2d05146b020a8cbc9f79881dcd575214.ppt

- Количество слайдов: 24

Viewpoint Portable connected devices: emerging opportunities for operators Cesar Bachelet November 2011

Portable connected devices: emerging opportunities for operators 2 Executive summary We anticipate that, worldwide, the number of connectable consumer devices (excluding PCs and mobile phones) will increase from 1. 2 billion in 2010 to 15. 7 billion by 2020, as a growing range of existing devices is enhanced with connectivity and as new devices appear. One of the main ways in which mobile and integrated operators can capitalise on this trend is by promoting the use of cellular, not just Wi-Fi, connectivity on most of these devices, as this increases the utility of the devices and helps to earn some additional revenue. However, operators will need to ensure that their tariff structures cater for patterns of mobile data usage that may differ substantially from those of smartphones. In this Viewpoint, we consider four different types of portable device with embedded wireless connectivity – e-book readers, connected portable games consoles, cameras and personal navigation devices (PNDs). There may be scope for operators to move up the value chain in order to generate more revenue in non. English speaking markets, where operators could launch a complete e-book service, including e-book readers, subject to forming the right partnerships with publishers. As far as other devices are concerned, the opportunities for operators are peripheral, and complement other areas where operators have a greater involvement in the value chain. Single-purpose devices typically cater for a niche market, and risk replacement by multi-functional devices in the mainstream. © Analysys Mason Limited 2011

Portable connected devices: emerging opportunities for operators 3 Recommendations: all devices Operators should capitalise on the growth of connected devices by taking a holistic view of their subscribers’ connectivity. Operators need to offer consumers a continuum of connectivity solutions, including fixed broadband, Wi-Fi and mobile broadband, thus providing them with near-ubiquitous connectivity for a wide range of usage scenarios. Bundling access to Wi-Fi hotspots with fixed or mobile broadband gives consumers more flexibility, stimulating usage of connected services. As far as mobile broadband is concerned, most operators currently require separate subscription plans for individual devices, thereby dissuading the take-up of connected services. Instead, they should make it easier for consumers to add new devices onto existing mobile data plans, and/or enable them to share their mobile data allowance across multiple devices. Operators should continue to concentrate most of their efforts on multi-functional devices, a market in which they already have a key presence. Operators are good at selling broad propositions to the mass market. For devices, it makes sense to keep the same focus, particularly as many of the more-niche, singlepurpose devices face the risk of substitution by multi-functional devices, such as handsets and tablet PCs. Where operators already deliver certain types of service to multi-functional devices, they can consider extending those services to single-purpose devices in order to move up the value chain. Operators already offer a wide range of services, such as multimedia and location-based services, to multifunctional devices, and can capitalise on this by also supplying such services to single-purpose devices. This would add value to the devices, while enabling the operator to move up the value chain, without having to start from the bottom. For example, operators that already deliver Vo. D services to TV sets and mobile handsets could extend this to portable games consoles. © Analysys Mason Limited 2011

Portable connected devices: emerging opportunities for operators 4 Recommendations: e-book readers Operators should consider launching their own services in less-mature markets that do not have a dominant player in order to capitalise on this opportunity. In non-English language markets that are not already dominated by large, established players, such as Amazon, there is an opportunity for operators to establish themselves as key players, as they are increasingly becoming acknowledged as distributors of digital content, both by publishers and consumers. Operators that launch their own services should also deliver e-books to multi-functional devices. Extending the availability of e-books to other portable devices, such as tablet PCs and smartphones, enables operators to target a wide segment of the market, including ‘casual’ readers who do not wish to purchase a dedicated device. At the same time, this positions operators in case the long-term future is not in singlepurpose devices. Operators should offer a ‘one-stop shop’ solution encompassing e-book readers and connectivity, using various pricing models. Although some consumers prefer to purchase e-book readers outright, offering a subscription-based service that bundles connectivity with the device reduces barriers to entry, as the devices are relatively expensive, usually at least EUR 150 each. If they do not wish to launch their own services, operators with extensive footprints should form partnerships with key global vendors of e-book readers in order to gain scale. In markets already dominated by large and well-established players, operators should focus on providing connectivity and, where possible, enablers and value-added services so as to ensure that they generate revenue from this rapidly growing opportunity. © Analysys Mason Limited 2011

Portable connected devices: emerging opportunities for operators 5 Recommendations: other devices Unless they already offer their existing subscribers comparable services on other devices, operators should not get involved in the delivery of services to niche, single-purpose devices, such as connected games consoles or cameras. The amount of resource necessary to develop propositions for the emerging categories of portable connected device is too big a commitment for operators faced with uncertain returns. In most cases, we believe the appeal of portable connected single-purpose devices is too niche to make the business case stack up. The exception to the rule would be operators with very large subscriber bases, such as AT&T and Vodafone, that would be able to gain the economies of scale needed to recoup their initial investments. Operators should focus on a lower-risk, ‘working behind the scenes’, approach to generate incremental revenue from the growth in portable connected devices. This approach enables operators to gain a share of the opportunity without incurring significant risk. Operators that are in a position to deliver services to emerging portable connected devices should offer solutions that provide consumers with an instant, affordable ‘out of the box’ experience. By pulling together all the elements required, selling them with different pricing models to make them affordable to a wide range of consumers and providing customer support, operators can increase the take-up of niche devices. Telecom Italia, for example, has done this with its biblet proposition, which encompasses an e-book reader, mobile broadband e-books. © Analysys Mason Limited 2011

Portable connected devices: emerging opportunities for operators 6 The number of connectable consumer devices is set to grow dramatically by the end of the decade We forecast that, worldwide, the number of connectable consumer devices (excluding computers and mobile phones) will increase from 1. 2 billion in 2010 to 15. 7 billion by 2020. A growing range of traditionally single-purpose portable devices is now being enhanced through the addition of Wi-Fi, or even cellular, connectivity. However, these single-purpose devices face a growing threat from a rising number of connected, increasingly multi-functional devices, such as smartphones and tablet PCs. Consumers are being presented with the choice of the extra cost and clutter of multiple, yet ‘best-of-breed’, single-purpose devices and the convenience of multi-functional devices that may turn out to be ‘jack of all trades and master of none’. In this Viewpoint, we assess the emerging opportunities for operators from four different types of portable device with embedded wireless (Wi-Fi or cellular) connectivity: e-book readers portable connected games consoles (traditional connected games consoles, such as the Nintendo Wii, the Sony PS 3 and the Microsoft Xbox 360 are beyond the scope of this Viewpoint, as they are not portable devices) connected cameras connected PNDs – (in-car satellite navigation units are beyond the scope of this Viewpoint, as they are not portable devices). © Analysys Mason Limited 2011

