3b4ab3a6c7975415c2f68b1756d385cf.ppt

- Количество слайдов: 19

Virginia-STAMP March 2 -3, 2006 Richmond, Virginia Thomas Jefferson Institute for Public Policy David G. Tuerck Alfonso Sanchez-Penalver Beacon Hill Institute

Virginia-STAMP March 2 -3, 2006 Richmond, Virginia Thomas Jefferson Institute for Public Policy David G. Tuerck Alfonso Sanchez-Penalver Beacon Hill Institute

About the Beacon Hill Institute Housed in the Department of Economics at Suffolk University in Boston, BHI specializes in the development of state-of-the-art economic and statistical models for policy analysis. The department offers degrees in Economics through the Ph. D. BHI’s major capabilities include: • State Tax Analysis Modeling Program (STAMP) • Local Area Modeling Program (LAMP) • Education Assessment Model • State Competitiveness Report

About the Beacon Hill Institute Housed in the Department of Economics at Suffolk University in Boston, BHI specializes in the development of state-of-the-art economic and statistical models for policy analysis. The department offers degrees in Economics through the Ph. D. BHI’s major capabilities include: • State Tax Analysis Modeling Program (STAMP) • Local Area Modeling Program (LAMP) • Education Assessment Model • State Competitiveness Report

Overview of VA-STAMP • STAMP is specified in terms of supply and demand for each factor of production and each commodity included in the model • STAMP is a CGE (computable general equilibrium) model – a computerized method of accounting for the economic effects of tax policy changes • Tax policy changes are shown to affect economic activity through their effects on the prices of outputs and on the factors of production • Government spending on infrastructure is modeled as exerting positive effects on production

Overview of VA-STAMP • STAMP is specified in terms of supply and demand for each factor of production and each commodity included in the model • STAMP is a CGE (computable general equilibrium) model – a computerized method of accounting for the economic effects of tax policy changes • Tax policy changes are shown to affect economic activity through their effects on the prices of outputs and on the factors of production • Government spending on infrastructure is modeled as exerting positive effects on production

What is a Computable General Equilibrium (CGE ) tax model? • A formal description of the economic relationships among producers, households and government in a particular state and the rest of the world • Computable: generates numeric solutions to concrete policy and tax changes, with the help of a computer • General: takes all the important markets and flows into account • Equilibrium: demand equals supply in every market

What is a Computable General Equilibrium (CGE ) tax model? • A formal description of the economic relationships among producers, households and government in a particular state and the rest of the world • Computable: generates numeric solutions to concrete policy and tax changes, with the help of a computer • General: takes all the important markets and flows into account • Equilibrium: demand equals supply in every market

STAMP Analysis of 2006 Tax Change Proposals in Virginia Proposals Analyzed: • Governor • Senate • House

STAMP Analysis of 2006 Tax Change Proposals in Virginia Proposals Analyzed: • Governor • Senate • House

Governor’s Proposal • Increase motor vehicles sales tax from 3% to 5% and increase the minimum tax levied on the sale of a motor vehicle from $35 to $55 • Increase motor vehicle insurance license tax from 2. 5% to 4. 5% • Convert Virginia’s registration fee into a weight-based registration system • Impose and collect fees on drivers who have accumulated more than eight net driver demerit points or have been convicted of reckless driving, driving on a suspended or revoked license, driving under the influence (DUI), or other misdemeanor • Reallocate $339 million for One-Time support to priority projects • Reallocation of existing Insurance Premiums totaling $579 million over four years

Governor’s Proposal • Increase motor vehicles sales tax from 3% to 5% and increase the minimum tax levied on the sale of a motor vehicle from $35 to $55 • Increase motor vehicle insurance license tax from 2. 5% to 4. 5% • Convert Virginia’s registration fee into a weight-based registration system • Impose and collect fees on drivers who have accumulated more than eight net driver demerit points or have been convicted of reckless driving, driving on a suspended or revoked license, driving under the influence (DUI), or other misdemeanor • Reallocate $339 million for One-Time support to priority projects • Reallocation of existing Insurance Premiums totaling $579 million over four years

