d62d2fa887633874af2cefe652daa3d3.ppt

- Количество слайдов: 32

VSD Logistics- Nordic

VSD Nordic + Baltics Ø VSD wants to become the Preferred 4 th Party Logistics Provider in the Nordic market for FMCG, with focus on the Beverages segment Ø VSD will be known for it’s Excellent Customer Service, Service Flexibility, Speed Of Reaction and Competitive Pricing in the Nordic Market place Ø VSD shall have Leading edge competence, flexibility in it’s Warehouse & Transportation infrastructure, efficient Organisational design and a Information & Application platform to enable business with Pan Nordic active companies as well as Local Country active companies Ø VSD will join forces & create Partner alliances with preferred business partners where a win-win situation can be proven to ensure competitive edge

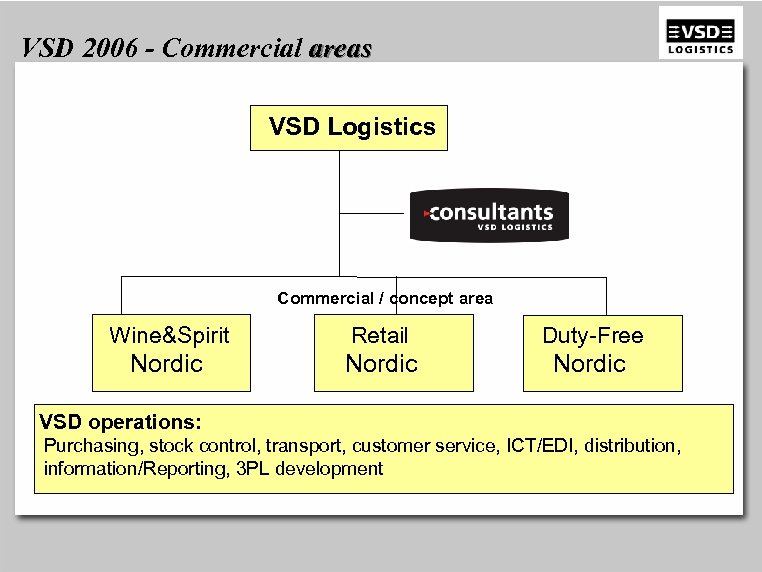

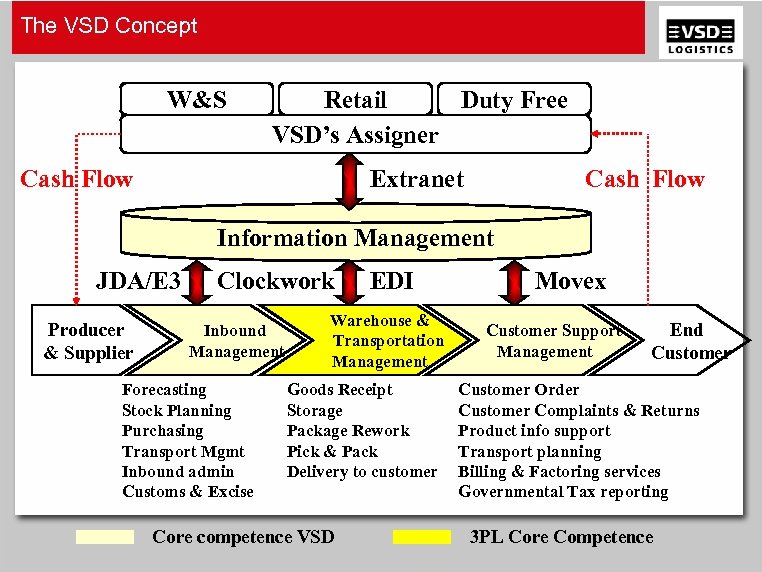

VSD 2006 - Commercial areas VSD Logistics Commercial / concept area Wine&Spirit Retail Duty-Free Nordic VSD operations: Purchasing, stock control, transport, customer service, ICT/EDI, distribution, information/Reporting, 3 PL development

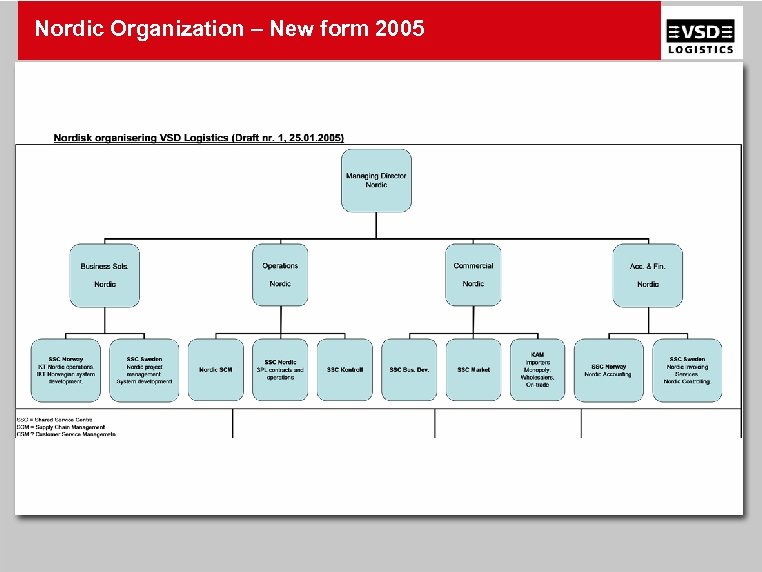

Nordic Organization – New form 2005

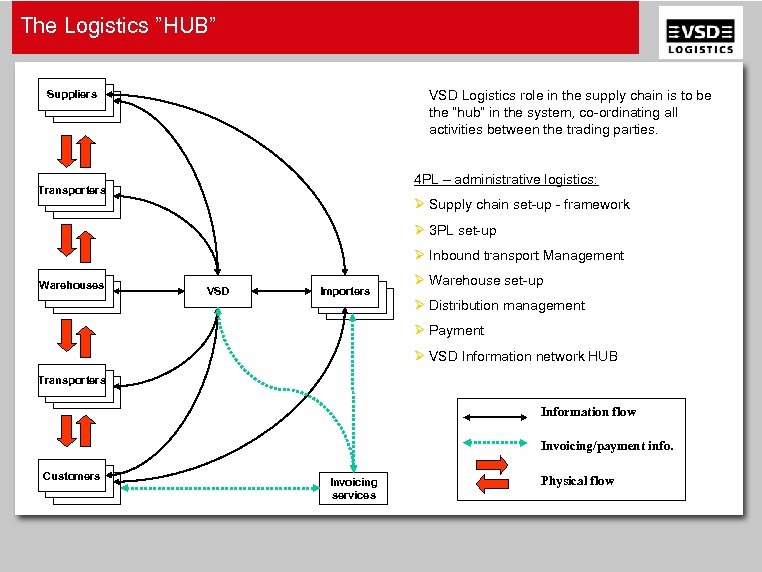

The Logistics ”HUB” VSD Logistics role in the supply chain is to be the “hub” in the system, co-ordinating all activities between the trading parties. Suppliers 4 PL – administrative logistics: Transporters Ø Supply chain set-up - framework Ø 3 PL set-up Ø Inbound transport Management Warehouses VSD Importers Ø Warehouse set-up Ø Distribution management Ø Payment Ø VSD Information network HUB Transporters Information flow Invoicing/payment info. Customers Invoicing services Physical flow