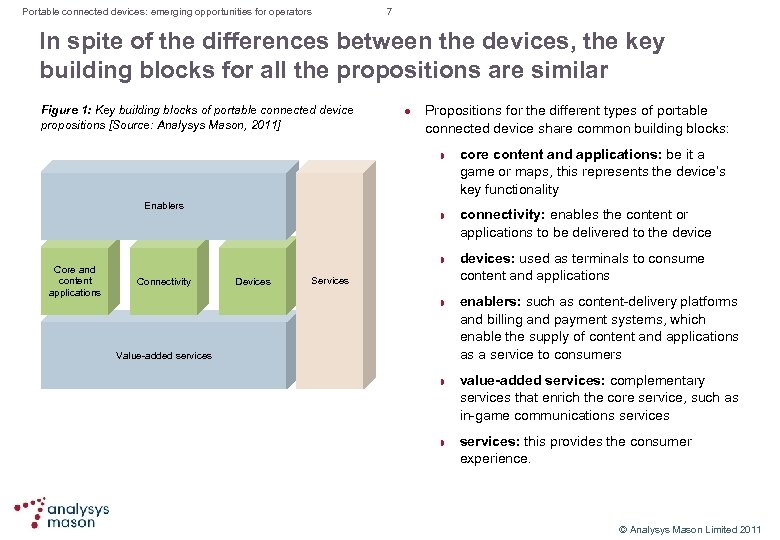

Portable connected devices: emerging opportunities for operators 7 In spite of the differences between the devices, the key building blocks for all the propositions are similar Figure 1: Key building blocks of portable connected device propositions [Source: Analysys Mason, 2011] Propositions for the different types of portable connected device share common building blocks: Enablers Core and content applications Connectivity Devices Services Value-added services core content and applications: be it a game or maps, this represents the device’s key functionality connectivity: enables the content or applications to be delivered to the devices: used as terminals to consume content and applications enablers: such as content-delivery platforms and billing and payment systems, which enable the supply of content and applications as a service to consumers value-added services: complementary services that enrich the core service, such as in-game communications services: this provides the consumer experience. © Analysys Mason Limited 2011

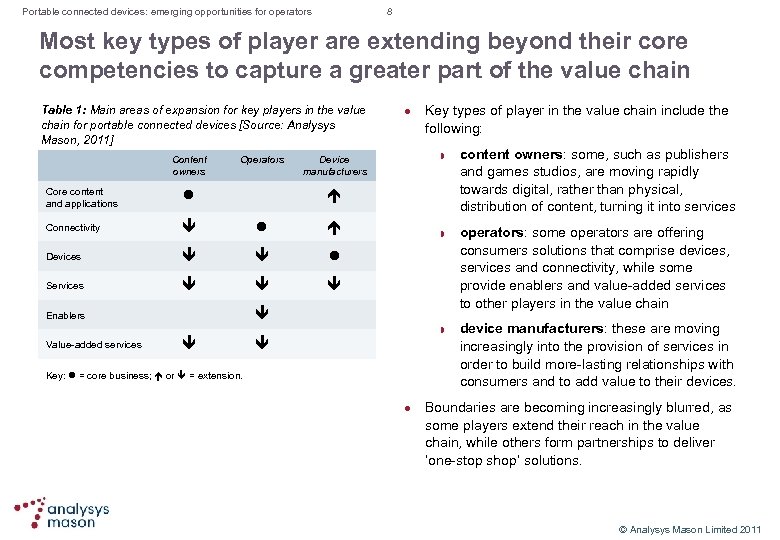

Portable connected devices: emerging opportunities for operators 8 Most key types of player are extending beyond their core competencies to capture a greater part of the value chain Table 1: Main areas of expansion for key players in the value chain for portable connected devices [Source: Analysys Mason, 2011] Content owners Operators Device manufacturers Core content and applications Connectivity Devices Services Key types of player in the value chain include the following: Enablers Value-added services Key: = core business; or = extension. content owners: some, such as publishers and games studios, are moving rapidly towards digital, rather than physical, distribution of content, turning it into services operators: some operators are offering consumers solutions that comprise devices, services and connectivity, while some provide enablers and value-added services to other players in the value chain device manufacturers: these are moving increasingly into the provision of services in order to build more-lasting relationships with consumers and to add value to their devices. Boundaries are becoming increasingly blurred, as some players extend their reach in the value chain, while others form partnerships to deliver ‘one-stop shop’ solutions. © Analysys Mason Limited 2011

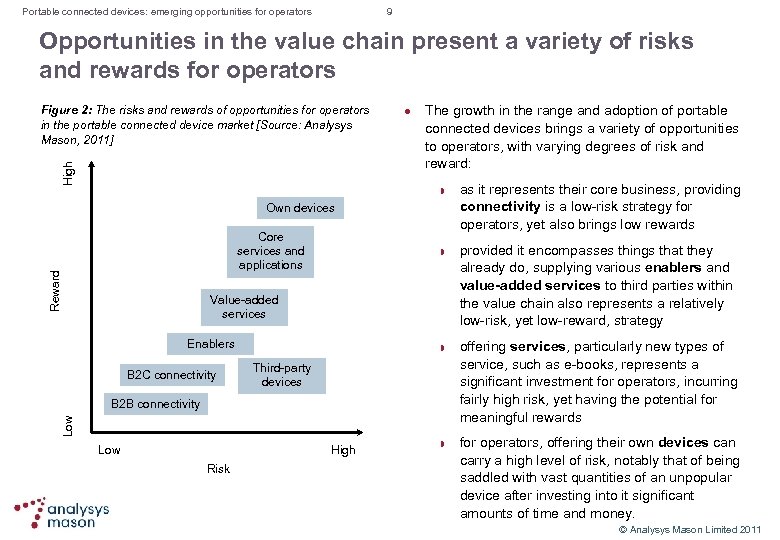

Portable connected devices: emerging opportunities for operators 9 Opportunities in the value chain present a variety of risks and rewards for operators High Figure 2: The risks and rewards of opportunities for operators in the portable connected device market [Source: Analysys Mason, 2011] The growth in the range and adoption of portable connected devices brings a variety of opportunities to operators, with varying degrees of risk and reward: Own devices Reward Core services and applications Value-added services Enablers B 2 C connectivity Third-party devices Low B 2 B connectivity Low High Risk as it represents their core business, providing connectivity is a low-risk strategy for operators, yet also brings low rewards provided it encompasses things that they already do, supplying various enablers and value-added services to third parties within the value chain also represents a relatively low-risk, yet low-reward, strategy offering services, particularly new types of service, such as e-books, represents a significant investment for operators, incurring fairly high risk, yet having the potential for meaningful rewards for operators, offering their own devices can carry a high level of risk, notably that of being saddled with vast quantities of an unpopular device after investing into it significant amounts of time and money. © Analysys Mason Limited 2011

