5df1b60adbe0a17c7afe6cff3c23765b.ppt

- Количество слайдов: 30

Vs. A Financial Analysis Which Stock to Decide on? A FINANCIAL COMPARISON - Samarth Patwardhan - Sachin Mylavarapu 1

Vs. A Financial Analysis Which Stock to Decide on? A FINANCIAL COMPARISON - Samarth Patwardhan - Sachin Mylavarapu 1

Agenda Ø Company Overview Ø Products and Services Ø Recent Developments Ø Financial Analysis Ø Future Plans Ø Conclusion A FINANCIAL COMPARISON 2

Agenda Ø Company Overview Ø Products and Services Ø Recent Developments Ø Financial Analysis Ø Future Plans Ø Conclusion A FINANCIAL COMPARISON 2

Company Overview Intel Corporation Incorporated as NM Electronics on July 18 th 1968 Ø Introduced first ever Microprocessor in 1971 Ø Went public on October 13 th 1971 Ø Sector – Technology, Industry – Semiconductor broad line(b = 2. 1) Ø Today – World leader in the Amanufacturing of microprocessors FINANCIAL Ø COMPARISON 3

Company Overview Intel Corporation Incorporated as NM Electronics on July 18 th 1968 Ø Introduced first ever Microprocessor in 1971 Ø Went public on October 13 th 1971 Ø Sector – Technology, Industry – Semiconductor broad line(b = 2. 1) Ø Today – World leader in the Amanufacturing of microprocessors FINANCIAL Ø COMPARISON 3

Company Overview Hitachi Corporation 1910 – Started as an Electrical Workshop Ø IPO – 1949 – Tokyo Stock Exchange, April’ 1982 – New York Stock Exchange Ø Sector – Consumer Goods, Industry – Electronic Equipment (b = 1. 04) Ø Today, Hitachi has a broad range of products to offer in the market Ø A FINANCIAL COMPARISON 4

Company Overview Hitachi Corporation 1910 – Started as an Electrical Workshop Ø IPO – 1949 – Tokyo Stock Exchange, April’ 1982 – New York Stock Exchange Ø Sector – Consumer Goods, Industry – Electronic Equipment (b = 1. 04) Ø Today, Hitachi has a broad range of products to offer in the market Ø A FINANCIAL COMPARISON 4

Products and Services Intel Corporation Classified in four main categories Ø Wide range of products Ø From wireless networking solutions to programmable hardware Ø Focus – Freedom of computing and reduction of infrastructure costs Ø A FINANCIAL COMPARISON 5

Products and Services Intel Corporation Classified in four main categories Ø Wide range of products Ø From wireless networking solutions to programmable hardware Ø Focus – Freedom of computing and reduction of infrastructure costs Ø A FINANCIAL COMPARISON 5

Products and Services Hitachi Corporation Much more diversified spectrum Ø Power and Industrial Systems, logistics services Ø Information and telecommunication systems, electronic devices Ø Media products, financial services Ø Focus - Creating e-business infrastructures that are tailored to specific Aindividual needs FINANCIAL Ø COMPARISON 6

Products and Services Hitachi Corporation Much more diversified spectrum Ø Power and Industrial Systems, logistics services Ø Information and telecommunication systems, electronic devices Ø Media products, financial services Ø Focus - Creating e-business infrastructures that are tailored to specific Aindividual needs FINANCIAL Ø COMPARISON 6

Recent Developments Intel corporation In the last 2 years, seven acquisitions to broaden its product portfolio Ø Target the network and Communications markets Ø Shifted more than half of their R&D expenditure to server-related chipsets, microprocessors and platforms Ø A FINANCIAL COMPARISON 7

Recent Developments Intel corporation In the last 2 years, seven acquisitions to broaden its product portfolio Ø Target the network and Communications markets Ø Shifted more than half of their R&D expenditure to server-related chipsets, microprocessors and platforms Ø A FINANCIAL COMPARISON 7