The VSD Concept W&S Retail Duty Free VSD’s Assigner Extranet Cash Flow Information Management JDA/E 3 Producer & Supplier Clockwork Inbound Management Forecasting Stock Planning Purchasing Transport Mgmt Inbound admin Customs & Excise EDI Warehouse & Transportation Management Goods Receipt Storage Package Rework Pick & Pack Delivery to customer Core competence VSD Movex Customer Support Management End Customer Order Customer Complaints & Returns Product info support Transport planning Billing & Factoring services Governmental Tax reporting 3 PL Core Competence

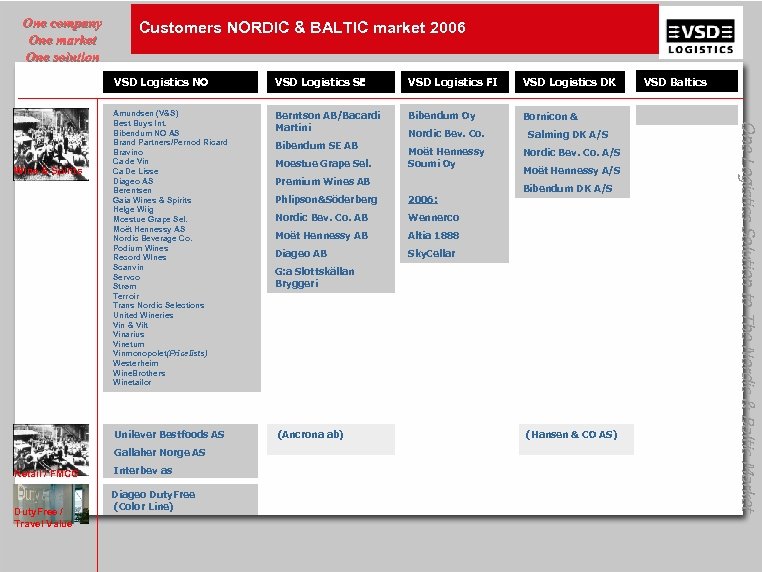

One company One market One solution Customers NORDIC & BALTIC market 2006 Wine & Spirits VSD Logistics SE VSD Logistics FI VSD Logistics DK Amundsen (V&S) Best Buys Int. Bibendum NO AS Brand Partners/Pernod Ricard Bravino Ca de Vin Ca De Lisse Diageo AS Berentsen Gaia Wines & Spirits Helge Wiig Moestue Grape Sel. Moët Hennessy AS Nordic Beverage Co. Podium Wines Record WInes Scanvin Servco Strøm Terroir Trans Nordic Selections United Wineries Vin & Vilt Vinarius Vinetum Vinmonopolet(Pricelists) Westerheim Wine. Brothers Winetailor Berntson AB/Bacardi Martini Bibendum Oy Bornicon & Unilever Bestfoods AS Gallaher Norge AS Retail / FMCG Duty. Free / Travel Value Interbev as Diageo Duty. Free (Color Line) Bibendum SE AB Moestue Grape Sel. Nordic Bev. Co. Moët Hennessy Soumi Oy Premium Wines AB Phlipson&Söderberg 2006: Nordic Bev. Co. AB Moët Hennessy A/S Bibendum DK A/S Altia 1888 Diageo AB Nordic Bev. Co. A/S Wennerco Moët Hennessy AB Salming DK A/S Sky. Cellar G: a Slottskällan Bryggeri (Ancrona ab) (Hansen & CO AS) VSD Baltics One Logistics Solution to The Nordic & Baltic Market VSD Logistics NO

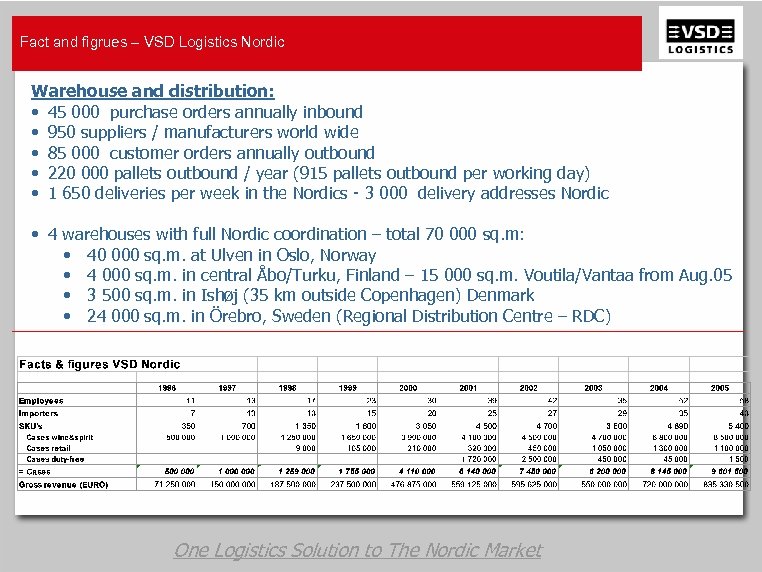

Fact and figrues – VSD Logistics Nordic Warehouse and distribution: • 45 000 purchase orders annually inbound • 950 suppliers / manufacturers world wide • 85 000 customer orders annually outbound • 220 000 pallets outbound / year (915 pallets outbound per working day) • 1 650 deliveries per week in the Nordics - 3 000 delivery addresses Nordic • 4 warehouses with full Nordic coordination – total 70 000 sq. m: • 40 000 sq. m. at Ulven in Oslo, Norway • 4 000 sq. m. in central Åbo/Turku, Finland – 15 000 sq. m. Voutila/Vantaa from Aug. 05 • 3 500 sq. m. in Ishøj (35 km outside Copenhagen) Denmark • 24 000 sq. m. in Örebro, Sweden (Regional Distribution Centre – RDC) One Logistics Solution to The Nordic Market