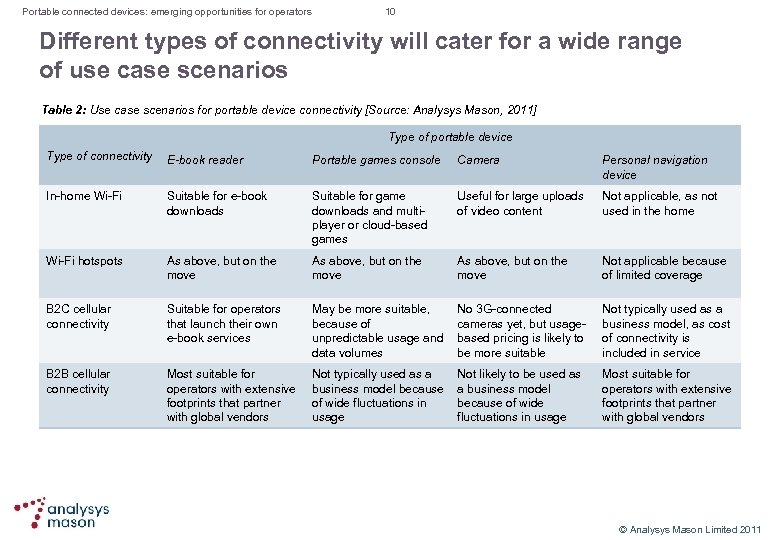

Portable connected devices: emerging opportunities for operators 10 Different types of connectivity will cater for a wide range of use case scenarios Table 2: Use case scenarios for portable device connectivity [Source: Analysys Mason, 2011] Type of portable device Type of connectivity E-book reader Portable games console Camera Personal navigation device In-home Wi-Fi Suitable for e-book downloads Suitable for game downloads and multiplayer or cloud-based games Useful for large uploads of video content Not applicable, as not used in the home Wi-Fi hotspots As above, but on the move Not applicable because of limited coverage B 2 C cellular connectivity Suitable for operators that launch their own e-book services May be more suitable, because of unpredictable usage and data volumes No 3 G-connected cameras yet, but usagebased pricing is likely to be more suitable Not typically used as a business model, as cost of connectivity is included in service B 2 B cellular connectivity Most suitable for operators with extensive footprints that partner with global vendors Not typically used as a business model because of wide fluctuations in usage Not likely to be used as a business model because of wide fluctuations in usage Most suitable for operators with extensive footprints that partner with global vendors © Analysys Mason Limited 2011

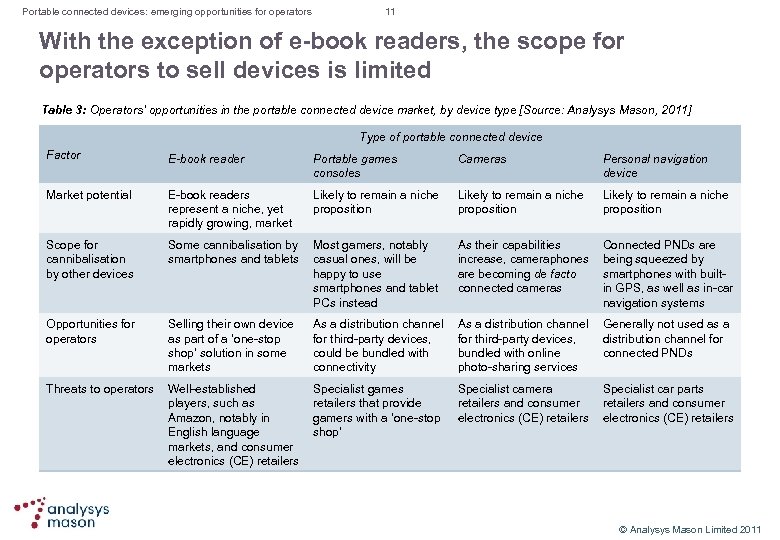

Portable connected devices: emerging opportunities for operators 11 With the exception of e-book readers, the scope for operators to sell devices is limited Table 3: Operators’ opportunities in the portable connected device market, by device type [Source: Analysys Mason, 2011] Type of portable connected device Factor E-book reader Portable games consoles Cameras Personal navigation device Market potential E-book readers represent a niche, yet rapidly growing, market Likely to remain a niche proposition Scope for cannibalisation by other devices Some cannibalisation by Most gamers, notably smartphones and tablets casual ones, will be happy to use smartphones and tablet PCs instead As their capabilities increase, cameraphones are becoming de facto connected cameras Connected PNDs are being squeezed by smartphones with builtin GPS, as well as in-car navigation systems Opportunities for operators Selling their own device as part of a ‘one-stop shop’ solution in some markets As a distribution channel for third-party devices, could be bundled with connectivity As a distribution channel Generally not used as a for third-party devices, distribution channel for bundled with online connected PNDs photo-sharing services Threats to operators Well-established players, such as Amazon, notably in English language markets, and consumer electronics (CE) retailers Specialist games retailers that provide gamers with a ‘one-stop shop’ Specialist camera retailers and consumer electronics (CE) retailers Specialist car parts retailers and consumer electronics (CE) retailers © Analysys Mason Limited 2011