Recent Developments Hitachi Corporation First half of Fiscal’ 01 – 2% drop in Sales Ø Hit by a 90% price collapse for DRAM chips Ø October’ 01 – decision to spin off two if its groups Ø Recent reform measures include alliances, JV’s, acquisitions etc. Ø A FINANCIAL COMPARISON 8

Recent Developments Hitachi Corporation First half of Fiscal’ 01 – 2% drop in Sales Ø Hit by a 90% price collapse for DRAM chips Ø October’ 01 – decision to spin off two if its groups Ø Recent reform measures include alliances, JV’s, acquisitions etc. Ø A FINANCIAL COMPARISON 8

Financial Analysis The 7 – Point Criteria Ø Ø Ø Ø Growth Liquidity Gain Market Value Risk Factors Future Stock Performance A FINANCIAL COMPARISON 9

Financial Analysis The 7 – Point Criteria Ø Ø Ø Ø Growth Liquidity Gain Market Value Risk Factors Future Stock Performance A FINANCIAL COMPARISON 9

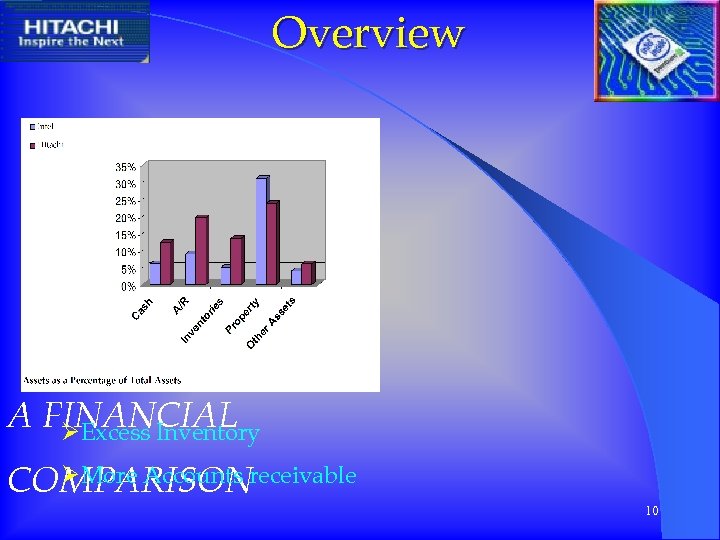

Overview A FINANCIAL ØExcess Inventory ØMore Accounts COMPARISONreceivable 10

Overview A FINANCIAL ØExcess Inventory ØMore Accounts COMPARISONreceivable 10

Overview Ø Mode of Financing A FINANCIAL COMPARISON 11

Overview Ø Mode of Financing A FINANCIAL COMPARISON 11

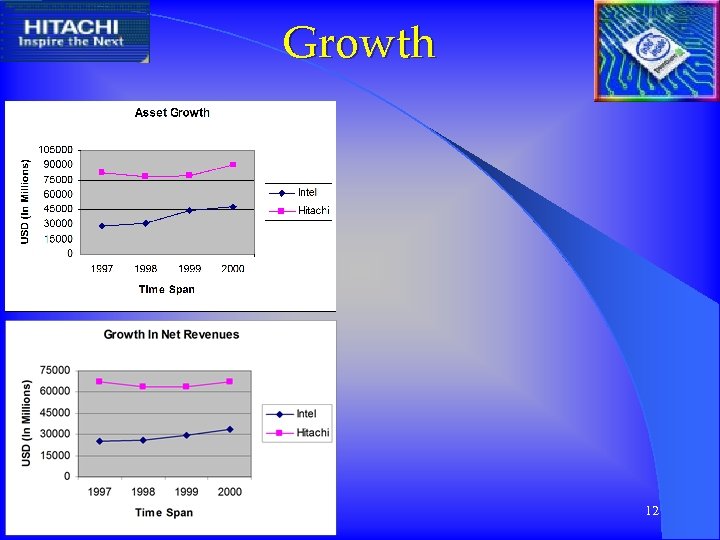

Growth A FINANCIAL COMPARISON 12

Growth A FINANCIAL COMPARISON 12

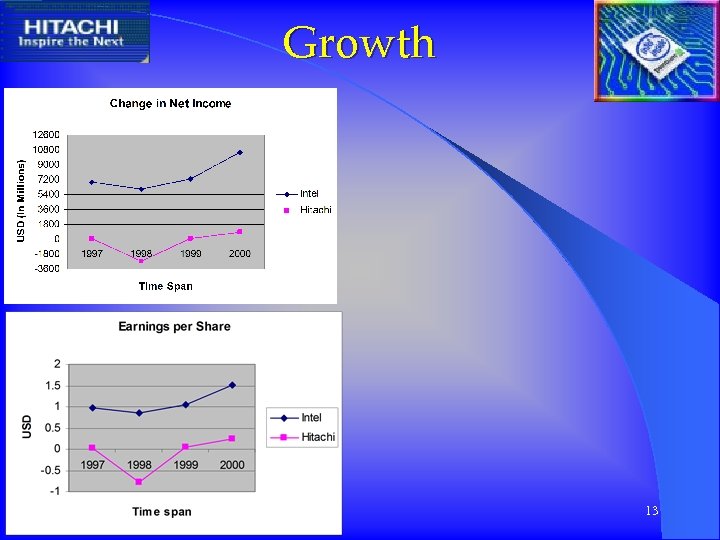

Growth A FINANCIAL COMPARISON 13

Growth A FINANCIAL COMPARISON 13

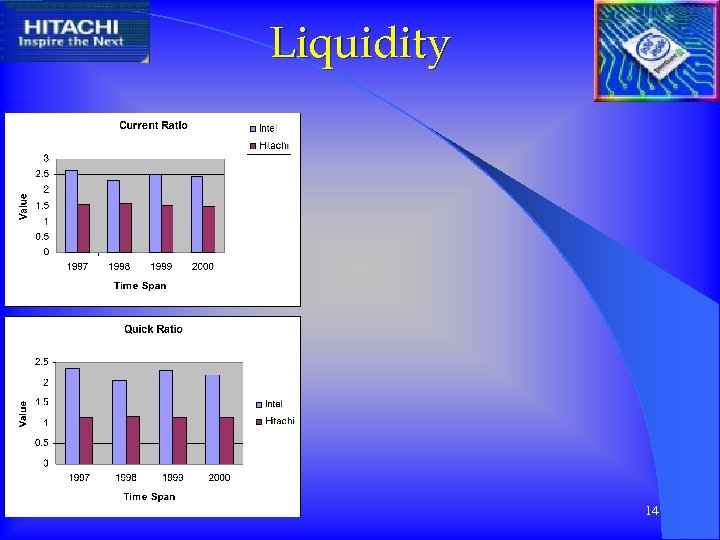

Liquidity A FINANCIAL COMPARISON 14

Liquidity A FINANCIAL COMPARISON 14

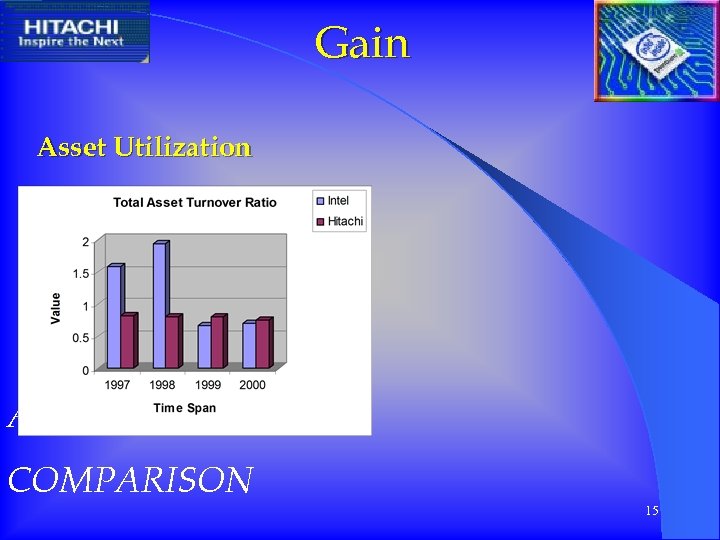

Gain Asset Utilization A FINANCIAL COMPARISON 15

Gain Asset Utilization A FINANCIAL COMPARISON 15

