity creating a new socio-economic transformation …propelled by BRAINS instead of BRAWN …driven off by both technology push and business pull …the foundation of a new economic order Nations need to identify clusters for industrial development and reposition themselves to be at the centre of the virtual marketspace… 22

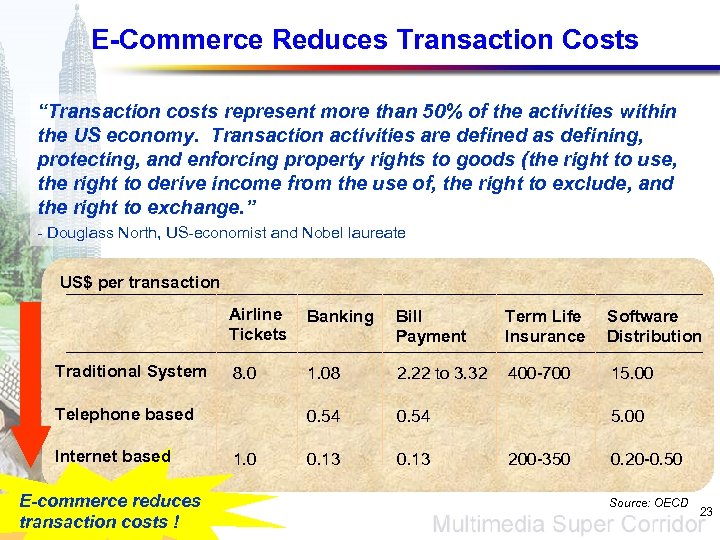

E-Commerce Reduces Transaction Costs “Transaction costs represent more than 50% of the activities within the US economy. Transaction activities are defined as defining, protecting, and enforcing property rights to goods (the right to use, the right to derive income from the use of, the right to exclude, and the right to exchange. ” - Douglass North, US-economist and Nobel laureate US$ per transaction Airline Tickets Traditional System Banking Bill Payment Term Life Insurance Software Distribution 8. 0 1. 08 2. 22 to 3. 32 400 -700 15. 00 0. 54 0. 13 Telephone based Internet based E-commerce reduces transaction costs ! 1. 0 5. 00 200 -350 0. 20 -0. 50 Source: OECD 23

E-Commerce Reduces Transaction Costs “Transaction costs represent more than 50% of the activities within the US economy. Transaction activities are defined as defining, protecting, and enforcing property rights to goods (the right to use, the right to derive income from the use of, the right to exclude, and the right to exchange. ” - Douglass North, US-economist and Nobel laureate US$ per transaction Airline Tickets Traditional System Banking Bill Payment Term Life Insurance Software Distribution 8. 0 1. 08 2. 22 to 3. 32 400 -700 15. 00 0. 54 0. 13 Telephone based Internet based E-commerce reduces transaction costs ! 1. 0 5. 00 200 -350 0. 20 -0. 50 Source: OECD 23

The Destruction Of The Vertically Integrated Value Chain Integrated monolithic Vertical value chain Multiple product specialists collaborating within an e-business community, creation of alliances Domain: Closed Proprietary Network Domain: The Internet CHANGE These Companies can deliver products and services at a much lower cost and utilising fewer assets ! 24

The Destruction Of The Vertically Integrated Value Chain Integrated monolithic Vertical value chain Multiple product specialists collaborating within an e-business community, creation of alliances Domain: Closed Proprietary Network Domain: The Internet CHANGE These Companies can deliver products and services at a much lower cost and utilising fewer assets ! 24