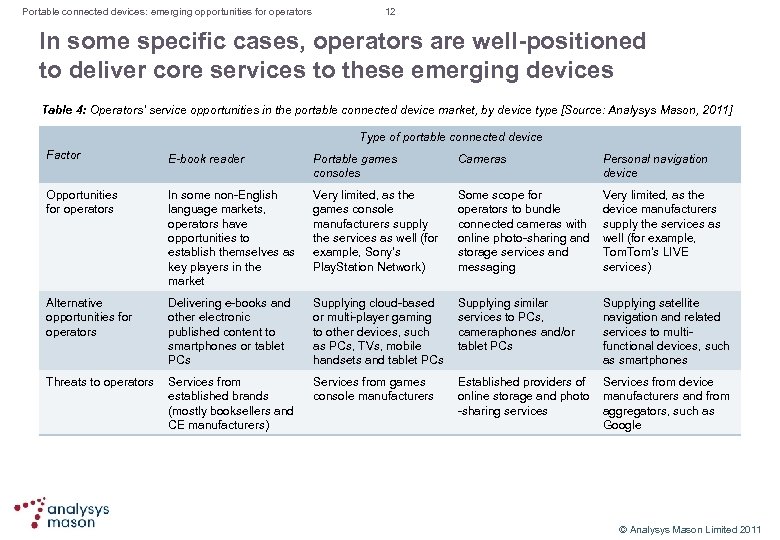

Portable connected devices: emerging opportunities for operators 12 In some specific cases, operators are well-positioned to deliver core services to these emerging devices Table 4: Operators’ service opportunities in the portable connected device market, by device type [Source: Analysys Mason, 2011] Type of portable connected device Factor E-book reader Portable games consoles Cameras Personal navigation device Opportunities for operators In some non-English language markets, operators have opportunities to establish themselves as key players in the market Very limited, as the games console manufacturers supply the services as well (for example, Sony’s Play. Station Network) Some scope for operators to bundle connected cameras with online photo-sharing and storage services and messaging Very limited, as the device manufacturers supply the services as well (for example, Tom’s LIVE services) Alternative opportunities for operators Delivering e-books and other electronic published content to smartphones or tablet PCs Supplying cloud-based or multi-player gaming to other devices, such as PCs, TVs, mobile handsets and tablet PCs Supplying similar services to PCs, cameraphones and/or tablet PCs Supplying satellite navigation and related services to multifunctional devices, such as smartphones Threats to operators Services from established brands (mostly booksellers and CE manufacturers) Services from games console manufacturers Established providers of online storage and photo -sharing services Services from device manufacturers and from aggregators, such as Google © Analysys Mason Limited 2011

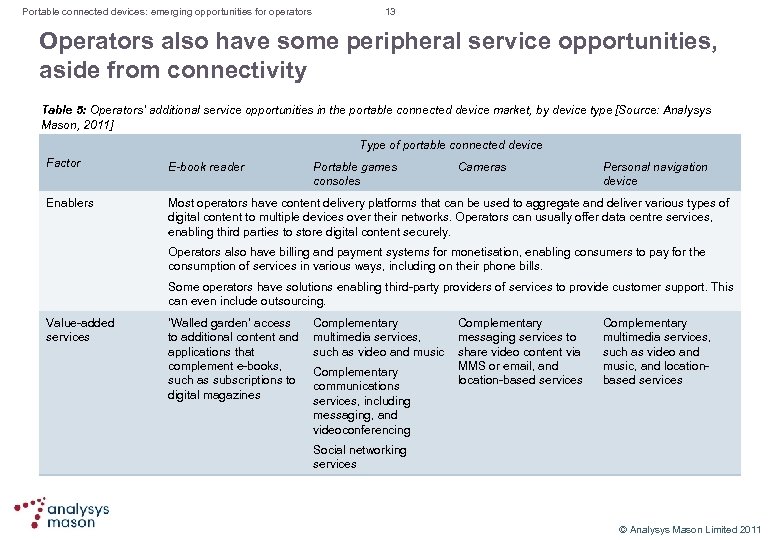

Portable connected devices: emerging opportunities for operators 13 Operators also have some peripheral service opportunities, aside from connectivity Table 5: Operators’ additional service opportunities in the portable connected device market, by device type [Source: Analysys Mason, 2011] Type of portable connected device Factor E-book reader Enablers Most operators have content delivery platforms that can be used to aggregate and deliver various types of digital content to multiple devices over their networks. Operators can usually offer data centre services, enabling third parties to store digital content securely. Portable games consoles Cameras Personal navigation device Operators also have billing and payment systems for monetisation, enabling consumers to pay for the consumption of services in various ways, including on their phone bills. Some operators have solutions enabling third-party providers of services to provide customer support. This can even include outsourcing. Value-added services ‘Walled garden’ access to additional content and applications that complement e-books, such as subscriptions to digital magazines Complementary multimedia services, such as video and music Complementary communications services, including messaging, and videoconferencing Complementary messaging services to share video content via MMS or email, and location-based services Complementary multimedia services, such as video and music, and locationbased services Social networking services © Analysys Mason Limited 2011