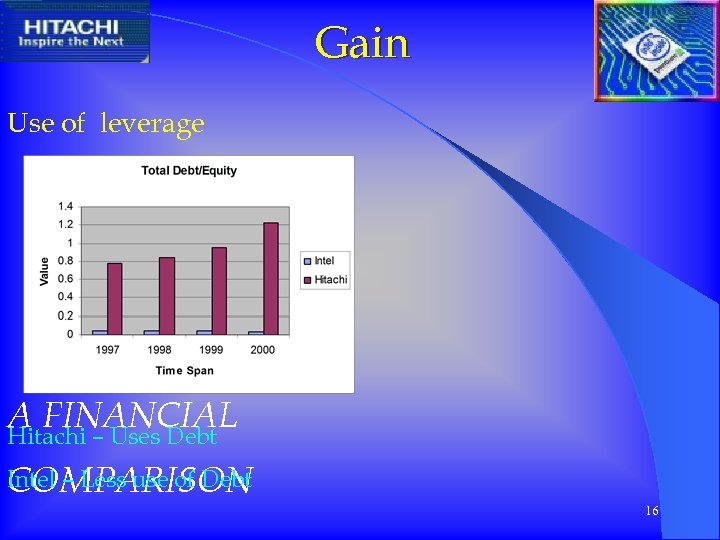

Gain Use of leverage A FINANCIAL Hitachi – Uses Debt Intel – Less use of Debt COMPARISON 16

Gain Use of leverage A FINANCIAL Hitachi – Uses Debt Intel – Less use of Debt COMPARISON 16

Gain Profit Margin A FINANCIAL ØCost of sales. ØMoney tied up in A/R and inventory COMPARISON 17

Gain Profit Margin A FINANCIAL ØCost of sales. ØMoney tied up in A/R and inventory COMPARISON 17

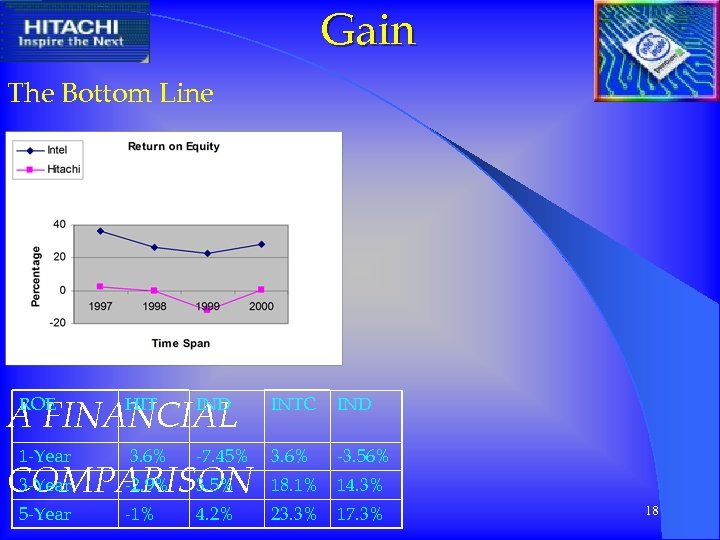

Gain The Bottom Line ROE HIT IND INTC IND 1 -Year 3. 6% -7. 45% 3. 6% -3. 56% 18. 1% 14. 3% 23. 3% 17. 3% A FINANCIAL 3 -Year -2. 9% 3. 5% COMPARISON 5 -Year -1% 4. 2% 18

Gain The Bottom Line ROE HIT IND INTC IND 1 -Year 3. 6% -7. 45% 3. 6% -3. 56% 18. 1% 14. 3% 23. 3% 17. 3% A FINANCIAL 3 -Year -2. 9% 3. 5% COMPARISON 5 -Year -1% 4. 2% 18