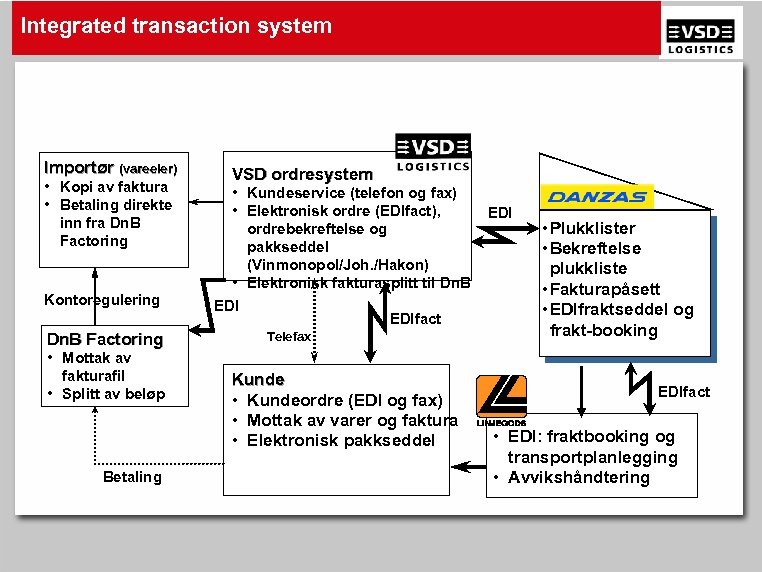

Integrated transaction system Importør (vareeier) • Kopi av faktura • Betaling direkte inn fra Dn. B Factoring Kontoregulering Dn. B Factoring • Mottak av fakturafil • Splitt av beløp Betaling VSD ordresystem • Kundeservice (telefon og fax) • Elektronisk ordre (EDIfact), ordrebekreftelse og pakkseddel (Vinmonopol/Joh. /Hakon) • Elektronisk fakturasplitt til Dn. B EDIfact Telefax Kunde • Kundeordre (EDI og fax) • Mottak av varer og faktura • Elektronisk pakkseddel EDI • Plukklister • Bekreftelse plukkliste • Fakturapåsett • EDIfraktseddel og frakt-booking EDIfact • EDI: fraktbooking og transportplanlegging • Avvikshåndtering

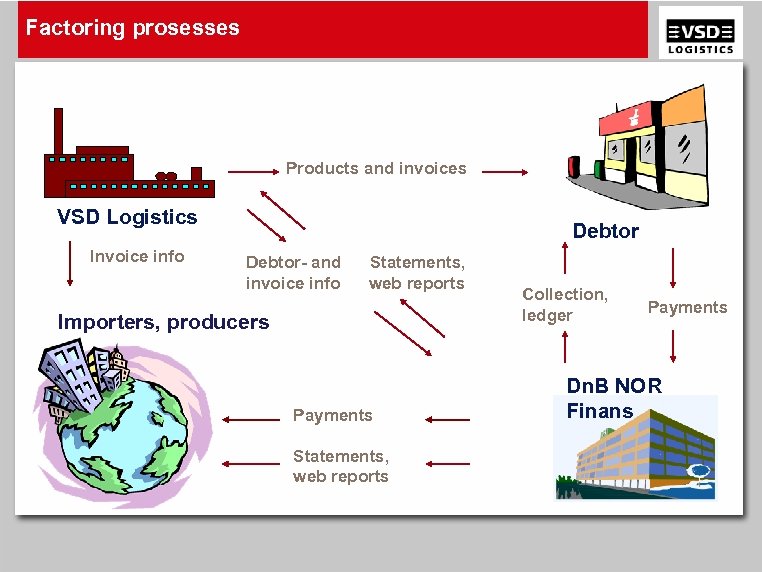

Factoring prosesses Products and invoices VSD Logistics Invoice info Debtor- and invoice info Statements, web reports Importers, producers Payments Statements, web reports Collection, ledger Payments Dn. B NOR Finans

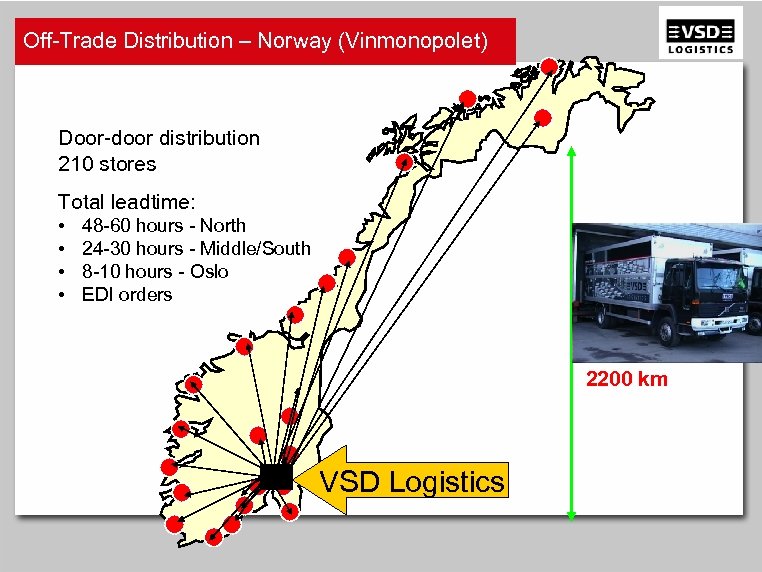

Off-Trade Distribution – Norway (Vinmonopolet) Door-door distribution 210 stores Total leadtime: • • 48 -60 hours - North 24 -30 hours - Middle/South 8 -10 hours - Oslo EDI orders 2200 km VSD Logistics

