743cd492fb693a277ef4dcfaf70d6138.ppt

- Количество слайдов: 19

Virtual Payments for Business Travel Mary Miklethun – SVP Commercial Card Product & Marketing, U. S. Bank © 2015 GBTA. All rights reserved.

Agenda • Key Research Findings • Beyond the Data: things to consider • Q&A © 2015 GBTA. All rights reserved. 2

Key Research Findings 3 © 2015 GBTA. All rights reserved.

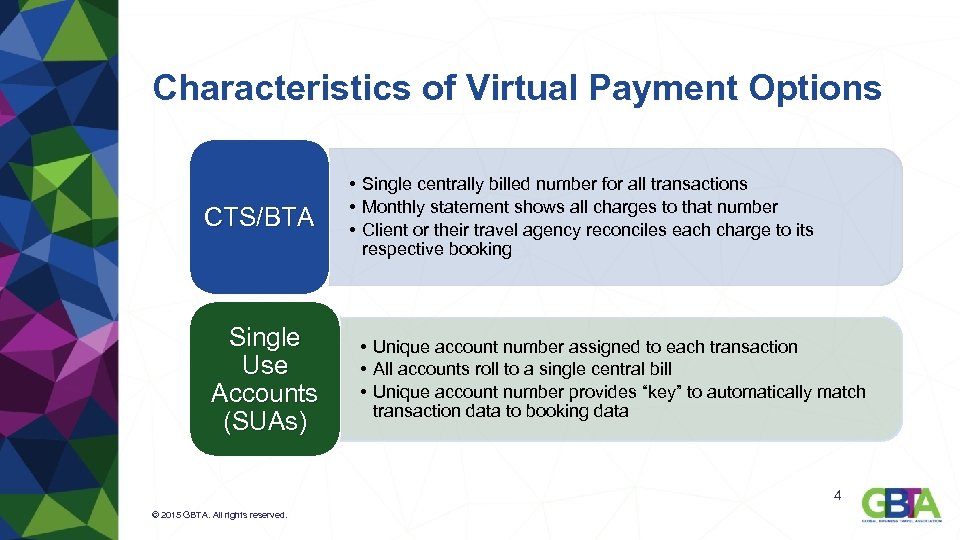

Characteristics of Virtual Payment Options CTS/BTA Single Use Accounts (SUAs) • Single centrally billed number for all transactions • Monthly statement shows all charges to that number • Client or their travel agency reconciles each charge to its respective booking • Unique account number assigned to each transaction • All accounts roll to a single central bill • Unique account number provides “key” to automatically match transaction data to booking data 4 © 2015 GBTA. All rights reserved.

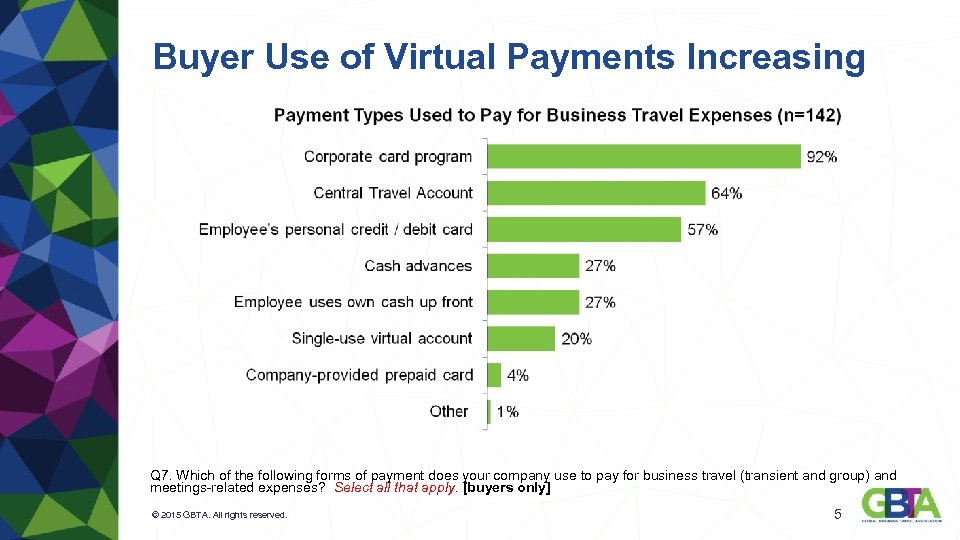

Buyer Use of Virtual Payments Increasing Q 7. Which of the following forms of payment does your company use to pay for business travel (transient and group) and meetings-related expenses? Select all that apply. [buyers only] © 2015 GBTA. All rights reserved. 5