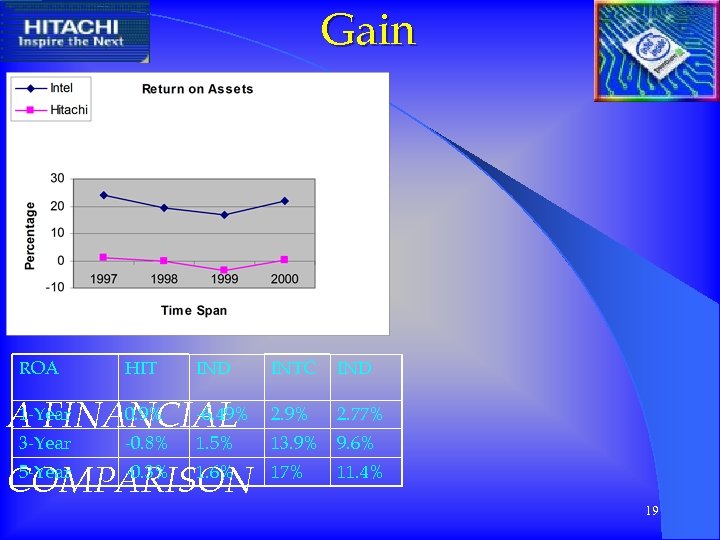

Gain ROA INTC IND 1 -Year 0. 9% -6. 49% A FINANCIAL 2. 9% 2. 77% 13. 9% 9. 6% 5 -Year -0. 3% 1. 6% COMPARISON 17% 11. 4% 3 -Year HIT -0. 8% IND 1. 5% 19

Gain ROA INTC IND 1 -Year 0. 9% -6. 49% A FINANCIAL 2. 9% 2. 77% 13. 9% 9. 6% 5 -Year -0. 3% 1. 6% COMPARISON 17% 11. 4% 3 -Year HIT -0. 8% IND 1. 5% 19

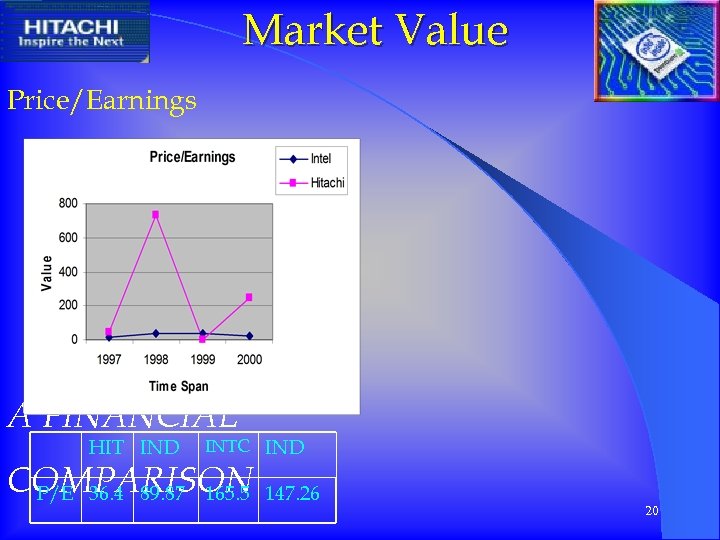

Market Value Price/Earnings A FINANCIAL HIT IND INTC IND COMPARISON P/E 36. 4 89. 87 165. 5 147. 26 20

Market Value Price/Earnings A FINANCIAL HIT IND INTC IND COMPARISON P/E 36. 4 89. 87 165. 5 147. 26 20

Future Plans Intel corporation Market share for processors – increase from 20% to 69% by ‘ 03 Ø Fiber optics industry Ø Hyper-Threading technology Ø CEO – “In the future, all computers will communicate and all communication devices will compute. ” Ø A FINANCIAL COMPARISON 22