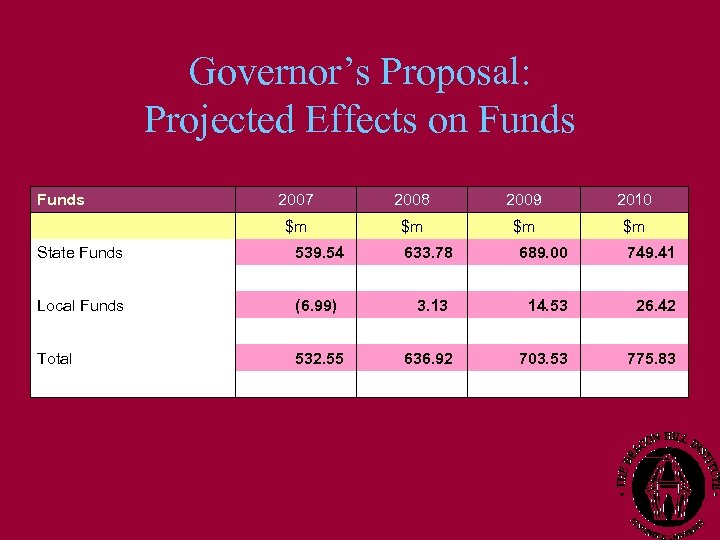

Governor’s Proposal: Projected Effects on Funds 2007 $m $m $m 633. 78 (6. 99) Total 2010 539. 54 Local Funds 2009 $m State Funds 2008 3. 13 532. 55 689. 00 14. 53 636. 92 749. 41 26. 42 703. 53 775. 83

Governor’s Proposal: Projected Effects on Funds 2007 $m $m $m 633. 78 (6. 99) Total 2010 539. 54 Local Funds 2009 $m State Funds 2008 3. 13 532. 55 689. 00 14. 53 636. 92 749. 41 26. 42 703. 53 775. 83

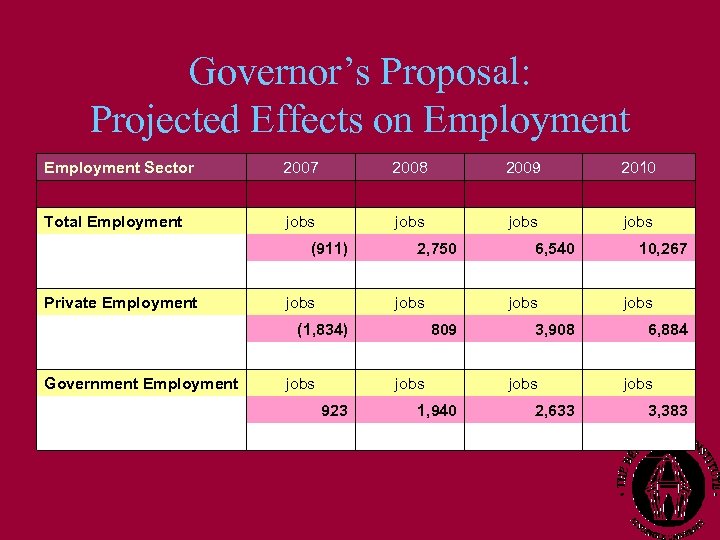

Governor’s Proposal: Projected Effects on Employment Sector 2007 2010 jobs Total Employment 2009 2008 jobs (911) Private Employment 2, 750 jobs (1, 834) Government Employment jobs 3, 908 jobs 6, 884 jobs 1, 940 10, 267 jobs 809 923 6, 540 jobs 2, 633 3, 383

Governor’s Proposal: Projected Effects on Employment Sector 2007 2010 jobs Total Employment 2009 2008 jobs (911) Private Employment 2, 750 jobs (1, 834) Government Employment jobs 3, 908 jobs 6, 884 jobs 1, 940 10, 267 jobs 809 923 6, 540 jobs 2, 633 3, 383