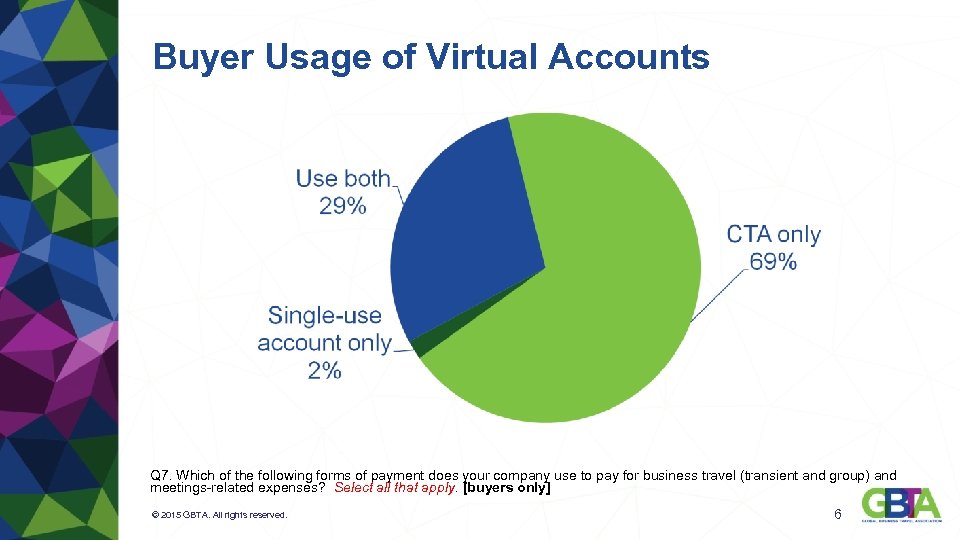

Buyer Usage of Virtual Accounts Q 7. Which of the following forms of payment does your company use to pay for business travel (transient and group) and meetings-related expenses? Select all that apply. [buyers only] © 2015 GBTA. All rights reserved. 6

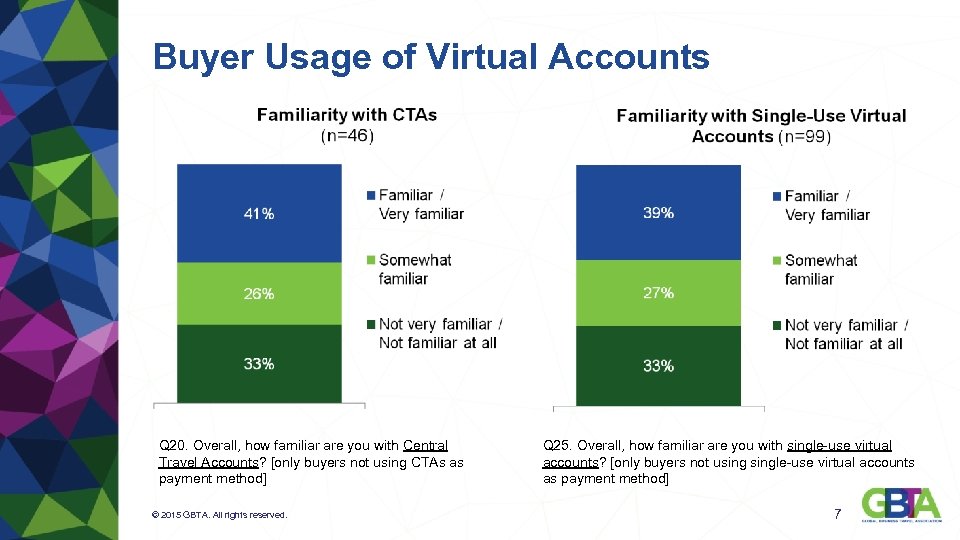

Buyer Usage of Virtual Accounts Q 20. Overall, how familiar are you with Central Travel Accounts? [only buyers not using CTAs as payment method] © 2015 GBTA. All rights reserved. Q 25. Overall, how familiar are you with single-use virtual accounts? [only buyers not usingle-use virtual accounts as payment method] 7