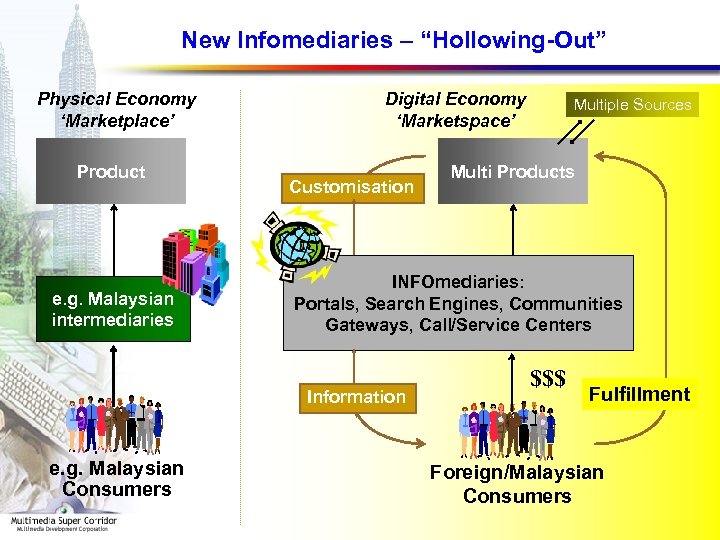

New Infomediaries – “Hollowing-Out” Physical Economy ‘Marketplace’ Product e. g. Malaysian intermediaries Digital Economy ‘Marketspace’ Customisation Multi Products INFOmediaries: Portals, Search Engines, Communities Gateways, Call/Service Centers Information e. g. Malaysian Consumers Multiple Sources $$$ Fulfillment Foreign/Malaysian Consumers 25

New Infomediaries – “Hollowing-Out” Physical Economy ‘Marketplace’ Product e. g. Malaysian intermediaries Digital Economy ‘Marketspace’ Customisation Multi Products INFOmediaries: Portals, Search Engines, Communities Gateways, Call/Service Centers Information e. g. Malaysian Consumers Multiple Sources $$$ Fulfillment Foreign/Malaysian Consumers 25

A Service Centric Model INFOMEDIARY operating under the VIRTUAL VALUE CHAIN PHYSICAL INFRASTRUCTURE (i) Telecommunications (ii) Integrated Global Logistics Supplier A Country 1 Manufacturer B Country 2 Designer C Country 3 Utilize : 1. Infrastructure to arbitrage cost, skills, productivity, taxes, etc. across multiple jurisdictions 2. Network and information 3. Channels of distribution Distributor D Country 2 Customer E Country 4 Infomediary leverages information by “BUYING at the point of LEAST COST and SELLING to the point of HIGHEST PRICE” 26

A Service Centric Model INFOMEDIARY operating under the VIRTUAL VALUE CHAIN PHYSICAL INFRASTRUCTURE (i) Telecommunications (ii) Integrated Global Logistics Supplier A Country 1 Manufacturer B Country 2 Designer C Country 3 Utilize : 1. Infrastructure to arbitrage cost, skills, productivity, taxes, etc. across multiple jurisdictions 2. Network and information 3. Channels of distribution Distributor D Country 2 Customer E Country 4 Infomediary leverages information by “BUYING at the point of LEAST COST and SELLING to the point of HIGHEST PRICE” 26