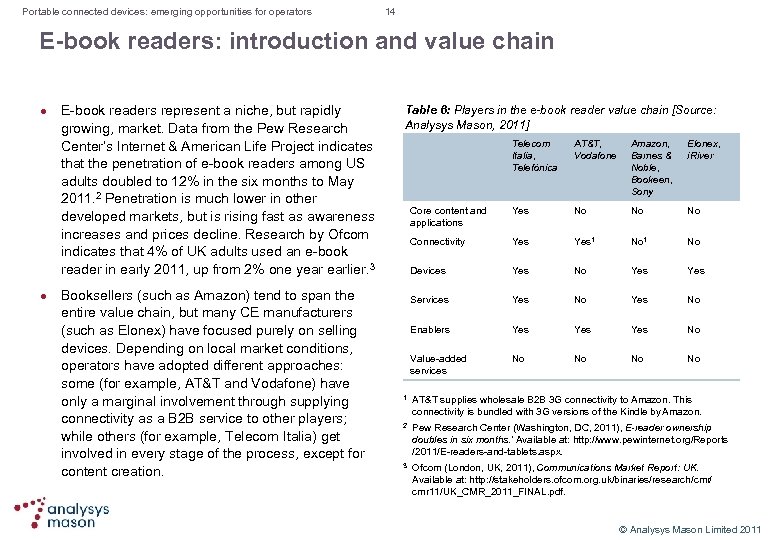

Portable connected devices: emerging opportunities for operators 14 E-book readers: introduction and value chain E-book readers represent a niche, but rapidly growing, market. Data from the Pew Research Center’s Internet & American Life Project indicates that the penetration of e-book readers among US adults doubled to 12% in the six months to May 2011. 2 Penetration is much lower in other developed markets, but is rising fast as awareness increases and prices decline. Research by Ofcom indicates that 4% of UK adults used an e-book reader in early 2011, up from 2% one year earlier. 3 Booksellers (such as Amazon) tend to span the entire value chain, but many CE manufacturers (such as Elonex) have focused purely on selling devices. Depending on local market conditions, operators have adopted different approaches: some (for example, AT&T and Vodafone) have only a marginal involvement through supplying connectivity as a B 2 B service to other players; while others (for example, Telecom Italia) get involved in every stage of the process, except for content creation. Table 6: Players in the e-book reader value chain [Source: Analysys Mason, 2011] Telecom Italia, Telefónica AT&T, Vodafone Amazon, Barnes & Noble, Bookeen, Sony Elonex, i. River Core content and applications Yes No No No Connectivity Yes 1 No Devices Yes No Yes Services Yes No Enablers Yes Yes No Value-added services No No 1 AT&T supplies wholesale B 2 B 3 G connectivity to Amazon. This connectivity is bundled with 3 G versions of the Kindle by Amazon. 2 Pew Research Center (Washington, DC, 2011), E-reader ownership doubles in six months. ’ Available at: http: //www. pewinternet. org/Reports /2011/E-readers-and-tablets. aspx. 3 Ofcom (London, UK, 2011), Communications Market Report: UK. Available at: http: //stakeholders. ofcom. org. uk/binaries/research/cmr/ cmr 11/UK_CMR_2011_FINAL. pdf. © Analysys Mason Limited 2011

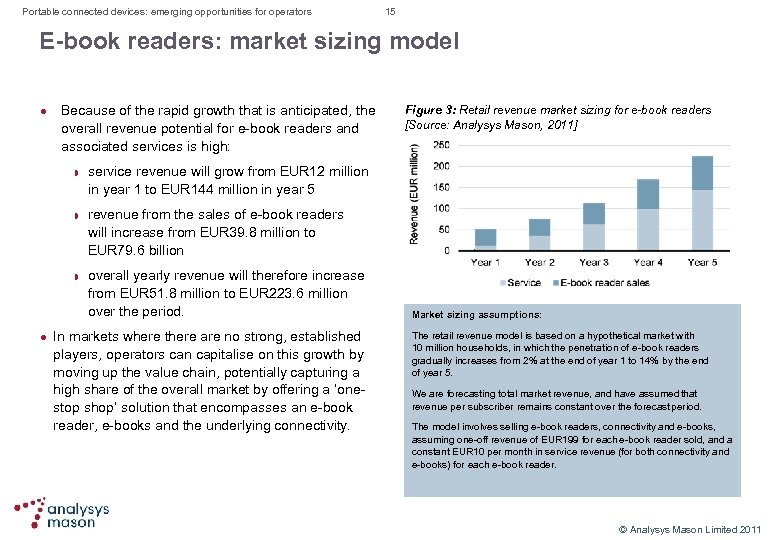

Portable connected devices: emerging opportunities for operators 15 E-book readers: market sizing model Because of the rapid growth that is anticipated, the overall revenue potential for e-book readers and associated services is high: Figure 3: Retail revenue market sizing for e-book readers [Source: Analysys Mason, 2011] service revenue will grow from EUR 12 million in year 1 to EUR 144 million in year 5 revenue from the sales of e-book readers will increase from EUR 39. 8 million to EUR 79. 6 billion overall yearly revenue will therefore increase from EUR 51. 8 million to EUR 223. 6 million over the period. In markets where there are no strong, established players, operators can capitalise on this growth by moving up the value chain, potentially capturing a high share of the overall market by offering a ‘onestop shop’ solution that encompasses an e-book reader, e-books and the underlying connectivity. Market sizing assumptions: The retail revenue model is based on a hypothetical market with 10 million households, in which the penetration of e-book readers gradually increases from 2% at the end of year 1 to 14% by the end of year 5. We are forecasting total market revenue, and have assumed that revenue per subscriber remains constant over the forecast period. The model involves selling e-book readers, connectivity and e-books, assuming one-off revenue of EUR 199 for each e-book reader sold, and a constant EUR 10 per month in service revenue (for both connectivity and e-books) for each e-book reader. © Analysys Mason Limited 2011

![Portable connected devices: emerging opportunities for operators 16 E-book readers: case studies [1] Table Portable connected devices: emerging opportunities for operators 16 E-book readers: case studies [1] Table](https://present5.com/presentation/2d05146b020a8cbc9f79881dcd575214/image-16.jpg)

Portable connected devices: emerging opportunities for operators 16 E-book readers: case studies [1] Table 7: E-book reader case studies [Source: Analysys Mason, Telecom Italia, KDDI, 2011] Telecom Italia’s biblet store KDDI’s LISMO Book Store Context Launched by the Italian incumbent telco at the Frankfurt Book Fair in October 2010 Launched by the Japanese altnet KDDI in December 2010; complements its LISMO multimedia services Description and costs Telecom Italia’s Wi-Fi and 3 G-enabled e-book reader is available to buy for EUR 199. 00 (including EUR 5. 00 of prepaid TIM credit, which can be used to buy e-books), or on a subscription basis for EUR 19. 00 per month over a 24 -month period. The subscriptionbased offer includes EUR 10 per month of credit to buy e-books, and the subscriber may keep the device at the end of the contract. Access to browse the biblet store’s catalogue is free The solar-powered, Wi-Fi and 3 G-enabled biblio Leaf SP 02 e-book reader is available for around JPY 15 000 (EUR 137. 45), supplemented by a monthly charge of JPY 525 (EUR 4. 81) for access to the service (over a two-year period). The device supports various e-book formats, such as XMDF, PDF and EPUB. The LISMO Book Store is integrated with a range of social networking tools by Twitter, GREE and Mixi Progress to date By March 2011, biblet was Italy’s largest e-book provider, with over 7000 titles from 143 different publishers The service featured 20 000 titles at launch and aims to have 100 000 titles by 2012 Availability on other devices The biblet store is also available as an app for the Apple i. Pad and for Android devices, broadening its appeal to those unwilling to buy a dedicated device In April 2011, the service was made available to KDDI’s range of Android smartphones Additional information The e-book reader is a white-label device supplied by the French device manufacturer Sagem The device is manufactured by Toshiba. The service is provided in collaboration with booklista, a joint venture between KDDI, Sony Corp, Toppan Printing Co Ltd and The Asahi Shimbun Company © Analysys Mason Limited 2011

![Portable connected devices: emerging opportunities for operators 17 E-book readers: case studies [2] AT&T Portable connected devices: emerging opportunities for operators 17 E-book readers: case studies [2] AT&T](https://present5.com/presentation/2d05146b020a8cbc9f79881dcd575214/image-17.jpg)