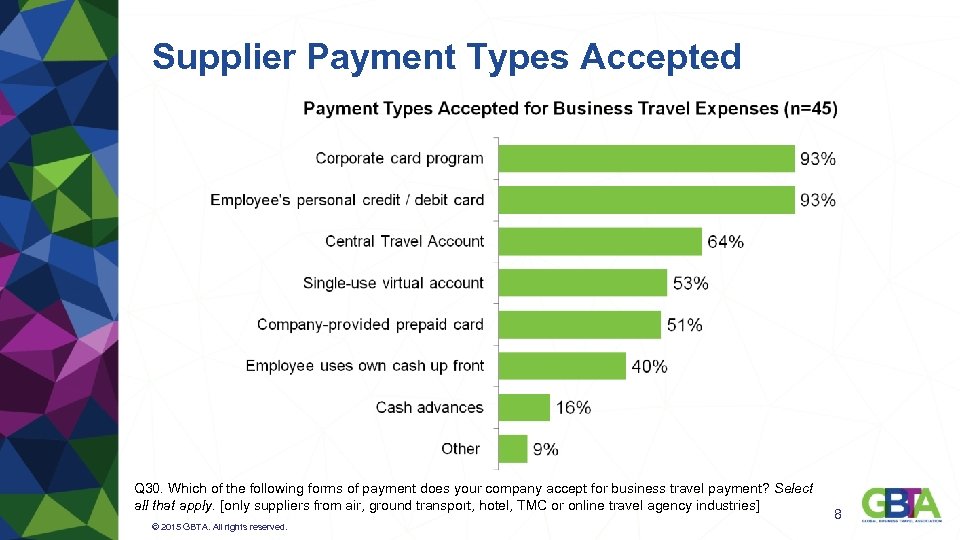

Supplier Payment Types Accepted Q 30. Which of the following forms of payment does your company accept for business travel payment? Select all that apply. [only suppliers from air, ground transport, hotel, TMC or online travel agency industries] © 2015 GBTA. All rights reserved. 8

Beyond the Data: Things to consider © 2015 GBTA. All rights reserved. 9

When Do Virtual Payments Make Sense? • Alternative to other central billing methods • Capture travel expenses that otherwise fall outside corporate card program § Infrequent travelers § Contractors § Recruits

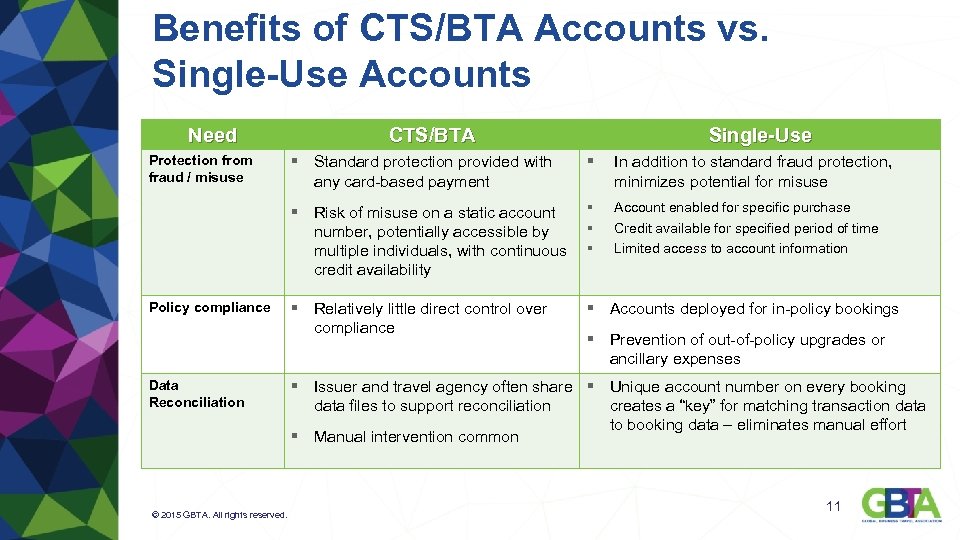

Benefits of CTS/BTA Accounts vs. Single-Use Accounts Need CTS/BTA Single-Use Policy compliance Data Reconciliation © 2015 GBTA. All rights reserved. § Standard protection provided with any card-based payment § In addition to standard fraud protection, minimizes potential for misuse § Risk of misuse on a static account number, potentially accessible by multiple individuals, with continuous credit availability Protection from fraud / misuse § § § Account enabled for specific purchase Credit available for specified period of time Limited access to account information § Relatively little direct control over compliance § Accounts deployed for in-policy bookings § Prevention of out-of-policy upgrades or ancillary expenses § Issuer and travel agency often share § Unique account number on every booking data files to support reconciliation creates a “key” for matching transaction data to booking data – eliminates manual effort § Manual intervention common 11