Future Plans Intel corporation Market share for processors – increase from 20% to 69% by ‘ 03 Ø Fiber optics industry Ø Hyper-Threading technology Ø CEO – “In the future, all computers will communicate and all communication devices will compute. ” Ø A FINANCIAL COMPARISON 22

Future Plans Hitachi Corporation April’ 2001 - The Corporate Innovation Innovative (CII) Ø Reduce material purchasing costs by 20% Ø Inventory and A/R by 25% Ø Aim at doubling the sales from Fiscal 2000 to Fiscal 2002 Ø A FINANCIAL COMPARISON 23

Future Plans Hitachi Corporation April’ 2001 - The Corporate Innovation Innovative (CII) Ø Reduce material purchasing costs by 20% Ø Inventory and A/R by 25% Ø Aim at doubling the sales from Fiscal 2000 to Fiscal 2002 Ø A FINANCIAL COMPARISON 23

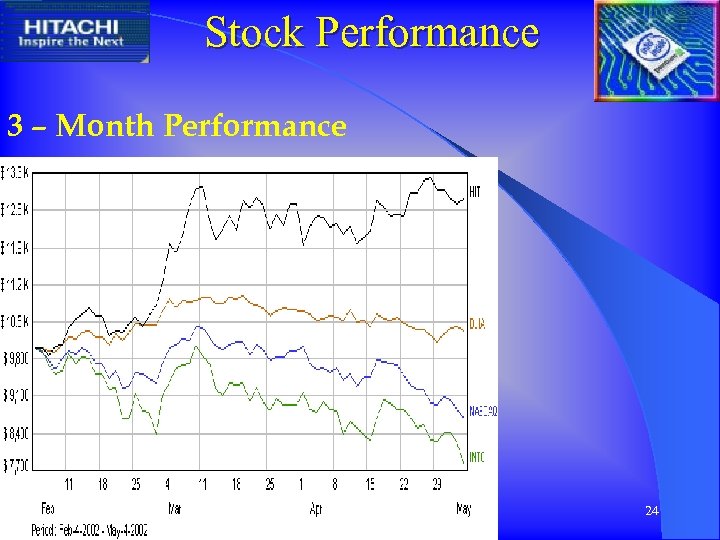

Stock Performance 3 – Month Performance A FINANCIAL COMPARISON 24

Stock Performance 3 – Month Performance A FINANCIAL COMPARISON 24

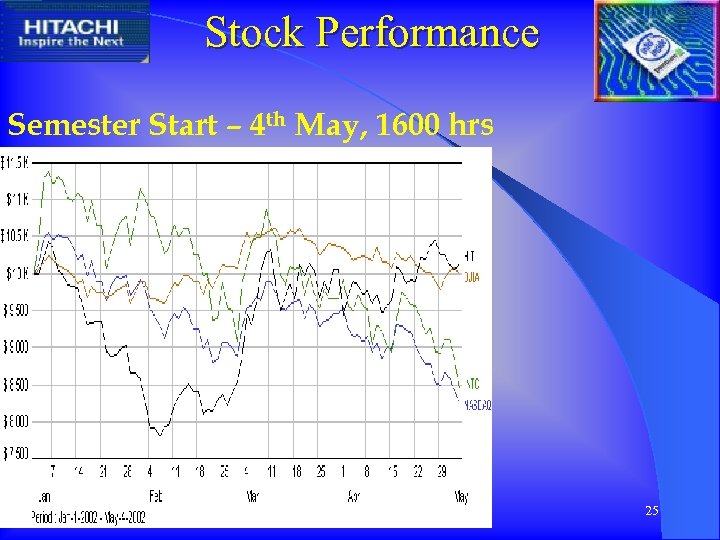

Stock Performance Semester Start – 4 th May, 1600 hrs A FINANCIAL COMPARISON 25

Stock Performance Semester Start – 4 th May, 1600 hrs A FINANCIAL COMPARISON 25

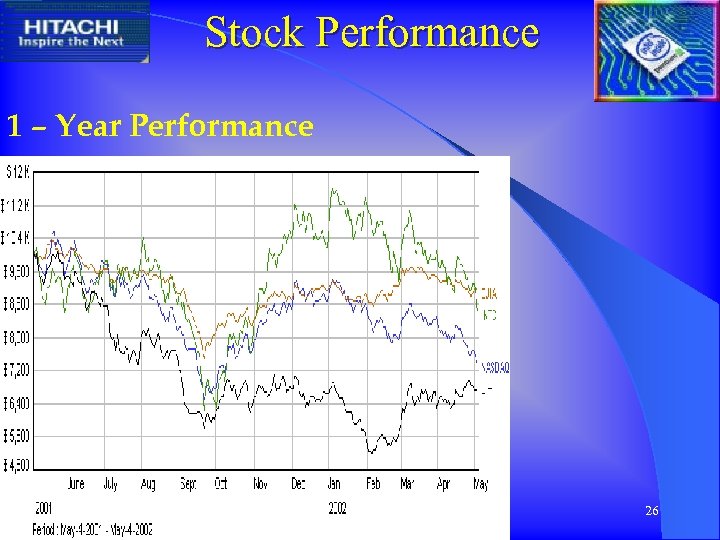