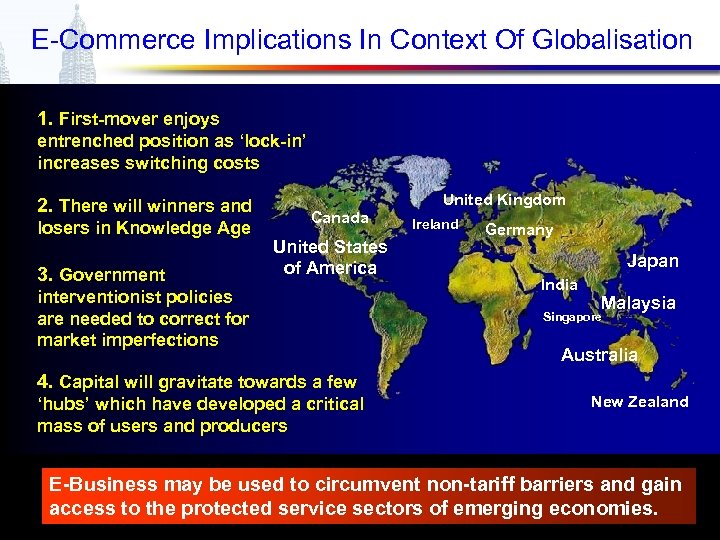

E-Commerce Implications In Context Of Globalisation 1. First-mover enjoys entrenched position as ‘lock-in’ increases switching costs 2. There will winners and losers in Knowledge Age 3. Government United Kingdom Canada United States of America interventionist policies are needed to correct for market imperfections 4. Capital will gravitate towards a few ‘hubs’ which have developed a critical mass of users and producers Ireland Germany Japan India Malaysia Singapore Australia New Zealand E-Business may be used to circumvent non-tariff barriers and gain access to the protected service sectors of emerging economies. 27

E-Commerce Implications In Context Of Globalisation 1. First-mover enjoys entrenched position as ‘lock-in’ increases switching costs 2. There will winners and losers in Knowledge Age 3. Government United Kingdom Canada United States of America interventionist policies are needed to correct for market imperfections 4. Capital will gravitate towards a few ‘hubs’ which have developed a critical mass of users and producers Ireland Germany Japan India Malaysia Singapore Australia New Zealand E-Business may be used to circumvent non-tariff barriers and gain access to the protected service sectors of emerging economies. 27

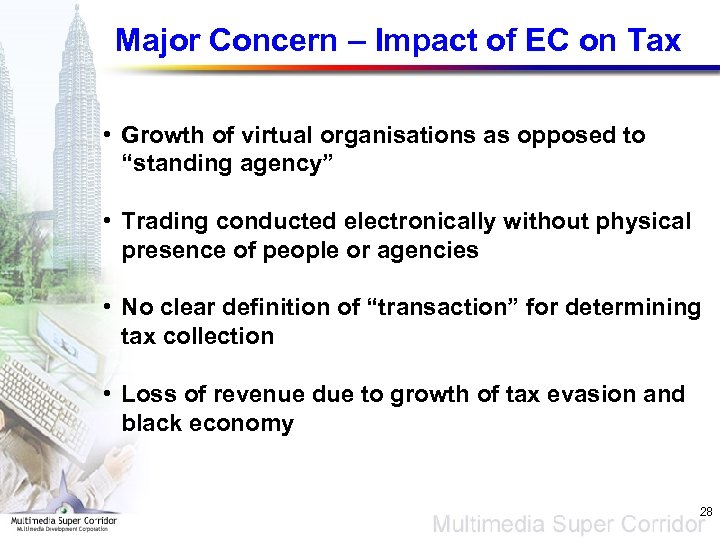

Major Concern – Impact of EC on Tax • Growth of virtual organisations as opposed to “standing agency” • Trading conducted electronically without physical presence of people or agencies • No clear definition of “transaction” for determining tax collection • Loss of revenue due to growth of tax evasion and black economy 28

Major Concern – Impact of EC on Tax • Growth of virtual organisations as opposed to “standing agency” • Trading conducted electronically without physical presence of people or agencies • No clear definition of “transaction” for determining tax collection • Loss of revenue due to growth of tax evasion and black economy 28