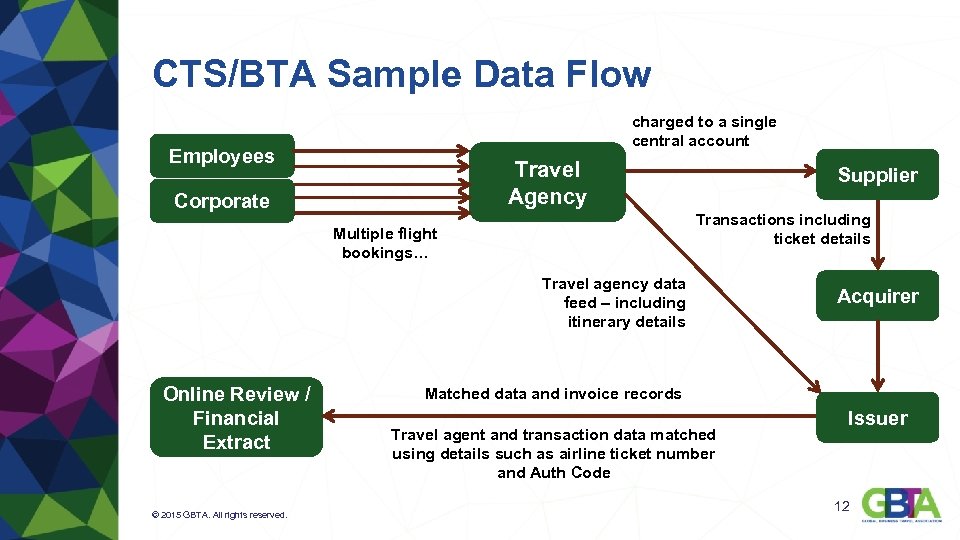

CTS/BTA Sample Data Flow charged to a single central account Employees Travel Agency Corporate Supplier Transactions including ticket details Multiple flight bookings… Travel agency data feed – including itinerary details Online Review / Financial Extract © 2015 GBTA. All rights reserved. Acquirer Matched data and invoice records Travel agent and transaction data matched using details such as airline ticket number and Auth Code Issuer 12

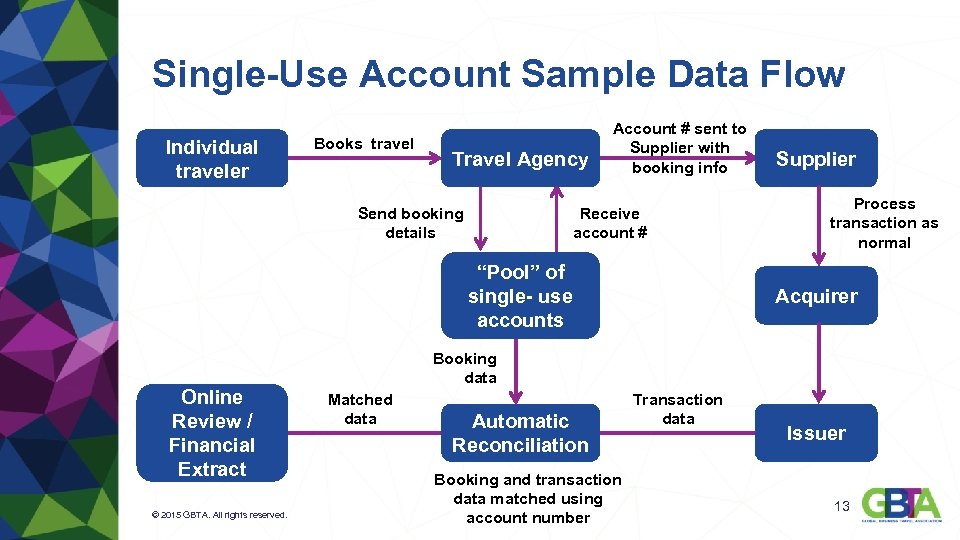

Single-Use Account Sample Data Flow Individual traveler Books travel Travel Agency Send booking details Account # sent to Supplier with booking info Receive account # “Pool” of single- use accounts Online Review / Financial Extract © 2015 GBTA. All rights reserved. Supplier Process transaction as normal Acquirer Booking data Matched data Automatic Reconciliation Booking and transaction data matched using account number Transaction data Issuer 13