Portable connected devices: emerging opportunities for operators 17 E-book readers: case studies [2] AT&T and Amazon have taken an innovative approach to drive take-up of 3 G, rather than just Wi-Fi-enabled, devices among consumers. By reducing the price, they have generated additional connectivity and content revenue through sales of more devices, as well as new advertising revenue. This has enabled them to turn the vicious circle of low sales of 3 G-enabled devices and ensuing low connectivity revenue into a virtuous circle of growth. Between May and July 2011, Amazon reduced the cost of its 3 G-enabled Kindle from USD 189 to USD 139 through an advertising-funded proposition and AT&T sponsorship. This followed an initial ad-funded proposition from Amazon, in May 2011, which reduced the cost to USD 164. Advertising partners include Buick, Visa and Proctor & Gamble’s Olay. Figure 4 a: Virtuous circle for e-book readers [Source: Analysys Mason, 2011] Lower cost Advertising revenue Higher take-up Higher M 2 M revenue Figure 4 b: Vicious circle for e-book readers [Source: Analysys Mason, 2011] High cost Low M 2 M revenue Low take-up The ad-funded version of the Kindle 3 G, known as Kindle 3 G with Special Offers, became Amazon’s best-selling e-book reader within two weeks of launch. © Analysys Mason Limited 2011

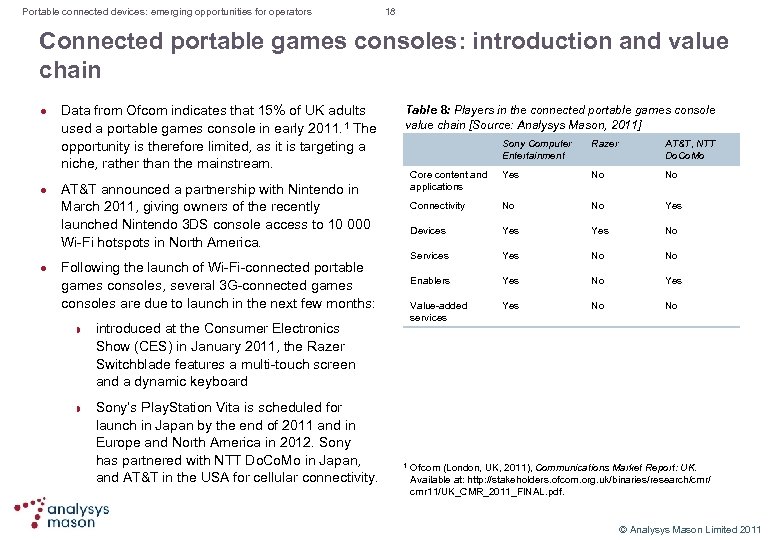

Portable connected devices: emerging opportunities for operators 18 Connected portable games consoles: introduction and value chain Data from Ofcom indicates that 15% of UK adults used a portable games console in early 2011. 1 The opportunity is therefore limited, as it is targeting a niche, rather than the mainstream. AT&T announced a partnership with Nintendo in March 2011, giving owners of the recently launched Nintendo 3 DS console access to 10 000 Wi-Fi hotspots in North America. Following the launch of Wi-Fi-connected portable games consoles, several 3 G-connected games consoles are due to launch in the next few months: introduced at the Consumer Electronics Show (CES) in January 2011, the Razer Switchblade features a multi-touch screen and a dynamic keyboard Sony’s Play. Station Vita is scheduled for launch in Japan by the end of 2011 and in Europe and North America in 2012. Sony has partnered with NTT Do. Co. Mo in Japan, and AT&T in the USA for cellular connectivity. Table 8: Players in the connected portable games console value chain [Source: Analysys Mason, 2011] Sony Computer Entertainment Razer AT&T, NTT Do. Co. Mo Core content and applications Yes No No Connectivity No No Yes Devices Yes No Services Yes No No Enablers Yes No Yes Value-added services Yes No No 1 Ofcom (London, UK, 2011), Communications Market Report: UK. Available at: http: //stakeholders. ofcom. org. uk/binaries/research/cmr/ cmr 11/UK_CMR_2011_FINAL. pdf. © Analysys Mason Limited 2011

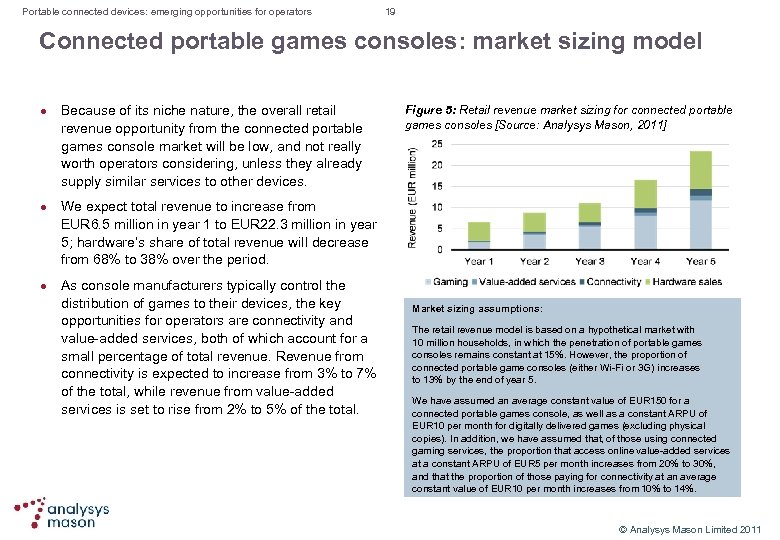

Portable connected devices: emerging opportunities for operators 19 Connected portable games consoles: market sizing model Because of its niche nature, the overall retail revenue opportunity from the connected portable games console market will be low, and not really worth operators considering, unless they already supply similar services to other devices. Figure 5: Retail revenue market sizing for connected portable games consoles [Source: Analysys Mason, 2011] We expect total revenue to increase from EUR 6. 5 million in year 1 to EUR 22. 3 million in year 5; hardware’s share of total revenue will decrease from 68% to 38% over the period. As console manufacturers typically control the distribution of games to their devices, the key opportunities for operators are connectivity and value-added services, both of which account for a small percentage of total revenue. Revenue from connectivity is expected to increase from 3% to 7% of the total, while revenue from value-added services is set to rise from 2% to 5% of the total. Market sizing assumptions: The retail revenue model is based on a hypothetical market with 10 million households, in which the penetration of portable games consoles remains constant at 15%. However, the proportion of connected portable game consoles (either Wi-Fi or 3 G) increases to 13% by the end of year 5. We have assumed an average constant value of EUR 150 for a connected portable games console, as well as a constant ARPU of EUR 10 per month for digitally delivered games (excluding physical copies). In addition, we have assumed that, of those using connected gaming services, the proportion that access online value-added services at a constant ARPU of EUR 5 per month increases from 20% to 30%, and that the proportion of those paying for connectivity at an average constant value of EUR 10 per month increases from 10% to 14%. © Analysys Mason Limited 2011