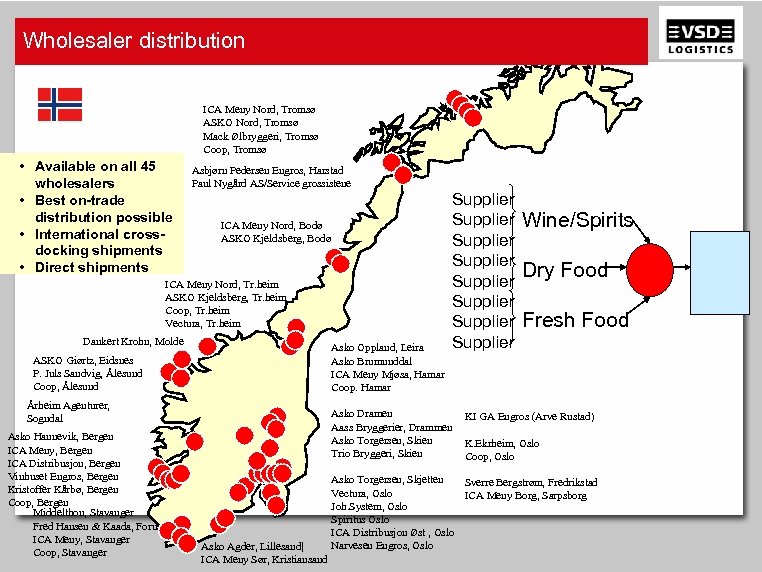

Wholesaler distribution ICA Meny Nord, Tromsø ASKO Nord, Tromsø Mack Ølbryggeri, Tromsø Coop, Tromsø • Available on all 45 wholesalers • Best on-trade distribution possible • International crossdocking shipments • Direct shipments Asbjørn Pedersen Engros, Harstad Paul Nygård AS/Service grossistene ICA Meny Nord, Bodø ASKO Kjeldsberg, Bodø ICA Meny Nord, Tr. heim ASKO Kjeldsberg, Tr. heim Coop, Tr. heim Vectura, Tr. heim Dankert Krohn, Molde Asko Oppland, Leira Asko Brumunddal ICA Meny Mjøsa, Hamar Coop. Hamar ASKO Giørtz, Eidsnes P. Juls Sandvig, Ålesund Coop, Ålesund Årheim Agenturer, Sogndal Asko Hannevik, Bergen ICA Meny, Bergen ICA Distribusjon, Bergen Vinhuset Engros, Bergen Kristoffer Kårbø, Bergen Coop, Bergen Middelthon, Stavanger Fred Hansen & Kaada, Forus ICA Meny, Stavanger Coop, Stavanger Supplier Supplier Asko Dramen Aass Bryggerier, Drammen Asko Torgersen, Skien Trio Bryggeri, Skien Asko Agder, Lillesand| ICA Meny Sør, Kristiansand Wine/Spirits Dry Food Fresh Food KI GA Engros (Arve Rustad) K. Ekrheim, Oslo Coop, Oslo Asko Torgersen, Skjetten Sverre Bergstrøm, Fredrikstad Vectura, Oslo ICA Meny Borg, Sarpsborg Joh. System, Oslo Spiritus Oslo ICA Distribusjon Øst , Oslo Narvesen Engros, Oslo

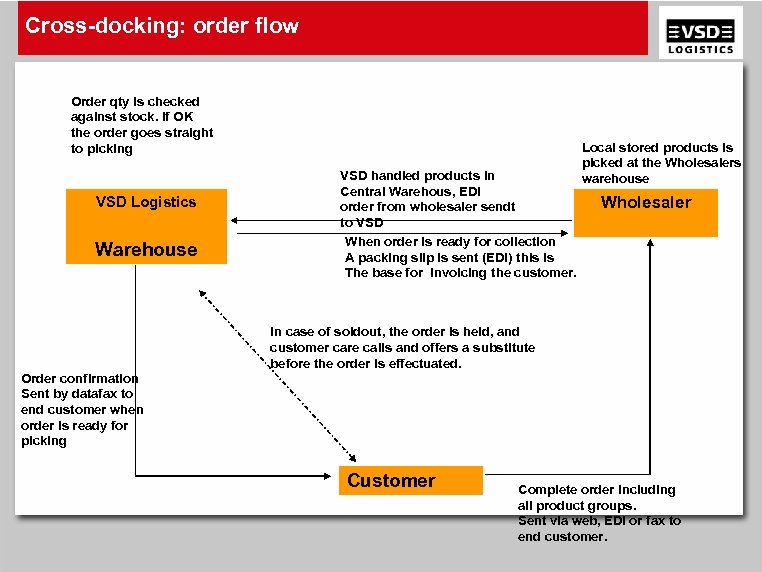

Cross-docking: order flow Order qty is checked against stock. If OK the order goes straight to picking VSD Logistics Warehouse VSD handled products in Central Warehous, EDI order from wholesaler sendt to VSD When order is ready for collection A packing slip is sent (EDI) this is The base for invoicing the customer. Local stored products is picked at the Wholesalers warehouse Wholesaler In case of soldout, the order is held, and customer care calls and offers a substitute before the order is effectuated. Order confirmation Sent by datafax to end customer when order is ready for picking Customer Complete order including all product groups. Sent via web, EDI or fax to end customer.

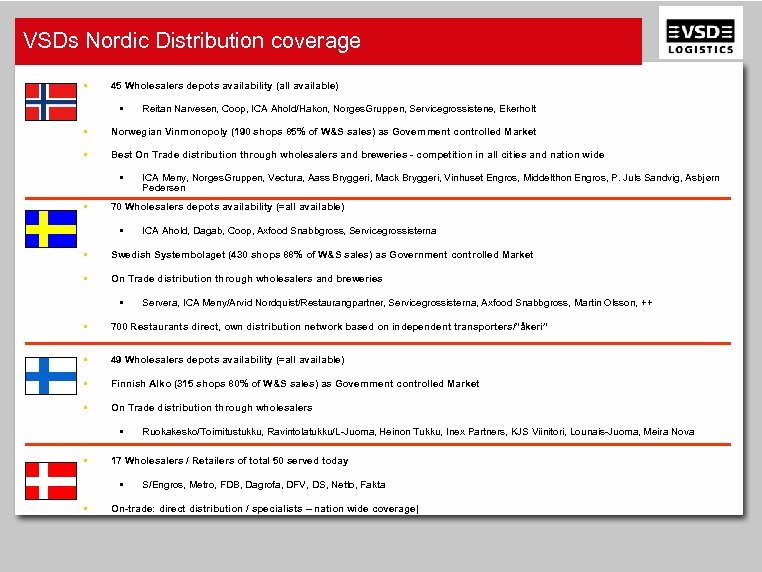

VSDs Nordic Distribution coverage • 45 Wholesalers depots availability (all available) • Reitan Narvesen, Coop, ICA Ahold/Hakon, Norges. Gruppen, Servicegrossistene, Ekerholt • Norwegian Vinmonopoly (190 shops 85% of W&S sales) as Government controlled Market • Best On Trade distribution through wholesalers and breweries - competition in all cities and nation wide • • ICA Meny, Norges. Gruppen, Vectura, Aass Bryggeri, Mack Bryggeri, Vinhuset Engros, Middelthon Engros, P. Juls Sandvig, Asbjørn Pedersen 70 Wholesalers depots availability (=all available) • ICA Ahold, Dagab, Coop, Axfood Snabbgross, Servicegrossisterna • Swedish Systembolaget (430 shops 88% of W&S sales) as Government controlled Market • On Trade distribution through wholesalers and breweries • Servera, ICA Meny/Arvid Nordquist/Restaurangpartner, Servicegrossisterna, Axfood Snabbgross, Martin Olsson, ++ • 700 Restaurants direct, own distribution network based on independent transporters/”åkeri” • 49 Wholesalers depots availability (=all available) • Finnish Alko (315 shops 80% of W&S sales) as Government controlled Market • On Trade distribution through wholesalers • • 17 Wholesalers / Retailers of total 50 served today • • Ruokakesko/Toimitustukku, Ravintolatukku/L-Juoma, Heinon Tukku, Inex Partners, KJS Viinitori, Lounais-Juoma, Meira Nova S/Engros, Metro, FDB, Dagrofa, DFV, DS, Netto, Fakta On-trade: direct distribution / specialists – nation wide coverage|

