a5464664f270f484abef8d4cfc94987b.ppt

- Количество слайдов: 17

Vince Bradley, CEO World Telecom Group Presents: Mobility: Also Known As Mobile Broadband March 27 th, 2008

Points of Focus • How to use mobile broadband • Finding new solutions to use mobile broadband (i. e. Hotspots via Mobile Bridges, Kiosks, TDM Back-Up, DSL Replacement) • Become efficient in mobile broadband

CDMA Wireless technology is leading the way in 4 G / Mobile Broadband while GSM is developing strategy. Review of CDMA Provider #1: Sprint

What Is Mobile Broadband? • High bandwidth wireless technology supporting up to 1 Mb. throughput • EV-DO is an overlay on the 1 x radio transmission technology (1 x. RTT) network • Utilizes the same back-end network resources but uses separate data channels for voice • EV-DO is the logical next step to higher wireless data speeds, followed by Wi. Max (2 – 20 Mb. ) MOBILE BROADBAND Wireless high-speed data solutions and services that run on a Carriers ubiquitous network (EVDO) DEFINED

Where We’re At and Where We’re Going • The Previous Decade • Wireless networks supported basic applications • Voice, email, ordering, and tracking • Technology developments were independent of the enterprise applications on the wireline side • Focus on Intranet and Internet applications. • The Next Decade • Integration of wireline and wireless applications • Enabled by new technologies such as IMS, 3 G networks, smart phones, and Wi. MAX devices. • Vertical/Industry migration from a fixed and locationcentric work environment to a dispersed mobile world

By The Numbers • Mobile has a new meaning; it’s no longer about making a call in the street, it’s about taking your computing power with you • By the end of 2008, about 14 percent of all wireless users will be broadband subscribers (28 M). • Mobile broadband will generate more than $400 billion in carrier service revenues worldwide by 2012

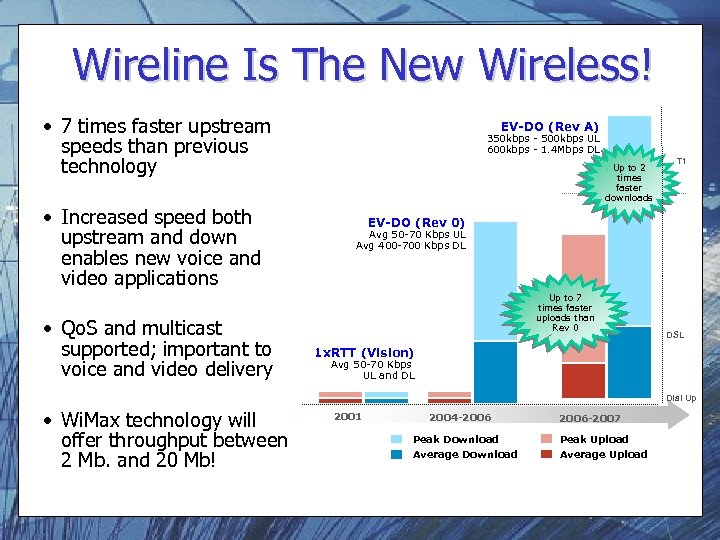

Wireline Is The New Wireless! • 7 times faster upstream speeds than previous technology • Increased speed both upstream and down enables new voice and video applications • Qo. S and multicast supported; important to voice and video delivery EV-DO (Rev A) 350 kbps - 500 kbps UL 600 kbps - 1. 4 Mbps DL Up to 2 times faster downloads T 1 EV-DO (Rev 0) Avg 50 -70 Kbps UL Avg 400 -700 Kbps DL Up to 7 times faster uploads than Rev 0 DSL 1 x. RTT (Vision) Avg 50 -70 Kbps UL and DL Dial Up • Wi. Max technology will offer throughput between 2 Mb. and 20 Mb! 2001 2004 -2006 -2007 Peak Download Peak Upload Average Download Average Upload

CDMA Provider #2 Verizon

LTE – Profiled The 3 GPP announced that the LTE radio access network specification has been approved as a standard under the GSM/UMTS family. LTE represents an evolution beyond HSPA, taking data download rates to 100 Mbps and upload rates to 50 Mbps in 20 MHz of spectrum, while increasing network capacity and boosting performance at the cell edge. LTE is often pegged as competing directly with the Wi. MAX 802. 16 e standard. Another competing technology, UMB, which is an evolution beyond CMDA EV-DO, occasionally gets thrown into the fray, but with two of CMDA’s largest customers recently defecting – Verizon to LTE and Sprint Nextel to Wi. MAX – the future of UMB is, at best, uncertain. LTE will largely be used by cellular operators with legacy networks (Sprint being a major exception) and Wi. MAX has been embraced by Greenfield operators, or fixed operators without any wireless infrastructure.