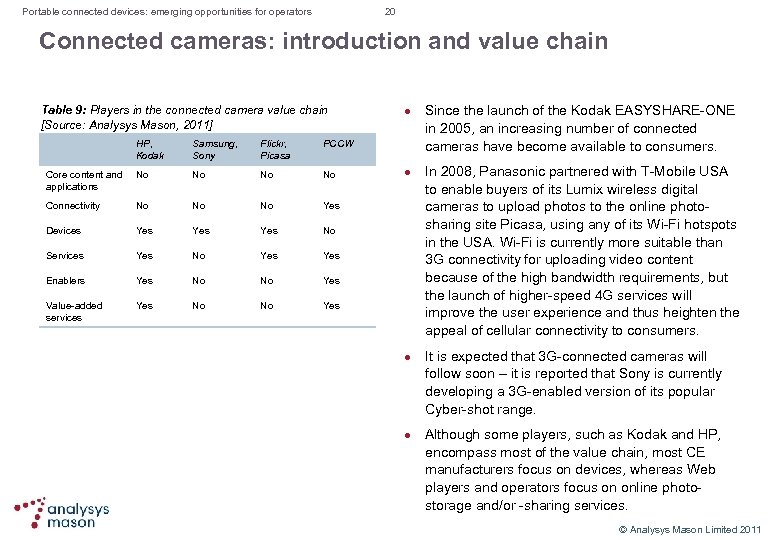

Portable connected devices: emerging opportunities for operators 20 Connected cameras: introduction and value chain Table 9: Players in the connected camera value chain [Source: Analysys Mason, 2011] HP, Kodak Samsung, Sony Flickr, Picasa PCCW Core content and applications No No Connectivity No No No Yes Devices Yes Yes No Services Yes No Yes Enablers Yes No No Yes Value-added services Yes No No Yes Since the launch of the Kodak EASYSHARE-ONE in 2005, an increasing number of connected cameras have become available to consumers. In 2008, Panasonic partnered with T-Mobile USA to enable buyers of its Lumix wireless digital cameras to upload photos to the online photosharing site Picasa, using any of its Wi-Fi hotspots in the USA. Wi-Fi is currently more suitable than 3 G connectivity for uploading video content because of the high bandwidth requirements, but the launch of higher-speed 4 G services will improve the user experience and thus heighten the appeal of cellular connectivity to consumers. It is expected that 3 G-connected cameras will follow soon – it is reported that Sony is currently developing a 3 G-enabled version of its popular Cyber-shot range. Although some players, such as Kodak and HP, encompass most of the value chain, most CE manufacturers focus on devices, whereas Web players and operators focus on online photostorage and/or -sharing services. © Analysys Mason Limited 2011

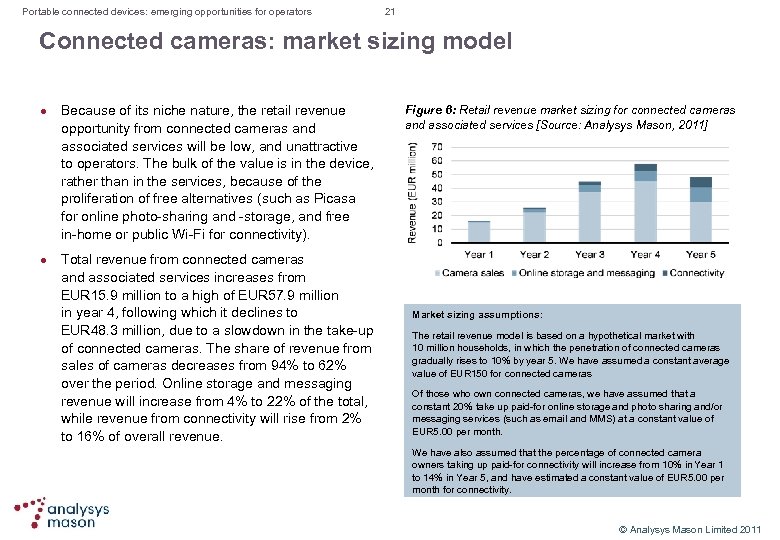

Portable connected devices: emerging opportunities for operators 21 Connected cameras: market sizing model Because of its niche nature, the retail revenue opportunity from connected cameras and associated services will be low, and unattractive to operators. The bulk of the value is in the device, rather than in the services, because of the proliferation of free alternatives (such as Picasa for online photo-sharing and -storage, and free in-home or public Wi-Fi for connectivity). Total revenue from connected cameras and associated services increases from EUR 15. 9 million to a high of EUR 57. 9 million in year 4, following which it declines to EUR 48. 3 million, due to a slowdown in the take-up of connected cameras. The share of revenue from sales of cameras decreases from 94% to 62% over the period. Online storage and messaging revenue will increase from 4% to 22% of the total, while revenue from connectivity will rise from 2% to 16% of overall revenue. Figure 6: Retail revenue market sizing for connected cameras and associated services [Source: Analysys Mason, 2011] Market sizing assumptions: The retail revenue model is based on a hypothetical market with 10 million households, in which the penetration of connected cameras gradually rises to 10% by year 5. We have assumed a constant average value of EUR 150 for connected cameras Of those who own connected cameras, we have assumed that a constant 20% take up paid-for online storage and photo sharing and/or messaging services (such as email and MMS) at a constant value of EUR 5. 00 per month. We have also assumed that the percentage of connected camera owners taking up paid-for connectivity will increase from 10% in Year 1 to 14% in Year 5, and have estimated a constant value of EUR 5. 00 per month for connectivity. © Analysys Mason Limited 2011