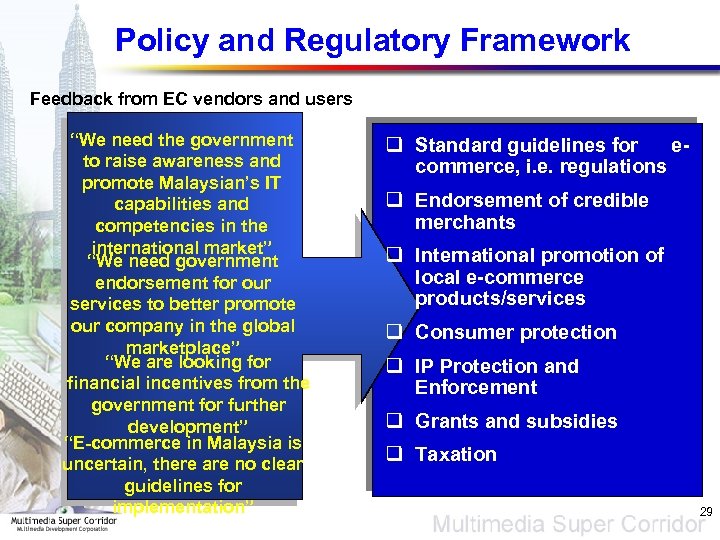

Policy and Regulatory Framework Feedback from EC vendors and users “We need the government to raise awareness and promote Malaysian’s IT capabilities and competencies in the international market” “We need government endorsement for our services to better promote our company in the global marketplace” “We are looking for financial incentives from the government for further development” “E-commerce in Malaysia is uncertain, there are no clear guidelines for implementation” q Standard guidelines for ecommerce, i. e. regulations q Endorsement of credible merchants q International promotion of local e-commerce products/services q Consumer protection q IP Protection and Enforcement q Grants and subsidies q Taxation 29

Policy and Regulatory Framework Feedback from EC vendors and users “We need the government to raise awareness and promote Malaysian’s IT capabilities and competencies in the international market” “We need government endorsement for our services to better promote our company in the global marketplace” “We are looking for financial incentives from the government for further development” “E-commerce in Malaysia is uncertain, there are no clear guidelines for implementation” q Standard guidelines for ecommerce, i. e. regulations q Endorsement of credible merchants q International promotion of local e-commerce products/services q Consumer protection q IP Protection and Enforcement q Grants and subsidies q Taxation 29

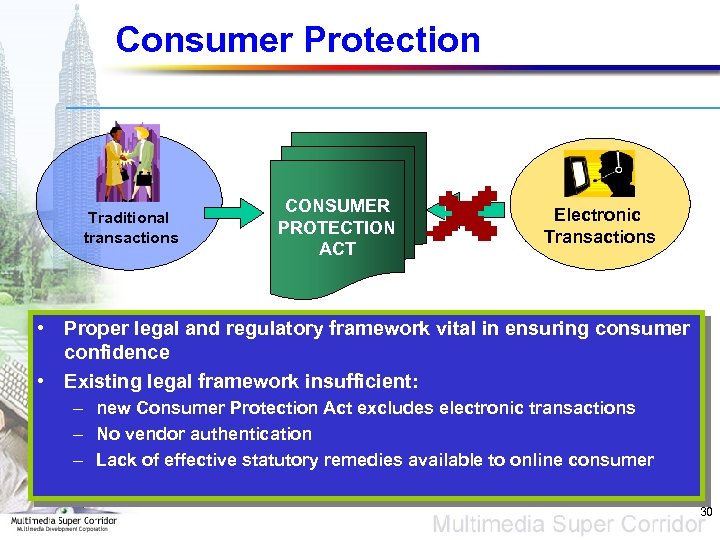

Consumer Protection Traditional transactions CONSUMER PROTECTION ACT Electronic Transactions • Proper legal and regulatory framework vital in ensuring consumer confidence • Existing legal framework insufficient: – new Consumer Protection Act excludes electronic transactions – No vendor authentication – Lack of effective statutory remedies available to online consumer 30

Consumer Protection Traditional transactions CONSUMER PROTECTION ACT Electronic Transactions • Proper legal and regulatory framework vital in ensuring consumer confidence • Existing legal framework insufficient: – new Consumer Protection Act excludes electronic transactions – No vendor authentication – Lack of effective statutory remedies available to online consumer 30

POLICY AND REGULATORY FRAMEWORK – Increasing Consumer Confidence CHALLENGES • Expanding existing laws and enacting new Act to apply to electronic transactions – Laws should apply equally to online and offline transactions • Review role of Existing Regulator: – New or existing regulator with expanded scope – Minimal and light handed intervention – Register of E-Commerce vendors • Promotion of Self Regulation: – Accreditation agencies to encourage reputable vendors – Consumer Code for vendors • Consumer Guidelines for consumers 31