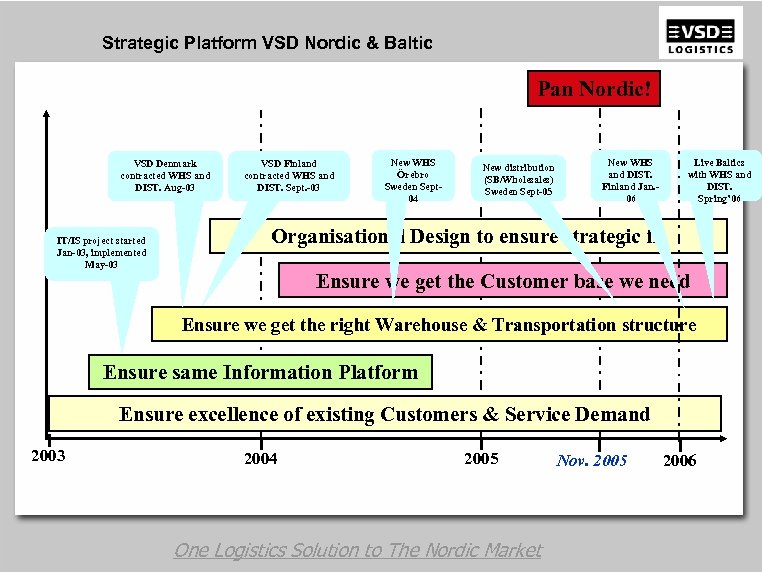

Strategic Platform VSD Nordic & Baltic Pan Nordic! VSD Denmark contracted WHS and DIST. Aug-03 IT/IS project started Jan-03, implemented May-03 VSD Finland contracted WHS and DIST. Sept. -03 New WHS Örebro Sweden Sept 04 New distribution (SB/Wholesales) Sweden Sept-05 New WHS and DIST. Finland Jan. 06 Live Baltics with WHS and DIST. Spring’ 06 Organisational Design to ensure strategic fit Ensure we get the Customer base we need Ensure we get the right Warehouse & Transportation structure Ensure same Information Platform Ensure excellence of existing Customers & Service Demand 2003 2004 2005 One Logistics Solution to The Nordic Market Nov. 2005 2006

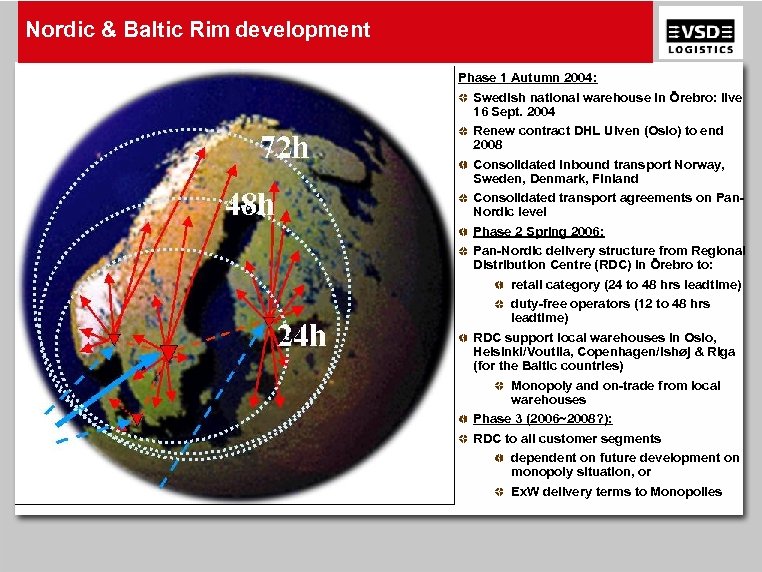

Nordic & Baltic Rim development Phase 1 Autumn 2004: Swedish national warehouse in Örebro: live 16 Sept. 2004 Renew contract DHL Ulven (Oslo) to end 2008 Consolidated inbound transport Norway, Sweden, Denmark, Finland Consolidated transport agreements on Pan. Nordic level Phase 2 Spring 2006: Pan-Nordic delivery structure from Regional Distribution Centre (RDC) in Örebro to: retail category (24 to 48 hrs leadtime) duty-free operators (12 to 48 hrs leadtime) RDC support local warehouses in Oslo, Helsinki/Voutila, Copenhagen/Ishøj & Riga (for the Baltic countries) Monopoly and on-trade from local warehouses Phase 3 (2006~2008? ): RDC to all customer segments dependent on future development on monopoly situation, or Ex. W delivery terms to Monopolies

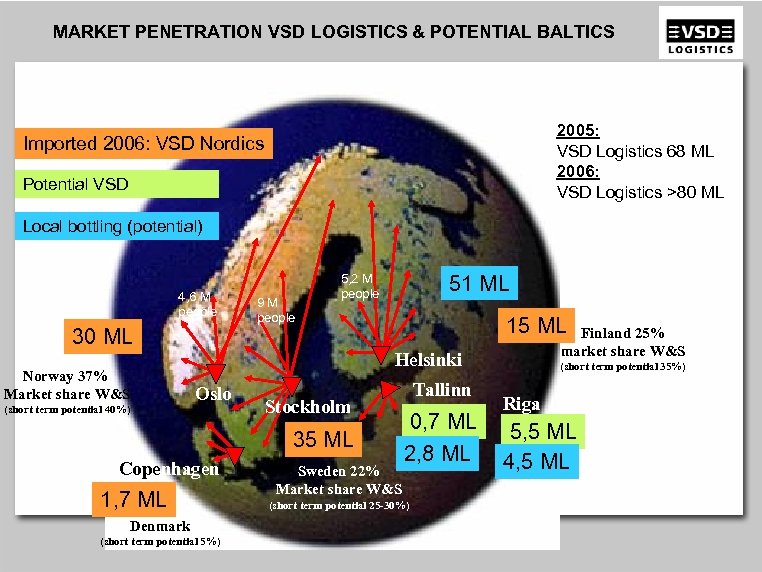

MARKET PENETRATION VSD LOGISTICS & POTENTIAL BALTICS 2005: VSD Logistics 68 ML 2006: VSD Logistics >80 ML Imported 2006: VSD Nordics Potential VSD Local bottling (potential) 4, 6 M people 30 ML Norway 37% Market share W&S (short term potential 40%) 9 M people 5, 2 M people 51 ML 15 ML Finland 25% market share W&S Helsinki Oslo Stockholm 35 ML Copenhagen 1, 7 ML Denmark (short term potential 5%) Sweden 22% Market share W&S Tallinn 0, 7 ML 2, 8 ML (short term potential 25 -30%) (short term potential 35%) Riga 5, 5 ML 4, 5 ML