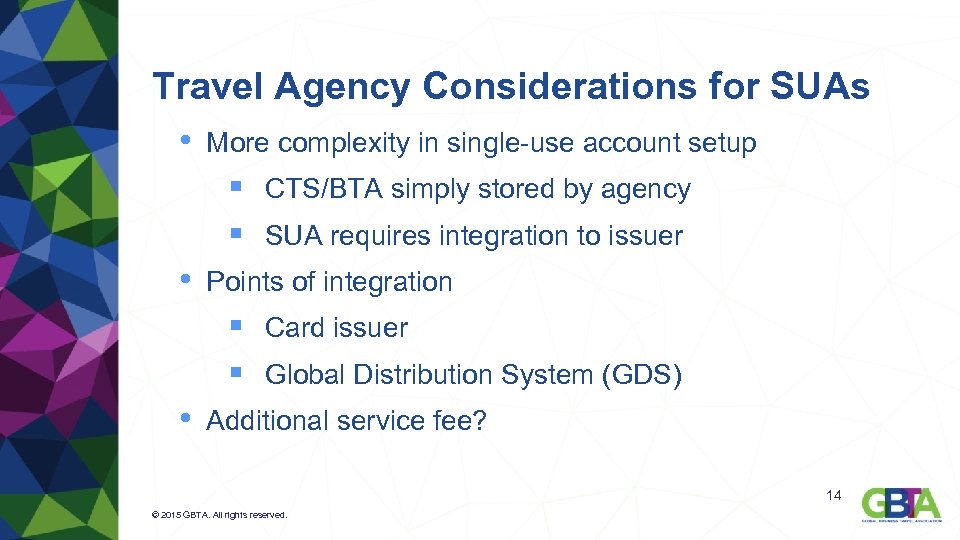

Travel Agency Considerations for SUAs • More complexity in single-use account setup § CTS/BTA simply stored by agency § SUA requires integration to issuer • Points of integration § Card issuer § Global Distribution System (GDS) • Additional service fee? 14 © 2015 GBTA. All rights reserved.

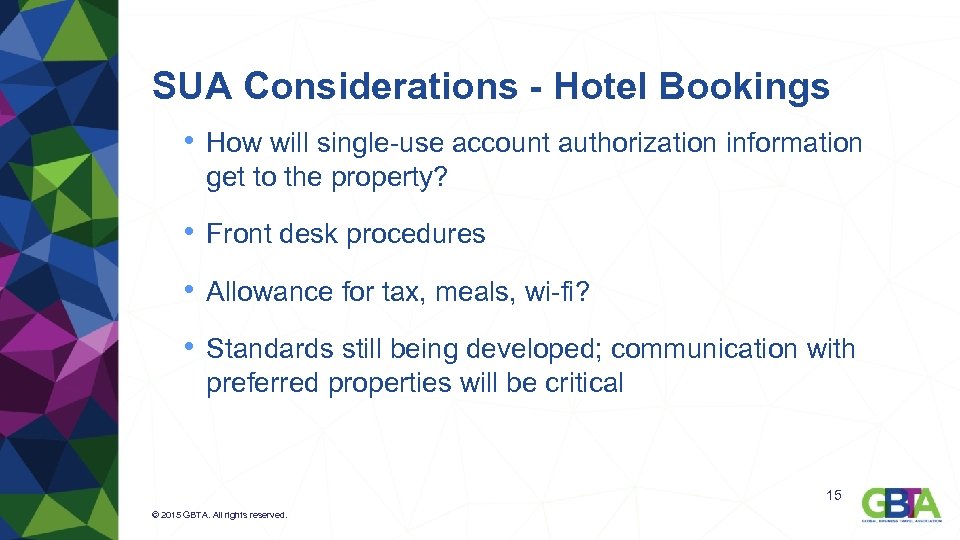

SUA Considerations - Hotel Bookings • How will single-use account authorization information get to the property? • Front desk procedures • Allowance for tax, meals, wi-fi? • Standards still being developed; communication with preferred properties will be critical 15 © 2015 GBTA. All rights reserved.