POLICY AND REGULATORY FRAMEWORK – Increasing Consumer Confidence CHALLENGES • Expanding existing laws and enacting new Act to apply to electronic transactions – Laws should apply equally to online and offline transactions • Review role of Existing Regulator: – New or existing regulator with expanded scope – Minimal and light handed intervention – Register of E-Commerce vendors • Promotion of Self Regulation: – Accreditation agencies to encourage reputable vendors – Consumer Code for vendors • Consumer Guidelines for consumers 31

Intellectual Property Management & Commercial Code Intellectual Property Management – Conflict between trademark rights and registration of domain names – Inequality of bargaining power in registration of domain names Commercial Code – Application of general contractual principles to E-Commerce, particularly cross border transactions 32

Intellectual Property Management & Commercial Code Intellectual Property Management – Conflict between trademark rights and registration of domain names – Inequality of bargaining power in registration of domain names Commercial Code – Application of general contractual principles to E-Commerce, particularly cross border transactions 32

Intellectual Property Management & Commercial Code CHALLENGES Commercial Code • Enacting new laws based on UNCITRAL Model Law to apply contractual principles to E-Commerce Intellectual Property Management • Accord Domain Name protection and management under the Communication and Multimedia Commission § Develop an IP management systems for the distribution and management of the intellectual property especially content services. § Educate consumer on the importance of the protection as well as its rules and regulation § Implement cyber laws that have already been implemented as well as keeping track of new technology to make a more proactive legislation 33

Intellectual Property Management & Commercial Code CHALLENGES Commercial Code • Enacting new laws based on UNCITRAL Model Law to apply contractual principles to E-Commerce Intellectual Property Management • Accord Domain Name protection and management under the Communication and Multimedia Commission § Develop an IP management systems for the distribution and management of the intellectual property especially content services. § Educate consumer on the importance of the protection as well as its rules and regulation § Implement cyber laws that have already been implemented as well as keeping track of new technology to make a more proactive legislation 33

Dispute Resolution Existing System New System Jurisdiction of dispute Malaysian Court Local or foreign court? Choice of law MALAYSIA LEGAL SYSTEM Jurisdiction of dispute Choice of law Malaysian Law foreign or local? Evidence Act REFJA (Reciprocal Enforcements of foreign Judgement Act) Evidence electronic document REFJA is not enforceable in some major trading partners The nature of E-Commerce causes existing laws not able to cover the resolution process especially in cross border issues 34

Dispute Resolution Existing System New System Jurisdiction of dispute Malaysian Court Local or foreign court? Choice of law MALAYSIA LEGAL SYSTEM Jurisdiction of dispute Choice of law Malaysian Law foreign or local? Evidence Act REFJA (Reciprocal Enforcements of foreign Judgement Act) Evidence electronic document REFJA is not enforceable in some major trading partners The nature of E-Commerce causes existing laws not able to cover the resolution process especially in cross border issues 34

Dispute Resolution (Cont’d) CHALLENGES • Amendments to the rule of procedure and evidence to allow for the evaluation of digital information • Establishing independent dispute resolution body to deal with E-Commerce effectively and expeditiously • Advance the enforcement of awards of such body transnationally 35

Dispute Resolution (Cont’d) CHALLENGES • Amendments to the rule of procedure and evidence to allow for the evaluation of digital information • Establishing independent dispute resolution body to deal with E-Commerce effectively and expeditiously • Advance the enforcement of awards of such body transnationally 35

Taxing E-Commerce Transactions Income Tax • • Difficulty in applying “source based” concept to E-Commerce. How far would a Web page/Server constitute a physical existence Provisions do not capture multi jurisdictional transactions Difficulties of enforcement, e. g. Encryption technology and Audit trails International cooperation is needed Stamp Duty • • Application of stamp duties apply to electronic documents - Stamp Act 1949 based on paper instruments Difficulty of enforcement and compliance Sales and Service Tax and Customs and Excise Duties • • Record keeping requirements still based on paper medium Enforcement provisions should provide for electronic records Delivery of intangible goods increases the avoidance of duty Provisions for compliance insufficient to capture E-Commerce transactions 36