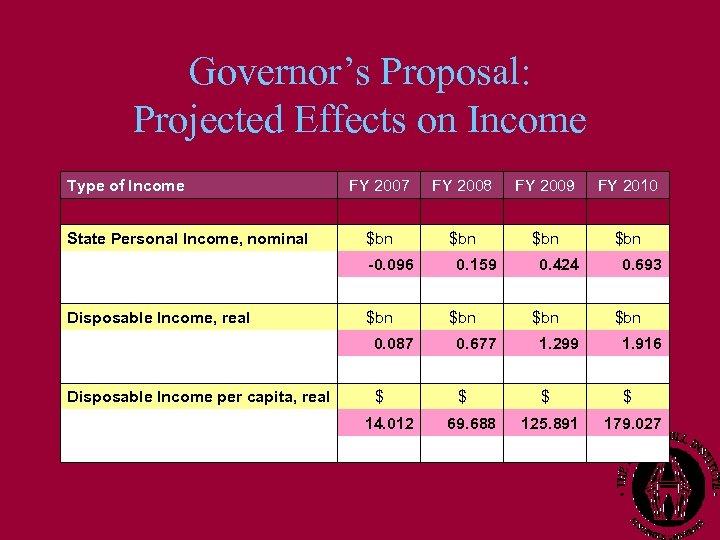

Governor’s Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal -0. 096 Disposable Income, real 0. 159 $bn Disposable Income per capita, real $ $bn 1. 299 $ 1. 916 $ 69. 688 0. 693 $bn 0. 677 14. 012 $bn 0. 087 0. 424 $ 125. 891 179. 027

Governor’s Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal -0. 096 Disposable Income, real 0. 159 $bn Disposable Income per capita, real $ $bn 1. 299 $ 1. 916 $ 69. 688 0. 693 $bn 0. 677 14. 012 $bn 0. 087 0. 424 $ 125. 891 179. 027

Senate Proposal • Increase motor vehicle registration fees • Increase motor vehicle sales and use tax by 0. 75%, in increments of 0. 25% over 3 years • Impose 5 % sales tax on motor fuels at the wholesale level • Increase tax on diesel fuel at the pump from $0. 16 to $0. 175 • Increase liquidated damages from overweight vehicles, based on weight • Impose abusive driver fees, with the rate based on accumulated driver demerit points • Increase grantor tax from $0. 10 to $0. 30 per $100 valuation • Dedicate auto insurance premium tax to transportation

Senate Proposal • Increase motor vehicle registration fees • Increase motor vehicle sales and use tax by 0. 75%, in increments of 0. 25% over 3 years • Impose 5 % sales tax on motor fuels at the wholesale level • Increase tax on diesel fuel at the pump from $0. 16 to $0. 175 • Increase liquidated damages from overweight vehicles, based on weight • Impose abusive driver fees, with the rate based on accumulated driver demerit points • Increase grantor tax from $0. 10 to $0. 30 per $100 valuation • Dedicate auto insurance premium tax to transportation

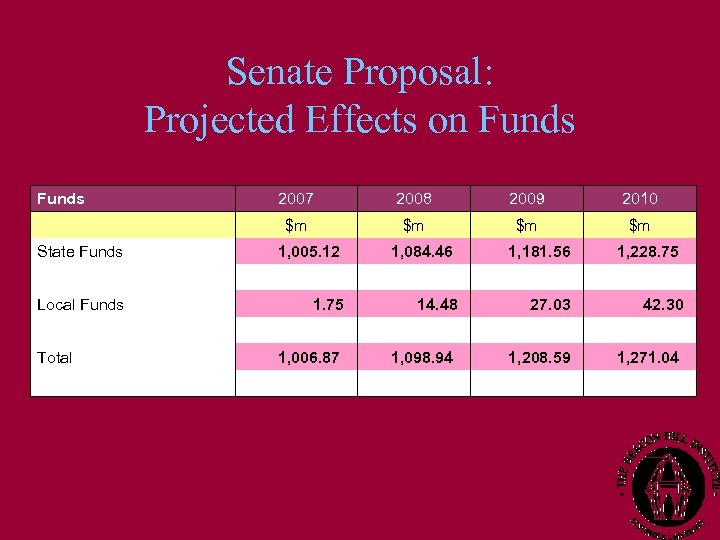

Senate Proposal: Projected Effects on Funds 2007 $m $m $m 1, 084. 46 1. 75 Total 2010 1, 005. 12 Local Funds 2009 $m State Funds 2008 14. 48 1, 006. 87 1, 181. 56 27. 03 1, 098. 94 1, 228. 75 42. 30 1, 208. 59 1, 271. 04

Senate Proposal: Projected Effects on Funds 2007 $m $m $m 1, 084. 46 1. 75 Total 2010 1, 005. 12 Local Funds 2009 $m State Funds 2008 14. 48 1, 006. 87 1, 181. 56 27. 03 1, 098. 94 1, 228. 75 42. 30 1, 208. 59 1, 271. 04