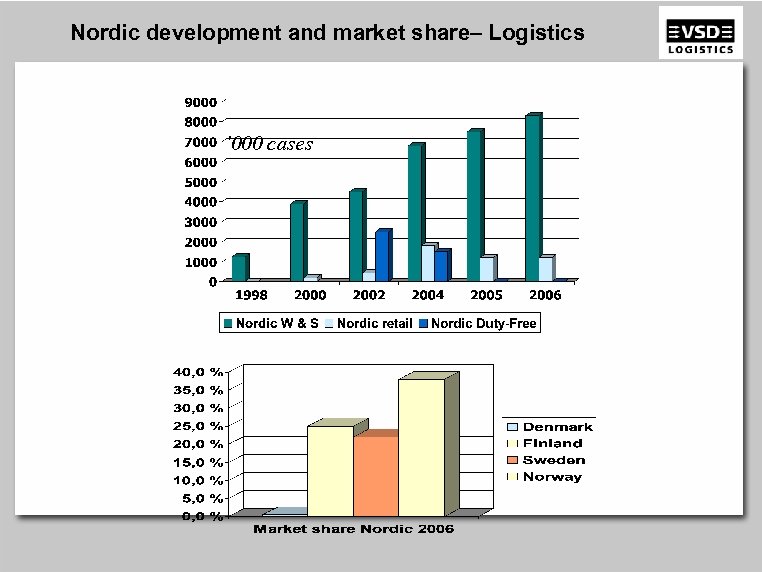

Nordic development and market share– Logistics ’ 000 cases

Maxi FMCG warehouse – VSD wine&spirit Örebro

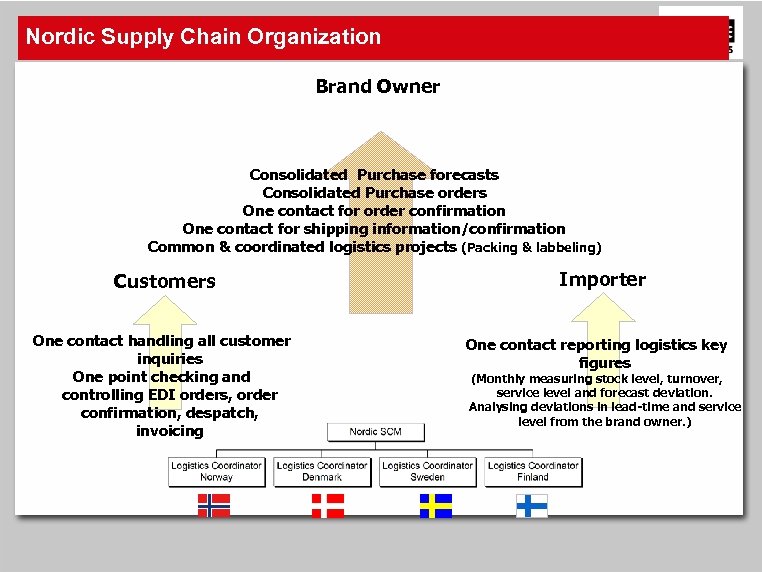

Nordic Supply Chain Organization Brand Owner Consolidated Purchase forecasts Consolidated Purchase orders One contact for order confirmation One contact for shipping information/confirmation Common & coordinated logistics projects (Packing & labbeling) Customers One contact handling all customer inquiries One point checking and controlling EDI orders, order confirmation, despatch, invoicing Importer One contact reporting logistics key figures (Monthly measuring stock level, turnover, service level and forecast deviation. Analysing deviations in lead-time and service level from the brand owner. )

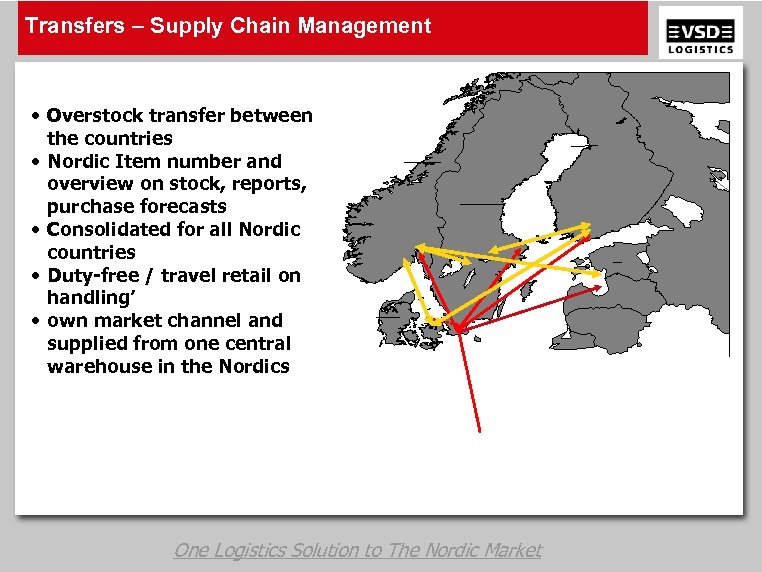

Transfers – Supply Chain Management • Overstock transfer between the countries • Nordic Item number and overview on stock, reports, purchase forecasts • Consolidated for all Nordic countries • Duty-free / travel retail on handling’ • own market channel and supplied from one central warehouse in the Nordics One Logistics Solution to The Nordic Market

Evaluations of advantages, I Main goal in the long run is to reduce logistics costs while improving service § Reducing No. of total SKUs – rational reduction of each subsidiaries portfolio – identify the same products in all countries to work with these on a Nordic level – not unique product per country – Inbound transport cost: – full loads and more rational handling for both brand owner, transport company and warehouse – Warehouse costs: – reduction of multiple SKUs, locations, higher volumes total per unique product – Administration cost: – reduction of administrative workload for both brand owner and VSD, reduced no. of shipments per year – Service level: – if country warehouses: flexible in the use of inbound shipments/re-route to other countries, share stock between the countries – if one Nordic Central Distribution Centre (CDC): use the same products for all markets