LTE – Profiled Another product which will also contribute an initial driving force is the wireless CPE - Customer Premise Equipment for accessing broadband at home or in the office - which will allow Wi. MAX and LTE operators to compete with fixed broadband service providers in certain markets. As volumes ramp and chip prices fall, a new generation of products are likely to emerge which take advantage of the new networks. Amazon’s ebook is such an example: currently enabled with EV-DO connectivity, an upgrade to LTE or WIMAX would enrich the quality of content it’s able to display. Naturally, LTE and Wi. MAX handsets will eventually come online, but it is entirely possible that the market for non-voice LTE and Wi. MAX devices will exceed that of the equivalent handset market for many years to come.

LTE – Profiled LTE and Mobile Wi. MAX may be technologically quite similar, and many vendors are supporting both platforms, but there are still deep seated political and commercial conflicts at stake, with some suppliers and operators staking their futures on one technology or the other. So the early weeks of 2008 have seen a flurry of announcements from both camps, designed to emphasize the advanced nature of the roadmap towards true 4 G. Verizon and Vodafone, and other major operators that have committed to LTE as their primary next generation network are pressurizing vendors to have equipment read for initial trials by the end of this year, while commercial, certified systems are likely to be available in 2010 -11, after Mobile Wi. MAX but before 802. 16 m, the future successor to 802. 16 e, (also known as Wi- MAX 2, and which some are dubbing with the snappier EC label Wi. Magic).

GSM Mobile Broadband Service: Provider #1: AT&T • at&t uses HSPA (High Speed Packet Access) • Average Upload Speed is 500 Kbps-800 Kbps. • Average Download Speed is 600 Kbps-1. 4 Mbps • Theoretical Peak Upload is 2. 1 Mbps/Peak Download 3. 6 Mbps • at&t has chosen LTE as their 4 G Upgrade Path Provider #2: T-Mobile Looking at same technology but considering others. 4 G development plan for 2009+ being finalized at this time.

Primary Applications 1. Wireless Backups 2. Retail Sales Stores 3. Construction Sites 4. Transportation 5. Guest Networks (Wi-Fi) 6. Mobile Computing (DSL to Go) 7. Disaster Recovery / Business Continuity 8. TEM (telecom expense management): ex: rate plan optimization; not as much a factor in data as in voice

Mobile Data Implementations to Slow in 2008 Growth in revenue for mobile business applications will be close to 50% between 2006 and 2007, and then slow to 44% from 2007 to 2008, reports In-Stat. These strong growth projections are good news for the wireless industry, but may be lower than some may be planning on based upon the literal reading of end-user survey data, the high-tech market research firm says. That's because there is a widening gap between what decision-makers expect that they will do and what they actually implement. Recent research by In-Stat found the following: • The penetration of at least one mobile data application among firms increased from 75% to 94% in 2007. • Smartphone use among US business users increased 34% between 2006 and 2007. • Four horizontal applications, wireless email, wireless Internet access, wireless instant messaging, and personal information management (PIM), have the highest penetration because they are easier to implement than the vertical market applications.

Future of Mobile Broadband 1, 400 CEO's put "Mobile Workforce Enablement" at the top of their priorities - Gartner More than 42% of the American Workforce will be "Mobile" - Yankee Group 30% of small business this year will enable remote network access for employees - IDC 33% of organizations believe that mobile broadband will transform the way they do business - Morpace International 266% growth expected for wireless data - IDC

Mobile Bridge and EVDO Technology Demonstration

Q & A WTG Wireless Mark Little – Wireless Sales Manager 310 -456 -2200 x 314 mlittle@wtgcom. com Vince Bradley President & CEO 310 -456 -2200 x 302 vbradley@wtgcom. com

a5464664f270f484abef8d4cfc94987b.ppt