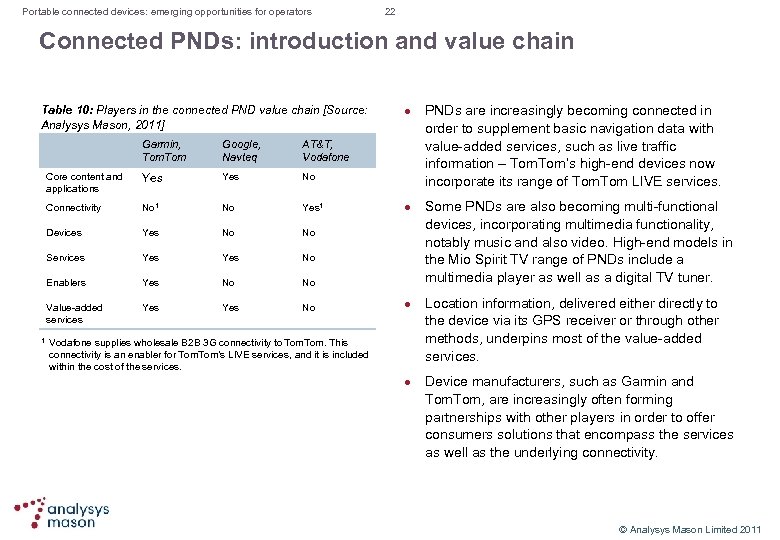

Portable connected devices: emerging opportunities for operators 22 Connected PNDs: introduction and value chain Table 10: Players in the connected PND value chain [Source: Analysys Mason, 2011] Garmin, Tom AT&T, Vodafone Core content and applications Yes No Connectivity No 1 No Yes 1 Devices Yes No No Services Yes No Enablers Yes No No Value-added services 1 Google, Navteq Yes No Vodafone supplies wholesale B 2 B 3 G connectivity to Tom. This connectivity is an enabler for Tom’s LIVE services, and it is included within the cost of the services. PNDs are increasingly becoming connected in order to supplement basic navigation data with value-added services, such as live traffic information – Tom’s high-end devices now incorporate its range of Tom LIVE services. Some PNDs are also becoming multi-functional devices, incorporating multimedia functionality, notably music and also video. High-end models in the Mio Spirit TV range of PNDs include a multimedia player as well as a digital TV tuner. Location information, delivered either directly to the device via its GPS receiver or through other methods, underpins most of the value-added services. Device manufacturers, such as Garmin and Tom, are increasingly often forming partnerships with other players in order to offer consumers solutions that encompass the services as well as the underlying connectivity. © Analysys Mason Limited 2011

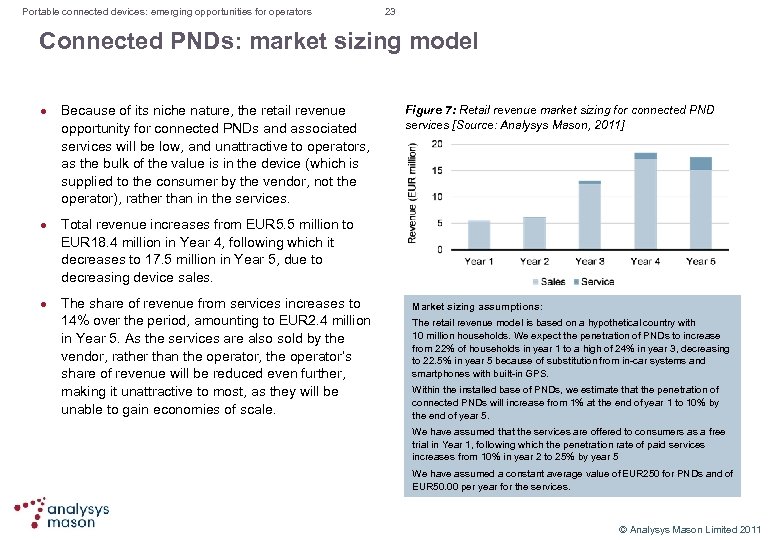

Portable connected devices: emerging opportunities for operators 23 Connected PNDs: market sizing model Because of its niche nature, the retail revenue opportunity for connected PNDs and associated services will be low, and unattractive to operators, as the bulk of the value is in the device (which is supplied to the consumer by the vendor, not the operator), rather than in the services. Figure 7: Retail revenue market sizing for connected PND services [Source: Analysys Mason, 2011] Total revenue increases from EUR 5. 5 million to EUR 18. 4 million in Year 4, following which it decreases to 17. 5 million in Year 5, due to decreasing device sales. The share of revenue from services increases to 14% over the period, amounting to EUR 2. 4 million in Year 5. As the services are also sold by the vendor, rather than the operator, the operator’s share of revenue will be reduced even further, making it unattractive to most, as they will be unable to gain economies of scale. Market sizing assumptions: The retail revenue model is based on a hypothetical country with 10 million households. We expect the penetration of PNDs to increase from 22% of households in year 1 to a high of 24% in year 3, decreasing to 22. 5% in year 5 because of substitution from in-car systems and smartphones with built-in GPS. Within the installed base of PNDs, we estimate that the penetration of connected PNDs will increase from 1% at the end of year 1 to 10% by the end of year 5. We have assumed that the services are offered to consumers as a free trial in Year 1, following which the penetration rate of paid services increases from 10% in year 2 to 25% by year 5 We have assumed a constant average value of EUR 250 for PNDs and of EUR 50. 00 per year for the services. © Analysys Mason Limited 2011

Portable connected devices: emerging opportunities for operators 24 Connected PNDs: case study Vodafone partnered with Tom to enable it to offer its Tom LIVE service in 34 European countries, providing the following: an embedded SIM card that provides cellular connectivity for Tom’s high-end PNDs, enabling GPS and additional data to be combined to provide the Tom LIVE service location data from mobile phones is combined with other sources of traffic information for Tom’s HD Traffic service, which provides real-time traffic information to drivers, helping them to avoid congestion on the roads. In addition to the HD Traffic service, Tom LIVE includes: Tom Mobile Speed Cameras, which enables users to notify other drivers about the location of mobile speed cameras Local Search with Google, enabling users to find relevant information from a Google Maps database Tom Weather, which provides a range of forecasts. Usage of the Tom LIVE service is bundled free of charge for a year with Tom’s high-end connected PNDs, after which the service costs EUR 49. 95 per year. In its second quarter of 2011 results, Tom revealed that its LIVE connected PNDs accounted for 24% of all new PNDs sold, up from 20% in the same quarter of the previous year. There is now an installed base of over 1 million active LIVE devices. © Analysys Mason Limited 2011

2d05146b020a8cbc9f79881dcd575214.ppt