Evaluations of advantages, II § Central Distribution Centre (CDC) – Inbound transport cost: – one delivery address for Sweden, Denmark and Norway, and one common warehouse for Finland, Latvia and Estonia – Pick&pack cost: – same workload, but economy of scale based on large volumes on the total portfolio – Storage cost: – reduced cost per distributed unit based on higher turnover and economy of scale in a central warehouse operations – Administration cost: – reduced from multiple warehouse operations to maximum of two for the Nordic region – Service level: – increased based on one central warehouse covering the Nordic region, more frequent deliveries from brand owners based on higher volume through warehouse

Evaluations of advantages, III § Nordic supply chain management – Brand owners: – reduced no of transactions (Purchase orders, order confirmations, shipments/export papers), consolidated volume and production forecasts, one contact person for all Nordic supply chain (VSD Nordic), VSD reporting Key Performance Indicators (KPI) regularly per month – Subsidiaries/importers: – benefit of Nordic consolidation of supply chain management, the reduced no of transactions will reduce the administrative work, no need for logistics management in the subsidiaries, VSD reporting Key Performance Indicators (KPI) regularly per month

Evaluations of advantages, IV § Development – Focus on sales development – knowledge and resources to work on development of the total supply chain – system and volume to protect Brand Owner’s interest when the Monopoly market open up for sales to retail shops/supermarkets – Display packing/value added services – one central warehouse to do large scale of display pallets, develop sales packaging – Pan Nordic product introduction – testing and introducing new products in the market will be coordinated with market activities, less sensitive to pipeline filling as volume in the CDC cover more than one market

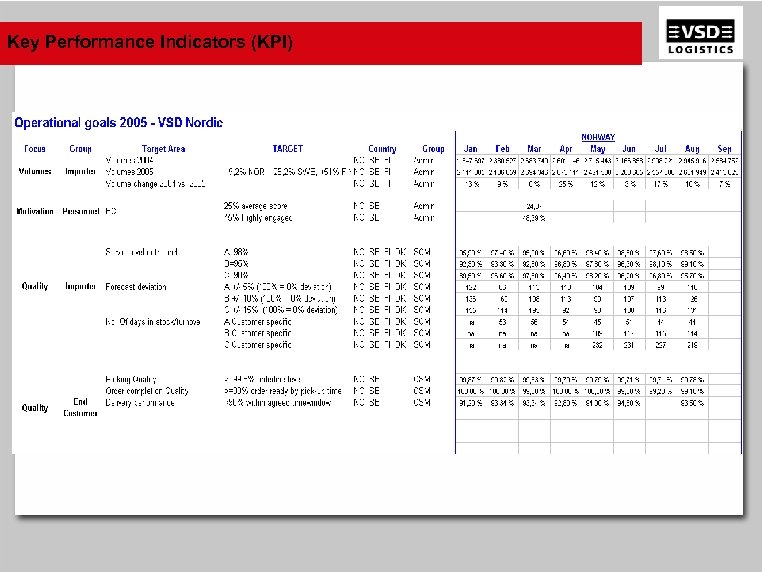

Key Performance Indicators (KPI)

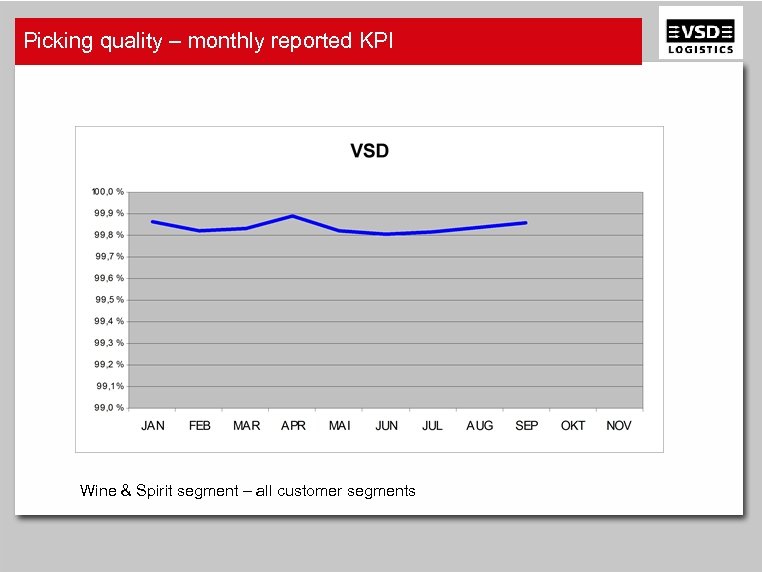

Picking quality – monthly reported KPI Wine & Spirit segment – all customer segments

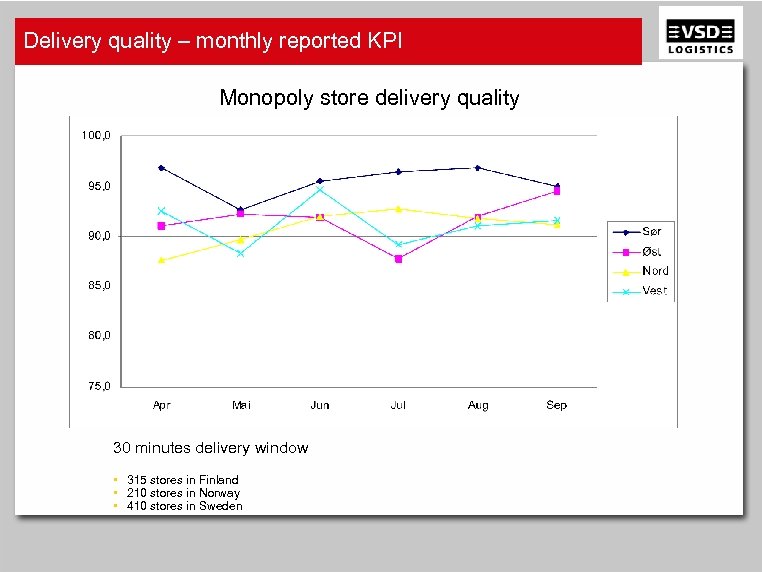

Delivery quality – monthly reported KPI Monopoly store delivery quality 30 minutes delivery window • 315 stores in Finland • 210 stores in Norway • 410 stores in Sweden