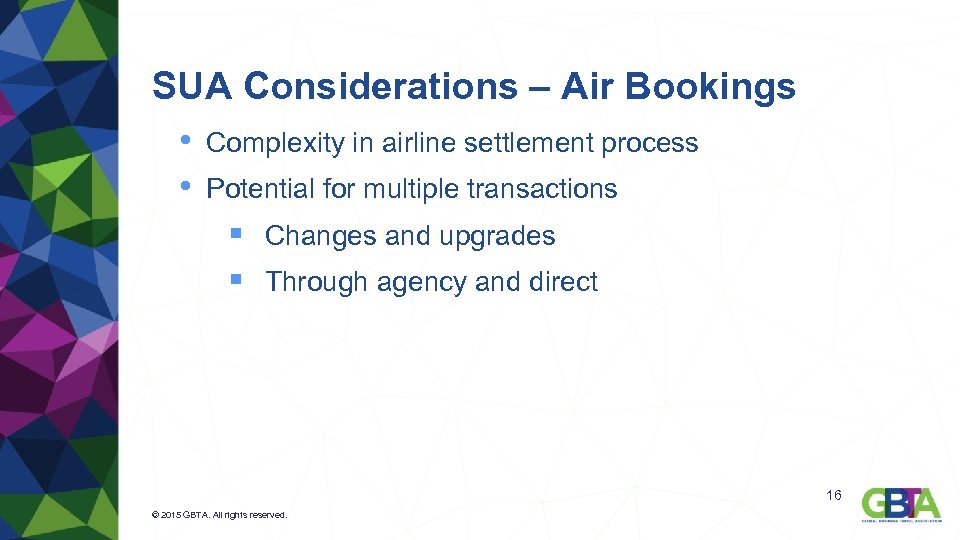

SUA Considerations – Air Bookings • Complexity in airline settlement process • Potential for multiple transactions § Changes and upgrades § Through agency and direct 16 © 2015 GBTA. All rights reserved.

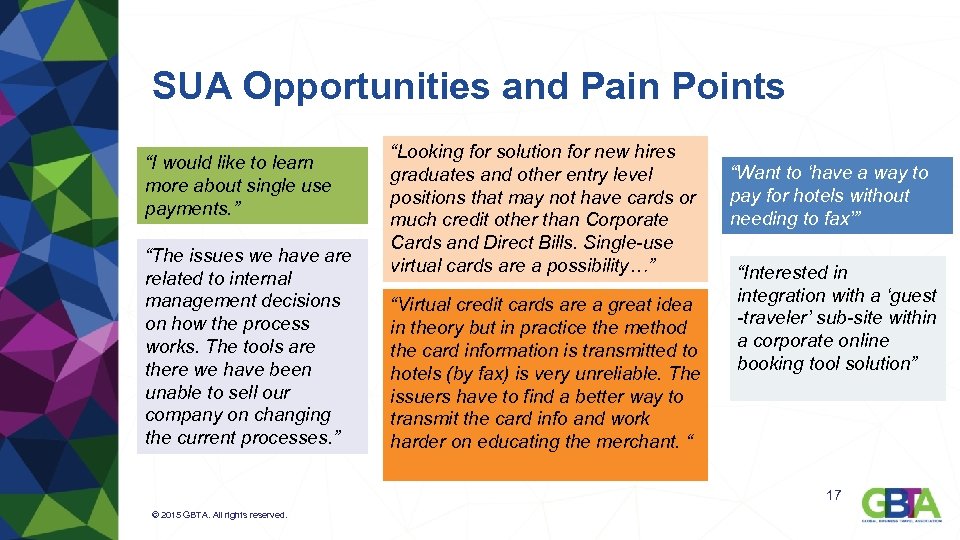

SUA Opportunities and Pain Points “I would like to learn more about single use payments. ” “The issues we have are related to internal management decisions on how the process works. The tools are there we have been unable to sell our company on changing the current processes. ” “Looking for solution for new hires graduates and other entry level positions that may not have cards or much credit other than Corporate Cards and Direct Bills. Single-use virtual cards are a possibility…” “Virtual credit cards are a great idea in theory but in practice the method the card information is transmitted to hotels (by fax) is very unreliable. The issuers have to find a better way to transmit the card info and work harder on educating the merchant. “ “Want to ‘have a way to pay for hotels without needing to fax’” “Interested in integration with a ‘guest -traveler’ sub-site within a corporate online booking tool solution” 17 © 2015 GBTA. All rights reserved.

Key Takeaways • Increase in adoption and awareness point to continued growth • Single-use accounts introduce new complexity, but deliver significant benefits • Processes at all points in the value chain – buyers, suppliers, agencies – may change 18 © 2015 GBTA. All rights reserved.

Thank you for joining the webinar. We will begin shortly. © 2015 GBTA. All rights reserved.

743cd492fb693a277ef4dcfaf70d6138.ppt