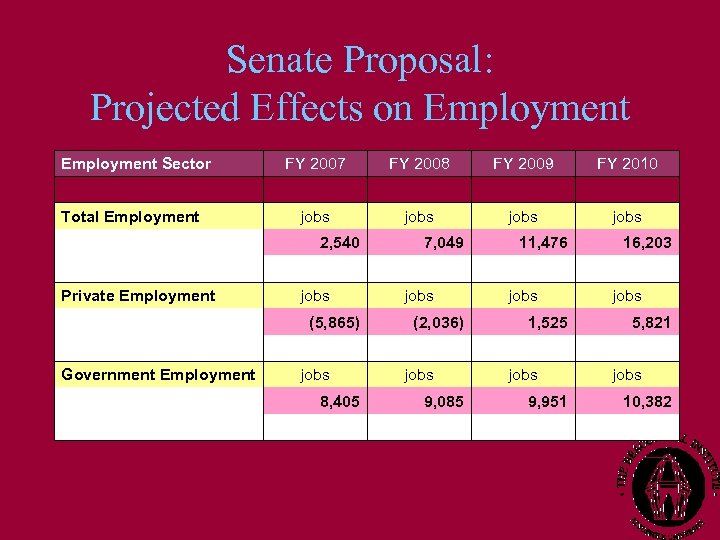

Senate Proposal: Projected Effects on Employment Sector FY 2007 FY 2010 jobs Total Employment FY 2009 FY 2008 jobs 2, 540 Private Employment 7, 049 jobs Government Employment jobs 1, 525 jobs 5, 821 jobs 9, 085 16, 203 jobs (2, 036) 8, 405 jobs (5, 865) 11, 476 jobs 9, 951 10, 382

Senate Proposal: Projected Effects on Employment Sector FY 2007 FY 2010 jobs Total Employment FY 2009 FY 2008 jobs 2, 540 Private Employment 7, 049 jobs Government Employment jobs 1, 525 jobs 5, 821 jobs 9, 085 16, 203 jobs (2, 036) 8, 405 jobs (5, 865) 11, 476 jobs 9, 951 10, 382

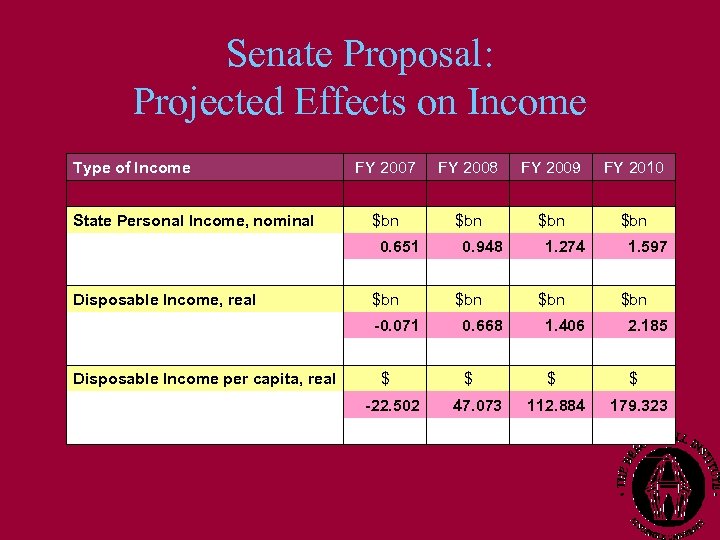

Senate Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal 0. 651 Disposable Income, real 0. 948 $bn Disposable Income per capita, real $ $bn 1. 406 $ 2. 185 $ 47. 073 1. 597 $bn 0. 668 -22. 502 $bn -0. 071 1. 274 $ 112. 884 179. 323

Senate Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal 0. 651 Disposable Income, real 0. 948 $bn Disposable Income per capita, real $ $bn 1. 406 $ 2. 185 $ 47. 073 1. 597 $bn 0. 668 -22. 502 $bn -0. 071 1. 274 $ 112. 884 179. 323