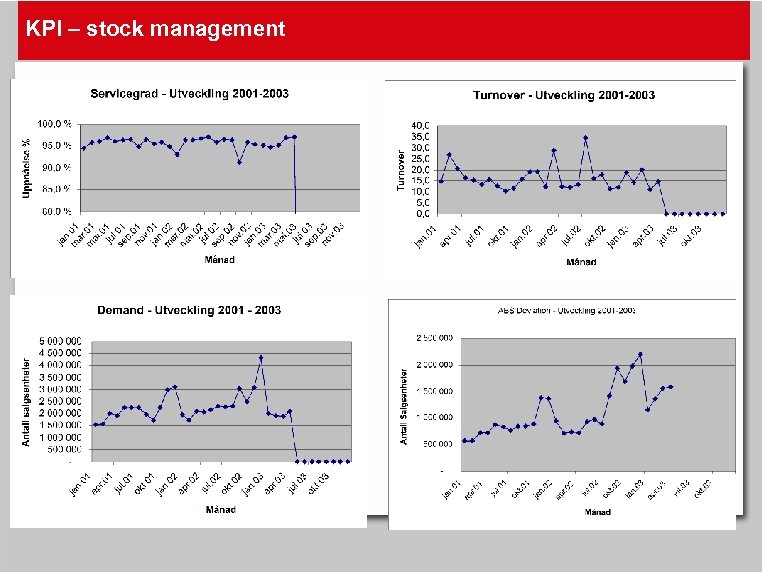

KPI – stock management

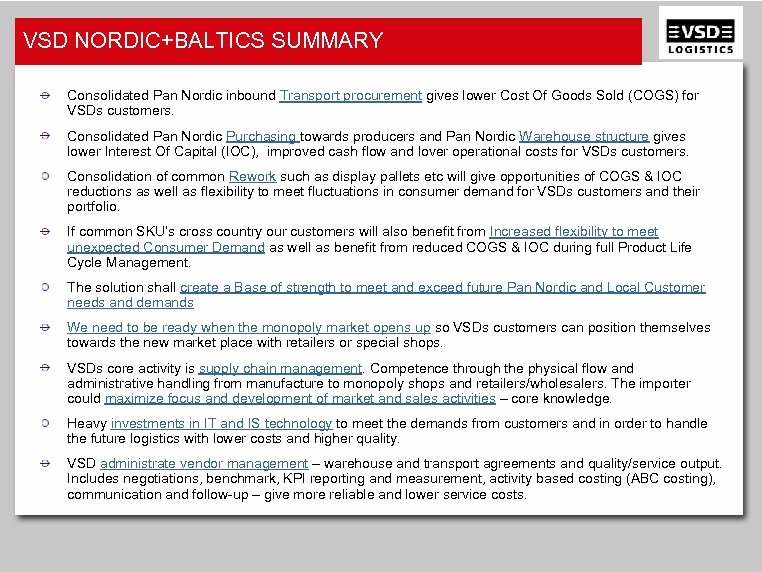

VSD NORDIC+BALTICS SUMMARY Consolidated Pan Nordic inbound Transport procurement gives lower Cost Of Goods Sold (COGS) for VSDs customers. Consolidated Pan Nordic Purchasing towards producers and Pan Nordic Warehouse structure gives lower Interest Of Capital (IOC), improved cash flow and lover operational costs for VSDs customers. Consolidation of common Rework such as display pallets etc will give opportunities of COGS & IOC reductions as well as flexibility to meet fluctuations in consumer demand for VSDs customers and their portfolio. If common SKU’s cross country our customers will also benefit from Increased flexibility to meet unexpected Consumer Demand as well as benefit from reduced COGS & IOC during full Product Life Cycle Management. The solution shall create a Base of strength to meet and exceed future Pan Nordic and Local Customer needs and demands We need to be ready when the monopoly market opens up so VSDs customers can position themselves towards the new market place with retailers or special shops. VSDs core activity is supply chain management. Competence through the physical flow and administrative handling from manufacture to monopoly shops and retailers/wholesalers. The importer could maximize focus and development of market and sales activities – core knowledge. Heavy investments in IT and IS technology to meet the demands from customers and in order to handle the future logistics with lower costs and higher quality. VSD administrate vendor management – warehouse and transport agreements and quality/service output. Includes negotiations, benchmark, KPI reporting and measurement, activity based costing (ABC costing), communication and follow-up – give more reliable and lower service costs.

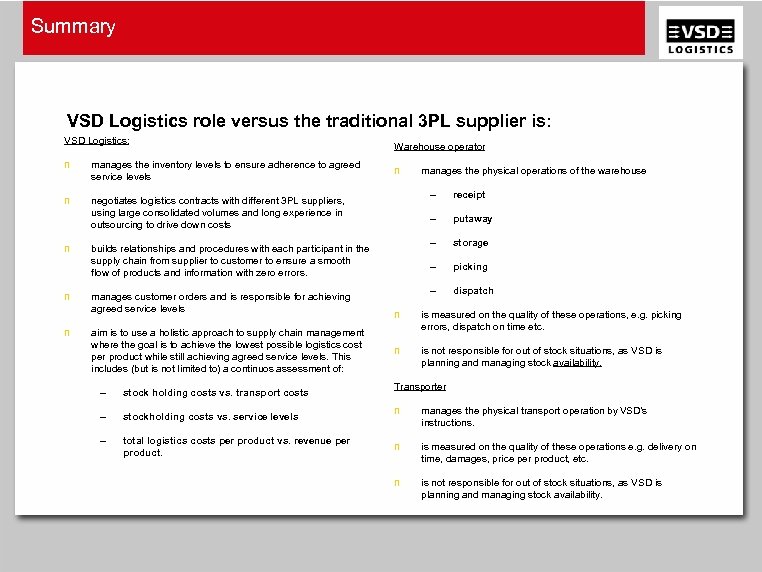

Summary VSD Logistics role versus the traditional 3 PL supplier is: VSD Logistics: n manages the inventory levels to ensure adherence to agreed service levels n Warehouse operator negotiates logistics contracts with different 3 PL suppliers, using large consolidated volumes and long experience in outsourcing to drive down costs n n – aim is to use a holistic approach to supply chain management where the goal is to achieve the lowest possible logistics cost per product while still achieving agreed service levels. This includes (but is not limited to) a continuos assessment of: – stock holding costs vs. transport costs – stockholding costs vs. service levels – total logistics costs per product vs. revenue per product. receipt – putaway – storage – picking – builds relationships and procedures with each participant in the supply chain from supplier to customer to ensure a smooth flow of products and information with zero errors. manages customer orders and is responsible for achieving agreed service levels manages the physical operations of the warehouse dispatch n is measured on the quality of these operations, e. g. picking errors, dispatch on time etc. n is not responsible for out of stock situations, as VSD is planning and managing stock availability. Transporter n manages the physical transport operation by VSD’s instructions. n is measured on the quality of these operations e. g. delivery on time, damages, price per product, etc. n is not responsible for out of stock situations, as VSD is planning and managing stock availability.

Kontaktinfo n Ved spørsmål eller ønske om kontakt, ta kontakt med n Lorna Dyrseth n Mail: lorna. dyrseth@vsd. no Mobil : 922 -22122

d62d2fa887633874af2cefe652daa3d3.ppt