Taxing E-Commerce Transactions Income Tax • • Difficulty in applying “source based” concept to E-Commerce. How far would a Web page/Server constitute a physical existence Provisions do not capture multi jurisdictional transactions Difficulties of enforcement, e. g. Encryption technology and Audit trails International cooperation is needed Stamp Duty • • Application of stamp duties apply to electronic documents - Stamp Act 1949 based on paper instruments Difficulty of enforcement and compliance Sales and Service Tax and Customs and Excise Duties • • Record keeping requirements still based on paper medium Enforcement provisions should provide for electronic records Delivery of intangible goods increases the avoidance of duty Provisions for compliance insufficient to capture E-Commerce transactions 36

Taxing E-Commerce Transactions CHALLENGES • Deeming provisions – The current Income Tax Act have to extend the source based tax regime to include income produced via ISP located in Malaysia • Stringent regulations as to identity – The authorities may want to consider the possibility of drafting legislation that would impose duty on the service provider to obtain the information of businesses registering with them • Wider powers of review – Wider audit power by IRB to investigate private documents that may include decoding any encrypted data or placing log file with the ISPs to monitor taxpayers activities on the Internet 37

Taxing E-Commerce Transactions CHALLENGES • Deeming provisions – The current Income Tax Act have to extend the source based tax regime to include income produced via ISP located in Malaysia • Stringent regulations as to identity – The authorities may want to consider the possibility of drafting legislation that would impose duty on the service provider to obtain the information of businesses registering with them • Wider powers of review – Wider audit power by IRB to investigate private documents that may include decoding any encrypted data or placing log file with the ISPs to monitor taxpayers activities on the Internet 37

Taxing E-Commerce Transactions (Cont’d) • Re-negotiate Double Tax Agreement (DTA) – The current DTAs are unclear as of whether websites or host server are permanent establishment that are subjected to tax • Electronic stamping – Extending the existing stamp duty to electronic documents • Monitor the flow of intangible goods – With the influx of intellectual property into the country, Royal Customs and Excise Department should monitor the size and growth of IP to ascertain whether to tax or not to tax • Technologically advanced IRB – The taxing authorities should upgrade their technical capabilities to deal with encryption technology and the paperless trail to further enhance their audit and investigative powers. 38

Taxing E-Commerce Transactions (Cont’d) • Re-negotiate Double Tax Agreement (DTA) – The current DTAs are unclear as of whether websites or host server are permanent establishment that are subjected to tax • Electronic stamping – Extending the existing stamp duty to electronic documents • Monitor the flow of intangible goods – With the influx of intellectual property into the country, Royal Customs and Excise Department should monitor the size and growth of IP to ascertain whether to tax or not to tax • Technologically advanced IRB – The taxing authorities should upgrade their technical capabilities to deal with encryption technology and the paperless trail to further enhance their audit and investigative powers. 38

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 39

Agenda q Background – Overview of Malaysia’s Broad Vision and Strategy q E-Commerce – The Scenario q Implications / Challenges of E-Commerce (The Malaysia Experience) q Closing Remarks 39

In Conclusion 1. Recognise that E-Commerce will transform the national/global economic landscape and the emergence of new breed of companies providing services in the e-space. 2. The borderless nature of E-Commerce will expose to the impacts of liberalisation and globalisation and it is imperative for nations to be e-ready. 3. The need to focus and develop skills in knowledge intensive areas required by global markets e. g. EC Tax advisors, Lawyers etc. 4. Clear policy framework required to create climate for growth of ICT sector. 40

In Conclusion 1. Recognise that E-Commerce will transform the national/global economic landscape and the emergence of new breed of companies providing services in the e-space. 2. The borderless nature of E-Commerce will expose to the impacts of liberalisation and globalisation and it is imperative for nations to be e-ready. 3. The need to focus and develop skills in knowledge intensive areas required by global markets e. g. EC Tax advisors, Lawyers etc. 4. Clear policy framework required to create climate for growth of ICT sector. 40

Thank-You 41

Thank-You 41