Stock Performance 1 – Year Performance A FINANCIAL COMPARISON 26

Stock Performance 1 – Year Performance A FINANCIAL COMPARISON 26

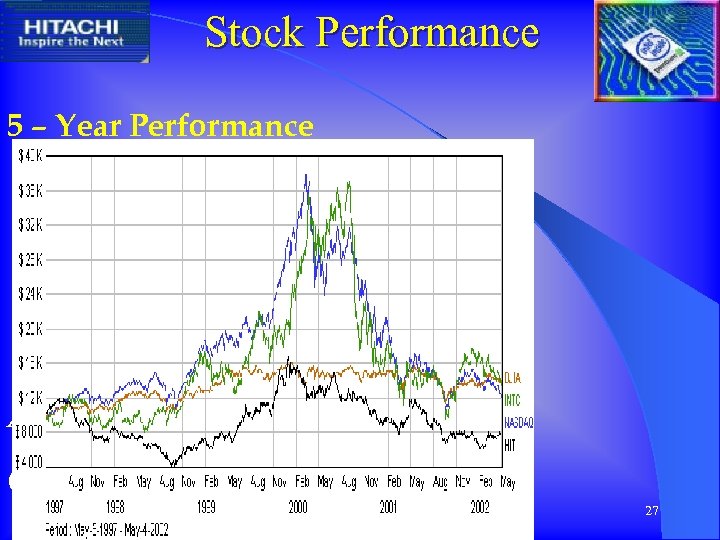

Stock Performance 5 – Year Performance A FINANCIAL COMPARISON 27

Stock Performance 5 – Year Performance A FINANCIAL COMPARISON 27

Summary Parameters HIT INTC 3 3 Growth 3 Liquidity 2 Gain 3 Market Value 2 Risk Factors 3 Future 4 4 4 3 3 2. 85 3. 42 A FINANCIAL Stock Performance COMPARISON Average 28

Summary Parameters HIT INTC 3 3 Growth 3 Liquidity 2 Gain 3 Market Value 2 Risk Factors 3 Future 4 4 4 3 3 2. 85 3. 42 A FINANCIAL Stock Performance COMPARISON Average 28

What to Do? Look beyond numbers Ø See as an opportunity to buy low Ø If you already have it, hold it Ø Good for long term investment Ø A FINANCIAL COMPARISON 29

What to Do? Look beyond numbers Ø See as an opportunity to buy low Ø If you already have it, hold it Ø Good for long term investment Ø A FINANCIAL COMPARISON 29

Risk is the Name of the Game! Are You Willing to Take it? A FINANCIAL COMPARISON 30

Risk is the Name of the Game! Are You Willing to Take it? A FINANCIAL COMPARISON 30

A FINANCIAL COMPARISON 31

A FINANCIAL COMPARISON 31