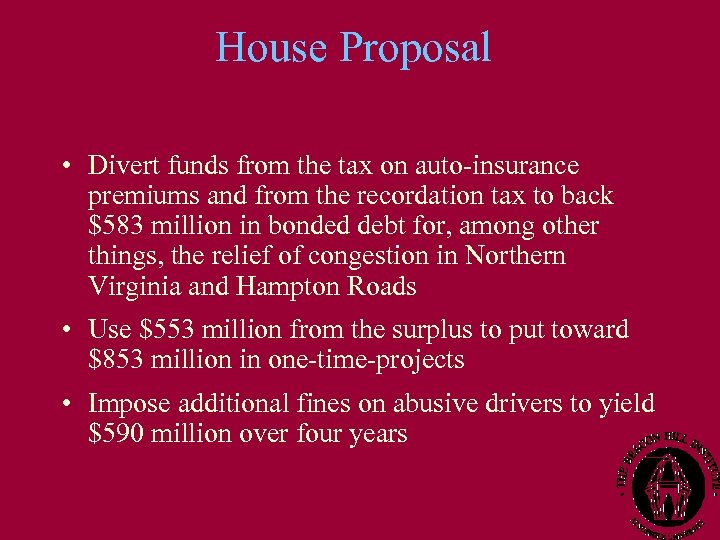

House Proposal • Divert funds from the tax on auto-insurance premiums and from the recordation tax to back $583 million in bonded debt for, among other things, the relief of congestion in Northern Virginia and Hampton Roads • Use $553 million from the surplus to put toward $853 million in one-time-projects • Impose additional fines on abusive drivers to yield $590 million over four years

House Proposal • Divert funds from the tax on auto-insurance premiums and from the recordation tax to back $583 million in bonded debt for, among other things, the relief of congestion in Northern Virginia and Hampton Roads • Use $553 million from the surplus to put toward $853 million in one-time-projects • Impose additional fines on abusive drivers to yield $590 million over four years

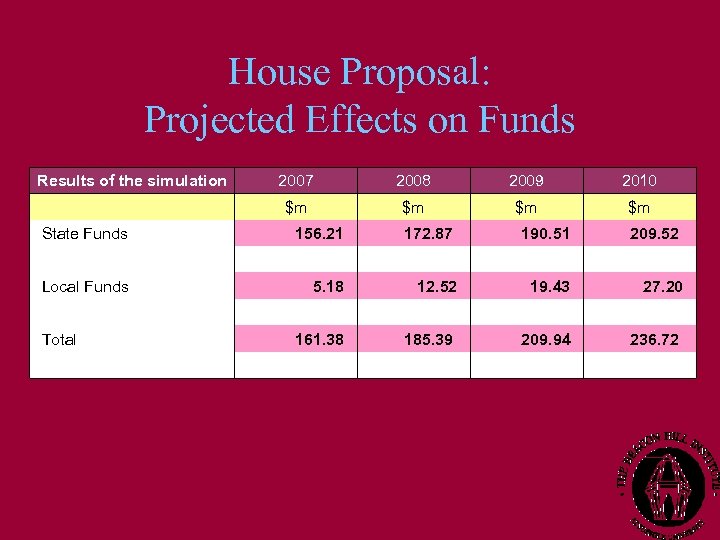

House Proposal: Projected Effects on Funds Results of the simulation 2007 $m $m $m 172. 87 5. 18 Total 2010 156. 21 Local Funds 2009 $m State Funds 2008 12. 52 161. 38 190. 51 19. 43 185. 39 209. 52 27. 20 209. 94 236. 72

House Proposal: Projected Effects on Funds Results of the simulation 2007 $m $m $m 172. 87 5. 18 Total 2010 156. 21 Local Funds 2009 $m State Funds 2008 12. 52 161. 38 190. 51 19. 43 185. 39 209. 52 27. 20 209. 94 236. 72

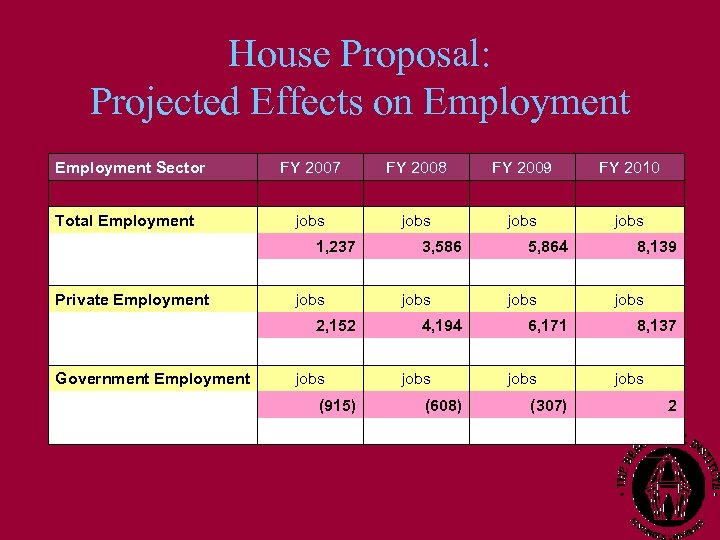

House Proposal: Projected Effects on Employment Sector FY 2007 FY 2010 jobs Total Employment FY 2009 FY 2008 jobs 1, 237 Private Employment 3, 586 jobs Government Employment jobs 6, 171 jobs 8, 137 jobs (608) 8, 139 jobs 4, 194 (915) jobs 2, 152 5, 864 jobs (307) 2

House Proposal: Projected Effects on Employment Sector FY 2007 FY 2010 jobs Total Employment FY 2009 FY 2008 jobs 1, 237 Private Employment 3, 586 jobs Government Employment jobs 6, 171 jobs 8, 137 jobs (608) 8, 139 jobs 4, 194 (915) jobs 2, 152 5, 864 jobs (307) 2

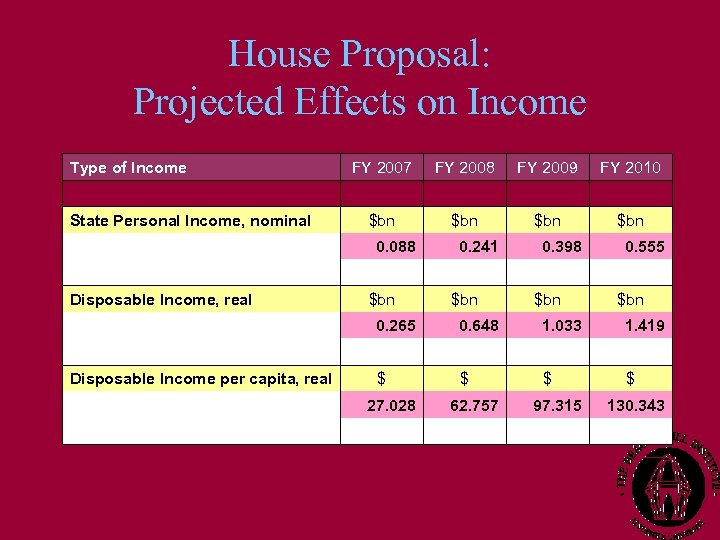

House Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal 0. 088 Disposable Income, real 0. 241 $bn Disposable Income per capita, real $ $bn 1. 033 $ 1. 419 $ 62. 757 0. 555 $bn 0. 648 27. 028 $bn 0. 265 0. 398 $ 97. 315 130. 343

House Proposal: Projected Effects on Income Type of Income FY 2007 FY 2008 FY 2009 FY 2010 $bn $bn State Personal Income, nominal 0. 088 Disposable Income, real 0. 241 $bn Disposable Income per capita, real $ $bn 1. 033 $ 1. 419 $ 62. 757 0. 555 $bn 0. 648 27. 028 $bn 0. 265 0. 398 $ 97. 315 130. 343

Summary: Effects After Four Years • Governor: – – • $2. 7 billion in new state funds $0. 9 billion in other funds 6, 884 new private sector jobs $179 in increased per-capita disposable income Senate: – $4. 5 billion in new state funds – 5, 821 new private sector jobs – $179 in increased per-capita disposable income • House: – – $729 million in new state funds $1. 4 billion in other funds 8, 137 new private sector jobs $130 in increased per-capita disposable income

Summary: Effects After Four Years • Governor: – – • $2. 7 billion in new state funds $0. 9 billion in other funds 6, 884 new private sector jobs $179 in increased per-capita disposable income Senate: – $4. 5 billion in new state funds – 5, 821 new private sector jobs – $179 in increased per-capita disposable income • House: – – $729 million in new state funds $1. 4 billion in other funds 8, 137 new private sector jobs $130 in increased per-capita disposable income

Beacon Hill Institute 8 Ashburton Place Boston, MA 02108 Phone: 617 -573 -8750 Fax: 617 -994 -4279 E-Mail: dtuerck@beaconhill. org Web: www. beaconhill. org

Beacon Hill Institute 8 Ashburton Place Boston, MA 02108 Phone: 617 -573 -8750 Fax: 617 -994 -4279 E-Mail: dtuerck@beaconhill. org Web: www. beaconhill. org